Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | x-20200730.htm |

Second Quarter 2020 Earnings Presentation July 30, 2020 www.ussteel.com

Forward-looking Statements These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation for the second quarter of 2020. They should be read in conjunction with the consolidated financial statements and Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute ”forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward- looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” "should," “will,” "may" and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, U. S. Steel's future ability or plans to take ownership of the Big River Steel joint venture as a wholly owned subsidiary, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2020 and June 30, 2020, and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries. 2

Explanation of Use of Non-GAAP Measures We present adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share, (loss) earnings before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA and segment EBITDA, considered along with net (loss) earnings and segment (loss) earnings before interest and income taxes, are relevant indicators of trends relating to our operating performance and provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Net debt is a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. Both EBITDA and net debt are used by analysts to refine and improve the accuracy of their financial models which utilize enterprise value. Adjusted net (loss) earnings and adjusted net (loss) earnings per diluted share are non-GAAP measures that exclude the effects of items such as the Tubular asset impairment charge, restructuring and other charges, the gain on previously held investment in UPI, the Tubular inventory impairment, the December 24, 2018 Clairton coke making facility fire, the Big river Steel options mark to market, and the FIN 48 reserve that are not part of the Company's core operations (Adjustment Items). Adjusted EBITDA is also a non-GAAP measure that excludes the financial effects of the Adjustment Items. We present adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the Adjustment Items. U. S. Steel's management considers adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share and adjusted EBITDA should not be considered a substitute for net (loss) earnings, (loss) earnings per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. 3

BUSINESS UPDATE

Business Update SAFETY: Protecting lives and livelihoods LIQUIDITY: Fortifying the balance sheet STRATEGY: Executing our “best of both” strategy OPERATIONS: Supporting increased customer demand 5

Protecting lives and livelihoods guided by our S.T.E.E.L. Principles Safety First 2 Benchmarks : BLS - Iron & Steel: 0.70 AISI: 0.31 0.14 0.10 0.07 2018 2019 2020 YTD Days Away from Work1 1 Days Away from Work is defined as number of days away cases x 200,000 / hours worked 2 BLS – Iron & Steel 2018 data. AISI first 9 months of 2019 data 6

Protecting lives and livelihoods 360 o safety Physical Safety environment free from harm or injury Psychological Safety environment where individuals are encouraged to contribute their unique ideas and perspectives Incorporating all aspects of a safe working environment 7

Fortifying the balance sheet prioritizing cash and liquidity NET PROCEEDS NET PROCEEDS $977 $410 million million SECURED NOTES COMMON STOCK Approximately $1.4 billion of additional liquidity raised in 2Q 2020 8

Fortifying the balance sheet strong liquidity in an unprecedented market Total Liquidity as of June 30, 2020 6% 7% 0% Continued focus $2.7B cash and cost improvements Liquidity 87% Cash ($2,300M) U.S. ABL ($190M) USSK Facilities ($155M) Actively marketing UPI ABL ($7M)1 non-core assets2 1 The UPI Amended Credit Facility agreement was terminated on July 17, 2020 and the outstanding borrowings were repaid using cash on hand. UPI’s trade accounts receivables and inventory were added as collateral to our $2.0B Credit Facility Agreement. 9 2 Non-core assets include primarily real estate assets and USS-POSCO Industries (UPI) finishing business and related property

Fortifying the balance sheet liquidity drivers progressing as expected 2Q Key Components Actuals Status Comment EBITDA expected to improve Adjusted EBITDA ($264M) throughout second half 2020 as expected Working capital release of Working Capital $120M ~$250M in second half of 2020 as expected Capital spending of ~$300M in Capital Spending ($173M) second half of 2020 as expected Cash interest of ~$175M in Cash Interest ($51M) second half of 20201 as expected 1 Including incremental cash interest expense of $65M associated with the 12% senior secured notes issued on May 29, 2020. This was not part of the $700M liquidity requirements disclosure. 10

Executing our “best of both” strategy Big River remains our #1 strategic priority 3+ years call option 2x Well-positioned to increasing operating leverage acquire the remaining by doubling capacity1 50.1% stake in Big River Steel on-track ahead of schedule and on-budget2 1 Big River Steel Phase 2-A expansion will double capacity from 1.6 million net tons currently, to 3.3 million net tons by year end 2 Big River Steel Phase 2-A expansion 11

Executing our “best of both” strategy strategic projects status Strategic Projects Status Details On track to complete in the fourth EAF at Tubular quarter of 2020 Status Update Endless Casting and Project delayed for an indeterminate Rolling at Mon Valley period of time Remaining upgrades delayed for an Gary Hot Strip Mill indeterminate period of time Project delayed for an indeterminate Dynamo Line at USSK period of time Big River Steel remains our top strategic priority 12

Supporting increased customer demand informed by our order book Operating Idled Indefinitely Idled Total Idled Capacity1 Iron ore pellets Minntac Keetac 6.0 22.4 rolled Clairton cokemaking Extended coking times – 4.3 - Gary BF #4 BF #6 BF #82 BF #14 1.5 7.5 Granite City BF ‘A’ BF ‘B’ 1.4 2.8 Great Lakes3 BF ‘A1’ BF ‘B2’ BF ‘D4’ 3.8 3.8 N.American Flat Mon Valley BF #1 BF #3 – 2.9 Kosice BF #1 BF #2 BF #3 1.7 5.0 Europe Fairfield seamless pipe – 0.75 Lorain #3 seamless pipe 0.38 0.38 Tubular Lone Star #1 ERW #2 ERW 0.79 0.79 1 Raw steel capacity, except at Minntac and Keetac (iron ore pellet capacity), Clairton (coke capacity), and Fairfield, Lorain, and Lone Star (pipe capacity) 2 Gary BF #8 to be restarted on August 1, 2020 13 3 Great Lakes D4 blast furnace idled as of April 2020; blast furnace A1/B2 previously idled

MARKETMARKET UPDATEUPDATE

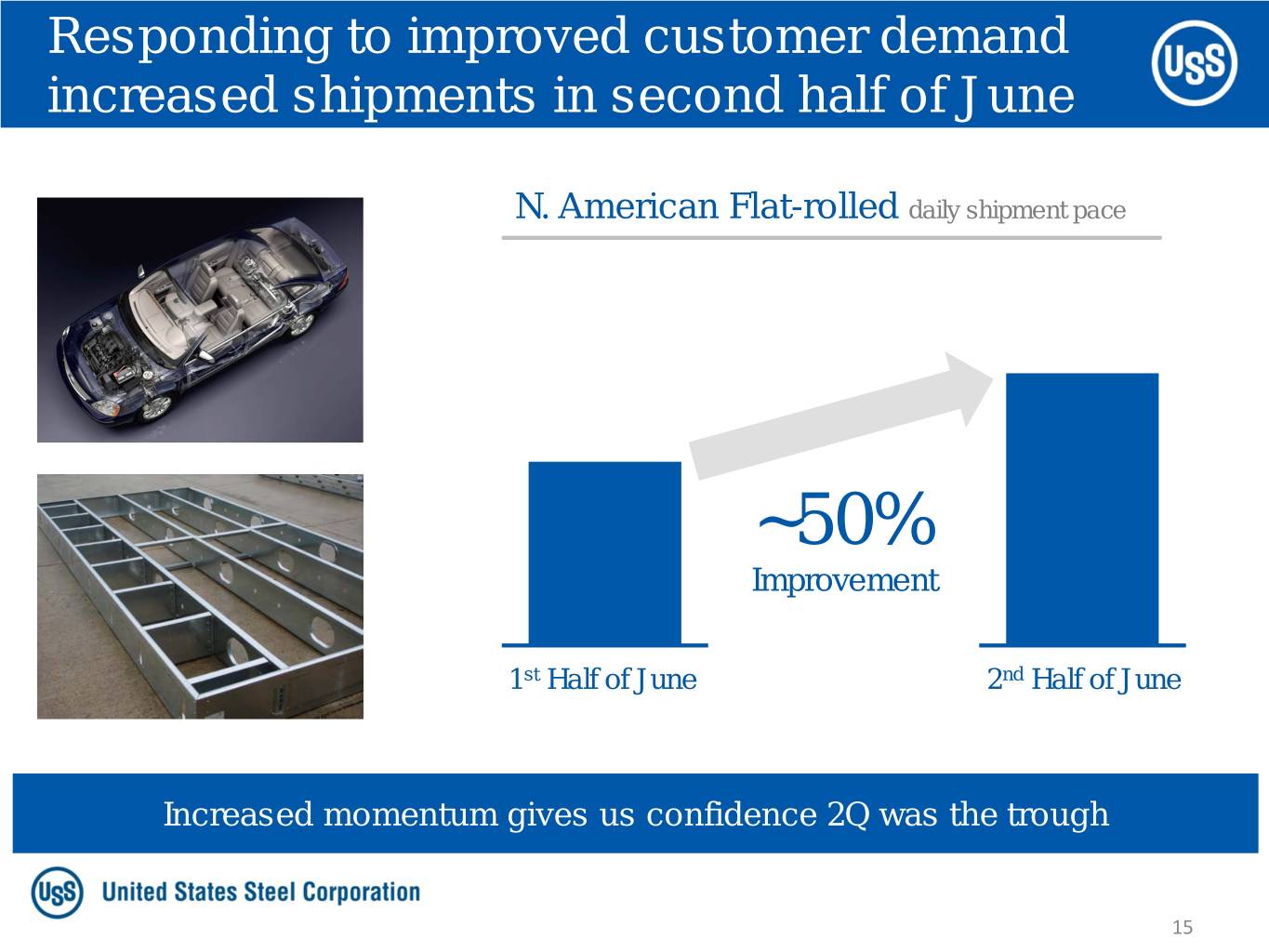

Responding to improved customer demand increased shipments in second half of June N. American Flat-rolled daily shipment pace ~50% Improvement 1st Half of June 2nd Half of June Increased momentum gives us confidence 2Q was the trough 15

Responding to improved customer demand encouraging signs of sustained improvement OEM restart activity accelerated in June and has sustained Automotive activity levels through July. Healthy production expected to continue in order to build vehicle inventory. 3Q construction order book has exceeded our expectations market - rolled and is expected to remain robust. Value-add construction - Construction demand for our Galvalume® product is particularly strong. end Flat Improving appliance demand was a factor in restarting blast N. American N. Appliance furnace #1 at Mon Valley in early June. Since then, the appliance-related orderbook has continued to improve. Automotive demand is improving with some EU countries Automotive supporting private car purchases. On-going improvement in passenger car registrations in June compared to April and May. Relatively resilient end-market throughout COVID-19 related market downturn. Current order book suggests this will continue to be - Construction the case. Europe end U. S. U. S. Steel Relatively resilient, similar to construction and packaging. Appliance Expected to normalize by 4Q 2020. OCTG demand remains under significant pressure as U.S. rig counts continue to decline. Oil prices have stabilized but market Oil & gas - remain at very low levels. Tubular end 16

SECOND QUARTER UPDATE

Second quarter 2020 financial highlights Reported Net (Loss) Earnings $ Millions Adjusted Net (Loss) Earnings $ Millions $68 $78 ($84) ($35) ($109) ($123) ($391) ($589) ($680) ($469) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Adjusted Profit 2% (3%) (24%) (14%) (28%) Profit 2% (1%) (4%) (4%) (22%) Margin: Margin: Segment EBIT1 $ Millions Adjusted EBITDA2 $ Millions $128 $278 $144 $64 ($17) $4 ($96) ($158) ($423) ($264) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Segment Adjusted EBIT 4% (1%) (6%) (3%) (20%) EBITDA 8% 5% 0% 2% (13%) Margin1: Margin2: Note: For reconciliation of non-GAAP amounts see Appendix 1 Earnings before interest and income taxes 2 Earnings before interest, income taxes, depreciation and amortization, and excluding adjustment items 18

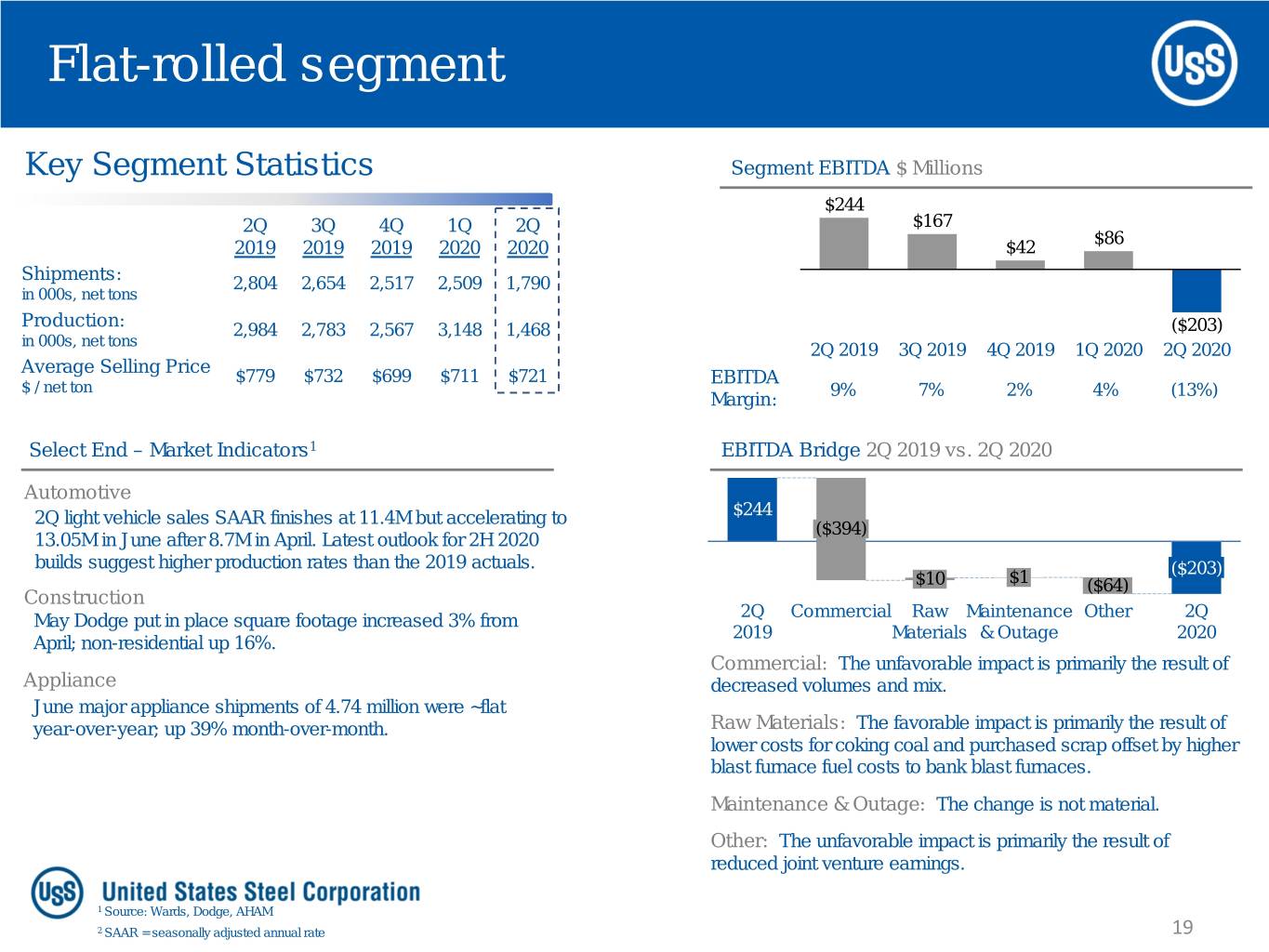

Flat-rolled segment Key Segment Statistics Segment EBITDA $ Millions $244 2Q 3Q 4Q 1Q 2Q $167 $86 2019 2019 2019 2020 2020 $42 Shipments: 2,804 2,654 2,517 2,509 1,790 in 000s, net tons Production: 2,984 2,783 2,567 3,148 1,468 ($203) in 000s, net tons 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Average Selling Price $779 $732 $699 $711 $721 EBITDA $ / net ton 9% 7% 2% 4% (13%) Margin: Select End – Market Indicators1 EBITDA Bridge 2Q 2019 vs. 2Q 2020 Automotive 2Q light vehicle sales SAAR finishes at 11.4M but accelerating to $244 ($394) 13.05M in June after 8.7M in April. Latest outlook for 2H 2020 builds suggest higher production rates than the 2019 actuals. ($203) $10 $1 ($64) Construction May Dodge put in place square footage increased 3% from 2Q Commercial Raw Maintenance Other 2Q 2019 Materials & Outage 2020 April; non-residential up 16%. Commercial: The unfavorable impact is primarily the result of Appliance decreased volumes and mix. June major appliance shipments of 4.74 million were ~flat year-over-year; up 39% month-over-month. Raw Materials: The favorable impact is primarily the result of lower costs for coking coal and purchased scrap offset by higher blast furnace fuel costs to bank blast furnaces. Maintenance & Outage: The change is not material. Other: The unfavorable impact is primarily the result of reduced joint venture earnings. 1 Source: Wards, Dodge, AHAM 2 SAAR = seasonally adjusted annual rate 19

U. S. Steel Europe segment Key Segment Statistics Segment EBITDA $ Millions $13 $9 2Q 3Q 4Q 1Q 2Q 2019 2019 2019 2020 2020 Shipments: ($3) 1,004 765 757 801 610 ($7) in 000s, net tons Production: 1,148 823 773 882 645 ($23) in 000s, net tons 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Average Selling Price $652 $656 $622 $611 $632 EBITDA $ / net ton 2% (4%) (1%) 2% (1%) Margin: Select End – Market Indicators1 EBITDA Bridge 2Q 2019 vs. 2Q 2020 Automotive $13 EU car production expected to decline 26% y-o-y in 2020. ($3) $11 The V4 region2 is projected to decline 22% y-o-y in 2020. ($48) $12 Construction $9 In 2020, the construction sector is expected to decline by 2Q Commercial Raw Maintenance Other 2Q 11.5% y-o-y. 2019 Materials & Outage 2020 Appliance Commercial: The unfavorable impact is primarily the result of decreased volumes and lower average realized prices. The EU appliance sector is expected to decline by 10.8% y-o-y. Raw Materials: The favorable impact is primarily the result of lower costs for iron ore pellets and coking coal. Maintenance & Outage: The favorable impact is primarily the result of cost control measures and fewer planned outages. Other: The favorable impact is primarily the result of non- recurring COVID-19 related government relief and lower energy costs. 1 Source: IHS, Euroconstruct, Eurofer 2 Visegrad Group – Czech Republic, Hungary, Poland, and Slovakia 20

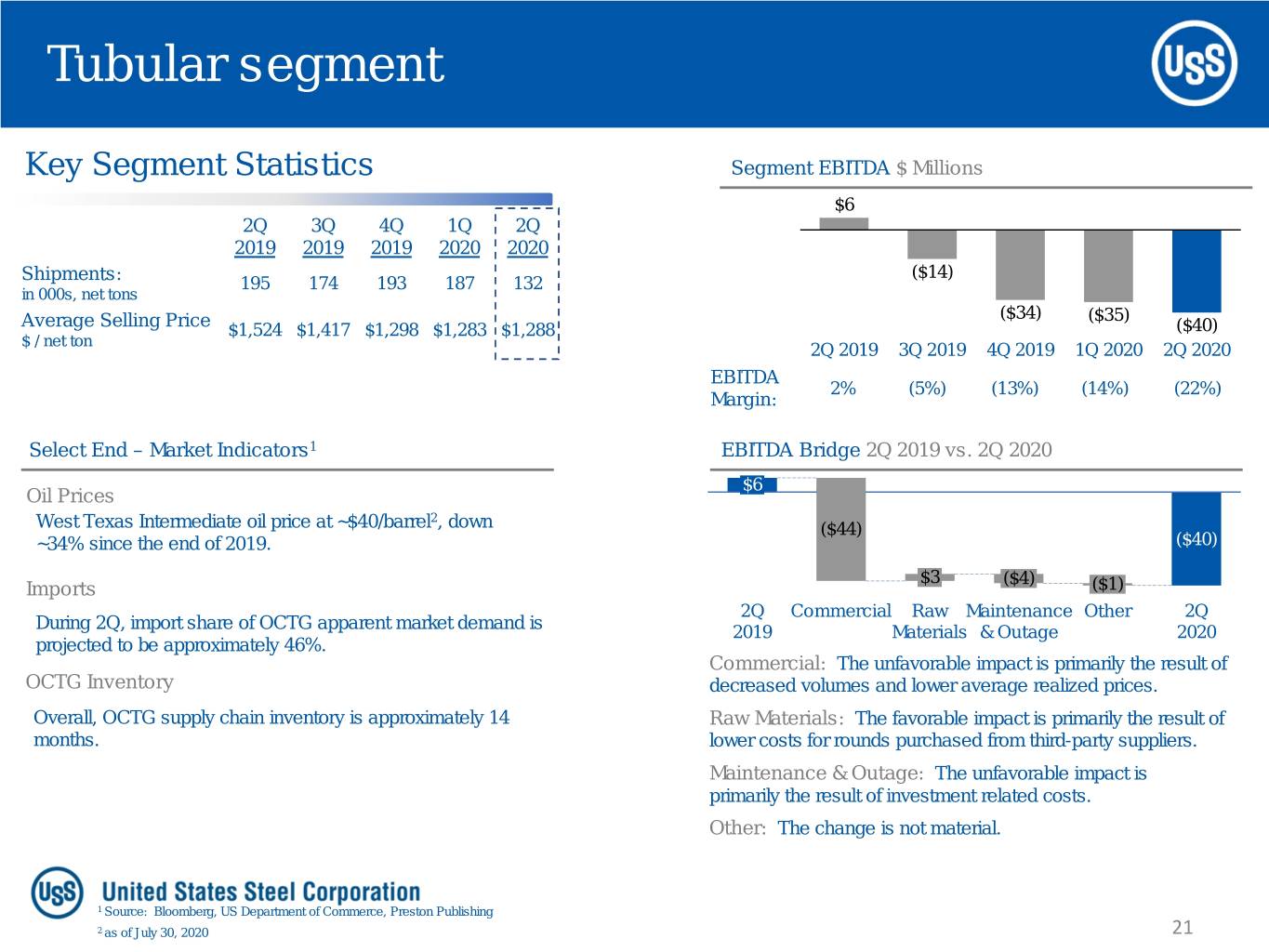

Tubular segment Key Segment Statistics Segment EBITDA $ Millions $6 2Q 3Q 4Q 1Q 2Q 2019 2019 2019 2020 2020 Shipments: ($14) 195 174 193 187 132 in 000s, net tons Average Selling Price ($34) ($35) $1,524 $1,417 $1,298 $1,283 $1,288 ($40) $ / net ton 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 EBITDA 2% (5%) (13%) (14%) (22%) Margin: Select End – Market Indicators1 EBITDA Bridge 2Q 2019 vs. 2Q 2020 $6 Oil Prices 2 West Texas Intermediate oil price at ~$40/barrel , down ($44) ~34% since the end of 2019. ($40) $3 ($4) Imports ($1) 2Q Commercial Raw Maintenance Other 2Q During 2Q, import share of OCTG apparent market demand is 2019 Materials & Outage 2020 projected to be approximately 46%. Commercial: The unfavorable impact is primarily the result of OCTG Inventory decreased volumes and lower average realized prices. Overall, OCTG supply chain inventory is approximately 14 Raw Materials: The favorable impact is primarily the result of months. lower costs for rounds purchased from third-party suppliers. Maintenance & Outage: The unfavorable impact is primarily the result of investment related costs. Other: The change is not material. 1 Source: Bloomberg, US Department of Commerce, Preston Publishing 2 as of July 30, 2020 21

Cash and liquidity Cash from Operations $ Millions Cash and Cash Equivalents $ Millions $938 $2,300 $826 $754 $682 $1,515 $1,553 $1,000 $749 ($362) YE 2016 YE 2017 YE 2018 YE 2019 1H 2020 YE 2016 YE 2017 YE 2018 YE 2019 1H 2020 Total Estimated Liquidity $ Millions Net Debt $ Millions $3,350 $3,299 $2,899 $2,892 $2,830 $2,652 $2,284 $1,516 $1,381 $1,150 YE 2016 YE 2017 YE 2018 YE 2019 1H 2020 YE 2016 YE 2017 YE 2018 YE 2019 1H 2020 22

APPENDIX

Second quarter segment EBITDA bridges 1Q 2020 vs 2Q 2020 Flat-rolled $ Millions The unfavorable impact is primarily the result of $86 Commercial: decreased volumes and mix. ($244) ($203) Raw Materials: The unfavorable impact is primarily the result of higher blast furnace fuel costs to bank blast furnaces. ($9) $2 ($38) 1Q Commercial Raw Maintenance Other 2Q Maintenance & Outage: The change is not material. 2020 Materials & Outage 2020 Other: The unfavorable impact is primarily the result of reduced joint venture earnings. U. S. Steel Europe $ Millions Commercial: The unfavorable impact is primarily the result of $9 ($11) decreased volumes. ($3) Raw Materials: The unfavorable impact is primarily the result of ($4) mix of raw materials. $8 ($5) Maintenance & Outage: The unfavorable impact is primarily the 1Q Commercial Raw Maintenance Other 2Q result of increased planned outages. 2020 Materials & Outage 2020 Other: The favorable impact is primarily the result of non-recurring COVID-19 related government relief and lower energy costs. Tubular $ Millions Commercial: The unfavorable impact is primarily the result of decreased volumes. ($35) ($40) Raw Materials: The change is not material. ($7) ($1) ($1) $4 Maintenance & Outage: The change is not material. 1Q Commercial Raw Maintenance Other 2Q 2020 Materials & Outage 2020 Other: The favorable impact is primarily the result of reduced SG&A costs. 24

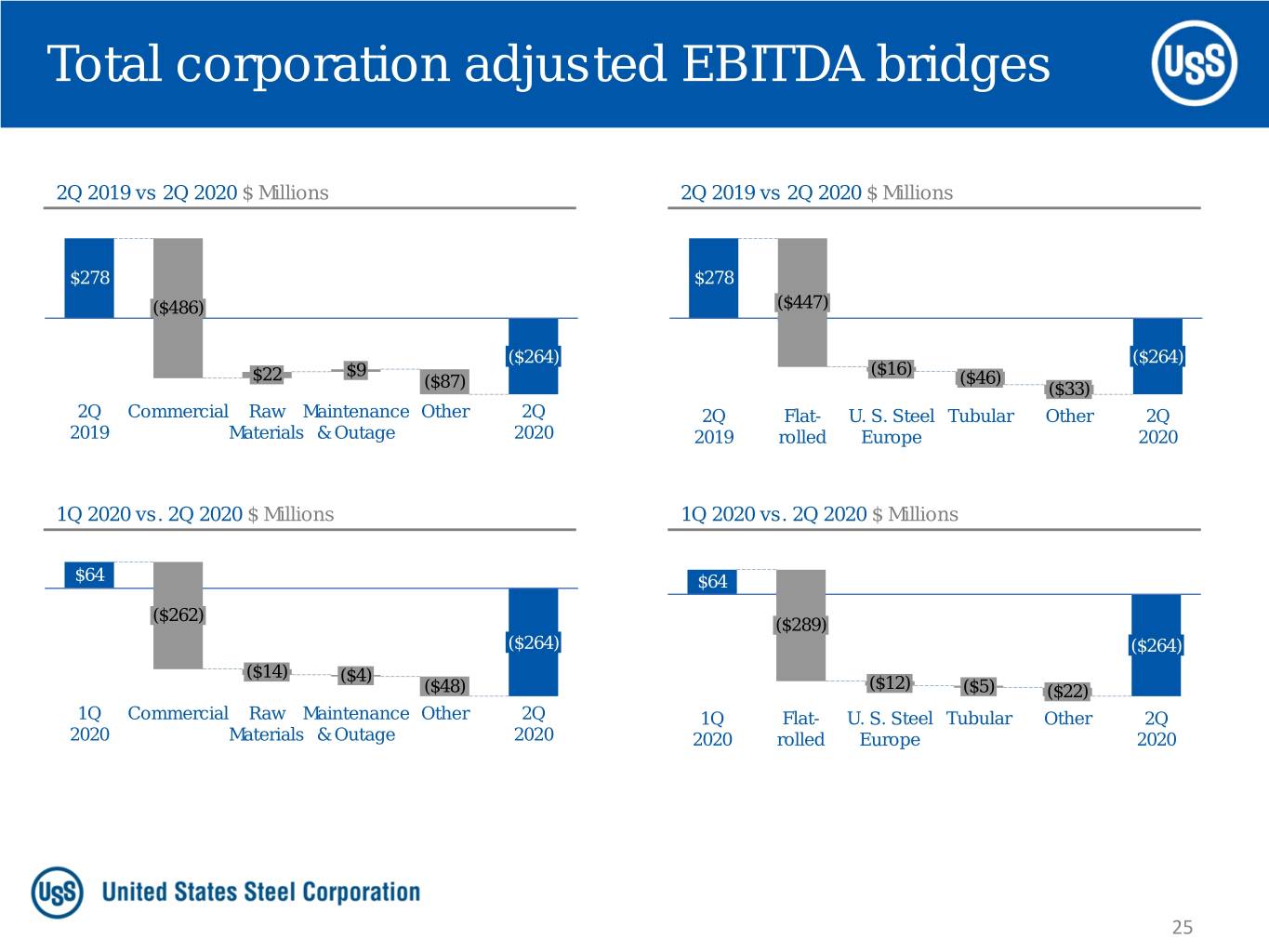

Total corporation adjusted EBITDA bridges 2Q 2019 vs 2Q 2020 $ Millions 2Q 2019 vs 2Q 2020 $ Millions $278 $278 ($486) ($447) ($264) ($264) ($16) $22 $9 ($46) ($87) ($33) 2Q Commercial Raw Maintenance Other 2Q 2Q Flat- U. S. Steel Tubular Other 2Q 2019 Materials & Outage 2020 2019 rolled Europe 2020 1Q 2020 vs. 2Q 2020 $ Millions 1Q 2020 vs. 2Q 2020 $ Millions $64 $64 ($262) ($289) ($264) ($264) ($14) ($4) ($48) ($12) ($5) ($22) 1Q Commercial Raw Maintenance Other 2Q 1Q Flat- U. S. Steel Tubular Other 2Q 2020 Materials & Outage 2020 2020 rolled Europe 2020 25

Reconciliation of segment EBITDA Flat-rolled ($millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Segment (loss) earnings before interest and income taxes $134 $46 ($79) ($35) ($329) Depreciation 110 121 121 121 126 Flat-rolled Segment EBITDA $244 $167 $42 $86 ($203) U. S. Steel Europe ($ millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Segment (loss) earnings before interest and income taxes ($10) ($46) ($30) ($14) ($26) Depreciation 23 23 23 23 23 U. S. Steel Europe Segment EBITDA $13 ($23) ($7) $9 ($3) Tubular ($ millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Segment (loss) earnings before interest and income taxes ($6) ($25) ($46) ($48) ($47) Depreciation 12 11 12 13 7 Tubular Segment EBITDA $6 ($14) ($34) ($35) ($40) Other Businesses ($ millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Segment (loss) earnings before interest and income taxes $10 $8 ($3) $1 ($21) Depreciation 5 6 6 3 3 Other Businesses Segment EBITDA $15 $14 $3 $4 ($18) 26

Reconciliation of net debt Net Debt YE 2016 YE 2017 YE 2018 YE 2019 1H 2020 ($ millions) Short-term debt and current maturities of long-term $50 $3 $65 $14 $94 debt Long-term debt, less unamortized discount and debt 2,981 2,700 2,316 3,627 5,505 issuance costs Total Debt $3,031 $2,703 $2,381 $3,641 $5,599 Less: Cash and cash equivalents 1,515 1,553 1,000 749 2,300 Net Debt $1,516 $1,150 $1,381 $2,892 $3,299 27

Reconciliation of reported and adjusted net earnings ($ millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Reported net (loss) earnings attributable to U. S. Steel $68 ($84) ($680) ($391) ($589) Tubular asset impairment charges ─ ─ ─ 263 ─ Restructuring and other charges ─ 42 221 41 82 Gain on previously held investment in UPI ─ ─ ─ (25) ─ Tubular inventory impairment ─ ─ ─ ─ 24 December 24, 2018 Clairton coke making facility fire 10 7 (3) ─ (4) Big River Steel options mark to market ─ ─ 7 (11) 5 Tax valuation allowance ─ ─ 346 ─ ─ FIN 48 reserve ─ ─ ─ ─ 13 Adjusted net (loss) earnings attributable to U. S. Steel $78 ($35) ($109) ($123) ($469) 28

Reconciliation of adjusted EBITDA ($ millions) 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Reported net (loss) earnings attributable to U. S. Steel $68 ($84) ($680) ($391) ($589) Income tax provision (benefit) (7) (44) 233 (19) (5) Net interest and other financial costs 54 48 71 35 62 Reported (loss) earnings before interest and income taxes $115 ($80) ($376) ($375) ($532) Depreciation, depletion and amortization expense 150 161 162 160 159 EBITDA $265 $81 ($214) ($215) ($373) Tubular asset impairment charges ─ ─ ─ 263 ─ Restructuring and other charges ─ 54 221 41 89 Gain on previously held investment in UPI ─ ─ ─ (25) ─ Tubular inventory impairment ─ ─ ─ ─ 24 December 24, 2018 Clairton coke making facility fire 13 9 (3) ─ (4) Adjusted EBITDA $278 $144 $4 $64 ($264) 29

INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 klewis@uss.com Eric Linn Senior Manager 412-433-2385 eplinn@uss.com www.ussteel.com