Attached files

| file | filename |

|---|---|

| 8-K - 8-K EARNINGS RELEASE 2Q2020 - AARON'S INC | aan-20200729.htm |

| EX-99.2 - EXHIBIT 99.2 AAN SEPARATION PRESS RELEASE - AARON'S INC | exhibit992aanseparation.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE 2Q2020 - AARON'S INC | a2020q2exhibit991secon.htm |

| EX-10.1 - EXHIBIT 10.1 WOODLEY LETTER AGREEMENT - AARON'S INC | exhibit101woodleylette.htm |

Exhibit 99.3 Announces Intent to Separate Into Two Public Companies July 29, 2020

SAFE HARBOR STATEMENT Forward-Looking Statements Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “intends,” “expected,” “planned,” "will,” “positioned,” and similar terminology. These risks and uncertainties include factors such as (a) uncertainties as to the timing of the separation and whether it will be completed; (b) the possibility that various closing conditions for the separation may not be satisfied; (c) failure of the separation to qualify for the expected tax treatment; (d) the risk that the Aaron's Business and Progressive Leasing will not be separated successfully or such separation may be more difficult, time-consuming and/or costly than expected; (e) the possibility that the operational, strategic and shareholder value creation opportunities from the separation may not be achieved; (f) the effects on our business from the COVID-19 pandemic, including its impact on our revenue and overall financial performance and the manner in which we are able to conduct our operations; (g) increases in lease merchandise write-offs and the provision for returns and uncollectible renewal payments in light of the impact of the COVID-19 pandemic; and (h) the other risks and uncertainties discussed under "Risk Factors" in Aaron's, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and in Aaron's, Inc.'s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. Statements in this presentation that are "forward-looking" include without limitation statements regarding the planned separation of the Aaron's Business and Progressive Leasing, the timing of any such separation, the expected benefits of the separation, and the future performance of the Aaron's Business and Progressive Leasing if the separation is completed. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, Aaron's, Inc. undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. Non-GAAP Financial Information This presentation includes non-GAAP financial measures, such as adjusted EBITDA and free cash flow, that exclude certain items we do not consider reflective of our cash operations and core business performance. We believe that the presentation of these non-GAAP financial measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP financial measures should be considered in context with our GAAP financial results. A reconciliation of each non- GAAP financial measure presented to the nearest equivalent GAAP financial measure appears in the appendix to this presentation. 2

OVERVIEW Intends to Separate into Two Independent, Highly-Focused Publicly-Traded Companies Comprised of ~1,400 company-operated and Comprised of Progressive Leasing and Vive Financial franchised stores in 47 U.S. States & Canada, the e- commerce platform Aarons.com, & Woodhaven Furniture Industries Partners With HEADQUARTERS 2019 REVENUE HEADQUARTERS 2019 REVENUE 1.2 Million Thousands of Retail DRAPER, UT $2.2B ATLANTA, GA $1.8B Customers Partners 3

PROGRESSIVE AT A GLANCE Key 2019 Highlights** Select Merchant Partnerships $2.2 Billion $269 Million $1.8 Billion Invoice* Revenue Adj. EBITDA 20.2% Growth 19.6% Growth 23.2% Growth* Adj. EBITDA Margin of Write-offs* 1.1 Million Customers 12.4% 7.2% of Net Revenue 22.4% Growth Key Investment Highlights Retail Partner Categories* – FY 2019 Other 1 Strong Value Proposition: Provides access to quality merchandise at leading Jewelry 2% retailers, through a simple and easy-to-use process with competitive pricing 16% Visibility into Lease Portfolio: Supported by advanced algorithms, additional 2 predictive metrics, and a short average portfolio duration of seven months Mobile Phones 12% Furniture Significant Opportunity in New and Existing Doors: Strong growth in new 53% 3 doors and continued growth in existing doors driven by increased penetration Automobile 7% Robust Pipeline: Expected future growth with many national and regional 4 retail partners across Progressive’s core verticals Mattresses 10% Source: Aaron’s, Inc. 10-K dated February 20, 2020 * Progressive Leasing business segment only; Retail Partner Category % represents Progressive Leasing revenue attributable to different retail partner categories. 4 ** - See Appendix for reconciliation of Non-GAAP financial measures

PROGRESSIVE LEADERSHIP TEAM • Named Chief Financial Officer and President of Strategic Operations of Aaron’s, Inc. in February of 2016 STEVE MICHAELS • Oversees several key business functions including analytics, business development and manufacturing • Previously served as Aaron’s President from April 2014 until February 2016, and in that role successfully developed and Chief Executive Officer implemented strategies to strengthen the Aaron’s Business and launch the Aaron’s e-commerce business • Holds a BS degree in Finance from the University of Florida and an MBA from Georgia State University • Named President and Chief Revenue Officer in January of 2015 following the Progressive acquisition by Aaron’s BLAKE WAKEFIELD • Joined Progressive in February of 2013 as the Senior Vice President of Sales and Marketing President & Chief • Prior to Progressive, served as the Sr. Director of Sales and Marketing in the Americas and EMEA for Seagate Technology Revenue Officer • Holds a Bachelor of Science degree in Marketing and International Business from Brigham Young University, and a Master of Business Administration degree from Portland State University • Board Director of Aaron’s, Inc. since 2002, and Non-executive Chairman since 2014 • Held several executive positions at AT&T from 1968-2003, including President of the Southern Region RAY ROBINSON • Extensive technology, banking, communications, strategic and executive leadership and marketing experience, as well as Chairman of the Board experience serving as a public company director • Holds a Bachelor of Science degree in Finance and Economics and a Master of Business Administration in Finance from the University of Denver Full management teams and boards for both companies will be provided in the months leading up to the separation 5

AARON’S AT A GLANCE Aaron’s offers a compelling customer value proposition and an attractive, recurring revenue business model Key 2019 Highlights* Strategic Priorities Utilize technology to simplify and digitize the customer experience $1.8 Billion $166 Million SSR of 0%, Revenue Adj. EBITDA 136 bps Improvement Optimize store footprint, generating substantial cash flow and a more efficient cost structure E-comm Lease 1.2 Million Vertically Integrated Originations Up 51% Customers Furniture Manufacturing Continue to strengthen the Aaron’s brand Key Investment Highlights Key Product Categories (% 2019 Revenue) Furniture (44%) Home Appliances (27%) 1 Large customer opportunity comprising ~30% of the U.S. population Compelling customer value proposition driven by competitive pricing, high 2 approval rates and local service advantages Digitally-enabled, omni-channel strategy that provides an integrated online and 3 in-store experience Consumer Electronics1 (20%) Computers (6%) 4 Opportunity to grow earnings by executing strategic priorities Expect attractive financial profile driven by strong cash generation with 5 substantial capital available to return to shareholders * - See Appendix for reconciliation of Non-GAAP financial measures 6 1 Consumer Electronics includes televisions, gaming and audio.

AARON’S BUSINESS LEADERSHIP TEAM • Served as Aaron’s Business President of Sales & Lease Ownership since February 2016 • More than 20 years of experience leading companies in the financial services and real estate industries DOUGLAS LINDSAY • Former CFO and COO of Ace Cash Express Chief Executive Officer • Holds an M.B.A. from the Cox School of Business at Southern Methodist University and a B.S. in Business Administration and Accounting from Washington and Lee University • Served as Aaron’s Business COO of Sales & Lease Ownership since May 2020 • Joined the company in December 2016 as the Chief Merchandising and Supply Chain Officer and was promoted to the Chief Transformation Officer in 2019 STEVE OLSEN • More than 23 years of experience in leadership positions at multiple retailers including, Total Wine & More, Orchard Supply President Hardware and Office Depot • Started his career with Accenture leading strategy consulting engagements across many retailers • Holds a B.A. in Organizational Behavior and Management and History from Brown University • CEO and member of the Aaron’s, Inc. Board of Directors since November 2014 JOHN ROBINSON • Holds a Bachelor of Arts degree from Washington & Lee University, and an MBA from the Tuck School of Business at Dartmouth Chairman of the Board College Full management teams and boards for both companies will be provided in the months leading up to the separation 7

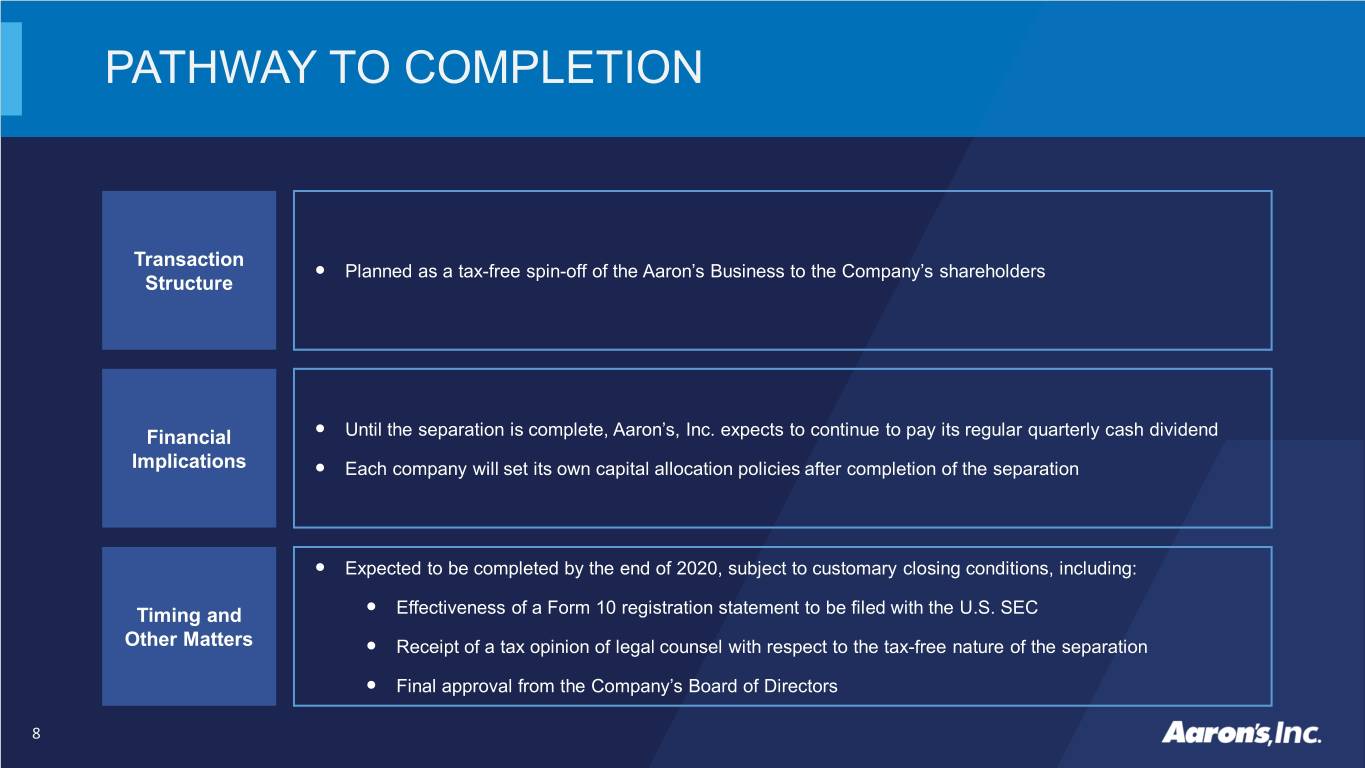

PATHWAY TO COMPLETION Transaction Planned as a tax-free spin-off of the Aaron’s Business to the Company’s shareholders Structure Financial Until the separation is complete, Aaron’s, Inc. expects to continue to pay its regular quarterly cash dividend Implications Each company will set its own capital allocation policies after completion of the separation Expected to be completed by the end of 2020, subject to customary closing conditions, including: Timing and Effectiveness of a Form 10 registration statement to be filed with the U.S. SEC Other Matters Receipt of a tax opinion of legal counsel with respect to the tax-free nature of the separation Final approval from the Company’s Board of Directors 8

2019 FINANCIALS Progressive ($ millions) Aaron's Business Consolidated + Vive Full presentations Total Revenues $ 2,163 $ 1,784 $ 3,947 detailing balance sheets and financial and operational YoY Growth 19.6% -0.5% 9.6% characteristics for both companies will be provided prior to separation Adjusted EBITDA* $ 269 $ 166 $ 435 Adjusted EBITDA Margin* 12.4% 9.3% 11.0% * - See Appendix for reconciliation of Non-GAAP financial measures 9

APPENDIX

Reconciliation of Non-GAAP Items: 2018 - 2019 REVENUE BY SEGMENT ($ 000s) Progressive + Vive Aaron's Business Consolidated Year Ending December 31, 2019 Lease Revenues and Fees $ 2,128,133 $ 1,570,358 $ 3,698,491 Retail Sales - 38,474 38,474 Non-Retail Sales - 140,950 140,950 Franchise Royalties and Fees - 33,432 33,432 Interest and Fees on Loans Receivable 35,046 - 35,046 Other - 1,263 1,263 Total Revenues $ 2,163,179 $ 1,784,477 $ 3,947,656 YoY Growth 19.6% (0.5%) 9.6% Year Ending December 31, 2018 Lease Revenues and Fees $ 1,998,981 $ 1,507,437 $ 3,506,418 Retail Sales - 31,271 31,271 Non-Retail Sales - 207,262 207,262 Franchise Royalties and Fees - 44,815 44,815 Interest and Fees on Loans Receivable 37,318 - 37,318 Other - 1,839 1,839 Total Revenues $ 2,036,299 $ 1,792,624 $ 3,828,923 Progressive Bad Debt Expense 227,813 - 227,813 Total Revenues, net of Progressive Bad Debt Expense (1) $ 1,808,486 $ 1,792,624 $ 3,601,110 (1) “Total Revenues, net of Progressive Bad Debt Expense” for 2018 are a supplemental measure of our performance that are not calculated in accordance with GAAP in place during 2018. The non-GAAP measures assumes that Progressive bad debt expense is recorded as a reduction to lease revenues and fees instead of within operating expenses in 2018 to provide comparability with the financial results we reported beginning in 2019 when ASC 842 became effective and we began reporting Progressive's bad debt expense as a reduction to lease revenues and fees. See Use of Non-GAAP Financial Information within Item 7 of the Company's Form 10-K filed on Feburary 20, 2020 for further details. 11

Reconciliation of Non-GAAP Items: 2018 - 2019 ADJUSTED EBITDA RECONCILIATION ($ 000s) Progressive + Vive Aaron's Business Consolidated Year Ending December 31, 2019 Net Earnings $ 31,472 Income Taxes (1) 61,316 Earnings Before Income Taxes $ 46,057 $ 46,731 $ 92,788 Interest Expense 12,099 4,868 16,967 Depreciation 9,089 60,415 69,504 Amortization 22,263 13,294 35,557 EBITDA $ 89,508 $ 125,308 $ 214,816 Restructuring Expense - 39,990 39,990 Acquisition Transaction and Transition Costs - 735 735 Legal and Regulatory Expenses 179,261 - 179,261 Adjusted EBITDA $ 268,769 $ 166,033 $ 434,802 Adjusted EBITDA Margin 12.4% 9.3% 11.0% Year Ending December 31, 2018 Net Earnings $ 196,210 Income Taxes (1) 55,994 Earnings Before Income Taxes $ 167,521 $ 84,683 $ 252,204 Interest Expense 19,384 (2,944) 16,440 Depreciation 7,143 54,022 61,165 Amortization 22,263 10,722 32,985 EBITDA $ 216,311 $ 146,483 $ 362,794 Restructuring Expense (Reversals), Net (10) 1,115 1,105 Acquisition Transaction and Transition Costs - 21,625 21,625 Legal and Regulatory Expenses - 1,490 1,490 Gain on Sale of Building (775) - (775) Adjusted EBITDA $ 215,526 $ 170,713 $ 386,239 Adjusted EBITDA Margin 11.9% 9.5% 10.7% (1) Taxes are calculated on a consolidated basis and are not identified by Company segments. 12

13