Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Virginia National Bankshares Corp | vabk-ex992_7.htm |

| 8-K - 8-K - Virginia National Bankshares Corp | vabk-8k_20200624.htm |

ANNUAL SHAREHOLDERS’ VIRTUAL MEETING June 25, 2020

FORWARD LOOKING STATEMENT 1 Certain statements contained or incorporated by reference in this quarterly report on Form 10-Q, including but not limited to, statements concerning future results of operations or financial position, borrowing capacity and future liquidity, future investment results, future credit exposure, future loan losses and plans and objectives for future operations, change in laws and regulations applicable to the Company and its subsidiaries, adequacy of funding sources, actuarial expected benefit payment, valuation of foreclosed assets, regulatory requirements, economic environment and other statements contained herein regarding matters that are not historical facts, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are often characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” “should,” or words of similar meaning or other statements concerning the opinions or judgement of the Company and its management about future events. While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management. Actual results may differ materially from those included in the forward-looking statements due to a number of factors, including, without limitation, the effects of and changes in: general economic and market conditions, including the effects of declines in real estate values, an increase in unemployment levels and general economic contraction as a result of COVID-19 or other pandemics; fluctuations in interest rates, deposits, loan demand, and asset quality; assumptions that underlie the Company’s allowance for loan losses; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts or public health events (e.g., COVID-19 or other pandemics), and of governmental and societal responses thereto; the performance of vendors or other parties with which the Company does business; competition; technology; laws, regulations and guidance; accounting principles or guidelines; performance of assets under management; and other factors impacting financial services businesses. Many of these factors and additional risks and uncertainties are described in the Company’s 2019 Form 10-K and other reports filed from time to time by the Company with the Securities and Exchange Commission. These statements speak only as of the date made, and the Company does not undertake to update any forward-looking statements to reflect changes or events that may occur after this release.

INTRODUCTION 2 Welcome and Remarks President and CEO, Glenn Rust Financial Presentation CFO, Tara Harrison

FINANCIAL INFORMATION Presented by Tara Harrison June 25, 2020

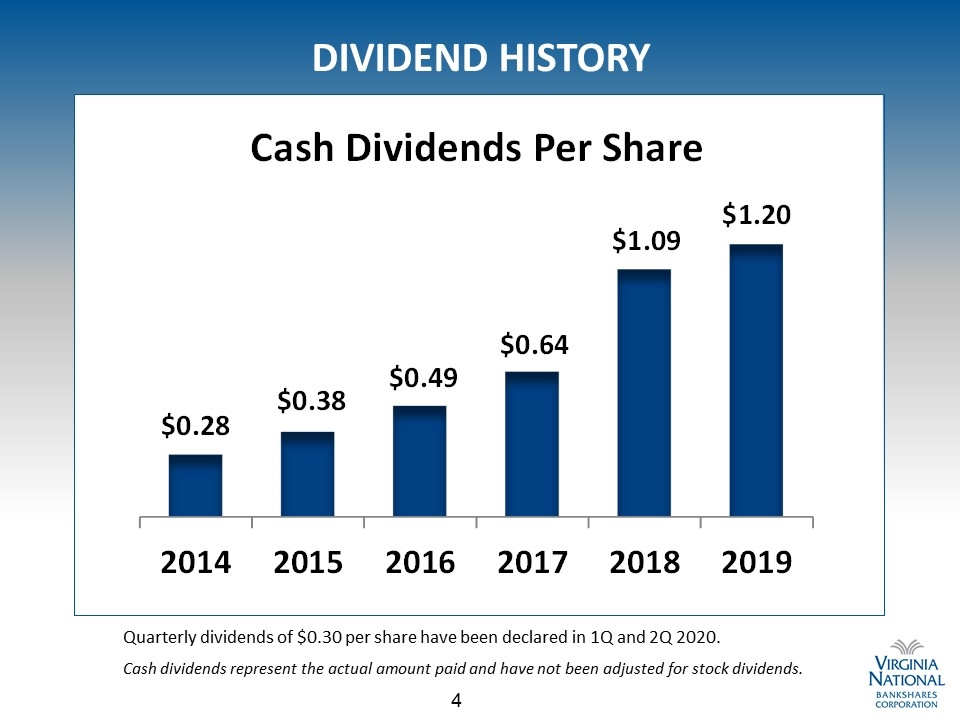

DIVIDEND HISTORY 4 Quarterly dividends of $0.30 per share have been declared in 1Q and 2Q 2020. Cash dividends represent the actual amount paid and have not been adjusted for stock dividends.

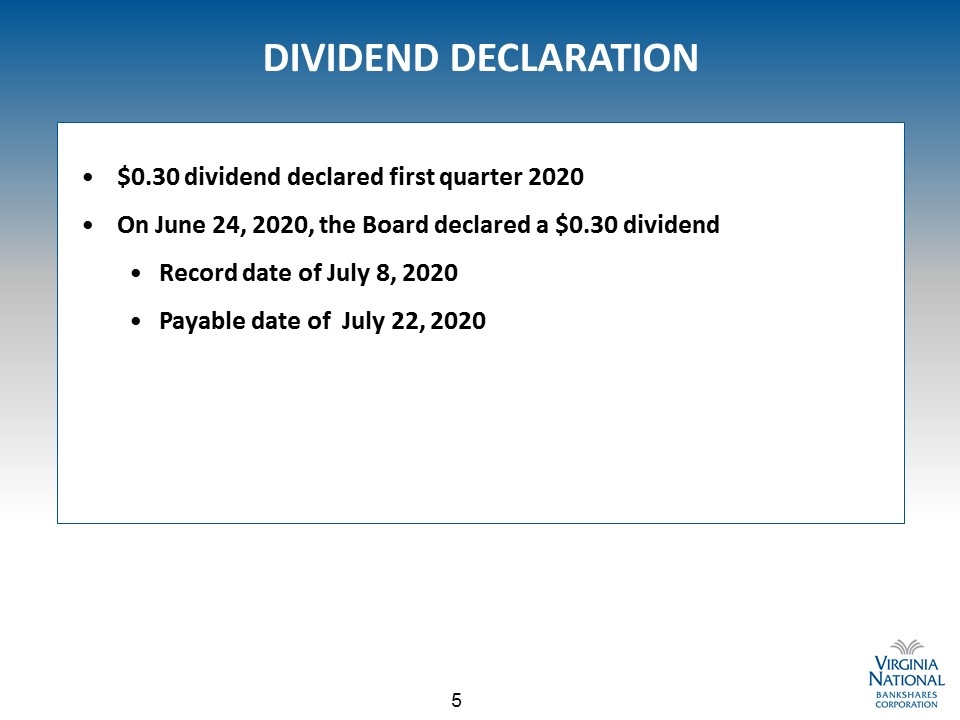

DIVIDEND DECLARATION 5 $0.30 dividend declared first quarter 2020 On June 24, 2020, the Board declared a $0.30 dividend Record date of July 8, 2020 Payable date of July 22, 2020

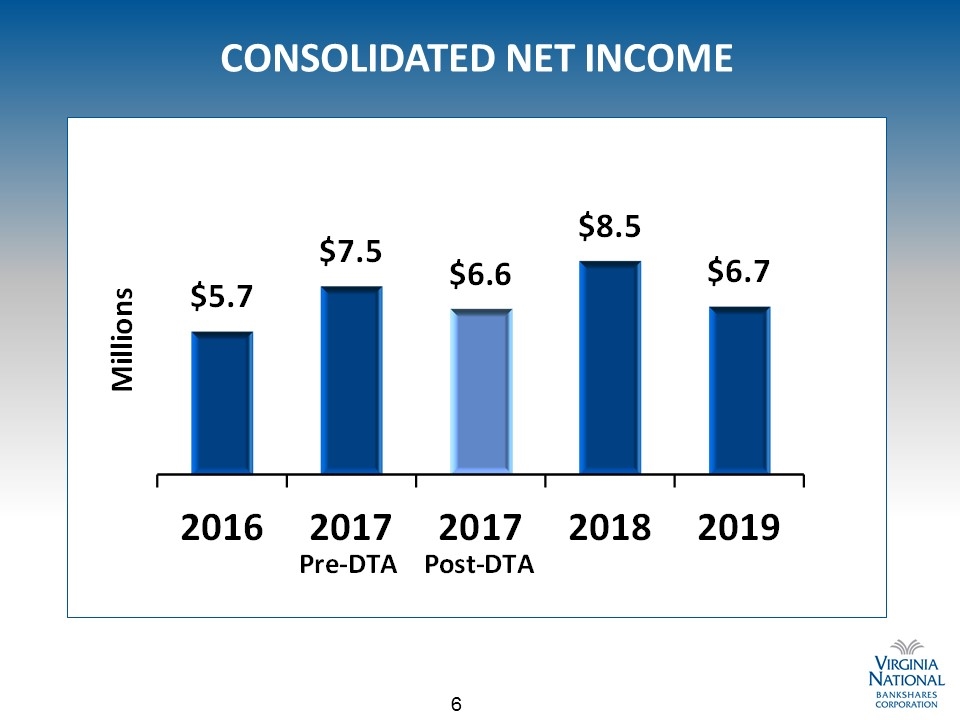

CONSOLIDATED NET INCOME 6

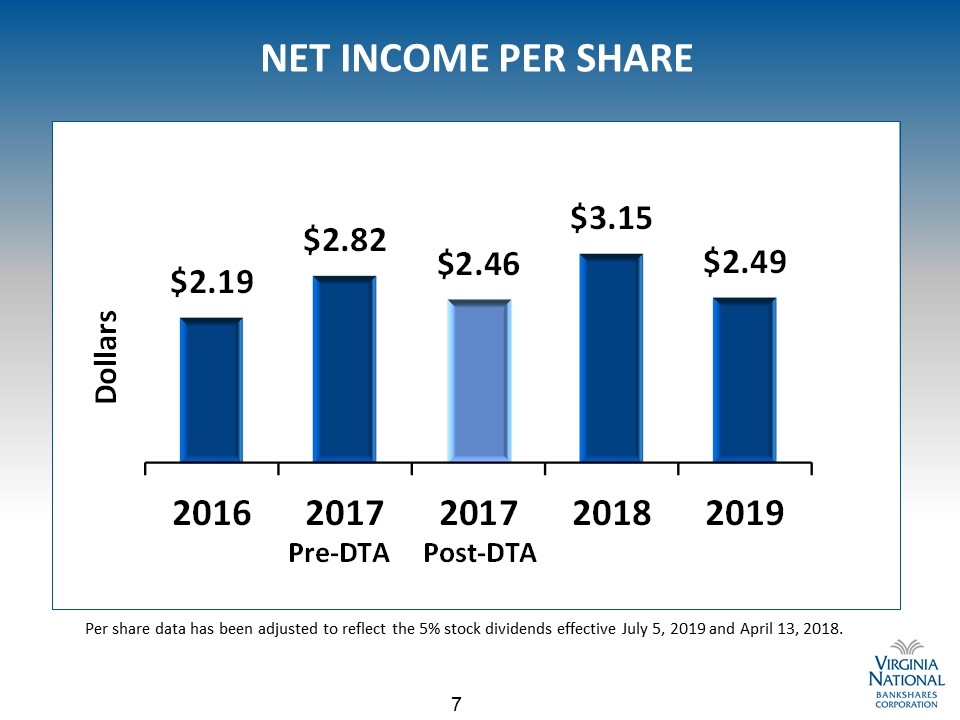

NET INCOME PER SHARE 7 Per share data has been adjusted to reflect the 5% stock dividends effective July 5, 2019 and April 13, 2018.

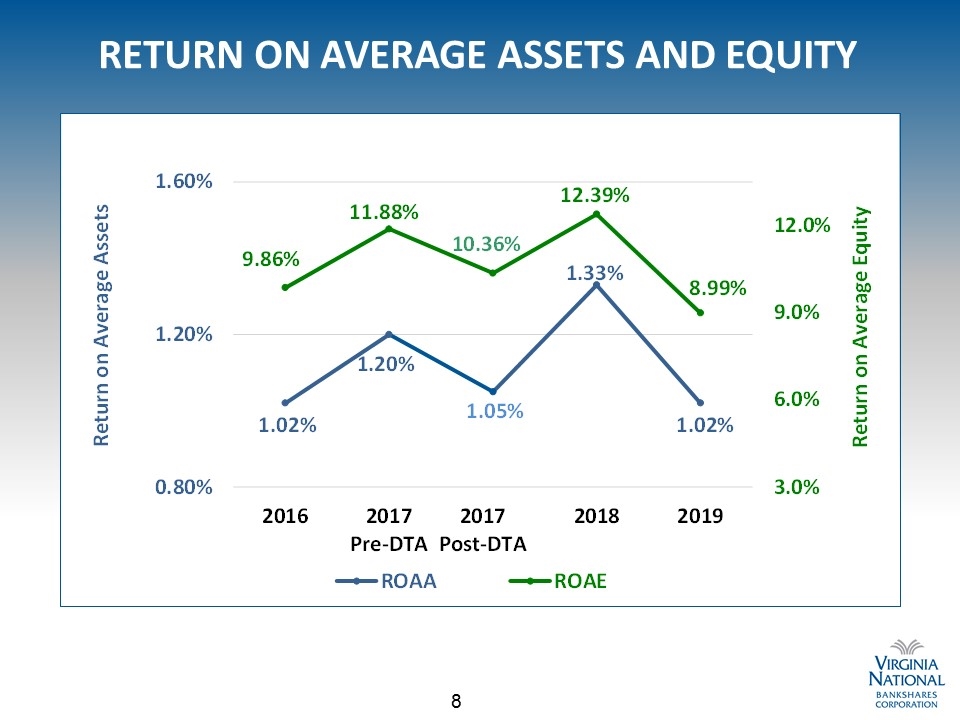

RETURN ON AVERAGE ASSETS AND EQUITY 8

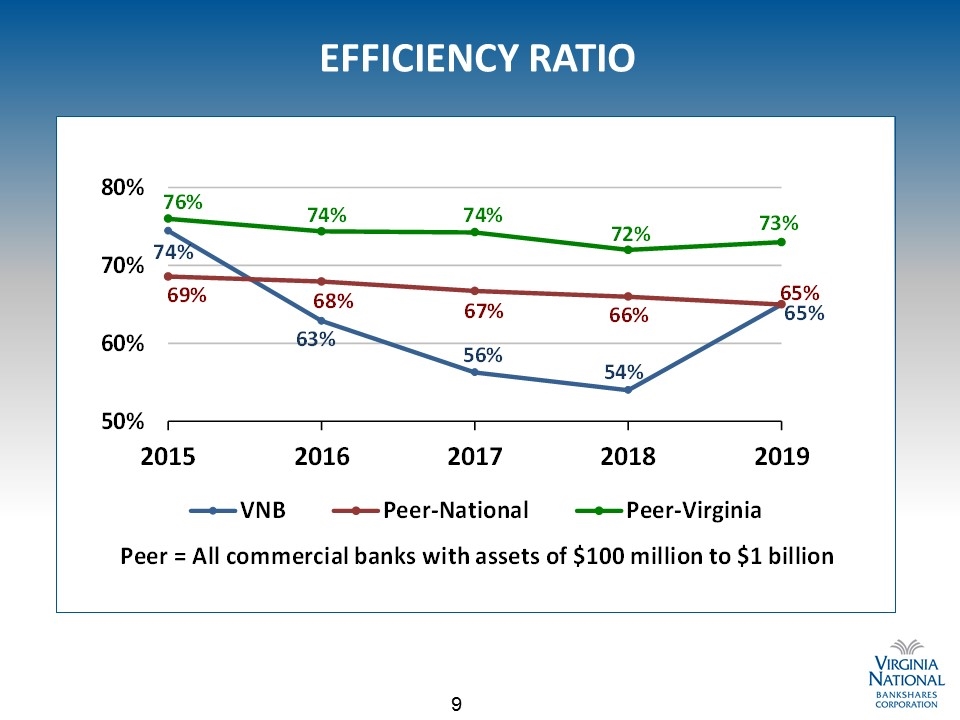

EFFICIENCY RATIO 9

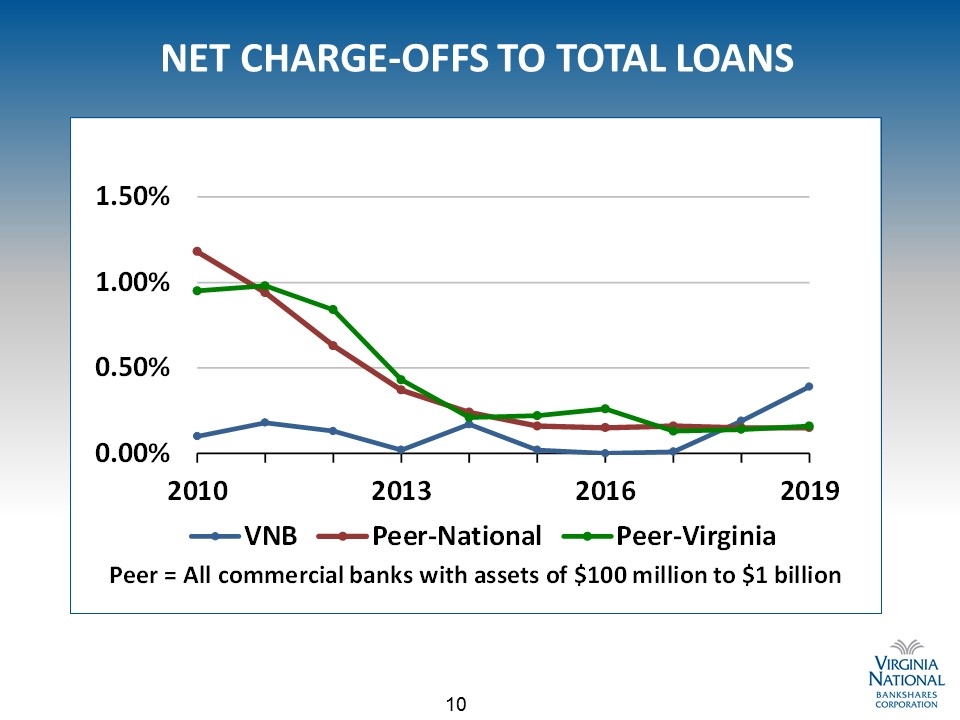

NET CHARGE-OFFS TO TOTAL LOANS 10

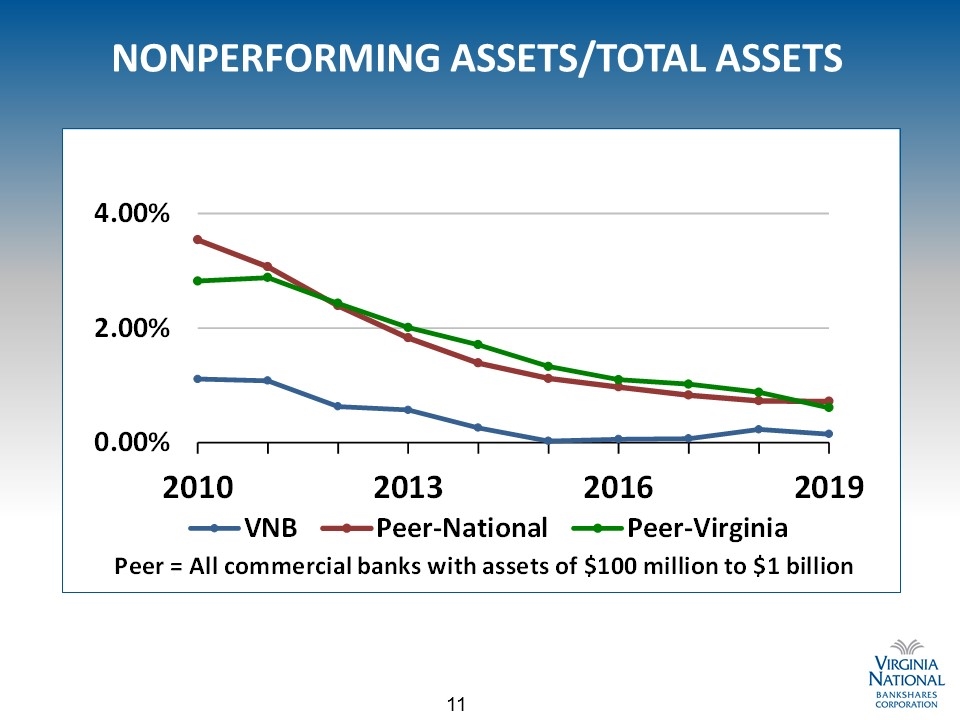

NONPERFORMING ASSETS/TOTAL ASSETS 11

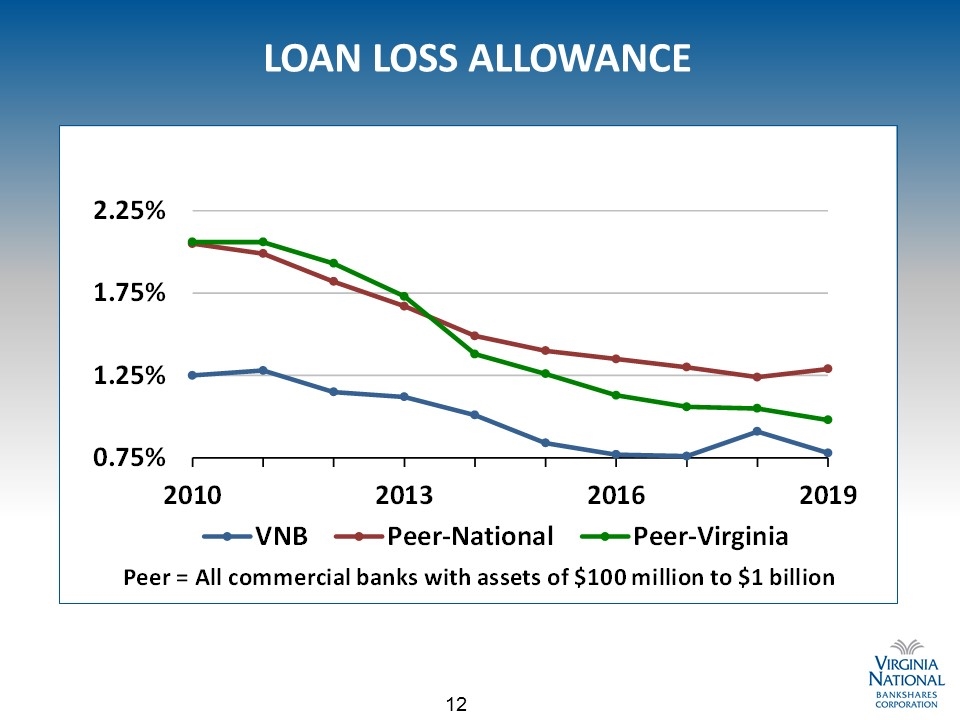

LOAN LOSS ALLOWANCE 12

VNB RANKINGS 13 Virginia National Bank is ranked #110 in the 2020 Top 200 Community Banks in the United States by American Banker.

1ST QUARTER FINANCIAL HIGHLIGHTS June 25, 2020

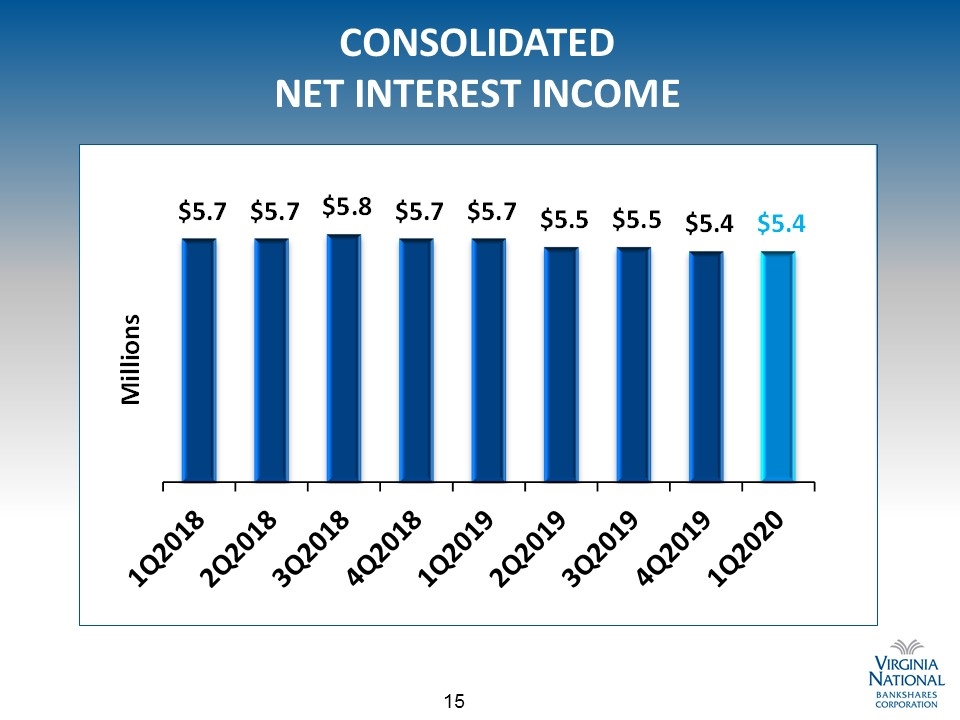

CONSOLIDATED NET INTEREST INCOME 15

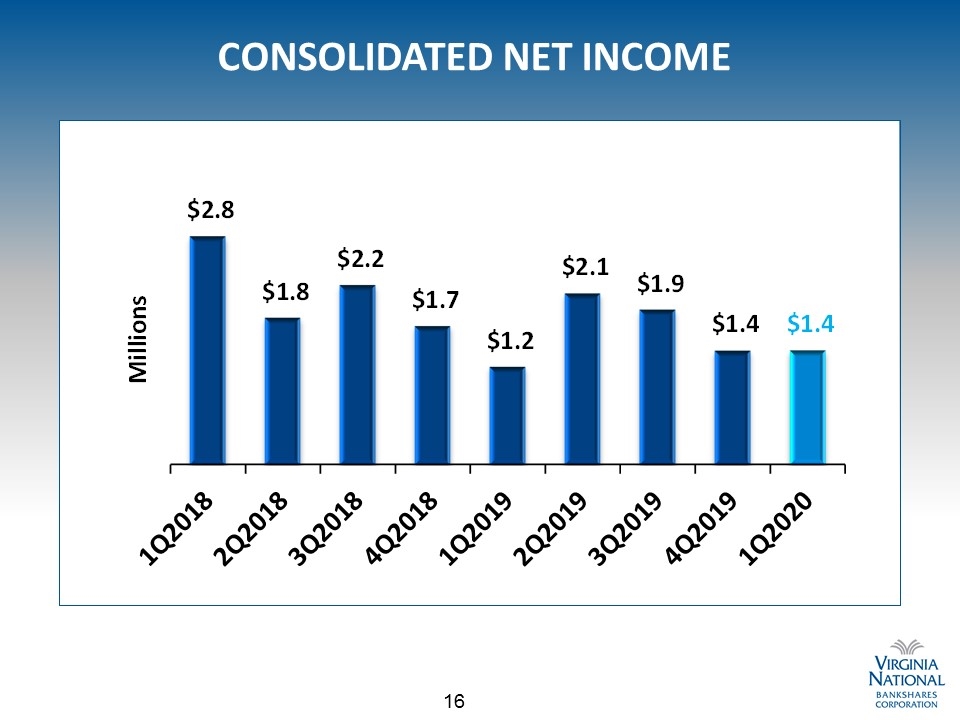

CONSOLIDATED NET INCOME 16

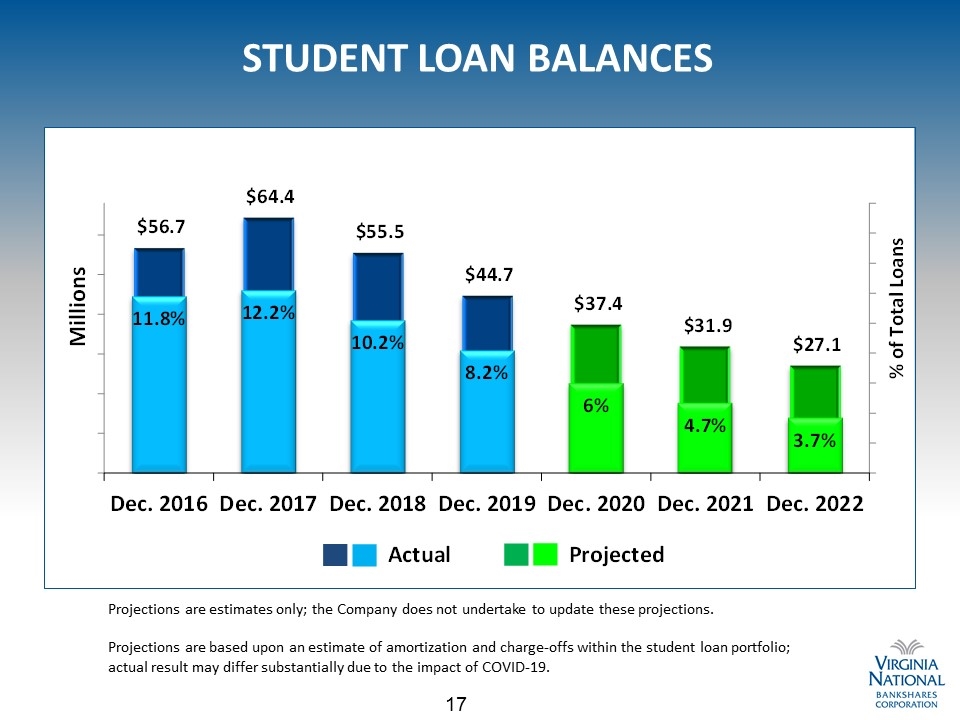

STUDENT LOAN BALANCES 17 Projections are estimates only; the Company does not undertake to update these projections. Projections are based upon an estimate of amortization and charge-offs within the student loan portfolio; actual result may differ substantially due to the impact of COVID-19.

STUDENT LOANS 18 Since inception - $13.4 million in interest income recognized 3Q 2015 – 2Q 2018 – avg 5.62% 3Q 2018 – 4.46% 4Q 2018 – 1.61%* 2019 – 3.36%** 2020 YTD – 3.06% In no quarter have charge-offs exceeded income **Active collection strategy in place mid-year *Prior to active collection strategy

CORPORATE CHALLENGES & INITIATIVES Presented by Glenn Rust June 25, 2020

COVID-19 20 VABK responded quickly to the threat of COVID-19 for the safety of our employees and customers. FEBRUARY Collected information and monitored situation of COVID-19 Management began discussing potential impact of employee environment and necessary precautions COVID-19 Task Force assembled to meet on regular basis APRIL Deployed PPE to all staff members Began daily temperature checks on employees Mandatory wearing of PPE Made decision to hold Virtual Shareholders’ Meeting MARCH Communication to staff and customers Began to disinfect offices with hospital-grade sanitizer Ordered PPE for employee protection Closed lobbies Most employees began to work from home Modified Bank hours Changed dress code Canceled corporate travel indefinitely May COVID-19 Task Force continued to meet weekly to reassess branch opening policy Canceled all corporate travel until December 31, 2020

SBA PPP LOANS AND ASSISTANCE 21 Processed over 550 applications totaling more than $85 million for the SBA Paycheck Protection Program (PPP) Accommodated requests from borrowers to allow for deferral of payments for a 90-day period in most instances, except as noted below. As of 5/31/2020, payment deferrals consisted of the following: Principal and Interest Deferments – 26 loans totaling $19.9 million Principal Only Deferments – 16 loans totaling $20.2 million USDA Guaranteed Loan Deferments1 – 14 loans totaling $7.9 million Student Loan Deferments2 – 133 loans totaling $1.7 million Revisited our capital and liquidity stress tests, as well as our capital and liquidity contingency plans 1 Interest on USDA loans is also guaranteed by the USDA. Deferments may be up to six months. 2 Student loan deferments may be up to six months.

CORPORATE CHANGES 22 Finance Career & Leadership Academy education program Commercial Lender certification and training program Richmond commercial lending team Wealth Management reorganization

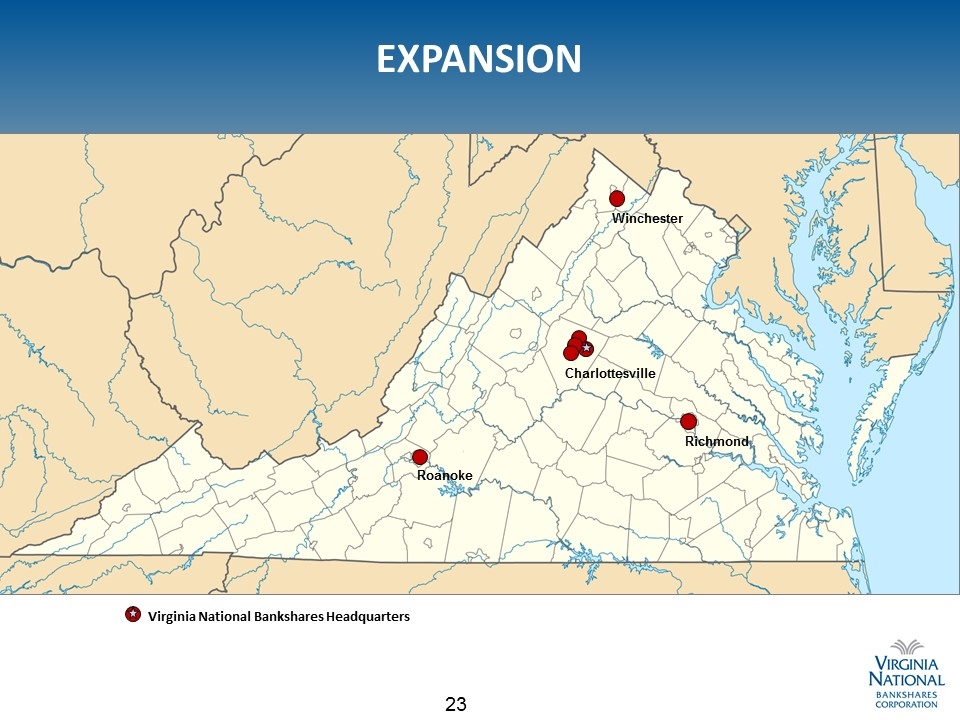

EXPANSION 23 Winchester Richmond Charlottesville Virginia National Bankshares Headquarters Roanoke

QUESTIONS June 25, 2020

THANK YOU June 25, 2020