Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Utz Brands, Inc. | tm2025973d1_ex99-2.htm |

| 8-K - FORM 8-K - Utz Brands, Inc. | tm2025973d1_8k.htm |

Exhibit 99.1

℠ Q2 Financial Update July 29, 2020

℠ This financial update (“Financial Update”) is for informational purposes only to assist interested parties in making their ow n e valuation with respect to the proposed business combination (the “Business Combination”) between Collier Creek (“CCH”) and Utz Brands Holdings, LLC (“Utz” or the “Company”). The information contained herein does not purport to be all - inclusive and none of CCH, Utz or their respective affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Financial Update. T his Financial Update should be considered together with the information set forth in the investor presentation of CCH, dated June 2020. This Financial Update does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securit ies or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Utz, CCH, or any of their respective affiliates. You should not construe the con ten ts of this Financial Update as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters describ ed herein, and, by accepting this Financial Update, you confirm that you are not relying upon the information contained herein to make any decision. The distribution of this Financial Update may also be restricted by law and persons into whose possession this Financial Upda te comes should inform themselves about and observe any such restrictions. The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concern ing a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purch ase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the "Exchange Act"), and that the recipient will neither use, nor ca use any third party to use, this Financial Update or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b - 5 thereunder. Forward - Looking Statements. Certain statements in this Financial Update may be considered forward - looking statements. Forward - lo oking statements generally relate to future events or CCH’s or the Company’s future financial or operating performance. For example, projections of future Adjusted Net Sales, Adjusted EBITDA, Pro Forma Adjusted EBITDA and oth er metrics are forward - looking statements. In some cases, you can identify forward - looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict” , “ potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ mat erially from those expressed or implied by such forward looking statements. These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by CCH and its manag ement, and Utz and its management, as the case may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the occurrence o f a ny event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination; (2) the outcome of any legal proceedings that may be instituted against CCH, the combined company or others following the announcement of the Business Combination and any definitive agreements with respect thereto; (3) the inability to complete the Business Combinati on due to the failure to obtain approval of the shareholders of CCH, to obtain financing to complete the Business Combination or to satisfy other conditions to closing; (4) changes to the proposed structure of the Business Combina tio n that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; (5) the ability to meet the NYSE’s listing standards following the co nsummation of the Business Combination; (6) the risk that the Business Combination disrupts current plans and operations of Utz as a result of the announcement and consummation of the Business Combination; (7) the ability to rec ognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with cu sto mers and suppliers and retain its management and key employees; (8) costs related to the Business Combination; (9) changes in applicable laws or regulations; (10) the possibility that Utz or the combined company may be adve rse ly affected by other economic, business, and/or competitive factors; (11) Utz’s estimates of expenses and profitability; and (12) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary No te Regarding Forward - Looking Statements” in CCH’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2019. Nothing in this Financial Update should be regarded as a representation by any person that the forward - looking statements set fo rth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements, which speak only as of the date they are ma de. Neither CCH nor the Company undertakes any duty to update these forward - looking statements. Non - GAAP Financial Information. In this Financial Update, CCH and the Company may refer to certain non - GAAP financial measures, including Pro Forma Net Sales, EBITDA, Adjusted EBITDA and Further Adjusted EBITDA, among others. Please refer to footnotes where presented on each page of this Financial Update or to the appendix found at the end o f t his Financial Update for a reconciliation of these measures to what the Company believes are the most directly comparable measure evaluated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). This Fin ancial Update also includes certain projections of non - GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projec ted measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP fina nci al measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward - looking non - GAAP financial measures is included. Use of Projections. This Financial Update contains financial forecasts of the Company. Neither the Company’s independent audi tor s, nor the independent registered public accounting firm of CCH, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Financial Update, and acc ord ingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Financial Update. These projections should not be relied upon as being necessarily indicative of futu re results. This Financial Update may contain trademarks, service marks, trade names and copyrights of other companies, which are the pro per ty of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Financial Update may be listed without the TM, SM, ©, ® or ™ symbols, but Coll ier Creek and Utz will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service mark, trade names and copyrights. Additional Information. In connection with the proposed Business Combination, including the domestication of CCH as a Delawar e c orporation, CCH has filed with the SEC a registration statement on Form S - 4 containing a preliminary proxy statement and a preliminary prospectus of CCH, and after the registration statement is declared effective, CCH will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its shareholders. This Financial Update does not contain all the information that should be considered concerning the proposed Bu sin ess Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. CCH’s shareholders and other interested persons are advised to read the prel imi nary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials conta in important information about Utz, CCH and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of CCH as of the record date which has been established for voting on the proposed Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive pr oxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Collier Creek Holdings, 200 Park Avenue, New York, NY 10166. Participants in the Solicitation. CCH and its directors and executive officers may be deemed participants in the solicitation of proxies from CCH’s shareholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in CCH is contained in CCH’s annual report on For m 1 0 - K for the fiscal year ended December 31, 2019, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Collier Creek Holdings, 200 Park Avenue, New York, NY 10166. Additional information regarding the interests of such participants is contained in the proxy statement/prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies fro m t he shareholders of CCH in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination is inclu ded in the preliminary proxy statement/prospectus for the proposed Business Combination. Disclaimer Q2 Financial Update July 29, 2020

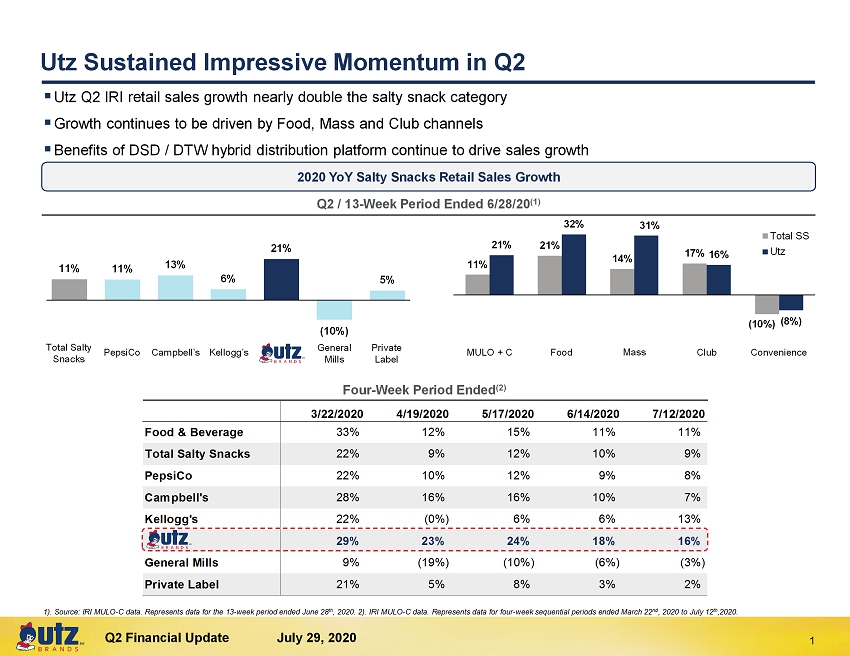

℠ 3/22/2020 4/19/2020 5/17/2020 6/14/2020 7/12/2020 Food & Beverage 33% 12% 15% 11% 11% Total Salty Snacks 22% 9% 12% 10% 9% PepsiCo 22% 10% 12% 9% 8% Campbell's 28% 16% 16% 10% 7% Kellogg's 22% (0%) 6% 6% 13% 29% 23% 24% 18% 16% General Mills 9% (19%) (10%) (6%) (3%) Private Label 21% 5% 8% 3% 2% Utz Sustained Impressive Momentum in Q2 1 1). Source : IRI MULO - C data. Represents data for the 13 - week period ended June 28 th , 2020. 2 ). IRI MULO - C data. Represents data for four - week sequential periods ended March 22 nd , 2020 to July 12 th ,2020. 2020 YoY Salty Snacks Retail Sales Growth Q2 / 13 - Week Period Ended 6/28/20 (1) Private Label Total Salty Snacks Four - Week Period Ended (2) ℠ Q2 Financial Update July 29, 2020 11% 11% 13% 6% 21% (10%) 5% 11% 21% 14% 17% (10%) 21% 32% 31% 16% (8%) MULO+C Food Mass Club Convenience Total SS Utz ▪ Utz Q2 IRI retail sales growth nearly double the salty snack category ▪ Growth continues to be driven by Food, Mass and Club channels ▪ Benefits of DSD / DTW hybrid distribution platform continue to drive sales growth General Mills Kellogg’s Campbell’s PepsiCo MULO + C Club Mass Food Convenience ℠

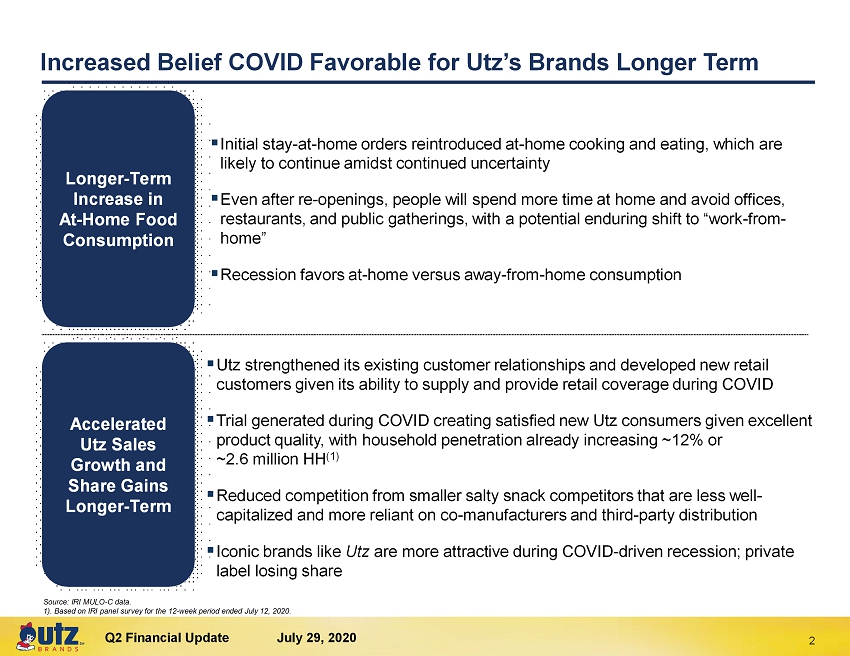

℠ Increased Belief COVID Favorable for Utz’s Brands Longer Term ▪ Initial stay - at - home orders reintroduced at - home cooking and eating, which are likely to continue amidst continued uncertainty ▪ Even after re - openings, people will spend more time at home and avoid offices, restaurants, and public gatherings, with a potential enduring shift to “work - from - home” ▪ Recession favors at - home versus away - from - home consumption Longer - Term Increase in At - Home Food Consumption ▪ Utz strengthened its existing customer relationships and developed new retail customers given its ability to supply and provide retail coverage during COVID ▪ Trial generated during COVID creating satisfied new Utz consumers given excellent product quality, with household penetration already increasing ~ 12% or ~ 2.6 million HH (1) ▪ Reduced competition from smaller salty snack competitors that are less well - capitalized and more reliant on co - manufacturers and third - party distribution ▪ Iconic brands like Utz are more attractive during COVID - driven recession; private label losing share Accelerated Utz Sales Growth and Share Gains Longer - Term 2 Source: IRI MULO - C data. 1). Based on IRI panel survey for the 12 - week period ended July 12, 2020. Q2 Financial Update July 29, 2020

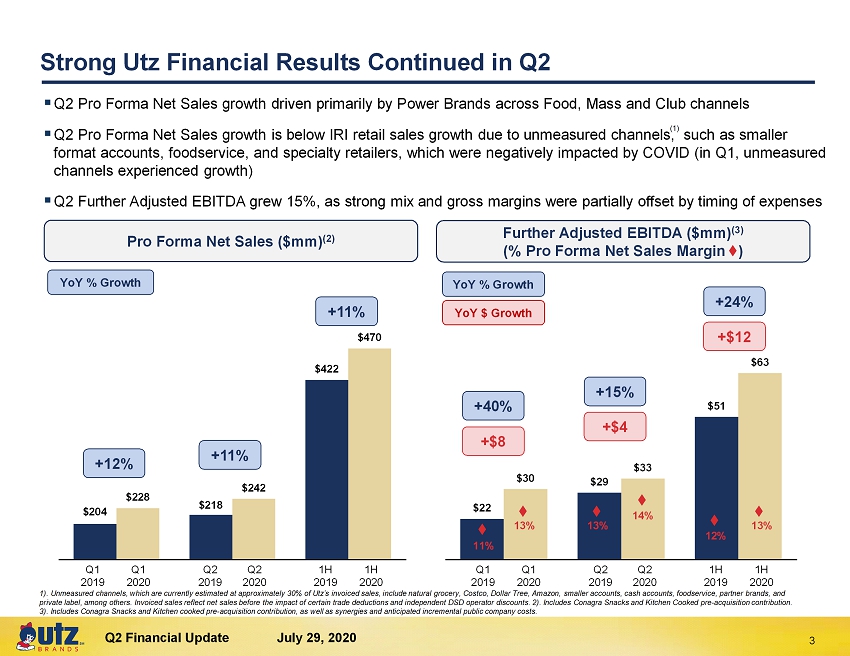

℠ $22 $29 $51 $30 $33 $63 Q1 Q2 - Q4 Full Year $204 $218 $422 $228 $242 $470 Q1 Q2 - Q4 Full Year Strong Utz Financial Results Continued in Q2 Pro Forma Net Sales ($mm ) (2) 1). Unmeasured channels, which are currently estimated at approximately 30% of Utz’s invoiced sales, include n atural grocery, Costco, Dollar Tree, Amazon, smaller accounts, cash accounts, foodservice, partner brands, and private label, among others. Invoiced sales reflect net sales before the impact of certain trade deductions and independent DSD operator discounts. 2 ). Includes Conagra Snacks and Kitchen Cooked pre - acquisition contribution. 3). Includes Conagra Snacks and Kitchen cooked pre - acquisition contribution, as well as synergies and anticipated incremental public company costs. +12% +11% Further Adjusted EBITDA ($mm ) (3) (% Pro Forma Net Sales Margin ) 14% 11% 13% 13% YoY % Growth YoY % Growth 3 YoY $ Growth +$8 +40% +24% +$12 Q1 2019 Q1 2020 ▪ Q2 Pro Forma Net Sales growth driven primarily by Power Brands across Food, Mass and Club channels ▪ Q2 Pro Forma Net Sales growth is below IRI retail sales growth due to unmeasured channels, such as smaller format accounts, foodservice, and specialty retailers, which were negatively impacted by COVID (in Q1, unmeasured channels experienced growth) ▪ Q2 Further Adjusted EBITDA grew 15%, as strong mix and gross margins were partially offset by timing of expenses (1) Q2 2019 Q2 2020 12% 13% 1H 2019 1H 2020 + 15% +$4 +11% Q1 2019 Q1 2020 Q2 2019 Q2 2020 1H 2019 1H 2020 Q2 Financial Update July 29, 2020

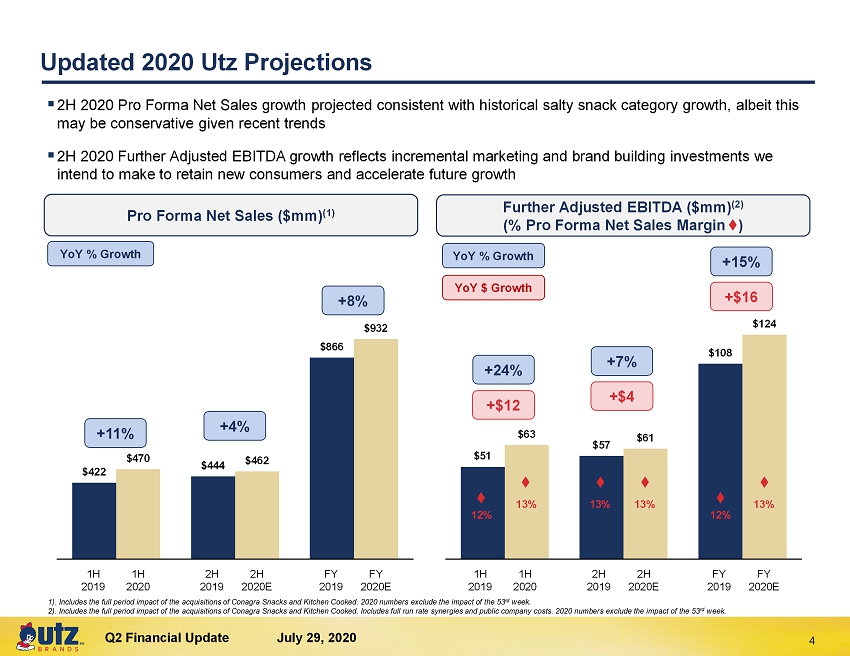

℠ $422 $444 $866 $470 $462 $932 Q1 Q2 - Q4 Full Year $51 $57 $108 $63 $61 $124 Q1 Q2 - Q4 Full Year Updated 2020 Utz Projections Pro Forma Net Sales ($mm) (1) 1). Includes the full period impact of the acquisitions of Conagra Snacks and Kitchen Cooked. 2020 numbers exclude the impact of the 53 rd week. 2). Includes the full period impact of the acquisitions of Conagra Snacks and Kitchen Cooked. Includes full run rate synergies and public company costs. 2020 numbers ex clu de the impact of the 53 rd week. +11% +4% Further Adjusted EBITDA ($mm) (2) (% Pro Forma Net Sales Margin ) 12% 13% 13% YoY % Growth YoY % Growth 4 YoY $ Growth +$12 +24% +7% +$4 1H 2019 +8% +15% +$16 1H 2020 2H 2019 2H 2020E FY 2019 FY 2020E 1H 2019 1H 2020 2H 2019 2H 2020E FY 2019 FY 2020E ▪ 2H 2020 Pro Forma Net Sales growth projected consistent with historical salty snack category growth, albeit this may be conservative given recent trends ▪ 2H 2020 Further Adjusted EBITDA growth reflects incremental marketing and brand building investments we intend to make to retain new consumers and accelerate future growth 12% 13% 13% Q2 Financial Update July 29, 2020

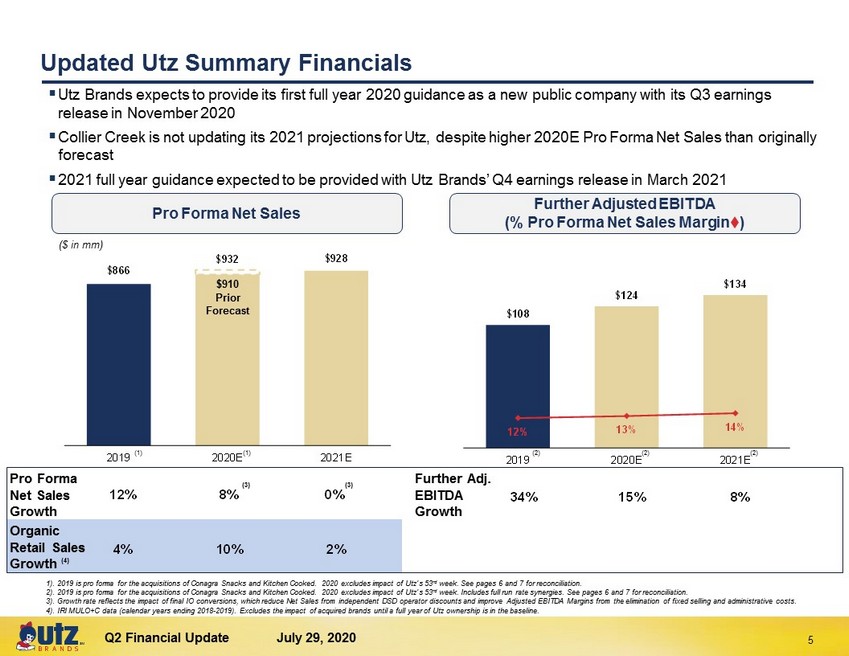

℠ $108 $124 $134 12% 13% 14% 2019 2020E 2021E $866 $928 $932 2019 2020E 2021E 12% 8% 0% Updated Utz Summary Financials 1). 2019 is p ro forma for the acquisitions of Conagra Snacks and Kitchen Cooked. 2020 excludes impact of Utz’s 53 rd week. See pages 6 and 7 for reconciliation. 2). 2019 is pro forma for the acquisitions of Conagra Snacks and Kitchen Cooked. 2020 excludes impact of Utz’s 53 rd week. Includes full run rate synergies. See pages 6 and 7 for reconciliation. 3). Growth rate reflects the impact of final IO conversions, which reduce Net Sales from independent DSD operator discounts a nd improve Adjusted EBITDA Margins from the elimination of fixed selling and administrative costs. 4). IRI MULO+C data (calendar years ending 2018 - 2019). Excludes the impact of acquired brands until a full year of Utz ownership is in the baseline. Pro Forma Net Sales Growth Organic Retail Sales Growth (4) 5 (2) (1) (1) Further Adj. EBITDA Growth (3) (2) (2) 34% 15% 8% 4% 10% 2% Prior Forecast Pro Forma Net Sales Further Adjusted EBITDA (% Pro Forma Net Sales Margin ) ($ in mm) ▪ Utz Brands expects to provide its first full year 2020 guidance as a new public company with its Q3 earnings release in November 2020 ▪ Utz currently not updating its 2021 projections, despite higher 2020E Pro Forma Net Sales than originally forecast ▪ 2021 full year guidance expected to be provided with Utz Brands’ Q4 earnings release in March 2021 $910 (3) Q2 Financial Update July 29, 2020

Appendix

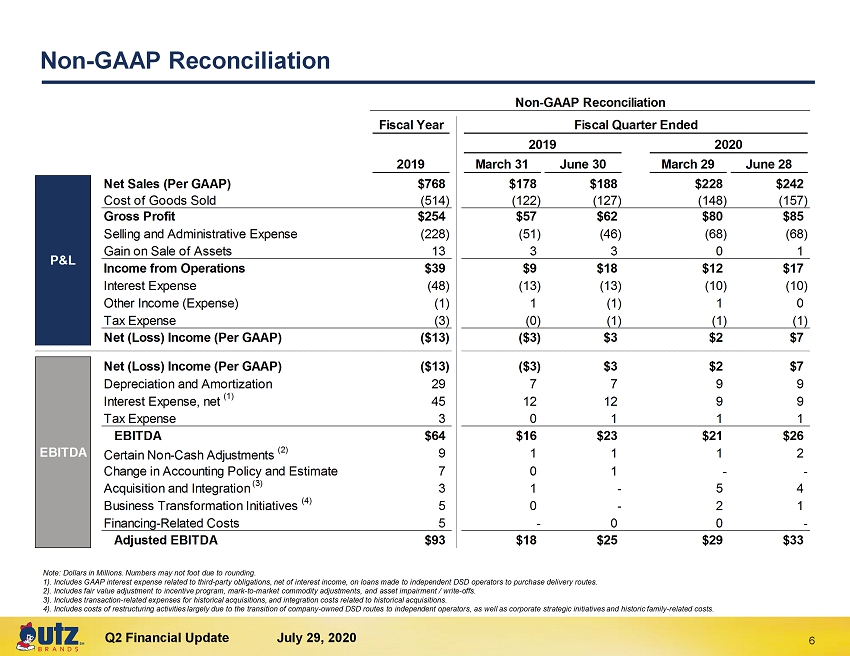

℠ Non - GAAP Reconciliation Note: Dollars in Millions. Numbers may not foot due to rounding. 1). Includes GAAP interest expense related to third - party obligations, net of interest income, on loans made to independent DSD operators to purchase delivery routes. 2 ). Includes fair value adjustment to incentive program, mark - to - market commodity adjustments, and asset impairment / write - offs. 3). Includes transaction - related expenses for historical acquisitions , and integration costs related to historical acquisitions. 4). Includes costs of restructuring activities largely due to the transition of company - owned DSD routes to independent operators, as well as corporate strategic initiatives and historic family - related costs. 6 Non-GAAP Reconciliation Fiscal Year Fiscal Quarter Ended 2019 2020 2019 March 31 June 30 March 29 June 28 Net Sales (Per GAAP) $768 $178 $188 $228 $242 Cost of Goods Sold (514) (122) (127) (148) (157) Gross Profit $254 $57 $62 $80 $85 Selling and Administrative Expense (228) (51) (46) (68) (68) Gain on Sale of Assets 13 3 3 0 1 Income from Operations $39 $9 $18 $12 $17 Interest Expense (48) (13) (13) (10) (10) Other Income (Expense) (1) 1 (1) 1 0 Tax Expense (3) (0) (1) (1) (1) Net (Loss) Income (Per GAAP) ($13) ($3) $3 $2 $7 Net (Loss) Income (Per GAAP) ($13) ($3) $3 $2 $7 Depreciation and Amortization 29 7 7 9 9 Interest Expense, net (1) 45 12 12 9 9 Tax Expense 3 0 1 1 1 EBITDA $64 $16 $23 $21 $26 Certain Non-Cash Adjustments (2) 9 1 1 1 2 Change in Accounting Policy and Estimate 7 0 1 - - Acquisition and Integration (3) 3 1 - 5 4 Business Transformation Initiatives (4) 5 0 - 2 1 Financing-Related Costs 5 - 0 0 - Adjusted EBITDA $93 $18 $25 $29 $33 EBITDA P&L Q2 Financial Update July 29, 2020

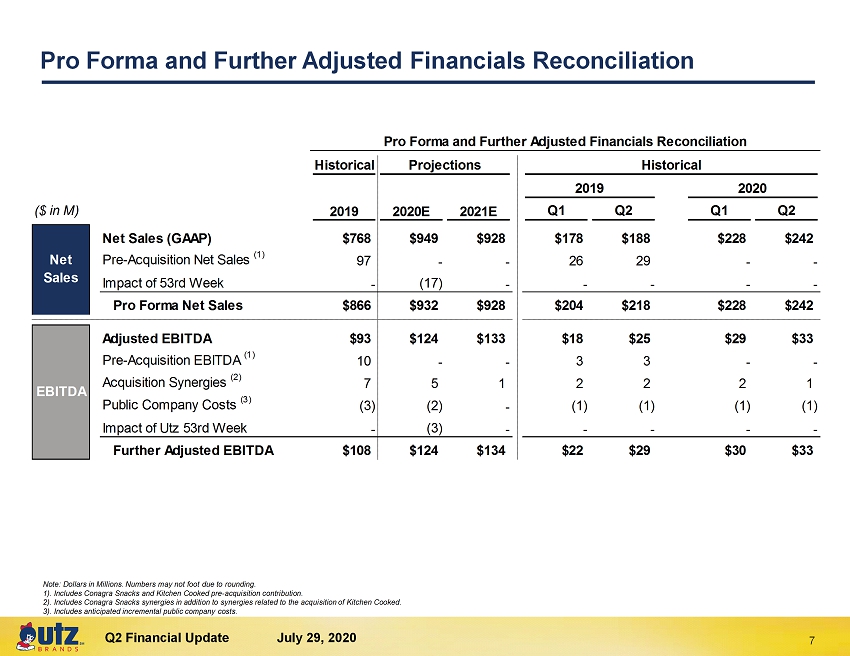

℠ Pro Forma and Further Adjusted Financials Reconciliation Note: Dollars in Millions . Numbers may not foot due to rounding. 1). Includes Conagra Snacks and Kitchen Cooked pre - acquisition contribution. 2). Includes Conagra Snacks synergies in addition to synergies related to the acquisition of Kitchen Cooked. 3). Includes anticipated incremental public company costs. 7 Pro Forma and Further Adjusted Financials Reconciliation Historical Projections Historical 2019 2020 ($ in M) 2019 2020E 2021E Q1 Q2 Q1 Q2 Net Sales (GAAP) $768 $949 $928 $178 $188 $228 $242 Pre-Acquisition Net Sales (1) 97 - - 26 29 - - Impact of 53rd Week - (17) - - - - - Pro Forma Net Sales $866 $932 $928 $204 $218 $228 $242 Adjusted EBITDA $93 $124 $133 $18 $25 $29 $33 Pre-Acquisition EBITDA (1) 10 - - 3 3 - - Acquisition Synergies (2) 7 5 1 2 2 2 1 Public Company Costs (3) (3) (2) - (1) (1) (1) (1) Impact of Utz 53rd Week - (3) - - - - - Further Adjusted EBITDA $108 $124 $134 $22 $29 $30 $33 Net Sales EBITDA Q2 Financial Update July 29, 2020