Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FORD MOTOR CO | fordearnings8-kdatedju.htm |

| EX-10.2 - EXHIBIT 10.2 - FORD MOTOR CO | exhibit102-supplementa.htm |

| EX-10.1 - EXHIBIT 10.1 - FORD MOTOR CO | exhibit101-sixteentham.htm |

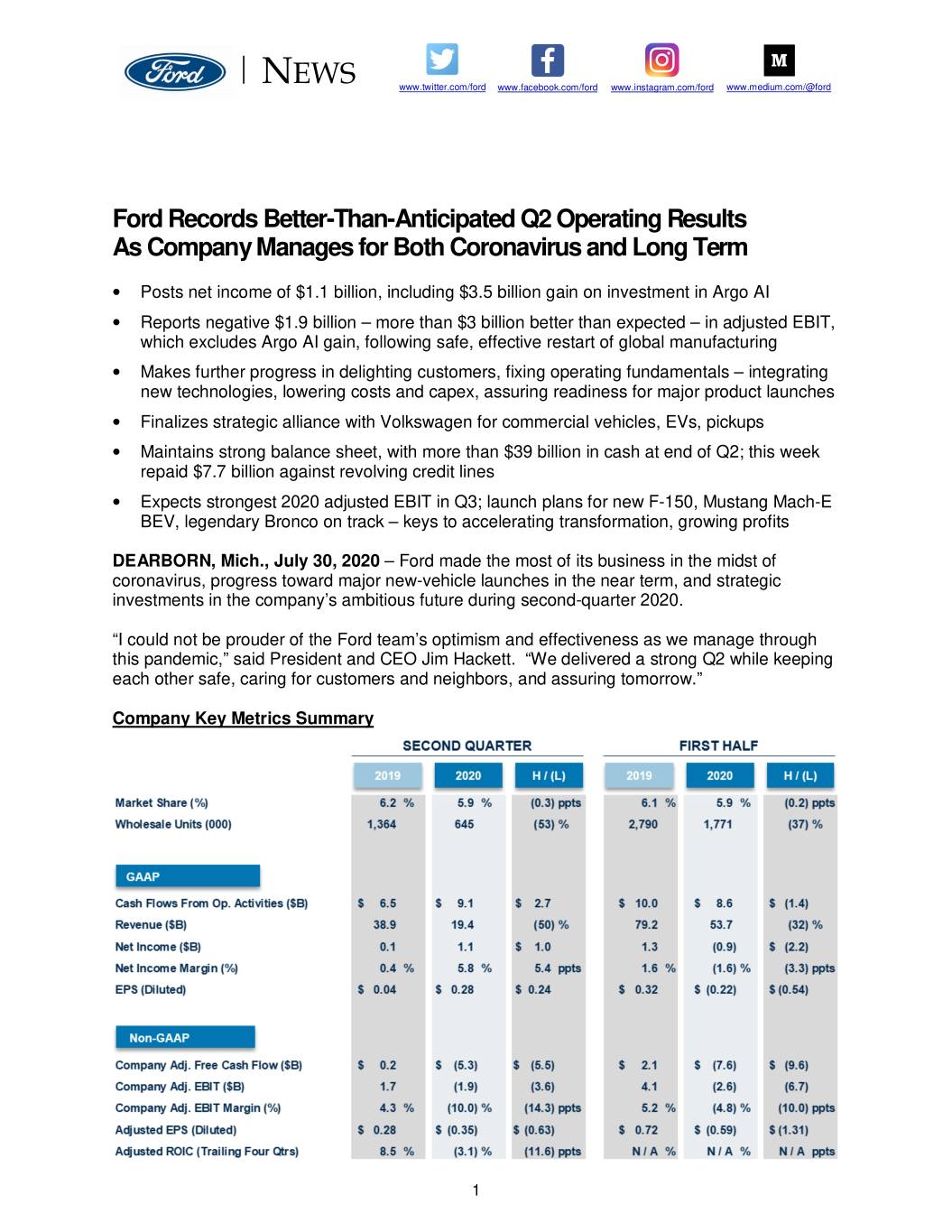

NEWS www.twitter.com/ford www.facebook.com/ford www.instagram.com/ford www.medium.com/@ford Ford Records Better-Than-Anticipated Q2 Operating Results As Company Manages for Both Coronavirus and Long Term • Posts net income of $1.1 billion, including $3.5 billion gain on investment in Argo AI • Reports negative $1.9 billion – more than $3 billion better than expected – in adjusted EBIT, which excludes Argo AI gain, following safe, effective restart of global manufacturing • Makes further progress in delighting customers, fixing operating fundamentals – integrating new technologies, lowering costs and capex, assuring readiness for major product launches • Finalizes strategic alliance with Volkswagen for commercial vehicles, EVs, pickups • Maintains strong balance sheet, with more than $39 billion in cash at end of Q2; this week repaid $7.7 billion against revolving credit lines • Expects strongest 2020 adjusted EBIT in Q3; launch plans for new F-150, Mustang Mach-E BEV, legendary Bronco on track – keys to accelerating transformation, growing profits DEARBORN, Mich., July 30, 2020 – Ford made the most of its business in the midst of coronavirus, progress toward major new-vehicle launches in the near term, and strategic investments in the company’s ambitious future during second-quarter 2020. “I could not be prouder of the Ford team’s optimism and effectiveness as we manage through this pandemic,” said President and CEO Jim Hackett. “We delivered a strong Q2 while keeping each other safe, caring for customers and neighbors, and assuring tomorrow.” Company Key Metrics Summary 1

Ford’s balance-sheet discipline provided strong liquidity and financial flexibility heading into the economic crisis and through the second quarter. The company ended Q2 with more than $39 billion in cash, reflecting, in part, $10 billion in new debt during the quarter. On July 27, Ford repaid $7.7 billion of an outstanding $15.4 billion on its revolving credit facilities, and also extended $4.8 billion of its three-year revolving credit lines. The company’s almost $40 billion in liquidity today is expected to be sufficient to maintain or exceed a target cash balance of $20 billion through the second half of this year, even if global demand declines or there is another major wave of pandemic-related plant closures. “Our global team is delivering great value for customers, performing strongly and advancing the business against extraordinary headwinds,” said Ford CFO Tim Stone. “You’re seeing us fix things that held us back in the past, accelerate in areas like commercial vehicles and SUVs, and set ourselves up for growth in connectivity, electrification and autonomous vehicles.” In June, Ford and Volkswagen finalized agreements that expanded their global alliance, leveraging complementary strengths across an expected combined 8 million commercial and electric vehicles, and midsize pickup trucks. The alliance emphasizes innovation and choice for their respective customers of commercial vehicles and high-performing EVs : • A medium pickup truck engineered and built by Ford • A city delivery van developed and made by Volkswagen Commercial Vehicles and a 1-tonne cargo van created by Ford, and • A highly differentiated Ford EV for Europe based on Volkswagen’s Modular Electric Drive, or MEB, toolkit. Volkswagen also completed its investment in Argo AI, a company in which Ford already had an ownership interest. Ford and Volkswagen will work with Argo AI to independently develop AVs at scale based on Argo AI’s innovative self-driving system. Argo AI’s SDS, the first with commercial deployment plans for both Europe and the U.S., has the largest geographic potential of any autonomous driving technology to date. Reach and scale are important to developing a robust, cost-efficient SDS. Ford directed much of its capabilities and resolve in the second quarter to understanding and helping meet coronavirus-related needs of customers, dealers, suppliers, healthcare professionals and first responders, and patients and communities. Initiatives like enhanced and new online services and deferred financing payments on new vehicles in the U.S. benefitted customers and Ford as commerce stalled, then began to recover. Ford’s engineering and manufacturing response to enormous global demand for personal protective and other healthcare equipment, much of it in partnership with the United Auto Workers, included production of: • More than 18 million face shields and 33-plus million face masks • 50,000 patient ventilators by the end of August • More than 32,000 powered air-purifying respirators in a collaboration with 3M • 1.4 million washable isolation gowns a week for three months with suppliers, and • About 7,500 ambulances, so far, prioritized by JMC, a Ford joint venture in China. 2

Regional Highlights Wholesale shipments, revenue and earnings before interest and taxes in Ford’s Automotive business were down in Q2 with virtually all of the company’s worldwide manufacturing suspended for much of the quarter. Improvements of roughly $1 billion each in net pricing and costs partially offset the effect of the shutdown on profitability. When it was appropriate, Ford brought its industrial, marketing, sales and service operations back up safely, efficiently and effectively. All of Ford’s regional businesses performed better than April expectations, as they further streamlined underlying operations. After being idled for six weeks, plants in North America smoothly resumed operations and ended the quarter at about 95 percent of their pre-pandemic production levels. Overall Q2 sales were down, but Ford gained more than one full percentage point of retail share on the strength of its F-150 and Ranger trucks, and Explorer and Lincoln Aviator and Corsair SUVs. Retail share for F-Series was up 2.5 percentage points – to more than 33 percent – just months ahead of production launch of the all-new, 2021 version of the F-150, America’s top-selling truck for 38 straight years. In July, the company unveiled reimagined versions of the legendary Bronco, along with the Bronco Sport that will expand the brand. Launches of F-150, the all-electric Mustang Mach-E and the Bronco family will be major steps in the ongoing transformation of Ford’s vehicle lineup – and in the process delight customers, drive growth and increase profitability. 3

In Europe , Ford had all its plants back in operation by May 4. Operating results were favorably influenced by further redesign of the regional business, together with a sharpened focus on Transit commercial vehicles, a category in which Ford had an industry-leading 15-percent share in June; selected passenger vehicles, particularly SUVs and crossovers; and iconic import products. Coronavirus risks developed and started moderating earlier in China , but persisted into Q2. Nonetheless, Ford achieved double-digit, year-over-year gains in wholesale volumes. Growth was driven by introductions of the Ford Escape and Lincoln Corsair, together with strong sales of commercial vehicles. Corsair, the first locally produced Lincoln product, contributed to an increase in Lincoln sales, with the new Lincoln Aviator now being introduced in China. Ford’s Q2 share was its highest in nearly two years. Strength in commercial vehicles produced a 34-percent increase in sales at JMC, a Ford joint-venture in China. All of Ford’s regional businesses will benefit from investments in new technologies, including electrification . So far, the company has spent about one-half of the more than $11.5 billion committed through 2022 – with more to follow – to be a leader in EVs. By the end of this year, customers around the globe will be able to choose from 15 electrified Ford nameplates expected to together account for nearly 10 percent of fourth-quarter wholesale volumes. Among current or planned electric versions of vehicles of strategic importance to Ford are the Territory SUV BEV, already on the road in China; the all-electric Mustang Mach-E, out later this year; Escape and Kuga plug-in hybrids; the F-150 PowerBoost hybrid; and all-electric models of two of the company’s most significant vehicles, F-150 and Transit. Electric is also a big part of Lincoln’s future. Ford Credit had another strong performance in Q2, demonstrating compelling value to customers and the company’s Automotive business. In spite of economic weakness, the unit’s portfolio performance was strong, with delinquencies and charge-offs at low levels. Ford and Ford Credit partnered on two recent programs to help auto customers facing financial hardship during the pandemic. One resulted in extensions of loan and lease payments for about 11 percent of Ford’s U.S. customers through May – with more than 90 percent of those customers resuming their payments as of the end of July. Another program, “Ford Promise,” gives customers who lose their jobs within 12 months of financing or leasing a new or used, 2019 through 2021 model-year Ford vehicle – from a participating Ford dealer and via Ford Credit – the option to return the vehicle. Outlook Stone said Ford’s expectations for the second half of 2020 assume no meaningful change in the current economic conditions, continued steady improvement in stability of the global automotive supply base, and no further significant coronavirus-related disruptions to production or distribution. In that environment, he said, the company anticipates third-quarter adjusted EBIT of $0.5 billion to $1.5 billion, reflecting economic effects of the pandemic; year-over-year weaker global demand for new vehicles, parts and services; and a lower profit from Ford Credit than a year ago. Ford plans to report third-quarter 2020 financial results on Oct. 28. 4

The company said its initial outlook for Q4 , which features three significant product launches delayed by the coronavirus shutdown earlier this year, is an adjusted EBIT loss. That reflects normal effects on volumes from downtime, changeover and ramp up for the all-new F-150, together with continued lower overall industry units. Wholesales of Mustang Mach-E and Bronco Sport, which will also start shipping to customers in the fourth quarter, will not have a material effect on the company’s Q4 results. Fourth-quarter profits at Ford Credit are anticipated to be lower than in the prior year. For full-year 2020 , Ford expects an adjusted EBIT loss. # # # About Ford Motor Company Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides financial services through Ford Motor Credit Company and is pursuing leadership positions in electrification; mobility solutions, including self-driving services; and connected services. Ford employs approximately 188,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit Company, please visit corporate.ford.com . Contacts: Fixed Income Equity Investment Investment Shareholder Media Community Community Inquiries T.R. Reid Lynn Antipas Tyson Karen Rocoff 1.800.555.5259 or 1.313.319.6683 1.313.621.2902 1.313.621.0965 1.313.845.8540 treid22@ford.com ltyson4@ford.com krocoff@ford.com stockinf@ford.com 5

Cautionary Note on Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford and Ford Credit’s financial condition and results of operations have been and may continue to be adversely affected by public health issues, including epidemics or pandemics such as COVID-19; • Ford’s long-term competitiveness depends on the successful execution of global redesign and fitness actions; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs; • Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, or new business strategies; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor issues, natural or man-made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Ford’s ability to attract and retain talented, diverse, and highly skilled employees is critical to its success and competitiveness; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events, including tariffs and Brexit; • Industry sales volume in any of our key markets can be volatile and could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford may face increased price competition or a reduction in demand for its products resulting from industry excess capacity, currency fluctuations, competitive actions, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, interest rates, and market value of our investments can have a significant effect on results; • Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than- expected return volumes for leased vehicles; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford may need to substantially modify its product plans to comply with safety, emissions, fuel economy, autonomous vehicle, and other regulations that may change in the future; • Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, and data protection laws and regulations as well as consumer expectations for the safeguarding of personal information; and • Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, as updated by our subsequent filings with the Securities and Exchange Commission. 6

Conference Call Details Ford Motor Company (NYSE:F) and Ford Motor Credit Company released their 2020 second-quarter financial results at 4:05 p.m. ET on Thursday, July 30. Following the release, Jim Hackett, Ford president and chief executive officer; Jim Farley, Ford chief operating officer; Tim Stone, Ford chief financial officer; and members of Ford’s senior management team will host a conference call at 5:00 p.m. ET to discuss the results. The presentation and supporting materials will be available at shareholder.ford.com . Representatives of the investment community will have the opportunity to ask questions on the call. Ford Earnings Call: 5:00 p.m. ET, Thursday, July 30 Toll-Free: 1.877.870.8664 International: 1.970.297.2423 Passcode: Ford Earnings Web: www.shareholder.ford.com REPLAY Available after 8:00 p.m. ET on July 30 through Aug. 5 Web: www.shareholder.ford.com Toll-Free: 1.855.859.2056 International: 1.404.537.3406 Conference ID: 6694664 The following applies to the information throughout this release: • See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). • Wholesale unit sales and production volumes include Ford brand and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliates; revenue does not include these sales. See materials supporting the July 30, 2020, conference call at shareholder.ford.com for further discussion of wholesale unit volumes. 7

FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended June 30, 2019 2020 First Half (unaudited) Cash flows from operating activities Net income/(loss) $ 1,333 $ (875 ) Depreciation and tooling amortization 4,988 4,802 Other amortization (587 ) (590 ) Held-for-sale impairment charges — 18 Provision for credit and insurance losses 166 779 Pension and other post-retirement employee benefits (“OPEB”) expense/(income) 123 (454) Equity investment dividends received in excess of (earnings)/losses 21 169 Foreign currency adjustments (92 ) 113 Net (gain)/loss on changes in investments in affiliates (2 ) (3,480 ) Stock compensation 169 107 Provision for deferred income taxes 200 655 Decrease/(Increase) in finance receivables (wholesale and other) 715 9,772 Decrease/(Increase) in accounts receivable and other assets (962 ) 220 Decrease/(Increase) in inventory (1,180 ) 66 Increase/(Decrease) in accounts payable and accrued and other liabilities 4,929 (2,485 ) Other 186 (175) Net cash provided by/(used in) operating activities 10,007 8,642 Cash flows from investing activities Capital spending (3,553 ) (2,955 ) Acquisitions of finance receivables and operating leases (26,202 ) (27,113) Collections of finance receivables and operating leases 24,974 22,923 Proceeds from sale of business — 1,340 Purchases of marketable securities and other investments (7,670 ) (19,624 ) Sales and maturities of marketable securities and other investments 8,540 10,804 Settlements of derivatives 83 73 Other 4 337 Net cash provided by/(used in) investing activities (3,824 ) (14,215 ) Cash flows from financing activities Cash payments for dividends and dividend equivalents (1,196 ) (596 ) Purchases of common stock — — Net changes in short-term debt 71 (789 ) Proceeds from issuance of long-term debt 26,233 44,303 Principal payments on long-term debt (25,767 ) (23,345 ) Other (149 ) (182) Net cash provided by/(used in) financing activities (808 ) 19,391 Effect of exchange rate changes on cash, cash equivalents, and restricted cash 24 (378 ) Net increase/(decrease) in cash, cash equivalents, and restricted cash $ 5,399 $ 13,440 Cash, cash equivalents, and restricted cash at beginning of period $ 16,907 $ 17,741 Net increase/(decrease) in cash, cash equivalents, and restricted cash 5,399 13,440 Cash, cash equivalents, and restricted cash at end of period $ 22,306 $ 31,181 8

FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) For the periods ended June 30, 2019 2020 2019 2020 Second Quarter First Half (unaudited) Revenues Automotive $ 35,758 $ 16,622 $ 72,997 $ 47,962 Ford Credit 3,089 2,739 6,186 5,706 Mobility 6 10 12 23 Total revenues 38,853 19,371 79,195 53,691 Costs and expenses Cost of sales 33,657 17,932 67,599 48,454 Selling, administrative, and other expenses 2,725 1,965 5,568 4,397 Ford Credit interest, operating, and other expenses 2,381 2,233 4,736 5,157 Total costs and expenses 38,763 22,130 77,903 58,008 Operating income/(loss) 90 (2,759 ) 1,292 (4,317 ) Interest expense on Automotive debt 230 439 461 653 Interest expense on Other debt 14 11 28 24 Other income/(loss), net 272 4,318 900 4,998 Equity in net income/(loss) of affiliated companies 87 (25 ) 112 (66 ) Income/(Loss) before income taxes 205 1,084 1,815 (62 ) Provision for/(Benefit from) income taxes 55 (34 ) 482 813 Net income/(loss) 150 1,118 1,333 (875 ) Less: Income/(Loss) attributable to noncontrolling interests 2 1 39 1 Net income/(loss) attributable to Ford Motor Company $ 148 $ 1,117 $ 1,294 $ (876 ) EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK Basic income/(loss) $ 0.04 $ 0.28 $ 0.33 $ (0.22 ) Diluted income/(loss) 0.04 0.28 0.32 (0.22 ) Weighted-average shares used in computation of earnings per share Basic shares 3,984 3,975 3,979 3,969 Diluted shares 4,013 3,992 4,005 3,969 9

FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, June 30, 2019 2020 (unaudited) ASSETS Cash and cash equivalents $ 17,504 $ 30,989 Marketable securities 17,147 26,141 Ford Credit finance receivables, net of allowance for credit losses of $162 and $396 53,651 42,720 Trade and other receivables, less allowances of $63 and $75 9,237 9,107 Inventories 10,786 10,220 Assets held for sale 2,383 720 Other assets 3,339 4,214 Total current assets 114,047 124,111 Ford Credit finance receivables, net of allowance for credit losses of $351 and $889 53,703 53,987 Net investment in operating leases 29,230 27,716 Net property 36,469 35,276 Equity in net assets of affiliated companies 2,519 4,651 Deferred income taxes 11,863 11,066 Other assets 10,706 12,559 Total assets $ 258,537 $ 269,366 LIABILITIES Payables $ 20,673 $ 16,360 Other liabilities and deferred revenue 22,987 20,792 Automotive debt payable within one year 1,445 2,084 Ford Credit debt payable within one year 52,371 53,260 Other debt payable within one year 130 — Liabilities held for sale 526 284 Total current liabilities 98,132 92,780 Other liabilities and deferred revenue 25,324 25,391 Automotive long-term debt 13,233 37,409 Ford Credit long-term debt 87,658 82,007 Other long-term debt 470 470 Deferred income taxes 490 454 Total liabilities 225,307 238,511 EQUITY Common Stock, par value $.01 per share (4,025 million shares issued of 6 billion authorized) 40 40 Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) 1 1 Capital in excess of par value of stock 22,165 22,210 Retained earnings 20,320 18,645 Accumulated other comprehensive income/(loss) (7,728 ) (8,471 ) Treasury stock (1,613) (1,601 ) Total equity attributable to Ford Motor Company 33,185 30,824 Equity attributable to noncontrolling interests 45 31 Total equity 33,230 30,855 Total liabilities and equity $ 258,537 $ 269,366 10

SUPPLEMENTAL INFORMATION The tables below provide supplemental consolidating financial information. Company excluding Ford Credit includes our Automotive and Mobility reportable segments, Corporate Other, Interest on Debt, and Special Items. Eliminations, where presented, primarily represent eliminations of intersegment transactions and deferred tax netting. Selected Cash Flow Information. The following tables provide supplemental cash flow information (in millions): For the period ended June 30, 2020 First Half Company excluding Cash flows from operating activities Ford Credit Ford Credit Eliminations Consolidated Net income/(loss) $ (1,303 ) $ 428 $ — $ (875 ) Depreciation and tooling amortization 2,743 2,059 — 4,802 Other amortization 28 (618 ) — (590 ) Held-for-sale impairment charges 18 — — 18 Provision for credit and insurance losses 34 745 — 779 Pension and OPEB expense/(income) (454) — — (454) Equity investment dividends received in excess of (earnings)/losses 177 (8 ) — 169 Foreign currency adjustments 160 (47 ) — 113 Net (gain)/loss on changes in investments in affiliates (3,472 ) (8 ) — (3,480 ) Stock compensation 105 2 — 107 Provision for deferred income taxes 1,347 (692 ) — 655 Decrease/(Increase) in finance receivables (wholesale and other) — 9,772 — 9,772 Decrease/(Increase) in intersegment receivables/payables (35 ) 35 — — Decrease/(Increase) in accounts receivable and other assets 242 (22 ) — 220 Decrease/(Increase) in inventory 66 — — 66 Increase/(Decrease) in accounts payable and accrued and other liabilities (2,365) (120 ) — (2,485) Other (130 ) (45 ) — (175 ) Interest supplements and residual value support to Ford Credit (2,065) 2,065 — — Net cash provided by/(used in) operating activities $ (4,904 ) $ 13,546 $ — $ 8,642 Company excluding Cash flows from investing activities Ford Credit Ford Credit Eliminations Consolidated Capital spending $ (2,935 ) $ (20 ) $ — $ (2,955 ) Acquisitions of finance receivables and operating leases — (27,113 ) — (27,113) Collections of finance receivables and operating leases — 22,923 — 22,923 Proceeds from sale of business — 1,340 1,340 Purchases of marketable and other investments (15,485 ) (4,139 ) — (19,624 ) Sales and maturities of marketable securities and other investments 8,379 2,425 — 10,804 Settlements of derivatives 36 37 — 73 Other 338 (1 ) — 337 Investing activity (to)/from other segments 550 (11 ) (539 ) — Net cash provided by/(used in) investing activities $ (9,117) $ (4,559) $ (539) $ (14,215) Company excluding Cash flows from financing activities Ford Credit Ford Credit Eliminations Consolidated Cash payments for dividends and dividend equivalents $ (596 ) $ — $ — $ (596 ) Purchases of common stock — — — — Net changes in short-term debt 879 (1,668 ) — (789 ) Proceeds from issuance of long-term debt 24,157 20,146 — 44,303 Principal payments on long-term debt (380 ) (22,965 ) — (23,345 ) Other (141) (41 ) — (182) Financing activity to/(from) other segments 11 (550 ) 539 — Net cash provided by/(used in) financing activities $ 23,930 $ (5,078) $ 539 $ 19,391 Effect of exchange rate changes on cash, cash equivalents, and restricted cash $ (204 ) $ — $ (174 ) $ (378 ) 11

Selected Income Statement Information. The following table provides supplemental income statement information (in millions): For the period ended June 30, 2020 Second Quarter Company excluding Ford Credit Automotive Mobility Other (a) Subtotal Ford Credit Consolidated Revenues $ 16,622 $ 10 $ — $ 16,632 $ 2,739 $ 19,371 Total costs and expenses 19,303 361 233 19,897 2,233 22,130 Operating income/(loss) (2,681 ) (351 ) (233 ) (3,265 ) 506 (2,759 ) Interest expense on Automotive debt — — 439 439 — 439 Interest expense on Other debt — — 11 11 — 11 Other income/(loss), net 601 31 3,651 4,283 35 4,318 Equity in net income/(loss) of affiliated companies (9 ) (12 ) (6 ) (27 ) 2 (25 ) Income/(Loss) before income taxes (2,089 ) (332) 2,962 541 543 1,084 Provision for/(Benefit from) income taxes (922 ) (79 ) 831 (170 ) 136 (34 ) Net income/(loss) (1,167 ) (253) 2,131 711 407 1,118 Less: Income/(Loss) attributable to noncontrolling interests 1 — — 1 — 1 Net income/(loss) attributable to Ford Motor Company $ (1,168) $ (253) $ 2,131 $ 710 $ 407 $ 1,117 For the period ended June 30, 2020 First Half Company excluding Ford Credit Automotive Mobility Other (a) Subtotal Ford Credit Consolidated Revenues $ 47,962 $ 23 $ — $ 47,985 $ 5,706 $ 53,691 Total costs and expenses 51,409 742 700 52,851 5,157 58,008 Operating income/(loss) (3,447 ) (719 ) (700 ) (4,866 ) 549 (4,317 ) Interest expense on Automotive debt — — 653 653 — 653 Interest expense on Other debt — — 24 24 — 24 Other income/(loss), net 1,237 65 3,680 4,982 16 4,998 Equity in net income/(loss) of affiliated companies (56 ) (12 ) (6 ) (74 ) 8 (66 ) Income/(Loss) before income taxes (2,266 ) (666) 2,297 (635 ) 573 (62) Provision for/(Benefit from) income taxes (701 ) (159 ) 1,528 668 145 813 Net income/(loss) (1,565 ) (507) 769 (1,303 ) 428 (875) Less: Income/(Loss) attributable to noncontrolling interests 1 — — 1 — 1 Net income/(loss) attributable to Ford Motor Company $ (1,566) $ (507) $ 769 $ (1,304) $ 428 $ (876) __________ (a) Other includes Corporate Other, Interest on Debt, and Special Items. 12

Selected Balance Sheet Information. The following tables provide supplemental balance sheet information (in millions): June 30, 2020 Company excluding Assets Ford Credit Ford Credit Eliminations Consolidated Cash and cash equivalents $ 18,151 $ 12,838 $ — $ 30,989 Marketable securities 21,105 5,036 — 26,141 Ford Credit finance receivables, net — 42,720 — 42,720 Trade and other receivables, net 3,065 6,042 — 9,107 Inventories 10,220 — — 10,220 Assets held for sale 670 50 — 720 Other assets 2,171 2,043 — 4,214 Receivable from other segments 253 2,157 (2,410) — Total current assets 55,635 70,886 (2,410 ) 124,111 Ford Credit finance receivables, net — 53,987 — 53,987 Net investment in operating leases 1,349 26,367 — 27,716 Net property 35,064 212 — 35,276 Equity in net assets of affiliated companies 4,539 112 — 4,651 Deferred income taxes 12,319 153 (1,406 ) 11,066 Other assets 9,613 2,946 — 12,559 Receivable from other segments 7 11 (18 ) — Total assets $ 118,526 $ 154,674 $ (3,834) $ 269,366 Company excluding Liabilities Ford Credit Ford Credit Eliminations Consolidated Payables $ 15,312 $ 1,048 $ — $ 16,360 Other liabilities and deferred revenue 19,233 1,559 — 20,792 Automotive debt payable within one year 2,084 — — 2,084 Ford Credit debt payable within one year — 53,260 — 53,260 Other debt payable within one year — — — — Liabilities held for sale 284 — — 284 Payable to other segments 2,410 — (2,410 ) — Total current liabilities 39,323 55,867 (2,410 ) 92,780 Other liabilities and deferred revenue 24,156 1,235 — 25,391 Automotive long-term debt 37,409 — — 37,409 Ford Credit long-term debt — 82,007 — 82,007 Other long-term debt 470 — — 470 Deferred income taxes 56 1,804 (1,406 ) 454 Payable to other segments 18 — (18 ) — Total liabilities $ 101,432 $ 140,913 $ (3,834 ) $ 238,511 13

Non-GAAP Financial Measures That Supplement GAAP Measures We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying business results and trends, and a means to assess our period-over- period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income attributable to Ford) – Earnings before interest and taxes (EBIT) excludes interest on debt (excl. Ford Credit Debt), taxes and pre-tax special items. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. Pre-tax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) significant personnel expenses, dealer-related costs, and facility-related charges stemming from efforts to match production capacity and cost structure to market demand and changing model mix, and (iii) other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income Margin) – Company Adjusted EBIT margin is Company Adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings Per Share (Most Comparable GAAP Measure: Earnings Per Share) – Measure of Company’s diluted net earnings per share adjusted for impact of pre-tax special items (described above), tax special items and restructuring impacts in noncontrolling interests. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of the underlying run rate of our business. When we provide guidance for adjusted earnings per share, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year- end, including pension and OPEB remeasurement gains and losses. • Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted Free Cash Flow (FCF) (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Automotive and Mobility capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, global redesign (including separations), and other items that are considered operating cash flows under GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company Adjusted FCF, we do not provide guidance for net cash provided by/(used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by/(used in) our operating activities. • Adjusted ROIC – Calculated as the sum of adjusted net operating profit after cash tax from the last four quarters, divided by the average invested capital over the last four quarters. This calculation provides management and investors with useful information to evaluate the Company’s after-cash tax operating return on its invested capital for the period presented. Adjusted net operating profit after cash tax measures operating results less special items, interest on debt (excl. Ford Credit Debt), and certain pension/OPEB costs. Average invested capital is the sum of average balance sheet equity, debt (excl. Ford Credit Debt), and net pension/OPEB liability. Note: Calculated results may not sum due to rounding 14

Net Income Reconciliation To Adjusted EBIT ($M) Q2 First Half Memo: 2019 2020 2019 2020 FY 2019 Net income / (loss) attributable to Ford (GAAP) $ 148 $ 1,117 $ 1,294 $ (876) $ 47 Income / (Loss) attributable to noncontrolling interests 2 1 39 1 37 Net income / (loss) $ 150 $ 1,118 $ 1,333 $ (875) $ 84 Less: (Provision for) / Benefit from income taxes (55) 34 (482) (813) 724 Income / (Loss) before income taxes $ 205 $ 1,084 $ 1,815 $ (62) $ (640) Less: Special items pre-tax (1,205) 3,480 (1,797) 3,193 (5,999) Income / (Loss) before special items pre-tax $ 1,410 $ (2,396) $ 3,612 $ (3,255) $ 5,359 Less: Interest on debt (244) (450) (489) (677) (1,020) Adjusted EBIT (Non-GAAP) $ 1,654 $ (1,946) $ 4,101 $ (2,578) $ 6,379 Memo: Revenue ($B) $ 38.9 $ 19.4 $ 79.2 $ 53.7 $ 155.9 Net income margin (GAAP) (%) 0.4% 5.8% 1.6% (1.6)% 0.0% Adjusted EBIT margin (Non-GAAP) (%) 4.3% (10.0)% 5.2% (4.8)% 4.1% Earnings Per Share Reconciliation To Adjusted Earnings Per Share Q2 First Half 2019 2020 2019 2020 Diluted After-Tax Results ($M) Diluted after-tax results (GAAP) $ 148 $ 1,117 $ 1,294 $ (876) Less: Impact of pre-tax and tax special items (989) 2,525 (1,574) 1,451 Less: Noncontrolling interests impact of Russia restructuring - - (35) - Adjusted net income - diluted (Non-GAAP) $ 1,137 $ (1,408) $ 2,903 $ (2,327) Basic and Diluted Shares (M) Basic shares (average shares outstanding) 3,984 3,975 3,979 3,969 Net dilutive options, unvested restricted stock units and restricted stock 29 17 26 - Diluted shares 4,013 3,992 4,005 3,969 Earnings per share - diluted (GAAP) $ 0.04 $ 0.28 $ 0.32 $ (0.22) Less: Net impact of adjustments (0.24) 0.63 (0.40) 0.37 Adjusted earnings per share - diluted (Non-GAAP)$ 0.28 $ (0.35) $ 0.72 $ (0.59) 15

Effective Tax Rate Reconciliation To Adjusted Effective Tax Rate 2020 Memo: Q2 First Half FY 2019 Pre-Tax Results ($M) Income / (Loss) before income taxes (GAAP) $ 1,084 $ (62) $ (640) Less: Impact of special items 3,480 3,193 (5,999) Adjusted earnings before taxes (Non-GAAP) $ (2,396) $ (3,255) $ (5,359) Taxes ($M) (Provision for) / Benefit from income taxes (GAAP) $ 34 $ (813) $ 724 Less: Impact of special items* (955) (1,742) 1,323 Adjusted (provision for) / benefit from income taxes (Non-GAAP)$ 989 $ 929 $ (599) Tax Rate (%) Effective tax rate (GAAP) (3.1)% (1,311)% 113.1% Adjusted effective tax rate (Non-GAAP) 41.3% 28.5% (11.2)% * Includes $(228) and $(1,084) in Q2 and YTD 2020, respectively, for the establishment of a valuation allowance Net Cash Provided By / (Used In) Operating Activities Reconciliation To Company Adjusted Free Cash Flow ($M) First Half Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 2019 2020 Net cash provided by / (used in) operating activities (GAAP)$ 3,544 $ 6,463 $ 4,732 $ 2,900 $ (473) $ 9,115 $ 10,007 $ 8,642 Less: Items Not Included in Company Adjusted Free Cash Flows Ford Credit operating cash flows 1,118 5,267 4,523 623 133 13,413 6,385 13,546 Funded pension contributions (294) (106) (211) (119) (175) (107) (400) (282) Global Redesign (including separations) (136) (222) (334) (219) (172) (99) (358) (271) Ford Credit tax payments / (refunds) under tax sharing agreement 98 - - 293 475 569 98 1,044 Other, net (120) 175 (124) 68 (15) (178) 55 (193) Add: Items Included in Company Adjusted Free Cash Flows Automotive and Mobility capital spending (1,620) (1,911) (1,787) (2,262) (1,770) (1,165) (3,531) (2,935) Ford Credit distributions 675 650 1,100 475 275 275 1,325 550 Settlement of derivatives (26) 86 16 31 (28) 64 60 36 Company Adjusted Free Cash Flow (Non-GAAP)$ 1,907 $ 174 $ 207 $ 498 $ (2,242) $ (5,309) $ 2,081 $ (7,551) 16

Adjusted ROIC Four Quarters Four Quarters Ended Q2 2019 Ended Q2 2020 ($B) ($B) Adjusted Net Operating Profit After Cash Tax Net income attributable to Ford $ 2.2 $ (2.1) Add: Noncontrolling interest 0.0 (0.0) Less: Income tax (0.7) 0.4 Add: Cash tax (0.8) (0.4) Less: Interest on debt (1.1) (1.2) Less: Total pension / OPEB income / (cost) (0.8) (2.0) Add: Pension / OPEB service costs (1.1) (1.1) Net operating profit after cash tax $ 3.0 $ (0.7) Less: Special items (excl. pension / OPEB) pre-tax (2.3) 1.4 Adj. net operating profit after cash tax $ 5.3 $ (2.1) Invested Capital Equity $ 36.1 $ 30.9 Redeemable noncontrolling interest - - Debt (excl. Ford Credit) 14.6 40.0 Net pension and OPEB liability 11.2 11.8 Invested capital (end of period) $ 62.0 $ 82.6 Average invested capital $ 62.7 $ 67.9 ROIC* 4.8% (1.1)% Adjusted ROIC (Non-GAAP)** 8.5% (3.1)% * Calculated as the sum of net operating profit after cash tax from the last four quarters, divided by the average invested capital over the last four quarters ** Calculated as the sum of adjusted net operating profit after cash tax from the last four quarters, divided by the average invested capital over the last four quarters 17

Special Items* ($B) Q2 First Half 2019 2020 2019 2020 Global Redesign Europe Excl. Russia $ (0.7) $ (0.1) $ (0.8) $ (0.2) India - (0.0) - (0.0) South America (0.2) (0.0) (0.4) (0.0) Russia (0.2) (0.0) (0.4) 0.0 China (0.0) (0.0) (0.0) (0.0) Separations and Other (Not Included Above) (0.0) (0.0) (0.1) (0.0) Subtotal Global Redesign $ (1.2) $ (0.1) $ (1.7) $ (0.2) Other Items Gain on Transation with Argo AI and VW $ - $ 3.5 $ - $ 3.5 Other, Incl. Focus Cancellation, Transit Connect Customs (0.0) (0.0) (0.1) (0.2) Ruling**, UAW Retirement Buyout and Chariot Subtotal Other Items $ (0.0) $ 3.5 $ (0.1) $ 3.2 Pension and OPEB Gain / (Loss) Pension and OPEB Remeasurement $ - $ 0.1 $ 0.0 $ 0.2 Pension Curtailment - (0.0) - (0.0) Subtotal Pension and OPEB Gain / (Loss) $ - $ 0.1 $ 0.0 $ 0.2 Total EBIT Special Items $ (1.2) $ 3.5 $ (1.8) $ 3.2 Cash Effects of Global Redesign (Incl. Separations) $ (0.2) $ (0.1) $ (0.4) $ (0.3) * The potential total Global Redesign impact may be up to $(11)B of EBIT charges and up to $(7)B cash effects, including $(3.7)B of EBIT and $(1.1)B of cash in prior years ** Transit Connect $(0.2)B impact accrued in Q3 2019 18

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions) For the periods ended June 30, 2019 2020 2019 2020 Second Quarter First Half (unaudited) Financing revenue Operating leases $ 1,472 $ 1,401 $ 2,949 $ 2,860 Retail financing 987 941 1,971 1,917 Dealer financing 596 341 1,204 826 Other financing 26 27 50 49 Total financing revenue 3,081 2,710 6,174 5,652 Depreciation on vehicles subject to operating leases (894 ) (990) (1,818 ) (2,042) Interest expense (1,114 ) (839 ) (2,235 ) (1,823 ) Net financing margin 1,073 881 2,121 1,787 Other revenue Insurance premiums earned 46 34 93 81 Fee based revenue and other 61 49 115 92 Total financing margin and other revenue 1,180 964 2,329 1,960 Expenses Operating expenses 350 305 714 667 Provision for credit losses 63 93 96 679 Insurance expenses 60 60 70 66 Total expenses 473 458 880 1,412 Other income / (loss), net 124 37 183 25 Income before income taxes 831 543 1,632 573 Provision for / (Benefit from) income taxes 218 136 416 145 Net income $ 613 $ 407 $ 1,216 $ 428 19

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, June 30, 2019 2020 (unaudited) ASSETS Cash and cash equivalents $ 9,067 $ 12,838 Marketable securities 3,296 5,036 Finance receivables, net Retail installment contracts, dealer financing, and other financing 106,131 96,418 Finance leases 8,186 7,500 Total finance receivables, net (includes allowance for credit losses of $513 and $1,285) 114,317 103,918 Net investment in operating leases 27,659 26,385 Notes and accounts receivable from affiliated companies 863 874 Derivative financial instruments 1,128 2,640 Assets held-for-sale 1,698 50 Other assets 3,398 3,535 Total assets $ 161,426 $ 155,276 LIABILITIES Accounts payable Customer deposits, dealer reserves, and other $ 1,002 $ 1,059 Affiliated companies 421 542 Total accounts payable 1,423 1,601 Debt 140,029 135,267 Deferred income taxes 2,593 1,804 Derivative financial instruments 356 668 Liabilities held-for-sale 45 — Other liabilities and deferred revenue 2,633 2,174 Total liabilities 147,079 141,514 SHAREHOLDER’S INTEREST Shareholder’s interest 5,227 5,227 Accumulated other comprehensive income / (loss) (785 ) (1,046) Retained earnings 9,905 9,581 Total shareholder’s interest 14,347 13,762 Total liabilities and shareholder’s interest $ 161,426 $ 155,276 20

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended June 30, 2019 2020 First Half (unaudited) Cash flows from operating activities Net Income $ 1,216 $ 428 Adjustments to reconcile net income to net cash provided in operations Provision for credit losses 96 679 Depreciation and amortization 2,214 2,436 Amortization of upfront interest supplements (1,062 ) (1,048 ) Net change in finance receivables held-for-sale — (74) Net change in deferred income taxes 82 (692 ) Net change in other assets (211) (27) Net change in other liabilities 571 (243 ) All other operating activities 3 31 Net cash provided by / (used in) operating activities $ 2,909 $ 1,490 Cash flows from investing activities Purchases of finance receivables (17,770 ) (20,424 ) Principal collections of finance receivables 20,888 19,377 Purchases of operating lease vehicles (6,500 ) (5,063 ) Proceeds from termination of operating lease vehicles 4,734 4,022 Net change in wholesale receivables and other short-duration receivables 896 9,953 Proceeds from sale of business — 1,340 Purchases of marketable securities (2,099 ) (4,139 ) Proceeds from sales and maturities of marketable securities 1,183 2,425 Settlements of derivatives 23 37 All other investing activities (24) (31) Net cash provided by / (used in) investing activities 1,331 7,497 Cash flows from financing activities Proceeds from issuances of long-term debt 24,983 20,146 Principal payments on long-term debt (24,298) (22,965) Change in short-term debt, net (565 ) (1,668 ) Cash distributions to parent (1,325) (550) All other financing activities (64 ) (41 ) Net cash provided by / (used in) financing activities (1,269) (5,078) Effect of exchange rate changes on cash, cash equivalents and restricted cash 24 (174 ) Net increase / (decrease) in cash, cash equivalents and restricted cash $ 2,995 $ 3,735 Cash, cash equivalents and restricted cash at beginning of period $ 9,747 $ 9,268 Net increase / (decrease) in cash, cash equivalents and restricted cash 2,995 3,735 Cash, cash equivalents and restricted cash at end of period $ 12,742 $ 13,003 21