Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MultiPlan Corp | tm2024610d1_ex99-1.htm |

| EX-10.6 - EXHIBIT 10.6 - MultiPlan Corp | tm2024610d1_ex10-6.htm |

| EX-10.5 - EXHIBIT 10.5 - MultiPlan Corp | tm2024610d1_ex10-5.htm |

| EX-10.4 - EXHIBIT 10.4 - MultiPlan Corp | tm2024610d1_ex10-4.htm |

| EX-10.3 - EXHIBIT 10.3 - MultiPlan Corp | tm2024610d1_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - MultiPlan Corp | tm2024610d1_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - MultiPlan Corp | tm2024610d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - MultiPlan Corp | tm2024610d1_ex2-1.htm |

| 8-K - FORM 8-K - MultiPlan Corp | tm2024610-1_8k.htm |

Exhibit 99.2

CHURCHILL CAPITAL | Investor Presentation July 2020

CHURCHILL CAPITAL Forward - Looking Statements This communication includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United Sta tes Private Securities Litigation Reform Act of 1995. Terms such as “anticipate,” “believe,” “will,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “pre dic t,” “should,” “would,” or similar expressions may identify forward - looking statements, but the absence of these words does not mean the statement is not forward - looking. Such forward looking statements include estimated financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Churchill, MultiPlan or the combined company after completion of the business combination are based on current expectations that are subject to known and unknown risks and uncertainties, which could cause actual results or outco mes to differ materially from expectations expressed or implied by such forward looking statements. Actual events or results may differ materially from those discussed in forward - looking statements as a result of various risks a nd uncertainties, including: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to complete the transactions con tem plated by the merger agreement due to the failure to obtain approval of the stockholders of Churchill or other conditions to closing in the merger agreement; the ability to meet applicable listing stan dar ds following the consummation of the transactions contemplated by the merger agreement; the risk that the proposed transaction disrupts current plans and operations of MultiPlan as a result of the announcement and consummation of the transactions contemplated by the merger agreement; the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, amo ng other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees ; c osts related to the proposed business combination; changes in applicable laws or regulations; the possibility that Churchill, MultiPlan or the combined company may be adversely affected by other political, economic, business, and/or competitive factors; the imp ac t of COVID - 19 and its related effects on Churchill, MultiPlan or the combined company’s projected results of operations, financial performance or other financial metrics; and other risks an d uncertainties indicated from time to time in the final prospectus for its initial public offering, including those under “Risk Factors” therein, and other documen ts filed or to be filed with the Securities and Exchange Commission (“SEC”) by Churchill. Forward - looking statements speak only as of the date made and, except as required by law, Churchill and MultiPlan undertake no obligation to update or revise these forward - looking statements, whether as a result of new information, future events or otherwise. Anyone using the presentation does so at their own risk a nd no responsibility is accepted for any losses which may result from such use directly or indirectly. Investors should carry out their own due diligence in connection with the assumptions contained herei n. The forward - looking statements in this communication speak as of the date of this communication. Although Churchill may from time to time voluntarily update its prior forward - looking statements, it disclaims an y commitment to do so whether as a result of new information, future events, changes in assumptions or otherwise except as required by securities laws. For additional information regarding these and oth er risks faced by us, refer to our public filings with the SEC, available on the SEC’s website at www.sec.gov. Additional Information and Where to Find It In connection with the proposed business combination, Churchill will file with the SEC and furnish to Churchill’s stockholder s a proxy statement and other relevant documents. This communication shall not constitute an offer to sell or the solicitation of any offer to buy any securities of Churchill or the solicitation of any vo te or approval, nor shall there be any sale of securities of the Company in any state or jurisdiction, domestic or foreign, in which such offer, solicitation or sale would be unlawful prior to registration or quali fic ation under the securities laws of any such state or jurisdiction. Stockholders are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the pr oposed business combination or incorporated by reference in the proxy statement because they will contain important information about the proposed business combination. Investors will be able to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s websi te at http://www.sec.gov. Copies of the documents filed with the SEC by Churchill when and if available, can be obtained free of charge by directing a written request to Churchill Capital Corp III, 640 Fifth Av enue, 12th Floor, New York, NY 10019. The directors, executive officers and certain other members of management and employees of Churchill may be deemed “participa nts ” in the solicitation of proxies from stockholders of Churchill in favor of the proposed business combination. Information regarding the persons who may, under the rules of the SEC, be considered participa nts in the solicitation of the stockholders of Churchill in connection with the proposed business combination will be set forth in the proxy statement and the other relevant documents to be filed with the SEC . You can find information about Churchill’s executive officers and directors in Churchill’s filings with the SEC, including Churchill’s final prospectus for its initial public offering. Disclaimer 2

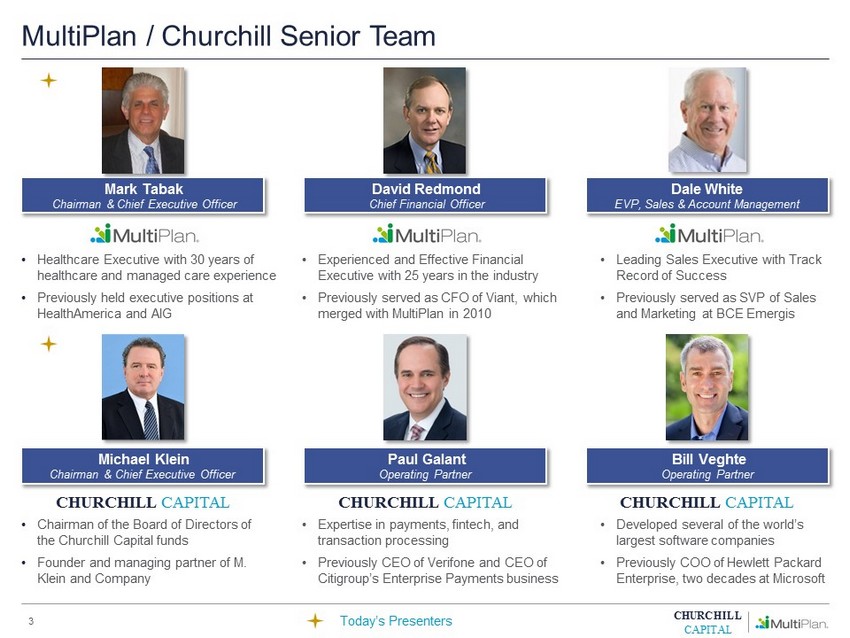

CHURCHILL CAPITAL Michael Klein Chairman & Chief Executive Officer CHURCHILL CAPITAL • Chairman of the Board of Directors of the Churchill Capital funds • Founder and managing partner of M. Klein and Company Mark Tabak Chairman & Chief Executive Officer • Healthcare Executive with 30 years of healthcare and managed care experience • Previously held executive positions at HealthAmerica and AIG David Redmond Chief Financial Officer • Experienced and Effective Financial Executive with 25 years in the industry • Previously served as CFO of Viant , which merged with MultiPlan in 2010 MultiPlan / Churchill Senior Team 3 Paul Galant Operating Partner Bill Veghte Operating Partner CHURCHILL CAPITAL CHURCHILL CAPITAL • Expertise in payments, fintech, and transaction processing • Previously CEO of Verifone and CEO of Citigroup’s Enterprise Payments business • Developed several of the world’s largest software companies • Previously COO of Hewlett Packard Enterprise, two decades at Microsoft Dale White EVP, Sales & Account Management • Leading Sales Executive with Track Record of Success • Previously served as SVP of Sales and Marketing at BCE Emergis Today’s Presenters

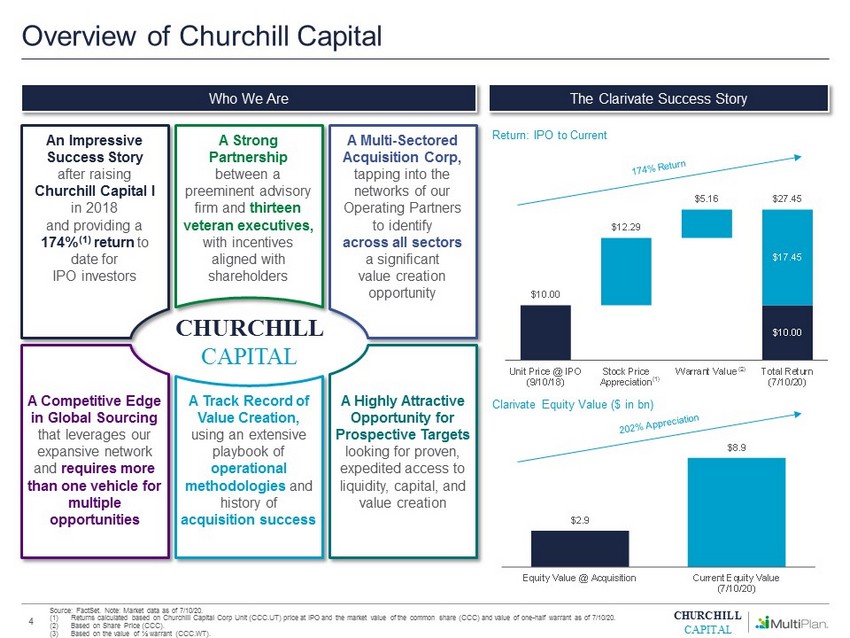

CHURCHILL CAPITAL $2.9 $8.9 Equity Value @ Acquisition Current Equity Value (7/10/20) $10.00 $17.45 $10.00 $12.29 $5.16 $27.45 Unit Price @ IPO (9/10/18) Stock Price Appreciation Warrant Value Total Return (7/10/20) Who We Are Source: FactSet. Note: Market data as of 7/10/20. (1) Returns calculated based on Churchill Capital Corp Unit (CCC.UT) price at IPO and the market value of the common share (CCC) and value of one - half warrant as of 7/10/20. (2) Based on Share Price (CCC). (3) Based on the value of ½ warrant (CCC.WT). An Impressive Success Story after raising Churchill Capital I in 2018 and providing a 174% (1) return to date for IPO investors A Strong Partnership between a preeminent advisory firm and thirteen veteran executives, with incentives aligned with shareholders A Multi - Sectored Acquisition Corp, tapping into the networks of our Operating Partners to identify across all sectors a significant value creation opportunity A Competitive Edge in Global Sourcing that leverages our expansive network and requires more than one vehicle for multiple opportunities A Track Record of Value Creation, using an extensive playbook of operational methodologies and history of acquisition success A Highly Attractive Opportunity for Prospective Targets looking for proven, expedited access to liquidity, capital, and value creation CHURCHILL CAPITAL Overview of Churchill Capital 4 Return: IPO to Current (2) (1) The Clarivate Success Story Clarivate Equity Value ($ in bn)

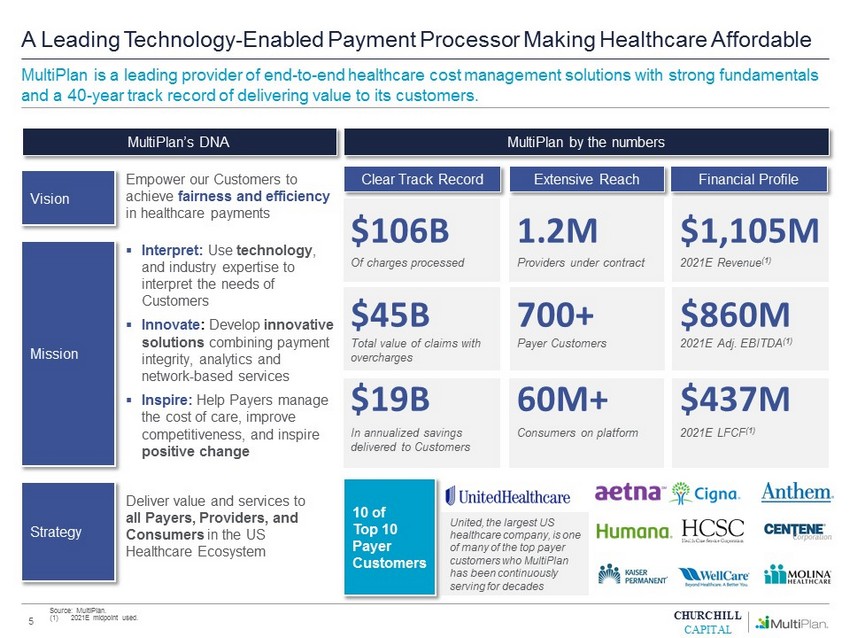

CHURCHILL CAPITAL A Leading Technology - Enabled Payment Processor Making Healthcare Affordable 5 $106B Of charges processed $19B In annualized savings delivered to Customers 1.2M Providers under contract 700+ Payer Customers Empower our Customers to achieve fairness and efficiency in healthcare payments ▪ Interpret: Use technology , and industry expertise to interpret the needs of Customers ▪ Innovate : Develop innovative solutions combining payment integrity, analytics and network - based services ▪ Inspire: Help Payers manage the cost of care, improve competitiveness, and inspire positive change Deliver value and services to all Payers, Providers, and Consumers in the US Healthcare Ecosystem United, the largest US healthcare company, is one of many of the top payer customers who MultiPlan has been continuously serving for decades 60M+ Consumers on platform $437M 2021E LFCF (1) $860M 2021E Adj. EBITDA (1) Clear Track Record Extensive Reach Financial Profile Source : MultiPlan . (1) 2021E midpoint used. $45B Total value of claims with overcharges Mission Strategy Vision 10 of Top 10 Payer Customers MultiPlan is a leading provider of end - to - end healthcare cost management solutions with strong fundamentals and a 40 - year track record of delivering value to its customers. MultiPlan by the numbers MultiPlan’s DNA $1,105M 2021E Revenue (1)

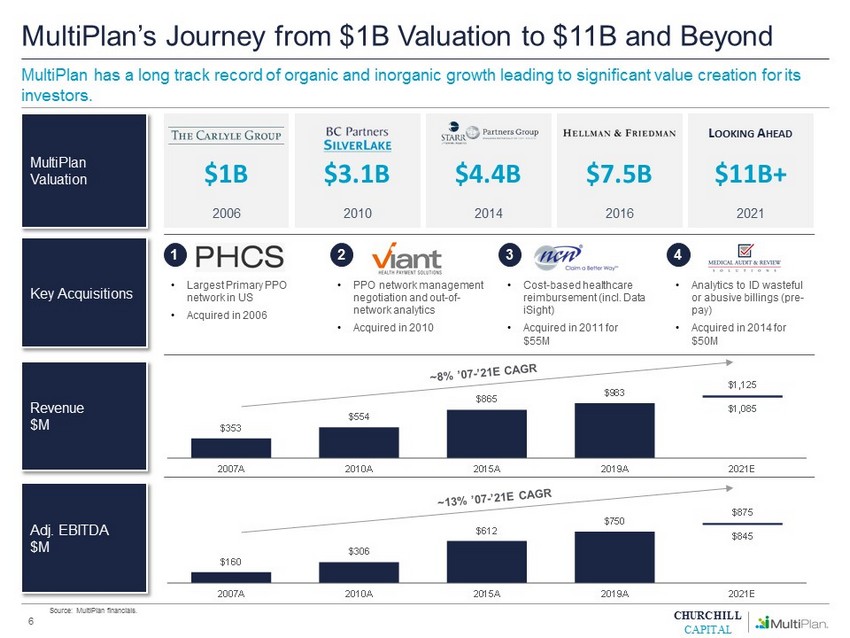

CHURCHILL CAPITAL MultiPlan’s Journey from $1B Valuation to $11B and Beyond Source: MultiPlan financials. 6 • Largest Primary PPO network in US • Acquired in 2006 • PPO network management negotiation and out - of - network analytics • Acquired in 2010 • Cost - based healthcare reimbursement (incl. Data iSight) • Acquired in 2011 for $55M • Analytics to ID wasteful or abusive billings (pre - pay) • Acquired in 2014 for $50M 1 2 3 4 2010 $3.1B 2006 $1B 2016 $7.5B 2014 $4.4B 2021 $11B+ L OOKING A HEAD MultiPlan has a long track record of organic and inorganic growth leading to significant value creation for its investors. Revenue $M MultiPlan Valuation Key Acquisitions Adj. EBITDA $M $1,085 $353 $554 $865 $983 $1,125 2007A 2010A 2015A 2019A 2021E $845 $160 $306 $612 $750 $875 2007A 2010A 2015A 2019A 2021E

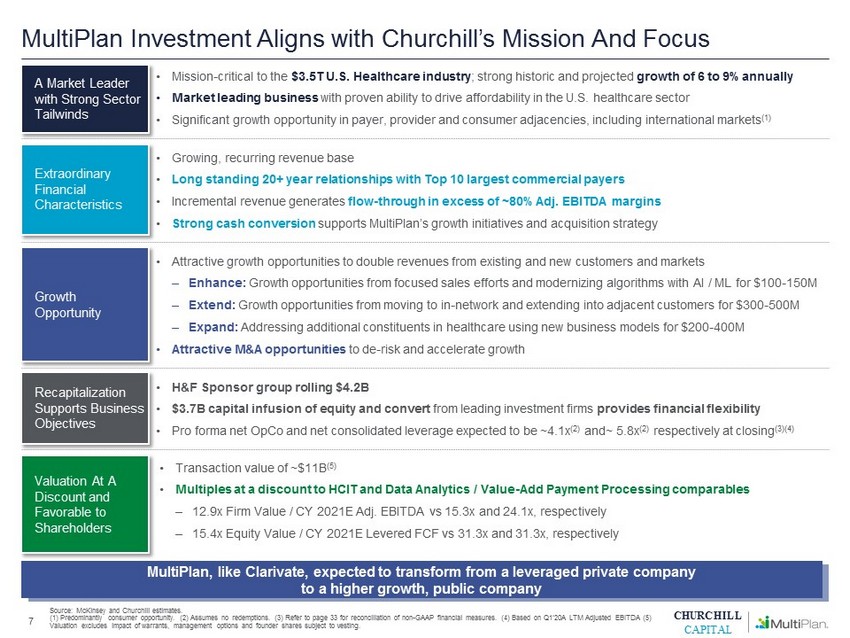

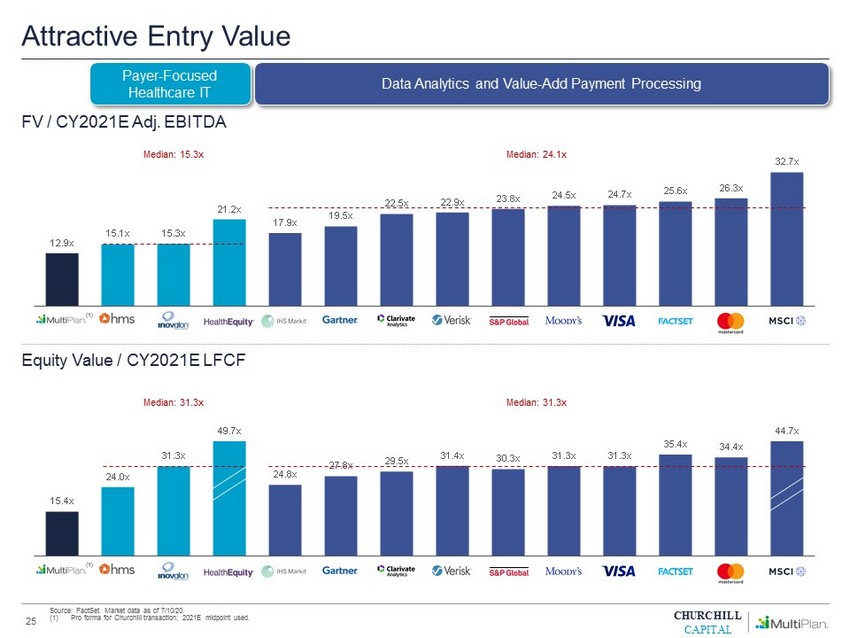

CHURCHILL CAPITAL MultiPlan Investment Aligns with Churchill’s Mission And Focus Source: McKinsey and Churchill estimates. (1) Predominantly consumer opportunity. (2) Assumes no redemptions. (3) Refer to page 33 for reconciliation of non - GAAP financia l measures. (4) Based on Q1’20A LTM Adjusted EBITDA (5) Valuation excludes impact of warrants, management options and founder shares subject to vesting. 7 Growth Opportunity A Market Leader with Strong Sector Tailwinds • Mission - critical to the $3.5T U.S. Healthcare industry ; strong historic and projected growth of 6 to 9% annually • Market leading business with proven ability to drive affordability in the U.S. healthcare sector • Significant growth opportunity in payer, provider and consumer adjacencies, including international markets (1) • Attractive growth opportunities to double revenues from existing and new customers and markets ‒ Enhance: Growth opportunities from focused sales efforts and modernizing algorithms with AI / ML for $100 - 150M ‒ Extend: Growth opportunities from moving to in - network and extending into adjacent customers for $300 - 500M ‒ Expand: Addressing additional constituents in healthcare using new business models for $200 - 400M • Attractive M&A opportunities to de - risk and accelerate growth Valuation At A Discount and Favorable to Shareholders • Transaction value of ~$11B (5) • Multiples at a discount to HCIT and Data Analytics / Value - Add Payment Processing comparables ‒ 12.9x Firm Value / CY 2021E Adj. EBITDA vs 15.3x and 24.1x, respectively ‒ 15.4x Equity Value / CY 2021E Levered FCF vs 31.3x and 31.3x, respectively Recapitalization Supports Business Objectives • H&F Sponsor group rolling $4.2B • $ 3.7 B capital infusion of equity and convert from leading investment firms provides financial flexibility • Pro forma net OpCo and net consolidated leverage expected to be ~4.1x (2) and~ 5.8x (2) respectively at closing (3)( 4 ) Extraordinary Financial Characteristics • Growing, recurring revenue base • Long standing 20+ year relationships with Top 10 largest commercial payers • Incremental revenue generates flow - through in excess of ~80% Adj. EBITDA margins • Strong cash conversion supports MultiPlan’s growth initiatives and acquisition strategy MultiPlan , like Clarivate, expected to transform from a leveraged private company to a higher growth, public company

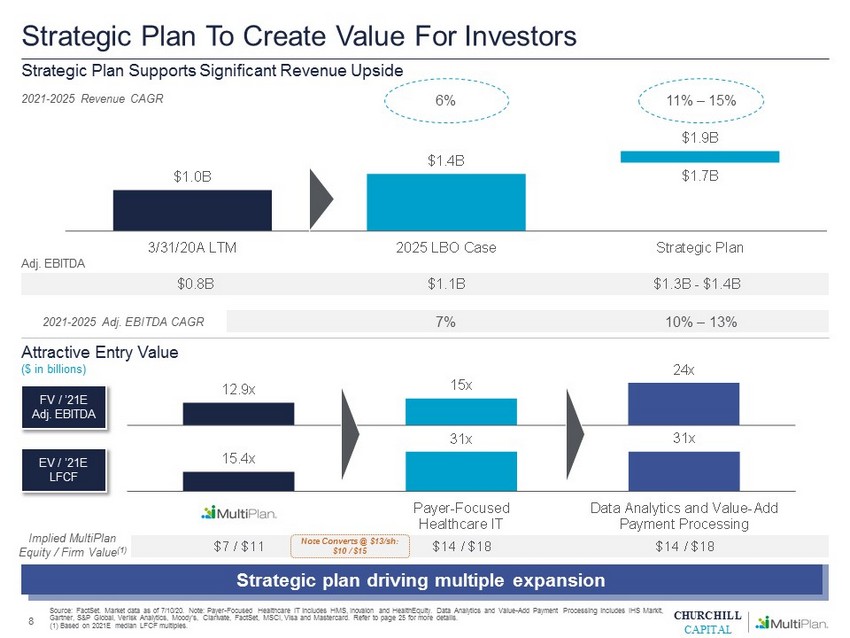

CHURCHILL CAPITAL $1.7B $1.0B $1.4B $1.9B 3/31/20A LTM 2025 LBO Case Strategic Plan 12.9x 15x 24x 15.4x 31x 31x Payer-Focused Healthcare IT Data Analytics and Value-Add Payment Processing $0.8B $1.1B $1.3B - $1.4B Strategic Plan To Create Value For Investors Source: FactSet. Market data as of 7/10/20. Note: Payer - Focused Healthcare IT includes HMS, Inovalon and HealthEquity. Data Analytics and Value - Add Payment Processing includes IHS Markit, Gartner, S&P Global, Verisk Analytics, Moody’s, Clarivate, FactSet, MSCI, Visa and Mastercard. Refer to page 25 for more deta ils . (1) Based on 2021E median LFCF multiples. 8 Strategic Plan Supports Significant Revenue Upside Attractive Entry Value ($ in billions) Strategic plan driving multiple expansion Adj. EBITDA 2021 - 2025 Adj. EBITDA CAGR Implied MultiPlan Equity / Firm Value (1) FV / ’21E Adj. EBITDA EV / ’21E LFCF 2021 - 2025 Revenue CAGR $7 / $11 $14 / $18 $14 / $18 6% 11% – 15% 7% 10% – 13% Note Converts @ $13/ sh : $10 / $15

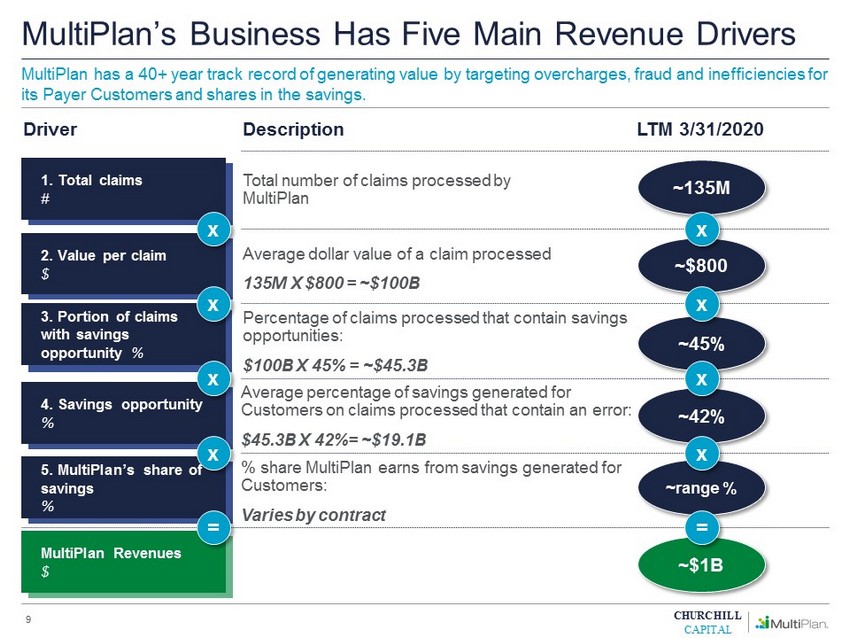

CHURCHILL CAPITAL MultiPlan’s Business Has Five Main Revenue Drivers Driver Description LTM 3/31/2020 1. Total claims # 2. Value per claim $ 3. Portion of claims with savings opportunity % 4. Savings opportunity % 5. MultiPlan’s share of savings % MultiPlan Revenues $ x x x x = Total number of claims processed by MultiPlan Average dollar value of a claim processed 135M X $800 = ~$100B Percentage of claims processed that contain savings opportunities: $100B X 45% = ~$45.3B Average percentage of savings generated for Customers on claims processed that contain an error: $45.3B X 42%= ~$19.1B % share MultiPlan earns from savings generated for Customers: Varies by contract ~135M ~$800 ~45% ~42% ~range % ~$1B x x x x = 9 MultiPlan has a 40+ year track record of generating value by targeting overcharges, fraud and inefficiencies for its Payer Customers and shares in the savings.

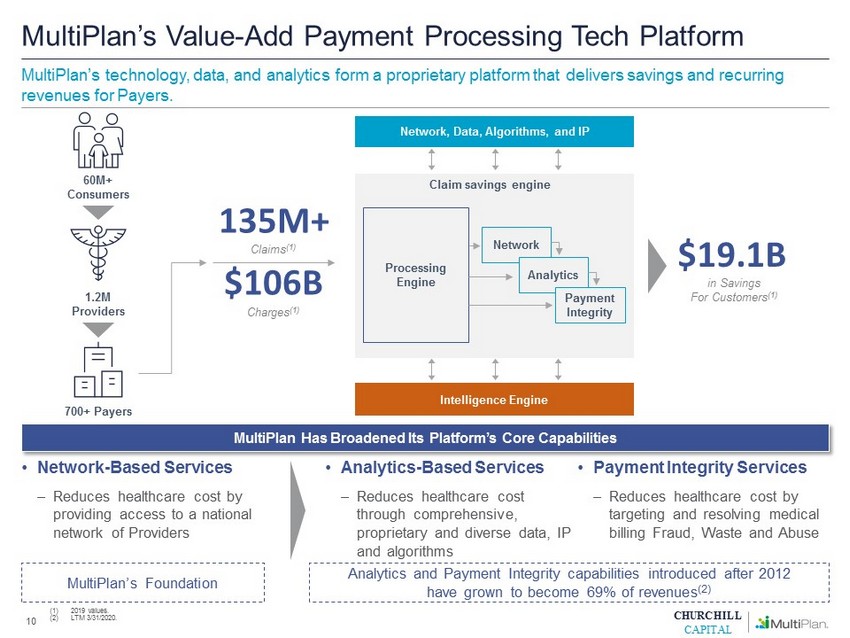

CHURCHILL CAPITAL MultiPlan’s Value - Add Payment Processing Tech Platform (1) 2019 values. (2) LTM 3/31/2020. 10 MultiPlan’s technology, data, and analytics form a proprietary platform that delivers savings and recurring revenues for Payers. MultiPlan Has Broadened Its Platform’s Core Capabilities • Network - Based Services ‒ Reduces healthcare cost by providing access to a national network of Providers • Analytics - Based Services ‒ Reduces healthcare cost through comprehensive, proprietary and diverse data, IP and algorithms • Payment Integrity Services ‒ Reduces healthcare cost by targeting and resolving medical billing Fraud, Waste and Abuse Intelligence Engine Network, Data, Algorithms, and IP Claim savings engine Processing Engine Network Analytics Payment Integrity 135M+ Claims (1) $106B Charges (1) $19.1B in Savings For Customers (1) 1.2M Providers 700+ Payers 60M+ Consumers MultiPlan’s Foundation Analytics and Payment Integrity capabilities introduced after 2012 have grown to become 69% of revenues (2)

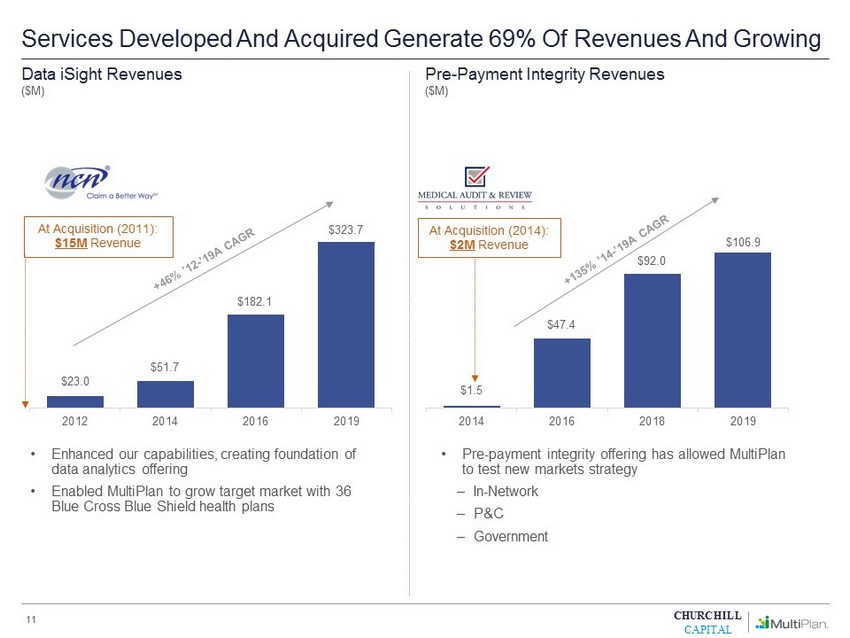

CHURCHILL CAPITAL $23.0 $51.7 $182.1 $323.7 2012 2014 2016 2019 $1.5 $47.4 $92.0 $106.9 2014 2016 2018 2019 Services Developed And Acquired Generate 69% Of Revenues And Growing 11 • Enhanced our capabilities, creating foundation of data analytics offering • Enabled MultiPlan to grow target market with 36 Blue Cross Blue Shield health plans At Acquisition (2011): $15M Revenue At Acquisition (2014): $2M Revenue Pre - Payment Integrity Revenues ($M) Data iSight Revenues ($M) • Pre - payment integrity offering has allowed MultiPlan to test new markets strategy ‒ In - Network ‒ P&C ‒ Government

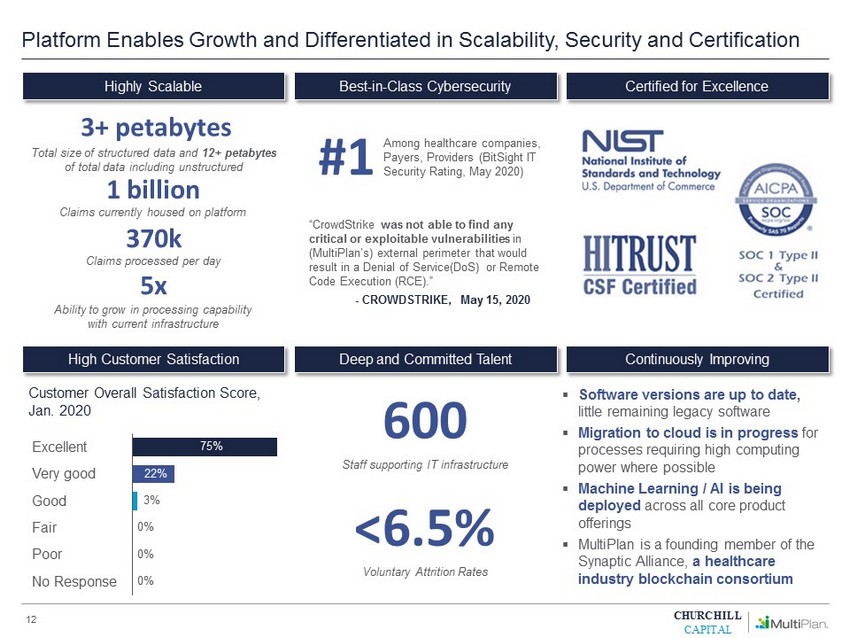

CHURCHILL CAPITAL Platform Enables Growth and Differentiated in Scalability, Security and Certification 1 billion Claims currently housed on platform 3+ petabytes Total size of structured data and 12+ petabytes of total data including unstructured 75 % Excellent No Response Fair 0 % 22 % Poor Very good Good 3 % 0 % 0 % Customer Overall Satisfaction Score, Jan. 2020 600 Staff supporting IT infrastructure < 6.5% Voluntary Attrition Rates ▪ Software versions are up to date, little remaining legacy software ▪ Migration to cloud is in progress for processes requiring high computing power where possible ▪ Machine Learning / AI is being deployed across all core product offerings ▪ MultiPlan is a founding member of the Synaptic Alliance, a healthcare industry blockchain consortium #1 Among healthcare companies, Payers, Providers ( BitSight IT Security Rating, May 2020) “CrowdStrike was not able to find any critical or exploitable vulnerabilities in ( MultiPlan’s ) external perimeter that would result in a Denial of Service(DoS) or Remote Code Execution (RCE).” - CROWDSTRIKE, May 15, 2020 5x Ability to grow in processing capability with current infrastructure 12 370k Claims processed per day Best - in - Class Cybersecurity Certified for Excellence Highly Scalable Deep and Committed Talent Continuously Improving High Customer Satisfaction

CHURCHILL CAPITAL Plan to Drive Growth and Create Value

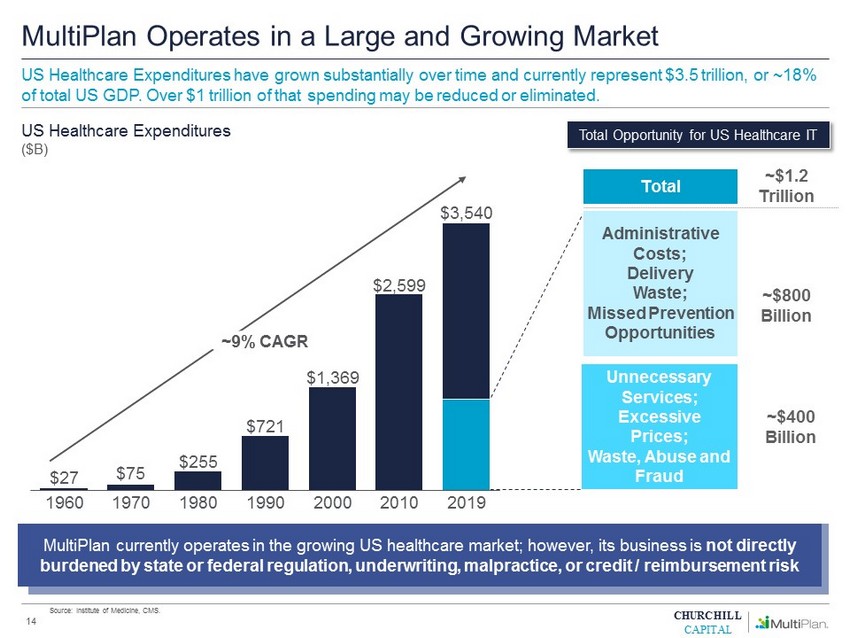

CHURCHILL CAPITAL MultiPlan Operates in a Large and Growing Market Source: Institute of Medicine, CMS. 14 ~$ 1.2 Trillion Total ~$400 Billion Unnecessary Services; Excessive Prices; Waste, Abuse and Fraud $27 $75 $255 $721 $1,369 $2,599 2019 2000 19 90 1960 19 70 1980 2010 $ 3,540 ~9% CAGR US Healthcare Expenditures ($B) US Healthcare Expenditures have grown substantially over time and currently represent $3.5 trillion, or ~18% of total US GDP. Over $1 trillion of that spending may be reduced or eliminated. Total Opportunity for US Healthcare IT Administrative Costs; Delivery Waste; Missed Prevention Opportunities ~$ 800 Billion MultiPlan currently operates in the growing US healthcare market; however, its business is not directly burdened by state or federal regulation, underwriting, malpractice, or credit / reimbursement risk

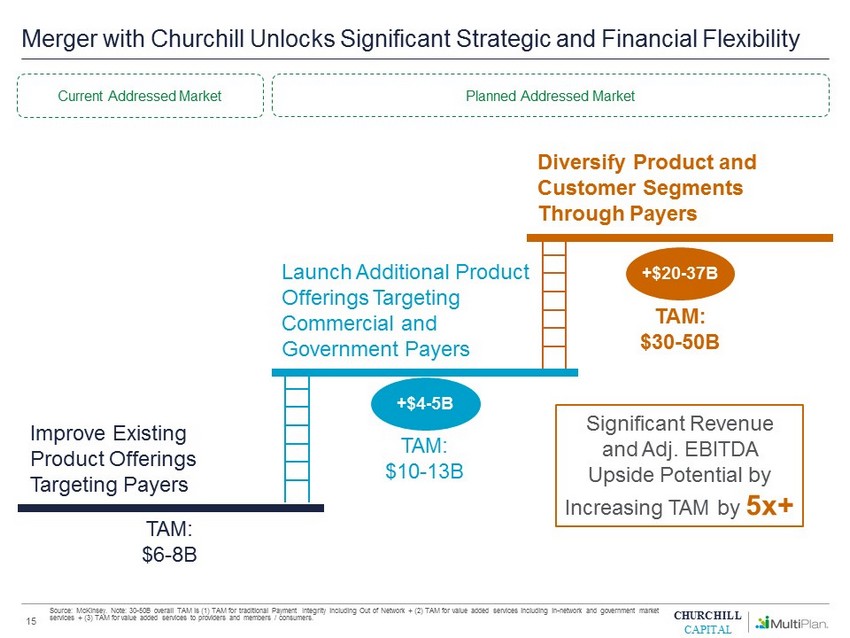

CHURCHILL CAPITAL Merger with Churchill Unlocks Significant Strategic and Financial Flexibility 15 TAM: $6 - 8B TAM: $10 - 13B TAM: $30 - 50B Improve Existing Product Offerings Targeting Payers Launch Additional Product Offerings Targeting Commercial and Government Payers Diversify Product and Customer Segments Through Payers Significant Revenue and Adj. EBITDA Upside Potential by Increasing TAM by 5x+ +$4 - 5B +$ 20 - 37 B Source: McKinsey. Note: 30 - 50B overall TAM is (1) TAM for traditional Payment Integrity including Out of Network + (2) TAM for v alue added services including in - network and government market services + (3) TAM for value added services to providers and members / consumers. Current Addressed Market Planned Addressed Market

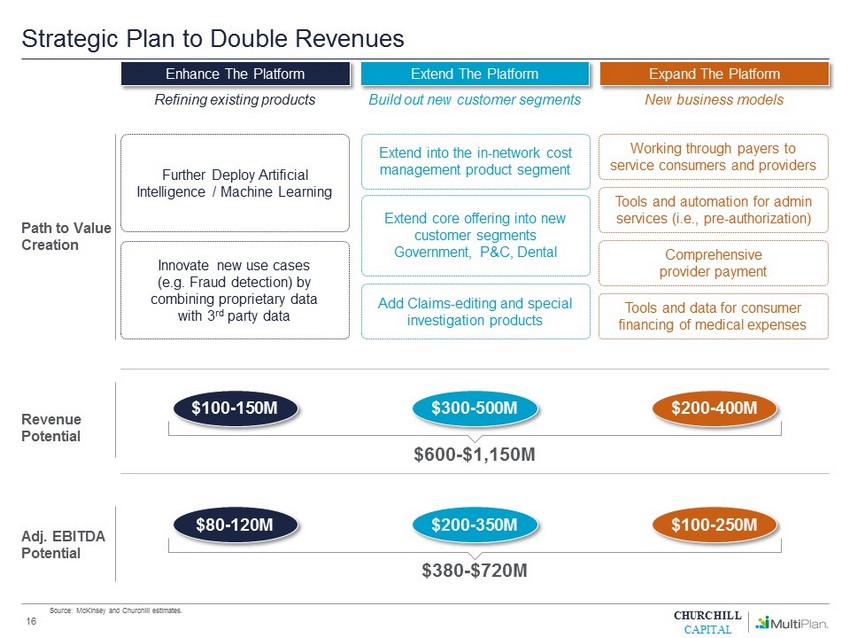

CHURCHILL CAPITAL Strategic Plan to Double Revenues Source: McKinsey and Churchill estimates. 16 Enhance The Platform Extend The Platform Expand The Platform Revenue Potential $100 - 150M $300 - 500M $200 - 400M $600 - $1,150M Adj. EBITDA Potential $80 - 120M $200 - 350M $100 - 250M $380 - $720M Path to Value Creation Innovate new use cases (e.g. Fraud detection) by combining proprietary data with 3 rd party data Further Deploy Artificial Intelligence / Machine Learning Extend core offering into new customer segments Government, P&C, Dental Extend into the in - network cost management product segment Add Claims - editing and special investigation products Tools and data for consumer financing of medical expenses Tools and automation for admin services (i.e., pre - authorization) Working through payers to service consumers and providers Comprehensive provider payment Build out new customer segments Refining existing products New business models

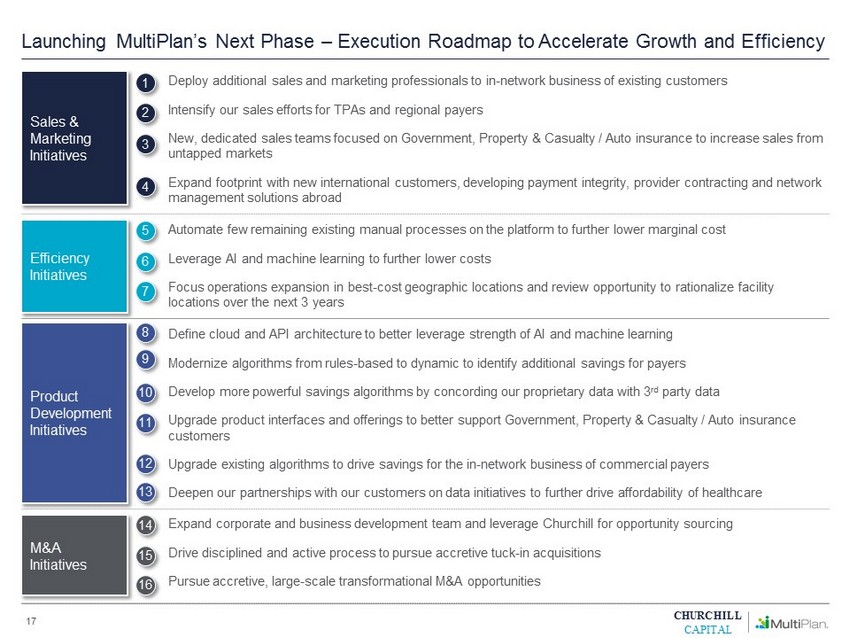

CHURCHILL CAPITAL Launching MultiPlan’s Next Phase – Execution Roadmap to Accelerate Growth and Efficiency 17 Efficiency Initiatives • Automate few remaining existing manual processes on the platform to further lower marginal cost • Leverage AI and machine learning to further lower costs • Focus operations expansion in best - cost geographic locations and review opportunity to rationalize facility locations over the next 3 years 5 6 7 Sales & Marketing Initiatives • Deploy additional sales and marketing professionals to in - network business of existing customers • Intensify our sales efforts for TPAs and regional payers • New, dedicated sales teams focused on Government, Property & Casualty / Auto insurance to increase sales from untapped markets • Expand footprint with new international customers, developing payment integrity, provider contracting and network management solutions abroad 1 2 3 4 M&A Initiatives • Expand corporate and business development team and leverage Churchill for opportunity sourcing • Drive disciplined and active process to pursue accretive tuck - in acquisitions • Pursue accretive, large - scale transformational M&A opportunities 14 15 16 Product Development Initiatives • Define cloud and API architecture to better leverage strength of AI and machine learning • Modernize algorithms from rules - based to dynamic to identify additional savings for payers • Develop more powerful savings algorithms by concording our proprietary data with 3 rd party data • Upgrade product interfaces and offerings to better support Government, Property & Casualty / Auto insurance customers • Upgrade existing algorithms to drive savings for the in - network business of commercial payers • Deepen our partnerships with our customers on data initiatives to further drive affordability of healthcare 9 10 11 12 8 13

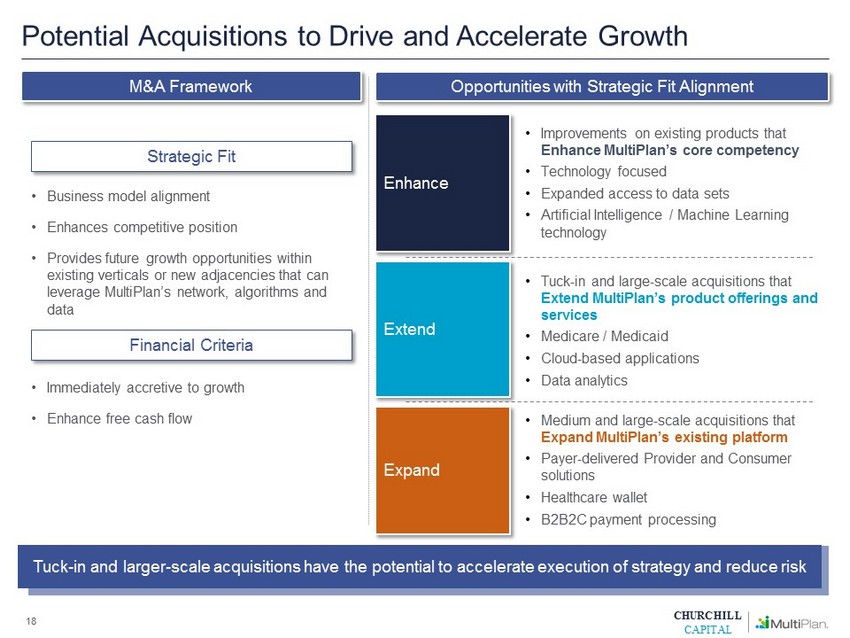

CHURCHILL CAPITAL Potential Acquisitions to Drive and Accelerate Growth 18 Opportunities with Strategic Fit Alignment M&A Framework Strategic Fit • Business model alignment • Enhances competitive position • Provides future growth opportunities within existing verticals or new adjacencies that can leverage MultiPlan’s network, algorithms and data Financial Criteria • Immediately accretive to growth • Enhance free cash flow • Improvements on existing products that Enhance MultiPlan’s core competency • Technology focused • Expanded access to data sets • Artificial Intelligence / Machine Learning technology Enhance • Tuck - in and large - scale acquisitions that Extend MultiPlan’s product offerings and services • Medicare / Medicaid • Cloud - based applications • Data analytics Extend • Medium and large - scale acquisitions that Expand MultiPlan’s existing platform • Payer - delivered Provider and Consumer solutions • Healthcare wallet • B2B2C payment processing Expand T uck - in and larger - scale acquisitions have the potential to accelerate execution of strategy and reduce risk

CHURCHILL CAPITAL Financial Overview and Value Creation

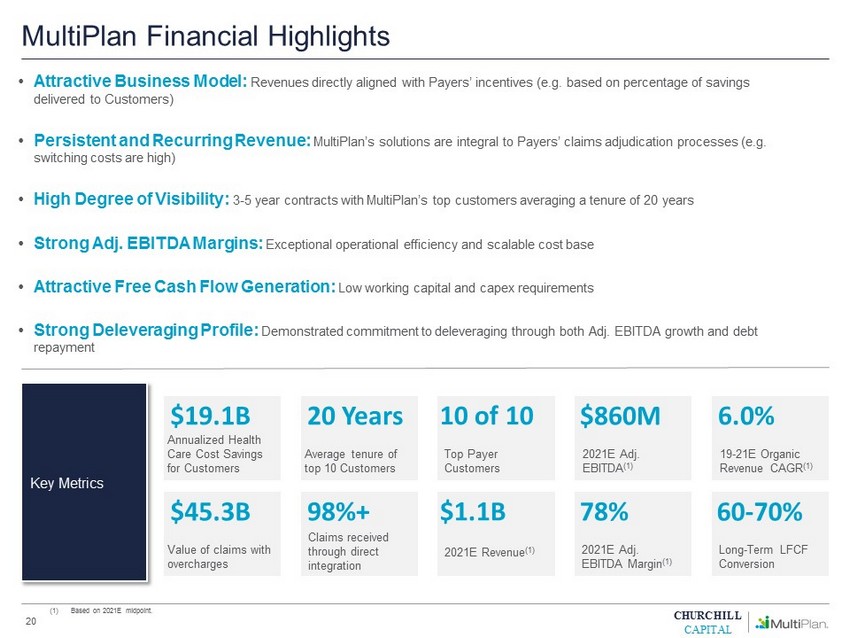

CHURCHILL CAPITAL MultiPlan Financial Highlights (1) Based on 2021E midpoint. • Attractive Business Model: Revenues directly aligned with Payers’ incentives (e.g. based on percentage of savings delivered to Customers) • Persistent and Recurring Revenue: MultiPlan’s solutions are integral to Payers’ claims adjudication processes (e.g. switching costs are high) • High Degree of Visibility: 3 - 5 year contracts with MultiPlan’s top customers averaging a tenure of 20 years • Strong Adj. EBITDA Margins: Exceptional operational efficiency and scalable cost base • Attractive Free Cash Flow Generation: Low working capital and capex requirements • Strong Deleveraging Profile: Demonstrated commitment to deleveraging through both Adj. EBITDA growth and debt repayment 20 Years Average tenure of top 10 Customers $860M 2021E Adj. EBITDA (1) 10 of 10 Top Payer Customers 20 Key Metrics 6.0% 19 - 21E Organic Revenue CAGR (1) $19.1B Annualized Health Care Cost Savings for Customers 60 - 70% Long - Term LFCF Conversion 78% 2021E Adj. EBITDA Margin (1) $1.1B 2021E Revenue (1) 98%+ Claims received through direct integration $45.3B Value of claims with overcharges

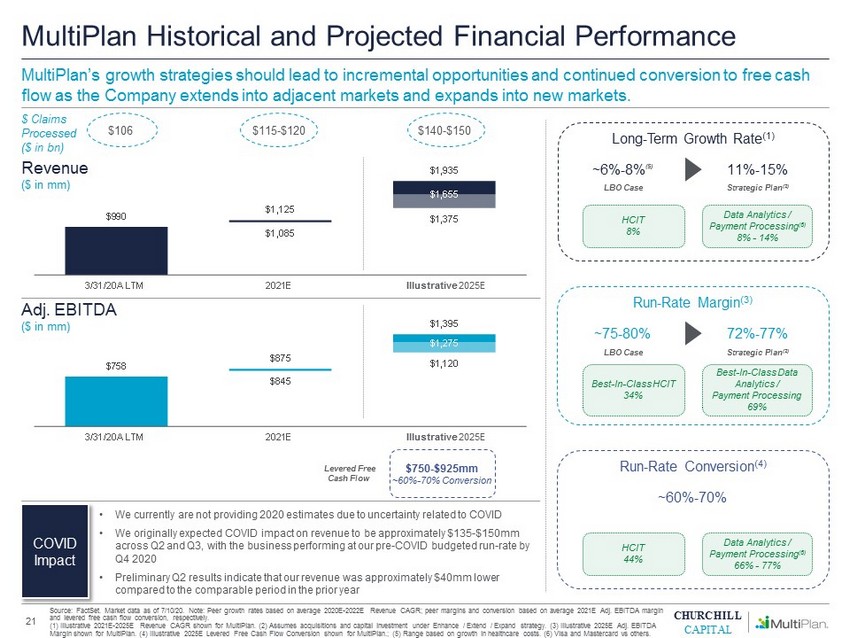

CHURCHILL CAPITAL $1,085 $1,375 $1,655 $990 $1,125 $1,935 3/31/20A LTM 2021E MultiPlan Historical and Projected Financial Performance Source: FactSet. Market data as of 7/10/20. Note: Peer growth rates based on average 2020E - 2022E Revenue CAGR; peer margins and conversion based on average 2021E Adj. EBITDA margin and levered free cash flow conversion, respectively. (1) Illustrative 2021E - 2025E Revenue CAGR shown for MultiPlan . (2) Assumes acquisitions and capital investment under Enhance / Extend / Expand strategy. (3) Illustrative 2025E Adj. EBITD A Margin shown for MultiPlan . (4) Illustrative 2025E Levered Free Cash Flow Conversion shown for MultiPlan .; (5) Range based on growth in healthcare costs. (6) Visa and Mastercard vs others. • We currently are not providing 2020 estimates due to uncertainty related to COVID • We originally expected COVID impact on revenue to be approximately $135 - $150mm across Q2 and Q3, with the business performing at our pre - COVID budgeted run - rate by Q4 2020 • Preliminary Q2 results indicate that our revenue was approximately $40mm lower compared to the comparable period in the prior year 21 Revenue ($ in mm) MultiPlan’s growth strategies should lead to incremental opportunities and continued conversion to free cash flow as the Company extends into adjacent markets and expands into new markets. Long - Term Growth Rate (1) HCIT 8% ~6% - 8% (5) LBO Case 11% - 15% Strategic Plan (2) Data Analytics / Payment Processing (6) 8% - 14% Run - Rate Margin (3) Best - In - Class HCIT 34% ~75 - 80% LBO Case 72% - 77% Strategic Plan (2) Best - In - Class Data Analytics / Payment Processing 69% Run - Rate Conversion (4) HCIT 44% ~60% - 70% Data Analytics / Payment Processing (6) 66% - 77% Levered Free Cash Flow $750 - $925mm ~60% - 70% Conversion COVID Impact Illustrative 2025E $845 $1,120 $1,275 $758 $875 $1,395 3/31/20A LTM 2021E Adj. EBITDA ($ in mm) Illustrative 2025E $ Claims Processed ($ in bn) $106 $115 - $120 $140 - $150

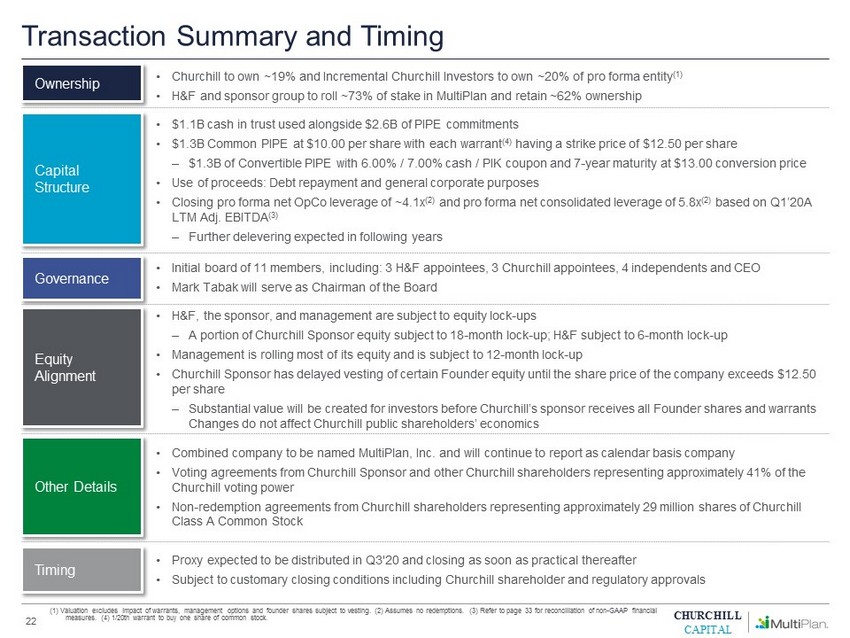

CHURCHILL CAPITAL (1) Valuation excludes impact of warrants, management options and founder shares subject to vesting. (2) Assumes no redemptio ns. (3) Refer to page 33 for reconciliation of non - GAAP financial measures. (4) 1/20th warrant to buy one share of common stock. 22 Transaction Summary and Timing Ownership • Churchill to own ~19% and Incremental Churchill Investors to own ~20% of pro forma entity (1) • H&F and sponsor group to roll ~73% of stake in MultiPlan and retain ~62% ownership Timing • Proxy expected to be distributed in Q3'20 and closing as soon as practical thereafter • Subject to customary closing conditions including Churchill shareholder and regulatory approvals • Combined company to be named MultiPlan , Inc. and will continue to report as calendar basis company • Voting agreements from Churchill Sponsor and other Churchill shareholders representing approximately 41% of the Churchill voting power • Non - redemption agreements from Churchill shareholders representing approximately 29 million shares of Churchill Class A Common Stock Other Details Governance • Initial board of 11 members, including: 3 H&F appointees, 3 Churchill appointees, 4 independents and CEO • Mark Tabak will serve as Chairman of the Board Equity Alignment • H&F, the sponsor, and management are subject to equity lock - ups ‒ A portion of Churchill Sponsor equity subject to 18 - month lock - up; H&F subject to 6 - month lock - up • Management is rolling most of its equity and is subject to 12 - month lock - up • Churchill Sponsor has delayed vesting of certain Founder equity until the share price of the company exceeds $12.50 per share ‒ Substantial value will be created for investors before Churchill’s sponsor receives all Founder shares and warrants Changes do not affect Churchill public shareholders’ economics Capital Structure • $1.1B cash in trust used alongside $2.6B of PIPE commitments • $1.3B Common PIPE at $10.00 per share with each warrant (4) having a strike price of $12.50 per share ‒ $1.3B of Convertible PIPE with 6.00% / 7.00% cash / PIK coupon and 7 - year maturity at $13.00 conversion price • Use of proceeds: Debt repayment and general corporate purposes • Closing pro forma net OpCo leverage of ~4.1x (2) and pro forma net consolidated leverage of 5.8x (2) based on Q1’20A LTM Adj. EBITDA (3) ‒ Further delevering expected in following years

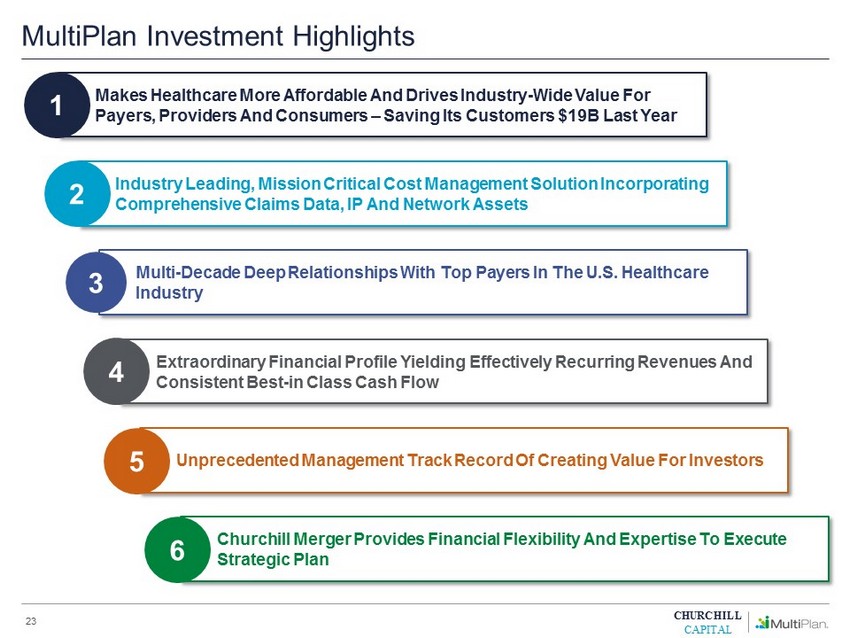

CHURCHILL CAPITAL MultiPlan Investment Highlights 23 Industry Leading, Mission Critical Cost Management Solution Incorporating Comprehensive Claims Data, IP And Network Assets 2 Multi - Decade Deep Relationships With Top Payers In The U.S. Healthcare Industry 3 Unprecedented Management Track Record Of Creating Value For Investors 5 Extraordinary Financial Profile Yielding Effectively Recurring Revenues And Consistent Best - in Class Cash Flow 4 Makes Healthcare More Affordable And Drives Industry - Wide Value For Payers, Providers And Consumers – Saving Its Customers $19B Last Year 1 Churchill Merger Provides Financial Flexibility And Expertise To Execute Strategic Plan 6

CHURCHILL CAPITAL Appendix

CHURCHILL CAPITAL 15.4x 24.0x 31.3x 49.7x 24.8x 27.8x 29.5x 31.4x 30.3x 31.3x 31.3x 35.4x 34.4x 44.7x 12.9x 15.1x 15.3x 21.2x 17.9x 19.5x 22.5x 22.9x 23.8x 24.5x 24.7x 25.6x 26.3x 32.7x Attractive Entry Value Source: FactSet. Market data as of 7/10/20. (1) Pro forma for Churchill transaction; 2021E midpoint used. Payer - Focused Healthcare IT Data Analytics and Value - Add Payment Processing FV / CY2021E Adj. EBITDA Median : 15.3x Median: 24.1x 25 (1) Equity Value / CY2021E LFCF Median: 31.3x Median : 31.3x (1)

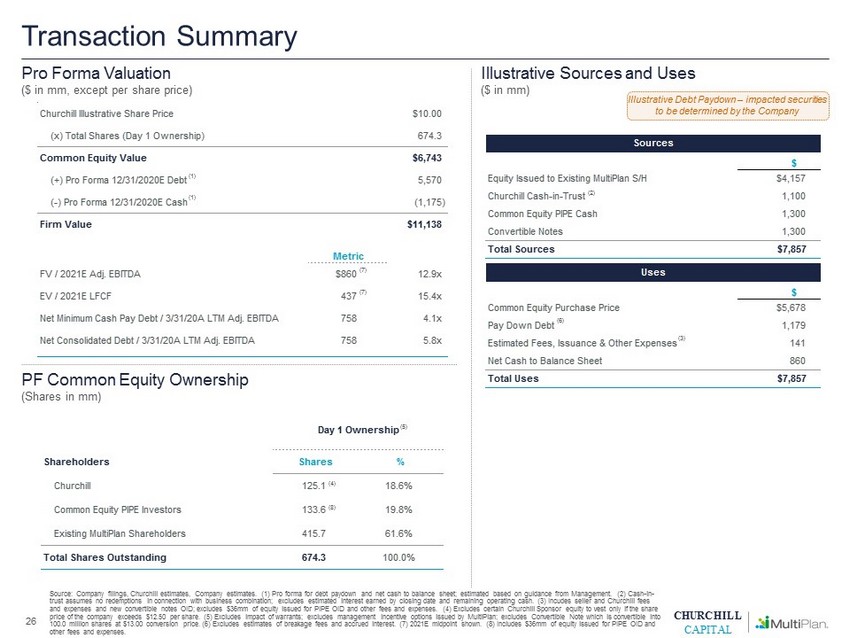

CHURCHILL CAPITAL Sources $ Equity Issued to Existing MultiPlan S/H $4,157 Churchill Cash-in-Trust 1,100 Common Equity PIPE Cash 1,300 Convertible Notes 1,300 Total Sources $7,857 Uses $ Common Equity Purchase Price $5,678 Pay Down Debt 1,179 Estimated Fees, Issuance & Other Expenses 141 Net Cash to Balance Sheet 860 Total Uses $7,857 Day 1 Ownership Incl. Revested Founder Shares & Convertible Note Shareholders Shares % Churchill 125.1 18.6% Common Equity PIPE Investors 133.6 19.8% Existing MultiPlan Shareholders 415.7 61.6% Total Shares Outstanding 674.3 100.0% Churchill Illustrative Share Price $10.00 (x) Total Shares (Day 1 Ownership) 674.3 Common Equity Value $6,743 (+) Pro Forma 12/31/2020E Debt 5,570 (-) Pro Forma 12/31/2020E Cash (1,175) Firm Value $11,138 Metric FV / 2021E Adj. EBITDA $860 12.9x EV / 2021E LFCF 437 15.4x Net Minimum Cash Pay Debt / 3/31/20A LTM Adj. EBITDA 758 4.1x Net Consolidated Debt / 3/31/20A LTM Adj. EBITDA 758 5.8x Transaction Summary Source: Company filings, Churchill estimates, Company estimates. (1) Pro forma for debt paydown and net cash to balance sheet ; e stimated based on guidance from Management. (2) Cash - in - trust assumes no redemptions in connection with business combination; excludes estimated interest earned by closing date and rem aining operating cash. (3) Incudes seller and Churchill fees and expenses and new convertible notes OID; excludes $36mm of equity issued for PIPE OID and other fees and expenses. (4) Exc lud es certain Churchill Sponsor equity to vest only if the share price of the company exceeds $12.50 per share. (5) Excludes impact of warrants; excludes management incentive options issued by MultiPlan ; excludes Convertible Note which is convertible into 100.0 million shares at $13.00 conversion price. (6) Excludes estimates of breakage fees and accrued interest. (7) 2021E midp oin t shown. (8) Includes $36mm of equity issued for PIPE OID and other fees and expenses. 26 Pro Forma Valuation ($ in mm, except per share price) Illustrative Sources and Uses ($ in mm) (1) PF Common Equity Ownership (Shares in mm) (2) (3) (5) (1) (6) (7) (4) (8) (7) Illustrative Debt Paydown – impacted securities to be determined by the Company

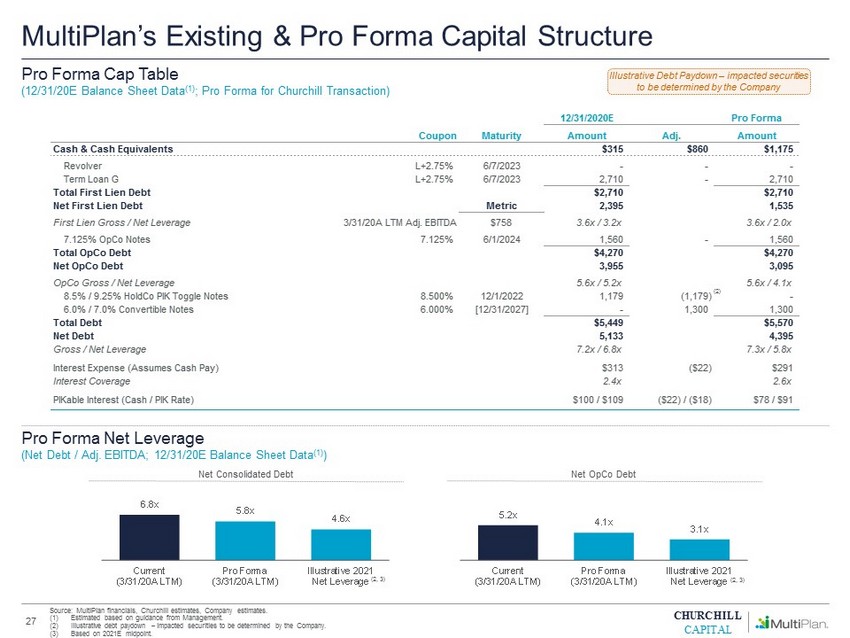

CHURCHILL CAPITAL MultiPlan’s Existing & Pro Forma Capital Structure 27 Pro Forma Cap Table (12/31/20E Balance Sheet Data (1) ; Pro Forma for Churchill Transaction) Pro Forma Net Leverage (Net Debt / Adj. EBITDA; 12/31/20E Balance Sheet Data (1) ) Source: MultiPlan financials, Churchill estimates, Company estimates. (1) Estimated based on guidance from Management. (2) Illustrative debt paydown – impacted securities to be determined by the Company. (3) Based on 2021E midpoint. Illustrative Debt Paydown – impacted securities to be determined by the Company 5.2x 4.1x 3.1x Current (3/31/20A LTM) Pro Forma (3/31/20A LTM) Illustrative 2021 Net Leverage Net OpCo Debt 6.8x 5.8x 4.6x Current (3/31/20A LTM) Pro Forma (3/31/20A LTM) Illustrative 2021 Net Leverage Net Consolidated Debt (2) (2, 3) (2, 3) 12/31/2020E Pro Forma Coupon Maturity Amount Adj. Amount Cash & Cash Equivalents $315 $860 $1,175 Revolver L+2.75% 6/7/2023 - - - Term Loan G L+2.75% 6/7/2023 2,710 - 2,710 Total First Lien Debt $2,710 $2,710 Net First Lien Debt Metric 2,395 1,535 First Lien Gross / Net Leverage 3/31/20A LTM Adj. EBITDA $758 3.6x / 3.2x 3.6x / 2.0x 7.125% OpCo Notes 7.125% 6/1/2024 1,560 - 1,560 Total OpCo Debt $4,270 $4,270 Net OpCo Debt 3,955 3,095 OpCo Gross / Net Leverage 5.6x / 5.2x 5.6x / 4.1x 8.5% / 9.25% HoldCo PIK Toggle Notes 8.500% 12/1/2022 1,179 (1,179) - 6.0% / 7.0% Convertible Notes 6.000% [12/31/2027] - 1,300 1,300 Total Debt $5,449 $5,570 Net Debt 5,133 4,395 Gross / Net Leverage 7.2x / 6.8x 7.3x / 5.8x Interest Expense (Assumes Cash Pay) $313 ($22) $291 Interest Coverage 2.4x 2.6x PIKable Interest (Cash / PIK Rate) $100 / $109 ($22) / ($18) $78 / $91

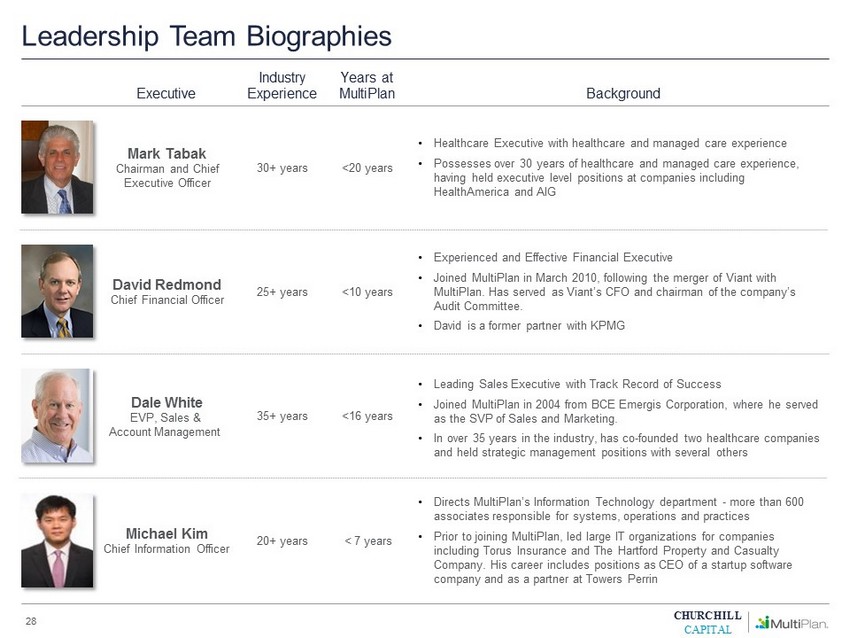

CHURCHILL CAPITAL Leadership Team Biographies 28 Executive Industry Experience Years at MultiPlan Background Mark T abak Chairman and Chief Executive Officer 30+ years <20 years • Healthcare Executive with healthcare and managed care experience • Possesses over 30 years of healthcare and managed care experience, having held executive level positions at companies including HealthAmerica and AIG David Redmond Chief Financial Officer 25+ years <10 years • Experienced and Effective Financial Executive • Joined MultiPlan in March 2010, following the merger of Viant with MultiPlan . Has served as Viant’s CFO and chairman of the company’s Audit Committee. • David is a former partner with KPMG Dale White EVP, Sales & Account Management 3 5+ years <16 years • Leading Sales Executive with Track Record of Success • Joined MultiPlan in 2004 from BCE Emergis Corporation, where he served as the SVP of Sales and Marketing. • In over 35 years in the industry, has co - founded two healthcare companies and held strategic management positions with several others Michael Kim Chief Information Officer 20+ years < 7 years • Directs MultiPlan’s Information Technology department - more than 600 associates responsible for systems, operations and practices • Prior to joining MultiPlan , led large IT organizations for companies including Torus Insurance and The Hartford Property and Casualty Company. His career includes positions as CEO of a startup software company and as a partner at Towers Perrin

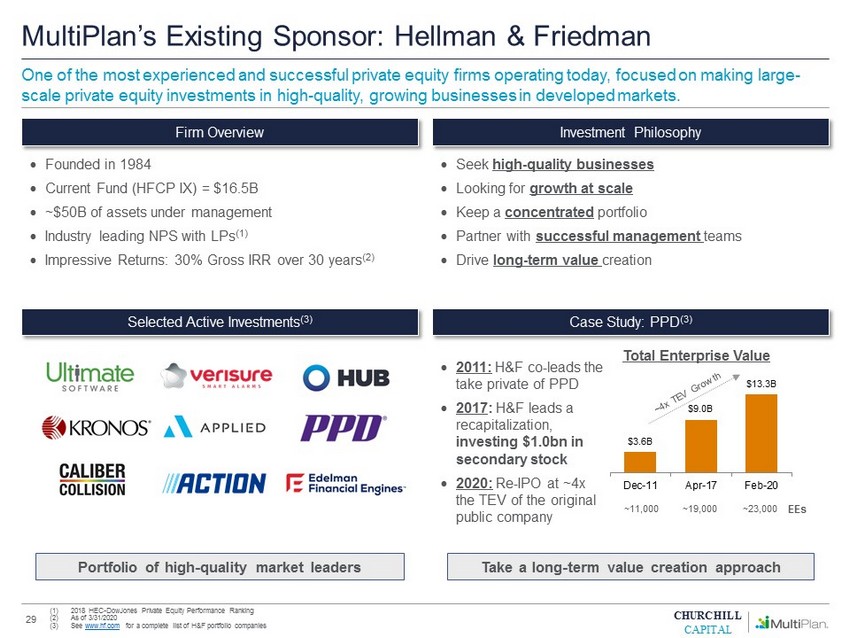

CHURCHILL CAPITAL MultiPlan’s Existing Sponsor: Hellman & Friedman 29 • Founded in 1984 • Current Fund (HFCP IX) = $16.5B • ~$50B of assets under management • Industry leading NPS with LPs (1) • Impressive Returns: 30% Gross IRR over 30 years (2) Portfolio of high - quality market leaders Take a long - term value creation approach $3.6B $9.0B $13.3B Dec-11 Apr-17 Feb-20 Total Enterprise Value • 2011: H&F co - leads the take private of PPD • 2017 : H&F leads a recapitalization, investing $1.0bn in secondary stock • 2020: Re - IPO at ~4x the TEV of the original public company • Seek high - quality businesses • Looking for growth at scale • Keep a concentrated portfolio • Partner with successful management teams • Drive long - term value creation EEs ~11,000 ~19,000 ~23,000 Firm Overview Selected Active Investments (3) Investment Philosophy Case Study : PPD (3) One of the most experienced and successful private equity firms operating today, focused on making large - scale private equity investments in high - quality, growing businesses in developed markets. (1) 2018 HEC - DowJones Private Equity Performance Ranking (2) As of 3/31/2020 (3) See www.hf.com for a complete list of H&F portfolio companies

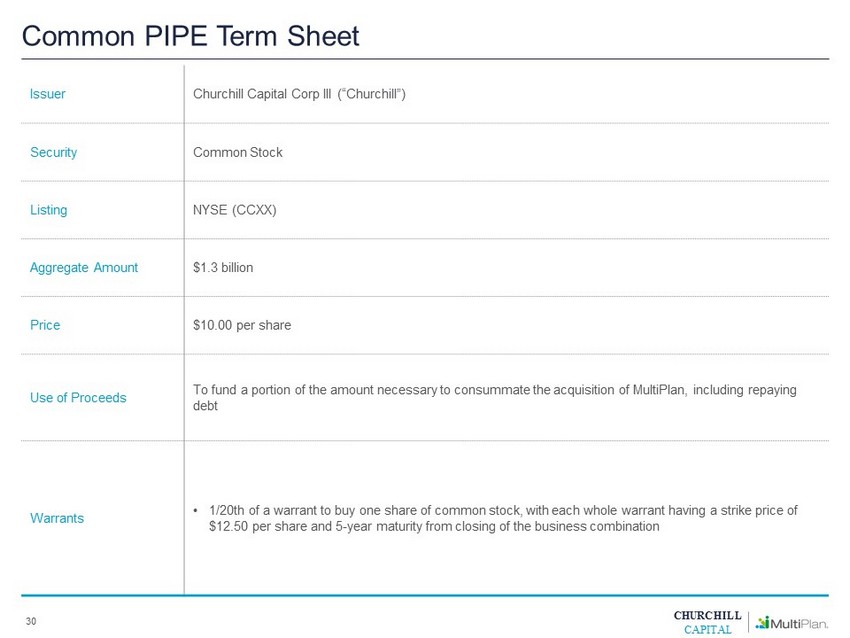

CHURCHILL CAPITAL Common PIPE Term Sheet 30 Issuer Churchill Capital Corp III (“Churchill”) Security Common Stock Listing NYSE (CCXX) Aggregate Amount $1.3 billion Price $10.00 per share Use of Proceeds To fund a portion of the amount necessary to consummate the acquisition of MultiPlan , including repaying debt Warrants • 1/20th of a warrant to buy one share of common stock, with each whole warrant having a strike price of $12.50 per share and 5 - year maturity from closing of the business combination

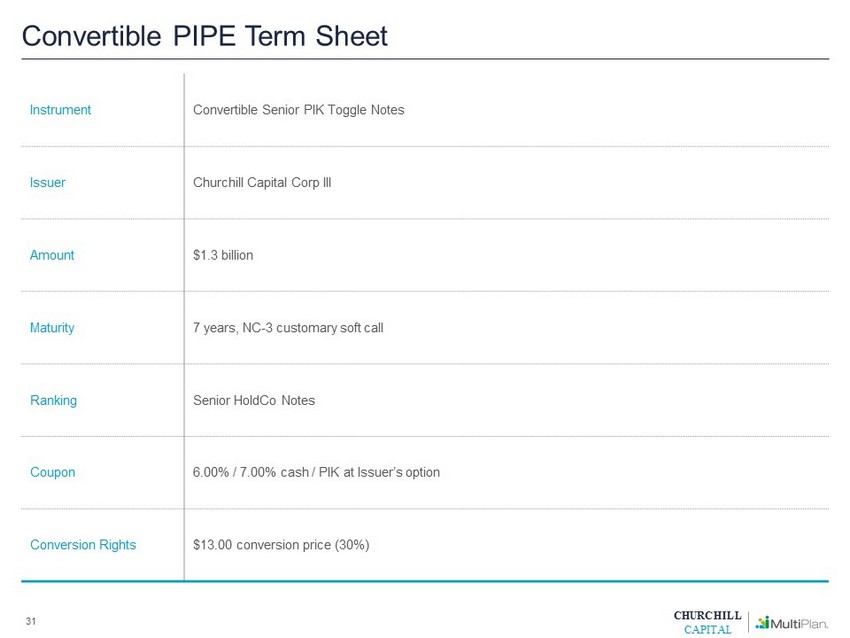

CHURCHILL CAPITAL Convertible PIPE Term Sheet 31 Instrument Convertible Senior PIK Toggle Notes Issuer Churchill Capital Corp III Amount $1.3 billion Maturity 7 years, NC - 3 customary soft call Ranking Senior HoldCo Notes Coupon 6.00% / 7.00% cash / PIK at Issuer’s option Conversion Rights $13.00 conversion price (30%)

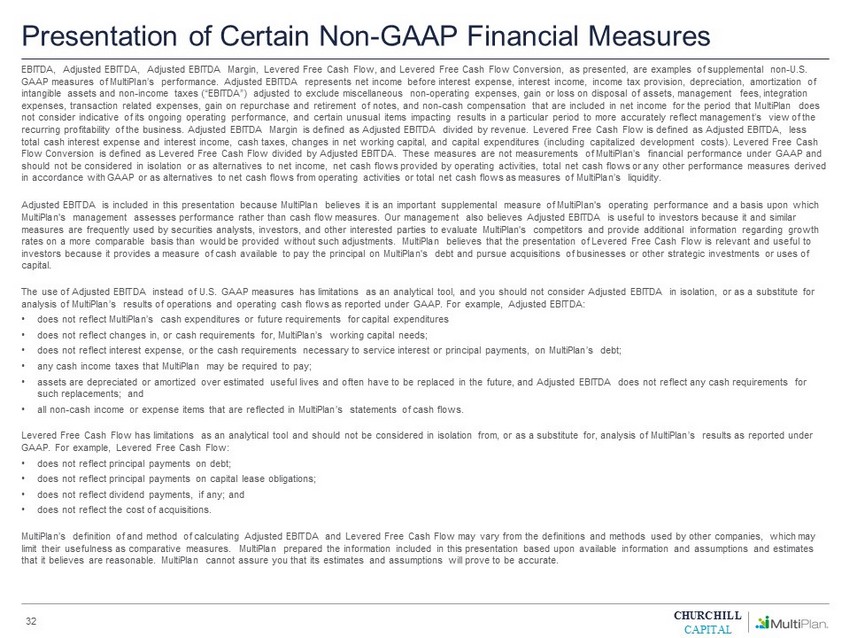

CHURCHILL CAPITAL Presentation of Certain Non - GAAP Financial Measures EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Levered Free Cash Flow, and Levered Free Cash Flow Conversion, as presented, ar e examples of supplemental non - U.S. GAAP measures of MultiPlan’s performance. Adjusted EBITDA represents net income before interest expense, interest income, income tax provision, depreciati on , amortization of intangible assets and non - income taxes (“EBITDA”) adjusted to exclude miscellaneous non - operating expenses, gain or loss on disp osal of assets, management fees, integration expenses, transaction related expenses, gain on repurchase and retirement of notes, and non - cash compensation that are included in net income for the period that MultiPlan does not consider indicative of its ongoing operating performance, and certain unusual items impacting results in a particular per iod to more accurately reflect management’s view of the recurring profitability of the business. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by revenue. Levered Fre e C ash Flow is defined as Adjusted EBITDA, less total cash interest expense and interest income, cash taxes, changes in net working capital, and capital expenditures (includ ing capitalized development costs). Levered Free Cash Flow Conversion is defined as Levered Free Cash Flow divided by Adjusted EBITDA. These measures are not measurements of MultiPlan’s financial performance under GAAP and should not be considered in isolation or as alternatives to net income, net cash flows provided by operating activities, tota l n et cash flows or any other performance measures derived in accordance with GAAP or as alternatives to net cash flows from operating activities or total net cash flows as measures of MultiPlan’s liquidity. Adjusted EBITDA is included in this presentation because MultiPlan believes it is an important supplemental measure of MultiPlan's operating performance and a basis upon which MultiPlan's management assesses performance rather than cash flow measures. Our management also believes Adjusted EBITDA is useful to inv es tors because it and similar measures are frequently used by securities analysts, investors, and other interested parties to evaluate MultiPlan's competitors and provide additional information regarding growth rates on a more comparable basis than would be provided without such adjustments. MultiPlan believes that the presentation of Levered Free Cash Flow is relevant and useful to investors because it provides a measure of cash available to pay the principal on MultiPlan's debt and pursue acquisitions of businesses or other strategic investments or uses of capital. The use of Adjusted EBITDA instead of U.S. GAAP measures has limitations as an analytical tool, and you should not consider A dju sted EBITDA in isolation, or as a substitute for analysis of MultiPlan’s results of operations and operating cash flows as reported under GAAP. For example, Adjusted EBITDA: • does not reflect MultiPlan’s cash expenditures or future requirements for capital expenditures • does not reflect changes in, or cash requirements for, MultiPlan’s working capital needs; • does not reflect interest expense, or the cash requirements necessary to service interest or principal payments, on MultiPlan’s debt; • any cash income taxes that MultiPlan may be required to pay; • assets are depreciated or amortized over estimated useful lives and often have to be replaced in the future, and Adjusted EBI TDA does not reflect any cash requirements for such replacements; and • all non - cash income or expense items that are reflected in MultiPlan’s statements of cash flows. Levered Free Cash Flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitu te for, analysis of MultiPlan’s results as reported under GAAP. For example, Levered Free Cash Flow: • does not reflect principal payments on debt; • does not reflect principal payments on capital lease obligations; • does not reflect dividend payments, if any; and • does not reflect the cost of acquisitions. MultiPlan’s definition of and method of calculating Adjusted EBITDA and Levered Free Cash Flow may vary from the definitions and methods us ed by other companies, which may limit their usefulness as comparative measures. MultiPlan prepared the information included in this presentation based upon available information and assumptions and estimates that it believes are reasonable. MultiPlan cannot assure you that its estimates and assumptions will prove to be accurate. 32

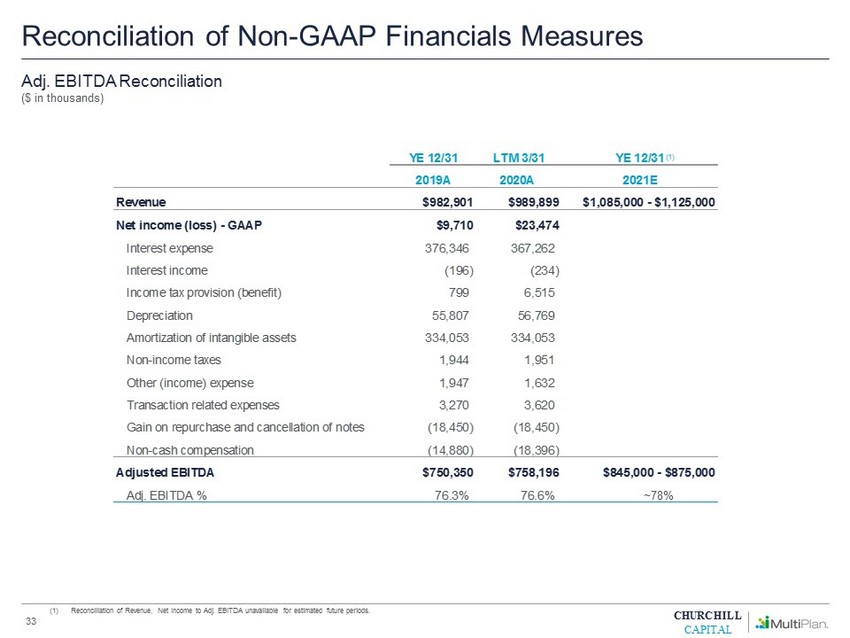

CHURCHILL CAPITAL YE 12/31 LTM 3/31 YE 12/31 2019A 2020A 2021E Revenue $982,901 $989,899 $1,085,000 - $1,125,000 Net income (loss) - GAAP $9,710 $23,474 Interest expense 376,346 367,262 Interest income (196) (234) Income tax provision (benefit) 799 6,515 Depreciation 55,807 56,769 Amortization of intangible assets 334,053 334,053 Non-income taxes 1,944 1,951 Other (income) expense 1,947 1,632 Transaction related expenses 3,270 3,620 Gain on repurchase and cancellation of notes (18,450) (18,450) Non-cash compensation (14,880) (18,396) Adjusted EBITDA $750,350 $758,196 $845,000 - $875,000 Adj. EBITDA % 76.3% 76.6% 77.8% Reconciliation of Non - GAAP Financials Measures 33 (1) Reconciliation of Revenue, Net Income to Adj. EBITDA unavailable for estimated future periods. Adj. EBITDA Reconciliation ($ in thousands) (1) ~78%