Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BankUnited, Inc. | earnings8kcover20200630.htm |

| EX-99.1 - EX-99.1 - BankUnited, Inc. | earningsdoc99120200630.htm |

Exhibit 99.2 BankUnited, Inc. Q2 2020 – Supplemental Information July 29, 2020

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates, ” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by the COVID-19 pandemic. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward- looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Financial Highlights

Strong Results in a Challenging Environment • PPNR grew to $122.3 million for Q2 from $85.0 million for the preceding quarter Solid Results with • NIM increased to 2.39% from 2.35% linked quarter • The cost of deposits declined by 0.56% to 0.80% quarter over quarter Improved PPNR • Operating expenses declined 11% quarter over quarter • Non-interest DDA growth of $1.3 billion or 28% for Q2 • CET1 ratios of 12.2% at the holding company and 13.4% at the Bank at June 30, 2020 Robust Capital and • Augmented Tier 2 capital with a $300 million subordinated debt raise Liquidity • Available liquidity totaling $9.8 billion at June 30, 2020 Continuing to Support • Originated over 3,500 PPP loans totaling $876 million • Provided initial 90 day payment deferrals on loans totaling $3.6 billion Our Customers • Waived select fees • Performed granular borrower outreach during the quarter Focused on Credit • Re-deferral requests to date total $748 million Quality • Re-evaluated risk rating of a substantial portion of the commercial portfolio, focusing on loans in high-risk segments and in deferral 4 • Continued enhancing our stress testing and workout capabilities

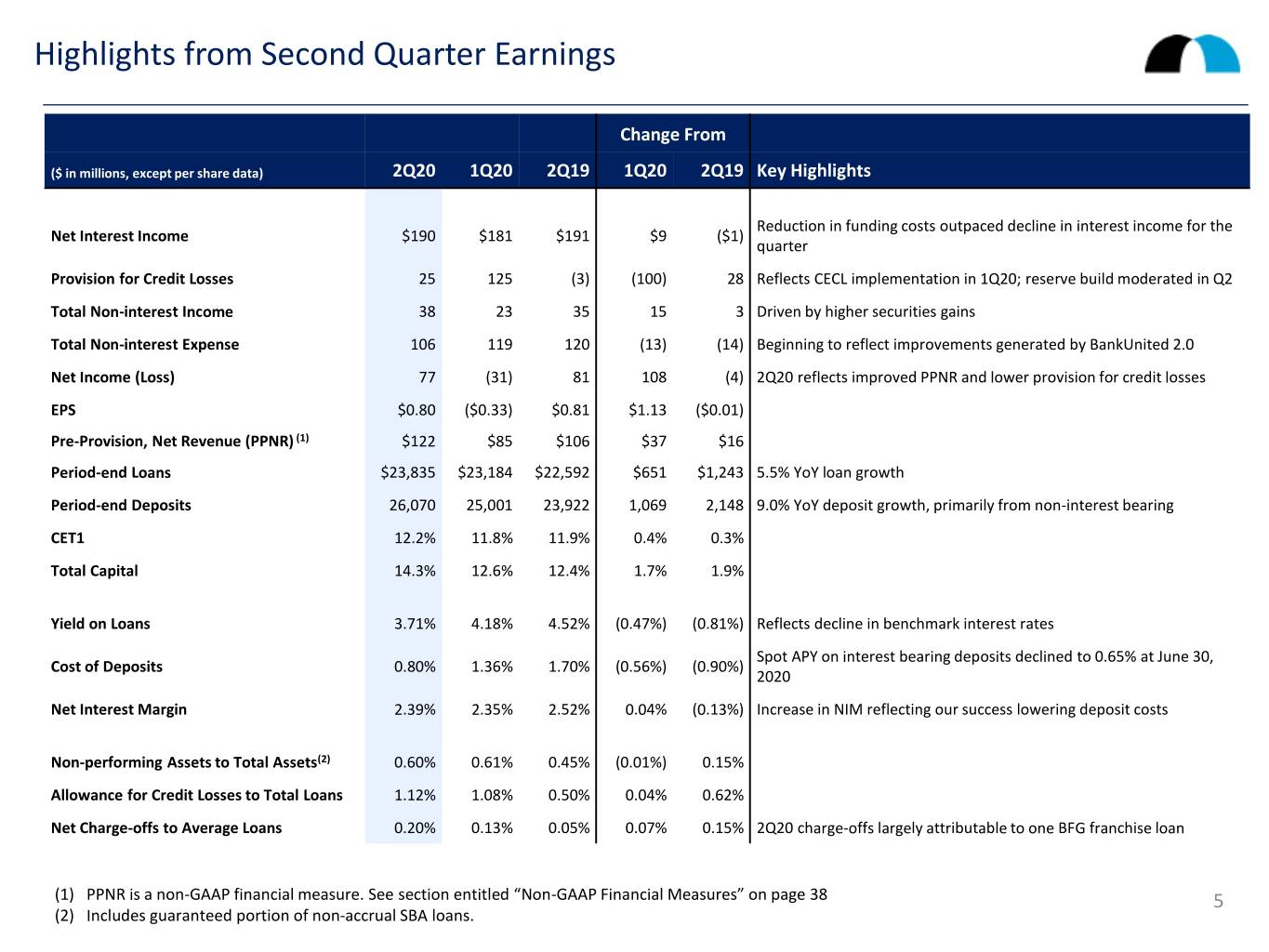

Highlights from Second Quarter Earnings Change From ($ in millions, except per share data) 2Q20 1Q20 2Q19 1Q20 2Q19 Key Highlights Reduction in funding costs outpaced decline in interest income for the Net Interest Income $190 $181 $191 $9 ($1) quarter Provision for Credit Losses 25 125 (3) (100) 28 Reflects CECL implementation in 1Q20; reserve build moderated in Q2 Total Non-interest Income 38 23 35 15 3 Driven by higher securities gains Total Non-interest Expense 106 119 120 (13) (14) Beginning to reflect improvements generated by BankUnited 2.0 Net Income (Loss) 77 (31) 81 108 (4) 2Q20 reflects improved PPNR and lower provision for credit losses EPS $0.80 ($0.33) $0.81 $1.13 ($0.01) Pre-Provision, Net Revenue (PPNR) (1) $122 $85 $106 $37 $16 Period-end Loans $23,835 $23,184 $22,592 $651 $1,243 5.5% YoY loan growth Period-end Deposits 26,070 25,001 23,922 1,069 2,148 9.0% YoY deposit growth, primarily from non-interest bearing CET1 12.2% 11.8% 11.9% 0.4% 0.3% Total Capital 14.3% 12.6% 12.4% 1.7% 1.9% Yield on Loans 3.71% 4.18% 4.52% (0.47%) (0.81%) Reflects decline in benchmark interest rates Spot APY on interest bearing deposits declined to 0.65% at June 30, Cost of Deposits 0.80% 1.36% 1.70% (0.56%) (0.90%) 2020 Net Interest Margin 2.39% 2.35% 2.52% 0.04% (0.13%) Increase in NIM reflecting our success lowering deposit costs Non-performing Assets to Total Assets(2) 0.60% 0.61% 0.45% (0.01%) 0.15% Allowance for Credit Losses to Total Loans 1.12% 1.08% 0.50% 0.04% 0.62% Net Charge-offs to Average Loans 0.20% 0.13% 0.05% 0.07% 0.15% 2Q20 charge-offs largely attributable to one BFG franchise loan (1) PPNR is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 38 5 (2) Includes guaranteed portion of non-accrual SBA loans.

Continuing to Transform our Deposit Mix Non-interest bearing demand deposits have grown by 62% since December 31, 2018 ($ in millions) $23,474 $23,679 $23,922 $23,956 $24,395 $25,001 $26,070 $4,599 $5,883 Non-interest Demand $3,621 $3,765 $4,099 $4,127 $4,295 Interest Demand $1,771 $1,761 $1,831 $1,847 $2,131 $2,536 $2,866 Money Market / Savings $10,324 Time $11,262 $11,386 $10,911 $10,936 $10,622 $10,590 $6,820 $6,767 $7,081 $7,046 $7,347 $7,542 $6,731 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 Cost of Deposits 1.52% 1.67% 1.70% 1.67% 1.48% 1.36% 0.80% Non-interest bearing 15.4% 15.9% 17.1% 17.2% 17.6% 18.4% 22.6% We have consistently priced down our deposit portfolio since the Fed began lowering interest rates in late 2019 Spot Average Annual Percentage Yield At December 31, 2019 At March 31, 2020 At June 30, 2020 (“APY”) Total non-maturity deposits 1.11% 0.83% 0.44% Total interest-bearing deposits 1.71% 1.35% 0.82% Total deposits 1.42% 1.12% 0.65% 6

Prudently Underwritten and Well-Diversified Loan Portfolio At June 30, 2020 ($ in millions) Loan Portfolio Over Time Commercial Loan Portfolio Residential and Other Consumer Multi-family Non-owner occupied CRE BFG- Construction and Land Franchise Owner Occupied CRE 3% C&I SBA PPP $23,835 BFG- CRE Mortgage Warehouse Lending $23,155 $23,185 Equipment 39% $21,977 $590 Pinnacle $685 $649 $623 3% $21,416 Bridge Franchise $627 $648 $1,243 $637 Pinnacle Bridge Equipment $603 $517 $1,202 $1,188 $436 $1,161 7% C&I $19,395 $1,463 $768 $852 $1,525 $827 MWL 37% $546 $432 SBA PPP $427 $459 5% 6% $1,318 $16,637 $4,656 $5,009 $322 $4,358 $4,691 $486 $3,676 $440 $1,086 $3,063 $82 Residential Loan Product Type $2,063 $2,013 $2,026 $2,041 $2,688 $2,120 $1,736 $244 $222 $311 $227 $247 $311 Formerly Govt $1,356 Insured 30 Yr Fixed Covered 15 & 20 $347 $4,475 $5,031 15% 14% $3,732 $4,689 $4,988 $4,941 2% Year Fixed 5/1 ARM 10% $2,905 8% 7/1 ARM 10/1 ARM $2,218 $1,968 $1,893 27% 24% $3,830 $3,219 $2,585 $3,477 $5,661 $5,635 $5,578 $4,699 $4,949 $3,770 $4,110 7 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 3/31/2020 06/30/2020

BankUnited 2.0 Update • 15 months into implementation, BankUnited 2.0 is currently tracking at 81% of our previously disclosed targets. • Cost savings continue ahead of schedule, while realization of revenue has been delayed as a result of a more challenging than anticipated interest rate environment and the COVID pandemic. No BankUnited 2.0 initiatives have been discontinued. Overview • We expect an increase in the BankUnited 2.0 revenue stream beginning in the second half of 2020 from several initiatives: • Anticipated launch of our commercial card program in August • Continued impact of a shift in strategic direction in treasury management • The recent launch of a more effective customer swap platform • New fee generating partnership with Goldman Sachs that will offer investment advisory and retirement planning services to corporate and commercial clients • Small business initiatives • generated 440 new DDA customer relationships in the second quarter • expect to launch our automated underwriting platform later in 2020 • On an annualized run rate basis, the benefit realized from BankUnited 2.0 had reached $49 million as of June 30, 2020 Financial Performance • $2 million from revenue initiatives, primarily treasury management pricing optimization • $47 million in expense reductions 8

Liquidity and Capital

Strong Capital – Well-Positioned to Withstand Severe Stress Stress Testing Results ($ in millions) BankUnited N.A. Regulatory Capital Total Risk Based Capital 14.3% CET1 Capital 13.7% 14.1% Tier 1 Leverage • We stressed our March 31, 2020 portfolio using both the 2018 DFAST 10.0% and 2020 DFAST severely adverse 9.3% 8.6% 8.9% scenarios. 13.4% • The table summarizes projected 5.0% 12.4% 12.9% lifetime losses under both DFAST scenarios and the pro-forma impact 6.5% of immediate recognition of additional stressed losses without PPNR benefit on BankUnited N.A.’s Lifetime Losses Lifetime Losses June 30, 2020 regulatory capital Required to be Current Ratios Projected Under Projected Under ratios. Considered “Well and Actual ACL – 2018 DFAST 2020 DFAST Capitalized” June 30, 2020 Severely Adverse¹ Severely Adverse¹ Expected • Pro-forma regulatory capital ratios n/a $266mm $575mm $445mm Lifetime Losses continue to exceed “well capitalized” Current ACL / guidelines under stress. Stress Scenario n/a – 46% 60% Lifetime Losses (1) The Pinnacle portfolio, which is a primarily investment grade municipal portfolio, was excluded from this stress testing exercise. 10

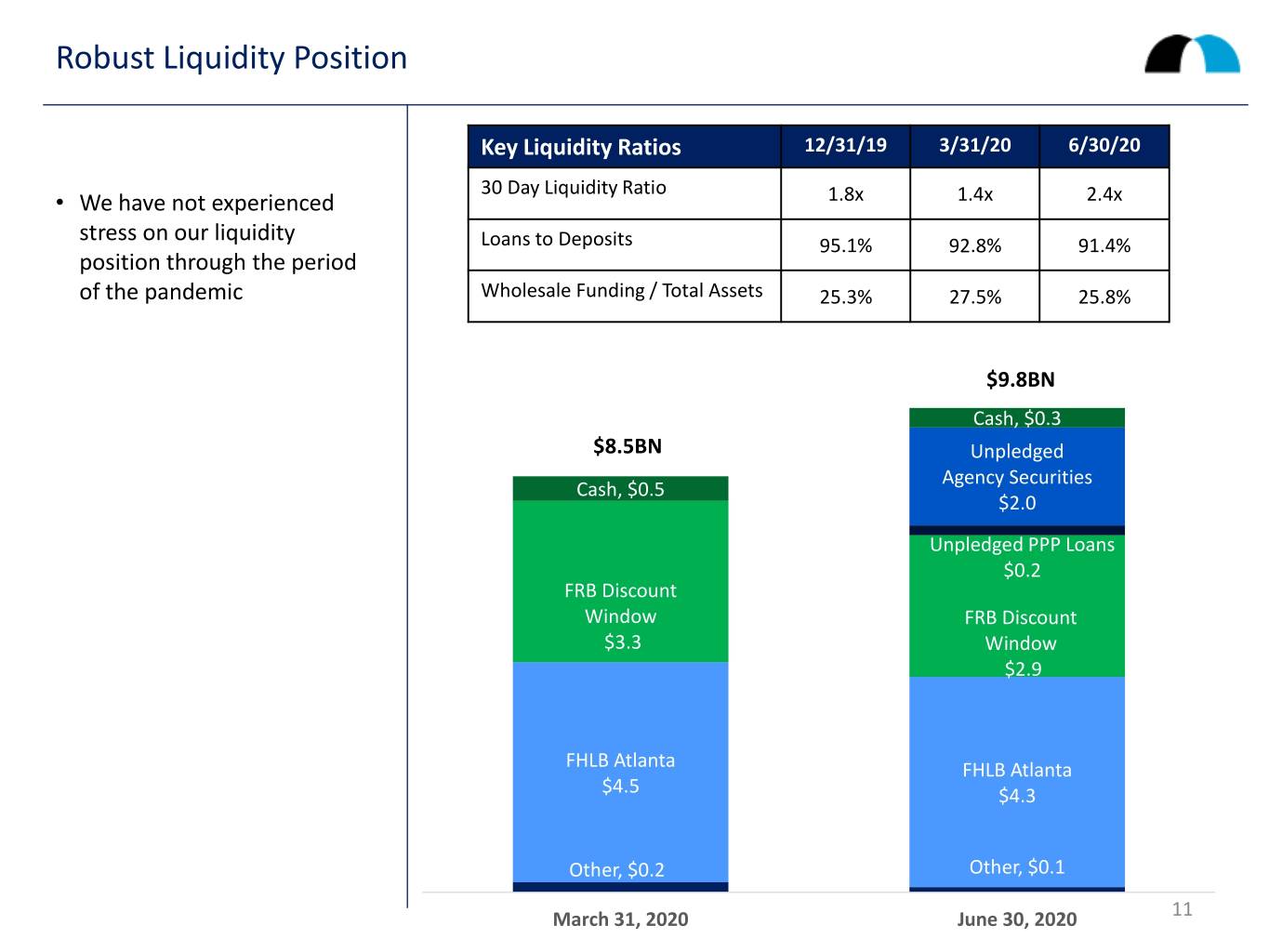

Robust Liquidity Position Key Liquidity Ratios 12/31/19 3/31/20 6/30/20 30 Day Liquidity Ratio • We have not experienced 1.8x 1.4x 2.4x stress on our liquidity Loans to Deposits 95.1% 92.8% 91.4% position through the period of the pandemic Wholesale Funding / Total Assets 25.3% 27.5% 25.8% $9.8BN Cash, $0.3 $8.5BN Unpledged Agency Securities Cash, $0.5 $2.0 Unpledged PPP Loans $0.2 FRB Discount Window FRB Discount $3.3 Window $2.9 FHLB Atlanta FHLB Atlanta $4.5 $4.3 Other, $0.2 Other, $0.1 March 31, 2020 June 30, 2020 11

Allowance for Credit Losses

CECL Methodology CECL Methodology Underlying Principles Economic Forecast Key Variables • The ACL under CECL represents • Our ACL estimate was informed by • The models ingest numerous national, management’s best estimate at the Moody’s economic scenarios regional and MSA level economic balance sheet date of expected credit published in June 2020. variables and data points. Economic losses over the life of the loan data and variables to which portfolio portfolio. • Unemployment starting at segments are most sensitive: 13%, declining to 9% by end • Required to consider historical of 2020 and to 7% by end of • Commercial information, current conditions and a 2021 o Market volatility index reasonable and supportable • Annualized growth in GDP o S&P 500 index economic forecast. starting at negative 27%, o Unemployment rate recovery beginning in Q32020, o A variety of interest rates • For most portfolio segments, returning to pre-recession and spreads BankUnited uses econometric models levels in 2023 • CRE to project PD, LGD and expected • VIX trailing average starting at o Unemployment losses at the loan level and 32, remaining elevated o CRE property forecast aggregates those expected losses by through 2020 and then o 10-year treasury segment. trending down o Baa corporate yield • S&P 500 starting at 2900, o Real GDP growth • Qualitative adjustments may be declining moderately through • Residential applied to the quantitative results. 2020 before increasing o HPI o Unemployment rate • Accounting standard requires an • 2 year reasonable and supportable o Real GDP growth estimate of expected prepayments forecast period. o Freddie Mac 30-year rate which may significantly impact the lifetime loss estimate. 13

Drivers of Change in the ACL ($ in millions) Qualitative Overlay Assumption Portfolio Changes Changes Economic Forecast • New loans • Additional • Primarily • Exits/runoff • Current qualitative updates to • Portfolio market overlay for assumptions seasoning adjustment borrowers about • Risk rating • Changes to impacted expected migration forward by COVID- prepayments • Changes in path of 19 specific economic reserves forecast and length of forecast period ACL ACL 3/31/20 6/30/20 %of Total 1.08% 1.12% Loans 14

Drivers of Change in the ACL by Portfolio Segment ($ in millions) Assumption Portfolio Economic Qualitative Changes Changes Forecast Overlay • More favorable outlook for volatility Commercial and equity prices ACL ACL 3/31/20 6/30/20 Assumption Portfolio Economic Qualitative Changes Changes Forecast Overlay • Less favorable CRE employment outlook and property forecast ACL ACL 3/31/20 6/30/20 Assumption Portfolio Economic Qualitative Changes Changes Forecast Overlay • Stable outlook; insured Residential loans a greater portion of the portfolio ACL ACL 3/31/20 6/30/20 15

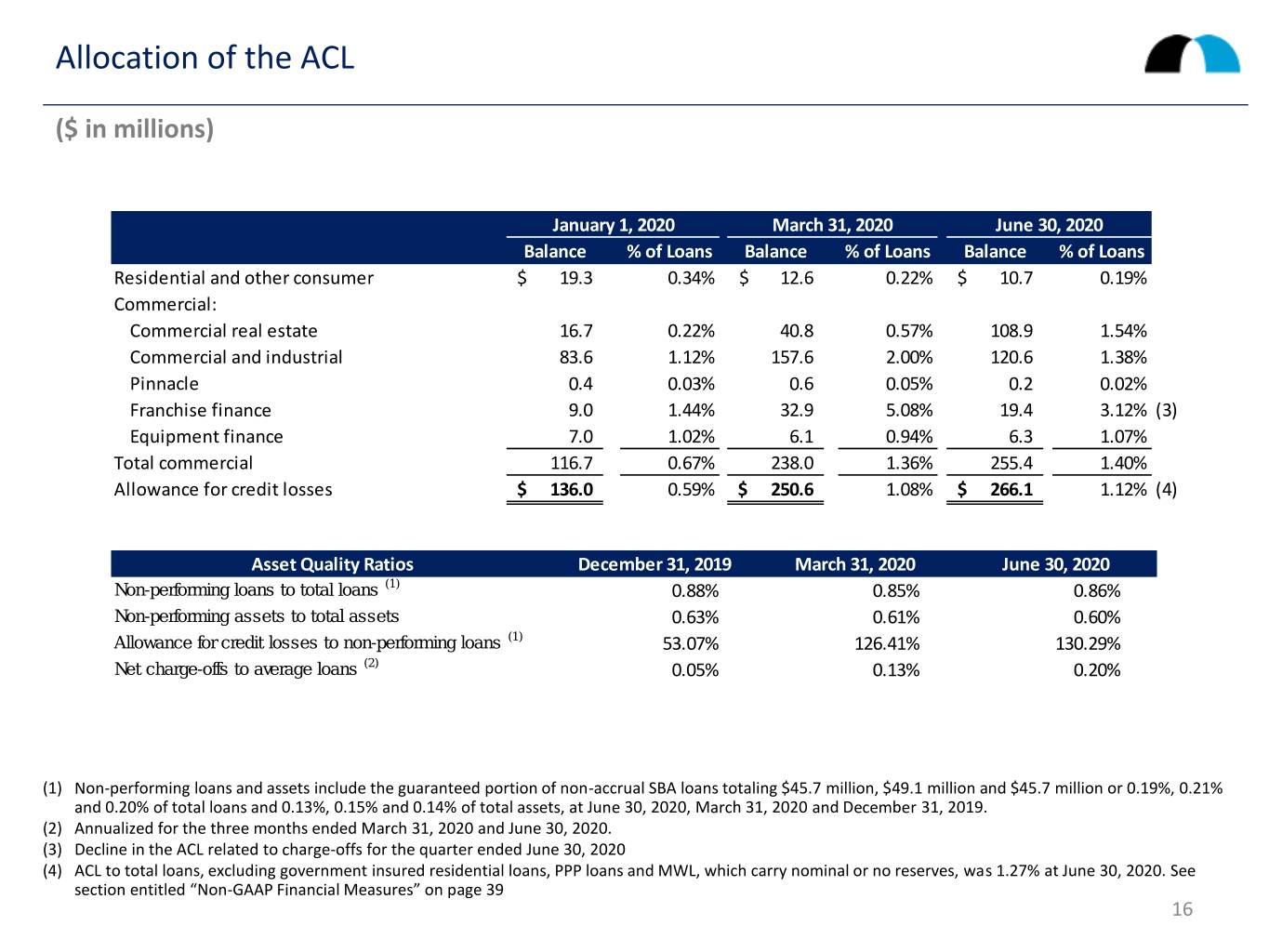

Allocation of the ACL ($ in millions) January 1, 2020 March 31, 2020 June 30, 2020 Balance % of Loans Balance % of Loans Balance % of Loans Residential and other consumer $ 19.3 0.34% $ 12.6 0.22% $ 10.7 0.19% Commercial: Commercial real estate 16.7 0.22% 40.8 0.57% 108.9 1.54% Commercial and industrial 83.6 1.12% 157.6 2.00% 120.6 1.38% Pinnacle 0.4 0.03% 0.6 0.05% 0.2 0.02% Franchise finance 9.0 1.44% 32.9 5.08% 19.4 3.12% (3) Equipment finance 7.0 1.02% 6.1 0.94% 6.3 1.07% Total commercial 116.7 0.67% 238.0 1.36% 255.4 1.40% Allowance for credit losses $ 136.0 0.59% $ 250.6 1.08% $ 266.1 1.12% (4) Asset Quality Ratios December 31, 2019 March 31, 2020 June 30, 2020 Non-performing loans to total loans (1) 0.88% 0.85% 0.86% Non-performing assets to total assets 0.63% 0.61% 0.60% Allowance for credit losses to non-performing loans (1) 53.07% 126.41% 130.29% Net charge-offs to average loans (2) 0.05% 0.13% 0.20% (1) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $45.7 million, $49.1 million and $45.7 million or 0.19%, 0.21% and 0.20% of total loans and 0.13%, 0.15% and 0.14% of total assets, at June 30, 2020, March 31, 2020 and December 31, 2019. (2) Annualized for the three months ended March 31, 2020 and June 30, 2020. (3) Decline in the ACL related to charge-offs for the quarter ended June 30, 2020 (4) ACL to total loans, excluding government insured residential loans, PPP loans and MWL, which carry nominal or no reserves, was 1.27% at June 30, 2020. See section entitled “Non-GAAP Financial Measures” on page 39 16

Loan Portfolio and Credit

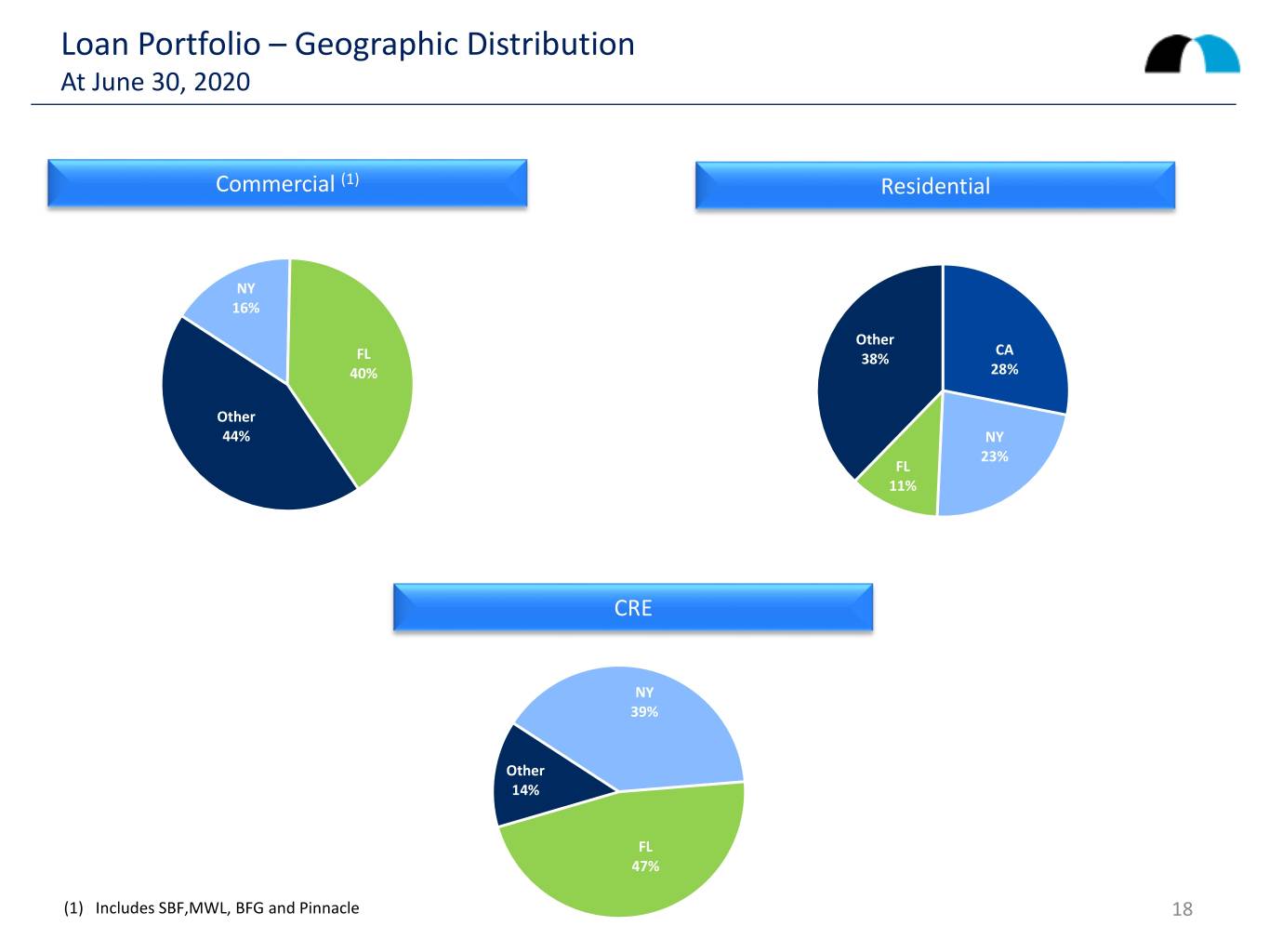

Loan Portfolio – Geographic Distribution At June 30, 2020 Commercial (1) Residential NY 16% Other CA FL 38% 40% 28% Other 44% NY 23% FL 11% CRE NY 39% Other 14% FL 47% (1) Includes SBF,MWL, BFG and Pinnacle 18

Loan Portfolio – Granular, Diversified Commercial & Industrial Portfolio At June 30, 2020 ($ in millions) • Includes $2.0 billion of First owner-occupied real estate Deferral Re-Deferral • Some key observations: Industry Balance (1) Commitment % of Portfolio Granted Requested • Educational services – Finance and Insurance $1,007 $1,799 15.1% $ 1 $ - well established private Wholesale Trade 720 1,025 10.7% 22 - colleges, universities Educational Services 641 673 9.5% 17 - and high schools Transportation and Warehousing 507 626 7.5% 35 - • Transportation and Health Care and Social Assistance 473 606 7.0% 59 - warehousing – cruise Manufacturing 376 515 5.6% 57 9 lines, aviation Accommodation and Food Services 359 445 5.3% 106 66 Retail Trade 332 454 4.9% 68 22 authorities, logistics Information 298 454 4.4% 1 - • Health care – larger Real Estate and Rental and Leasing 288 444 4.3% 8 - physician practice Professional, Scientific, and Technical Services 277 371 4.1% 14 - management Construction 274 447 4.1% 14 - companies, HMO’s, Public Administration 245 262 3.6% - - mental health & Administrative and Support and Waste Management 239 302 3.5% 11 - substance abuse; no Other Services (except Public Administration) 239 282 3.5% 17 - small practices Arts, Entertainment, and Recreation 216 265 3.2% 38 4 • Arts and entertainment Utilities 189 212 2.8% - - – stadiums, professional Other 53 72 0.9% 1 - sports teams, gaming $6,733 $9,254 100.0% $469 $101 • Accommodation and food services – time share, direct food services businesses and concessionaires (1) Includes amounts from SBF. 19

Loan Portfolio – Commercial Real Estate by Property Type At June 30, 2020 ($ in millions) First Wtd. Avg. Wtd. Avg. Non- Deferral Re-Deferral Property Type Balance FL NY Other DSCR LTV Performing Granted Requested Office $ 2,080 53% 30% 17% 2.17 59.0% $ - $ 372 $ 54 Multifamily 2,010 24% 65% 11% 1.77 56.0% 9 277 12 Retail 1,438 48% 42% 10% 1.61 59.3% 11 769 76 Warehouse/Industrial 783 69% 19% 12% 2.52 55.5% - 98 - Hotel 621 75% 12% 13% 1.59 57.1% 33 537 298 Other 149 85% 10% 5% 1.66 48.9% 4 1 - $ 7,081 46% 40% 14% 1.92 57.4% $ 57 $ 2,054 $ 440 • Commercial real estate loans are secured by income-producing, non-owner occupied properties, typically with well capitalized middle market sponsors • 75% of the CRE portfolio has LTVs less than 65% • 79% of the retail segment and 76% of the hotel segment have LTVs less than 65% • Construction and land loans, included in the table, represent only 1% of the total loan portfolio. • Rent collections based on data generally collected in June: • Multi-family – averaging 70% to 95% depending on geography and property type • Office – FL averaging 87%; NY averaging 71% • Retail – overall average 62%; generally higher in FL than in NY • Hotel occupancy – ranging from 30% to 57% in Florida; most hotel properties now open 20

Loan Portfolio – Deferrals Summary ($ in millions) Through July 17, 2020 First Deferral Granted Re-Deferral Requested • We granted initial Count Balance % of Portfolio Count Balance % of Portfolio CRE - Property Type: COVID related Retail 119 $769 53% 8 $76 5% payment deferral Hotel 93 $537 86% 21 $298 48% requests for loans Office 30 $372 18% 2 $54 3% with balances Multifamily 37 $277 14% 2 $12 1% totaling $3.6 billion Industrial 14 $98 13% - $0 0% • Initial deferrals Other 1 $1 1% - $0 0% were 90 day Total CRE - Proprty Type 294 $2,054 29% 33 $440 6% deferrals C&I - Industry • Re-deferral rate is Accommodation and Food Services 89 $106 30% 21 $66 18% significantly lower Retail Trade 221 $68 20% 4 $22 7% to date Health Care and Social Assistance 126 $59 12% - $0 0% Manufacturing 35 $57 15% 1 $9 2% Other 265 $179 3% 1 $4 0% Total C&I - Industry 736 $469 7% 27 $101 1% BFG - Equipment 35 $35 6% - $0 0% BFG - Franchise 362 $460 74% 82 $155 25% Total Commercial 1,427 $3,018 17% 142 $696 4% Through June 30, 2020 First Deferral Granted Continued to Pay Granted Re-Deferral % of % of Initial % of Count Balance Count Balance Count Balance Portfolio Deferral Portfolio Residential 1,189 $594 13% 548 $252 42% 119 $52 1% 21

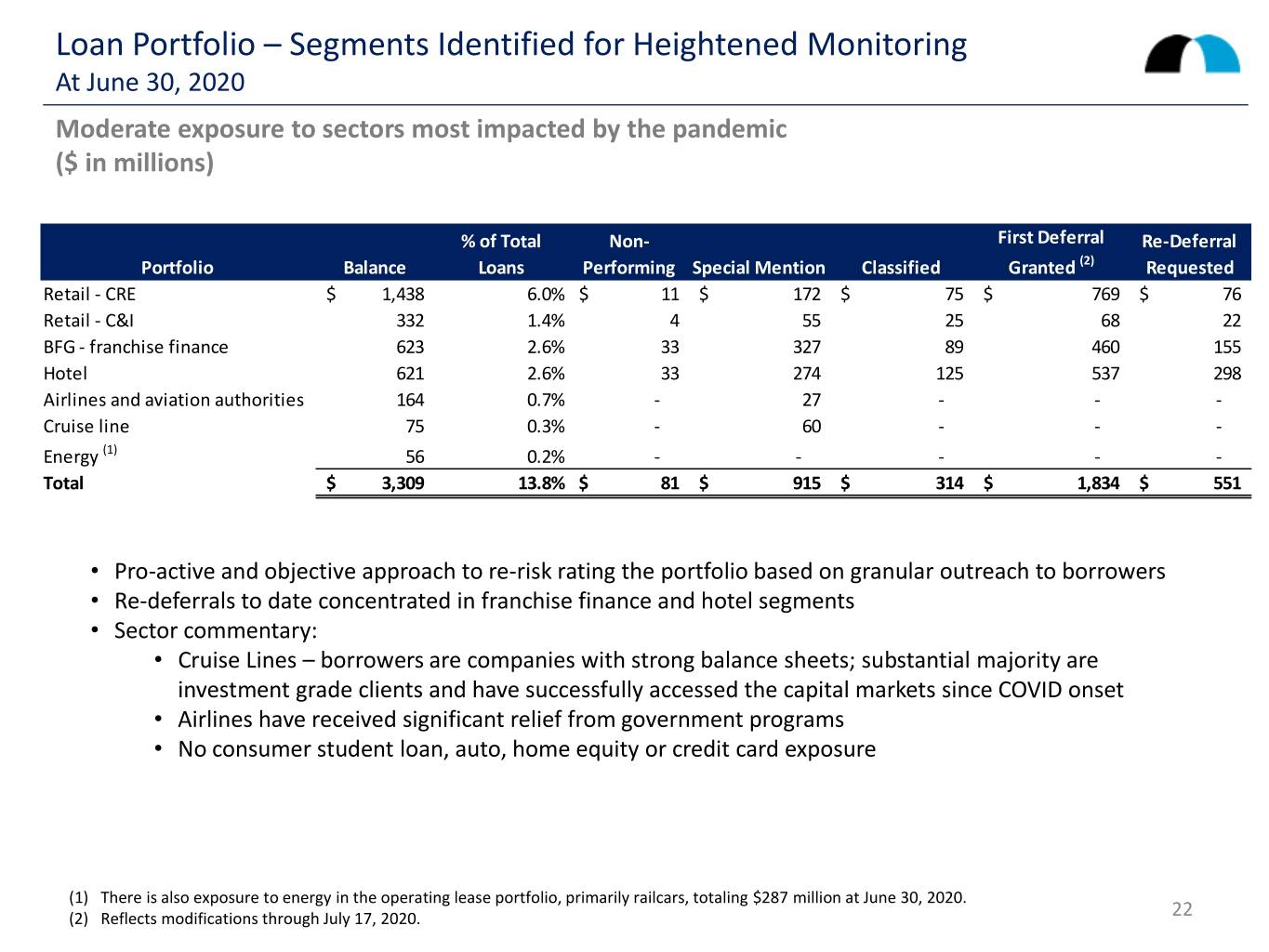

Loan Portfolio – Segments Identified for Heightened Monitoring At June 30, 2020 Moderate exposure to sectors most impacted by the pandemic ($ in millions) % of Total Non- First Deferral Re-Deferral Portfolio Balance Loans Performing Special Mention Classified Granted (2) Requested Retail - CRE $ 1,438 6.0% $ 11 $ 172 $ 75 $ 769 $ 76 Retail - C&I 332 1.4% 4 55 25 68 22 BFG - franchise finance 623 2.6% 33 327 89 460 155 Hotel 621 2.6% 33 274 125 537 298 Airlines and aviation authorities 164 0.7% - 27 - - - Cruise line 75 0.3% - 60 - - - Energy (1) 56 0.2% - - - - - Total $ 3,309 13.8% $ 81 $ 915 $ 314 $ 1,834 $ 551 • Pro-active and objective approach to re-risk rating the portfolio based on granular outreach to borrowers • Re-deferrals to date concentrated in franchise finance and hotel segments • Sector commentary: • Cruise Lines – borrowers are companies with strong balance sheets; substantial majority are investment grade clients and have successfully accessed the capital markets since COVID onset • Airlines have received significant relief from government programs • No consumer student loan, auto, home equity or credit card exposure (1) There is also exposure to energy in the operating lease portfolio, primarily railcars, totaling $287 million at June 30, 2020. (2) Reflects modifications through July 17, 2020. 22

Loan Portfolio – Retail At June 30, 2020 ($ in millions) Retail - Commercial Real Estate First Deferral Re-Deferral Property Type Balance Granted Requested • No significant mall or “big Retail - Unanchored $ 734 $ 373 $ 48 Retail - Anchored 644 369 28 box” exposure Restaurant 28 18 - Gas station 25 2 - Construction to perm 7 7 - $ 1,438 $ 769 $ 76 Retail – Commercial & Industrial First Not Secured by Owner Occupied Total Deferral Re-Deferral Industry Real Estate Real Estate Balance Granted Requested Gasoline Stations $ 1 $ 97 $ 99 $ 24 $ - Health and Personal Care Stores 29 7 35 - - Furniture Stores 21 6 28 1 - Grocery Stores 1 22 23 - - Vending Machine Operators 21 1 22 22 21 Specialty Food Stores 2 18 19 - - Automobile Dealers 7 7 14 6 - Clothing Stores 1 11 12 2 - Electronics and Appliance Stores 1 11 11 - - Other 27 42 69 13 1 $ 111 $ 222 $ 332 $ 68 $ 22 23

Loan Portfolio – BFG Franchise Finance At June 30, 2020 ($ in millions) Portfolio Breakdown by Concept First Deferral Re-Deferral Restaurant Concepts Balance % of BFG Franchise Granted Requested Burger King $ 66 11% $ 19 $ - Dunkin Donuts 45 7% 38 4 Popeyes 28 4% 15 5 Jimmy John's 23 4% 22 13 Domino's 23 4% 20 - Other 194 31% 141 54 $ 379 61% $ 255 $ 76 First Deferral Re-Deferral Non-Restaurant Concept Balance % of BFG Franchise Granted Requested Planet Fitness $ 107 17% $ 78 $ 14 Orange Theory Fitness 87 14% 86 58 Other 50 8% 41 7 $ 244 39% $ 205 $ 79 Portfolio Breakdown by Geography CA 18% FL 11% Other CO 58% 7% TX 24 6%

Loan Portfolio – Hotel At June 30, 2020 ($ in millions) Exposure by Flag • 75% of our exposure is in Florida, followed by 12% in New York Other • Includes $59.7 million in SBA Sheraton $88 Marriott loans of which $13.7 million is $39 14% $171 guaranteed 6% 28% • Substantially all hotel properties are now open in IHG both New York and Florida $59 9% Hilton $86 Independent 14% $178 29% Total Portfolio: $620.6mm 25

BFG Energy Exposure At June 30, 2020 ($ in millions) BFG Energy Portfolio • Our energy exposure is modest Balance • Assets in the operating lease Operating leases $ 286.9 portfolio have useful lives that Loan/Finance Lease 56.3 span multiple economic cycles Total $ 343.2 • Railcar fleet is 55% tank cars, 43% sand hoppers and 2% other Exposure by Asset Type Other 6% Marine 16% Aircraft 11% Rail 67% 26

Credit Quality – Residential At June 30, 2020 High quality residential portfolio consists FICO Distribution(1) of primarily prime jumbo mortgages with de-minimis charge-offs since <719 or inception as well as fully government NA insured assets 13% 720-759 21% >760 66% Breakdown by LTV(1) Breakdown by Vintage(1) More 2020 than 80% 5% 60% or 4% 2019 less Prior 17% 29% 71% - 35% 80% 2018 44% 61% - 10% 70% 23% 2016 2017 17% 16% (1) Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination. 27

Asset Quality Metrics ($ in millions) Non-performing Loans to Total Loans Non-performing Assets to Total Assets Incl. guaranteed portion of non-accrual SBA loans Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 1.00% 0.86% 1.00% 0.88% 0.85% 0.75% 0.67% 0.75% 0.59% 0.63% 0.61% 0.60% 0.68% 0.64% 0.50% 0.50% 0.43% 0.47% 0.51% 0.49% 0.46% 0.25% 0.25% 0.37% 0.00% 0.00% Dec 18 Dec 19 Mar 20 Jun 20 Dec 18 Dec 19 Mar 20 Jun 20 Net Charge-offs to Average Loans(1)(2) 0.60% 0.40% 0.28% 0.20% 0.20% 0.13% 0.05% 0.00% Dec 18 Dec 19 Mar 20 Jun 20 (1) Net charge-off ratio is annualized for the three months ended June 30, 2020 and March 31, 2020. 28 (2) Net charge-offs for the three months ended June 30, 2020 included $16.1 million related to one BFG franchise borrower.

Non-Performing Loans by Portfolio Segment ($ in millions) Residential CRE C&I Equipment Franchise SBF(1) $204,787 $204,248 $198,221 $61,892 $63,713 $63,726 $129,891 $13,631 $32,857 $20,939 $34,108 $37,635 $1,148 $5,308 $11,561 $17,424 $65,296 $65,588 $28,309 $51,130 $24,135 $37,488 $17,213 $27,759 $18,894 $16,956 $7,254 $13,183 12/31/2018 12/31/2019 3/31/2020 6/30/2020 (1) Includes the guaranteed portion of non-accrual SBA loans totaling $45.7 million, $49.1 million, $45.7 million and $17.8 at June 30, 2020, March 31, 2020, December 31, 2019 and December 2018, respectively. 29

Criticized and Classified Loans ($ in millions) Commercial Real Estate Commercial & Industrial $600 $600 $500 $500 $400 $400 $300 $300 $200 $200 $100 $100 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 Franchise Finance Equipment Finance SBF(1) $600 $600 $600 $500 $500 $500 $400 $400 $400 $300 $300 $300 $200 $200 $200 $100 $100 $100 $0 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 (1) Includes the guaranteed portion of non-accrual SBA loans totaling $45.7 million, $49.1 million, $45.7 million and $17.8 at June 30, 2020, 30 March 31, 2020, December 31, 2019 and December 2018, respectively.

Criticized and Classified - CRE by Property Type ($ in millions) Office Multifamily Retail $275 $275 $275 $250 $250 $250 $225 $225 $225 $200 $200 $200 $175 $175 $175 $150 $150 $150 $125 $125 $125 $100 $100 $100 $75 $75 $75 $50 $50 $50 $25 $25 $25 $0 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 Warehouse/Industrial Hotel Other $275 $275 $275 $250 $250 $250 $225 $225 $225 $200 $200 $200 $175 $175 $175 $150 $150 $150 $125 $125 $125 $100 $100 $100 $75 $75 $75 $50 $50 $50 $25 $25 $25 $0 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 31

Criticized and Classified – BFG Franchise Finance ($ in millions) Restaurant Concepts Fitness Concepts $160 $160 $140 $140 $120 $120 $100 $100 $80 $80 $60 $60 $40 $40 $20 $20 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 Other $160 $140 $120 $100 $80 $60 $40 $20 $0 32 12/31/18 12/31/19 3/31/20 6/30/20

Asset Quality - Delinquencies ($ in millions) Commercial CRE $105 $105 $90 $90 $75 $75 $60 $60 $45 $45 $30 $30 $15 $15 $0 $0 12/31/18 12/31/19 3/31/20 6/30/20 12/31/18 12/31/19 3/31/20 6/30/20 Residential (1) (1) $105 $90 $75 $60 $45 $30 $15 $0 (1) Excludes government insured residential loans. 33 12/31/18 12/31/19 3/31/20 6/30/20

Investment Portfolio

Investment Securities AFS No credit losses expected on the $8.7 billion portfolio; unrealized losses attributable primarily to widening spreads - valuations have recovered materially during the second quarter. ($ in millions) Portfolio Composition Ratings Distribution State and Other A NR Municipal 3% 1% 1% Obligations AA 3% CLOs 7% Residential 13% US Gov real estate Government 37% lease-backed and agency securities 37% 7% AAA Private 54% label CMBS Private label 24% RMBS and CMOs 13% December 31, 2019 March 31, 2020 June 30, 2020 Net Unrealized Net Unrealized Net Unrealized Portfoio Gain (Loss) Fair Value Gain (Loss) Fair Value Gain (Loss) Fair Value US Government and agency 10,516 2,826,207 $ (23,649) 2,893,932 $ 17,035 $ 3,167,239 Private label RMBS and CMOs 10,840 1,012,177 (11,659) 1,173,880 14,696 1,116,086 Private label CMBS 5,456 1,724,684 (123,796) 1,604,814 (32,063) 2,043,620 Residential real estate lease-backed securities 2,566 470,025 (21,188) 528,793 10,188 618,207 CLOs (7,539) 1,197,366 (74,676) 1,094,793 (38,176) 1,128,753 State and Municipal Obligations 15,774 273,302 15,431 271,033 19,993 259,495 Other 733 194,904 (10,283) 255,161 5,677 261,531 Total $ 38,346 $ 7,698,665 $ (249,820) $ 7,822,406 $ (2,650) $ 8,594,931 35

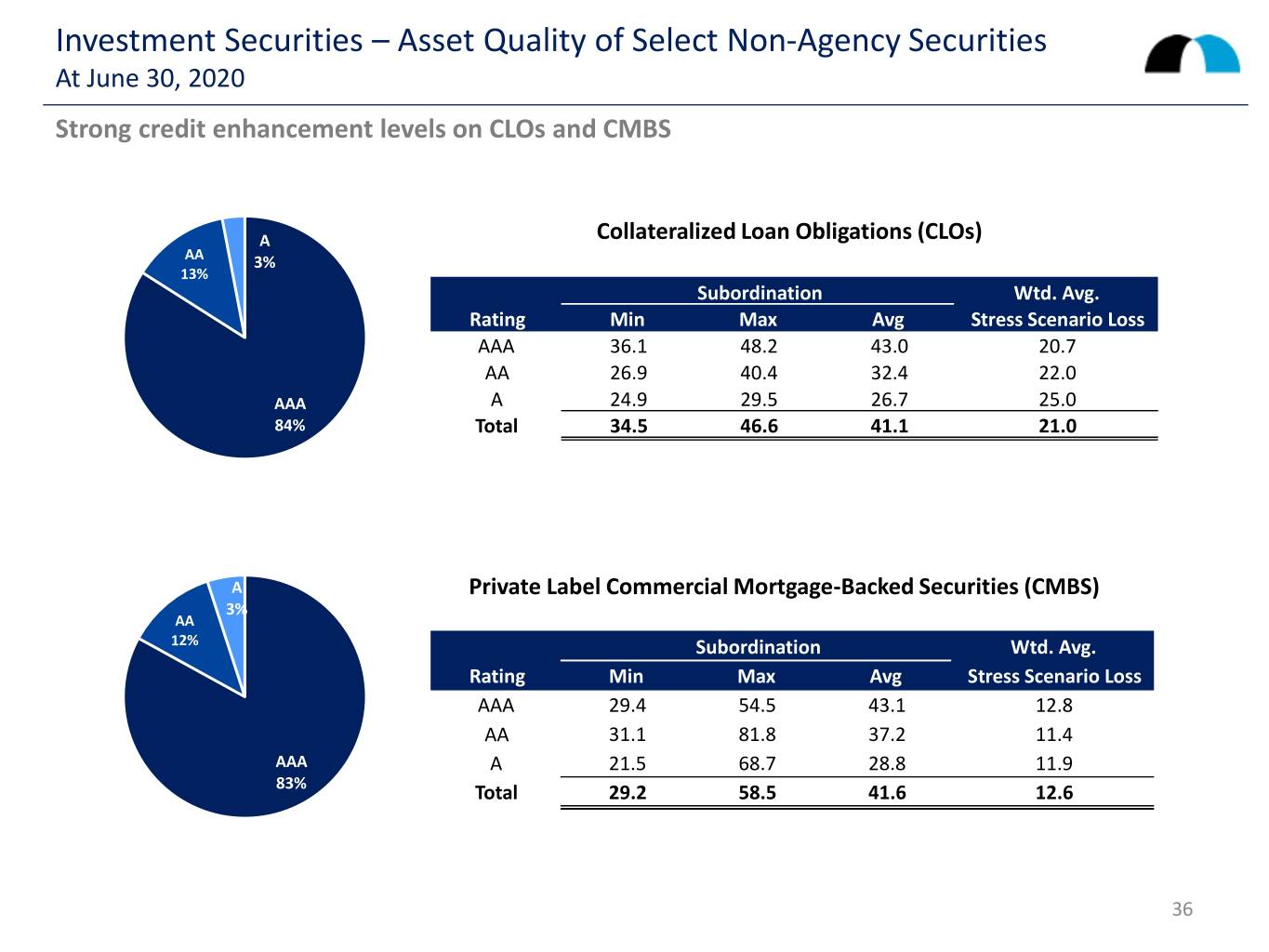

Investment Securities – Asset Quality of Select Non-Agency Securities At June 30, 2020 Strong credit enhancement levels on CLOs and CMBS A Collateralized Loan Obligations (CLOs) AA 3% 13% Subordination Wtd. Avg. Rating Min Max Avg Stress Scenario Loss AAA 36.1 48.2 43.0 20.7 AA 26.9 40.4 32.4 22.0 AAA A 24.9 29.5 26.7 25.0 84% Total 34.5 46.6 41.1 21.0 A Private Label Commercial Mortgage-Backed Securities (CMBS) 3% AA 12% Subordination Wtd. Avg. Rating Min Max Avg Stress Scenario Loss AAA 29.4 54.5 43.1 12.8 AA 31.1 81.8 37.2 11.4 AAA A 21.5 68.7 28.8 11.9 83% Total 29.2 58.5 41.6 12.6 36

Non-GAAP Financial Measures

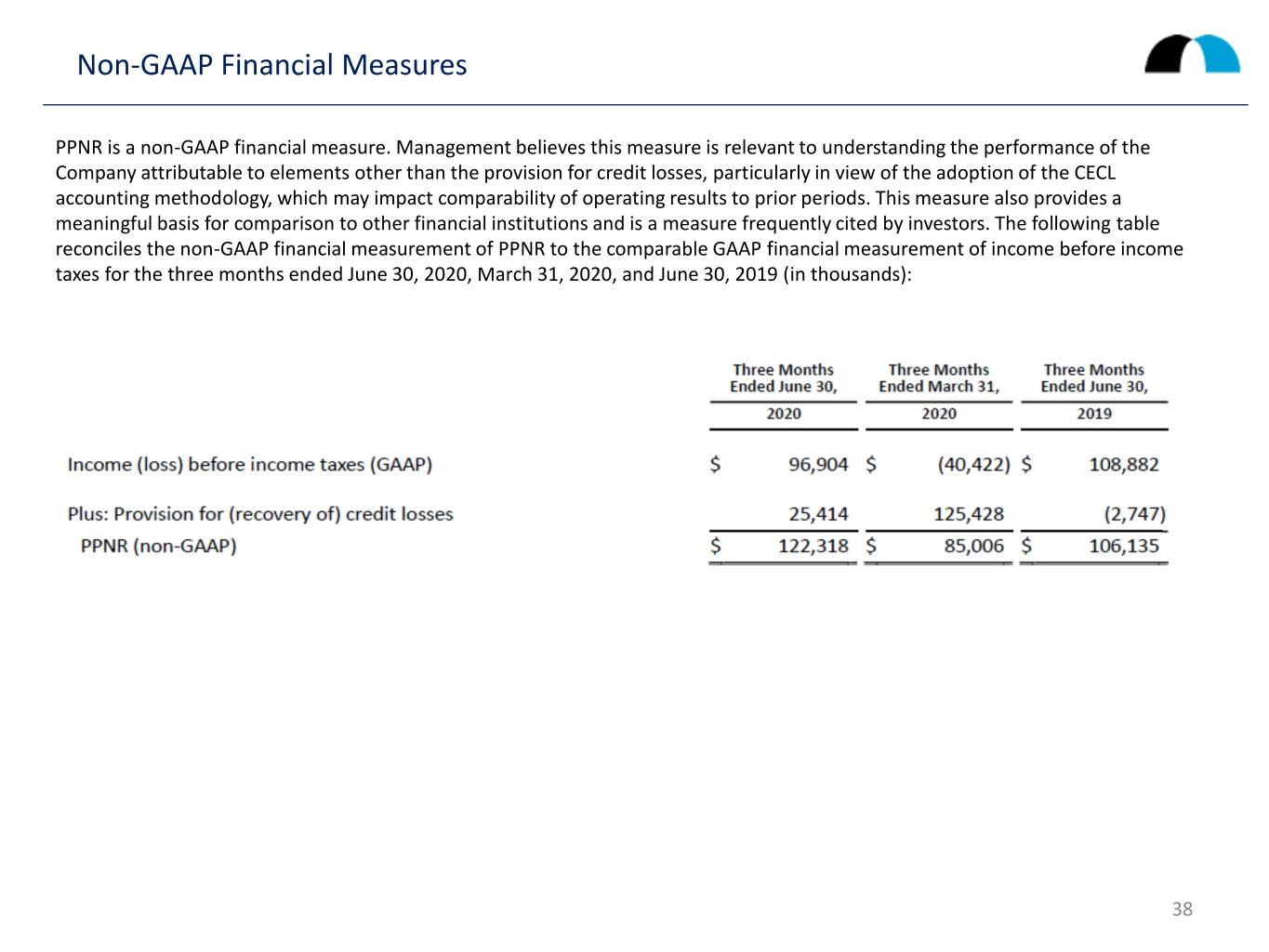

Non-GAAP Financial Measures PPNR is a non-GAAP financial measure. Management believes this measure is relevant to understanding the performance of the Company attributable to elements other than the provision for credit losses, particularly in view of the adoption of the CECL accounting methodology, which may impact comparability of operating results to prior periods. This measure also provides a meaningful basis for comparison to other financial institutions and is a measure frequently cited by investors. The following table reconciles the non-GAAP financial measurement of PPNR to the comparable GAAP financial measurement of income before income taxes for the three months ended June 30, 2020, March 31, 2020, and June 30, 2019 (in thousands): 38

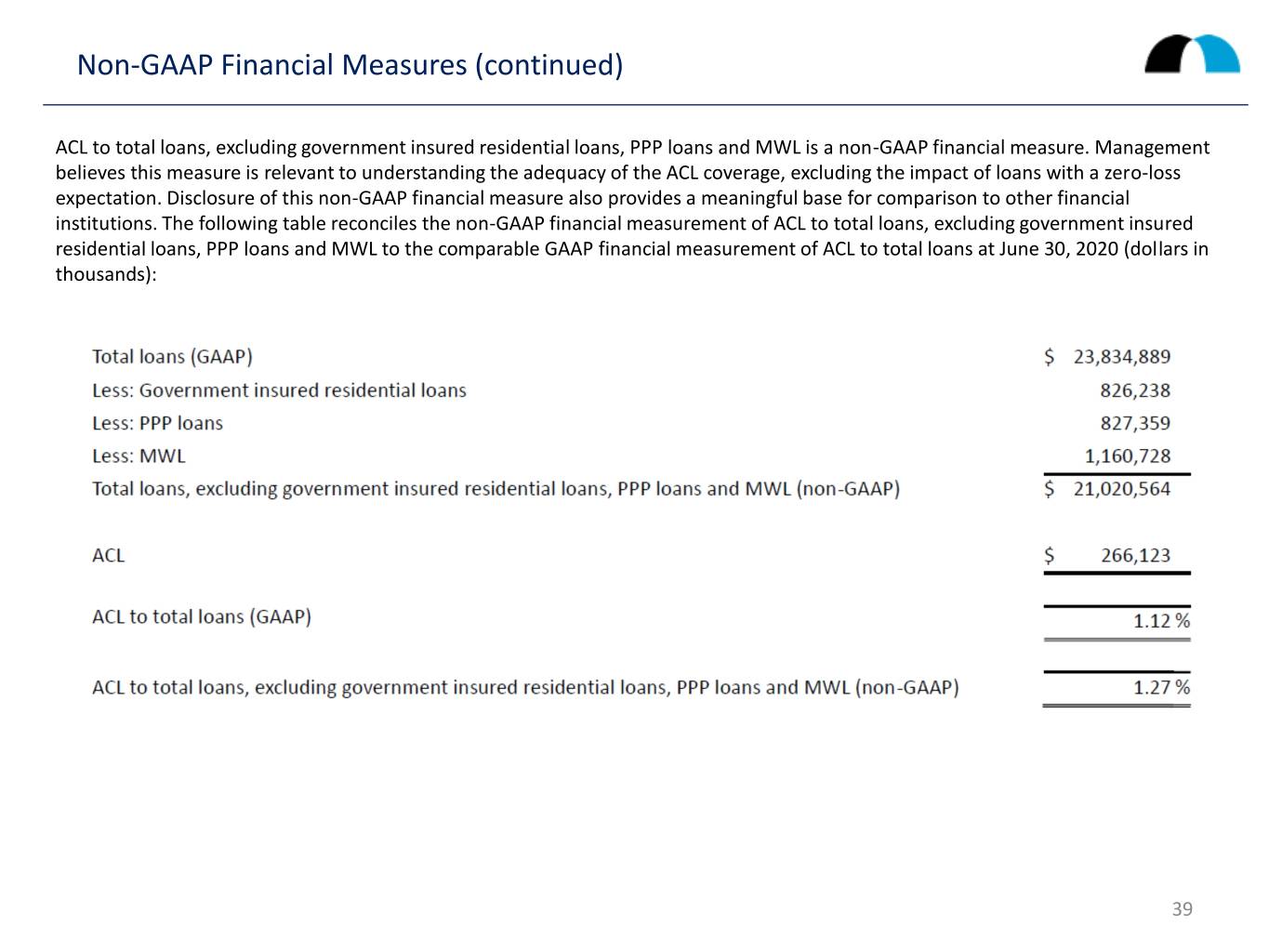

Non-GAAP Financial Measures (continued) ACL to total loans, excluding government insured residential loans, PPP loans and MWL is a non-GAAP financial measure. Management believes this measure is relevant to understanding the adequacy of the ACL coverage, excluding the impact of loans with a zero-loss expectation. Disclosure of this non-GAAP financial measure also provides a meaningful base for comparison to other financial institutions. The following table reconciles the non-GAAP financial measurement of ACL to total loans, excluding government insured residential loans, PPP loans and MWL to the comparable GAAP financial measurement of ACL to total loans at June 30, 2020 (dollars in thousands): 39