Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Citizens Community Bancorp Inc. | exhibit991earningsrelc.htm |

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kearningsrelczwi2020.htm |

Exhibit 99.2 Earnings Release Supplement Second Quarter 2020

Citizens Community Bancorp, Inc. Table of Contents Segment Profiles Page(s) CZWI Focus Items 2 COVID-19 Related Loan Deferrals 3 Non-Owner Occupied CRE 4 Owner Occupied CRE 5 Multi-family 6 Construction and Development Loans 7 Commercial and Industrial Loans 8 Agricultural Real Estate and Operating Loans 9 Commercial Real Estate by Vintage and Risk Rating 10 Residential Loans 11 Hotel Loans 12 Restaurant Loans 13 Credit Quality Risk Rating Descriptions 14 Loans by Risk Rating as of June 30, 2020 15 Loans by Risk Rating as of March 31, 2020 16 Loans by Risk Rating as of December 31, 2019 17 Loans by Risk Rating as of June 30, 2019 18 1

CZWI Focus Items INCREASE TANGIBLE BOOK AND SHAREHOLDER VALUE Grow TBV >10% annually, increase TCE to Total Assets >8% and achieve ROA and ROE in the upper half of its peer group. REDUCE NPA’S & CLASSIFIED LOANS TO PEER GROUP MEDIAN Aggressively reduce problem assets from acquired banks, manage the originated book prudently, and build the allowance to absorb potential COVID related losses. INCREASE OPERATING LEVERAGE Achieve an efficiency ratio in the mid 60% range by reducing branch and support expenses, optimize commercial portfolios, and increase non-interest income sources. CONSISTENCY IN CULTURE Apply software and API’s to increase productivity and support future growth, while proactively managing operating and credit risk. 2

Dollars In Thousands Modification Types Balances of Loans Interest Only P&I Payments % of Total Category Loan Category Modified Payment Deferred Loans Commercial Real Estate $ 147,235 34.1% 40.5% 11.4% Agricultural Real Estate $ 2,289 0.0% 1.2% 0.2% Multi-family $ 14,835 3.5% 4.0% 1.2% Construction & Development $ 16,795 3.0% 5.5% 1.3% Commercial & Industrial $ 12,493 4.4% 1.9% 1.0% Agricultural Operating $ 66 0.0% 0.0% 0.0% Residential Mortgage $ 3,054 0.0% 1.5% 0.2% Consumer Installment & Originated Indirect $ 544 0.0% 0.3% 0.0% Total $ 197,311 45.0% 55.0% 15.3% Balances of Loans High Exposure Commercial Segments Interest Only Principal Only Modified Hotel $ 78,151 17.8% 21.8% Restaurant $ 24,657 8.6% 3.9% Other Non-Owner Occupied Commercial Real Estate $ 39,069 9.9% 9.9% Total $ 141,877 36.3% 35.6% Notes All loan deferments qualified for temporary suspension of troubled • No completed COVID–19 related modifications/deferrals processed as debt restructuring requirements of March 31, 2020 pursuant to section 4013 of the CARES • Over 97% COVID-19 modifications occurred in April and May Act. Source: Internal Company Documents 3

Non – Owner Occupied CRE Non – Owner Portfolio Characteristics 9% Occupied 4% 27% Non - Owner Occupied CRE CRE 4% 5% 5% Loan Balance Outstanding - In Millions $303 5% Number of Loans 850 6% 7% 28% Average Loan Size - In Thousands $356 Approximate Weighted Average LTV 55% Investor Residential Hotel Retail Senior Living Office Industrial/Manufacturing Approximate Weighted Average DSCR 2.1x Restaurant Warehouse/Mini Storage Mixed Use Seasoning In Months 43 Other 2019 Net Charge-Offs 0.00% By Geography 12% Portfolio Fundamentals 49% 39% Wisconsin Minnesota Other Source: Internal Company Documents 4

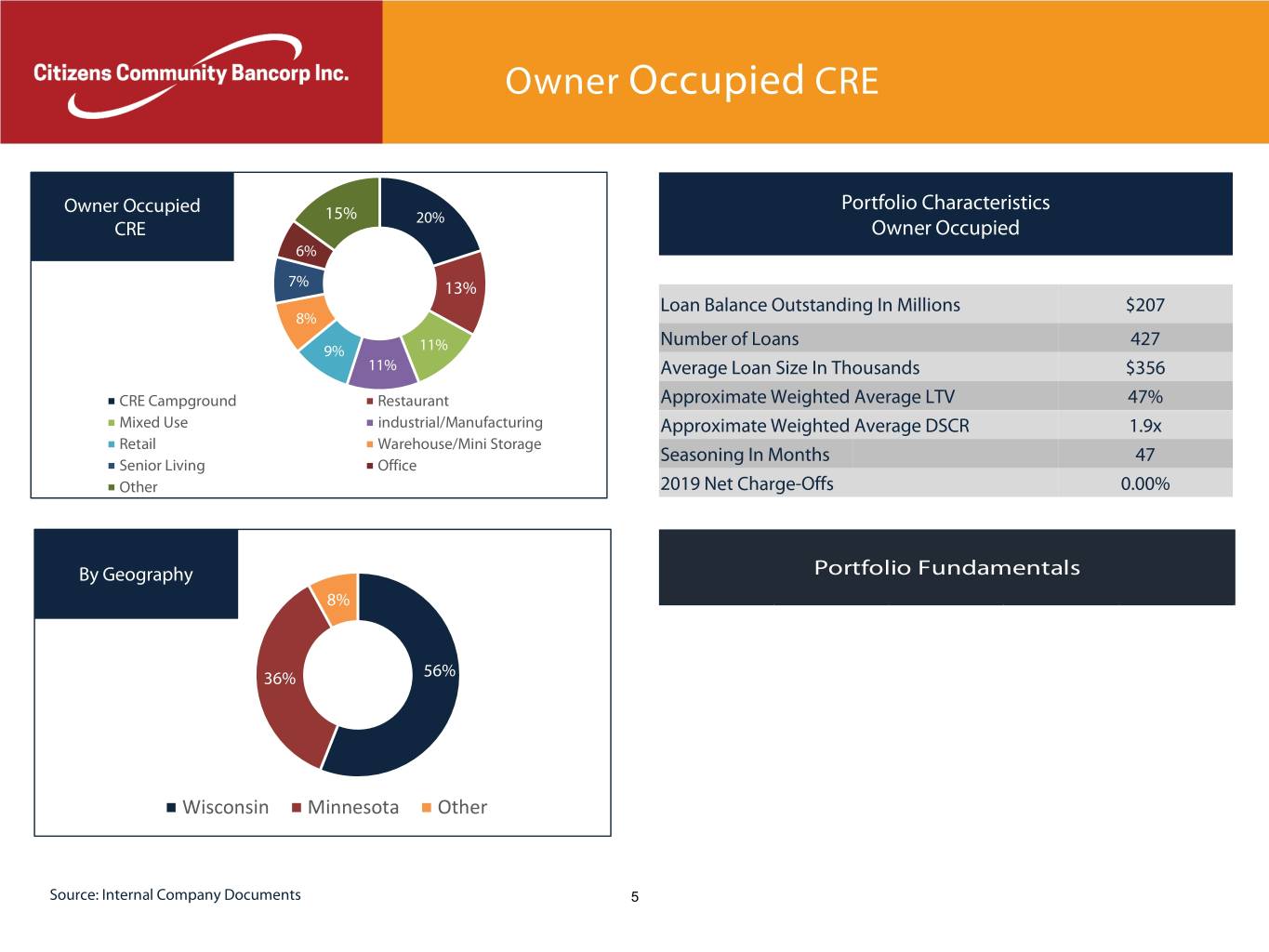

Owner Occupied CRE Owner Occupied Portfolio Characteristics 15% 20% CRE Owner Occupied 6% 7% 13% Loan Balance Outstanding In Millions $207 8% Number of Loans 427 9% 11% 11% Average Loan Size In Thousands $356 CRE Campground Restaurant Approximate Weighted Average LTV 47% Mixed Use industrial/Manufacturing Approximate Weighted Average DSCR 1.9x Retail Warehouse/Mini Storage Seasoning In Months 47 Senior Living Office Other 2019 Net Charge-Offs 0.00% By Geography Portfolio Fundamentals 8% 36% 56% Wisconsin Minnesota Other Source: Internal Company Documents 5

Multi-family Multi-family Portfolio Characteristics - Multi-family Loan Balance Outstanding In Millions $104 100% Number of Loans 93 Average Loan Size In Millions $1.1 Approximate Weighted Average LTV 59% Approximate Weighted Average DSCR 1.77x Seasoning In Months 27 Multi-family Net Charge-Offs 0.00% 2% By Geography Portfolio Fundamentals 29% • Robust housing markets in Eau Claire and Mankato markets supported by student populations at state universities, technical colleges, and growing population and job markets • Multi-family sponsors experienced owners with multi-project portfolios 69% • Typically underwritten to 75% LTV based on appraised value with recourse; metro markets and/or strong sponsors may warrant up to 80% LTV • Term of 5-10 years with 20 to 25-year amortization (varies by new versus existing, size of market and sponsor strength) Wisconsin Minnesota Other • Covenant for minimum DSC/Global DSC 6

Construction & Development Loans Commercial & 3% 3% 7% Development 3% Portfolio Characteristics - Construction & Development 4% 37% 6% Loan Balance Outstanding In Millions $110 9% Number of Loans 278 11% 17% Average Loan Size In Millions $396 Multi-family CRE Hospitality Approximate Weighted Average LTV 62% Commercial 1-4 Family Construction CRE Industrial/Manufacturing 2019 Net Charge-Offs CRE Senior Living CRE Warehouse/Mini Storage 0.00% Residential Lot Other Land Percent Utilized of Commitments 74% Retail Other Portfolio Fundamentals By Geography 11% • Underwritten to 75-80% LTV based on lesser of cost or appraised value 29% with full recourse 60% • Interest only typically up to 18 months (depending on project complexity and seasonal timing) followed by amortization of 15-25 years (terms vary by property type) • Borrower equity contribution of cash/land value =>15% injected at the beginning of project (cash/land contribution) • Construction loans require 3rd Party inspections and Title Company Wisconsin Minnesota Other draws after balancing to sworn construction statement • 1-4 Residential construction centered in eastern Twin Cities and 7 Northwest Wisconsin. Generally 80% LTC /60%-80% of AV. Spec building capped. Progress reporting monthly by individual home.

Commercial & Industrial Loans 2% 2% 3% Commercial & 3% Industrial Portfolio Characteristics - Commercial & Industrial 4% 14% 4% 5% 12% 6% Loan Balance In Millions $110 7% 11% Number of Loans 864 8% 10% Average Loan Size In Thousands $127 8% Approximate Weighted Average DSCR 2.6 Manufacturing Public Administration Construction Real Estate, Rental and Leasing Seasoning in months 34 Transportation and Warehousing Other Services Wholesale Trade Retail Trade Administrative Services Professional Services Net Charge-Offs 0.00% Other Services Finance and Insurance Educational Services Agriculture Committed Line, if collateral 65 Accomodation Services 3% By Geography Portfolio Fundamentals 13% • Highly diversified, secured loan portfolio underwritten with recourse • Lines of credit reviewed annually and may have borrowing base certificates governing line usage • Fixed asset LTV’s based on age and type of equipment; <5-year amortization 84% • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • “Retail Trade” segment consists of Farm Supply, Franchised Hardware, Wisconsin Minnesota Other Franchised Auto Parts, Franchised and Non-franchised Auto Dealers and Repair Shops, Convenience Stores/Gas Stations 8

Agricultural RE & Operating Loans Agricultural Portfolio Characteristics - Agricultural 22% 36% Loan Balance Outstanding - In Millions $110 13% Number of Loans 664 Average Loan Size - In Thousands $165 29% Approximate Weighted Average DSCR 1.9x Seasoning In Months 52 Crop Dairy Other Farming Owned Land 2019 Net Charge-Offs 0.30% 4% By Geography Portfolio Fundamentals • Producers required to have marketing plans to mitigate volatility of 36% commodities 60% • Appropriate crop/revenue insurance and/or dairy margin protection required • Maximum Ag RE LTV of less than 65%; Equipment LTV of less than 75% • Appropriate structuring to separate crop production cycles and to match length of loan with asset financed • Use of Farmer Mac, FSA, SBA or USDA programs to address DSC, Wisconsin Minnesota Other collateral margins or working capital 9

Dollars In Thousands 2015 & 2016 2017 2018 2019 2020 Total Pass Rated Prior Commercial Real Estate $33,663 $75,501 $117,981 $134,109 $56,550 $70,832 $488,636 Agricultural Real Estate $4,438 $8,980 $16,383 $9,842 $9,857 $18,804 $68,304 Multi-family $6,034 $6,032 $26,761 $22,493 $38,655 $3,516 $103,491 Construction and Development $1,380 $756 $12,077 $73,365 $11,888 $1,131 $100,597 $45,515 $91,269 $173,202 $239,809 $116,950 $94,283 $761,028 Special Mention Rated Commercial Real Estate $10 $5,267 $250 $514 $1,679 $3,931 $11,651 Agricultural Real Estate $63 $0 $386 $0 $0 $20 $469 Construction and Development $0 $0 $5,867 $0 $0 $0 $5,867 $73 $5,267 $6,503 $514 $1,679 $3,951 $17,987 Substandard Rated Commercial Real Estate $2,091 $265 $0 $109 $0 $6,973 $9,438 Agricultural Real Estate $1,165 $1,808 $1,751 $3,295 $248 $1,152 $9,419 Multi-family $0 $0 $0 $0 $0 $148 $148 Construction and Development $3,478 $0 $0 $0 $0 $190 $3,668 $6,734 $2,073 $1,751 $3,404 $248 $8,463 $22,673 Source: Internal Company Documents 10

Residential Loans Dollars In Thousands Year Of Origination By FICO Score Band 2016 2017 2018 2019 2020 2015 & Prior Grand Total Greater than 740 $5,926 $5,442 $8,708 $9,701 $1,558 $52,015 $83,350 >680-740 $2,325 $1,189 $3,834 $3,198 $1,006 $21,651 $33,203 580-680 $1,192 $745 $1,897 $1,829 $372 $18,499 $24,534 Less than 580 $1,190 $304 $472 $167 $131 $7,128 $9,392 Not Available $369 $258 $0 $0 $0 $1,318 $1,945 Total $11,002 $7,938 $14,911 $14,895 $3,067 $100,611 $152,424 Year Of Origination By LTV Range 2016 2017 2018 2019 2020 2015 & Prior Grand Total > 75% $1,706 $1,509 $3,032 $6,406 $1,222 $5,826 $19,701 >65-75% $2,088 $892 $2,431 $1,725 $439 $18,128 $25,703 >55-65% $2,111 $1,192 $1,928 $1,791 $265 $20,263 $27,550 <= 55% $5,097 $4,345 $7,520 $4,973 $1,141 $56,394 $79,470 Total $11,002 $7,938 $14,911 $14,895 $3,067 $100,611 $152,424 11

Hotel Loans Hotels Portfolio Characteristics - Hotels 8% 12% Loan Balance Outstanding In Millions $109 Number of Loans 43 Average Loan Size In Millions $2.3 21% 59% Approximate Weighted Average LTV 64% Approximate DSCR - Non-Construction 1.6x Net Charge Offs 0.00% Construction Loan Balance 19 Flagged Historic Boutique Wisconsin Dells Area Other Percent Utilized of Commitments 84% By Geography Portfolio Fundamentals 15% 41% • Mainly experienced multi project hoteliers and guarantors with strong personal financial statements (net worth and liquidity) • Mainly flagged properties, Historic hotels, including two hotels in Minneapolis 44% • Wisconsin Dells Area projects were acquired from F&M • One Historic project is approved for SBA 504 structure and there is a flagged project approved with the SBA 504 structure; both nearing completion of construction Wisconsin Minnesota Illinois • Underwriting consistent with management's conservative approach to Investor Secured CRE, emphasizing actual results in underwriting 12

Restaurant Loans 6% Restaurants 8% Portfolio Characteristics - Restaurants 9% 44% 12% Loan Balance Outstanding In Millions $42 Number of Loans 99 21% Average Loan Size In Thousands $426 Culver's - Limited Service Restaurants Approximate Weighted Average LTV 54% Lessors of RE for Restaurant use Micro Breweries Approximate Weighted Average DSCR 2.2x Other National Limited Services Drinking Establishments Net Charge-Offs in 2019 0.00% By Geography 1% Portfolio Fundamentals 19% • Experienced developers/operators of national Limited /Quick Service brands (Culver’s, Subway, Dairy Queen, McDonalds, Jimmy John’s, A&W) • Underwritten to =<80% LTV with full recourse (depending on sponsor history); 20-year amortization with 5 to 10-year terms • Use of SBA Guaranty Program (Preferred Lender or General Processing) 80% as appropriate • Drinking establishments may have other collateral pledged and tend to be in smaller communities in our footprint • Micro Breweries concentrated in Eau Claire area Wisconsin Minnesota Other • Lessors of RE include investor and owner-occupied structure 13

Credit Quality/Risk Ratings: Management utilizes a numeric risk rating system to identify and quantify the Bank’s risk of loss within its loan portfolio. Ratings are initially assigned prior to funding the loan, and may be changed at any time as circumstances warrant. Ratings range from the highest to lowest quality based on factors that include measurements of ability to pay, collateral type and value, borrower stability and management experience. The Bank’s loan portfolio is presented below in accordance with the risk rating framework that has been commonly adopted by the federal banking agencies. The definitions of the various risk rating categories are as follows: 1 through 4 - Pass. A “Pass” loan means that the condition of the borrower and the performance of the loan is satisfactory or better. 5 - Watch. A “Watch” loan has clearly identifiable developing weaknesses that deserve additional attention from management. Weaknesses that are not corrected or mitigated, may jeopardize the ability of the borrower to repay the loan in the future. 6 - Special Mention. A “Special Mention” loan has one or more potential weakness that deserve management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the loan or in the institution’s credit position in the future. 7 - Substandard. A “Substandard” loan is inadequately protected by the current net worth and paying capacity of the obligor or the collateral pledged, if any. Assets classified as substandard must have a well-defined weakness, or weaknesses, that jeopardize the liquidation of the debt. They are characterized by the distinct possibility that the Bank will sustain some loss if the deficiencies are not corrected. 8 - Doubtful. A “Doubtful” loan has all the weaknesses inherent in a Substandard loan with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions and values, highly questionable and improbable. 9 - Loss. Loans classified as “Loss” are considered uncollectible, and their continuance as bankable assets is not warranted. This classification does not mean that the loan has absolutely no recovery or salvage value, and a partial recovery may occur in the future. 14

Below is a breakdown of loans by risk rating as of June 30, 2020: 1 to 5 6 7 8 9 TOTAL Originated Loans: Commercial/Agricultural real estate: Commercial real estate $ 308,633 $ 4,952 $ 805 $ — $ — $ 314,390 Agricultural real estate 32,592 469 2,077 — — 35,138 Multi-family real estate 90,617 — — — — 90,617 Construction and land development 85,511 5,867 3,478 — — 94,856 C&I/Agricultural operating: Commercial and industrial 76,447 661 3,261 — — 80,369 C&I SBA PPP loans 137,330 — — — — 137,330 Agricultural operating 24,488 768 557 — — 25,813 Residential mortgage: Residential mortgage 91,649 — 4,015 — — 95,664 Purchased HELOC loans 6,534 — 327 — — 6,861 Consumer installment: Originated indirect paper 31,815 — 216 — — 32,031 Other consumer 14,082 — 93 — — 14,175 Total originated loans $ 899,698 $ 12,717 $ 14,829 $ — $ — $ 927,244 Acquired Loans: Commercial/Agricultural real estate: Commercial real estate $ 180,003 $ 6,699 $ 8,633 $ — $ — $ 195,335 Agricultural real estate 35,712 — 7,342 — — 43,054 Multi-family real estate 12,874 — 148 — — 13,022 Construction and land development 15,086 — 190 — — 15,276 C&I/Agricultural operating: Commercial and industrial 28,274 59 1,144 — — 29,477 Agricultural operating 10,723 80 1,321 — — 12,124 Residential mortgage: Residential mortgage 54,058 403 2,299 — — 56,760 Consumer installment: Other consumer 1,634 — 5 — — 1,639 Total acquired loans $ 338,364 $ 7,241 $ 21,082 $ — $ — $ 366,687 Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 488,636 $ 11,651 $ 9,438 $ — $ — $ 509,725 Agricultural real estate 68,304 469 9,419 — — 78,192 Multi-family real estate 103,491 — 148 — — 103,639 Construction and land development 100,597 5,867 3,668 — — 110,132 C&I/Agricultural operating: Commercial and industrial 104,721 720 4,405 — — 109,846 C&I SBA PPP loans 137,330 — — — — 137,330 Agricultural operating 35,211 848 1,878 — — 37,937 Residential mortgage: Residential mortgage 145,707 403 6,314 — — 152,424 Purchased HELOC loans 6,534 — 327 — — 6,861 Consumer installment: Originated indirect paper 31,815 — 216 — — 32,031 Other consumer 15,716 — 98 — — 15,814 Gross loans $ 1,238,062 $ 19,958 $ 35,911 $ — $ — $ 1,293,931 Less: Unearned net deferred fees and costs and loans in process (5,369) Unamortized discount on acquired loans (7,387) Allowance for loan losses (13,373) Loans receivable, net $ 1,267,802 15

Below is a breakdown of loans by risk rating as of March 31, 2020: 1 to 5 6 7 8 9 TOTAL Originated Loans: Commercial/Agricultural real estate: Commercial real estate $ 307,313 $ 4,978 $ 856 $ — $ — $ 313,147 Agricultural real estate 33,069 469 2,114 — — 35,652 Multi-family real estate 89,474 — — — — 89,474 Construction and land development 72,427 5,780 3,478 — — 81,685 C&I/Agricultural operating: Commercial and industrial 80,746 1,115 3,388 — — 85,249 Agricultural operating 21,552 428 720 — — 22,700 Residential mortgage: Residential mortgage 98,138 35 4,681 — — 102,854 Purchased HELOC loans 7,367 — 234 — — 7,601 Consumer installment: Originated indirect paper 36,153 — 261 — — 36,414 Purchased indirect paper ————— — Other consumer 14,923 — 157 — — 15,080 Total originated loans $ 761,162 $ 12,805 $ 15,889 $ — $ — $ 789,856 Acquired Loans: Commercial/Agricultural real estate: Commercial real estate $ 192,367 $ 5,513 $ 9,123 $ — $ — $ 207,003 Agricultural real estate 39,729 — 8,037 — — 47,766 Multi-family real estate 13,361 — 148 — — 13,509 Construction and land development 13,982 — 251 — — 14,233 C&I/Agricultural operating: Commercial and industrial 34,914 563 1,280 — — 36,757 Agricultural operating 13,700 82 1,458 — — 15,240 Residential mortgage: Residential mortgage 60,335 424 2,198 — — 62,957 Consumer installment: Other consumer 2,095 — 9 — — 2,104 Total acquired loans $ 370,483 $ 6,582 $ 22,504 $ — $ — $ 399,569 Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 499,680 $ 10,491 $ 9,979 $ — $ — $ 520,150 Agricultural real estate 72,798 469 10,151 — — 83,418 Multi-family real estate 102,835 — 148 — — 102,983 Construction and land development 86,409 5,780 3,729 — — 95,918 C&I/Agricultural operating: Commercial and industrial 115,660 1,678 4,668 — — 122,006 Agricultural operating 35,252 510 2,178 — — 37,940 Residential mortgage: Residential mortgage 158,473 459 6,879 — — 165,811 Purchased HELOC loans 7,367 — 234 — — 7,601 Consumer installment: Originated indirect paper 36,153 — 261 — — 36,414 Purchased indirect paper ————— — Other consumer 17,018 — 166 — — 17,184 Gross loans $ 1,131,645 $ 19,387 $ 38,393 $ — $ — $ 1,189,425 Less: Unearned net deferred fees and costs and loans in process (510) Unamortized discount on acquired loans (7,964) Allowance for loan losses (11,835) Loans receivable, net $ 1,169,116 16

Below is a breakdown of loans by risk rating as of December 31, 2019: 1 to 5 6 7 8 9 TOTAL Originated Loans: Commercial/Agricultural real estate: Commercial real estate $ 301,381 $ 266 $ 899 $ — $ — $ 302,546 Agricultural real estate 31,129 829 2,068 — — 34,026 Multi-family real estate 71,877 — — — — 71,877 Construction and land development 67,989 — 3,478 — — 71,467 C&I/Agricultural operating: Commercial and industrial 85,248 1,023 3,459 — — 89,730 Agricultural operating 19,545 402 770 — — 20,717 Residential mortgage: Residential mortgage 104,428 — 4,191 — — 108,619 Purchased HELOC loans 8,407 — — — — 8,407 Consumer installment: — Originated indirect paper 39,339 — 246 — — 39,585 Purchased indirect paper ————— — Other consumer 15,425 — 121 — — 15,546 Total originated loans $ 744,768 $ 2,520 $ 15,232 $ — $ — $ 762,520 Acquired Loans: Commercial/Agricultural real estate: Commercial real estate $ 196,692 $ 6,084 $ 9,137 $ — $ — $ 211,913 Agricultural real estate 42,381 534 8,422 — — 51,337 Multi-family real estate 13,533 — 1,598 — — 15,131 Construction and land development 14,181 — 762 — — 14,943 C&I/Agricultural operating: Commercial and industrial 41,587 932 1,485 — — 44,004 Agricultural operating 15,621 350 1,092 — — 17,063 Residential mortgage: Residential mortgage 65,125 436 2,152 — — 67,713 Consumer installment: Other consumer 2,628 — 12 — — 2,640 Total acquired loans $ 391,748 $ 8,336 $ 24,660 $ — $ — $ 424,744 Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 498,073 $ 6,350 $ 10,036 $ — $ — $ 514,459 Agricultural real estate 73,510 1,363 10,490 — — 85,363 Multi-family real estate 85,410 — 1,598 — — 87,008 Construction and land development 82,170 — 4,240 — — 86,410 C&I/Agricultural operating: Commercial and industrial 126,835 1,955 4,944 — — 133,734 Agricultural operating 35,166 752 1,862 — — 37,780 Residential mortgage: Residential mortgage 169,553 436 6,343 — — 176,332 Purchased HELOC loans 8,407 — — — — 8,407 Consumer installment: Originated indirect paper 39,339 — 246 — — 39,585 Purchased indirect paper ————— — Other consumer 18,053 — 133 — — 18,186 Gross loans $ 1,136,516 $ 10,856 $ 39,892 $ — $ — $ 1,187,264 Less: Unearned net deferred fees and costs and loans in process (393) Unamortized discount on acquired loans (9,491) Allowance for loan losses (10,320) Loans receivable, net $ 1,167,060 17

Below is a breakdown of loans by risk rating as of June 30, 2019: 1 to 5 6 7 8 9 TOTAL Originated Loans: Commercial/Agricultural real estate: Commercial real estate $ 237,548 $ 349 $ 1,154 $ — $ — $ 239,051 Agricultural real estate 32,681 111 2,135 — — 34,927 Multi-family real estate 75,663 — 1 — — 75,664 Construction and land development 31,530 — 3,500 — — 35,030 C&I/Agricultural operating: Commercial and industrial 70,605 1,141 3,440 — — 75,186 Agricultural operating 19,778 1,157 841 — — 21,776 Residential mortgage: Residential mortgage 114,787 54 2,744 — — 117,585 Purchased HELOC loans 11,125 — — — — 11,125 Consumer installment: Originated indirect paper 47,188 — 203 — — 47,391 Purchased indirect paper 11,155 — — — — 11,155 Other consumer 15,187 — 42 — — 15,229 Total originated loans $ 667,247 $ 2,812 $ 14,060 $ — $ — $ 684,119 Acquired Loans: Commercial/Agricultural real estate: Commercial real estate $ 123,977 $ 5,648 $ 5,765 $ — $ — $ 135,390 Agricultural real estate 50,217 1,297 5,696 — — 57,210 Multi-family real estate 7,600 — 159 — — 7,759 Construction and land development 16,630 38 373 — — 17,041 C&I/Agricultural operating: Commercial and industrial 29,127 1,526 1,915 — — 32,568 Agricultural operating 13,699 195 1,157 — — 15,051 Residential mortgage: Residential mortgage 71,810 462 2,033 — — 74,305 Consumer installment: Other consumer 3,139 — 21 — — 3,160 Total acquired loans $ 316,199 $ 9,166 $ 17,119 $ — $ — $ 342,484 Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 361,525 $ 5,997 $ 6,919 $ — $ — $ 374,441 Agricultural real estate 82,898 1,408 7,831 — — 92,137 Multi-family real estate 83,263 — 160 — — 83,423 Construction and land development 48,160 38 3,873 — — 52,071 C&I/Agricultural operating: Commercial and industrial 99,732 2,667 5,355 — — 107,754 Agricultural operating 33,477 1,352 1,998 — — 36,827 Residential mortgage: Residential mortgage 186,597 516 4,777 — — 191,890 Purchased HELOC loans 11,125 — — — — 11,125 Consumer installment: Originated indirect paper 47,188 — 203 — — 47,391 Purchased indirect paper 11,155 — — — — 11,155 Other consumer 18,326 — 63 — — 18,389 Gross loans $ 983,446 $ 11,978 $ 31,179 $ — $ — $ 1,026,603 Less: Unearned net deferred fees and costs and loans in process 98 Unamortized discount on acquired loans (6,744) Allowance for loan losses (8,759) Loans receivable, net $ 1,011,198 18