Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 PDF - UDR, Inc. | udr-20200728ex9920479bd.pdf |

| EX-99.1 - EX-99.1 PDF - UDR, Inc. | udr-20200728ex99196a06d.pdf |

| EX-99.1 - EX-99.1 - UDR, Inc. | udr-20200728ex991479933.htm |

| 8-K - 8-K - UDR, Inc. | udr-20200728x8k.htm |

Exhibit 99.2

Financial Highlights

UDR, Inc.

As of End of Second Quarter 2020

(Unaudited) (1)

| | | | Actual Results | | Actual Results | | | ||

Dollars in thousands, except per share and unit | | | | 2Q 2020 | | YTD 2020 | | | | |

| | | | | | | | | | |

GAAP Metrics | | | | | | | | | | |

Net income/(loss) attributable to UDR, Inc. | | | | $57,771 | | $62,992 | | | | |

Net income/(loss) attributable to common stockholders | | | | $56,709 | | $60,864 | | | | |

Income/(loss) per weighted average common share, diluted | | | | $0.19 | | $0.21 | | | | |

| | | | | | | | | | |

Per Share Metrics | | | | | | | | | | |

FFO per common share and unit, diluted | | | | $0.51 | | $1.04 | | | | |

FFO as Adjusted per common share and unit, diluted | | | | $0.51 | | $1.05 | | | | |

Adjusted Funds from Operations ("AFFO") per common share and unit, diluted | | | | $0.47 | | $0.98 | | | | |

Dividend declared per share and unit | | | | $0.36 | | $0.72 | | | | |

| | | | | | | | | | |

Combined Same-Store Operating Metrics (4) | | | | | | | | | | |

Combined Revenue growth | | | | -2.1% | | 0.3% | | | | |

Combined Expense growth | | | | 2.5% | | 2.1% | | | | |

Combined NOI growth | | | | -4.0% | | -0.4% | | | | |

Combined Physical Occupancy | | | | 96.3% | | 96.6% | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Property Metrics | | | | Homes | | Communities | | % of Total NOI | | |

Combined Same-Store (4) | | | | 42,639 | | 136 | | 83.7% | | |

Acquired JV Same-Store Portfolio (4) | | | | (3,619) | | (11) | | -7.1% | | |

UDR Same-Store | | | | 39,020 | | 125 | | 76.6% | | |

Stabilized, Non-Mature | | | | 4,021 | | 10 | | 8.8% | | |

Acquired JV Same-Store Portfolio (4) | | | | 3,619 | | 11 | | 7.1% | | |

Redevelopment | | | | 652 | | 2 | | 2.0% | | |

Development, completed | | | | 59 | | - | | 0.0% | | |

Non-Residential / Other | | | | N/A | | N/A | | 0.6% | | |

Joint Venture (includes completed Joint Venture developments) (2) | | | | 3,130 | | 14 | | 4.9% | | |

Total completed homes | | | | 50,501 | | 162 | | 100% | | |

Under Development | | | | 819 | | 3 | | - | | |

Total Quarter-end homes (2)(3) | | | | 51,320 | | 165 | | 100% | | |

| | | | | | | | | | |

| | | | | | | | | | |

Balance Sheet Metrics (adjusted for non-recurring items) | | | | | | | | | | |

| | | | 2Q 2020 | | 2Q 2019 | | | | |

Consolidated Interest Coverage Ratio | | | | 4.7x | | 5.0x | | | | |

Consolidated Fixed Charge Coverage Ratio | | | | 4.6x | | 4.9x | | | | |

Consolidated Debt as a percentage of Total Assets | | | | 34.2% | | 32.1% | | | | |

Consolidated Net Debt-to-EBITDAre | | | | 6.2x | | 5.4x | | | | |

| | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Joint venture NOI is based on UDR's share. Homes and communities at 100%. |

| (3) | Excludes 2,483 homes that are part of the Developer Capital Program as described in Attachment 12(B). |

| (4) | Amounts include the Acquired JV Same-Store Portfolio Communities as if these communities were 100% owned by UDR during all periods presented. These communities were stabilized as of the beginning of the prior year, were not in process of any substantial redevelopment activities, and were not held for disposition. Because these communities became wholly owned by UDR in 2019 (the 11 communities and 3,619 homes were previously owned by UDR unconsolidated JVs), they are not included in the UDR Same-Store Communities. These 11 communities will be eligible to join the UDR Same-Store Communities on January 1, 2021. |

1

Attachment 1

UDR, Inc.

Consolidated Statements of Operations

(Unaudited) (1)

| | Three Months Ended | | Six Months Ended | ||||||||

| | June 30, | | June 30, | ||||||||

In thousands, except per share amounts | | 2020 | | 2019 | | 2020 | | 2019 | ||||

| | | | | | | | | | | | |

REVENUES: | | | | | | | | | | | | |

Rental income (2) | | $ | 305,982 | | $ | 278,463 | | $ | 626,075 | | $ | 546,385 |

Joint venture management and other fees | | | 1,274 | | | 2,845 | | | 2,662 | | | 5,596 |

Total revenues | | | 307,256 | | | 281,308 | | | 628,737 | | | 551,981 |

| | | | | | | | | | | | |

OPERATING EXPENSES: | | | | | | | | | | | | |

Property operating and maintenance | | | 48,717 | | | 42,894 | | | 98,200 | | | 84,833 |

Real estate taxes and insurance | | | 45,012 | | | 35,834 | | | 90,157 | | | 72,134 |

Property management | | | 8,797 | | | 8,006 | | | 18,000 | | | 15,709 |

Other operating expenses | | | 6,100 | | | 2,735 | | | 11,066 | | | 8,381 |

Real estate depreciation and amortization | | | 155,056 | | | 117,934 | | | 310,532 | | | 230,402 |

General and administrative | | | 10,971 | | | 12,338 | | | 25,949 | | | 24,805 |

Casualty-related charges/(recoveries), net | | | 102 | | | 246 | | | 1,353 | | | 246 |

Other depreciation and amortization | | | 2,027 | | | 1,678 | | | 4,052 | | | 3,334 |

Total operating expenses | | | 276,782 | | | 221,665 | | | 559,309 | | | 439,844 |

| | | | | | | | | | | | |

Gain/(loss) on sale of real estate owned | | | 61,303 | | | 5,282 | | | 61,303 | | | 5,282 |

Operating income | | | 91,777 | | | 64,925 | | | 130,731 | | | 117,419 |

| | | | | | | | | | | | |

Income/(loss) from unconsolidated entities (2) | | | 8,021 | | | 6,625 | | | 11,388 | | | 6,674 |

Interest expense | | | (38,597) | | | (34,417) | | | (77,914) | | | (67,959) |

Interest income and other income/(expense), net | | | 2,421 | | | 1,310 | | | 5,121 | | | 11,123 |

| | | | | | | | | | | | |

Income/(loss) before income taxes | | | 63,622 | | | 38,443 | | | 69,326 | | | 67,257 |

Tax (provision)/benefit, net | | | (1,526) | | | (125) | | | (1,690) | | | (2,337) |

| | | | | | | | | | | | |

Net Income/(loss) | | | 62,096 | | | 38,318 | | | 67,636 | | | 64,920 |

Net (income)/loss attributable to redeemable noncontrolling interests in the OP and DownREIT Partnership | | | (4,291) | | | (2,652) | | | (4,604) | | | (4,709) |

Net (income)/loss attributable to noncontrolling interests | | | (34) | | | (47) | | | (40) | | | (89) |

| | | | | | | | | | | | |

Net income/(loss) attributable to UDR, Inc. | | | 57,771 | | | 35,619 | | | 62,992 | | | 60,122 |

Distributions to preferred stockholders - Series E (Convertible) | | | (1,062) | | | (1,031) | | | (2,128) | | | (2,042) |

| | | | | | | | | | | | |

Net income/(loss) attributable to common stockholders | | $ | 56,709 | | $ | 34,588 | | $ | 60,864 | | $ | 58,080 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Income/(loss) per weighted average common share - basic: | | | $0.19 | | | $0.12 | | | $0.21 | | | $0.21 |

Income/(loss) per weighted average common share - diluted: | | | $0.19 | | | $0.12 | | | $0.21 | | | $0.21 |

| | | | | | | | | | | | |

Common distributions declared per share | | | $0.3600 | | | $0.3425 | | | $0.7200 | | | $0.6850 |

| | | | | | | | | | | | |

Weighted average number of common shares outstanding - basic | | | 294,710 | | | 281,960 | | | 294,584 | | | 279,494 |

Weighted average number of common shares outstanding - diluted | | | 295,087 | | | 282,575 | | | 295,083 | | | 280,081 |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | During the three months ended June 30, 2020, UDR collected 96.1% of billed residential revenue and 70.8% of billed retail revenue. Of the 3.9% and 29.2% not collected, UDR reserved (reflected as a reduction to revenues) approximately 1.7% or $5.5 million for residential, including $0.4 million for UDR’s share from unconsolidated joint ventures, and 163.6% or $3.5 million, including straight-line rent receivables and $0.1 million for UDR’s share from unconsolidated joint ventures, for retail. The reserves are based on probability of collection. |

2

Attachment 2

UDR, Inc.

Funds From Operations

(Unaudited) (1)

| | Three Months Ended | | Six Months Ended | ||||||||

| | June 30, | | June 30, | ||||||||

In thousands, except per share and unit amounts | | 2020 | | 2019 | | | 2020 | | 2019 | |||

| | | | | | | | | | | | |

Net income/(loss) attributable to common stockholders | | $ | 56,709 | | $ | 34,588 | | $ | 60,864 | | $ | 58,080 |

| | | | | | | | | | | | |

Real estate depreciation and amortization | | | 155,056 | | | 117,934 | | | 310,532 | | | 230,402 |

Noncontrolling interests | | | 4,325 | | | 2,699 | | | 4,644 | | | 4,798 |

Real estate depreciation and amortization on unconsolidated joint ventures | | | 8,745 | | | 15,211 | | | 17,561 | | | 30,885 |

Net gain on the sale of unconsolidated depreciable property | | | - | | | (5,251) | | | - | | | (5,251) |

Net gain on the sale of depreciable real estate owned | | | (61,303) | | | - | | | (61,303) | | | - |

Funds from operations ("FFO") attributable to common stockholders and unitholders, basic | | $ | 163,532 | | $ | 165,181 | | $ | 332,298 | | $ | 318,914 |

| | | | | | | | | | | | |

Distributions to preferred stockholders - Series E (Convertible) (2) | | | 1,062 | | | 1,031 | | | 2,128 | | | 2,042 |

| | | | | | | | | | | | |

FFO attributable to common stockholders and unitholders, diluted | | $ | 164,594 | | $ | 166,212 | | $ | 334,426 | | $ | 320,956 |

| | | | | | | | | | | | |

FFO per weighted average common share and unit, basic | | $ | 0.52 | | $ | 0.54 | | $ | 1.05 | | $ | 1.05 |

FFO per weighted average common share and unit, diluted | | $ | 0.51 | | $ | 0.54 | | $ | 1.04 | | $ | 1.05 |

| | | | | | | | | | | | |

Weighted average number of common shares and OP/DownREIT Units outstanding - basic | | | 317,096 | | | 304,696 | | | 316,891 | | | 302,998 |

Weighted average number of common shares, OP/DownREIT Units, and common stock | | | | | | | | | | | | |

equivalents outstanding - diluted | | | 320,426 | | | 308,322 | | | 320,372 | | | 306,596 |

| | | | | | | | | | | | |

Impact of adjustments to FFO: | | | | | | | | | | | | |

Promoted interest on settlement of note receivable, net of tax | | $ | - | | $ | - | | $ | - | | $ | (6,482) |

Legal and other costs | | | 1,586 | | | - | | | 2,344 | | | 3,660 |

Net gain on the sale of non-depreciable real estate owned | | | - | | | (5,282) | | | - | | | (5,282) |

Unrealized (gain)/loss on unconsolidated technology investments, net of tax | | | (3,334) | | | - | | | (3,302) | | | (229) |

Severance costs and other restructuring expense | | | - | | | - | | | 1,642 | | | - |

Casualty-related charges/(recoveries), net | | | 249 | | | 246 | | | 1,648 | | | 261 |

Casualty-related charges/(recoveries) on unconsolidated joint ventures, net | | | - | | | 81 | | | 31 | | | 227 |

| | $ | (1,499) | | $ | (4,955) | | $ | 2,363 | | $ | (7,845) |

| | | | | | | | | | | | |

FFO as Adjusted attributable to common stockholders and unitholders, diluted | | $ | 163,095 | | $ | 161,257 | | $ | 336,789 | | $ | 313,111 |

| | | | | | | | | | | | |

FFO as Adjusted per weighted average common share and unit, diluted | | $ | 0.51 | | $ | 0.52 | | $ | 1.05 | | $ | 1.02 |

| | | | | | | | | | | | |

Recurring capital expenditures | | | (12,504) | | | (12,750) | | | (21,713) | | | (19,968) |

AFFO attributable to common stockholders and unitholders, diluted | | $ | 150,591 | | $ | 148,507 | | $ | 315,076 | | $ | 293,143 |

| | | | | | | | | | | | |

AFFO per weighted average common share and unit, diluted | | $ | 0.47 | | $ | 0.48 | | $ | 0.98 | | $ | 0.96 |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Series E preferred shares are dilutive for purposes of calculating FFO per share for the three and six months ended June 30, 2020 and June 30, 2019. Consequently, distributions to Series E preferred stockholders are added to FFO and the weighted average number of shares are included in the denominator when calculating FFO per common share and unit, diluted. |

3

Attachment 3

UDR, Inc.

Consolidated Balance Sheets

(Unaudited) (1)

| | June 30, | | December 31, | ||

In thousands, except share and per share amounts | | 2020 | | 2019 | ||

| | | | | | |

ASSETS | | | | | | |

| | | | | | |

Real estate owned: | | | | | | |

Real estate held for investment | | $ | 12,643,851 | | $ | 12,532,324 |

Less: accumulated depreciation | | | (4,372,321) | | | (4,131,330) |

Real estate held for investment, net | | | 8,271,530 | | | 8,400,994 |

Real estate under development | | | | | | |

(net of accumulated depreciation of $203 and $23) | | | 131,585 | | | 69,754 |

Total real estate owned, net of accumulated depreciation | | | 8,403,115 | | | 8,470,748 |

| | | | | | |

Cash and cash equivalents | | | 833 | | | 8,106 |

Restricted cash | | | 22,043 | | | 25,185 |

Notes receivable, net | | | 155,956 | | | 153,650 |

Investment in and advances to unconsolidated joint ventures, net | | | 598,058 | | | 588,262 |

Operating lease right-of-use assets | | | 202,586 | | | 204,225 |

Other assets | | | 181,880 | | | 186,296 |

Total assets | | $ | 9,564,471 | | $ | 9,636,472 |

| | | | | | |

LIABILITIES AND EQUITY | | | | | | |

| | | | | | |

Liabilities: | | | | | | |

Secured debt | | $ | 1,112,870 | | $ | 1,149,441 |

Unsecured debt | | | 3,653,934 | | | 3,558,083 |

Operating lease liabilities | | | 197,092 | | | 198,558 |

Real estate taxes payable | | | 31,952 | | | 29,445 |

Accrued interest payable | | | 47,087 | | | 45,199 |

Security deposits and prepaid rent | | | 45,607 | | | 48,353 |

Distributions payable | | | 115,254 | | | 109,382 |

Accounts payable, accrued expenses, and other liabilities | | | 111,264 | | | 90,032 |

Total liabilities | | | 5,315,060 | | | 5,228,493 |

| | | | | | |

Redeemable noncontrolling interests in the OP and DownREIT Partnership | | | 834,466 | | | 1,018,665 |

| | | | | | |

Equity: | | | | | | |

Preferred stock, no par value; 50,000,000 shares authorized | | | | | | |

2,695,363 shares of 8.00% Series E Cumulative Convertible issued | | | | | | |

and outstanding (2,780,994 shares at December 31, 2019) | | | 44,764 | | | 46,200 |

14,452,717 shares of Series F outstanding (14,691,274 shares | | | | | | |

at December 31, 2019) | | | 1 | | | 1 |

Common stock, $0.01 par value; 350,000,000 shares authorized | | | | | | |

295,067,779 shares issued and outstanding (294,588,305 shares at December 31, 2019) | | | 2,951 | | | 2,946 |

Additional paid-in capital | | | 5,794,428 | | | 5,781,975 |

Distributions in excess of net income | | | (2,432,882) | | | (2,462,132) |

Accumulated other comprehensive income/(loss), net | | | (11,940) | | | (10,448) |

Total stockholders' equity | | | 3,397,322 | | | 3,358,542 |

Noncontrolling interests | | | 17,623 | | | 30,772 |

Total equity | | | 3,414,945 | | | 3,389,314 |

Total liabilities and equity | | $ | 9,564,471 | | $ | 9,636,472 |

| (1) | See Attachment 16 for definitions and other terms. |

4

Attachment 4(A)

UDR, Inc.

Selected Financial Information

(Unaudited) (1)

| | | | | | | | | | June 30, | | December 31, |

Common Stock and Equivalents | | | | | | | | | | 2020 | | 2019 |

| | | | | | | | | | | | |

Common shares | | | | | | | | | | 294,807,144 | | 294,340,740 |

Restricted shares | | | | | | | | | | 260,635 | | 247,565 |

Total common shares | | | | | | | | | | 295,067,779 | | 294,588,305 |

Restricted unit and common stock equivalents | | | | | | | | | | 168,914 | | 766,926 |

Operating and DownREIT Partnership units | | | | | | | | | | 20,572,201 | | 20,061,283 |

Class A Limited Partnership units | | | | | | | | | | 1,751,671 | | 1,751,671 |

Series E cumulative convertible preferred shares (2) | | | | | | | | | | 2,918,127 | | 3,010,843 |

Total common shares, OP/DownREIT units, and common stock equivalents | | | | | | | | | | 320,478,692 | | 320,179,028 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Weighted Average Number of Shares Outstanding | | | | | | | | | | 2Q 2020 | | 2Q 2019 |

| | | | | | | | | | | | |

Weighted average number of common shares and OP/DownREIT units outstanding - basic | | | | | | | | | | 317,096,319 | | 304,695,905 |

Weighted average number of OP/DownREIT units outstanding | | | | | | | | | | (22,386,642) | | (22,736,366) |

Weighted average number of common shares outstanding - basic per the Consolidated Statements of Operations | | | | | | | | | | 294,709,677 | | 281,959,539 |

| | | | | | | | | | | | |

Weighted average number of common shares, OP/DownREIT units, and common stock equivalents outstanding - diluted | | | | | | | | | | 320,425,840 | | 308,322,431 |

Weighted average number of OP/DownREIT units outstanding | | | | | | | | | | (22,386,642) | | (22,736,366) |

Weighted average number of Series E cumulative convertible preferred shares outstanding (3) | | | | | | | | | | (2,952,768) | | (3,010,843) |

Weighted average number of common shares outstanding - diluted per the Consolidated Statements of Operations | | | | | | | | | | 295,086,430 | | 282,575,222 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | Year-to-Date 2020 | | Year-to-Date 2019 |

| | | | | | | | | | | | |

Weighted average number of common shares and OP/DownREIT units outstanding - basic | | | | | | | | | | 316,890,705 | | 302,998,559 |

Weighted average number of OP/DownREIT units outstanding | | | | | | | | | | (22,307,263) | | (23,504,227) |

Weighted average number of common shares outstanding - basic per the Consolidated Statements of Operations | | | | | | | | | | 294,583,442 | | 279,494,332 |

| | | | | | | | | | | | |

Weighted average number of common shares, OP/DownREIT units, and common stock equivalents outstanding - diluted | | | | | | | | | | 320,371,665 | | 306,596,164 |

Weighted average number of OP/DownREIT units outstanding | | | | | | | | | | (22,307,263) | | (23,504,227) |

Weighted average number of Series E cumulative convertible preferred shares outstanding (3) | | | | | | | | | | (2,981,806) | | (3,010,843) |

Weighted average number of common shares outstanding - diluted per the Consolidated Statements of Operations | | | | | | | | | | 295,082,596 | | 280,081,094 |

| | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | At June 30, 2020 and December 31, 2019 there were 2,695,363 and 2,780,994 of Series E cumulative convertible preferred shares outstanding, which is equivalent to 2,918,127 and 3,010,843 shares of common stock if converted (after adjusting for the special dividend paid in 2008). |

| (3) | Series E cumulative convertible preferred shares are anti-dilutive for purposes of calculating Income/(loss) per weighted average common share for the three and six months ended June 30, 2020 and June 30, 2019. |

5

Attachment 4(B)

UDR, Inc.

Selected Financial Information

(Unaudited) (1)

| | | | | | | | | | | | | | Weighted | | Weighted |

| | | | | | | | | | | | | | Average | | Average Years |

Debt Structure, In thousands | | | | | | | | Balance | | | % of Total | | Interest Rate | | to Maturity (2) | |

| | | | | | | | | | | | | | | | |

Secured | | | Fixed | | | | | $ | 1,057,839 | | | 22.2% | | 3.85% | | 5.2 |

| | | Floating | | | | | | 27,000 | | | 0.6% | | 0.85% | | 11.7 |

| | | Combined | | | | | | 1,084,839 | | | 22.8% | | 3.77% | | 5.4 |

| | | | | | | | | | | | | | | | |

Unsecured | | | Fixed | | | | | | 3,430,644 | (3) | | 72.2% | | 3.44% | | 7.9 |

| | | Floating | | | | | | 237,180 | | | 5.0% | | 0.58% | | 0.6 |

| | | Combined | | | | | | 3,667,824 | | | 77.2% | | 3.26% | | 7.4 |

| | | | | | | | | | | | | | | | |

Total Debt | | | Fixed | | | | | | 4,488,483 | | | 94.4% | | 3.54% | | 7.3 |

| | | Floating | | | | | | 264,180 | | | 5.6% | | 0.61% | | 1.7 |

| | | Combined | | | | | | 4,752,663 | | | 100.0% | | 3.37% | | 7.0 |

| | | Total Non-Cash Adjustments (4) | | | | | | 14,141 | | | | | | | |

| | | Total per Balance Sheet | | | | | $ | 4,766,804 | | | | | 3.24% | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Debt Maturities, In thousands | | | | | | | | | | | | | | | | |

| | | | | | | | Revolving Credit | | | | | | | | |

| | | | | Unsecured | | Facilities & Comm. | | | | | | | Weighted Average | ||

| | Secured Debt (5) | | Debt (5) | | Paper (2) (6) (7) | | Balance | | % of Total | | Interest Rate | ||||

| | | | | | | | | | | | | | | | |

2020 | | $ | 83,752 | | $ | - | | $ | 185,000 | | $ | 268,752 | | 5.7% | | 1.66% |

2021 | | | 8,763 | | | - | | | 17,180 | | | 25,943 | | 0.5% | | 2.15% |

2022 | | | 9,159 | | | - | | | - | | | 9,159 | | 0.2% | | 4.42% |

2023 | | | 295,965 | | | 350,000 | | | - | | | 645,965 | | 13.6% | | 3.37% |

2024 | | | 95,280 | | | 315,644 | | | - | | | 410,924 | | 8.6% | | 3.77% |

2025 | | | 173,189 | | | 300,000 | | | - | | | 473,189 | | 10.0% | | 4.22% |

2026 | | | 51,070 | | | 300,000 | | | - | | | 351,070 | | 7.4% | | 3.00% |

2027 | | | 1,111 | | | 300,000 | | | - | | | 301,111 | | 6.3% | | 3.50% |

2028 | | | 122,466 | | | 300,000 | | | - | | | 422,466 | | 8.9% | | 3.67% |

2029 | | | 144,584 | | | 300,000 | | | - | | | 444,584 | | 9.4% | | 3.89% |

Thereafter | | | 99,500 | | | 1,300,000 | | | - | | | 1,399,500 | | 29.4% | | 3.13% |

| | | 1,084,839 | | | 3,465,644 | | | 202,180 | | | 4,752,663 | | 100.0% | | 3.37% |

Total Non-Cash Adjustments (4) | | | 28,031 | | | (13,890) | | | - | | | 14,141 | | | | |

Total per Balance Sheet | | $ | 1,112,870 | | $ | 3,451,754 | | $ | 202,180 | | $ | 4,766,804 | | | | 3.24% |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | The 2020 maturity reflects the $185.0 million of principal outstanding at an interest rate of 0.45%, an equivalent of LIBOR plus a spread of 26 basis points, on the Company’s unsecured commercial paper program as of June 30, 2020. Under the terms of the program the Company may issue up to a maximum aggregate amount outstanding of $500.0 million. If the commercial paper was refinanced using the line of credit, the weighted average years to maturity would be 7.1 years with and without extensions. |

| (3) | Includes $315.0 million of floating rate debt that has been fixed using interest rate swaps at a weighted average all-in rate of 2.55% until January 2021. |

| (4) | Includes the unamortized balance of fair market value adjustments, premiums/discounts and deferred financing costs. |

| (5) | Includes principal amortization, as applicable. |

| (6) | There were no borrowings outstanding on our $1.1 billion line of credit at June 30, 2020. The facility has a maturity date of January 2023, plus two six-month extension options and carries an interest rate equal to LIBOR plus a spread of 82.5 basis points. |

| (7) | There was $17.2 million outstanding on our $75.0 million working capital credit facility at June 30, 2020. In July 2020, the facility maturity date was extended from January 2021 to January 2022. The working capital credit facility carries an interest rate equal to LIBOR plus a spread of 82.5 basis points. |

6

Attachment 4(C)

UDR, Inc.

Selected Financial Information

(Dollars in Thousands)

(Unaudited) (1)

| | | | | | | | | | | | Quarter Ended | |

Coverage Ratios | | | | | | | | | | | | June 30, 2020 | |

Net income/(loss) | | | | | | | | | | | | $ | 62,096 |

Adjustments: | | | | | | | | | | | | | |

Interest expense, including costs associated with debt extinguishment | | | | | | | | 38,597 | |||||

Real estate depreciation and amortization | | | | | | | | | | | | | 155,056 |

Other depreciation and amortization | | | | | | | | | | | | | 2,027 |

Tax provision/(benefit), net | | | | | | | | | | | | | 1,526 |

Net gain on the sale of depreciable real estate owned | | | | | | | | | | | | | (61,303) |

Adjustments to reflect the Company's share of EBITDAre of unconsolidated joint ventures | | | | | | | | 13,295 | |||||

EBITDAre | | | | | | | | | | | | $ | 211,294 |

| | | | | | | | | | | | | |

Casualty-related charges/(recoveries), net | | | | | | | | | | | | | 249 |

Legal and other costs | | | | | | | | | | | | | 1,586 |

(Income)/loss from unconsolidated entities | | | | | | | | | | | | | (8,021) |

Adjustments to reflect the Company's share of EBITDAre of unconsolidated joint ventures | | | | | | | | (13,295) | |||||

Management fee expense on unconsolidated joint ventures | | | | | | | | | | | | | (584) |

Consolidated EBITDAre - adjusted for non-recurring items | | | | | | | | | | | | $ | 191,229 |

| | | | | | | | | | | | | |

Annualized consolidated EBITDAre - adjusted for non-recurring items | | | | | | | | | | | | $ | 764,916 |

| | | | | | | | | | | | | |

Interest expense, including costs associated with debt extinguishment | | | | | | | | | | | | | 38,597 |

Capitalized interest expense | | | | | | | | | | | | | 1,663 |

Total interest | | | | | | | | | | | | $ | 40,260 |

| | | | | | | | | | | | | |

Preferred dividends | | | | | | | | | | | | $ | 1,062 |

| | | | | | | | | | | | | |

Total debt | | | | | | | | | | | | $ | 4,766,804 |

Cash | | | | | | | | | | | | | (833) |

Net debt | | | | | | | | | | | | $ | 4,765,971 |

| | | | | | | | | | | | | |

Consolidated Interest Coverage Ratio - adjusted for non-recurring items | | | | | | | | 4.7x | |||||

| | | | | | | | | | | | | |

Consolidated Fixed Charge Coverage Ratio - adjusted for non-recurring items | | | | | | | | 4.6x | |||||

| | | | | | | | | | | | | |

Consolidated Net Debt-to-EBITDAre - adjusted for non-recurring items | | | | | | | | 6.2x | |||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Debt Covenant Overview | |||||||||||||

| | | | | | | | | | | | | |

Unsecured Line of Credit Covenants (2) | | | | | | | Required | | | Actual | | | Compliance |

| | | | | | | | | | | | | |

Maximum Leverage Ratio | | | | | | | ≤60.0% | | | 34.0% (2) | | | Yes |

Minimum Fixed Charge Coverage Ratio | | | | | | | ≥1.5x | | | 4.1x | | | Yes |

Maximum Secured Debt Ratio | | | | | | | ≤40.0% | | | 11.1% | | | Yes |

Minimum Unencumbered Pool Leverage Ratio | | | | | | | ≥150.0% | | | 341.3% | | | Yes |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Senior Unsecured Note Covenants (3) | | | | | | | Required | | | Actual | | | Compliance |

| | | | | | | | | | | | | |

Debt as a percentage of Total Assets | | | | | | | ≤65.0% | | | 34.3% (3) | | | Yes |

Consolidated Income Available for Debt Service to Annual Service Charge | | | | | | | ≥1.5x | | | 5.2x | | | Yes |

Secured Debt as a percentage of Total Assets | | | | | | | ≤40.0% | | | 8.0% | | | Yes |

Total Unencumbered Assets to Unsecured Debt | | | | | | | ≥150.0% | | | 309.1% | | | Yes |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Securities Ratings | | | | | | | Debt | | | Outlook | | | Commercial Paper |

| | | | | | | | | | | | | |

Moody's Investors Service | | | | | | | Baa1 | | | Stable | | | P-2 |

S&P Global Ratings | | | | | | | BBB+ | | | Stable | | | A-2 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | Gross | | | % of |

| | Number of | | 2Q 2020 NOI (1) | | | | | Carrying Value | | | Total Gross | |

Asset Summary | | Homes | | ($000s) | | % of NOI | | | ($000s) | | | Carrying Value | |

| | | | | | | | | | | | | |

Unencumbered assets | | 39,437 | | $ | 179,166 | | 84.4% | | $ | 10,730,870 | | | 84.0% |

Encumbered assets | | 7,934 | | | 33,087 | | 15.6% | | | 2,044,769 | | | 16.0% |

| | 47,371 | | $ | 212,253 | | 100.0% | | $ | 12,775,639 | | | 100.0% |

| | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | As defined in our credit agreement dated September 27, 2018. |

| (3) | As defined in our indenture dated November 1, 1995 as amended, supplemented or modified from time to time. |

7

Attachment 5

UDR, Inc.

Operating Information

(Unaudited) (1)

| | Total | | Quarter Ended | | Quarter Ended | | | Quarter Ended | | | Quarter Ended | | | Quarter Ended | ||

Dollars in thousands | | Homes | | June 30, 2020 | | March 31, 2020 | | | December 31, 2019 | | | September 30, 2019 | | | June 30, 2019 | ||

Revenues | | | | | | | | | | | | | | | | | |

Combined Same-Store Communities (5) | | 42,639 | | $ | 265,372 | | $ | 275,695 | | $ | 273,227 | | $ | 274,049 | | $ | 271,122 |

Acquired JV Same-Store Portfolio Communities (5) | | (3,619) | | | (23,421) | | | (24,228) | | | (23,656) | | | (23,919) | | | (23,698) |

UDR Same-Store Communities | | 39,020 | | | 241,951 | | | 251,467 | | | 249,571 | | | 250,130 | | | 247,424 |

Stabilized, Non-Mature Communities | | 4,021 | | | 28,210 | | | 28,166 | | | 25,433 | | | 21,209 | | | 14,761 |

Acquired JV Same-Store Portfolio Communities | | 3,619 | | | 23,421 | | | 24,228 | | | 11,161 | | | 1,022 | | | - |

Redevelopment Communities | | 652 | | | 7,287 | | | 7,928 | | | 7,703 | | | 6,979 | | | 7,487 |

Development Communities | | 59 | | | 58 | | | 7 | | | - | | | - | | | - |

Non-Residential / Other (2) | | - | | | 4,206 | | | 6,088 | | | 6,671 | | | 7,425 | | | 5,997 |

Total | | 47,371 | | $ | 305,133 | | $ | 317,884 | | $ | 300,539 | | $ | 286,765 | | $ | 275,669 |

| | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | | |

Combined Same-Store Communities (5) | | | | $ | 79,092 | | $ | 79,436 | | $ | 77,010 | | $ | 80,149 | | $ | 77,142 |

Acquired JV Same-Store Portfolio Communities (5) | | | | | (7,673) | | | (7,900) | | | (7,342) | | | (7,831) | | | (8,196) |

UDR Same-Store Communities | | | | | 71,419 | | | 71,536 | | | 69,668 | | | 72,318 | | | 68,946 |

Stabilized, Non-Mature Communities | | | | | 8,402 | | | 8,250 | | | 7,353 | | | 6,462 | | | 4,121 |

Acquired JV Same-Store Portfolio Communities | | | | | 7,673 | | | 7,900 | | | 3,318 | | | 260 | | | - |

Redevelopment Communities | | | | | 2,843 | | | 3,002 | | | 3,085 | | | 3,170 | | | 2,575 |

Development Communities | | | | | 123 | | | 47 | | | 6 | | | 2 | | | - |

Non-Residential / Other (2) | | | | | 2,976 | | | 3,317 | | | 3,531 | | | 2,572 | | | 2,501 |

Total (3) | | | | $ | 93,436 | | $ | 94,052 | | $ | 86,961 | | $ | 84,784 | | $ | 78,143 |

| | | | | | | | | | | | | | | | | |

Net Operating Income | | | | | | | | | | | | | | | | | |

Combined Same-Store Communities (5) | | | | $ | 186,280 | | $ | 196,259 | | $ | 196,217 | | $ | 193,900 | | $ | 193,980 |

Acquired JV Same-Store Portfolio Communities (5) | | | | | (15,748) | | | (16,328) | | | (16,314) | | | (16,088) | | | (15,502) |

UDR Same-Store Communities | | | | | 170,532 | | | 179,931 | | | 179,903 | | | 177,812 | | | 178,478 |

Stabilized, Non-Mature Communities | | | | | 19,808 | | | 19,916 | | | 18,080 | | | 14,747 | | | 10,640 |

Acquired JV Same-Store Portfolio Communities | | | | | 15,748 | | | 16,328 | | | 7,843 | | | 762 | | | - |

Redevelopment Communities | | | | | 4,444 | | | 4,926 | | | 4,618 | | | 3,809 | | | 4,912 |

Development Communities | | | | | (65) | | | (40) | | | (6) | | | (2) | | | - |

Non-Residential / Other (2) | | | | | 1,230 | | | 2,771 | | | 3,140 | | | 4,853 | | | 3,496 |

Total | | | | $ | 211,697 | | $ | 223,832 | | $ | 213,578 | | $ | 201,981 | | $ | 197,526 |

| | | | | | | | | | | | | | | | | |

Operating Margin | | | | | | | | | | | | | | | | | |

Combined Same-Store Communities | | | | | 70.2% | | | 71.2% | | | 71.8% | | | 70.8% | | | 71.5% |

| | | | | | | | | | | | | | | | | |

Weighted Average Physical Occupancy | | | | | | | | | | | | | | | | | |

Combined Same-Store Communities (5) | | | | | 96.3% | | | 97.0% | | | 96.8% | | | 96.8% | | | 96.8% |

Acquired JV Same-Store Portfolio Communities (5) | | | | | 95.8% | | | 96.0% | | | 95.8% | | | 95.7% | | | 95.7% |

UDR Same-Store Communities | | | | | 96.3% | | | 97.1% | | | 96.9% | | | 96.9% | | | 96.9% |

Stabilized, Non-Mature Communities | | | | | 94.7% | | | 95.8% | | | 95.4% | | | 93.5% | | | 89.7% |

Acquired JV Same-Store Portfolio Communities | | | | | 95.8% | | | 96.0% | | | 95.8% | | | 96.8% | | | - |

Redevelopment Communities | | | | | 89.4% | | | 94.6% | | | 93.4% | | | 90.0% | | | 93.2% |

Development Communities | | | | | 44.5% | | | - | | | - | | | - | | | - |

Other (4) | | | | | - | | | 97.3% | | | 98.1% | | | 97.4% | | | 97.4% |

Total | | | | | 96.0% | | | 96.9% | | | 96.6% | | | 96.5% | | | 96.4% |

| | | | | | | | | | | | | | | | | |

Sold and Held for Disposition Communities | | | | | | | | | | | | | | | | | |

Revenues | | - | | $ | 849 | | $ | 2,209 | | $ | 2,207 | | $ | 2,243 | | $ | 2,794 |

Expenses (3) | | | | | 293 | | | 576 | | | 549 | | | 575 | | | 585 |

Net Operating Income/(Loss) | | | | $ | 556 | | $ | 1,633 | | $ | 1,658 | | $ | 1,668 | | $ | 2,209 |

| | | | | | | | | | | | | | | | | |

Total | | 47,371 | | $ | 212,253 | | $ | 225,465 | | $ | 215,236 | | $ | 203,649 | | $ | 199,735 |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Primarily non-residential revenue and expense and straight-line adjustment for concessions. |

| (3) | The summation of Total expenses and Sold and Held for Disposition Communities expenses above agrees to the summation of property operating and maintenance and real estate taxes and insurance expenses on Attachment 1. |

| (4) | Includes occupancy of Sold and Held for Disposition Communities. |

| (5) | Amounts include the Acquired JV Same-Store Portfolio Communities as if these communities were 100% owned by UDR during all periods presented. These communities were stabilized as of the beginning of the prior year, were not in process of any substantial redevelopment activities, and were not held for disposition. Because these communities became wholly owned by UDR in 2019 (the 11 communities and 3,619 homes were previously owned by UDR unconsolidated JVs), they are not included in the UDR Same-Store Communities. These 11 communities will be eligible to join the UDR Same-Store Communities on January 1, 2021. |

8

Attachment 6

UDR, Inc.

Combined Same-Store Operating Expense Information (1)

(Dollars in Thousands)

(Unaudited) (2)

| | % of 2Q 2020 | | | | | | | | |

| | Combined SS | | | | | | | | |

Year-Over-Year Comparison | | Operating Expenses | | 2Q 2020 | | 2Q 2019 | | % Change | ||

| | | | | | | | | | |

Personnel | | 18.4% | | $ | 14,545 | | $ | 15,744 | | -7.6% |

Utilities | | 13.0% | | | 10,262 | | | 9,898 | | 3.7% |

Repair and maintenance | | 15.2% | | | 12,001 | | | 11,102 | | 8.1% |

Administrative and marketing | | 6.1% | | | 4,838 | | | 5,747 | | -15.8% |

Controllable expenses | | 52.7% | | | 41,646 | | | 42,491 | | -2.0% |

| | | | | | | | | | |

Real estate taxes (3) | | 43.0% | | $ | 34,008 | | $ | 31,570 | | 7.7% |

Insurance | | 4.3% | | | 3,438 | | | 3,081 | | 11.6% |

Combined Same-Store operating expenses (3) | | 100.0% | | $ | 79,092 | | $ | 77,142 | | 2.5% |

| | | | | | | | | | |

Combined Same-Store Homes | | 42,639 | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | % of 2Q 2020 | | | | | | | | |

| | Combined SS | | | | | | | | |

Sequential Comparison | | Operating Expenses | | 2Q 2020 | | 1Q 2020 | | % Change | ||

| | | | | | | | | | |

Personnel | | 18.4% | | $ | 14,545 | | $ | 14,344 | | 1.4% |

Utilities | | 13.0% | | | 10,262 | | | 10,918 | | -6.0% |

Repair and maintenance | | 15.2% | | | 12,001 | | | 11,185 | | 7.3% |

Administrative and marketing | | 6.1% | | | 4,838 | | | 5,631 | | -14.1% |

Controllable expenses | | 52.7% | | | 41,646 | | | 42,078 | | -1.0% |

| | | | | | | | | | |

Real estate taxes (3) | | 43.0% | | $ | 34,008 | | $ | 34,056 | | -0.1% |

Insurance | | 4.3% | | | 3,438 | | | 3,302 | | 4.1% |

Combined Same-Store operating expenses (3) | | 100.0% | | $ | 79,092 | | $ | 79,436 | | -0.4% |

| | | | | | | | | | |

Combined Same-Store Homes | | 42,639 | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | % of YTD 2020 | | | | | | | | |

| | Combined SS | | | | | | | | |

Year-to-Date Comparison | | Operating Expenses | | YTD 2020 | | YTD 2019 | | % Change | ||

| | | | | | | | | | |

Personnel | | 18.2% | | $ | 28,030 | | $ | 30,739 | | -8.8% |

Utilities | | 13.4% | | | 20,689 | | | 20,329 | | 1.8% |

Repair and maintenance | | 14.6% | | | 22,515 | | | 20,682 | | 8.9% |

Administrative and marketing | | 6.6% | | | 10,086 | | | 10,750 | | -6.2% |

Controllable expenses | | 52.8% | | | 81,320 | | | 82,500 | | -1.4% |

| | | | | | | | | | |

Real estate taxes (3) | | 42.9% | | $ | 66,115 | | $ | 62,041 | | 6.6% |

Insurance | | 4.3% | | | 6,608 | | | 6,279 | | 5.2% |

Combined Same-Store operating expenses (3) | | 100.0% | | $ | 154,043 | | $ | 150,820 | | 2.1% |

| | | | | | | | | | |

Combined Same-Store Homes | | 41,529 | | | | | | | | |

| (1) | 2Q19 and YTD19 operating expenses include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | See Attachment 16 for definitions and other terms. |

| (3) | The year-over-year, sequential and year-to-date comparisons presented above include $280 thousand, $0 and $560 thousand, respectively, of higher New York real estate taxes due to 421g exemption and abatement reductions. |

9

Attachment 7(A)

UDR, Inc.

Apartment Home Breakout

Portfolio Overview as of Quarter Ended

June 30, 2020

(Unaudited) (1)

| | | | Non-Mature Homes | | | | Unconsolidated | | | ||

| | | | | | | | Total | | Joint Venture | | Total |

| | Total Combined | | | | Non- | | Consolidated | | Operating | | Homes |

| | Same-Store Homes | | Stabilized (2) | | Stabil. / Other (3) | | Homes | | Homes (4) | | (incl. JV) (4) |

West Region | | | | | | | | | | | | |

Orange County, CA | | 4,820 | | 516 | | - | | 5,336 | | 381 | | 5,717 |

San Francisco, CA | | 2,751 | | - | | - | | 2,751 | | 602 | | 3,353 |

Seattle, WA | | 2,725 | | - | | - | | 2,725 | | - | | 2,725 |

Los Angeles, CA | | 1,225 | | - | | - | | 1,225 | | 633 | | 1,858 |

Monterey Peninsula, CA | | 1,565 | | - | | - | | 1,565 | | - | | 1,565 |

| | 13,086 | | 516 | | - | | 13,602 | | 1,616 | | 15,218 |

| | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | |

Metropolitan DC | | 8,305 | | - | | - | | 8,305 | | - | | 8,305 |

Richmond, VA | | 1,358 | | - | | - | | 1,358 | | - | | 1,358 |

Baltimore, MD | | 1,099 | | 498 | | - | | 1,597 | | - | | 1,597 |

| | 10,762 | | 498 | | - | | 11,260 | | - | | 11,260 |

| | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | |

Boston, MA | | 2,440 | | 1,699 | | 159 | | 4,298 | | 250 | | 4,548 |

New York, NY | | 1,640 | | 185 | | 493 | | 2,318 | | 710 | | 3,028 |

| | 4,080 | | 1,884 | | 652 | | 6,616 | | 960 | | 7,576 |

| | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | |

Orlando, FL | | 2,500 | | - | | - | | 2,500 | | - | | 2,500 |

Tampa, FL | | 2,668 | | 534 | | - | | 3,202 | | - | | 3,202 |

Nashville, TN | | 2,260 | | - | | - | | 2,260 | | - | | 2,260 |

| | 7,428 | | 534 | | - | | 7,962 | | - | | 7,962 |

| | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | |

Dallas, TX | | 3,864 | | - | | 59 | | 3,923 | | - | | 3,923 |

Austin, TX | | 1,272 | | - | | - | | 1,272 | | - | | 1,272 |

| | 5,136 | | - | | 59 | | 5,195 | | - | | 5,195 |

| | | | | | | | | | | | |

Other Markets (5) | | 2,147 | | 589 | | - | | 2,736 | | 554 | | 3,290 |

| | | | | | | | | | | | |

Totals | | 42,639 | | 4,021 | | 711 | | 47,371 | | 3,130 | | 50,501 |

| | | | | | | | | | | | |

Communities (6) | | 136 | | 10 | | 2 | | 148 | | 14 | | 162 |

| | | | | | | | | | | | |

| | | | | | Homes | | Communities | | | | |

Total completed homes | | | | | | 50,501 | | 162 | | | | |

Under Development (7) | | | | | | 819 | | 3 | | | | |

| | | | | | | | | | | | |

Total Quarter-end homes and communities | | | | | | 51,320 | | 165 | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Represents homes included in Stabilized, Non-Mature Communities category on Attachment 5. |

| (3) | Represents homes included in Acquired, Development, Redevelopment and Non-Residential/Other Communities categories on Attachment 5. Excludes development homes not yet completed and Sold and Held for Disposition Communities. |

| (4) | Represents joint venture operating homes at 100 percent. Excludes joint venture held for disposition communities. See Attachment 12(A) for UDR's joint venture and partnership ownership interests. |

| (5) | Other Markets include Denver (218 homes), Palm Beach (636 homes), Inland Empire (654 homes), San Diego (163 wholly owned, 264 JV homes), Portland (752 homes) and Philadelphia (313 wholly owned, 290 JV homes). |

| (6) | Represents communities where 100 percent of all development homes have been completed. |

| (7) | See Attachment 9 for UDR’s developments and ownership interests. |

10

Attachment 7(B)

UDR, Inc.

Non-Mature Home Summary

Portfolio Overview as of Quarter Ended

June 30, 2020

(Unaudited) (1)(2)

Non-Mature Home Breakout - By Date (quarter indicates anticipated date of QTD Same-Store inclusion) | |||||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Community | | | Category | | # of Homes | | Market | | Same-Store Quarter (3) | | | ||

| | | | | | | | | | | | | |

The Residences at Pacific City | | | Stabilized, Non-Mature | | 516 | | Orange County, CA | | 3Q20 | | | ||

| | | | | | | | | | | | | |

345 Harrison Street | | | Stabilized, Non-Mature | | 585 | | Boston, MA | | 3Q20 | | | ||

| | | | | | | | | | | | | |

The Preserve at Gateway | | | Stabilized, Non-Mature | | 240 | | Tampa, FL | | 3Q20 | | | ||

| | | | | | | | | | | | ||

Currents on the Charles | | | Stabilized, Non-Mature | | 200 | | Boston, MA | | 3Q20 | | | ||

| | | | | | | | | | | | ||

Rodgers Forge | | | Stabilized, Non-Mature | | 498 | | Baltimore, MD | | 4Q20 | | | ||

| | | | | | | | | | | | ||

The Commons at Windsor Gardens | | | Stabilized, Non-Mature | | 914 | | Boston, MA | | 4Q20 | | | ||

| | | | | | | | | | | | ||

One William | | | Stabilized, Non-Mature | | 185 | | New York, NY | | 4Q20 | | | ||

| | | | | | | | | | | | ||

Park Square | | | Stabilized, Non-Mature | | 313 | | Philadelphia, PA | | 1Q21 | | | ||

| | | | | | | | | | | | ||

The Slade at Channelside | | | Stabilized, Non-Mature | | 294 | | Tampa, FL | | 2Q21 | | | ||

| | | | | | | | | | | | ||

The Arbory | | | Stabilized, Non-Mature | | 276 | | Portland, OR | | 2Q21 | | | ||

| | | | | | | | | | | | ||

10 Hanover Square | | | Redevelopment | | 493 | | New York, NY | | 4Q21 | | | ||

| | | | | | | | | | | | | |

Vitruvian West Phase 2 | | | Development | | 59 | (4) | Dallas, TX | | 2Q22 | | | ||

| | | | | | | | | | | | ||

Garrison Square | | | Redevelopment | | 159 | | Boston, MA | | 3Q22 | | | ||

| | | | | | | | | | | | | |

Total | | | | | | | 4,732 | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Summary of Non-Mature Home Activity | |||||||||||||

| | | | | Stabilized, | | | | | | | | |

| | | Market | | Non-Mature | | Acquired | | Redevelopment | | Development | | Total |

Non-Mature Homes at March 31, 2020 | | 4,561 | | 570 | | 652 | | - | | 5,783 | |||

The Slade at Channelside | | | Tampa, FL | | 294 | | (294) | | - | | - | | - |

The Arbory | | | Portland, OR | | 276 | | (276) | | - | | - | | - |

Parallel | | | Orange County, CA | | (386) | | - | | - | | - | | (386) |

CityLine II | | | Seattle, WA | | (155) | | - | | - | | - | | (155) |

Leonard Pointe | | | New York, NY | | (188) | | - | | - | | - | | (188) |

Peridot Palms | | | Tampa, FL | | (381) | | - | | - | | - | | (381) |

Vitruvian West Phase 2 | | | Dallas, TX | | - | | - | | - | | 59 | | 59 |

Non-Mature Homes at June 30, 2020 | | 4,021 | | - | | 652 | | 59 | | 4,732 | |||

| | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Excludes the Acquired JV Same-Store Portfolio Communities (11 communities and 3,619 homes). |

| (3) | Estimated Same-Store quarter represents the quarter UDR anticipates contributing the community to the QTD same-store pool. |

| (4) | 59 homes of 366 total homes have been delivered as of June 30, 2020 as described on Attachment 9. |

11

Attachment 7(C)

UDR, Inc.

Total Revenue Per Occupied Home Summary

Portfolio Overview as of Quarter Ended

June 30, 2020

(Unaudited) (1)

| | | | Non-Mature Homes | | | | Unconsolidated | | | ||||||||

| | Total Combined | | | | | | | | Total | | Joint Venture | | Total | ||||

| | Same-Store | | | | | | Non- | | Consolidated | | Operating | | Homes | ||||

| | Homes | | Stabilized (2) | | | Stabilized (3) | | Homes | | Homes (4) | | (incl. JV at share) (4) | |||||

| | | | | | | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | | | | | | |

Orange County, CA | | $ | 2,329 | | $ | 4,045 | | $ | - | | $ | 2,495 | | $ | 2,588 | | $ | 2,498 |

San Francisco, CA | | | 3,647 | | | - | | | - | | | 3,647 | | | 5,236 | | | 3,799 |

Seattle, WA | | | 2,463 | | | - | | | - | | | 2,463 | | | - | | | 2,463 |

Los Angeles, CA | | | 2,793 | | | - | | | - | | | 2,793 | | | 3,456 | | | 2,924 |

Monterey Peninsula, CA | | | 1,918 | | | - | | | - | | | 1,918 | | | - | | | 1,918 |

| | | | | | | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 2,147 | | | - | | | - | | | 2,147 | | | - | | | 2,147 |

Richmond, VA | | | 1,414 | | | - | | | - | | | 1,414 | | | - | | | 1,414 |

Baltimore, MD | | | 1,711 | | | 1,384 | | | - | | | 1,611 | | | - | | | 1,611 |

| | | | | | | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 2,704 | | | 2,674 | | | 5,043 | | | 2,771 | | | 2,086 | | | 2,751 |

New York, NY | | | 4,291 | | | 2,703 | | | 3,897 | | | 4,076 | | | 4,770 | | | 4,168 |

| | | | | | | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | |

Orlando, FL | | | 1,398 | | | - | | | - | | | 1,398 | | | - | | | 1,398 |

Tampa, FL | | | 1,514 | | | 1,777 | | | - | | | 1,557 | | | - | | | 1,557 |

Nashville, TN | | | 1,362 | | | - | | | - | | | 1,362 | | | - | | | 1,362 |

| | | | | | | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 1,480 | | | - | | | 1,399 | | | 1,479 | | | - | | | 1,479 |

Austin, TX | | | 1,522 | | | - | | | - | | | 1,522 | | | - | | | 1,522 |

| | | | | | | | | | | | | | | | | | |

Other Markets | | | 2,020 | | | 1,993 | | | - | | | 2,014 | | | 2,989 | | | 2,104 |

| | | | | | | | | | | | | | | | | | |

Weighted Average | | $ | 2,155 | | $ | 2,469 | | $ | 4,056 | | $ | 2,206 | | $ | 3,777 | | $ | 2,255 |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Represents homes included in Stabilized, Non-Mature Communities category on Attachment 5. |

| (3) | Represents homes included in Acquired, Development, Redevelopment and Non-Residential/Other Communities categories on Attachment 5. Excludes development homes not yet completed and Sold and Held for Disposition Communities. |

| (4) | Represents joint ventures at UDR's ownership interests. Excludes joint venture held for disposition communities. See Attachment 12(A) for UDR's joint venture and partnership ownership interests. |

12

Attachment 7(D)

UDR, Inc.

Net Operating Income Breakout By Market

June 30, 2020

(Dollars in Thousands)

(Unaudited) (1)

| Three Months Ended June 30, 2020 | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | |

| | Combined | | | | | UDR's | | | | | | | | | ||

| | Same-Store | | Non Same-Store (2) | | Share of JVs (2)(3) | | Total | | | | | | ||||

| | | | | | | | | | | | | | | | | |

Net Operating Income | | $ | 186,280 | | $ | 25,417 | | $ | 10,948 | | $ | 222,645 | | | | | |

| | | | | | | | | | | | | | | | | |

% of Net Operating Income | | | 83.7% | | | 11.4% | | | 4.9% | | | 100.0% | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Three Months Ended June 30, 2020 | |||||||||||||||||

| | | | | | | | | | | | | | | | | |

| | As a % of NOI | | | | | As a % of NOI | ||||||||||

| | Combined | | | | | | | Combined | | | | | | |||

Region | | Same-Store | | Total | | Region | | Same-Store | | | Total | ||||||

| | | | | | | | | | | | | | | | | |

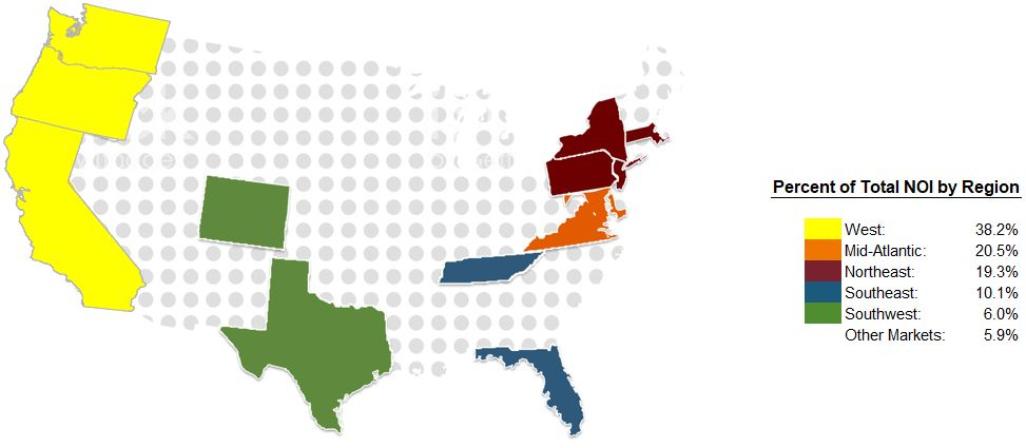

West Region | | | | | | | | Southeast Region | | | | | | | | | |

Orange County, CA | | | 13.4% | | | 13.6% | | Tampa, FL | | | 4.0% | | | | | 4.1% | |

San Francisco, CA | | | 11.2% | | | 10.7% | | Orlando, FL | | | 3.8% | | | | | 3.2% | |

Seattle, WA | | | 7.6% | | | 6.8% | | Nashville, TN | | | 3.4% | | | | | 2.8% | |

Los Angeles, CA | | | 3.8% | | | 4.0% | | | | | | 11.2% | | | | | 10.1% |

Monterey Peninsula, CA | | | 3.7% | | | 3.1% | | | | | | | | | | | |

| | | 39.7% | | | 38.2% | | Southwest Region | | | | | | | | | |

| | | | | | | | Dallas, TX | | | 5.3% | | | | | 4.5% | |

Mid-Atlantic Region | | | | | | | | Austin, TX | | | 1.8% | | | | | 1.5% | |

Metropolitan DC | | | 19.3% | | | 16.3% | | | | | | 7.1% | | | | | 6.0% |

Richmond, VA | | | 2.2% | | | 1.9% | | | | | | | | | | | |

Baltimore, MD | | | 2.1% | | | 2.3% | | Other Markets | | | 4.7% | | | | | 5.9% | |

| | | 23.6% | | | 20.5% | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | |

Boston, MA | | | 7.6% | | | 11.5% | | | | | | | | | | | |

New York, NY | | | 6.1% | | | 7.8% | | | | | | | | | | | |

| | | 13.7% | | | 19.3% | | Total | | | 100.0% | | | | | 100.0% | |

| | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Excludes results from Sold and Held for Disposition Communities. |

| (3) | Includes UDR's share of joint venture and partnership NOI on Attachment 12(A). |

13

Attachment 8(A)

UDR, Inc.

Combined Same-Store Operating Information By Major Market (1) (2)

Current Quarter vs. Prior Year Quarter

June 30, 2020

(Unaudited) (3)

| | | % of Combined | | | | | | | | | | |

| | Total | Same-Store | | Combined Same-Store | ||||||||

| | Combined | Portfolio | | | | | | | | | | |

| | Same-Store | Based on | | Physical Occupancy | | Total Revenue per Occupied Home | ||||||

| | Homes | 2Q 2020 NOI | | 2Q 20 | 2Q 19 | Change | | 2Q 20 | 2Q 19 | Change | ||

| | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | |

Orange County, CA | | 4,820 | 13.4% | | 96.0% | 95.8% | 0.2% | | $ | 2,329 | $ | 2,346 | -0.7% |

San Francisco, CA | | 2,751 | 11.2% | | 92.9% | 97.1% | -4.2% | | | 3,647 | | 3,769 | -3.2% |

Seattle, WA | | 2,725 | 7.6% | | 96.6% | 97.0% | -0.4% | | | 2,463 | | 2,500 | -1.5% |

Los Angeles, CA | | 1,225 | 3.8% | | 95.8% | 95.9% | -0.1% | | | 2,793 | | 2,896 | -3.6% |

Monterey Peninsula, CA | | 1,565 | 3.7% | | 96.8% | 97.2% | -0.4% | | | 1,918 | | 1,875 | 2.3% |

| | 13,086 | 39.7% | | 95.6% | 96.5% | -0.9% | | | 2,620 | | 2,674 | -2.0% |

| | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | |

Metropolitan DC | | 8,305 | 19.3% | | 96.8% | 97.3% | -0.5% | | | 2,147 | | 2,161 | -0.6% |

Richmond, VA | | 1,358 | 2.2% | | 97.4% | 97.9% | -0.5% | | | 1,414 | | 1,390 | 1.7% |

Baltimore, MD | | 1,099 | 2.1% | | 98.0% | 96.6% | 1.4% | | | 1,711 | | 1,739 | -1.6% |

| | 10,762 | 23.6% | | 97.0% | 97.3% | -0.3% | | | 2,009 | | 2,020 | -0.6% |

| | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | |

Boston, MA | | 2,440 | 7.6% | | 95.3% | 96.3% | -1.0% | | | 2,704 | | 2,815 | -3.9% |

New York, NY | | 1,640 | 6.1% | | 92.6% | 97.5% | -4.9% | | | 4,291 | | 4,434 | -3.2% |

| | 4,080 | 13.7% | | 94.2% | 96.8% | -2.6% | | | 3,331 | | 3,471 | -4.0% |

| | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | |

Tampa, FL | | 2,668 | 4.0% | | 96.8% | 96.5% | 0.3% | | | 1,514 | | 1,501 | 0.9% |

Orlando, FL | | 2,500 | 3.8% | | 97.2% | 96.4% | 0.8% | | | 1,398 | | 1,408 | -0.7% |

Nashville, TN | | 2,260 | 3.4% | | 97.9% | 97.5% | 0.4% | | | 1,362 | | 1,322 | 3.0% |

| | 7,428 | 11.2% | | 97.3% | 96.8% | 0.5% | | | 1,428 | | 1,415 | 1.0% |

| | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | |

Dallas, TX | | 3,864 | 5.3% | | 96.6% | 96.4% | 0.2% | | | 1,480 | | 1,470 | 0.7% |

Austin, TX | | 1,272 | 1.8% | | 97.8% | 97.4% | 0.4% | | | 1,522 | | 1,516 | 0.4% |

| | 5,136 | 7.1% | | 96.9% | 96.6% | 0.3% | | | 1,490 | | 1,481 | 0.6% |

| | | | | | | | | | | | | |

Other Markets | | 2,147 | 4.7% | | 96.4% | 95.9% | 0.5% | | | 2,020 | | 2,051 | -1.5% |

| | | | | | | | | | | | | |

Total Combined/ Weighted Avg. | | 42,639 | 100.0% | | 96.3% | 96.8% | -0.5% | | $ | 2,155 | $ | 2,190 | -1.6% |

| (1) | 2Q19 amounts include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | 2Q20 includes a reserve (reflected as a reduction to revenues) of approximately $4.5 million or 1.7% of billed residential revenue on our Combined Same-Store Communities. The reserve is based on probability of collection. |

| (3) | See Attachment 16 for definitions and other terms. |

14

Attachment 8(B)

UDR, Inc.

Combined Same-Store Operating Information By Major Market(1)

Current Quarter vs. Prior Year Quarter

June 30, 2020

(Unaudited) (2)

| | | | Combined Same-Store ($000s) | |||||||||||||||

| Total | | | | | | | | | | | | | | | | | | |

| Combined | | | | | | | | | | | | | | | | | | |

| Same-Store | | Revenues | | Expenses | | Net Operating Income | ||||||||||||

| Homes | | 2Q 20 | 2Q 19 | Change | | 2Q 20 | 2Q 19 | Change | | 2Q 20 | 2Q 19 | Change | ||||||

| | | | | | | | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | | | | | | | |

Orange County, CA | 4,820 | | $ | 32,329 | $ | 32,503 | -0.5% | | $ | 7,479 | $ | 7,364 | 1.6% | | $ | 24,850 | $ | 25,139 | -1.1% |

San Francisco, CA | 2,751 | | | 27,962 | | 30,206 | -7.4% | | | 7,041 | | 7,022 | 0.3% | | | 20,921 | | 23,184 | -9.8% |

Seattle, WA | 2,725 | | | 19,450 | | 19,825 | -1.9% | | | 5,230 | | 5,079 | 3.0% | | | 14,220 | | 14,746 | -3.6% |

Los Angeles, CA | 1,225 | | | 9,833 | | 10,207 | -3.7% | | | 2,755 | | 2,693 | 2.3% | | | 7,078 | | 7,514 | -5.8% |

Monterey Peninsula, CA | 1,565 | | | 8,718 | | 8,558 | 1.9% | | | 1,854 | | 1,845 | 0.5% | | | 6,864 | | 6,713 | 2.2% |

| 13,086 | | | 98,292 | | 101,299 | -3.0% | | | 24,359 | | 24,003 | 1.5% | | | 73,933 | | 77,296 | -4.4% |

| | | | | | | | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | 8,305 | | | 51,776 | | 52,385 | -1.2% | | | 15,785 | | 15,589 | 1.3% | | | 35,991 | | 36,796 | -2.2% |

Richmond, VA | 1,358 | | | 5,612 | | 5,544 | 1.2% | | | 1,470 | | 1,381 | 6.4% | | | 4,142 | | 4,163 | -0.5% |

Baltimore, MD | 1,099 | | | 5,527 | | 5,540 | -0.3% | | | 1,734 | | 1,560 | 11.1% | | | 3,793 | | 3,980 | -4.7% |

| 10,762 | | | 62,915 | | 63,469 | -0.9% | | | 18,989 | | 18,530 | 2.5% | | | 43,926 | | 44,939 | -2.3% |

| | | | | | | | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | |

Boston, MA | 2,440 | | | 18,864 | | 19,841 | -4.9% | | | 4,766 | | 5,022 | -5.1% | | | 14,098 | | 14,819 | -4.9% |

New York, NY | 1,640 | | | 19,548 | | 21,268 | -8.1% | | | 8,095 | | 7,259 | 11.5% | | | 11,453 | | 14,009 | -18.2% |

| 4,080 | | | 38,412 | | 41,109 | -6.6% | | | 12,861 | | 12,281 | 4.7% | | | 25,551 | | 28,828 | -11.4% |

| | | | | | | | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | |

Tampa, FL | 2,668 | | | 11,730 | | 11,591 | 1.2% | | | 4,212 | | 3,882 | 8.5% | | | 7,518 | | 7,709 | -2.5% |

Orlando, FL | 2,500 | | | 10,189 | | 10,180 | 0.1% | | | 3,049 | | 2,963 | 2.9% | | | 7,140 | | 7,217 | -1.1% |

Nashville, TN | 2,260 | | | 9,039 | | 8,739 | 3.4% | | | 2,810 | | 2,345 | 19.8% | | | 6,229 | | 6,394 | -2.6% |

| 7,428 | | | 30,958 | | 30,510 | 1.5% | | | 10,071 | | 9,190 | 9.6% | | | 20,887 | | 21,320 | -2.0% |

| | | | | | | | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | |

Dallas, TX | 3,864 | | | 16,568 | | 16,424 | 0.9% | | | 6,716 | | 6,913 | -2.9% | | | 9,852 | | 9,511 | 3.6% |

Austin, TX | 1,272 | | | 5,682 | | 5,635 | 0.8% | | | 2,332 | | 2,402 | -2.9% | | | 3,350 | | 3,233 | 3.6% |

| 5,136 | | | 22,250 | | 22,059 | 0.9% | | | 9,048 | | 9,315 | -2.9% | | | 13,202 | | 12,744 | 3.6% |

| | | | | | | | | | | | | | | | | | | |

Other Markets | 2,147 | | | 12,545 | | 12,676 | -1.0% | | | 3,764 | | 3,823 | -1.5% | | | 8,781 | | 8,853 | -0.8% |

| | | | | | | | | | | | | | | | | | | |

Total Combined | 42,639 | | $ | 265,372 | $ | 271,122 | -2.1% | | $ | 79,092 | $ | 77,142 | 2.5% | | $ | 186,280 | $ | 193,980 | -4.0% |

| (1) | 2Q19 amounts include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | See Attachment 16 for definitions and other terms. |

15

Attachment 8(C)

UDR, Inc.

Combined Same-Store Operating Information By Major Market

Current Quarter vs. Last Quarter

June 30, 2020

(Unaudited) (1)

| | Total | | Combined Same-Store | ||||||||

| | Combined | | | | | | | | | | |

| | Same-Store | | Physical Occupancy | | Total Revenue per Occupied Home | ||||||

| | Homes | | 2Q 20 | 1Q 20 | Change | | 2Q 20 | 1Q 20 | Change | ||

| | | | | | | | | | | | |

West Region | | | | | | | | | | | | |

Orange County, CA | | 4,820 | | 96.0% | 97.2% | -1.2% | | $ | 2,329 | $ | 2,368 | -1.6% |

San Francisco, CA | | 2,751 | | 92.9% | 96.5% | -3.6% | | | 3,647 | | 3,753 | -2.8% |

Seattle, WA | | 2,725 | | 96.6% | 97.6% | -1.0% | | | 2,463 | | 2,547 | -3.3% |

Los Angeles, CA | | 1,225 | | 95.8% | 97.0% | -1.2% | | | 2,793 | | 2,939 | -5.0% |

Monterey Peninsula, CA | | 1,565 | | 96.8% | 95.9% | 0.9% | | | 1,918 | | 1,953 | -1.8% |

| | 13,086 | | 95.6% | 97.0% | -1.4% | | | 2,620 | | 2,700 | -2.9% |

| | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | |

Metropolitan DC | | 8,305 | | 96.8% | 97.4% | -0.6% | | | 2,147 | | 2,202 | -2.5% |

Richmond, VA | | 1,358 | | 97.4% | 97.1% | 0.3% | | | 1,414 | | 1,407 | 0.5% |

Baltimore, MD | | 1,099 | | 98.0% | 96.6% | 1.4% | | | 1,711 | | 1,749 | -2.2% |

| | 10,762 | | 97.0% | 97.3% | -0.3% | | | 2,009 | | 2,056 | -2.3% |

| | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | |

Boston, MA | | 2,440 | | 95.3% | 95.9% | -0.6% | | | 2,704 | | 2,860 | -5.5% |

New York, NY | | 1,640 | | 92.6% | 98.4% | -5.8% | | | 4,291 | | 4,471 | -4.0% |

| | 4,080 | | 94.2% | 96.9% | -2.7% | | | 3,331 | | 3,518 | -5.3% |

| | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | |

Tampa, FL | | 2,668 | | 96.8% | 96.7% | 0.1% | | | 1,514 | | 1,540 | -1.7% |

Orlando, FL | | 2,500 | | 97.2% | 96.0% | 1.2% | | | 1,398 | | 1,420 | -1.5% |

Nashville, TN | | 2,260 | | 97.9% | 97.7% | 0.2% | | | 1,362 | | 1,359 | 0.2% |

| | 7,428 | | 97.3% | 96.8% | 0.5% | | | 1,428 | | 1,444 | -1.1% |

| | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | |

Dallas, TX | | 3,864 | | 96.6% | 96.9% | -0.3% | | | 1,480 | | 1,510 | -2.0% |

Austin, TX | | 1,272 | | 97.8% | 97.6% | 0.2% | | | 1,522 | | 1,550 | -1.8% |

| | 5,136 | | 96.9% | 97.1% | -0.2% | | | 1,490 | | 1,520 | -1.9% |

| | | | | | | | | | | | |

Other Markets | | 2,147 | | 96.4% | 96.2% | 0.2% | | | 2,020 | | 2,060 | -1.9% |

| | | | | | | | | | | | |

Total Combined/ Weighted Avg. | | 42,639 | | 96.3% | 97.0% | -0.7% | | $ | 2,155 | $ | 2,222 | -3.1% |

| (1) | See Attachment 16 for definitions and other terms. |

16

Attachment 8(D)

UDR, Inc.

Combined Same-Store Operating Information By Major Market

Current Quarter vs. Last Quarter

June 30, 2020

(Unaudited) (1)

| Total | | | Combined Same-Store ($000s) | |||||||||||||||

| Combined | | | | | | | | | | | | | | | | | | |

| Same-Store | | Revenues | | Expenses | | Net Operating Income | ||||||||||||

| Homes | | 2Q 20 | 1Q 20 | Change | | 2Q 20 | 1Q 20 | Change | | 2Q 20 | 1Q 20 | Change | ||||||

| | | | | | | | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | | | | | | | |

Orange County, CA | 4,820 | | $ | 32,329 | $ | 33,278 | -2.8% | | $ | 7,479 | $ | 7,767 | -3.7% | | $ | 24,850 | $ | 25,511 | -2.6% |

San Francisco, CA | 2,751 | | | 27,962 | | 29,892 | -6.5% | | | 7,041 | | 7,291 | -3.4% | | | 20,921 | | 22,601 | -7.4% |

Seattle, WA | 2,725 | | | 19,450 | | 20,323 | -4.3% | | | 5,230 | | 5,269 | -0.7% | | | 14,220 | | 15,054 | -5.5% |

Los Angeles, CA | 1,225 | | | 9,833 | | 10,477 | -6.1% | | | 2,755 | | 2,814 | -2.1% | | | 7,078 | | 7,663 | -7.6% |

Monterey Peninsula, CA | 1,565 | | | 8,718 | | 8,795 | -0.9% | | | 1,854 | | 1,943 | -4.6% | | | 6,864 | | 6,852 | 0.2% |

| 13,086 | | | 98,292 | | 102,765 | -4.4% | | | 24,359 | | 25,084 | -2.9% | | | 73,933 | | 77,681 | -4.8% |

| | | | | | | | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | 8,305 | | | 51,776 | | 53,426 | -3.1% | | | 15,785 | | 16,118 | -2.1% | | | 35,991 | | 37,308 | -3.5% |

Richmond, VA | 1,358 | | | 5,612 | | 5,566 | 0.8% | | | 1,470 | | 1,392 | 5.7% | | | 4,142 | | 4,174 | -0.8% |

Baltimore, MD | 1,099 | | | 5,527 | | 5,569 | -0.8% | | | 1,734 | | 1,649 | 5.1% | | | 3,793 | | 3,920 | -3.2% |

| 10,762 | | | 62,915 | | 64,561 | -2.5% | | | 18,989 | | 19,159 | -0.9% | | | 43,926 | | 45,402 | -3.3% |

| | | | | | | | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | |

Boston, MA | 2,440 | | | 18,864 | | 20,076 | -6.0% | | | 4,766 | | 5,273 | -9.6% | | | 14,098 | | 14,803 | -4.8% |

New York, NY | 1,640 | | | 19,548 | | 21,645 | -9.7% | | | 8,095 | | 8,193 | -1.2% | | | 11,453 | | 13,452 | -14.9% |

| 4,080 | | | 38,412 | | 41,721 | -7.9% | | | 12,861 | | 13,466 | -4.5% | | | 25,551 | | 28,255 | -9.6% |

| | | | | | | | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | |

Tampa, FL | 2,668 | | | 11,730 | | 11,918 | -1.6% | | | 4,212 | | 4,008 | 5.1% | | | 7,518 | | 7,910 | -5.0% |

Orlando, FL | 2,500 | | | 10,189 | | 10,225 | -0.4% | | | 3,049 | | 2,934 | 3.9% | | | 7,140 | | 7,291 | -2.1% |

Nashville, TN | 2,260 | | | 9,039 | | 9,005 | 0.4% | | | 2,810 | | 2,381 | 18.0% | | | 6,229 | | 6,624 | -6.0% |

| 7,428 | | | 30,958 | | 31,148 | -0.6% | | | 10,071 | | 9,323 | 8.0% | | | 20,887 | | 21,825 | -4.3% |

| | | | | | | | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | |

Dallas, TX | 3,864 | | | 16,568 | | 16,965 | -2.3% | | | 6,716 | | 6,481 | 3.6% | | | 9,852 | | 10,484 | -6.0% |

Austin, TX | 1,272 | | | 5,682 | | 5,772 | -1.6% | | | 2,332 | | 2,264 | 3.0% | | | 3,350 | | 3,508 | -4.5% |

| 5,136 | | | 22,250 | | 22,737 | -2.1% | | | 9,048 | | 8,745 | 3.5% | | | 13,202 | | 13,992 | -5.6% |

| | | | | | | | | | | | | | | | | | | |

Other Markets | 2,147 | | | 12,545 | | 12,763 | -1.7% | | | 3,764 | | 3,659 | 2.8% | | | 8,781 | | 9,104 | -3.5% |

| | | | | | | | | | | | | | | | | | | |

Total Combined | 42,639 | | $ | 265,372 | $ | 275,695 | -3.7% | | $ | 79,092 | $ | 79,436 | -0.4% | | $ | 186,280 | $ | 196,259 | -5.1% |

| (1) | See Attachment 16 for definitions and other terms. |

17

Attachment 8(E)

UDR, Inc.

Combined Same-Store Operating Information By Major Market (1)(2)

Current Year-to-Date vs. Prior Year-to-Date

June 30, 2020

(Unaudited) (3)

| | Total | % of Combined | | | | | | | | | | |

| | Combined | Same-Store Portfolio | | Combined Same-Store | ||||||||

| | Same-Store | Based on | | Physical Occupancy | | Total Revenue per Occupied Home | ||||||

| | Homes | YTD 2020 NOI | | YTD 20 | YTD 19 | Change | | YTD 20 | YTD 19 | Change | ||

| | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | |

Orange County, CA | | 4,434 | 12.6% | | 96.6% | 96.0% | 0.6% | | $ | 2,358 | $ | 2,347 | 0.5% |

San Francisco, CA | | 2,751 | 11.7% | | 94.7% | 97.1% | -2.4% | | | 3,701 | | 3,710 | -0.2% |

Seattle, WA | | 2,570 | 7.4% | | 97.1% | 96.6% | 0.5% | | | 2,521 | | 2,485 | 1.4% |

Los Angeles, CA | | 1,225 | 4.0% | | 96.4% | 96.4% | 0.0% | | | 2,867 | | 2,885 | -0.6% |

Monterey Peninsula, CA | | 1,565 | 3.7% | | 96.3% | 96.6% | -0.3% | | | 1,937 | | 1,863 | 4.0% |

| | 12,545 | 39.4% | | 96.2% | 96.5% | -0.3% | | | 2,679 | | 2,668 | 0.4% |

| | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | |

Metropolitan DC | | 8,305 | 19.7% | | 97.1% | 97.5% | -0.4% | | | 2,174 | | 2,152 | 1.0% |

Richmond, VA | | 1,358 | 2.2% | | 97.3% | 97.7% | -0.4% | | | 1,410 | | 1,377 | 2.4% |

Baltimore, MD | | 1,099 | 2.1% | | 97.3% | 96.8% | 0.5% | | | 1,729 | | 1,726 | 0.2% |

| | 10,762 | 24.0% | | 97.1% | 97.5% | -0.4% | | | 2,032 | | 2,011 | 1.1% |

| | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | |

Boston, MA | | 2,440 | 7.8% | | 95.6% | 96.0% | -0.4% | | | 2,782 | | 2,801 | -0.7% |

New York, NY | | 1,452 | 5.8% | | 95.3% | 97.8% | -2.5% | | | 4,489 | | 4,518 | -0.6% |

| | 3,892 | 13.6% | | 95.5% | 96.7% | -1.2% | | | 3,418 | | 3,449 | -0.9% |

| | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | |

Tampa, FL | | 2,287 | 3.5% | | 96.8% | 97.0% | -0.2% | | | 1,470 | | 1,452 | 1.2% |

Orlando, FL | | 2,500 | 3.9% | | 96.6% | 96.5% | 0.1% | | | 1,409 | | 1,400 | 0.6% |

Nashville, TN | | 2,260 | 3.5% | | 97.8% | 97.3% | 0.5% | | | 1,361 | | 1,315 | 3.5% |

| | 7,047 | 10.9% | | 97.0% | 96.9% | 0.1% | | | 1,413 | | 1,390 | 1.7% |

| | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | |

Dallas, TX | | 3,864 | 5.5% | | 96.8% | 96.1% | 0.7% | | | 1,494 | | 1,469 | 1.7% |

Austin, TX | | 1,272 | 1.8% | | 97.7% | 97.4% | 0.3% | | | 1,536 | | 1,509 | 1.8% |

| | 5,136 | 7.3% | | 97.0% | 96.4% | 0.6% | | | 1,504 | | 1,479 | 1.7% |

| | | | | | | | | | | | | |

Other Markets | | 2,147 | 4.8% | | 96.3% | 96.0% | 0.3% | | | 2,040 | | 2,034 | 0.3% |

| | | | | | | | | | | | | |

Total Combined/ Weighted Avg. | | 41,529 | 100.0% | | 96.6% | 96.8% | -0.2% | | $ | 2,184 | $ | 2,173 | 0.5% |

| (1) | YTD19 amounts include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | YTD20 includes a reserve (reflected as a reduction to revenues) of approximately $4.4 million or 0.8% of billed residential revenue on our Combined Same-Store Communities. The reserve is based on probability of collection. |

| (3) | See Attachment 16 for definitions and other terms. |

18

Attachment 8(F)

UDR, Inc.

Combined Same-Store Operating Information By Major Market (1)

Current Year-to-Date vs. Prior Year-to-Date

June 30, 2020

(Unaudited) (2)

| Total | | | Combined Same-Store ($000s) | |||||||||||||||

| Combined | | | | | | | | | | | | | | | | | | |

| Same-Store | | Revenues | | Expenses | | Net Operating Income | ||||||||||||

| Homes | | YTD 20 | YTD 19 | Change | | YTD 20 | YTD 19 | Change | | YTD 20 | YTD 19 | Change | ||||||

| | | | | | | | | | | | | | | | | | | |

West Region | | | | | | | | | | | | | | | | | | | |

Orange County, CA | 4,434 | | $ | 60,599 | $ | 59,933 | 1.1% | | $ | 13,603 | $ | 13,398 | 1.5% | | $ | 46,996 | $ | 46,535 | 1.0% |

San Francisco, CA | 2,751 | | | 57,853 | | 59,464 | -2.7% | | | 14,332 | | 13,835 | 3.6% | | | 43,521 | | 45,629 | -4.6% |

Seattle, WA | 2,570 | | | 37,744 | | 37,017 | 2.0% | | | 10,119 | | 9,865 | 2.6% | | | 27,625 | | 27,152 | 1.7% |

Los Angeles, CA | 1,225 | | | 20,311 | | 20,440 | -0.6% | | | 5,569 | | 5,455 | 2.1% | | | 14,742 | | 14,985 | -1.6% |

Monterey Peninsula, CA | 1,565 | | | 17,513 | | 16,902 | 3.6% | | | 3,797 | | 3,706 | 2.5% | | | 13,716 | | 13,196 | 3.9% |

| 12,545 | | | 194,020 | | 193,756 | 0.1% | | | 47,420 | | 46,259 | 2.5% | | | 146,600 | | 147,497 | -0.6% |

| | | | | | | | | | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | 8,305 | | | 105,202 | | 104,546 | 0.6% | | | 31,902 | | 31,721 | 0.6% | | | 73,300 | | 72,825 | 0.7% |

Richmond, VA | 1,358 | | | 11,178 | | 10,960 | 2.0% | | | 2,862 | | 2,734 | 4.7% | | | 8,316 | | 8,226 | 1.1% |

Baltimore, MD | 1,099 | | | 11,095 | | 11,017 | 0.7% | | | 3,383 | | 3,141 | 7.7% | | | 7,712 | | 7,876 | -2.1% |

| 10,762 | | | 127,475 | | 126,523 | 0.8% | | | 38,147 | | 37,596 | 1.5% | | | 89,328 | | 88,927 | 0.5% |

| | | | | | | | | | | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | |

Boston, MA | 2,440 | | | 38,940 | | 39,369 | -1.1% | | | 10,039 | | 10,439 | -3.8% | | | 28,901 | | 28,930 | -0.1% |

New York, NY | 1,452 | | | 37,271 | | 38,497 | -3.2% | | | 15,534 | | 13,730 | 13.1% | | | 21,737 | | 24,767 | -12.2% |

| 3,892 | | | 76,211 | | 77,866 | -2.1% | | | 25,573 | | 24,169 | 5.8% | | | 50,638 | | 53,697 | -5.7% |

| | | | | | | | | | | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | |

Tampa, FL | 2,287 | | | 19,532 | | 19,324 | 1.1% | | | 6,512 | | 6,183 | 5.3% | | | 13,020 | | 13,141 | -0.9% |

Orlando, FL | 2,500 | | | 20,413 | | 20,266 | 0.7% | | | 5,984 | | 5,855 | 2.2% | | | 14,429 | | 14,411 | 0.1% |

Nashville, TN | 2,260 | | | 18,045 | | 17,347 | 4.0% | | | 5,190 | | 4,742 | 9.5% | | | 12,855 | | 12,605 | 2.0% |

| 7,047 | | | 57,990 | | 56,937 | 1.8% | | | 17,686 | | 16,780 | 5.4% | | | 40,304 | | 40,157 | 0.4% |

| | | | | | | | | | | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | |

Dallas, TX | 3,864 | | | 33,533 | | 32,729 | 2.5% | | | 13,197 | | 13,768 | -4.1% | | | 20,336 | | 18,961 | 7.3% |

Austin, TX | 1,272 | | | 11,454 | | 11,217 | 2.1% | | | 4,596 | | 4,758 | -3.4% | | | 6,858 | | 6,459 | 6.2% |

| 5,136 | | | 44,987 | | 43,946 | 2.4% | | | 17,793 | | 18,526 | -4.0% | | | 27,194 | | 25,420 | 7.0% |

| | | | | | | | | | | | | | | | | | | |

Other Markets | 2,147 | | | 25,307 | | 25,152 | 0.6% | | | 7,424 | | 7,490 | -0.9% | | | 17,883 | | 17,662 | 1.3% |

| | | | | | | | | | | | | | | | | | | |

Total Combined | 41,529 | | $ | 525,990 | $ | 524,180 | 0.3% | | $ | 154,043 | $ | 150,820 | 2.1% | | $ | 371,947 | $ | 373,360 | -0.4% |

| (1) | YTD19 amounts include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | See Attachment 16 for definitions and other terms. |

19

Attachment 8(G)

UDR, Inc.

Combined Same-Store Operating Information By Major Market (1)

June 30, 2020

(Unaudited) (2)

| | Combined Effective Blended Lease Rate Growth | | Combined Effective New Lease Rate Growth | | Combined Effective Renewal Lease Rate Growth | | Combined Annualized Turnover (3)(4) | |||

| | 2Q 2020 | | 2Q 2020 | | 2Q 2020 | | 2Q 2020 | 2Q 2019 | YTD 2020 | YTD 2019 |

| | | | | | | | | | | |

West Region | | | | | | | | | | | |

Orange County, CA | | 0.8% | | -2.4% | | 4.2% | | 52.0% | 62.8% | 47.2% | 54.0% |

San Francisco, CA | | -0.4% | | -7.2% | | 3.1% | | 59.6% | 59.0% | 50.9% | 51.8% |

Seattle, WA | | 1.5% | | -2.1% | | 3.8% | | 49.3% | 54.0% | 48.5% | 48.6% |

Los Angeles, CA | | 0.4% | | -4.4% | | 4.4% | | 35.4% | 52.7% | 33.6% | 44.3% |

Monterey Peninsula, CA | | 3.8% | | 1.1% | | 5.5% | | 34.6% | 40.2% | 36.9% | 38.8% |

| | 0.8% | | -3.2% | | 3.9% | | 50.8% | 57.4% | 46.4% | 50.2% |

| | | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | |

Metropolitan DC | | 0.4% | | -4.6% | | 3.8% | | 43.9% | 52.0% | 36.2% | 41.1% |

Richmond, VA | | 1.9% | | -2.0% | | 5.1% | | 46.1% | 50.5% | 45.0% | 45.1% |

Baltimore, MD | | 1.3% | | -1.7% | | 4.1% | | 47.8% | 60.2% | 42.5% | 48.4% |

| | 0.6% | | -4.0% | | 4.0% | | 44.6% | 52.8% | 38.3% | 42.5% |

| | | | | | | | | | | |

Northeast Region | | | | | | | | | | | |

Boston, MA | | 1.4% | | -3.2% | | 4.3% | | 51.9% | 59.2% | 43.2% | 48.4% |

New York, NY | | 0.3% | | -6.4% | | 2.0% | | 71.9% | 42.6% | 46.5% | 29.3% |

| | 0.7% | | -4.3% | | 3.0% | | 61.6% | 53.8% | 44.6% | 42.9% |

| | | | | | | | | | | |

Southeast Region | | | | | | | | | | | |

Tampa, FL | | 0.7% | | -2.8% | | 4.7% | | 57.9% | 58.8% | 54.0% | 52.3% |

Orlando, FL | | -0.6% | | -3.8% | | 3.3% | | 47.8% | 55.8% | 46.0% | 48.6% |

Nashville, TN | | 2.0% | | -2.0% | | 5.1% | | 45.6% | 55.6% | 44.1% | 47.6% |

| | 0.7% | | -3.0% | | 4.4% | | 51.3% | 56.8% | 48.7% | 49.7% |

| | | | | | | | | | | |

Southwest Region | | | | | | | | | | | |

Dallas, TX | | 1.7% | | -1.9% | | 4.8% | | 47.2% | 54.3% | 44.0% | 47.3% |

Austin, TX | | 1.6% | | -2.4% | | 4.8% | | 44.1% | 56.4% | 43.5% | 52.3% |

| | 1.7% | | -2.0% | | 4.8% | | 46.5% | 54.8% | 43.9% | 48.6% |

| | | | | | | | | | | |

Other Markets | | 1.8% | | -1.0% | | 4.2% | | 46.3% | 57.7% | 42.7% | 49.4% |

| | | | | | | | | | | |

Total Combined/Weighted Avg. | | 0.8% | | -3.3% | | 3.9% | | 48.9% | 55.1% | 43.7% | 46.8% |

| | | | | | | | | | | |

| | | | | | | | | | | |

2Q 2019 Combined Weighted Avg. Lease Rate Growth (4) | | 4.4% | | 3.2% | | 5.6% | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

2Q 2020 Combined Percentage of Total Repriced Homes | | | | 43.8% | | 56.2% | | | | | |

| (1) | 2Q19 and YTD19 amounts include the Acquired JV Same-Store Portfolio Communities (the 11 communities and 3,619 homes previously owned by UDR unconsolidated JVs) as if these communities were 100% owned by UDR during all periods presented. |

| (2) | See Attachment 16 for definitions and other terms. |

| (3) | 2Q20 Combined same-store home count: 42,639. YTD 2020 Combined same-store home count: 41,529. |

| (4) | 2Q19 Combined same-store home count: 41,796. YTD 2019 Combined same-store home count: 41,578. |

20

Attachment 9

UDR, Inc.

Development Summary

June 30, 2020

(Dollars in Thousands)

(Unaudited) (1)

Wholly-Owned | | | | | | | | | | | | | | | | | | | | | | |||

| | | | | | | | | | | | | | | Schedule | | | Percentage | ||||||

| | # of | Compl. | Cost to | Budgeted | Est. Cost | | Project | | | Initial | | | | | | ||||||||

Community | Location | Homes | Homes | Date | Cost | per Home | | Debt | Start | Occ. | Compl. | | Leased | | Occupied | |||||||||

| | | | | | | | | | | | | | | | | | | | | | |||