Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - MASIMO CORP | masiq22020nongaapsuppl.htm |

| EX-99.1 - EXHIBIT 99.1 - MASIMO CORP | masi-20200728xex991.htm |

| 8-K - 8-K - MASIMO CORP | masi-20200728x8k.htm |

Second Quarter 2020 Improving Patient Outcomes Earnings Presentation | July 28, 2020 Reducing the Cost of Care®

FORWARD-LOOKING STATEMENTS These presentations contain forward-looking statements within the meaning of federal securities laws, including, among others, statements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assume,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of these presentations are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in these presentations. The risks and uncertainties that may cause actual results to differ materially from Masimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10-K and Form 10-Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request.

NON-GAAP FINANCIAL MEASURES The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to- period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on- going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has presented the following non-GAAP measures to assist investors in understanding the Company’s core net operating results on an on-going basis: (i) constant currency product revenue growth %, (ii) non-GAAP gross profit/margin %, (iii) non-GAAP SG&A expense, (iv) non- GAAP R&D expense, (v) non-GAAP operating expense %, (vi) non-GAAP operating income/margin %, (vii) non-GAAP earnings per diluted share and (viii) adjusted free cash flow. These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes constant currency product revenue growth, non-GAAP gross profit/margin, non-GAAP operating income/margin, non-GAAP net income, non-GAAP net income per diluted share, and adjusted free cash flow are important measures in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non-GAAP reconciliations, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

Second Quarter 2020 Highlights Total revenue, including royalty and other revenue, increased 31.0% to $301.0 million Revenue Product revenue increased 31.1% to $301.0 million, or 32.0% on a constant currency basis(1) Shipments Shipments of noninvasive technology boards and instruments were 165,600 GAAP operating margin was 20.7% Profitability Non-GAAP operating margin(1) was 21.1% GAAP EPS was $0.96 per diluted share EPS Non-GAAP EPS(1) was $0.85 per diluted share Operating cash flow was $63.7 million Cash Adjusted free cash flow(1) was $49.4 million Cash and investments balance was $681.9 million (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

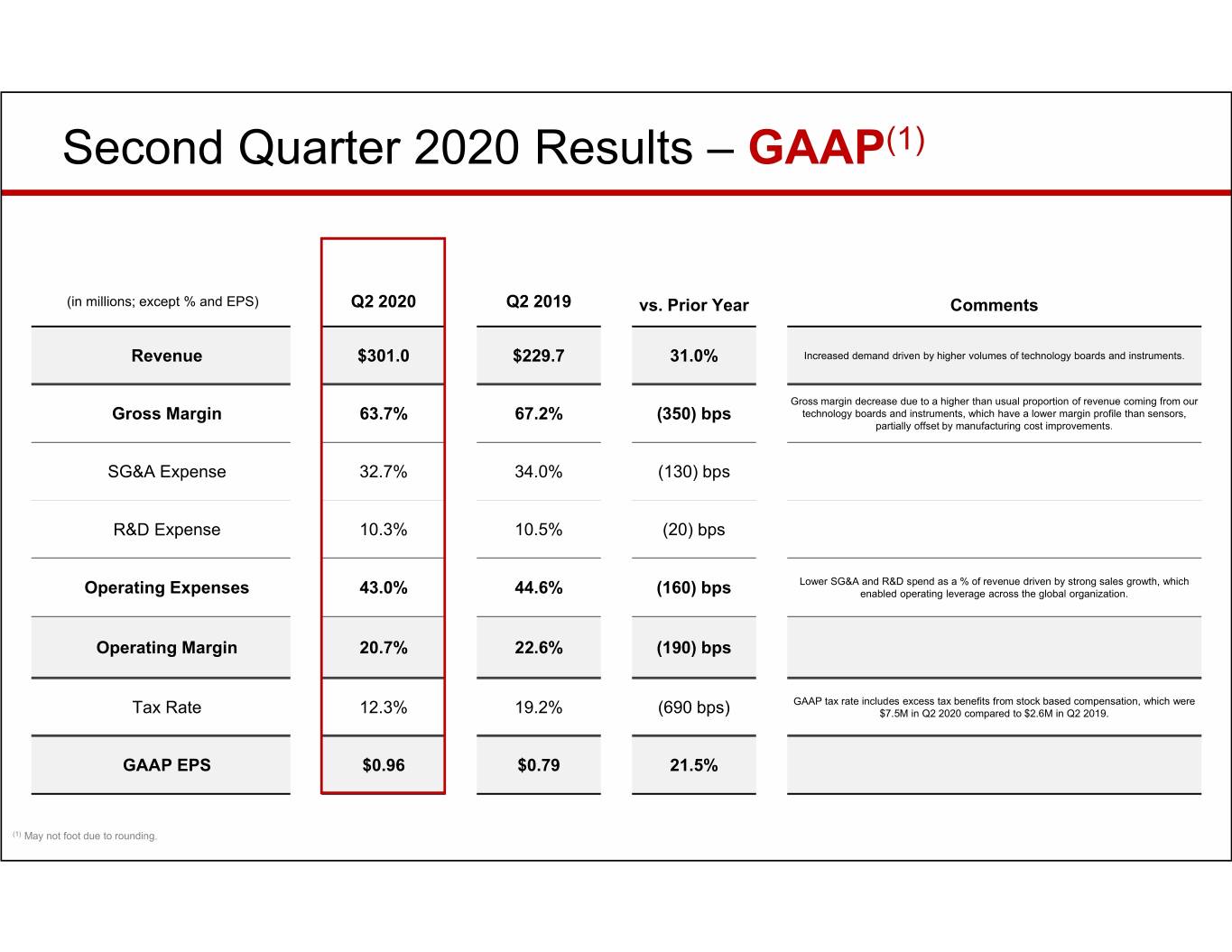

Second Quarter 2020 Results – GAAP(1) (in millions; except % and EPS) Q2 2020 Q2 2019 vs. Prior Year Comments Revenue $301.0 $229.7 31.0% Increased demand driven by higher volumes of technology boards and instruments. Gross margin decrease due to a higher than usual proportion of revenue coming from our Gross Margin 63.7% 67.2% (350) bps technology boards and instruments, which have a lower margin profile than sensors, partially offset by manufacturing cost improvements. SG&A Expense 32.7% 34.0% (130) bps R&D Expense 10.3% 10.5% (20) bps Lower SG&A and R&D spend as a % of revenue driven by strong sales growth, which Operating Expenses 43.0% 44.6% (160) bps enabled operating leverage across the global organization. Operating Margin 20.7% 22.6% (190) bps GAAP tax rate includes excess tax benefits from stock based compensation, which were Tax Rate 12.3% 19.2% (690 bps) $7.5M in Q2 2020 compared to $2.6M in Q2 2019. GAAP EPS $0.96 $0.79 21.5% (1) May not foot due to rounding.

Second Quarter 2020 Results – Non-GAAP(1) vs. Prior Year Constant (in millions; except % and EPS) Q2 2020 Q2 2019 Reported Comments Currency Increased demand driven by higher volumes of technology Revenue $301.0 $229.5 31.1% 32.0% boards and instruments. Gross margin decrease due to a higher than usual proportion of revenue coming from our technology boards and instruments, Gross Margin 63.9% 67.2% (330) bps which have a lower margin profile than sensors, partially offset by manufacturing cost improvements. SG&A Expense 32.5% 33.6% (110) bps R&D Expense 10.3% 10.5% (20) bps Lower SG&A and R&D spend as a % of revenue driven by strong sales growth, which enabled operating leverage across the global Operating Expenses 42.7% 44.1% (140) bps organization. Operating Margin 21.1% 23.1% (200) bps Tax Rate 24.2% 23.8% 40 bps Non-GAAP EPS $0.85 $0.76 11.8% (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. May not foot due to rounding.

Second Quarter 2020 Results – Non-GAAP(1) Non-GAAP(1) Non-GAAP(1) Product Revenue Operating Margin EPS $301M 23.1% $0.85 $230M 21.1% $0.76 Constant Currency +32.0%Growth(1) (200) bps +11.8% Q2 2019 Q2 2020 Q2 2019 Q2 2020 Q2 2019 Q2 2020 (1) Non-GAAP measures shown have been adjusted for certain items that are fully described in the Appendix. Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information.

Context for 2020 Outlook • Given the uncertainties around the COVID-19 pandemic and its potential impacts on our business, the Company is not providing guidance for 2020. • The potential positive impacts include increased demand for our products from both direct and OEM customers. • The potential negative impacts include potential interruptions in our manufacturing operations and our suppliers’ manufacturing operations, and potential reductions in future demand if there has been overbuying of our products due to the pandemic.

APPENDICES Improving Patient Outcomes GAAP to Non-GAAP Reducing the Cost of Care® Adjustments and Reconciliations

Description of Non-GAAP Adjustments The non-GAAP financial measures reflect adjustments for the following items, as well as the related income tax effects thereof: Constant currency adjustments Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period to period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our product revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our product revenue growth rate will continue to occur in future periods. Royalty and other revenue, net of related costs We derive royalty and other revenue, net of related costs, associated with certain non-recurring contractual arrangements that we do not expect to continue in the future. We believe the exclusion of royalty and other revenue, net of related costs, associated with these certain non-recurring revenue streams is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Acquisition/strategic investment-related costs, including depreciation and amortization Depreciation and amortization related to the revaluation of assets and liabilities (primarily intangible assets, property, plant and equipment adjustments, inventory revaluation, lease liabilities, etc.) to fair value through purchase accounting related to value created by the seller prior to the acquisition/strategic investment rather than ongoing costs of operating our core business. As a result, we believe that exclusion of these costs in presenting non-GAAP financial measures provides management and investors a more effective means of evaluating historical performance and projected costs and the potential for realizing cost efficiencies within our core business. Depreciation and amortization related to the revaluation of acquisition related assets and liabilities will generally recur in future periods. In the event the Company acquires, invests in or divests certain business operations, there may be non-recurring gains, losses or expenses that will be recognized related to the assets and/or liabilities sold or acquired that are not representative of normal on-going cash flows. These gains, losses or expenses are excluded from non-GAAP earnings. Litigation damages, awards and settlements In connection with litigation proceedings arising in the course of our business, we have recorded expenses as a defendant in such proceedings in the form of damages, as well as gains as a plaintiff in such proceedings in the form of litigation awards and settlement proceeds. We believe that exclusion of these gains (netofanyrelatedcosts incurred in the period the award or settlement is recognized) and losses is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these expenses and gains are generally unrelated to our core business and/or infrequent in nature.

Description of Non-GAAP Adjustments Realized and unrealized gains or losses from foreign currency transactions: We are exposed to foreign currency gains or losses on outstanding foreign currency denominated receivables and payables related to certain customer sales agreements, product costs and other operating expenses. As the Company does not actively hedge these currency exposures, changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Since such realized and unrealized foreign currency gains and losses are the result of macro-economic factors and can vary significantly from one period to the next, we believe that exclusion of such realized and unrealized gains and losses are useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. Realized and unrealized foreign currency gains and losses are likely to recur in future periods. Excess tax benefits from stock-based compensation Current authoritative accounting guidance requires that excess tax benefits or costs recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. Since we cannot control or predict when stock option awards will be exercised or the price at which such awards will be exercised, the impact of such guidance can create significant volatility in our effective tax rate from one period to the next. We believe that exclusion of these excess tax benefits or costs is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. These excess tax benefits or costs will generally recur in future periods as long as we continue to issue equity awards to our employees. Tax impacts that may not be representative of the ongoing results of our core operations The Tax Cuts and Jobs Act of 2017 (2017 Tax Act) was signed into law in December 2017, and became effective January 1, 2018. The 2017 Tax Act included a number of changes to existing U.S. federal tax law impacting businesses including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21%, a one-time transition tax on the “deemed repatriation” of cumulative undistributed foreign earnings as of December 31, 2017 and changes in the prospectivetaxationofthe foreign operations of U.S. multinational companies. From time to time, we may also record tax benefits relating to the de-recognition of uncertain tax positions due to the expiration of the statutes of limitations. During the twelve months ended December 29, 2018, we recorded a significant tax benefit due to the expiration of the applicable statutes of limitations related to certain non-recurring transactions. We believe that exclusion of the tax charges related to the 2017 Tax Act and the tax benefit resulting from the expiration of certain statutes of limitations related to non- recurring transactions is useful to management and investors in evaluating the performance of our ongoing operations on a period-to-period basis. In this regard, we note that these tax items are unrelated to our core business and non-recurring in nature. Adjusted Free Cash Flow Represents free cash flow (cash flow from operations less cash used for the purchase of property, plant and equipment) adjusted for the impact of cash receipts or payments relating to certain previously described non-GAAP adjustments, which may impact period over period comparability.

Constant Currency Product Revenue(1),(2) RECONCILIATION OF GAAP PRODUCT REVENUE GROWTH TO CONSTANT CURRENCY PRODUCT REVENUE GROWTH (in thousands, except percentages) Q2 2019 Q2 2020 GAAP product revenue $ 229,510 $ 300,953 Constant currency F/X adjustments 1,997 Constant currency (non-GAAP) product revenue $ 229,510 $302,950 GAAP product revenue growth 31.1% Constant currency (non-GAAP) product revenue growth 32.0% (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding.

Non-GAAP Gross Margin %(1),(2) RECONCILIATION OF GAAP GROSS PROFIT/MARGIN TO NON-GAAP GROSS PROFIT/MARGIN: (in thousands, except percentages) Q2 2019 Q2 2020 GAAP gross profit/margin$ 154,339 $ 191,584 Non-GAAP adjustments: Royalty and other revenue, net of related costs (111) - Acquisition & investment related costs 114 578 Total non-GAAP gross profit/margin adjustments 3 578 Non-GAAP gross profit/margin$ 154,343 $ 192,163 Non-GAAP gross margin % (3) 67.2% 63.9% (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Calculated as a percentage of product revenue.

Non-GAAP Operating Expense %(1),(2) RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: (in thousands, except percentages) Q2 2019 Q2 2020 GAAP selling, general and administrative operating expenses$ 78,160 $ 98,461 Non-GAAP adjustments: Acquisition & investment related costs (1,022) (711) Non-GAAP selling, general and administrative operating expenses $ 77,138 $ 97,750 Non-GAAP selling, general and administrative operating expenses % (3) 33.6% 32.5% GAAP research and development operating expenses$ 24,175 $ 30,878 Non-GAAP adjustments: Acquisition & investment related costs - (24) Non-GAAP research and development operating expenses$ 24,175 $ 30,854 Non-GAAP research and development operating expenses % (3) 10.5% 10.3% GAAP litigation settlement, award and/or defense costs$ - $ 25 Non-GAAP adjustments: Litigation damages, awards and settlements - (25) Non-GAAP litigation settlement, award and/or defense costs$ - $ - GAAP operating expenses$ 102,335 $ 129,364 Non-GAAP adjustments: Acquisition & investment related costs (1,022) (735) Litigation damages, awards and settlements - $ (25) Total non-GAAP operating expense adjustments (1,022) (760) Non-GAAP operating expenses$ 101,312 $ 128,604 Non-GAAP operating expenses % (3) 44.1% 42.7% (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Calculated as a percentage of product revenue.

Non-GAAP Operating Margin %(1),(2) RECONCILIATION OF GAAP OPERATING INCOME/MARGIN TO NON-GAAP OPERATING INCOME/MARGIN: (in thousands, except percentages) Q2 2019 Q2 2020 GAAP operating income/margin$ 52,004 $ 62,220 Non-GAAP adjustments: Royalty and other revenue, net of related costs (111) - Acquisition & investment related costs 1,136 1,313 Litigation damages, awards and settlements - 25 Total non-GAAP operating income/margin adjustments 1,025 1,338 Non-GAAP operating income/margin$ 53,030 $ 63,558 Non-GAAP operating income % (3) 23.1% 21.1% (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding. (3) Calculated as a percentage of product revenue.

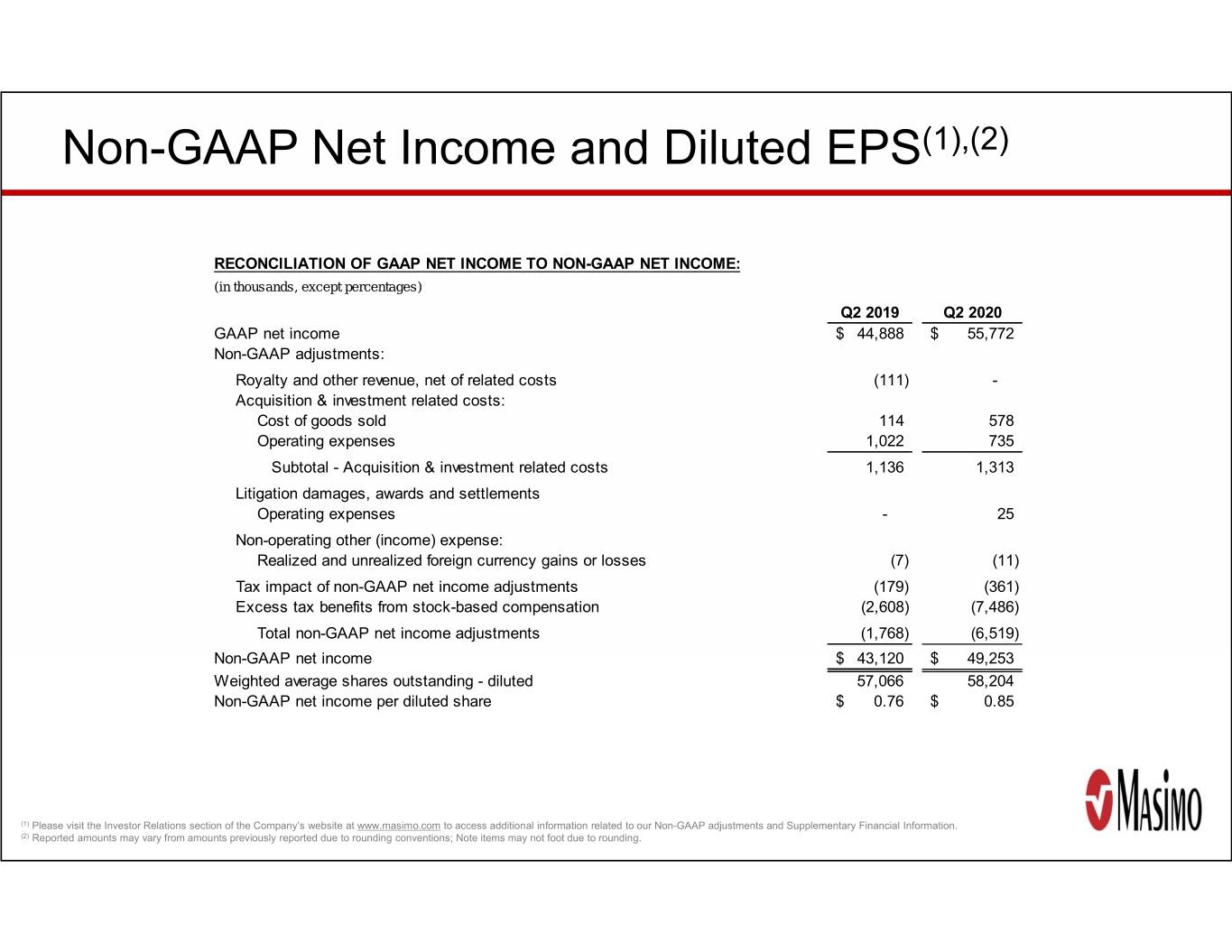

Non-GAAP Net Income and Diluted EPS(1),(2) RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: (in thousands, except percentages) Q2 2019 Q2 2020 GAAP net income $ 44,888 $ 55,772 Non-GAAP adjustments: Royalty and other revenue, net of related costs (111) - Acquisition & investment related costs: Cost of goods sold 114 578 Operating expenses 1,022 735 Subtotal - Acquisition & investment related costs 1,136 1,313 Litigation damages, awards and settlements Operating expenses - 25 Non-operating other (income) expense: Realized and unrealized foreign currency gains or losses (7) (11) # Tax impact of non-GAAP net income adjustments (179) (361) 980Excess tax benefits from stock-based compensation (2,608) (7,486) Total non-GAAP net income adjustments (1,768) (6,519) Non-GAAP net income$ 43,120 $ 49,253 Weighted average shares outstanding - diluted 57,066 58,204 Non-GAAP net income per diluted share$ 0.76 $ 0.85 (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding.

Adjusted Free Cash Flow(1),(2) RECONCILIATION OF FREE CASH FLOW TO ADJUSTED FREE CASH FLOW (in thousands, except percentages) Q2 2019 Q2 2020 Net cash provided by operating activities Net cash provided by operating activities$ 58,311 $ 63,712 Purchases of property and equipment, net (40,360) (14,266) Free cash flow 17,951 49,446 Litigation damages, awards and settlements - - Tax payments related to litigation awards and damages - - Adjusted free cash flow $ 17,951 $ 49,446 (1) Please visit the Investor Relations section of the Company’s website at www.masimo.com to access additional information related to our Non-GAAP adjustments and Supplementary Financial Information. (2) Reported amounts may vary from amounts previously reported due to rounding conventions; Note items may not foot due to rounding.