Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hi-Crush Inc. | d939998d8k.htm |

Cleansing Materials July 2020 July 2020 D:\Hi-Crush\Project Holtz\Presentations\2020.07.12 Public Disclosures\2020.07.12 Cleansing Materials_v05.pptx Time Stamp : 9 March 2017 10:42:26 Exhibit 99.1

Forward Looking Statements and Non-GAAP Measures Cleansing Materials Forward-Looking Statements and Cautionary Statements Some of the information in this presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements give our current expectations, and contain projections of results of operations or of financial condition, or forecasts of future events. Words such as "may," "should," "assume," "forecast," "position," "predict," "strategy," "expect," "intend," "hope," "plan," "estimate,“ "anticipate," "could," "believe," "project," "budget," "potential," "likely," or "continue," and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Hi-Crush Inc. reports filed with the SEC, including those described under Item 1A of Hi-Crush Inc. Form 10-K for the year ended December 31, 2019. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward looking statements include: the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any pending litigation, claims or assessments, including unasserted claims; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush Inc. forward-looking statements speak only as of the date made and Hi-Crush Inc. undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Hi-Crush Inc. most recent earnings release at www.hicrushinc.com. 1

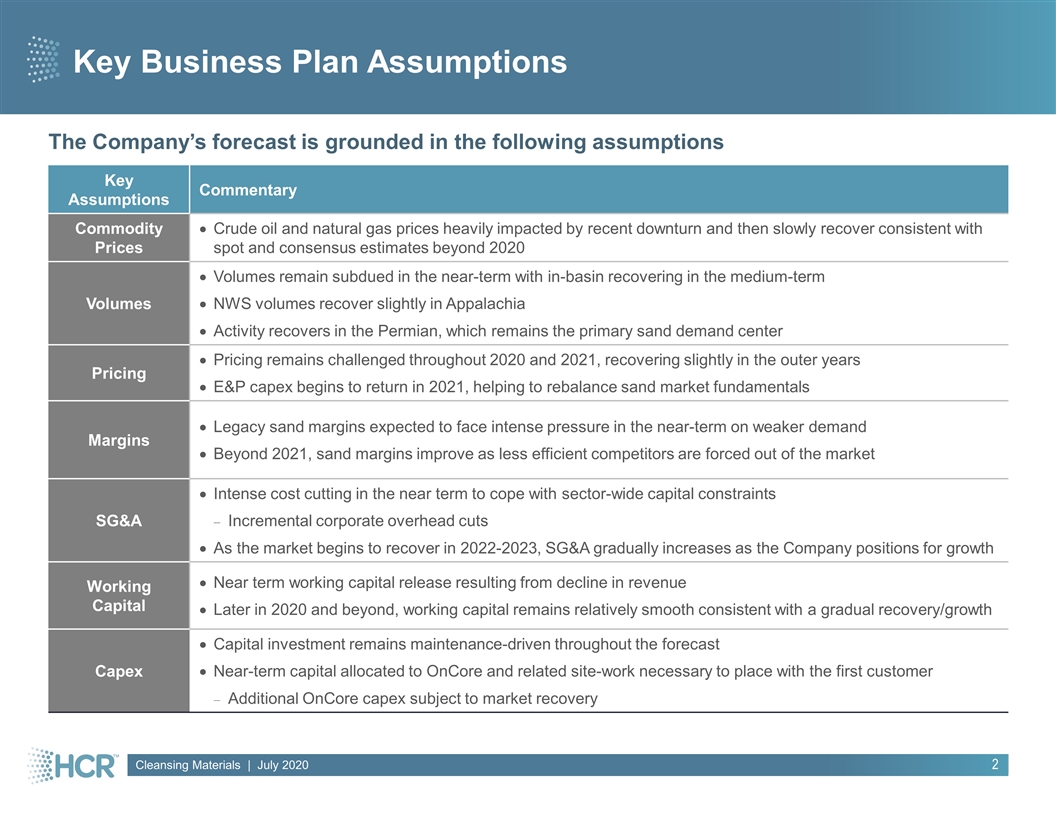

Key Business Plan Assumptions Cleansing Materials The Company’s forecast is grounded in the following assumptions Key Assumptions Commentary Commodity Prices Crude oil and natural gas prices heavily impacted by recent downturn and then slowly recover consistent with spot and consensus estimates beyond 2020 Volumes Volumes remain subdued in the near-term with in-basin recovering in the medium-term NWS volumes recover slightly in Appalachia Activity recovers in the Permian, which remains the primary sand demand center Pricing Pricing remains challenged throughout 2020 and 2021, recovering slightly in the outer years E&P capex begins to return in 2021, helping to rebalance sand market fundamentals Margins Legacy sand margins expected to face intense pressure in the near-term on weaker demand Beyond 2021, sand margins improve as less efficient competitors are forced out of the market SG&A Intense cost cutting in the near term to cope with sector-wide capital constraints Incremental corporate overhead cuts As the market begins to recover in 2022-2023, SG&A gradually increases as the Company positions for growth Working Capital Near term working capital release resulting from decline in revenue Later in 2020 and beyond, working capital remains relatively smooth consistent with a gradual recovery/growth Capex Capital investment remains maintenance-driven throughout the forecast Near-term capital allocated to OnCore and related site-work necessary to place with the first customer Additional OnCore capex subject to market recovery 2

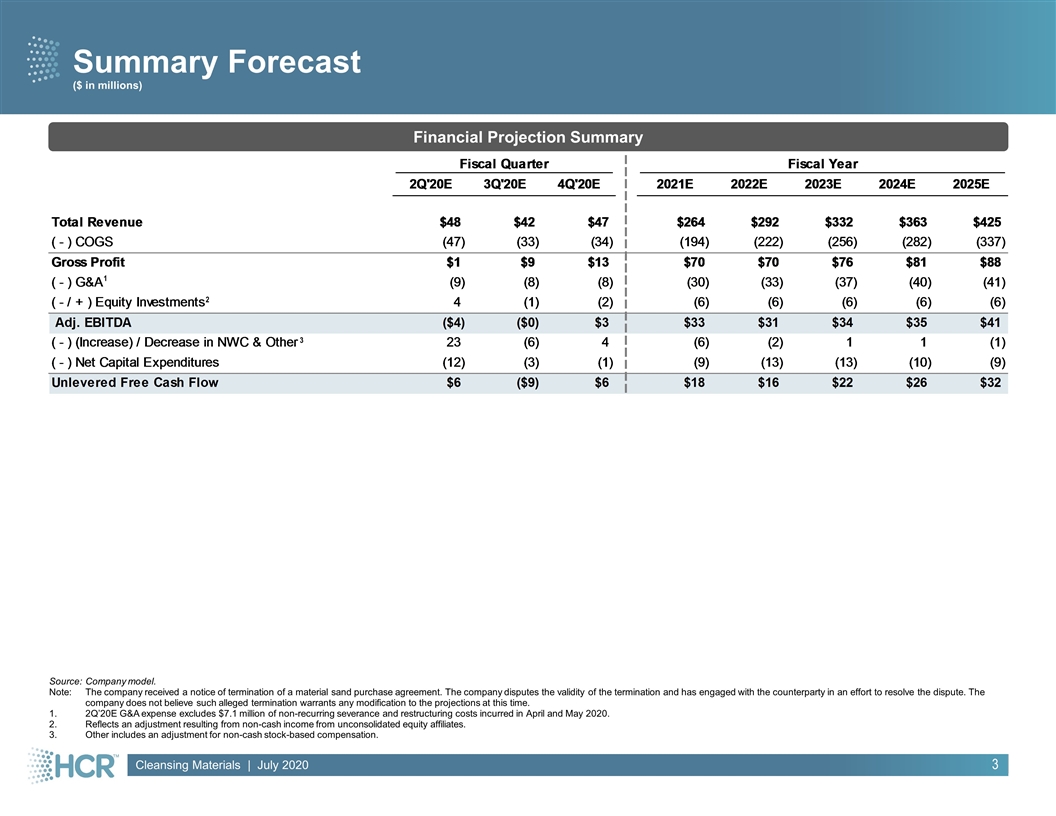

Summary Forecast ($ in millions) Cleansing Materials Financial Projection Summary 3 Source:Company model. Note:The company received a notice of termination of a material sand purchase agreement. The company disputes the validity of the termination and has engaged with the counterparty in an effort to resolve the dispute. The company does not believe such alleged termination warrants any modification to the projections at this time. 1.2Q’20E G&A expense excludes $7.1 million of non-recurring severance and restructuring costs incurred in April and May 2020. 2.Reflects an adjustment resulting from non-cash income from unconsolidated equity affiliates. 3.Other includes an adjustment for non-cash stock-based compensation. 1 3 2