Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF WWC, PC - Kenongwo Group US, Inc. | ea124254ex23-1_kenongwo.htm |

| EX-10.7 - ENGLISH TRANSLATION OF THE COOPERATION AGREEMENT, DATED APRIL 27, 2019, BY AND A - Kenongwo Group US, Inc. | ea124254ex10-7_kenongwo.htm |

As filed with the Securities and Exchange Commission on July 17, 2020

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

KENONGWO GROUP US, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 2870 | 37-1914208 | ||

(State or jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

Yangjia Group, Xiaobu Town

Yuanzhou District, Yichun City

Jiangxi Province, China 336000

+86-400-915-2178

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jianjun Zhong, President

Yangjia Group, Xiaobu Town

Yuanzhou District, Yichun City

Jiangxi Province, China 336000

+86-400-915-2178

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Elizabeth Fei Chen, Esq.

Pryor

Cashman LLP

7 Times Square

New York, NY 10036

(212) 326-0199

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

Non-accelerated filer ☒

|

Smaller reporting company ☒ Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered | Amount to be Registered(1)(2) | Proposed Maximum Offering Price Per Share (3) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, $0.0001 par value | 3,517,893 | $ | 0.10 | $ | 351,789 | $ | 45.66 | |||||||||

| (1) | Pursuant to Rule 416 under the Securities Act, the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (2) | This registration statement covers the resale by the selling stockholders of the registrant of up to 3,517,893 shares of common stock previously issued to the selling stockholders as named in the prospectus. |

| (3) | Calculated pursuant to Rule 457(a) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

PRELIMINARY PROSPECTUS DATED JULY 17, 2020

Kenongwo Group US, Inc.

3,517,893 Shares of Common Stock

This prospectus relates to the registration and resale of up to 3,517,893 shares of our common stock, par value $0.0001 per share, by the selling stockholders named in this prospectus at a fixed price of $0.10 per share for a total amount of up to $351,789 until such time, if ever, that our common stock is quoted on the OTC QB tier (the “OTCQB”) under the OTC Markets Group.

We will pay all expenses of registering the shares of common stock. We will not receive any proceeds from the sale of the common stock by the selling stockholders.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the OTCQB. To be eligible for quotation, issuers must remain current in their quarterly and annual filings with the SEC. If we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTCQB or other quotation service. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information or to make any representations about us, the securities being offered pursuant to this prospectus or any other matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities laws.

This investment involves a high degree of risk. You should purchase shares of common stock only if you can afford a complete loss. See “Risk Factors” beginning on page 4 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE DATE OF THIS PROSPECTUS IS ______________

TABLE OF CONTENTS

i

This summary highlights selected information contained elsewhere in this prospectus. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements. Unless the context otherwise requires, references contained in this prospectus to the “Company,” “we,” “us,” or “our” refers to Kenongwo Group US, Inc. and its subsidiaries.

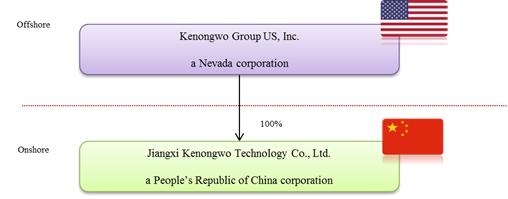

Kenongwo Group US, Inc. (“we”, “us”, or the “Company”) is an early stage company focused on the development, manufacture and commercialization of bamboo charcoal biomass organic fertilizers, amino acid water-soluble fertilizers, selenium-rich foliage fertilizers and other types of fertilizers through its subsidiary, Jiangxi Kenongwo Technology Co., Ltd. (“Jiangxi Kenongwo”), a company incorporated under the laws of the People’s Republic of China (the “PRC”).

Company Overview

The Company was incorporated in the State of Nevada on October 17, 2018. On January 1, 2019, we acquired all of the issued and outstanding shares of Jiangxi Kenongwo pursuant to certain share transfer agreements with two former shareholders of Jiangxi Kenongwo (the “Share Transfer”). The Share Transfer was completed on January 9, 2019. As a result of the completion of the Share Transfer, Jiangxi Kenongwo became our wholly-owned subsidiary.

We primarily engage in studying, developing, manufacturing and selling bamboo charcoal biomass organic fertilizers, amino acid water-soluble fertilizers, selenium-rich foliage fertilizers and other types of fertilizers in the PRC.

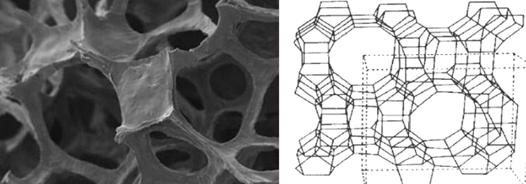

The main raw materials that are used in our organic fertilizers include bamboo charcoal, bamboo vinegar, rapeseed dregs and organic selenium. Bamboo charcoal is carbonized from bamboo and it is an excellent fertilizer carrier that can slowly release the fertilizer substance and at the same time reduce the pollution in the soil. Bamboo vinegar is a liquid obtained by condensing the water volatile organics in Moso bamboo, which is released during the high temperature pyrolysis through our patented technology. Fermented rapeseed dregs are the component of organic materials, which can significantly impact the quality of soil. Selenium is an essential trace mineral that is important for many bodily processes. By adding organic selenium into our fertilizers and applying them to the crops, selenium can be well absorbed and converted, making the final agricultural products rich of selenium. Our fertilizers also provide optimum levels of primary plant nutrients which including multi-minerals, proteins and carbohydrates that promote the healthiest soils capable of growing the healthy crops and vegetables. It can effectively reduce the use of chemical fertilizers and pesticides as well as reduce the penetration of large chemical fertilizers and pesticides into the soil and thus avoid water pollution. Therefore, our fertilizer can effectively improve fertility of soil, and the quality and safety of agricultural products.

We generated our revenue from the sales of our organic fertilizers. We currently have one integrated factory covering a land area of 143,590 square feet in Yichun City, Jiangxi Province, PRC to produce our organic fertilizers, which has been in operations since 2017. We plan to expand our production capacity and build an automatic and standardized production line.

We believe that our brand reputation and ability to tailor our products to meet the requirements of various regions of the PRC affords us a competitive advantage. We purchase the majority of our raw materials from suppliers located in the PRC and use suppliers that are located in close proximity to our manufacturing facilities, which helps us to control our cost of revenue.

1

China is the principal market for our products, which are primarily sold to farmers through distributors in over ten provinces in China, including Jiangxi, Hunan, Hubei, Fujian, Jiangsu, Shanghai, Zhejiang, Sichuan, Chongqing, Guangdong, Hainan, Xinjiang, Guizhou and Guangxi provinces.

Our independent registered public accountant has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern as more fully described under Note 1 of the notes to the financial statements for the fiscal years ended December 31, 2019 and 2018. In addition, the Company has incurred a net loss of $123,589 for the three months ended March 31, 2020. As of March 31, 2020, the Company had an accumulated deficit of $324,364, working capital deficit of $395,955, and stockholders’ deficit of $30,281; its net cash used in operating activities for the three months ended March 31, 2020 was $63,860.

Our Chief Executive Officer, Mr. Jianjun Zhong, beneficially owns approximately 74.4% of our issued and outstanding shares of common stock and therefore has the ability to control all matters submitted to stockholders for approval.

We have not applied to register the shares in any state. An exemption from registration will be relied upon in the states where the shares are distributed and may only be traded in such jurisdictions after compliance with applicable securities laws. There can be no assurances that the shares will be eligible for sale or resale in such jurisdictions. We may apply to register the shares in several states for secondary trading; however, we are under no requirement to do so.

Debt-to-Equity Conversion

On September 5, 2019, the Company agreed to issue an aggregate of 2,887,893 shares of the common stock to 17 creditors to covert a debt of RMB716,161 (approximately $104,273) owed to such creditors by Jiangxi Kenongwo pursuant to certain debt-to-equity conversion agreements entered into by and among the Company, Jiangxi Kenongwo and such creditors. The issuance of our common stock is in reliance upon the exemption under Regulation S of the Securities Act.

Equity Financing

On October 16, 2019, the Company agreed to issue an aggregate of 606,922 shares of the common stock to a total of 41 investors for an aggregate purchase price of RMB 418,166 (approximately $60,692) in a private placement. In January 2020, the Company agreed to issue an aggregate of 1,300,000 shares of the common stock to two investors for an aggregate purchase price of RMB 897,000 (approximately $130,000) in a private placement. The issuance of our common stock is in reliance upon the exemption under Regulation S of the Securities Act.

2

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 3,517,893 shares of common stock. The selling stockholders will sell their shares of common stock at the fixed price of $0.10 per share until such time, if ever, that the common stock is quoted on the OTCQB. We will not receive any proceeds from the sale of the shares of common stock by the selling stockholders.

| Common stock offered by the selling stockholders | Up to 3,517,893 shares | |

| Determination of the Offering Price | The offering price of $0.10 per share has been and in the future may be arbitrarily determined by the selling stockholders based on estimates of the price that purchasers of speculative securities, such as the shares, will be willing to pay considering the nature and capital structure of our company, the experience of our officers and directors and the market conditions for the sale of equity securities in similar companies. For purposes of calculating the registration fee for the common stock included in this prospectus, we have used an estimated public offering price of $0.10 per share. We can offer no assurances that the $0.10 price bears any relation to the value of the shares as of the date of this prospectus. | |

| Use of Proceeds | We will not receive any of the proceeds from the sale of the common stock by the selling stockholders named in this prospectus. |

3

An investment in our shares of common stock involves a high degree of risk. Before deciding whether to invest in our shares of common stock, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our shares of common stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the sections referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our shares of common stock if you can bear the risk of loss of your entire investment.

Risks Relating to Our Business and Industry

Our fertilizer business is seasonal and affected by factors beyond our control, which may cause our sales and operating results to fluctuate significantly.

The sale of fertilizer products is partially dependent upon planting and growing seasons, which vary from year to year, and are expected to result in both seasonal patterns and substantial fluctuations in quarterly sales and profitability. Weather conditions and natural disasters, such as heavy rains, hail, floods, freezing conditions, windstorms or fire, also affect decisions by our distributors, direct customers and end users about the types and amounts of products to use and the timing of harvesting and planting. As we increase our sales in our current markets and expand into new markets in different geographies, it is possible that we may experience different seasonality patterns in our business.

Disruptions may lead to delays in harvesting or planting by growers which can result in pushing orders to a future quarter, which could negatively affect results for the quarter in question and cause fluctuations in our operating results. Seasonal variations may be especially pronounced because our product lines are mainly sold in China. Planting and growing seasons, climatic conditions and other variables on which sales of our products are dependent vary from year to year and quarter to quarter. As a result, we may experience substantial fluctuations in quarterly sales.

The overall level of seasonality in our business is difficult to evaluate as a result of our relatively early stage of development, our limited number of commercialized products, our expansion into new geographical territories, the introduction of new products and the timing of introductions of new products. It is possible that our business may be more seasonal or experience seasonality in different periods than anticipated. Other factors may also contribute to the unpredictability of our operating results, including the size and timing of significant distributor transactions, the delay or deferral of use of our commercial technology or products and the fiscal or quarterly budget cycles of our direct customers, distributors, licensees and end users. Customers may purchase large quantities of our products in a particular quarter to store and use over long periods of time or time their purchases to manage their inventories, which may cause significant fluctuations in our operating results for a particular quarter or year.

Competition in fertilizer and agricultural industrial products is intense and requires continuous technological development.

We currently face significant direct and indirect competition in the markets in which we operate. The markets for fertilizers are intensely competitive and rapidly changing. Many companies engage in the development of fertilizers, and speed in commercializing a new product can be a significant competitive advantage.

4

In most segments of the fertilizer markets, the number of products available to end customers is steadily increasing as new products are introduced. We may be unable to compete successfully against our current and future competitors, which may result in price reductions, reduced margins and the inability to achieve market acceptance for products containing our seed traits and technology. In addition, many of our competitors have substantially greater financial, marketing, sales, distribution and technical resources than us and some of our competitors have more experience in R&D, regulatory matters, manufacturing and marketing. We anticipate increased competition in the future as new companies enter the market and new technologies become available. Programs to improve genetics and crop protection chemicals are generally concentrated within a relatively small number of large companies, while non-genetic approaches are underway with broader set of companies. Mergers and acquisitions in the plant science, specialty food ingredient and agricultural biotechnology seed and chemical industries may result in even more resources being concentrated among a smaller number of our competitors.

Although we believe we have strong competence in the current market, our technology may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors in the future, which will prevent or limit our ability to generate revenues from the commercialization of our technology. Our ability to compete effectively and to achieve commercial success depends, in part, on our ability to control manufacturing and marketing costs; effectively price and market our products, successfully develop an effective marketing program and an efficient supply chain, develop new products with properties attractive to food manufacturers or growers and commercialize our products quickly without incurring major regulatory costs. We may not be successful in achieving these factors and any such failure may adversely affect our business, results of operations and financial condition.

If we are unable to compete successfully with our competitors, our financial condition and results of operations may be harmed.

We encounter intense competition in each of our business segments on a national, regional and local level. Competition in the industry is primarily based on quality of services, brand name recognition, geographic coverage and range of services. New and existing competitors may offer competitive rates, greater convenience or superior services, which could attract customers away from us, resulting in lower revenues for our operations. Competition among fertilizer companies may cause a decrease in price of sales to attract or retain talented employees.

We do not have multinational competitors. Due to the high price of organic fertilizers from other countries, China has little organic fertilizer imports. The fertilizers produced by international fertilizer companies entering the Chinese organic fertilizer market are mainly special functional fertilizers such as foliar fertilizers. These functional fertilizers are not sold well in the domestic market due to high price.

Some of our competitors may have a broader national presence than us and may have a more established branding recognition than us in major markets, and also may have more financial or other resources than us. Others may have smaller aggregate businesses than us, but may be more established and have greater market presence and brand name recognition on a local or regional basis. We are also subject to competition from other large national and international companies. These companies may have more financial or other resources than us. If we fail to compete effectively, our business operations and financial condition will suffer.

The loss of any of our key suppliers and/or customers could have a materially adverse effect on our results of operations.

We consider our major suppliers in each period to be those suppliers that accounted for more than 10% of overall purchases in such period. For the year ended December 31, 2019, over 40% of our supplies came from two key suppliers. Although we believe that we can locate replacement suppliers readily on the market for prevailing prices and that we may not have significant difficulty replacing a given supplier, any difficulty in replacing such a supplier could adversely affect our company’s performance to the extent it results in higher prices, slower supply chain and ultimately less desirable results of operations.

5

In addition, for the year ended December 31, 2019, two key customers accounted for a total of over 47% of our revenues. As the majority of our revenues are driven by individual orders for fertilizer products, there can be no assurance that we will maintain or improve the relationships with customers. There can be no assurance that we will maintain or improve the relationships with customers. If we cannot maintain long-term relationships with major customers or replace major customers from period to period with equivalent customers, the loss of such sales could have an adverse effect on our business, financial condition and results of operations.

Our product development cycle is lengthy and uncertain and we may never generate revenues or earn revenues on the sale of our products currently in development.

The research and development in the crop productivity and agriculture biotech industries is expensive, complex, prolonged and uncertain. We may spend many years and dedicate significant financial and other resources developing products that may never generate revenues or come to market. Our process of developing and commercializing technologies involves several phases and can take several years from discovery to commercialization of a product.

Development of new or improved agricultural products involves risks of failure inherent in the development of products based on innovative and complex technologies. These risks include the possibility that:

| ● | our products will fail to perform as expected in the field; |

| ● | our products will not receive necessary regulatory permits and governmental clearances in the markets in which we intend to sell them; |

| ● | consumer preferences, which are unpredictable and can vary greatly, may change quickly, making our products no longer desirable; |

| ● | our competitors develop new products that have other more appealing characteristics than our products; |

| ● | our products will be viewed as too expensive by food companies or growers as compared to competitive products; |

| ● | our products will be difficult to produce on a large scale or will not be economical to grow; |

| ● | intellectual property and other proprietary rights of third parties will prevent us, our research and development partners, or our licensees from marketing and selling our products; |

| ● | we may be unable to patent or otherwise obtain intellectual property protection for our discoveries in the necessary jurisdictions; |

| ● | we or the customers that we sell our products to may be unable to fully develop or commercialize our products in a timely manner or at all; and |

| ● | third parties may develop superior or equivalent products. |

We intend to continue to invest in research and development including additional and expanded field testing to validate potential products in real world conditions. Because of the long product development cycle and the complexities and uncertainties associated with biotech and agricultural industrial technologies, there can be no assurance that we will ever generate significant revenues from the technologies or products that we are currently developing without significant delay, without the incurrence of unanticipated costs or at all.

6

We depend on our key personnel and research employees and we may be adversely affected if we are unable to attract and retain qualified scientific and business personnel.

Our business is dependent on our ability to recruit and maintain highly skilled and educated individuals through direct employment or collaboration arrangements, with expertise in a range of disciplines, including biology, chemistry, plant genetics, agronomics, mathematics programming and other subjects relevant to our business. Our ability to recruit such a work force depends in part on our ability to maintain our market leadership in agricultural biotech industry in China. Maintaining our ability to attract highly-skilled workers and leading scientific institutions depends in part on our ability to maintain a strong technology platform and state-of-the-art facilities, as well as our ability to consistently and successfully commercialize our technology. There can be no assurance that we will be able to maintain leading scientific capabilities or continue to successfully maintain advanced technology in the market.

We have a limited operating history in our market, which makes it difficult to evaluate our future prospects.

We started engaging in our business in the last few years and have limited revenues to date. As our business develops or in response to competition, we may continue to introduce new products and services or make adjustments to our existing offerings and business model. In connection with the introduction of new products or in response to general economic conditions, we may impose more stringent borrower qualifications to ensure the quality of loans facilitated by our companies, which may negatively affect the growth of our business. Any significant change to our business model may not achieve expected results and may have a material and adverse impact on our financial conditions and results of operations. It is therefore difficult to effectively assess our future prospects. The risks and challenges we encounter or may encounter in this developing and rapidly evolving market may have impacts on our business and prospects. These risks and challenges include our ability to, among other things:

| ● | navigate an evolving regulatory environment; |

| ● | expand the base of borrowers and lenders; |

| ● | broaden our loan product offerings; |

| ● | enhance our risk management capabilities; |

| ● | improve our operational efficiency; |

| ● | cultivate a vibrant consumer finance ecosystem; |

| ● | maintain the security of our IT infrastructure and the confidentiality of the information provided and utilized across our platform; |

| ● | attract, retain and motivate talented employees; and |

| ● | defend ourselves against litigation, regulatory, intellectual property, privacy or other claims. |

If we fail to educate potential borrowers and lenders about the value of our services, if the market for our services does not develop as we expect, or if we fail to address the needs of our target market, or other risks and challenges, our business and results of operations will be harmed.

Our auditor has expressed substantial doubt about our ability to continue as a going concern and absent additional financing we may be unable to remain a going concern.

In light of our recurring losses, accumulated deficit and negative cash flow as described in our notes to our audited financial statements, the report of our independent registered public accounting firm on our financial statements for the year ended December 31, 2019 contained an explanatory paragraph raising substantial doubt about our ability to continue as a going concern. If we are unable to develop sufficient revenues and additional customers for our products, we may not generate enough revenue to sustain our business, and we may have to liquidate our assets and may receive less than the value at which those assets are carried on our audited consolidated financial statements, and it is likely that investors will lose all or a part of their investment. There can be no assurance that we will be able to continue as a going concern.

7

Any failure of any of our key suppliers to deliver necessary materials could result in delays in our products development or marketing schedules.

For the year ended December 31, 2019, two major suppliers accounted more than 40% of our purchases. We are dependent on our suppliers for our products. Our suppliers may fail to meet timelines or contractual obligations or provide us with sufficient products, which may adversely affect our business. Failure to appropriately structure or adequately manage our agreements with third parties may adversely affect our supply of products. We may not be able to replace a service provider within a reasonable period of time, on as favorable terms or without disruption to our operations. Any adverse changes to our relationships with third-party suppliers could have a material adverse effect on our image, brand and reputation, as well as on our business, financial condition and results of operations.

If we do not compete effectively, our results of operations could be harmed.

Our industry in China is intensely competitive and evolving. Our competitors operate with different business models, have different cost structures or participate selectively in different market segments. They may ultimately prove more successful or more adaptable to new regulatory, technological and other developments. Some of our current and potential competitors have significantly more financial, technical, marketing and other resources than we do and may be able to devote greater resources to the development, promotion, sale and support of their services. Our competitors may also have longer operating histories, more extensive borrower or lender bases, greater brand recognition and brand loyalty and broader partner relationships than us. Additionally, a current or potential competitor may acquire one or more of our existing competitors or form a strategic alliance with one or more of our competitors. If we are unable to compete with such companies and meet the need for innovation in our industry, the demand for our services could stagnate or substantially decline, we could experience reduced revenues or our services could fail to achieve or maintain more widespread market acceptance, any of which could harm our business and results of operations.

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

The continued development and success of our business rely on the recognition of our brands. We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing borrowers and lenders to our services. Successful promotion of our brand and our ability to attract qualified borrowers and sufficient lenders depend largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. Our efforts to build our brand have caused us to incur significant expenses, and it is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results.

If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common shares.

8

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting. In connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected. We determined that our disclosure controls and procedures over financial reporting are not effective and were not effective as of December 31, 2019 and 2018.

The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that we will implement and maintain adequate controls over our financial process and reporting in the future or that the measures we will take will remediate any material weaknesses that we may identify in the future.

Our business depends on the continued efforts of our senior management. If one or more of our key executives were unable or unwilling to continue in their present positions, our business may be severely disrupted.

Our business operations depend on the continued services of our senior management, particularly the executive officers named in this prospectus. While we have provided different incentives to our management, we cannot assure you that we can continue to retain their services. Although we maintained certain accident insurance policies for our officers, we currently do not carry a “key man” life insurance on the officers. Therefore, if one or more of our key executives were unable or unwilling to continue in their present positions, we may incur substantial cost or may not be able to replace them at all. Consequently, our future growth may be constrained, our business may be severely disrupted and our financial condition and results of operations may be materially and adversely affected. If that’s the case, we may incur additional expenses to recruit, train and retain qualified personnel. In addition, although we have entered into confidentiality and non-competition agreements with our management, there is no assurance that any member of our management team will not join our competitors or form a competing business. If any dispute arises between our current or former officers and us, we may have to incur substantial costs and expenses in order to enforce such agreements in China or we may be unable to enforce them at all.

Competition for employees is intense, and we may not be able to attract and retain the qualified and skilled employees needed to support our business.

We believe our success depends on the efforts and talent of our employees. Our future success depends on our continued ability to attract, develop, motivate and retain qualified and skilled employees. Competition for highly skilled technical, risk management and financial personnel is extremely intense. We may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Some of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment.

In addition, we invest significant time and expenses in training our employees, which increases their value to competitors who may seek to recruit them. If we fail to retain our employees, we could incur significant expenses in hiring and training their replacements, and the quality of our services and our ability to serve borrowers and lenders could diminish, resulting in a material adverse effect to our business.

9

Increases in labor costs in the PRC may adversely affect our business and results of operations.

The economy in China has experienced increases in inflation and labor costs in recent years. As a result, average wages in the PRC are expected to continue to increase. In addition, we are required by PRC laws and regulations to pay various statutory employee benefits, including pension, housing fund, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance to designated government agencies for the benefit of our employees. The relevant government agencies may examine whether an employer has made adequate payments to the statutory employee benefits, and those employers who fail to make adequate payments may be subject to late payment fees, fines and/or other penalties. We expect that our labor costs, including wages and employee benefits, will continue to increase. Unless we are able to control our labor costs or pass on these increased labor costs to our users by increasing the fees of our services, our financial condition and results of operations may be adversely affected.

We do not have any business insurance coverage.

Insurance companies in China currently do not offer as extensive an array of insurance products as insurance companies in more developed economies. Currently, we do not have any business liability or disruption insurance to cover our operations. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Any uninsured business disruptions may result in our incurring substantial costs and the diversion of resources, which could have an adverse effect on our results of operations and financial condition.

We face risks related to natural disasters, health epidemics and other outbreaks, which could significantly disrupt our operations.

We are vulnerable to natural disasters and other calamities. Fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks or similar events may give rise to server interruptions, breakdowns, system failures, technology service failures or internet failures, which could cause the loss or corruption of data or malfunctions of software or hardware as well as adversely affect our ability to provide products and services on our service.

Our business could also be adversely affected by the effects of virus, such as novel (new) coronavirus causing outbreak of respiratory illness in China (“Covid-19”), flu and other diseases. Our business operations could be disrupted if any of our employees is suspected of having virus, flu and other diseases, since it could require our employees to be quarantined and/or our offices to be disinfected. Our results of operations could be adversely affected to the extent that the Covid-19 harms our suppliers and customers and harms the Chinese economy in general.

We may be subject to the general risks underlying the agriculture industry in PRC market.

The agriculture industry in the PRC market has been mature. Particularly, we are principally engaged in the fertilizer processing and distribution business in the PRC. Therefore, we need to be cautious in selecting our business focus and expansion strategy, and we should be constantly aware of the innovation risk, technology risk and market risk in the industries. If we fail to make an accurate judgment of the current market, our performance can be severely impacted.

We may be adversely affected by global economic conditions.

Our ability to continue to develop and grow our business, build proprietary distribution channels and generate revenues from product sales and royalty payments may be adversely affected by global economic conditions in the future, including instability in credit markets, declining consumer and business confidence, fluctuating commodity prices and interest rates, volatile exchange rates and other challenges that could affect the global economy such as the changing financial regulatory environment. For example, our customers and licensees may experience deterioration of their businesses, cash flow shortages or difficulties obtaining financing, which could adversely affect the demand for our technologies, products and services. In addition, our earnings may be adversely affected by fluctuations in the price of certain commodities, such as grains, milk, meat, biofuels and biomaterials. If commodity prices are negatively impacted, the value of our products could be directly and negatively impacted. Additionally, growers’ incomes have historically been negatively affected by commodity prices. As a result, fluctuations in commodity prices could have an impact on growers’ purchasing decisions and negatively affect their ability and decisions to purchase our seeds or products that incorporate our proprietary technology. We cannot anticipate all of the ways in which the current economic climate and financial market conditions could adversely impact our business.

10

Changes in laws and regulations to which we are subject, or to which we may become subject in the future, may materially increase our costs of operation, decrease our operating revenues and disrupt our business.

Laws and regulatory standards and procedures that impact our business are continuously changing. Responding to these changes and meeting existing and new requirements may be costly and burdensome. Changes in laws and regulations may occur that could:

| ● | impair or eliminate our ability to source technology and develop our products, including validating our products through field trials and passing biosafety evaluations; |

| ● | increase our compliance and other costs of doing business through increases in the cost to protect our intellectual property, including know-how, trade secrets and regulatory data, or increases in the cost to obtain the necessary regulatory approvals to commercialize and market the products we develop directly or jointly; |

| ● | require significant product redesign or redevelopment; |

| ● | render our seed traits and technology and products that incorporate them less profitable or less attractive compared to competing products; and |

| ● | reduce the amount of revenues we receive from government grants, licenses or other royalties. |

Any of these events could have a material adverse effect on our business, results of operations and financial condition. Legislation and jurisprudence on intellectual property in the key markets where we seek protection, primarily in China, is evolving and changes in laws could affect our ability to obtain or maintain intellectual property protection for our products. Any changes to these existing laws and regulations may materially increase our costs, decrease our revenues and disrupt our business.

The overall agricultural industry is susceptible to commodity price changes and we, along with our customers and grower customers, are exposed to market risks from changes in commodity prices.

Changes in the prices of certain commodity products could result in higher overall cost along the agricultural supply chain, which may negatively affect our ability to commercialize our products. We will be susceptible to changes in costs in the agricultural industry as a result of factors beyond our control, such as general economic conditions, seasonal fluctuations, weather conditions, demand, and government regulations. As a result, we may not be able to anticipate or react to changing costs by adjusting our practices, which could cause our operating results to deteriorate.

Our operations are subject to various health and environmental risks

We are subject to numerous state, local and foreign environmental, health and safety laws and regulations, including those governing the handling, use, storage, treatment, manufacture and disposal of wastes, discharge of pollutants into the environment and human health and safety matters.

11

Although there are no hazardous substances in the raw materials used by us that will affect and damage the Company’s employees, factory, other property and the environment, the safety of raw materials is also one of the requirements when applying for the fertilizer registration certificate. We cannot completely eliminate the risk of contamination or discharge and any resultant injury from these materials. If these risks were to materialize, we could be subject to fines, liability, reputational harm or otherwise adverse effects on our business. We may be sued for any injury or contamination that results from our use or the use by third parties of these materials, or may otherwise be required to remedy the contamination, and our liability may exceed any insurance coverage and our total assets. Furthermore, compliance with environmental, health and safety laws and regulations may be expensive and may impair our research & development efforts. If we fail to comply with these requirements, we could incur substantial costs and liabilities, including civil or criminal fines and penalties, clean-up costs or capital expenditures for control equipment or operational changes necessary to achieve and maintain compliance. In addition, we cannot predict the impact on our business of new or amended environmental, health and safety laws or regulations or any changes in the way existing and future laws and regulations are interpreted and enforced. These current or future laws and regulations may impair our research, development or production efforts.

Failure to maintain or enhance our brands or image could have a material and adverse effect on our business and results of operations.

We believe our brands are associated with a well-recognized, integrated fertilizers company in the local markets that it operates, with consistent high-quality products end customers in China. Our brands are integral to our sales and marketing efforts. Our continued success in maintaining and enhancing our brand and image depends to a large extent on our ability to satisfy customer needs by further developing and maintaining quality of services across our operations, as well as our ability to respond to competitive pressures. If we are unable to satisfy customer needs or if our public image or reputation were otherwise diminished, our business transactions with our customers may decline, which could in turn adversely affect our results of operations.

Any failure to protect our trademarks and other intellectual property rights could have a negative impact on our business.

We have one patent over our production device and four trademarks. Any unauthorized use of our intellectual property rights could harm our competitive advantages and business. Historically, China has not protected intellectual property rights to the same extent as the United States, and infringement of intellectual property rights continues to pose a serious risk of doing business in China. Monitoring and preventing unauthorized use is difficult. The measures we take to protect our intellectual property rights may not be adequate. Furthermore, the application of laws governing intellectual property rights in China and abroad is uncertain and evolving, and could involve substantial risks to us. If we are unable to adequately protect our brand, trademarks and other intellectual property rights, we may lose these rights and our business may suffer materially.

Increases in labor costs in the PRC may adversely affect our business and our profitability.

China’s economy has experienced increases in labor costs in recent years. China’s overall economy and the average wage in China are expected to continue to grow. The average wage level for our employees has also increased in recent years. We expect that our labor costs, including wages and employee benefits, will continue to increase. Unless we are able to pass on these increased labor costs to our customers by increasing prices for our products or services, our profitability and results of operations may be materially and adversely affected.

12

In addition, we have been subject to stricter regulatory requirements in terms of entering into labor contracts with our employees and paying various statutory employee benefits, including pensions, housing fund, medical insurance, work-related injury insurance, unemployment insurance and childbearing insurance to designated government agencies for the benefit of our employees. Pursuant to the PRC Labor Contract Law, or the Labor Contract Law, that became effective in January 2008 and its implementing rules that became effective in September 2008 and its amendments that became effective in July 2013, employers are subject to stricter requirements in terms of signing labor contracts, minimum wages, paying remuneration, determining the term of employees’ probation and unilaterally terminating labor contracts. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the Labor Contract Law and its implementation rules may limit our ability to effect those changes in a desirable or cost-effective manner, which could adversely affect our business and results of operations. Besides, pursuant to the Labor Contract Law and its amendments, dispatched employees are intended to be a supplementary form of employment and the fundamental form should be direct employment by enterprises and organizations that require employees.

As the interpretation and implementation of labor-related laws and regulations are still evolving, we cannot assure you that our employment practice does not and will not violate labor-related laws and regulations in China, which may subject us to labor disputes or government investigations. If we are deemed to have violated relevant labor laws and regulations, we could be required to provide additional compensation to our employees and our business, financial condition and results of operations could be materially and adversely affected.

Risks Relating to Doing Business in China

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

Substantially all of our assets and operations are located in China. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to a reduction in demand for our products and adversely affect our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in China, which may adversely affect our business and operating results.

Uncertainties with respect to the PRC legal system could adversely affect us.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value.

13

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation since then has significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, the interpretation and enforcement of these laws and regulations involve uncertainties. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. These uncertainties may affect our judgment on the relevance of legal requirements and our ability to enforce our contractual rights or tort claims. In addition, the regulatory uncertainties may be exploited through unmerited or frivolous legal actions or threats in attempts to extract payments or benefits from us.

Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all and may have a retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in this prospectus based on foreign laws.

We conduct substantially all of our operations in China, and substantially all of our assets are located in China. In addition, all our directors and executive officers reside within China for a significant portion of the time and are PRC nationals. As a result, it may be difficult for our shareholders to effect service of process upon us or those persons inside China. In addition, China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States of America and many other countries and regions. Therefore, recognition and enforcement in China of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or impossible.

We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.

We are a Nevada holding company and we rely principally on dividends and other distributions on equity from our PRC subsidiaries for our cash requirements, including for services of any debt we may incur.

Our PRC subsidiary’s ability to distribute dividends is based upon its distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries are required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of our PRC subsidiaries as a Foreign Invested Enterprise, or FIE, is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at its discretion. These reserves are not distributable as cash dividends. If our PRC subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. Any limitation on the ability of our PRC subsidiary to distribute dividends or other payments to its shareholder could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are incorporated.

14

Our employment practices may be adversely impacted under the labor contract law of the PRC.

The PRC National People’s Congress promulgated the Labor Contract Law which became effective on January 1, 2008 and was amended on December 28, 2012, and the State Council promulgated implementing rules for the labor contract law on September 18, 2008. The labor contract law and the implementing rules impose requirements concerning, among others, the execution of written contracts between employers and employees, the time limits for probationary periods, and the length of employment contracts. The interpretation and implementation of these regulations are still evolving, our employment practices may violate the labor contract law and related regulations and we could be subject to penalties, fines or legal fees as a result. If we are subject to severe penalties or incur significant legal fees in connection with labor law disputes or investigations, our business, financial condition and results of operations may be adversely affected.

We may be subject to additional contributions of social insurance and housing fund and late payments and fines imposed by relevant governmental authorities.

In accordance with the PRC Social Insurance Law and the Regulations on the Administration of Housing Fund and other relevant laws and regulations, China establishes a social insurance system and other employee benefits including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance, maternity insurance, housing fund, and a handicapped employment security fund, or collectively the Employee Benefits. An employer shall pay the Employee Benefits for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance and other Employee Benefits that should be assumed by the employees. For example, an employer that has not made social insurance contributions at a rate and based on an amount prescribed by the law, or at all, may be ordered to rectify the non-compliance and pay the required contributions within a stipulated deadline and be subject to a late fee of up to 0.05% or 0.2% per day, as the case may be. If the employer still fails to rectify the failure to make social insurance contributions within the stipulated deadline, it may be subject to a fine ranging from one to three times of the amount overdue.

Under the Social Insurance Law and the Regulations on the Administration of Housing Fund, PRC subsidiaries shall register with local social insurance agencies and register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC subsidiaries and their employees are required to contribute to the Employee Benefits.

As of the date of this prospectus, our PRC subsidiary is in the process of completing the social insurance registration and the housing fund registration, and we have not made adequate contributions to Employee Benefits for some of our employees. We have recorded accruals for the estimated underpaid amounts of Employee Benefits in our financial statements. As of the date of this prospectus, we have not received any notice from the relevant government authorities or any claim or request from these employees in this regard. However, we cannot assure you that the relevant government authorities will not require us to pay the outstanding amount and impose late fees or fines on us. If we fail to make the outstanding Employee Benefit contributions within the prescribed time frame, we may be subject to a fine of up to three times the amount of the overdue payment. If we are otherwise subject to investigations related to non-compliance with labor laws and are imposed severe penalties or incur significant legal fees in connection with labor law disputes or investigations, our business, financial condition and results of operations may be adversely affected.

15

Non-compliance with labor-related laws and regulations of the PRC may have an adverse impact on our financial condition and results of operation.

We have been subject to stricter regulatory requirements in terms of entering into labor contracts with our employees and paying various statutory employee benefits, including pensions, housing fund, medical insurance, work-related injury insurance, unemployment insurance and childbearing insurance to designated government agencies for the benefit of our employees. Pursuant to the PRC Labor Contract Law, or the Labor Contract Law, that became effective in January 2008 and its implementing rules that became effective in September 2008 and was amended in July 2013, employers are subject to stricter requirements in terms of signing labor contracts, minimum wages, paying remuneration, determining the term of employees’ probation and unilaterally terminating labor contracts. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the Labor Contract Law and its implementation rules may limit our ability to effect those changes in a desirable or cost-effective manner, which could adversely affect our business and results of operations. We believe our current practice complies with the Labor Contract Law and its amendments. However, the relevant governmental authorities may take a different view and impose fines on us.

As the interpretation and implementation of labor-related laws and regulations are still evolving, we cannot assure you that our employment practice does not and will not violate labor-related laws and regulations in China, which may subject us to labor disputes or government investigations. If we are deemed to have violated relevant labor laws and regulations, we could be required to provide additional compensation to our employees and our business, financial condition and results of operations could be materially and adversely affected.

The custodians or authorized users of our controlling non-tangible assets, including chops and seals, may fail to fulfill their responsibilities, or misappropriate or misuse these assets.

Under PRC law, legal documents for corporate transactions, including agreements and contracts are executed using the chop or seal of the signing entity or with the signature of a legal representative whose designation is registered and filed with relevant PRC industry and commerce authorities.

In order to secure the use of our chops and seals, we have established internal control procedures and rules for using these chops and seals. In any event that the chops and seals are intended to be used, the responsible personnel will submit the application through our office automation system and the application will be verified and approved by authorized employees in accordance with our internal control procedures and rules. In addition, in order to maintain the physical security of our chops, we generally have them stored in secured locations accessible only to authorized employees. Although we monitor such authorized employees, the procedures may not be sufficient to prevent all instances of abuse or negligence. There is a risk that our employees could abuse their authority, for example, by entering into a contract not approved by us or seeking to gain control of one of our subsidiaries. If any employee obtains, misuses or misappropriates our chops and seals or other controlling non-tangible assets for whatever reason, we could experience disruption to our normal business operations, and we may have to take corporate or legal action, which could involve significant time and resources to resolve and divert management from our operations.

Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions and the foreign exchange policy adopted by the PRC government. It is difficult to predict how long such depreciation of RMB against the U.S. dollar may last and when and how the relationship between the RMB and the U.S. dollar may change again. All of our revenues and substantially all of our costs are denominated in Renminbi. We are a holding company and we rely on dividends paid by our operating subsidiaries in China for our cash needs. Any significant revaluation of Renminbi may materially and adversely affect our results of operations and financial position reported in Renminbi when translated into U.S. dollars, and the value of, and any dividends payable on, the common stock in U.S. dollars. To the extent that we need to convert U.S. dollars into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar would have an adverse effect on the Renminbi amount we would receive. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making payments for dividends on our common stock or for other business purposes, appreciation of the U.S. dollar against the Renminbi would have a negative effect on the U.S. dollar amount.

16

Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in Renminbi. Under our current corporate structure, our holding company primarily relies on dividend payments from our PRC subsidiaries to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval of SAFE by complying with certain procedural requirements. Specifically, under the existing exchange restrictions, without prior approval of SAFE, cash generated from the operations of our PRC subsidiaries in China may be used to pay dividends to our company. However, approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. As a result, we need to obtain SAFE approval to use cash generated from the operations of our PRC subsidiaries to pay off their respective debt in a currency other than Renminbi owed to entities outside China, or to make other capital expenditure payments outside China in a currency other than Renminbi. The PRC government may at its discretion restrict access to foreign currencies for current account transactions in the future. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of the common stock.

Certain PRC regulations may make it more difficult for us to pursue growth through acquisitions.

Among other things, the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex. Such regulation requires, among other things, that the MOFCOM be notified in advance of any change-of-control transaction in which a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds under the Provisions on Thresholds for Prior Notification of Concentrations of Undertakings, issued by the State Council in 2008, are triggered. Moreover, the Anti-Monopoly Law promulgated by the Standing Committee of the NPC which became effective in 2008 requires that transactions which are deemed concentrations and involve parties with specified turnover thresholds must be cleared by the MOFCOM before they can be completed. In addition, PRC national security review rules which became effective in September 2011 require acquisitions by foreign investors of PRC companies engaged in military-related or certain other industries that are crucial to national security be subject to security review before consummation of any such acquisition. We may pursue potential strategic acquisitions that are complementary to our business and operations.

Complying with the requirements of these regulations to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval or clearance from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

17

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us.

In July 2014, SAFE promulgated the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment Through Special Purpose Vehicles, or SAFE Circular 37, to replace the Notice on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents’ Financing and Roundtrip Investment Through Offshore Special Purpose Vehicles, or SAFE Circular 75, which ceased to be effective upon the promulgation of SAFE Circular 37. SAFE Circular 37 requires PRC residents (including PRC individuals and PRC corporate entities) to register with SAFE or its local branches in connection with their direct or indirect offshore investment activities. SAFE Circular 37 is applicable to our shareholders who are PRC residents and may be applicable to any offshore acquisitions that we make in the future.