Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - IDEX CORP /DE/ | iex-20200723xex991.htm |

| 8-K - 8-K - IDEX CORP /DE/ | iex-20200723.htm |

Second Quarter 2020 Earnings July 24, 2020

Agenda IDEX Business Overview • Q2 Overview • COVID-19 • End Market Update Financials • Q2 Performance • Operating Profit • Liquidity Q3 Summary Q&A 2 IDEX Proprietary & Confidential

Replay Information • Dial toll–free: 877.660.6853 • International: 201.612.7415 • Conference ID: #13694805 • Log on to: www.idexcorp.com 3 IDEX Proprietary & Confidential

Cautionary Statement Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation and discussion will include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the anticipated effects of the coronavirus pandemic, including with respect to the Company’s revenues, facility closures and access to capital, capital expenditures, acquisitions, cost reductions, cash flow, cash requirements, revenues, earnings, market conditions, global economies, plant and equipment capacity and operating improvements, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: the duration of the coronavirus pandemic and the effects of the coronavirus on our ability to operate our business and facilities, on our customers and on the U.S. and global economy generally; economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries – all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the company’s most recent annual report on Form 10-K filed with the SEC and the other risks discussed in the company’s filings with the SEC. The forward-looking statements included in this presentation and discussion are only made as of today’s date, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information in this presentation and discussion. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the six-month period ending June 30, 2020, which is available on our website. 4 IDEX Proprietary & Confidential

Business Update IDEX Proprietary & Confidential

Q2 Overview We are in this fight! • Employees going above and beyond • Essential products delivered globally • Innovating with Customers Executing in an challenging environment • Operations and Supply Chain performing • Diversified portfolio balancing declines • Record Q2 cash flow generation Controlling the controllable… • Discretionary costs down approximately 50% • Targeted restructuring actions • Key investments made 6 IDEX Proprietary & Confidential

Operating our COVID-19 Playbook Focus on our people around the world and actions taken to Safety keep people physically, emotionally, and financially safe Prepared to manage our businesses in a volatile environment; Business how we handle supply chain, internal operations and customer Continuity disruptions Managing cash flow, strong liquidity position, and our staying Liquidity power Playing Adapting to help with the COVID-19 fight and what we are Offense doing to position ourselves for the recovery 7 IDEX Proprietary & Confidential

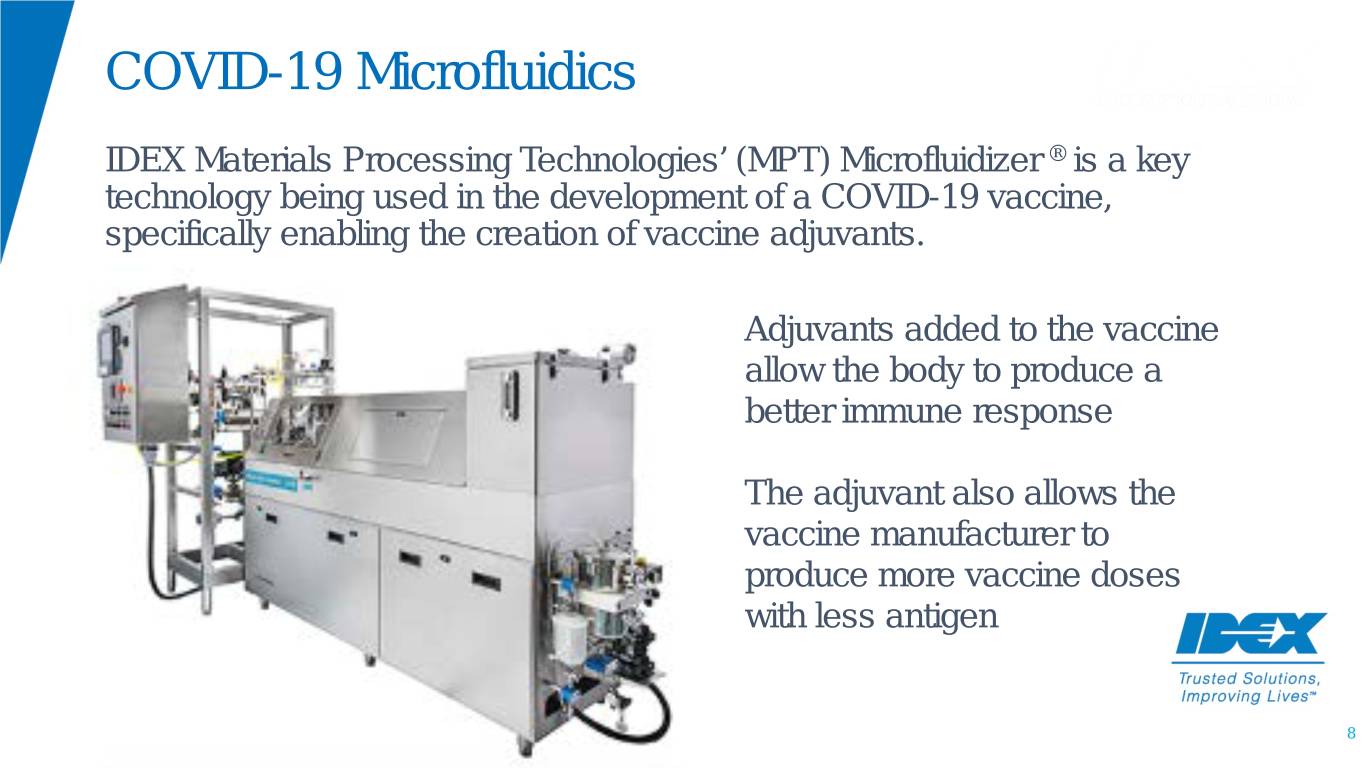

COVID-19 Microfluidics IDEX Materials Processing Technologies’ (MPT) Microfluidizer ® is a key technology being used in the development of a COVID-19 vaccine, specifically enabling the creation of vaccine adjuvants. Adjuvants added to the vaccine allow the body to produce a better immune response The adjuvant also allows the vaccine manufacturer to produce more vaccine doses with less antigen 8

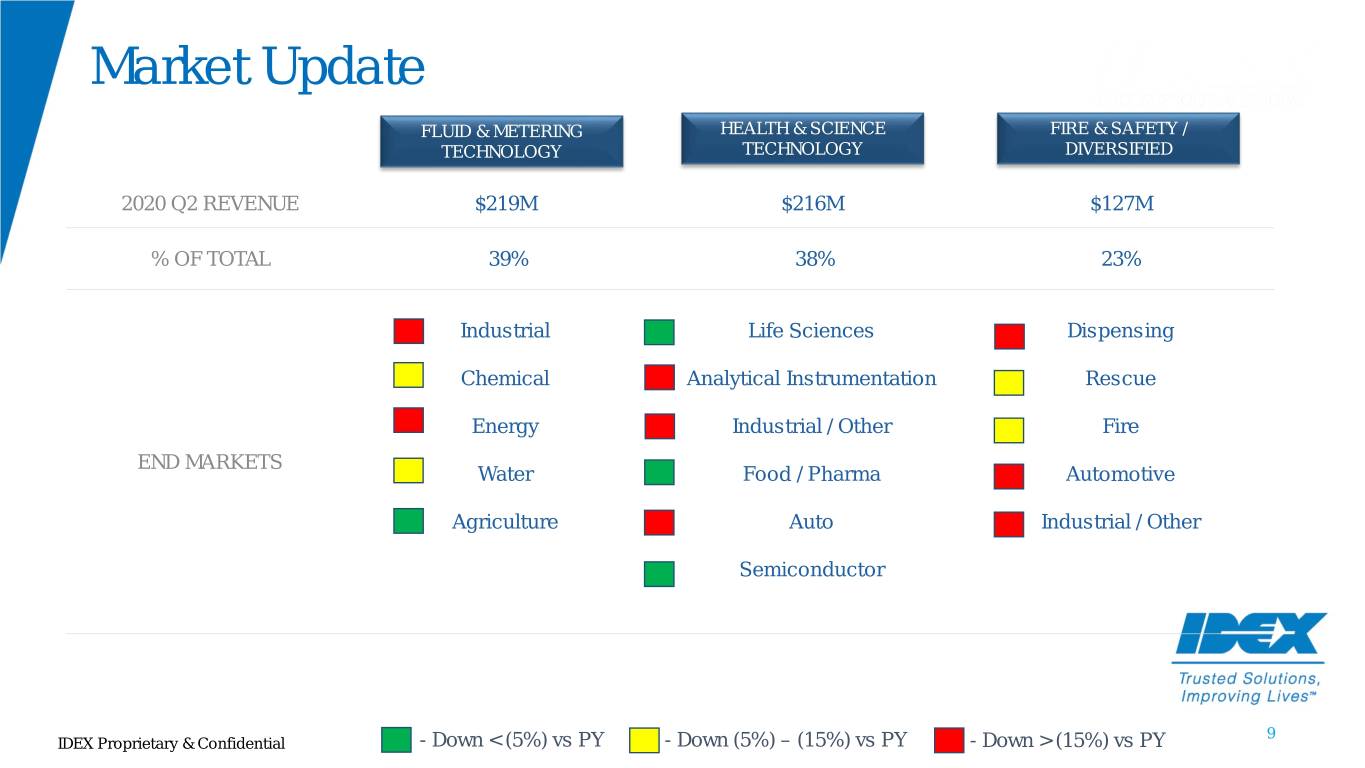

Market Update FLUID & METERING HEALTH & SCIENCE FIRE & SAFETY / TECHNOLOGY TECHNOLOGY DIVERSIFIED 2020 Q2 REVENUE $219M $216M $127M % OF TOTAL 39% 38% 23% Industrial Life Sciences Dispensing Chemical Analytical Instrumentation Rescue Energy Industrial / Other Fire END MARKETS Water Food / Pharma Automotive Agriculture Auto Industrial / Other Semiconductor 9 IDEX Proprietary & Confidential - Down < (5%) vs PY - Down (5%) – (15%) vs PY - Down > (15%) vs PY

Financials IDEX Proprietary & Confidential

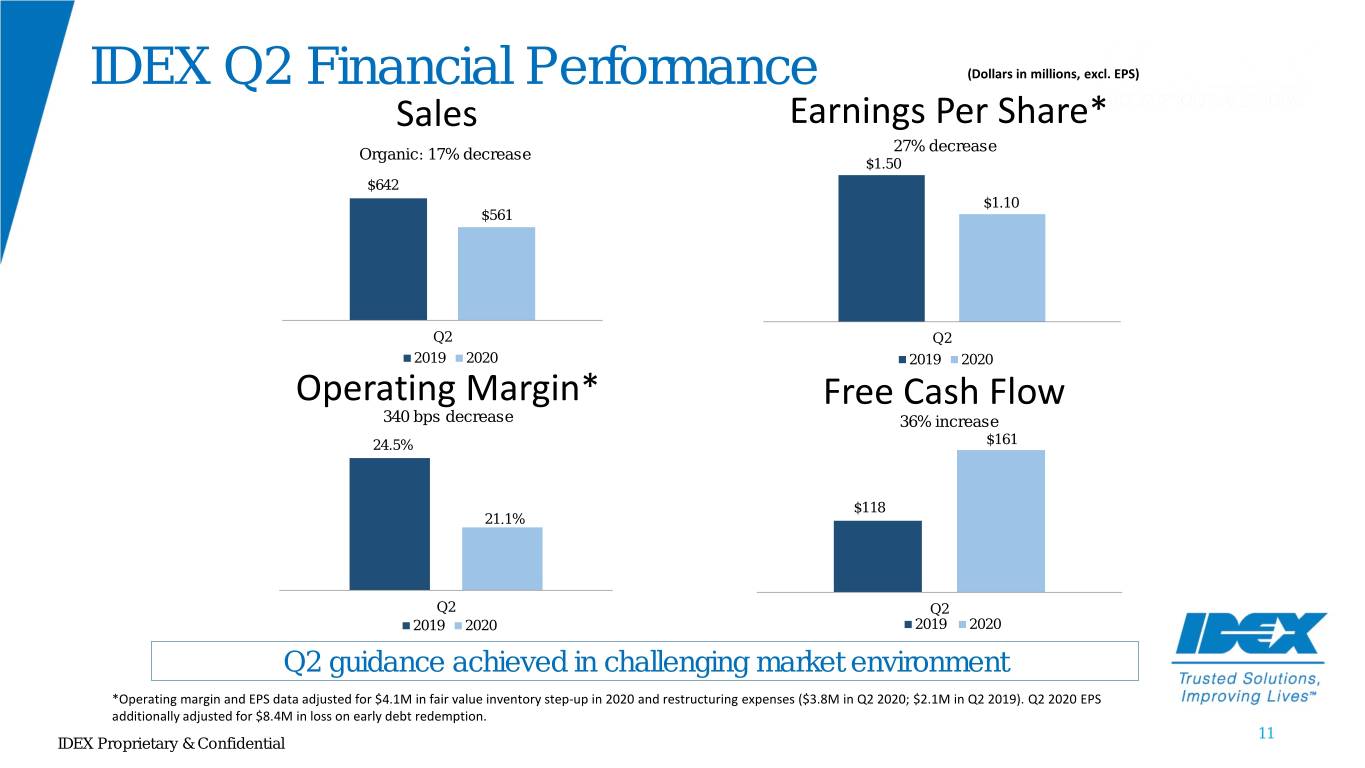

IDEX Q2 Financial Performance (Dollars in millions, excl. EPS) Sales Earnings Per Share* 27% decrease Organic: 17% decrease $1.50 $642 $1.10 $561 Q2 Q2 2019 2020 2019 2020 Operating Margin* Free Cash Flow 340 bps decrease 36% increase 24.5% $161 $118 21.1% Q2 Q2 2019 2020 2019 2020 Q2 guidance achieved in challenging market environment *Operating margin and EPS data adjusted for $4.1M in fair value inventory step-up in 2020 and restructuring expenses ($3.8M in Q2 2020; $2.1M in Q2 2019). Q2 2020 EPS additionally adjusted for $8.4M in loss on early debt redemption. 11 IDEX Proprietary & Confidential

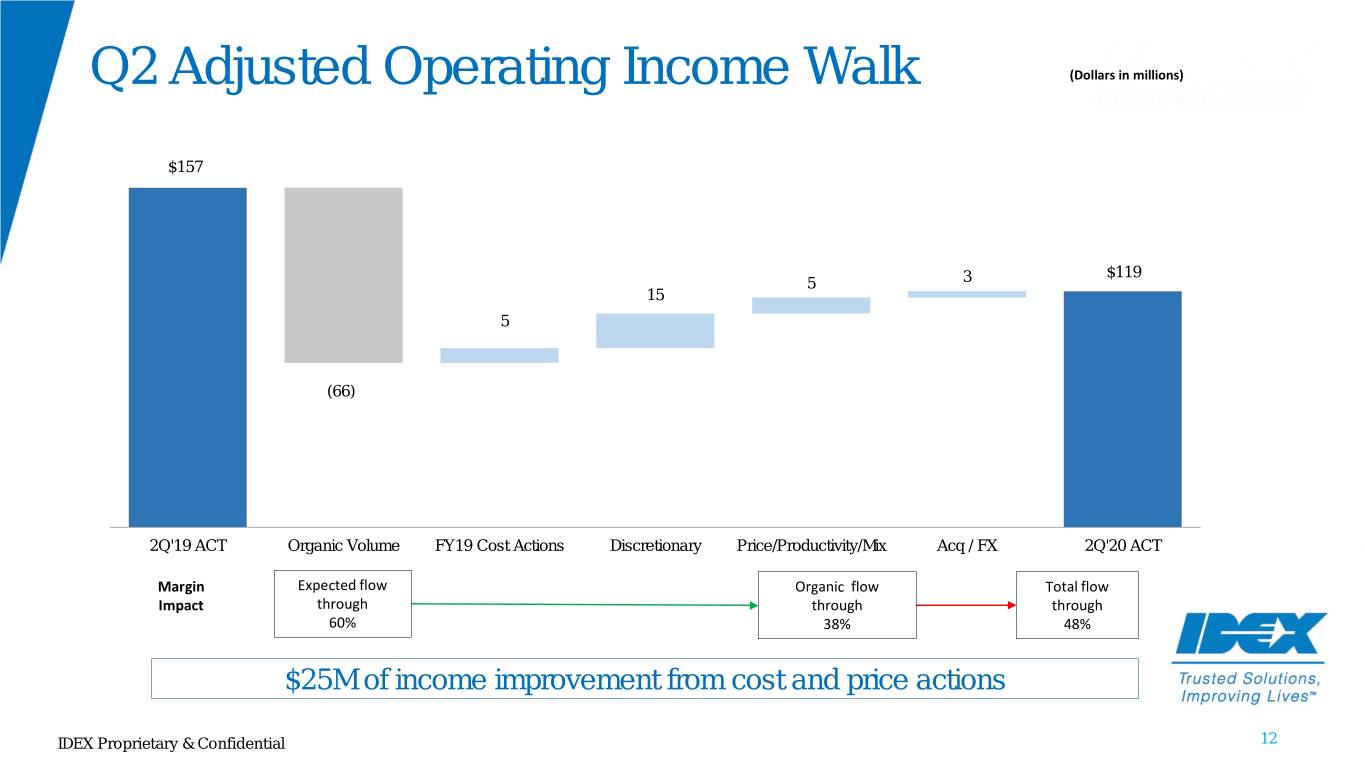

Q2 Adjusted Operating Income Walk (Dollars in millions) $157 $119 5 3 15 5 (66) 2Q'19 ACT Organic Volume FY19 Cost Actions Discretionary Price/Productivity/Mix Acq / FX 2Q'20 ACT Margin Expected flow Organic flow Total flow Impact through through through 60% 38% 48% $25M of income improvement from cost and price actions IDEX Proprietary & Confidential 12

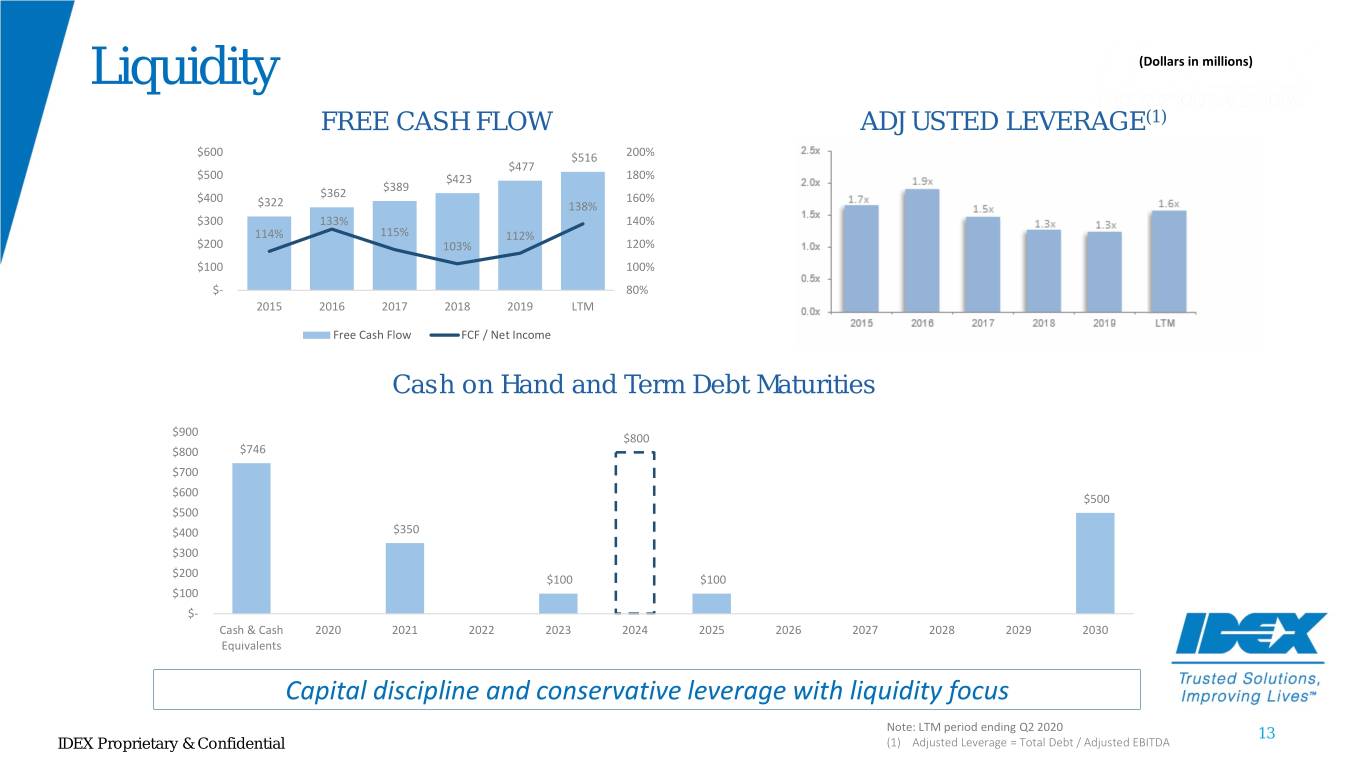

Liquidity (Dollars in millions) FREE CASH FLOW ADJUSTED LEVERAGE(1) $600 $516 200% $477 $500 $423 180% $389 $400 $362 160% $322 138% $300 133% 140% 114% 115% 112% $200 103% 120% $100 100% $- 80% 2015 2016 2017 2018 2019 LTM Free Cash Flow FCF / Net Income Cash on Hand and Term Debt Maturities $900 $800 $800 $746 $700 $600 $500 $500 $400 $350 $300 $200 $100 $100 $100 $- Cash & Cash 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Equivalents Capital discipline and conservative leverage with liquidity focus Note: LTM period ending Q2 2020 13 IDEX Proprietary & Confidential (1) Adjusted Leverage = Total Debt / Adjusted EBITDA

Q3 Summary . Organic revenue expected to be down 12% - 17% . Significant discretionary cost reductions already taken, top line flow through ~45% . Managing short-term volatility while investing for long-term growth . Free cash flow conversion greater than 100% of net income 14 IDEX Proprietary & Confidential

Appendix IDEX Proprietary & Confidential

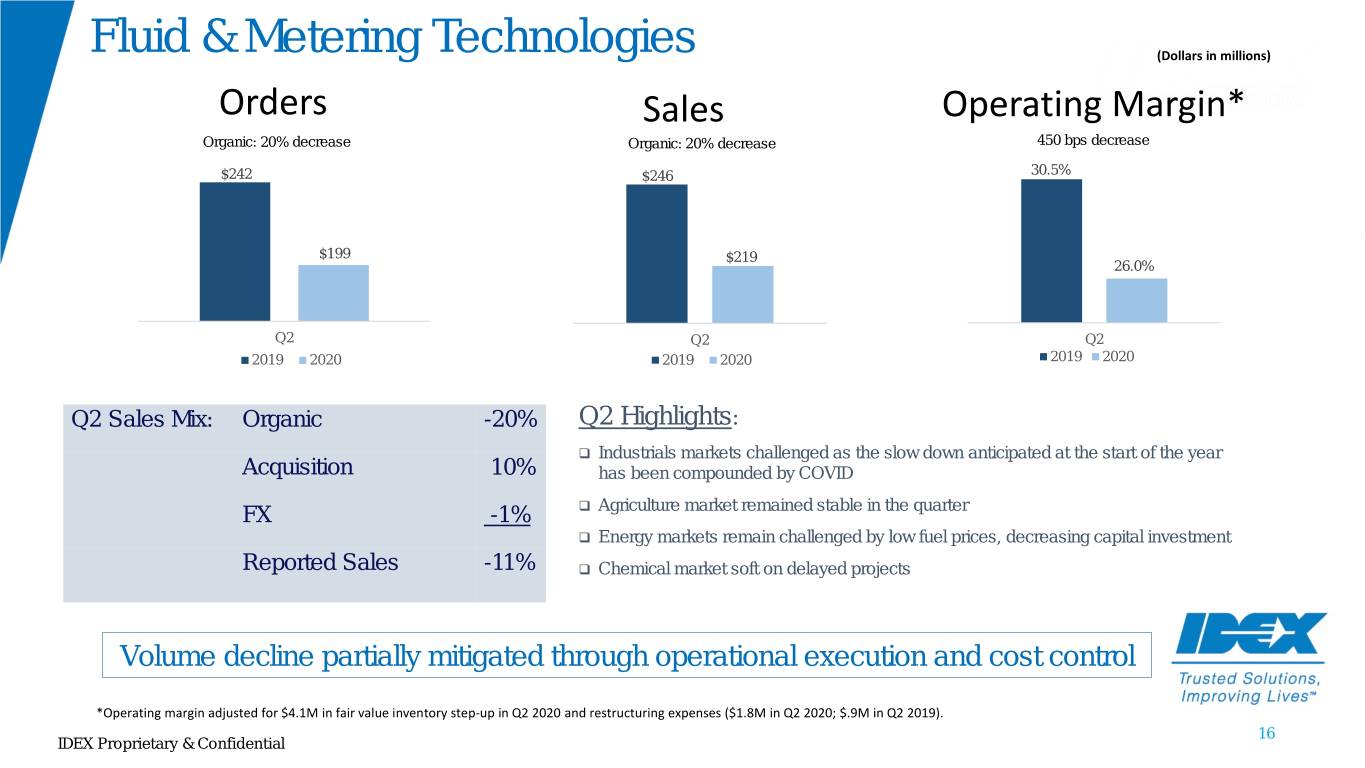

Fluid & Metering Technologies (Dollars in millions) Orders Sales Operating Margin* Organic: 20% decrease Organic: 20% decrease 450 bps decrease $242 $246 30.5% $199 $219 26.0% Q2 Q2 Q2 2019 2020 2019 2020 2019 2020 Q2 Sales Mix: Organic -20% Q2 Highlights: Industrials markets challenged as the slow down anticipated at the start of the year Acquisition 10% has been compounded by COVID FX -1% Agriculture market remained stable in the quarter Energy markets remain challenged by low fuel prices, decreasing capital investment Reported Sales -11% Chemical market soft on delayed projects Volume decline partially mitigated through operational execution and cost control *Operating margin adjusted for $4.1M in fair value inventory step-up in Q2 2020 and restructuring expenses ($1.8M in Q2 2020; $.9M in Q2 2019). 16 IDEX Proprietary & Confidential

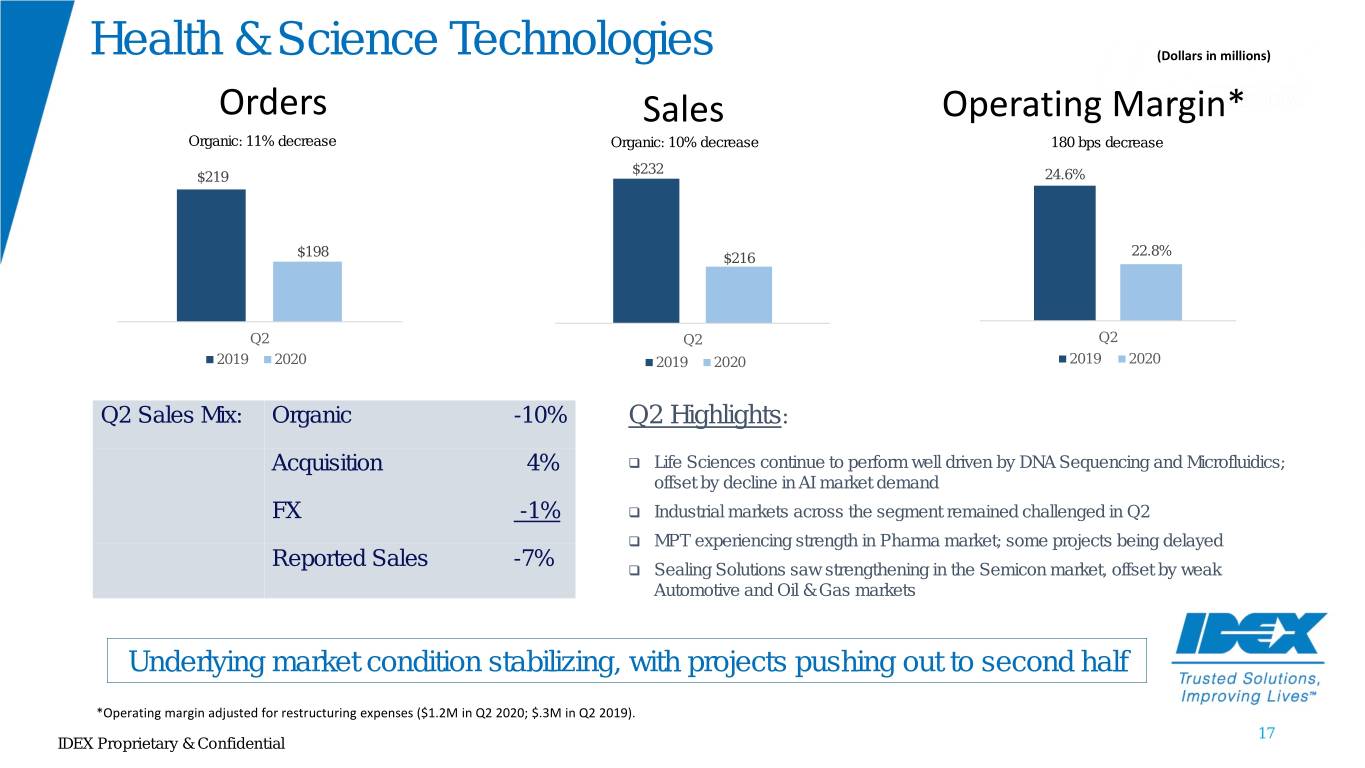

Health & Science Technologies (Dollars in millions) Orders Sales Operating Margin* Organic: 11% decrease Organic: 10% decrease 180 bps decrease $232 $219 24.6% 22.8% $198 $216 Q2 Q2 Q2 2019 2020 2019 2020 2019 2020 Q2 Sales Mix: Organic -10% Q2 Highlights: Acquisition 4% Life Sciences continue to perform well driven by DNA Sequencing and Microfluidics; offset by decline in AI market demand FX -1% Industrial markets across the segment remained challenged in Q2 MPT experiencing strength in Pharma market; some projects being delayed Reported Sales -7% Sealing Solutions saw strengthening in the Semicon market, offset by weak Automotive and Oil & Gas markets Underlying market condition stabilizing, with projects pushing out to second half *Operating margin adjusted for restructuring expenses ($1.2M in Q2 2020; $.3M in Q2 2019). 17 IDEX Proprietary & Confidential

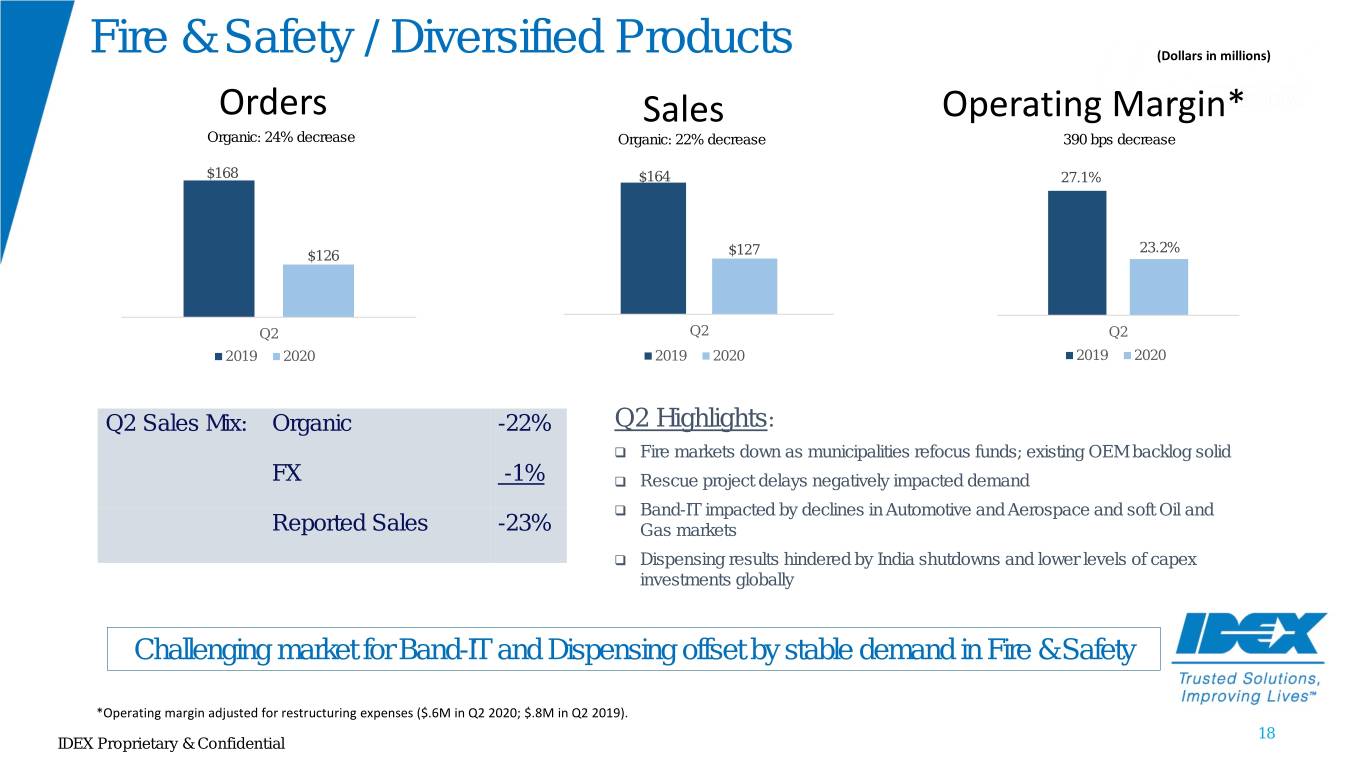

Fire & Safety / Diversified Products (Dollars in millions) Orders Sales Operating Margin* Organic: 24% decrease Organic: 22% decrease 390 bps decrease $168 $164 27.1% 23.2% $126 $127 Q2 Q2 Q2 2019 2020 2019 2020 2019 2020 Q2 Sales Mix: Organic -22% Q2 Highlights: Fire markets down as municipalities refocus funds; existing OEM backlog solid FX -1% Rescue project delays negatively impacted demand Band-IT impacted by declines in Automotive and Aerospace and soft Oil and Reported Sales -23% Gas markets Dispensing results hindered by India shutdowns and lower levels of capex investments globally Challenging market for Band-IT and Dispensing offset by stable demand in Fire & Safety *Operating margin adjusted for restructuring expenses ($.6M in Q2 2020; $.8M in Q2 2019). 18 IDEX Proprietary & Confidential