Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JETBLUE AIRWAYS CORP | form8-kxq22020earnings.htm |

| EX-99.1 - EXHIBIT 99.1 - JETBLUE AIRWAYS CORP | ex991-earningsreleaseq.htm |

2Q 2020 EARNINGS PRESENTATION JULY 28, 2020

SAFE HARBOR Statements in this presentation (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; our significant fixed obligations and substantial indebtedness; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; the impact of infectious diseases that affects demand for air travel or travel behavior, such as the ongoing impact of the coronavirus (“COVID-19”); adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2019 Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. Our forward-looking statements speak only as of the date of this presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. This presentation also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within the Appendix A section of this presentation.

2Q 2020 EARNINGS UPDATE ROBIN HAYES CHIEF EXECUTIVE OFFICER

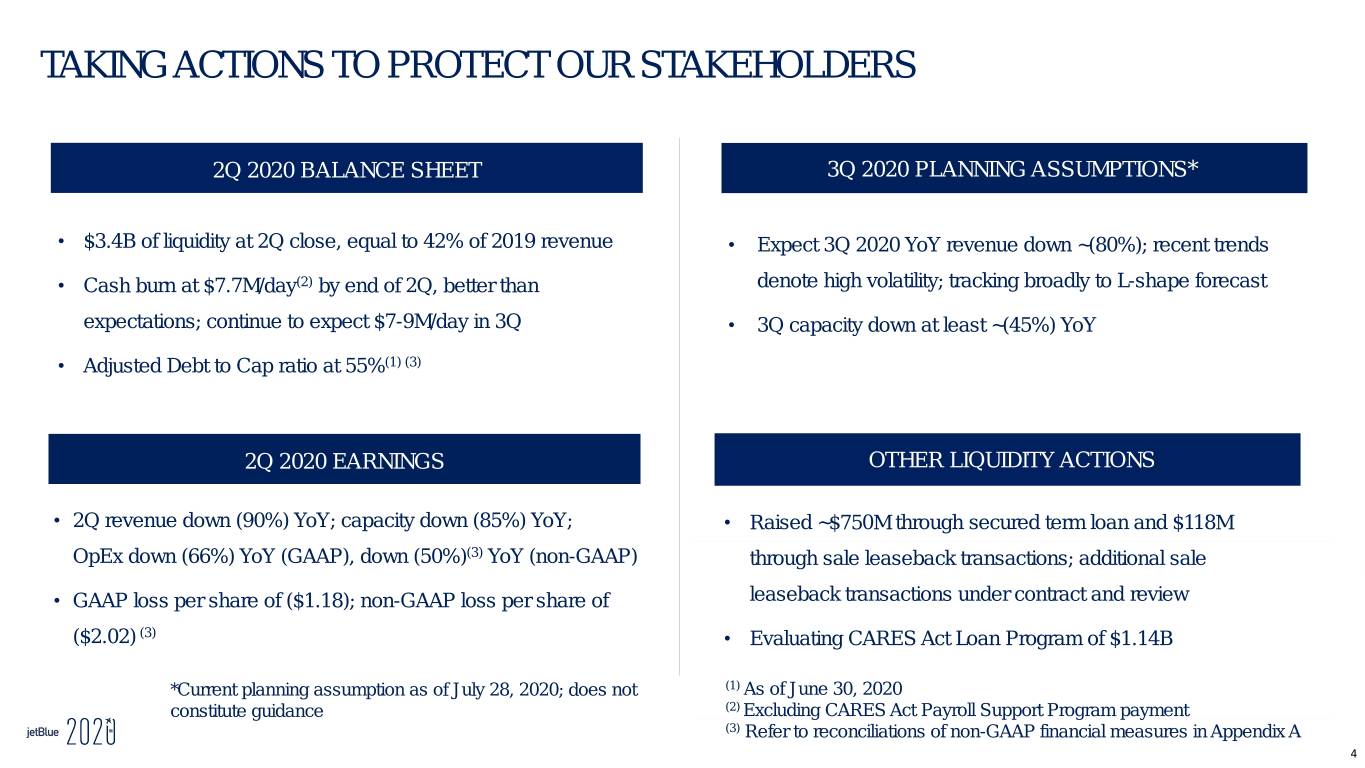

TAKING ACTIONS TO PROTECT OUR STAKEHOLDERS 2Q 2020 BALANCE SHEET 3Q 2020 PLANNING ASSUMPTIONS* • $3.4B of liquidity at 2Q close, equal to 42% of 2019 revenue • Expect 3Q 2020 YoY revenue down ~(80%); recent trends • Cash burn at $7.7M/day(2) by end of 2Q, better than denote high volatility; tracking broadly to L-shape forecast expectations; continue to expect $7-9M/day in 3Q • 3Q capacity down at least ~(45%) YoY • Adjusted Debt to Cap ratio at 55%(1) (3) 2Q 2020 EARNINGS OTHER LIQUIDITY ACTIONS • 2Q revenue down (90%) YoY; capacity down (85%) YoY; • Raised ~$750M through secured term loan and $118M OpEx down (66%) YoY (GAAP), down (50%)(3) YoY (non-GAAP) through sale leaseback transactions; additional sale • GAAP loss per share of ($1.18); non-GAAP loss per share of leaseback transactions under contract and review ($2.02) (3) • Evaluating CARES Act Loan Program of $1.14B *Current planning assumption as of July 28, 2020; does not (1) As of June 30, 2020 constitute guidance (2) Excluding CARES Act Payroll Support Program payment (3) Refer to reconciliations of non-GAAP financial measures in Appendix A 4

FOCUSED ON NEAR AND LONG TERM RECOVERY PLAN • Balance capacity, aligning variable costs to revenue trends 1. Reduce Cash Burn • Support cash generation with tactical network actions • Reduce working capital and near-term CAPEX • Generate operating cash, working towards positive free cash flow 2. Rebuild Margins • Reduce fixed cost base to support recovery efforts • Balance ROIC-accretive fleet and technology investments • Aim to achieve pre-COVID investment grade metrics 3. Repair Balance Sheet • Balance CAPEX in light of required debt payments • Maintain liquidity to mitigate impact of demand environment 5

COMMERCIAL UPDATE & OUTLOOK JOANNA GERAGHTY PRESIDENT & CHIEF OPERATING OFFICER

EXECUTING STRATEGY TO MANAGE SHORT TERM AND ACCELERATE RECOVERY Agreement reached with LAWA to grow LAX to 70 daily departures by 2025 SHORT- MEDIUM TERM ACTIONS LONG TERM ACTIONS − Leveraging Newark access to strengthen New York Focus City − Partnering with American Airlines to bring low-fares, increase options for − Reallocating assets to reflect demand environment, generate cash; Northeast customers maintaining flexibility to adjust capacity as needed − Consolidating Long Beach operation to LAX to drive efficiency in near-term; − Permanently closing Long Beach, and tactically suspending under-performing solidifying Transcon success, and setting up platform for future growth margin routes − Improving connectivity in Fort Lauderdale to strengthen competitive advantage, complement point-to-point model 7

MANAGING SHORT TERM BOOKINGS VOLATILITY REVENUE YOY GROWTH Actual Estimate • Demand bottomed in mid-April; some improvement through 2Q started in late May Current planning assumption* − 2Q 2020 revenue declined (90%) YoY, driven by acute demand challenges − Small improvement in volumes stalled in July -15% • Expect continued volatility in 3Q bookings − Based on latest forward bookings and current planning assumptions, estimating 3Q revenue decline of approximately (80%) YoY -83% -80% -94% -93% -90% − Demand continues to be driven by COVID-19 infection rates and quarantine measures in place April May June 1Q 2Q 3Q* *Current planning assumption as of July 28, 2020; does not constitute guidance 8

ADJUSTING CAPACITY TO EVOLVING DEMAND TRENDS ASM YOY GROWTH Flown Planned • Significant capacity reductions in 2Q in response to lower demand Current planning assumption* − 2Q capacity down (85%) YoY; continued to manage scheduled and close-in cancels − Near-term capacity actions aimed at generating cash -4% • 3Q capacity aimed at cash generation opportunities − Planning Q3 capacity decline of at least ~(45%) YoY; -45% managing capacity to drive improvements in bookings and revenue -79% -85% -85% − Adapting quickly to volatile revenue trends; reduced -91% August schedules ~20% in late July in response to April May June 1Q 2Q 3Q* demand stalling in July *Current planning assumption as of July 28, 2020; does not constitute guidance 9

FINANCIAL UPDATE & OUTLOOK STEVE PRIEST CHIEF FINANCIAL OFFICER

SUMMARY FINANCIALS 2Q 2020 METRIC 2Q 2020 2Q 2019 Change YoY ASM (millions) 2,413 16,029 (84.9%) RASM (cents) 8.91 13.14 (32.2%) CASM (cents) 25.90 11.58 123.7% CASM ex-Fuel(1) (cents) 36.95 8.46 336.6% Fuel ($/gallon) 0.96 2.16 (55.4%) Earnings per Share (GAAP) (1.18) 0.59 Earnings per Share(1) (Non-GAAP) (2.02) 0.60 (1) Refer to reconciliations of non-GAAP financial measures in Appendix A 11

MAINTAINING A STRONG LIQUIDITY POSITION 3,434 118 717 936 533 1,799 403 691 550 67 78 150 3/31/20 Cash from CAPEX Debt Barclays Credit Payroll Term Loan Sale Total Liquidity(1) Ops(2) Payments Point Revolver Support After Fees Leaseback Liquidity as Purchase Program(3) Transactions of 6/30/20(1) (1) Cash, cash equivalents and short-term investments, and restricted cash for CARES Act PSP. (2) Operating cash burn through June 30, 2020. Cash burn includes net sales, operating cash outlays, working capital timing, and excludes financing for future aircraft deliveries. This cash burn includes SW&B paid with PSP funds (3) Includes $403M of PSP funds used to pay for SW&B and $533M of remaining restricted PSP funds 12

REBUILDING OUR MARGINS THROUGH COST EXECUTION YOY OPERATING EXPENSES COST INITIATIVES Actual GAAP Actual Non-GAAP (1) Planned Current planning • Aggressive cost reductions and capacity actions assumption* in response to changes in demand 7% ‒ Managing variable and fixed costs in the short term, -4% with capacity actions to protect liquidity and generate cash • Planning for margin recovery through cost -35% -45% restructuring efforts -49% -50% -55% ‒ Permanently removing fixed costs, maximizing -64% -64% -66% -71% variable/fixed ratio April May June 1Q 2Q 3Q* *Current planning assumption as of July 28, 2020; does not constitute guidance (1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A 13

REDUCING OUR CAPITAL EXPENDITURES REVISED CAPEX FLEET* Actual Planned (US$ million) As of 12/31/2019 As of 12/31/2020* 1 6 13 800 - 850 35 35 28 28 130 130 175 67 60 60 2Q 3Q* 2020* 2019 2020* E190 A320 A321 HD A321 Mint A321neo HD A220 • Expect to continue revisiting CAPEX based on recovery • On July 1st, took delivery of one A321neo, fleet count 263 trends • Remaining 2020 NEO deliveries to be financed through sale • Anticipate taking three more A321neos, one A220 leasebacks *Current planning assumption as of July 28, 2020; does not constitute guidance. Please refer to Appendix C for latest order book 14

TAKING ACTION TO PROTECT LIQUIDITY LEVERAGE DEBTDEBT REPAYMENTS* REPAYMENTS* Principal Interest Adjusted (US$ million) Debt to Cap (1) Actuals Planned 55% 44% 34% 102 93 78 89 (2) 41 44 19 30 Dec 31 2019 Mar 31 2020 Jun 30 2020 1Q 2Q 3Q* 4Q* • Raised ~$750M via term loan, exceeding initial expectations *Cash outflows related to debt repayment schedule (principal and • Executed $118M in sale leaseback (“SLB”) transactions in 2Q; interest) as of 6/30/2020; does not assume any future debt raises and does not constitute guidance additional SLBs under contract • Received $251M under CARES Act PSP. Evaluating CARES (1) Refer to reconciliations of non-GAAP financial measures in Appendix A Act Loan Program for $1.14B as contingency plan (2) $32M additional cash outflows during period related to financing fees 15

QUESTIONS?

APPENDIX A Non-GAAP Financial Measures JetBlue sometimes uses non-GAAP financial measures in this presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information in Appendices A and B provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. 17

2Q 2020 FINANCIAL RESULTS US$ Millions 2Q 2020 2Q 2019 Var % Total Operating Revenues 215 2,105 (89.8) Aircraft fuel and related taxes 29 484 (94.0) Salaries, wages and benefits 477 576 (17.1) Landing fees and other rents 62 121 (48.8) Depreciation and amortization 140 127 10.2 Aircraft rent 16 25 (36.7) Sales and marketing 8 75 (89.6) Maintenance, materials and repairs 73 168 (56.4) Other operating expenses 124 277 (55.3) Special items (304) 2 (13,121.7) Operating (Loss) Income (410) 250 (264.3) Other Income (Expense) (40) (14) (198.6) (Loss) income before income taxes (450) 236 (290.2) Income tax (benefit) expense (130) 57 (326.8) * Refer to reconciliations of NET (LOSS) INCOME (320) 179 (278.6) non-GAAP Pre-Tax Margin (209.2%) 11.2% (220.4) pts financial (Loss) Earnings per Share (EPS) (GAAP) ($1.18) $0.59 measures in this Appendix A Adj. Pre-Tax Margin* (351.0%) 11.3% (362.3) pts Adj. (Loss) Earnings per Share (EPS)* (Non- GAAP) ($2.02) $0.60 18

Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non-GAAP financial measure. In 2020, special items include contra expenses recognized on the utilization of payroll support grants received under the CARES Act and the impairment charge of our Embraer E190 fleet. Special items for 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operatingLOCATIONexpense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines. NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited) Three Months Ended Six Months Ended June 30, June 30, 2020 2019 2020 2019 $ per ASM $ per ASM $ per ASM $ per ASM Total operating expenses $ 625 $ 25.90 $ 1,855 $ 11.58 $ 2,547 $ 14.72 $ 3,652 $ 11.60 Less: Aircraft fuel and related taxes 29 1.21 484 3.02 394 2.28 921 2.93 Other non-airline expenses 9 0.36 12 0.09 22 0.13 23 0.07 Special items (304) (12.62) 2 0.01 (102) (0.59) 14 0.04 Operating expenses, excluding fuel $ 891 $ 36.95 $ 1,357 $ 8.46 $ 2,233 $ 12.90 $ 2,694 $ 8.56 19

Operating Expense, Income before Taxes, Net Income and Earnings per Share, excluding special items Our GAAP results in the applicable periods were impacted by charges that are deemed special items. We believe the impacts of these items make our results difficult to compare to prior periods as well as future periods and guidance. In 2020, special items include contra expenses recognized on the utilization of payroll support grants received under the CARES Act and the impairment charge of our Embraer E190 fleet. Special items for 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe the impacts of these items distort our overall trends and that our metrics and results are enhanced with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impacts of these items. NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE, INCOME BEFORE TAXES, NET INCOME AND EARNINGS PER SHARE EXCLUDING SPECIAL ITEMS (in millions, except per share amounts) (unaudited) Three Months Ended Six Months Ended June 30, June 30, 2020 2019 2020 2019 Total operating revenues $ 215 $ 2,105 $ 1,803 $ 3,977 Total operating expenses $ 625 $ 1,855 $ 2,547 $ 3,652 Less: Special items (304) 2 (102) 14 Total operating expenses excluding special items $ 929 $ 1,853 $ 2,649 $ 3,638 Operating (loss) income $ (410) $ 250 $ (744) $ 325 Add back: Special items (304) 2 (102) 14 Operating (loss) income excluding special items $ (714) $ 252 $ (846) $ 339 Operating margin excluding special items -332.6% 12.0% -46.9% 8.5% (Loss) income before income taxes $ (450) $ 236 $ (804) $ 294 Add back: Special items (304) 2 (102) 14 (Loss) income before income taxes excluding special items $ (754) $ 238 $ (906) $ 308 Pre-tax margin excluding special items -351.0% 11.3% -50.2% 7.8% Net (loss) income $ (320) $ 179 $ (588) $ 221 Add back: Special items (304) 2 (102) 14 Less: Income tax (expense) benefit related to special items (76) 1 (26) 3 Net (loss) income excluding special items $ (548) $ 180 $ (664) $ 232 (Loss) Earnings Per Common Share: Basic $ (1.18) $ 0.60 $ (2.14) $ 0.73 Add back: Special items, net of tax (0.84) - (0.28) 0.03 Basic excluding special items $ (2.02) $ 0.60 $ (2.42) $ 0.76 Diluted $ (1.18) $ 0.59 $ (2.14) $ 0.73 Add back: Special items, net of tax (0.84) 0.01 (0.28) 0.03 Diluted excluding special items $ (2.02) $ 0.60 $ (2.42) $ 0.76 20

Operating Expense, Income before Taxes, Net Income and Earnings per Share, excluding special items Our GAAP results in the applicable periods were impacted by charges that are deemed special items. We believe the impacts of these items make our results difficult to compare to prior periods as well as future periods and guidance. In 2020, special items include contra expenses recognized on the utilization of payroll support grants received under the CARES Act and the impairment charge of our Embraer E190 fleet. Special items for 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe the impacts of these items distort our overall trends and that our metrics and results are enhanced with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impacts of these items. NON-GAAP FINANCIAL MEASURE RECONCILIATION OF MONTHLY OPERATING EXPENSE EXCLUDING SPECIAL ITEMS (in millions) (unaudited) Month ended 2020 2019 April 30, May 31, June 30, April 30, May 31, June 30, Total operating expenses $ 219 $ 182 $ 224 $ 607 $ 631 $ 617 Less: Special items (113) (99) (92) 1 1 - Operating expenses, excluding special items $ 332 $ 281 $ 316 $ 606 $ 630 $ 617 21

APPENDIX B: CALCULATION OF LEVERAGE RATIOS Adjusted Debt to Capitalization Ratio Adjusted debt to capitalization ratio is a non-GAAP financial metric which we believe is helpful to investors in assessing the company's overall debt profile. Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted capitalization represents total equity plus adjusted debt. LOCATION NON-GAAP FINANCIAL MEASURE ADJUSTED DEBT TO CAPITALIZATION RATIO (in millions) (unaudited) June 30, 2020 December 31, 2019 Long-term debt and finance leases $ 3,430 $ 1,990 Current maturities of long-term debt and finance leases 362 344 Short-term borrowings 984 - Operating lease liabilities - aircraft 163 183 Adjusted debt 4,939 2,517 Long-term debt and finance leases 3,430 1,990 Current maturities of long-term debt and finance leases 362 344 Short-term borrowings 984 - Operating lease liabilities - aircraft 163 183 Stockholders' equity 4,094 4,799 Adjusted capitalization 9,033 7,316 Adjusted debt to capitalization ratio 55% 34% 22

APPENDIX C: CONTRACTUAL ORDER BOOK A220 A321NEO A321NEO LR Total 2020* 1 7 8 2021 7 5 5 17 2022 8 7 15 Total 16 12 12 40 Delivery schedule, as of July 28, 2020 *Includes 3 deliveries received in 1Q 2020 23

APPENDIX D: RELEVANT JETBLUE MATERIALS www.investor.jetblue.com/investor-relations DOCUMENT LOCATION Investor Presentations http://blueir.investproductions.com/investor-relations/events-and-presentations/presentations Earnings Releases http://blueir.investproductions.com/investor-relations/financial-information/quarterly-results Annual Reports http://blueir.investproductions.com/investor-relations/financial-information/reports/annual-reports SEC Filings http://blueir.investproductions.com/investor-relations/financial-information/sec-filings Proxy Statements http://blueir.investproductions.com/investor-relations/financial-information/reports/proxy-statements Investor Updates http://blueir.investproductions.com/investor-relations/financial-information/investor-updates Traffic Reports http://blueir.investproductions.com/investor-relations/financial-information/traffic-releases ESG Reports* http://blueir.investproductions.com/investor-relations/financial-information/reports/sustainable-accounting-standards-board-reports * Environmental, Social, and Governance Reports 24