Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PLUG POWER INC | tm2023176d1_ex99-1.htm |

| EX-2.2 - EXHIBIT 2.2 - PLUG POWER INC | tm2023176d1_ex2-2.htm |

| EX-2.1 - EXHIBIT 2.1 - PLUG POWER INC | tm2023176d1_ex2-1.htm |

| 8-K - FORM 8-K - PLUG POWER INC | tm2023176-1_8k.htm |

Exhibit 99.2

Copyright 2020, Plug Power Inc. June 23, 2020 Plug Power Continues to Execute on its Hydrogen Strategy

2 Cautionary Note on Forward Looking Statements This communication contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties about Plug Power Inc . , including but not limited to statements about our expectations regarding the effects of the acquisitions on our company, including our 2020 full - year revenue target and 2024 financial targets ; capabilities in hydrogen generation, liquefaction and logistics ; moving the hydrogen economy from low - carbon to zero - carbon solutions ; reduction in the cost of hydrogen ; the amount of hydrogen used by our customers by 2024 ; the amount of hydrogen that is green by 2024 ; expansion of United Hydrogen’s hydrogen production capacity ; and Giner ELX increasing our overall green hydrogen supply capabilities and growing our servable addressable market . You are cautioned that such statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times that, or by which, such performance or results will have been achieved . Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in these statements . In particular, the risks and uncertainties include, among other things, the risk that we continue to incur losses and might never achieve or maintain profitability ; the risk that we will need to raise additional capital to fund our operations and such capital may not be available to us ; the risk of dilution to our stockholders and/or stock price should we need to raise additional capital ; the risk that our lack of extensive experience in manufacturing and marketing products may impact our ability to manufacture and market products on a profitable and large - scale commercial basis ; the risk that unit orders may not ship, be installed and/or converted to revenue, in whole or in part ; the risk that pending orders may not convert to purchase orders, in whole or in part ; the risk that a loss of one or more of our major customers, or the delay or inability of payment by one of our customers, could result in a material adverse effect on our financial condition ; the risk that a sale of a significant number of shares of stock could depress the market price of our common stock ; the risk that our convertible senior notes, if settled in cash, could have a material effect on our financial results ; the risk that our convertible note hedges may affect the value of our convertible senior notes and our common stock ; the risk that negative publicity related to our business or stock could result in a negative impact on our stock value and profitability ; the risk of potential losses related to any product liability claims or contract disputes ; the risk of loss related to an inability to maintain an effective system of internal controls ; our ability to attract and maintain key personnel ; the risks related to use of flammable fuels in our products ; the cost and timing of developing, marketing and selling our products ; our ability to obtain financing arrangements to support the sale or leasing of our products and services to customers ; the ability to achieve the forecasted gross margin on the sale of our products ; the risks, liabilities and costs related to environmental, health and safety matters ; the risk of elimination of government subsidies and economic incentives for alternative energy products ; the cost and availability of fuel and fueling infrastructures for our products ; market acceptance of our products and services, including GenDrive, GenSure and GenKey systems ; the volatility of our stock price ; our ability to establish and maintain relationships with third parties with respect to product development, manufacturing, distribution and servicing and the supply of key product components ; the cost and availability of components and parts for our products ; general global economic and political conditions that harm the worldwide economy, disrupt our supply chain, increase material costs or reduce demand for our component products (including changes in the level of gross domestic product in various regions of the world, natural disasters, terrorist act, global conflicts and public health crises such as the coronavirus) ; the risk that possible new tariffs could have a material adverse effect on our business ; our ability to develop commercially viable products ; our ability to reduce product and manufacturing costs ; our ability to successfully expand our product lines ; our ability to successfully market, distribute and service our products and services internationally ; our ability to improve system reliability for our products ; competitive factors, such as price competition and competition from other traditional and alternative energy companies ; our ability to protect our intellectual property ; the risk of dependency on information technology on our operations and the failure of such technology ; the cost of complying with current and future federal, state and international governmental regulations ; our subjectivity to legal proceedings and legal compliance ; the risks associated with past and potential future acquisitions ; the volatility of our stock price ; and other risks and uncertainties referenced in our public filings with the Securities and Exchange Commission (the “SEC”) . For additional disclosure regarding these and other risks faced by us, see disclosures contained in our public filings with the SEC including, the "Risk Factors" section of our Annual Report on Form 10 - K for the year ended December 31 , 2019 , Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2020 as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC . You should consider these factors in evaluating the forward - looking statements included in this presentation and not place undue reliance on such statements . The forward - looking statements are made as of the date hereof, and we undertake no obligation to update such statements as a result of new information .

3 Electrification Hydrogen Economy Plug Power Continues to Execute on its Plan to Build the Green Hydrogen Economy Closed acquisitions of United Hydrogen and Giner ELX Positions Plug Power to transition from low carbon to zero carbon hydrogen solutions Vertical integration positions Plug as the global leader in generation, liquefaction, distribution and dispensing capabilities In - house capability to become one of the largest green hydrogen generation companies over the next several years Ideally positioned to benefit from anticipated substantial growth in the electrolyzer business on a global basis Raising 2024 revenue and adjusted EBITDA targets underscoring growth and margin leverage from the acquisitions

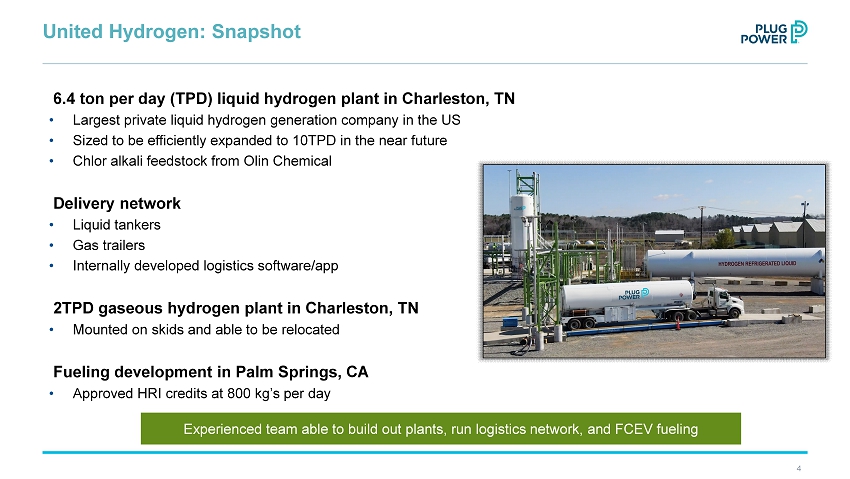

4 United Hydrogen: Snapshot 6.4 ton per day (TPD) liquid hydrogen plant in Charleston, TN • Largest private liquid hydrogen generation company in the US • Sized to be efficiently expanded to 10TPD in the near future • Chlor alkali feedstock from Olin Chemical Delivery network • Liquid tankers • Gas trailers • Internally developed logistics software/app 2TPD gaseous hydrogen plant in Charleston, TN • Mounted on skids and able to be relocated Fueling development in Palm Springs, CA • Approved HRI credits at 800 kg’s per day Experienced team able to build out plants, run logistics network, and FCEV fueling

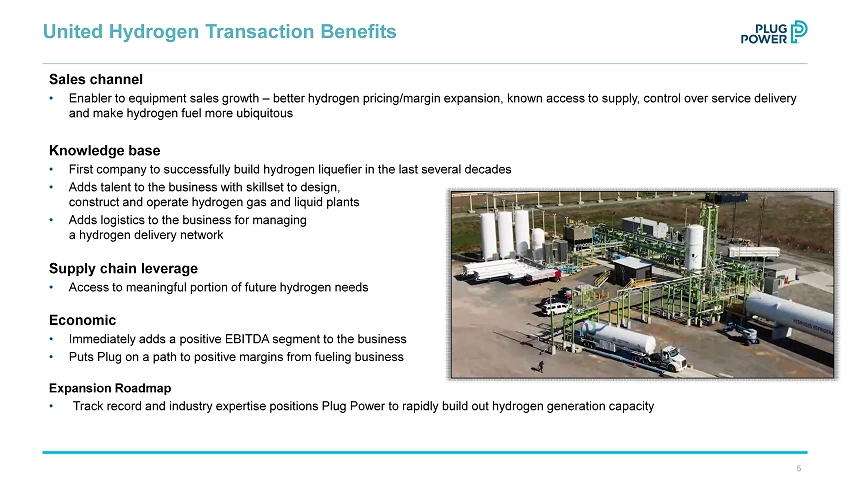

5 United Hydrogen Transaction Benefits Sales channel • Enabler to equipment sales growth – better hydrogen pricing/margin expansion, known access to supply, control over service deliv ery and make hydrogen fuel more ubiquitous Knowledge base • First company to successfully build hydrogen liquefier in the last several decades • Adds talent to the business with skillset to design, construct and operate hydrogen gas and liquid plants • Adds logistics to the business for managing a hydrogen delivery network Supply chain leverage • Access to meaningful portion of future hydrogen needs Economic • Immediately adds a positive EBITDA segment to the business • Puts Plug on a path to positive margins from fueling business Expansion Roadmap • Track record and industry expertise positions Plug Power to rapidly build out hydrogen generation capacity

6 Giner ELX: Snapshot Market leader in PEM electrolyzer • 4 decades+ experience with operating units worldwide • Strong sales channels in Europe • Blue - chip customers • Strong IP position • Technology leader with PEM electrolyzer • Multi - MW electrolyzer platform that can be scaled rapidly

7 Giner ELX Transaction Benefits • Strong sales channel in the European market • European Hydrogen Council recommending 2X40 GW of electrolyzer installation by 2030 • Electrolyzers are key to accomplishing over 50% green hydrogen usage by 2024 • Electrolyzers can turn domestically generated low cost renewable into high value green hydrogen fuel • Domestically produced hydrogen benefits US both from energy and national security perspective • Speed to Market with Electrolyzers • Immediate manufacturing capacity in Rochester - Plug Power’s MEA technology and manufacturing scale - up allows for rapid production of large - scale electrolyzers • Levelized Cost Roadmap of Green Hydrogen • According to Bloomberg New Energy Finance, the cost of green hydrogen is expected to decline by over 50% by 2030, and will be in parity with traditional SMR - based processes 0.0 1.0 2.0 3.0 4.0 5.0 2019 2030 2019 $ / kg Projected Global Levelized Cost of Renewable Hydrogen Production (2) Source: Bloomberg New Energy Finance

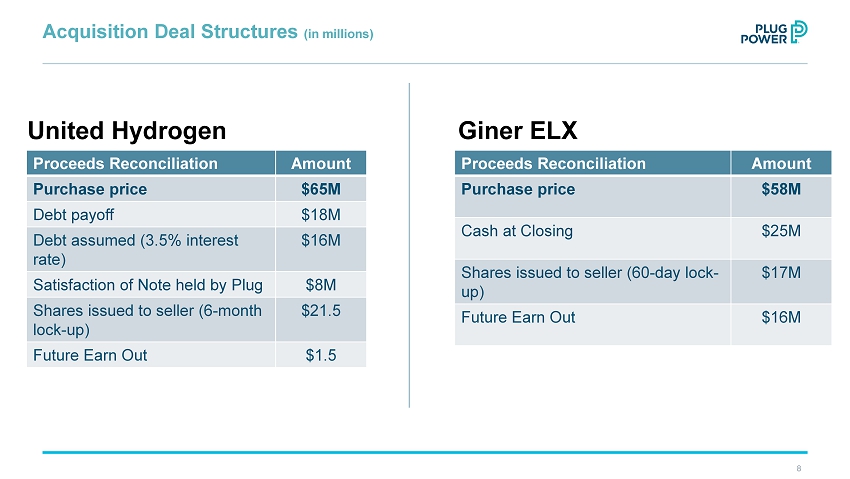

8 Acquisition Deal Structures (in millions) Proceeds Reconciliation Amount Purchase price $58M Cash at Closing $25M Shares issued to seller (60 - day lock - up) $17M Future Earn Out $16M Proceeds Reconciliation Amount Purchase price $65M Debt payoff $18M Debt assumed (3.5% interest rate) $16M Satisfaction of Note held by Plug $8M Shares issued to seller (6 - month lock - up) $21.5 Future Earn Out $1.5 United Hydrogen Giner ELX

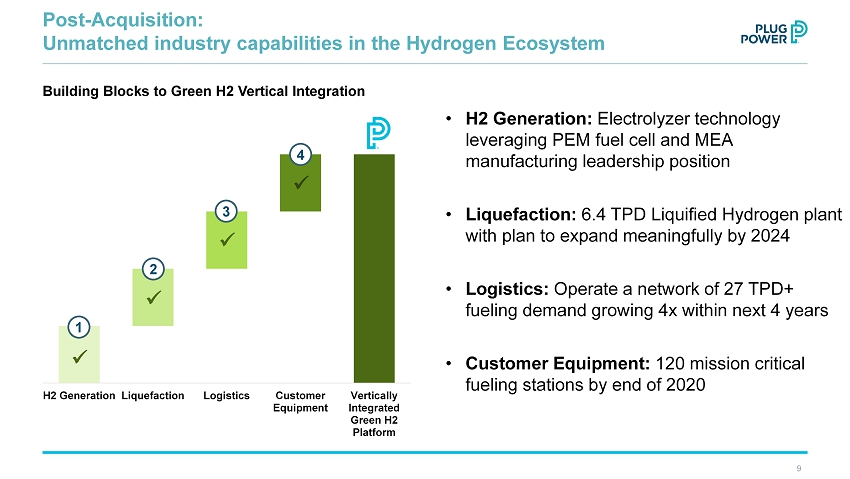

9 Post - Acquisition: Unmatched industry capabilities in the Hydrogen Ecosystem • H2 Generation: Electrolyzer technology leveraging PEM fuel cell and MEA manufacturing leadership position • Liquefaction: 6.4 TPD Liquified Hydrogen plant with plan to expand meaningfully by 2024 • Logistics: Operate a network of 27 TPD+ fueling demand growing 4x within next 4 years • Customer Equipment: 120 mission critical fueling stations by end of 2020 H2 Generation Liquefaction Logistics Customer Equipment Vertically Integrated Green H2 Platform Building Blocks to Green H2 Vertical Integration 1 2 3 4 x x x x

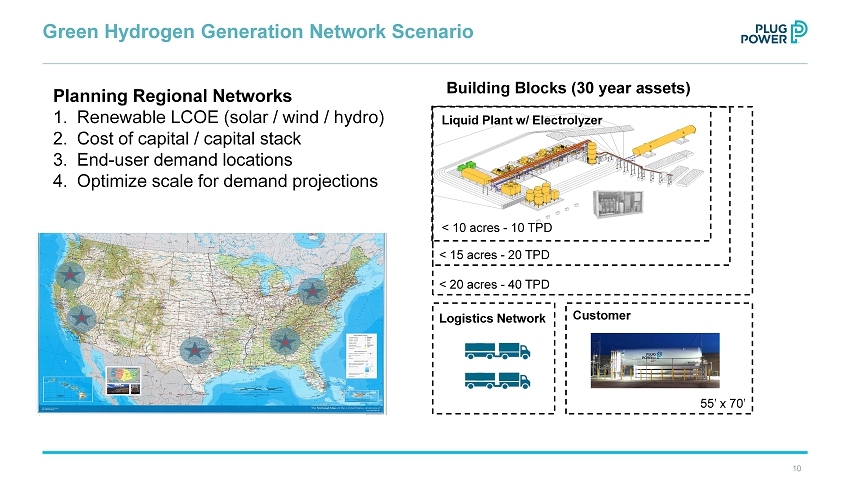

10 Green Hydrogen Generation Network Scenario Planning Regional Networks 1. Renewable LCOE (solar / wind / hydro) 2. Cost of capital / capital stack 3. End - user demand locations 4. Optimize scale for demand projections Building Blocks (30 year assets) < 15 acres - 20 TPD < 20 acres - 40 TPD < 10 acres - 10 TPD Liquid Plant w/ Electrolyzer Logistics Network 55’ x 70’ Customer

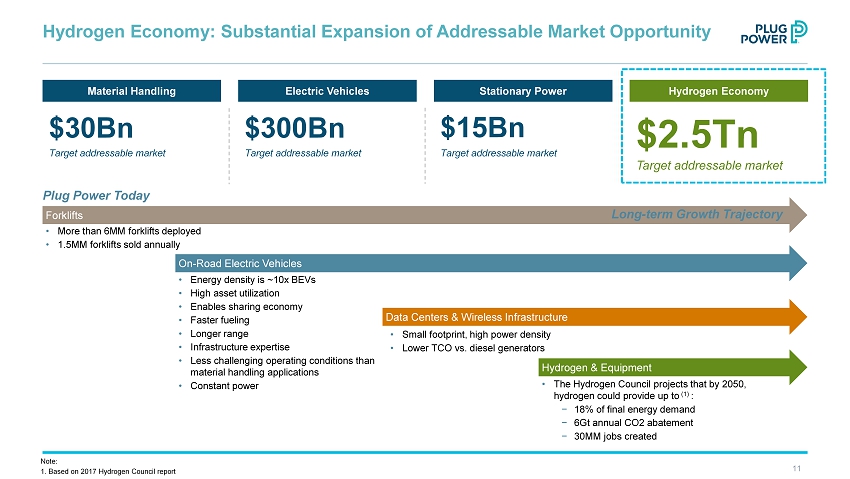

11 Hydrogen Economy: Substantial Expansion of Addressable Market Opportunity Material Handling Stationary Power Electric Vehicles $30Bn Target addressable market $300Bn Target addressable market $15Bn Target addressable market Forklifts On - Road Electric Vehicles Data Centers & Wireless Infrastructure • More than 6MM forklifts deployed • 1.5MM forklifts sold annually Plug Power Today • Energy density is ~10x BEVs • High asset utilization • Enables sharing economy • Faster fueling • Longer range • Infrastructure expertise • Less challenging operating conditions than material handling applications • Constant power • Small footprint, high power density • Lower TCO vs. diesel generators Long - term Growth Trajectory Hydrogen Economy $2.5Tn Target addressable market Hydrogen & Equipment • The Hydrogen Council projects that by 2050, hydrogen could provide up to (1) : − 18% of final energy demand − 6Gt annual CO2 abatement − 30MM jobs created Note: 1. Based on 2017 Hydrogen Council report

12 Green Hydrogen Can Power the Future • Green hydrogen checks all the boxes • Up to 6Gt of annual abatement could come across multiple industries by 2050 (1) • We expect many industries will need green hydrogen Domestically produced green hydrogen strengthens energy and national security % Global Emissions in 2017 (2) Renewables EVs CCS Hydrogen Biofuels Power 41% Transport 24% Industry 24% Buildings 8% x x x x x x x x x x x Source: 1. Based on 2017 Hydrogen Council report 2. Based on 2019 International Energy Agency (IEA) report

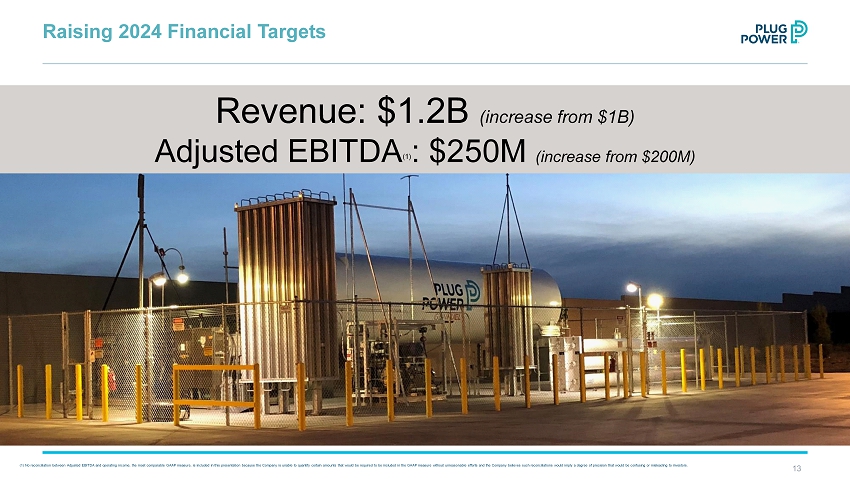

13 Raising 2024 Financial Targets Revenue: $1.2B (increase from $1B) Adjusted EBITDA (1) : $250M (increase from $200M) (1) No reconciliation between Adjusted EBITDA and operating income, the most comparable GAAP measure, is included in this pre sen tation because the Company is unable to quantify certain amounts that would be required to be included in the GAAP measure wi tho ut unreasonable efforts and the Company believes such reconciliations would imply a degree of precision that would be confusi ng or misleading to investors.

Corporate Headquarters 968 Albany Shaker Road, Latham, NY 12110 plugpower.com