Attached files

| file | filename |

|---|---|

| EX-10.2 - UNOFFICIAL ENGLISH TRANSLATION OF THE ACQUISITION AGREEMENT DATED JUNE 25, 2020 - TD Holdings, Inc. | ea123606ex10-2_tdhold.htm |

| EX-10.1 - UNOFFICIAL ENGLISH TRANSLATION OF THE VIE TERMINATION AGREEMENT DATED JUNE 25, 2 - TD Holdings, Inc. | ea123606ex10-1_tdhold.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 30, 2020

TD Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36055 | 45-4077653 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

Room 104, No. 33 Section D,

No. 6 Middle Xierqi Road,

Haidian District, Beijing, China

(Address of Principal Executive Offices)

+86 (010) 59441080

(Issuer’s telephone number)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 | GLG | Nasdaq Capital Market |

| Item 1.02 | Termination of a Material Definitive Agreement. |

As previously reported, on November 22, 2019, Hao Limo Technology (Beijing) Co., Ltd. (“Hao Limo”), an indirectly wholly owned subsidiary of TD Holdings, Inc. (the “Company”, “we” or “us”), entered into a series of agreements (the “Huamucheng VIE Agreements”) with Shenzhen Huamucheng Trading Co., Ltd. (“Huamucheng”) and the shareholders of Huamucheng (the “Huamucheng Shareholders”) pursuant to which the Company obtained control of Huamucheng. The Huamucheng VIE Agreements include the Exclusive Business Cooperation Agreement, Exclusive Option Agreement, Share Pledge Agreement, Timely Reporting Agreement and the Powers of Attorney. The Company entered into the Huamucheng VIE Agreements in order to start its commodities trading business.

On June 25, 2020, Hao Limo and Huamucheng entered into certain VIE Termination Agreement (the “VIE Termination Agreement”) to terminate the Huamucheng VIE Agreements. As such, Hao Limo will no longer have the control rights and rights to the assets, property and revenue of Huamucheng.

The unofficial English translation of the VIE Termination Agreement is qualified in its entirety by reference to the complete text of the unofficial English translation of the VIE Termination Agreement, which is filed hereto as Exhibit 10.1.

| Item 1.01 | Entry into a Material Definitive Agreement. |

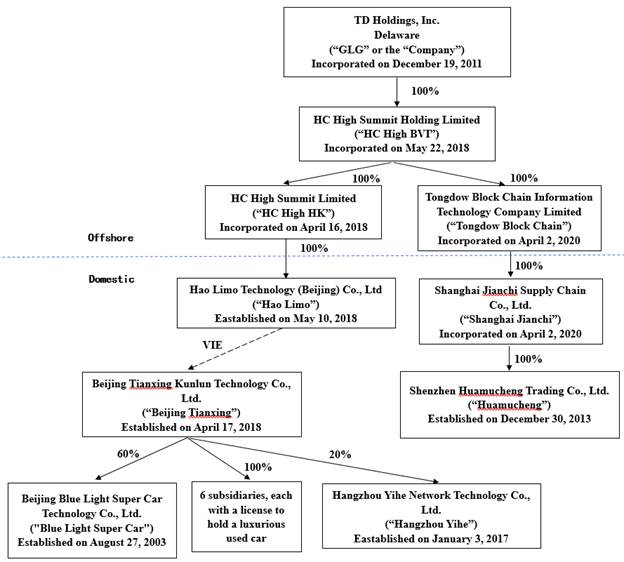

HC High Summit Holding Limited (“HC High BVI”), the Company’s wholly owned subsidiary, established and owns 100% equity interest of Tongdow Block Chain Information Technology Company Limited (“Tongdow Block Chain”), a Hong Kong limited liability company, and Tongdow Block Chain owns 100% equity interest of Shanghai Jianchi Supply Chain Company Limited (“Shanghai Jianchi”), a People’s Republic of China limited liability company.

On June 25, 2020, Shanghai Jianchi, Huamucheng and the shareholders of Huamucheng (the “Huamucheng Shareholders”) entered into certain Share Acquisition Agreement (the “Acquisition Agreement”) pursuant to which Shanghai Jianchi acquired 100% equity interest of Huamucheng from the Huamucheng Shareholders for nominal consideration.

The unofficial English translation of the Acquisition Agreement is qualified in its entirety by reference to the complete text of the unofficial English translation of the Acquisition Agreement, which is filed hereto as Exhibit 10.2.

The consummation of the VIE Termination Agreement occurred concurrently with Shanghai Jianchi’s acquisition of 100% equity interest of Huamucheng pursuant to the Acquisition Agreement (the “Acquisition”).

The following diagram illustrates our corporate structure after the completion of the Acquisition:

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

| 10.1 | Unofficial English Translation of the VIE Termination Agreement dated June 25, 2020 |

| 10.2 | Unofficial English Translation of the Acquisition Agreement dated June 25, 2020 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TD HOLDINGS, INC. | ||

| Date: June 30, 2020 | By: | /s/ Renmei Ouyang |

| Name: | Renmei Ouyang | |

| Title: | Chief Executive Officer | |