Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - A10 Networks, Inc. | atenq22020exhibit991.htm |

| 8-K - 8-K - A10 Networks, Inc. | form8-k7282020.htm |

Q2 2020 Financial Results & Commentary July 28, 2020 Always Secure. Always Available.

Cautionary Statements & Disclosures This presentation and the accompanying oral presentation contain “forward-looking” statements that are based on our management’s beliefs and assumptions, including statements regarding market trends, the impact of COVID-19 on our business, including demand for our products, pipeline and near-term disruption in our supply chain, our positioning and recurring revenues, our strategy and objectives, our expectations as to future operating results, including as to non-GAAP profitability and operating expenses, our plans with respect to issuing guidance. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our actual results to differ materially from those anticipated or implied by our forward-looking statements. These factors include, but are not limited to, the impact of COVID-19 on our business, on the business of our customers and suppliers, and on the global economy in general, execution risks related to closing key deals and improving our execution, successfully executing our strategies, market adoption of our products, successfully anticipating market needs and opportunities, timely development of new products and features, achieving or maintaining profitability, loss or delay of expected purchases, our ability to maintain or improve our competitive position; competitive and execution risks related to cloud-based computing trends, attracting and retaining new end-customers, maintaining and enhancing our brand and reputation, changes demanded by our customers in the deployment and payment model for our products, growth in markets relating to network security, the success of any future acquisitions or investments, the success of our partnerships with technology providers, the ability of our sales team to execute well, our ability to shorten our close cycle, the ability of our channel partners to sell our products, variations in product mix or geographic locations of our sales, our presence in international markets, and other factors described in our quarterly reports on Form 10-Q, annual reports on Form 10-K and other filings made with the Securities and Exchange Commission, to which your attention is directed. The forward-looking statements included in this presentation are based on current expectations and beliefs as of July 28, 2020 only. We do not intend to update this information contained in the forward-looking statements, except as required by law. This presentation and the accompanying oral presentation also include certain non-GAAP financial measures. Non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under U.S. GAAP. We consider these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used by the company's management for that purpose. Definitions of our non-GAAP financial measures and a reconciliation between GAAP and non-GAAP financial measures can be found in the appendix to this document and in the accompanying financial results press release. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis is not available due to high variability and low visibility with respect to the charges which are excluded from these non-GAAP measures. 2

Agenda • Introduction • 2Q Overview • 2Q Financial Performance 3

A10 Core Purpose, Mission and Vision CORE PURPOSE VISION MISSION Enabling a secure To empower our We enable service and available digital customers to providers and world provide the most enterprises to secure and deliver business- available digital critical applications experience that are secure, available and efficient for multi-cloud transformation and 5G readiness 4

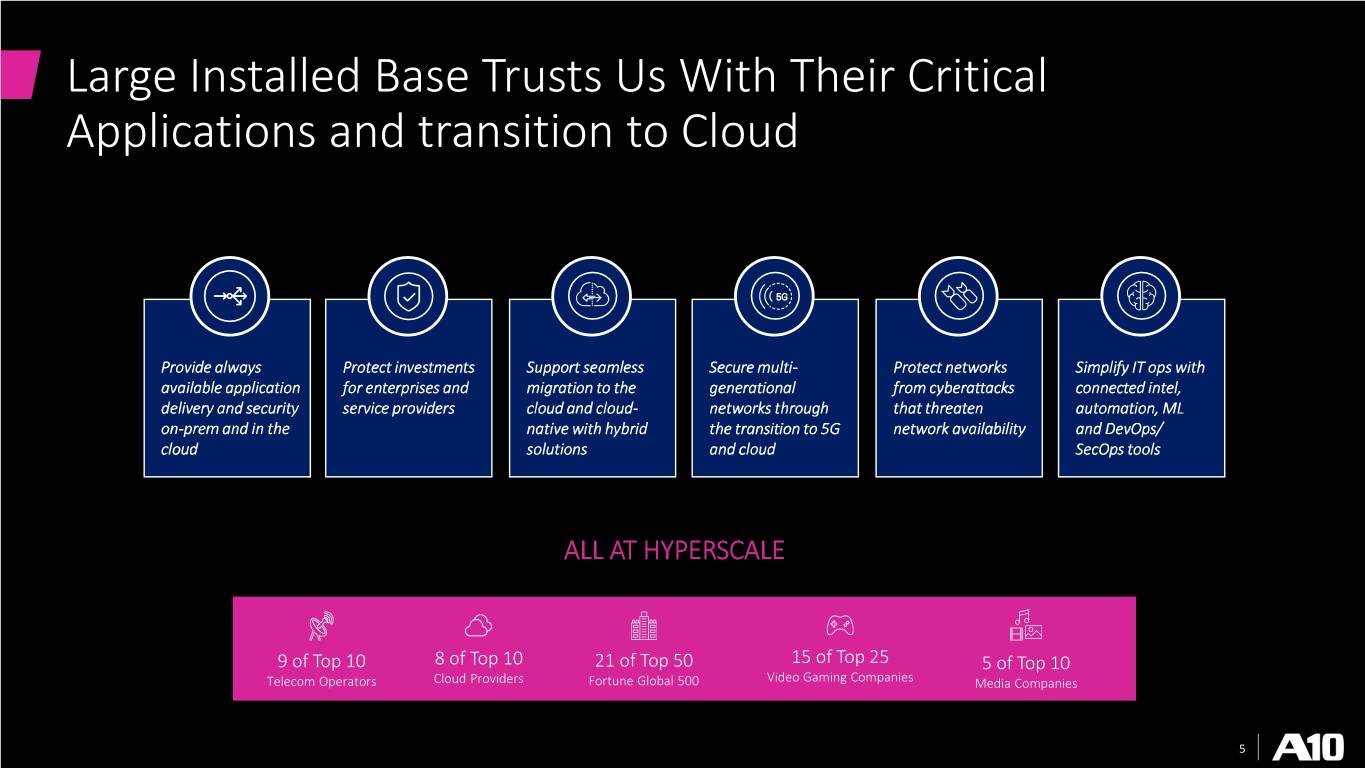

Large Installed Base Trusts Us With Their Critical Applications and transition to Cloud Provide always Protect investments Support seamless Secure multi- Protect networks Simplify IT ops with available application for enterprises and migration to the generational from cyberattacks connected intel, delivery and security service providers cloud and cloud- networks through that threaten automation, ML on-prem and in the native with hybrid the transition to 5G network availability and DevOps/ cloud solutions and cloud SecOps tools ALL AT HYPERSCALE 9 of Top 10 8 of Top 10 21 of Top 50 15 of Top 25 5 of Top 10 Telecom Operators Cloud Providers Fortune Global 500 Video Gaming Companies Media Companies 5

Market Trends driving our Solutions IoT Shift to 5G/4G+ Operational Security Proliferation Cloud Deployment Complexity Threats 6

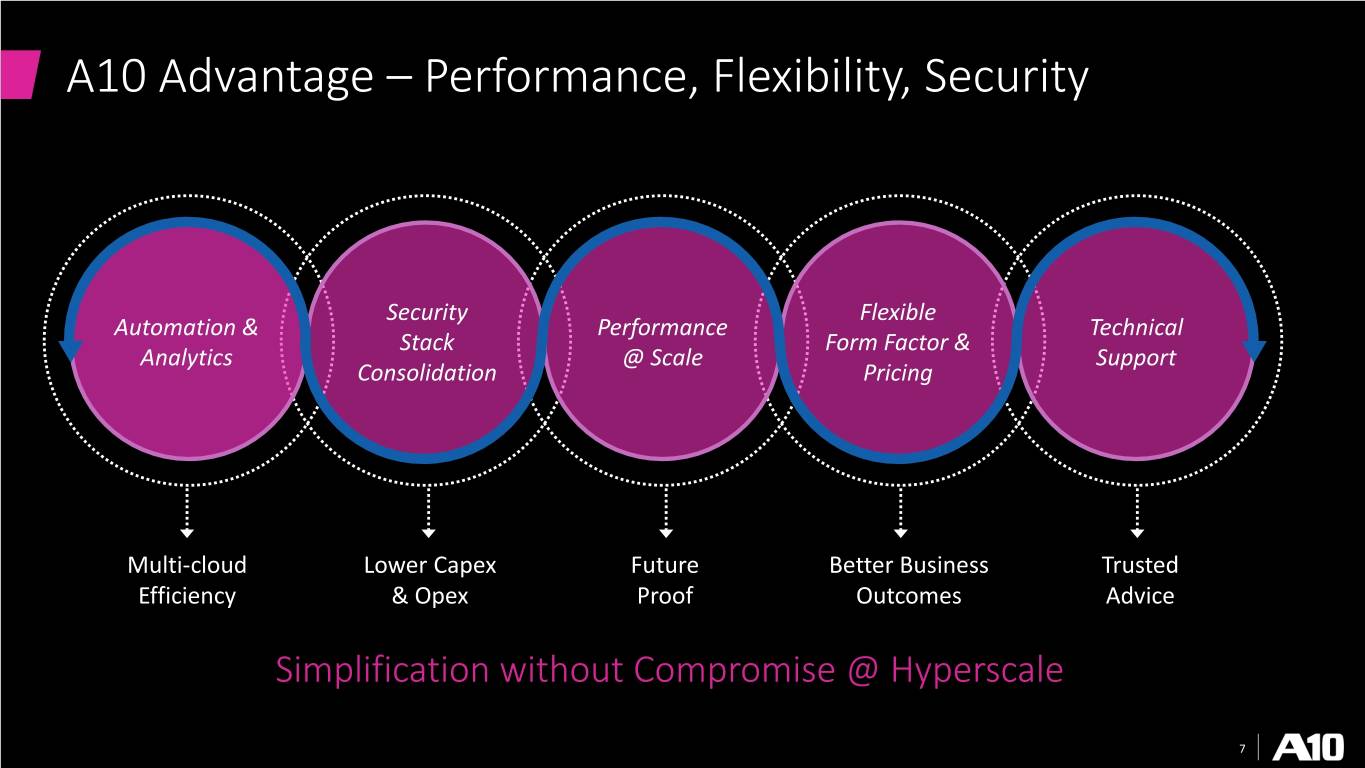

A10 Advantage – Performance, Flexibility, Security Security Flexible Automation & Performance Technical Stack Form Factor & Analytics @ Scale Support Consolidation Pricing Multi-cloud Lower Capex Future Better Business Trusted Efficiency & Opex Proof Outcomes Advice Simplification without Compromise @ Hyperscale 7

Q2’20: Delivering Results • Delivered strong operating results in Q2 while diligently navigating a rapidly changing economic environment • Year-over-Year growth for: • Revenue • Net Income • Adjusted EBITDA • Diluted EPS • Significantly improved earnings power • Reduced operating expenses • Objectives • Remain laser focused on improving our execution, our efficiency and long-term objectives • Clear goal of maximizing profitability and building shareholder value 8

Near-term Expectations • Continue to expect to see some near-term delays related to COVID-19 • Well-equipped to mitigate any related disruption • Strong pipeline and win rate with lower visibility of order patterns in the next 90-day period related to changing global business environment • Guidance • Continuing to suspend practice of providing quarterly guidance • Expect to maintain profitability in Q3 • Now expect to reduce annual Operating Expenses by $14 million o Up from original expectation of $10 million reduction 9

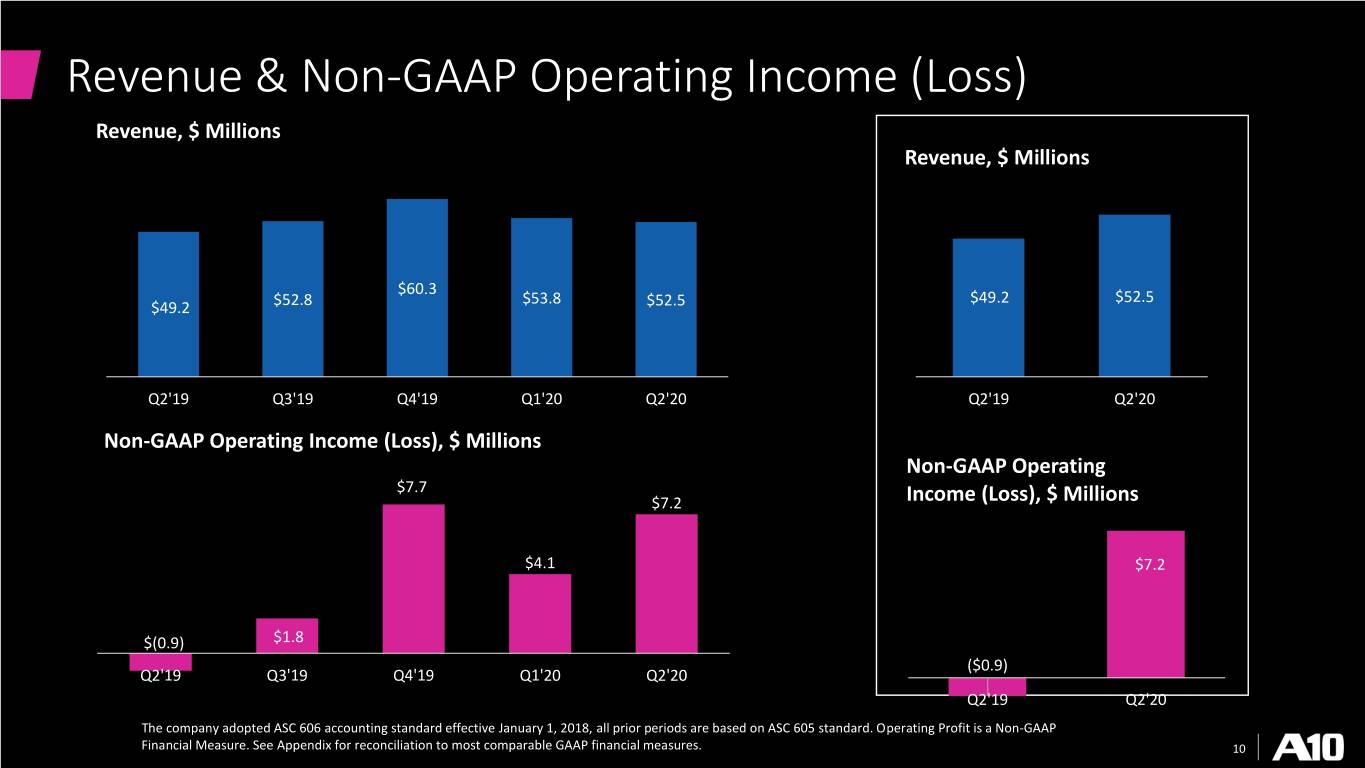

Revenue & Non-GAAP Operating Income (Loss) Revenue, $ Millions Revenue, $ Millions $60.3 $53.8 $49.2 $52.5 $49.2 $52.8 $52.5 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q2'19 Q2'20 Non-GAAP Operating Income (Loss), $ Millions Non-GAAP Operating $7.7 $7.2 Income (Loss), $ Millions $4.1 $7.2 $(0.9) $1.8 ($0.9) Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q2'19 Q2'20 The company adopted ASC 606 accounting standard effective January 1, 2018, all prior periods are based on ASC 605 standard. Operating Profit is a Non-GAAP Financial Measure. See Appendix for reconciliation to most comparable GAAP financial measures. 10

Revenue by Customer Vertical $Millions 36% 35% 2Q 2020 45% 41% 42% $52.5 million 42% 64% 65% 58% 55% 59% 58% Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Service and Cloud Providers Enterprise The company adopted ASC 606 accounting standard effective January 1, 2018, all prior periods are based on ASC 605 standard. 11

Revenue by Geography $Millions 13% 12% 12% 11% 15% 2Q 2020 $52.5 million 9% 15% 19% 16% 15% 33% 29% 27% 24% 15% 30% 15% 46% 46% 47% 46% 24% 38% 43% Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Americas Japan APAC ex Japan EMEA The company adopted ASC 606 accounting standard effective January 1, 2018, all prior periods are based on ASC 605 standard. 12

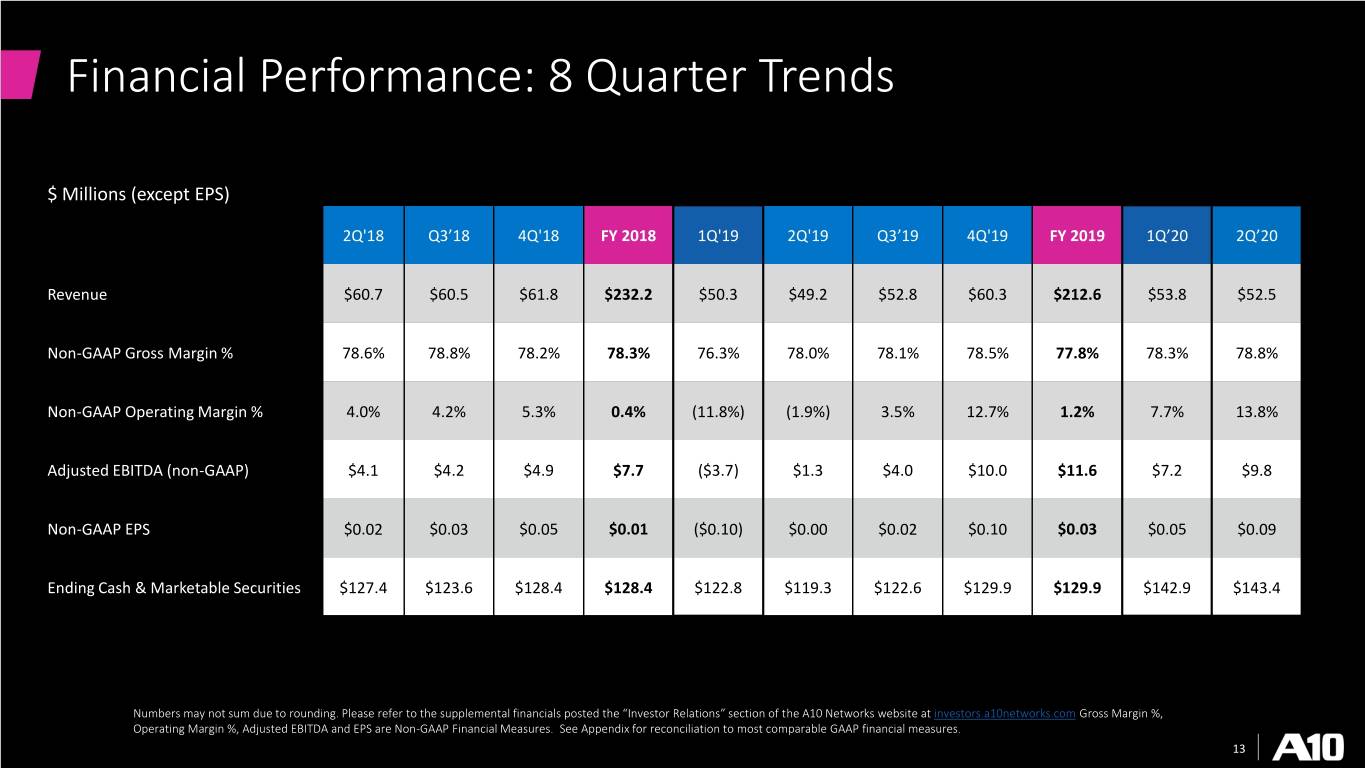

Financial Performance: 8 Quarter Trends $ Millions (except EPS) 2Q'18 Q3’18 4Q'18 FY 2018 1Q'19 2Q'19 Q3’19 4Q'19 FY 2019 1Q’20 2Q’20 Revenue $60.7 $60.5 $61.8 $232.2 $50.3 $49.2 $52.8 $60.3 $212.6 $53.8 $52.5 Non-GAAP Gross Margin % 78.6% 78.8% 78.2% 78.3% 76.3% 78.0% 78.1% 78.5% 77.8% 78.3% 78.8% Non-GAAP Operating Margin % 4.0% 4.2% 5.3% 0.4% (11.8%) (1.9%) 3.5% 12.7% 1.2% 7.7% 13.8% Adjusted EBITDA (non-GAAP) $4.1 $4.2 $4.9 $7.7 ($3.7) $1.3 $4.0 $10.0 $11.6 $7.2 $9.8 Non-GAAP EPS $0.02 $0.03 $0.05 $0.01 ($0.10) $0.00 $0.02 $0.10 $0.03 $0.05 $0.09 Ending Cash & Marketable Securities $127.4 $123.6 $128.4 $128.4 $122.8 $119.3 $122.6 $129.9 $129.9 $142.9 $143.4 Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com Gross Margin %, Operating Margin %, Adjusted EBITDA and EPS are Non-GAAP Financial Measures. See Appendix for reconciliation to most comparable GAAP financial measures. 13

Appendix 14

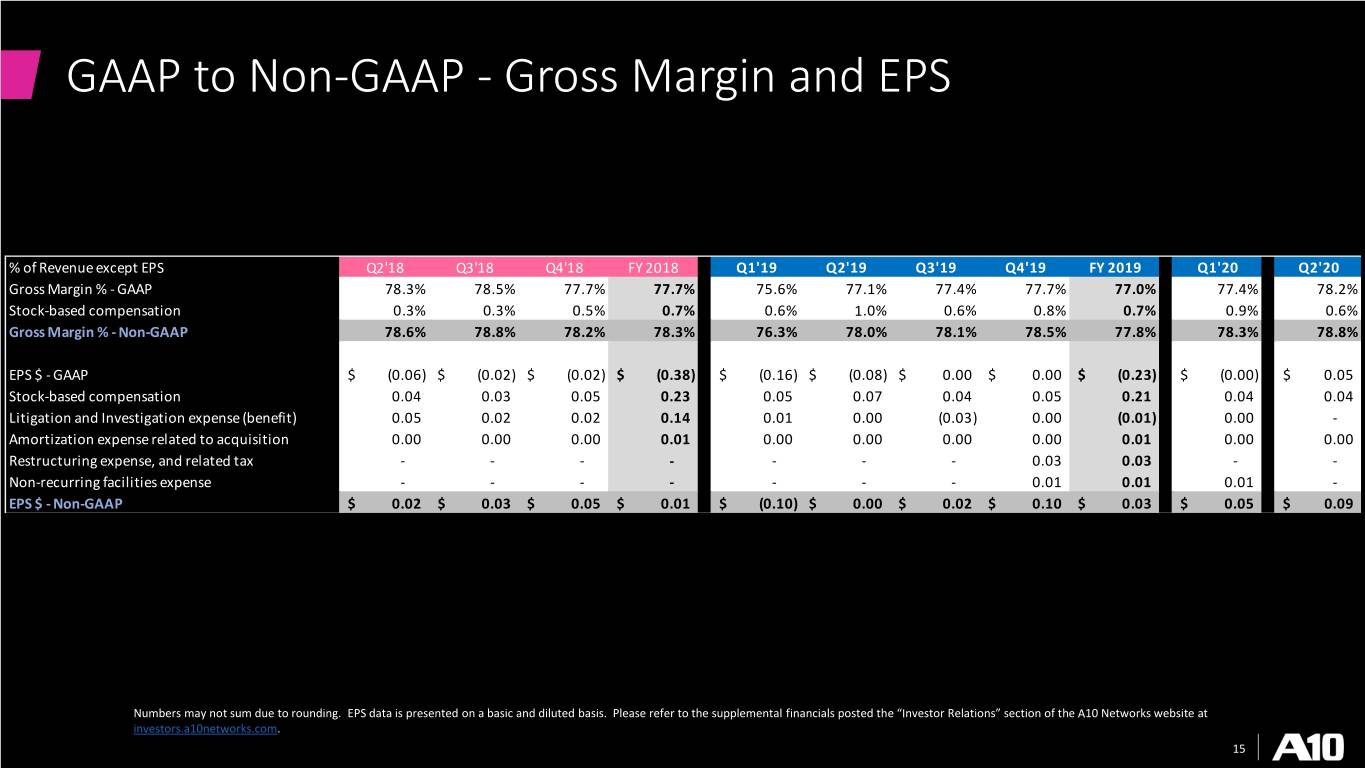

GAAP to Non-GAAP - Gross Margin and EPS % of Revenue except EPS Q2'18 Q3'18 Q4'18 FY 2018 Q1'19 Q2'19 Q3'19 Q4'19 FY 2019 Q1'20 Q2'20 Gross Margin % - GAAP 78.3% 78.5% 77.7% 77.7% 75.6% 77.1% 77.4% 77.7% 77.0% 77.4% 78.2% Stock-based compensation 0.3% 0.3% 0.5% 0.7% 0.6% 1.0% 0.6% 0.8% 0.7% 0.9% 0.6% Gross Margin % - Non-GAAP 78.6% 78.8% 78.2% 78.3% 76.3% 78.0% 78.1% 78.5% 77.8% 78.3% 78.8% EPS $ - GAAP $ ( 0.06) $ ( 0.02) $ ( 0.02) $ ( 0.38) $ ( 0.16) $ ( 0.08) $ 0.00 $ 0.00 $ ( 0.23) $ ( 0.00) $ 0.05 Stock-based compensation 0.04 0.03 0.05 0.23 0.05 0.07 0.04 0.05 0.21 0.04 0.04 Litigation and Investigation expense (benefit) 0.05 0.02 0.02 0.14 0.01 0.00 ( 0.03) 0.00 ( 0.01) 0.00 - Amortization expense related to acquisition 0.00 0.00 0.00 0.01 0.00 0.00 0.00 0.00 0.01 0.00 0.00 Restructuring expense, and related tax - - - - - - - 0.03 0.03 - - Non-recurring facilities expense - - - - - - - 0.01 0.01 0.01 - EPS $ - Non-GAAP $ 0.02 $ 0.03 $ 0.05 $ 0.01 $ ( 0.10) $ 0.00 $ 0.02 $ 0.10 $ 0.03 $ 0.05 $ 0.09 Numbers may not sum due to rounding. EPS data is presented on a basic and diluted basis. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. 15

GAAP to Non-GAAP - Operating Expenses $ Millions Q2'18 Q3'18 Q4'18 FY 2018 Q1'19 Q2'19 Q3'19 Q4'19 FY 2019 Q1'20 Q2'20 Total operating expenses $ - GAAP $ 51.2 $ 49.1 $ 50.4 $ 208.0 $ 49.0 $ 44.3 $ 40.7 $ 46.8 $ 180.8 $ 41.8 $ 37.2 Stock-based compensation ( 2.4) ( 2.1) ( 3.7) ( 15.4) ( 3.6) ( 4.6) ( 3.2) ( 3.9) ( 15.2) ( 2.7) ( 2.8) Litigation and Investigation expense (benefit) ( 3.3) ( 1.5) ( 1.5) ( 10.5) ( 0.9) ( 0.2) 2.2 ( 0.0) 1.1 ( 0.0) - Amortization expense related to acquisition ( 0.3) ( 0.3) ( 0.3) ( 1.0) ( 0.3) ( 0.3) ( 0.3) ( 0.3) ( 1.0) ( 0.3) ( 0.3) Restructuring expense - - - - - - - ( 2.5) ( 2.5) - - Non-recurring facilities expense - - - - - - - ( 0.4) ( 0.4) ( 0.8) - Total operating expenses $ - Non-GAAP $ 45.3 $ 45.1 $ 45.1 $ 181.1 $ 44.3 $ 39.3 $ 39.4 $ 39.7 $ 162.7 $ 38.0 $ 34.1 0.1217746 0.1228406 % of Revenue Total operating expenses % - GAAP 84.4 % 81.1 % 81.6 % 89.6 % 97.4 % 90.1 % 77.0 % 77.6 % 85.1 % 77.8 % 70.8 % Stock-based compensation (3.9)% (3.5)% (5.9)% (6.6)% (7.1)% (9.3)% (6.0)% (6.4)% (7.1)% (5.1)% (5.3)% Litigation and Investigation expense (benefit) (5.4)% (2.5)% (2.4)% (4.5)% (1.7)% (0.4)% 4.1 % (0.1)% 0.5 % (0.1)% —% Amortization expense related to acquisition (0.4)% (0.4)% (0.4)% (0.4)% (0.5)% (0.5)% (0.5)% (0.4)% (0.5)% (0.5)% (0.5)% Restructuring expense —% —% —% —% —% —% —% (4.2)% (1.2)% —% —% Non-recurring facilities expense —% —% —% —% —% —% —% (0.7)% (0.2)% (1.5)% —% Total operating expenses % - Non-GAAP 74.6 % 74.6 % 72.9 % 78.0 % 88.1 % 80.0 % 74.6 % 65.8 % 76.5 % 70.7 % 65.0 % Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. 16

GAAP to Non-GAAP - Operating Income $ Millions Q2'18 Q3'18 Q4'18 FY 2018 Q1'19 Q2'19 Q3'19 Q4'19 FY 2019 Q1'20 Q2'20 Income (loss) from operations $ - GAAP $ ( 3.7) $ ( 1.6) $ ( 2.4) $ ( 27.7) $ ( 11.0) $ ( 6.4) $ 0.2 $ 0.1 $ ( 17.1) $ ( 0.2) $ 3.9 Stock-based compensation 2.6 2.3 4.0 17.0 3.9 5.0 3.5 4.3 16.8 3.2 3.1 Litigation and Investigation expense (benefit) 3.3 1.5 1.5 10.5 0.9 0.2 ( 2.2) 0.0 ( 1.1) 0.0 - Amortization expense related to acquisition 0.3 0.3 0.3 1.0 0.3 0.3 0.3 0.3 1.0 0.3 0.3 Restructuring expense - - - - - - - 2.5 2.5 - - Non-recurring facilities expense - - - - - - - 0.4 0.4 0.8 - Income (loss) from operations $ - Non-GAAP $ 2.4 $ 2.5 $ 3.3 $ 0.9 $ ( 5.9) $ ( 0.9) $ 1.8 $ 7.7 $ 2.6 $ 4.1 $ 7.2 % of Revenue Income (loss) from operations % - GAAP (6.1)% (2.6)% (3.9)% (11.9)% (21.8)% (13.1)% 0.4 % 0.1 % (8.0)% (0.4)% 7.5 % Stock-based compensation 4.2 % 3.9 % 6.4 % 7.3 % 7.7 % 10.3 % 6.6 % 7.2 % 7.9 % 6.0 % 5.9 % Litigation and Investigation expense (benefit) 5.4 % 2.5 % 2.4 % 4.5 % 1.7 % 0.4 % (4.1)% 0.1 % (0.5)% 0.1 % —% Amortization expense related to acquisition 0.4 % 0.4 % 0.4 % 0.4 % 0.5 % 0.5 % 0.5 % 0.4 % 0.5 % 0.5 % 0.5 % Restructuring expense —% —% —% —% —% —% —% 4.2 % 1.2 % —% —% Non-recurring facilities expense —% —% —% —% —% —% —% 0.7 % 0.2 % 1.5 % —% Income (loss) from operations % - Non-GAAP 4.0 % 4.2 % 5.3 % 0.4 % (11.8)% (1.9)% 3.5 % 12.7 % 1.2 % 7.6 % 13.8 % Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. 17

GAAP to Non-GAAP - Adjusted EBITDA $ Millions Q2'18 Q3'18 Q4'18 FY 2018 Q1'19 Q2'19 Q3'19 Q4'19 FY 2019 Q1'20 Q2'20 GAAP net income (loss) $ ( 4.5) $ ( 1.8) $ ( 1.6) $ ( 27.6) $ ( 12.3) $ ( 5.8) $ 0 .2 $ 0 .1 $ ( 17.8) $ ( 0.3) $ 3 .8 Exclude: Interest expense 0 .0 0 .0 0 .0 0 .1 0 .2 0 .0 0 .0 0 .0 0 .2 - 0 .0 Exclude: Interest inc and other (inc) exp, net 0 .4 0 .1 ( 1.3) ( 1.3) 0 .6 ( 0.8) ( 0.3) ( 0.5) ( 0.9) ( 0.2) ( 0.2) Exclude: Depreciation & amortization expense 2 .0 1 .9 1 .9 7 .9 2 .4 2 .5 2 .5 2 .6 1 0.0 3 .3 2 .8 Exclude: Provision for income taxes 0 .4 0 .1 0 .4 1 .1 0 .5 0 .1 0 .3 0 .5 1 .4 0 .3 0 .3 EBITDA ( 1.7) 0 .3 ( 0.6) ( 19.8) ( 8.5) ( 3.9) 2 .7 2 .7 ( 7.1) 3 .1 6 .7 Exclude: Stock-based compensation 2 .6 2 .3 4 .0 1 7.0 3 .9 5 .0 3 .5 4 .3 1 6.8 3 .2 3 .1 Exclude: Litigation settlement and investigation exp 3 .3 1 .5 1 .5 1 0.5 0 .9 0 .2 ( 2.2) 0 .0 ( 1.1) 0 .0 - Exclude: Restructuring expense - - - - - - - 2 .5 2 .5 - - Exclude: Non-recurring facilities costs - - - - - - - 0 .4 0 .4 0 .8 - Adjusted EBITDA - Non-GAAP $ 4.1 $ 4.2 $ 4.9 $ 7.7 $ ( 3.7) $ 1.3 $ 4.0 $ 10.0 $ 11.6 $ 7.2 $ 9.8 Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. 18

Thank You Investors@a10networks.Com Always Secure. Always Available.