Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Four Corners Property Trust, Inc. | fcpt2020q2earningspr7292.htm |

| 8-K - 8-K - Four Corners Property Trust, Inc. | fcpt2020secondquartere.htm |

FOUR CORNERS PROPERTY TRUST NYSE: FCPT SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION | Q2 2020 www.fcpwww.fcpt.comt.com 1 | FCPT | Q2 2020

CAUTIONARY NOTE REGARDING FORWARD- LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding FCPT’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, acquisition pipeline, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics such as COVID-19 on the business operations of FCPT and FCPT’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of FCPT’s public disclosure obligations, FCPT expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in FCPT’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward- looking statements are based on management’s current expectations and beliefs and FCPT can give no assurance that its expectations or the events described will occur as described. For a further discussion of these and other factors that could cause FCPT’s future results to differ materially from any forward- looking statements, see the risk factors described under the section entitled “Item 1A. Risk Factors” in FCPT’s annual report on Form 10-K for the year ended December 31, 2019, as supplemented by the risk factor described under “Part II, Item 1A. Risk Factors” in FCPT’s quarterly report on Form 10-Q for the quarter ended March 31, 2020, and other risks described in documents subsequently filed by FCPT from time to time with the Securities and Exchange Commission 2 | FCPT | Q2 2020

TABLE OF CONTENTS Financial Summary Page Consolidating Balance Sheet 4 Consolidated Income Statement 5 FFO and AFFO Reconciliation 6 COVID-19 Rent Collections Update 7 Net Asset Value Components 8 Capitalization and Key Credit Metrics 9 Debt Summary 10 Debt Maturity Schedule 11 Debt Covenants 12 Real Estate Portfolio Summary Property Locations by Brand 13 Brand Diversification 14 Geographic Diversification 15 Lease Maturity Schedule 16 Exhibits Glossary and Non-GAAP Definitions 17 Reconciliation of Net Income to Adjusted EBITDAre 18 3 | FCPT | Q2 2020

CONSOLIDATING BALANCE SHEET As of 6/30/2020 As of 12/31/2019 ($000s, except shares and per share data) Real Estate Restaurant Consolidated Consolidated Unaudited Operations Operations Elimination FCPT FCPT ASSETS Real estate investments: Land$ 728,629 $ 5,051 $ - $ 733,680 $ 690,575 Buildings, equipment and improvements 1,283,567 11,916 - 1,295,483 1,277,159 Total real estate investments 2,012,196 16,967 - 2,029,163 1,967,734 Less: accumulated depreciation (641,486) (5,637) - (647,123) (635,630) Real estate investments, net 1,370,710 11,330 - 1,382,040 1,332,104 Intangible real estate assets, net 66,398 - - 66,398 57,917 Total real estate investments and intangible real estate assets, net 1,437,108 11,330 - 1,448,438 1,390,021 Cash and cash equivalents 4,373 725 - 5,098 5,083 Straight-line rent adjustment 43,621 - - 43,621 39,350 Other assets 10,799 4,199 - 14,998 10,165 Derivative assets - - - - 1,451 Investment in subsidiary 12,015 - (12,015) - - Intercompany receivable 578 - (578) - - Total Assets $ 1,508,494 $ 16,254 $ (12,593) $ 1,512,155 $ 1,446,070 LIABILITIES AND EQUITY Liabilities: Term loan ($400,000, net of deferred financing costs)$ 395,878 $ - $ - $ 395,878 $ 395,012 Revolving facility ($250,000 capacity) 4,500 - - 4,500 52,000 Unsecured notes ($350,000, net of deferred financing costs) 346,918 - - 346,918 222,928 Rent received in advance 9,036 - - 9,036 10,463 Derivative liabilities 22,019 - - 22,019 5,005 Dividends payable 21,420 - - 21,420 21,325 Other liabilities 9,466 5,486 - 14,952 12,596 Intercompany payable - 578 (578) - - Total liabilities$ 809,237 $ 6,064 $ (578) $ 814,723 $ 719,329 Equity: Preferred stock $ - $ - $ - $ - $ - Common stock 7 - - 7 7 Additional paid-in capital 690,389 12,015 (12,015) 690,389 686,181 Accumulated other comprehensive (loss) income (30,168) - - (30,168) (3,539) Noncontrolling interest 3,912 - - 3,912 5,691 Retained earnings 35,117 (1,825) - 33,292 38,401 Total equity$ 699,257 $ 10,190 $ (12,015) $ 697,432 $ 726,741 Total Liabilities and Equity $ 1,508,494 $ 16,254 $ (12,593) $ 1,512,155 $ 1,446,070 4 | FCPT | Q2 2020

CONSOLIDATED INCOME STATEMENT ($000s, except shares and per share data) Three Months Ended June 30, Six Months Ended June 30, Unaudited 2020 2019 2020 2019 Revenues: Rental revenue$ 38,034 $ 34,415 $ 75,759 $ 68,623 Restaurant revenue 2,895 5,153 7,599 10,546 Total revenues 40,929 39,568 83,358 79,169 Operating expenses: General and administrative 3,719 3,431 7,560 7,377 Depreciation and amortization 7,093 6,518 14,148 12,879 Property expenses 1,066 417 1,701 725 Restaurant expenses 3,310 4,954 7,812 9,937 Total operating expenses 15,188 15,320 31,221 30,918 Interest expense (7,319) (6,557) (14,322) (13,304) Other income, net 162 306 166 719 Income tax expense (64) (61) (125) (129) Net income 18,520 17,936 37,856 35,537 Net income attributable to noncontrolling interest (54) (68) (125) (166) Net Income Attributable to Common Shareholders $ 18,466 $ 17,868 $ 37,731 $ 35,371 Basic net income per share$ 0.26 $ 0.26 $ 0.54 $ 0.52 Diluted net income per share$ 0.26 $ 0.26 $ 0.54 $ 0.52 Regular dividends declared per share$ 0.3050 $ 0.2875 $ 0.6100 $ 0.5750 Weighted-average shares outstanding: Basic 70,261,189 68,302,395 70,137,490 68,252,947 Diluted 70,370,769 68,501,181 70,288,408 68,475,778 5 | FCPT | Q2 2020

FFO & AFFO RECONCILIATION ($000s, except shares and per share data) Three Months Ended June 30, Six Months Ended June 30, Unaudited 2020 2019 2020 2019 Net income$ 18,520 $ 17,936 $ 37,856 $ 35,537 Depreciation and amortization 7,075 6,501 14,112 12,845 FFO (as defined by NAREIT)$ 25,595 $ 24,437 $ 51,968 $ 48,382 Straight-line rent (2,109) (2,234) (4,270) (4,593) Recognized rental revenue expected to be abated(1) (1,372) - (1,372) - Stock-based compensation 797 776 1,628 1,989 Non-cash amortization of deferred financing costs 534 514 1,046 1,027 Other non-cash interest income (1) (1) (2) (5) Non-real estate investment depreciation 18 17 35 34 Amortization of above and below market leases, net 202 12 387 24 Adjusted Funds From Operations (AFFO)$ 23,664 $ 23,521 $ 49,420 $ 46,858 Fully diluted shares outstanding(2) 70,575,161 68,795,687 70,518,676 68,797,156 FFO per diluted share $ 0.36 $ 0.36 $ 0.74 $ 0.70 AFFO per diluted share $ 0.34 $ 0.34 $ 0.70 $ 0.68 Supplemental disclosures on lease receivables(3) Base rent subject to deferral per lease amendments(4) $ 1,056 - $ 1,056 - Base rent expected to be abated(1) $ 1,372 - $ 1,372 - Remaining uncollected base rent$ 1,455 - $ 1,455 - ___________________________ (1) Amount represents base rent that the Company believes it will abate as a result of lease amendments. GAAP requires revenue recognition for the abated rent in the current period. For the second quarter of 2020, this amount is recorded in rental revenue and accounts receivable. When an amendment is signed, the accounts receivable balance equal to the abated rental payment will be recognized as a lease incentive and amortized as a reduction to rental revenue over the future lease term. (2) Assumes the issuance of common shares for OP units held by non-controlling interests. (3) Beginning in the second quarter of 2020, the Company began providing supplemental disclosures due to the COVID-19 pandemic. Base rent represents monthly contractual cash rent, excluding percentage rents and other recurring operating cost reimbursements, from leases. (4) The Company recognizes rental revenue under deferral agreements it expects to collect. 6 | FCPT | Q2 2020

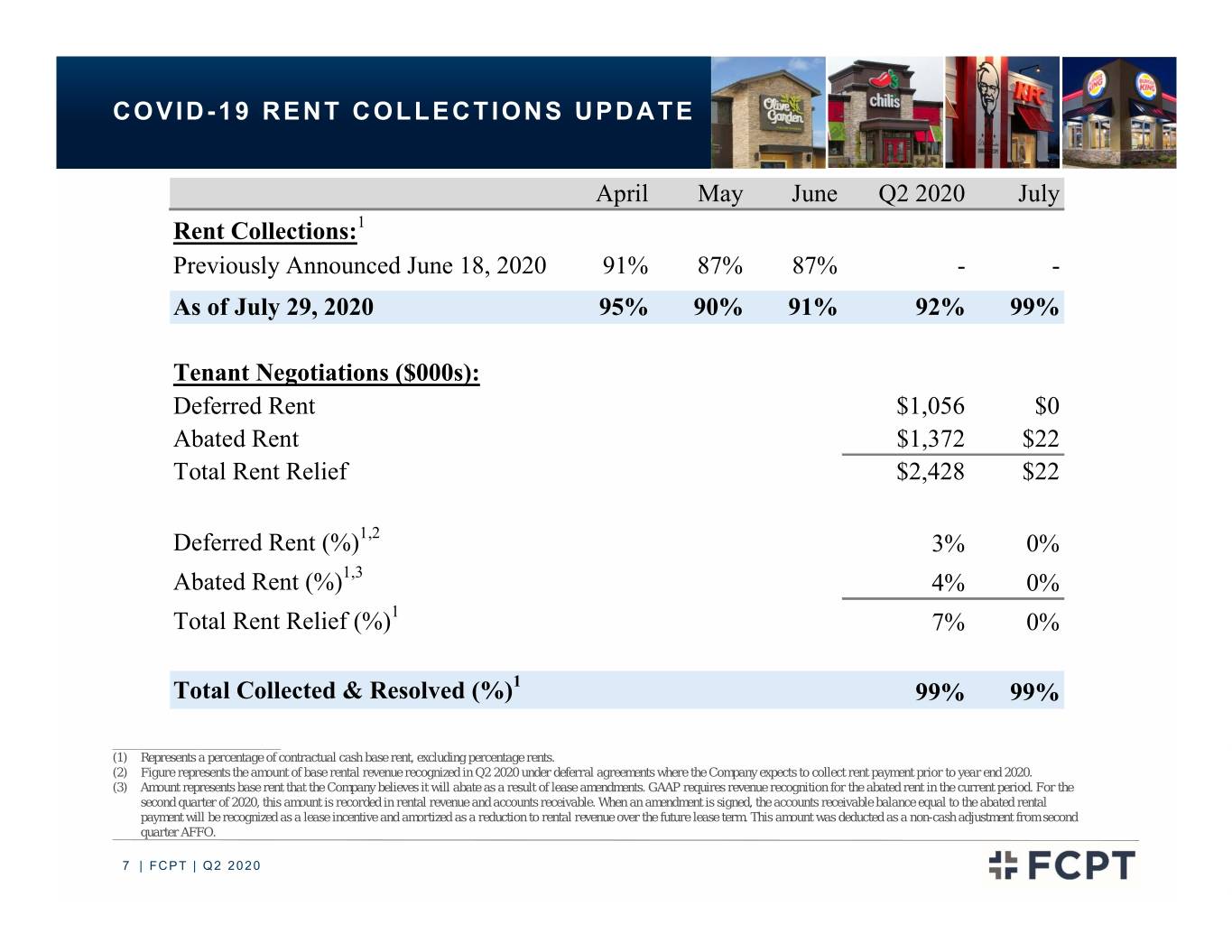

COVID-19 RENT COLLECTIONS UPDATE April May June Q2 2020 July Rent Collections:1 Previously Announced June 18, 2020 91% 87% 87% - - As of July 29, 2020 95% 90% 91% 92% 99% Tenant Negotiations ($000s): Deferred Rent $1,056 $0 Abated Rent $1,372 $22 Total Rent Relief $2,428 $22 Deferred Rent (%)1,2 3% 0% Abated Rent (%)1,3 4% 0% Total Rent Relief (%)1 7% 0% Total Collected & Resolved (%)1 99% 99% ___________________________ (1) Represents a percentage of contractual cash base rent, excluding percentage rents. (2) Figure represents the amount of base rental revenue recognized in Q2 2020 under deferral agreements where the Company expects to collect rent payment prior to year end 2020. (3) Amount represents base rent that the Company believes it will abate as a result of lease amendments. GAAP requires revenue recognition for the abated rent in the current period. For the second quarter of 2020, this amount is recorded in rental revenue and accounts receivable. When an amendment is signed, the accounts receivable balance equal to the abated rental payment will be recognized as a lease incentive and amortized as a reduction to rental revenue over the future lease term. This amount was deducted as a non-cash adjustment from second quarter AFFO. 7 | FCPT | Q2 2020

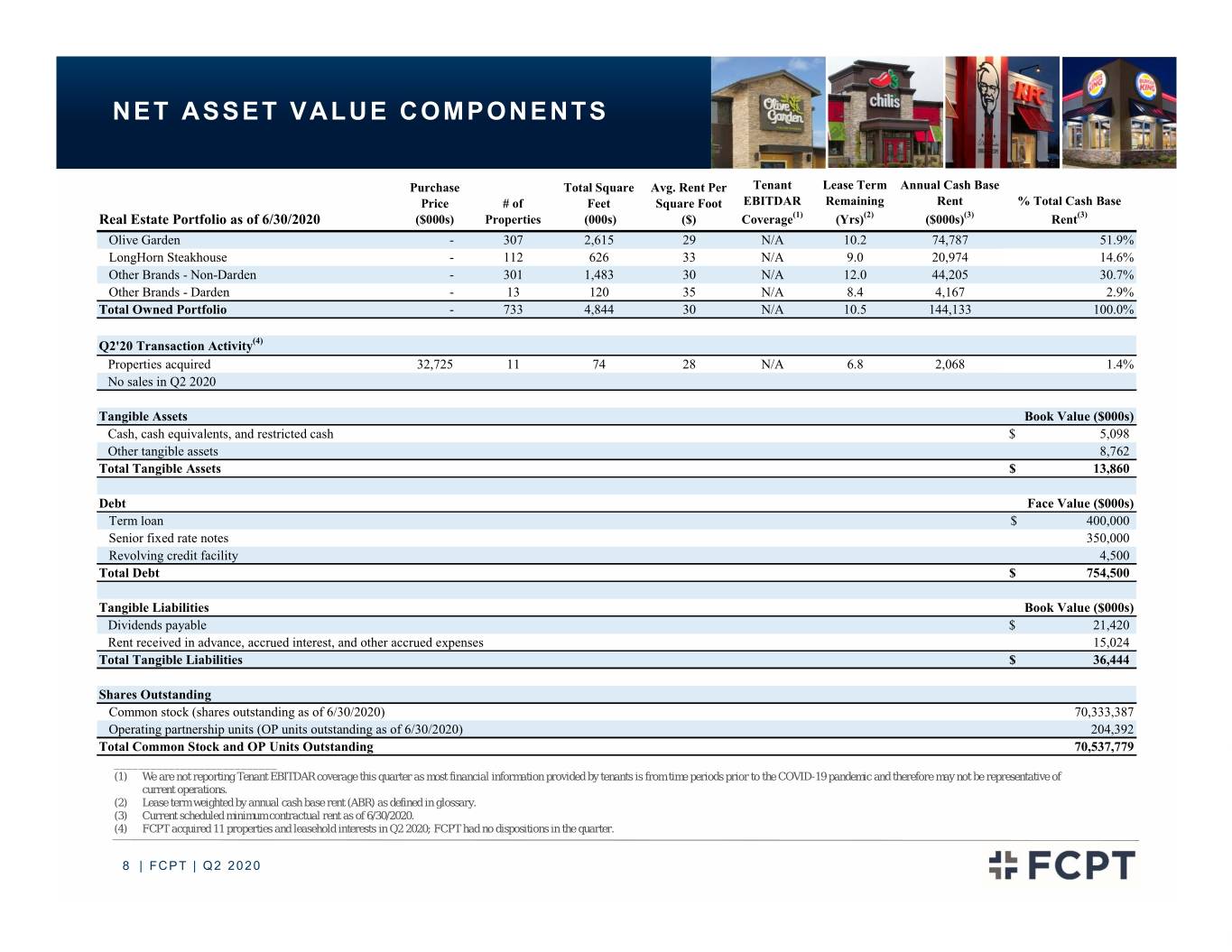

NET ASSET VALUE COMPONENTS Purchase Total Square Avg. Rent Per Tenant Lease Term Annual Cash Base Price # of Feet Square Foot EBITDAR Remaining Rent % Total Cash Base Real Estate Portfolio as of 6/30/2020 ($000s) Properties (000s) ($) Coverage(1) (Yrs)(2) ($000s)(3) Rent(3) Olive Garden - 307 2,615 29 N/A 10.2 74,787 51.9% LongHorn Steakhouse - 112 626 33 N/A 9.0 20,974 14.6% Other Brands - Non-Darden - 301 1,483 30 N/A 12.0 44,205 30.7% Other Brands - Darden - 13 120 35 N/A 8.4 4,167 2.9% Total Owned Portfolio - 733 4,844 30 N/A 10.5 144,133 100.0% Q2'20 Transaction Activity(4) Properties acquired 32,725 11 74 28 N/A 6.8 2,068 1.4% No sales in Q2 2020 Tangible Assets Book Value ($000s) Cash, cash equivalents, and restricted cash $ 5,098 Other tangible assets 8,762 Total Tangible Assets $ 13,860 Debt Face Value ($000s) Term loan $ 400,000 Senior fixed rate notes 350,000 Revolving credit facility 4,500 Total Debt $ 754,500 Tangible Liabilities Book Value ($000s) Dividends payable $ 21,420 Rent received in advance, accrued interest, and other accrued expenses 15,024 Total Tangible Liabilities $ 36,444 Shares Outstanding Common stock (shares outstanding as of 6/30/2020) 70,333,387 Operating partnership units (OP units outstanding as of 6/30/2020) 204,392 Total Common Stock and OP Units Outstanding 70,537,779 ___________________________ (1) We are not reporting Tenant EBITDAR coverage this quarter as most financial information provided by tenants is from time periods prior to the COVID-19 pandemic and therefore may not be representative of current operations. (2) Lease term weighted by annual cash base rent (ABR) as defined in glossary. (3) Current scheduled minimum contractual rent as of 6/30/2020. (4) FCPT acquired 11 properties and leasehold interests in Q2 2020; FCPT had no dispositions in the quarter. 8 | FCPT | Q2 2020

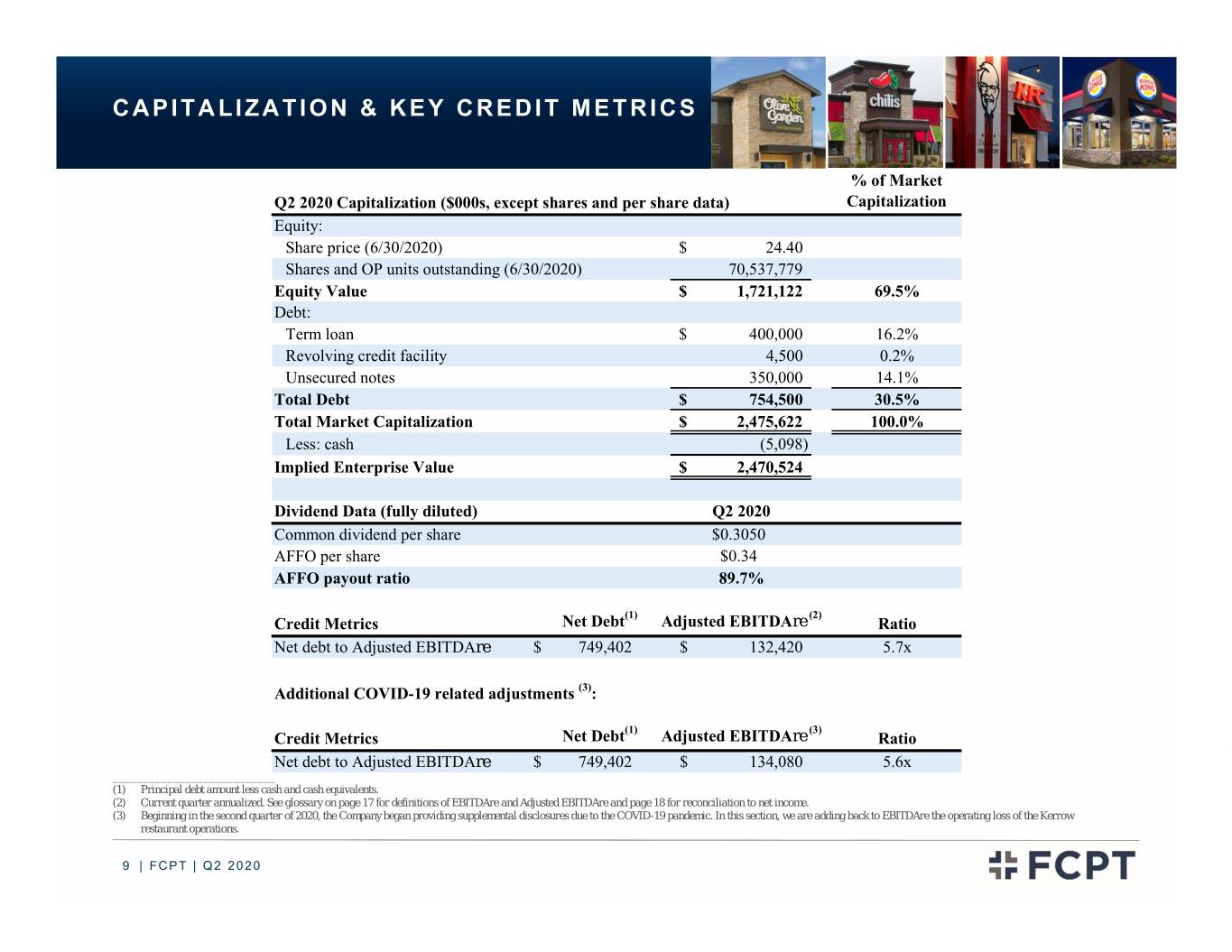

CAPITALIZATION & KEY CREDIT METRICS % of Market Q2 2020 Capitalization ($000s, except shares and per share data) Capitalization Equity: Share price (6/30/2020)$ 24.40 Shares and OP units outstanding (6/30/2020) 70,537,779 Equity Value$ 1,721,122 69.5% Debt: Term loan$ 400,000 16.2% Revolving credit facility 4,500 0.2% Unsecured notes 350,000 14.1% Total Debt$ 754,500 30.5% Total Market Capitalization$ 2,475,622 100.0% Less: cash (5,098) Implied Enterprise Value$ 2,470,524 Dividend Data (fully diluted) Q2 2020 Common dividend per share $0.3050 AFFO per share $0.34 AFFO payout ratio 89.7% (1) (2) Credit Metrics Net Debt Adjusted EBITDAre Ratio Net debt to Adjusted EBITDAre $ 749,402 $ 132,420 5.7x Additional COVID-19 related adjustments (3): (1) (3) Credit Metrics Net Debt Adjusted EBITDAre Ratio Net debt to Adjusted EBITDAre $ 749,402 $ 134,080 5.6x ___________________________ (1) Principal debt amount less cash and cash equivalents. (2) Current quarter annualized. See glossary on page 17 for definitions of EBITDAre and Adjusted EBITDAre and page 18 for reconciliation to net income. (3) Beginning in the second quarter of 2020, the Company began providing supplemental disclosures due to the COVID-19 pandemic. In this section, we are adding back to EBITDAre the operating loss of the Kerrow restaurant operations. 9 | FCPT | Q2 2020

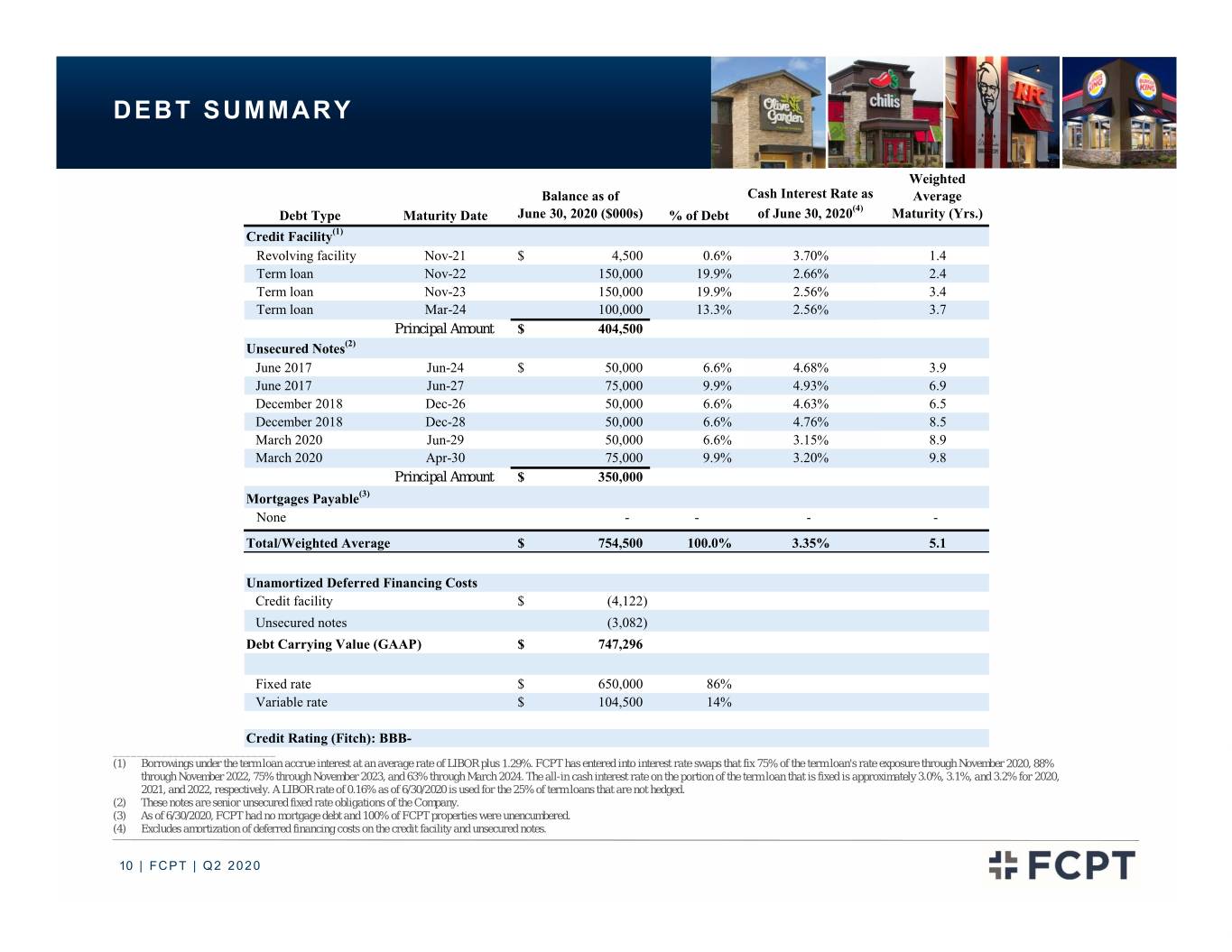

DEBT SUMMARY Weighted Balance as of Cash Interest Rate as Average (4) Debt Type Maturity Date June 30, 2020 ($000s) % of Debt of June 30, 2020 Maturity (Yrs.) Credit Facility(1) Revolving facility Nov-21$ 4,500 0.6% 3.70% 1.4 Term loan Nov-22 150,000 19.9% 2.66% 2.4 Term loan Nov-23 150,000 19.9% 2.56% 3.4 Term loan Mar-24 100,000 13.3% 2.56% 3.7 Principal Amount $ 404,500 Unsecured Notes(2) June 2017 Jun-24$ 50,000 6.6% 4.68% 3.9 June 2017 Jun-27 75,000 9.9% 4.93% 6.9 December 2018 Dec-26 50,000 6.6% 4.63% 6.5 December 2018 Dec-28 50,000 6.6% 4.76% 8.5 March 2020 Jun-29 50,000 6.6% 3.15% 8.9 March 2020 Apr-30 75,000 9.9% 3.20% 9.8 Principal Amount $ 350,000 Mortgages Payable(3) None - - - - Total/Weighted Average$ 754,500 100.0% 3.35% 5.1 Unamortized Deferred Financing Costs Credit facility$ (4,122) Unsecured notes (3,082) Debt Carrying Value (GAAP)$ 747,296 Fixed rate$ 650,000 86% Variable rate$ 104,500 14% Credit Rating (Fitch): BBB- ___________________________ (1) Borrowings under the term loan accrue interest at an average rate of LIBOR plus 1.29%. FCPT has entered into interest rate swaps that fix 75% of the term loan's rate exposure through November 2020, 88% through November 2022, 75% through November 2023, and 63% through March 2024. The all-in cash interest rate on the portion of the term loan that is fixed is approximately 3.0%, 3.1%, and 3.2% for 2020, 2021, and 2022, respectively. A LIBOR rate of 0.16% as of 6/30/2020 is used for the 25% of term loans that are not hedged. (2) These notes are senior unsecured fixed rate obligations of the Company. (3) As of 6/30/2020, FCPT had no mortgage debt and 100% of FCPT properties were unencumbered. (4) Excludes amortization of deferred financing costs on the credit facility and unsecured notes. 10 | FCPT | Q2 2020

FCPT DEBT MATURITY SCHEDULE Current Debt Maturity Schedule (1) 5.1-year weighted average term Undrawn Revolver Capacity 86% fixed rate debt Drawn Revolver 3.3% weighted average cash interest rate Unsecured Term Loan $245 million available on revolver Unsecured Notes $250 $150 $150 $150 $100 $75 $75 $50 $50 $50 $50 $0 $5 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 % of Total Debt 0% 1% 20% 20% 20% 0% 7% 10% 7% 7% 10% Outstanding ___________________ Figures as of 6/30/2020 (1) The revolving credit facility expires on November 9, 2021 subject to FCPT’s availability to extend the term for two additional six-month periods to November 9, 2022. 11 | FCPT | Q2 2020

DEBT COVENANTS As of June 30, 2020 The following is a summary of the key financial covenants for our unsecured credit facility. These calculations are not based on U.S. GAAP measurements and are presented to demonstrate compliance with current credit covenants. Covenants Requirement Q2 2020 Limitation on incurrence of total debt ≤ 60% of consolidated capitalization value 34.9% Limitation on incurrence of secured debt ≤ 40% of consolidated capitalization value 0.0% Fixed charge coverage ratio ≥ 1.50x 4.8x Limitation on unencumbered leverage ≤ 60% 35.0% Unencumbered interest coverage ratio ≥ 1.75x 5.5x 12 | FCPT | Q2 2020

PROPERTY LOCATIONS BY BRAND Lease Count: Olive Garden (307) Longhorn Steakhouse (112) Chili’s (64) Burger King (24) Red Lobster (21) KFC (20) Buffalo Wild Wings (18) Bob Evans (17) Arby’s (14) Taco Bell (11) Bahama Breeze (9) BJ’s Restaurant (8) Texas Roadhouse (7) Wendy’s (7) Pizza Hut (6) Starbucks (6) Chick-Fil-A (5) McDonald’s (5) Outback Steakhouse (5) IHOP (4) Other (68) 738 Leases (1) 69 Brands ___________________________ Figures as of 6/30/2020 (1) FCPT owns 733 properties as of 6/30/2020 with 738 leases. 13 | FCPT | Q2 2020

BRAND DIVERSIFICATION FCPT total ABR(1): FCPT Portfolio Brands $144.1 million Square Feet % of Rank Brand Name Number (000s) ABR(1) 1 Olive Garden 307 2,615 51.9% 2 Longhorn Steakhouse 112 626 14.6% 15% 3 Chili's 64 352 8.8% 112 Units 4 Red Lobster 21 155 3.3% 5 Burger King 24 77 2.3% 6 Buffalo Wild Wings 18 111 2.1% 7 Bahama Breeze 9 84 2.1% 9% 8 Bob Evans 17 93 1.9% 64 Units 9 BJ's Restaurant 8 66 1.1% 10 KFC 20 57 1.1% 52% 11 Arby's 14 44 1.0% 3% 13 Units Other Darden2 12 Taco Bell 11 28 0.7% 307 Units 13 Texas Roadhouse 7 50 0.6% Other Restaurants 14 Seasons 52 2 18 0.5% 20% 15 Outback Steakhouse 5 33 0.5% 220 units 16 Wendy's 7 24 0.5% 43 brands 17 McDonald's 5 23 0.5% 18 McAlister's Deli 4 15 0.4% 19 Starbucks 6 13 0.4% 20 Chick-Fil-A 5 24 0.4% 21 Panera 4 22 0.3% 22 Pizza Hut 6 15 0.3% 23 Steak 'N Shake 4 15 0.3% Non-Restaurant Retail 24 Popeyes 4 12 0.3% 2% / 22 units / 19 brands 25 REI 1 20 0.2% 26-69 Other 53 232 4.0% Total Lease Portfolio 738 4,824 100% ___________________ 1. Represents current scheduled minimum Annual Cash Base Rent (ABR) as of 6/30/2020, as defined in glossary. 2. Other Darden represents Bahama Breeze, Cheddar’s, Seasons 52, and Eddie V’s branded restaurants. 14 | FCPT | Q2 2020

GEOGRAPHIC DIVERSIFICATION ND WA MT MN ME SD WI ID MI VT NH OR WY NY IA MA NE CT RI PA OH NV IL IN NJ UT CO MD DE KS MO WV KY VA CA TN OK NC (1) AR % ABR AZ NM SC ≥10.0% MS AL GA 5.0%–10.0% LA TX 3.0%–5.0% 2.0%–3.0% 1.0 %–2.0% FL <1.0% No Properties State % ABR Leases TX 12.1% 72 IL 3.4% 32 CO 2.3% 21 MN 1.7% 11 WV 1.0% 6 FL 10.9% 66 PA 2.9% 19 IA 2.2% 22 KY 1.6% 11 Other 7.7% 54 OH 6.7% 50 NC 2.7% 22 SC 2.2% 18 AZ 1.6% 11 GA 6.1% 43 CA 2.7% 14 WI 2.0% 20 NV 1.5% 8 MI 4.7% 43 MD 2.6% 21 NY 2.0% 13 LA 1.4% 9 IN 4.0% 44 VA 2.4% 19 AL 1.8% 16 AR 1.2% 8 TN 3.4% 28 MS 2.3% 18 OK 1.7% 12 KS 1.0% 7 ___________________________ (1) Annual cash base rent (ABR) as defined in glossary. 15 | FCPT | Q2 2020

LEASE MATURITY SCHEDULE Lease Maturity Schedule (% Annualized Cash Base Rent1) 15.8% 99.6% occupied2 as of 6/30/2020 14.1% 12.7% 11.6% 11.2% Weighted average lease term of 10.5 10.2% years 7.3% Less than 6.6% of rental income matures prior to 2027 3.3% 2.9% 2.5% 1.5% 1.2% 1.1% 1.3% 0.7% 0.9% 0.8% 0.7% 0.0% 0.2% 0.1% 0.0% 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 ___________________ Note: Excludes renewal options. All data as of 6/30/2020 1. Annual cash base rent (ABR) as defined in glossary. 2. Occupancy based on portfolio square footage. 16 | FCPT | Q2 2020

GLOSSARY AND NON-GAAP DEFINITIONS Non-GAAP Definitions and Cautionary Note Regarding Forward-Looking Statements: This document includes certain non-GAAP financial measures that employed by other REITs. condition and results from operations, the utility of FFO as a measure management believes are helpful in understanding our business, as of our performance is limited. FFO is a non-GAAP measure and further described below. Our definition and calculation of non-GAAP Tenant EBITDAR is calculated as EBITDA plus rental expense. should not be considered a measure of liquidity including our ability financial measures may differ from those of other REITs and therefore EBITDAR is derived from the most recent data provided by tenants to pay dividends or make distributions. In addition, our calculations of may not be comparable. The non-GAAP measures should not be that disclose this information. For Darden, EBITDAR is updated once FFO are not necessarily comparable to FFO as calculated by other considered an alternative to net income as an indicator of our annually by multiplying the most recent individual property level REITs that do not use the same definition or implementation performance and should be considered only a supplement to net sales information (reported by Darden twice annually to FCPT) by the guidelines or interpret the standards differently from us. Investors in income, and to cash flows from operating, investing or financing brand average EBITDA margin reported by Darden in its most recent our securities should not rely on these measures as a substitute for any activities as a measure of profitability and/or liquidity, computed in comparable period, and then adding back property level rent. FCPT GAAP measure, including net income. accordance with GAAP. does not independently verify financial information provided by its tenants. Adjusted Funds From Operations “AFFO” is a non-GAAP ABR refers to annual cash base rent as of 6/30/2020 and represents measure that is used as a supplemental operating measure specifically monthly contractual cash rent, excluding percentage rents, from Tenant EBITDAR coverage is calculated by dividing our reporting for comparing year over year ability to fund dividend distribution leases, recognized during the final month of the reporting period, tenants’ most recently reported EBITDAR by annual in-place cash from operating activities. AFFO is used by us as a basis to address our adjusted to exclude amounts received from properties sold during that base rent. ability to fund our dividend payments. We calculate adjusted funds period and adjusted to include a full month of contractual rent for from operations by adding to or subtracting from FFO: properties acquired during that period. Funds From Operations (“FFO”) is a supplemental measure of our 1. Transaction costs incurred in connection with business performance which should be considered along with, but not as an combinations EBITDA represents earnings (GAAP net income) plus interest alternative to, net income and cash provided by operating activities as 2. Straight-line rent and other non-cash revenue adjustments expense, income tax expense, depreciation and amortization. a measure of operating performance and liquidity. We calculate FFO 3. Stock-based compensation expense in accordance with the standards established by NAREIT. FFO 4. Non-cash amortization of deferred financing costs EBITDAre is a non-GAAP measure computed in accordance with represents net income (loss) (computed in accordance with GAAP), 5. Other non-cash interest expense (income) the definition adopted by the National Association of Real Estate excluding gains (or losses) from sales of property and undepreciated 6. Non-real estate investment depreciation Investment Trusts (“NAREIT”) as EBITDA (as defined above) land and impairment write-downs of depreciable real estate, plus real 7. Merger, restructuring and other related costs excluding gains (or losses) on the disposition of depreciable real estate estate related depreciation and amortization (excluding amortization 8. Impairment charges and real estate impairment losses. of deferred financing costs) and after adjustments for unconsolidated 9. Amortization of above and below market leases partnerships and joint ventures. We also omit the tax impact of non- 10. Amortization of capitalized leasing costs Adjusted EBITDAre is computed as EBITDAre (as defined above) FFO producing activities from FFO determined in accordance with the 11. Debt extinguishment gains and losses excluding transaction costs incurred in connection with the acquisition NAREIT definition. 12. Recurring capital expenditures and tenant improvements of real estate investments and gains or losses on the extinguishment of AFFO is not intended to represent cash flow from operations for the debt. Our management uses FFO as a supplemental performance measure period, and is only intended to provide an additional measure of because, in excluding real estate related depreciation and amortization performance by adjusting the effect of certain items noted above We believe that presenting supplemental reporting measures, or non- and gains and losses from property dispositions, it provides a included in FFO. AFFO is a widely-reported measure by other REITs; GAAP measures, such as EBITDA, EBITDAre and Adjusted performance measure that, when compared year over year, captures however, other REITs may use different methodologies for EBITDAre, is useful to investors and analysts because it provides trends in occupancy rates, rental rates and operating costs. We offer calculating AFFO and, accordingly, our AFFO may not be important information concerning our on-going operating this measure because we recognize that FFO will be used by investors comparable to other REITs. performance exclusive of certain non-cash and other costs. These non- as a basis to compare our operating performance with that of other GAAP measures have limitations as they do not include all items of REITs. However, because FFO excludes depreciation and Properties refers to properties available for lease. income and expense that affect operations. Accordingly, they should amortization and captures neither the changes in the value of our not be considered alternatives to GAAP net income as a performance properties that result from use or market conditions, nor the level of measure and should be considered in addition to, and not in lieu of, capital expenditures and capitalized leasing commissions necessary to GAAP financial measures. Our presentation of such non-GAAP maintain the operating performance of our properties, all of which measures may not be comparable to similarly titled measures have real economic effect and could materially impact our financial 17 | FCPT | Q2 2020

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDARE ($000s, except shares and per share data) Three Months Ended June 30, Six Months Ended June 30, Unaudited 2020 2019 2020 2019 Net Income$ 18,520 $ 17,936 $ 37,856 $ 35,537 Adjustments: Interest expense 7,319 6,557 14,322 13,304 Income tax expense 64 61 125 129 Depreciation and amortization 7,093 6,518 14,148 12,879 EBITDA(1) 32,996 31,072 66,451 61,849 Adjustments: Gain on dispositions and exchange of real estate - - - - Provision for impairment of real estate - - - - EBITDAre (1) 32,996 31,072 66,451 61,849 Adjustments: Real estate transaction costs 109 34 132 43 Gain or loss on extinguishment of debt - - - - Adjusted EBITDAre (1) 33,105 31,106 66,583 61,892 Annualized Adjusted EBITDAre $ 132,420 $ 124,422 $ 133,165 $ 123,783 Additional COVID-19 related adjustments(2): Kerrow operating loss 415 - 415 - Adjusted EBITDAre after COVID-19 adjustments 33,520 31,106 66,998 61,892 Annualized Adjusted EBITDAre (2) $ 134,080 $ 124,422 $ 133,995 $ 123,783 ___________________________ (1) See glossary on page 17 for non-GAAP definitions. (2) Beginning in the second quarter of 2020, the Company began providing supplemental disclosures due to the COVID-19 pandemic. In this section, we are adding back to EBITDAre the operating loss of the Kerrow restaurant operations for the second quarter. 18 | FCPT | Q2 2020

FOUR CORNERS PROPERTY TRUST NYSE: FCPT SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION | Q2 2020 www.fcpt.com 19 | FCPT | Q2 2020