Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 EARNINGS PRESENTATION PDF - LEGG MASON, INC. | f1q21earningspresentation.pdf |

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE PDF - LEGG MASON, INC. | pressrelease6302020a03.pdf |

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - LEGG MASON, INC. | exhibit9916302020.htm |

| 8-K - 8-K - LEGG MASON, INC. | exhibit8-k6302020.htm |

Fiscal First Quarter 2021 Results Executive Earnings Commentary July 27, 2020

Important Disclosures Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are not statements of facts or guarantees of future performance, and are subject to risks, uncertainties and other factors that may cause actual results to differ materially from those discussed in the statements. For a discussion of these risks and uncertainties, please see “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2020 and in the Company’s quarterly reports on Form 10-Q. Non-GAAP Financial Measures This presentation includes non-GAAP financial information. This non-GAAP information is in addition to, not a substitute for or superior to, measures of financial performance or liquidity determined in accordance with GAAP. The Company undertakes no obligation to update the information contained in this presentation to reflect subsequently occurring events or circumstances. Page 1

Table of Contents Contents Page(s) Highlights 3 Affiliate Flows and Unfunded Wins/Committed Uncalled Capital 4 – 5 Global Distribution 6 Financial Results and AUM 7 – 8 Operating Expenses 9 – 10 Adj. Operating Margin and EPS Roll Forward 11 – 12 Appendix 13 – 23 Page 2

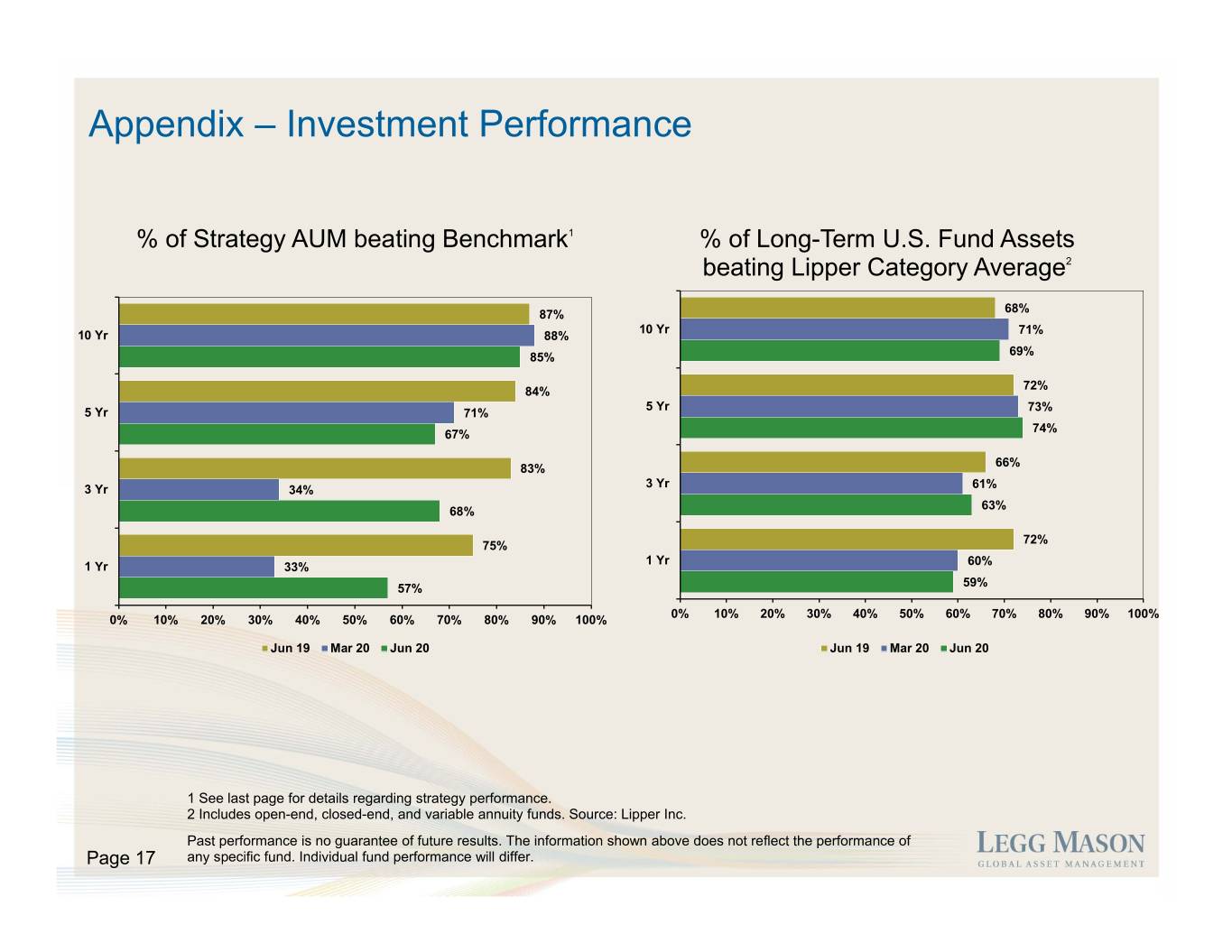

Highlights • Net Income of $49.4M, or $0.54 per diluted share Financial Results1 − Includes strategic restructuring and merger related charges of $30.9M, or $0.24 per diluted share • Adjusted Net Income1 of $65.4M, or $0.71 per diluted share • Strategic Restructuring Strategic − Achieved annualized run-rate savings of $104.5M Restructuring − Costs to achieve of $88.4M, $8.0M incurred in current quarter • Total AUM of $783.4B Assets Under • Long-term net outflows of $4.6B Management/ − Fixed Income outflows of $3.1B Flows − Equity outflows of $2.0B − Alternative inflows of $0.5B • Quarterly gross sales of $26.7B Global Distribution • Quarterly net sales of $2.2B Investment • 68% (3yr) and 67% (5yr) of strategy AUM beat benchmarks Performance2 • 63% (3yr) and 74% (5yr) of long-term US fund assets beat Lipper category averages • On May 28, 2020, ClearBridge launched Legg Mason's first exchange-traded fund (ETF) using the semi-transparent technology of Precidian Investments LLC, ActiveShares®. The ClearBridge Focus Value ETF (CFCV) is a series of Other Legg Mason's ActiveShares® ETF Trust. • On July 17, 2020, Franklin Templeton and Legg Mason announced that all conditions to the closing of its merger with Franklin Resources, Inc. have been satisfied and is scheduled to close on July 31, 2020. Our strategic restructuring efforts reached 104% of our targeted annualized run-rate savings. Cumulative realized savings of $84 million. Total costs to achieve of $88 million significantly below our prior forecasted range. 1 See appendix for GAAP reconciliation. 2 See appendix for details regarding strategy performance. Includes open-end, closed-end, and variable annuity funds. Source: Lipper Inc. Past performance is no guarantee of future results. The information shown above does not reflect Page 3 the performance of any specific fund. Individual fund performance will differ.

Affiliate Flows and Unfunded Wins/Committed Uncalled Capital 1 The pipeline of new opportunities remains healthy across asset classes and strategies. Unfunded wins and committed uncalled capital of $10.4 billion. 1 Realizations represent investment manager-driven distributions primarily related to the sale of assets. Realizations are specific to our alternative managers and do not include client-driven distributions (e.g. client requested redemptions, liquidations or asset transfers). 2 EnTrust Global reports total assets of $18.2B, which includes ending AUM, ending AUA, committed uncalled capital, and unfunded wins. Affiliates ordered by contribution to annual pre-tax earnings less noncontrolling interest. Page 4 Legg Mason ending AUM includes other entities not shown with ending AUM of $1.6B and LT Flows of $0.1B.

Drivers of Quarterly Long-Term Flows Equity Fixed Income Alternative AUM Flows AUM Flows AUM Flows ($B) ($B) ($B) ($B) ($B) ($B) Large Cap 82.7 0.7 Core Plus 106.0 1.9 Real Estate 56.2 0.5 Enhanced Liquidity 7.7 0.5 Real Assets 0.7 0.1 CLO 5.8 0.5 Inflow Drivers Mid Cap 2.8 (1.3) Global Opportunistic 30.0 (1.6) Hedge Funds 10.1 (0.1) All Cap 24.8 (1.2) Long Duration 48.2 (1.5) TIPS 6.7 (1.0) Global Income 19.5 (0.7) Drivers Outflow Macro Opportunities 13.2 (0.5) Short Duration 8.7 (0.5) Unfunded Wins ($B) Unfunded Wins ($B) Unfunded Wins ($B) Large Cap 0.2 Core Bond 2.4 Alternative Solutions1 0.7 Emerging Markets 0.2 Corporate 2.3 Equity International 0.1 Multi-Sector 0.6 Committed Uncalled Capital ($B) Global Opportunistic 0.5 Alternative Solutions1 1.2 Emerging Markets 0.4 Real Estate 0.6 Mortgage-Backed Securities 0.3 Total Committed Uncalled 1.8 Intermediate 0.2 Capital Total Equity 0.8 Total Fixed Income 7.1 Total Alternative 2.5 Uncalled Capital Uncalled % of Total Unfunded Wins and % of Total Unfunded Wins and % of Total Unfunded Wins and 8% 68% 24% Unfunded Wins/ Committed Committed Unfunded Wins/ Committed Uncalled Capital Committed Uncalled Capital Committed Uncalled Capital Unfunded wins and committed uncalled capital asset class mix of 68% from fixed income, 24% from alternatives, and 8% from equities. 1 Alternative Solutions include strategic partnerships and commingled funds. Page 5

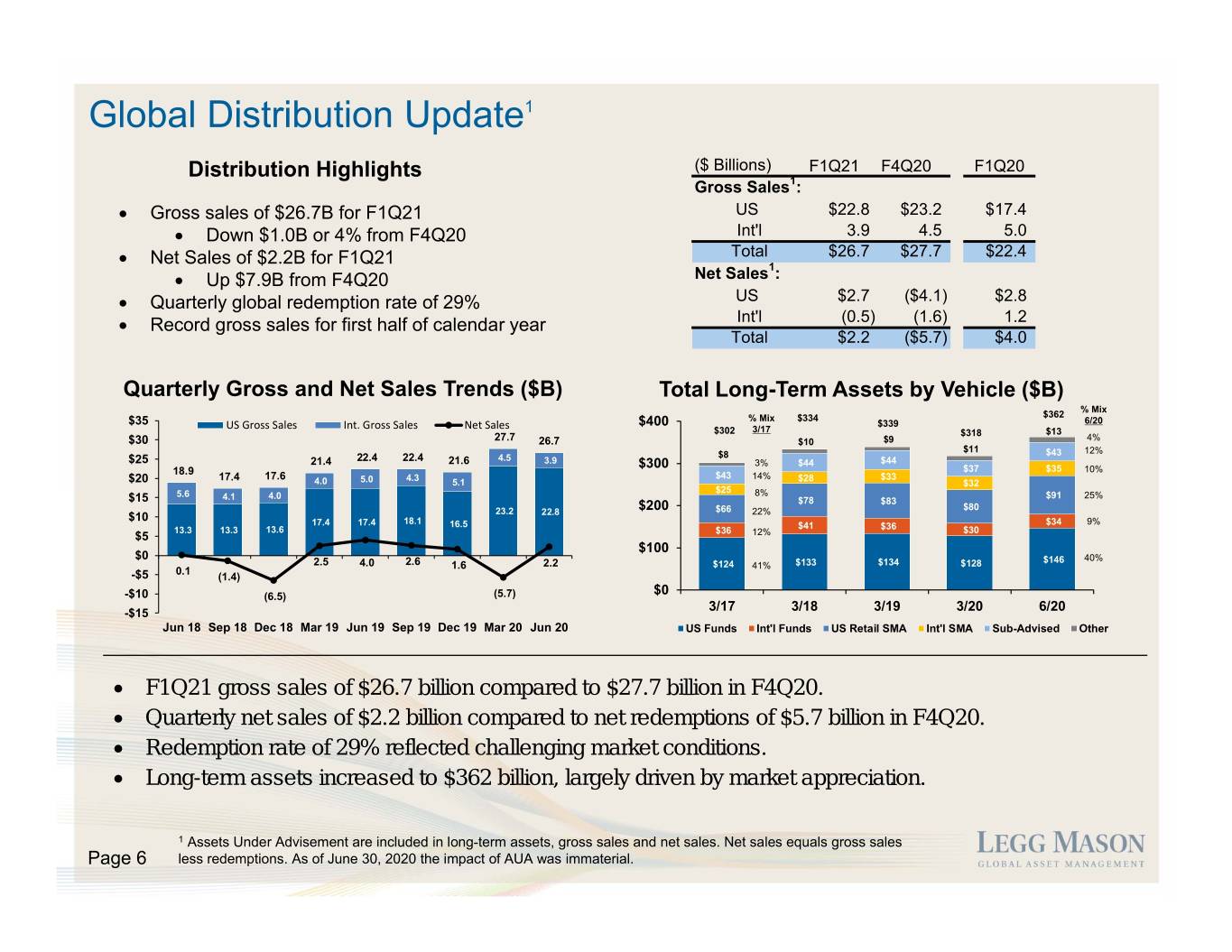

Global Distribution Update1 Distribution Highlights ($ Billions) F1Q21 F4Q20 F1Q20 Gross Sales1: Gross sales of $26.7B for F1Q21 US $22.8 $23.2 $17.4 Down $1.0B or 4% from F4Q20 Int'l 3.9 4.5 5.0 Total $26.7 $27.7 $22.4 Net Sales of $2.2B for F1Q21 1 Up $7.9B from F4Q20 Net Sales : Quarterly global redemption rate of 29% US $2.7 ($4.1) $2.8 Record gross sales for first half of calendar year Int'l ( 0.5) ( 1.6) 1.2 Total $2.2 ($5.7) $4.0 Quarterly Gross and Net Sales Trends ($B) Total Long-Term Assets by Vehicle ($B) % Mix % Mix $334 $362 $35 US Gross Sales Int. Gross Sales Net Sales $400 $339 6/20 $302 3/17 $318 $13 $30 27.7 26.7 $10 $9 4% $11 $43 12% 22.4 22.4 4.5 $8 $25 21.4 21.6 3.9 $300 3% $44 $44 18.9 $37 $35 10% 17.4 17.6 4.3 $43 14% $28 $33 $20 4.0 5.0 5.1 $32 $25 5.6 4.0 8% $91 25% $15 4.1 $78 $83 $200 $66 $80 $10 23.2 22.8 22% 17.4 17.4 18.1 16.5 $34 9% 13.6 $41 $36 $30 $5 13.3 13.3 $36 12% $100 $0 $146 40% 2.5 4.0 2.6 1.6 2.2 $124 41% $133 $134 $128 0.1 -$5 (1.4) -$10 (6.5) (5.7) $0 3/17 3/18 3/19 3/20 6/20 -$15 Jun 18 Sep 18 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 US Funds Int'l Funds US Retail SMA Int'l SMA Sub-Advised Other F1Q21 gross sales of $26.7 billion compared to $27.7 billion in F4Q20. Quarterly net sales of $2.2 billion compared to net redemptions of $5.7 billion in F4Q20. Redemption rate of 29% reflected challenging market conditions. Long-term assets increased to $362 billion, largely driven by market appreciation. 1 Assets Under Advisement are included in long-term assets, gross sales and net sales. Net sales equals gross sales Page 6 less redemptions. As of June 30, 2020 the impact of AUA was immaterial.

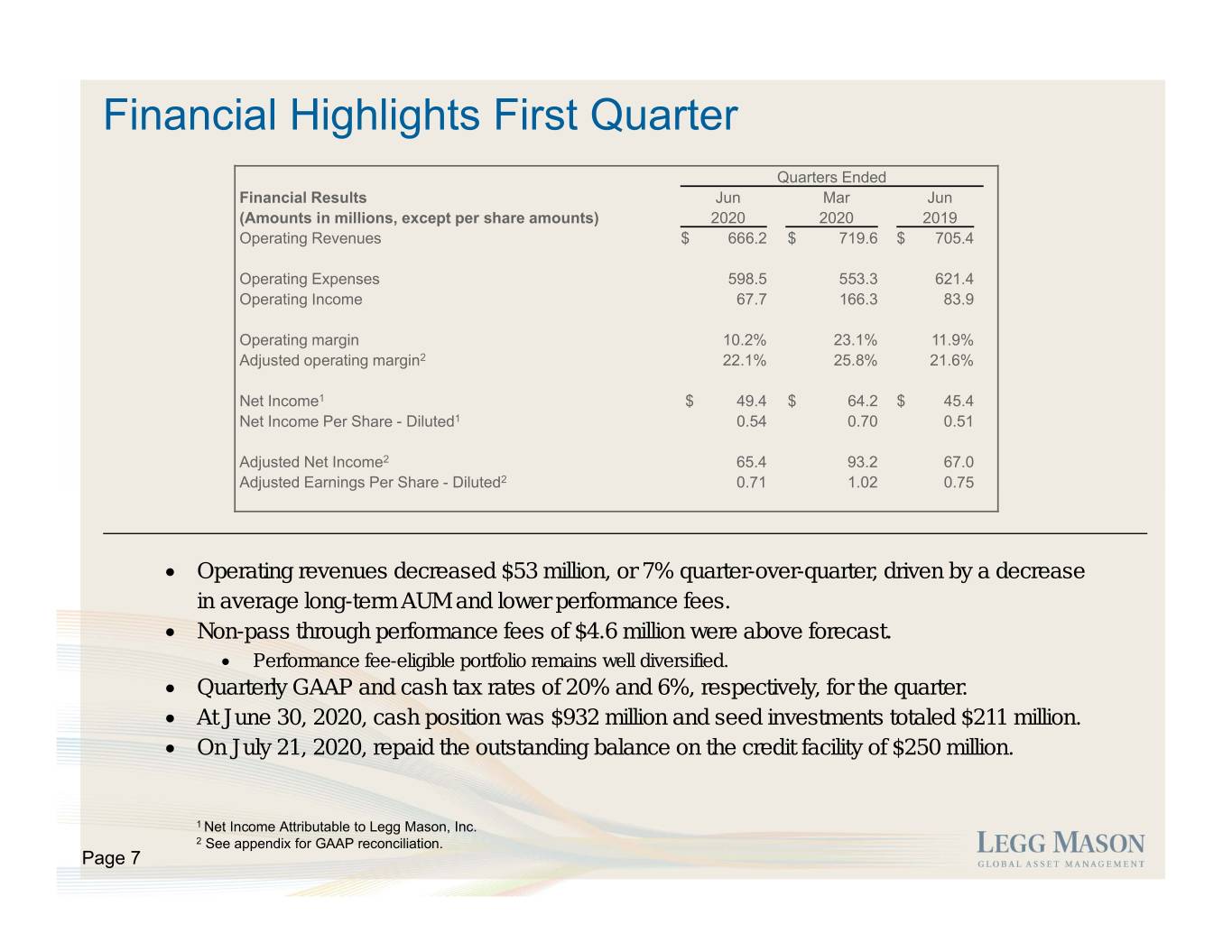

Financial Highlights First Quarter Quarters Ended Financial Results Jun Mar Jun (Amounts in millions, except per share amounts) 2020 2020 2019 Operating Revenues $ 666.2 $ 719.6 $ 705.4 Operating Expenses 598.5 553.3 621.4 Operating Income 67.7 166.3 83.9 Operating margin 10.2% 23.1% 11.9% Adjusted operating margin2 22.1% 25.8% 21.6% Net Income1 $ 49.4 $ 64.2 $ 45.4 Net Income Per Share - Diluted1 0.54 0.70 0.51 Adjusted Net Income2 65.4 93.2 67.0 Adjusted Earnings Per Share - Diluted2 0.71 1.02 0.75 Operating revenues decreased $53 million, or 7% quarter-over-quarter, driven by a decrease in average long-term AUM and lower performance fees. Non-pass through performance fees of $4.6 million were above forecast. Performance fee-eligible portfolio remains well diversified. Quarterly GAAP and cash tax rates of 20% and 6%, respectively, for the quarter. At June 30, 2020, cash position was $932 million and seed investments totaled $211 million. On July 21, 2020, repaid the outstanding balance on the credit facility of $250 million. 1 Net Income Attributable to Legg Mason, Inc. 2 See appendix for GAAP reconciliation. Page 7

Assets Under Management by Asset Class $800 42 9% 9% 9% 9% 10% 28% $600 26% 25% 39 39 bps 27% 22% 38 bps 37 bps 37 bps 37 bps 36 bps 36 bps 36 bps $400 36 34 bps Ending AUM ($B) Ending AUM 55% 56% $200 33 58% 57% 56% Yield (bps) Revenue Oeprating 8% 9% 8% 10% 9% $0 30 Jun 18 Sep 18 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 1 Liquidity Fixed Income Equity Alternative Operating Revenue Yield Ending AUM Long-term $685 $693 $654 $690 $714 $719 $740 $656 $713 Total $745 $755 $727 $758 $780 $782 $804 $731 $783 AUM increased $52.6 billion, or 7%, from the prior quarter due to market appreciation and FX, partially offset by outflows in liquidity and long-term AUM. Operating revenue yield declined reflecting the mix shift from average long-term AUM to liquidity AUM. Average AUM decreased 2% from the prior quarter driven by a decline in equity of 6%, fixed income of 3% and alternatives of 2%, partially offset by an increase in liquidity of 13%. 1 Operating revenue yield equals total operating revenues less performance fees divided by average AUM. Page 8 See appendix for supporting detail by asset class.

Operating Expenses $640 $53 ($8) $620 ($14) $598 $600 $580 $14 $ in Millions $ $560 $553 $540 $520 Mar Qtr Restructuring Costs¹ MTM on Deferred D&S Expense Other Jun Qtr Comp and Seed Inv Operating expenses increased $45 million on a sequential basis, driven by a $52 million increase in compensation & benefits largely due to gains on investments in deferred compensation plans during the current quarter (compared to losses in the prior quarter). D&S expense declined $8 million largely due to lower average AUM. Other expenses decreased largely due to lower “business as usual” spend related to T&E, advertising, and conferences. 1 Restructuring costs includes strategic restructuring costs of $8.0M and merger related costs of $22.9M in the current quarter and strategic restructuring costs of $3.7M and merger related costs of $13.3M in the prior quarter. Page 9

Compensation and Benefits % of % of $ 1 1 Jun Qtr Net Rev. Mar Qtr Net Rev. Change Salary, incentives and benefits$ 324.5 57%$ 323.9 53%$ 0.6 Restructuring Costs2 1.9 0% 4.6 0% (2.7) MTM on deferred comp and seed inv 20.0 4% (32.5) (5%) 52.5 Comp and benefits (ex pass through fees) 346.4 61% 296.0 48% 50.4 Clarion pass through performance fees 6.8 8.3 (1.5) Total Compensation and Benefits$ 353.2 $ 304.3 $ 48.9 Salary, incentives, and benefits increased from the prior quarter largely due to seasonal accelerated deferred compensation and the compensation impact of lower non-compensation expenses at revenue-share affiliates, partially offset by the compensation impact of lower net revenue. Quarterly compensation ratio of 57%, up from the prior quarter. 1 Net Revenue is equal to Adjusted Operating Revenues. See appendix for GAAP reconciliation. 2 Includes strategic restructuring costs, merger related costs, and affiliate charges. Page 10

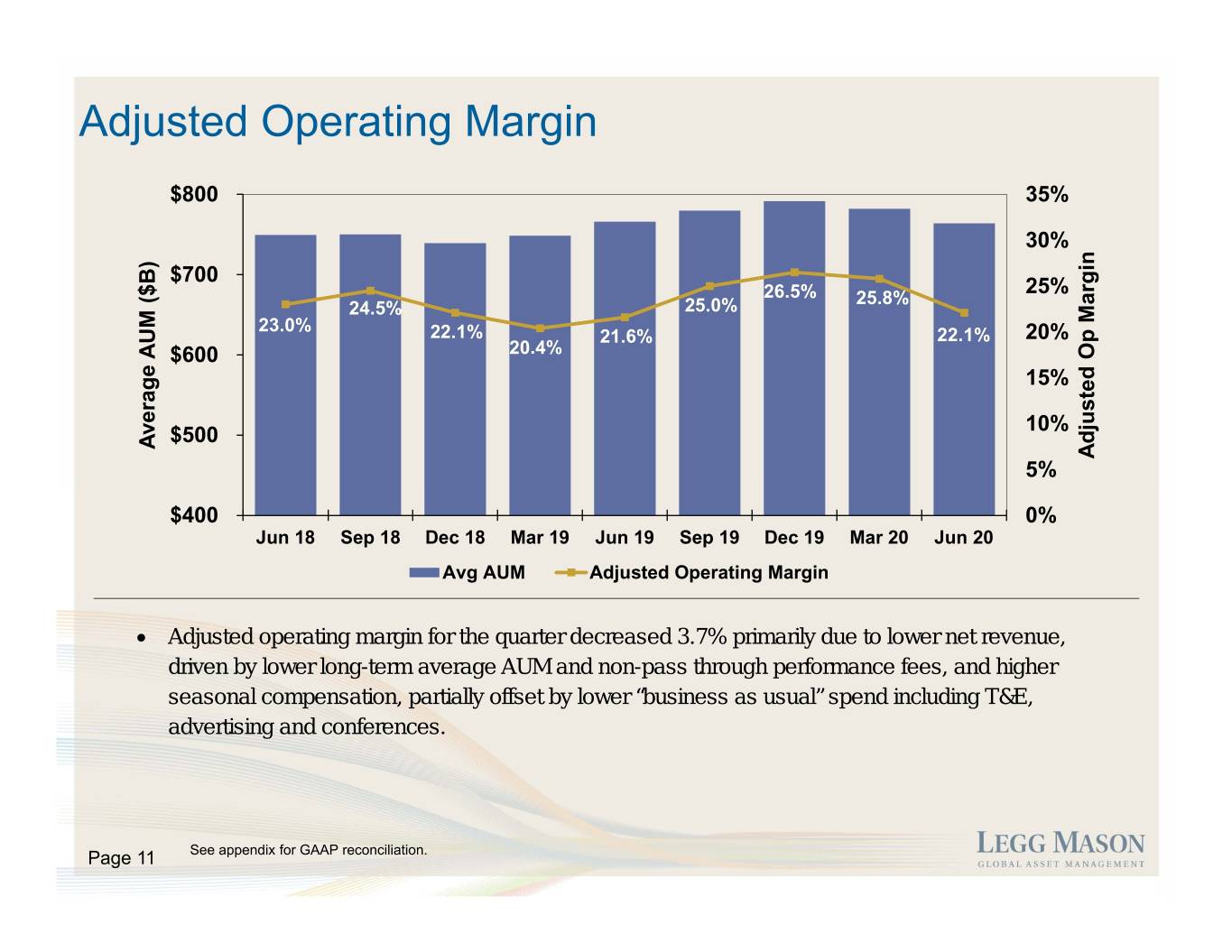

Adjusted Operating Margin $800 35% 30% $700 25% 26.5% 25.8% 24.5% 25.0% 23.0% 22.1% 21.6% 22.1% 20% $600 20.4% 15% 10% $500 Average AUM ($B) AUM Average Adjusted MarginOp Adjusted 5% $400 0% Jun 18 Sep 18 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 Avg AUM Adjusted Operating Margin Adjusted operating margin for the quarter decreased 3.7% primarily due to lower net revenue, driven by lower long-term average AUM and non-pass through performance fees, and higher seasonal compensation, partially offset by lower “business as usual” spend including T&E, advertising and conferences. Page 11 See appendix for GAAP reconciliation.

First Quarter Adjusted Earnings Per Share Roll Forward GAAP GAAP EPS $0.70 EPS $0.54 $1.10 $1.02 $0.22 $1.00 $0.90 $0.10 $0.80 $0.07 $0.03 EPS $0.03 $0.71 $0.70 $0.60 $0.50 Mar Qtr Lower Net Seasonal Comp BAU Spend Interest Tax Jun Qtr Adj EPS Revenue Adj EPS GAAP EPS decreased $0.16 to $0.54 largely due to lower net revenue, higher strategic restructuring and merger related charges, and seasonal compensation, partially offset by gains on investments not offset by compensation and hedges (compared to losses in the prior quarter), lower GAAP tax rate, and lower “business as usual” spend. Adjusted EPS declined $0.31 from lower net revenue, seasonal compensation, higher net interest expenses, and a higher adjusted tax rate, partially offset by lower “business as usual” spend. Page 12 See appendix for GAAP reconciliation.

Appendix

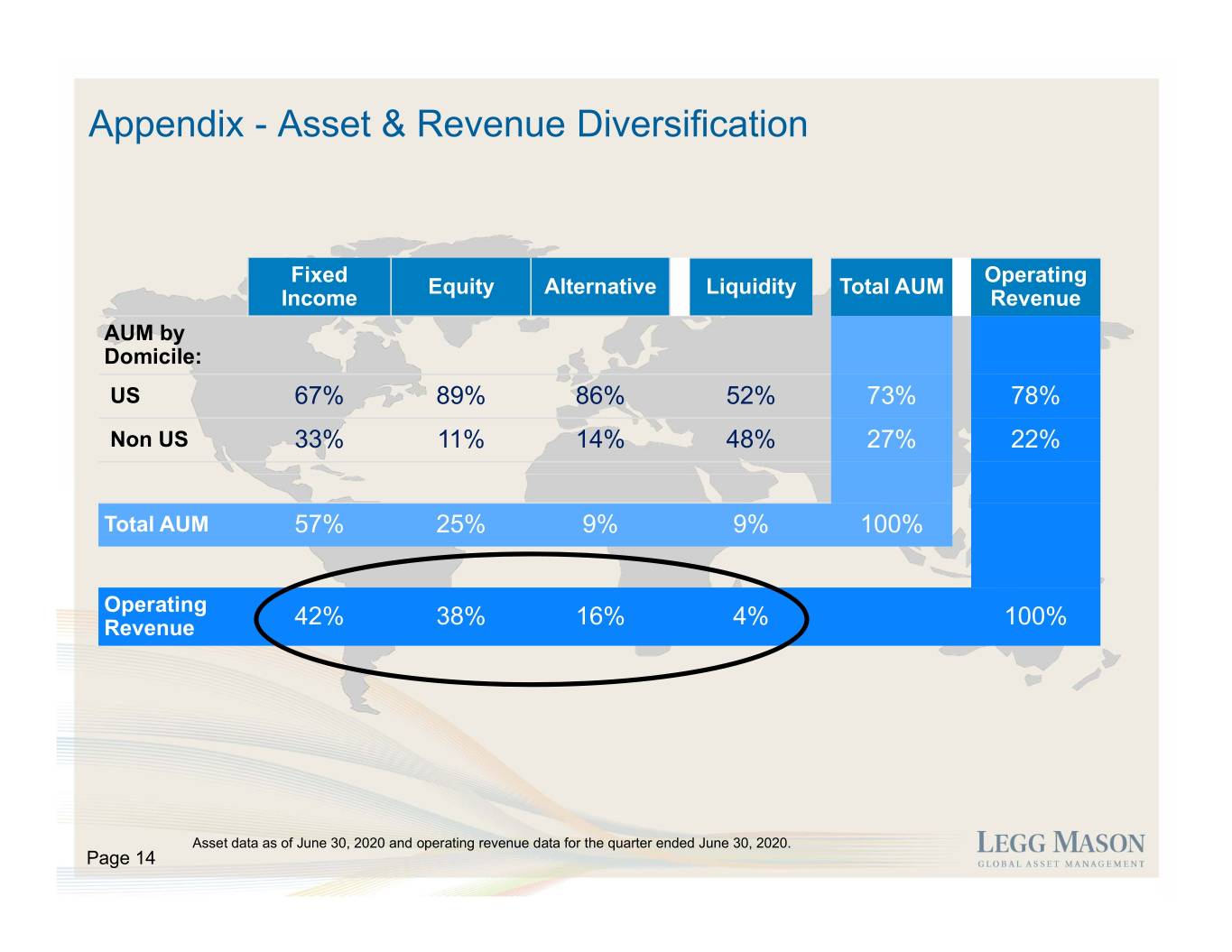

Appendix - Asset & Revenue Diversification Fixed Operating Equity Alternative Liquidity Total AUM Income Revenue AUM by Domicile: US 67% 89% 86% 52% 73% 78% Non US 33% 11% 14% 48% 27% 22% Total AUM 57% 25% 9% 9% 100% Operating Revenue 42% 38% 16% 4% 100% Asset data as of June 30, 2020 and operating revenue data for the quarter ended June 30, 2020. Page 14

Appendix - Operating Revenue Yield by Asset Class1 Yield (bps) Jun 18 Sep 18 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 Alternative 63 61 59 60 60 58 58 58 56 Equity 61 60 59 58 58 57 56 58 55 Fixed Income 28 27 27 27 26 26 26 26 25 Liquidity 13 14 13 14 14 14 14 14 15 1 Operating revenue yield equals total operating revenues less performance fees divided by average AUM. Page 15

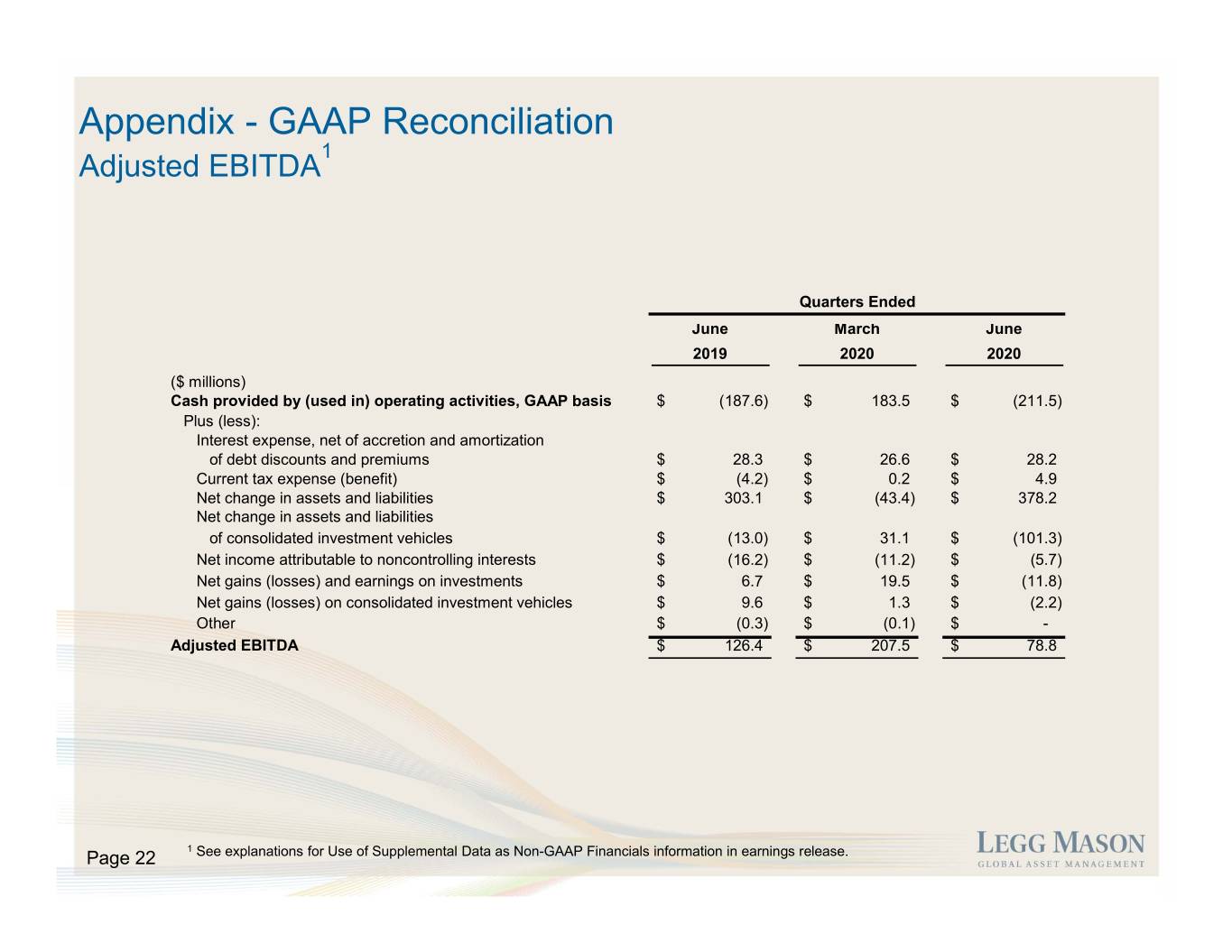

Appendix - First Quarter Adjusted EBITDA1 Roll Forward Cash Provided By (Used In) Mar 20 Qtr Jun 20 Qtr Operating Activities, $183.5 ($211.5) GAAP $250 $16.0 $115.3 $207.5 $200 $150 ($29.4) $100 $78.8 $50 $ in Millions $0 Mar 20 Qtr Q4 Items Net Change in Adjusted EBITDA Q1 Items Jun 20 Qtr Adjusted EBITDA decreased primarily due to realized losses on investments in the current period as compared to realized gains on investments in the prior period and lower net revenue, partially offset by lower “business as usual” spend. F4Q20 and F1Q21 items include strategic restructuring costs, merger related costs and affiliate charges ultimately settled in cash. 1 See page 22 for GAAP reconciliation. Page 16

Appendix – Investment Performance % of Strategy AUM beating Benchmark1 % of Long-Term U.S. Fund Assets beating Lipper Category Average2 68% 87% 10 Yr 71% 10 Yr 88% 85% 69% 84% 72% 5 Yr 73% 5 Yr 71% 74% 67% 66% 83% 3 Yr 3 Yr 34% 61% 63% 68% 72% 75% 1 Yr 60% 1 Yr 33% 57% 59% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Jun 19 Mar 20 Jun 20 Jun 19 Mar 20 Jun 20 1 See last page for details regarding strategy performance. 2 Includes open-end, closed-end, and variable annuity funds. Source: Lipper Inc. Past performance is no guarantee of future results. The information shown above does not reflect the performance of Page 17 any specific fund. Individual fund performance will differ.

Appendix – Additional Investment Performance Detail % of Strategy AUM Beating Benchmark1 June 30, 2020 March 31, 2020 June 30, 2019 1-Year 3-Year 5-Year 1-Year 3-Year 5-Year 1-Year 3-Year 5-Year Total (includes liquidity) 57% 68% 67% 33% 34% 71% 75% 83% 84% Equity: Large cap 17% 24% 13% 21% 21% 56% 60% 49% 65% Small cap 67% 73% 80% 77% 64% 69% 74% 68% 40% Total Equity (includes other equity) 62% 62% 70% 68% 58% 65% 61% 56% 48% Fixed Income: US taxable 74% 99% 95% 6% 9% 90% 97% 99% 95% US tax-exempt 0% 0% 0% 0% 0% 0% 0% 100% 100% Global taxable 45% 35% 50% 30% 33% 35% 45% 92% 86% Total Fixed Income 62% 76% 78% 13% 15% 69% 77% 97% 92% Total Alternative2 78% 90% 79% 93% 93% 90% 98% 84% 98% 1 See last page for details regarding strategy performance. Past performance is no guarantee of future results. The information shown above does not reflect the performance of any specific fund. Individual fund performance will differ. 2 Alternative assets include AUM managed by Clarion Partners and RARE Infrastructure totaling three funds. Page 18

Appendix – Additional Investment Performance Detail % of Long-Term U.S. Fund Assets beating Lipper Category Average1 June 30, 2020 March 31, 2020 June 30, 2019 1-Year 3-Year 5-Year 1-Year 3-Year 5-Year 1-Year 3-Year 5-Year Total (excludes liquidity) 59% 63% 74% 60% 61% 73% 72% 66% 72% Equity: Large cap 27% 39% 70% 40% 41% 75% 70% 42% 70% Small cap 79% 73% 80% 70% 65% 71% 75% 76% 76% Total Equity (includes other equity) 41% 48% 72% 47% 47% 72% 72% 51% 72% Fixed Income: US taxable 88% 92% 92% 86% 88% 92% 93% 95% 91% US tax-exempt 16% 8% 6% 10% 6% 5% 10% 28% 24% Global taxable 53% 48% 43% 45% 42% 38% 41% 76% 32% Total Fixed Income 75% 76% 76% 70% 71% 73% 73% 81% 73% Total Alternative2 77% 77% N/A 58% 100% N/A 18% 24% 0% 1 Includes open-end, closed-end, and variable annuity funds. Source: Lipper Inc. Past performance is no guarantee of future results. The information shown above does not reflect the performance of any specific fund. Individual fund performance will differ. 2 Page 19 Alternative assets include AUM managed by Clarion Partners and RARE Infrastructure totaling three funds.

Appendix – GAAP Reconciliation Adjusted income1 Quarters Ended June March June ($ millions) 2019 2020 2020 Net Income (Loss) Attributable to Legg Mason, Inc. $ 45.4 $ 64.2 $ 49.4 Plus (less): Restructuring costs: Strategic restructuring and merger related charges 32.9 17.0 31.0 Affiliate charges 1.2 0.7 0.5 Amortization of intangible assets 5.4 5.6 5.5 Gains and losses on seed and other investments not offset by compensation or hedges (6.4) 12.6 (8.1) Acquisition and transition-related costs - - 0.6 Contingent consideration fair value adjustments (1.2) 0.3 - Income tax adjustments2: Impacts of non-GAAP adjustments (8.6) (9.7) (8.3) Other tax items (1.7) 2.5 (5.2) Adjusted Net Income $ 67.0 $ 93.2 $ 65.4 Net Income (Loss) Per Diluted Share Attributable to Legg Mason, Inc. Shareholders $ 0.51 $ 0.70 $ 0.54 Plus (less), net of tax impacts: Restructuring costs: Strategic restructuring and merger related charges 0.27 0.14 0.24 Affiliate charges 0.01 - - Amortization of intangible assets 0.04 0.05 0.04 Gains and losses on seed and other investments not offset by compensation or hedges (0.05) 0.10 (0.06) Acquisition and transition-related costs - - 0.01 Contingent consideration fair value adjustments (0.01) - - Other tax items (0.02) 0.03 (0.06) Adjusted Earnings per Diluted Share $ 0.75 $ 1.02 $ 0.71 1 See explanations for Use of Supplemental Data as Non-GAAP Financials information in earnings release. 2 Page 20 The non-GAAP effective tax rates for the quarters ended June 30,2019, March 31, 2020 and June 30, 2020 were 27.0%, 24.6% and 28.0%, respectively.

Appendix – GAAP Reconciliation Adjusted Operating Margin1 ($ millions) Jun 18 Sep 18 Dec 18 Mar 19 Jun 19 Sep 19 Dec 19 Mar 20 Jun 20 Operating Revenues, GAAP basis $ 747.9 $ 758.4 $ 704.3 $ 692.6 $ 705.4 $ 743.3 $ 753.9 $ 719.6 $ 666.2 Plus (less): Pass through performance fees (12.6) (24.0) (7.4) (5.0) (1.0) (21.9) (10.7) (8.3) (6.8) Operating revenues eliminated upon consolidation of investment vehicles 0.2 0.1 0.2 0.2 0.1 0.1 0.1 - 0.1 Distribution and servicing fees (79.2) (79.1) (72.2) (72.5) (69.9) (67.1) (67.6) (65.8) (59.9) Investment advisory fees (37.4) (35.4) (36.6) (26.8) (34.0) (37.1) (36.7) (34.0) (31.6) Adjusted Operating Revenues $ 618.9 $ 620.0 $ 588.3$ 588.5 $ 600.6 $ 617.3 $ 639.0$ 611.5 $ 568.0 Operating Income (Loss), GAAP basis $ 125.7 $ 135.7 $ (236.4) $ 78.1 $ 83.9 $ 125.0 $ 130.0 $ 166.3 $ 67.7 Plus (less): Restructuring costs: Strategic restructuring and merger related charges 2.8 5.6 5.9 9.4 32.9 19.7 20.9 17.0 30.9 Affiliate charges - - - 9.3 1.2 0.2 0.2 0.7 0.6 Amortization of intangible assets 6.2 6.1 6.1 6.0 5.5 5.4 6.0 5.6 5.5 Gains (losses) on deferred compensation and seed investments, net 1.3 4.0 (10.8) 16.0 7.0 2.9 12.0 (32.5) 20.0 Acquisition and transition-related costs 1.4 - - 1.2 - - - - 0.6 Impairment of intangible assets - - 365.2 - - - - - - Contingent consideration fair value adjustments 0.4 0.1 - - (1.2) - - 0.2 - Charges related to significant regulatory matters 4.0 0.2 - - - - - - - Operating income (loss) of consolidated investment vehicles, net 0.6 0.4 0.3 0.3 0.3 1.3 0.2 0.2 - Adjusted Operating Income $ 142.4 $ 152.1 $ 130.3$ 120.3 $ 129.6 $ 154.5 $ 169.3$ 157.5 $ 125.3 Operating Margin, GAAP basis 16.8% 17.9% (33.6%) 11.3% 11.9% 16.8% 17.2% 23.1% 10.2% Adjusted Operating Margin 23.0% 24.5% 22.1% 20.4% 21.6% 25.0% 26.5% 25.8% 22.1% 1 Page 21 See explanations for Use of Supplemental Data as Non-GAAP Financials information in earnings release.

Appendix - GAAP Reconciliation 1 Adjusted EBITDA Quarters Ended June March June 2019 2020 2020 ($ millions) Cash provided by (used in) operating activities, GAAP basis $ (187.6) $ 183.5 $ (211.5) Plus (less): Interest expense, net of accretion and amortization of debt discounts and premiums$ 28.3 $ 26.6 $ 28.2 Current tax expense (benefit)$ (4.2) $ 0.2 $ 4.9 Net change in assets and liabilities$ 303.1 $ (43.4) $ 378.2 Net change in assets and liabilities of consolidated investment vehicles$ (13.0) $ 31.1 $ (101.3) Net income attributable to noncontrolling interests$ (16.2) $ (11.2) $ (5.7) Net gains (losses) and earnings on investments$ 6.7 $ 19.5 $ (11.8) Net gains (losses) on consolidated investment vehicles$ 9.6 $ 1.3 $ (2.2) Other $ (0.3) $ (0.1) $ - Adjusted EBITDA $ 126.4 $ 207.5 $ 78.8 1 Page 22 See explanations for Use of Supplemental Data as Non-GAAP Financials information in earnings release.

Appendix – Strategy Performance For purposes of investment performance comparisons, strategies are an aggregation of discretionary portfolios (separate accounts, investment funds, and other products) into a single group that represents a particular investment objective. In the case of separate accounts, the investment performance of the account is based upon the performance of the strategy to which the account has been assigned. Each of our asset managers has its own specific guidelines for including portfolios in their strategies. For those managers which manage both separate accounts and investment funds in the same strategy, the performance comparison for all of the assets is based upon the performance of the separate account. Approximately 88% of total AUM is included in strategy AUM as of June 30, 2020, although not all strategies have three, five, and ten year histories. Total strategy AUM includes liquidity assets. Certain assets are not included in reported performance comparisons. These include: accounts that are not managed in accordance with the guidelines outlined above; accounts in strategies not marketed to potential clients; accounts that have not yet been assigned to a strategy; and certain smaller products at some of our affiliates. Past performance is not indicative of future results. For AUM included in institutional and retail separate accounts and investment funds managed in the same strategy as separate accounts, performance comparisons are based on gross-of-fee performance. For investment funds which are not managed in a separate account format, performance comparisons are based on net-of-fee performance. Funds-of-hedge funds generally do not have specified benchmarks. For purposes of this comparison, performance of those products is net-of-fees, and is compared to the relevant HFRX index. These performance comparisons do not reflect the actual performance of any specific separate account or investment fund; individual separate account and investment fund performance may differ. The information in this presentation is provided solely for use in connection with this presentation, and is not directed toward existing or potential clients of Legg Mason. Page 23