Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - WeTrade Group Inc. | wtg_ex322.htm |

| EX-32.1 - CERTIFICATION - WeTrade Group Inc. | wtg_ex321.htm |

| EX-31.2 - CERTIFICATION - WeTrade Group Inc. | wtg_ex312.htm |

| EX-31.1 - CERTIFICATION - WeTrade Group Inc. | wtg_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

| For the quarterly period ended: March 31, 2020 |

|

|

|

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

| For the transition period from ____________ to _____________ |

| WETRADE GROUP INC |

| (Exact name of small business issuer as specified in its charter) |

| WYOMING |

| |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Tax. I.D. No.) |

| No 1 Gaobei South Coast, Yi An Men 111 Block 37, Chao Yang District, Beijing City, People Republic of China |

| (Address of Principal Executive Offices) |

|

|

| (852) 67966335 |

| (Registrant’s Telephone Number, Including Area Code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller Reporting Company | x |

| Emerging growth company | ¨ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 29, 2020, there were 101,740,666 shares of common stock outstanding.

|

| 3 | |||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| 4 |

| ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 15 |

| |

|

| 17 |

| ||

|

| 17 |

| ||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| 18 |

| ||

|

| 18 |

| ||

|

| 18 |

| ||

|

| 18 |

| ||

|

| 18 |

| ||

|

| 18 |

| ||

|

| 19 |

| ||

|

|

|

|

|

|

|

| 20 |

| ||

| 2 |

| Table of Content |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). These forward-looking statements are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These forward-looking statements are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. You should not unduly rely on these statements.

We identify forward-looking statements by use of terms such as “may,” “will,” “expect,” “anticipate,” “estimate,” “hope,” “plan,” “believe,” “predict,” “envision,” “intend,” “will,” “continue,” “potential,” “should,” “confident,” “could” and similar words and expressions, although some forward-looking statements may be expressed differently. You should be aware that our actual results could differ materially from those contained in the forward-looking statements.

Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report. These factors include, among others:

|

| ● | our ability to execute on our growth strategies; |

|

|

|

|

|

| ● | our ability to find manufacturing partners on favorable terms; |

|

|

|

|

|

| ● | declines in general economic conditions in the markets where we may compete; |

|

|

|

|

|

| ● | our anticipated needs for working capital; and |

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis.

Forward-looking statements speak only as of the date of this report or the date of any document incorporated by reference in this report. Except to the extent required by applicable law or regulation, we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

| 3 |

| Table of Content |

PART I – FINANCIAL INFORMATION

WETRADE GROUP INC

BALANCE SHEETS

| (All amounts shown in U.S. Dollars) |

| March 31, |

|

| December 31, |

| ||

|

|

| (unaudited) |

|

| (audited) |

| ||

| ASSETS |

|

|

|

|

|

| ||

| Current Assets: |

|

|

|

|

|

| ||

| Cash and Cash Equivalents |

| $ | 5,192,095 |

|

|

| 6,591,128 |

|

|

|

|

|

|

|

|

|

|

|

| Non current Assets: |

|

|

|

|

|

|

|

|

| Intangible asset |

|

| 56,191 |

|

|

| - |

|

| Prepaid Expenses |

|

| 13,531 |

|

|

| - |

|

| Total Assets: |

|

| 5,261,817 |

|

|

| 6,591,128 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accrued expenses |

|

| 20,210 |

|

|

| 32,000 |

|

| Amount due to related parties |

|

| 416,515 |

|

|

| 1,754,515 |

|

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

| 436,725 |

|

|

| 1,786,515 |

|

| Total Liabilities |

|

| 436,725 |

|

|

| 1,786,515 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Common Stock; $0.00 per share par value; 101,740,666 issued and outstanding at March 31, 2020; 100,074,000 issued and outstanding at December 31, 2019 |

|

| - |

|

|

| - |

|

| Additional Paid in Capital |

|

| 5,222,020 |

|

|

| 222,020 |

|

| Share to be issued |

|

| 78,000 |

|

|

| 5,000,000 |

|

| Accumulated other comprehensive loss |

|

| (57,060 | ) |

|

| - |

|

| Accumulated Deficit |

|

| (417,868 | ) |

|

| (417,407 | ) |

| Total Stockholders’ Equity |

|

| 4,825,092 |

|

|

| 4,804,613 |

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

| $ | 5,261,817 |

|

|

| 6,591,128 |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 4 |

| Table of Content |

WETRADE GROUP INC

STATEMENTS OF OPERATIONS

|

|

| For the Period March 31, 2020 |

|

| From the period March 28, 2019 (Inception) to March 31, 2019 |

| ||

|

|

| (unaudited) |

|

| (unaudited) |

| ||

| Revenue: |

|

|

|

|

|

| ||

| Service revenue, related party |

| $ | 21,070 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Total net revenues |

|

| 21,070 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

| General and Administrative |

|

| 25,070 |

|

|

| 4,000 |

|

| Operations Loss |

|

| (4,000 | ) |

|

| (4,000 | ) |

| Other revenue |

|

| 3,539 |

|

|

|

|

|

| Net Loss |

|

| (461 | ) |

|

| (4,000 | ) |

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive Loss |

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

|

| (57,060 | ) |

|

| - |

|

| Total comprehensive Loss |

|

| (56,599 | ) |

|

| (4,000 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Net Loss per share: |

|

| (0.00 | ) |

|

| (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding; Basic and Diluted |

|

| 100,629,555 |

|

|

| 100,000,000 |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 5 |

| Table of Content |

WETRADE GROUP INC

STATEMENTS OF CASH FLOWS

|

|

| From the period March 31, 2020 |

|

| For the Period March 28, 2019 (Inception) to March 31, 2019 |

| ||

|

|

| (unaudited) |

|

| (unaudited) |

| ||

| Cash Flows from Operating Activities: |

|

|

|

|

|

| ||

| Net Loss |

| $ | (461 | ) |

|

| (4,000 | ) |

|

|

|

| (461 | ) |

|

| (4,000 | ) |

| Changes in Operating Assets and Liabilities: |

|

|

|

|

|

|

|

|

| Amount due to related parties |

|

| (1,338,000 | ) |

|

| 4,000 |

|

| Accrued expense |

|

| (11,790 | ) |

|

| - |

|

| Intangible assets |

|

| (56,191 | ) |

|

| - |

|

| Prepaid expenses |

|

| (13,531 | ) |

|

| - |

|

| Net Cash Flows Used in Operating Activities: |

|

| (1,419,973 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from financing activities: |

|

|

|

|

|

| - |

|

| Share issued for cash |

|

| 78,000 |

|

|

|

|

|

| Net cash provided by financing activities: |

|

| 78,000 |

|

|

| - |

|

| Effect of exchange rate changes on cash |

|

| (57,060 | ) |

|

| - |

|

| Change in Cash and Cash Equivalents: |

|

| (1,399,033 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, Beginning of Period |

|

| 6,591,128 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, End of Period |

| $ | 5,192,095 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Cash Flow Information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

| $ | - |

|

|

| - |

|

| Cash paid for taxes |

|

| - |

|

|

| - |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 6 |

| Table of Content |

WETRADE GROUP INC AND SUBSIDIARY

Statement of Changes in Stockholders’ Equity (Deficit)

Period Ended March 31, 2020 and 2019

|

|

| Common Stock |

|

| Additional Paid in |

|

| Share to |

|

| Retained Earnings (Accumulated |

|

| Accumulated Other comprehensive |

|

| Total Shareholder Equity |

| ||||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| be issued |

|

| Deficit) |

|

| loss |

|

| (Deficit) |

| |||||||

| Balance as of December 31, 2019 |

|

| 100,074,000 |

|

| $ | - |

|

| $ | 222,020 |

|

| $ | 5,000,000 |

|

| $ | (417,407 | ) |

| $ | - |

|

| $ | 4,804,613 |

|

| Stock issued during the period |

|

| 1,666,666 |

|

|

| - |

|

|

| 5,000,000 |

|

|

| (5,000,000 | ) |

|

| - |

|

|

| - |

|

|

| - |

|

| Share to be issued |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 78,000 |

|

|

| - |

|

|

| - |

|

|

| 78,000 |

|

| Foreign currency translation adjustment |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (57,060 | ) |

|

| (57,060 | ) |

| Net loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | (461 | ) |

|

| - |

|

| $ | (461 | ) |

| Balance as of March 31, 2020 (unaudited) |

|

| 101,740,666 |

|

| $ | - |

|

| $ | 5,222,020 |

|

| $ | 78,000 |

|

| $ | (417,868 | ) |

|

| (57,060 | ) |

| $ | 4,825,092 |

|

|

|

| Common Stock |

|

| Additional Paid in |

|

| Share to |

|

| Retained Earnings (Accumulated |

|

| Accumulated other comprehensive |

|

| Total Shareholder Equity |

| ||||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| be issued |

|

| Deficit) |

|

| loss |

|

| (Deficit) |

| |||||||

| Balance as of March 28, 2019 (inception) |

|

| 100,000,000 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

|

| - |

|

| $ - |

| |

| Stock issued during the period |

|

| - |

|

|

| - |

|

|

|

|

|

|

| - |

|

|

| - |

|

|

|

|

|

|

| - |

|

| Share to be issued |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Foreign currency adjustment |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Net loss for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | (4,000 | ) |

|

| - |

|

| $ | (4,000 | ) |

| Balance as of March 31, 2019 (unaudited) |

|

| 100,000,000 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | (4,000 | ) |

|

|

|

|

| $ | (4,000 | ) |

The accompanying notes are an integral part of these unaudited financial statements.

| 7 |

| Table of Content |

Wetrade Group Inc

Notes to Financial Statements

For the Three Months Ended March 31, 2020

(Unaudited)

NOTE 1. NATURE OF BUSINESS

Organization

WeTrade Group Inc. was incorporated in the State of Wyoming on March 28, 2019.

WeTrade Group Inc. is in the business of providing technical services and solutions via its membership-based social e-commerce platform and the Group is target to provided technical and auto-billing management services for 100 million micro-business online stores in China.

In January 2020, WeTrade have appointed 3rd party software company to develop an auto-billing management system (“Wepay System”) at the cost of RMB 400,000 in order to provide online payment services for its online store customers in PRC.

The main functions of Wepay System is an online payment services, CPS profit management services, multi-channels App and data analysis, which is developed to provide payment and auto-billing services for online store customers from retail, tourism industry, hospitality and beauty industry.

WeTrade Group INC had successful conducted its business operations in mainland China and trial operation in Hong Kong, Philippines and Singapore. WeTrade has also formed the long-term technical cooperation with Yuetao App, Daren App, Yuebei App, Jingdong App, Yuedian App and Lvyue App.

On March 1, 2020 WeTrade Group Inc.’s wholly owned subsidiary, known as Yue Shang Information Technology (Beijing) Co Limited, has entered into a Technical Entrust (Agency) Agreement with a related company owned by Company’s director, known as Global Joy Trip Technology (Beijing) Co Limited.

| 8 |

| Table of Content |

According to the Agreement, the Group will provide auto-billing management services and technical support to Global Joy Trip Technology (Beijing) Co Limited (“Global Joy”) in its e-commerce platform, including, but not limited to: system background construction, foreground APP, basic application training, etc.

Accordingly, the Group shall receive 2% of the total Gross Merchandise Volume (“GMV”) generated in Global Joy e-commerce platform as service fee.

The Board believes that the Technical Entrust Agreement will provide the Group with the opportunity to leverage on its extensive experience in China social e-commerce business. The Board also believes that it could expand the Group’s business scope, broaden income sources and enhance its financial performance, as well as in the interests of the Company and its shareholders.

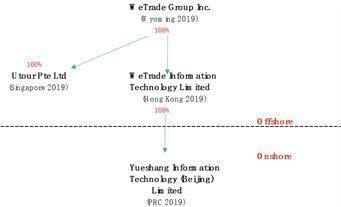

The following diagram sets forth the structure of the Company as of the date of this Current Report:

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation of financial statements

The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The consolidated financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation.

The condensed consolidated financial statements of the Company as of and for the three ended March 31, 2020 and 2019 are unaudited. In the opinion of management, all adjustments (including normal recurring adjustments) that have been made are necessary to fairly present the financial position of the Company as of March 31, 2020, the results of its operations for the three months ended March 31, 2020 and 2019, and its cash flows for the three months ended March 31, 2020 and 2019. Operating results for the interim periods presented are not necessarily indicative of the results to be expected for a full fiscal year. The balance sheet as of December 31, 2019 has been derived from the Company’s audited financial statements included in the Form 10-K for the year ended December 31, 2019.

The statements and related notes have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the financial statements and other information included in the Company’s Annual Report on Form 10-K as filed with the SEC for the fiscal year ended December 31, 2019.

As of March 31, 2020, the details of the consolidating subsidiaries are as follows:

|

|

| Place of |

| Attributable |

| |

| Name of Company |

| incorporation |

| equity interest % |

| |

| Utour Pte Ltd |

| Singapore |

|

| 100 | % |

|

|

|

|

|

|

|

|

| WeTrade Information Technology Limited (“WITL”) |

| Hong Kong |

|

| 100 | % |

|

|

|

|

|

|

|

|

| Yueshang Information Technology (Beijing) Co., Ltd. (“YITB”) |

| P.R.C. |

|

| 100 | % |

| 9 |

| Table of Content |

Nature of Operations

WeTrade Group Inc. (the “Company” or or “We’ or “Us”) is a Wyoming corporation incorporated on March 28, 2019. The Company is an investment holding company that formed as a Wyoming corporation to use as a vehicle for raising equity outside the US.

As of March 31, 2020, the nature operation of its subsidiaries are as follows:

|

| Place of |

| Nature of | |

| Name of Company |

| incorporation |

| operation |

| Utour Pte Ltd |

| Singapore | Investment holding company | |

|

| ||||

| WeTrade Information Technology Limited (“WITL”) |

| Hong Kong | Investment holding company | |

|

| ||||

| Yueshang Information Technology (Beijing) Co., Ltd. (“YITB”) |

| P.R.C. | Providing of social e-commerce services, technical system support and services |

COVID-19 outbreak

In March 2020 the World Health Organization declared coronavirus COVID-19 a global pandemic. The COVID-19 pandemic has negatively impacted the global economy, workforces, customers, and created significant volatility and disruption of financial markets. It has also disrupted the normal operations of many businesses, including ours. This outbreak could decrease spending, adversely affect demand for our services and harm our business and results of operations. It is not possible for us to predict the duration or magnitude of the adverse results of the outbreak and its effects on our business or results of operations at this time.

Revenue recognition

The Company follows the guidance of Accounting Standards Codification (ASC) 606, Revenue from Contracts. ASC 606 creates a five-step model that requires entities to exercise judgment when considering the terms of contracts, which includes (1) identifying the contracts or agreements with a customer, (2) identifying our performance obligations in the contract or agreement, (3) determining the transaction price, (4) allocating the transaction price to the separate performance obligations, and (5) recognizing revenue as each performance obligation is satisfied. The Company only applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange for the services it transfers to its clients.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with a maturity period of three months or less to be cash or cash equivalents. The carrying amounts reported in the accompanying unaudited condensed consolidated balance sheets for cash and cash equivalents approximate their fair value. All of the Company’s cash that is held in bank accounts in Singapore and PRC is not protected by Federal Deposit Insurance Corporation (“FDIC”) insurance or any other similar insurance in the PRC, or Singapore.

| 10 |

| Table of Content |

Use of Estimate

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of expenses during the reporting periods. Actual results could differ from those estimates.

Concentration of Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. Cash on hand amounted to $5,192,095 as of March 31, 2020.

Intangible Asset

Intangible asset is software development cost incurred by company, it will be amortized on a straight line basis over the estimated useful life of 5 years.

Income Tax

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the periods in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The Company has a subsidiary in Singapore and PRC. The Company is subject to tax in Singapore and PRC jurisdictions. As a result of its future business activities, the Company will be required to file tax returns that are subject to examination by the Inland Revenue Authority of Singapore and Tax Department of PRC.

Loss Per Share

Basic net income (loss) per share of common stock attributable to common stockholders is calculated by dividing net income (loss) attributable to common stockholders by the weighted-average shares of common stock outstanding for the period. Potentially dilutive shares, which are based on the weighted-average shares of common stock underlying outstanding stock-based awards, warrants, options, or convertible debt using the treasury stock method or the if-converted method, as applicable, are included when calculating diluted net income (loss) per share of common stock attributable to common stockholders when their effect is dilutive.

Potential dilutive securities are excluded from the calculation of diluted EPS in loss periods as their effect would be anti-dilutive.

| 11 |

| Table of Content |

As of March 31, 2020, there were potentially dilutive shares.

|

|

| For the period March 31, 2020 |

|

| For the period March 31, 2019 |

| ||

| Statement of Operations Summary Information: |

|

|

|

|

|

| ||

| Net Loss |

| $ | 461 |

|

|

| 4,000 |

|

| Weighted-average common shares outstanding - basic and diluted |

|

| 100,629,555 |

|

|

| 100,000,000 |

|

| Net loss per share, basic and diluted |

| $ | 0.00 |

|

|

| 0.00 |

|

Fair Value

The Company follows guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. Additionally, the Company adopted guidance for fair value measurement related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value.

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs are unobservable inputs for the asset or liability. The carrying amounts of financial assets such as cash approximate their fair values because of the short maturity of these instruments.

NOTE 3. RECENT ACCOUNTING PRONOUNCEMENTS

Recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the United States Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future financial statements.

NOTE 4 – REVENUE

The main functions of Wepay System is an online payment services, CPS profit management services, multi-channels App and data analysis, which is developed to provide payment and auto-billing services for online store customers from retail, tourism industry, hospitality and beauty industry.

We earn revenue primarily by completing payment transactions for customers through our “Wepay System” and from other value added services. Our revenues are classified into two categories: transaction revenues based on Gross Merchandise volume (“GMV”) of online stores and revenues from other value added services or online technical services from store customers.

As per the agreement with related company, known as Global Joy Trip Technology (Beijing) Co Limited, which will shall be 0.5% of the actual Gross Merchandise Volume (“GMV”) during trial period and subsequently 2% of GMV pay to the Company as the system service fee.

| 12 |

| Table of Content |

NOTE 5. CASH AT BANK

As of March 31, 2020, the Company held cash in bank in the amount of $5,192,095, which consist of the following:

|

|

| March 31, 2020 |

|

| December 31, 2019 |

| ||

| Bank Deposits-China |

| $ | 4,943,930 |

|

|

| 5,000,014 |

|

| Bank Deposits-Singapore |

|

| 248,165 |

|

|

| 1,591,114 |

|

|

|

|

| 5,192,095 |

|

|

| 6,591,128 |

|

NOTE 6. INTANGIBLE ASSET

Intangible asset is software development cost incurred by company, it will be amortized on a straight line basis over the estimated useful life of 5 years as follow:

|

|

| March 31, 2020 | ||||||||||||||

|

|

| Gross Carrying Amount |

|

| Accumulated Amortization |

|

| Net Carrying Amount |

|

| Weighted Average Useful Life (Years) |

| ||||

|

| ||||||||||||||||

| Intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Software development |

| $ | 57,143 |

|

| $ | (952 | ) |

| $ | 56,191 |

|

|

| 5 |

|

| Intangible assets, net |

| $ | 57,143 |

|

| $ | (952 | ) |

| $ | 56,919 |

|

|

|

|

|

Amortization expense for intangible assets was $952 for the three months ended March 31, 2020.

Expected future intangible asset amortization as of March 31, 2020 was as follows:

| Fiscal years: |

|

|

| |

| Remaining 2020 |

| $ | 56,191 |

|

| 2021 |

|

| 44,767 |

|

| 2022 |

|

| 33,343 |

|

| 2023 |

|

| 21,919 |

|

| Thereafter |

|

| 10,497 |

|

| 13 |

| Table of Content |

NOTE 7. AMOUNT DUE TO DIRECTOR

As of March 31, 2020, amount due to related parties consist of the following:

|

|

| As of March 31, 2020 |

|

| As of December 31, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Related parties payable |

|

| 276,515 |

|

|

| 254,515 |

|

| Related party loan |

|

| 140,000 |

|

|

| 1,500,000 |

|

|

|

| $ | 416,515 |

|

|

| 1,754,515 |

|

The related party balance of $416,515 represented an outstanding loan of $140,000 from the related company owned by Company’s director for daily business operation in Singapore, and professional expenses paid on behalf by Director of $276,515 and which consist of $224,515 advance from Dai Zheng, $42,000 advance from Li Zhuo and $10,000 from Che Kean Tat. It is unsecured, interest-free with no fixed payment term and imputed interest is consider to be immaterial.

The Company have settled related party loan of $650,000 and $710,000 in January 21, 2020 and March 2, 2020 respectively due to cost cutting in business operation in Singapore as a result of change in business plan. As of March 31, 2020, there were $140,000 of related party loan that are due to the company owned by Mr. Dai, the Chairman of the Board.

NOTE 8. SHAREHOLDERS’ EQUITY (DEFICIT)

The Company issued 1,660,680 shares of common stock in February 2020 at price of $3 per share.

The Company has an unlimited number of ordinary shares authorized, and has issued 101,740,666 shares with no par value as of March 31, 2020.

There are 26,000 shares to be issued at $3 per share to 2 new shareholder in July 2020.

| 14 |

| Table of Content |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors discussed elsewhere in this report.

Overview

WeTrade Group Inc. is in the business of providing technical services and solutions via its membership-based social e-commerce platform and the Group is target to provided technical and auto-billing management services for 100 million micro-business online stores in China.

In January 2020, WeTrade have appointed 3rd party software company to develop an auto-billing management system (“Wepay System”) at the cost of RMB 400,000 in order to provide online payment services for its online store customers in PRC.

The main functions of Wepay System is an online payment services, CPS profit management services, multi-channels App and data analysis, which is developed to provide payment and auto-billing services for online store customers from retail, tourism industry, hospitality and beauty industry.

On March 1, 2020 WeTrade Group Inc.’s wholly owned subsidiary, known as Yue Shang Information Technology (Beijing) Co Limited, has entered into a Technical Entrust (Agency) Agreement with a related company owned by Company’s director, known as Global Joy Trip Technology (Beijing) Co Limited.

According to the Agreement, the Group will provide auto-billing management services and technical support to Global Joy Trip Technology (Beijing) Co Limited (“Global Joy”) in its e-commerce platform, including, but not limited to: system background construction, foreground APP, basic application training, etc. Accordingly, the Group shall receive 2% of the total Gross Merchandise Volume (“GMV”) generated in Global Joy e-commerce platform as service fee.

Results of Operations

The following tables provide a comparison of a summary of our results of operations for the three month period ended March 31, 2020 and 2019.

Results of Operations for the Three month period Ended March 31, 2020 and 2019

|

|

| For the Period March 31, 2020 |

|

| From the period March 28, 2019 (Inception) to March 31, 2019 |

| ||

| Revenue: |

| $ | 21,070 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

| General and Administrative |

|

| (25,070 | ) |

|

| (4,000 | ) |

| Operations Loss |

|

| (4,000 | ) |

|

| (4,000 | ) |

| Other revenue |

|

| 3,539 |

|

|

| - |

|

| Net Loss |

|

| (461 | ) |

|

| (4,000 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Net Loss per share: |

|

| (0.00 | ) |

|

| (0.00 | ) |

| 15 |

| Table of Content |

Revenue from Operations

For the three-month period ended March 31, 2020, total revenue was $21,070 from related company, which are mainly from the service revenue generated from auto-billing management system from related company.

General and Administrative Expenses

For the three month period ended March 31, 2020, general and administrative expenses were $25,070 , the increase is mainly due to maintenance fee of software development, audit fee and lawyers review fees from the periodic filings with the SEC.

Net Income (Loss)

As a result of the factors described above, there was a net loss of $461 for the three month period ended March 31, 2020, the decrease in loss is mainly due to revenue generated from auto-billing management system from related party.

Results of Operations for the Three month period Ended March 31, 2020.

|

|

| 2020 |

|

| 2019 |

| ||

| Revenue |

| $ | 21,070 |

|

|

| - |

|

| General and Administrative Expense |

|

| (25,070 | ) |

|

| (4,000 | ) |

| Loss from Operations |

|

| (4,000 | ) |

|

| (4,000 | ) |

| Other revenue |

|

| 3,539 |

|

|

| - |

|

| Net Loss |

| $ | (461 | ) |

|

| (4,000 | ) |

Liquidity and Capital Resources

As of March 31, 2020, We had cash on hand of $5,192,095. The decrease is mainly due to the repayment of related party loan of $650,000 and $710,000 in January 21, 2020 and March 2, 2020 respectively as compare to the bank balance of $6,591,128 in December 31, 2019.

Operating activities

Our continuing operating activities used cash of ($1,419,973) during the period, which was mainly due to loan repayment of approximately $1.3 million to related parties as compare to $4,000 in 2019.

Financing activities

Cash provided in our financing activities was increased to $78,000 for the three month period ended March 31, 2020 as compared to $nil in 2019, which is due to additional 26,000 shares to be issued to new 2 shareholders in July 2020.

Inflation

Inflation does not materially affect our business or the results of our operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies

We prepare our financial statements in accordance with generally accepted accounting principles of the United States (“GAAP”). GAAP represents a comprehensive set of accounting and disclosure rules and requirements. The preparation of our financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Our actual results could differ from those estimates. We use historical data to assist in the forecast of our future results. Deviations from our projections are addressed when our financials are reviewed on a monthly basis. This allows us to be proactive in our approach to managing our business. It also allows us to rely on proven data rather than having to make assumptions regarding our estimates.

Recent Accounting Pronouncements

We have reviewed all the recently issued, but not yet effective, accounting pronouncements and we do not believe any of these pronouncements will have a material impact on the Company financial statements.

| 16 |

| Table of Content |

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a “smaller reporting company” as defined by Item 10(f)(1) of Regulation S-K, and as such are not required to provide the information contained in this item pursuant to Item 305 of Regulation S-K.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures.

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

With respect to the period ending March 31, 2020, under the supervision and with the participation of our management, we conducted an evaluation of the effectiveness of the design and operations of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) promulgated under the Securities Exchange Act of 1934.

Based upon our evaluation regarding the period ending March 31, 2020, the Company’s management, including its Principal Executive Officer, has concluded that its disclosure controls and procedures were not effective due to the Company’s limited internal resources and lack of ability to have multiple levels of transaction review. Material weaknesses noted are lack of an audit committee, lack of a majority of outside directors on the board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; and management is dominated by two individuals, without adequate compensating controls. However, management believes the financial statements and other information presented herewith are materially correct.

The Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives. However, the Company’s management, including its Principal Executive Officer, does not expect that its disclosure controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefit of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during our most recently completed fiscal quarter that has materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 17 |

| Table of Content |

We were not subject to any legal proceedings during the three months ended March 31, 2020, nor to the best of our knowledge and belief are any threatened or pending.

We are a “smaller reporting company” as defined by Item 10(f)(1) of Regulation S-K, and as such are not required to provide the information contained in this item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

The Company has issued additional 1,666,666 shares to 2 shareholders during the three months ended March 31, 2020.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

No senior securities were issued and outstanding during the three months ended March 31, 2020.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable to our Company.

None.

| 18 |

| Table of Content |

| Exhibit No. |

| Description |

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

| 101 |

| Financial statements from the quarterly report on Form 10-Q of Wetrade Group Inc for the fiscal quarter ended March 31, 2020, formatted in XBRL: (i) the Balance Sheet; (ii) the Statement of Income; (iii) the Statement of Cash Flows; and (iv) the Notes to the Financial Statements Filed herewith |

| 19 |

| Table of Content |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| WETRADE GROUP INC |

| |

|

|

|

|

|

| Dated June 30, 2020 | By: | /s/ Zheng, Dai |

|

|

| Zheng, Dai |

| |

|

|

| Chief Executive Officer |

|

|

|

|

|

|

|

|

| /s/ Kean Tat, Che |

|

|

|

| Kean Tat, Che |

|

|

|

| Chief Financial Officer |

|

| 20 |