Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GERMAN AMERICAN BANCORP, INC. | a8k72020investorpresen.htm |

German American Symbol: GABC July 28 – 30, 2020 Keefe Bruyette & Woods Community Bank Investor Conference

Presented By Mark A. Schroeder, Chairman and CEO (812) 482-0701 mark.schroeder@germanamerican.com Bradley M. Rust, EVP and CFO (812) 482-0718 brad.rust@germanamerican.com 2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2019 as updated and supplemented by our other SEC reports filed from time to time. 3

Who We Are Indiana & Kentucky Community-focused Financial Services Organization • Banking, Insurance, Investments & Trust • $4.9 Billion Total Banking Assets • $1.6 Billion Investment and Trust Assets Under Management • $60 Million Annual Insurance Premiums • 825+ FTEs • 73 Banking Offices 4

COVID-19 Credit Risk Management • Industry Segment Risk Profile • COVID-19 Related Loan Deferrals • Paycheck Protection Program • Strong Capital Structure 5

Industry Segment Profiles Affected by COVID-19 As of June 30, 2020 Industry Segment Number of Loans Outstanding % Of Total Loans (Dollars in Thousands) Balance Lodging/Hotels 51 $130,112 4.0% Student Housing 107 $94,226 2.9% Retail Shopping/ Strip Centers 61 $93,172 2.9% Restaurants 190 $50,724 1.6% 6

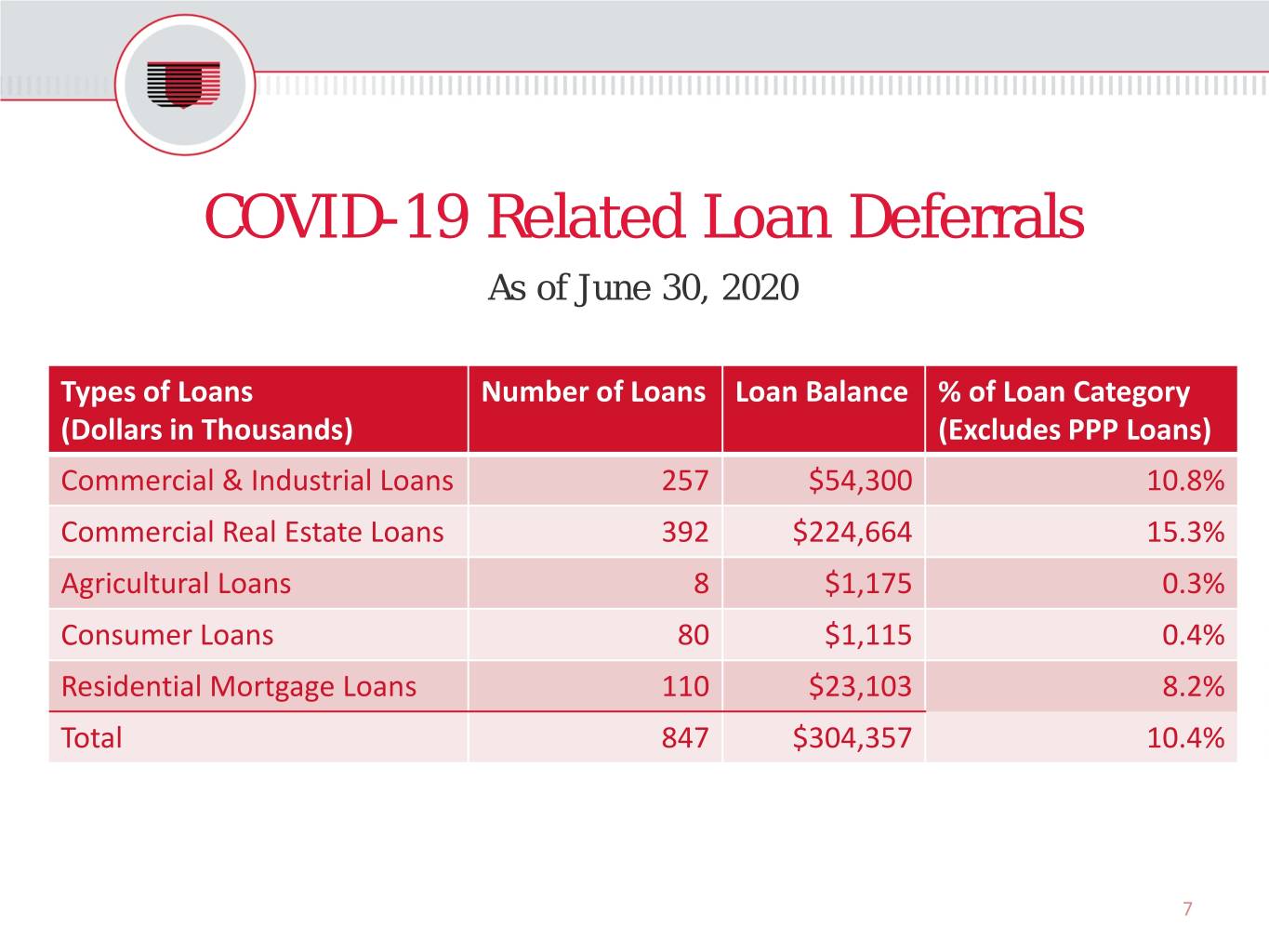

COVID-19 Related Loan Deferrals As of June 30, 2020 Types of Loans Number of Loans Loan Balance % of Loan Category (Dollars in Thousands) (Excludes PPP Loans) Commercial & Industrial Loans 257 $54,300 10.8% Commercial Real Estate Loans 392 $224,664 15.3% Agricultural Loans 8 $1,175 0.3% Consumer Loans 80 $1,115 0.4% Residential Mortgage Loans 110 $23,103 8.2% Total 847 $304,357 10.4% 7

SBA Payroll Protection Plan As of June 30, 2020 • 3,000 SBA payroll protection plan loans • $350 million total • $12.6 million potential fees (gross) 8

Strong Capital Structure Key Ratios as of June 30, 2020 TCE/ Tangible Assets 9.79% Total Risk-based 15.22% Tier 1 Risk-based 13.35% Leverage 9.97% 9

Diversified Economic Base Regional Education, Health Care Manufacturing & Logistics Life Sciences & Technology MAJOR INDIANA EMPLOYERS: Manufacturing & Logistics Energy Education Aisin U.S.A. MFG, Inc. Indiana University ALCOA Warrick Operations Indiana University Southeast Amazon Fulfillment Service Life Sciences & Technology University of Southern Indiana Batesville Services Inc Baxter BioPharma Solutions Vincennes University Berry Global Crane Naval Surface Weapons Center Greater Clark County School Corp Best Chairs Inc Cook Group, Inc. Evansville Vanderburgh County School Corp Costco Home & Office Products Mead Johnson Nutrition Monroe County School Corporation Cummins, Inc. (Cummins Diesel) Samtec New Albany – Floyd County School Corp Faurecia Gladstone Grote Industries Inc Energy Health Care Hillenbrand Inc Duke Energy Indiana University Health Honda Manufacturing LLC Vectren Baptist Health Floyd Hospital Jasper Engines & Transmissions Columbus Regional Hospital Kimball Electronics Clark Memorial Hospital Kimball International, Inc. Deaconess Health System Koch Enterprises, Inc. Good Samaritan Hospital Lowe’s Distribution Center King’s Daughters’ Hospital MasterBrand Cabinets, Inc. Margaret Mary Hospital and Health NTN Driveshaft Inc Memorial Hospital OFS Brands (Office-Furniture Systems) St Vincent’s Medical Center TMMI Walmart Distribution Center Waupaca Foundry Inc 10 Valeo Sylvania LLC

Diversified Economic Base Regional Education Health Care & Social Assistance Manufacturing & Logistics MAJOR KENTUCKY EMPLOYERS: Retail & Government Education University of Kentucky Manufacturing & Logistics Retail Western Kentucky University Bowling Green Metal Forming Amazon Daviess County Public School System Fruit of the Loom Houchens Industries Fayette County Public Schools Ashland Oil Corporate Headquarters Warren County Public Schools Lexmark International Inc Government General Motors Co Lexington-Fayette Urban County Health Care & Social Assistance UPS Customer Center Owensboro Health Regional Hospital Lockheed Martin Commonwealth Health Corp Conduent, Inc. Baptist Health Lexington Family Bluegrass Federal Medical Center Lexington Clinic Pfc St. Joseph East Emergency St. Joseph Hospital UK Advance Eye Care UK Albert B Chandler Hospital US Veterans Medical Ctr VA Medical Center- Leestown 11

Capitalize upon Market Strength & Growth Indiana Small MSA Market Expansion Total Market GABC Deposit Market Share # of Market Deposits Market Share*** Position*** Branches Heritage Markets* $ 5,300,573 34% #1 31 Evansville/Newburgh $ 4,830,382 10% #3 8 Bloomington $ 2,474,524 9% #4 3 Columbus $ 1,297,390 11% #3 5 Louisville MSA (Indiana Portion)** $ 3,260,863 5% #8 5 Total Indiana Growth $ 11,863,159 Markets * Includes the Indiana counties of Daviess, Dubois, Gibson, Jefferson, Knox, Lawrence, Martin, Perry, Pike & Spencer ** Includes the Indiana counties of Clark & Floyd *** Source: FDIC 06/30/19 Statistics. 12

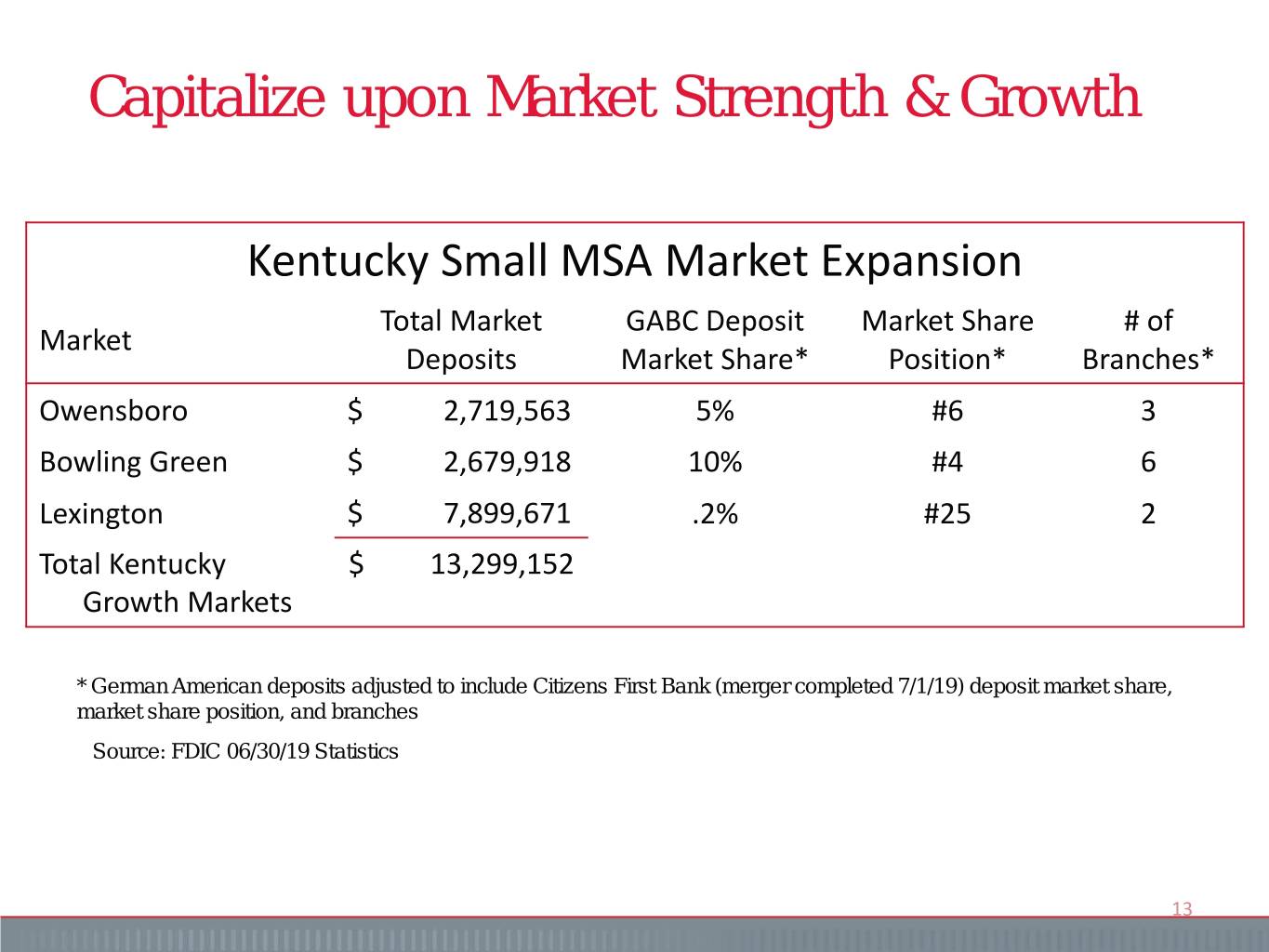

Capitalize upon Market Strength & Growth Kentucky Small MSA Market Expansion Total Market GABC Deposit Market Share # of Market Deposits Market Share* Position* Branches* Owensboro $ 2,719,563 5% #6 3 Bowling Green $ 2,679,918 10% #4 6 Lexington $ 7,899,671 .2% #25 2 Total Kentucky $ 13,299,152 Growth Markets * German American deposits adjusted to include Citizens First Bank (merger completed 7/1/19) deposit market share, market share position, and branches Source: FDIC 06/30/19 Statistics 13

History of Superior Financial Performance Ten Years of Consecutive Record Earnings Performance Double-Digit Return on Equity for Past 15 Consecutive Fiscal Years KBW/Stifel 2010 thru 2020 Bank Honor Roll Recipient Bank Director Magazine - Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 ($1 - $5 billion Publicly-traded Companies) Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017 & 2018 14

Financial Trends 15

Total Assets Annualized Return on Assets $6,000 $5,000 $4,851 $4,398 $3,929 $4,000 $3,144 $2,956 $3,000 $2,374 1.43% $2,000 1.33% 1.35% 1.38% 1.24% 1.18% $1,000 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 (Dollars in Millions) 16

Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans $3,500 $3,266 $3,250 $3,077 $3,000 $2,728 $2,750 $2,500 $2,250 $2,142 $1,990 $2,000 $1,750 $1,564 $1,500 $1,250 82% 81% 81% 82% $1,000 78% 80% $750 $500 $250 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 (Dollars in Millions) 17

Loan Composition as of June 30, 2020 Total Loans $3,266.3 million Residential Mortgage Loans, $ 287.9 million, 9% Construction & Development Loans, Home Equity Loans, $ 194.3 million, 6% $ 217.1 million, 6% Agricultural Loans, $ 383.4 million, 12% Consumer Loans, $ 59.3 million, 2% Commercial Real Estate Owner Occupied, $ 353.0 million, 11% Commercial & Industrial Loans, $ 805.7 million, 24% Commercial Real Estate Non- Owner Occupied, $ 743.6 million, 23% Multi-Family Residential Properties, $ 222.0 million, 7% 18

Non-Performing Assets to Total Assets 2.50% 2.00% 1.50% 1.00% 0.84% 0.76% 0.63% 0.59% 0.56% 0.49%* 0.50% 0.15% 0.38% 0.40% 0.14% 0.34% 0.33% 0.00% 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 GABC Peer Group *Peer Group Information as of 3/31/20 19

Total Deposits Non-Maturity Deposit Accounts as % of Total Deposits $3,979 $4,000 $3,500 $3,430 $3,073 $3,000 $2,484 $2,500 $2,350 $2,000 $1,826 86% 84% 84% 83% 82% $1,500 81% $1,000 $500 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 (Dollars in Millions) 20

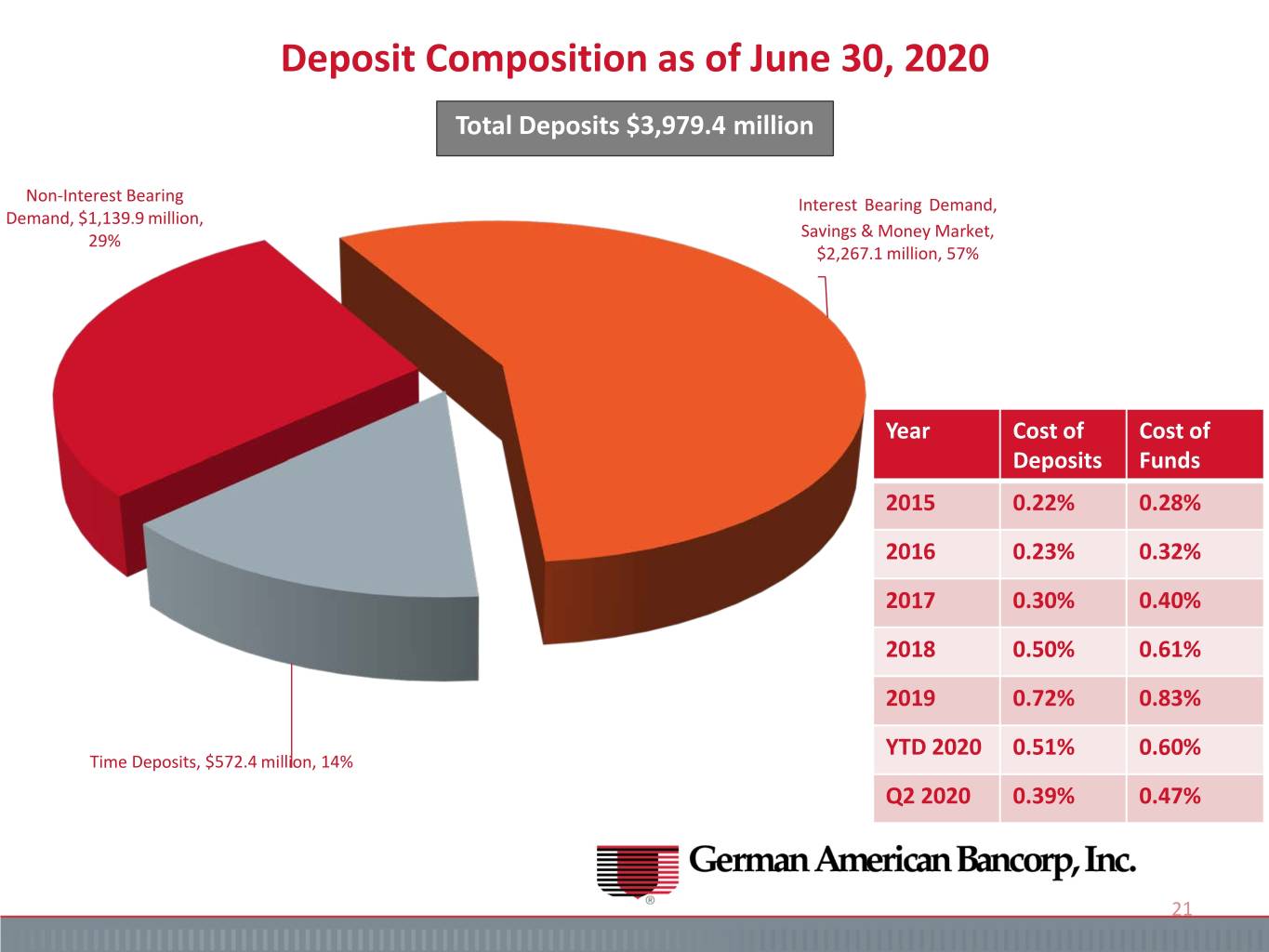

Deposit Composition as of June 30, 2020 Total Deposits $3,979.4 million Non-Interest Bearing Interest Bearing Demand, Demand, $1,139.9 million, Savings & Money Market, 29% $2,267.1 million, 57% Year Cost of Cost of Deposits Funds 2015 0.22% 0.28% 2016 0.23% 0.32% 2017 0.30% 0.40% 2018 0.50% 0.61% 2019 0.72% 0.83% YTD 2020 0.51% 0.60% Time Deposits, $572.4 million, 14% Q2 2020 0.39% 0.47% 21

Total Shareholders’ Equity Annualized Return on Tangible Equity $650 $595 $600 $574 $550 $500 $459 $450 $400 $365 $350 $330 $300 $252 $250 14.98% 13.82% 14.82% 13.74% 13.02% 11.91% $200 $150 $100 $50 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 (Dollars in Millions) 22

Net Interest Income Net Interest Margin (Tax-Equivalent) $160,000 $145,225 $140,000 $120,000 $114,610 $99,909 $100,000 $94,904 3.92% $80,000 $75,552 $74,715 $67,232 3.75% 3.76% 3.75% $60,000 3.70% 3.86% $40,000 3.66% $20,000 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/19 6/30/20 YTD YTD (Dollars in Thousands) 23

Provision for Credit Losses Net Charge-off to Average Loans $12,000 $11,050 $11,000 $10,000 $9,000 $8,000 $7,000 $6,000 $5,325 $5,000 $4,000 $3,000 $2,070 $2,000 $1,750 $- $1,200 0.17% $925 $1,000 0.08% 0.03% 0.04% 0.04% 0.04% 0.03% $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/19 6/30/20 YTD YTD (Dollars in Thousands) 24

Non-Interest Income Non-Interest Income as % of Total Revenue $50,000 $45,501 $45,000 $40,000 $37,070 $35,000 $32,013 $31,854 $30,000 $27,444 $26,504 $25,000 $22,167 26% 26% 24% 24% $20,000 23% 24% 24% $15,000 $10,000 $5,000 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/19 6/30/20 YTD YTD (Dollars in Thousands) 25

Non-Interest Expense Efficiency Ratio $120,000 $114,162 $100,000 $93,553 $80,000 $76,587 $77,803 $61,326 $58,416 $60,000 60.6% $52,377 59.0% 58.3% 57.6% 57.7% $40,000 56.8% 56.9% $20,000 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/19 6/30/20 YTD YTD (Dollars in Thousands) 26

Net Income & Earnings Per Share Earnings Per Share* $59,222 $60,000 $50,000 $46,529 $40,676 $40,000 $35,184 $30,064 $30,338 $30,000 $2.29 $26,727 $1.99 $1.77 $1.57 $20,000 $1.51 $1.21 $1.01 $10,000 $- 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 6/30/19 6/30/20 YTD YTD (Dollars in Thousands, Except Per Share Amounts) *Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 27

Why Invest in GABC? 28

Why Invest in GABC? * GABC Earnings Per Share Growth $2.29 $1.99 $1.77 $1.51 $1.57 $1.43 $1.27 $1.32 $1.07 $0.81 As of 12/31 for years shown *Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 29

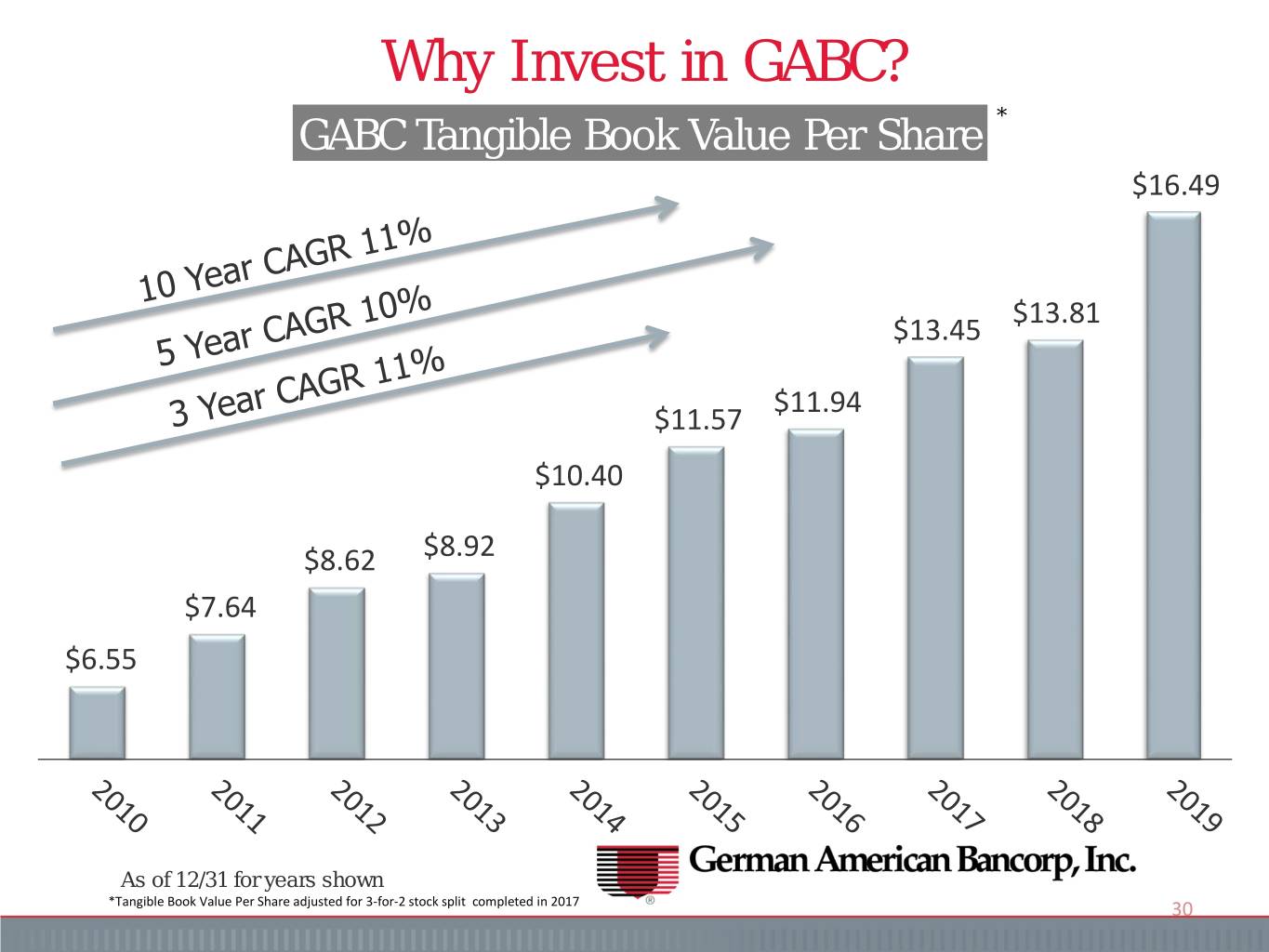

Why Invest in GABC? * GABC Tangible Book Value Per Share $16.49 $13.81 $13.45 $11.94 $11.57 $10.40 $8.62 $8.92 $7.64 $6.55 As of 12/31 for years shown *Tangible Book Value Per Share adjusted for 3-for-2 stock split completed in 2017 30

Why Invest in GABC? * GABC Stock Price Appreciation $35.07 $35.33 $35.62 $27.77 $22.21 $20.35 $18.95 $14.48 $12.28 $12.13 As of 12/31 for years shown *Stock Price adjusted for 3-for-2 stock split completed in 2017 31

Why Invest in GABC? • Proven Executive Management Team • Track Record of Consistent Top Quartile Financial Performance • Experienced in Operating Plan Execution and M & A Transitions • Potential Growth within New Market Areas – Small MSA Focus • Existing Platform for Operating Efficiency • Infrastructure in Place for Perpetuating Ongoing EPS Growth • Consistent Strong Dividend Yield and Dividend Pay-out Capacity 32

German American Bancorp, Inc. Mark A. Schroeder, Chairman and CEO (812) 482-0701 mark.schroeder@germanamerican.com Bradley M. Rust, EVP and CFO (812) 482-0718 brad.rust@germanamerican.com 33