Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCULAR THERAPEUTIX, INC | tm2024905-1_8k.htm |

Exhibit 99.1

|

(NASDAQ: OCUL) TRANSFORMING DRUG DELIVERY LEVERAGING A NOVEL TECHNOLOGY PLATFORM ANTONY MATTESSICH, CHIEF EXECUTIVE OFFICER Ophthalmology Innovation Summit (OIS) Virtual Public Company Showcase July 16, 2020 |

|

FORWARD LOOKING STATEMENTS Any statements in this presentation about future expectations, plans, and prospects for the Company, including the commercialization of DEXTENZA®, ReSure® Sealant, or any of the Company’s product candidates; the commercial launch of, and effectiveness of reimbursement codes for, DEXTENZA; the development and regulatory status of the Company’s product candidates, such as the Company’s development of and prospects for approvability of DEXTENZA for additional indications including allergic conjunctivitis, OTX-DED for the treatment of temporary dry eye disease, OTX-CSI for the treatment of dry eye disease, OTX-TIC for the treatment of primary open-angle glaucoma and ocular hypertension, OTX-TKI for the treatment of retinal diseases including wet AMD, and OTX-AFS as an extended-delivery formulation of the VEGF trap aflibercept for the treatment of retinal diseases including wet AMD; the ongoing development of the Company’s extended-delivery hydrogel depot technology; the size of potential markets for our product candidates; the potential utility of any of the Company’s product candidates; the potential benefits and future operation of the collaboration with Regeneron Pharmaceuticals, including any potential future payments thereunder; projected net product revenue and other financial metrics of DEXTENZA; the expected impact of the COVID-19 pandemic on the Company and its operations; the sufficiency of the Company’s cash resources and other statements containing the words "anticipate," "believe," "estimate," "expect," "intend", "goal," "may", "might," "plan," "predict," "project," "target," "potential," "will," "would," "could," "should," "continue," and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors. Such forward-looking statements involve substantial risks and uncertainties that could cause the Company’s clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the timing and costs involved in commercializing DEXTENZA, ReSure Sealant or any product candidate that receives regulatory approval, including the conduct of post-approval studies, the ability to retain regulatory approval of DEXTENZA, ReSure Sealant or any product candidate that receives regulatory approval, the ability to maintain reimbursement codes for DEXTENZA, the initiation, timing and conduct of clinical trials, availability of data from clinical trials and expectations for regulatory submissions and approvals, the Company’s scientific approach and general development progress, the availability or commercial potential of the Company’s product candidates, the Company’s ability to generate its projected net product revenue and contribution on the timeline expected, if at all, the sufficiency of cash resources, the Company’s existing indebtedness, the ability of the Company’s creditors to accelerate the maturity of such indebtedness upon the occurrence of certain events of default, the outcome of the Company’s ongoing legal proceedings, the severity and duration of the COVID-19 pandemic including its effect on the Company’s and relevant regulatory authorities’ operations, the need for additional financing or other actions and other factors discussed in the “Risk Factors” section contained in the Company’s quarterly and annual reports on file with the Securities and Exchange Commission. In addition, the forward-looking statements included in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so except as required by law. These forward- looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation. 2 |

|

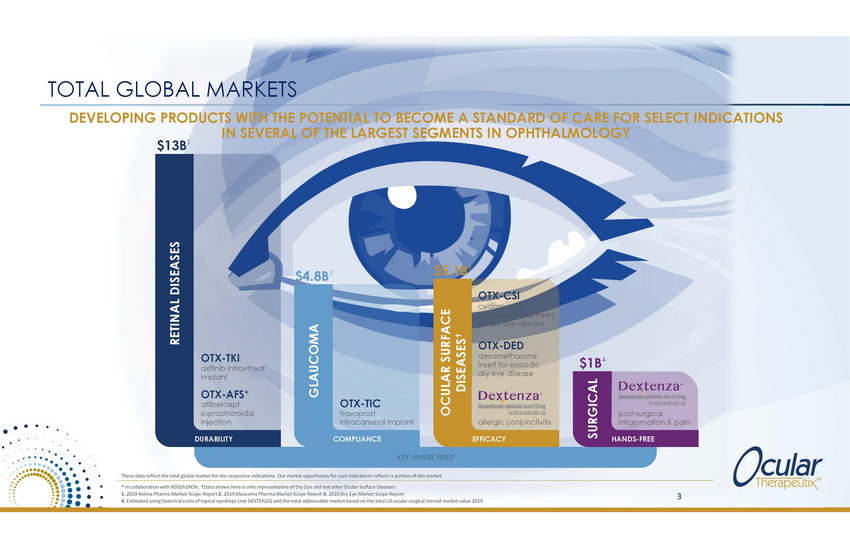

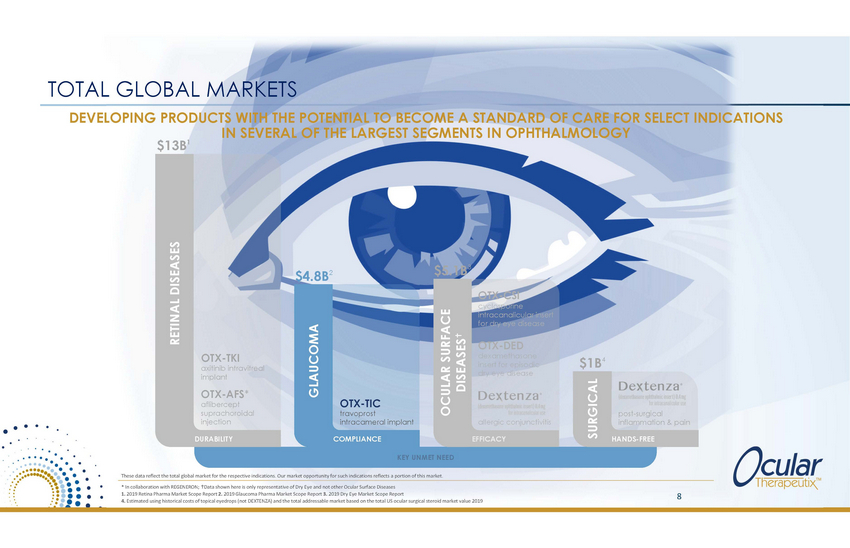

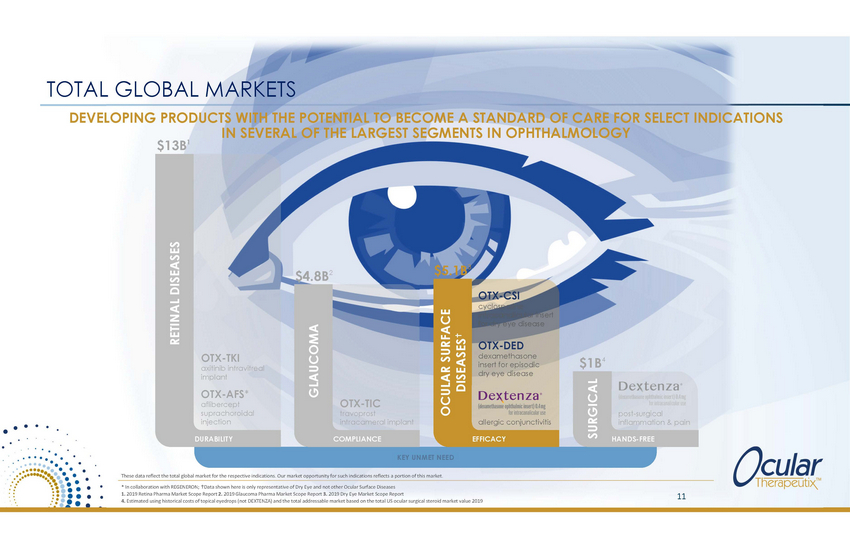

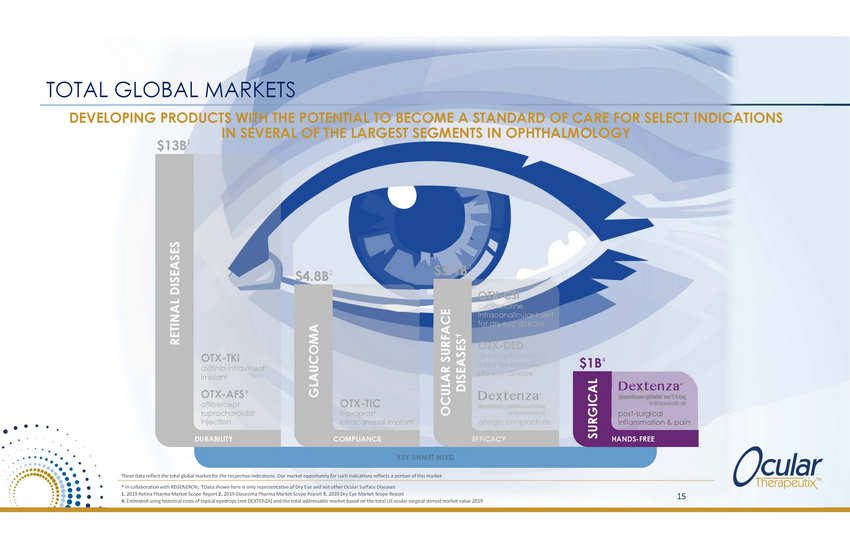

TOTAL GLOBAL MARKETS DEVELOPING PRODUCTS WITH THE POTENTIAL TO BECOME A STANDARD OF CARE FOR SELECT INDICATIONS IN SEVERAL OF THE LARGEST SEGMENTS IN OPHTHALMOLOGY $13B1 3 $5.1B $4.8B2 OTX-CSI cyclosporine intracanalicular insert for dry eye disease OTX-DED dexamethasone insert for episodic dry eye disease OTX-TKI axitinib intravitreal implant $1B4 OTX-AFS* aflibercept suprachoroidal injection OTX-TIC travoprost intracameral implant post-surgical inflammation & pain allergic conjunctivitis DURABILITY COMPLIANCE EFFICACY HANDS-FREE KEY UNMET NEED These data reflect the total global market for the respective indications. Our market opportunity for such indications reflects a portion of this market. * In collaboration with REGENERON; Data shown here is only representative of Dry Eye and not other Ocular Surface Diseases 1. 2019 Retina Pharma Market Scope Report 2. 2019 Glaucoma Pharma Market Scope Report 3. 2019 Dry Eye Market Scope Report 4. Estimated using historical costs of topical eyedrops (not DEXTENZA) and the total addressable market based on the total US ocular surgical steroid market value 2019 3 RETINAL DISEASES GLAUCOMA OCULAR SURFACE DISEASES SURGICAL |

|

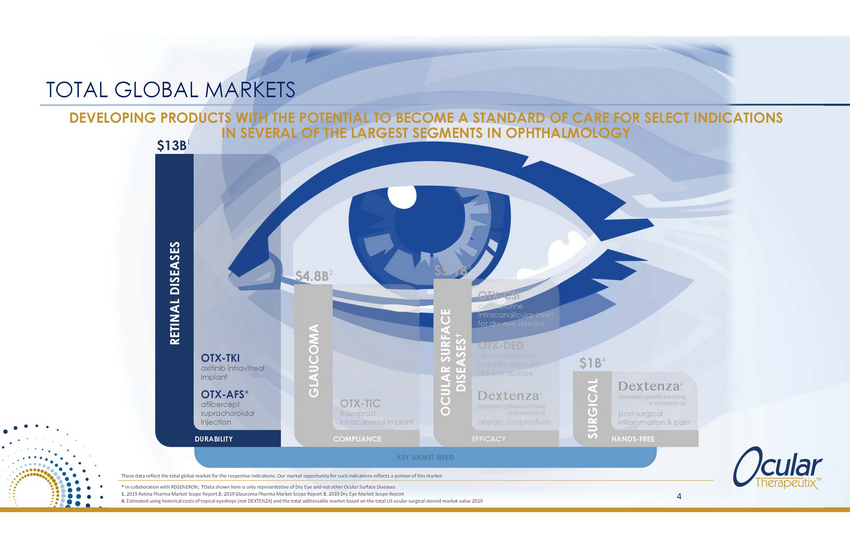

TOTAL GLOBAL MARKETS DEVELOPING PRODUCTS WITH THE POTENTIAL TO BECOME A STANDARD OF CARE FOR SELECT INDICATIONS IN SEVERAL OF THE LARGEST SEGMENTS IN OPHTHALMOLOGY $13B1 3 $5.1B $4.8B2 OTX-CSI cyclosporine intracanalicular insert for dry eye disease OTX-DED dexamethasone insert for episodic dry eye disease OTX-TKI axitinib intravitreal implant $1B4 OTX-AFS* aflibercept suprachoroidal injection OTX-TIC travoprost intracameral implant post-surgical inflammation & pain allergic conjunctivitis DURABILITY COMPLIANCE EFFICACY HANDS-FREE KEY UNMET NEED These data reflect the total global market for the respective indications. Our market opportunity for such indications reflects a portion of this market. * In collaboration with REGENERON; Data shown here is only representative of Dry Eye and not other Ocular Surface Diseases 1. 2019 Retina Pharma Market Scope Report 2. 2019 Glaucoma Pharma Market Scope Report 3. 2019 Dry Eye Market Scope Report 4. Estimated using historical costs of topical eyedrops (not DEXTENZA) and the total addressable market based on the total US ocular surgical steroid market value 2019 4 RETINAL DISEASES GLAUCOMA OCULAR SURFACE DISEASES SURGICAL |

|

OTX-TKI (AXITINIB INTRAVITREAL IMPLANT) SUSTAINED RELEASE THERAPY FOR RETINAL DISEASES Plan to provide Phase 1 clinical update at AAO (Nov 2020) and file for US exploratory IND in 2020 ISSUES WITH EXISTING TREATMENTS • • Require injections every 4-8 weeks1,2 May cause endophthalmitis, hemorrhage, damage to the lens or retinal detachment due to repeated injections3 Cause discomfort, eye pain, decreased vision, increased photosensitivity, and floaters with injections for patients3 • KEY PRODUCT ATTRIBUTES • • • • Targeting sustained release for 4.5-6 months Broader anti-angiogenic profile (small molecule) Small fiber (27-30G needle) with minimal/no visual impact Preservative-free ONGOING PHASE 1 CLINICAL TRIAL • • • First (200µg) and second (400µg) cohorts fully enrolled Currently dosing third (600µg) cohort To date, observed to have a generally favorable safety profile 1. EYLEA Full Prescribing information 2019 2. Lucentis full Prescribing Information 2019 3. Bochot A, Fattal E. Liposomes for intravitreal drug delivery: a state of the art. J Control Release. 2012;161(2):628-634. 5 |

|

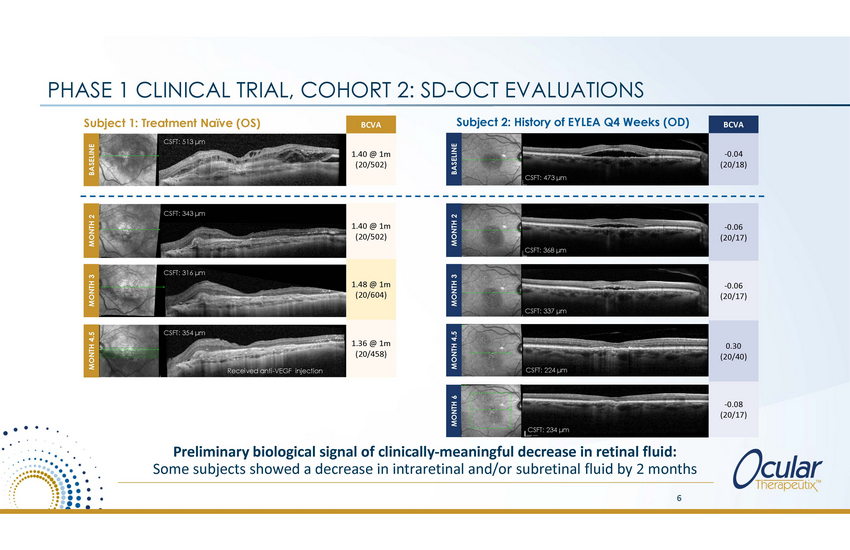

PHASE 1 CLINICAL TRIAL, Subject 1: Treatment Naïve (OS) COHORT 2: SD-OCT EVALUATIONS Subject 2: History of EYLEA Q4 Weeks (OD) CSFT: 513 μm CSFT: 473 μm CSFT: 343 μm CSFT: 368 μm CSFT: 316 μm CSFT: 337 μm CSFT: 354 μm (20/458) CSFT: 224 μm Received anti-VEGF injection CSFT: XXX μm CSFT: 23245 μm Preliminary biological signal of clinically-meaningful decrease in retinal fluid: Some subjects showed a decrease in intraretinal and/or subretinal fluid by 2 months 6 MONTH 4.5 MONTH 3 MONTH 2 BASELINE MONTH 6 MONTH 4.5 MONTH 3 MONTH 2 BASELINE 1.40 @ 1m (20/502) 1.48 @ 1m (20/604) 1.36 @ 1m -0.06 (20/17) -0.06 (20/17) 0.30 (20/40) -0.08 (20/17) BCVA 1.40 @ 1m (20/502) BCVA -0.04 (20/18) |

|

REGENERON PARTNERSHIP OTX-AFS (AFLIBERCEPT SUPRACHOROIDAL INJECTION)* ® AMENDED AGREEMENT TO DEVELOP A NOVEL, SUSTAINED-RELEASE FORMULATION OF EYLEA(AFLIBERCEPT) • EYLEA is a vascular endothelial growth factor (VEGF) trap approved degeneration (wet AMD) and other serious retinal diseases for the treatment of wet age-related macular ▪ EYLEA is the global market leader with $7.5 billion in revenue in 20191 • Evaluating opportunity to incorporate aflibercept with our hydrogel for injection in the suprachoroidal space ▪ Goal is to overcome limitations of intravitreal injections and extend aflibercept’s duration of activity, thereby decreasing dosing frequency • Deal parameters ▪ ▪ Regeneron subsidizes Ocular Therapeutix formulation efforts Regeneron to fund personnel and material costs associated with pre-clinical development Regeneron to fund up to $305 million in milestone payments with royalties in high single digits to low-to-mid-teens as a % of net sales Includes only large molecule anti-VEGFs ▪ ▪ 1. 2019 Regeneron annual report 7 *Formerly known as OTX-IVT |

|

TOTAL GLOBAL MARKETS DEVELOPING PRODUCTS WITH THE POTENTIAL TO BECOME A STANDARD OF CARE FOR SELECT INDICATIONS IN SEVERAL OF THE LARGEST SEGMENTS IN OPHTHALMOLOGY $13B1 $5.1B3 $4.8B2 OTX-CSI cyclosporine intracanalicular insert for dry eye disease OTX-DED dexamethasone insert for episodic dry eye disease OTX-TKI axitinib intravitreal implant $1B4 OTX-AFS* aflibercept suprachoroidal injection OTX-TIC travoprost intracameral implant post-surgical inflammation & pain allergic conjunctivitis DURABILITY COMPLIANCE EFFICACY HANDS-FREE KEY UNMET NEED These data reflect the total global market for the respective indications. Our market opportunity for such indications reflects a portion of this market. * In collaboration with REGENERON; Data shown here is only representative of Dry Eye and not other Ocular Surface Diseases 1. 2019 Retina Pharma Market Scope Report 2. 2019 Glaucoma Pharma Market Scope Report 3. 2019 Dry Eye Market Scope Report 4. Estimated using historical costs of topical eyedrops (not DEXTENZA) and the total addressable market based on the total US ocular surgical steroid market value 2019 8 RETINAL DISEASES GLAUCOMA OCULAR SURFACE DISEASES SURGICAL |

|

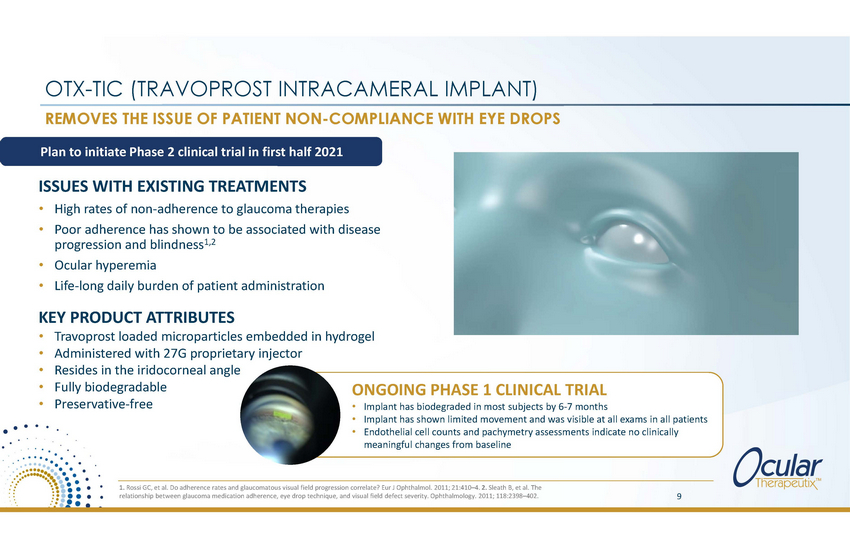

OTX-TIC (TRAVOPROST INTRACAMERAL IMPLANT) REMOVES THE ISSUE OF PATIENT NON-COMPLIANCE WITH EYE DROPS Plan to initiate Phase 2 clinical trial in first half 2021 ISSUES WITH EXISTING TREATMENTS • • High rates of non-adherence to glaucoma therapies Poor adherence has shown to be associated with disease progression and blindness1,2 Ocular hyperemia Life-long daily burden of patient administration • • KEY PRODUCT ATTRIBUTES • • • • • Travoprost loaded microparticles embedded in hydrogel Administered with 27G proprietary injector Resides in the iridocorneal angle Fully biodegradable Preservative-free ONGOING PHASE 1 CLINICAL TRIAL • • • Implant has biodegraded in most subjects by 6-7 months Implant has shown limited movement and was visible at all exams in all patients Endothelial cell counts and pachymetry assessments indicate no clinically meaningful changes from baseline 1. Rossi GC, et al. Do adherence rates and glaucomatous visual field progression correlate? Eur J Ophthalmol. 2011; 21:410–4. 2. Sleath B, et al. The relationship between glaucoma medication adherence, eye drop technique, and visual field defect severity. Ophthalmology. 2011; 118:2398–402. 9 |

|

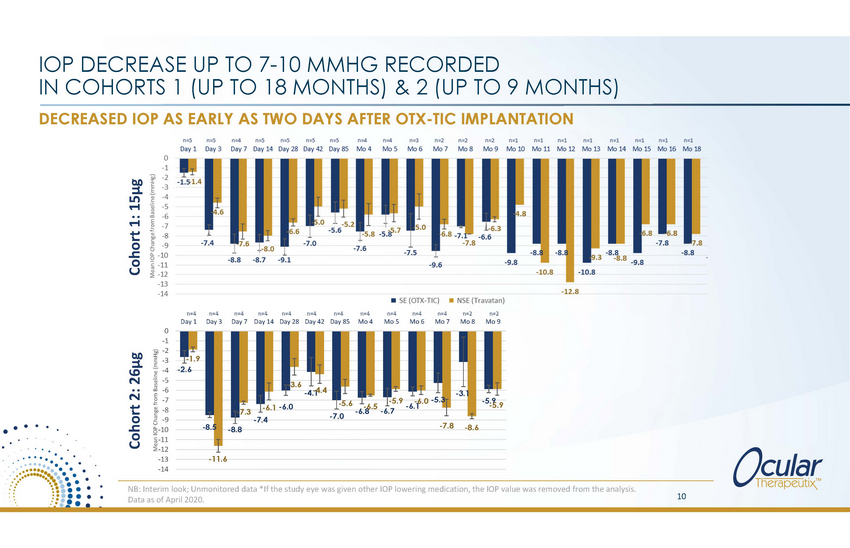

IOP DECREASE UP TO 7-10 MMHG RECORDED IN COHORTS 1 (UP TO 18 MONTHS) & 2 (UP TO 9 MONTHS) DECREASED IOP AS EARLY AS TWO DAYS AFTER OTX-TIC IMPLANTATION n=4 Day 1 n=4 Day 3 n=4 Day 7 n=4 Day 14 n=4 Day 28 n=4n=4 Day 42 Day 85 n=4 Mo 4 n=4 Mo 5 n=4 Mo 6 n=4 Mo 7 n=2n=2 Mo 8 Mo 9 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 -11 -12 -13 -14 -1.9 -2.6 3.6 -4.-14.4 -3.1 -6.0 -5.3 -5.9 -5.6 -6.5 -6.1 -6.8-6.7 7.3 -7.0 -7.4 -7.8 -8.5 -8.6 -8.8 -11.6 NB: Interim look; Unmonitored data *If the study eye was given other IOP lowering medication, the IOP value was removed from the analysis. Data as of April 2020. 10 Cohort 2: 26μg Mean IOP Change from Baseline (mmHg) Cohort 1: 15μg - - -5.9 -5.9 -6.1 -6.0 |

|

TOTAL GLOBAL MARKETS DEVELOPING PRODUCTS WITH THE POTENTIAL TO BECOME A STANDARD OF CARE FOR SELECT INDICATIONS IN SEVERAL OF THE LARGEST SEGMENTS IN OPHTHALMOLOGY $13B1 3 $5.1B $4.8B2 OTX-CSI cyclosporine intracanalicular insert for dry eye disease OTX-DED dexamethasone insert for episodic dry eye disease OTX-TKI axitinib intravitreal implant $1B4 OTX-AFS* aflibercept suprachoroidal injection OTX-TIC travoprost intracameral implant post-surgical inflammation & pain allergic conjunctivitis DURABILITY COMPLIANCE EFFICACY HANDS-FREE KEY UNMET NEED These data reflect the total global market for the respective indications. Our market opportunity for such indications reflects a portion of this market. * In collaboration with REGENERON; Data shown here is only representative of Dry Eye and not other Ocular Surface Diseases 1. 2019 Retina Pharma Market Scope Report 2. 2019 Glaucoma Pharma Market Scope Report 3. 2019 Dry Eye Market Scope Report 4. Estimated using historical costs of topical eyedrops (not DEXTENZA) and the total addressable market based on the total US ocular surgical steroid market value 2019 11 RETINAL DISEASES GLAUCOMA OCULAR SURFACE DISEASES SURGICAL |

|

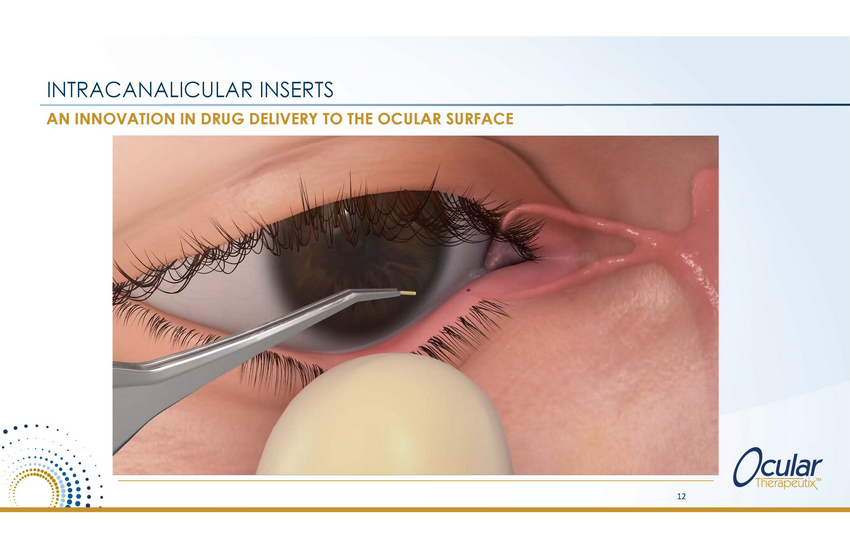

INTRACANALICULAR INSERTS AN INNOVATION IN DRUG DELIVERY TO THE OCULAR SURFACE 12 |

|

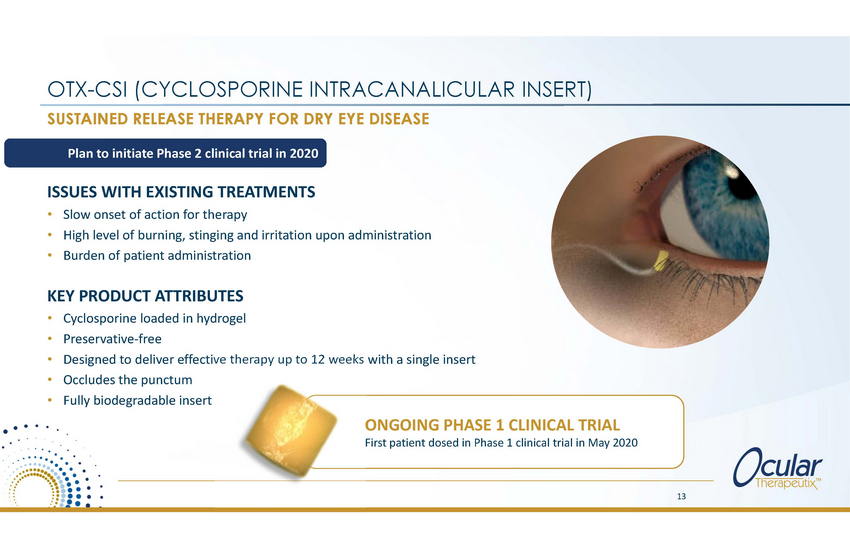

OTX-CSI (CYCLOSPORINE INTRACANALICULAR SUSTAINED RELEASE THERAPY FOR DRY EYE DISEASE INSERT) Plan to initiate Phase 2 clinical trial in 2020 ISSUES WITH EXISTING TREATMENTS • • • Slow onset of action for therapy High level of burning, stinging and irritation upon administration Burden of patient administration KEY PRODUCT ATTRIBUTES • • • • • Cyclosporine loaded in hydrogel Preservative-free Designed to deliver effective therapy up to 12 weeks with a single insert Occludes the punctum Fully biodegradable insert ONGOING PHASE 1 CLINICAL TRIAL First patient dosed in Phase 1 clinical trial in May 2020 13 |

|

NEW PRODUCT CANDIDATE OTX-DED (DEXAMETHASONE INTRACANALICULAR INSERT) STEROIDS ARE CURRENTLY USED TO TREAT EPISODIC ISSUES WITH EXISTING TREATMENTS DRY EYE Plan to submit Phase 2–enabling IND in 2020 • Approved therapies for DED are known for slow onset of action and burning/stinging upon application Topical steroids (which are not FDA approved for DED) can be abused and contain preservatives causing ocular toxicity • KEY PRODUCT ATTRIBUTES • • • • • Dexamethasone loaded in hydrogel Preservative-free Occludes the canaliculus providing more rapid onset of action Fully biodegradable insert Shorter duration and lower concentration of steroid release compared with DEXTENZA® (FDA approved dexamethasone intracanalicular insert for the treatment of inflammation and pain following ophthalmic surgery) Leverages strong safety profile of DEXTENZA® • 14 |

|

TOTAL GLOBAL MARKETS DEVELOPING PRODUCTS WITH THE POTENTIAL TO BECOME A STANDARD OF CARE FOR SELECT INDICATIONS IN SEVERAL OF THE LARGEST SEGMENTS IN OPHTHALMOLOGY $13B1 3 $5.1B $4.8B2 OTX-CSI cyclosporine intracanalicular insert for dry eye disease OTX-DED dexamethasone insert for episodic dry eye disease OTX-TKI axitinib intravitreal implant 4 $1B OTX-AFS* aflibercept suprachoroidal injection OTX-TIC travoprost intracameral implant post-surgical inflammation & pain allergic conjunctivitis DURABILITY COMPLIANCE EFFICACY HANDS-FREE KEY UNMET NEED These data reflect the total global market for the respective indications. Our market opportunity for such indications reflects a portion of this market. * In collaboration with REGENERON; Data shown here is only representative of Dry Eye and not other Ocular Surface Diseases 1. 2019 Retina Pharma Market Scope Report 2. 2019 Glaucoma Pharma Market Scope Report 3. 2019 Dry Eye Market Scope Report 4. Estimated using historical costs of topical eyedrops (not DEXTENZA) and the total addressable market based on the total US ocular surgical steroid market value 2019 15 RETINAL DISEASES GLAUCOMA OCULAR SURFACE DISEASES SURGICAL |

|

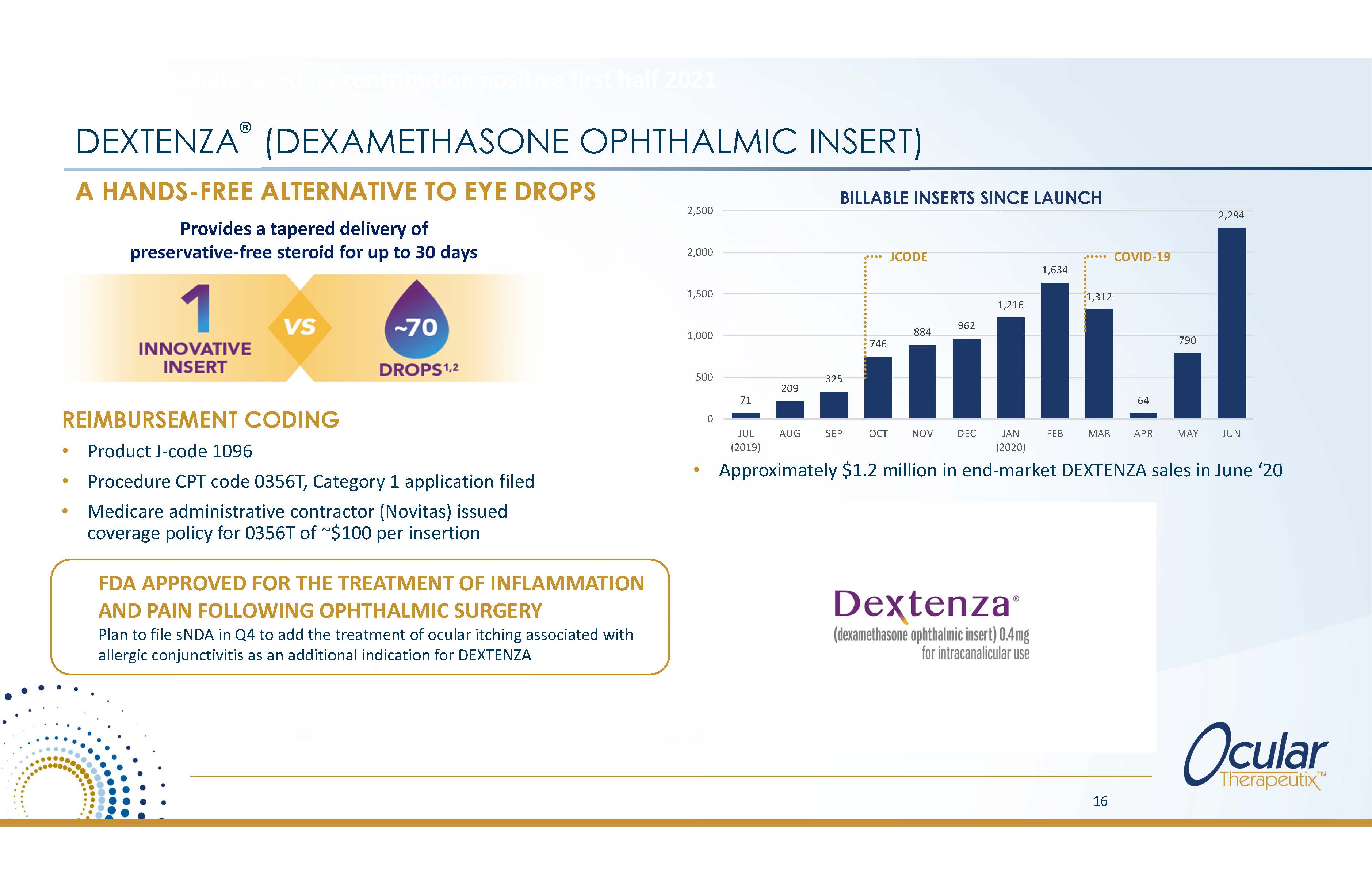

DEXTENZA (DEXAMETHASONE OPHTHALMIC INSERT) REIMBURSEMENT CODING Product J?code 1096 Procedure CPT code 0356T, Category 1 application filed Medicare administrative contractor (Novitas) issued coverage policy for 0356T of ~$100 per insertion A HANDS-FREE ALTERNATIVE TO EYE DROPS Provides a tapered delivery of preservative?free steroid for up to 30 days 71 209 325 746 884 962 1,216 1,634 1,312 64 790 2,294 0 500 1,000 1,500 2,000 2,500 JUL (2019) AUG SEP OCT NOV DEC JAN (2020) FEB MAR APR MAY JUN JCODE COVID?19 BILLABLE INSERTS SINCE LAUNCH Anticipates becoming product contribution positive first half 2021 16 FDA APPROVED FOR THE TREATMENT OF INFLAMMATION AND PAIN FOLLOWING OPHTHALMIC SURGERY Plan to file sNDA in Q4 to add the treatment of ocular itching associated with allergic conjunctivitis as an additional indication for DEXTENZA Approximately $1.2 million in end?market DEXTENZA sales in June '20 |

|

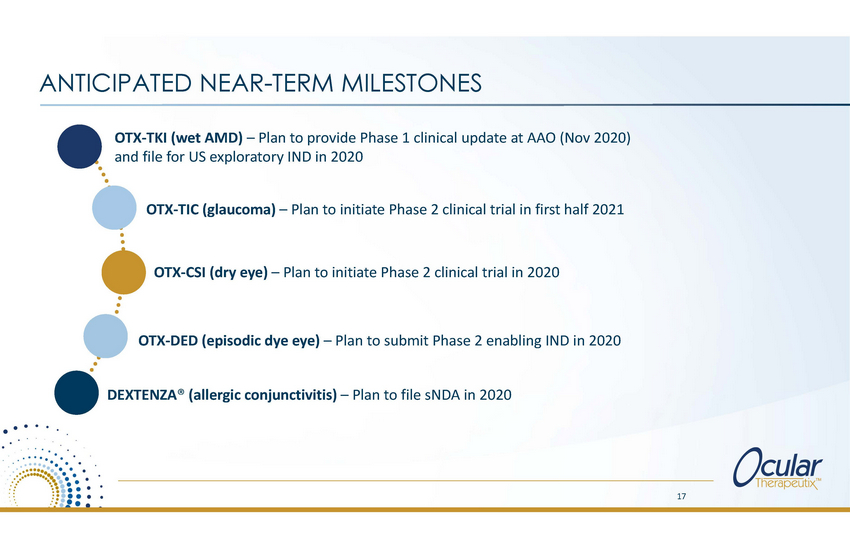

ANTICIPATED NEAR-TERM MILESTONES OTX-TKI (wet AMD) – Plan to provide Phase 1 clinical update at AAO (Nov 2020) and file for US exploratory IND in 2020 OTX-TIC (glaucoma) – Plan to initiate Phase 2 clinical trial in first half 2021 OTX-CSI (dry eye) – Plan to initiate Phase 2 clinical trial in 2020 OTX-DED (episodic dye eye) – Plan to submit Phase 2 enabling IND in 2020 DEXTENZA® (allergic conjunctivitis) – Plan to file sNDA in 2020 17 |

|

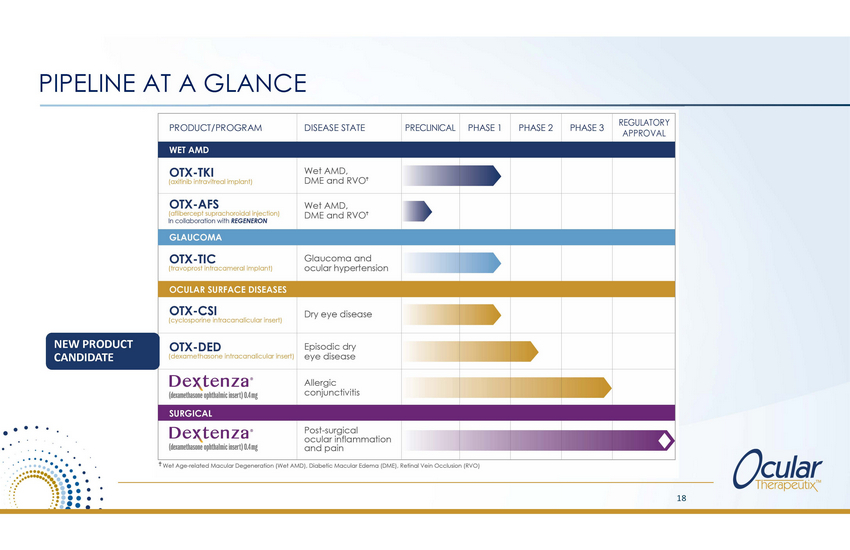

PIPELINE AT A GLANCE APPROVAL OTX-TKI (axitinib intravitreal implant) Wet AMD, DME and RVOt OTX-AFS (aflibercept suprachoroidal injection) In collaboration with REGENERON Wet AMD, DME and RVOt OTX-CSI (cyclosporine intracanalicular insert) Dry eye disease OTX-DED (dexamethasone intracanalicular insert) Episodic dry eye disease Dex_tenza· (dexamethasone ophthalmicinsert) 0.4mg f Allergic conjunctivitis • • • • • • ocular inflammation . . ....•.•.•.•.•..•..•.·_·-. •·.•..•.. • • • • • • • •• • • • •. .• • • • t Wet Age-related Macular Degeneration (Wet AMD) . Diabetic Macular Edema (DME). Retinal Vein Occlusion (RVO) . .:..: . • • • • .• .• • •• . . 18 Dex.tenza®Post-surgical (dexamethasone ophthalmicinsert) 0.4mg and pain NEW PRODUCT CANDIDATE WET AMD PRODUCT /PROGRAMDISEASE STATEPRECLINICALPHASE 1PHASE 2 PHASE 3 REGULATORY |