Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - EVERSOURCE ENERGY | tm2026105d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - EVERSOURCE ENERGY | tm2026105d1_ex99-1.htm |

| 8-K - FORM 8-K - EVERSOURCE ENERGY | tm2026105-1_8k.htm |

Exhibit 99.3

2020 Second Quarter Results July 31, 2020

Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities allocat ed to such business, but rather represent a direct interest in Eversource Energy's assets and liabilities as a whole. EPS by business is a non - GAAP (not determined using generall y accepted accounting principles) measure that is calculated by dividing the net income or loss attributable to common shareholders of each business by the wei ght ed average diluted Eversource Energy common shares outstanding for the period. Earnings discussions also include non - GAAP financial measures referencing 2020 earnin gs and EPS excluding certain acquisition costs and Q2 2019 earnings and EPS excluding the NPT impairment charge. Eversource Energy uses these non - GAAP finan cial measures to evaluate and provide details of earnings results by business and to more fully compare and explain 2020 and 2019 results without including th ese items. Management believes the acquisition costs and the NPT impairment charge are not indicative of Eversource Energy’s ongoing costs and performance. Due to the nature and significance of these items on net income attributable to common shareholders, management believes that the non - GAAP presentation is a more meaningful representation of Eversource Energy’s financial performance and provides additional and useful information to readers in analyzing historical and future p erf ormance of the business. Non - GAAP financial measures should not be considered as alternatives to Eversource Energy’s consolidated net income attributable to co mmo n shareholders or EPS determined in accordance with GAAP as indicators of Eversource Energy’s operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, as sumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statem ents” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of w ords or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could” and other similar expressions. Fo rward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - looking statemen ts. Factors that may cause actual results to differ materially from those included in the forward - looking statements include, but are not limited to: cyberattacks or breache s, including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of our customers; disruptions in the capit al markets or other events that make our access to necessary capital more difficult or costly; the negative impacts of the novel coronavirus (COVID - 19) pandemic on our customers, vendors, employees, regulators, and operations; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ab ility; ability or inability to commence and complete our major strategic development projects and opportunities; acts of war or terrorism, physical attacks or grid distu rba nces that may damage and disrupt our electric transmission and electric, natural gas, and water distribution systems; actions or inaction of local, state and fede ral regulatory, public policy and taxing bodies; substandard performance of third - party suppliers and service providers; fluctuations in weather patterns, including extreme weat her due to climate change; changes in business conditions, which could include disruptive technology or development of alternative energy sources related to our cu rre nt or future business model; contamination of, or disruption in, our water supplies; changes in levels or timing of capital expenditures, including the Columbia Gas of Mas sachusetts asset acquisition; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations; changes in accounting standar ds and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to pr edict and contain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control. You should not place undue relia nce on the forward - looking statements, as each speaks only as of the date on which such statement is made, and, except as required by federal securities laws, Eversour ce Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

2 2Q 2020 2Q 2019 2Q Change 1H 2020 1H 2019 1H Change $0.34 $0.33 $0.01 $0.73 $0.71 $0.02 0.39 0.37 0.02 0.76 0.74 0.02 0.01 0.00 0.01 0.26 0.23 0.03 0.03 0.02 0.01 0.04 0.03 0.01 (0.01) 0.02 (0.03) (0.02) 0.00 (0.02) 0.76 0.74 0.02 1.77 1.71 0.06 0.00 (0.64) 0.64 0.00 (0.64) 0.64 (0.01) 0.00 (0.01) (0.02) 0.00 (0.02) $0.75 $0.10 $0.65 $1.75 $1.07 $0.68 Electric Distribution Electric Transmission Ex. NPT Impairment (Non - GAAP) Natural Gas Distribution Parent & Other (Non - GAAP) Water Distribution Second Quarter and First Half 2020 EPS Results EPS, Ex. NPT Impairment, Columbia Gas Asset Acquisition Costs (Non - GAAP) Columbia Gas Asset Acquisition Costs Reported EPS (GAAP) NPT Impairment

2020 Guidance, Long - Term Growth Rate Intact Key 2020 Earnings Drivers EPS Range $3.60 - $3.70 • Distribution rate increases • Transmission rate base growth • Growth in distribution capital tracking programs • Higher depreciation and property taxes • Higher interest expense • Higher share count 3 Long - Term Growth 5% - 7%

Eversource Executing Its Business Plan and Serving 4 Million Customers During COVID - 19 Crisis ▪ Extensive efforts to protect our 8,300 employees, moving to remote working, hygienically sanitizing facilities and fleet, promoting social distancing ▪ In March, approximately 4,000 employees normally working in ES facilities successfully redeployed to work from home, including vast majority of customer service representatives – Only limited essential activities and projects have returned to the workplace – Vast majority of employees working remotely will continue to do so through the end of the summer or longer – Re - entry playbook developed and disseminated to employees ▪ Resumed all normal field construction conditions with pandemic protocols in place ▪ Moratorium on customer shut - offs in MA and CT. Gov. Sununu lifted the moratorium in NH, but we have not resumed shutoffs ▪ No significant supply issues ▪ Very positive feedback on COVID response from customers , policymakers 4

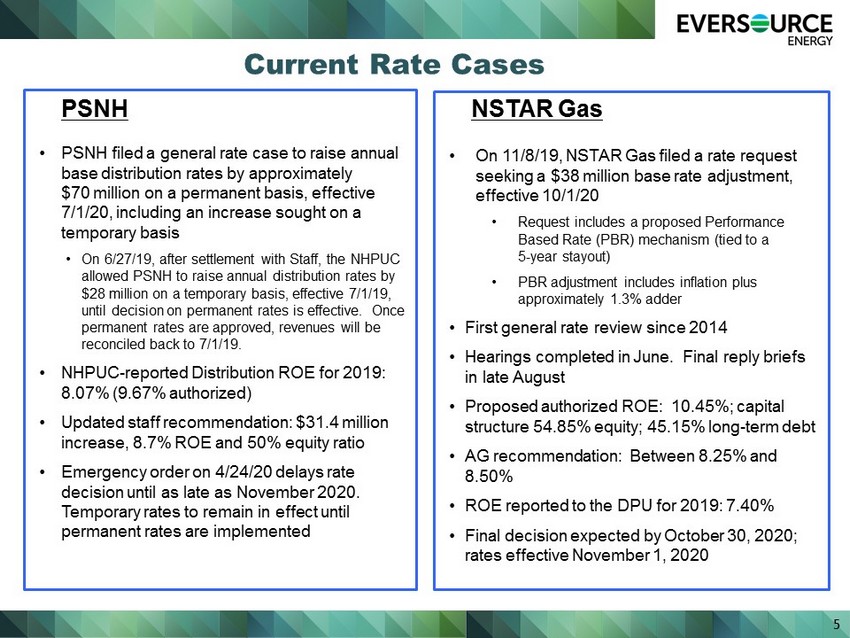

5 Current Rate Cases • PSNH filed a general rate case to raise annual base distribution rates by approximately $70 million on a permanent basis, effective 7/1/20, including an increase sought on a temporary basis • On 6/27/19, after settlement with Staff, the NHPUC allowed PSNH to raise annual distribution rates by $28 million on a temporary basis, effective 7/1/19, until decision on permanent rates is effective. Once permanent rates are approved, revenues will be reconciled back to 7/1/19. • NHPUC - reported Distribution ROE for 2019: 8.07% (9.67% authorized) • Updated staff recommendation: $31.4 million increase, 8.7% ROE and 50% equity ratio • Emergency order on 4/24/20 delays rate decision until as late as November 2020. Temporary rates to remain in effect until permanent rates are implemented PSNH • On 11/8/19, NSTAR Gas filed a rate request seeking a $38 million base rate adjustment, effective 10/1/20 • Request includes a proposed Performance Based Rate (PBR) mechanism (tied to a 5 - year stayout ) • PBR adjustment includes inflation plus approximately 1.3% adder • First general rate review since 2014 • Hearings completed in June. Final reply briefs in late August • Proposed authorized ROE: 10.45%; capital structure 54.85% equity; 45.15% long - term debt • AG recommendation: Between 8.25% and 8.50% • ROE reported to the DPU for 2019: 7.40% • Final decision expected by October 30, 2020; rates effective November 1, 2020 NSTAR Gas

Key Elements of Eversource’s Grid Mod Filing in CT This Week AMI • Recommend a full rollout to all CL&P customers by the end of 2024 • Significant economic, environmental and operational benefits for the state, 1.25 million CL&P customers • $500 million capital investment from 2021 - 2025 with most spending in 2022 - 2024 • Most CL&P meters currently in the field near the end of their life expectancy Electric Vehicle Infrastructure ▪ Rollout to include 3,000 level - 2 chargers, 20 DC fast chargers, 2,500 single - family homes ▪ Three - year rollout, $55 million program includes $20 - $25 million of capital ▪ No utility ownership beyond the meter Storage ▪ $110 million program to include 30 MW of residential and 20 MW of C/I storage ▪ Five year rollout ▪ No utility capital investment, but performance incentives similar to energy efficiency Timing: All proposals due July 31, 2020. Decisions expected as soon as December 31, 2020 6

7 Eversource to Acquire MA Natural Gas Assets of NiSource ▪ $1.1 billion in cash (~1x rate base) ▪ Financing to be consistent with existing ES capital structure ▪ Equity sold in June ▪ No assumption of debt ▪ Expected to be accretive over first 12 months and incrementally accretive over following years ▪ DPU key approval required — settlement with AG, DOER, and Low Income Network filed July 2 ▪ DPU approval expected by September 30

Key Elements of Settlement ▪ Joint settlement with MA AG, DOER, NiSource and low - income network ▪ Eight - year rate plan ▪ Day One rate base of approximately $1 billion ▪ Authorized ROE: 9.7% ▪ Authorized equity in capital structure of 53.25% ▪ General rate increases of $13 million on 11/1/21 and $10 million on 11/1/22 ▪ GSEP - related rate changes continue annually (pipe replacement rate under GSEP to continue at 45 miles/year) ▪ Report on status of Columbia Gas system due to the DPU by 9/1/21 with proposed work plan ▪ Additional base rate adjustments tied to non - GSEP investments on 11/1/24 and 11/1/27 ▪ NiSource to pay $56 million in lieu of penalties – $41 million to establish a Merrimack Valley Renewal Fund – $15 million for Arrearage Forgiveness ▪ Requested approval date: 9/30/20 and closing by early October 8

South Fork Wind Revolution Wind Sunrise Wind Size 130 MW 704 MW 880 MW Price as of first day of commercial operation ~ $160.33/MWH for 90 MW ~ $86.25/MWH for 40 MW (avg. annual escalator: 2%) $98.43/MWH for RI (no escalator) CT pricing not disclosed $110.37/MWH (no escalator) Status of Contracts Negotiating agreement to increase original 90 MW to 130 MW. NY Comptroller and AG approval required 400 MW for RI approved 304 MW for CT approved Contract signed with NYSERDA in October 2019 Most Recent Projected In - Service Date End of 2022 End of 2023 End of 2024 Permitting Status BOEM COP application filed on 3/13/20. BOEM review schedule expected late this year On - shore and off - shore survey work resumed in NY in June. COP filing expected later this year 9 Expected Timeline For Eversource - Ørsted Projects BOEM expected to release project review schedule this summer

10 APPENDIX

Eversource Has Completed Several Equity and Debt Financings This Year ▪ ES sold 6 million shares in June for Columbia Gas financing – Debt component to be financed later this year. ▪ NSTAR Electric sold $400M of 10 - year “Green Bonds” in March ▪ ES closed on the remaining nearly $420M of its June 2019 forward sale arrangement in March ▪ NSTAR Gas sold $190M of 5 - year and 30 - year bonds in May ▪ ES parent sold $350M of 30 - year notes in January ▪ Remaining maturities for 2020 total only $25M 11

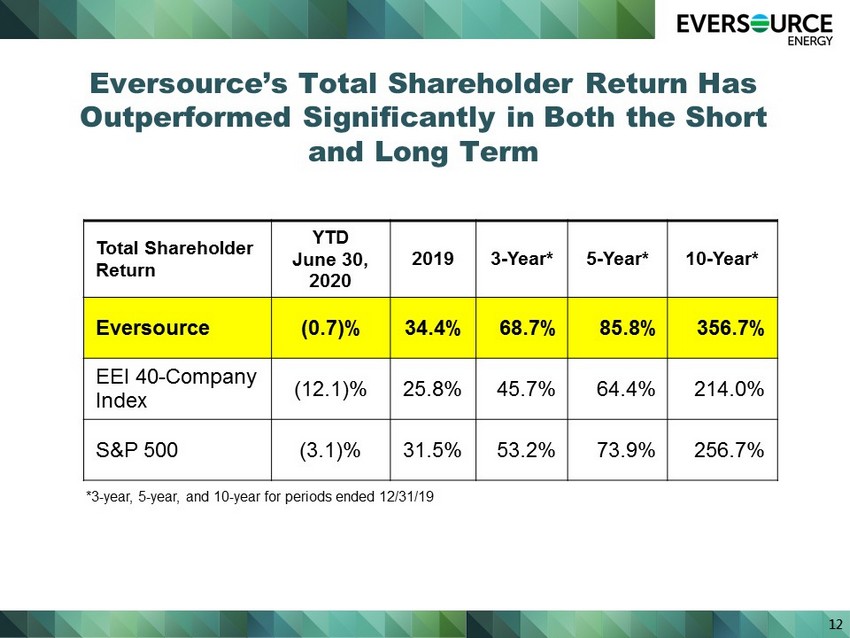

Eversource’s Total Shareholder Return Has Outperformed Significantly in Both the Short and Long Term 12 Total Shareholder Return YTD June 30, 2020 2019 3 - Year* 5 - Year* 10 - Year* Eversource (0.7)% 34.4% 68.7% 85.8% 356.7% EEI 40 - Company Index (12.1)% 25.8% 45.7% 64.4% 214.0% S&P 500 (3.1)% 31.5% 53.2% 73.9% 256.7% *3 - year, 5 - year, and 10 - year for periods ended 12/31/19

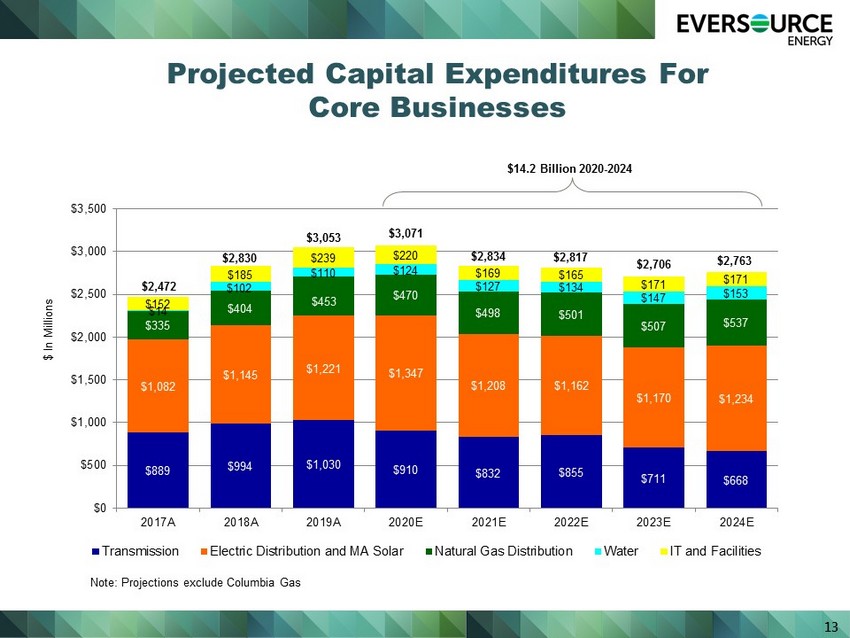

13 $889 $994 $1,030 $910 $832 $855 $711 $668 $1,082 $1,145 $1,221 $1,347 $1,208 $1,162 $1,170 $1,234 $335 $404 $453 $470 $498 $501 $507 $537 $14 $102 $110 $124 $127 $134 $147 $153 $152 $185 $239 $220 $169 $165 $171 $171 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E Transmission Electric Distribution and MA Solar Natural Gas Distribution Water IT and Facilities $2,817 $2,834 $ In Millions Projected Capital Expenditures For Core Businesses $3,053 $2,830 $2,472 $14.2 Billion 2020 - 2024 $3,071 $2,706 $2,763 Note: Projections exclude Columbia Gas

14 • New 13 - mile project between Portsmouth and Madbury , NH • Completed: May 2020 • Total investment: $123 million Seacoast Reliability Project • 26 of 27 projects now in service • One project under construction • Projected completion: Q4 2020 • Total projected investment: $350 million • Investment through June 30, 2020: $290.8 million Hartford - Area Transmission Projects Progress on Major Transmission Reliability Projects • All development and management plans approved by CSC • Projected completion: Fall 2020 • Total projected investment: $110 million • Investment through June 30, 2020: $89.3 million Greenwich Substation Project Eastern MA Transmission Projects • 22 projects in service; 5 under construction; 1 expected to enter construction in Q2 2021 • Approval of remaining 1 project received in Q4 2019; decision appealed January 2020 • Projected completion: 2023 • Total projected investment: approximately $750 million • Investment through June 30, 2020: $466.8 million

15 Key Facts About Columbia Gas of MA Number of customers ~330,000 Communities served 65 (~20 served by NSTAR Electric) Allowed ROE in most recent rate case 9.55% (settlement authorizes 9.7%) Average annual net income 2016 - 2017 $32 million (non - GAAP) Average annual cap ex 2016 - 2017 $124 million Owned LNG storage 1.83 bcf Annual customer growth rate (2018 - 2019) 1.4% Total miles of main ~5,000