Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Origin Bancorp, Inc. | a06302020earningsrelea.htm |

| EX-99.3 - EX-99.3 - Origin Bancorp, Inc. | a3q2020dividenddeclara.htm |

| EX-99.1 - EX-99.1 - Origin Bancorp, Inc. | a06302020obnkexhibit99.htm |

ORIGIN BANCORP, INC. 2Q TWENTY20 INVESTOR PRESENTATION ORIGIN BANCORP, INC. _______

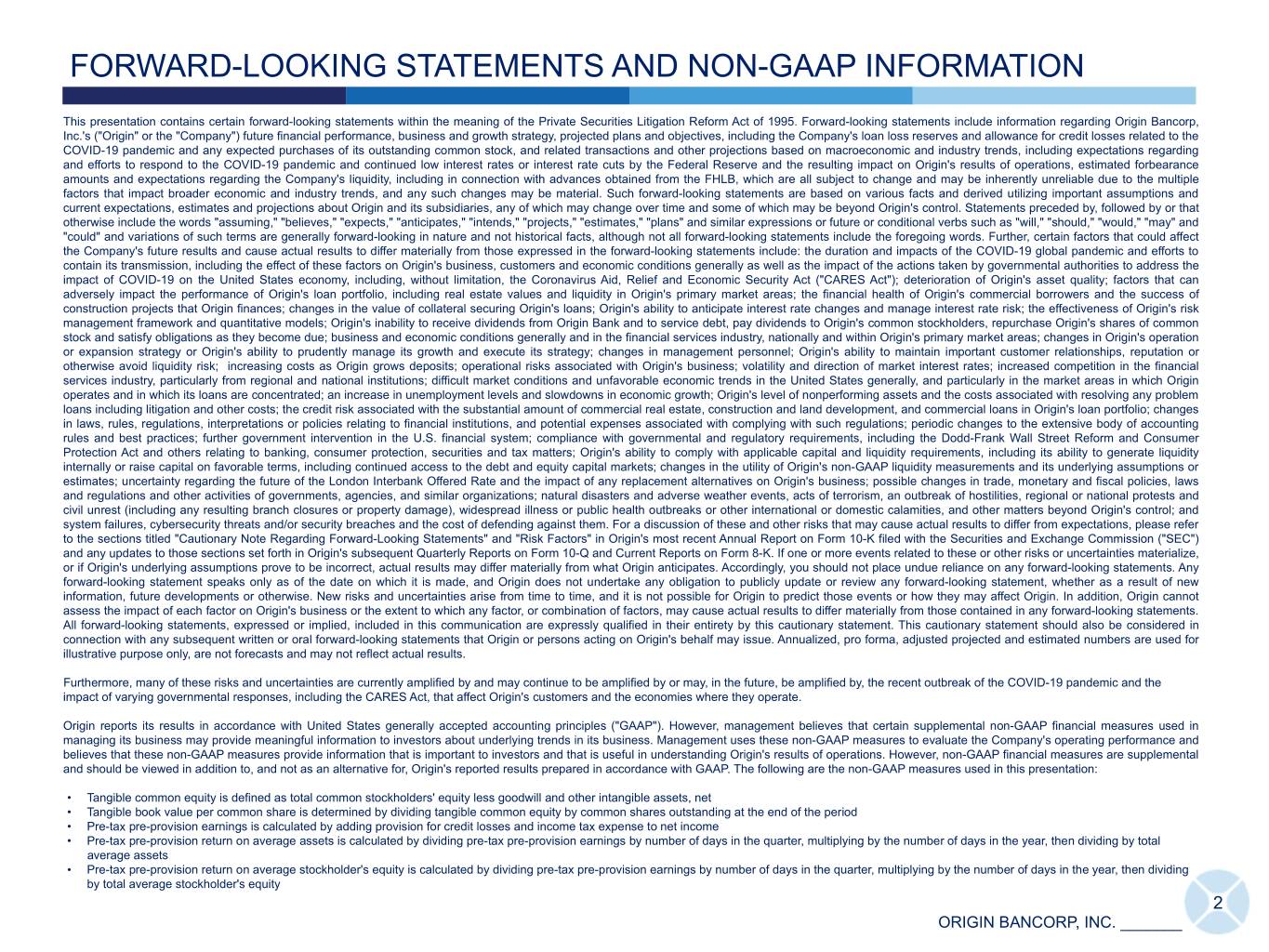

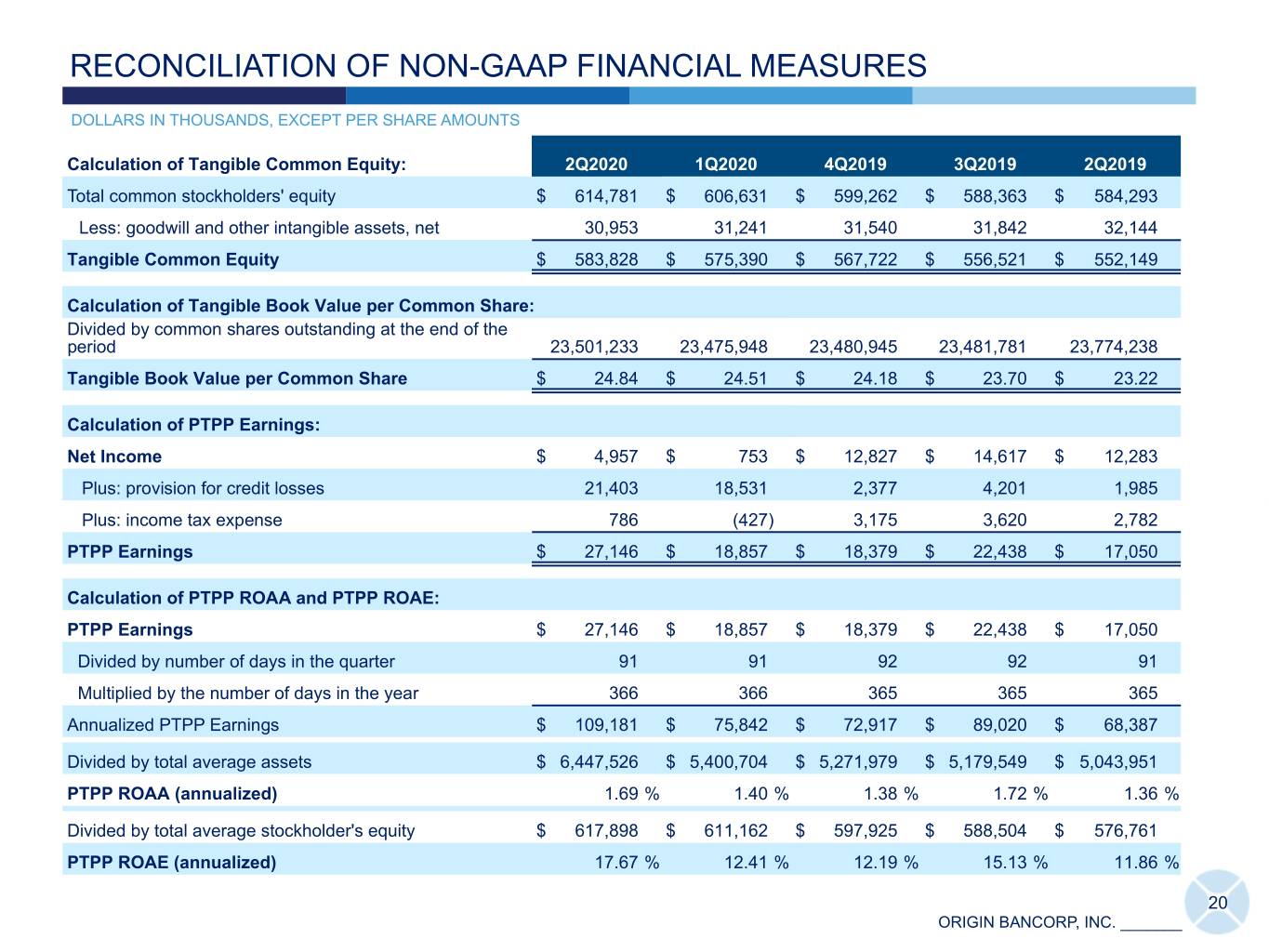

FORWARD-LOOKING STATEMENTS AND NON-GAAP INFORMATION This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc.'s ("Origin" or the "Company") future financial performance, business and growth strategy, projected plans and objectives, including the Company's loan loss reserves and allowance for credit losses related to the COVID-19 pandemic and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including expectations regarding and efforts to respond to the COVID-19 pandemic and continued low interest rates or interest rate cuts by the Federal Reserve and the resulting impact on Origin's results of operations, estimated forbearance amounts and expectations regarding the Company's liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin's control. Statements preceded by, followed by or that otherwise include the words "assuming," "believes," "expects," "anticipates," "intends," "projects," "estimates," "plans" and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect the Company's future results and cause actual results to differ materially from those expressed in the forward-looking statements include: the duration and impacts of the COVID-19 global pandemic and efforts to contain its transmission, including the effect of these factors on Origin's business, customers and economic conditions generally as well as the impact of the actions taken by governmental authorities to address the impact of COVID-19 on the United States economy, including, without limitation, the Coronavirus Aid, Relief and Economic Security Act ("CARES Act"); deterioration of Origin's asset quality; factors that can adversely impact the performance of Origin's loan portfolio, including real estate values and liquidity in Origin's primary market areas; the financial health of Origin's commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin's loans; Origin's ability to anticipate interest rate changes and manage interest rate risk; the effectiveness of Origin's risk management framework and quantitative models; Origin's inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin's common stockholders, repurchase Origin's shares of common stock and satisfy obligations as they become due; business and economic conditions generally and in the financial services industry, nationally and within Origin's primary market areas; changes in Origin's operation or expansion strategy or Origin's ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin's ability to maintain important customer relationships, reputation or otherwise avoid liquidity risk; increasing costs as Origin grows deposits; operational risks associated with Origin's business; volatility and direction of market interest rates; increased competition in the financial services industry, particularly from regional and national institutions; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin's loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities and tax matters; Origin's ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin's non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the future of the London Interbank Offered Rate and the impact of any replacement alternatives on Origin's business; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities, regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin's control; and system failures, cybersecurity threats and/or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" in Origin's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") and any updates to those sections set forth in Origin's subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin's underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin's behalf may issue. Annualized, pro forma, adjusted projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be amplified by, the recent outbreak of the COVID-19 pandemic and the impact of varying governmental responses, including the CARES Act, that affect Origin's customers and the economies where they operate. Origin reports its results in accordance with United States generally accepted accounting principles ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures used in managing its business may provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to evaluate the Company's operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Origin's results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: • Tangible common equity is defined as total common stockholders' equity less goodwill and other intangible assets, net • Tangible book value per common share is determined by dividing tangible common equity by common shares outstanding at the end of the period • Pre-tax pre-provision earnings is calculated by adding provision for credit losses and income tax expense to net income • Pre-tax pre-provision return on average assets is calculated by dividing pre-tax pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average assets • Pre-tax pre-provision return on average stockholder's equity is calculated by dividing pre-tax pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average stockholder's equity 2 ORIGIN BANCORP, INC. _______

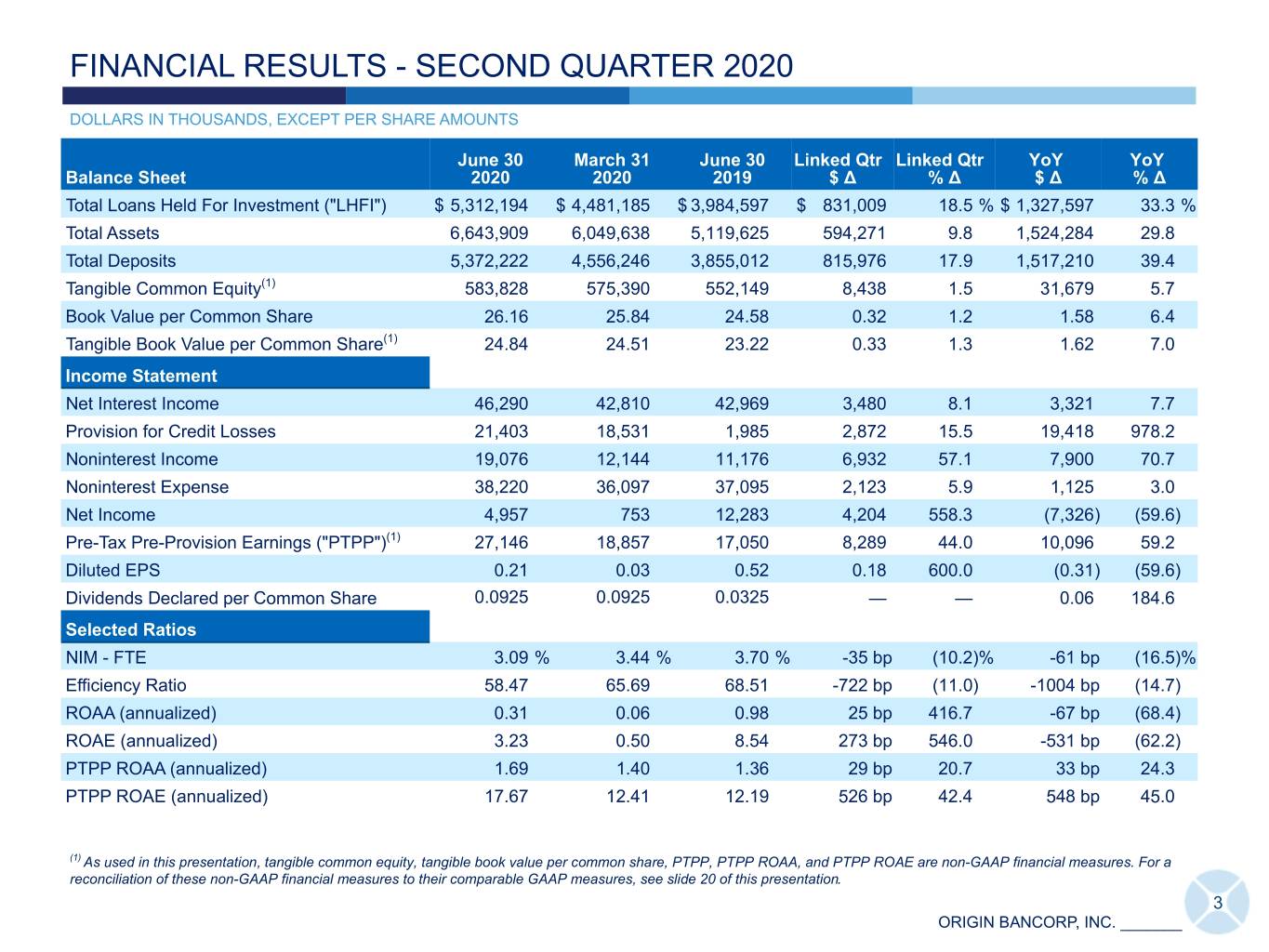

FINANCIAL RESULTS - SECOND QUARTER 2020 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS June 30 March 31 June 30 Linked Qtr Linked Qtr YoY YoY Balance Sheet 2020 2020 2019 $ Δ % Δ $ Δ % Δ Total Loans Held For Investment ("LHFI") $ 5,312,194 $ 4,481,185 $ 3,984,597 $ 831,009 18.5 % $ 1,327,597 33.3 % Total Assets 6,643,909 6,049,638 5,119,625 594,271 9.8 1,524,284 29.8 Total Deposits 5,372,222 4,556,246 3,855,012 815,976 17.9 1,517,210 39.4 Tangible Common Equity(1) 583,828 575,390 552,149 8,438 1.5 31,679 5.7 Book Value per Common Share 26.16 25.84 24.58 0.32 1.2 1.58 6.4 Tangible Book Value per Common Share(1) 24.84 24.51 23.22 0.33 1.3 1.62 7.0 Income Statement Net Interest Income 46,290 42,810 42,969 3,480 8.1 3,321 7.7 Provision for Credit Losses 21,403 18,531 1,985 2,872 15.5 19,418 978.2 Noninterest Income 19,076 12,144 11,176 6,932 57.1 7,900 70.7 Noninterest Expense 38,220 36,097 37,095 2,123 5.9 1,125 3.0 Net Income 4,957 753 12,283 4,204 558.3 (7,326) (59.6) Pre-Tax Pre-Provision Earnings ("PTPP")(1) 27,146 18,857 17,050 8,289 44.0 10,096 59.2 Diluted EPS 0.21 0.03 0.52 0.18 600.0 (0.31) (59.6) Dividends Declared per Common Share 0.0925 0.0925 0.0325 — — 0.06 184.6 Selected Ratios NIM - FTE 3.09 % 3.44 % 3.70 % -35 bp (10.2) % -61 bp (16.5) % Efficiency Ratio 58.47 65.69 68.51 -722 bp (11.0) -1004 bp (14.7) ROAA (annualized) 0.31 0.06 0.98 25 bp 416.7 -67 bp (68.4) ROAE (annualized) 3.23 0.50 8.54 273 bp 546.0 -531 bp (62.2) PTPP ROAA (annualized) 1.69 1.40 1.36 29 bp 20.7 33 bp 24.3 PTPP ROAE (annualized) 17.67 12.41 12.19 526 bp 42.4 548 bp 45.0 (1) As used in this presentation, tangible common equity, tangible book value per common share, PTPP, PTPP ROAA, and PTPP ROAE are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slide 20 of this presentation. 3 ORIGIN BANCORP, INC. _______

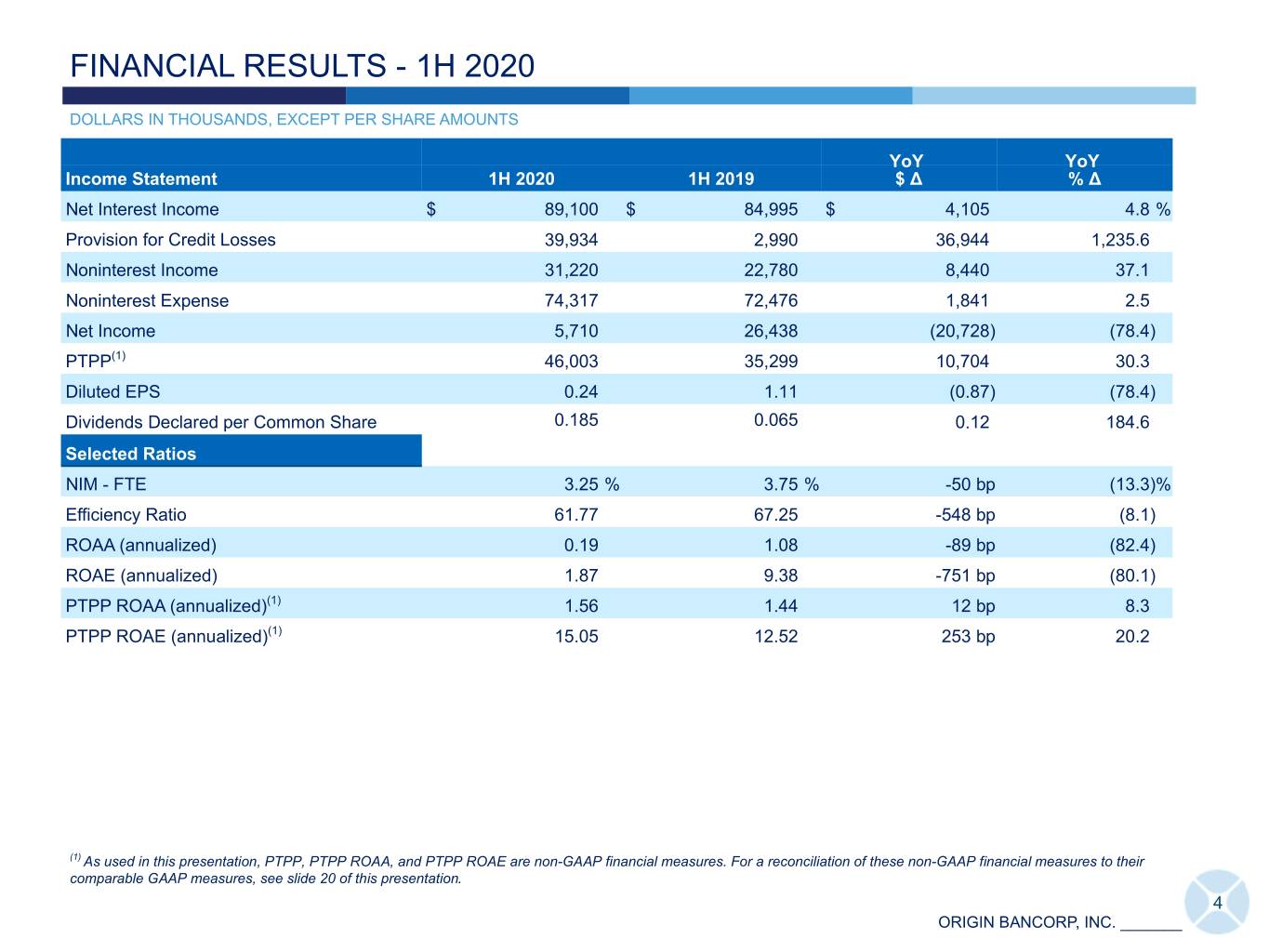

FINANCIAL RESULTS - 1H 2020 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS YoY YoY Income Statement 1H 2020 1H 2019 $ Δ % Δ Net Interest Income $ 89,100 $ 84,995 $ 4,105 4.8 % Provision for Credit Losses 39,934 2,990 36,944 1,235.6 Noninterest Income 31,220 22,780 8,440 37.1 Noninterest Expense 74,317 72,476 1,841 2.5 Net Income 5,710 26,438 (20,728) (78.4) PTPP(1) 46,003 35,299 10,704 30.3 Diluted EPS 0.24 1.11 (0.87) (78.4) Dividends Declared per Common Share 0.185 0.065 0.12 184.6 Selected Ratios NIM - FTE 3.25 % 3.75 % -50 bp (13.3) % Efficiency Ratio 61.77 67.25 -548 bp (8.1) ROAA (annualized) 0.19 1.08 -89 bp (82.4) ROAE (annualized) 1.87 9.38 -751 bp (80.1) PTPP ROAA (annualized)(1) 1.56 1.44 12 bp 8.3 PTPP ROAE (annualized)(1) 15.05 12.52 253 bp 20.2 (1) As used in this presentation, PTPP, PTPP ROAA, and PTPP ROAE are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slide 20 of this presentation. 4 ORIGIN BANCORP, INC. _______

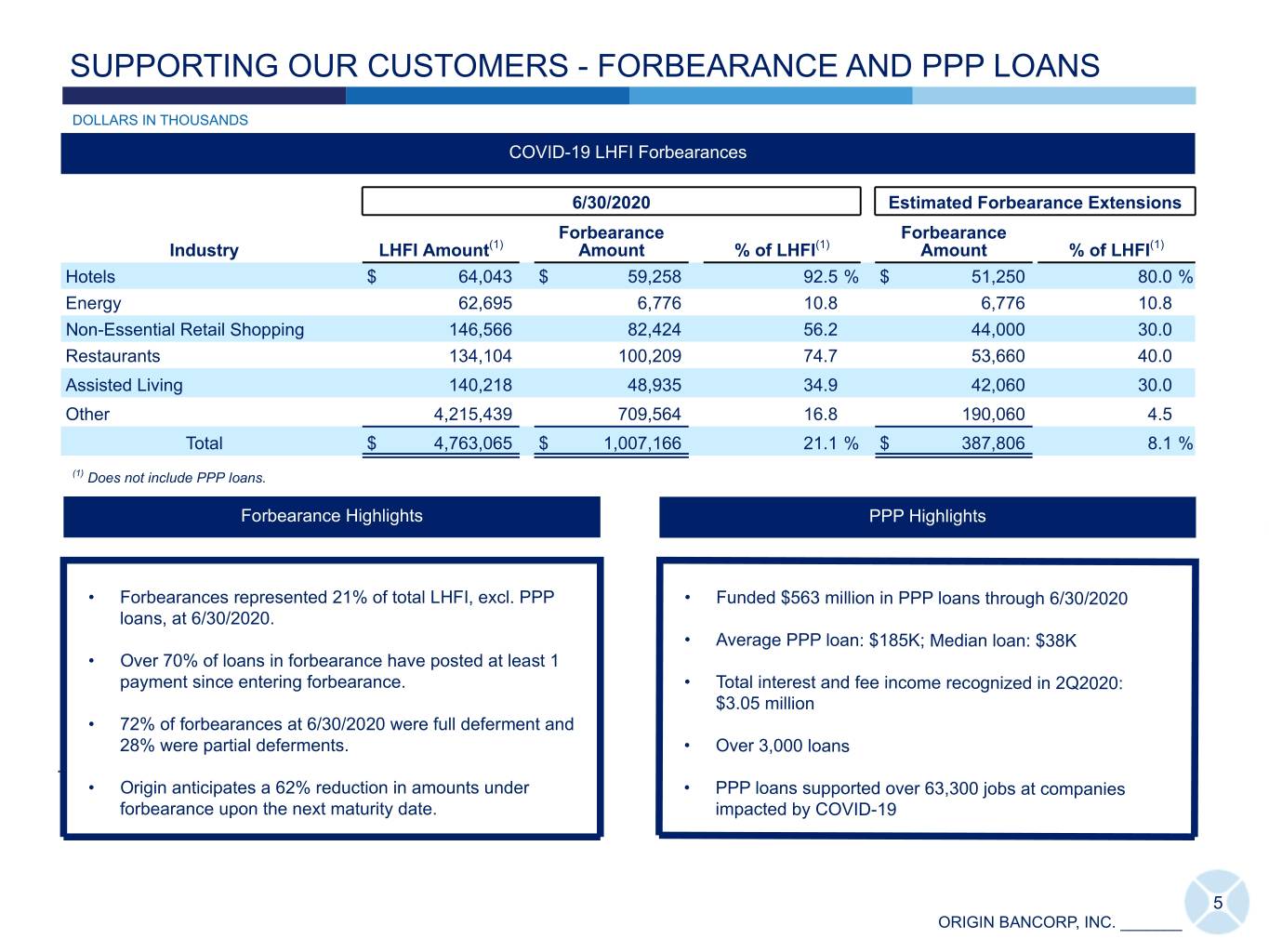

SUPPORTING OUR CUSTOMERS - FORBEARANCE AND PPP LOANS DOLLARS IN THOUSANDS COVID-19 LHFI Forbearances 6/30/2020 Estimated Forbearance Extensions Forbearance Forbearance Industry LHFI Amount(1) Amount % of LHFI(1) Amount % of LHFI(1) Hotels $ 64,043 $ 59,258 92.5 % $ 51,250 80.0 % Energy 62,695 6,776 10.8 6,776 10.8 Non-Essential Retail Shopping 146,566 82,424 56.2 44,000 30.0 Restaurants 134,104 100,209 74.7 53,660 40.0 Assisted Living 140,218 48,935 34.9 42,060 30.0 Other 4,215,439 709,564 16.8 190,060 4.5 Total $ 4,763,065 $ 1,007,166 21.1 % $ 387,806 8.1 % (1) Does not include PPP loans. Forbearance Highlights PPP Highlights • Forbearances represented 21% of total LHFI, excl. PPP • Funded $563 million in PPP loans through 6/30/2020 loans, at 6/30/2020. • Average PPP loan: $185K; Median loan: $38K • Over 70% of loans in forbearance have posted at least 1 payment since entering forbearance. • Total interest and fee income recognized in 2Q2020: $3.05 million • 72% of forbearances at 6/30/2020 were full deferment and 28% were partial deferments. • Over 3,000 loans . • Origin anticipates a 62% reduction in amounts under • PPP loans supported over 63,300 jobs at companies forbearance upon the next maturity date. impacted by COVID-19 5 ORIGIN BANCORP, INC. _______

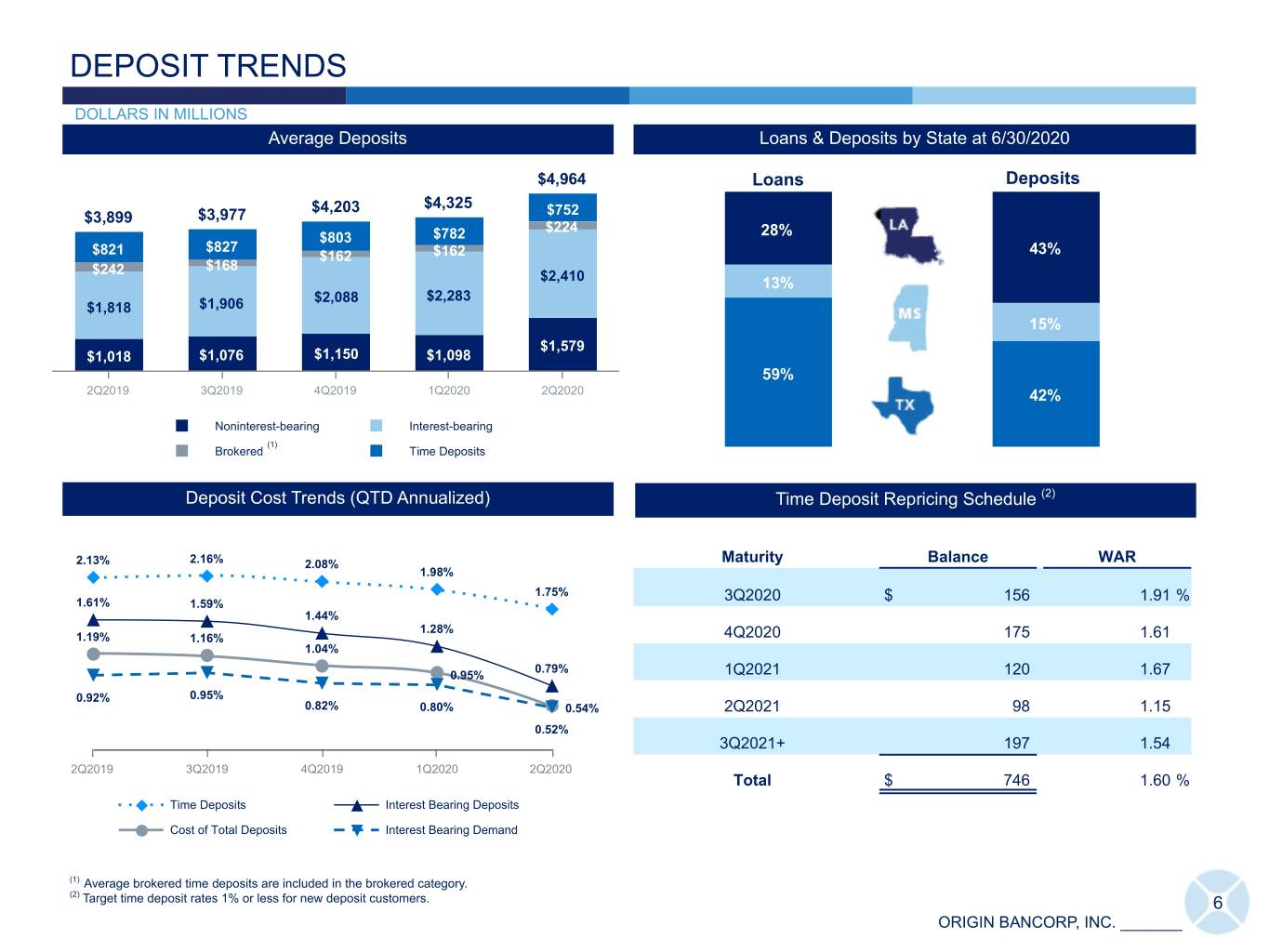

DEPOSIT TRENDS DOLLARS IN MILLIONS Average Deposits Loans & Deposits by State at 6/30/2020 $4,964 Loans Deposits $4,203 $4,325 $3,899 $3,977 $752 $224 $803 $782 28% $827 $821 $162 $162 43% $242 $168 $2,410 13% $2,088 $2,283 $1,818 $1,906 15% $1,579 $1,018 $1,076 $1,150 $1,098 59% 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 42% Noninterest-bearing Interest-bearing (1) Brokered Time Deposits Deposit Cost Trends (QTD Annualized) Time Deposit Repricing Schedule (2) 2.13% 2.16% 2.08% Maturity Balance WAR 1.98% 1.75% 3Q2020 $ 156 1.91 % 1.61% 1.59% 1.44% 1.28% 1.19% 1.16% 4Q2020 175 1.61 1.04% 0.79% 0.95% 1Q2021 120 1.67 0.92% 0.95% 0.82% 0.80% 0.54% 2Q2021 98 1.15 0.52% 3Q2021+ 197 1.54 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 Total $ 746 1.60 % Time Deposits Interest Bearing Deposits Cost of Total Deposits Interest Bearing Demand (1) Average brokered time deposits are included in the brokered category. (2) Target time deposit rates 1% or less for new deposit customers. 6 ORIGIN BANCORP, INC. _______

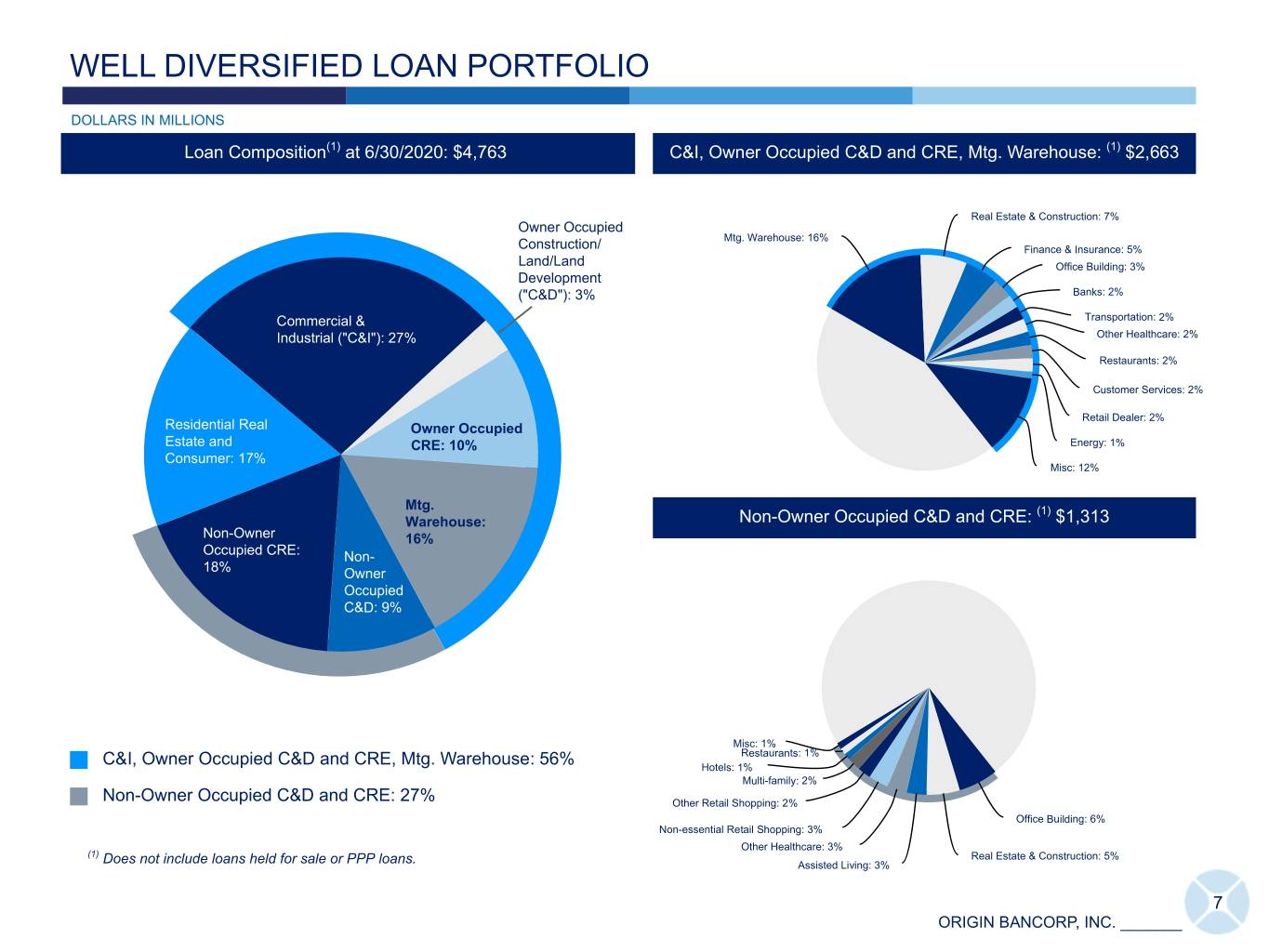

WELL DIVERSIFIED LOAN PORTFOLIO DOLLARS IN MILLIONS Loan Composition(1) at 6/30/2020: $4,763 C&I, Owner Occupied C&D and CRE, Mtg. Warehouse: (1) $2,663 Real Estate & Construction: 7% Owner Occupied Mtg. Warehouse: 16% Construction/ Finance & Insurance: 5% Land/Land Office Building: 3% Development ("C&D"): 3% Banks: 2% Commercial & Transportation: 2% Industrial ("C&I"): 27% Other Healthcare: 2% Restaurants: 2% Customer Services: 2% Retail Dealer: 2% Residential Real Owner Occupied Estate and CRE: 10% Energy: 1% Consumer: 17% Misc: 12% Mtg. (1) Warehouse: Non-Owner Occupied C&D and CRE: $1,313 Non-Owner 16% Occupied CRE: Non- 18% Owner Occupied C&D: 9% Misc: 1% Restaurants: 1% C&I, Owner Occupied C&D and CRE, Mtg. Warehouse: 56% Hotels: 1% Multi-family: 2% Non-Owner Occupied C&D and CRE: 27% Other Retail Shopping: 2% Office Building: 6% Non-essential Retail Shopping: 3% Other Healthcare: 3% (1) Real Estate & Construction: 5% Does not include loans held for sale or PPP loans. Assisted Living: 3% 7 ORIGIN BANCORP, INC. _______

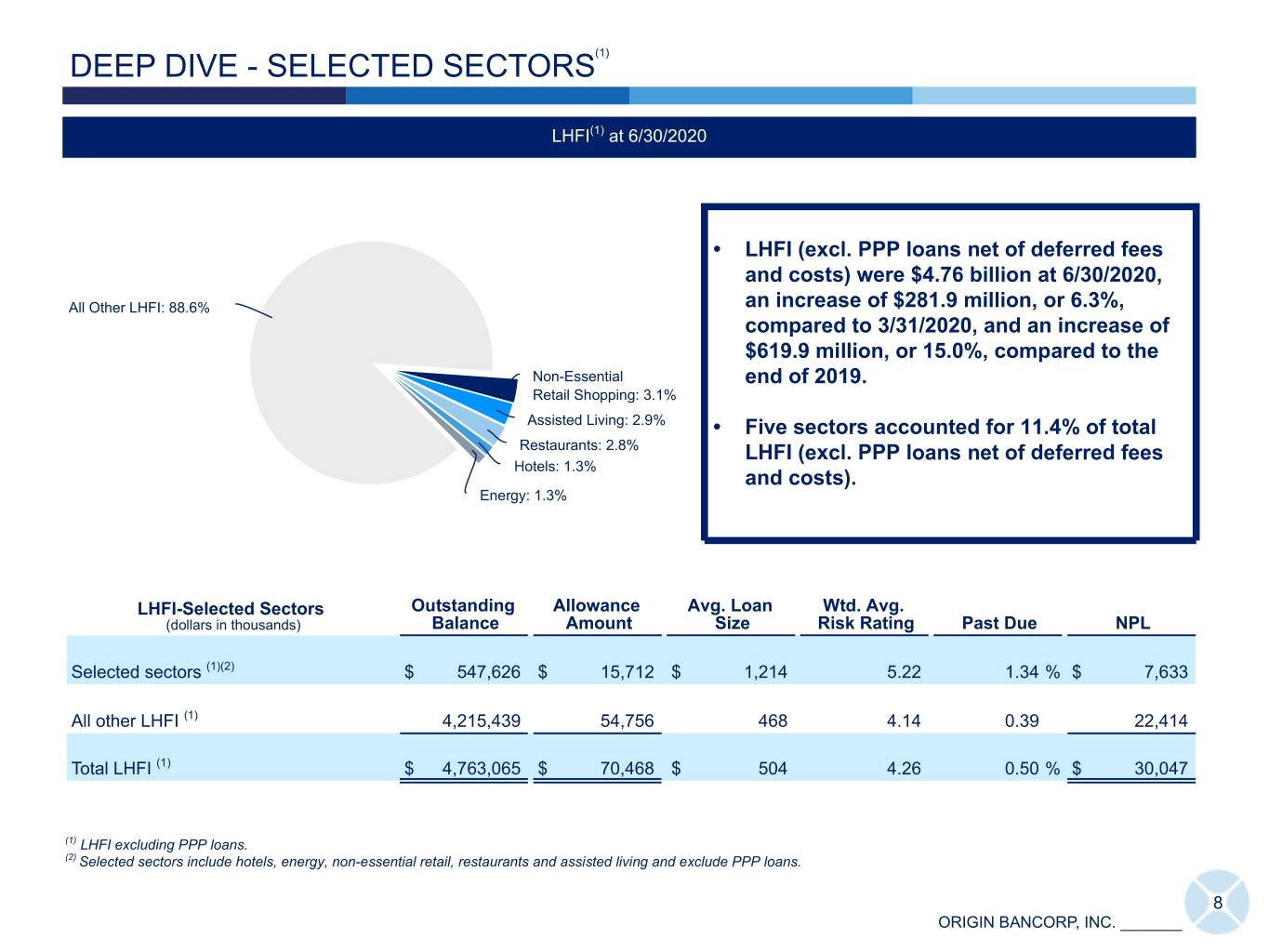

DEEP DIVE - SELECTED SECTORS(1) LHFI(1) at 6/30/2020 • LHFI (excl. PPP loans net of deferred fees and costs) were $4.76 billion at 6/30/2020, All Other LHFI: 88.6% an increase of $281.9 million, or 6.3%, compared to 3/31/2020, and an increase of $619.9 million, or 15.0%, compared to the Non-Essential end of 2019. Retail Shopping: 3.1% Assisted Living: 2.9% • Five sectors accounted for 11.4% of total Restaurants: 2.8% LHFI (excl. PPP loans net of deferred fees Hotels: 1.3% and costs). Energy: 1.3% LHFI-Selected Sectors Outstanding Allowance Avg. Loan Wtd. Avg. (dollars in thousands) Balance Amount Size Risk Rating Past Due NPL Selected sectors (1)(2) $ 547,626 $ 15,712 $ 1,214 5.22 1.34 % $ 7,633 All other LHFI (1) 4,215,439 54,756 468 4.14 0.39 22,414 Total LHFI (1) $ 4,763,065 $ 70,468 $ 504 4.26 0.50 % $ 30,047 (1) LHFI excluding PPP loans. (2) Selected sectors include hotels, energy, non-essential retail, restaurants and assisted living and exclude PPP loans. 8 ORIGIN BANCORP, INC. _______

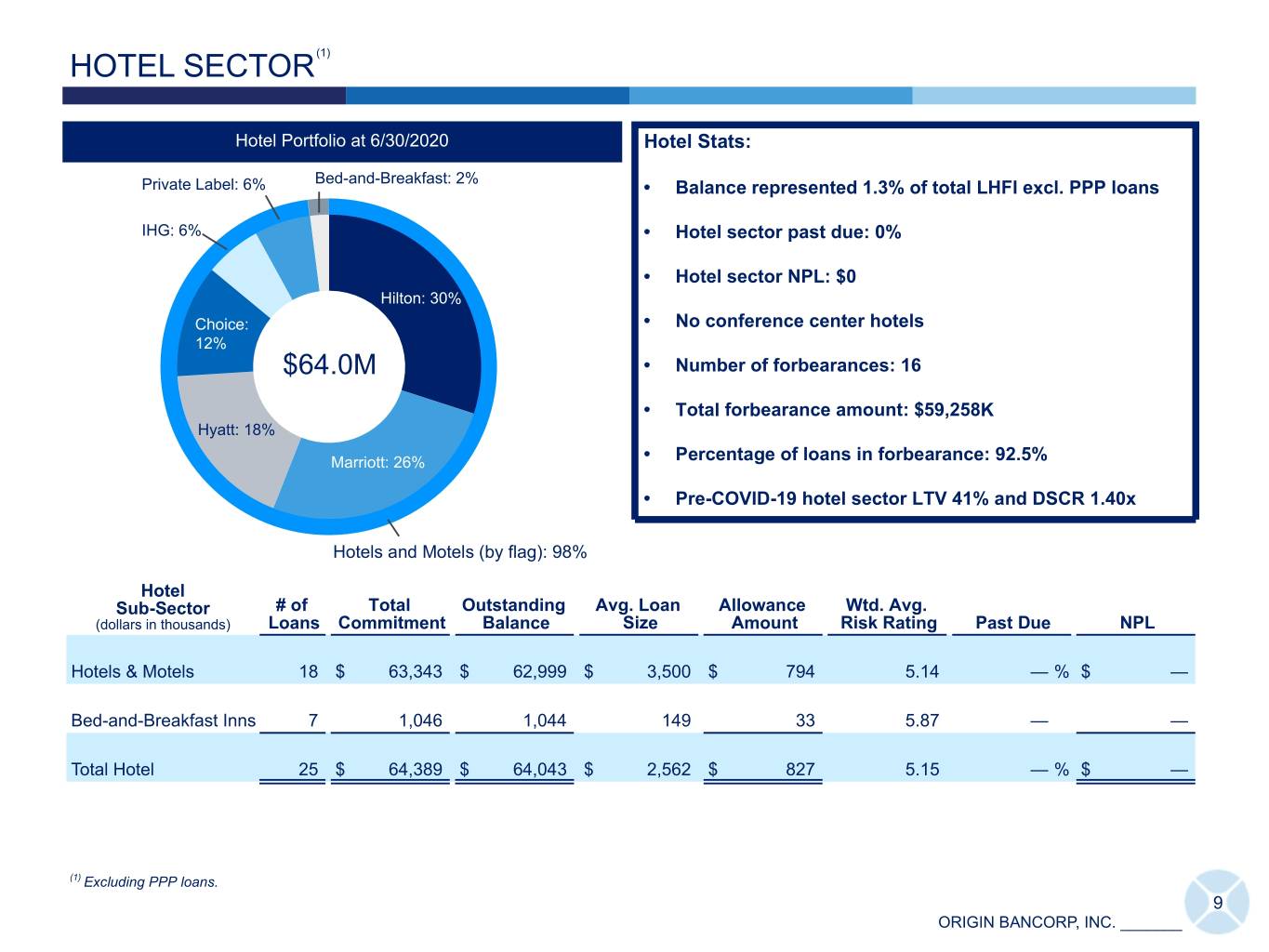

HOTEL SECTOR(1) Hotel Portfolio at 6/30/2020 Hotel Stats: Bed-and-Breakfast: 2% Private Label: 6% • Balance represented 1.3% of total LHFI excl. PPP loans IHG: 6% • Hotel sector past due: 0% • Hotel sector NPL: $0 Hilton: 30% Choice: • No conference center hotels 12% $64.0M • Number of forbearances: 16 • Total forbearance amount: $59,258K Hyatt: 18% Marriott: 26% • Percentage of loans in forbearance: 92.5% • Pre-COVID-19 hotel sector LTV 41% and DSCR 1.40x Hotels and Motels (by flag): 98% Hotel Sub-Sector # of Total Outstanding Avg. Loan Allowance Wtd. Avg. (dollars in thousands) Loans Commitment Balance Size Amount Risk Rating Past Due NPL Hotels & Motels 18 $ 63,343 $ 62,999 $ 3,500 $ 794 5.14 — % $ — Bed-and-Breakfast Inns 7 1,046 1,044 149 33 5.87 — — Total Hotel 25 $ 64,389 $ 64,043 $ 2,562 $ 827 5.15 — % $ — (1) Excluding PPP loans. 9 ORIGIN BANCORP, INC. _______

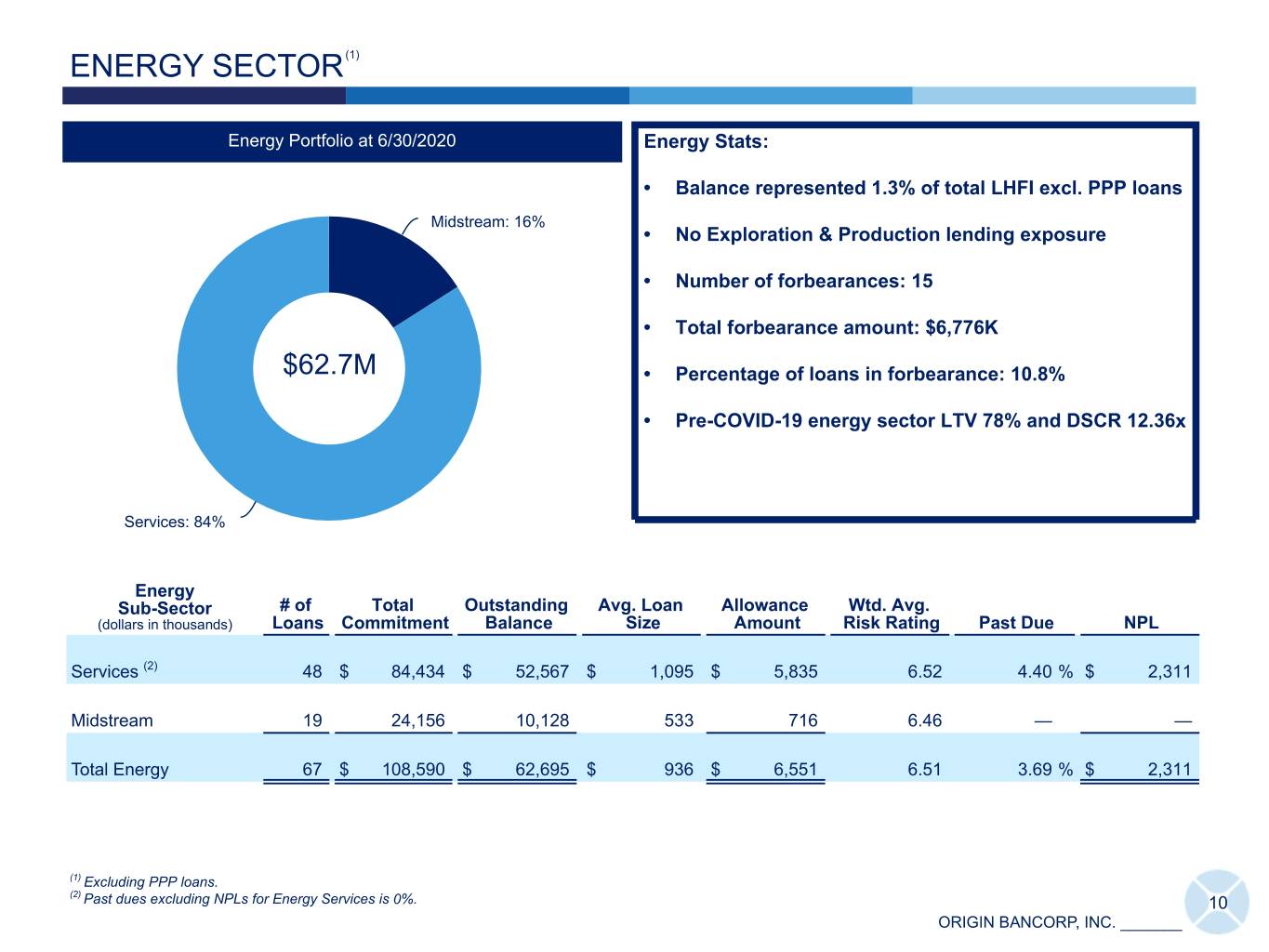

ENERGY SECTOR (1) Energy Portfolio at 6/30/2020 Energy Stats: • Balance represented 1.3% of total LHFI excl. PPP loans Midstream: 16% • No Exploration & Production lending exposure • Number of forbearances: 15 • Total forbearance amount: $6,776K $62.7M • Percentage of loans in forbearance: 10.8% • Pre-COVID-19 energy sector LTV 78% and DSCR 12.36x Services: 84% Energy Sub-Sector # of Total Outstanding Avg. Loan Allowance Wtd. Avg. (dollars in thousands) Loans Commitment Balance Size Amount Risk Rating Past Due NPL Services (2) 48 $ 84,434 $ 52,567 $ 1,095 $ 5,835 6.52 4.40 % $ 2,311 Midstream 19 24,156 10,128 533 716 6.46 — — Total Energy 67 $ 108,590 $ 62,695 $ 936 $ 6,551 6.51 3.69 % $ 2,311 (1) Excluding PPP loans. (2) Past dues excluding NPLs for Energy Services is 0%. 10 ORIGIN BANCORP, INC. _______

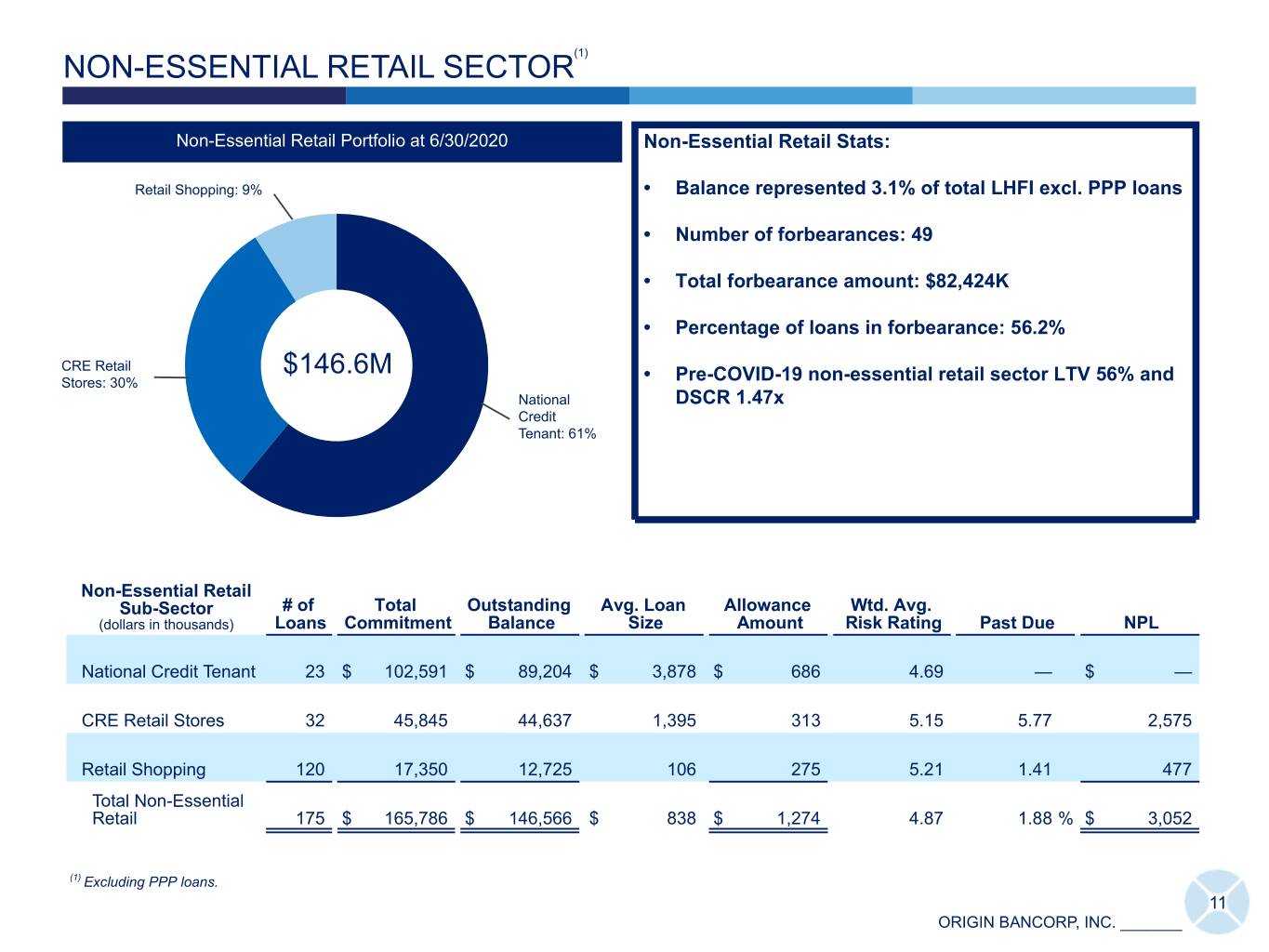

NON-ESSENTIAL RETAIL SECTOR(1) Non-Essential Retail Portfolio at 6/30/2020 Non-Essential Retail Stats: Retail Shopping: 9% • Balance represented 3.1% of total LHFI excl. PPP loans • Number of forbearances: 49 • Total forbearance amount: $82,424K • Percentage of loans in forbearance: 56.2% CRE Retail $146.6M Stores: 30% • Pre-COVID-19 non-essential retail sector LTV 56% and National DSCR 1.47x Credit Tenant: 61% Non-Essential Retail Sub-Sector # of Total Outstanding Avg. Loan Allowance Wtd. Avg. (dollars in thousands) Loans Commitment Balance Size Amount Risk Rating Past Due NPL National Credit Tenant 23 $ 102,591 $ 89,204 $ 3,878 $ 686 4.69 — $ — CRE Retail Stores 32 45,845 44,637 1,395 313 5.15 5.77 2,575 Retail Shopping 120 17,350 12,725 106 275 5.21 1.41 477 Total Non-Essential Retail 175 $ 165,786 $ 146,566 $ 838 $ 1,274 4.87 1.88 % $ 3,052 (1) Excluding PPP loans. 11 ORIGIN BANCORP, INC. _______

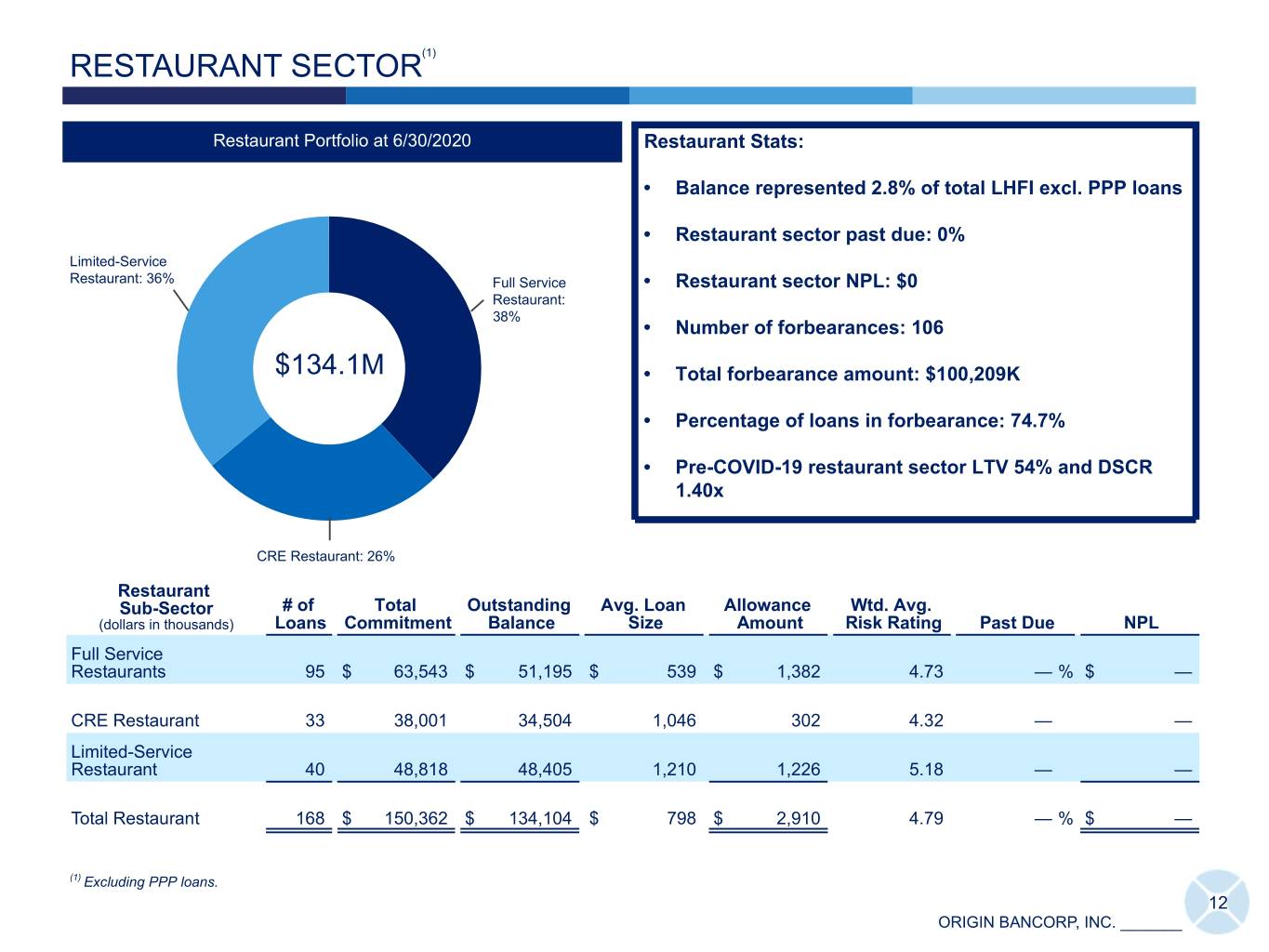

RESTAURANT SECTOR(1) Restaurant Portfolio at 6/30/2020 Restaurant Stats: • Balance represented 2.8% of total LHFI excl. PPP loans • Restaurant sector past due: 0% Limited-Service Restaurant: 36% Full Service • Restaurant sector NPL: $0 Restaurant: 38% • Number of forbearances: 106 $134.1M • Total forbearance amount: $100,209K • Percentage of loans in forbearance: 74.7% • Pre-COVID-19 restaurant sector LTV 54% and DSCR 1.40x CRE Restaurant: 26% Restaurant Sub-Sector # of Total Outstanding Avg. Loan Allowance Wtd. Avg. (dollars in thousands) Loans Commitment Balance Size Amount Risk Rating Past Due NPL Full Service Restaurants 95 $ 63,543 $ 51,195 $ 539 $ 1,382 4.73 — % $ — CRE Restaurant 33 38,001 34,504 1,046 302 4.32 — — Limited-Service Restaurant 40 48,818 48,405 1,210 1,226 5.18 — — Total Restaurant 168 $ 150,362 $ 134,104 $ 798 $ 2,910 4.79 — % $ — (1) Excluding PPP loans. 12 ORIGIN BANCORP, INC. _______

ASSISTED LIVING SECTOR(1) Assisted Living Portfolio at 6/30/2020 Assisted Living Stats: • Balance represented 2.9% of total LHFI excl. PPP loans • Number of forbearances: 5 Assisted Living Facilities: 100% • Total forbearance amount: $48,935K • Percentage of loans in forbearance: 34.9% $140.2M • Pre-COVID-19 assisted living sector LTV 75% and DSCR 0.31x Assisted Living Sub-Sector # of Total Outstanding Avg. Loan Allowance Wtd. Avg. (dollars in thousands) Loans Commitment Balance Size Amount Risk Rating Past Due NPL Assisted Living (2) 16 $ 157,033 $ 140,218 $ 8,764 $ 4,150 5.46 1.62 % $ 2,270 (1) Excluding PPP loans. (2) Past dues excluding NPLs for assisted living, which is one relationship, is 0%. 13 ORIGIN BANCORP, INC. _______

CREDIT QUALITY Asset Quality Trends 1.14% 2.02% 0.80% 1.92% 0.75% 0.75% 0.74% 1.65% 1.57% 1.67% 0.76% 0.63% 0.72% 0.72% 0.50% 0.58% 0.29% 0.26% 0.07% 0.11% 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 Nonperforming LHFI / LHFI excl. PPP loans Classified Loans / LHFI excl. PPP loans Past due LHFI / LHFI excl. PPP loans Net Charge-Offs / Average LHFI excl. PPP loans (annualiz… CECL 1Q2020 2Q2020 Allowance Allowance Economic Drivers: (dollars in thousands) 1/1/2020 Increase 3/31/2020 Increase (1) 6/30/2020 Commercial real estate $ 4,961 $ 4,293 $ 9,254 $ 792 $ 10,046 • Shrinking U.S. economy in 2020 Construction/land/land development 4,852 202 5,054 1,806 6,860 Key source: Moody's Analytics Residential real estate 3,806 689 4,495 2,416 6,911 • Elevated unemployment rate Commercial and industrial 24,256 11,567 35,823 9,458 45,281 Key source: Moody's Analytics Mortgage warehouse lines of credit 291 488 779 (177) 602 • Loss reversion period extended to Consumer 602 56 658 110 768 18 months from 12 months Total $ 38,768 $ 17,295 $ 56,063 $ 14,405 $ 70,468 % of LHFI 0.94 % 1.25 % 1.33 % % of LHFI excl. PPP loans and mtg. warehouse 0.99 % 1.37 % 1.75 % (1) Net of charge-offs. 14 ORIGIN BANCORP, INC. _______

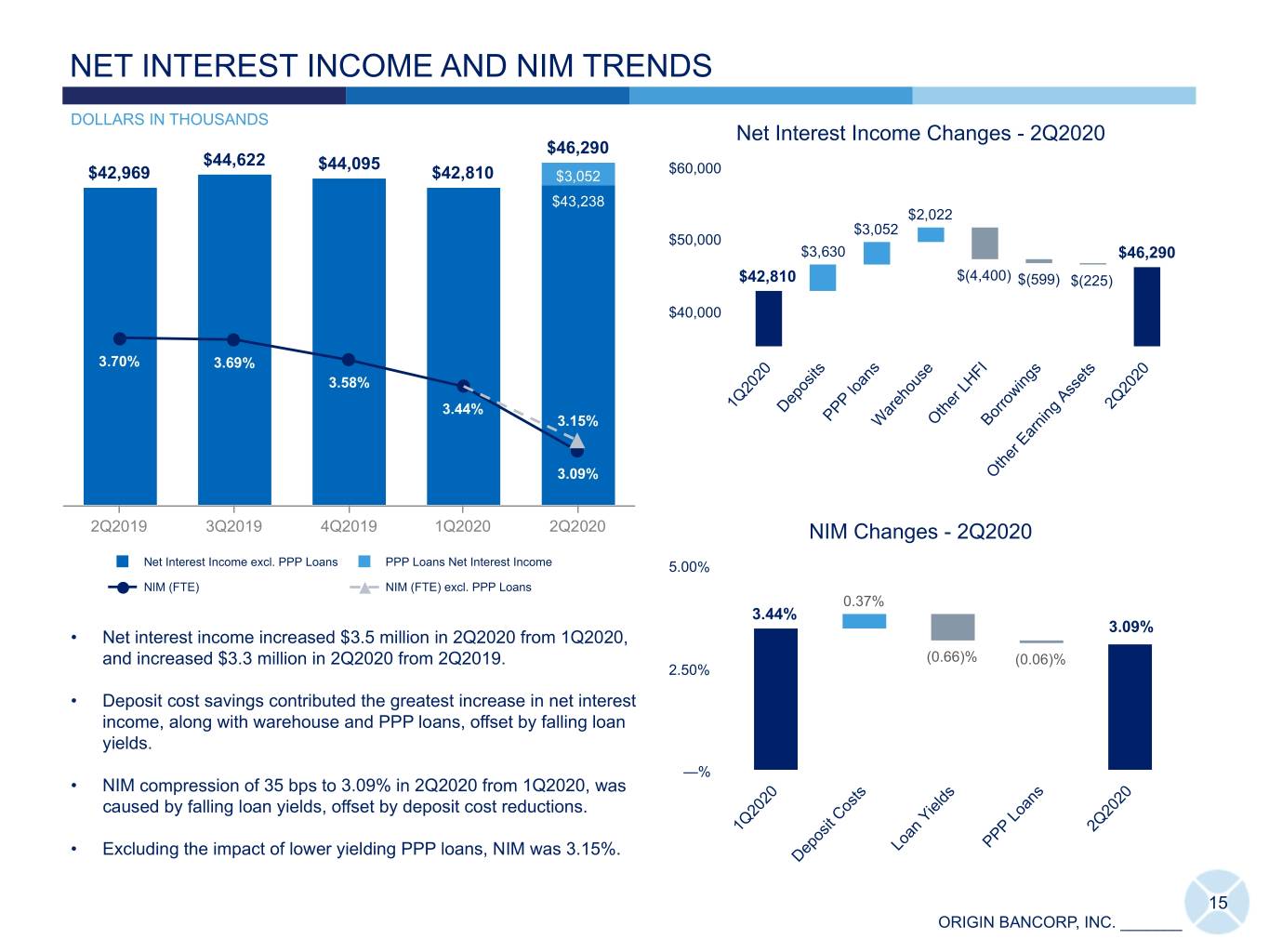

NET INTEREST INCOME AND NIM TRENDS DOLLARS IN THOUSANDS Net Interest Income Changes - 2Q2020 $46,290 $44,622 $44,095 $60,000 $42,969 $42,810 $3,052 $43,238 $2,022 $3,052 $50,000 $3,630 $46,290 $42,810 $(4,400) $(599) $(225) $40,000 3.70% 3.69% 3.58% 3.44% 1Q2020 Deposits 2Q2020 PPP loans 3.15% WarehouseOther LHFIBorrowings 3.09% Other Earning Assets 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 NIM Changes - 2Q2020 Net Interest Income excl. PPP Loans PPP Loans Net Interest Income 5.00% NIM (FTE) NIM (FTE) excl. PPP Loans 0.37% 3.44% 3.09% • Net interest income increased $3.5 million in 2Q2020 from 1Q2020, and increased $3.3 million in 2Q2020 from 2Q2019. (0.66)% (0.06)% 2.50% • Deposit cost savings contributed the greatest increase in net interest income, along with warehouse and PPP loans, offset by falling loan yields. —% • NIM compression of 35 bps to 3.09% in 2Q2020 from 1Q2020, was caused by falling loan yields, offset by deposit cost reductions. 1Q2020 2Q2020 • Excluding the impact of lower yielding PPP loans, NIM was 3.15%. Loan Yields PPP Loans Deposit Costs 15 ORIGIN BANCORP, INC. _______

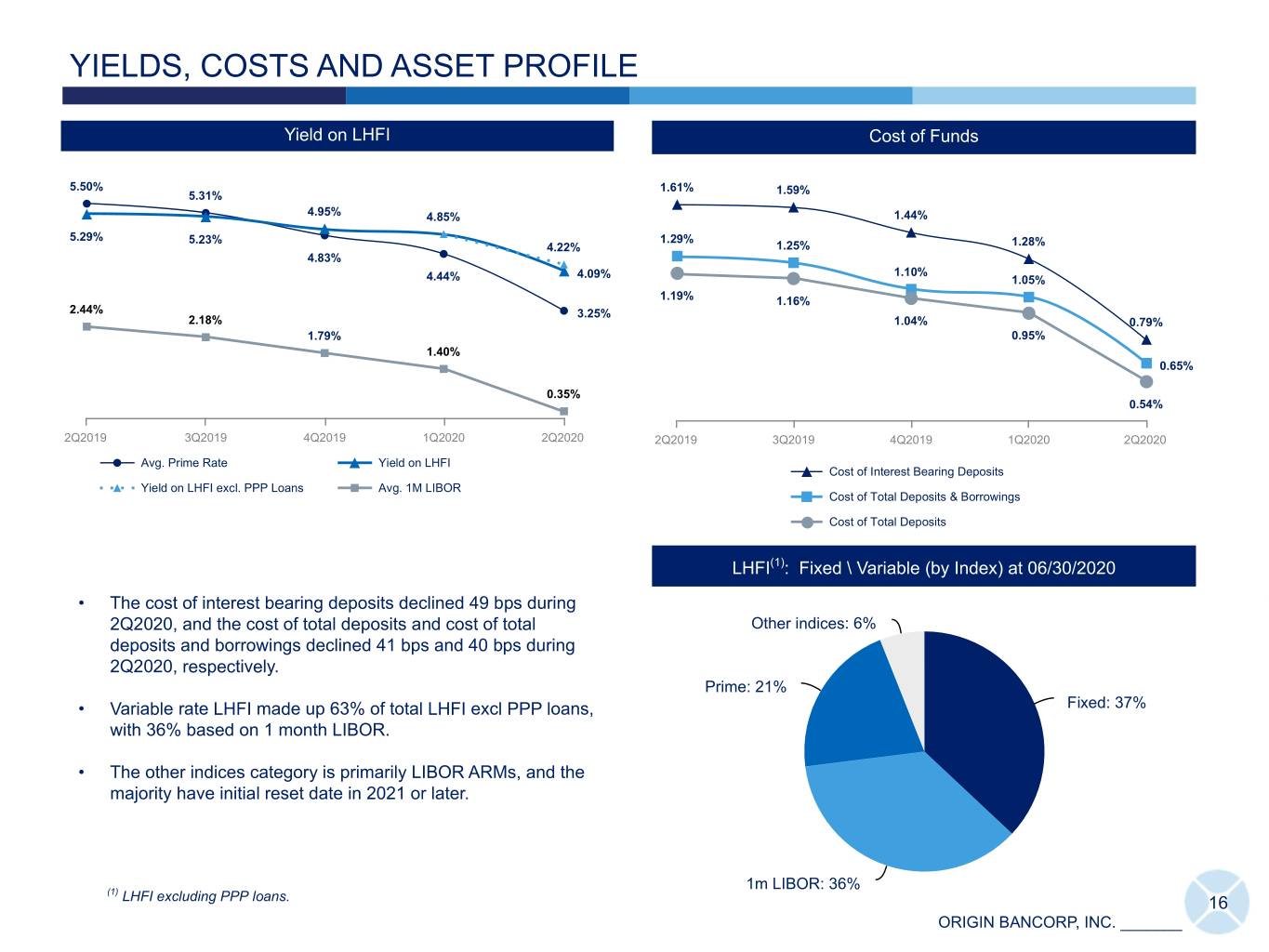

YIELDS, COSTS AND ASSET PROFILE Yield on LHFI Cost of Funds 5.50% 1.61% 5.31% 1.59% 4.95% 4.85% 1.44% 5.29% 5.23% 1.29% 4.22% 1.25% 1.28% 4.83% 4.09% 1.10% 4.44% 1.05% 1.19% 1.16% 2.44% 3.25% 2.18% 1.04% 0.79% 1.79% 0.95% 1.40% 0.65% 0.35% 0.54% 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 Avg. Prime Rate Yield on LHFI Cost of Interest Bearing Deposits Yield on LHFI excl. PPP Loans Avg. 1M LIBOR Cost of Total Deposits & Borrowings Cost of Total Deposits LHFI(1): Fixed \ Variable (by Index) at 06/30/2020 • The cost of interest bearing deposits declined 49 bps during 2Q2020, and the cost of total deposits and cost of total Other indices: 6% deposits and borrowings declined 41 bps and 40 bps during 2Q2020, respectively. Prime: 21% • Variable rate LHFI made up 63% of total LHFI excl PPP loans, Fixed: 37% with 36% based on 1 month LIBOR. • The other indices category is primarily LIBOR ARMs, and the majority have initial reset date in 2021 or later. (1) 1m LIBOR: 36% LHFI excluding PPP loans. 16 ORIGIN BANCORP, INC. _______

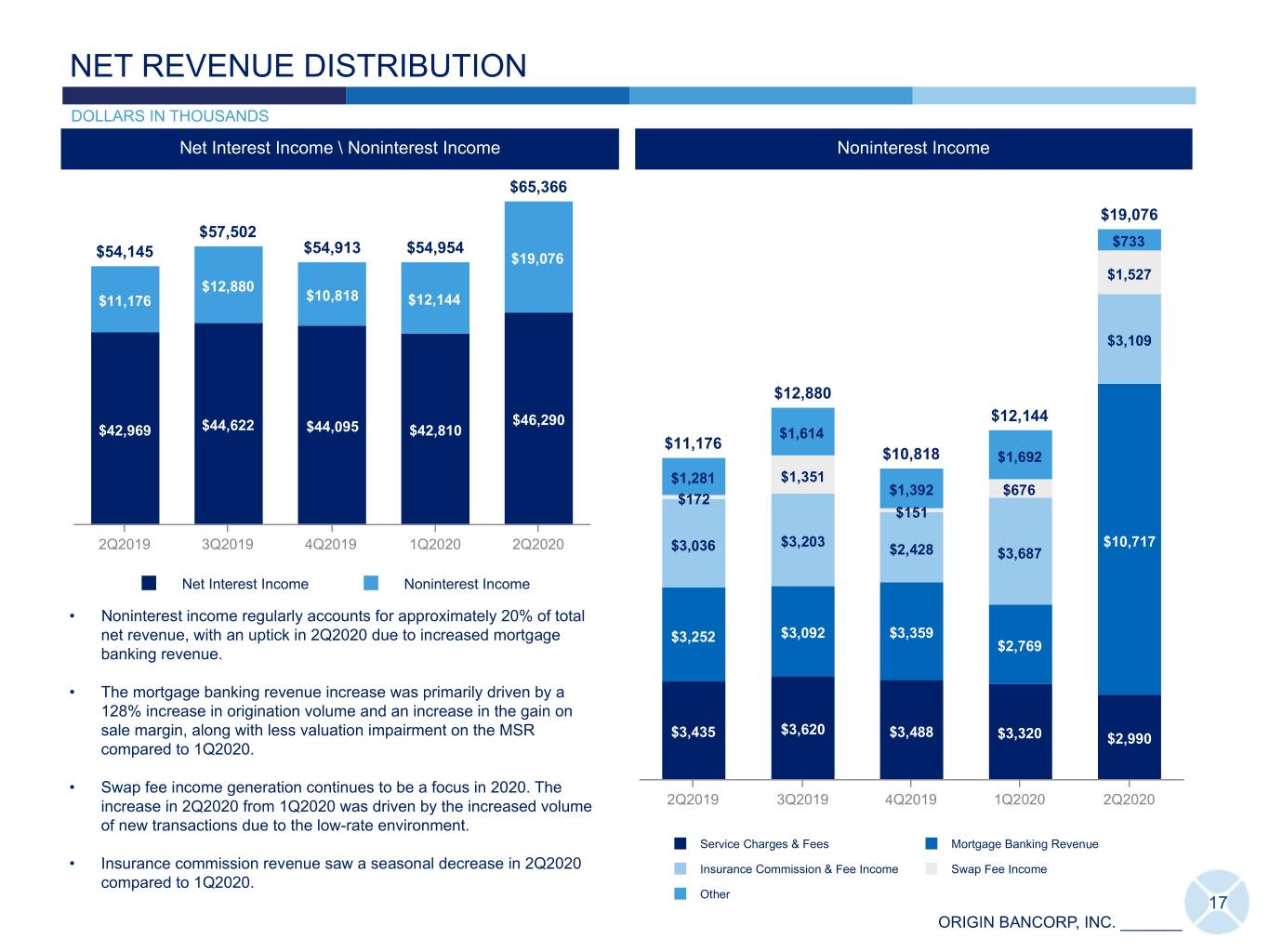

NET REVENUE DISTRIBUTION DOLLARS IN THOUSANDS Net Interest Income \ Noninterest Income Noninterest Income $65,366 $19,076 $57,502 $54,913 $54,954 $733 $54,145 $19,076 $1,527 $12,880 $11,176 $10,818 $12,144 $3,109 $12,880 $12,144 $44,622 $46,290 $42,969 $44,095 $42,810 $1,614 $11,176 $10,818 $1,692 $1,281 $1,351 $1,392 $676 $172 $151 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 $3,036 $3,203 $10,717 $2,428 $3,687 Net Interest Income Noninterest Income • Noninterest income regularly accounts for approximately 20% of total net revenue, with an uptick in 2Q2020 due to increased mortgage $3,252 $3,092 $3,359 banking revenue. $2,769 • The mortgage banking revenue increase was primarily driven by a 128% increase in origination volume and an increase in the gain on sale margin, along with less valuation impairment on the MSR $3,620 $3,435 $3,488 $3,320 $2,990 compared to 1Q2020. • Swap fee income generation continues to be a focus in 2020. The increase in 2Q2020 from 1Q2020 was driven by the increased volume 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 of new transactions due to the low-rate environment. Service Charges & Fees Mortgage Banking Revenue • Insurance commission revenue saw a seasonal decrease in 2Q2020 Insurance Commission & Fee Income Swap Fee Income compared to 1Q2020. Other 17 ORIGIN BANCORP, INC. _______

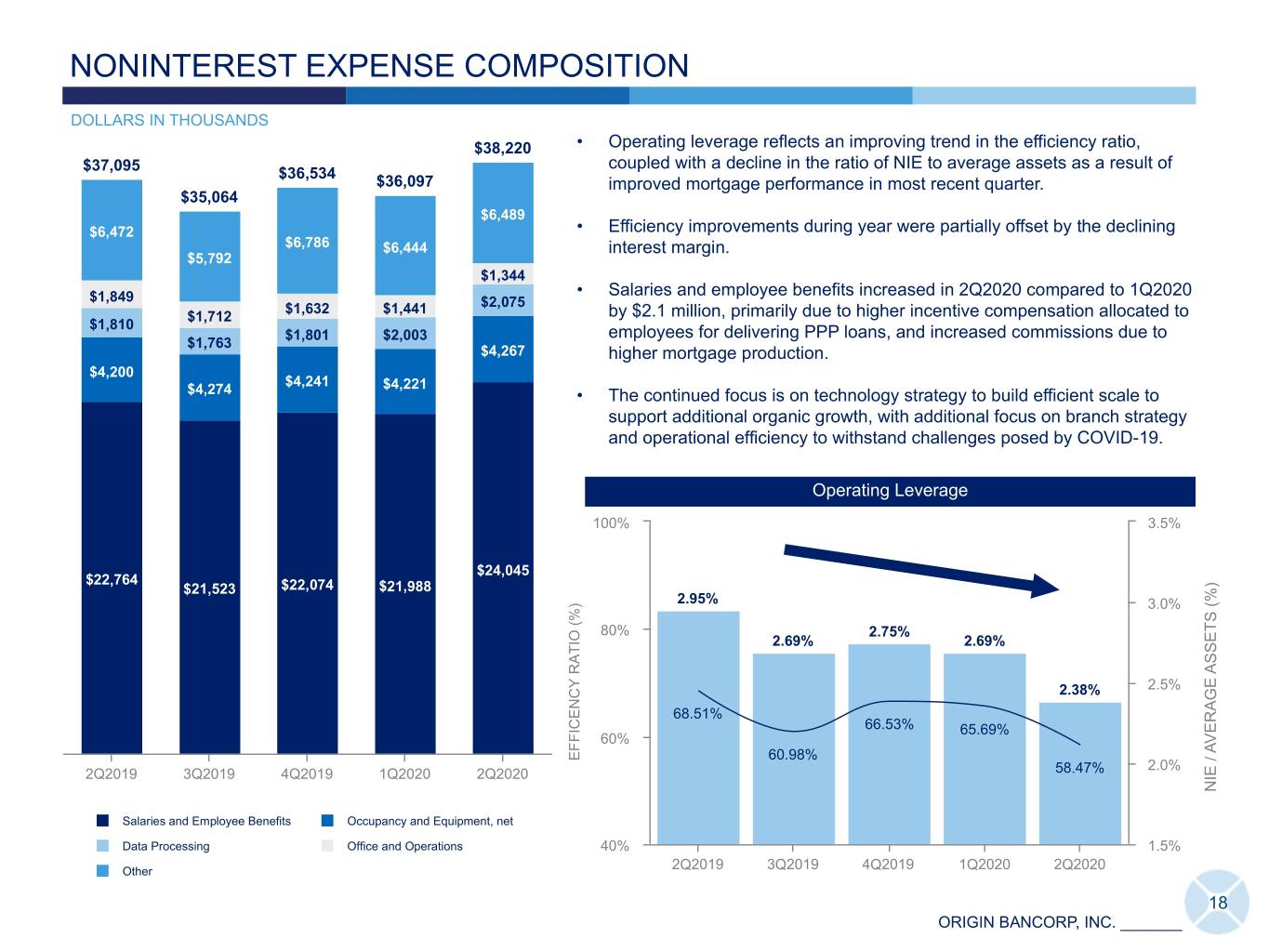

NONINTEREST EXPENSE COMPOSITION DOLLARS IN THOUSANDS $38,220 • Operating leverage reflects an improving trend in the efficiency ratio, coupled with a decline in the ratio of NIE to average assets as a result of $37,095 $36,534 $36,097 improved mortgage performance in most recent quarter. $35,064 $6,489 $6,472 • Efficiency improvements during year were partially offset by the declining $6,786 $6,444 interest margin. $5,792 $1,344 $1,849 • Salaries and employee benefits increased in 2Q2020 compared to 1Q2020 $1,632 $1,441 $2,075 $1,712 by $2.1 million, primarily due to higher incentive compensation allocated to $1,810 $1,801 $2,003 employees for delivering PPP loans, and increased commissions due to $1,763 $4,267 higher mortgage production. $4,200 $4,241 $4,221 $4,274 • The continued focus is on technology strategy to build efficient scale to support additional organic growth, with additional focus on branch strategy and operational efficiency to withstand challenges posed by COVID-19. Operating Leverage 100% 3.5% $24,045 $22,764 $21,523 $22,074 $21,988 2.95% 3.0% 80% 2.75% 2.69% 2.69% 2.38% 2.5% 68.51% 66.53% 65.69% 60% EF FICENCY RATIO (%) 60.98% 2.0% 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 58.47% NIE / AVERAGE ASSETS (%) AVERAGE NIE / Salaries and Employee Benefits Occupancy and Equipment, net Data Processing Office and Operations 40% 1.5% Other 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 18 ORIGIN BANCORP, INC. _______

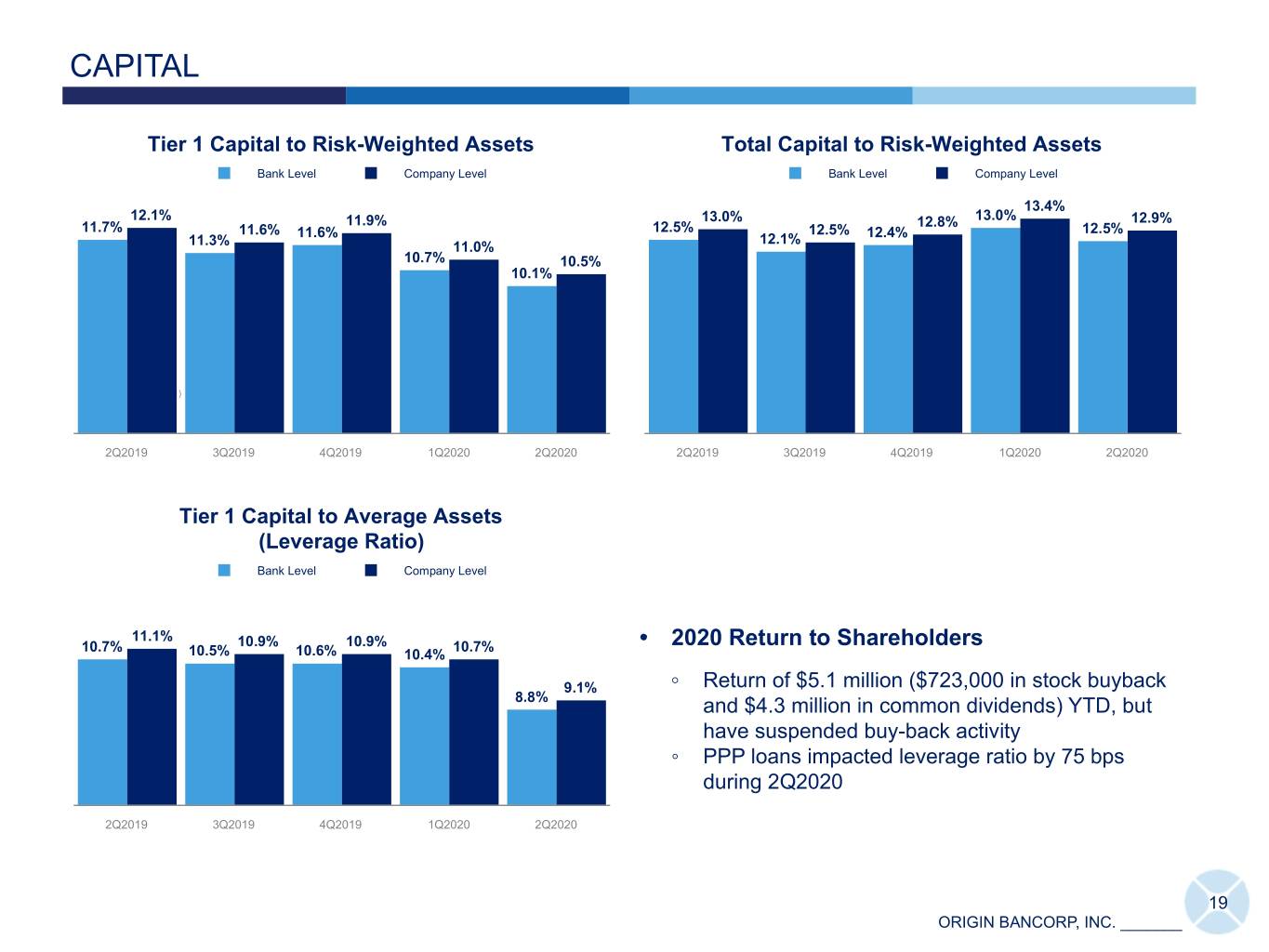

CAPITAL Tier 1 Capital to Risk-Weighted Assets Total Capital to Risk-Weighted Assets Bank Level Company Level Bank Level Company Level 13.4% 12.1% 11.9% 13.0% 12.8% 13.0% 12.9% 11.7% 11.6% 12.5% 12.5% 12.5% 11.6% 12.1% 12.4% 11.3% 11.0% 10.7% 10.5% 10.1% (1) 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 Tier 1 Capital to Average Assets (Leverage Ratio) Bank Level Company Level 11.1% 10.7% 10.9% 10.9% 10.7% • 2020 Return to Shareholders 10.5% 10.6% 10.4% 9.1% ◦ Return of $5.1 million ($723,000 in stock buyback 8.8% and $4.3 million in common dividends) YTD, but have suspended buy-back activity ◦ PPP loans impacted leverage ratio by 75 bps during 2Q2020 2Q2019 3Q2019 4Q2019 1Q2020 2Q2020 19 ORIGIN BANCORP, INC. _______

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS Calculation of Tangible Common Equity: 2Q2020 1Q2020 4Q2019 3Q2019 2Q2019 Total common stockholders' equity $ 614,781 $ 606,631 $ 599,262 $ 588,363 $ 584,293 Less: goodwill and other intangible assets, net 30,953 31,241 31,540 31,842 32,144 Tangible Common Equity $ 583,828 $ 575,390 $ 567,722 $ 556,521 $ 552,149 Calculation of Tangible Book Value per Common Share: Divided by common shares outstanding at the end of the period 23,501,233 23,475,948 23,480,945 23,481,781 23,774,238 Tangible Book Value per Common Share $ 24.84 $ 24.51 $ 24.18 $ 23.70 $ 23.22 Calculation of PTPP Earnings: Net Income $ 4,957 $ 753 $ 12,827 $ 14,617 $ 12,283 Plus: provision for credit losses 21,403 18,531 2,377 4,201 1,985 Plus: income tax expense 786 (427) 3,175 3,620 2,782 PTPP Earnings $ 27,146 $ 18,857 $ 18,379 $ 22,438 $ 17,050 Calculation of PTPP ROAA and PTPP ROAE: PTPP Earnings $ 27,146 $ 18,857 $ 18,379 $ 22,438 $ 17,050 Divided by number of days in the quarter 91 91 92 92 91 Multiplied by the number of days in the year 366 366 365 365 365 Annualized PTPP Earnings $ 109,181 $ 75,842 $ 72,917 $ 89,020 $ 68,387 Divided by total average assets $ 6,447,526 $ 5,400,704 $ 5,271,979 $ 5,179,549 $ 5,043,951 PTPP ROAA (annualized) 1.69 % 1.40 % 1.38 % 1.72 % 1.36 % Divided by total average stockholder's equity $ 617,898 $ 611,162 $ 597,925 $ 588,504 $ 576,761 PTPP ROAE (annualized) 17.67 % 12.41 % 12.19 % 15.13 % 11.86 % 20 ORIGIN BANCORP, INC. _______