Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEW YORK COMMUNITY BANCORP INC | d903133d8k.htm |

Second Quarter 2020 Investor Presentation Exhibit 99.1

Forward-Looking Information This presentation may include forward‐looking statements by the Company and our authorized officers pertaining to such matters as our goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward‐looking statements are subject to the following principal risks and uncertainties: the effect of the COVID-19 pandemic, including the length of time that the pandemic continues, the ability of state and local governments to successfully implement the lifting of restrictions on movement and the potential imposition of further restrictions on movement and travel in the future, the effect of the pandemic on the general economy and on the businesses of our borrowers and their ability to make payments on their obligations, the remedial actions and stimulus measures adopted by federal, state, and local governments, and the inability of employees to work due to illness, quarantine, or government mandates; general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in competitive pressures among financial institutions or from non‐financial institutions; our ability to obtain the necessary shareholder and regulatory approvals of any acquisitions we may propose; our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we may acquire into our operations, and our ability to realize related revenue synergies and cost savings within expected time frames; changes in legislation, regulations, and policies; the impact of recently adopted accounting pronouncements; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. More information regarding some of these factors is provided in the Risk Factors section of our Form 10‐K for the year ended December 31, 2019 and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this presentation, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov. Our Supplemental Use of Non-GAAP Financial Measures This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our performance and financial condition with those of other banks. Such non-GAAP financial measures are supplemental to, and are not to be considered in isolation or as a substitute for, measures calculated in accordance with GAAP. Cautionary Statements

→ We are a leading producer of multi-family loans in New York City. Within this market we focus almost exclusively on the non-luxury, rent regulated niche, where average rents are below market. → Our expertise in this particular lending niche arises from: A consistent presence in this market for over 50 years Long standing relationships with our borrowers, who come to us for our service and execution capabilities Decades long relationships with the top commercial mortgage brokers in the NYC market Significant expertise at the Board level in the NYC real estate market → In addition, we originate commercial real estate loans, and commercial loans, including asset-based lending through our specialty finance team. → We operate over 230 branches in five states with leading market share in many of the markets we operate in. → We are a conservative lender across all of our loan portfolios. → We are a low-cost provider, resulting in an efficient operation. → We complement our organic growth with accretive acquisitions. Overview: Who we are

COVID-19 Response and Support Employees Health and safety of our employees is paramount Extensive precautions have been taken to protect employees returning to their offices and in the branches Dedicated Human Resources team providing direct employee assistance A 24-hour help line for employees and their family members to speak with qualified clinicians Daily communications to ensure employees have ongoing access to critical information Significant changes to branch operations to ensure safety Depositors Waivers for certain retail banking fees Enhanced online banking and mobile app availability/capabilities 90-day payment forbearance for residential mortgage loans Ability to bank by appointment Borrowers Proactive borrower outreach program Enhanced risk mitigation strategies Payment options for up to 6 months

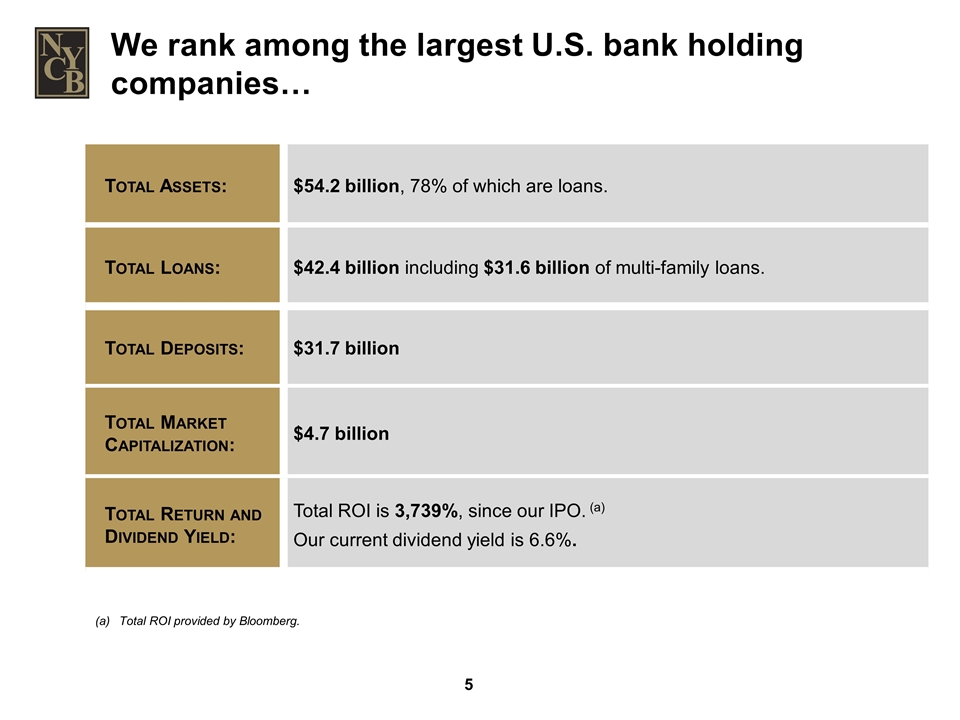

We rank among the largest U.S. bank holding companies… Total Assets: $54.2 billion, 78% of which are loans. Total Deposits: $31.7 billion Total Loans: $42.4 billion including $31.6 billion of multi-family loans. Total Market Capitalization: $4.7 billion Total Return and Dividend Yield: Total ROI is 3,739%, since our IPO. (a) Our current dividend yield is 6.6%. Total ROI provided by Bloomberg.

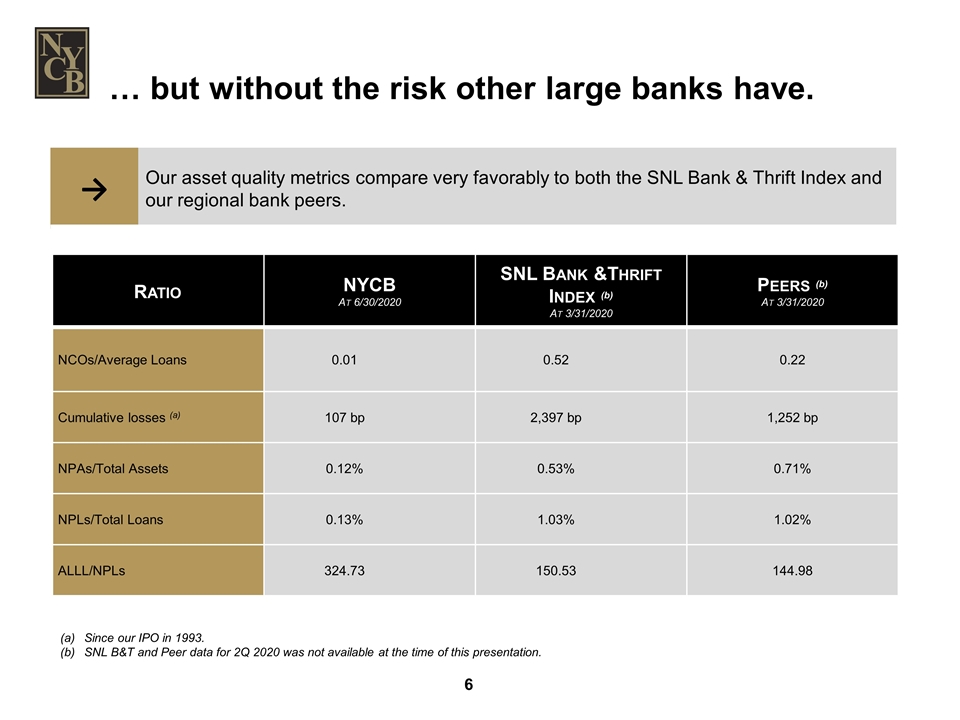

… but without the risk other large banks have. Ratio NYCB At 6/30/2020 SNL Bank &Thrift Index (b) At 3/31/2020 Peers (b) At 3/31/2020 NCOs/Average Loans 0.01 0.52 0.22 Cumulative losses (a) 107 bp 2,397 bp 1,252 bp NPAs/Total Assets 0.12% 0.53% 0.71% NPLs/Total Loans 0.13% 1.03% 1.02% ALLL/NPLs 324.73 150.53 144.98 → Our asset quality metrics compare very favorably to both the SNL Bank & Thrift Index and our regional bank peers. Since our IPO in 1993. SNL B&T and Peer data for 2Q 2020 was not available at the time of this presentation.

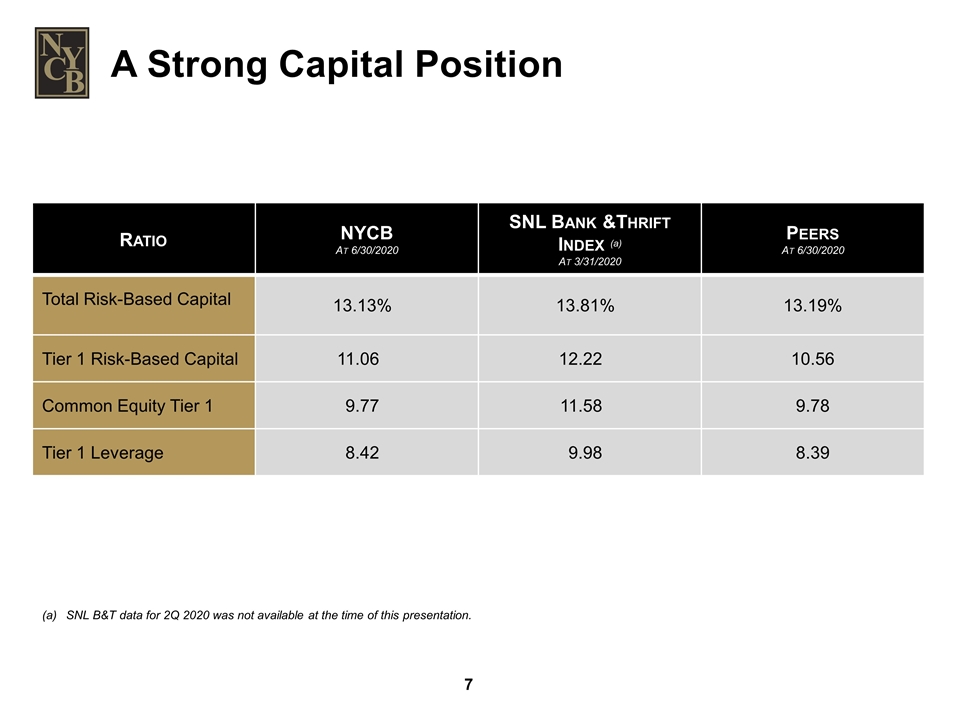

A Strong Capital Position Ratio NYCB At 6/30/2020 SNL Bank &Thrift Index (a) At 3/31/2020 Peers At 6/30/2020 Total Risk-Based Capital 13.13% 13.81% 13.19% Tier 1 Risk-Based Capital 11.06 12.22 10.56 Common Equity Tier 1 9.77 11.58 9.78 Tier 1 Leverage 8.42 9.98 8.39 SNL B&T data for 2Q 2020 was not available at the time of this presentation.

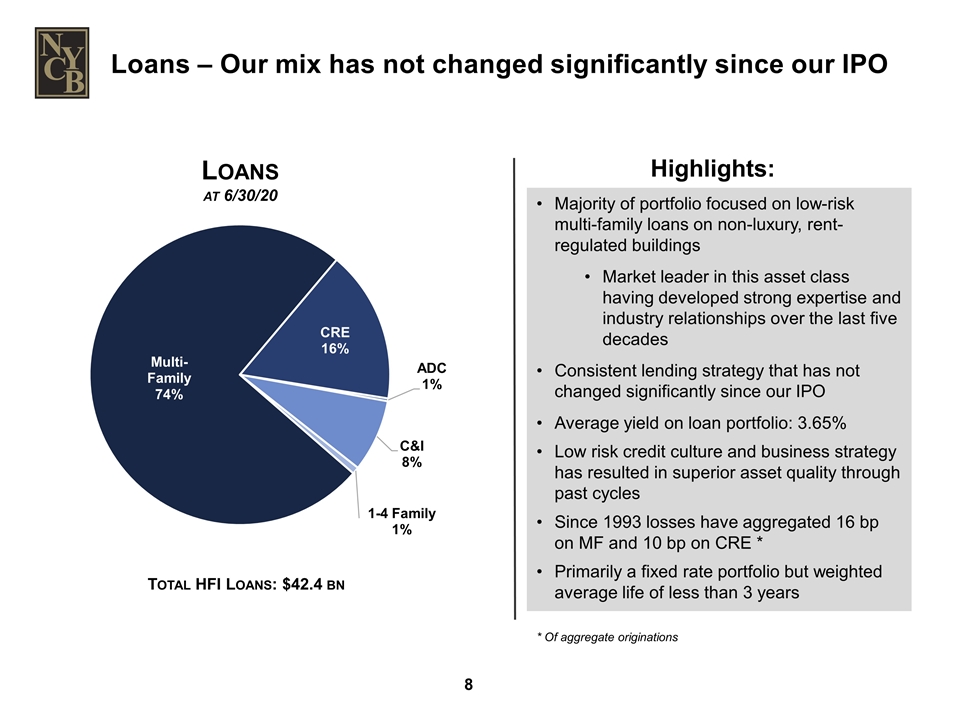

Total HFI Loans: $42.4 bn Loans at 6/30/20 Loans – Our mix has not changed significantly since our IPO Majority of portfolio focused on low-risk multi-family loans on non-luxury, rent-regulated buildings Market leader in this asset class having developed strong expertise and industry relationships over the last five decades Consistent lending strategy that has not changed significantly since our IPO Average yield on loan portfolio: 3.65% Low risk credit culture and business strategy has resulted in superior asset quality through past cycles Since 1993 losses have aggregated 16 bp on MF and 10 bp on CRE * Primarily a fixed rate portfolio but weighted average life of less than 3 years Highlights: * Of aggregate originations

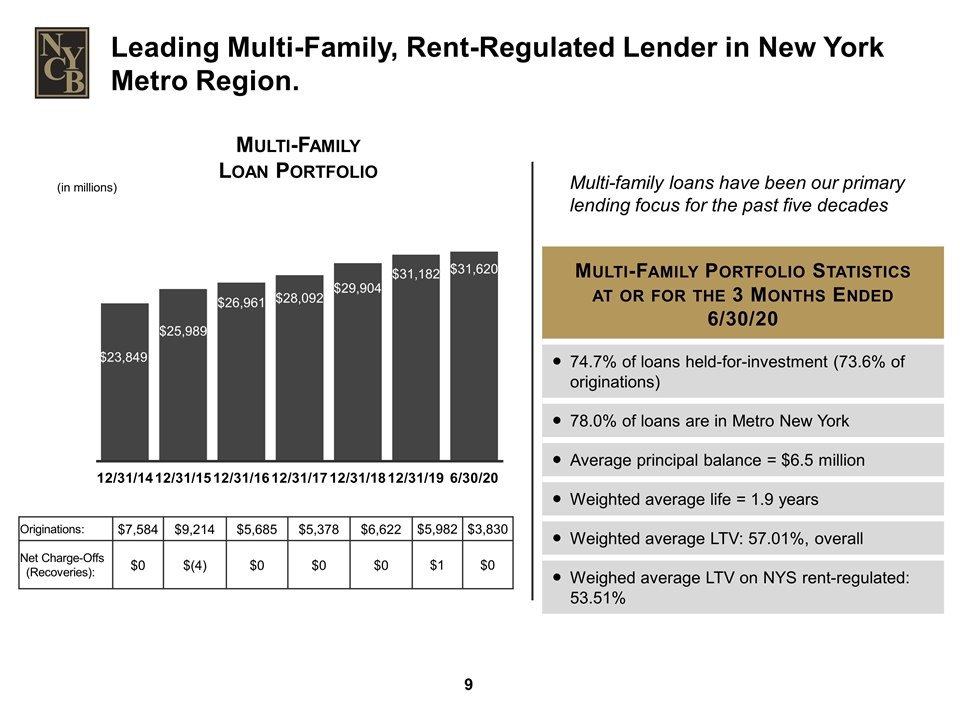

Multi-Family Portfolio Statistics at or for the 3 Months Ended 6/30/20 74.7% of loans held-for-investment (73.6% of originations) 78.0% of loans are in Metro New York Average principal balance = $6.5 million Weighted average life = 1.9 years Weighted average LTV: 57.01%, overall Weighed average LTV on NYS rent-regulated: 53.51% Multi-Family Loan Portfolio (in millions) Originations: $7,584 $9,214 $5,685 $5,378 $6,622 $5,982 $3,830 Net Charge-Offs (Recoveries): $0 $(4) $0 $0 $0 $1 $0 Leading Multi-Family, Rent-Regulated Lender in New York Metro Region. Multi-family loans have been our primary lending focus for the past five decades

Best-in-Class Credit Underwriting Conservative Underwriting Conservative loan-to-value ratios Conservative debt service coverage ratios: 120% for multi-family loans and 130% for CRE loans Multi-family and CRE loans are based on the lower of economic or market value Active Board Involvement The Mortgage Committee and the Credit Committee approve all mortgage loans >$50 million and all “other C&I” loans >$5 million; the Credit Committee also approves all specialty finance loans >$15 million A member of the Mortgage or Credit Committee participates in inspections on multi-family loans in excess of $7.5 million, and CRE and ADC loans in excess of $4.0 million All loans of $20 million or more originated by the Community Bank Four Directors have significant experience in the NYC commercial real estate market Multiple Appraisals All properties are appraised by independent appraisers All independent appraisals are reviewed by in-house appraisal officers A second independent appraisal review is performed on loans that are large and complex

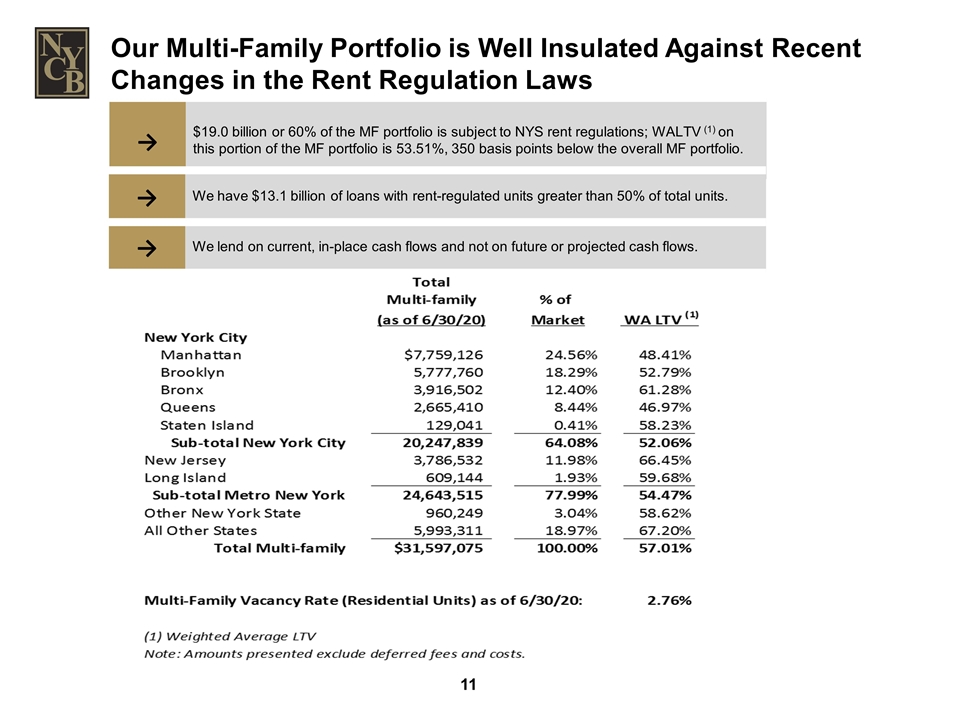

→ $19.0 billion or 60% of the MF portfolio is subject to NYS rent regulations; WALTV (1) on this portion of the MF portfolio is 53.51%, 350 basis points below the overall MF portfolio. Our Multi-Family Portfolio is Well Insulated Against Recent Changes in the Rent Regulation Laws → We lend on current, in-place cash flows and not on future or projected cash flows. → We have $13.1 billion of loans with rent-regulated units greater than 50% of total units.

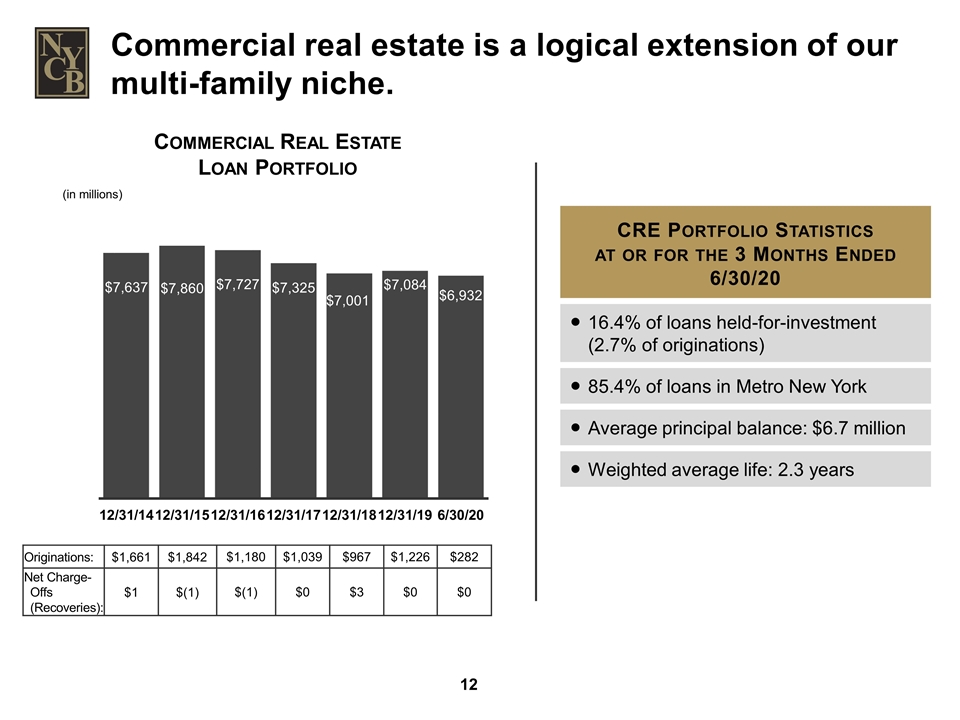

Commercial Real Estate Loan Portfolio (in millions) Originations: $1,661 $1,842 $1,180 $1,039 $967 $1,226 $282 Net Charge-Offs (Recoveries): $1 $(1) $(1) $0 $3 $0 $0 Commercial real estate is a logical extension of our multi-family niche. CRE Portfolio Statistics at or for the 3 Months Ended 6/30/20 16.4% of loans held-for-investment (2.7% of originations) 85.4% of loans in Metro New York Average principal balance: $6.7 million Weighted average life: 2.3 years

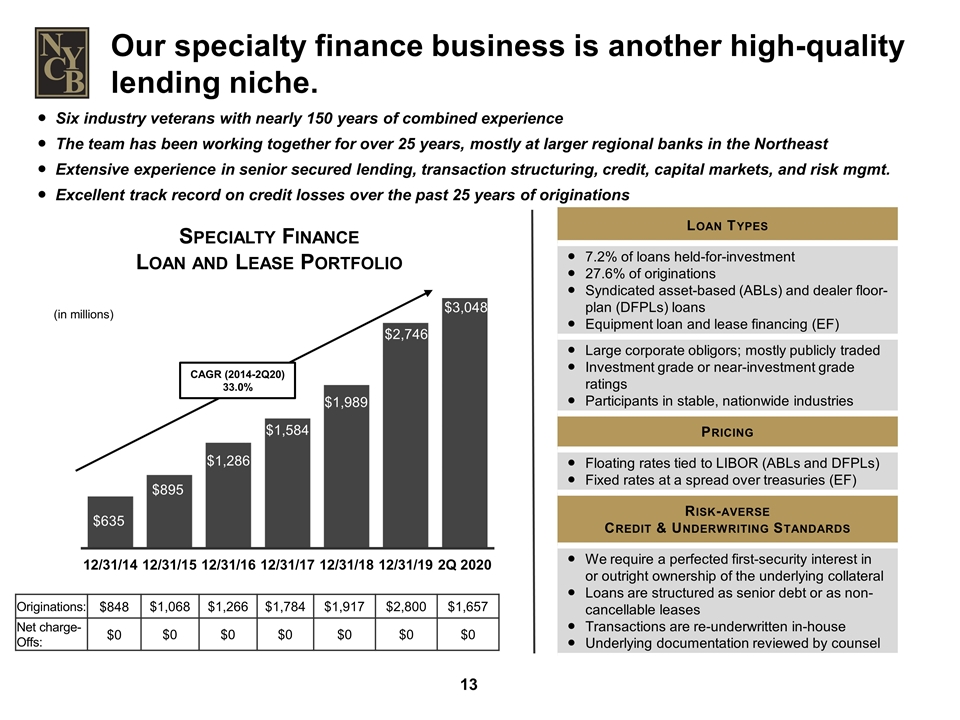

Specialty Finance Loan and Lease Portfolio (in millions) Originations: $848 $1,068 $1,266 $1,784 $1,917 $2,800 $1,657 Net charge-Offs: $0 $0 $0 $0 $0 $0 $0 Our specialty finance business is another high-quality lending niche. Loan Types 7.2% of loans held-for-investment 27.6% of originations Syndicated asset-based (ABLs) and dealer floor-plan (DFPLs) loans Equipment loan and lease financing (EF) Large corporate obligors; mostly publicly traded Investment grade or near-investment grade ratings Participants in stable, nationwide industries Pricing Floating rates tied to LIBOR (ABLs and DFPLs) Fixed rates at a spread over treasuries (EF) Risk-averse Credit & Underwriting Standards We require a perfected first-security interest in or outright ownership of the underlying collateral Loans are structured as senior debt or as non-cancellable leases Transactions are re-underwritten in-house Underlying documentation reviewed by counsel CAGR (2014-2Q20) 33.0% Six industry veterans with nearly 150 years of combined experience The team has been working together for over 25 years, mostly at larger regional banks in the Northeast Extensive experience in senior secured lending, transaction structuring, credit, capital markets, and risk mgmt. Excellent track record on credit losses over the past 25 years of originations

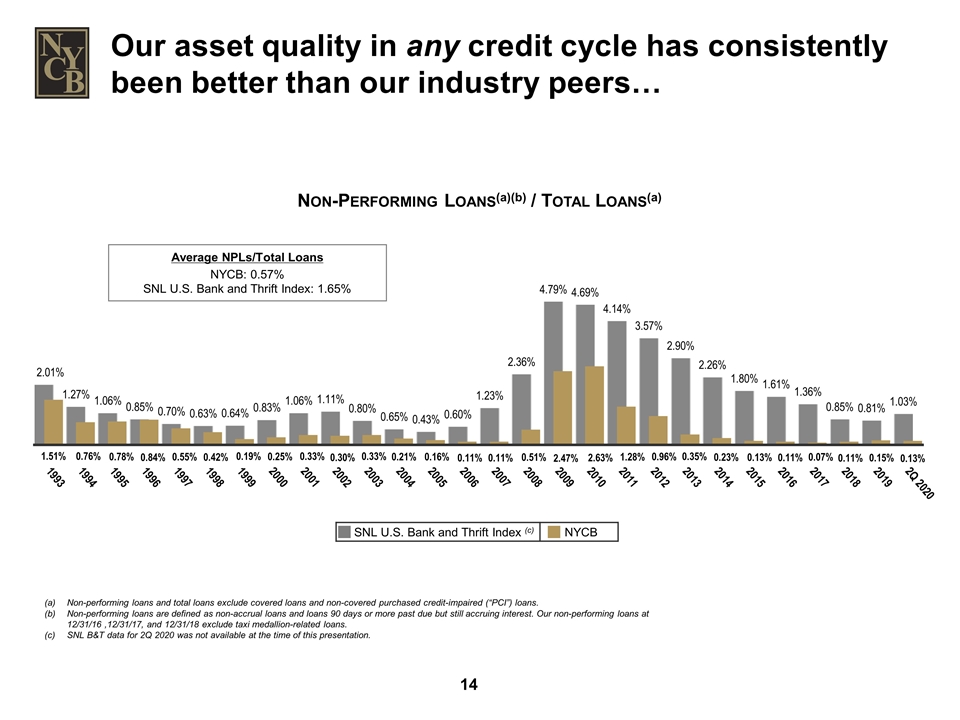

Non-Performing Loans(a)(b) / Total Loans(a) Non-performing loans and total loans exclude covered loans and non-covered purchased credit-impaired (“PCI”) loans. Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. Our non-performing loans at 12/31/16 ,12/31/17, and 12/31/18 exclude taxi medallion-related loans. SNL B&T data for 2Q 2020 was not available at the time of this presentation. Average NPLs/Total Loans NYCB: 0.57% SNL U.S. Bank and Thrift Index: 1.65% SNL U.S. Bank and Thrift Index (c) NYCB Our asset quality in any credit cycle has consistently been better than our industry peers…

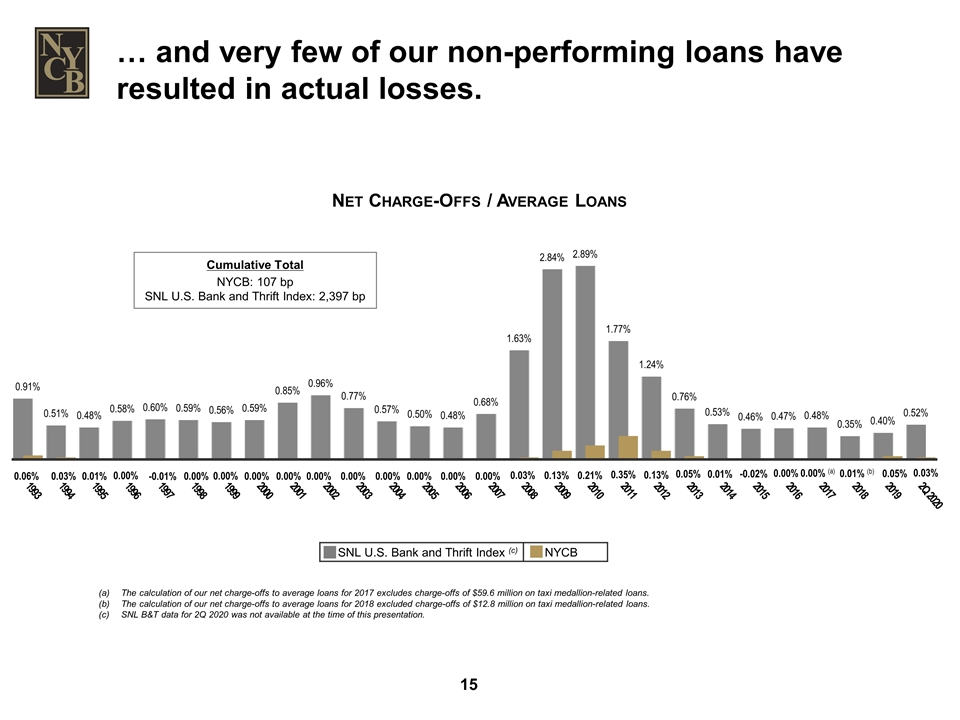

… and very few of our non-performing loans have resulted in actual losses. Net Charge-Offs / Average Loans Cumulative Total NYCB: 107 bp SNL U.S. Bank and Thrift Index: 2,397 bp The calculation of our net charge-offs to average loans for 2017 excludes charge-offs of $59.6 million on taxi medallion-related loans. The calculation of our net charge-offs to average loans for 2018 excluded charge-offs of $12.8 million on taxi medallion-related loans. SNL B&T data for 2Q 2020 was not available at the time of this presentation. SNL U.S. Bank and Thrift Index (c) NYCB

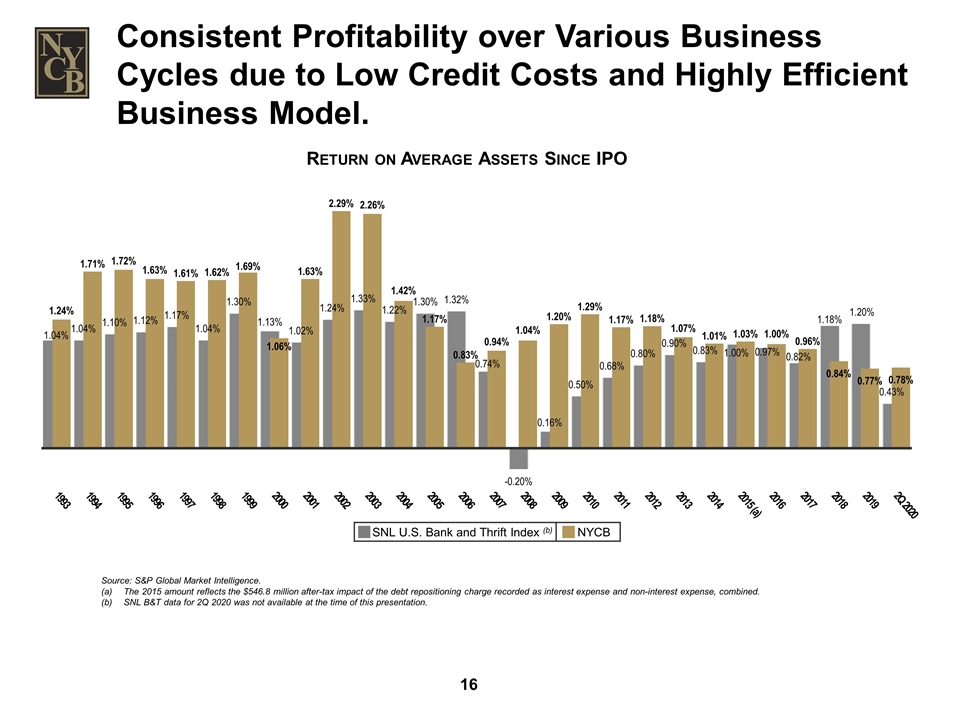

Consistent Profitability over Various Business Cycles due to Low Credit Costs and Highly Efficient Business Model. Source: S&P Global Market Intelligence. The 2015 amount reflects the $546.8 million after-tax impact of the debt repositioning charge recorded as interest expense and non-interest expense, combined. SNL B&T data for 2Q 2020 was not available at the time of this presentation. SNL U.S. Bank and Thrift Index (b) NYCB Return on Average Assets Since IPO

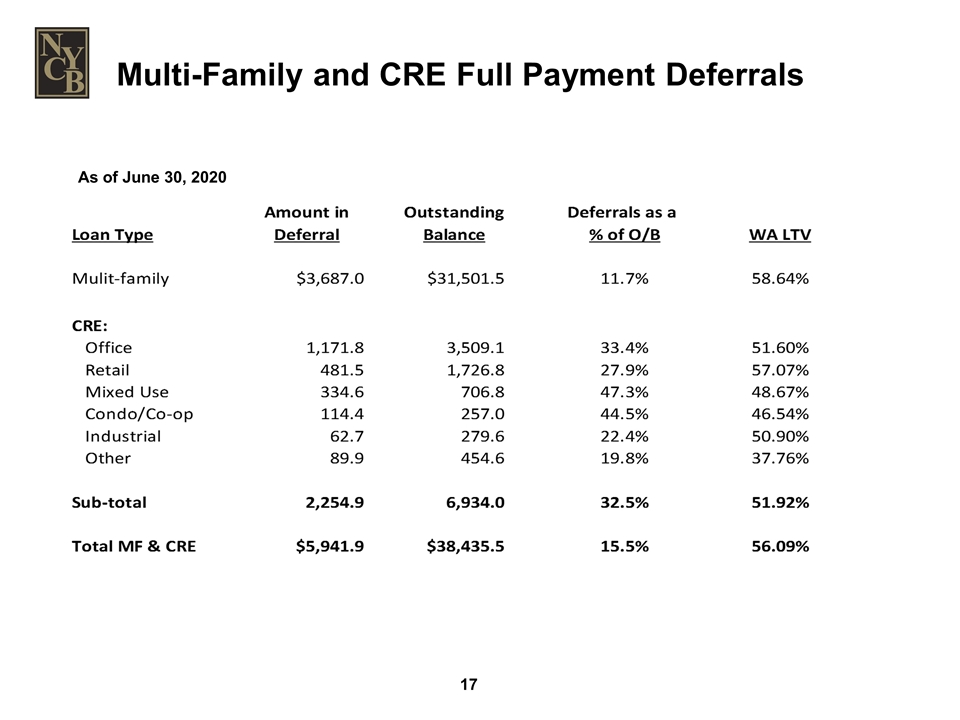

Multi-Family and CRE Full Payment Deferrals As of June 30, 2020

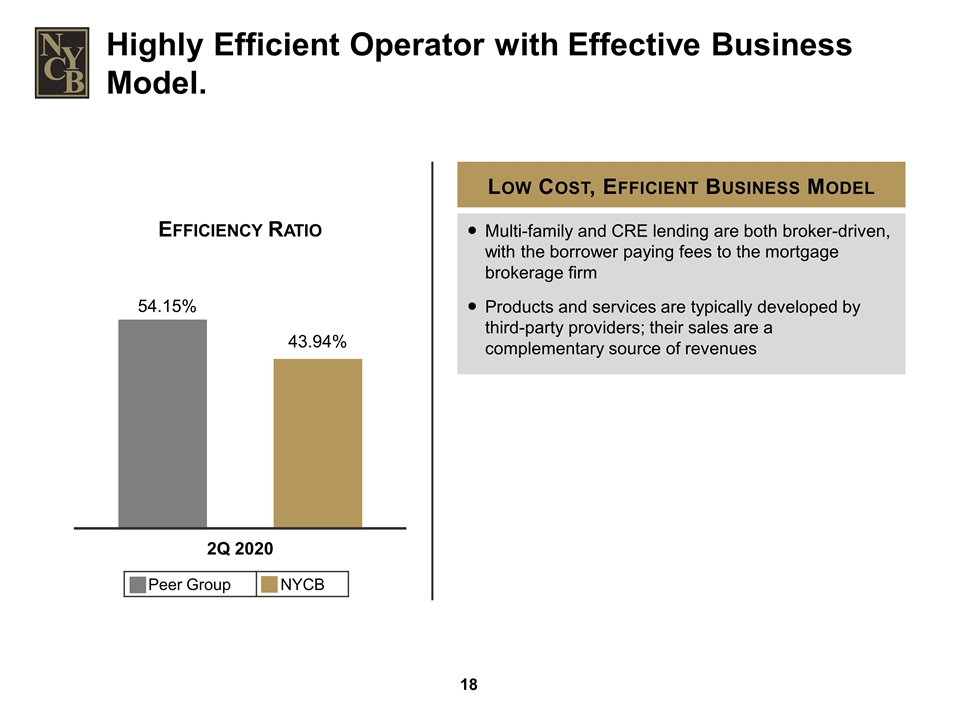

Efficiency Ratio Peer Group NYCB Highly Efficient Operator with Effective Business Model. Low Cost, Efficient Business Model Multi-family and CRE lending are both broker-driven, with the borrower paying fees to the mortgage brokerage firm Products and services are typically developed by third-party providers; their sales are a complementary source of revenues

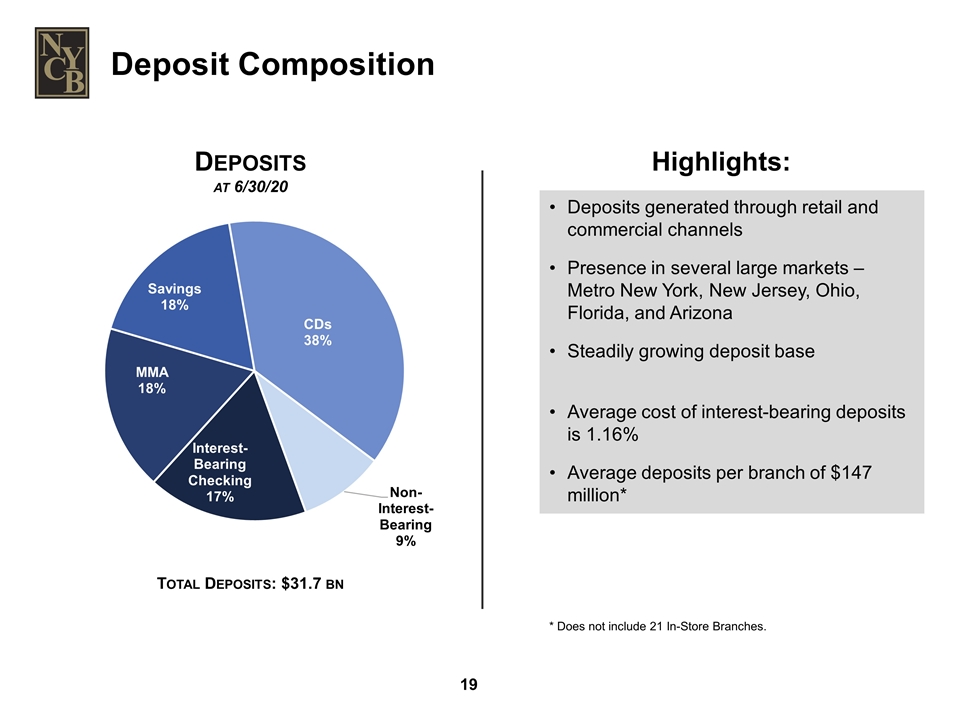

Total Deposits: $31.7 bn Deposits at 6/30/20 Deposit Composition Deposits generated through retail and commercial channels Presence in several large markets – Metro New York, New Jersey, Ohio, Florida, and Arizona Steadily growing deposit base Average cost of interest-bearing deposits is 1.16% Average deposits per branch of $147 million* Highlights: * Does not include 21 In-Store Branches.

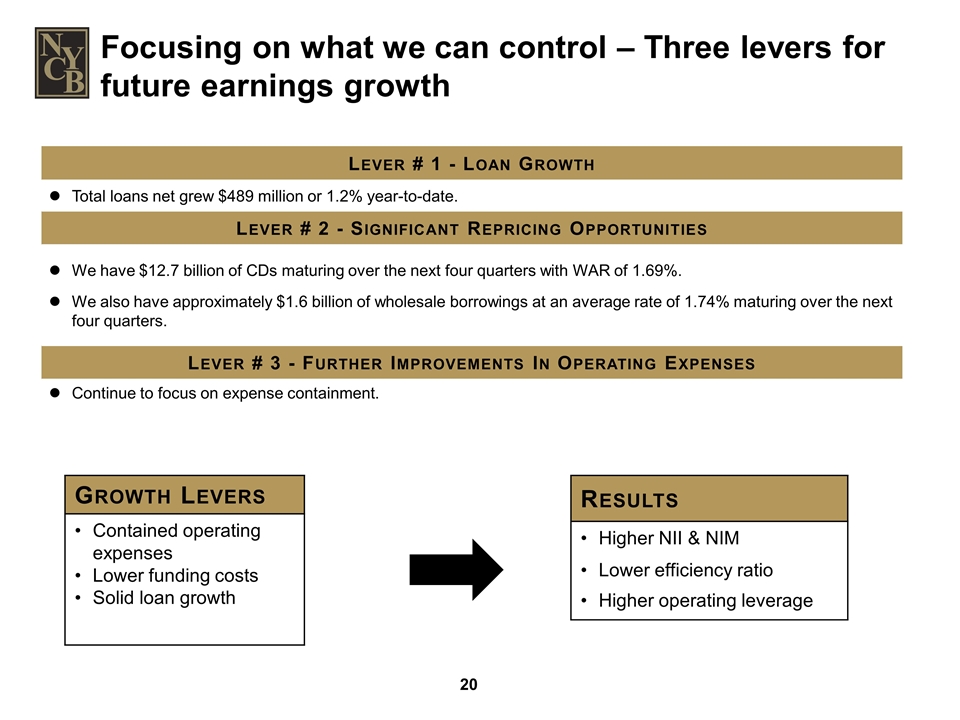

Lever # 1 - Loan Growth Total loans net grew $489 million or 1.2% year-to-date. Lever # 2 - Significant Repricing Opportunities We have $12.7 billion of CDs maturing over the next four quarters with WAR of 1.69%. We also have approximately $1.6 billion of wholesale borrowings at an average rate of 1.74% maturing over the next four quarters. Lever # 3 - Further Improvements In Operating Expenses Continue to focus on expense containment. Focusing on what we can control – Three levers for future earnings growth Growth Levers Contained operating expenses Lower funding costs Solid loan growth Results Higher NII & NIM Lower efficiency ratio Higher operating leverage

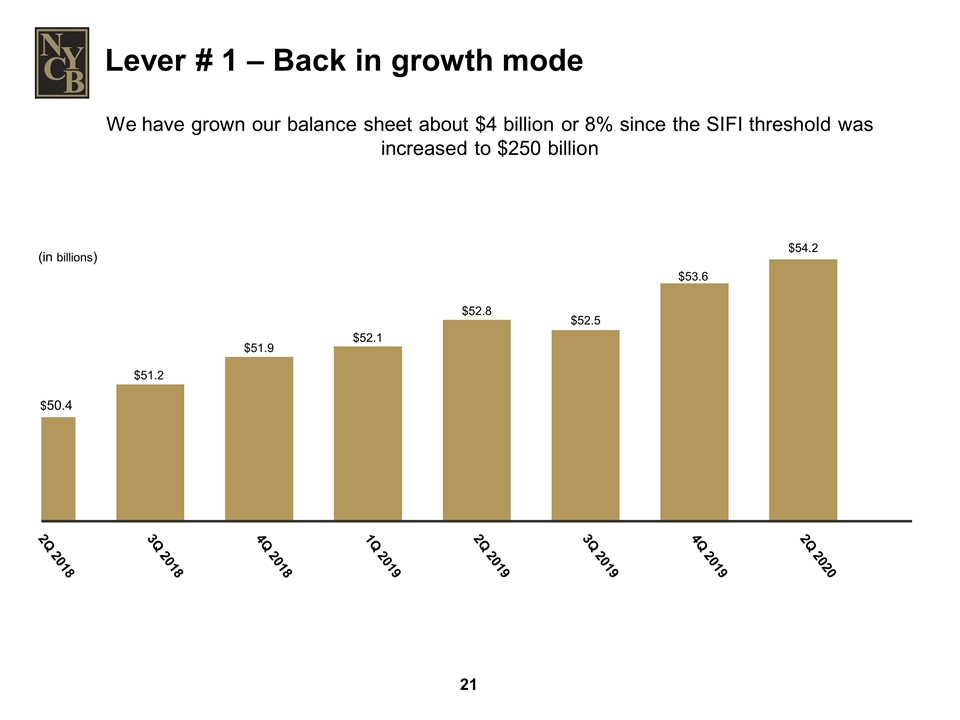

Lever # 1 – Back in growth mode We have grown our balance sheet about $4 billion or 8% since the SIFI threshold was increased to $250 billion

Lever # 2 - Re-pricing Opportunities → Approximately $1.6 billion of wholesale borrowings at an average rate of 1.74% maturing over the next four quarters. → Approximately $12.7 billion of CDs maturing over the next four quarters at an average rate of 1.69%.

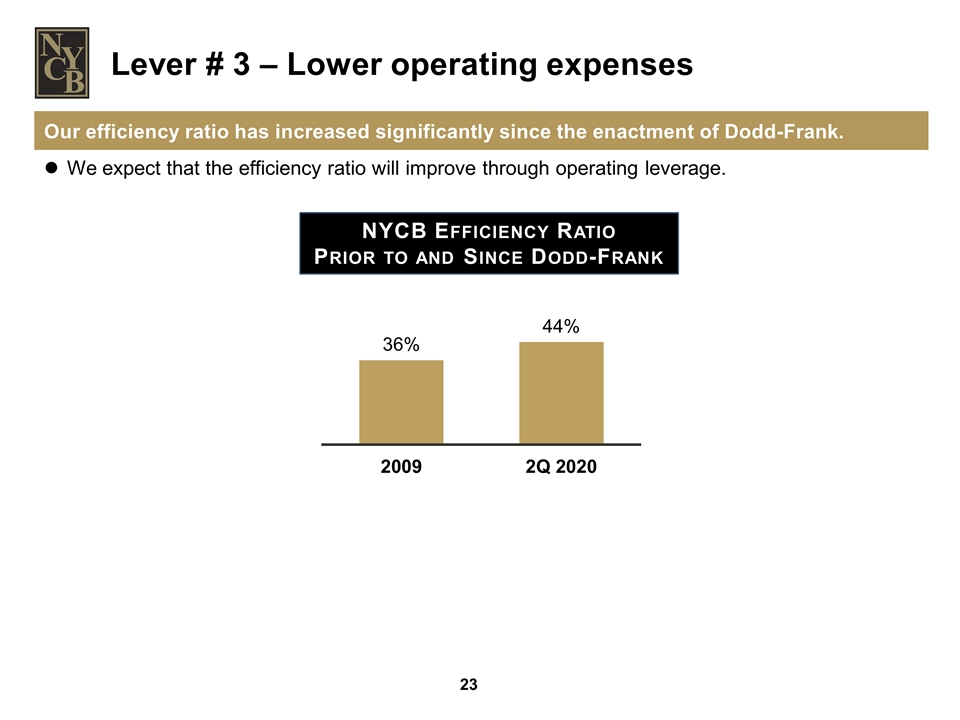

NYCB Efficiency Ratio Prior to and Since Dodd-Frank Our efficiency ratio has increased significantly since the enactment of Dodd-Frank. We expect that the efficiency ratio will improve through operating leverage. Lever # 3 – Lower operating expenses

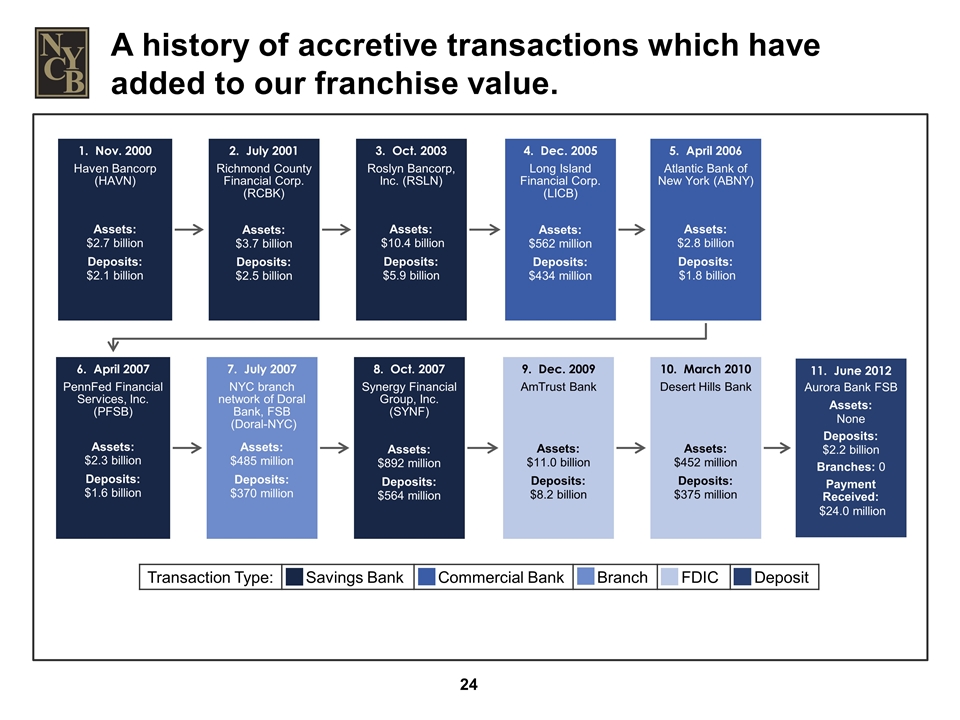

Transaction Type: Savings Bank Commercial Bank Branch FDIC Deposit A history of accretive transactions which have added to our franchise value. 1 . Nov. 2000 Haven Bancorp (HAVN) Assets: $2.7 billion Deposits: $2.1 billion 3 . Oct. 2003 Roslyn Bancorp, Inc. (RSLN) Assets: $10.4 billion Deposits: $5.9 billion 4. Dec. 2005 Long Island Financial Corp. (LICB) Assets: $562 million Deposits: $434 million 2 . July 2001 Richmond County Financial Corp. (RCBK) Assets: $3.7 billion Deposits: $2.5 billion 5. April 2006 Atlantic Bank of New York (ABNY) Assets: $2.8 billion Deposits: $1.8 billion 6. April 2007 PennFed Financial Services, Inc. (PFSB) Assets: $2.3 billion Deposits: $1.6 billion 7. July 2007 NYC branch network of Doral Bank, FSB (Doral-NYC) Assets: $485 million Deposits: $370 million 8. Oct. 2007 Synergy Financial Group, Inc. (SYNF) Assets: $892 million Deposits: $564 million 9. Dec. 2009 AmTrust Bank Assets: $11.0 billion Deposits: $8.2 billion 10. March 2010 Desert Hills Bank Assets: $452 million Deposits: $375 million 11. June 2012 Aurora Bank FSB Assets: None Deposits: $2.2 billion Branches: 0 Payment Received: $24.0 million

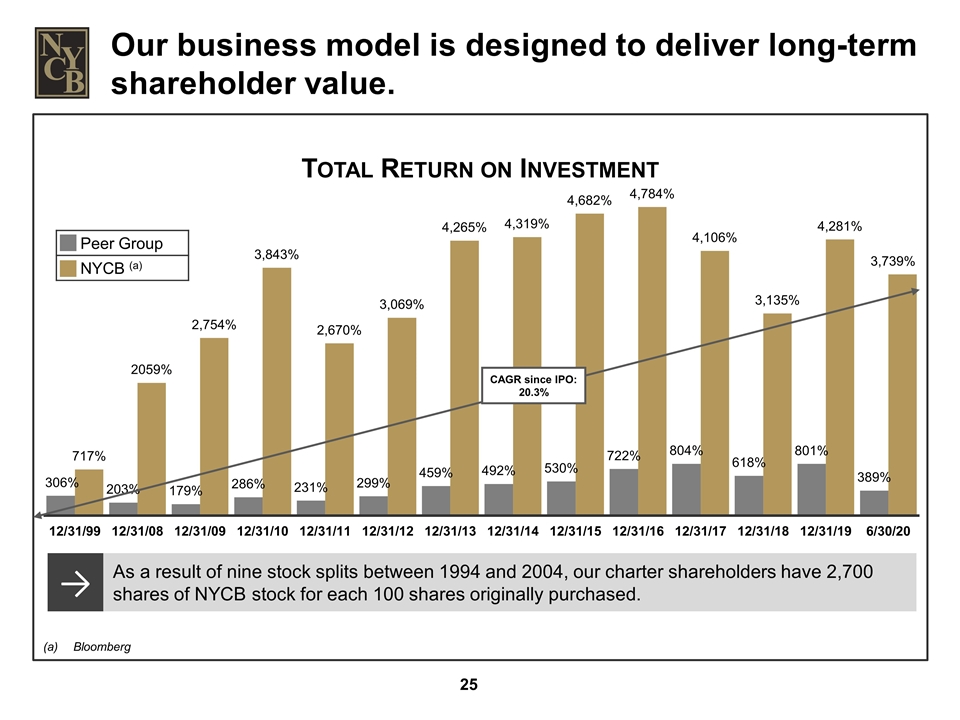

Our business model is designed to deliver long-term shareholder value. Total Return on Investment Bloomberg CAGR since IPO: 20.3% → As a result of nine stock splits between 1994 and 2004, our charter shareholders have 2,700 shares of NYCB stock for each 100 shares originally purchased. Peer Group NYCB (a)

Key Investment Highlights Uniquely positioned in the current environment Expect double-digit EPS growth in 2020 and 2021 Expect double-digit NIM expansion throughout the year Minimal credit losses and provisioning under CECL even after taking COVID-19 impact into account Expenses will remain well contained Above-average dividend yield Strong capital position 1 4 5 3 2 6 7

Visit our website: ir.myNYCB.com E-mail requests to: ir@myNYCB.com Call Investor Relations at: (516) 683-4420 Write to: Investor Relations New York Community Bancorp, Inc. 615 Merrick Avenue Westbury, NY 11590 For More Information

Appendix

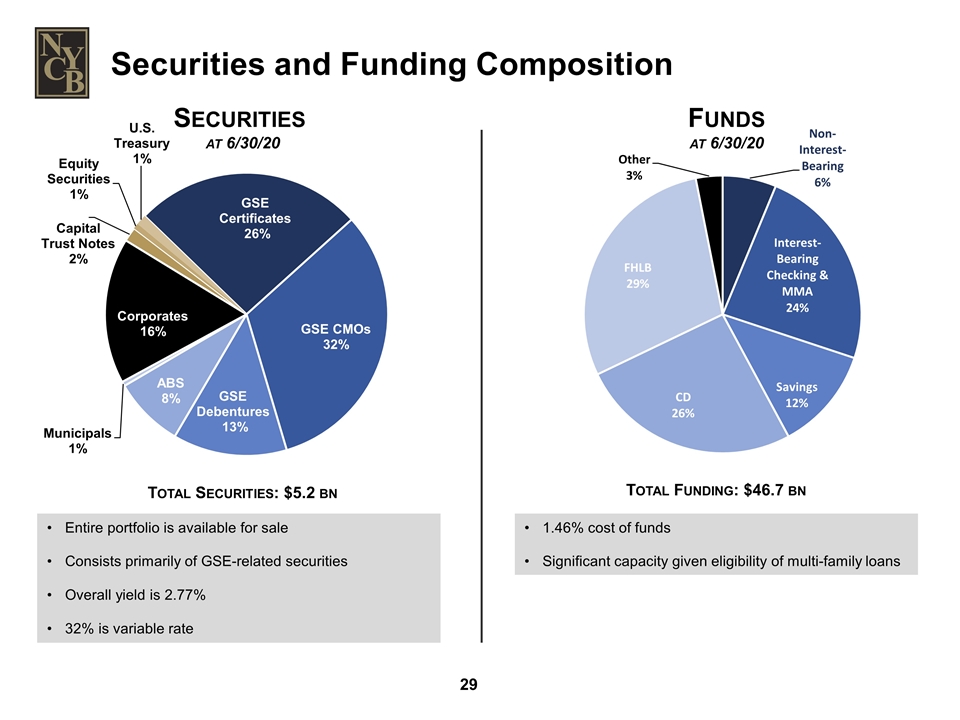

Securities and Funding Composition Funds at 6/30/20 1.46% cost of funds Significant capacity given eligibility of multi-family loans Total Funding: $46.7 bn Entire portfolio is available for sale Consists primarily of GSE-related securities Overall yield is 2.77% 32% is variable rate Securities at 6/30/20 Total Securities: $5.2 bn

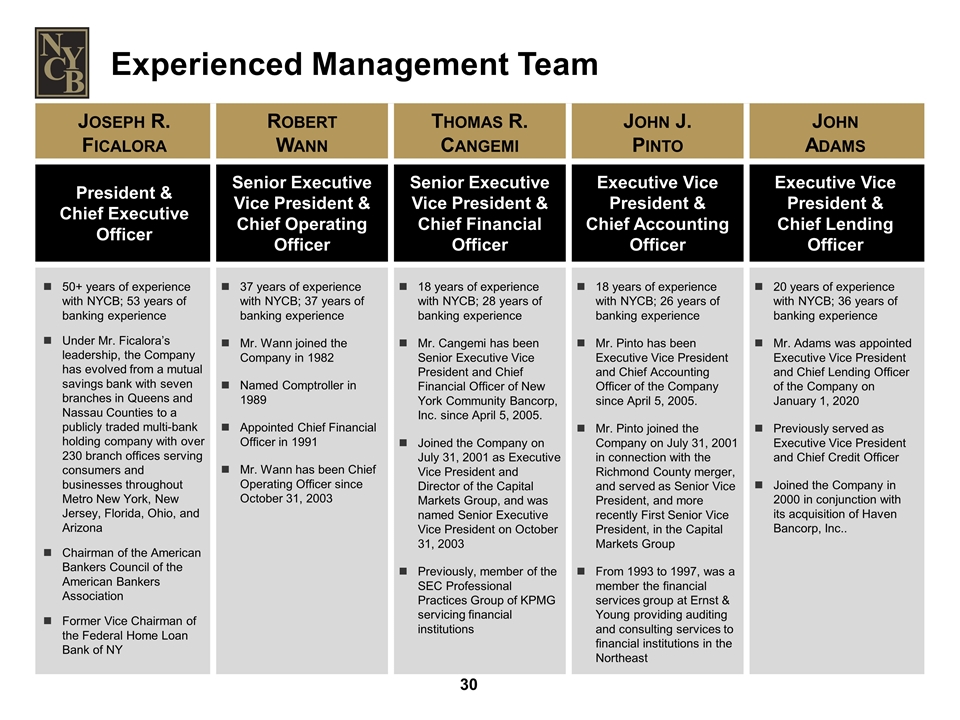

Experienced Management Team Joseph R. Ficalora Robert Wann Thomas R. Cangemi John J. Pinto John Adams President & Chief Executive Officer Senior Executive Vice President & Chief Operating Officer Senior Executive Vice President & Chief Financial Officer Executive Vice President & Chief Accounting Officer Executive Vice President & Chief Lending Officer 50+ years of experience with NYCB; 53 years of banking experience Under Mr. Ficalora’s leadership, the Company has evolved from a mutual savings bank with seven branches in Queens and Nassau Counties to a publicly traded multi-bank holding company with over 230 branch offices serving consumers and businesses throughout Metro New York, New Jersey, Florida, Ohio, and Arizona Chairman of the American Bankers Council of the American Bankers Association Former Vice Chairman of the Federal Home Loan Bank of NY 37 years of experience with NYCB; 37 years of banking experience Mr. Wann joined the Company in 1982 Named Comptroller in 1989 Appointed Chief Financial Officer in 1991 Mr. Wann has been Chief Operating Officer since October 31, 2003 18 years of experience with NYCB; 28 years of banking experience Mr. Cangemi has been Senior Executive Vice President and Chief Financial Officer of New York Community Bancorp, Inc. since April 5, 2005. Joined the Company on July 31, 2001 as Executive Vice President and Director of the Capital Markets Group, and was named Senior Executive Vice President on October 31, 2003 Previously, member of the SEC Professional Practices Group of KPMG servicing financial institutions 18 years of experience with NYCB; 26 years of banking experience Mr. Pinto has been Executive Vice President and Chief Accounting Officer of the Company since April 5, 2005. Mr. Pinto joined the Company on July 31, 2001 in connection with the Richmond County merger, and served as Senior Vice President, and more recently First Senior Vice President, in the Capital Markets Group From 1993 to 1997, was a member the financial services group at Ernst & Young providing auditing and consulting services to financial institutions in the Northeast 20 years of experience with NYCB; 36 years of banking experience Mr. Adams was appointed Executive Vice President and Chief Lending Officer of the Company on January 1, 2020 Previously served as Executive Vice President and Chief Credit Officer Joined the Company in 2000 in conjunction with its acquisition of Haven Bancorp, Inc..

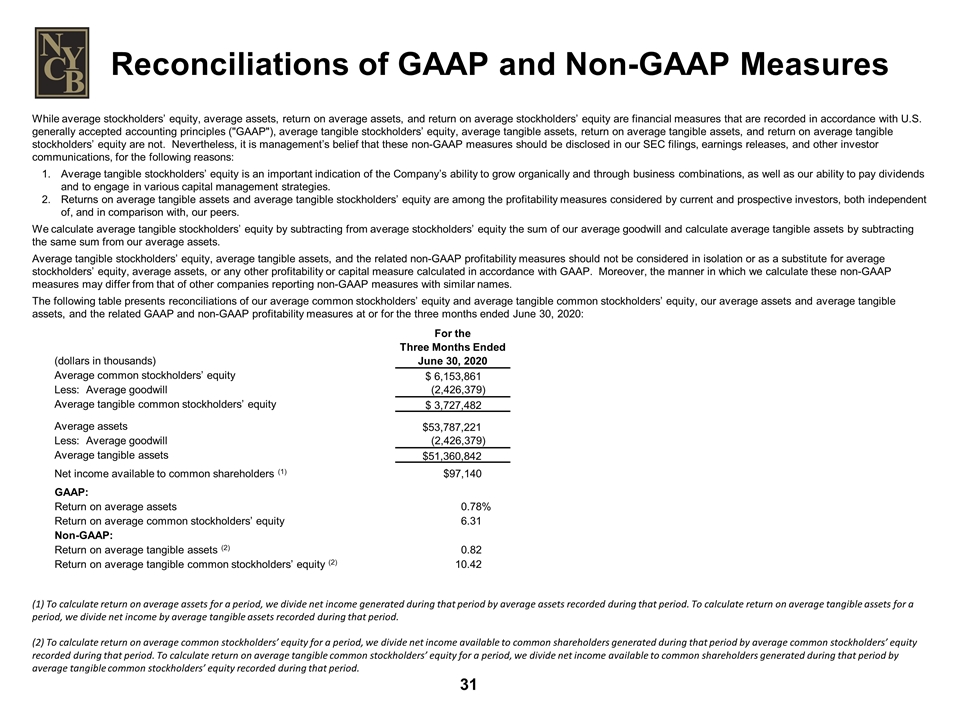

While average stockholders’ equity, average assets, return on average assets, and return on average stockholders’ equity are financial measures that are recorded in accordance with U.S. generally accepted accounting principles ("GAAP"), average tangible stockholders’ equity, average tangible assets, return on average tangible assets, and return on average tangible stockholders’ equity are not. Nevertheless, it is management’s belief that these non-GAAP measures should be disclosed in our SEC filings, earnings releases, and other investor communications, for the following reasons: Average tangible stockholders’ equity is an important indication of the Company’s ability to grow organically and through business combinations, as well as our ability to pay dividends and to engage in various capital management strategies. Returns on average tangible assets and average tangible stockholders’ equity are among the profitability measures considered by current and prospective investors, both independent of, and in comparison with, our peers. We calculate average tangible stockholders’ equity by subtracting from average stockholders’ equity the sum of our average goodwill and calculate average tangible assets by subtracting the same sum from our average assets. Average tangible stockholders’ equity, average tangible assets, and the related non-GAAP profitability measures should not be considered in isolation or as a substitute for average stockholders’ equity, average assets, or any other profitability or capital measure calculated in accordance with GAAP. Moreover, the manner in which we calculate these non-GAAP measures may differ from that of other companies reporting non-GAAP measures with similar names. The following table presents reconciliations of our average common stockholders’ equity and average tangible common stockholders’ equity, our average assets and average tangible assets, and the related GAAP and non-GAAP profitability measures at or for the three months ended June 30, 2020: (1) To calculate return on average assets for a period, we divide net income generated during that period by average assets recorded during that period. To calculate return on average tangible assets for a period, we divide net income by average tangible assets recorded during that period. (2) To calculate return on average common stockholders’ equity for a period, we divide net income available to common shareholders generated during that period by average common stockholders’ equity recorded during that period. To calculate return on average tangible common stockholders’ equity for a period, we divide net income available to common shareholders generated during that period by average tangible common stockholders’ equity recorded during that period. Reconciliations of GAAP and Non-GAAP Measures (dollars in thousands) For the Three Months Ended June 30, 2020 Average common stockholders’ equity $ 6,153,861 Less: Average goodwill (2,426,379) Average tangible common stockholders’ equity $ 3,727,482 Average assets $53,787,221 Less: Average goodwill (2,426,379) Average tangible assets $51,360,842 Net income available to common shareholders (1) $97,140 GAAP: Return on average assets 0.78% Return on average common stockholders’ equity 6.31 Non-GAAP: Return on average tangible assets (2) 0.82 Return on average tangible common stockholders’ equity (2) 10.42

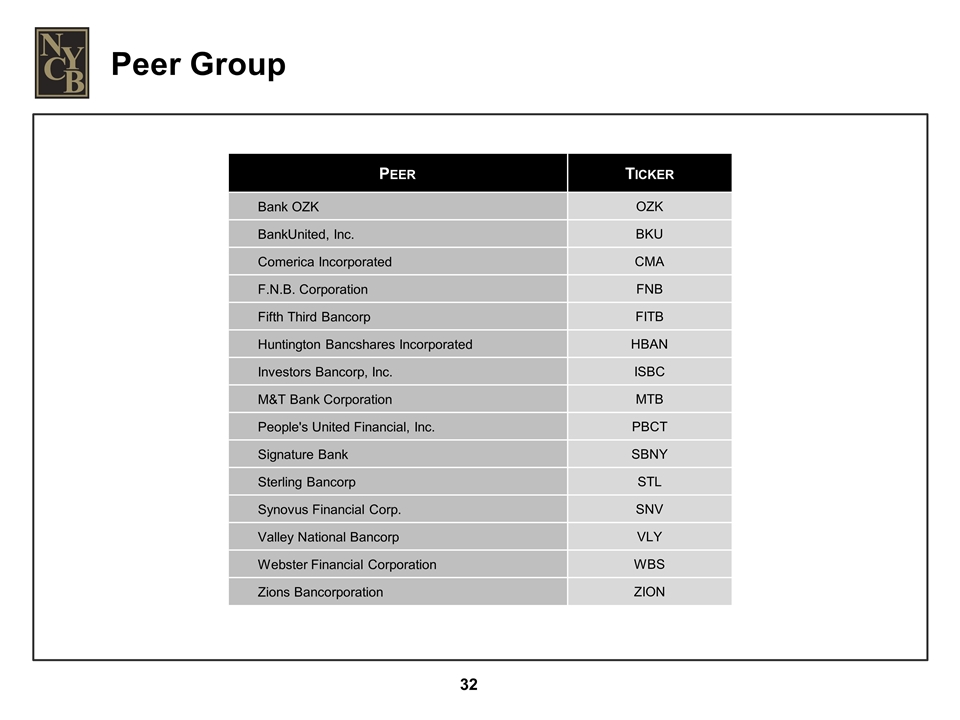

Peer Group Peer Ticker Bank OZK OZK BankUnited, Inc. BKU Comerica Incorporated CMA F.N.B. Corporation FNB Fifth Third Bancorp FITB Huntington Bancshares Incorporated HBAN Investors Bancorp, Inc. ISBC M&T Bank Corporation MTB People's United Financial, Inc. PBCT Signature Bank SBNY Sterling Bancorp STL Synovus Financial Corp. SNV Valley National Bancorp VLY Webster Financial Corporation WBS Zions Bancorporation ZION