Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - China VTV Ltd | cvtv_ex322.htm |

| EX-32.1 - CERTIFICATION - China VTV Ltd | cvtv_ex321.htm |

| EX-31.2 - CERTIFICATION - China VTV Ltd | cvtv_ex312.htm |

| EX-31.1 - CERTIFICATION - China VTV Ltd | cvtv_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended February 29, 2020 | |

| or | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transaction period from _____________ to _____________ | |

Commission File No. 333-203754

| CHINA VTV LIMITED |

| (Exact name of registrant as specified in its charter) |

| Nevada | 47-3176820 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| New Times Centre, 393 Jaffe Road, Suite 17A, Wan Chai, Hong Kong |

| (Address of principal executive offices, Zip Code) |

+85267353339

(Registrant’s telephone number, including area code)

________________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☒ Yes ☐ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $454,725,300.

As of July 13, 2020, the Company had 284,280,000 shares of common stock issued and outstanding.

TABLE OF CONTENTS

| 2 |

| Table of Contents |

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. These forward-looking statements speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

| 3 |

| Table of Contents |

Business Overview

China VTV Limited (the “Company,” “we,” “us,” or “our”) was incorporated in the State of Nevada, originally under the name T-Bamm, on February 19, 2015. The Company has conducted limited business operations and has had no revenues from operations since its inception. The Company was organized to sell Bamboo T-Shirts over the internet. On February 9, 2018, the Company changed its name from T-Bamm to “China VTV Limited”.

On March 15, 2019, the Company and Mr. Guoping Chen, the then Principal Executive Officer and President of the Company, entered into a share exchange agreement (the “Share Exchange Agreement”) with China VTV Ltd. (“China VTV”), a Hong Kong company, and all of the shareholders of China VTV ( “China VTV Shareholders”), pursuant to which the Company acquired all of the issued and outstanding shares of common stock of China VTV from the China VTV Shareholders by issuing an aggregate of 110,550,000 restricted shares of common stock of the Company (the “Stock Exchange”) to China VTV Shareholders pro rata upon closing of the Stock Exchange. Upon closing of the Stock Exchange, China VTV became a wholly-owned subsidiary of the Company and China VTV Shareholders collectively owned approximately 51.29% of the then issued and outstanding shares of the Company’s common stock on a fully diluted basis. As a result of the Stock Exchange, the Company and its operational subsidiaries primarily engaged in broadcasting news, videos, television shows, tourists’ programs and other entertainment programs via the over-the-top (the “OTT”) platform over the internet. We disclosed such transaction in a current report on Form 8-K filed with the Securities and Exchange Commission (the “Commission”) on March 21, 2019, which is incorporated herein by reference.

On December 18, 2019, the Company, VTV Global Culture Media (Beijing) Co., Ltd., a Chinese wholly foreign owned entity and a wholly-owned subsidiary of the Company (“WFOE”), Butterfly Effect Culture Media (Beijing) Co., Ltd., a corporation formed under the laws of China (the “Butterfly Effect”) and each and all of the shareholders of Butterfly Effect Media (each, a “Target Shareholder”, and collectively, “Target Shareholders”) entered into a business acquisition agreement (the “Acquisition Agreement”), pursuant to which the Company through its WFOE agreed to acquire Butterfly Effect Media through a series of management agreements (the “VIE Agreements”) to effectively control and own Butterfly Effect Media (the “Acquisition”). In accordance with the Acquisition Agreement, in consideration for the effective control over Butterfly Effect Media, the Company issued an aggregate of 24,000,000 shares of its common stock (the “Common Stock”), par value $0.001 per share, at the stipulated price of $4.00 per share (the “Stock Consideration”) without respect of the stock price at which the Common Stock trades, to the Target Shareholders in accordance with the percentage (the “Target Shareholder Equity Percentage”) listed on Schedule A as set forth in the Acquisition Agreement. In addition, subject to the terms and conditions in the Acquisition Agreement, the Company and its subsidiaries agreed to pay a total of RMB 288,000,000 (the “Cash Consideration”) to the Target Shareholders pro rata with the Target Shareholder Equity Percentage over a period of time as set forth therein.

On February 24, 2020, the Company completed the acquisition transaction of Butterfly Effect Media contemplated under the Acquisition Agreement dated December 18, 2019, as amended, pursuant to which the Company effectively controls Butterfly Effect Media via a series of variable interest entity Agreements. Butterfly Effect Media is a literature and media company that devotes to literary adaptation to another medium, such as television shows, movies, audible books or video games. Butterfly Effect Media’s business chain starts from composing books or scripts, licensing copyrights, producing moving pictures or video games to eventually distributing the moving pictures, audio products and video games on the internet. With the addition of Butterfly Effect Media, we expanded our internet media platform business into the content production business and hope that our Blockchain cloud-based platform and the content production business may benefit from each other, although there is no assurance of any of such benefits or advantages.

Through mergers and acquisitions, we have become an internet-based online entertainment media company with focuses on audience interaction, entertainment and business opportunities. The Company’s goal is to build a dream for young entertainment people and create entertainment value for audience. As of the date of this annual report, the Company primarily distributes news, produces moving pictures, trades copyrights, and produces video games.

| 4 |

| Table of Contents |

Corporate History

The Company was incorporated by its former president Mr. Harald Stobbe on February 19, 2015. On March 1, 2017, Mr. Guoping Chen was appointed as the sole director of the Company. On June 2, 2017, Mr. Guoping Chen became president, secretary and treasurer of the Company and the Company’s former officers Mr. Stobbe and Mr. Junlao resigned as officers of the Company.

In connection with the execution of the Share Exchange Agreement, on March 15, 2019, Mr. Guoping Chen, the Company’s then sole director and executive officer, increased the number of members of the Board from one (1) director to seven (7) and appointed the following six (6) individuals as new members (the “New Directors”) of the board of the directors (the “Board”) of the Company: Tijin Song, Liqiang Meng, Yatao Wang, Daoxin Zhang, Hongbin Dong, and Tung Ho Yu. On the same day, Mr. Guoping Chen appointed Mr. Tung Ho Yu as the Chief Marketing and Branding Officer, Mr. Tijin Song as the Chief Executive Officer and President of the Company, and then resigned from the Chief Executive Officer and President positions of the Company. The aforementioned change of management and Board members became effective on April 18, 2019.

On November 29, 2019, the board of directors (the “Board”) of the Company appointed Mr. Bing Liu as a member of the Board and the Company’s Chief Technology Officer (“CTO”), Ms. Gehui Xu and Mr. Chi-Chung Cheng as members of the Board, effective immediately. Each of Mr. Bing Liu, Ms. Gehui Xu and Mr. Chi-Chung Cheng serves as a member of the Board until the next annual shareholder meeting and until his or her successor shall be duly elected and qualified or his or her early resignation.

On January 10, 2020, the Board reviewed and accepted Mr. Hongbin Dong’s resignation as a member of the Board, effective January 6, 2020. In addition, on January 10, 2020, the Board appointed Mr. Hongbin Dong as the Chairman of the supervisory board of the Company effective immediately, where Mr. Hongbin Dong oversees the general operations of the Company and advises on the executive compensation.

On January 10, 2020, the Board elected Ms. Qiongfang Shi as a member of the Board in connection with the acquisition of Butterfly Effect Media, effective immediately. Ms. Qiongfang Shi serves as a member of the Board until the next annual shareholder meeting and until her successor shall be duly elected and qualified or her early resignation.

On February 24, 2020, the Company completed the acquisition transaction of Butterfly Effect Media as contemplated under the Acquisition Agreement dated December 18, 2019, as amended, pursuant to which the Company effectively controls Butterfly Effect Media via a series of variable interest entity Agreements.

| 5 |

| Table of Contents |

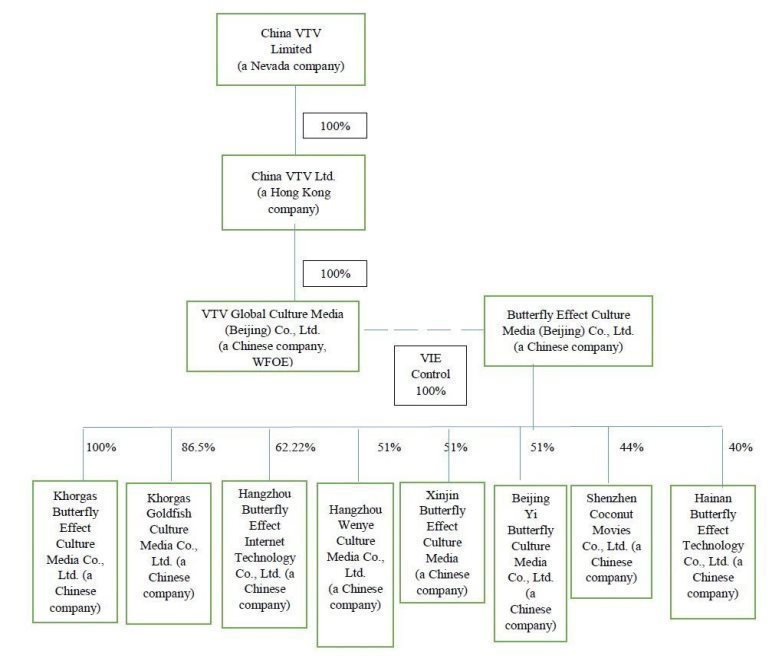

Corporate Structure

The diagram below illustrates our corporate structure following the Stock Exchange and acquisition of Butterfly Effect Media.

The Company’s consolidated financial statements for the year ended February 29, 2020 do not include the financial information of the following four non-wholly-owned subsidiaries: Hangzhou Wenye Culture Media Co., Ltd., Xinjin Butterfly Effect Culture Media Co, Ltd., Beijing Yi Butterfly Culture Media Co., Ltd., and Shenzhen Coconut Movies Co., Ltd.

| 6 |

| Table of Contents |

Principal Products

We are at the early stage of our business development. As of the date of this annual report, the Company has established a functioning Blockchain cloud-based platform which distributes news, videos, television shows, travel programs and other entertainment programs via internet to the end devices (the “End Devices”), such as computers, smart TVs, smart phones and tablets.

The Company has engaged Xin Mei Culture Distribution Co., Ltd. (“Xin Mei Technology”) to develop the cloud technology and internet services which are integral to the establishment and maintenance of the OTT platform. On December 22, 2016, China VTV (HK) and Xin Mei Technology entered into the OTT development and maintenance agreement (the “OTT Development Agreement”) pursuant to which Xin Mei Technology provided the information technology to build and update a customized OTT platform for China VTV(HK), through which China VTV (HK) may distribute its programs and shows to the audiences’ End Devices. The term of the OTT Development Agreement was five years. The total consideration of the OTT Development Agreement was an aggregate of thirty million (RMB 30,000,000) Chinese dollars (equivalent to $4,474,673 U.S. dollars), which was payable over the five-year period in the combination of cash and the Company’s stock. Later the Company and Xin Mei Technology mutually agreed to terminate the OTT Development Agreement due to changes to the Company’s business needs. On December 31, 2018, the Company and Xin Mei Technology entered into a termination agreement, pursuant to which Xin Mei ceased its maintenance services to the Company’s OTT platform on December 31, 2018 and also waived the Company’s obligation to pay the balance of service fee balance of RMB 16,000,000 in cash or the Company’s common stock.

In addition, the new CTO of the Company and the engineers at CybEye Image, Inc. (“CybEye”) play an important role in incorporating the blockchain technology to the OTT Platform and updating and maintaining the OTT Platform to ensure high quality online streaming services. On September 30, 2019, the Company entered into a strategic development agreement (the “Strategic Development Agreement”) with CybEye pursuant to which CybEye will develop and provide technical support and maintenance to the Company’s online streaming media platform, the platform, and incorporate blockchain technologies to the Company’s media platform to enhance security. The Strategic Development Agreement shall continue in full force and effect until September 29, 2022. During the term of the Strategic Development Agreement, CybEye will develop the OTT Platform only for the Company, and will not engage in providing any services to other media companies. Subject to the terms and conditions of the Strategic Development Agreement, the Company shall issue to CybEye two million and five hundred thousand (2,500,000) shares of its unissued and registered common stock at one time and forty thousand (40,000) shares its unissued and registered common stock per month during the term of the Strategic Development Agreement upon the effectiveness of a registration statement to register those shares.

In connection with the Strategic Development Agreement, on September 30, 2019, the Company and CybEye entered into a non-exclusive licensing agreement (the “Licensing Agreement”), pursuant to which the Company and its affiliates were granted a fully-paid perpetual non-exclusive right and license to use and develop any intellectual property and proprietary information, including, without limitation, any patents and trademarks as set forth in Schedule A thereto, which CybEye owns, to carry out the purposes and goals of the Strategic Development Agreement. On December 13, 2019, the Company and CybEye entered into an amendment to the Licensing Agreement, pursuant to which the term of the Licensing Agreement was amended to twenty (20) years (from September 30, 2019 to September 29, 2039) and the Company agreed to issue 2,500,000 shares of its common stock to CybEye as set forth in the Strategic Development Agreement dated September 30, 2019.

Our internal information technology team and CybEye have included blockchain and cloud data technologies to our online OTT platform and developed the second generation of our media distribution platform (hereinafter referred as the “blockchain cloud-based platform”). The Blockchain cloud-based platform consists of the IOS app, the Android app, online updates, online video and audio services, channel services and multi-media functions. The fully-integrated OTT system digitalizes the traditional film-based videos and distributes the digital contents over the internet to various End Devices. Recently, the Company and its technology partners together developed the live-streaming function of the blockchain cloud-based platform where the Company can distribute live programs digitally. As of the date of this report, the Company has broadcasted many live programs, such as Boao Forum for Asia (an established political forum in Asia) and Xiang Fei Jia Dao (a travel program). The Company has reached more than 1 million viewers who watched its live programs. The blockchain cloud-based platform can distribute, upload and broadcast contents constantly (24-7) on multiple social media channels and websites on smart TVs and smart phones.

| 7 |

| Table of Contents |

The Company’s representative original programs include, without limitation, China Symbol, China Temperature, V Spring Festival Party, Global Good Voice (Los Angeles), Confucianism Ceremony, various talk shows, and Qing Tan Guo Xue Ge Feng Ya (a series TV show focused on traditional Chinese culture). In addition, the Company has the exclusive online broadcasting right to a number of Chinese TV shows in various regions.

Furthermore, our literary adaptation line of business, Butterfly Effect Media and its subsidiaries, is developing scripts and producing TV shows, movies, audio books and video games to be distributed online. As of the date of this annual report, Butterfly Effect Media owned various copyrights to approximately 49 original stories, including the right to develop the audible versions and other adaptation rights. Among these original stories, Butterfly Effect Media was working on nine TV scripts for future TV show production. The nine TV show scripts include Chinese martial art actions, contemporary detective, historical dramas, Chinese civil war-themed stories, and science fictions. Among the TV scripts that Butterfly Effect Media was working on, there are five popular or “hot” scripts:

|

| i) | “The Legacy of Chu Liu Xiang” authored by Long Gu, a topnotch novelist in China with specialty in the martial art genre. The Legacy of Chu Liu Xiang is a martial art classic enjoying widespread popularity in Chinese speaking communities. We have the full copyrights to adapt the classic story “The Legacy of Chu Liu Xiang” to any type of moving pictures. |

|

|

|

|

|

| ii) | “The Bride with White Hair” authored by Yu Sheng Liang, who was one of the four “fathers”/ founding writers of New Martial Arts Writing and was a member of the Chinese Author Association. The three other founding writers of the New Martial Arts Writing style are Yong Jin, Long Gu, and Rui’an Wen. The Bride with White Hair movie (1993 version) received the Hong Kong Film Award for Best Cinematography. We have the copyright to adapt The Bride with White Hair to TV shows. |

|

|

|

|

|

| iii) | “The Legend of Sword and Fairy 2,” which was one of the most popular video games in China. We have the full copyrights to adapt the Legend of Sword and Fairy 2 to all types of moving picture products. |

|

|

|

|

|

| iv) | “Yi Nian Yong Heng (Moment of Forever),” written by Er Gen, one of the most well-known internet writers in China. We have the full copyrights to adapt Yi Nian Yong Heng (Moment of Forever) to all types of moving picture products. |

|

|

|

|

|

| v) | “Qin Xu,” written by Guan Yue, a topnotch historian novelist. We have the full copyrights to adapt Qin Xu to all types of moving picture products. |

With respect to cell phone video games, Butterfly Effect launched a few internal testing on the cell phone video game named after the same name of the original book “The Qin Empire” in March 2020. The testing has started generating revenue for the Company.

Targeted Customers

Our targeted customers include IP TV subscribers outside mainland China, mainland internet distribution platforms, local enterprises, municipalities, and celebrities in various regions and countries, including mainland China. Our revenues for the years ended February 29, 2020 and February 28, 2019 derive primarily from the sales of copyrights, original stories, and finished products, licensing literal copyrights, and advertising services .

During the fiscal year ended February 29, 2020, we did not have any major client that contributed to more than 10% of our consolidated revenue.

| 8 |

| Table of Contents |

Intellectual Property

We rely on a combination of copyright, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology and brand names. Monitoring unauthorized use of our products and brands is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our technology and brand names, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

In addition, third parties may initiate litigation against us alleging infringement of their proprietary rights. In the event of a successful claim of infringement and our failure or inability to develop non-infringing technology or license the infringed or similar technology on a timely basis, our business could be harmed. In addition, even if we are able to license the infringed or similar technology, license fees could be substantial and may adversely affect our results of operations.

Copyrights

The Company and its strategic partner CybEye have developed a new software system for the blockchain cloud-based platform. The Company may register any copyrights related to the blockchain cloud-based platform.

As of the date of this annual report, the Company, through Butterfly Effect Media, owned various copyrights to approximately 49 original stories, including the right to adapt the original stories to audible books, TV shows, movies, or video games and market and distribute online or offline the adapted contents.

Domain Names

As of the date of this report, the Company has an aggregate of six (6) domain names registered under its name for the use in various jurisdictions as set forth below.

| Domain Names | Jurisdiction | Valid Period | Ownership | |

| From | To | |||

| chinavtv.tv | China | 2015/4/3 | 2022/4/3 | direct |

| chinavtv.tw | Taiwan | 2015/4/3 | 2022/4/3 | direct |

| chinavtv.Vip | China | 2018/2/3 | 2022/2/3 | direct |

| zhonghuaweishi.com | China | 2015/5/9 | 2021/5/9 | direct |

| zhonghuaweishi.com.cn | China | 2015/5/9 | 2021/5/9 | direct |

| chinavtv.hk | Hong Kong |

|

| direct |

Patents

In connection with the Strategic Development Agreement with CybEye, on September 30, 2019, the Company and CybEye entered into the Licensing Agreement, pursuant to which the Company and its affiliates were granted a fully-paid non-exclusive right and license to use and develop any intellectual property and proprietary information, including, without limitation, any patents and trademarks that CybEye owned as of September 30, 2019 and are set forth in Schedule A thereto. As of the date of this annual report, we licensed nine patents and five trademarks from CybEye.

| 9 |

| Table of Contents |

Trademarks

In addition to the licensed marks from CybEye, we have our own marks to distinguish ourselves from other online media companies. The Company started using the mark or logo as referenced below since February 2015 in various jurisdictions, such as mainland China, Taiwan, Hong Kong, the U.S., France, Japan and Malaysia.

Later in 2019, we updated the company’s logo as following:

On November 15, 2017, the Company and China VTV Taiwan Co., Ltd. (“China VTV Taiwan”) entered into a strategic partnership agreement, pursuant to which the two parties agreed to work together to promote the visibility of the Company. The Company believes that China VTV Taiwan did not perform under such agreement and the agreement was terminated shortly thereafter. However, the Company then discovered that China VTV Taiwan submitted a trademark registration of the Company’s mark consisting of the English letters, Chinese letters and the rainbow, as referenced above under its own name in Taiwan without consent or approval from the Company. Immediately thereafter on December 7, 2018, the Company filed an opposition to China VTV Taiwan’s mark registration in front of the Taiwan Intellectual Property Office. On November 12, 2019, the Taiwan Intellectual Property Office denied China VTV Taiwan’s mark registration application and China VTV Taiwan appealed such decision to the Ministry of Economic Affairs of Taiwan. On April 14, 2020, the Ministry of Economic Affairs of Taiwan affirmed the decision of the Taiwan Intellectual Property Office that it agreed with the Company on denying China VTV Taiwan’s mark registration in Taiwan. On July 7, 2020, the Company’s wholly owned subsidiary in Hong Kong received the affirmation from the Taiwan Intellectual Property Office to register the Company’s mark and the accompanying text in Taiwan.

| 10 |

| Table of Contents |

Employees

As of February 29, 2020, we, together with our wholly-owned and majority-owned subsidiaries, either through direct ownership or the VIE agreements, had a total of 96 employees, all of whom are full-time and are based in Hong Kong and mainland China. The breakdown of our employees based on departments is set forth below:

| Department |

| Number of Employees |

| |

| Management |

|

| 7 |

|

| Content Editing |

|

| 7 |

|

| Technology Development and Coding |

|

| 16 |

|

| Sales and Marketing |

|

| 6 |

|

| Product Testing |

|

| 5 |

|

| Strategy |

|

| 7 |

|

| Production and micro-movies |

|

| 4 |

|

| Creative Writing |

|

| 10 |

|

| Celebrity Management |

|

| 2 |

|

| Art Design |

|

| 7 |

|

| Administration |

|

| 12 |

|

| Accounting |

|

| 7 |

|

| International Business Development |

|

| 6 |

|

There are no collective bargaining contracts of any of our employees. We believe our relationship with our employees is satisfactory.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information under this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not required for a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K.

Our corporate headquarters are located at New Times Centre, 393 Jaffe Road, Suite 17A, Wan Chai, Hong Kong. We do not pay rent for this office space and there is only a verbal lease between the Company and the landlord, who is a friend of one of the directors. Some of our cloud disks are maintained in such office space in Hong Kong. The Company and the landlord have the mutual understanding that the Company may use such office space till the end of 2020. There is no assurance how long this office accommodation will last.

In addition, a director of the Company has verbally agreed to host the Company’s office in Beijing, China for seven years beginning from the year of 2020. The Company’s office space in Beijing, China is approximately 600 square meters (approximately 6,458 square feet) and currently the Company is not obligated to pay any rent.

Butterfly Effect Media leases its main office space in Chaoyang District, Beijing, China from September 22, 2017 to September 21, 2020. Its offices in Beijing occupy approximately 7,290 square feet, consisting of offices, an entertainment lounge, and a terrace. The annual base rent for the Beijing office was approximately $211,000 from September 22, 2018 to September 21, 2019 and $227,600 from September 22, 2019 to September 21, 2020. Butterfly Effect is responsible for all the expenses incurred because of the use of the office space, such as electricity, internet, telecommunication, water and parking.

On November 15, 2017, the Company and China VTV Taiwan entered into a strategic partnership agreement, pursuant to which the two parties agreed to work together to promote the visibility of the Company. The Company believes that China VTV Taiwan did not perform under such agreement and the agreement was terminated shortly thereafter. However, the Company then discovered that China VTV Taiwan submitted a trademark registration of the Company’s mark consisting of the English letters, Chinese letters and the rainbow, as referenced above under its own name in Taiwan without consent or approval from the Company. Immediately thereafter on December 7, 2018, the Company filed an opposition to China VTV Taiwan’s mark registration in front of the Taiwan Intellectual Property Office. On November 12, 2019, the Taiwan Intellectual Property Office denied China VTV Taiwan’s mark registration application and China VTV Taiwan appealed such decision to the Ministry of Economic Affairs of Taiwan. On April 14, 2020, the Ministry of Economic Affairs of Taiwan affirmed the decision of the Taiwan Intellectual Property Office that it agreed with the Company on denying China VTV Taiwan’s mark registration in Taiwan. On July 7, 2020, the Company’s wholly owned subsidiary in Hong Kong received the affirmation from the Taiwan Intellectual Property Office to register the Company’s mark and the accompanying text in Taiwan.

Other than the administrative proceeding set forth above, there are no other pending or threatened legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse to the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 11 |

| Table of Contents |

Market Information

Our common stock, par value $0.001 per share, is quoted on the OTC Pink platform under the symbol “CVTV”.

The following table sets forth the range of high and low bid quotations for our common stock. The quotations represent inter-dealer prices without retail markup, markdown or commission, and may not necessarily represent actual transactions.

| Quarter Ended |

| High Bid |

|

| Low Bid |

| ||

|

|

|

|

|

|

|

| ||

| 5/31/19 |

|

| - |

|

|

| - |

|

| 8/31/19 |

|

| 6.87 |

|

|

| 6.70 |

|

| 11/30/19 |

|

| 12.00 |

|

|

| 3.57 |

|

| 02/29/20 |

|

| 11.00 |

|

|

| 3.25 |

|

|

|

|

|

|

|

|

|

|

|

| 5/31/18 |

|

| 1.75 |

|

|

| 1.75 |

|

| 8/31/18 |

|

| 2.00 |

|

|

| 2.00 |

|

| 11/30/18 |

|

| 2.00 |

|

|

| 2.00 |

|

| 02/28/19 |

|

| - |

|

|

| - |

|

As of July 13, 2020, there were 108 holders of record of the Company’s common stock.

Securities authorized for issuance under equity compensation plans.

As of February 29, 2020, there were 12,450,000 shares of common stock granted to the Company’s officers, directors, employees and consultants pursuant to its 2019 equity compensation plan (the “2019 Incentive Plan”). On November 29, 2019, the Board of the Company adopted the 2019 Incentive Plan, under which the Company may issue up to an aggregate of 22,000,000 shares of stock awards, options, or performance shares, subject to certain adjustments set forth therein. The Board of the Company has the sole authority to implement and administer the 2019 Incentive Plan and may delegate a committee or one or more officers to grant awards under the 2019 Incentive Plan. This 2019 Incentive Plan became effective upon the Board approval on November 29, 2019 and shall terminate ten years thereafter. On June 8, 2020, the holders of a majority outstanding voting power of the Company approved the 2019 Incentive Plan.

Dividends.

The Company has not and does not intend to pay dividends on its common stock in the near future.

Issuer Purchases.

None.

ITEM 6. SELECTED FINANCIAL DATA

Not required for a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and the accompanying notes thereto included in “Item 8. Financial Statements and Supplementary Data.” In addition to historical financial information, the following discussion and analysis may contain forward-looking statements that involve risks, uncertainties and assumptions. See “Forward-Looking Statements.” Our results and the timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors.

| 12 |

| Table of Contents |

Organization and Business Operations

China VTV Limited (the “Company,” “we,” “us,” or “our”) was incorporated under the laws of the State of Nevada on February 19, 2015. On February 9, 2018, we filed with the Nevada Secretary of State to change the name of our corporation from “T-Bamm” to “China VTV Limited”.

China VTV Ltd. (“China VTV HK”) was incorporated on January 9, 2015 under the laws of Hong Kong. The business of China VTV is developing an Over-The-Top (the “OTT”) streaming media platform that distributes streaming media as a standalone product directly to viewers over the Internet, bypassing telecommunications, multichannel television, and broadcast television platforms that traditionally act as a controller or distributor of such content. China VTV HK provides news, entertainment shows, TV episodes and other programs on its website and social media accounts.

Pursuant to the Share Exchange Agreement dated March 15, 2019, on May 6, 2019, we issued an aggregate of 115,550,000 shares of our common stock to the shareholders of China VTV HK in exchange for all of the issued and outstanding equity interests of China VTV HK and five individuals who provided prior services to China VTV HK. As a result, China VTV HK has become our wholly-owned subsidiary. The acquisition of China VTV HK is treated as a reverse acquisition, and the business of China VTV became our business.

On December 18, 2019, the Company, VTV Global Culture Media (Beijing) Co., Ltd., a Chinese wholly foreign owned entity and a wholly-owned subsidiary of the Company (“WFOE”), Butterfly Effect Culture Media (Beijing) Co., Ltd., a corporation formed under the laws of China (the “Target”) and each and all of the shareholders of the Target (each, a “Target Shareholder”, and collectively, “Target Shareholders”) entered into a business acquisition agreement (the “Acquisition Agreement”), pursuant to which the Company through its WFOE agreed to acquire the Target through a series of management agreements (the “VIE Agreements”) to effectively control and own the Target (the “Acquisition”). In accordance with the Acquisition Agreement, in consideration for the effective control over the Target, the Company issued an aggregate of 24,000,000 shares of its common stock (the “Common Stock”) to the Target Shareholders in accordance with the percentage (the “Target Shareholder Equity Percentage”) as set forth in the Acquisition Agreement. In addition, subject to the terms and conditions in the Acquisition Agreement, the Company and its subsidiaries agreed to pay a total of RMB 288,000,000 (the “Cash Consideration”) to the Target Shareholders pro rata with the Target Shareholder Equity Percentage over a period of time as set forth therein.

Pursuant to the terms and conditions of the Acquisition Agreement, the Company also agreed to dedicate forty percent (40%) of the net proceeds actually received in any public or private equity offering (the “Qualified Offering”), in which the Company raises at least $20,000,000 USD in gross proceeds before deducting any underwriter or placement agent’s discount and commissions and any offering expenses, to be used to pay the Target Shareholders pro rata with the Target Shareholder Equity Percentage until the total amount of the Cash Consideration is paid in full, without the obligation to pay any interest thereon.

In addition, the Acquisition Agreement provides that in the event that the Target fails to meet the net profit milestones as set forth in the Acquisition Agreement, each Target Shareholder shall return the Common Stock or equivalent amount of cash (the “Claw-back”) according to the formula specified in the Acquisition Agreement. However, subject to the Claw-back provision, the Acquisition Agreement prescribes that if the Company does not make payments of at least half of the Cash Consideration to the Target Shareholders within one (1) year commencing on the first trading day (excluding the first trading day) of the Common Stock on a national stock exchange, i) the Target shall have the right to appoint the majority of the Company’s Board and manage and operate the Company and its subsidiaries and ii) each of the Target Shareholders shall have the right to receive the number of shares of the Common Stock equal to the result of (the total amount of Cash Consideration – the sum of cash received by the Target Shareholders)/ $2.00 per share* Target Shareholder Equity Percentage.

The Company completed this acquisition transaction on February 24, 2020 (the “Closing Date”) and acquired Butterfly Effect Media’s business.

Butterfly Effect Culture Media is primarily engaging in literary adaptation business. The Company centers its business on internet Chinese literary and literary adaptation for television shows, movies, audible books and mobile phone video games that are primarily distributed through online platforms to provide marketing and media services to the entertainment industry in China, including production of media promotion and advertising services to movies, television shows, actors and commercial products in China. For the year ended February 29, 2020, the focus and revenue stream for the Company was the purchase and sale of literature copyrights, and licensing of the copyrights to video game software development companies.

Following the acquisition, the Company plans to operate as a single entity with two relatively separate but integrated business units, which are 1) the e-media online streaming platform operated by the Company’s Hong Kong subsidiary and 2) the literary adaptation business whereby the Target adapts original stories or books into TV shows, movies and mobile video games to be distributed in and outside the People’s Republic of China (the “PRC”) through the internet. The Company is currently exploring the model to distribute contents, such as TV show episodes, produced by Butterfly Effect Culture Media on our online streaming platform. While each of the two business units is operating independently of each other, they are supervised by the board of directors (the “Board”) of the Company and share certain common resources and functions, including, but not limited to, accounting, business development, an marketing functions. The new Board after January 10, 2020 has representatives from both the Company and Butterfly Effect Media.

| 13 |

| Table of Contents |

Strategic Development with CybEye and Chief Technology Officer

On September 30, 2019, we entered into a strategic development agreement (the “Strategic Development Agreement”) with CybEye Image, Inc. (“CybEye”), pursuant to which CybEye is developing and providing technical support and maintenance to the Company’s online streaming media OTT Platform and incorporating blockchain technologies to the Company’s OTT Platform to enhance security. CybEye is a mobile video-messaging APP platform company that builds customized applications for various industries. The Strategic Development Agreement shall continue in full force and effect until September 29, 2022. During the term of the Strategic Development Agreement, CybEye will develop the OTT Platform only for the Company, and will not engage in providing any services to other media companies. Subject to the terms and conditions of the Strategic Development Agreement, the Company shall issue to CybEye two million and five hundred thousand (2,500,000) shares of its unissued and registered common stock at one time and forty thousand (40,000) shares its unissued and registered common stock per month during the term of the Strategic Development Agreement upon the effectiveness of a registration statement to register those shares. Pursuant to the terms of the Strategic Development Agreement, upon listing of the Company’s common stock on a national stock exchange market, the Company shall make a cash payment of $150,000 to CybEye instead of the stock payment at the end of each whole month for CybEye’s services pursuant to this Agreement.

In connection with the Strategic Development Agreement, on September 30, 2019, the Company and CybEye entered into a non-exclusive licensing agreement (the “Licensing Agreement”), pursuant to which the Company and its affiliates were granted a fully-paid perpetual non-exclusive right and license to use and develop any intellectual property and proprietary information, including, without limitation, any patents and trademarks as set forth in Schedule A thereto, which CybEye owns, to carry out the purposes and goals of the Strategic Development Agreement. On December 13, 2019, the Company and CybEye entered into an amendment to the Licensing Agreement dated September 30, 2019, pursuant to which the term of the Licensing Agreement was amended to twenty (20) years (from September 30, 2019 to September 29, 2039) and the Company agreed to issue 2,500,000 shares of its common stock to CybEye as set forth in the Strategic Development Agreement dated September 30, 2019. A copy of such amendment was filed in a current report on Form 8-K on December 17, 2019.

In addition, on September 30, 2019, the Company and Mr. Bing Liu (the “Executive”) entered into an executive employment agreement (the “Executive Employment Agreement”), in accordance with which, subject to the approval of the board of directors of the Company (the “Board”), the Executive shall be elected as a member of the Board and the Chief Technology Officer (“CTO”) of the Company. The Executive Employment Agreement has a term (the “Term”) of three (3) years, unless terminated earlier pursuant to the termination provisions therein. In accordance with the Employment Agreement, the Executive shall receive incentive stock options to purchase five hundred thousand (500,000) shares of the Company’s common stock each year during the Term of the employment pursuant to the stock option agreement (the “Stock Option Agreement”). Upon termination of the Strategic Development Agreement, the Executive Employment Agreement shall also be terminated, unless otherwise mutually agreed in writing. In connection with the Executive Employment Agreement, on September 30, 2019 (the “Grant Date”), the Company and the Executive entered into the Stock Option Agreement under the Company’s 2019 stock plan (the “Plan”), whereby the Company issued the Executive options (the “Options”) to purchase an aggregate of five hundred thousand (500,000) shares of the Company’s common stock, at an exercise price of $12.00 per share. The Stock Option Agreement provides that the Options shall become exercisable on September 29, 2020, one year from the Grant Date, and shall expire on September 29, 2026. Subject to the terms of the Stock Option Agreement and Plan, the Options shall vest in equal amounts each quarter from the Grant Date.

Copies of the Strategic Development Agreement, Licensing Agreement, Executive Employment Agreement and Stock Option Agreement were filed in a current report on Form 8-K on October 3, 2019.

Since November 2019, our blockchain-operated App have been available for both iPhone and Android mobile phone users, and we have been trying to recruit more mobile phone users to use our App to watch our online media programs.

Change of Directors

On November 29, 2019, the board of directors (the “Board”) of the Company appointed Mr. Bing Liu as a member of the Board and the Company’s Chief Technology Officer (“CTO”), Ms. Gehui Xu and Mr. Chi-Chung Cheng as members of the Board, effective immediately. Each of Mr. Bing Liu, Ms. Gehui Xu and Mr. Chi-Chung Cheng serves as a member of the Board until the next annual shareholder meeting and until his or her successor shall be duly elected and qualified or his or her early resignation.

Mr. Bing Liu, 60 years old, is the founder and Chief Executive Officer of CybEye, Inc., which was incorporated in October 2011. He owns fourteen U.S. patents and has the expertise in social networking platform, internet security, cloud computing and multi-lingual processing. Mr. Bing Liu received a Bachelor and a Masters of Computer Science from Tsinghua University in China. The Company has thus determined that it is in its best interest of the shareholders to appoint Mr. Liu the CTO and a member of its Board to fill a vacancy on the Board.

| 14 |

| Table of Contents |

Ms. Gehui Xu, 51 years old, was a well-known television hostess at China Central Television Station from 1991 until 1995 and started her career as a television hostess at Hong Kong Phoenix Television Station in 1996. Ms. Gehui Xu received the award as one of the Top Ten Television Hostesses in China in 1994. Ms. Gehui Xu currently hosts three TV programs at Hong Kong Phoenix Television Station. Ms. Xu received a Bachelor’s Degree in English from Beijing Foreign Language College. Therefore, the Company has determined that it is in its best interest of the shareholders to elect Ms. Gehui Xu to the Board to fill a vacancy on the Board.

Mr. Chi-Chung Cheng, 53 years old, has been a director of ETtoday Dongsen News Cloud Co., Ltd. since 2018. From 2011 to 2018, Mr. Chi-Chung Cheng was the Chairman, Chief Executive Officer and a director of SMI Holdings Group Limited (a company previously listed on the Hong Kong Stock Exchange). Mr. Chi-Chung Cheng received a Bachelor’s Degree from Taiwan University and an MBA Degree from Tsinghua University. Therefore, the Company has determined that it is in its best interest of the shareholders to appoint Mr. Chi-Chung Cheng to the Board to fill a vacancy on the Board.

On January 10, 2020, the Board reviewed and accepted Mr. Hongbin Dong’s resignation letter as a member of the Board, effective January 6, 2020. In addition, on January 10, 2020, the Board appointed Mr. Hongbin Dong as the Chairman of the supervisory board of the Company effective immediately, where Mr. Hongbin Dong oversees the general operations of the Company and advises on the executive compensation.

On January 10, 2020, the Board elected Ms. Qiongfang Shi as a member of the Board in connection with the Acquisition Agreement with Butterfly Effect, effective immediately. Ms. Qiongfang Shi serves as a member of the Board until the next annual shareholder meeting and until her successor shall be duly elected and qualified or her early resignation.

Ms. Qiongfang Shi, 39 years old, has been a member of the board of directors of Butterfly Effect since July 2015. Previously Ms. Shi served as the Vice President of Jiubang Digital Technology (Guangzhou) Co., Ltd. from November 2010 to June 2015. In addition, Ms. Shi has had various roles in the areas of Chinese literature, sales and marketing and project management. Ms. Qiongfang Shi received an associate’s degree in international accounting from Guangdong Industry Technical College in 2000, an associate’s degree in property management from Guangzhou Caimao Guanli Ganbu College in 2004, and has been pursuing an MBA at Communication University of China since September 2019.

Impact of Covid-19

A novel strain of coronavirus, or COVID-19, was first identified in China in December 2019 and subsequently declared a pandemic in March 11, 2020, by the World Health Organization. As a result of the COVID-19 pandemic, all travel has been severely curtailed to protect the health of our employees and comply with local guidelines, and we temporarily closed our china offices from February to early March 2020. To date, COVID-19 has surfaced in nearly all regions around the world and resulted in travel restrictions and business slowdowns in affected areas. The full impact of the pandemic on our business, operations and financial results will depend on various factors that continue to evolve which we may not accurately predict.

Results of Operations

Fiscal Year Ended February 29, 2020 compared to the Fiscal Year Ended February 28, 2019

The following table sets forth our consolidated statements of operations for the years indicated:

|

|

| For the Years Ended |

| |||||||||

|

|

| February 29, |

|

| February 28, |

|

| Dollar |

| |||

| Net Revenue |

| $ | 3,834 |

|

| $ | - |

|

| $ | 3,834 |

|

| Cost of Revenue |

|

| 1,278 |

|

|

| - |

|

|

| 1,278 |

|

| Gross Profit |

|

| 2,556 |

|

|

| - |

|

|

| 2,556 |

|

| Sales and marketing expenses |

|

| 6,390 |

|

|

| - |

|

|

| 6,390 |

|

| Research and Development Expenses |

|

| 231,791 |

|

|

| 861,581 |

|

|

| (629,790 | ) |

| General and Administrative Expenses |

|

| 1,271,630 |

|

|

| 13,426 |

|

|

| 1,258,204 |

|

| Total Operating Expenses |

|

| 1,509,811 |

|

|

| 875,007 |

|

|

| 634,804 |

|

| Interest expense |

|

| 316 |

|

|

| - |

|

|

| 316 |

|

| Loss before income tax |

|

| (1,507,571 | ) |

|

| (875,007 | ) |

|

| (632,564 | ) |

| Provision for Income Tax |

|

| - |

|

|

| - |

|

|

| - |

|

| Net Loss |

|

| (1,507,571 | ) |

|

| (875,007 | ) |

|

| (632,564 | ) |

| Comprehensive Loss |

| $ | (1,508,905 | ) |

| $ | (875,770 | ) |

| $ | (633,135 | ) |

| 15 |

| Table of Contents |

Revenue:

During the year ended February 29, 2020, we realized $3,834 in revenue, representing an increase of $3,834 as compared to $0 for the year ended February 28, 2019, as a result of one-time advertising revenue that was generated by the Company’s subsidiary, China VTV Ltd. The Company acquired China VTV Ltd., through a reverse merger transaction, in May 2019.

Cost of Revenue:

Our cost of sales consisted of the fees that we paid to telecommunication carriers and other service providers for telecommunications and other content delivery-related services. During the year ended February 29, 2020, we had cost of revenue of $1,278, compared to $0 during the year ended February 28, 2019, as a result of the increase in advertising revenue.

Sales and marketing expenses:

Sales and marketing expenses during the year ended February 29, 2020 was $6,390, an increase of $6,390 from $0 during the year ended February 28, 2019. The Company did not have any business operations during the year ended February 28, 2019.

Research and Development Expenses:

Research and development expenses mainly consisted of the costs incurred in the development and improvement of the Company’s OTT service platform. Research and development expenses decreased by $629,790 to $231,791 for the year ended February 29, 2020, as compared to $861,581 for the year ended February 28, 2019. The decrease in the research and development expenses was primarily due to the decrease in the development and technical support cost for our OTT Platform.

During the year ended February 29, 2020, we engaged our business strategic partner, CybEye Image, Inc. (“CybEye”), in developing and providing technical support and maintenance to the Company’s online streaming media OTT Platform and incorporating blockchain technologies to the Company’s OTT Platform to enhance security. Pursuant to the “Strategic Development Agreement”, entered by the Company and CybEye, the Company shall issue 2,500,000 shares of its common stock at one time and forty thousand (40,000) shares its common stock per month to CybEye during the term of the contract term. In addition, the Company granted the CybEye’s developers stock options to purchase 500,000 shares of the Company’s common stock each year during the term of the employment pursuant to the stock option agreement. The total share-based compensation of $231,791 was recognized as research and development expenses for the year ended February 29, 2020.

General and Administrative Expenses:

General and administrative expenses primarily consist of legal, accounting, other professional service fees, the compensations to the Company’s employees, executives, and directors, and depreciation expenses of the capital assets. General and administrative expenses were $1,271,630 for the year ended February 29, 2020, as compared to $13,426 for the year ended February 28, 2019, representing an increase of $1,258,204.

The increase in general and administrative expenses for the year ended February 29, 2020 was primarily attributable to the increase in stock-based compensations to the Company’s executives and directors of $713,415, legal fees of $107,651, impairment of intangible assets and depreciation expenses of $183,088, accrued salaries of $146,396, travel expenses of $28,649, and rental expenses of $6,953.

Net Loss:

Our net loss was $1,507,571 for the year ended February 29, 2020, as compared to $875,007 for the year ended February 28, 2019, representing an increase of $632,564. The increase in net loss for the year ended February 29, 2020 was primarily attributable to the stock-based compensations to Cybeye developers and the Company’s executives and directors. The stock-based compensations, totaling $872,914, were recognized as operating expenses for the year ended February 29, 2020.

| 16 |

| Table of Contents |

Comprehensive Loss:

Our business operates in Chinese RMB and Hong Kong Dollars, but we report our results in our SEC filings in U.S. Dollars. The conversion of our accounts from RMB and Hong Kong Dollars to U.S. Dollars results in translation adjustments, which are reported as a middle step between net income and comprehensive income. The net loss is added to the accumulated deficit while the translation adjustment is added to a line item on our balance sheet labeled "other comprehensive income," since it is more reflective of changes in the relative values of U.S. and the foreign currencies than of the success of our business. During the year ended February 29, 2020, the effect of converting our financial results to USD was a loss of $1,335 to our other comprehensive income, as compared to a loss of $763 during the year ended February 28, 2019 as a result of the currency exchange rate fluctuation.

Liquidity and Capital Resources

Overview

Prior to the acquisitions of China VTV Ltd. (“China VTV HK”) and Butterfly Effect Media, the Company had only nominal operations and did not have any cash generated from business operations. We funded our operating expenses by borrowing loans from our related parties. We had cash and cash equivalents of $51,551 at February 29, 2020, compared to $17,548 at February 28, 2019. As of February 29, 2020, we have incurred accumulated operating losses of $3,844,738 since inception. As of February 29, 2020, and February 28, 2019, we had a working capital deficit of $28,066,471 and $598,354, respectively.

During the year ended February 29, 2020, we issued 25.1M common stock shares to four individual subscribers for gross proceeds of $732,963, in which $114,678 was received and the rest of $618,285 was to be received in the following year. In May 2019, we acquired China VTV HK that generated 3,834 revenue during the year ended February 29, 2020. In February 2020, we acquired Butterfly Effect Culture Media through a series of management agreements (the “VIE Agreements”). In accordance with the Business Cooperation Agreement, in exchange for the Company’s exclusive technical, business and other related consulting services, the VIE will pay a service fee to the Company, which constitutes 100% of the VIE’s after-tax income, resulting in a transfer of 100% of the net profits from the VIE to the Company. The service fees shall be due and payable on a monthly basis, within 30 days after the end of each month. Butterfly Effect Culture Media has been profitable in the past three years, and its financing arrangements consist of a revolving credit facility from the Bank of Beijing that met our short-term liquidity requirements for the past year. During the next twelve months, we will file a Form S-1, shortly after the filing of our 10-K, to raise approximately $120 million fund; we also plan to raise approximately $3 million from private placements, and sign additional equity credit lines of $1.5 million with other banks. We anticipate that the cash generated from the VIE operations as well as these financing activities will be sufficient to satisfy our liquidity requirements for the next 12 months.

The following table sets forth a summary of our cash flows for periods indicated:

|

|

| For the Years Ended |

| |||||

|

|

| February 29, 2020 |

|

| February 28, 2019 |

| ||

| Net Cash Used in Operating Activities |

| $ | (471,808 | ) |

| $ | (508,322 | ) |

| Net Cash Used in Investing Activities |

|

| (78,466 | ) |

|

| - |

|

| Net Cash Provided by Financing Activities |

|

| 506,476 |

|

|

| 60,918 |

|

| Effect of Exchange Rate Changes on Cash and Cash Equivalents |

|

| 77,801 |

|

|

| 413,501 |

|

| Net Increase (Decrease) in Cash and Cash Equivalents |

|

| 34,003 |

|

|

| (33,903 | ) |

| Cash and Cash Equivalents |

|

|

|

|

|

|

|

|

| Beginning |

|

| 17,548 |

|

|

| 51,451 |

|

| Ending |

| $ | 51,551 |

|

| $ | 17,548 |

|

| 17 |

| Table of Contents |

Net Cash Used in Operating Activities

Net cash used in operating activities was $471,808 during the year ended February 29, 2020, compared to net cash used in operating activities of $508,322 for the year ended February 28, 2019. The decrease in the cash used in operating activities was primarily due to the increase in accounts payable and wages payable for the year ended February 29, 2020, compared to the year ended February 28, 2019.

Net Cash Used in Investing Activities

Net cash used in investing activities was $78,466 during the year ended February 29, 2020, compared to net cash used in investing activities of $0 for the year ended February 28, 2019. The increase in cash used in investing activities was primarily due to the purchase of office equipment and furniture, offset by $33,313 cash proceeds we acquired from the acquisition of Butterfly Effect Media.

Net Cash Provided by Financing Activities

Net cash provided by financing activities was $506,476 during the year ended February 29, 2020, compared to $60,918 for the year ended February 28, 2019. The increase in the cash provided by financing activities was primarily due to the sale of newly issued common stock shares of $114,679 and the $391,797 increase in the balance of due to related parties during the year ended February 29, 2020, compared to the year ended February 28, 2019.

Net increase in cash and cash equivalents was $34,002 for the year ended February 29, 2020, compared to net decrease in cash and cash equivalents of $33,903 for the year ended February 28, 2019.

Summary of Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires estimates and assumptions that affect the reported amounts and classifications of assets and liabilities, revenues and expenses, and the related disclosures of contingent liabilities in the consolidated financial statements and accompanying notes. The SEC has defined critical accounting policies as those policies management believes are most important to the portrayal of the Company's financial condition and results of operations and which require the Company to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition, the Company has identified the following critical accounting policies and estimates addressed below. Our significant accounting policies are summarized in Note 2, Summary of Significant Accounting Policies to our Consolidated Financial Statements. The following describes our critical accounting policies and estimates:

Use of Estimates

Our consolidated financial statements and notes thereto are prepared in conformity with accounting principles generally accepted in the United States, which require management to make estimates and assumptions that affect the amounts reported and disclosed in the consolidated financial statements and the accompanying notes. Actual results could differ materially from these estimates.

We base our estimates on historical experience, available market information, appropriate valuation methodologies, and on various other assumptions that we believe to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Estimates are used for such items as depreciable lives for long-lived assets including intangible assets, fair value of stock-based compensations, tax provisions, and assets and liabilities assumed in business combinations, among others. In addition, estimates are used to test long-lived assets and goodwill for impairment.

| 18 |

| Table of Contents |

Business Combinations

We account for acquired businesses treated as a business combination using the acquisition method of accounting, which requires that assets acquired and liabilities assumed be recorded at the date of acquisition at their respective fair values. Any excess of the purchase price over the estimated fair values of the net assets acquired is recorded as goodwill. Acquisition-related costs are expensed as incurred in the consolidated financial statements. Significant judgments are used in determining the estimated fair values assigned to the assets acquired and liabilities assumed and in determining estimates of useful lives of long-lived assets acquired. Estimates of the fair values of assets acquired and liabilities assumed are based upon assumptions believed to be reasonable, and when appropriate, include assistance from independent third-party appraisal firms.

Share-based compensation

We adopted the provision of ASC Topic 718 which requires us to measure and recognize compensation expenses for an award of an equity instrument based on the grant-date fair value. The cost is recognized over the vesting period (or the requisition service period). ASC Topic 718 also requires us to measure the cost of a liability classified award based on its current fair value. The fair value of the award will be remeasured subsequently at each reporting date through the settlement date. Changes in fair value during the requisite service period are recognized as compensation cost over that period. Further, ASC Topic 718 requires us to estimate forfeitures in calculating the expense related to stock-based compensation,

The fair value of each option award is estimated on the date of grant using the Black-Sholes Valuation Model. The expect volatility was based on the historical volatilities of our listed common stocks in the United States and other relevant market information. We use historical data to estimate share option exercises and employee departure behavior used in the valuation model. The expected terms of share options granted is derived from the output of the option pricing model and represents the period that share options granted are expected to be outstanding. Since the share options once exercised will primarily traded in the U.S. capital market, the risk-free rate for periods within the contractual term of the share option is based on the U.S. Treasury yield curve in effect at the time of grant.

Valuation of Goodwill, Intangible Assets and Investments:

As of February 29, 2020, the Company had goodwill of $21,552,596 as a result of the acquisitions of Butterfly Effect Media. In addition, the Company recognized intangible assets measured primarily based upon significant inputs that are not observable in the market and represent Level 3 measurements as defined by ASC 820, Fair Value Measurements.

The Company applies ASC 805, Business Combinations and ASC 350, Intangibles - Goodwill and Other to account for goodwill and intangible assets. The Company amortizes all finite-lived intangible assets over their respective estimated useful lives while goodwill has an indefinite life and is not amortized. Goodwill is tested for impairment on an annual basis and, when specific circumstances dictate, between annual tests. As of February 29, 2020, the carrying amount of the Company’s goodwill was considered as the fair value of the goodwill.

We also perform a review of our purchased-intangible assets whenever events or changes in circumstances indicate that the useful life is shorter than we had originally estimated or that the carrying amount of assets may not be recoverable. If such facts and circumstances exist, we assess the recoverability of purchased-intangible assets by comparing the projected undiscounted net cash flows associated with the related asset or group of assets over their remaining lives against their respective carrying amounts. Impairments, if any, are based on the excess of the carrying amount over the fair value of those assets. If the useful life of the asset is shorter than originally estimated, we accelerate the rate of amortization and amortize the remaining carrying value over the new shorter useful life. There was no impairment of purchased-intangible assets identified for the years ended February 29, 2020 and February 28, 2019.

The Company has investments in equity securities. For equity securities that do not have a readily determinable fair value, we consider forecasted financial performance of the investee companies, as well as volatility inherit in the external markets for these investments. If these forecasts are not met, impairment charges may be recorded.

| 19 |

| Table of Contents |

Valuation of Income Taxes

We recognize deferred tax assets and liabilities at enacted income tax rates for the temporary differences between the financial reporting bases and the tax bases of our assets and liabilities. Any effects of changes in income tax rates or tax laws are included in the provision for income taxes in the period of enactment. Our net deferred taxes primarily consist of net operating loss carry forwards, or NOLs, intangibles and prepaids. We are required to record a valuation allowance against our net deferred tax assets if we conclude that it is more likely than not that taxable income generated in the future will be insufficient to utilize the future income tax benefit from our net deferred tax assets (namely, the NOLs) prior to expiration. We periodically review this conclusion, which requires significant management judgment. If we are able to conclude in a future period that a future income tax benefit from our net deferred tax assets has a greater than 50% likelihood of being realized, we are required in that period to reduce the related valuation allowance with a corresponding decrease in income tax expense. This would result in a non-cash benefit to our net income in the period of the determination. In subsequent periods, we would expect to recognize income tax expense equal to our pre-tax income multiplied by our effective income tax rate, an expense that was not recognized prior to the reduction of the valuation allowance.

As of February 29, 2020, we had NOLs for United States federal and state tax purposes, including those NOLs acquired as part of past business combinations, of $3,068,446 and $506,960, respectively, expiring at various times through 2037. In addition, we had Non-US NOLs of $1,861,468 primarily related to China, which has no expiration date.

Recent Accounting Pronouncements

See Note 2 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies and Practices – Recently Issued Accounting Standards,” for information regarding new accounting pronouncements.

Off-Balance Sheet Arrangements

As of February 29, 2020, there were no off-balance sheet arrangements currently contemplated by management or in place that are reasonably likely to have a current or future effect on the business, financial condition, changes in financial condition, revenue or expenses, result of operations, liquidity, capital expenditures and/or capital resources.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required for a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The full text of the Company’s audited financial statements for the fiscal years ended February 29, 2020 and February 28, 2019, begins on page F-1 of this Annual Report on Form 10-K.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISLCOSURES

There have been no changes in or disagreements with accountants regarding our accounting, financial disclosures or any other matter.

| 20 |

| Table of Contents |

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Management of the Company conducted an evaluation of the effectiveness of the Company’s disclosure controls and procedures (as such term is defined in Rule 13a-15(e) and Rule 15d-15(e) under the 1934 Act) pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as of the end of the period covered by this report. The Company’s disclosure controls and procedures are designed to ensure that information required to be disclosed by the Company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and that such information is accumulated and communicated to management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Based on this evaluation, management concluded that the design and operation of our disclosure controls and procedures are not effective due to the material weaknesses described below.

Management’s Report on Internal Control over Financial Reporting

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting, as required by Sarbanes-Oxley (SOX) Section 404 A. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

Management assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments as of the end of the period covered by this report. Management conducted the assessment based on certain criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013). Based on this assessment, management concluded that our internal controls over financial reporting were not effective as of February 29, 2020.

The matters involving internal controls and procedures that the Company’s management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company’s Chief Financial Officer in connection with the audit of our financial statements as of February 29, 2020 and communicated the matters to our management.