Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ANNOUNCING SECOND QUARTER RESULTS - UMPQUA HOLDINGS CORP | umpq-20200630ex991earn.htm |

| 8-K - 8-K - UMPQUA HOLDINGS CORP | umpq-20200722.htm |

Umpqua Holdings Corporation 2nd Quarter 2020 Earnings Conference Call Presentation July 23, 2020

Forward-looking Statements This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward- looking statements and we undertake no obligation to update any such statements. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In this press release we make forward-looking statements about the projected impact on our business operations of the COVID-19 global pandemic. Risks that could cause results to differ from forward-looking statements we make are set forth in our filings with the SEC and include, without limitation: current and future economic and market conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, and any slowdown in economic growth particularly in the western United States; the effect of the COVID-19 pandemic, including on our credit quality, deferral programs, and business operations, as well as its impact on general economic and financial market conditions; economic forecast variables that are either materially worse or better than end of quarter projections and deterioration in the economy that exceeds current consensus estimates; our ability to effectively manage problem credits; our ability to successfully implement efficiency and operational excellence initiatives; our ability to successfully develop and market new products and technology; and changes in laws or regulations. We also caution that the amount and timing of any future common stock dividends or repurchases will depend on the earnings, cash requirements and financial condition of the Company, market conditions, capital requirements, applicable law and regulations (including federal securities laws and federal banking regulations), and other factors deemed relevant by the Company’s Board of Directors, and may be subject to regulatory approval or conditions.

COVID-19 Response Associates Customers Communities • Initiated a remote work program • Active participant in the Paycheck • $3.0 million in combined grants for associates. About 90% of our Protection Program (PPP). and investments to organizations non-store associates are operating Complete PPP details follow on providing COVID-19 community remotely. slide #5 which show over 15,000 relief and small business loans produced for $2.0B. microloans: • Diligent and planful return to office ~225,000 estimated jobs saved. • 57% of Q2 grants to non- strategies being developed profits focusing on economic working with multiple state-level • Transitioned store operations opportunity for underserved proclamations and CDC guidance. which has allowed over 95% of communities. stores on any given day to remain • 43% of Q2 grants to non- • Supplemental front line associate open throughout the crisis. profits whose programming pay. focuses on educational • Working closely with customers attainment. • Established pandemic pay bank who require payment deferrals. for associates needing additional Deferral program details follow on • Initiated Virtual Volunteerism time off due to various COVID-19 slide #6. Program in which associates impacts. have logged over 1,500 hours of virtual volunteer work this year. • Associate 3:1 Giving Match 3

Q2 2020 Highlights (compared to Q1 2020) • Net interest income decreased by $6.0 million on a quarter to quarter basis primarily driven by lower average yields on loans and leases, partially offset by a lower cost of interest bearing deposits. • Provision for credit losses decreased by $31.0 million, although still elevated from historical levels reflecting the continued influence of the COVID-19 global pandemic on economic forecasts. • Net charge-offs decreased by twelve basis points to 0.29% of average loans and leases (annualized). • Non-interest income increased by $74.8 million, driven primarily by an increase in net mortgage banking revenue. • Non-interest expense decreased by $1.8 billion, driven by the $1.8 billion goodwill impairment that was recorded in the prior period. Absent the goodwill impairment charge, non-interest expense increased by $4.2 million from the prior quarter primarily due to strong mortgage production. • Non-performing assets to total assets decreased six basis points to 0.26% from 0.32%. • Estimated total risk-based capital ratio of 14.4% and estimated Tier 1 common to risk weighted assets ratio of 11.1%. • Issued a Form 8-K on June 17, 2020 announcing the shift in timing of a dividend declaration date from historical intra-quarter announcements to after quarterly earnings are finalized and applicable regulatory approval 4 processes are complete.

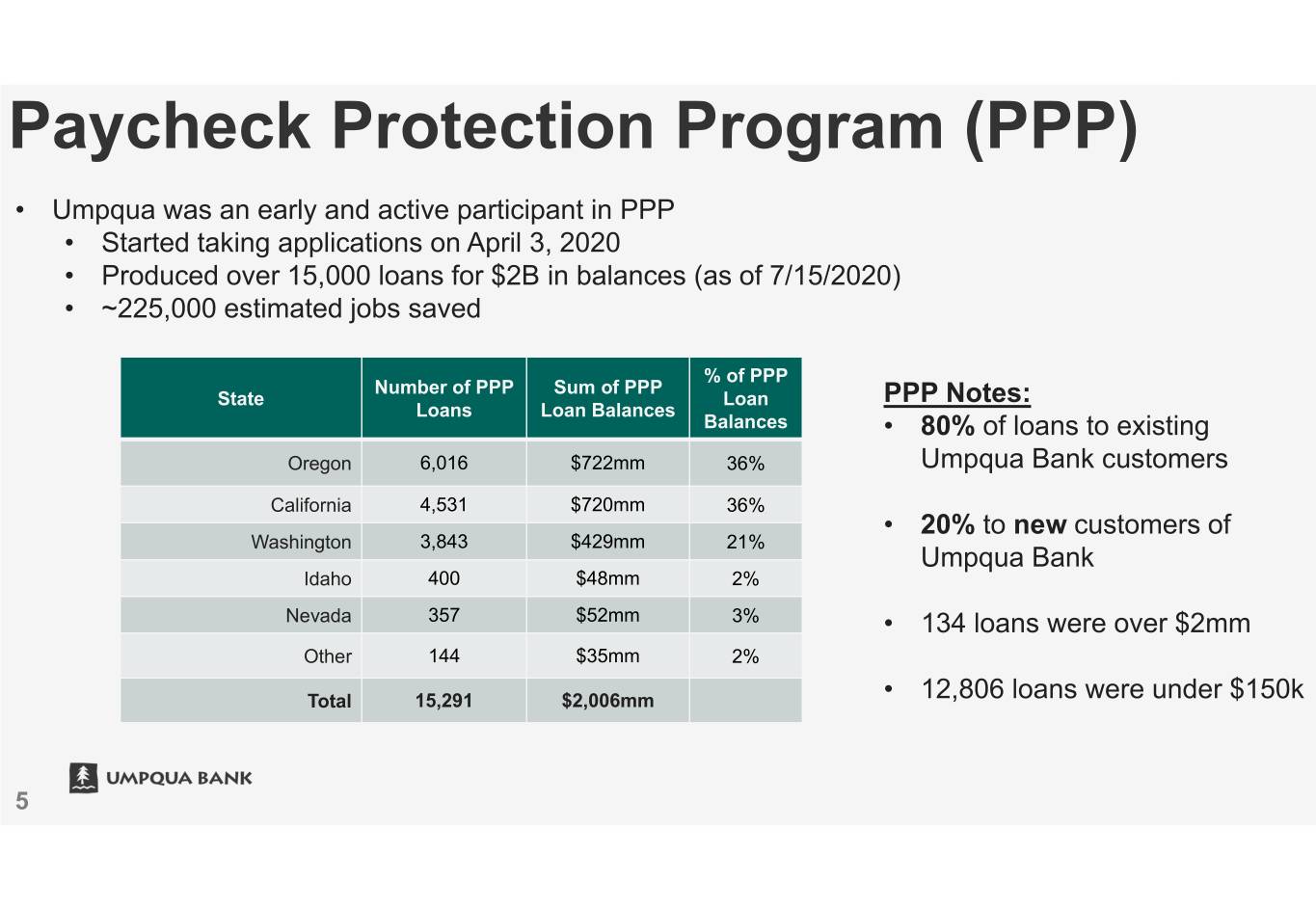

Paycheck Protection Program (PPP) • Umpqua was an early and active participant in PPP • Started taking applications on April 3, 2020 • Produced over 15,000 loans for $2B in balances (as of 7/15/2020) • ~225,000 estimated jobs saved % of PPP Number of PPP Sum of PPP State Loan PPP Notes: Loans Loan Balances Balances • 80% of loans to existing Oregon 6,016 $722mm 36% Umpqua Bank customers California 4,531 $720mm 36% • 20% to new customers of Washington 3,843 $429mm 21% Umpqua Bank Idaho 400 $48mm 2% Nevada 357 $52mm 3% • 134 loans were over $2mm Other 144 $35mm 2% Total 15,291 $2,006mm • 12,806 loans were under $150k 5

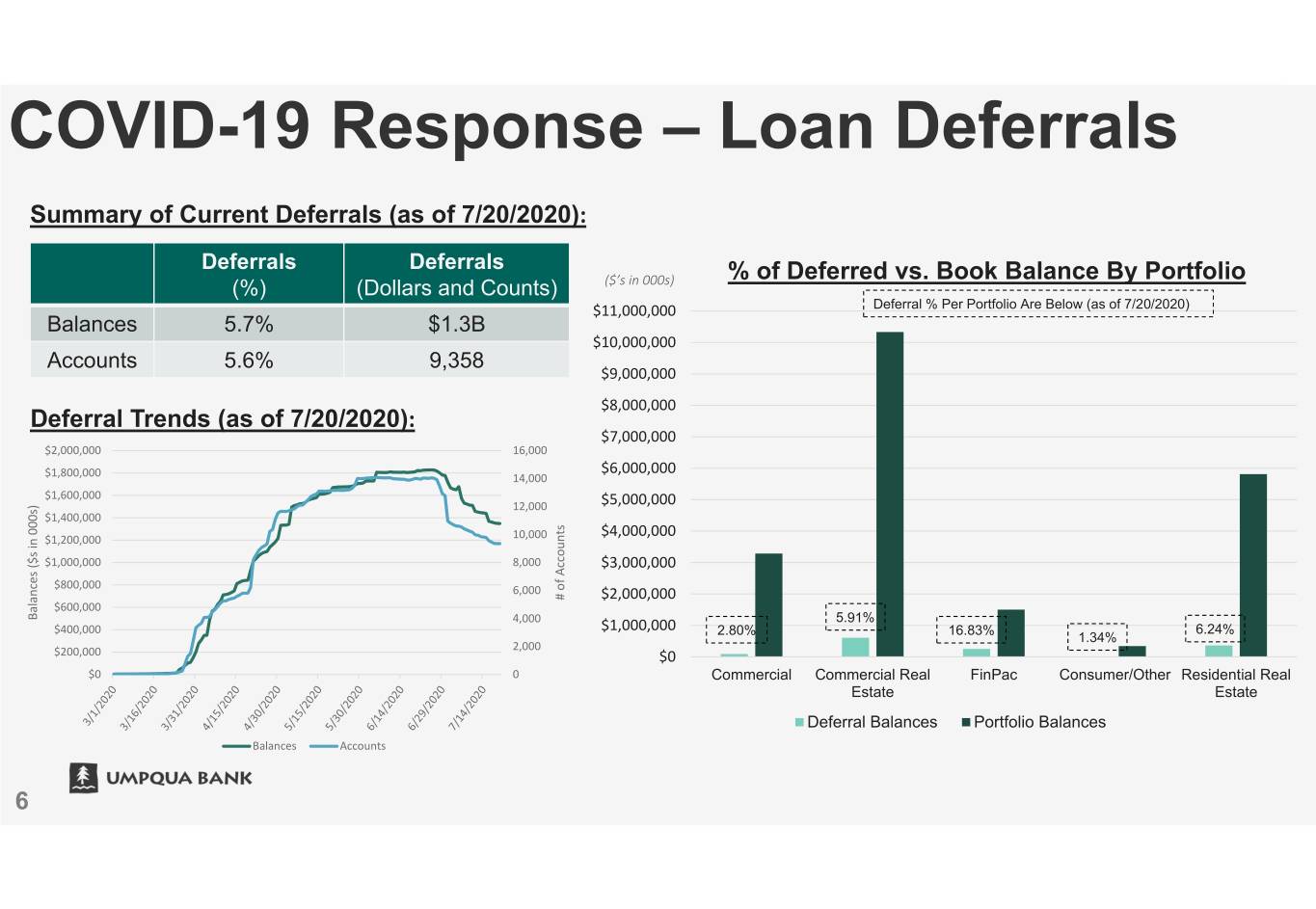

COVID-19 Response – Loan Deferrals Summary of Current Deferrals (as of 7/20/2020): Deferrals Deferrals % of Deferred vs. Book Balance By Portfolio (%) (Dollars and Counts) ($’s in 000s) $11,000,000 Deferral % Per Portfolio Are Below (as of 7/20/2020) Balances 5.7% $1.3B $10,000,000 Accounts 5.6% 9,358 $9,000,000 $8,000,000 Deferral Trends (as of 7/20/2020): $7,000,000 $2,000,000 16,000 $6,000,000 $1,800,000 14,000 $1,600,000 12,000 $5,000,000 $1,400,000 000s) $4,000,000 $1,200,000 10,000 in ($s $1,000,000 8,000 $3,000,000 Accounts $800,000 of 6,000 # $2,000,000 $600,000 Balances 4,000 5.91% $400,000 $1,000,000 2.80% 16.83% 6.24% 1.34% 2,000 $200,000 $0 $0 0 Commercial Commercial Real FinPac Consumer/Other Residential Real Estate Estate Deferral Balances Portfolio Balances Balances Accounts 6

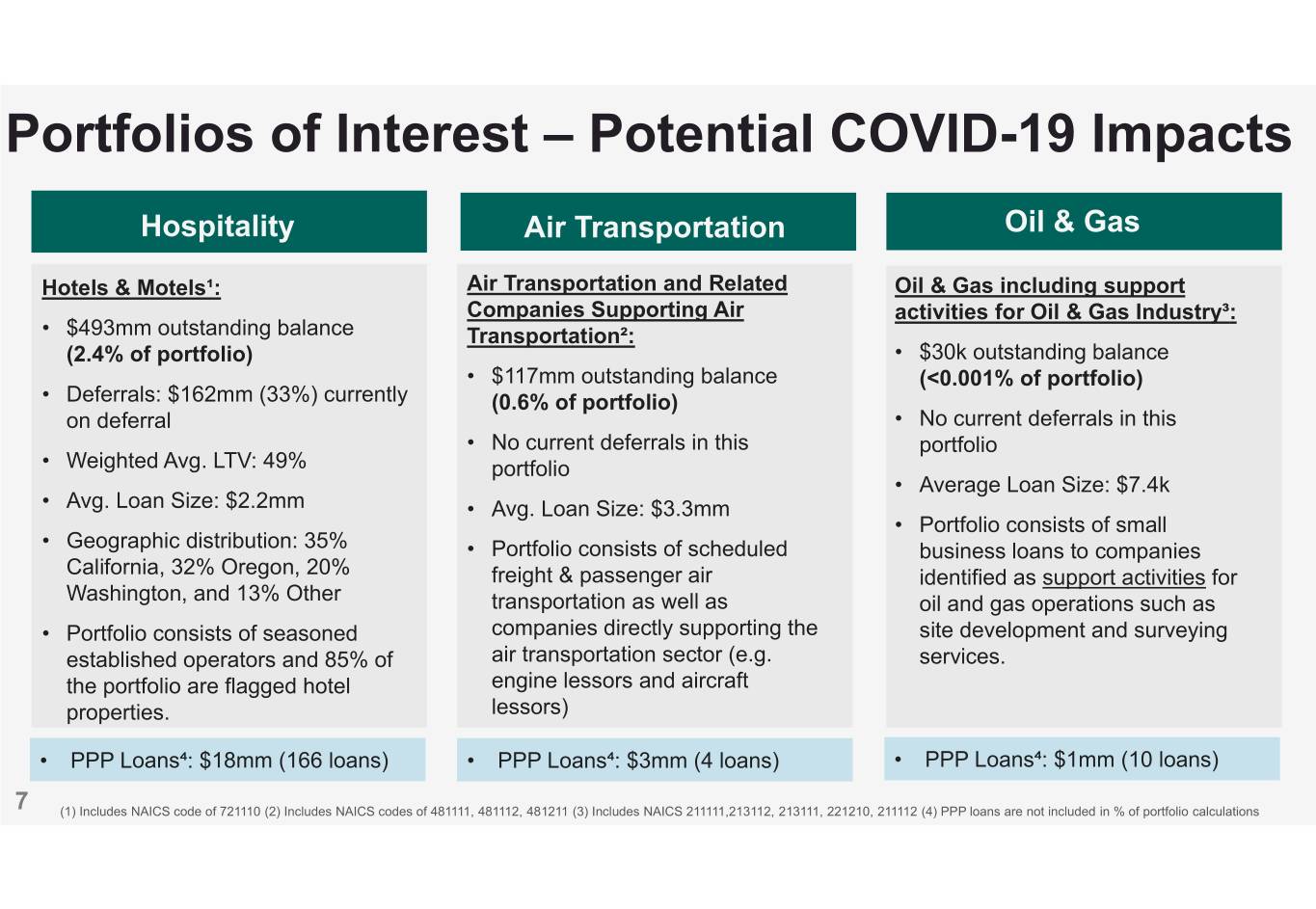

Portfolios of Interest – Potential COVID-19 Impacts Hospitality Air Transportation Oil & Gas Hotels & Motels¹: Air Transportation and Related Oil & Gas including support Companies Supporting Air activities for Oil & Gas Industry³: • $493mm outstanding balance Transportation²: (2.4% of portfolio) • $30k outstanding balance • $117mm outstanding balance (<0.001% of portfolio) • Deferrals: $162mm (33%) currently (0.6% of portfolio) on deferral • No current deferrals in this • No current deferrals in this portfolio • Weighted Avg. LTV: 49% portfolio • Average Loan Size: $7.4k • Avg. Loan Size: $2.2mm • Avg. Loan Size: $3.3mm • Portfolio consists of small • Geographic distribution: 35% • Portfolio consists of scheduled business loans to companies California, 32% Oregon, 20% freight & passenger air identified as support activities for Washington, and 13% Other transportation as well as oil and gas operations such as • Portfolio consists of seasoned companies directly supporting the site development and surveying established operators and 85% of air transportation sector (e.g. services. the portfolio are flagged hotel engine lessors and aircraft properties. lessors) • PPP Loans⁴: $18mm (166 loans) • PPP Loans⁴: $3mm (4 loans) • PPP Loans⁴: $1mm (10 loans) 7 (1) Includes NAICS code of 721110 (2) Includes NAICS codes of 481111, 481112, 481211 (3) Includes NAICS 211111,213112, 213111, 221210, 211112 (4) PPP loans are not included in % of portfolio calculations

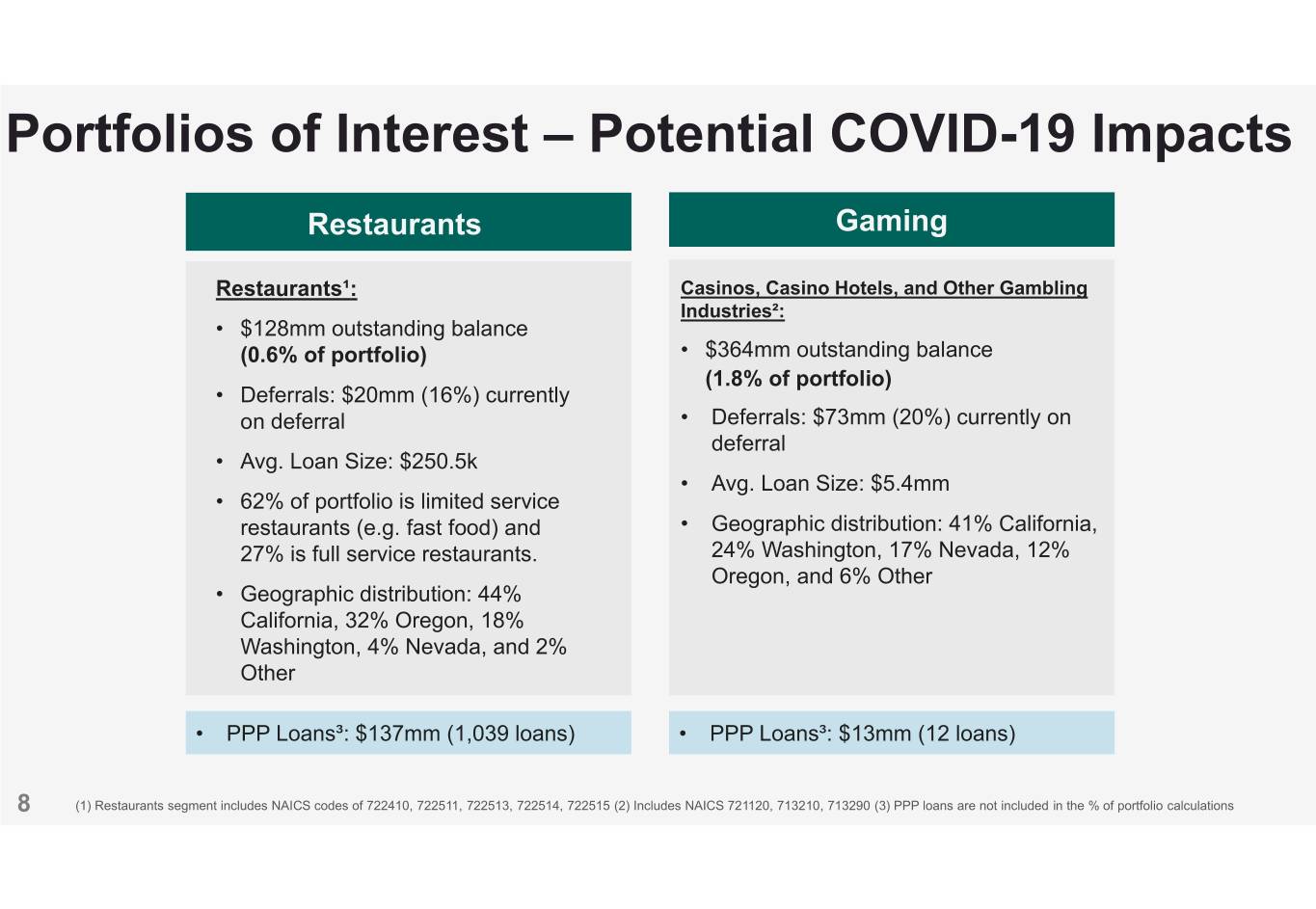

Portfolios of Interest – Potential COVID-19 Impacts Restaurants Gaming Restaurants¹: Casinos, Casino Hotels, and Other Gambling Industries²: • $128mm outstanding balance (0.6% of portfolio) • $364mm outstanding balance (1.8% of portfolio) • Deferrals: $20mm (16%) currently on deferral • Deferrals: $73mm (20%) currently on deferral • Avg. Loan Size: $250.5k • Avg. Loan Size: $5.4mm • 62% of portfolio is limited service restaurants (e.g. fast food) and • Geographic distribution: 41% California, 27% is full service restaurants. 24% Washington, 17% Nevada, 12% Oregon, and 6% Other • Geographic distribution: 44% California, 32% Oregon, 18% Washington, 4% Nevada, and 2% Other • PPP Loans³: $137mm (1,039 loans) • PPP Loans³: $13mm (12 loans) 8 (1) Restaurants segment includes NAICS codes of 722410, 722511, 722513, 722514, 722515 (2) Includes NAICS 721120, 713210, 713290 (3) PPP loans are not included in the % of portfolio calculations

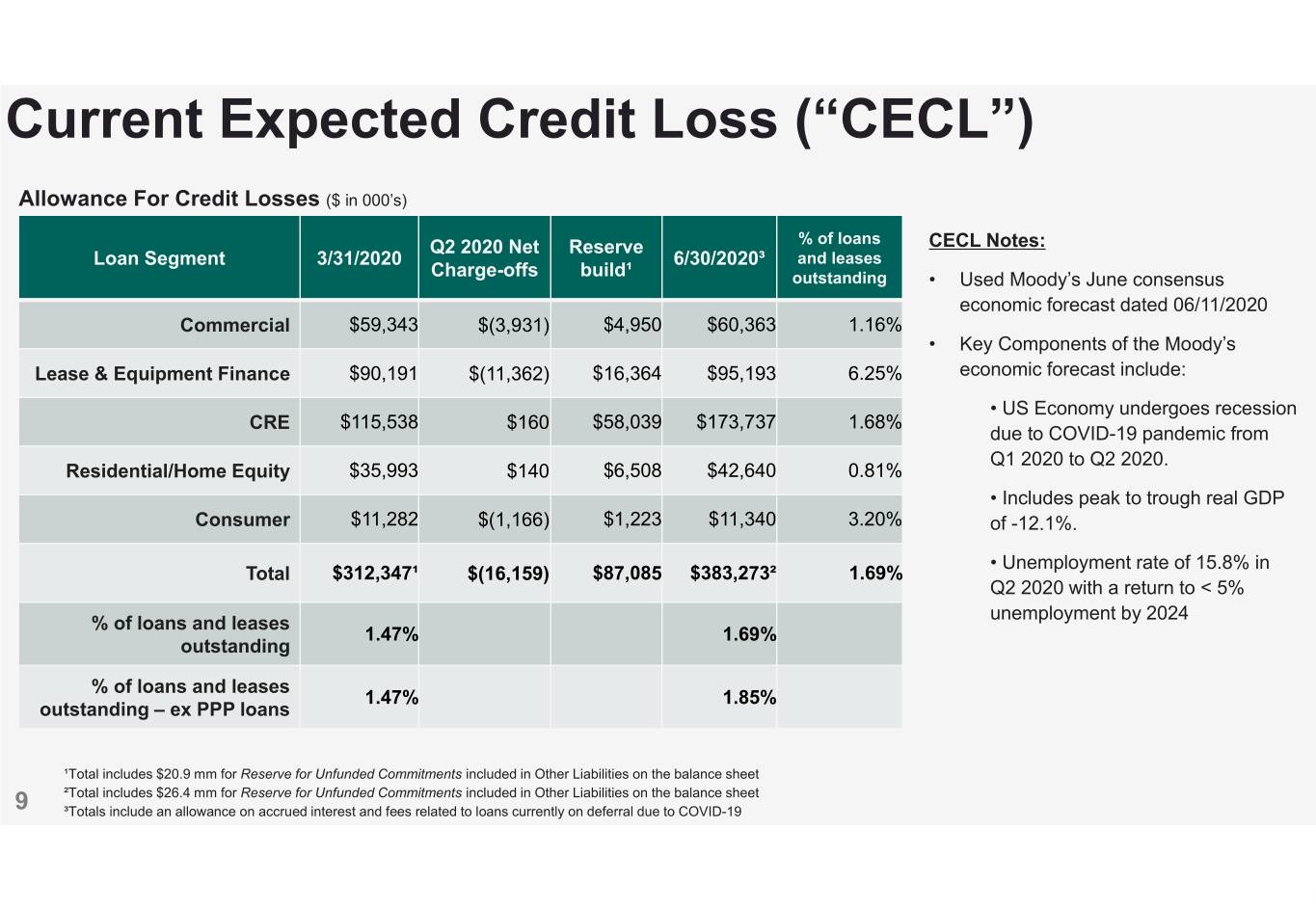

Current Expected Credit Loss (“CECL”) Allowance For Credit Losses ($ in 000’s) Q2 2020 Net Reserve % of loans CECL Notes: Loan Segment 3/31/2020 6/30/2020³ and leases Charge-offs build¹ outstanding • Used Moody’s June consensus economic forecast dated 06/11/2020 Commercial $59,343 $(3,931) $4,950 $60,363 1.16% • Key Components of the Moody’s Lease & Equipment Finance $90,191 $(11,362) $16,364 $95,193 6.25% economic forecast include: • US Economy undergoes recession CRE $115,538 $160 $58,039 $173,737 1.68% due to COVID-19 pandemic from Q1 2020 to Q2 2020. Residential/Home Equity $35,993 $140 $6,508 $42,640 0.81% • Includes peak to trough real GDP Consumer $11,282 $(1,166) $1,223 $11,340 3.20% of -12.1%. • Unemployment rate of 15.8% in Total $312,347¹ $(16,159) $87,085 $383,273² 1.69% Q2 2020 with a return to < 5% unemployment by 2024 % of loans and leases 1.47% 1.69% outstanding % of loans and leases 1.47% 1.85% outstanding – ex PPP loans ¹Total includes $20.9 mm for Reserve for Unfunded Commitments included in Other Liabilities on the balance sheet ²Total includes $26.4 mm for Reserve for Unfunded Commitments included in Other Liabilities on the balance sheet 9 ³Totals include an allowance on accrued interest and fees related to loans currently on deferral due to COVID-19

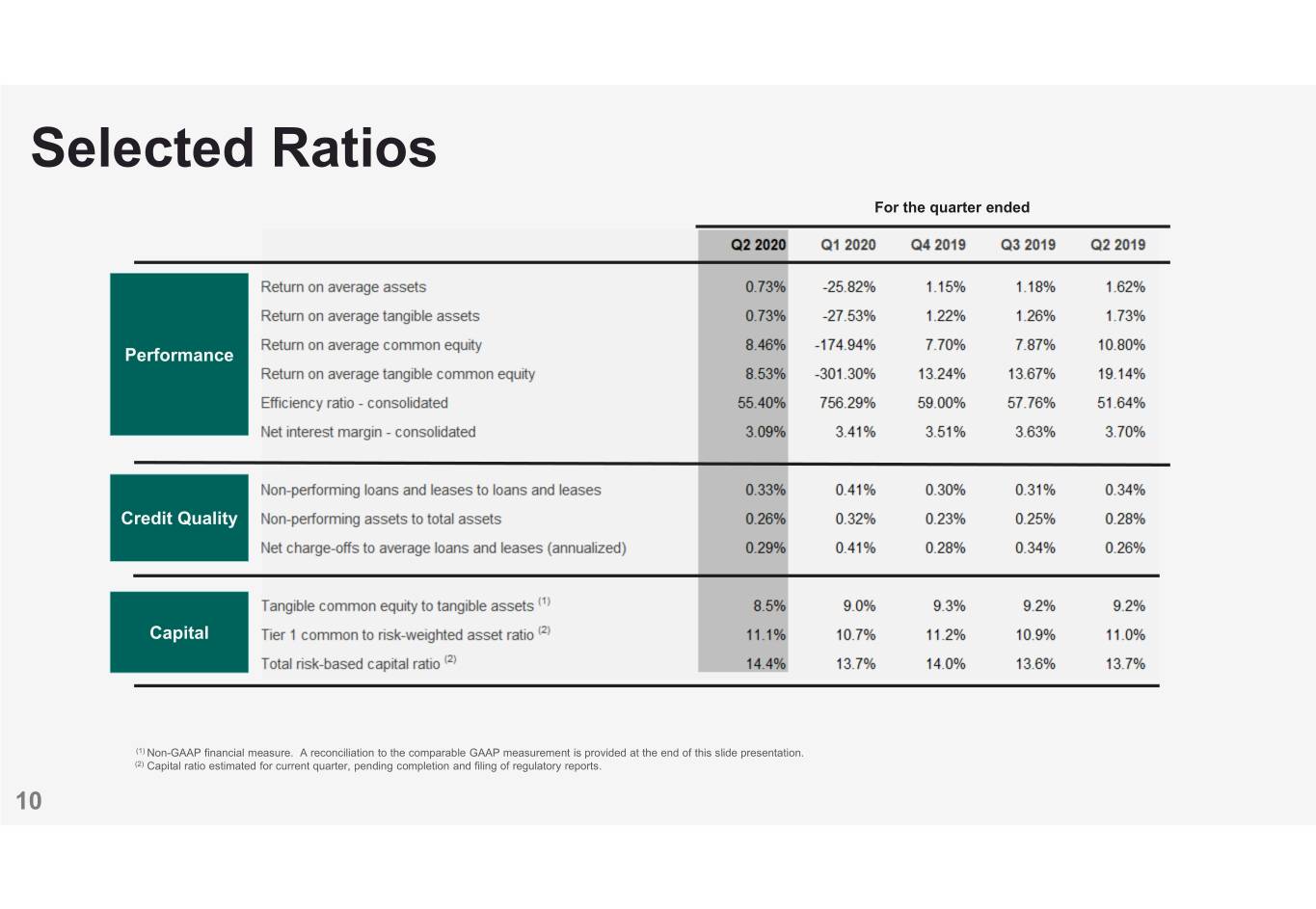

Selected Ratios For the quarter ended Performance Credit Quality Capital (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. (2) Capital ratio estimated for current quarter, pending completion and filing of regulatory reports. 10

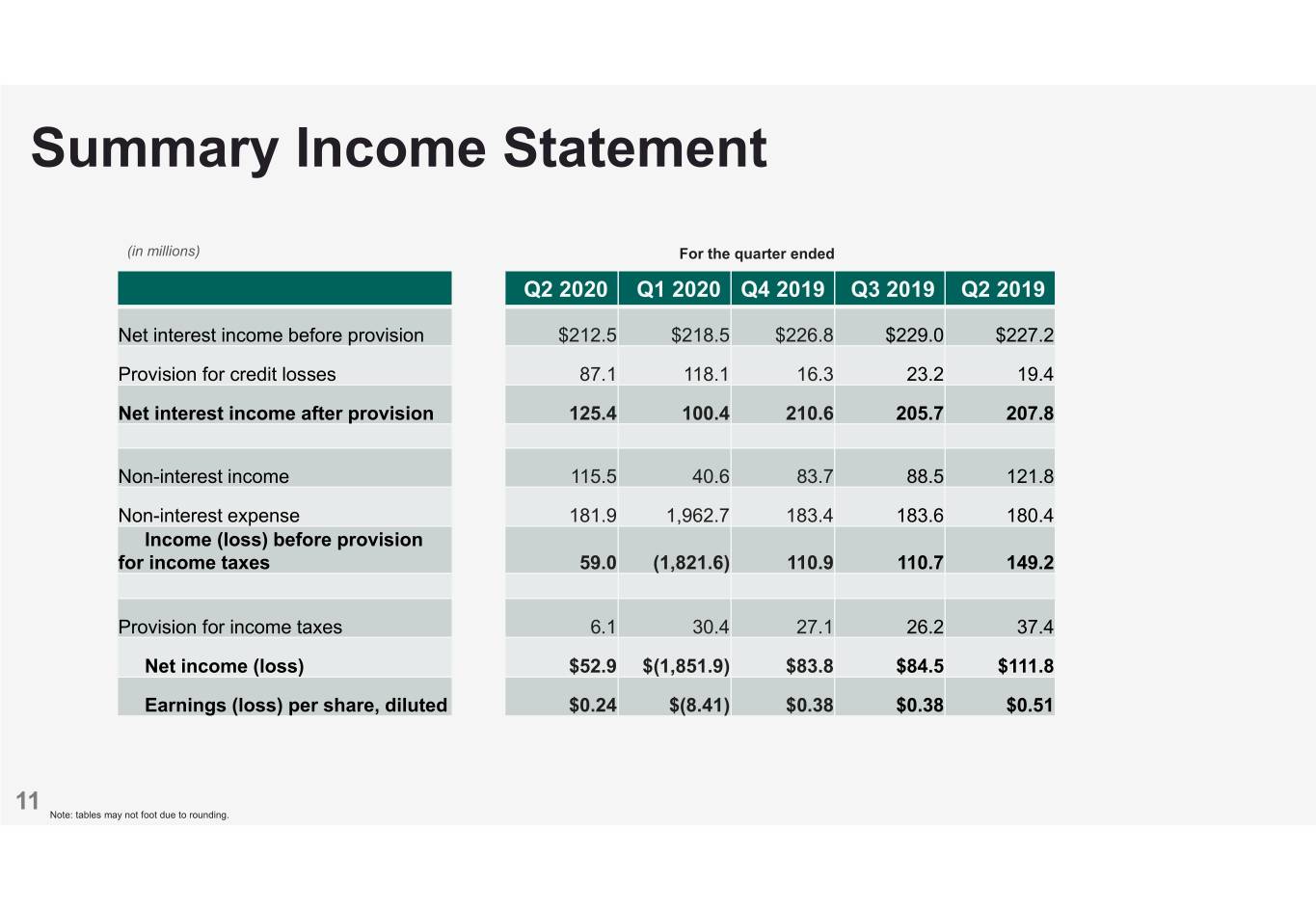

Summary Income Statement (in millions) For the quarter ended Q2 2020 Q1 2020 Q4 2019 Q3 2019 Q2 2019 Net interest income before provision $212.5 $218.5 $226.8 $229.0 $227.2 Provision for credit losses 87.1 118.1 16.3 23.2 19.4 Net interest income after provision 125.4 100.4 210.6 205.7 207.8 Non-interest income 115.5 40.6 83.7 88.5 121.8 Non-interest expense 181.9 1,962.7 183.4 183.6 180.4 Income (loss) before provision for income taxes 59.0 (1,821.6) 110.9 110.7 149.2 Provision for income taxes 6.1 30.4 27.1 26.2 37.4 Net income (loss) $52.9 $(1,851.9) $83.8 $84.5 $111.8 Earnings (loss) per share, diluted $0.24 $(8.41) $0.38 $0.38 $0.51 11 Note: tables may not foot due to rounding.

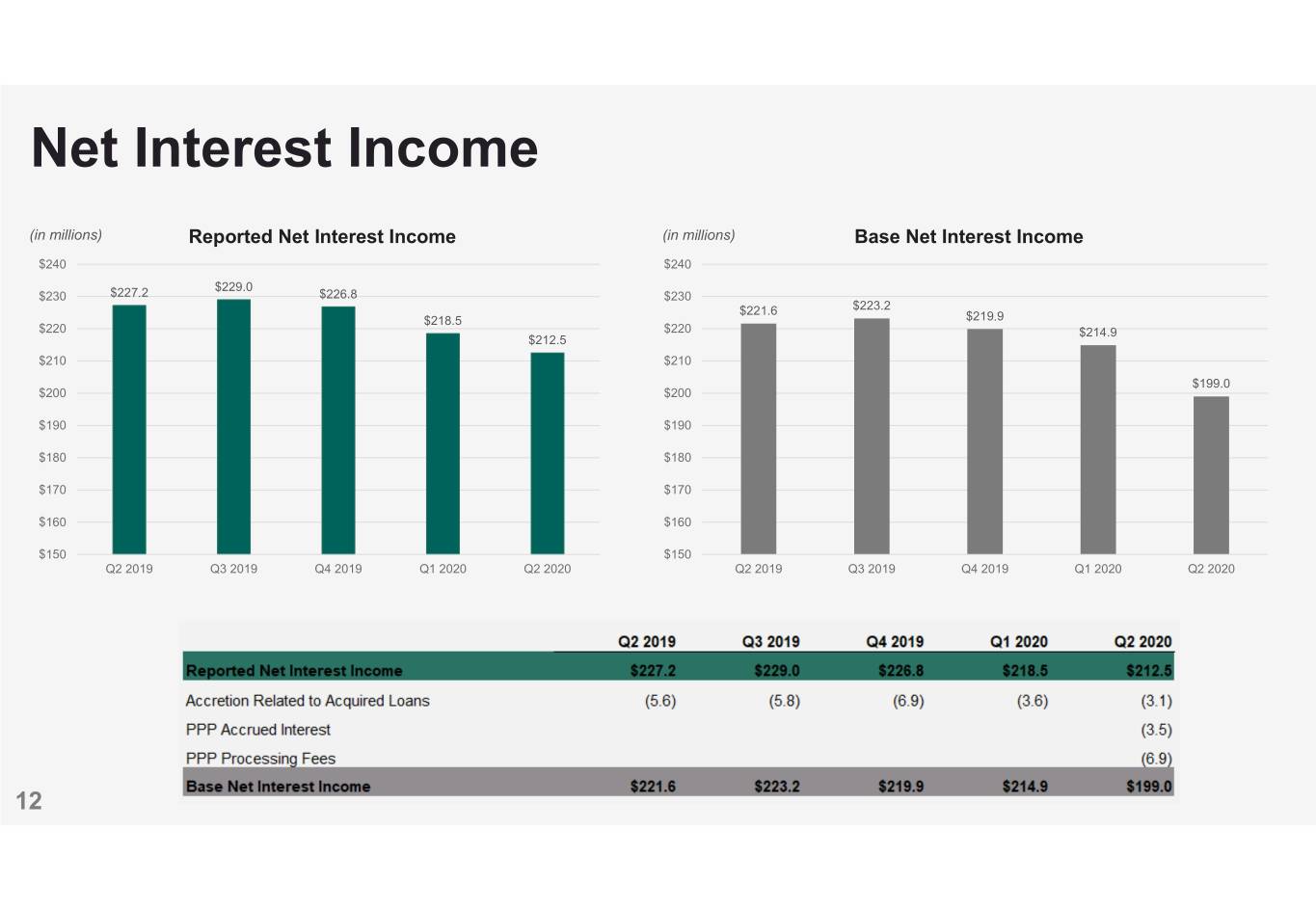

Net Interest Income (in millions) Reported Net Interest Income (in millions) Base Net Interest Income $240 $240 $229.0 $230 $227.2 $226.8 $230 $221.6 $223.2 $218.5 $219.9 $220 $220 $214.9 $212.5 $210 $210 $199.0 $200 $200 $190 $190 $180 $180 $170 $170 $160 $160 $150 $150 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 12

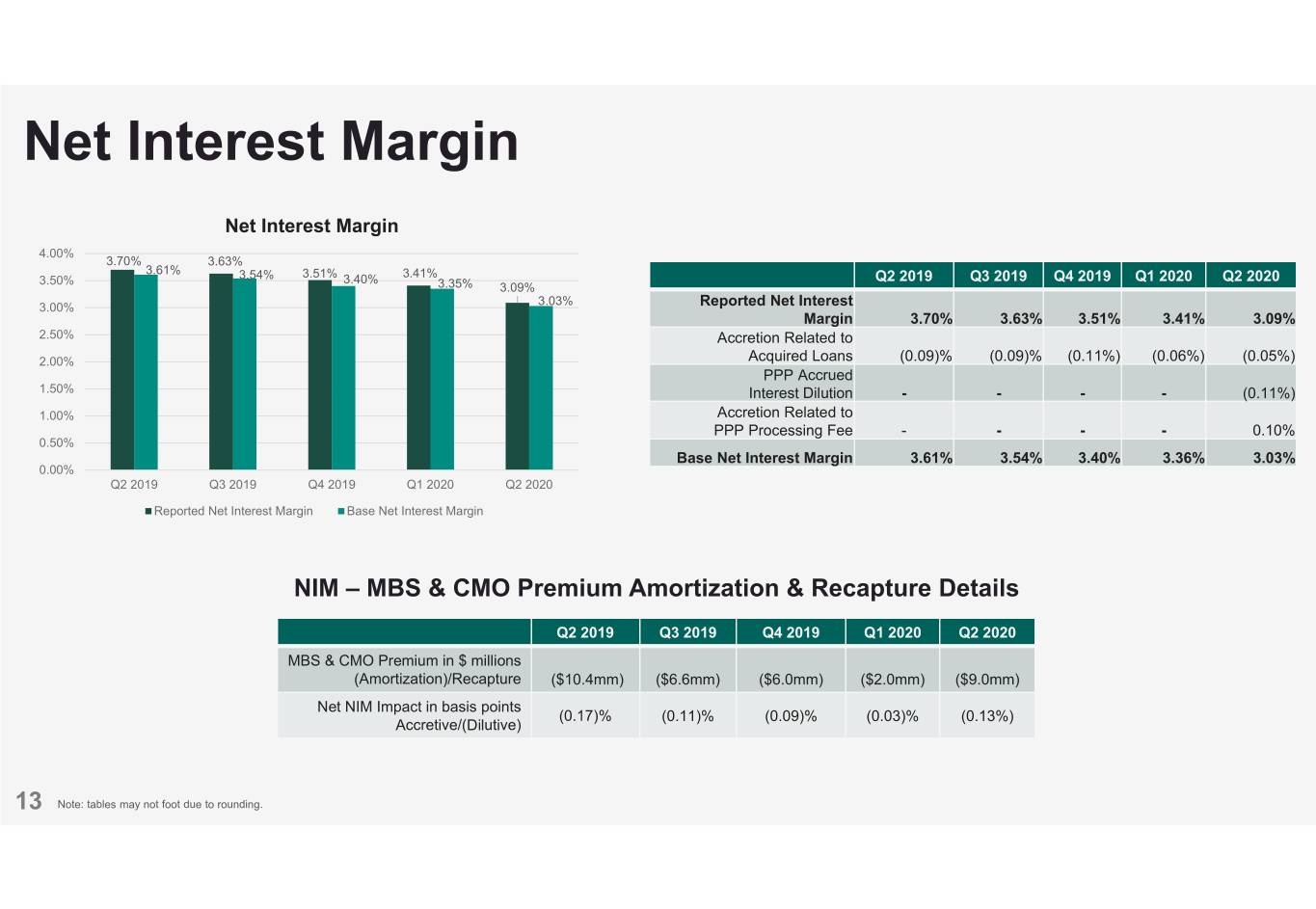

Net Interest Margin Net Interest Margin 4.00% 3.70% 3.63% 3.61% 3.51% 3.41% 3.50% 3.54% 3.40% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 3.35% 3.09% 3.03% 3.00% Reported Net Interest Margin 3.70% 3.63% 3.51% 3.41% 3.09% 2.50% Accretion Related to 2.00% Acquired Loans (0.09)% (0.09)% (0.11%) (0.06%) (0.05%) PPP Accrued 1.50% Interest Dilution ----(0.11%) 1.00% Accretion Related to PPP Processing Fee - --- 0.10% 0.50% Base Net Interest Margin 3.61% 3.54% 3.40% 3.36% 3.03% 0.00% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Reported Net Interest Margin Base Net Interest Margin NIM – MBS & CMO Premium Amortization & Recapture Details Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 MBS & CMO Premium in $ millions (Amortization)/Recapture ($10.4mm) ($6.6mm) ($6.0mm) ($2.0mm) ($9.0mm) Net NIM Impact in basis points (0.17)% (0.11)% (0.09)% (0.03)% (0.13%) Accretive/(Dilutive) 13 Note: tables may not foot due to rounding.

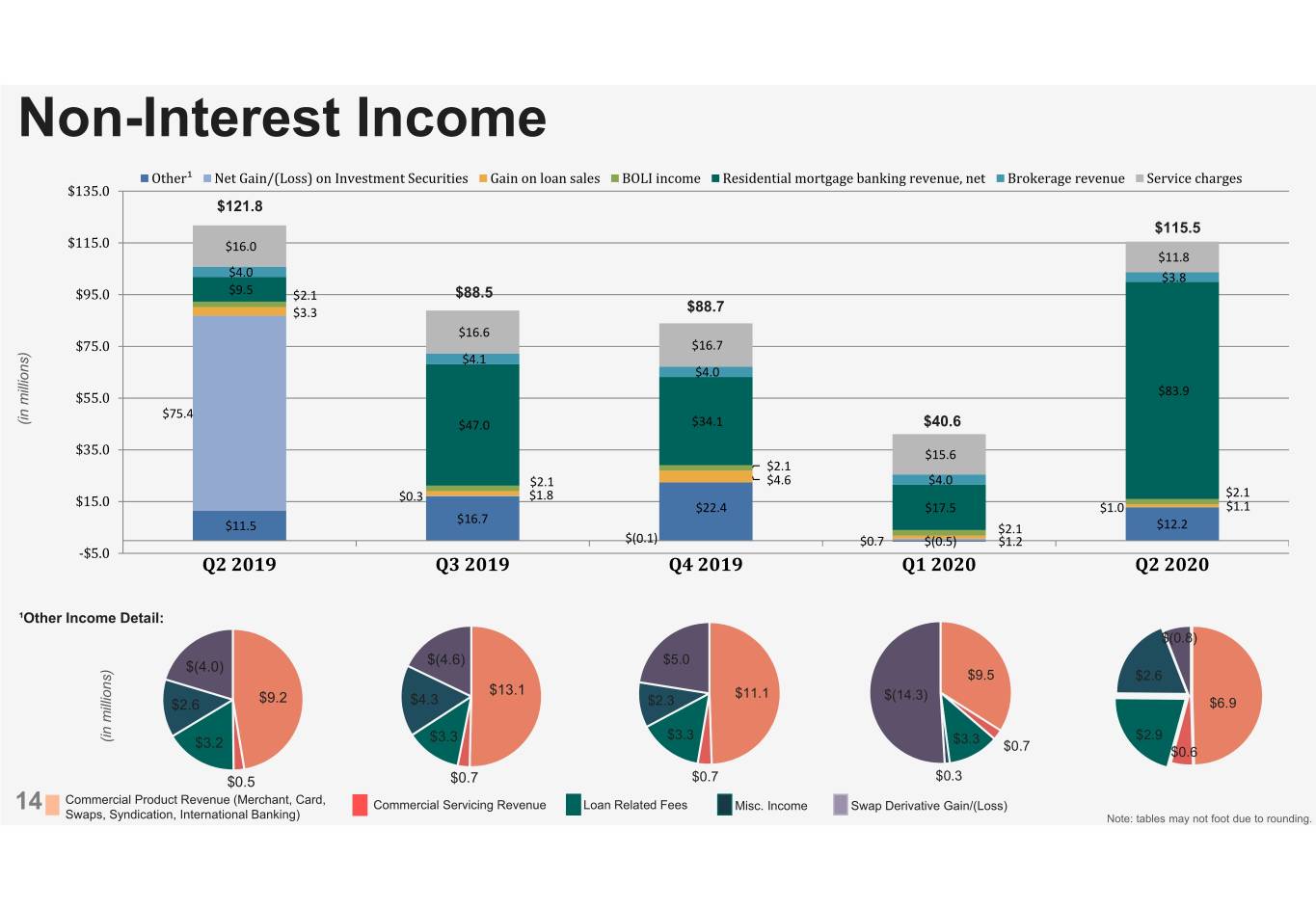

Non-Interest Income Other¹ Net Gain/(Loss) on Investment Securities Gain on loan sales BOLI income Residential mortgage banking revenue, net Brokerage revenue Service charges $135.0 $121.8 $115.5 $115.0 $16.0 $11.8 $4.0 $3.8 $95.0 $9.5 $2.1 $88.5 $3.3 $88.7 $16.6 $75.0 $16.7 $4.1 $4.0 $55.0 $83.9 $75.4 (in millions) $47.0 $34.1 $40.6 $35.0 $15.6 $2.1 $2.1 $4.6 $4.0 $0.3 $1.8 $2.1 $15.0 $22.4 $17.5 $1.0 $1.1 $16.7 $11.5 $2.1 $12.2 $(0.1) $0.7 $(0.5) $1.2 -$5.0 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 ¹Other Income Detail: $(0.8) $(4.6) $5.0 $(4.0) $9.5 $2.6 $13.1 $11.1 $(14.3) $2.6 $9.2 $4.3 $2.3 $6.9 $3.3 $2.9 (in millions) $3.2 $3.3 $3.3 $0.7 $0.6 $0.5 $0.7 $0.7 $0.3 Commercial Product Revenue (Merchant, Card, 14 Commercial Servicing Revenue Loan Related Fees Misc. Income Swap Derivative Gain/(Loss) Swaps, Syndication, International Banking) Note: tables may not foot due to rounding.

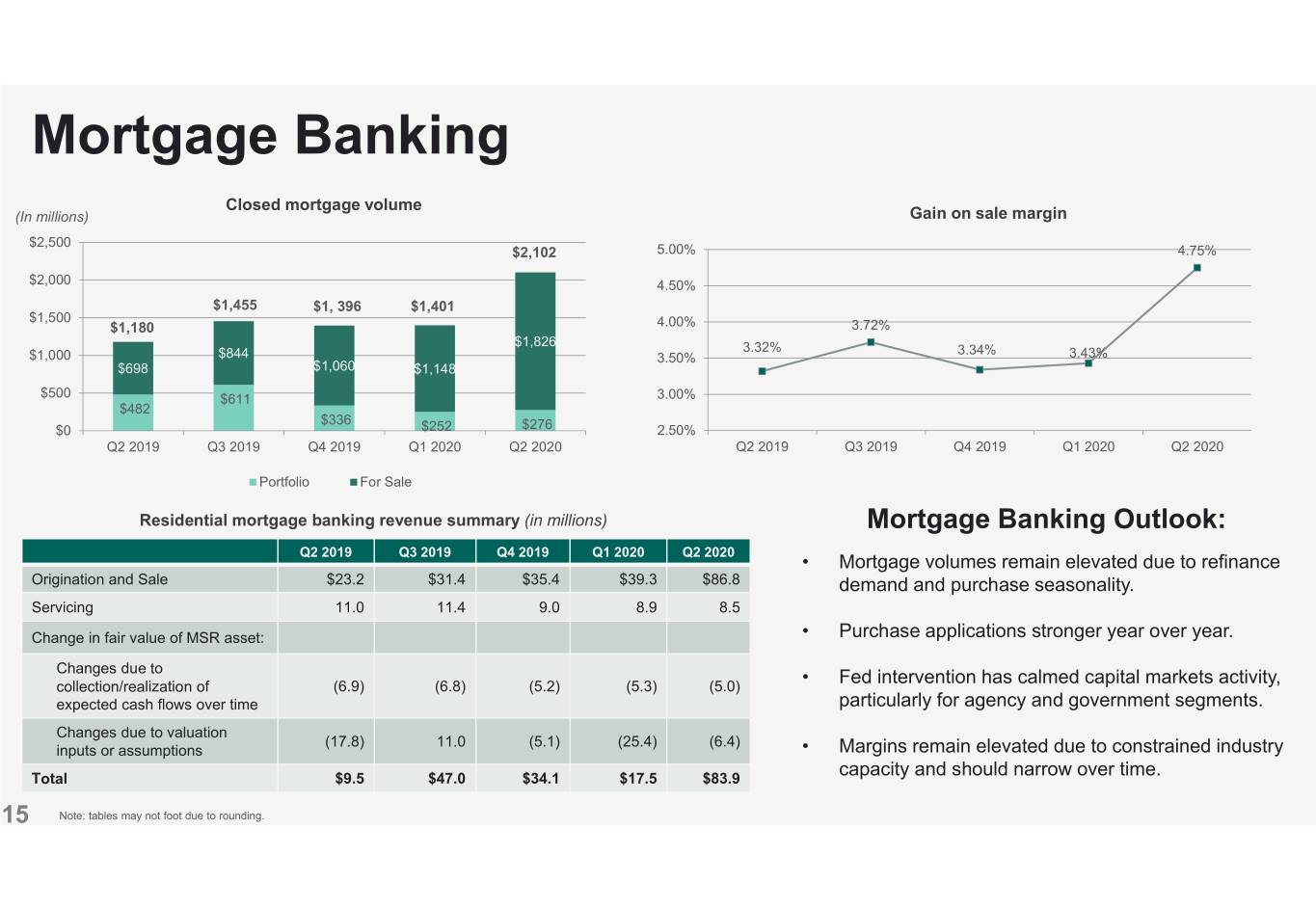

Mortgage Banking Closed mortgage volume (In millions) Gain on sale margin $2,500 $2,102 5.00% 4.75% $2,000 4.50% $1,455 $1, 396 $1,401 $1,500 $1,180 4.00% 3.72% $1,826 3.32% 3.34% $1,000 $844 3.50% 3.43% $698 $1,060 $1,148 $500 $611 3.00% $482 $336 $0 $252 $276 2.50% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Portfolio For Sale Residential mortgage banking revenue summary (in millions) Mortgage Banking Outlook: Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 • Mortgage volumes remain elevated due to refinance Origination and Sale $23.2 $31.4 $35.4 $39.3 $86.8 demand and purchase seasonality. Servicing 11.0 11.4 9.0 8.9 8.5 Change in fair value of MSR asset: • Purchase applications stronger year over year. Changes due to collection/realization of (6.9) (6.8) (5.2) (5.3) (5.0) • Fed intervention has calmed capital markets activity, expected cash flows over time particularly for agency and government segments. Changes due to valuation (17.8) 11.0 (5.1) (25.4) (6.4) inputs or assumptions • Margins remain elevated due to constrained industry Total $9.5 $47.0 $34.1 $17.5 $83.9 capacity and should narrow over time. 15 Note: tables may not foot due to rounding.

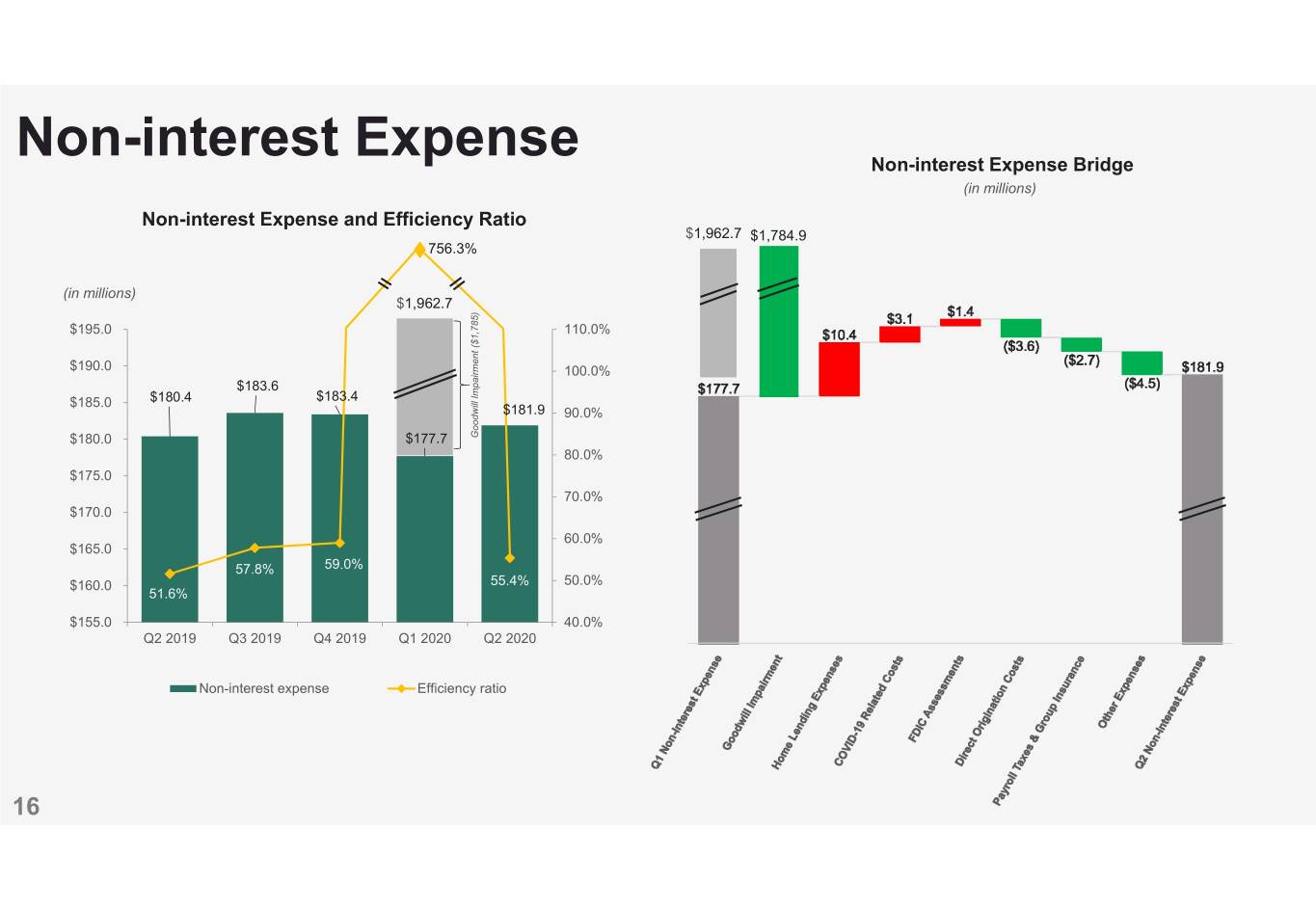

Non-interest Expense Non-interest Expense Bridge (in millions) Non-interest Expense and Efficiency Ratio $1,962.7 $1,784.9 756.3% (in millions) $1,962.7 $195.0 110.0% $190.0 100.0% $183.6 $185.0 $180.4 $183.4 $181.9 90.0% $180.0 $177.7 Goodwill Impairment ($1,785) 80.0% $175.0 70.0% $170.0 60.0% $165.0 57.8% 59.0% $160.0 55.4% 50.0% 51.6% $155.0 40.0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Non-interest expense Efficiency ratio 16

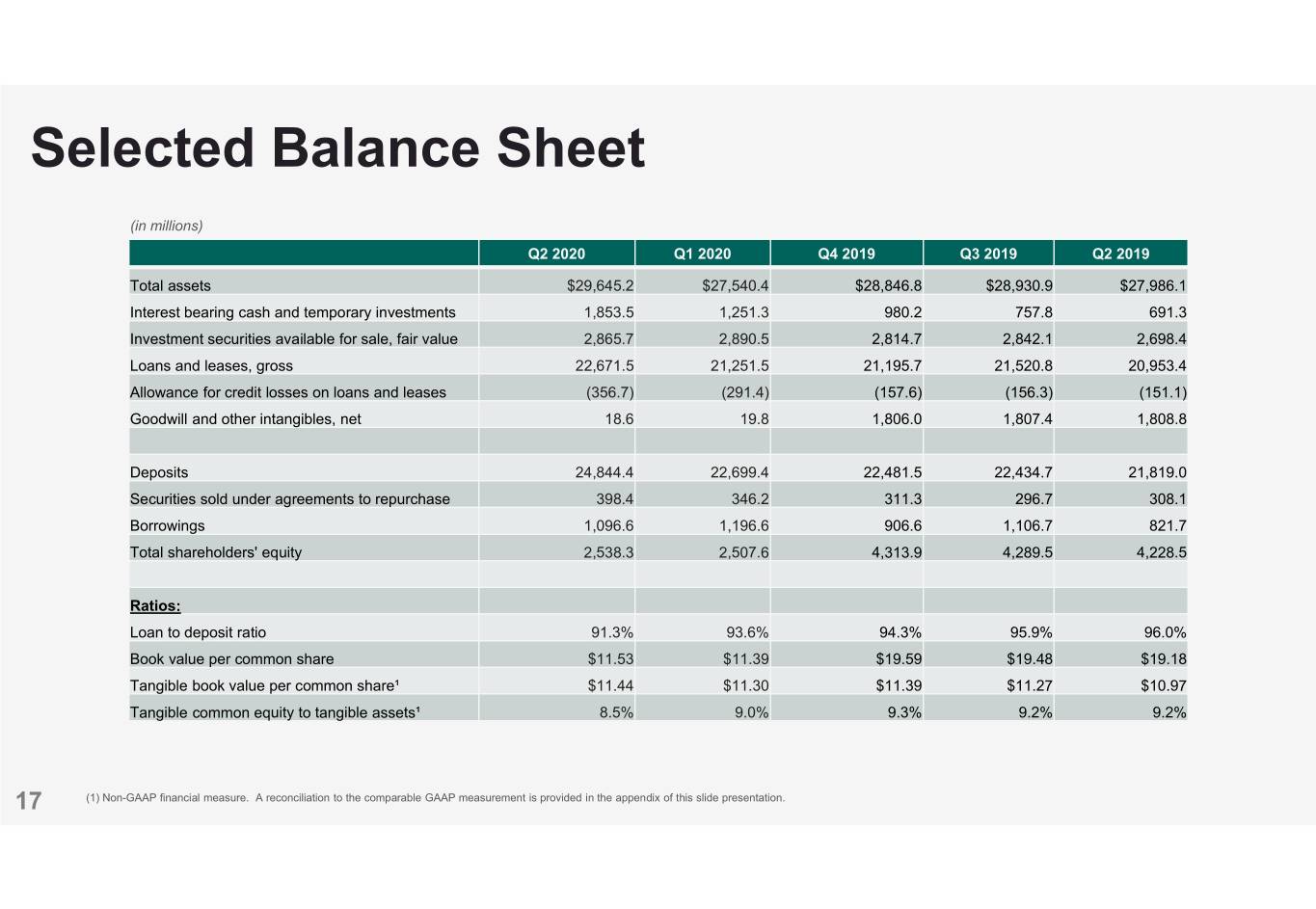

Selected Balance Sheet (in millions) Q2 2020 Q1 2020 Q4 2019 Q3 2019 Q2 2019 Total assets $29,645.2 $27,540.4 $28,846.8 $28,930.9 $27,986.1 Interest bearing cash and temporary investments 1,853.5 1,251.3 980.2 757.8 691.3 Investment securities available for sale, fair value 2,865.7 2,890.5 2,814.7 2,842.1 2,698.4 Loans and leases, gross 22,671.5 21,251.5 21,195.7 21,520.8 20,953.4 Allowance for credit losses on loans and leases (356.7) (291.4) (157.6) (156.3) (151.1) Goodwill and other intangibles, net 18.6 19.8 1,806.0 1,807.4 1,808.8 Deposits 24,844.4 22,699.4 22,481.5 22,434.7 21,819.0 Securities sold under agreements to repurchase 398.4 346.2 311.3 296.7 308.1 Borrowings 1,096.6 1,196.6 906.6 1,106.7 821.7 Total shareholders' equity 2,538.3 2,507.6 4,313.9 4,289.5 4,228.5 Ratios: Loan to deposit ratio 91.3% 93.6% 94.3% 95.9% 96.0% Book value per common share $11.53 $11.39 $19.59 $19.48 $19.18 Tangible book value per common share¹ $11.44 $11.30 $11.39 $11.27 $10.97 Tangible common equity to tangible assets¹ 8.5% 9.0% 9.3% 9.2% 9.2% 17 (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation.

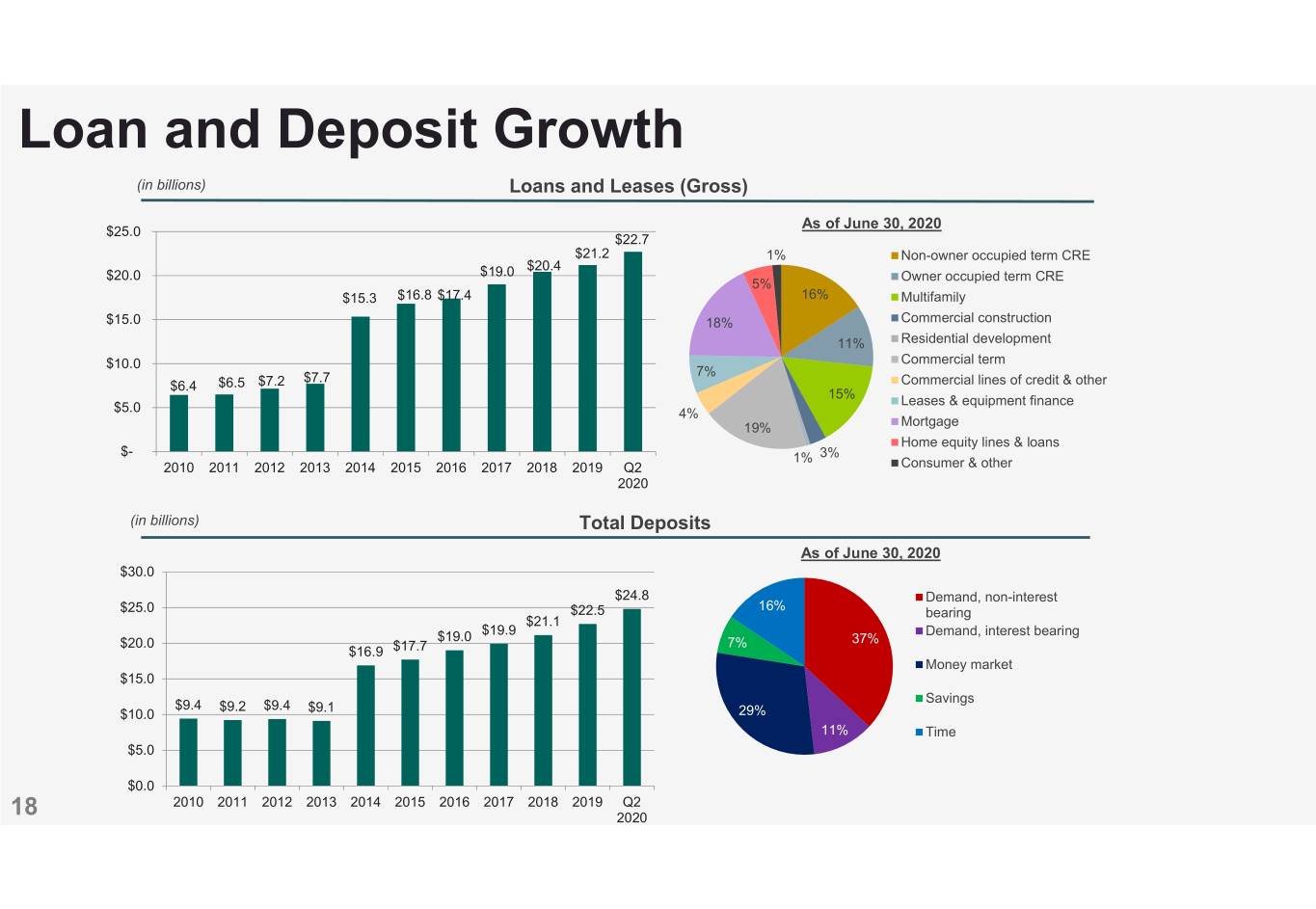

Loan and Deposit Growth (in billions) Loans and Leases (Gross) As of June 30, 2020 $25.0 $22.7 $21.2 1% Non-owner occupied term CRE $20.4 $20.0 $19.0 Owner occupied term CRE 5% $15.3 $16.8 $17.4 16% Multifamily $15.0 18% Commercial construction 11% Residential development $10.0 Commercial term $7.7 7% $6.4 $6.5 $7.2 Commercial lines of credit & other 15% Leases & equipment finance $5.0 4% 19% Mortgage Home equity lines & loans $- 1% 3% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q2 Consumer & other 2020 (in billions) Total Deposits As of June 30, 2020 $30.0 $24.8 Demand, non-interest 16% $25.0 $22.5 bearing $21.1 $19.9 Demand, interest bearing $20.0 $19.0 7% 37% $16.9 $17.7 Money market $15.0 Savings $9.4 $9.2 $9.4 $9.1 $10.0 29% 11% Time $5.0 $0.0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q2 18 2020

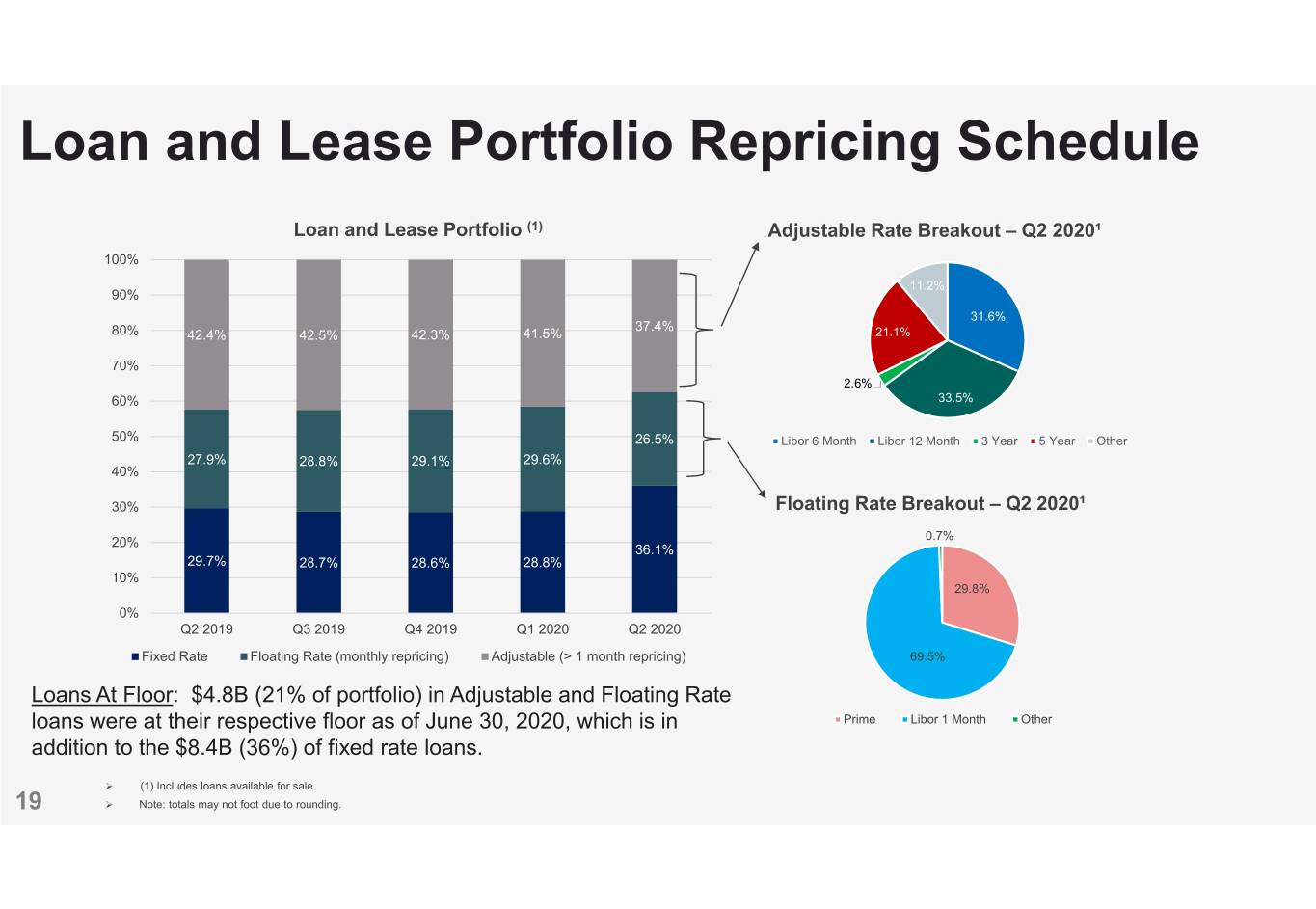

Loan and Lease Portfolio Repricing Schedule Loan and Lease Portfolio (1) Adjustable Rate Breakout – Q2 2020¹ 100% 11.2% 90% 31.6% 37.4% 80% 42.4% 42.5% 42.3% 41.5% 21.1% 70% 2.6% 60% 33.5% 50% 26.5% Libor 6 Month Libor 12 Month 3 Year 5 Year Other 27.9% 28.8% 29.1% 29.6% 40% 30% Floating Rate Breakout – Q2 2020¹ 20% 0.7% 36.1% 29.7% 28.7% 28.6% 28.8% 10% 29.8% 0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Fixed Rate Floating Rate (monthly repricing) Adjustable (> 1 month repricing) 69.5% Loans At Floor: $4.8B (21% of portfolio) in Adjustable and Floating Rate loans were at their respective floor as of June 30, 2020, which is in Prime Libor 1 Month Other addition to the $8.4B (36%) of fixed rate loans. (1) Includes loans available for sale. 19 Note: totals may not foot due to rounding.

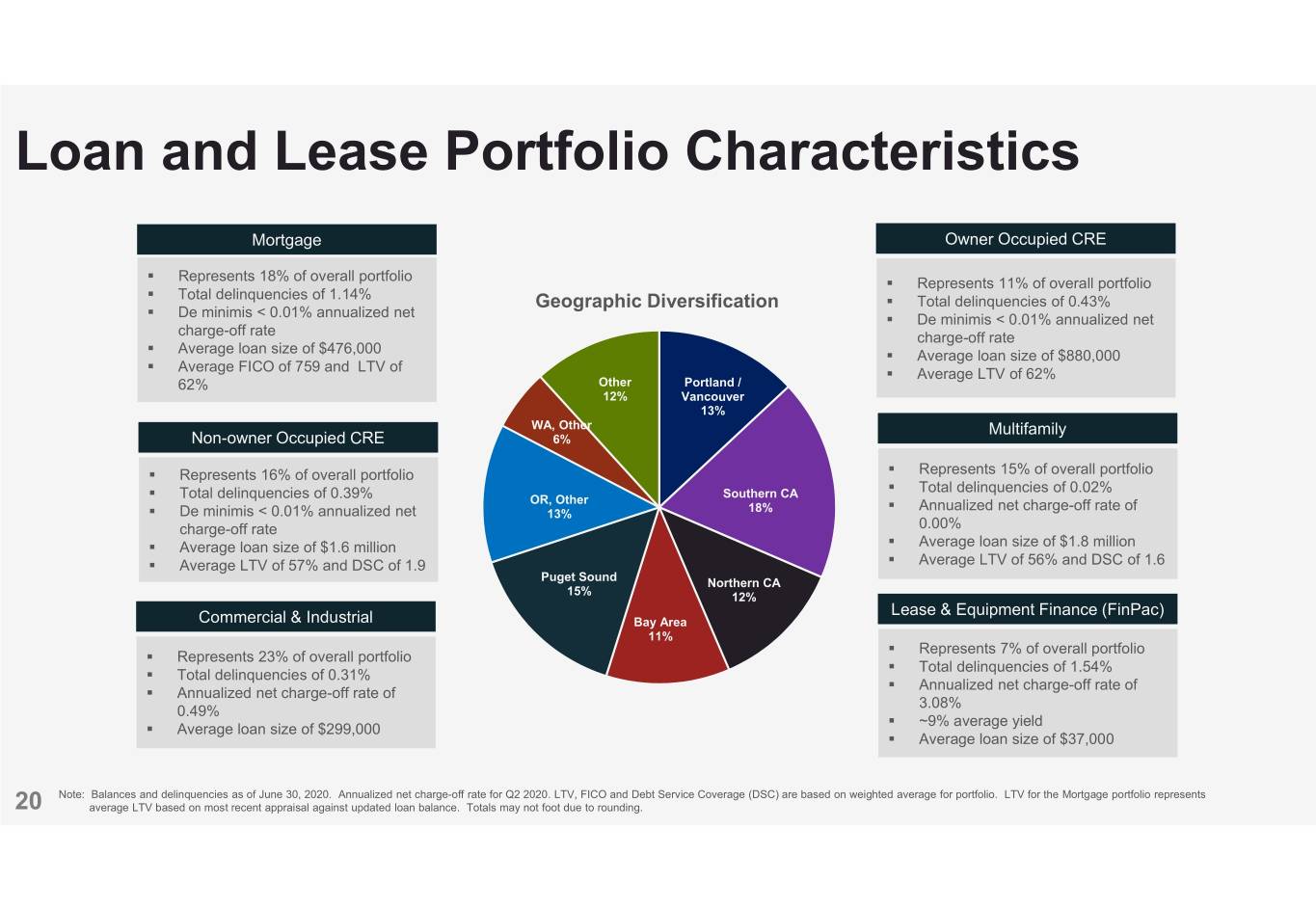

Loan and Lease Portfolio Characteristics Mortgage Owner Occupied CRE . Represents 18% of overall portfolio . Represents 11% of overall portfolio . Total delinquencies of 1.14% Geographic Diversification . Total delinquencies of 0.43% . De minimis < 0.01% annualized net . De minimis < 0.01% annualized net charge-off rate charge-off rate . Average loan size of $476,000 . Average loan size of $880,000 . Average FICO of 759 and LTV of . Average LTV of 62% 62% Other Portland / 12% Vancouver 13% WA, Other Multifamily Non-owner Occupied CRE 6% . Represents 16% of overall portfolio . Represents 15% of overall portfolio . Total delinquencies of 0.39% Southern CA . Total delinquencies of 0.02% OR, Other . Annualized net charge-off rate of . De minimis < 0.01% annualized net 13% 18% charge-off rate 0.00% . Average loan size of $1.6 million . Average loan size of $1.8 million . Average LTV of 57% and DSC of 1.9 . Average LTV of 56% and DSC of 1.6 Puget Sound Northern CA 15% 12% Lease & Equipment Finance (FinPac) Commercial & Industrial Bay Area 11% . Represents 7% of overall portfolio . Represents 23% of overall portfolio . Total delinquencies of 1.54% . Total delinquencies of 0.31% . Annualized net charge-off rate of . Annualized net charge-off rate of 3.08% 0.49% . ~9% average yield . Average loan size of $299,000 . Average loan size of $37,000 Note: Balances and delinquencies as of June 30, 2020. Annualized net charge-off rate for Q2 2020. LTV, FICO and Debt Service Coverage (DSC) are based on weighted average for portfolio. LTV for the Mortgage portfolio represents 20 average LTV based on most recent appraisal against updated loan balance. Totals may not foot due to rounding.

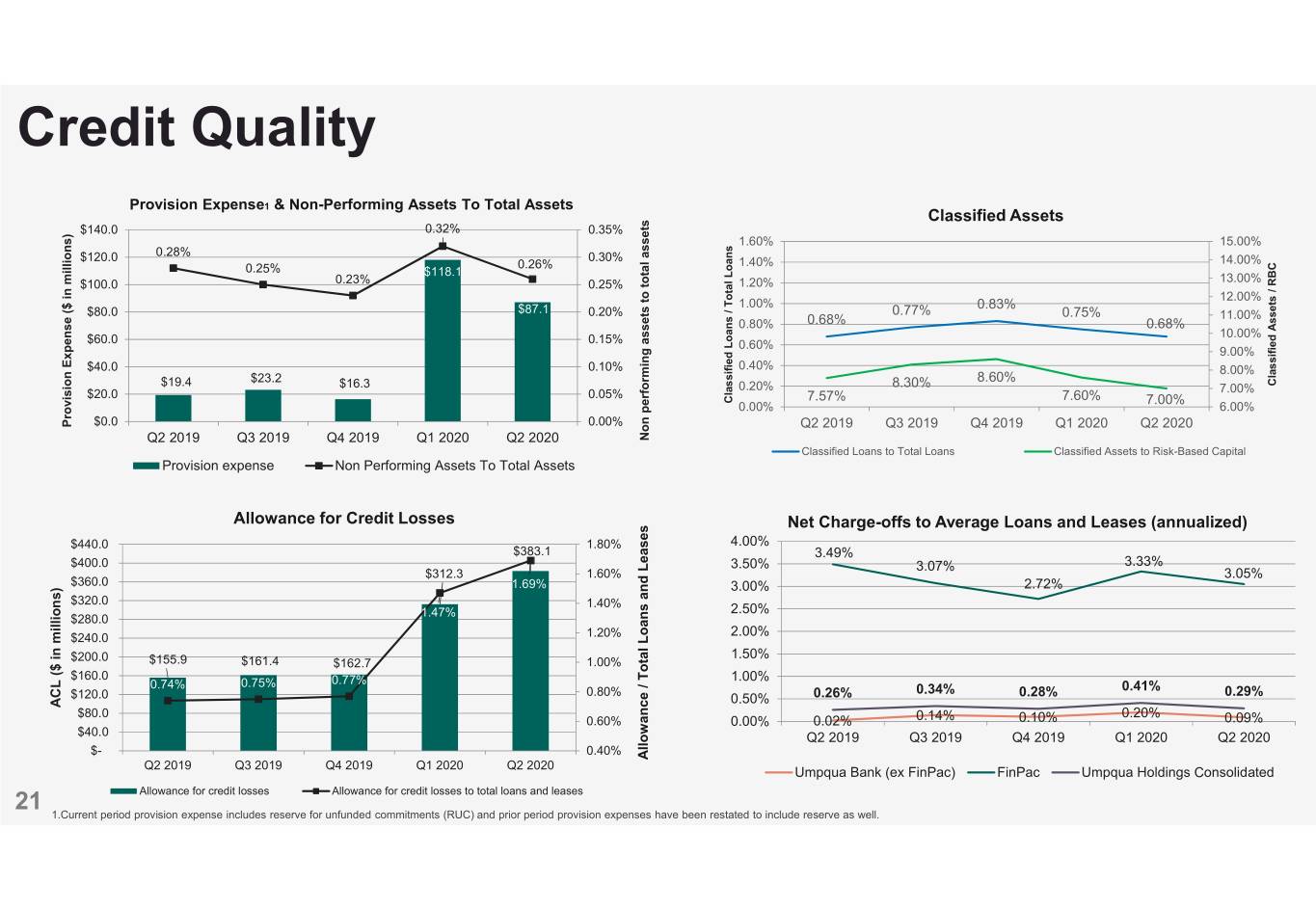

Credit Quality Provision Expense1 & Non-Performing Assets To Total Assets Classified Assets $140.0 0.32% 0.35% 1.60% 15.00% $120.0 0.28% 0.30% 0.26% 1.40% 14.00% 0.25% $118.1 13.00% $100.0 0.23% 0.25% 1.20% 12.00% 1.00% 0.83% $80.0 $87.1 0.20% 0.77% 0.75% 11.00% 0.80% 0.68% 0.68% 10.00% $60.0 0.15% 0.60% 9.00% $40.0 0.10% 0.40% 8.00% $23.2 8.60% $19.4 RBC Classified Assets / $16.3 0.20% 8.30% 7.00% $20.0 0.05% 7.57% 7.60% Classified Loans / Total Loans Total Classified Loans / 7.00% 0.00% 6.00% Provision ($ in millions) Expense Provision $0.0 0.00% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 assets total to assets Non performing Classified Loans to Total Loans Classified Assets to Risk-Based Capital Provision expense Non Performing Assets To Total Assets Allowance for Credit Losses Net Charge-offs to Average Loans and Leases (annualized) $440.0 1.80% 4.00% $383.1 3.49% $400.0 3.50% 3.07% 3.33% $312.3 1.60% 3.05% $360.0 1.69% 3.00% 2.72% $320.0 1.40% 1.47% 2.50% $280.0 $240.0 1.20% 2.00% $200.0 1.50% $155.9 $161.4 $162.7 1.00% $160.0 1.00% 0.74% 0.75% 0.77% 0.80% 0.34% 0.28% 0.41% 0.29% $120.0 0.50% 0.26% ACL ($ in millions) in ($ ACL $80.0 0.20% 0.60% 0.00% 0.02% 0.14% 0.10% 0.09% $40.0 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 $- 0.40% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Allowance / Total Loans and Leases Umpqua Bank (ex FinPac) FinPac Umpqua Holdings Consolidated 21 Allowance for credit losses Allowance for credit losses to total loans and leases 1.Current period provision expense includes reserve for unfunded commitments (RUC) and prior period provision expenses have been restated to include reserve as well.

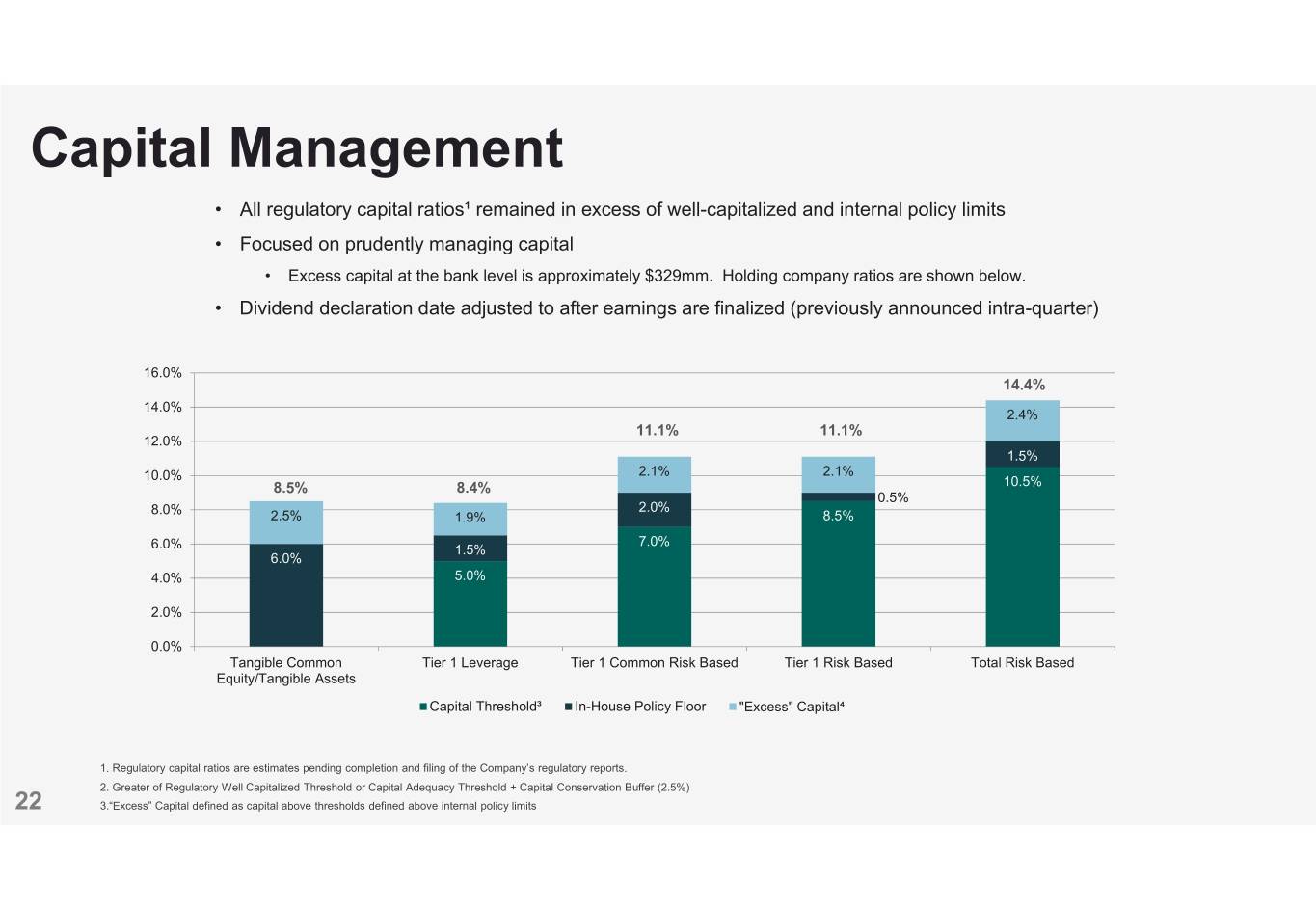

Capital Management • All regulatory capital ratios¹ remained in excess of well-capitalized and internal policy limits • Focused on prudently managing capital • Excess capital at the bank level is approximately $329mm. Holding company ratios are shown below. • Dividend declaration date adjusted to after earnings are finalized (previously announced intra-quarter) 16.0% 14.4% 14.0% 2.4% 11.1% 11.1% 12.0% 1.5% 10.0% 2.1% 2.1% 8.5% 8.4% 10.5% 0.5% 8.0% 2.0% 2.5% 1.9% 8.5% 7.0% 6.0% 1.5% 6.0% 4.0% 5.0% 2.0% 0.0% Tangible Common Tier 1 Leverage Tier 1 Common Risk Based Tier 1 Risk Based Total Risk Based Equity/Tangible Assets Capital Threshold³ In-House Policy Floor "Excess" Capital⁴ 1. Regulatory capital ratios are estimates pending completion and filing of the Company’s regulatory reports. 2. Greater of Regulatory Well Capitalized Threshold or Capital Adequacy Threshold + Capital Conservation Buffer (2.5%) 22 3.“Excess” Capital defined as capital above thresholds defined above internal policy limits

Appendix – Non GAAP Reconciliation

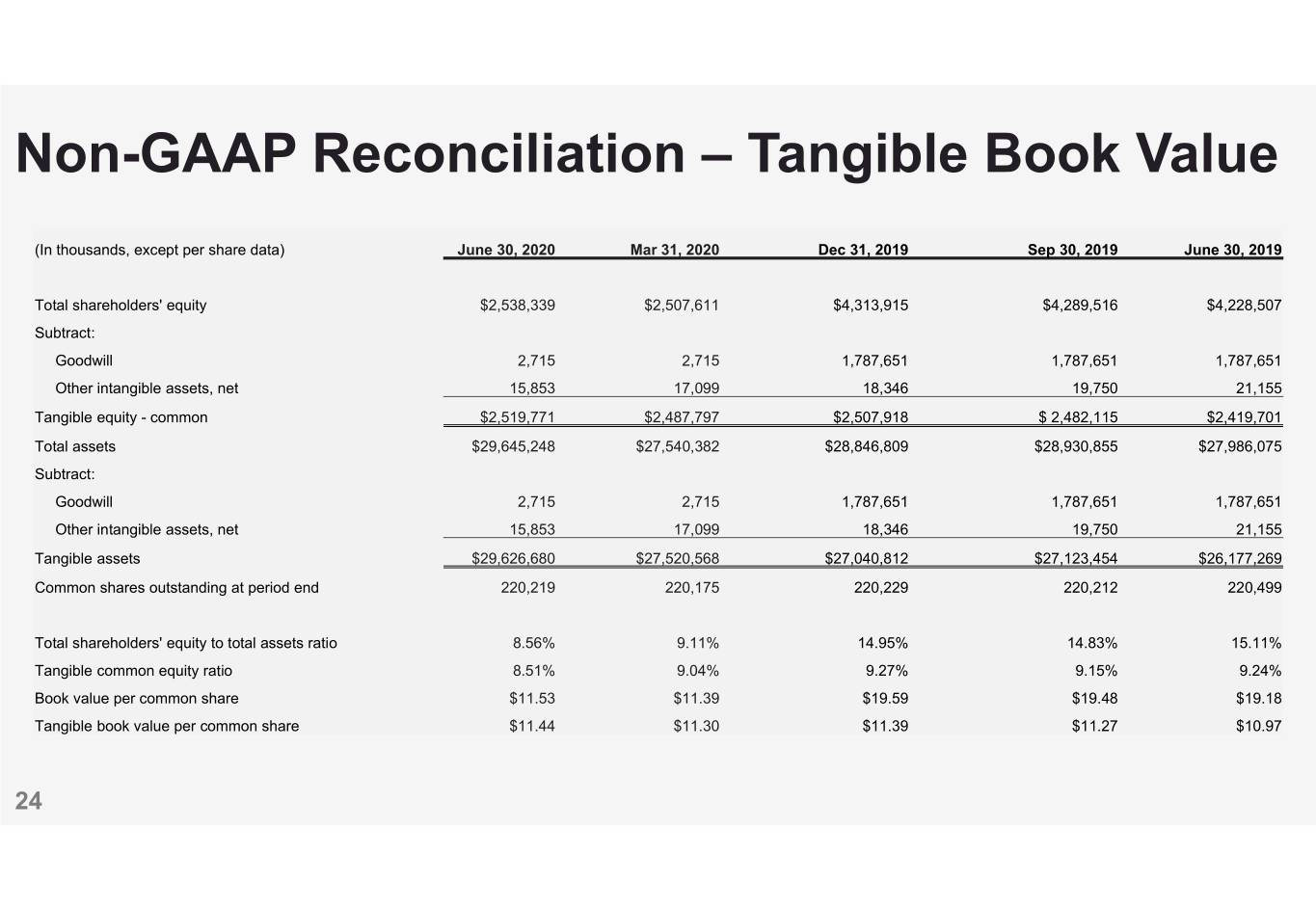

Non-GAAP Reconciliation – Tangible Book Value (In thousands, except per share data) June 30, 2020 Mar 31, 2020 Dec 31, 2019 Sep 30, 2019 June 30, 2019 Total shareholders' equity $2,538,339 $2,507,611 $4,313,915 $4,289,516 $4,228,507 Subtract: Goodwill 2,715 2,715 1,787,651 1,787,651 1,787,651 Other intangible assets, net 15,853 17,099 18,346 19,750 21,155 Tangible equity - common $2,519,771 $2,487,797 $2,507,918 $ 2,482,115 $2,419,701 Total assets $29,645,248 $27,540,382 $28,846,809 $28,930,855 $27,986,075 Subtract: Goodwill 2,715 2,715 1,787,651 1,787,651 1,787,651 Other intangible assets, net 15,853 17,099 18,346 19,750 21,155 Tangible assets $29,626,680 $27,520,568 $27,040,812 $27,123,454 $26,177,269 Common shares outstanding at period end 220,219 220,175 220,229 220,212 220,499 Total shareholders' equity to total assets ratio 8.56% 9.11% 14.95% 14.83% 15.11% Tangible common equity ratio 8.51% 9.04% 9.27% 9.15% 9.24% Book value per common share $11.53 $11.39 $19.59 $19.48 $19.18 Tangible book value per common share $11.44 $11.30 $11.39 $11.27 $10.97 24

Thank You