Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AZZ INC | azz-20200709.htm |

| EX-99.1 - EX-99.1 - AZZ INC | exhibit991fy21q1earnin.htm |

AZZ Inc. Q1 FY2021 Earnings Release Presentation July 9, 2020

Q1 FY2021 EARNINGS PRESENTATION Safe Harbor Statement Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Certain factors could affect the outcome of the matters described herein. This press release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the power generation markets, electrical transmission and distribution markets, the industrial markets, and the metal coatings markets. In addition, within each of the markets we serve, our customers and our operations could potentially be adversely impacted by the ongoing COVID-19 pandemic. We could also experience fluctuations in prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; supply-chain vendor delays ; customer requested delays of our products or services; delays in additional acquisition opportunities; currency exchange rates; adequacy of financing; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 29, 2020 and other filings with the Securities and Exchange Commission (“SEC”), available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise. 2

Q1 FY2021 EARNINGS PRESENTATION COVID-19 Update Impact on Financial Suspended previously issued FY2021 guidance Results Energy platform has been negatively affected by turnaround deferrals and lower project bookings due to customer slow-downs Cash balance of $26.4 million as of Q1 FY 2021 Balance Sheet / Debt balance of $219.0 million at end of Q1 FY2021, EBITDA of $24.5 million at end of Q1 FY2021 Liquidity Available debt capacity of $342.3 million on revolving credit facility at end of Q1 FY2021 North America – All plants remain open and operating Continued travel limitations – Country borders just now re-opening Operational Impacts Monitoring and adhering to WHO, CDC, and state agency guidelines for cleaning and disinfecting, social distancing, health and safety, PPE Temporarily suspended revolving debt payments during Q1 FY2021 to accumulate cash on Balance Sheet Mitigation Adjusted personnel to align to volume reductions utilizing state work-share programs, furloughs and where necessary reductions Efforts in force Accessed Cares Act provision for deferrals of employer portion of FICA taxes to 2022 and 2023 Paid quarterly dividends in Q4 FY2020, and Q1 FY2021 Capital Allocation No share repurchases during Q1 FY2021 Decisions Continuing to support capital expenditures for safety and growth initiative projects Situational AZZ’s Leadership team continues to be direct contact with the White House, CDC, and other state and governmental agencies. Awareness 3

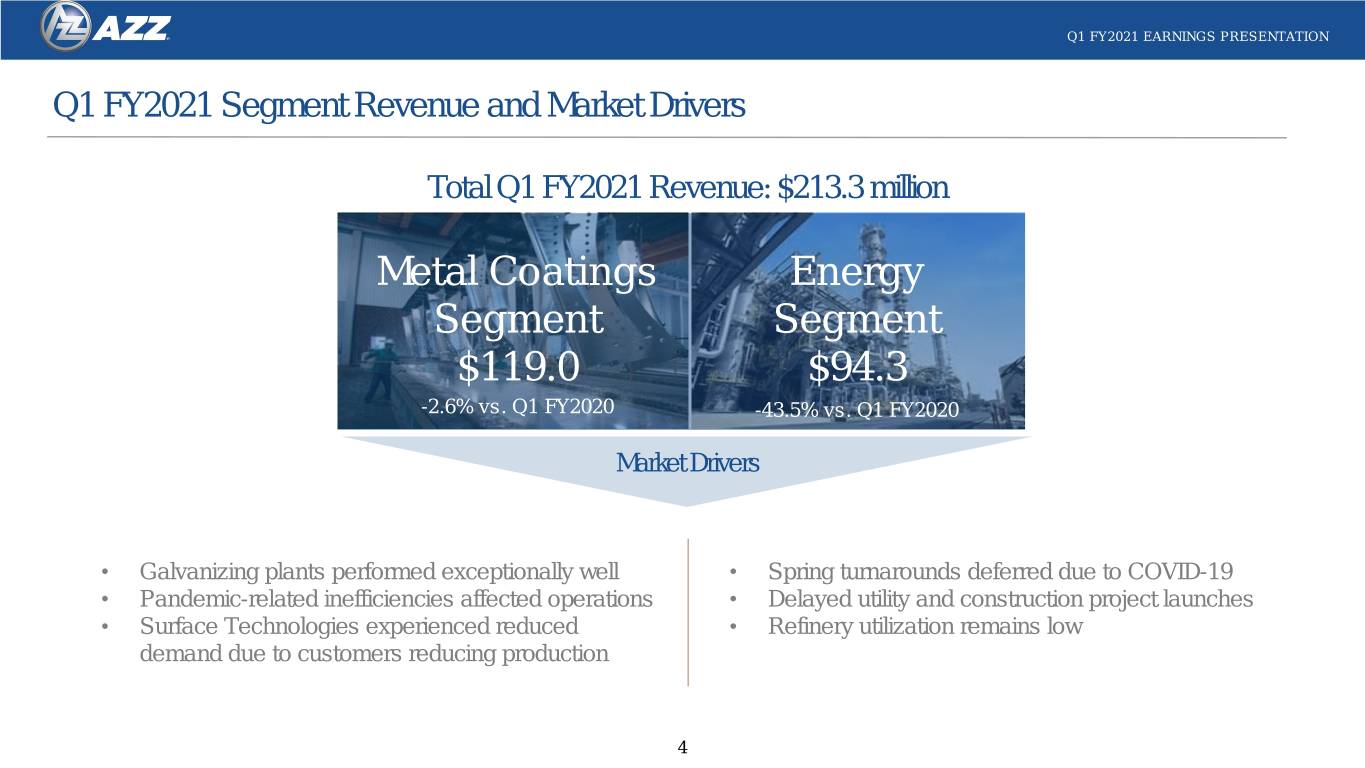

Q1 FY2021 EARNINGS PRESENTATION Q1 FY2021 Segment Revenue and Market Drivers Total Q1 FY2021 Revenue: $213.3 million Metal Coatings Energy Segment Segment $119.0 $94.3 -2.6% vs. Q1 FY2020 -43.5% vs. Q1 FY2020 Market Drivers • Galvanizing plants performed exceptionally well • Spring turnarounds deferred due to COVID-19 • Pandemic-related inefficiencies affected operations • Delayed utility and construction project launches • Surface Technologies experienced reduced • Refinery utilization remains low demand due to customers reducing production 4

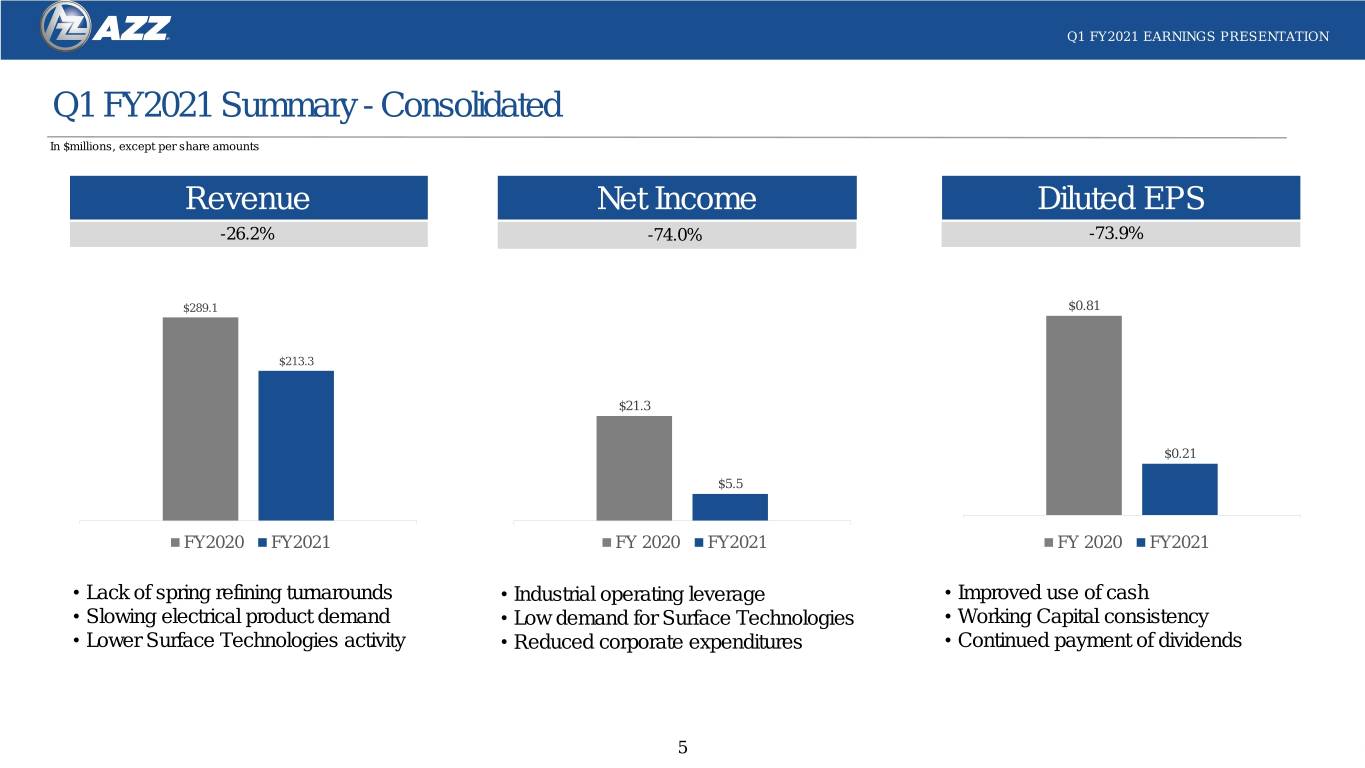

Q1 FY2021 EARNINGS PRESENTATION Q1 FY2021 Summary - Consolidated In $millions, except per share amounts Revenue Net Income Diluted EPS -26.2% -74.0% -73.9% $289.1 $0.81 $213.3 $21.3 $0.21 $5.5 FY2020 FY2021 FY 2020 FY2021 FY 2020 FY2021 • Lack of spring refining turnarounds • Industrial operating leverage • Improved use of cash • Slowing electrical product demand • Low demand for Surface Technologies • Working Capital consistency • Lower Surface Technologies activity • Reduced corporate expenditures • Continued payment of dividends 5

Q1 FY2021 EARNINGS PRESENTATION Q1 FY2021 Segment Results – Metal Coatings In millions $ except percentages Revenue Operating Income Operating Margin Key Statistics -2.6% -14.7% -300 bps $122.2 $122.2 FY2020 Revenue $119.0 $29.4 24.1% $25.1 21.1% Organic $(7.6) Acquisitions $4.4 FY2021 Revenue $119.0 FY2020 FY2021 FY2020 FY2021 FY2020 FY2021 Segment Summary: • Galvanizing business remained open for business as “essential infrastructure” • Revenue decline driven by COVID-19 impact – Surface Technologies customers temporarily shuttered operations • Lower zinc costs in Galvanizing were offset by lower productivity levels at Surface Technologies • Operating Margins of 21.1%, compared to 24.1% for same quarter in the prior year result of inefficiencies due to COVID-19 6

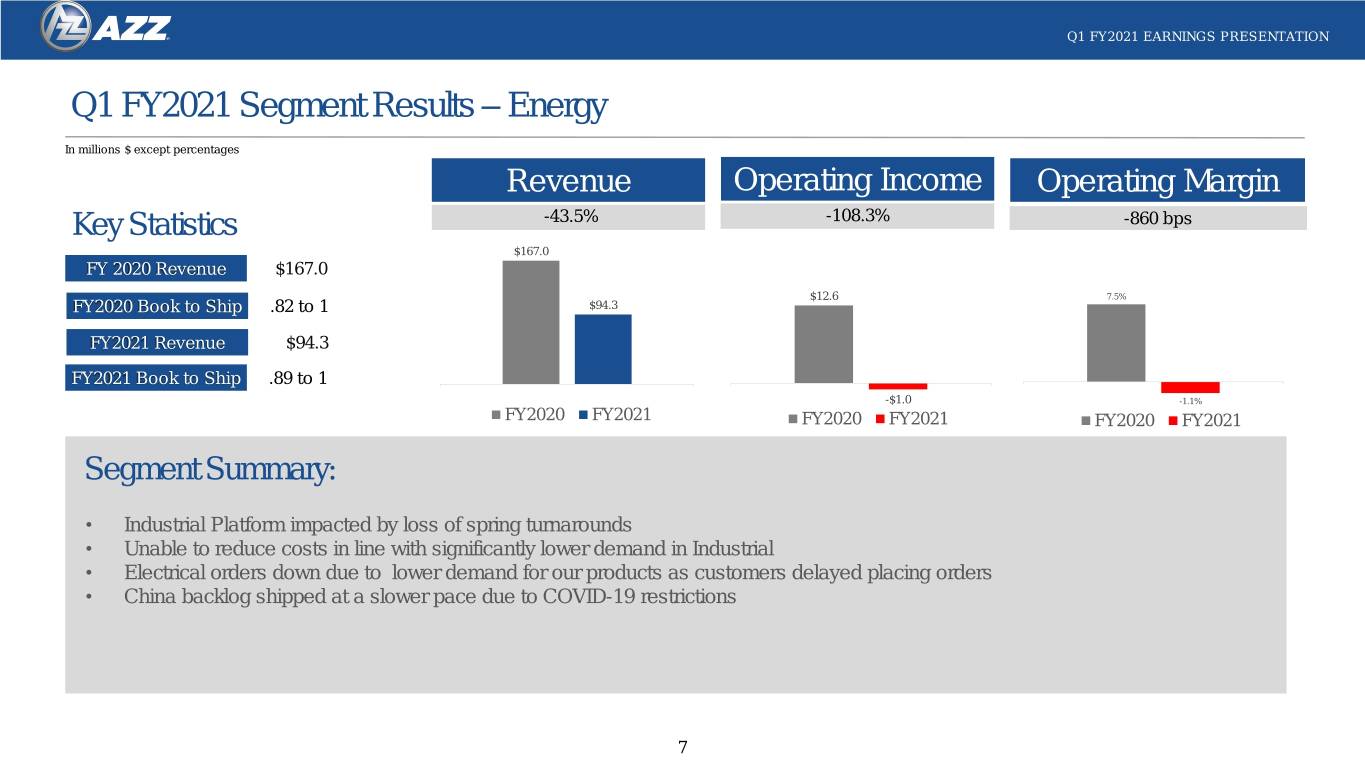

Q1 FY2021 EARNINGS PRESENTATION Q1 FY2021 Segment Results – Energy In millions $ except percentages Revenue Operating Income Operating Margin Key Statistics -43.5% -108.3% -860 bps $167.0 FY 2020 Revenue $167.0 $12.6 7.5% FY2020 Book to Ship .82 to 1 $94.3 FY2021 Revenue $94.3 FY2021 Book to Ship .89 to 1 -$1.0 -1.1% FY2020 FY2021 FY2020 FY2021 FY2020 FY2021 Segment Summary: • Industrial Platform impacted by loss of spring turnarounds • Unable to reduce costs in line with significantly lower demand in Industrial • Electrical orders down due to lower demand for our products as customers delayed placing orders • China backlog shipped at a slower pace due to COVID-19 restrictions 7

Q1 FY2021 EARNINGS PRESENTATION Full Year Financial Guidance FY2021 Range Key Drivers: In millions , except for EPS Metal Coatings: COVID-19 impact on future quarters Revenue $970-$1,060 Lower zinc costs & Digital Galvanizing System Suspended FY21 Guidance Energy: $2.65-$3.15 Fall refining turnaround uncertainty Earnings Per Share Order uncertainty for Electrical equipment Refinery utilization remains low 8

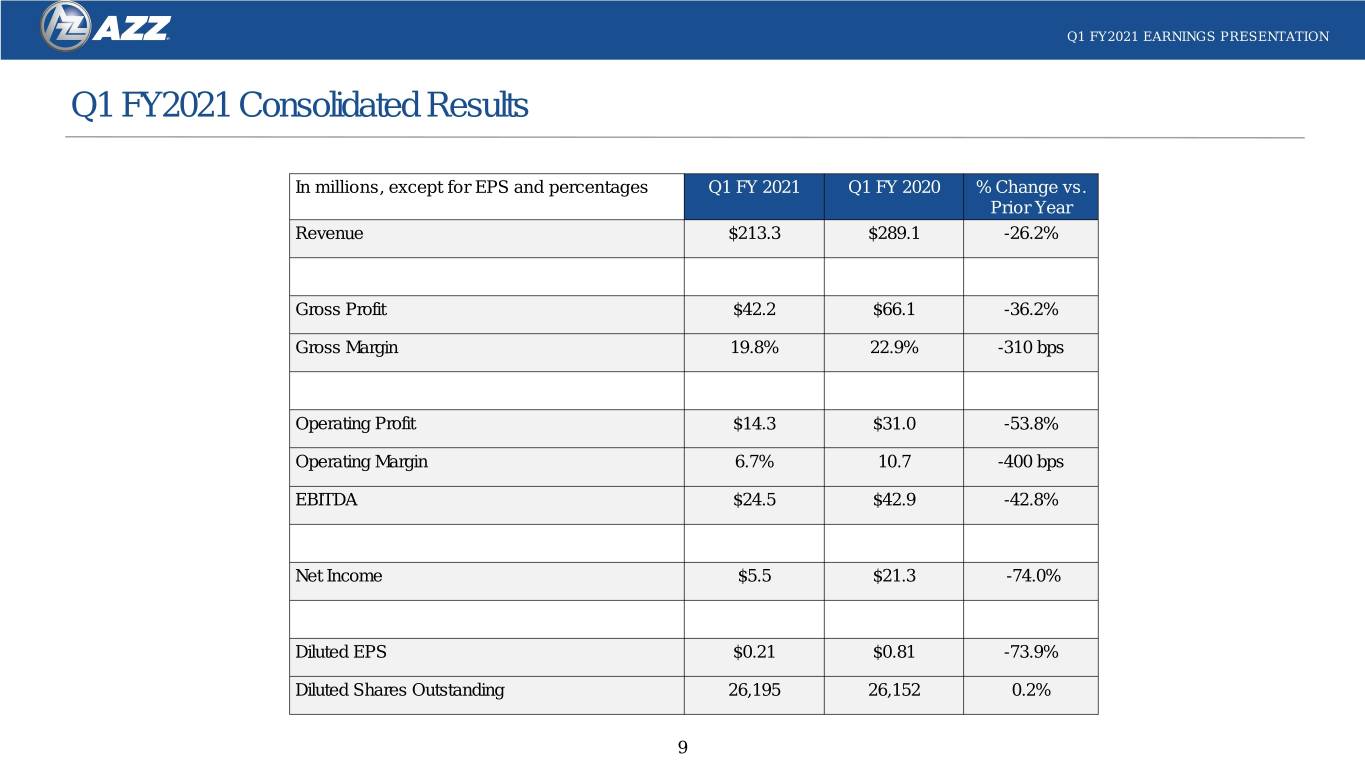

Q1 FY2021 EARNINGS PRESENTATION Q1 FY2021 Consolidated Results In millions, except for EPS and percentages Q1 FY 2021 Q1 FY 2020 % Change vs. Prior Year Revenue $213.3 $289.1 -26.2% Gross Profit $42.2 $66.1 -36.2% Gross Margin 19.8% 22.9% -310 bps Operating Profit $14.3 $31.0 -53.8% Operating Margin 6.7% 10.7 -400 bps EBITDA $24.5 $42.9 -42.8% Net Income $5.5 $21.3 -74.0% Diluted EPS $0.21 $0.81 -73.9% Diluted Shares Outstanding 26,195 26,152 0.2% 9

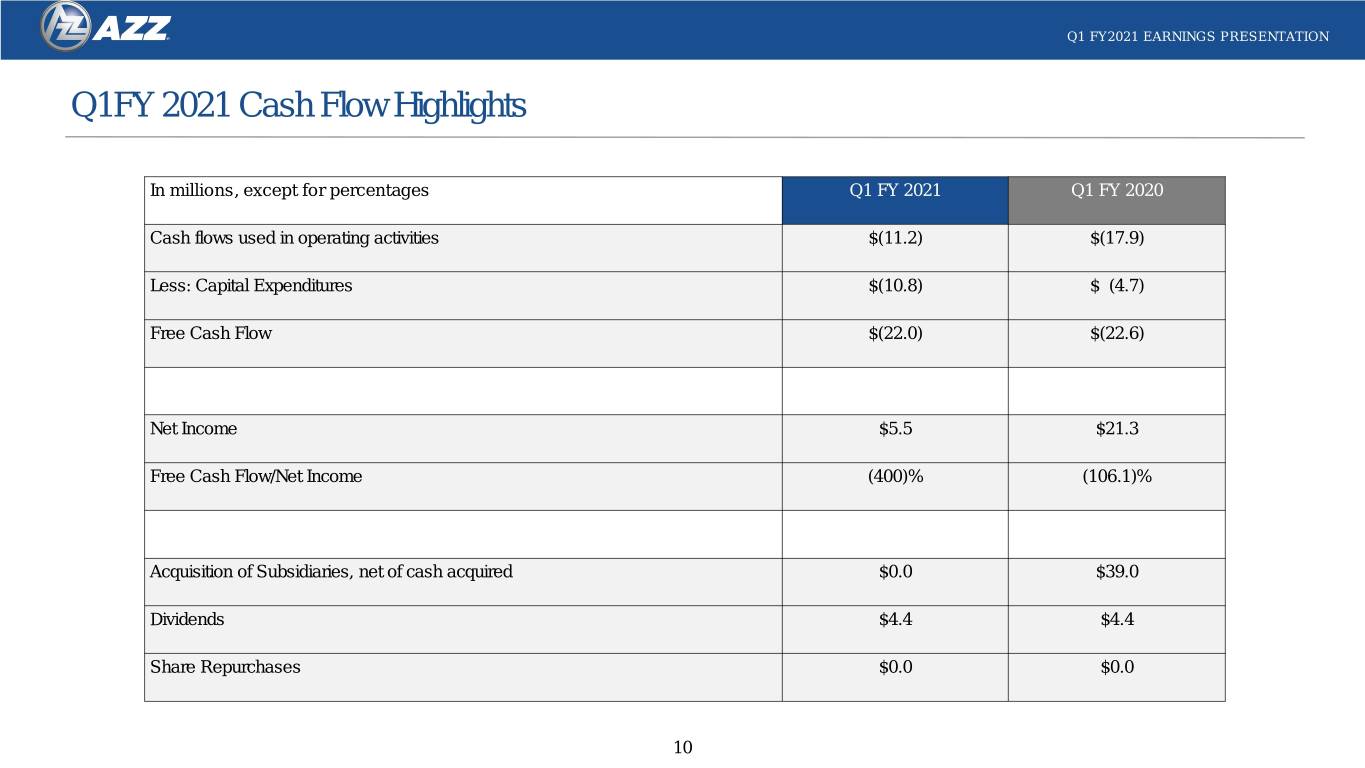

Q1 FY2021 EARNINGS PRESENTATION Q1FY 2021 Cash Flow Highlights In millions, except for percentages Q1 FY 2021 Q1 FY 2020 Cash flows used in operating activities $(11.2) $(17.9) Less: Capital Expenditures $(10.8) $ (4.7) Free Cash Flow $(22.0) $(22.6) Net Income $5.5 $21.3 Free Cash Flow/Net Income (400)% (106.1)% Acquisition of Subsidiaries, net of cash acquired $0.0 $39.0 Dividends $4.4 $4.4 Share Repurchases $0.0 $0.0 10

Q1 FY2021 EARNINGS PRESENTATION Capital Allocation Focused on Growth In millions Q1 2021 Capital Deployment • Safety, Health and Environmental Capital • Facility expansion Expenditures • Product growth initiatives $10.8 • No acquisitions in Q1 FY2021 Growth • Pandemic-related deal travel Acquisitions restricted, but improving • Active portfolio of opportunities • Temporarily suspended share Share repurchase program $4.4 Repurchases • Will restart share repurchases to minimize dilution • Approved second quarter FY2021 Dividends dividend $0.0 $0.0 Shareholder Return Shareholder Capital Expenditures Acquisitions Share Repurchases Dividends 11

Key Indicators 12

Q1 FY2021 EARNINGS PRESENTATION Key Indicators Metal Coatings Segment • Fabrication activity remains solid for Q2, but seeing some steel shortages • Zinc cost level remains low and cost of zinc in our kettles continues to drop • Surface Technology customers are anticipated to return to more normal production levels by the end of Q2 FY2021 Energy Segment • Industrial platform • Fall turnaround season is shaping up internationally • Seeing the normal, seasonally slow, summer • Electrical platform • Bookings expected to increase in second quarter and beyond • China shipments expected to continue Corporate • Continue to tightly monitor cash flow and customer credit 13

Q1 FY2021 EARNINGS PRESENTATION Strategic Direction • Long term strategy to continue to grow Metal Coatings organically and with a robust acquisition program, while targeting sustainable 21-23% Operating Margins • Focus on operating excellence and providing outstanding customer service • Assumes continued inorganic growth in Galvanizing and Surface Technologies • Energy will continue to focus on operational excellence and profitable growth in its core businesses while divesting or exiting non-core operations • Specialty Welding will grow through continued international expansion, offering the best customized welding technology, and continuing to reduce dependence on nuclear markets • Electrical businesses will continue to focus on improving profitability through process alignment, and focus on domestic market growth 14

Q&A

Reg G Tables

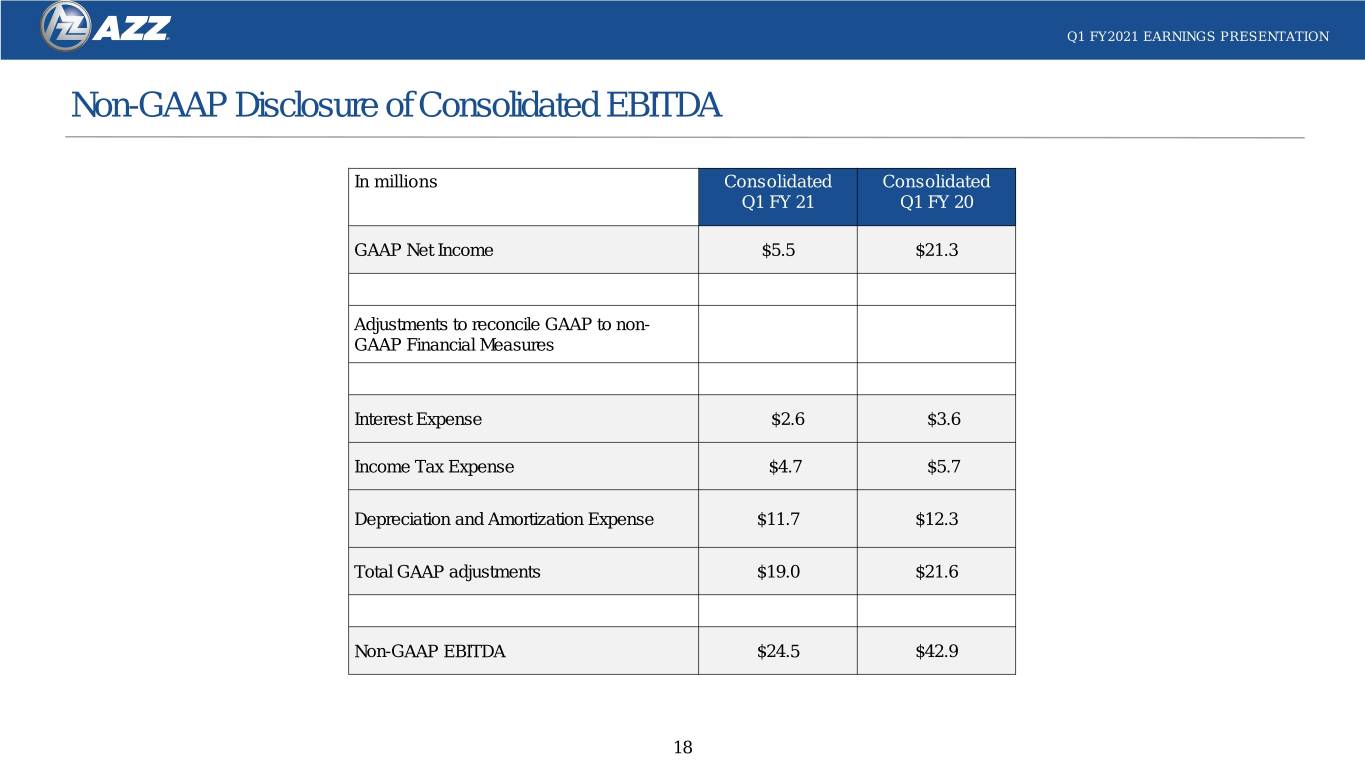

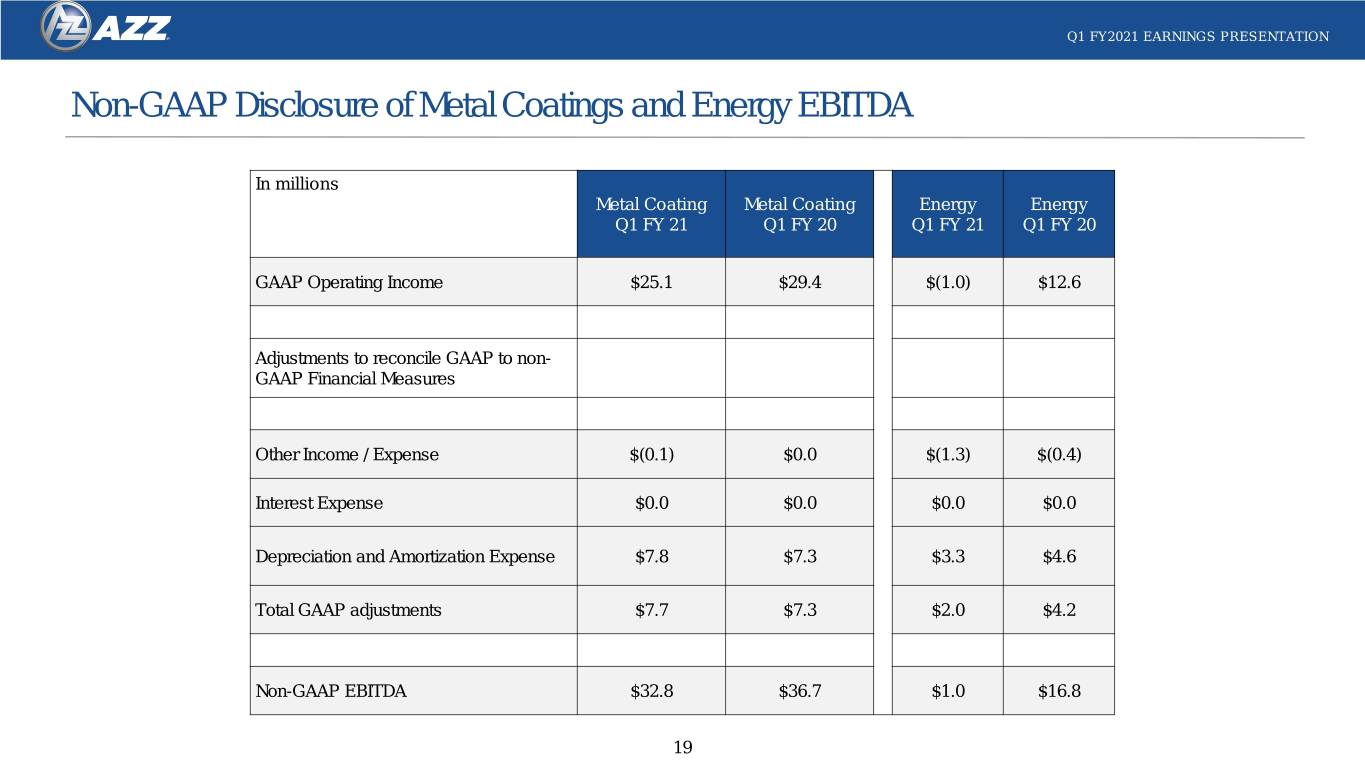

Q1 FY2021 EARNINGS PRESENTATION Non-GAAP Disclosure of EBITDA • In addition to reporting financial results in accordance with Generally Accepted Accounting Principles in the United States ("GAAP"), AZZ has provided EBITDA, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with a greater transparency comparison of operating results across a broad spectrum of companies, which provides a more complete understanding of AZZ’s financial performance, competitive position and prospects for the future. Management also believes that investors regularly rely on non-GAAP financial measures, such as EBITDA, to assess operating performance and that such measures may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. 17

Q1 FY2021 EARNINGS PRESENTATION Non-GAAP Disclosure of Consolidated EBITDA In millions Consolidated Consolidated Q1 FY 21 Q1 FY 20 GAAP Net Income $5.5 $21.3 Adjustments to reconcile GAAP to non- GAAP Financial Measures Interest Expense $2.6 $3.6 Income Tax Expense $4.7 $5.7 Depreciation and Amortization Expense $11.7 $12.3 Total GAAP adjustments $19.0 $21.6 Non-GAAP EBITDA $24.5 $42.9 18

Q1 FY2021 EARNINGS PRESENTATION Non-GAAP Disclosure of Metal Coatings and Energy EBITDA In millions Metal Coating Metal Coating Energy Energy Q1 FY 21 Q1 FY 20 Q1 FY 21 Q1 FY 20 GAAP Operating Income $25.1 $29.4 $(1.0) $12.6 Adjustments to reconcile GAAP to non- GAAP Financial Measures Other Income / Expense $(0.1) $0.0 $(1.3) $(0.4) Interest Expense $0.0 $0.0 $0.0 $0.0 Depreciation and Amortization Expense $7.8 $7.3 $3.3 $4.6 Total GAAP adjustments $7.7 $7.3 $2.0 $4.2 Non-GAAP EBITDA $32.8 $36.7 $1.0 $16.8 19