Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PROS Holdings, Inc. | irfactsheetq22020.htm |

| EX-99.1 - EX-99.1 - PROS Holdings, Inc. | a2020q2ex991prosearnin.htm |

| 8-K - 8-K - PROS Holdings, Inc. | pro-20200730.htm |

PROS Holdings Q2 2020 NYSE: PRO

Disclaimer / Forward-Looking Statements Included in this presentation are forward-looking statements including, but not limited to, those related to earnings, addressable market and other financial projections. These predictions, estimates, and other forward-looking statements involve known and unknown risks and uncertainties that may cause actual results to differ materially from those expressed or implied in this presentation. We refer you to the documents we file with the Securities and Exchange Commission, which identify and discuss important factors that could cause actual results to differ materially from those discussed in these forward-looking statements. All statements included in these materials are based upon information known as of the date hereof, and PROS Holdings assumes no obligation to update any such statements, except as required by law. This presentation includes certain supplemental non-GAAP financial measures, that we believe are useful to investors as useful tools for assessing the comparability between periods as well as company by company. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, our financial information and results prepared in accordance with U.S. GAAP included in our periodic filings made with the SEC. Further information relevant to the interpretation of non-GAAP financial measures, and reconciliations of these non-GAAP financial measures to the most comparable GAAP measures, may be found in the Appendix to this presentation. Page 2 ©2020 PROS Holdings, Inc. All rights reserved.

Our Vision To be the dynamic AI platform powering commerce in the digital economy

PROS Strategic Pillars Help our people to learn and grow Drive an incredible customer experience, adoption & value Accelerate market penetration & customer expansions Lead AI innovation powering digital commerce 2020 Focus: Operationalize for Growth & Scale Page 4

©2020 PROS Holdings, Inc. All rights reserved.

PROS at a Glance $260mm+ 93%+ 37% Total Revenue 2019 Customer Gross Subscription Revenue LTM Revenue Retention Rate Growth LTM 85% 60+ ~1.7T Q2 Recurring Revenue Countries with Transactions as a % of Total Revenue Customers Processed in 2019 Page 6 ©2020 PROS Holdings, Inc. All rights reserved.

Disruption Is Driving Opportunity for Digital Leaders 70% 7 out of 10 B2B buyers are and only 1of 3 buyers feel their vendors shifting their wallet share… were well prepared to support them virtually June 2020 Survey of 210 B2B Purchasing Professionals conducted by Hanover Research, commissioned by PROS. Page 7 ©2020 PROS Holdings, Inc. All rights reserved.

PROS AI Solutions Power Companies to Compete and Win in Today’s Digital Economy ©2020 PROS Holdings, Inc. All rights reserved.

DIGITAL CHANNELS CRM Cross-sell Merchandising Social Buyer Web Configuration Products & Offers Mobile Quoting & Shopping Cart Marketplaces TRADITIONAL eCommerce CHANNELS Price Optimization Stores Dynamic Pricing Sales Partners Demand Forecasting PROS Provides ERP Price Management Intelligence Supply Optimization to Commerce Opportunity Identification

Powerful, Flexible, & Self-Learning AI Capabilities Automotive Chemicals Food & Travel & Industrial B2B Services & Energy Consumables Healthcare Technology Without manual Predicts, intervention Understands Learns from Personalizes prescribes, Improves a user’s data and and adapts and continuously context actions automates Leveraging AI Technology + + All the information Computational Machine learning and available power of the cloud other algorithms Pagepage 10 ©2020 PROS Holdings, Inc. All rights reserved.

PROS Powers Commerce in the Digital Economy There are small cost investment, With PROS, dealers can order directly In the emerging digital selling landscape, large impact, like Salesforce, PROS from an electronic catalog to configure customers are looking for frictionless as a pricing tool, Tableau as an and place orders, ensuring a real-time buying experiences, with immediate analytical tool. sales experience and complete order responses about pricing and delivery. accuracy. PROS has proved to be an excellent Lance Fritz partner, committed to our success. Chief Executive Officer Randy Carey, Q2 2020 Earnings Call Vice President, Digital Transformation Jean-Phillippe Bitouzet, Supply Chain & Business Model Director Page 11 ©2020 PROS Holdings, Inc. All rights reserved.

We Power Commerce for Leading Enterprises Across Industries Automotive Chemicals Food & Travel & Industrial B2B Services & Energy Consumables Healthcare Technology Page 12 ©2020 PROS Holdings, Inc. All rights reserved.

PROS TAM is Massive, Global, and Growing Underpenetrated, $30B+ Addressable Market(1) Strategic Industries Emerging Industries $9B and Geographies + $21B and Geographies $2.4B Automotive & Industrial $1.0B B2B Services $1.6B Food & Consumables $800mm Technology $1.3B Healthcare $700mm Chemicals & Energy $1.2B Travel Note: (1) TAM represents our estimated global total revenue and market opportunity but does not represent the actual market opportunity that we may target or ultimately service or otherwise derive revenue from. Our estimate of TAM may be revised in the future depending on a variety of factors, including competitive dynamics, our sales efforts, customer needs, industry shifts and other economic factors. Page 13 ©2020 PROS Holdings, Inc. All rights reserved.

Numerous Vectors for Growth Continued Product Innovation Cross/Up-Sell Existing Customers Land New Logos Migrate Legacy Customers to Cloud Strategic M&A Page 14 ©2020 PROS Holdings, Inc. All rights reserved.

©2020 PROS Holdings, Inc. All rights reserved.

Second Quarter 2020 Earnings Recap Q2 Q2 LTM LTM $mm (Except Per Share) Delta Delta 2020 2019 06/30/20 06/30/19 Total Revenue $63.7 $63.9 - $260.4 $221.7 17% Subscription Revenue $42.4 $35.1 21% $164.8 $120.0 37% Adjusted EBITDA ($5.7) ($1.8) ($3.9) ($24.0) ($13.3) ($10.7) Free Cash Flow ($23.5) ($5.2) ($18.3) ($35.1) ($3.4) ($31.7) Non-GAAP Net Loss Per Share ($0.14) ($0.07) ($0.07) ($0.54) ($0.37) ($0.17) For a reconciliation of GAAP to Non-GAAP metrics refer to the appendix. Page 16 ©2020 PROS Holdings, Inc. All rights reserved.

Strong and Consistent Cloud Growth Trajectory ($mm) Subscription Revenue ARR Recurring Revenue 43% CAGR 22% CAGR 20% CAGR 220 204 189 161 163 145 136 122 119 99 66 50 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 Note(s): ARR is one of PROS key performance metrics and should be viewed independently of revenue or other similar GAAP measure. ARR is defined, as of a specific date, as contracted recurring revenue, including contracts with a future start date, together with annualized overage fees incurred above contracted minimum transactions, and excluding perpetual and term license agreements recognized as license revenue in accordance with GAAP. Estimated ARR does not represent actual market or revenue opportunity, and such estimates may be revised in the future depending on a variety of factors, including competitive dynamics, our sales efforts, customer needs, industry shifts and other economic factors. As of 1/1/2020, license revenue and license cost of revenue are now combined with subscription revenue and subscription cost of revenue, respectively. Page 17 ©2020 PROS Holdings, Inc. All rights reserved.

Globally Diversified Business United States Europe Rest of World 34% 30% 36% of 2019 Total Revenue of 2019 Total Revenue of 2019 Total Revenue Page 18 ©2020 PROS Holdings, Inc. All rights reserved.

Investment Highlights • Leading end-to-end AI platform powering digital commerce • We believe the massive market opportunity is at an inflection point • Real-time, mission critical solutions delivering powerful customer ROI • Loyal customer base consisting of leading blue-chip companies • Deep competitive moat built through 30 years of AI leadership • Rapidly growing, highly visible subscription revenue • Strong culture of innovation and execution Page 19 ©2020 PROS Holdings, Inc. All rights reserved.

©2020 PROS Holdings, Inc. All rights reserved.

Helping People and Companies Outperform We are OWNERS We are INNOVATORS We CARE Looking for every opportunity to Thinking creatively to find Putting people first - our customers, create a better PROS and a better new paths to success for our employees, partners, and community - experience for our customers, and people, our customers, and it’s how our company was started, and we hold ourselves accountable our business how we’ll always run it Page 21 ©2020 PROS Holdings, Inc. All rights reserved.

Strong and Experienced Leadership Team Andres Reiner Stefan Schulz Les Rechan President & CEO Chief Financial Officer Chief Operating Officer 25+ years in enterprise 25+ years in enterprise 30+ years in enterprise technology technology including 20 technology including PROS, including PROS, Solace, Halogen years at PROS BMC, Lawson, & Digital River Software & IBM John Allessio Nikki Brewer Celia Fleischaker Chief Customer Officer Chief People Officer Chief Marketing Officer 30+ years in customer 15+ years in HR & Total Rewards 20+ years in enterprise success and enterprise including 3 years at PROS technology including PROS technology at Red Hat & IBM & Epicor Rob Reiner Scott Cook Damian Olthoff Chief Technology Officer Chief Accounting Officer General Counsel & Secretary 20+ years in enterprise 20+ years in accounting and 20+ years in corporate law technology including PROS, finance at PROS including 8 years at PROS BMC & NetIQ ©2020 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Employee Resource Groups: The Heart of Our Culture Our Employee Resource Groups (ERGs) are formed and led by employees, with company support, and any interested employee may join any group. Organized around common life experiences and backgrounds, they serve to champion our diversity initiatives and facilitate a workplace culture of equality and inclusion. Dedicated to the professional development of women at PROS and in the surrounding tech community. Created to attract, develop and retain Black talent at PROS. Represents the interests of the PROS and local Hispanic community while also celebrating the culture and values. Serves as a resource that positively influences and ensures the development of its LGBTQIA+ members. Connects the community of young professionals across PROS to foster growth and development of leadership skills. Page 23 ©2020 PROS Holdings, Inc. All rights reserved.

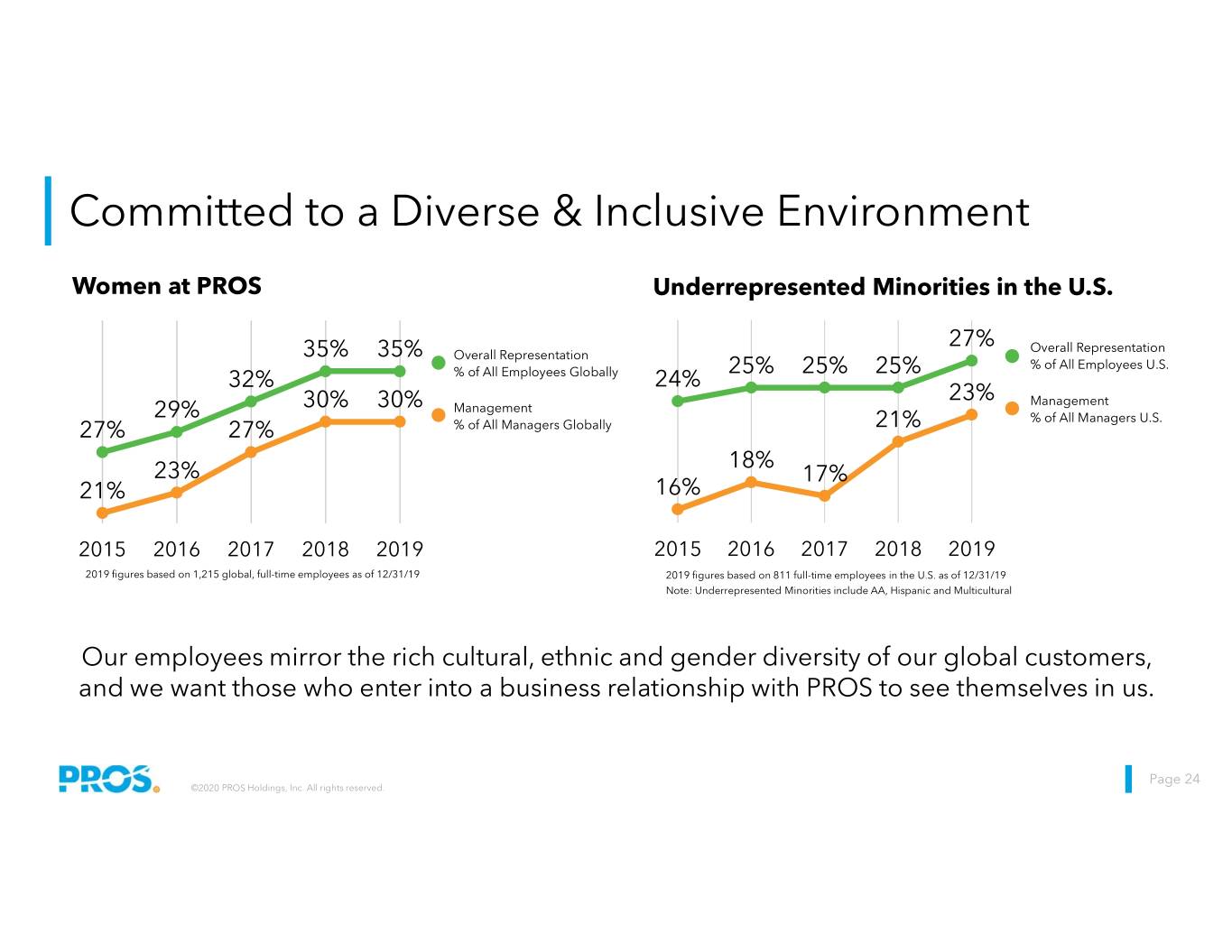

Committed to a Diverse & Inclusive Environment Women at PROS Underrepresented Minorities in the U.S. 27% Overall Representation 35% 35% Overall Representation 25% 25% 25% % of All Employees U.S. 32% % of All Employees Globally 24% 23% Management 30% 30% Management 29% % of All Managers U.S. 27% 27% % of All Managers Globally 21% 18% 23% 17% 21% 16% 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2019 figures based on 1,215 global, full-time employees as of 12/31/19 2019 figures based on 811 full-time employees in the U.S. as of 12/31/19 Note: Underrepresented Minorities include AA, Hispanic and Multicultural Our employees mirror the rich cultural, ethnic and gender diversity of our global customers, and we want those who enter into a business relationship with PROS to see themselves in us. Page 24 ©2020 PROS Holdings, Inc. All rights reserved.

Committed to a Sustainable Business Our Corporate Social Responsibility Report outlines our vision and strategy for creating a sustainable business that prioritizes our responsibilities to the world in which we live. Green Office Spaces Our new global headquarters is LEED Silver certified and designed to minimize carbon emissions, conserve energy and water resources, as well as maximize natural light dispersion. Sustainable Data Centers Worldwide By partnering with Microsoft, we deliver our innovative solutions via data centers that operate using at least 50% green energy sources and are 100% carbon neutral. Recycling Efforts All PROS offices have a robust recycling program. Office-wide recycling efforts vary by location, but include such items as paper, plastic, glass, and aluminum, as well as common office consumables. Page 25 ©2020 PROS Holdings, Inc. All rights reserved.

Contact Us Email: ir@pros.com Phone: 832.924.4781 Web: pros.com Page 26 ©2020 PROS Holdings, Inc. All rights reserved.

©2020 PROS Holdings, Inc. All rights reserved.

GAAP to Non-GAAP Quarter over Year over Three Months Ended June 30, Quarter Six Months Ended June 30, Year Reconciliation 2020 2019 % change 2020 2019 % change (Unaudited) GAAP gross profit $ 37,797 $ 40,295 (6) % $ 75,381 $ 75,636 — % Non-GAAP adjustments: New headquarters noncash rent expense 156 160 318 313 Amortization of acquisition-related intangibles 948 993 1,790 2,027 Share-based compensation 502 494 1,026 1,032 Non-GAAP gross profit $ 39,403 $ 41,942 (6) % $ 78,515 $ 79,008 (1) % Non-GAAP gross margin 61.8 % 65.7 % 60.4 % 65.8 % GAAP loss from operations $ (15,139) $ (12,145) 25 % $ (36,491) $ (25,755) 42 % Non-GAAP adjustments: Debt extinguishment fees — 319 — 319 New headquarters noncash rent expense 554 555 1,109 1,109 Amortization of acquisition-related intangibles 1,375 1,425 2,758 3,008 Share-based compensation 5,752 5,979 12,099 12,025 Total Non-GAAP adjustments 7,681 8,278 15,966 16,461 Non-GAAP loss from operations $ (7,458) $ (3,867) 93 % $ (20,525) $ (9,294) 121 % Non-GAAP loss from operations % of total revenue (11.7) % (6.1) % (15.8) % (7.7) % GAAP net loss $ (17,208) $ (17,517) (2) % $ (39,943) $ (34,434) 16 % Non-GAAP adjustments: Total Non-GAAP adjustments affecting loss from operations 7,681 8,278 15,966 16,461 Amortization of debt discount and issuance costs 1,726 3,168 3,428 6,274 Loss on debt extinguishment — 2,266 — 2,266 Tax impact related to non-GAAP adjustments 1,818 1,022 4,741 2,433 Non-GAAP net loss $ (5,983) $ (2,783) 115 % $ (15,808) $ (7,000) 126 % Non-GAAP diluted loss per share $ (0.14) $ (0.07) $ (0.37) $ (0.18) Shares used in computing non-GAAP loss per share 43,304 39,413 43,203 38,518 Page 28 ©2020 PROS Holdings, Inc. All rights reserved.

GAAP to Non-GAAP Reconciliation (Unaudited) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 GAAP Loss from Operations $ (15,139) $ (12,145) $ (36,491) $ (25,755) Amortization of acquisition-related intangibles 1,375 1,425 2,758 3,008 New headquarters noncash rent expense 554 555 1,109 1,109 Debt extinguishment fees — 319 — 319 Share-based compensation 5,752 5,979 12,099 12,025 Depreciation and other amortization 2,138 2,079 4,175 3,821 Capitalized internal-use software development costs (394) — (806) (868) Adjusted EBITDA $ (5,714) $ (1,788) $ (17,156) $ (6,341) Net cash used in operating activities $ (22,782) $ (3,549) $ (46,955) $ (11,644) Purchase of property and equipment (excluding new headquarters) (306) (1,658) (1,263) (2,269) Purchase of intangible asset — — — (50) Capitalized internal-use software development costs (394) — (806) (868) Free Cash Flow $ (23,482) $ (5,207) $ (49,024) $ (14,831) Page 29 ©2020 PROS Holdings, Inc. All rights reserved.

GAAP to Non-GAAP Reconciliation (Unaudited) Page 30 ©2020 PROS Holdings, Inc. All rights reserved.

GAAP to Non-GAAP Reconciliation (Unaudited) Page 31 ©2020 PROS Holdings, Inc. All rights reserved.

Quarter Three Months Ended over Year over December 31, Quarter Year Ended December 31, Year 2019 2018 % change 2019 2018 % change GAAP to Non-GAAP GAAP gross profit $ 37,814 $ 33,155 14% $ 151,217 $ 119,845 26 % Non-GAAP adjustments: Reconciliation New headquarters noncash rent expense 167 48 646 48 Amortization of acquisition-related intangibles 907 1,077 3,895 4,624 (Unaudited) Share-based compensation 490 396 2,025 1,721 Non-GAAP gross profit $ 39,378 $ 34,676 14% $ 157,783 $ 126,238 25 % Non-GAAP gross margin 59.5 % 65.9 % 63.0 % 64.1 % GAAP loss from operations $ (15,071) $ (9,609) 57% $ (53,338) $ (49,215) 8 % Non-GAAP adjustments: Acquisition-related expenses 254 — 502 95 Debt extinguishment fees — — 319 — New headquarters noncash rent expense 555 185 2,218 185 Amortization of acquisition-related intangibles 1,398 1,694 5,831 7,396 Share-based compensation 6,446 5,098 24,680 21,453 Total Non-GAAP adjustments 8,653 6,977 33,550 29,129 Non-GAAP loss from operations $ (6,418) $ (2,632) 144% $ (19,788) $ (20,086) (1 )% Non-GAAP loss from operations % of total revenue (9.7)% (5.0)% (7.9)% (10.2)% GAAP net loss $ (17,300) $ (12,760) 36% $ (69,081) $ (64,246) 8 % Non-GAAP adjustments: Total Non-GAAP adjustments affecting loss from operations 8,653 6,977 33,550 29,129 Amortization of debt discount and issuance costs 1,945 3,065 11,074 11,986 Loss on debt extinguishment 660 — 5,660 — Tax impact related to non-GAAP adjustments 1,375 617 4,623 5,244 Non-GAAP net loss $ (4,667) $ (2,101) 122% $ (14,174) $ (17,887) (21 )% Non-GAAP diluted loss per share $ (0.11) $ (0.06) $ (0.35) $ (0.52) Shares used in computing non-GAAP loss per share 42,615 37,154 40,232 34,465 Page 32 ©2020 PROS Holdings, Inc. All rights reserved.

GAAP to Non-GAAP Reconciliation (Unaudited) Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 Adjusted EBITDA GAAP Loss from Operations $ (15,071 ) $ (9,609) $ (53,338) $ (49,215 ) Acquisition-related expenses 254 — 502 95 Amortization of acquisition-related intangibles 1,398 1,694 5,831 7,396 New headquarters noncash rent expense 555 185 2,218 185 Debt extinguishment fees — — 319 — Share-based compensation 6,446 5,098 24,680 21,453 Depreciation and other amortization 2,208 1,576 8,039 5,659 Capitalized internal-use software development costs (415) (927) (1,436) (4,613) Adjusted EBITDA $ (4,625 ) $ (1,983) $ (13,185) $ (19,040 ) Free Cash Flow Net cash provided by operating activities $ 12,852 $ 15,188 $ 5,245 $ 5,703 Purchase of property and equipment (excluding new headquarters) (1,481) (69) (4,626) (1,475) Purchase of intangible asset — (125) (50) (125) Capitalized internal-use software development costs (415) (927) (1,436) (4,613) Free Cash Flow $ 10,956 $ 14,067 $ (867) $ (510 ) Page 33 ©2020 PROS Holdings, Inc. All rights reserved.