Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlueLinx Holdings Inc. | q22020earnings8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BlueLinx Holdings Inc. | q22020earnings991.htm |

BlueLinx (NYSE: BXC) Second Quarter 2020 Earnings Call Presentation August 4, 2020

Notes to Investors Forward-Looking Statements. This presentation contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” “will be,” “will likely continue,” “will likely result” or words or phrases of similar meaning. The forward-looking statements in this presentation include statements about the recovery in single-family housing starts; our areas of focus in response to the COVID-19 pandemic; the potential long-term benefits of working capital efficiencies; our outlook for the single-family housing, Structural products and end-use markets and the conditions thereof; the outlook for Structural product commodity pricing; our pursuit of opportunities to monetize real estate assets and the potential success thereof; trends in our business and the markets in July and their potential impact on our future results. Forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those listed under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 28, 2019, and those discussed in our Quarterly Reports on Form 10-Q and in our periodic reports filed with the SEC from time to time. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: the COVID-19 pandemic and other contagious illness outbreaks and their potential effects on our industry, suppliers and supply chain, and customers, and our business, results of operations, cash flows, financial condition, and future prospects; our ability to integrate and realize anticipated synergies from acquisitions; loss of material customers, suppliers, or product lines in connection with acquisitions; operational disruption in connection with the integration of acquisitions; our indebtedness and its related limitations; sufficiency of cash flows and capital resources; our ability to monetize real estate assets; fluctuations in commodity prices; adverse housing market conditions; disintermediation by customers and suppliers; changes in prices, supply and/or demand for our products; inventory management; competitive industry pressures; industry consolidation; product shortages; loss of and dependence on key suppliers and manufacturers; import taxes and costs, including new or increased tariffs, anti-dumping duties, countervailing duties or similar duties; our ability to successfully implement our strategic initiatives; fluctuations in operating results; sale-leaseback transactions and their effects; real estate leases; changes in interest rates; exposure to product liability claims; our ability to complete offerings under our shelf registration statement on favorable terms, or at all; changes in our product mix; petroleum prices; information technology security and business interruption risks; litigation and legal proceedings; natural disasters and unexpected events; activities of activist stockholders; labor and union matters; limits on net operating loss carryovers; pension plan assumptions and liabilities; risks related to our internal controls; retention of associates and key personnel; federal, state, local and other regulations, including environmental laws and regulations; and changes in accounting principles. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures. BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). We also believe that presentation of certain non-GAAP measures, such as EBITDA, Adjusted EBITDA and our Term Loan Leverage Ratio, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Explanations of these non-GAAP measures are included in the accompanying Appendix to this presentation. And any non-GAAP measures used herein are reconciled herein, in the Appendix, or in the financial tables in the Appendix, to their most directly comparable GAAP measures. We caution that non-GAAP measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Cedar Creek Acquisition. We completed the acquisition of Cedar Creek on April 13, 2018 (the “Closing Date”). As a result, Cedar Creek’s financial results are only included in the combined company’s reported financial results from the Closing Date forward, and period over period results may not be directly comparable. Product Category Information. With the acquisition and integration of Cedar Creek, we changed our internal product hierarchy within our Structural and Specialty product categories. As a result, prior year amounts have been reclassified to conform to the current year product mix of Structural and Specialty products. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 2

Q2 2020 Overview • Responded quickly to COVID-19 with focus on safety • Generated strong financial results for Q2 2020 with Net Sales of $699 million, record Gross Margin of 14.4%, and Adjusted EBITDA of $31 million, a $6 million improvement • Builders Confidence Index returns to pre-COVID-19 levels, Single Family Housing starts recovering rapidly • Structural commodity pricing declined dramatically in April but recovered during the quarter helping to drive a Structural gross margin improvement of 151 basis points • Improved liquidity results in ABL Excess Availability and cash on hand of $138 million 3

COVID-19 Update • Safety and health of associates highest priority with respect to all business decisions • Our operations have remained intact and working efficiently; minimal business interruption to-date • Cost containment remains a primary focus • Significant working capital efficiencies achieved with sustainable long-term benefits • Effectively operating in the pandemic environment as an “essential” business has enabled BlueLinx to service customers with minimal disruption 4

Current Market Conditions Single Family Housing Market Dynamics + Improvement versus April low point + Current pricing above prior year + Current mortgage rates at historical lows + Momentum going into the third quarter + Strong demand in repair & remodel - Lumber Futures lower than current price - Some constraints on labor availability - Mills returning to pre-COVID volumes - Increasing cost of raw materials +/- Pandemic creates supply chain disruptions 5

End-Use Market Outlook • Seasonally adjusted single-family housing starts jumped 17.2% from May to June; still down 4% from June 2019 and well below the 50-year historical average • According to the latest National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index (HMI) builder confidence in the market for newly-built single-family homes jumped 14 points to 72 in July • Current 30-year fixed rate mortgage rates under 3.0%; uncertainty around employment outlook US Single Family Housing Starts Builders Confidence Index U.S. Census Bureau, Seasonally Adjusted NAHB Builders Confidence Index (%) (in 000s) 1,100 85 50 Year Historical Average 1,000 75 900 65 800 55 Positive outlook >50% 700 45 600 35 500 25 2015 2016 2017 2018 2019 2020 2015 2016 2017 2018 2019 2020 © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 6

Financial Overview 7

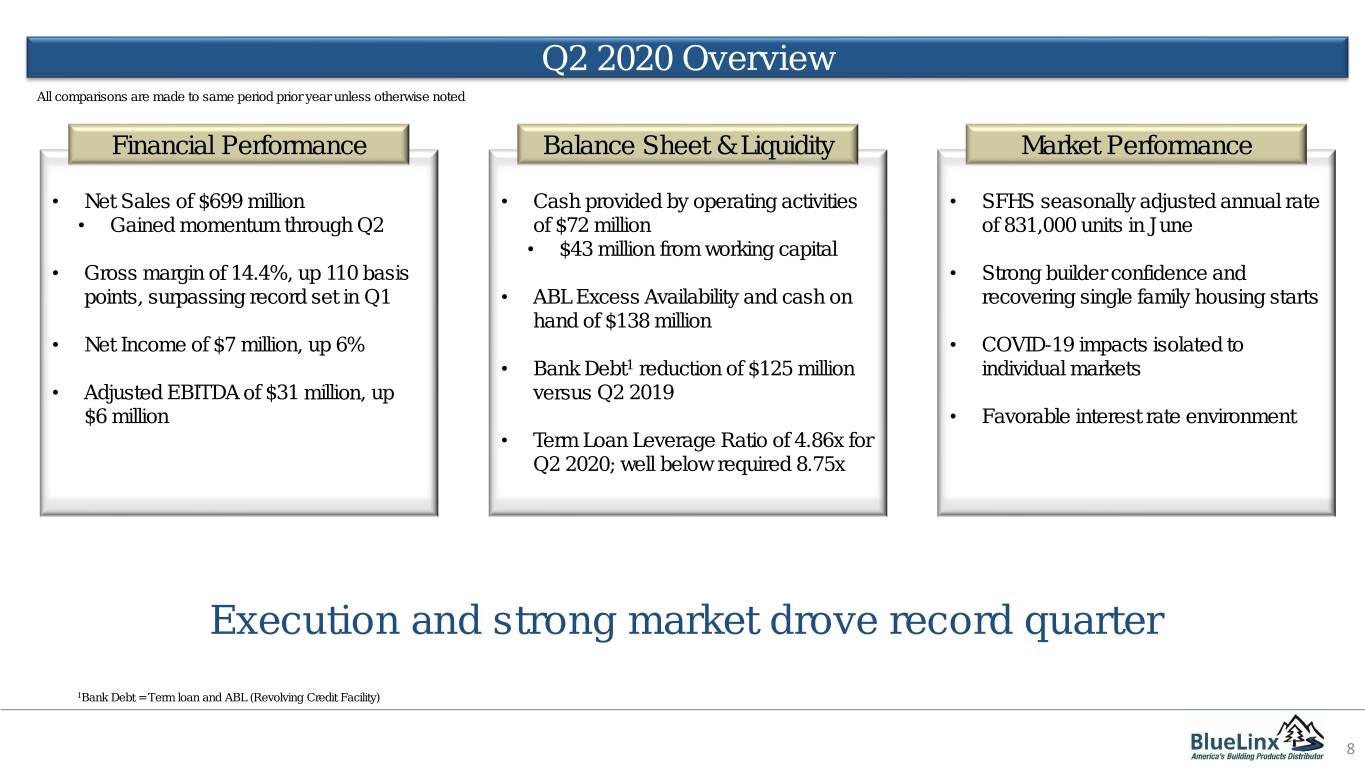

Q2 2020 Overview All comparisons are made to same period prior year unless otherwise noted Financial Performance Balance Sheet & Liquidity Market Performance • Net Sales of $699 million • Cash provided by operating activities • SFHS seasonally adjusted annual rate • Gained momentum through Q2 of $72 million of 831,000 units in June • $43 million from working capital • Gross margin of 14.4%, up 110 basis • Strong builder confidence and points, surpassing record set in Q1 • ABL Excess Availability and cash on recovering single family housing starts hand of $138 million • Net Income of $7 million, up 6% • COVID-19 impacts isolated to • Bank Debt1 reduction of $125 million individual markets • Adjusted EBITDA of $31 million, up versus Q2 2019 $6 million • Favorable interest rate environment • Term Loan Leverage Ratio of 4.86x for Q2 2020; well below required 8.75x Execution and strong market drove record quarter 1Bank Debt = Term loan and ABL (Revolving Credit Facility) 8

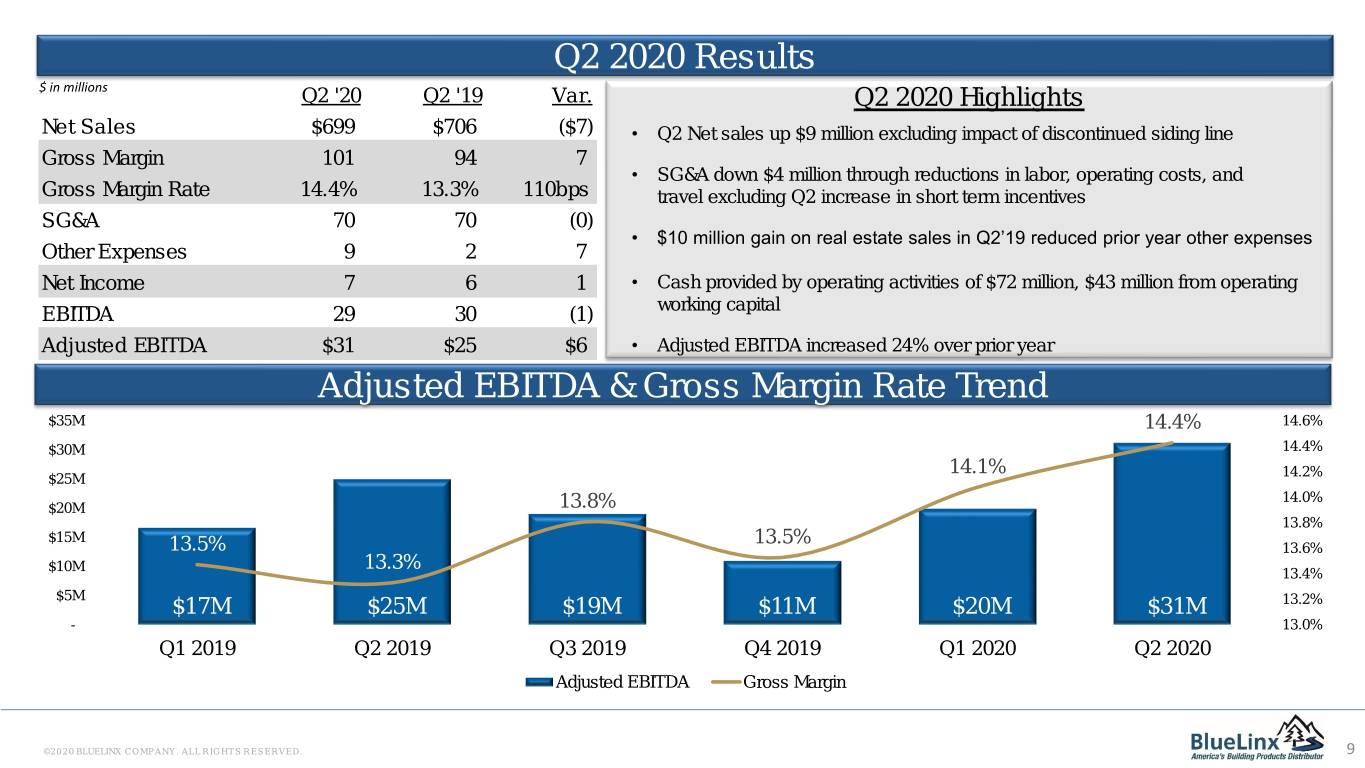

Q2 2020 Results $ in millions Q2 '20 Q2 '19 Var. Q2 2020 Highlights Net Sales $699 $706 ($7) • Q2 Net sales up $9 million excluding impact of discontinued siding line Gross Margin 101 94 7 • SG&A down $4 million through reductions in labor, operating costs, and Gross Margin Rate 14.4% 13.3% 110bps travel excluding Q2 increase in short term incentives SG&A 70 70 (0) • $10 million gain on real estate sales in Q2’19 reduced prior year other expenses Other Expenses 9 2 7 Net Income 7 6 1 • Cash provided by operating activities of $72 million, $43 million from operating EBITDA 29 30 (1) working capital Adjusted EBITDA $31 $25 $6 • Adjusted EBITDA increased 24% over prior year Adjusted EBITDA & Gross Margin Rate Trend $35M 14.4% 14.6% $30M 14.4% 14.1% 14.2% $25M 14.0% $20M 13.8% 13.8% $15M 13.5% 13.5% 13.6% $10M 13.3% 13.4% $5M $17M $25M $19M $11M $20M $31M 13.2% - 13.0% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Adjusted EBITDA Gross Margin © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 9

Structural Product Commodity Pricing Update Framing Lumber Composite Price Structural Panel Composite Price Source: Random Lengths Source: Random Lengths $550 $550 2020 2020 $450 $450 5YR AVG $383 2019 2018 5YR AVG $404 $350 $350 2018 2019 $250 $250 Mar Jun Sep Dec Mar Jun Sep Dec • Structural gross margins benefitted by increases in underlying commodity pricing within the quarter • Recovery from mid-April enhanced structural margins which remained below Q1 levels • Overall sales volumes rebounded through the quarter to levels consistent with prior year, with a slight change in mix toward Structural products • July average lumber and panel composite pricing above 2018 levels at $558 and $552, respectively © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 10

Sales and Gross Margin by Product Q2’19 vs. Q2’20 Sales by Product Historical Gross Margin Q2’19 Q2’20 17.3% 16.4% $706M $699M 15.9% 16.2% 16.1% 15.2% Specialty 14.4% 13.8% 14.1% Structural Structural Total 13.5% 13.3% 13.5% $224M $250M 32% 36% Specialty 10.1% 9.5% 9.3% $482M Specialty 8.9% 8.7% 68% $449M Structural 7.7% 64% Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Second Quarter Highlights • Specialty revenues disrupted by COVID-19 impacts early in the quarter • Primarily industrial end markets • Gross Margin improvement trend continued • 35 basis points higher than Q1 2020 • Specialty gross margin increased to 17.3%, Structural gross margin decline since Q1 driven by April lows • Most Specialty major product categories had improved gross margins year-over-year © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 11

Operating Working Capital1 $ in millions Jun-20 Jun-19 Variance • Decreased inventory balance by $65 Current assets: million since the end of the first quarter Cash $11 $13 ($2) -15% Receivables 265 262 3 1% • Days Sales of Inventory remains Inventories, net 314 358 (44) -12% significantly better than prior year $590 $633 ($43) -7% • 7.4 days improvement Current liabilities: • Year over year, Q2 Days Sales Accounts payable $159 $175 ($16) -9% Outstanding improved by 2.2 days $159 $175 ($16) -9% Operating working capital $431 $458 ($27) -6% Working capital focus supporting strong cash flow 1Operating working capital is defined as the sum of cash, receivables, and inventory less accounts payable. 12

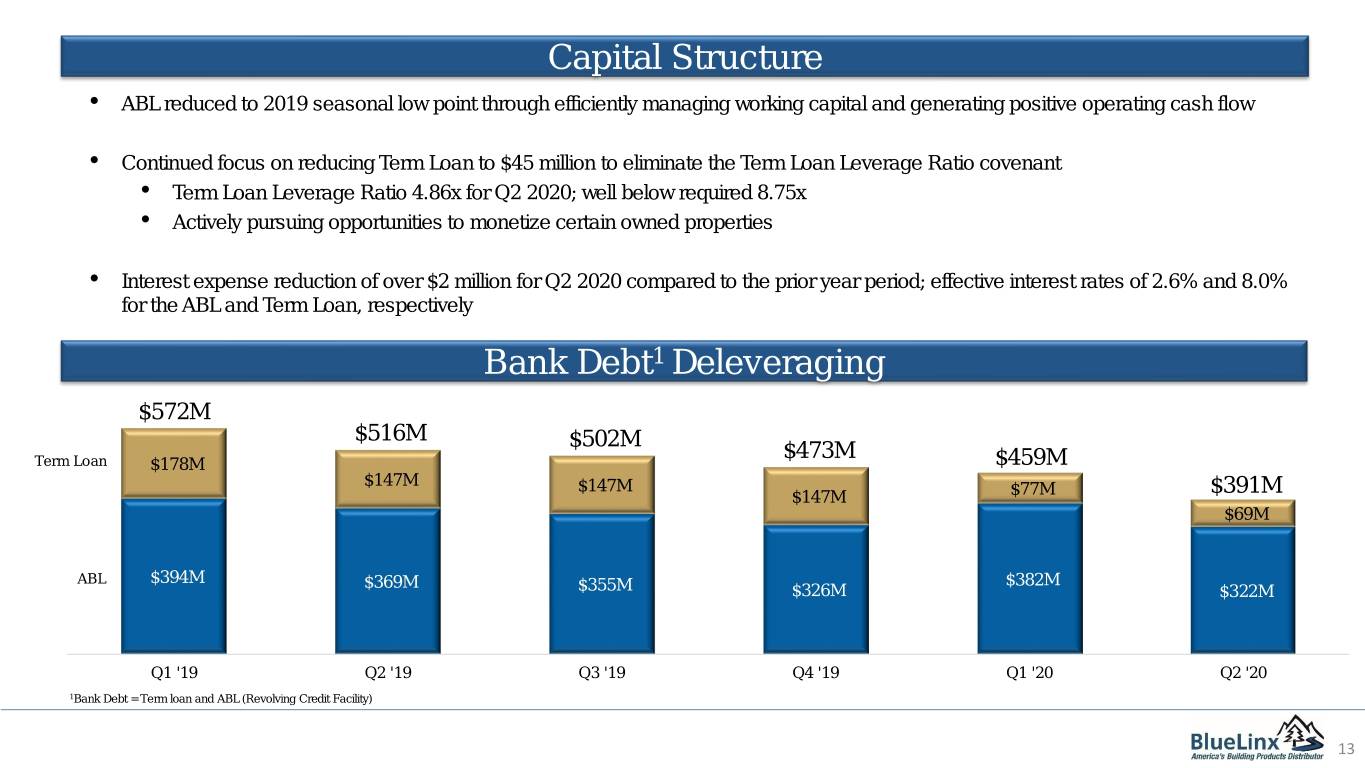

Capital Structure • ABL reduced to 2019 seasonal low point through efficiently managing working capital and generating positive operating cash flow • Continued focus on reducing Term Loan to $45 million to eliminate the Term Loan Leverage Ratio covenant • Term Loan Leverage Ratio 4.86x for Q2 2020; well below required 8.75x • Actively pursuing opportunities to monetize certain owned properties • Interest expense reduction of over $2 million for Q2 2020 compared to the prior year period; effective interest rates of 2.6% and 8.0% for the ABL and Term Loan, respectively 1 $ in millions $700M Bank Debt Deleveraging $600M $572M $516M $502M $473M $500MTerm Loan $178M $459M $147M $147M $77M $391M $400M $147M $69M $300M $200M ABL $394M $369M $382M $355M $326M $322M $100M - Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 1Bank Debt = Term loan and ABL (Revolving Credit Facility) 13

July 2020 Update • Sales volumes positive to prior year, with both Structural and Specialty increasing • Growth stronger in Structural • Positive in all operating regions • Average commodity prices over 50% higher than July 2019 • Continued emphasis on working capital management • Carefully monitoring Structural inventory to manage the risk of a pricing decline • Ongoing deleveraging efforts through monetizing our real estate portfolio • Focused on strategic sales growth opportunities 14

Appendix 15

Cash Flow Statement $ in millions Q2 ‘20 YTD ‘20 Actual Prior Year Actual Prior Year Cash flows from operating activities: Net income $6.7 $6.3 $5.9 ($0.4) Changes in net cash from other operating activities 18.1 7.2 20.3 5.5 Changes in operating assets and liabilities: Receivables (16.7) (15.4) (71.8) (53.6) Inventories 64.7 28.7 31.8 (16.8) Accounts payable (3.5) 5.5 26.6 25.7 Decrease (increase) in prepaid assets (0.2) (7.7) (3.2) (8.1) Other assets and liabilities 9.7 (6.4) 9.2 (5.7) Net cash provided by operating activities $72.1 $11.9 $12.9 ($53.0) Cash flows from investing activities: Acquisition of business - net of cash acquired 0.0 0.0 0.0 6.0 Property, plant, and equipment investments (0.5) (0.5) (1.8) (1.8) Proceeds from disposition of assets 0.1 10.6 0.1 10.8 Net cash (used in) provided by investing activities ($0.4) $10.1 ($1.7) $15.0 Cash flows from financing activities: Repayments/borrowings on revolving credit facilities (59.4) (24.4) (4.3) 35.8 Repayments on term loan (8.6) (31.0) (77.9) (31.9) Proceeds from sale/leaseback transactions 0.0 44.8 78.3 44.8 Payments on finance lease obligations (2.4) (2.0) (4.6) (4.4) Other (2.3) (9.4) (2.9) (2.5) Net cash used in financing activities ($72.7) ($22.0) ($11.4) $41.8 (Decrease) increase in cash (1.1) (0.0) (0.1) 3.8 Cash balance, beginning of period 12.6 12.7 11.6 8.9 Cash balance, end of period $11.5 $12.7 $11.5 $12.7 © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 16

Non-GAAP Measures BlueLinx reports its financial results in accordance with GAAP, but we also believe that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. We caution that non-GAAP measures should be considered in addition to, but not as a substitute for, our reported GAAP results. EBITDA and Adjusted EBITDA. We define EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and we define Adjusted EBITDA as EBITDA adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to the Cedar Creek acquisition, and gains on sales of properties including amortization of deferred gains. We present EBITDA and Adjusted EBITDA because they are the primary measures used by management to evaluate operating performance and, we believe, help to enhance investors’ overall understanding of the financial performance and cash flows of our business. We believe EBITDA and Adjusted EBITDA are helpful in highlighting operating trends. We also believe that EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an EBITDA Adjusted EBITDA measure when reporting their results. However, EBITDA and Adjusted EBITDA are not presentations made in accordance with GAAP, and are not intended to present a superior measure of the financial condition from those determined under GAAP. EBITDA and Adjusted EBITDA, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. Term Loan Leverage Ratio. Our term loan agreement requires us to maintain a Term Loan Leverage Ratio below certain levels. The Term Loan Leverage Ratio is calculated by dividing “Consolidated Total Debt” by “Consolidated EBITDA,” as those terms are defined in our term loan agreement. “Consolidated Total Debt” under the term loan agreement is determined by adding the balance of our term loan, the prior month’s average balance of our revolving credit facility, and our equipment finance lease liability, and reducing that amount by unrestricted cash up to $10.0 million. On June 27, 2020, the balance of our term loan was $68.8 million, the average balance of our revolving credit facility for the prior month was $320.1 million, our equipment finance lease liability was $29.2 million, and unrestricted cash was $10.0 million, resulting in “Consolidated Total Debt” of $408.1 million for purposes of the Term Loan Leverage Ratio. Liabilities related to sale-leaseback transactions are excluded from the calculation of “Consolidated Total Debt”. “Consolidated EBITDA” under the term loan agreement is generally determined by taking the Adjusted EBITDA that we report, which is calculated as described above, and adding additional adjustments and add-backs specified by the term loan agreement. We believe that our Term Loan Leverage Ratio is a meaningful metric to investors in evaluating our financial leverage. In addition, as mentioned above, our term loan agreement requires us to maintain our Term Loan Leverage Ratio below certain levels. Under the term loan agreement, the required Term Loan Leverage Ratio is 8.75:1.00 for the second and third quarters of 2020, and then it generally reduces on a quarterly basis for the remaining term of the loan. The Term Loan Leverage Ratio is not a presentation made in accordance with GAAP, and is not intended to present a superior measure of the financial condition from ratios determined under GAAP. Term Loan Leverage Ratio, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 17

Adjusted EBITDA $ in millions Q1 ‘19 Q2 ‘19 Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 TTM Net income (loss) ($6.7) $6.3 ($7.0) ($10.2) ($0.8) $6.7 ($11.3) Adjustments: Depreciation and amortization 7.3 7.5 7.6 7.8 7.6 7.1 30.1 Interest expense, net 13.4 13.7 13.4 13.7 14.4 11.5 53.0 Provision for (benefit from) income taxes (2.5) 2.4 0.2 (4.0) (5.0) 3.4 (5.4) EBITDA 11.5 29.9 14.2 7.3 16.2 28.7 66.4 Gain from sales of property (9.8) (0.0) (3.3) (0.5) - (3.8) Amortization of deferred gain (1.0) (1.0) (1.1) (1.0) (1.0) (1.0) (4.0) Share-based compensation expense 0.7 0.6 1.2 0.1 1.0 0.9 3.1 Pension settlement and withdrawal costs 0.9 3.5 4.4 Merger and acquisition costs1 4.6 4.2 2.5 3.0 1.1 0.6 7.1 Restructuring and other2 0.8 1.0 1.3 1.3 3.1 2.0 7.7 Adjusted EBITDA $16.6 $24.9 $19.0 $10.9 $19.9 $31.2 $81.0 Term Loan adjustments and add-backs3 3.0 4 Consolidated EBITDA $84.0 1Reflects primarily legal, professional, and other integration costs related to the Cedar Creek acquisition 2Reflects costs related to our restructuring efforts, such as severance, net of other one-time non-operating items 3Adjusments and add-backs specified by the Term Loan agreement 4Use for purposes of calculating Term Loan Leverage Ratio under the Company’s Term Loan agreement © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 18

Please reference the Earnings Release, 10-K and 10-Q available on our website www.BlueLinxCo.com © 2 0 2 0 BLUELINX C O MP A N Y . A L L R I G H T S R E S E R V E D . 19