Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Maxar Technologies Inc. | tm2023248d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Maxar Technologies Inc. | tm2023248d1_ex99-1.htm |

| 8-K - FORM 8-K - Maxar Technologies Inc. | tm2023248-1_8k.htm |

Exhibit 99.3

© 2020 Maxar Technologies 1

© 2020 Maxar Technologies 2 This presentation and associated conference call / webcast, which includes discussion of potential transactions and market an d f inancial outlooks (collectively, the “Information”), contain certain “forward - looking statements” or “forward - looking information” under applicabl e securities laws. Forward - looking terms such as “may,” “will,” “could,” “should,” “would,” “plan,” “potential,” “intend,” “anticipate,” “project,” “tar get ,” “believe,” “plan,” “outlook,” “estimate,” “guidance” or “expect” and other words, terms and phrases of similar nature are often intended to identify forwar d - l ooking statements, although not all forward - looking statements contain these identifying words. Forward - looking statements are based on certain key expectations and assumptions made by the Company. Although management of th e Company believes that the expectations and assumptions on which such forward - looking statements are based are reasonable, undue reliance should not be placed on the forward - looking statements because the Company can give no assurance that they will prove to be correct. Any such forward - looking statements are subject to a number of risks and uncertainties that could cause actual results and expectations to differ mate ria lly from the anticipated results or expectations expressed in the Earnings Information. The Company cautions readers that should certain risks or unce rta inties materialize, or should underlying assumptions prove incorrect, actual results may vary significantly from those expected. The risks that could cause actual results to differ materially from current expectations include, but are not limited to thos e R isk Factors set forth in our Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, which are available online under the Company’s EDGAR profile at w ww.sec.gov or on the Company’s website at www.maxar.com, as well as the Company’s continuous disclosure materials filed from time to time w ith Canadian securities regulatory authorities, which are available online under the Company’s SEDAR profile at www.sedar.com or on the Co mpa ny’s website at www.maxar.com. The risk factors detailed in the foregoing are not intended to be exhaustive and there may be other key risks tha t are not identified that are not presently known to the Company or that the Company currently deems immaterial. These risks and uncertainties are am plified by the global COVID - 19 pandemic, which has caused and will continue to cause significant challenges, instability and uncertainty. The forward - looking statements contained in the Earnings Information are expressly qualified in their entirety by the foregoing cautionary statements. All such forward - looking statements are based upon data available as of the date of the Earnings Information or other specified date and speak only as of such date. The Company disclaims any intention or obligation to update or revise any forward - looking statements herein as a r esult of new information, future events or otherwise, other than as may be required under applicable securities law. Caution concerning forward looking statements

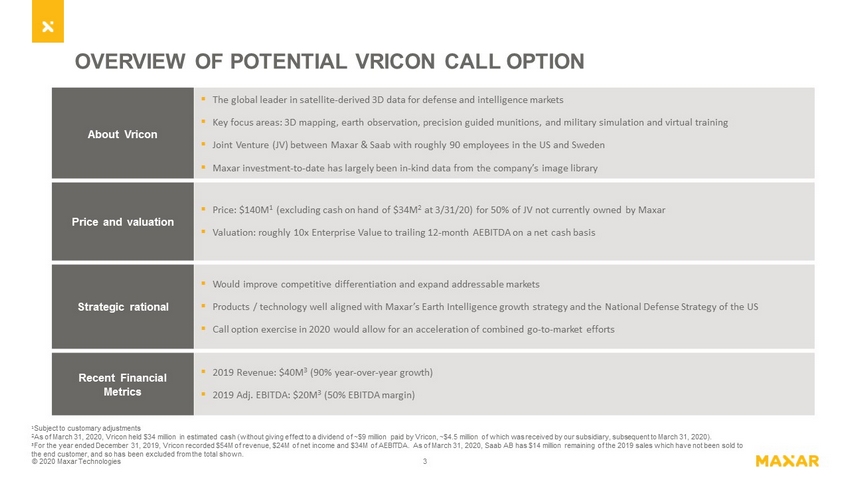

© 2020 Maxar Technologies 3 About Vricon ▪ The global leader in satellite - derived 3D data for defense and intelligence markets ▪ Key focus areas: 3D mapping, earth observation, precision guided munitions, and military simulation and virtual training ▪ Joint Venture (JV) between Maxar & Saab with roughly 90 employees in the US and Sweden ▪ Maxar investment - to - date has largely been in - kind data from the company’s image library Price and valuation ▪ Price: $140M 1 (excluding cash on hand of $34M 2 at 3/31/20) for 50% of JV not currently owned by Maxar ▪ Valuation: r oughly 10x Enterprise Value to trailing 12 - month AEBITDA on a net cash basis Strategic rational ▪ Would improve competitive differentiation and expand addressable markets ▪ Products / technology well aligned with Maxar’s Earth Intelligence growth strategy and the National Defense Strategy of the US ▪ Call option exercise in 2020 would allow for an acceleration of combined go - to - market efforts Recent Financial Metrics ▪ 2019 Revenue: $40M 3 (90% year - over - year growth) ▪ 2019 Adj. EBITDA: $20M 3 (50% EBITDA margin) 1 Subject to customary adjustments 2 As of March 31, 2020, Vricon held $34 million in estimated cash (without giving effect to a dividend of ~$9 million paid by Vricon , ~$4.5 million of which was received by our subsidiary, subsequent to March 31, 2020). 3 For the year ended December 31, 2019, Vricon recorded $54M of revenue, $24M of net income and $34M of AEBITDA. As of March 31, 2020, Saab AB has $14 million remaining of th e 2019 sales which have not been sold to the end customer, and so has been excluded from the total shown. OVERVIEW OF POTENTIAL VRICON CALL OPTION

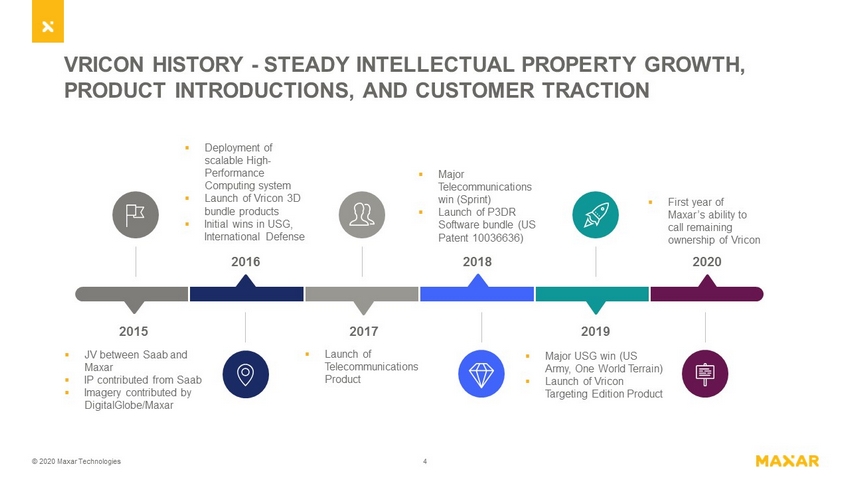

© 2020 Maxar Technologies 4 VRICON HISTORY - STEADY INTELLECTUAL PROPERTY GROWTH, PRODUCT INTRODUCTIONS, AND CUSTOMER TRACTION 2019 2015 2017 2016 2018 2020 ▪ Deployment of scalable High - Performance Computing system ▪ Launch of Vricon 3D bundle products ▪ Initial wins in USG, International Defense ▪ Major Telecommunications win (Sprint) ▪ Launch of P3DR Software bundle (US Patent 10036636) ▪ First year of Maxar’s ability to call remaining ownership of Vricon ▪ JV between Saab and Maxar ▪ IP contributed from Saab ▪ Imagery contributed by DigitalGlobe / Maxar ▪ Launch of Telecommunications Product ▪ Major USG win (US Army, One World Terrain) ▪ Launch of Vricon Targeting Edition Product

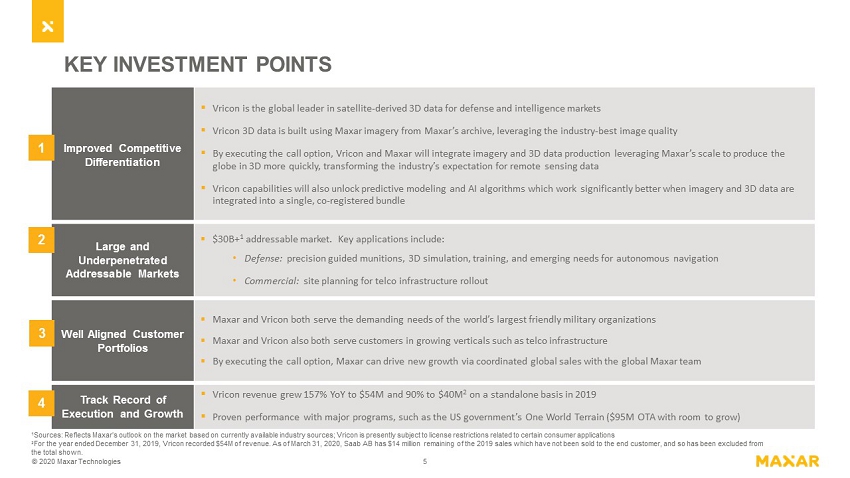

© 2020 Maxar Technologies 5 Improved Competitive Differentiation ▪ Vricon is the global leader in satellite - derived 3D data for defense and intelligence markets ▪ Vricon 3D data is built using Maxar imagery from Maxar’s archive, leveraging the industry - best image quality ▪ By executing the call option, Vricon and Maxar will integrate imagery and 3D data production leveraging Maxar’s scale to prod uce the globe in 3D more quickly, transforming the industry’s expectation for remote sensing data ▪ Vricon capabilities will also unlock predictive modeling and AI algorithms which work significantly better when imagery and 3 D d ata are integrated into a single, co - registered bundle Large and Underpenetrated Addressable Markets ▪ $30B+ 1 addressable market. Key applications include: • Defense: precision guided munitions, 3D simulation, training, and emerging needs for GPS - denied navigation • Commercial: site planning for telco infrastructure rollout Well Aligned Customer Portfolios ▪ Maxar and Vricon both serve the demanding needs of the world’s largest friendly military organizations ▪ Maxar and Vricon also both serve customers in growing verticals such as telco infrastructure ▪ By executing the call option, Maxar can drive new growth via coordinated global sales with the global Maxar team Track Record of Execution and Growth ▪ Vricon revenue grew 157% YoY to $54M and 90% to $40M 2 on a standalone basis in 2019 ▪ Proven performance with major programs, such as the US government’s One World Terrain ($95M OTA with room to grow) 1 2 3 4 KEY INVESTMENT POINTS 1 Sources: Reflects Maxar’s outlook on the market based on currently available industry sources; Vricon is presently subject to license restrictions related to certain consumer applications 2 For the year ended December 31, 2019, Vricon recorded $54M of revenue. As of March 31, 2020, Saab AB has $14 million remaining of the 2019 sales which have not been sold to the end customer, and so has been excluded from the total shown.

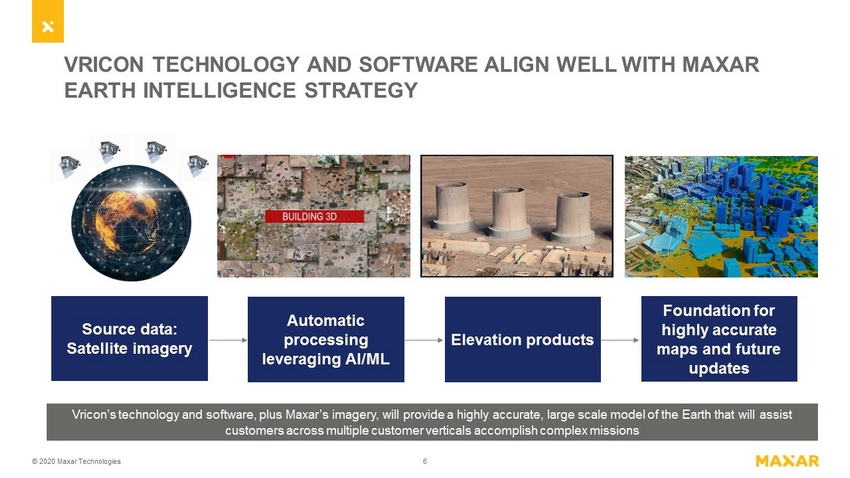

© 2020 Maxar Technologies 6 VRICON TECHNOLOGY AND SOFTWARE ALIGN WELL WITH MAXAR EARTH INTELLIGENCE STRATEGY Source data: Satellite imagery Automatic processing leveraging AI/ML Elevation products Foundation for highly accurate maps and future updates Vricon’s technology and software, plus Maxar’s imagery, will provide a highly accurate, large scale model of the Earth that will assist customers across multiple customer verticals accomplish complex missions

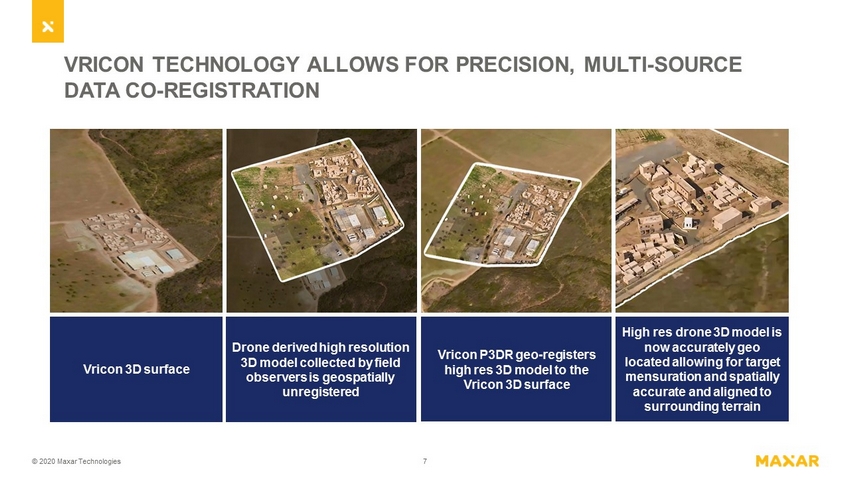

© 2020 Maxar Technologies 7 VRICON TECHNOLOGY ALLOWS FOR PRECISION, MULTI - SOURCE DATA CO - REGISTRATION Vricon 3D surface Drone derived high resolution 3D model collected by field observers is geospatially unregistered Vricon P3DR geo - registers high res 3D model to the Vricon 3D surface High res drone 3D model is now accurately geo located allowing for target mensuration and spatially accurate and aligned to surrounding terrain

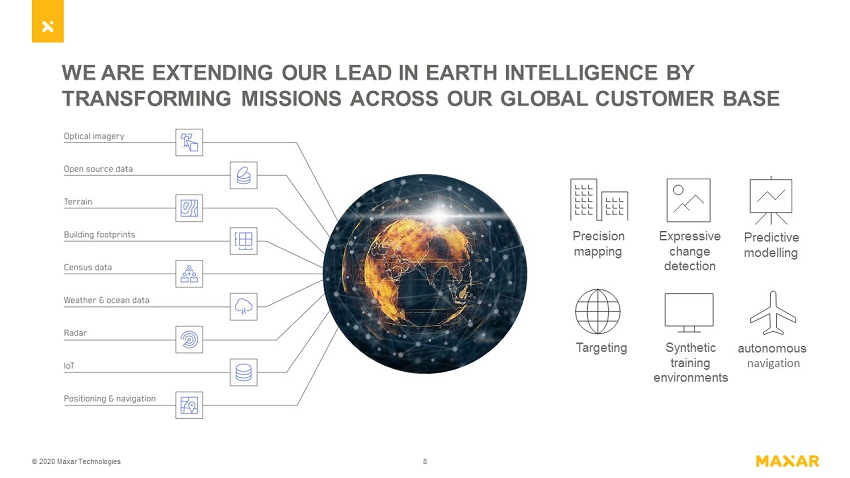

© 2020 Maxar Technologies 8 Precision mapping Expressive change detection Predictive modelling Targeting Synthetic training environments GPS denied navigation WE ARE EXTENDING OUR LEAD IN EARTH INTELLIGENCE BY TRANSFORMING MISSIONS ACROSS OUR GLOBAL CUSTOMER BASE

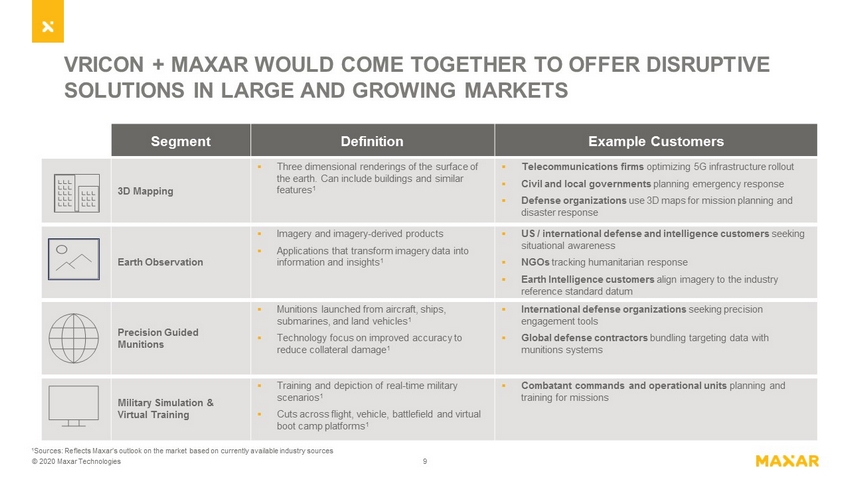

© 2020 Maxar Technologies 9 Segment Definition Example Customers 3D Mapping ▪ Three dimensional renderings of the surface of the earth. Can include buildings and similar features 1 ▪ Telecommunications firms optimizing 5G infrastructure rollout ▪ Civil and local governments planning emergency response ▪ Defense organizations use 3D maps for mission planning and disaster response Earth Observation ▪ Imagery and imagery - derived products ▪ Applications that transform imagery data into information and insights 1 ▪ US / international defense and intelligence customers seeking situational awareness ▪ NGOs tracking humanitarian response ▪ Earth Intelligence customers align imagery to the industry reference standard datum Precision Guided Munitions ▪ Munitions launched from aircraft, ships, submarines, and land vehicles 1 ▪ Technology focus on improved accuracy to reduce collateral damage 1 ▪ International defense organizations seeking precision engagement tools ▪ Global defense contractors bundling targeting data with munitions systems Military Simulation & Virtual Training ▪ Training and depiction of real - time military scenarios 1 ▪ Cuts across flight, vehicle, battlefield and virtual boot camp platforms 1 ▪ Combatant commands and operational units planning and training for missions VRICON + MAXAR WOULD COME TOGETHER TO OFFER DISRUPTIVE SOLUTIONS IN LARGE AND GROWING MARKETS 1 Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

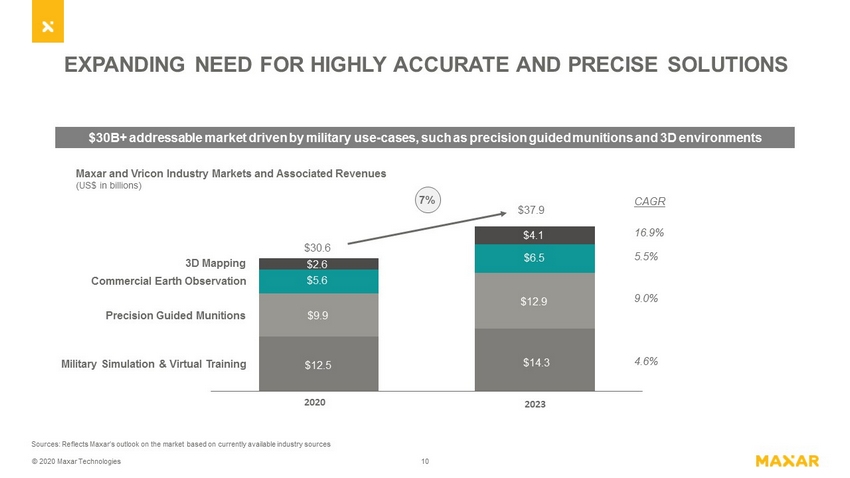

© 2020 Maxar Technologies 10 EXPANDING NEED FOR HIGHLY ACCURATE AND PRECISE SOLUTIONS 16.9% 5.5% CAGR 4.6% 9.0% $ 2.6 $ 5.6 2020 $ 6.5 $ 4.1 2023 $ 30.6 $ 37.9 $ 12.5 $ 14.3 $ 12.9 $ 9.9 3D Mapping Commercial Earth Observation Precision Guided Munitions Military Simulation & Virtual Training $30B+ addressable market driven by military use - cases, such as precision guided munitions and 3D environments Maxar and Vricon Industry Markets and Associated Revenues (US$ in billions) 7% Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

© 2020 Maxar Technologies 11 PRECISION GUIDED MUNITIONS Description: Munitions launched from aircraft, ships, submarines and land vehicles that are intended to minimize collateral damage and increase the lethality against intended targets; munitions that can be aimed and directed against single or multip le targets using either external guidance or its own guidance system Vricon Advantage: X,Y&Z target coordinates are a crucial competent for these munitions as well as positional awareness and obstruction avoidance to limit collateral damage and drive success mission outcomes. The Vricon solution offer 3 m precision coordinate mensuration on a global scale at >2x improvement over current Cat1 targeting accuracy requirements. Vricon’s precision registration technology (P3DR) combined with 3D reference data enables onboard sensors to triangulate position as well as georeferencing of sensor target views for precise engagement Vricon customer segments: ▪ Domestic and international army forces ▪ Special operations units ▪ Air force programs TAM: 2020=$9.9B 2023=$12.9B Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

© 2020 Maxar Technologies 12 MILITARY SIMULATION AND VIRTUAL TRAINING Description: Training and depiction of real - time military scenarios for ground and air applications across flight, vehicle, battlefield and virtual boot camp platforms Vricon Advantage: Vricon’s accurate and realistic 3D representation of current and future battlefield environments around the world enable life - like flight simulations and a precise Sandbox environment to train and simulate mobility and tactical planning . 3 - dimensional information shared across multiple defense agencies allows for common 3D environment whereby operators can conduct synthetic training activities with a shared vision of the operation theater. P3DR + Vricon 3D allows geo registration and integration of additional higher resolution imagery, drone and ground - based immersive 3D data tied to a standard reference set, allowing virtual reality experience that replicates vehicle and ground force engagements Vricon customer segments : ▪ U.S. military ▪ International defense organizations TAM: 2020=$12.5B 2023=$14.3B Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

© 2020 Maxar Technologies 13 Vricon customer segments: ▪ Overhead imagery collectors (drone, aerial, satellite) ▪ Imagery users (defense, intelligence, civil government) EARTH OBSERVATION Description: Imagery and related products; processing and applications that transform imagery data into information and analysis; analysis of multiple images and a wide variety of datasets in order to extract information Vricon Advantage: Accurate positional information is required to derive actionable intelligence from overhead imagery, existing satellite, aerial and UAV data are notoriously inaccurate, limiting the value and utility of the information captured within the images as well as limiting the effectiveness of AI to produce constant results. Vricon provides multiple georeferenced information layers to enhance and standardize the extraction of remotely sensed information. P3DR + Vricon data allows consistent positional accuracy of all overhead images and information layers, broadening the value and utility of those data across the market TAM: 2020=$5.6B 2023=$6.5B Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

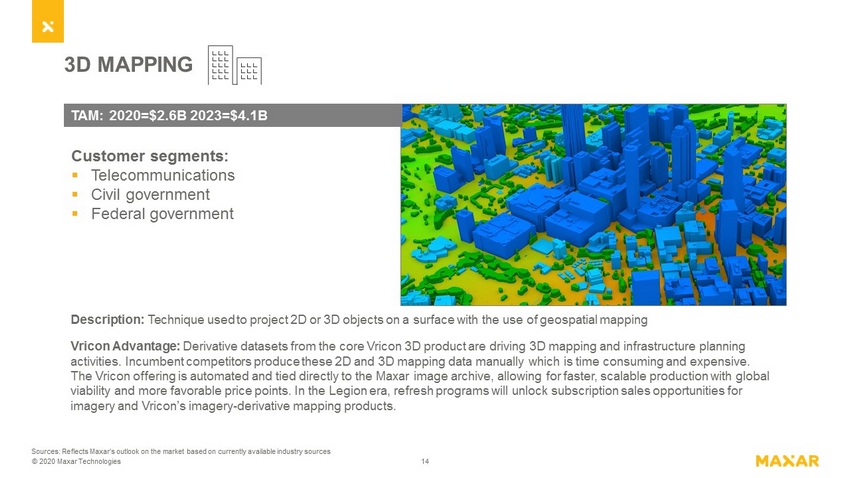

© 2020 Maxar Technologies 14 3D MAPPING Description: Technique used to project 2D or 3D objects on a surface with the use of geospatial mapping Vricon Advantage: Derivative datasets from the core Vricon 3D product are driving 3D mapping and infrastructure planning activities. Incumbent competitors produce these 2D and 3D mapping data manually which is time consuming and expensive. The Vricon offering is automated and tied directly to the Maxar image archive, allowing for faster, scalable production with global viability and more favorable price points. In the Legion era, refresh programs will unlock subscription sales opportunities f or imagery and Vricon’s imagery - derivative mapping products. Customer segments: ▪ Telecommunications ▪ Civil government ▪ Federal government TAM: 2020=$2.6B 2023=$4.1B Sources: Reflects Maxar’s outlook on the market based on currently available industry sources

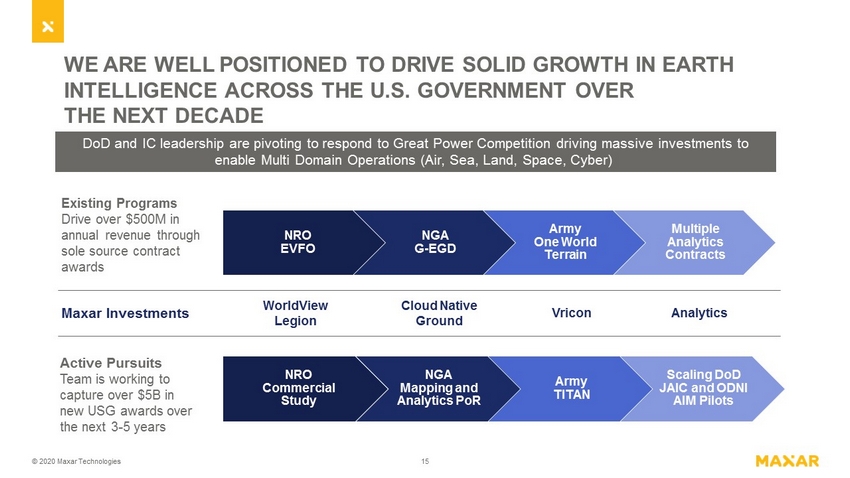

© 2020 Maxar Technologies 15 DoD and IC leadership are pivoting to respond to Great Power Competition driving massive investments to enable Multi Domain Operations (Air, Sea, Land, Space, Cyber) NRO EVFO NGA G - EGD Army One World Terrain Multiple Analytics Contracts Existing Programs Drive over $500M in annual revenue through sole source contract awards Maxar Investments NRO Commercial Study NGA Mapping and Analytics PoR Army TITAN Scaling DoD JAIC and ODNI AIM Pilots WorldView Legion Cloud Native Ground Vricon Analytics Active Pursuits Team is working to capture over $5B in new USG awards over the next 3 - 5 years WE ARE WELL POSITIONED TO DRIVE SOLID GROWTH IN EARTH INTELLIGENCE ACROSS THE U.S. GOVERNMENT OVER THE NEXT DECADE

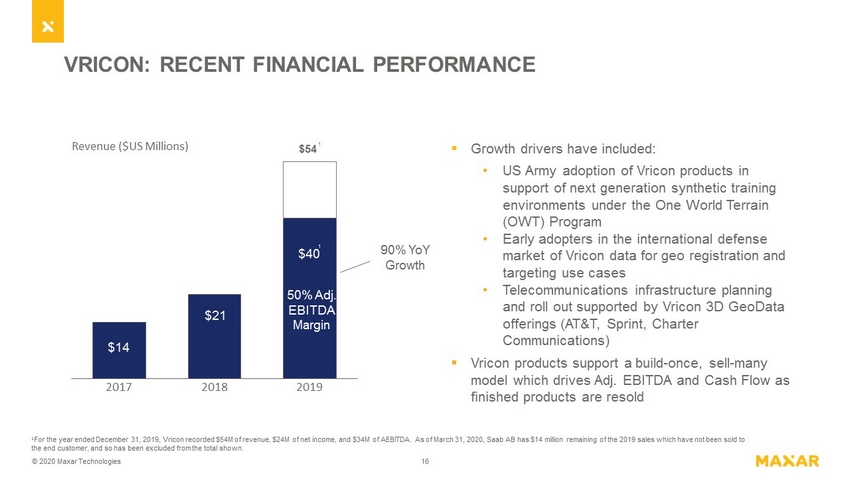

© 2020 Maxar Technologies 16 VRICON: RECENT FINANCIAL PERFORMANCE ▪ Growth drivers have included: • US Army adoption of Vricon products in support of next generation synthetic training environments under the One World Terrain (OWT) Program • Early adopters in the international defense market of Vricon data for geo registration and targeting use cases • Telecommunications infrastructure planning and roll out supported by Vricon 3D GeoData offerings (AT&T, Sprint, Charter Communications) ▪ Vricon products support a build - once, sell - many model which drives Adj. EBITDA and Cash Flow as finished products are resold $14 $21 $40 2017 2018 2019 Revenue ($US Millions) 90% YoY Growth 50% Adj. EBITDA Margin 1 For the year ended December 31, 2019, Vricon recorded $54M of revenue, $24M of net income, and $34M of AEBITDA. As of March 31, 2020, Saab AB has $14 million remaining of t he 2019 sales which have not been sold to the end customer, and so has been excluded from the total shown. 1 $54 1

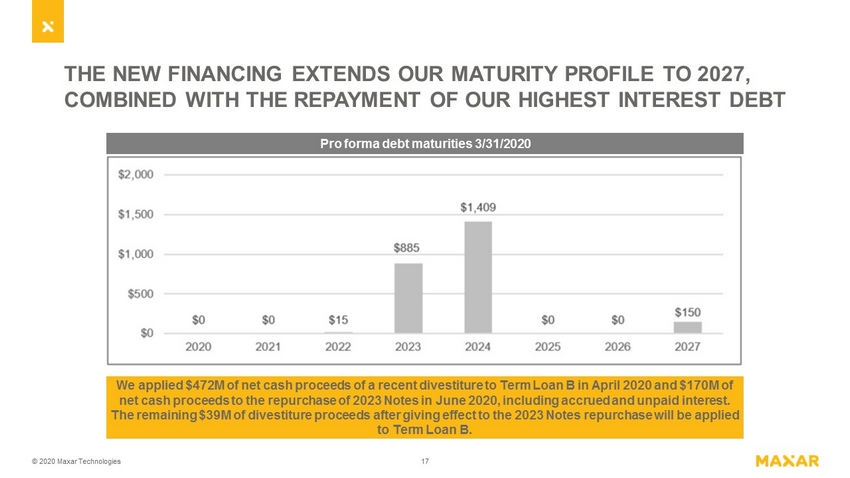

© 2020 Maxar Technologies 17 THE NEW FINANCING EXTENDS OUR MATURITY PROFILE TO 2027, COMBINED WITH THE REPAYMENT OF OUR HIGHEST INTEREST DEBT We applied $472M of net cash proceeds of a recent divestiture to Term Loan B in April 2020 and $170M of net cash proceeds to the repurchase of 2023 Notes in June 2020, including accrued and unpaid interest. The remaining $39M of divestiture proceeds after giving effect to the 2023 Notes repurchase will be applied to Term Loan B. Pro forma debt maturities 3/31/2020

© 2020 Maxar Technologies 18 Appendix In addition to results reported in accordance with U.S. GAAP, we use certain non - GAAP financial measures as supplemental indicat ors of our financial and operating performance. These non - GAAP financial measures include EBITDA, Adjusted EBITDA, cash Adjusted EBITDA, and free cash flow. We define EBITDA as earnings before interest, taxes, depreciation and amortization, and Adjusted EBITDA as EBITDA adjusted for certain items affecting comparability as specified in the calculation. Certain items affecting comparability include restructuring, impairments, sate lli te insurance recovery, gain on sale of assets, CEO severance and transaction and integration related expense. Transaction and integration related expense in clu des costs associated with de - leveraging activities, acquisitions and dispositions and the integration of acquisitions. Management believes that exclu sion of these items assists in providing a more complete understanding of our underlying results and trends, and management uses these measures along wit h t he corresponding U.S. GAAP financial measures to manage our business, evaluate our performance compared to prior periods and the marketplace, and to establish operational goals. Adjusted EBITDA is a measure being used as a key element of our incentive compensation plan. The Syndicate d C redit Facility also uses Adjusted EBITDA in the determination of our debt leverage covenant ratio. The definition of Adjusted EBITDA in the Syndi cat ed Credit Facility includes a more comprehensive set of adjustments. We believe that these non - GAAP measures, when read in conjunction with our U.S. GAAP results, provide useful information to inve stors by facilitating the comparability of our ongoing operating results over the periods presented, the ability to identify trends in our underlyi ng business, and the comparison of our operating results against analyst financial models and operating results of other public companies. EBITDA and Adjusted EBITDA are not recognized terms under U.S. GAAP and may not be defined similarly by other companies. EBIT DA and Adjusted EBITDA should not be considered alternatives to net (loss) income as indications of financial performance or as alternate to cas h flows from operations as measures of liquidity. EBITDA and Adjusted EBITDA have limitations as an analytical tool and should not be considered in isol ati on or as a substitute for our results reported under U.S. GAAP.

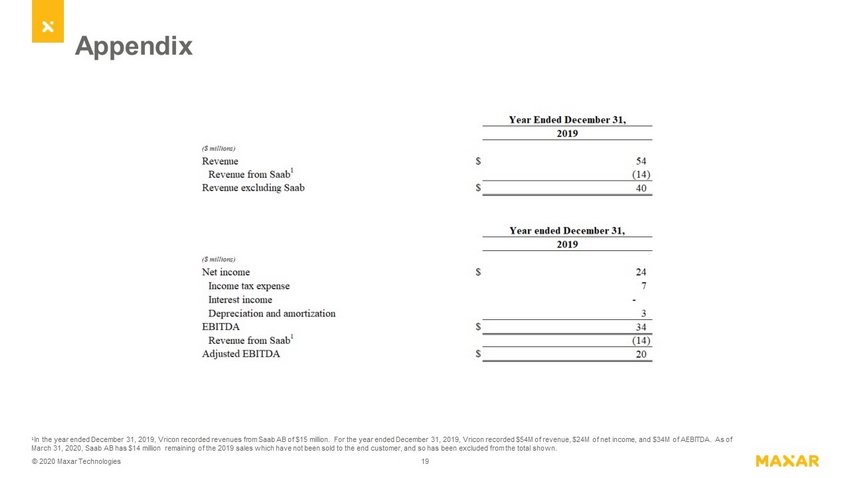

© 2020 Maxar Technologies 19 Appendix 1 In the year ended December 31, 2019, Vricon recorded revenues from Saab AB of $15 million. For the year ended December 31, 2019, Vricon recorded $54M of revenue, $24M of net income, and $34M of AEBITDA. As of March 31, 2020, Saab AB has $14 million remaining of the 2019 sales which have not been sold to the end customer, and so has bee n excluded from the total shown.

MAXAR .COM © 2020 Maxar Technologies Company Proprietary - Internal Use Only