Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - ACELL INC | a2242011zex-23_1.htm |

As Filed with the Securities and Exchange Commission on July 15, 2020

Registration No. 333-239471

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACell, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3841 (Primary Standard Industrial Classification Code Number) |

04-3496380 (I.R.S. Employer Identification Number) |

6640 Eli Whitney Drive

Columbia, Maryland 21046

(800) 826-2926

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Patrick A. McBrayer

President and Chief Executive Officer

ACell, Inc.

6640 Eli Whitney Drive

Columbia, Maryland 21046

(800) 826-2926

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||||

Darren DeStefano Christian E. Plaza Katie Kazem Cooley LLP 11951 Freedom Drive Reston, Virginia 20190 (703) 456-8034 |

Christopher F. Branch Chief Operating Officer and General Counsel ACell, Inc. 6640 Eli Whitney Drive Columbia, Maryland 21046 (800) 826-2926 |

Benjamin K. Marsh William A. Magioncalda Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, New York 10018 (212) 813-8800 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

|

Title of each class of securities to be registered |

Amount to be registered(1)

|

Proposed maximum offering price per share |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee(2)(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, par value $0.001 per share |

5,750,000 | $16.00 | $92,000,000 | $11,941.60 | ||||

|

||||||||

- (1)

- Includes

750,000 shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant will file a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Subject to Completion, Dated July 15, 2020 |

| |

5,000,000 Shares

ACell, Inc.

Common Stock

This is the initial public offering of shares of common stock of ACell, Inc. We are offering 5,000,000 shares of common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price for our common stock will be between $14.00 and $16.00 per share. We have applied to list our common stock on the Nasdaq Global Market under the symbol "ACLL."

We are an "emerging growth company" as defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our common stock involves a high degree of risk. Before buying any shares of our common stock, you should carefully read the discussion of material risks of investing in our common stock in "Risk factors" beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Initial public offering price |

$ | $ | |||||

| | | | | | | | |

Underwriting discounts and commissions(1) |

$ | $ | |||||

| | | | | | | | |

Proceeds, before expenses, to ACell, Inc. |

$ | $ | |||||

| | | | | | | | |

- (1)

- See "Underwriting" for additional information regarding compensation payable to the underwriters.

The selling stockholders identified in this prospectus have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 750,000 shares of common stock from them at the initial public offering price, less the underwriting discounts and commissions. We will not receive any of the proceeds from the sale of any common stock by the selling stockholders upon any such exercise.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2020.

| UBS Investment Bank | Barclays | RBC Capital Markets | ||

SunTrust Robinson Humphrey |

||||

Prospectus dated , 2020.

None of us, the selling stockholders or any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. None of us, the selling stockholders or any of the underwriters take responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

TABLE OF CONTENTS

i

About this prospectus

For investors outside the United States: None of us, the selling stockholders or any of the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the possession and distribution of this prospectus outside of the United States.

Any discrepancies included in this prospectus between totals and the sums of the percentages and dollar amounts presented are due to rounding.

ii

This summary highlights selected information included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled "Risk factors," "Management's discussion and analysis of financial condition and results of operations," "Business," and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, all references in this prospectus to "ACell," the "company," "we," "our," "us" or similar terms refer to ACell, Inc. We refer to our Series A convertible preferred stock, Series B convertible preferred stock, Series C convertible preferred stock and Series D convertible preferred stock as our "convertible preferred stock" in this prospectus.

BUSINESS OVERVIEW

Our company

We are a leading regenerative medicine company focused on the development, manufacture and sale of products primarily used in acute care settings as part of the treatment and management of moderate to severe wounds and reinforcement of soft tissue surgical defects. Our products utilize our proprietary porcine urinary bladder matrix platform technology, which is designed to enhance the body's ability to restore natural tissue and minimize scarring in the management of traumatic, surgical and chronic wounds, burns, hernias and other conditions requiring the reinforcement of soft tissue. We believe we are at the forefront of advancing the global standard of care for wounds and soft tissue surgical defects by providing solutions that are designed to significantly improve patient outcomes while lowering the overall cost of care. Since our commercial launch in 2009, we have sold over 500,000 units of our urinary bladder matrix, or UBM, products.

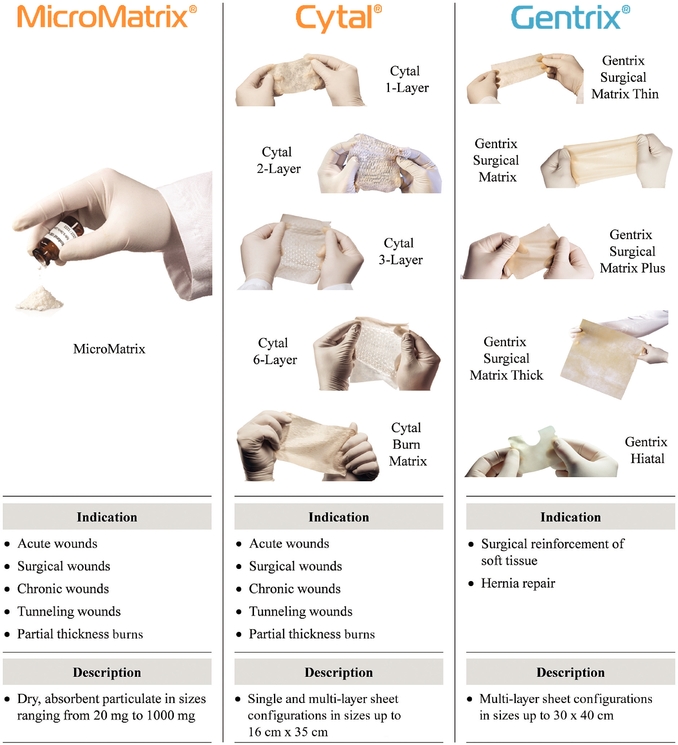

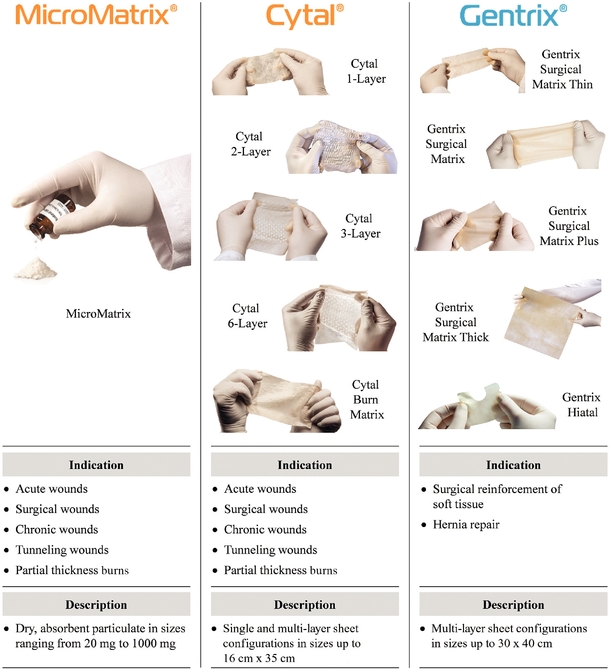

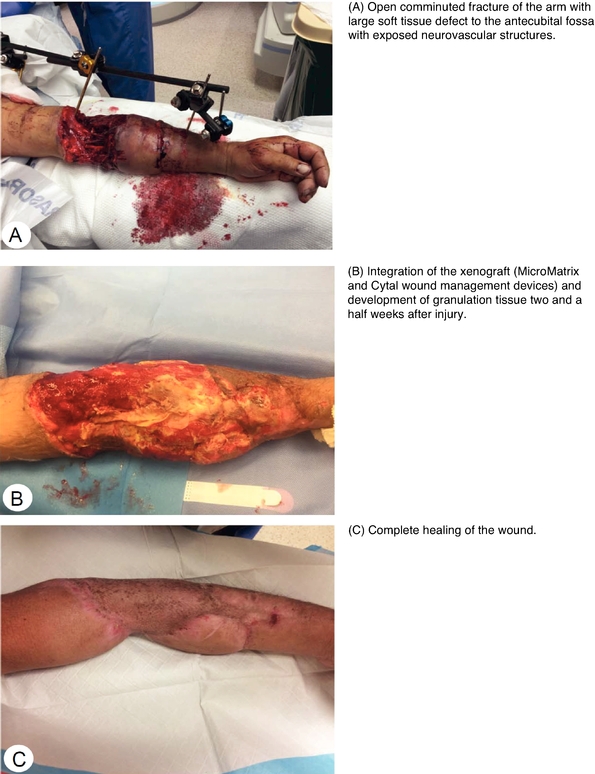

We manufacture the only commercially available extracellular matrix, or ECM, products that utilize porcine UBM. When applied to a wound or soft tissue surgical defect, our products are typically resorbed over time and replaced with newly formed tissue that replicates uninjured tissue where scarring would normally occur. This capability enables our products to promote durable wound closure and soft tissue defect repair, restore natural tissue function and enhance aesthetic outcomes. Our products are available in sheet and particulate form for wound management, and in multiple layering configurations of various sizes for surgical soft tissue repair, including hernia repair. We market MicroMatrix, a particulate formulation, and Cytal Wound Matrix products, in sheet formulations, for the management of acute, surgical, chronic and tunneling wounds and partial thickness burns. We also market Gentrix Surgical Matrix products, in sheet formulations, for the reinforcement of soft tissue in certain surgical applications, such as for hernia repair. We manufacture our products using our proprietary know-how, trade secrets and patented technology.

Our products address large, underserved and growing markets with significant commercial potential. In addition to the ongoing need to manage traumatic injuries, we believe that long-term demand for our products is increasing due to aging demographics and the growing prevalence of conditions such as diabetes, obesity and vascular disease. We estimate that our total addressable market in the United States for our currently marketed products is over $2 billion, based on estimated 2019 revenues for hernia matrices and biologic skin and dermal substitutes for wound care. We intend to grow our business and market opportunity by further penetrating our current acute care customer accounts, increasing our acute care customer base, selectively expanding the sale of our products into non-acute care settings, expanding our international sales opportunity and enhancing and expanding our product portfolio.

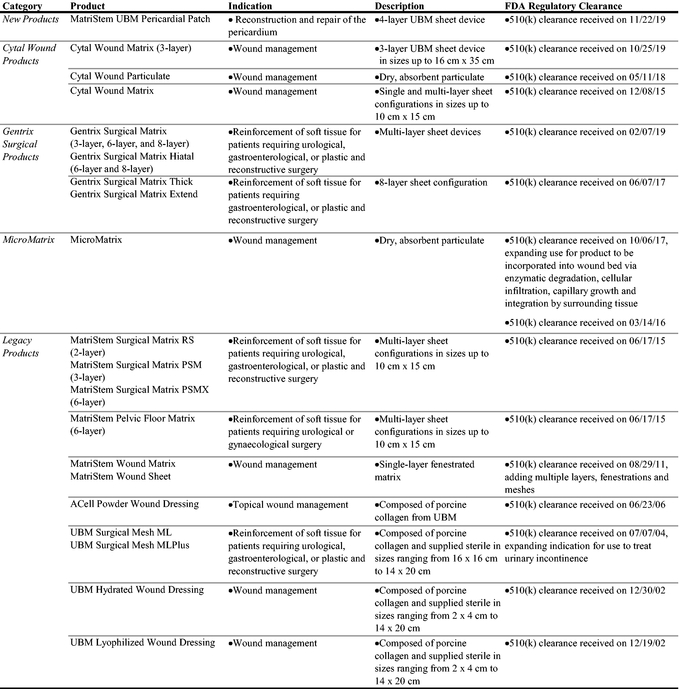

We have 17 clearances from the U.S. Food and Drug Administration, or FDA, and many of our products are also approved for sale in Canada and Saudi Arabia. We are also seeking regulatory approvals to sell our products in several international markets including China, South Korea and the

1

European Union. We currently sell and market our products in the United States through a dedicated, surgically-focused direct sales force of approximately 160 employees as of April 30, 2020 that sell into hospital operating rooms and intensive care units. To complement our direct sales efforts, we also have established a national accounts team that supports our commercial efforts with group purchasing organizations, or GPOs, integrated delivery networks, or IDNs, and government facilities, including Department of Veterans Affairs and Department of Defense medical facilities. During the year ended December 31, 2019, we sold our products to over 1,900 customers and had contracts with eight GPOs and seven distributors in 11 countries. We also provide medical education programs that offer hands-on and virtual education for all of our products and host symposiums throughout the United States, including at our state-of-the-art surgical learning center in Columbia, Maryland.

We have achieved significant revenue growth since the launch of our first commercial product in 2009. Our revenue increased to $100.8 million for the year ended December 31, 2019 from $89.2 million for the year ended December 31, 2018, an increase of 13.0%. For the years ended December 31, 2019 and 2018, we recorded a gross margin of 81.0% and 81.7%, respectively, and net income of $1.4 million and net loss of $3.1 million, respectively. In the three months ended March 31, 2020 and 2019, we recorded revenue of $23.7 million and $24.2 million, respectively, a gross margin of 80.4% and 81.6%, respectively, and net loss of $2.7 million and net income of $0.1 million, respectively.

Industry background

Worldwide, the epidemiological burden of acute and chronic wounds is significant, driving the need for improved healing and wound management solutions. Acute wounds include traumatic wounds, surgical wounds and moderate to severe burns. Traumatic wounds were estimated to have a global incidence of at least 5.6 million in 2019. In the United States and European Union alone, major surgical wounds were estimated to have an incidence of approximately 12.8 million in 2019. In 2019, medically treated burns were expected to have a global incidence of over 6.3 million, while burns requiring hospitalization were estimated to have a global incidence of approximately 597,000. Chronic wounds include stage 3 and stage 4 pressure ulcers, diabetic ulcers and venous and arterial ulcers, which were estimated to have global incidences in 2019 of approximately 22.6 million, 14.5 million and 13.3 million, respectively. We believe the annual incidence of acute wounds, aging demographics and increased prevalence of systemic comorbidities, including growth of vascular complications and diabetes, are contributing to the growth in wound management procedures and demand for alternative therapies.

Incidence of hernias, a type of soft tissue defect, and the resulting market for hernia repair are increasing. Surgery is the only treatment that can permanently repair a hernia, and synthetic or biologically-derived mesh is used in about 90% of those surgeries to reinforce torn or damaged tissue around hernias. In the United States alone, approximately 1.2 million hernia repairs were estimated to have occurred in 2019. We believe the growth in hernia repair procedures, increased incidence of obesity, aging demographics and incidence and awareness of infection and rejection of synthetic or other biologically-derived meshes, is driving the need for new therapies.

Our UBM platform technology

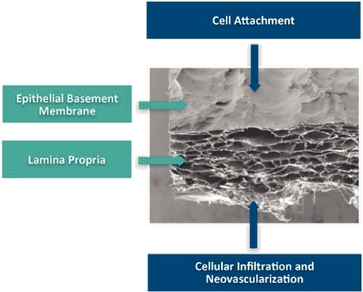

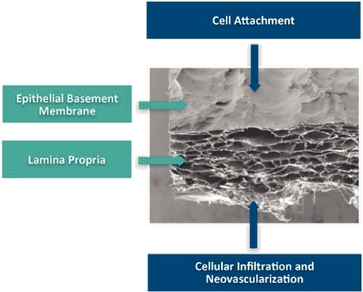

Our UBM platform technology is built on over 40 years of tissue regeneration and ECM constructs research. Our platform technology is based on an ECM comprised of the two innermost layers of porcine urinary bladder depicted in the image below. The epithelial basement membrane on one side of the ECM is a thin, delicate membrane of proteins that serves as a natural barrier to separate tissue layers. The lamina propria layer on the opposite side is rough and absorptive, serving as a porous scaffold that allows for the body's cells to infiltrate the UBM. Through our proprietary manufacturing process, we retain both of these layers while removing cellular content without the use of harsh and damaging detergents or chemicals. Our ability to retain these two layers differentiates our products from other ECM-based products. Specifically, our products contain a protein composition that

2

provides a surface for cellular ingrowth and maturation, with the intent to help restore natural tissue function at the wound or surgical site. In addition, we use a proprietary processing method to remove the cellular content specific to a pig. This decellularization process isolates the ECM of the tissue, resulting in products that are acellular scaffolds appropriate for use in humans. When used to treat a wound or soft tissue surgical defect, these scaffolds provide a platform for the body's cells to populate and differentiate, resulting in biomechanically-functional tissue.

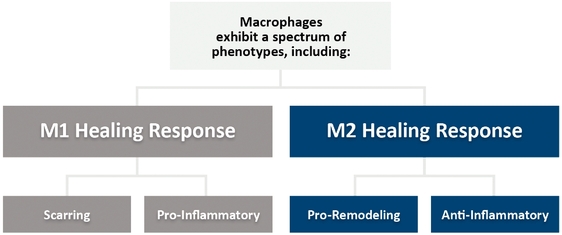

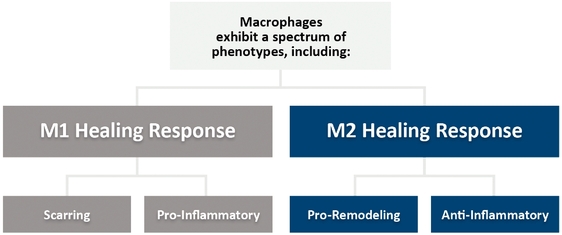

In a normal healing process, the body works to close disrupted tissues to prevent infection and further tissue damage, often resulting in the development of fibrous scar tissue and potentially diminishing biomechanical functionality. This process is largely regulated by macrophages in the immune system. There are two main types of macrophages involved in the healing process: M1, or pro-inflammatory macrophages, and M2, or anti-inflammatory macrophages. While pro-inflammatory M1 macrophages play an important role in the early stages of normal wound healing, the ability of the body to transition to a predominately M2 macrophage environment is crucial to promote repair and regeneration of damaged tissues.

The unique structure and composition of UBM is designed to provide an environment in which macrophages are more likely to exhibit an M2-type healing response. While an M1 process often results in increased inflammation and scarring, in an M2 process, the macrophages and other cells break down the UBM as the body naturally generates new proteins, remodeling the scaffold into a tissue that is similar to the native tissue structure and biomechanical function while potentially reducing scarring and resulting in better aesthetic outcomes.

3

Our UBM products

The following table summarizes the key indications and attributes of our currently marketed products:

Limitations of competitive biologically-derived and synthetic products

The clinical goal in the treatment of moderate to severe wounds and soft tissue surgical defects is to promote healing through the restoration of natural, functional tissue while avoiding adverse reactions such as infection, chronic inflammation, excessive scarring and undesirable aesthetic outcomes. There are a number of currently available alternative products that are typically used for complex wound

4

treatment, including those made from biologic tissue such as human, porcine, bovine and ovine sources and those made from synthetic materials such as polyethylene, polypropylene or polyester. Biologically-derived products include chemically strengthened, or crosslinked, products and cellular, acellular and amniotic products. We believe characteristics of competing products including (i) the type of tissue or synthetic material utilized, (ii) the processing techniques required and (iii) physical attributes including thickness, porosity, pliability and form, can limit the functional healing response of the body.

Specifically, we believe these limitations include:

- ➤

- Risk of foreign body response and

inflammation. Use of synthetic and many biologically-derived products can lead to a foreign body response, characterized by chronic inflammation and scarring.

- ➤

- Limited remodeling, formation of scar tissue and

infection. Rather than remodel functional tissue, many synthetic and biologically-derived products heal through the formation of scar tissue, thereby limiting the

body's healing response and potentially leading to decreased function, prolonged healing times, infection, dehiscence and other surgical complications.

- ➤

- Limited or lack of

resorption. The body has difficulty resorbing crosslinked and synthetic products, limiting the body's natural healing process and resulting in complications such

as adhesions, fistula formation and product erosion into surrounding tissues and organs.

- ➤

- Limited application

versatility. The strength levels and handling characteristics of synthetic and biologically-derived products vary, which can limit their range of applications

depending on the needs for strength and conformability for a given type of wound being treated. Furthermore, most synthetic and biologically-derived products come in sheet form and lack alternative

configurations, such as a particulate formulation, making the management of wounds or defects with irregular topographies more difficult.

- ➤

- Limited storage flexibility and logistical

challenges. Many currently available products have manufacturing and storage limitations that restrict their use and potential range of applications.

- ➤

- Cost-effectiveness concerns. We believe the cost-effectiveness of such products, taking into account both clinical performance and price, is an important consideration for use. While synthetic products can be effective and are typically lower priced, they can lead to costly complications and a higher overall cost of care. Biologically-derived products can be effective when synthetic products fail or are not appropriate, but typically command a higher price.

Key advantages of our products

Our products support the body's natural remodeling process and address many of the limitations of competitive biologically-derived and synthetic products. The advantages of our products include:

- ➤

- Clinically favorable healing with reduced foreign body

response and inflammation. Unlike synthetic and many other biologically-derived products, our products are acellular scaffolds that the body recognizes as natural

tissue, which facilitates new healthy tissue growth while avoiding foreign body response. Both the non-synthetic and fully resorbable nature of our products allow for rapid cell infiltration in the

wound tissue where scarring would typically occur, leading to the restoration of functional tissue with more desirable aesthetic outcomes. Moreover, our products can be placed in challenging defects

while avoiding many of the clinical complications associated with chronic inflammation.

- ➤

- Natural, functional tissue remodeling in place of scar tissue. Our products facilitate the body's ability to form tissue that has characteristics similar to natural, uninjured tissue. This feature minimizes encapsulation, related infections and complications associated with the formation of scar tissue and tissue adhesions.

5

- ➤

- Non-crosslinked and

resorbable. Our products do not require harsh chemicals to decellularize the porcine bladder material. Furthermore, the composition of our products does not

require crosslinking to achieve adequate strength. These characteristics allow our products to be highly resorbable by the body, which facilitates the body's natural healing process.

- ➤

- Broad application

versatility. The physical properties of our technology combined with our ability to offer our products in a variety of forms enable us to address a wide range of

clinical applications. Our products are available as flexible sheets that vary in the number of UBM layers and sizing as well as in a particulate formulation that is especially useful for wounds or

defects with irregular topographies. In applications like hernia repair, in which strength is a significant consideration, we manufacture various configurations to enable clinicians to provide the

appropriate products to their patients. In addition, our sheet and particulate products are cleared by the FDA for concomitant use in wound management, which we believe enables clinicians to more

thoroughly and uniformly address the wound site and differentiates us from our competitors.

- ➤

- Convenience and ease of

use. Our products have a two-year shelf life, can be stored at room temperature and do not require special handling. These attributes may provide greater

convenience for our customers compared to other biologically-derived products. Moreover, because our products are not human-derived, they are not subject to The American Association of Tissue Banks

requirements, which enables ease of access to our products.

- ➤

- Cost-effective alternative. We offer products with high clinical utility as part of the treatment of a broad range of moderate to severe traumatic wounds and the reinforcement of soft tissue surgical defects. We believe that because our products provide durable wound repair and restoration of natural tissue, while avoiding many clinical complications often associated with other biologic and synthetic alternatives, we provide cost-effective solutions.

Our growth strategies

We strive to enhance our position as a leading regenerative medicine company focused on the development, manufacture and commercialization of acute care solutions as part of the treatment and management of moderate to severe wounds and reinforcement of soft tissue surgical defects. In order to achieve this goal, we seek to establish our products as standards of care across multiple delivery channels by employing the following strategies:

- ➤

- Increase awareness of our products in the markets in

which we compete. We intend to broaden our market presence by further increasing awareness of our differentiated technology, products and brand among hospitals,

wound care centers, long-term acute care hospitals, or LTACHs, government facilities, ambulatory surgical centers, physician offices and patient advocates, as well as other key clinical and economic

decision-makers.

- ➤

- Continue the development of data supporting the

clinical benefits of UBM. We intend to grow the body of clinical evidence supporting the benefits and efficacy of UBM in order to further drive adoption of our

products. We are conducting post-market studies which we believe can expand the commercialization potential for our existing portfolio, primarily by broadening clinical differentiation and

reimbursement coverage for additional care settings.

- ➤

- Expand and enhance the effectiveness of our U.S.

commercial organization to achieve greater market adoption. Through disciplined expansion and development of our sales and marketing teams, we intend to focus our

sales and marketing efforts to grow our business by:

- -

- Further penetrating existing acute care customer accounts. We intend to leverage our established contracts with hospitals, hospital networks, GPOs, IDNs and government facilities to drive further penetration in acute care settings.

6

- -

- Growing our acute care customer base. In addition to our existing acute care accounts, we plan to add new

acute care customers, both within the traditional hospital setting, as well as through the targeting of LTACHs and facilities operated by the Department of Veterans Affairs.

- -

- Selectively expanding the sale of our products into non-acute care facilities. We believe our direct sales

force will be able to strategically drive adoption and utilization of our products in some non-acute care facilities, such as outpatient wound management centers and physician's offices, representing

a potential opportunity for longer-term growth.

- ➤

- Expand our international sales

opportunities. We will continue to work with distributors to attain regulatory approval for our products in additional jurisdictions outside of the United States.

We expect to continue to expand our international sales opportunities in the following regions:

- -

- APAC: China and South Korea represent our most significant opportunities within APAC due to high unmet

demand for quality healthcare, increasing initiatives by governments to improve healthcare infrastructure, growing awareness about the clinical benefits of regenerative medicine among end-users and

the increasing prevalence of chronic and acute diseases.

- -

- EMEA: Western Europe represents our most significant opportunity in EMEA due to the increasing incidence

of acute and chronic diseases, high awareness of technologically advanced regenerative therapies and the rapidly aging population.

- -

- Rest of world: The need for treatment and management of moderate to severe wounds and reinforcement of

soft tissue surgical defects is a global issue. We plan on selectively entering additional international markets based on varying country-specific factors, including the regulatory environment,

awareness and advocacy of regenerative medicine technologies, healthcare infrastructure and economic development.

- ➤

- Expand and enhance our product portfolio, including expanding treatment applications, to grow our addressable markets. We intend to submit additional 510(k) premarket notifications to the FDA in the coming years, as well as actively consider other product opportunities that may require a premarket approval application or biologics license application. We also intend to pursue a number of initiatives, which include adding features and designs to our existing products, as well as expanding treatment applications for these products. If successful, we believe these additional applications may provide opportunities to increase future sales by allowing us to address large, underserved markets.

Effects of the COVID-19 pandemic on our business

With the global spread of the ongoing COVID-19 pandemic, we have implemented business continuity plans designed to address and mitigate the impact of the COVID-19 pandemic on our employees, customers and business. For example, we have implemented new safety measures designed to minimize risk for our employees and, ultimately, our customers, such as enacting new employee screening procedures for possible COVID-19 exposure, having certain employees work in two-week rotating shifts and allowing certain employees to work from home. Given the global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic, our business, financial condition, results of operations and growth prospects have been, and we believe are likely in the near-term to continue to be, adversely affected. See the section titled "Risk factors" in this prospectus for more details on the risks we face as a result of the COVID-19 pandemic. We continue to closely monitor the COVID-19 situation as we evolve our business continuity plans and response strategy.

7

Recent Developments

We began to observe a decline in procedure volumes in the second half of March 2020, driven by impacts of the COVID-19 pandemic. Factors that specifically impacted our business included limitations on access to hospitals, reduced incidents of trauma driven by restricted mobility and deferrals of elective procedures. However, in April 2020, as hospital access began to resume and restrictions on mobility began to lift in certain areas in the United States, we began to observe a gradual recovery in weekly procedure volumes.

Based on available information to date, for the three months ended June 30, 2020, we estimate that we achieved revenue of $19.4 million to $19.7 million, representing a decrease of approximately 21.2% to 22.4% on a year-over-year basis from $25.0 million for the three months ended June 30, 2019. Our business and revenues gradually began to recover throughout the second quarter of 2020 and while estimated sales during the months of April and May were lower than in the corresponding months in the prior year period, estimated sales in June were higher as compared to June 2019.

These estimates are preliminary and unaudited. In addition, such preliminary revenue data is based on our current expectations and may be adjusted as a result of, among other things, the completion of our quarter-end financial and accounting closing procedures for the quarter ended June 30, 2020 and other developments that may arise between now and the time the financial results for this period are finalized, and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with accounting principles generally accepted in the United States.

RISK FACTORS SUMMARY

Investing in our common stock involves substantial risks. The risks described in the section titled "Risk factors" immediately following this prospectus summary may cause us to not realize the full benefits of our strengths or to be unable to successfully execute all or part of our strategy. Some of the more significant risks include the following:

- ➤

- We may not be profitable in the near term or maintain profitability in the

future.

- ➤

- We may be unable to successfully execute on our growth strategy.

- ➤

- Our future success will largely depend on our ability to maintain and further

grow clinical acceptance and adoption of our products, and we may be unable to adequately educate healthcare practitioners on the use and benefits of our products.

- ➤

- We could be subject to increased monetary penalties and other sanctions,

including exclusion from federal healthcare programs, if we fail to comply with the terms of our Federal Settlement Agreement, State Settlement Agreements or Corporate Integrity Agreement.

- ➤

- The global COVID-19 pandemic and related impacts are having a material adverse

effect on our operations, financial performance and cash flows. We are unable to predict the extent to which the pandemic and related impacts will continue to adversely impact our business operations,

financial performance, results of operations, financial position and the achievement of our strategic objectives.

- ➤

- Our results of operations could suffer if we are unable to manage our planned

international expansion effectively.

- ➤

- We may be unable to maintain current, and obtain future, contracts with

major GPOs and IDNs for our products, and even if we are able to do so, such contracts may not generate sufficient sales of our products.

- ➤

- We may be unable to compete successfully against our existing or future

competitors.

- ➤

- We rely on third-party suppliers and providers, some of which are currently the only source for the respective materials or services they provide to us.

8

- ➤

- Substantially all of our revenue has been, and we expect that it will continue

to be, generated from sales of our UBM products, and we therefore are highly dependent on their success.

- ➤

- We rely heavily on our sales professionals to market and sell our products

worldwide. If we are unable to hire, effectively train, manage, improve the productivity of, and retain our sales professionals, our business will be harmed, which would impair our future revenue and

profitability.

- ➤

- Product liability lawsuits against us could cause us to incur substantial

liabilities and could limit commercialization of any products we may develop.

- ➤

- If our products are found to be defective or otherwise pose certain safety

risks, we may decide, or the FDA could require us, to initiate a recall, and we will be subject to medical device reporting requirements, and we could be subject to agency enforcement actions.

- ➤

- A reclassification of our products by the FDA could significantly increase our

regulatory costs, including the time and expense associated with required clinical trials, or may require us to suspend or discontinue sales of our products.

- ➤

- Changes in existing third-party coverage and reimbursement may impact our

ability to sell our products.

- ➤

- We may need additional funding beyond the proceeds of this offering and may be

unable to raise capital when needed, which would force us to delay, reduce, eliminate or abandon our commercialization efforts or product development programs.

- ➤

- Our core patents with claims directed to our currently marketed products will soon expire and our remaining patents and other intellectual property rights may not adequately protect our products.

OUR CORPORATE INFORMATION

We were incorporated under the laws of the State of Delaware in June 1999. Our principal executive offices are located at 6640 Eli Whitney Drive, Columbia, Maryland 21046, and our telephone number is (800) 826-2926. Our website address is www.acell.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus or in deciding to purchase our common stock.

We have proprietary rights to a number of trademarks used in this prospectus which are important to our business. "ACell," "MicroMatrix," "Cytal," "Gentrix" and our other registered and common law trade names, trademarks and service marks are the property of ACell, Inc. Other trade names, trademarks and service marks used in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We may take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm under Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," our annual gross

9

revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until those standards apply to private companies. We have elected to use the extended transition period under the JOBS Act. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

10

The offering

Common stock offered by us |

5,000,000 shares | |

Option to purchase additional shares of common stock offered by the selling stockholders |

750,000 shares |

|

Common stock to be outstanding after this offering |

22,675,510 shares |

|

Use of proceeds |

We estimate that our net proceeds from the sale of our common stock that we are offering will be approximately $67.4 million, assuming an initial public offering price of $15.00 per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. |

|

|

The principal purposes of this offering are to increase our capitalization and financial flexibility, to create a public market for our common stock and to facilitate our future access to the capital markets. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds we receive from this offering. However, we currently intend to use the net proceeds we receive from this offering to increase awareness of our technology and products, fund clinical trials and post-market studies, grow our sales force, upgrade our Lafayette, Indiana facility, expand our international sales, expand and enhance our product portfolio and for working capital and general corporate purposes. |

|

|

See "Use of proceeds" for additional information. |

|

Selling stockholders |

Certain selling stockholders have granted the underwriters an option to purchase 750,000 shares of common stock. See "Principal and selling stockholders" for additional information. |

|

Risk factors |

You should carefully read the section titled "Risk factors" beginning on page 14 and the other information included in this prospectus for a discussion of facts that you should consider before deciding to invest in shares of our common stock. |

|

Proposed Nasdaq Global Market symbol |

"ACLL" |

The number of shares of common stock that will be outstanding after this offering is based on 17,675,510 shares, which consists of (i) 4,806,044 shares of common stock outstanding as of March 31, 2020 and (ii) 12,869,466 shares of common stock issuable upon the automatic conversion

11

of all outstanding shares of convertible preferred stock, which will occur immediately prior to the completion of this offering. This number excludes:

- ➤

- 2,609,229 shares of common stock issuable on the exercise of outstanding stock

options as of March 31, 2020 under our 2002 Stock Option and Incentive Plan, or 2002 Plan, our 2011 Stock Option and Grant Plan, or 2011 Plan, and granted outside of our equity incentive plans,

with a weighted average exercise price of $5.13 per share;

- ➤

- 2,206 shares of common stock issuable on the exercise of a common stock warrant

at an exercise price of $1.13 per share, which will expire upon the earlier of August 24, 2020 or the completion of this offering;

- ➤

- 4,925,786 shares of common stock reserved for future issuance under our 2020

equity incentive plan, or our 2020 Plan, which will become effective immediately prior to the execution of the underwriting agreement related to this offering, as well as any future increases,

including annual automatic evergreen increases, in the number of shares of common stock reserved for issuance thereunder, and any shares underlying outstanding stock awards granted under our 2002 Plan

and 2011 Plan that expire or are repurchased, forfeited, cancelled or withheld, as more fully described in the section titled "Executive compensation—Equity Incentive Plans"; and

- ➤

- 282,396 shares of common stock reserved for issuance under our employee stock purchase plan, or our ESPP, which will become effective immediately prior to the execution of the underwriting agreement related to this offering, as well as any future increases, including annual automatic evergreen increases, in the number of shares of common stock reserved for future issuance thereunder.

In addition, unless we specifically state otherwise, the information in this prospectus assumes:

- ➤

- a 1-for-2.8329 reverse stock split of our common stock effected on

July 10, 2020;

- ➤

- the filing of our amended and restated certificate of incorporation and the

effectiveness of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering;

- ➤

- no exercise of the underwriters' option to purchase additional shares of common

stock from the selling stockholders in this offering; and

- ➤

- no exercise of the outstanding stock options and warrant described above.

12

Summary financial data

The summary statements of operations data for the fiscal years ended December 31, 2019 and 2018 have been derived from our audited financial statements included elsewhere in this prospectus. The summary statements of operations data for the three months ended March 31, 2020 and 2019 and the summary balance sheet data as of March 31, 2020 have been derived from our unaudited interim financial statements included elsewhere in this prospectus. You should read the financial data set forth below in conjunction with our financial statements and the accompanying notes and the information in the section titled "Management's discussion and analysis of financial condition and results of operations" included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected for any period in the future.

| |

Year ended December 31, |

Three months ended March 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Statements of operations data:

|

2019

|

2018

|

2020

|

2019

|

|||||||||

| | | | | | | | | | | | | | |

| |

(in thousands, except share and per share data)

|

||||||||||||

Revenue |

$ | 100,794 | $ | 89,221 | $ | 23,684 | $ | 24,151 | |||||

Cost of goods sold |

19,111 | 16,289 | 4,646 | 4,434 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

81,684 | 72,932 | 19,038 | 19,716 | |||||||||

| | | | | | | | | | | | | | |

Operating expenses: |

|||||||||||||

Selling, general and administrative |

72,364 | 66,977 | 20,040 | 17,438 | |||||||||

Research and development |

7,944 | 9,020 | 1,739 | 2,288 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

80,307 | 75,997 | 21,779 | 19,725 | |||||||||

| | | | | | | | | | | | | | |

Income (loss) from operations |

1,376 | (3,065 | ) | (2,741 | ) | (9 | ) | ||||||

| | | | | | | | | | | | | | |

Other income (expense): |

|||||||||||||

Interest expense |

(373 | ) | (303 | ) | (98 | ) | (127 | ) | |||||

Interest income |

166 | 180 | 24 | 42 | |||||||||

Other income |

121 | 9 | 59 | — | |||||||||

| | | | | | | | | | | | | | |

Total other expense |

(87 | ) | (115 | ) | (15 | ) | (85 | ) | |||||

| | | | | | | | | | | | | | |

Income (loss) before income taxes |

1,289 | (3,180 | ) | (2,756 | ) | (94 | ) | ||||||

Income taxes benefit |

160 | 49 | 86 | 160 | |||||||||

| | | | | | | | | | | | | | |

Net income (loss) |

$ | 1,449 | $ | (3,131 | ) | $ | (2,671 | ) | $ | 66 | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net income (loss) per common share, basic(1) |

$ | 0.08 | $ | (0.78 | ) | $ | (0.56 | ) | $ | 0.00 | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net income (loss) per common share, diluted(1) |

$ | 0.08 | $ | (0.78 | ) | $ | (0.56 | ) | $ | 0.00 | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted average number of common shares outstanding, basic(1) |

4,715,669 | 4,006,027 | 4,802,342 | 4,659,219 | |||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted average number of common shares outstanding, diluted(1) |

5,885,061 | 4,006,027 | 4,802,342 | 5,918,452 | |||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Pro forma net income (loss) per common share, basic(1) |

$ | 0.08 | $ | (0.15 | ) | ||||||||

Pro forma net income (loss) per common share, diluted(1) |

$ | 0.08 | $ | (0.15 | ) | ||||||||

Pro forma weighted average number of common shares outstanding, basic(1) |

17,585,135 | 17,671,808 | |||||||||||

Pro forma weighted average number of common shares outstanding, diluted(1) |

18,754,527 | 17,671,808 | |||||||||||

- (1)

- See Note 2 to our financial statements appearing at the end of this prospectus for further details on the calculations of basic and diluted net income (loss) per common share. The pro forma numbers above also give effect to the issuance of 12,869,466 shares of common stock issuable upon the automatic conversion of all outstanding shares of convertible preferred stock, which will occur immediately prior to the completion of this offering.

13

| |

As of March 31, 2020 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Balance sheet data:

|

Actual

|

Pro forma(1)

|

Pro forma as adjusted(2)(3) |

|||||||

| | | | | | | | | | | |

| |

(in thousands)

|

|||||||||

Cash and cash equivalents |

$ | 4,559 | $ | 19,099 | $ | 86,978 | ||||

Working capital(4) |

16,705 | 31,245 | 98,551 | |||||||

Total assets |

38,976 | 53,516 | 120,293 | |||||||

Legal settlement liability, including current portion(5) |

12,325 | 12,325 | 12,325 | |||||||

Debt |

500 | 15,040 | 15,040 | |||||||

Total liabilities |

22,312 | 36,852 | 36,279 | |||||||

Convertible preferred stock |

33 | — | — | |||||||

Additional paid-in capital |

42,715 | 42,748 | 110,080 | |||||||

Accumulated deficit |

(26,089 | ) | (26,089 | ) | (26,089 | ) | ||||

Total stockholders' equity |

16,664 | 16,664 | 84,014 | |||||||

- (1)

- The

pro forma balance sheet data gives effect to the automatic conversion of all outstanding shares of convertible preferred stock into an aggregate of 12,869,466

shares of common stock, which will occur immediately prior to the completion of this offering, as well as the receipt in April 2020 of (i) $9.0 million as part of the federal Paycheck

Protection Program which we refer to as the PPP loan, and (ii) $5.5 million from the SVB line of credit.

- (2)

- The

pro forma as adjusted balance sheet data gives effect to (a) the items described in footnote (1) above and (b) our receipt of estimated net

proceeds from the sale of 5,000,000 shares of common stock that we are offering at an assumed initial public offering price of $15.00 per share, the midpoint of the estimated price range set forth on

the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

- (3)

- A

$1.00 increase (decrease) in the assumed initial public offering price of $15.00 per share, the midpoint of the estimated price range set forth on the cover page

of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, total assets, and total stockholders' equity by $4.7 million, assuming that the number of

shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and commissions and estimated

offering expenses payable by us. Each increase (decrease) of 1,000,000 shares in the number of shares of common stock offered by us would increase (decrease) each of cash and cash equivalents, working

capital, total assets, and total stockholders' equity by $14.0 million, assuming the assumed initial public offering price of $15.00 per share of common stock remains the same, and after

deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

- (4)

- Working

capital is defined as current assets less current liabilities.

- (5)

- Represents payment obligations pursuant to settlement agreements with the U.S. federal government and certain states. See "Business—Legal proceedings" for more details regarding these settlement agreements.

14

Risk factors

An investment in our common stock involves a high degree of risk. You should consider carefully the following risks and other information contained in this prospectus before you decide whether to buy our common stock. If any of the events contemplated by the following discussion of risks should occur, our business, results of operations, financial condition and growth prospects could suffer significantly. As a result, the market price of our common stock could decline, and you may lose all or part of the money you paid to buy our common stock. The risks below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business. Certain statements below are forward-looking statements. See "Special note regarding forward-looking statements" in this prospectus.

RISKS RELATED TO OUR BUSINESS AND GROWTH STRATEGY

We may not be profitable in the near term or maintain profitability in the future.

We reported a net loss of $2.7 million for the three months ended March 31, 2020 and there can be no assurance that we will achieve or maintain profitability in the future. As of March 31, 2020, we had an accumulated deficit of $26.1 million. Our future profitability depends on, among other things, our ability to generate revenue in excess of our costs. We expect to incur significant operating costs in the near term as we conduct or fund research, including clinical trials and post-market studies, seek to expand our product portfolio and the applications for which our products may be used, grow our commercial organization and incur additional expenses related to operating as a public company. In addition, we have significant and continuing fixed costs relating to the maintenance of our assets and business. We may incur significant losses in the future for a number of reasons, including the other risks described in this prospectus and specifically those related to the COVID-19 pandemic, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events.

We may be unable to successfully execute on our growth strategy.

We intend to grow our business and market opportunity by further penetrating our current acute care customer accounts, growing our acute care customer base, selectively expanding the sale of our products into non-acute care settings, expanding our international sales opportunity and enhancing and expanding our product portfolio. Each of these growth strategies will require considerable time and resources, and we may not be successful in executing on any or all of these strategies. Furthermore, the continued impact of the COVID-19 pandemic may delay our ability to execute on our strategy.

A primary component of our growth strategy is to increase awareness of our products in the markets in which we compete. We may be unable to increase awareness cost-efficiently, on a timely basis or at all among hospitals, wound care centers, long-term acute care hospitals, or LTACHs, government facilities, ambulatory surgical centers, physician offices and patient advocates, as well as other key clinical and economic decision-makers. A significant part of our strategy to increase awareness is to continue the development of data supporting the clinical benefits of porcine urinary bladder matrix, or UBM. In order to do so, we will be required to invest significant time, resources and money in conducting or sponsoring research, including clinical trials and post-market studies, which could divert our resources from other parts of our business and growth strategy. Even if we are able to develop additional data on UBM and our products, there is no guarantee that the data will support the efficacy, cost-effectiveness and other benefits of our products at all or to the extent we expect. If the outcomes of such studies and trials are not positive or do not show statistically significant benefits of UBM, our technology platform or our products, we may suffer setbacks in increasing awareness and adoption of our products despite making these significant investments.

15

Risk factors

Another component of our growth strategy is to expand and enhance our product portfolio, including expanding treatment applications for our current products. We intend to submit additional 510(k) premarket notifications in the coming years to pursue a number of initiatives, which include adding features and designs to our existing products as well as expanding treatment applications for these products. We may not be successful in obtaining the regulatory clearances that we seek, which could limit our market opportunities for our products. In addition, we are actively considering other product opportunities for which the U.S. Food and Drug Administration, or the FDA, may require a premarket approval application, or PMA, or biologics license application, or BLA, to commercialize. We have no experience applying for or receiving approval of a PMA or BLA and may not be successful in these efforts.

Our growth strategy also involves expanding our international operations. In addition to risks associated with international operations in general, we will also need to navigate complex foreign regulatory requirements with which we may not be familiar or have experience. To obtain regulatory approval in other countries, we must comply with numerous and varying regulatory requirements of such countries regarding safety, efficacy, manufacturing, clinical trials, commercial sales, pricing and distribution of our products. Although we have received regulatory clearance for our products in the United States and some other countries, we cannot ensure that we will obtain regulatory clearance or approval in other countries. If we fail to obtain regulatory clearance approval in any jurisdiction, the geographic market for our products could be limited.

There are several aspects of our growth strategy and opportunities to grow our sales and product portfolio. However, we have limited financial and managerial resources, and we may forego or delay pursuit of growth opportunities that later prove to have greater value to our business. Our resource allocation decisions may cause us to fail to capitalize on viable opportunities, and we could spend resources on strategies that are not ultimately successful.

Our future success will largely depend on our ability to maintain and further grow clinical acceptance and adoption of our products, and we may be unable to adequately educate healthcare practitioners on the use and benefits of our products.

Healthcare practitioners play a significant role in determining the course of a patient's treatment and, ultimately, the type of product that will be used to treat the patient. As a result, our commercial success is heavily dependent on our ability to educate these practitioners on the use of our products in surgical soft tissue repair procedures and complex wound management. Acceptance and adoption of our products in our markets depends on educating healthcare practitioners as to the distinctive characteristics, benefits, safety, clinical efficacy and cost-effectiveness of our products, including potential comparisons to our competitors' products, and on training healthcare practitioners in the proper application of our products. If we are not successful in convincing healthcare practitioners of the merits and advantages of our products compared to our competitors' products, they may not use our products and we will be unable to increase our sales and sustain growth or profitability.

Convincing healthcare practitioners to dedicate the time and energy necessary to properly train to use new products and techniques is challenging, and we may not be successful in these efforts. In particular, as healthcare resources are strained due to the ongoing COVID-19 pandemic, it may be more difficult to convince healthcare practitioners to commit their time and resources to learning to use a new product. If healthcare practitioners are not properly trained, they may use our products ineffectively, resulting in unsatisfactory patient outcomes, patient injury, negative publicity or lawsuits against us. Accordingly, even if our products show superior benefits, safety or efficacy, based on head-to-head clinical trials, in comparison to alternative treatments, our success will depend on our ability to gain and maintain market acceptance for our products. If we fail to do so, our sales will not

16

Risk factors

grow and our business, financial condition and results of operations will be adversely affected. We may not have adequate resources to effectively educate the medical community and our efforts may not be successful due to physician resistance or negative perceptions regarding our products.

Healthcare practitioners may be hesitant to change their medical treatment practices for the following reasons, among others:

- ➤

- lack of experience with extracellular matrix and UBM technologies or other

biologically-derived regenerative products;

- ➤

- lack or perceived lack of evidence supporting additional patient benefits;

- ➤

- perceived liability risks generally associated with the use of new products and

procedures;

- ➤

- limited or lack of availability of coverage and reimbursement within healthcare

payment systems;

- ➤

- existing sole-source supply contracts with purchasing entities, such as

hospital systems and group purchasing organizations, or GPOs, that do not use our products;

- ➤

- limited or lack of available published clinical data;

- ➤

- pressure to contain costs and use lower cost alternatives to our products;

- ➤

- costs associated with the purchase of new products; and

- ➤

- the time commitment that may be required for training to use new products or technologies.

In addition, we believe recommendations and support of our products by key opinion leaders are essential for market acceptance and adoption. If we do not receive support from such key opinion leaders or if long-term clinical data does not show the benefits of using our products, we may not achieve adequate commercial acceptance of our products.

We could be subject to increased monetary penalties and other sanctions, including exclusion from federal healthcare programs, if we fail to comply with the terms of our Federal Settlement Agreement, State Settlement Agreements or Corporate Integrity Agreement.

On May 14, 2019, we entered into a civil False Claims Act settlement with the United States, acting through the United States Department of Justice and on behalf of the Office of Inspector General of the Department of Health and Human Services, or OIG-HHS, the Defense Health Agency, acting on behalf of the TRICARE Program and the United States Department of Veteran Affairs, which is referred to herein as the Federal Settlement Agreement. As contemplated by the Federal Settlement Agreement, the United States Attorney's Office for the District of Maryland, or USAO, filed an Information against us on June 6, 2019, in a case captioned United States of America v. ACell, Inc., Action No. ELH-19-0282 in the United States District Court for the District of Maryland, and, on June 11, 2019, we entered into a plea agreement with the USAO on behalf of the Department of Justice and pled guilty to one misdemeanor count of failure to report a medical device removal. In connection with the plea agreement, we also agreed to pay a criminal fine of $3.0 million and establish and maintain a compliance and ethics program. On May 14, 2019, we also entered into civil False Claims Act settlement agreements with the states of Maryland, Wisconsin, and Florida, which are referred to collectively herein as the State Settlement Agreements, on the basis of the same conduct that was the subject of the Federal Settlement Agreement.

Under the terms of the Federal Settlement Agreement and the State Settlement Agreements, we have agreed to pay to the Department of Justice and the states of Maryland, Wisconsin, and Florida a total

17

Risk factors

of $12.8 million, plus interest at a rate of 2.875%, referred to herein as the Settlement Amount, over the course of five years, and a total amount of $222,500 in attorneys' fees and costs for plaintiffs' counsel in the two qui tam complaints. Subject to our payment of the Settlement Amount, the United States has released us from any civil or administrative monetary claim the United States has under the False Claims Act and certain other statutes and common law theories of liability arising from the conduct that was the subject of the Federal Settlement Agreement, and the states of Maryland, Wisconsin and Florida have released us from any civil or administrative monetary cause of action that the state had for any claims submitted or caused to be submitted to the state's Medicaid Programs as a result of the conduct covered by the State Settlement Agreements. Likewise, in consideration of the obligations in the Federal Settlement Agreement and the Corporate Integrity Agreement, as described below, OIG-HHS agreed to release and refrain from instituting, directing or maintaining any administrative action seeking to exclude us from Medicare, Medicaid and other Federal health care programs.

If we violate the terms of the Federal Settlement Agreement or State Settlement Agreements, consequences could include accelerated settlement payments, rescission of the agreements and/or exclusion or disbarment from participation in all federal health care programs. A breach of the terms of our plea agreement could result in the rescission of the plea agreement and monetary penalties.

On May 13, 2019, we entered into a Corporate Integrity Agreement with the OIG-HHS. The Corporate Integrity Agreement has a term of five years and contains various compliance obligations designed to help ensure our ongoing compliance with federal health care program requirements. The terms of the Corporate Integrity Agreement include internal monitoring requirements, compliance training, certification obligations by our Board of Directors and certain employees, reporting requirements to OIG-HHS, and the engagement of an independent review organization to review and prepare written reports regarding reviews of certain of our systems and transactions.

If we fail to comply with the terms of the Corporate Integrity Agreement, we may be required to pay certain monetary penalties. Furthermore, material, uncorrected violations of the Corporate Integrity Agreement could lead to our exclusion or disbarment from participation in Medicare, Medicaid and other federal and state healthcare programs and subject us to repayment obligations. Any such exclusion or disbarment would result in the revocation or termination of certain government contracts and potentially have a material adverse effect on our results of operations. In addition, the Corporate Integrity Agreement increases the amount of information we must provide to the federal government regarding our compliance with federal regulations. The reports we provide in connection with the Corporate Integrity Agreement could result in greater scrutiny by other regulatory agencies.

In addition, we could be subject to future investigations. Many healthcare companies have announced government investigations of their sales and marketing practices and other activities. Even with compliance training and a company culture of compliance, our current or future practices may nonetheless become the subject of an investigation. A number of laws, often referred to as "whistleblower" statutes, provide for financial rewards to employees and others for bringing to the attention of the government practices that the government views as illegal or fraudulent. The costs of investigating any claims, responding to subpoenas of investigators and any resulting fines can be significant and could divert the attention of our management from operating our business.

18

Risk factors

The global COVID-19 pandemic and related impacts are having an adverse effect on our operations, financial performance and cash flows. We are unable to predict the extent to which the pandemic and related impacts will continue to adversely impact our business operations, financial performance, results of operations, financial position and the achievement of our strategic objectives.

Our operations, financial performance and cash flows have been negatively impacted by the COVID-19 pandemic that has caused, and is expected to continue to cause, the global slowdown of economic activity, including the decrease in demand for a broad variety of goods and services, disruptions in global supply chains and significant volatility and disruption of financial markets. Because the severity, magnitude and duration of the COVID-19 pandemic and its economic consequences are uncertain, rapidly changing, and difficult to predict, the pandemic's impact on our operations and financial performance, as well as its impact on our ability to successfully execute our business strategies and initiatives, remains uncertain and difficult to predict. In addition, the ultimate impact of the COVID-19 pandemic on our operations and financial performance depends on many factors that are not within our control.

The COVID-19 pandemic has subjected, and is expected to continue to subject, our operations, financial performance and financial condition to a number of risks including, but not limited to, the following:

- ➤

- Product sales

risks: Beginning in mid-March 2020, we began experiencing decreased demand for our products, resulting in a material decrease in our product sales. As a result of

impacts associated with preventive and precautionary measures that we, other businesses and governments are taking to quell the spread of COVID-19 and protect our customers, employees, and the

patients receiving our products, we may experience significant and unpredictable reductions in demand for certain of our products as health care customers re-prioritize the treatment of patients. This

decrease in demand, and potential decreased demand in the future, may be attributable to:

- •

- Lower rates of traumatic acute wounds. We believe that state stay-at-home

orders, closures of businesses, restrictions on travel and social distancing measures have all contributed to fewer acute injuries as people stay and work in their homes.

- •

- Slowdown of elective surgeries. In the United States in mid-March 2020,

governmental authorities began recommending, and in certain cases required, that elective procedures be suspended or canceled to avoid non-essential patient exposure to medical environments and

potential infection with COVID-19 and to focus limited resources and personnel capacity toward the treatment of COVID-19. Although some healthcare facilities are in the early stages of resuming

elective procedures, these policies vary from facility to facility.

- •

- Temporary hospital limitations and restrictions on visitors. A key element of

our strategy and success has been the relationships our sales representatives have forged with hospitals and physicians, and their presence in the operating room when the decision to use our products

is made. As hospitals seek to limit the spread of COVID-19, many have instituted temporary restrictions which have included requiring some of our sales force personnel to present documentation of a

negative COVID-19 test result in order to be present in the hospital.

- ➤

- Operations-related risks: We are facing increased operational challenges from the need to protect employee health and safety. While many of our employees are able to work remotely, we also must continue our manufacturing and distribution operations. We have implemented new safety measures designed to minimize risk for our employees and, ultimately, our customers, such as enacting a new screening protocol to identify employees who may have been exposed to COVID-19 and having

19

Risk factors

these employees work in two-week rotating shifts. However, because the severity, magnitude, and duration of the COVID-19 pandemic and its economic consequences are uncertain, rapidly changing, and difficult to predict, we may, in the future, have to consider taking additional actions including further reductions to salary and work hours, furloughs, restructuring, layoffs or extensions of remote work arrangements, which may negatively impact our workforce and our business. These negative impacts could include inhibiting our ability to quickly respond to increased customer demand and to take advantage of more favorable economic and market conditions after the pandemic subsides as well as lower productivity and higher employee attrition.

- ➤

- Liquidity- and funding-related risks: Although we had cash and cash equivalents of $4.6 million as of March 31, 2020 and have subsequently drawn approximately $5.5 million on our line of credit and received approximately $9.0 million as part of the federal Paycheck Protection Program, a prolonged period of generating lower cash flows from operations could adversely affect our financial condition and the achievement of our strategic objectives. Additionally, as a result of weaker than previously anticipated operating and financial performance of our business, our cost of funds and related margins, liquidity, competitive position and access to capital markets may be adversely affected, negatively impacting our business. Any future credit downgrades could further adversely affect our cost of funds and related margins, liquidity, competitive position and access to capital markets, and a significant downgrade could have an adverse commercial impact on our business. Conditions in the financial and credit markets may also limit the availability of funding or increase the cost of funding, which could adversely affect our business, financial position and results of operations. Although the U.S. federal and other governments have announced a number of funding programs to support businesses, our ability or willingness to access funding under such programs may be limited by regulations or other guidance, by further change or uncertainty related to the terms of these programs or by being a public company.

As the COVID-19 pandemic continues to adversely affect our operating and financial results, it may also have the effect of heightening many of the other risks described in this prospectus. Further, the COVID-19 pandemic may also affect our operating and financial results in a manner that is not presently known to us or that we currently do not expect to present significant risks to our operations or financial results, particularly if the COVID-19 pandemic and its associated impacts reoccur in successive waves in the coming months.

Our results of operations could suffer if we are unable to manage our planned international expansion effectively.