Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST HORIZON CORP | a2q20208-kdocument1.htm |

First Horizon National Corporation Second Quarter 2020 Earnings July 17, 2020

Disclaimer Portions of this presentation use non-GAAP financial information. Each of those portions is so noted, and a reconciliation of that non-GAAP information to comparable GAAP information is provided in a footnote or in the appendix at the end of this presentation. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity” and certain financial measures excluding notable items, including merger-related charges. Notable items include certain revenue or expense items that may occur in a reporting period which management does not consider indicative of ongoing financial performance. Management believes it is useful for the investment community to consider financial metrics with and without notable items in order to enable a better understanding of company results, facilitate comparability of period-to-period financial results, and to evaluate and forecast those results. Although FHN has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation. Forward-Looking Statements This communication may contain forward-looking information, including guidance, involving significant risks and uncertainties. Forward-looking information is identified by words such as "believe," "expect," "anticipate," "intend," "estimate," "should," "is likely," "will," "going forward," and other expressions that indicate future events and trends and may be followed by or reference cautionary statements. A number of factors could cause actual results to differ materially from results stated in or suggested by forward-looking information. Those factors include: general economic and financial market conditions, including expectations of and actual timing and amount of interest rate movements including the slope of the yield curve; competition; ability to execute business plans; regional, national, and world-wide political developments; recent and future legislative and regulatory developments; inflation or deflation; market (particularly real estate market) and monetary fluctuations; pestilence; man-made or natural disasters; customer, investor and regulatory responses to any of those conditions or events; matters mentioned in this release; critical accounting estimates; FHN’s success in executing its business plans and strategies following its 2020 merger with IBERIABANK Corporation, and managing the risks involved; the potential impacts on FHN’s businesses of the coronavirus COVID-19 pandemic, including negative impacts from quarantines, market declines, and volatility, and changes in customer behavior related to COVID-19; and other factors described in FHN's annual report on Form 10-K, FHN’s other recent filings with the SEC, and FHN’s most recent earnings release and related materials. FHN disclaims any obligation to update any forward-looking statements to reflect future events or developments, or changes in expectations. Throughout this presentation, numbers may not foot due to rounding. 2

2Q20 GAAP Financial Summary Reported Change vs. $s in millions 2Q20 1Q20 4Q19 3Q19 2Q19 1Q20 2Q19 Net Interest Income $305 $303 $311 $301 $304 $2 1% $1 - Fee Income $206 $175 $183 $172 $158 $31 18% $48 30% Total Revenue $512 $478 $495 $472 $462 $34 7% $50 11% Expense $332 $311 $327 $308 $300 $21 7% $32 11% Pre-Provision Net Revenue (PPNR) 1 $179 $166 $167 $165 $161 $13 8% $17 10% Loan Loss Provision $110 $145 $10 $15 $13 ($35) (24%) $97 NM Pre-Tax Income $69 $21 $157 $150 $148 $48 NM ($79) (53%) Income Tax Expense $13 $5 $36 $36 $34 $8 NM ($21) (62%) Net Income $57 $16 $121 $114 $114 $40 NM ($57) (50%) Non-controlling & Pref. Dividends $4 $4 $4 $4 $4 - - $0 0% NIAC $52 $12 $117 $110 $109 $40 NM ($57) (52%) $s in billions Avg Loans $34.0 $30.5 $30.7 $30.0 $28.7 $3.5 11% $5.3 18% Period-end Loans $32.7 $33.4 $31.1 $31.3 $30.0 ($0.7) (2%) $2.7 9% Avg Deposits $37.5 $32.9 $32.8 $32.4 $32.0 $4.6 14% $5.5 17% Period-end Deposits $37.8 $34.4 $32.4 $31.9 $32.3 $3.4 10% $5.5 17% Key Performance Metrics Net Interest Margin (NIM) 2.90% 3.16% 3.26% 3.21% 3.34% (26bps) (44bps) Loan to Deposit Ratio 91% 93% 94% 93% 90% (231bps) 100bps ROCE 4.50% 1.05% 9.97% 9.50% 9.79% 345bps (529bps) ROTCE 6.7% 1.6% 15.0% 14.5% 15.1% 515bps (840bps) ROA 0.48% 0.15% 1.12% 1.08% 1.11% 33bps (63bps) Efficiency Ratio 64.74% 65.19% 66.19% 65.14% 65.08% (45bps) (34bps) FTEs 5,006 4,969 5,005 5,116 5,287 37 1% (281) (5%) CET1 Ratio2 9.26% 8.54% 9.20% 9.01% 9.25% 72bps 1bp Effective Tax Rate 18% 22% 23% 24% 23% (404bps) (500bps) Per Common Share Diluted EPS $0.17 $0.04 $0.37 $0.35 $0.35 $0.13 NM ($0.18) (51%) Tangible Book Value Per Share $9.99 $9.96 $10.02 $9.76 $9.47 $0.03 - $0.52 5% Avg. Diluted Shares Outstanding 312.9 313.2 313.4 313.8 315.8 (0.2) - (2.9) (1%) (in millions) 1Pre-provision net revenue and ROTCE are non-GAAP - see non-GAAP reconciliation in the appendix.. 22Q20 CET1 ratio is an estimate. 3

Table of Contents FHN: Well-positioned in a Challenging Environment ………………………………………………………………………………………………………………………5 2Q20 Adjusted Financial Highlights ……………………………………………………………………………………………………………………………………………..6 NII/NIM …………………………………………………………………..………………………………………………………………………………………………………………….7 Fee Income………………………………………………………….. …………………………………………………………………………………………………………………….8 Adjusted Expense……………………………………………………. ………………………………………………………………………………………………………………...9 Loans and Funding……………..……………………………………………….………………………………………………………………………………………….......10-11 Capital ……………………....…………………………………………………………………………………………………………………………………………………………….12 Loan Loss Reserves ……………………………………………………………………………………………………………………………………………………………….13 Asset Quality Review ………………………………………………………………………………………………………………………………………………………..14 2Q20 IBKC Financial Highlights …………………………………….………………………………………………………………………………………………………….15 Estimated IBKC Loan Marks and Purchase Accounting Impact…………………………………………………………...........................................16-17 Expected Merger Cost Saves ………………………………………………………………….………………………………………………………………………………....18 Key Takeaways………………………………..……………………………………….………………………………………………………………………………………………..19 Appendix ……………………………………………………………………………………………………………………………………………………………………………..20-31 4

FHN: Well- Positioned in a Challenging Environment ● Adjusted PPNR up 13% LQ and 2% YoY with revenue growth of 7% LQ and 11% YoY . Counter-cyclical businesses (Fixed Income and Loans to Mortgage Companies) partially Solid Results with offset ZIRP impacts on NIM Strong Adjusted PPNR . Modest NII increase driven by loan growth of 11% LQ and 18% YoY . Fee income up 18% LQ and 31% YoY . Continued expense discipline bolstered by IBKC merger saves ● CET1 improved ~70 bps to 9.3%2 Robust Capital & ● CECL reserve build of $93mm with allowance coverage of ~2% ex LMC/PPP portfolios Liquidity ● Period-end loan-to-deposit ratio improved to 87% from 97% in 1Q20 and 92% in 2Q19 ● Capital ratios further supported by the issuance of $450mm of bank sub-debt and $150mm of holdco preferred ● Total PPP portfolio of ~$2 billion, providing aid to more than 300,000 employees across our Continued customer base Customer Support ● ~5,700 customers assisted through forbearance While Managing ● Line utilizations moderating to 42% in 2Q20 from 52% in 1Q20 Risk ● Debit and ATM transaction volumes up more than 20% from mid-April lows ● Continued prudent risk management in face of pandemic with net charge-offs of 20 bps ● IBKC MOE closed July 1, 2020 th Strategic ● TFC branch acquisition scheduled for July 17 adding $440mm of loans and $2.3B of core Update deposits at 3.4% premium ● Transactions further enhance scale, market presence and provide strong platform for growth and improved returns 1Adjusted financials which exclude notable items are Non-GAAP and are reconciled in the appendix. 22Q20 CET1 ratio is an estimate. 5 .

2Q20 Adjusted1 Financial Highlights Adjusted Change vs. ● Adjusted EPS of $0.20; TBV per share of $9.99 $ in millions except per share data 2Q20 1Q20 2Q19 1Q20 2Q19 . Provision reflects CECL reserve build of Net Interest Income $305 $303 $304 $3 1% $2 1% $93mm, or $0.23 per share Fee Income $206 $175 $158 $32 18% $48 31% . Allowance totals 90% of 2019 stress losses Total Revenue $512 $478 $462 $34 7% $50 11% ● Adjusted PPNR up 13% LQ and 2% YoY given Expense $318 $306 $272 $12 4% $46 17% strength in fee income and relatively stable NII Pre-Provision Net Revenue $194 $172 $189 $22 13% $4 2% (PPNR)2 ● Revenue up 7% LQ, up 11% YoY Loan Loss Provision $110 $145 $13 ($35) (24%) $97 NM ● NII up modestly LQ despite rate headwinds Net Charge-offs $17 $7 $5 $9 NM $11 NM . 11% loan growth driven by strength in loans Reserve Build (Release) $93 $138 $8 ($44) (32%) $86 NM to mortgage companies and PPP loans NIAC $64 $17 $132 $47 NM ($68) (51%) . NIM decreased 26 bps LQ driven by LIBOR Key Performance decline and higher cash positions tied to Metrics strong deposit growth; PE LDR of 87% Fee Income as a % of 40% 37% 34% 390bps 627bps Total Revenue ● Fee income of $206mm up 18% LQ and 31% YoY Efficiency Ratio 62% 64% 59% (203bps) 295bps driven by strength in fixed income and higher ROTCE 8.26% 2.19% 18.19% 607bps (993bps) deferred comp despite COVID-19 impact on bank Diluted EPS $0.20 $0.05 $0.42 $0.15 NM ($0.21) (51%) fees Tangible Book Value $9.99 $9.96 $9.47 $0.03 - $0.52 5% ● Adjusted expense up $12mm driven by a $20mm Effective Tax Rate 18% 22% 23% (404bps) (485bps) increase in deferred comp costs which was largely offset by lower advertising, T&E and the benefit of merger expense saves . Efficiency ratio of 62% 1Adjusted financials which exclude notable items are Non-GAAP and are reconciled in the appendix. 6

NII Relatively Stable Despite Interest Rate Headwinds ($s in millions) ● NII up modestly 2Q20 vs. 1Q20 NII NIM . Impact of challenging yield curve more than offset by 1Q20 - Reported $303 3.16% growth in loans to mortgage companies & PPP and deposit pricing discipline Less: 1Q20 CBF Loan Accretion -$9 -9bps 1 ● NIM down 26 bps LQ given lower rates and excess cash 1Q20 - Core $294 3.07% positions partially offset by deposit pricing discipline Loan Rates (primarily LIBOR/prime) -$50 -48bps . Avg. LIBOR down 105 bps LQ Deposit Rates $30 29bps . Total deposit costs decreased 40bps to 27bps; interest-bearing deposit costs down 52bps Excess Fed Balances -$ 1 -9bps NII and NIM Trends Loans to Mortgage Companies $15 1bp $311 $305 Other -$4 - $304 $301 $303 1 $297 2Q20 - Core 2.80% $295 $294 $285 $291 $285 Plus: 2Q20 PPP Loans & Fees $15 4bps Plus: 2Q20 Loan Accretion $6 6bps 3.34% 3.21% 3.26% 3.16% 2.90% 2Q20 - Reported $305 2.90% 2Q19 3Q19 4Q19 1Q20 2Q20 Core NIM1 3.20% 3.15% 3.11% 3.07% 2.80% Core NII Reported NII Reported NIM 1Core excludes impact of accretion and impact of PPP loans, and is a Non-GAAP number. See appendix for information on use of non-GAAP and reconciliation to GAAP. 7

Fee Income Growth Led By Strength in Fixed Income ($s in millions) ● Fee income up 18% LQ and up 31% YoY driven by strength in fixed income and deferred comp partially Fee Income offset by lower deposit, card and wealth fees given COVID-19 impacts $206 ● Fixed Income up $17mm reflecting robust sales volume and a reversal of LQ trading losses/gains $183 4% $175 $172 2% 15% ● Fixed Income average daily revenue (ADR) of $158 20% 17% $1.6mm up 26% LQ and 84% YoY 1% 7% Deferred Comp 18% 18% 13% ● Deposit transaction fees relatively stable as the 12% 12% 15% benefit of a $5mm debit card incentive payment more than offset declines largely related to COVID- Other 14% 21% 19 impacts 24% 23% 25% . Daily debit card and ATM transaction volumes Brokerage Fees & improved 20% and 37% respectively from Trust Services 54% their lows in Mid-April 55% 45% 44% ● Brokerage, trust, and bankcard down LQ from lower Deposit 42% Transactions & AUM valuation levels and COVID-19 impacts; Bankcard Income somewhat mitigated by improved market activity in wealth management Fixed Income (6%)(1) ● Other income increased $16mm LQ, driven by 2Q19 3Q19 4Q19 1Q20 2Q20 deferred comp as value of investments increased in ADR $866K $994K $1.1mm $1.3mm $1.6mm 2Q20 and are offset in expense 11Q20 includes ($9.5mm) of deferred compensation. 8

Adjusted Expense1 Trends Reflect Underlying Discipline ($s in millions) Adjusted Expense $316 $318 ● Employee comp. up $13mm LQ driven by a $20mm $290 $272 $276 increase in deferred comp with offset in other income Deferred Comp 22% Expense 17% 22% 16% 16% ● Results reflect a reduction in stock-based Fixed Income Comp. 36% compensation and a $3mm benefit from PPP-related Expense 46% 45% 43% 39% FAS 91 deferrals Other Comp. Expense ● $7mm reduction in Advertising/PR and T&E was 45% 38% 39% 38% 36% partially offset by a $2mm increase in unfunded All Other Exp. commitments expense largely tied to the impact of (3%)2 COVID-19 2Q19 3Q19 4Q19 1Q20 2Q20 1Q20-2Q20 Adjusted Expense $318 $2 $306 $16 ($7) ($3) $4 Achieved Total 1H20 Merger Savings of ~$10mm with ~$5mm at FHN and ~$5mm at IBKC 1Q20 Deferred Reserve for Advertising, Merger All Other 2Q20 Comp. and Unfunded PR, and T&E Savings Expenses FAS91 Commitments Deferrals, net 1Adjusted financials which exclude notable items are Non-GAAP and are reconciled in the appendix. 21Q20 includes ($9.5mm) of deferred compensation. 9

Loan Growth Driven by Loans to Mortgage Co. & PPP Total Average Loans ● Average loan growth of 11% LQ and 18% YoY $34.0B . Average loans to mortgage companies up $1.7B 6% LQ, reflecting strong volume due to low rates $30.7B $30.5B 1% $30.0B 2% All other commercial loans grew ~$1.0B LQ due $28.7B 2% 2% . 2% 18% to $2.1B in PPP originations, partially offset 20% by~$1.1B in reductions in line utilizations 20% 20% 21% . Line utilization decrease driven by paydowns and increased customer liquidity from PPP funds 13% 15% 15% ● Peak utilization rates in early-April and moderated 11% 14% during June 13% 14% 14% 13% 15% 1Q20-2Q20 Line Utilization 12/31/2019 3/31/2020 6/30/2020 53% 51% 50% 52% 45% Utilization % 47% 52% 42% 2Q19 3Q19 4Q19 1Q20 2Q20 Yields 4.95% 4.73% 4.60% 4.33% 3.65% Core Yields 4.78% 4.65% 4.42% 4.22% 3.55% Avg 1M LIBOR 2.44% 2.17% 1.79% 1.41% 0.38% C&I CRE Loans to Mortgage Co. Consumer Real Estate Credit Card & Other PPP 10

Continue to Enhance Funding Mix While Reducing Costs Average Interest-bearing Liabilities and DDA $41.9B ● Deposits up 14% LQ driven by strength in DDA, and Corporate Long$40.5B Term 3% savings Funding $37.6B 5% $36.2B $37.0B 2% . DDA of $11.3B increased $2.6B $35.6B 2% 2% $35.5B 3% 7% Fed Funds, Repos, & ST 3% 6% 14% . Consumer deposits up ~$689mm as customers Funding 4% 5% 3% 3% 3% 3% preserve cash $30.5B 11% 12% 12% FHN Financial IB 11% ● Interest bearing deposit (IBD) costs decreased 52 bps Liabilities 16% to 38 bps reflecting lower rates and pricing discipline $25.5B 18% 17% 17% 17% Market Indexed 7% . Last ZIRP cycle IBD rate of 17 bps in 3Q15 $20.5B 9% ● Issued $1.25B of debt securities including: 13% 12% 11% Interest Checking 25% . $450mm of bank sub-debt $15.5B 27% . $800mm of holdco senior debt; prefunded CDs 26% 26% 26% $500mm of debt maturing in 4Q20 $10.5B Money Market & Savings $5.5B 27% 22% 23% 23% 23% DDA $0.5B 2Q19 3Q19 4Q19 1Q20 2Q20 Deposit Cost of Funds 0.99% 0.96% 0.82% 0.67% 0.27% Total Cost of Funds 1.22% 1.17% 1.00% 0.81% 0.40% Avg 1M LIBOR 2.44% 2.17% 1.79% 1.41% 0.38% 11

Strong Capital Position1 Improving Capital Levels 12.48% 11.34% 11.01% 11.22% ● Robust PPNR provides dividend support and 10.78% 10.69% 10.24% 9.97% 10.15% 9.52% additional loss-absorbing capital ● CET1 improved 72bps driven by reduction in risk- weighted assets 9.25% 9.01% 9.20% 8.54% 9.26% ● Capital bolstered by the issuance of sub-debt and preferred stock 2Q19 3Q19 4Q19 1Q20 2Q20 CET1 Ratio Tier 1 Capital Ratio Total Capital Ratio 2Q20 vs. 1Q20 CET1 Ratio 0.25% 0.35% 0.39% (0.14%) (0.13%) 9.26% 8.54% 1Q20 PPNR1 Provision, Common Lower Net 2Q20 Actuals Net of & Pref. LMC Bal. Decline Estimate CECL Div. Other Deferral Loans 1Utilized regulatory relief to defer CECL day 1 impact and portion of quarterly provision impact on CET1. 2Q20 capital ratios are estimates. 1PPNR is a Non-GAAP number and is reconciled in the appendix. 12

Significant Reserves for Current Environment ($ in millions) 1Q20 vs. 2Q20 Loan Loss Reserves ● CECL reserve build reflects further deterioration in overall macro-economic outlook ($5) $538 $115 . Utilized Moody’s May 27th scenario as baseline, ($17) supplemented with two alternative scenarios as $445 Portfolio well as detailed portfolio reviews of industries Mix Changes Net Macro- currently affected by pandemic economic Charge-offs Additional factors such as the reemergence of Changes . COVID cases, additional geographic data, impact of stimulus programs, and overall economic uncertainty Beginning Ending Reserve Balance 3/31/2020 6/30/2020 Reserves/Loans Reserves/Annualized NCOs 2.01% 1.64% 8.1x FHN FHN Ex. LMC & PPP FHN 13

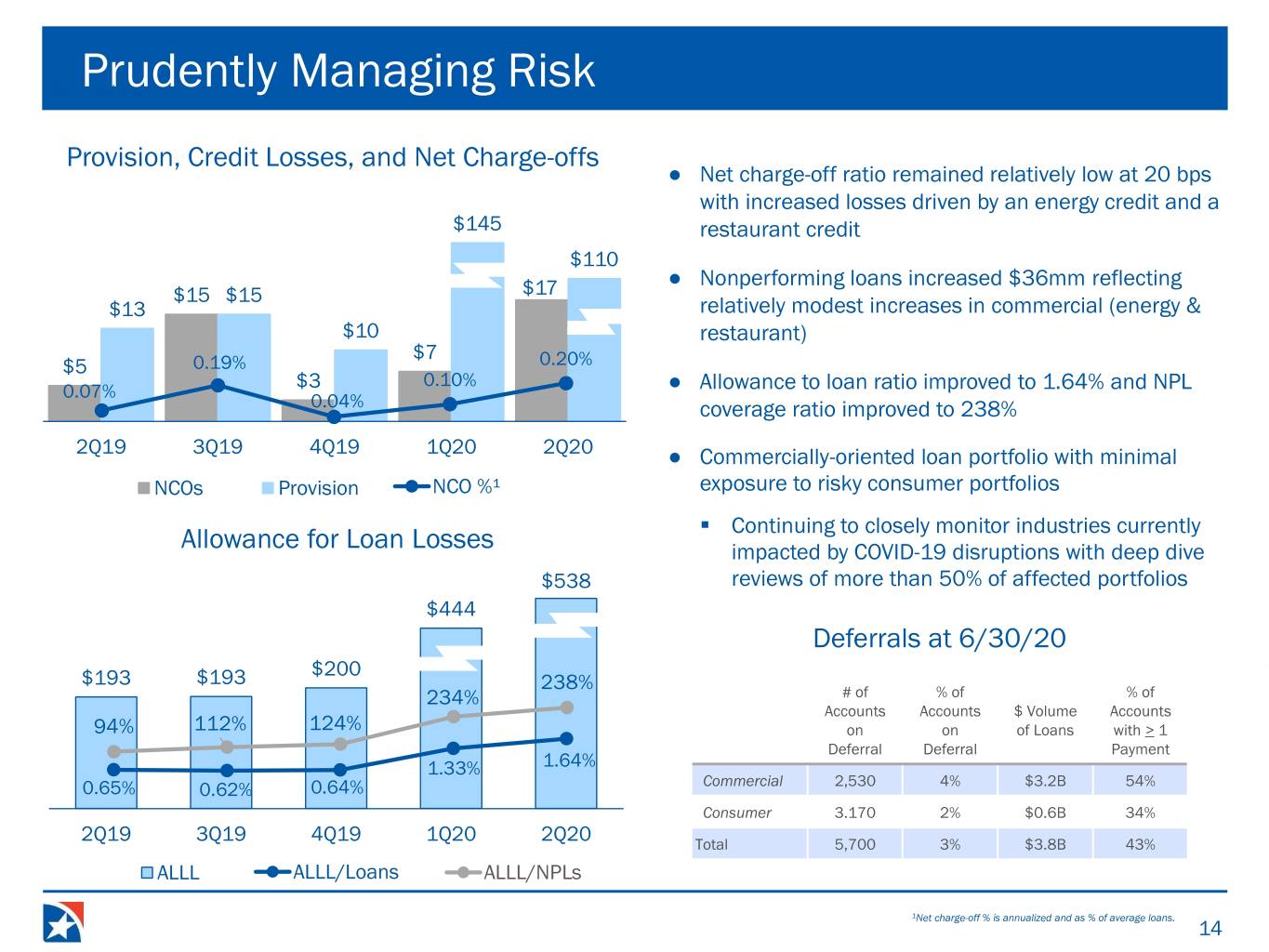

($s inPrudently millions ) Managing Risk Provision, Credit Losses, and Net Charge-offs ● Net charge-off ratio remained relatively low at 20 bps with increased losses driven by an energy credit and a $145 restaurant credit $110 ● Nonperforming loans increased $36mm reflecting $15 $15 $17 $13 relatively modest increases in commercial (energy & $10 restaurant) $7 $5 0.19% 0.20% 0.10% 0.07% $3 ● Allowance to loan ratio improved to 1.64% and NPL 0.04% coverage ratio improved to 238% 2Q19 3Q19 4Q19 1Q20 2Q20 ● Commercially-oriented loan portfolio with minimal NCOs Provision NCO %¹ exposure to risky consumer portfolios . Continuing to closely monitor industries currently Allowance for Loan Losses impacted by COVID-19 disruptions with deep dive $538 reviews of more than 50% of affected portfolios $444 Deferrals at 6/30/20 $200 $193 $193 238% 234% # of % of % of Accounts Accounts $ Volume Accounts 94% 112% 124% on on of Loans with > 1 Deferral Deferral Payment 1.33% 1.64% 0.65% 0.62% 0.64% Commercial 2,530 4% $3.2B 54% Consumer 3.170 2% $0.6B 34% 2Q19 3Q19 4Q19 1Q20 2Q20 Total 5,700 3% $3.8B 43% ALLL ALLL/Loans ALLL/NPLs 1Net charge-off % is annualized and as % of average loans. 14

IBKC 2Q20 Financial1 Highlights ● Total revenue of $314mm, up 7% LQ, flat YoY ● Average loan growth of 7% LQ and 12% YoY Change vs. . Commercial and consumer line utilization was 52% and 59%, respectively from 52% $ in millions except per share data 2Q20 1Q20 2Q19 1Q20 2Q19 and 64% at 1Q20 Net Interest Income $228 $230 $255 ($2) -1% ($27) -11% ● Average deposit growth of 8% LQ and 14% YoY Non-Interest Income $86 $65 $59 $21 33% $27 46% . Non-interest bearing deposits increased to Total Revenue $314 $295 $314 $19 7% $0 0% 29% of deposits, up from 26% LQ Non-Interest Expense $194 $177 $170 $17 10% $25 15% ● NIM declined 25 bps LQ driven by a 63 bps decline Non-Interest Expense $179 $174 $170 $5 3% $9 11% in earning asset yields given higher levels of cash, (Adjusted)1 lower LIBOR, and the impact of $2.1B of PPP loans, Pre-Provision Net $120 $118 $144 $2 2% ($24) -17% somewhat offset by a 42bps decline in cost of funds Revenue (PPNR) ● Record non-interest income up 33% LQ and 46% YoY Adjusted PPNR $129 $121 $145 $8 7% ($16) -11% driven by mortgage growth Provision for Credit $134 $69 $11 $65 95% $123 1148% . Mortgage income up $18.5mm LQ; title Losses income increased $1.6mm LQ Pre-Tax Income (Loss) ($14) $49 $134 ($63) -129% ($148) -111% . As of June 30, 2020 the Company’s locked NIAC ($14) $33 $101 ($47) -144% ($115) -114% mortgage pipeline was $599mm EPS (GAAP) (0.27) $0.62 $1.86 ($0.89) (1.44) (2.13) -115% ● Non-interest expense increased $17mm LQ, EPS (Adjusted) (0.13) $0.67 $1.87 ($0.80) (1.19) (2.00) -107% primarily driven by a $9mm increase in professional Average Loans ($B) $25.9 $24.2 $23.1 $1.7 7% $2.8 12% services and a $6.7mm increase in mortgage Period-End Loans ($B) $26.1 $24.5 $23.4 $1.6 6% $2.7 12% commissions Average Deposits ($B) $27.5 $25.5 $24.1 $2.0 8% $3.4 14% . $11.1mm in non-core merger expenses Period-End Deposits ($B) $28.3 $25.5 $24.3 $2.8 11% $4.0 17% during the quarter Net Interest Margin (TE) 2.92% 3.17% 3.57% (25bps) -8% (65bps) -18% ● Provision of $134mm increased $65mm LQ, CET1 Ratio2 10.65% 10.44% 10.37% 21bps 28bps primarily due to recent changes in underlying Tax Rate 27.50% 25.10% 24.10% 10% 14% economic forecast in reserve calculations ● Tax rate increase due to certain non-deductible legal costs associated with merger 1Adjusted results and PPNR are Non-GAAP and are reconciled in the appendix. Adjusted results exclude notable items as outlined in the appendix. 2Q20 capital ratios are estimates. 15

IBKC Estimated Loan Marks & Accretion IBKC Estimated 7/1/20 Loan Portfolio Merger Accounting Impacts Interest/ Total Balances % of Total Credit Mark Liquidity Mark Mark PCD Loans ~$12.6 B ~52% ~($300mm)/~2.4% ~($60mm)/~0.45% ~($360mm)/~2.9% Non-PCD Loans ~$11.6 B ~48% ~($160mm)/~1.4% ~($40mm)/~0.35% ~($200mm)/~1.7% Total $24.2 B ~($460mm)/~1.9% ~($100mm)/~0.40% ~($560mm)/~2.3% ● ~$720mm (3% of loans) estimated total credit marks (~$460mm/1.9%), interest/liquidity marks (~$100mm/0.4%), and Non- PCD provision expense (~$160mm/0.65%) ● ~$260mm of accretion estimated over time for Non-PCD credit mark (~$160mm) and total interest/liquidity mark (~$100mm) ● ~$460mm estimated increase to Allowance for Loan Losses for acquired loans . Allowance for PCD loans recorded in purchase accounting and estimated at ~$300mm . Provision expense for Non-PCD loans recorded in 3Q20 income statement estimated at ~$160mm . Estimated Energy portfolio credit mark of ~7.75% ● ~$550mm net impact from reversal of IBKC ALLL (~$400mm) and write-up of existing IBKC loan discounts (~$150mm) ● ~20 bps initial net decrease to CET1 from loan-related items above Estimated NII Impact from Loan & Other Notable Marks $mm 2H20 2021 2022 2023 & Beyond Non-PCD Credit and Interest/Liquidity Marks ~$35 ~$65 ~$55 ~$105 Time Deposit Premium Amortization ~$14 ~$6 ~$0 ~$0 Trust Preferred Discount Accretion ~($1) ~($2) ~($2) ~($20) Loan balances as of 05.31.20 and exclude $2.02 billion of PPP loans and $38mm of fully-charged off loans. Final valuation will be as of 07.01.20. All valuation marks are estimated. Valuations and categorization of loans are subject to refinement. 16

Estimated Merger Purchase Accounting Impact Calculation of Merger Purchase Accounting Adjustments ($s in millions) Fair Value of Assets less Fair Value of Liabilities Net Fair Value of Assets/Liabilities Acquired ~$3,000 (Loans,securities, fixed assets, etc. less CDs, TRUPS, FHLB, etc.) Total IBKC Purchase Price ~$2,495 (IBKC shares outstanding *4.584 exchange ratio) * $9.40/share as of Common Stock ~$2,243 7/1/20 plus cash in lieu of fractional shares Preferred Stock ~$231 Equity awards consideration ~$22 Merger Purchase Accounting Adjustment Impact ~$500 Reflected in 3Q20 Income Statement - Tax-Free Addition to Tangible Common Equity Created Through the Transaction ~$2,750 Data represents estimates which are subject to change. 17

Expected Merger-related Cost Saves & Expenses Targeted Cost Savings on Track 2020 2021 2022 ● ~$10mm of total savings achieved in 2Q20 (~$5mm FHN and ~$5mm IBKC) $42.5mm $127.5mm $170mm ● Targeted savings expected to come from run-rate by year-end in-year savings in-year savings personnel (~$120mm), vendors (~$40mm) and reduced occupancy (25% of cost-saves target) (75% of cost-saves target) (100% of cost-saves target) expense (~$10mm) ● Savings are net of expected dis-synergies Expected Merger-Related Expenses In-Line with Original Estimates Purchase 4Q19-2Q20 3Q20 4Q20 2021 Accounting ● Expect ~$440mm of merger-related expense in categories such as Professional Fees, Personnel (CIC, Severance, ~$50mm ~$120mm ~$130mm ~$40mm ~$100mm expensed by will not flow Retention), Charitable Foundation, FHN & IBKC through Contract Termination, Integration income stmt. Data represents estimates which are subject to change.. 18

Key Takeaways ● Strong PPNR generation, liquidity, capital, and reserves ● Uniquely positioned to capture merger benefits . Marked loan book . Healthy reserves . Targeted cost saves of ~$170mm ● More diversified business mix ● Solid deposit franchise ● Countercyclical businesses providing offsets in a declining rate environment ● Strong expense discipline ● Continued prudent risk management 19

APPENDIX 20

FHN Reserve by Portfolio 3/31/20 6/30/20 FHN Reserve 6/30/20 FHN Allowance FHN Build FHN Allowance Coverage Allowance Coverage $ in millions Loans to Mortgage Companies 0.07% - $4 0.10% Energy 2.95% $37 $59 7.64% C&I excl. Loans to Mortgage Companies & Energy 1.46% $28 $256 1.54% Total C&I 1.15% $65 $319 1.49% CRE 1.03% $9 $57 1.19% Total Commercial 1.13% $74 $376 1.43% Cons. Real Estate Secured 2.01% $21 $144 2.38% Other Consumer 3.91% ($1) $18 4.03% Total Consumer 2.15% $20 $162 2.49% Grand Total 1.33% $94 $538 1.64% Total excl. Loans to Mortgage Companies & PPP Loans 1.59% $94 $534 2.01% 21

FHN 2Q20 Credit Quality Summary by Portfolio Regional Banking Corporate6 Non-Strategic FHNC Commercial Consumer Consumer Commercial Consumer ($ in millions) CRE Other2 Subtotal Other3 Total (C&I & Other) Real Estate1 Real Estate1 (C&I & Other) Real Estate1 $21,074 $4,794 $5,692 $430 $31,990 $28 $339 $332 $20 $32,709 Period-end Loans 0.03% 0.00% 0.42% 0.74% 0.10% 4.90% 0.00% 2.11% 1.42% 0.13% 30+ Delinquency % $6 $0 $24 $3 $33 $1 $0 $7 $1 $42 Dollars 0.60% 0.04% 0.80% 0.02% 0.55% 4.34% 0.00% 14.88% 0.79% 0.69% NPL4 % $127 $2 $46 $0 $175 $1 $0 $49 $0 $226 Dollars 0.31% NM NM 1.42% 0.22% NM 0.00% NM NM 0.20% Net Charge-offs5 % $17 ($0) ($1) $2 $18 $0 ($0) ($1) ($0) $17 Dollars $308 $57 $121 $18 $504 $0 $11 $23 $0 $538 Allowance 1.46% 1.18% 2.12% 4.14% 1.58% NM 3.19% 6.89% 1.57% 1.64% Allowance / Loans % Data as of 2Q20. NM - Not meaningful. Numbers may not add to total due to rounding. 1Includes HE and HELOC. 2Includes Credit card and Other. 3Includes Credit card, OTC, and Other Consumer. 4Non-performing loans excludes held-for-sale loans. 5Net charge-offs are annualized. 6Exercised clean-up calls on jumbo securitizations in 1Q13, 3Q12, 2Q11, and 4Q10, which are now on the balance sheet in the Corporate segment. 22

FHN/IBKC Loan Portfolio Mix ($ in millions) FHN IBKC 2Q20 Period- % of 2Q20 Period- % of end Balance Balance end Balance Balance Other C&I $4,320 13% $3,885 15% Loans to Mortgage Companies $4,055 12% $35 - Finance & Insurance $2,436 7% $701 3% Health Care & Social Assistance $1,863 6% $927 4% Accommodation & Food Service $1,754 5% $566 2% Real Estate Rental & Leasing $1,558 5% $1,410 5% Wholesale Trade $1,410 4% $725 3% Manufacturing $1,303 4% $694 3% Retail Trade $1,005 3% $607 2% Transportation & Warehousing $720 2% $558 2% Energy $701 2% $1,286 5% Arts, Entertainment & Recreation $400 1% $296 1% Consumer Loans $6,375 19% $7,226 28% Other CRE $3,386 10% $5,293 20% CRE-IP: Retail $883 3% $1,454 6% CRE-IP: Hospitality $538 2% $615 2% Total Loans $32,709 100% $26,278 100% PPP Loans included in C&I FHN IBKC Total PPP Loans $2.1B $2.1B $4.2B Data based on NAICs codes as of 2Q20. Energy-related loans represented across various categories Numbers may not add to total due to rounding. 23

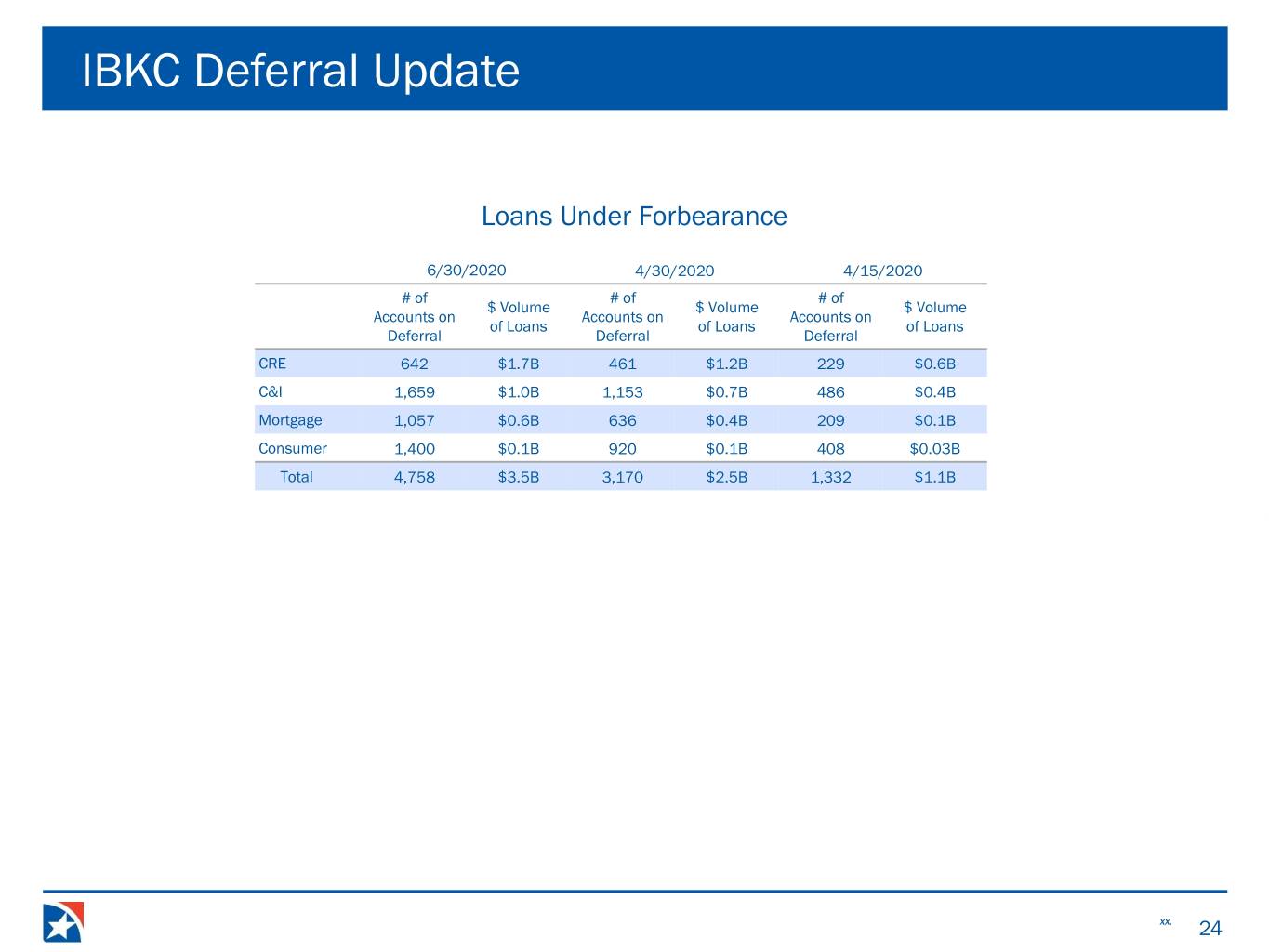

IBKC Deferral Update Loans Under Forbearance 6/30/2020 4/30/2020 4/15/2020 # of # of # of $ Volume $ Volume $ Volume Accounts on Accounts on Accounts on of Loans of Loans of Loans Deferral Deferral Deferral CRE 642 $1.7B 461 $1.2B 229 $0.6B C&I 1,659 $1.0B 1,153 $0.7B 486 $0.4B Mortgage 1,057 $0.6B 636 $0.4B 209 $0.1B Consumer 1,400 $0.1B 920 $0.1B 408 $0.03B Total 4,758 $3.5B 3,170 $2.5B 1,332 $1.1B xx. 24

Estimated Purchase Accounting Marks Asset Pre-Tax Marks (Negative Mark is dilutive to TBV) Liability Pre-Tax Marks (Negative Mark is accretive to TBV) Announcement Announcement Estimate Current Estimate Estimate Current Estimate Securities (AFS & HTM) $8mm $15mm Time Deposits $2mm $20mm ($130mm) ($300mm) Loans – PCD Credit Mark (3% of loans) (52% of loans) FHLB Advances $30mm $60mm ($165mm) ($160mm) Non-PCD Credit Mark (97% of loans) (48% of loans) Lease Liabilities $0 $25mm Interest/ Liquidity Mark ($110mm) ($100mm) Trust Preferred Securities ($3mm) ($25mm) Other Real Estate Owned ($1mm) ($5mm) Preferred Stock Mark (Negative Mark is accretive to TBV) Fixed Assets ($3mm) ($30mm) Announcement Lease Asset $0 $20mm Estimate Current Estimate Goodwill $960mm $0 Preferred Stock $24mm ($7mm) Core Deposit Intangible $265mm $160mm Other Intangibles $15mm ● Core Deposit Intangible of ~$215mm estimated to be recorded through purchase accounting with existing IBKC CDI eliminated ● Accelerated amortization of CDI estimated to result in ~$20mm of expense in 2H20 and ~$40mm of expense in 2021 Loan balances as of 05.31.20 and exclude $2.02 billion of PPP loans and $38mm of fully-charged off loans. Final valuation will be as of 07.01.20. All valuation marks are estimated. Valuations and categorization of loans are subject to refinement. 25

Notable Items-2019 & 2020 Pre-Tax Pre-Tax 2019 Amount 2020 Amount Restructuring ($12.2mm) 1Q Acquisition Expense ($5.8mm) Acquisition Expense ($5.7mm) Restructuring ($18.7mm) Acquisition Expense ($14.3mm) 2Q Rebranding ($9.1mm) Acquisition Expense ($8.6mm) Legal Resolution Expense Reversal $8.3mm Rebranding ($3.1mm) Acquisition Expense ($9.0mm) 3Q Restructuring ($7.8mm) Net Impact of Legal Resolutions ($7.5mm) Visa Derivative Valuation Adjustments ($4.0mm) Acquisition Expense ($15.7mm) Charitable Contributions ($11.0mm) 4Q Rebranding Expense ($9.1mm) Restructuring ($1.2mm) 26

Reconciliation to GAAP Financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. ($ in millions) Pre-provision Net Revenue ("PPNR") 2Q20 1Q20 4Q19 3Q19 2Q19 Net interest income (GAAP) $305 $303 $311 $301 $304 Plus: Noninterest income (GAAP) $206 $175 $183 172 158 Total revenues (GAAP) $512 $478 $495 472 462 Less: Noninterest expense (GAAP) $332 $311 $327 308 300 PPNR (Non-GAAP) $179 $166 $167 165 161 Provision/(provision credit) for loan losses (GAAP) $110 $145 $10 15 13 Income before income taxes (pre-tax income ("PTI")) (GAAP) $69 $21 $157 $150 $148 Adjusted Noninterest expense 2Q20 1Q20 4Q19 3Q19 2Q19 Noninterest expense (GAAP) $332 $311 $327 308 300 Plus notable items (GAAP) -$14 -$6 -$37 (31) (28) Adjusted noninterest expense (Non-GAAP) $318 $306 $290 276 272 ($ in millions) Adjusted Return on Average Common Equity ("ROCE")/ Return on Average Tangible Common Equity ("ROTCE") 2Q20 1Q20 2Q19 NIAC (annualized) (GAAP) a $210 $49 $439 Adjusted NIAC (annualized) (Non-GAAP) b $257 $67 $528 Average Common Equity (GAAP) c $4,673 $4,611 $4,478 Less: Intangible Assets (GAAP) $1,555 $1,560 $1,579 Average Tangible Common Equity (Non-GAAP) d $3,117 $3,051 $2,900 Less: Equity Adjustment (Non-GAAP) $0 $0 $0 Adjusted Average Tangible Common Equity (Non-GAAP) e $3,117 $3,051 $2,900 LQ Change YOY Change ROCE (GAAP) a/c 4.50% 1.05% 9.79% 345 bps (529) bps Adjusted ROCE (Non-GAAP) b/c 5.51% 1.45% 11.78% 406 bps (627) bps ROTCE (Non-GAAP) a/d 6.74% 1.59% 15.12% 515 bps (838) bps Adjusted ROTCE (Non-GAAP) b/e 8.26% 2.19% 18.19% 607 bps (993) bps 1Tax-affected notable items assume an effective tax rate of ~18% in 2Q20, ~21% in 1Q20, ~19% in 4Q19, ~22% in 3Q19, and ~21% in 2Q19. 2Calculated using a tax rate of ~25%. 3Amount calculated under the interim final rule to delay the effects of CECL on regulatory capital for two years, followed by a three-year transition period. 27

Reconciliation to GAAP Financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. ($ in millions) Adjusted Noninterest expense 2Q20 1Q20 2Q19 LQ Change YOY Change Noninterest expense (GAAP) $332 $311 $300 $21 7% $32 11% Plus notable items (GAAP) ($14) ($6) ($28) Adjusted noninterest expense (Non-GAAP) $318 $306 $272 $12 4% $46 17% Adjusted PPNR 2Q20 1Q20 2Q19 PPNR (Non-GAAP) $179 $166 $161 $13 8% $18 11% Plus notable items (GAAP) $14 $6 $28 Adjusted noninterest expense (Non-GAAP) $194 $172 $189 $22 13% $4 2% Adjusted Diluted EPS 2Q20 1Q20 2Q19 Net income available to common ("NIAC") (GAAP) a $52 $12 $109 $40NM ($57) -52% Plus Tax effected notable items (Non-GAAP)* $12 $5 $22 Adjusted NIAC (Non-GAAP) b $64 $17 $132 $47NM ($68) -51% Diluted Shares (GAAP) c $313 $313 $316 Diluted EPS (GAAP) a/c $0.17 $0.04 $0.35 $0.13NM ($0.18) -51% Adjusted diluted EPS (Non-GAAP) b/c $0.20 $0.05 $0.42 $0.15NM ($0.22) -52% Adjusted Efficiency Ratio 2Q20 1Q20 2Q19 Noninterest expense (GAAP) d $332 $311 $300 Plus notable items (GAAP) ($14) ($6) ($28) Adjusted noninterest expense (Non-GAAP) e $318 $306 $272 Revenue excluding securities gains/losses (GAAP) f $513 $478 $462 Plus notable items (GAAP) $0 $0 $0 Adjusted revenue excluding esecurities gains/losses (Non-GAAP) g $513 $478 $462 Efficiency ratio (GAAP) d/f 65 % 65 % 65 % (46) bps (35) bps Adjusted efficiency ratio (Non-GAAP) e/g 62 % 64 % 59 % (204) bps 294 bps 1Tax-affected notable items assume an effective tax rate of ~18% in 2Q20, ~21% in 1Q20, ~19% in 4Q19, ~22% in 3Q19, and ~21% in 2Q19. 2Calculated using a tax rate of ~25%. 3Amount calculated under the interim final rule to delay the effects of CECL on regulatory capital for two years, followed by a three-year transition period. 28

Reconciliation to GAAP Financials NII in 000s NII Margin NII in 000s NII Margin NII in 000s NII Margin 1Q20 Reported $303 3.16% 4Q19 Reported $311 3.26% 3Q19 Reported $301 3.21% Prior Period Accretion -$9 -0.09% Prior Period Accretion -$14 -0.15% Prior Period Accretion -$6 -0.06% 1Q20 Actual Core NII $294 3.07% 4Q19 Actual Core NII $297 3.11% 3Q19 Actual Core NII $295 3.15% Days $0 Days -$3 Days Loan Rates (primarily Loan Rates (primarily Loan Rates (primarily LIBOR/Prime) -$50 -0.48% LIBOR/Prime) -$15 -0.15% LIBOR/Prime) -$19 -0.19% Deposit Rates $30 0.29% Deposit Rates $11 0.11% Deposit Rates $11 0.11% Loans to Mortgage Companies $15 0.01% Trading Securities & Other $5 Trading Securities & Other Fed Balances -$1 -0.09% Deposit Volume $2 0.02% Deposit Volume $3 0.03% Other -$4 0.00% Loan Volume -$2 Loan Volume $3 2Q20 Actual Core NII $284 2.80% Loan Fees & Cash Basis -$1 -0.02% Other $4 0.02% PPP Loans and Fees $15 0.04% 1Q20 Actual Core NII $294 3.07% 4Q19 Actual Core NII $297 3.11% Current Period Accretion $6 0.06% PPP Loans and Fees PPP Loans and Fees 2Q20 Reported $305 2.90% Current Period Accretion $9 0.09% Current Period Accretion $14 0.15% 4Q19 Reported $311 3.26% 1Q20 Reported $303 3.16% NII in 000s NII Margin 2Q19 Reported $303.6 3.34% NII in 000s NII Margin Prior Period Accretion -$12.3 -0.13% 1Q19 Reported $294.5 3.34% 2Q19 Actual Core NII $291.3 3.20% Prior Period Accretion -$9.5 -0.13% Days $2.5 1Q19 Actual Core NII $285.0 3.20% Loan Rates (primarily Days $2.4 LIBOR/Prime) -$12.3 -0.13% Loan Rates (primarily LIBOR/Prime) -$2.0 -0.02% Deposit Rates $3.7 0.04% Deposit Rates Trading Securities & Other Trading Securities & Other Loans to Mortgage Companies $7.2 0.01% Deposit Volume Loans to Mortgage Companies Loan Volume Deposit Volume $0.8 0.01% Loan Fees & Cash Basis $1.4 0.01% Loan Volume $8.4 -0.03% Interest Bearing Cash 0.01% Loan Fees & Cash Basis -$1.4 -0.02% Other $1.0 0.01% Interest Bearing Cash 0.10% 3Q19 Actual Core NII $294.8 3.15% Other -$1.8 -0.05% PPP Loans and Fees 2Q19 Actual Core NII $291.4 3.20% Current Period Accretion $5.8 0.06% PPP Loans and Fees 3Q19 Reported $300.7 3.21% Current Period Accretion $12.3 0.13% 2Q19 Reported $303.8 3.34% 29

Reconciliation to GAAP Financials 3/31/2020 6/30/2020 FHN FHN Period-End Allowance Period-End Allowance $ in millions Allowance Loans Coverage Allowance Loans Coverage Loans to Mortgage Companies 4 5,714 0.07% 4 4,021 0.10% Energy 22 747 2.95% 59 772 7.64% C&I exlc. Loans to Mortgage Companies & Energy 228 15,663 1.46% 256 16,601 1.54% Total C&I 254 22,124 1.15% 319 21,394 1.49% CRE 48 4,640 1.04% 57 4,813 1.18% Total Commerical 302 26,764 1.13% 376 26,207 1.43% Cons. Real Estate Secured 123 6,119 2.01% 144 6,053 2.38% Other Consumer 19 495 3.84% 18 449 4.01% Total Consumer 142 6,614 2.15% 162 6,502 2.48% Total 444 33,378 1.33% 538 32,709 1.65% PPP Loans - - - 2,042 Total excl. Loans to Mortgage Companies & PPP Loans 440 27,664 1.59% 534 26,646 2.01% 30

Reconciliation to GAAP Financials $ in millions except per share data IBKC Adjusted Noninterest Expense 2Q20 1Q20 2Q19 Noninterest expense GAAP) $ 194 $ 177 $ 170 Less: Notable items (Non-GAAP) (a) $ (15) $ (3) $ - Adjusted Noninterest expense (Non-GAAP) $ 179 $ 174 $ 170 IBKC Pre-provision Net Revenue ("PPNR")/ Adjusted PPNR 2Q20 1Q20 2Q19 Net interest income (GAAP) $ 228 $ 230 $ 255 Plus: Noninterest income (GAAP) $ 86 $ 65 $ 59 Total revenues (GAAP) $ 314 $ 295 $ 314 Less: Noninterest expense (GAAP) $ 194 $ 177 $ 170 PPNR (Non-GAAP) $ 120 $ 118 $ 144 Provision/(provision credit) for loan losses (GAAP) $ 134 $ 69 $ 11 Income before income taxes (pre-tax income ("PTI")) (GAAP) $ (14) $ 49 $ 134 PPNR (Non-GAAP) $ 120 $ 118 $ 144 Plus: Notable items (Non-GAAP) (b) $ 9 $ 3 $ 0 Adjusted PPNR (Non-GAAP) $ 129 $ 121 $ 145 IBKC Diluted EPS 2Q20 1Q20 2Q19 Net income available to common ("NIAC") (GAAP) $ (14) $ 33 $ 101 Plus Tax effected notable items (Non-GAAP) (c) $ 7 $ 3 $ - Adjusted NIAC (Non-GAAP) $ (7) $ 36 $ 101 Diluted Shares (GAAP) (millions) 52.8 52.8 54.2 Diluted EPS (GAAP) $ (0.27) $ 0.62 $ 1.86 Adjusted diluted EPS (Non-GAAP) $ (0.13) $ 0.67 $ 1.87 (a) 2Q20, 1Q20, include $11.1 million and $2.4 million, respectively of pre-tax acquisition-related expenses largely associated with the merger of equals with FHN, $4.0 million and $0.3 million, respectively, of Hazard related expenses.(b) 2Q20, 1Q20, include $11.1 million and $2.4 million, respectively of pre-tax acquisition-related expenses largely associated with the merger of equals with FHN, and $4.0 million and $0.3 million, respectively, of Hazard related expenses. 2Q20 also includes $5.6 million of securities gains, and have been adjusted using an incremental tax rate of approximately 28 percent in 2Q20 and 15 percent in 1Q20. (c) 2Q20, 1Q20, include $11.1 million and $2.4 million, respectively of pre-tax 31 acquisition-related expenses largely associated with the merger of equals with FHN, and $4.0 million and $0.3 million, respectively, of Hazard related expenses. 2Q20 also includes $5.6 million of securities gains.