Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FUELCELL ENERGY INC | tm2023174d2_8k.htm |

Exhibit 99.1

FUELCELL ENERGY INVESTOR PRESENTATION FuelCell Energy Company Update June 2020

FUELCELL ENERGY INVESTOR PRESENTATION Safe Harbor Statement This presentation contains forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements with respect to the Company’s anticipated financial results and statements regardin g t he Company's plans and expectations regarding the continuing development, commercialization and financing of its fuel cell technology and its business plans and str ategies. All forward looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Factors tha t c ould cause such a difference include, without limitation, changes to projected deliveries and order flow, changes to production rate and product costs, general ris ks associated with product development, manufacturing, changes in the regulatory environment, customer strategies, ability to access certain markets, unanticipated m anu facturing issues that impact power plant performance, changes in critical accounting policies, access to and ability to raise capital and attract financing, pot ent ial volatility of energy prices, rapid technological change, competition, the Company’s ability to successfully implement its new business strategies and achieve it s g oals, the Company’s ability to achieve its sales plans and cost reduction targets, changes by the U.S. Small Business Administration or other governmental authoriti es regarding the Coronavirus Aid, Relief, and Economic Security Act, the Payroll Protection Program or related administrative matters, and concerns with, threats of, o r t he consequences of, pandemics, contagious diseases or health epidemics, including the novel coronavirus, and resulting supply chain disruptions, shifts in c lea n energy demand, impacts to customers’ capital budgets and investment plans, impacts to the Company’s project schedules, impacts to the Company’s ability to service ex isting projects, and impacts on the demand for the Company’s products , as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission. The forward - looking statements contained herein speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, condi tio ns or circumstances on which any such statement is based. The Company refers to non - GAAP financial measures in this presentation. The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis. Please refer to the Company’s earnings release and the ap pendix to this presentation for further disclosure and reconciliation of non - GAAP financial measures. (As used herein, the term “GAAP” refers to generally accep ted accounting principles in the U.S.) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annu al Report on Form 10 - K for the fiscal year ended October 31, 2019, filed with the SEC on January 22, 2020, our Quarterly Report on Form 10 - Q for the fiscal quarter ended A pril 30, 2020, filed with the SEC on June 12 2020, and our earnings release for the second quarter ended April 30, 2020, filed as an exhibit to our Current Report on Form 8 - K filed with the SEC on June 12, 2020. 2

FUELCELL ENERGY INVESTOR PRESENTATION Purpose Statement 3 Enable The World To Live A Life Empowered By Clean Energy

FUELCELL ENERGY INVESTOR PRESENTATION GLOBAL CUSTOMERS FuelCell Energy: A Global Leader in Fuel Cell Technology – Operating Since 1969 Demand for Clean, Reliable Electricity Driving Adoption of Fuel Cell Technology COMPANY HIGHLIGHTS 1 Headquarters Danbury, CT Listing: NASDAQ FCEL Employees ~300 Continents 3 Global Plant Installations 59 Capacity in Field >260 MW TOTAL FY 2019 REVENUE BREAKDOWN: $60.8M Service & License 44% Advanced Technologies 32% Generation 23% Product 1% High Visibility to Recurring Revenue Note: Percentages are % of FY19 revenue. 1 As of the quarter ended April 30, 2020. 4 COMPANY OVERVIEW ▪ Deliver clean and affordable fuel cell solutions for the supply, recovery and storage of energy ▪ SureSource fuel cell systems provide continuous baseload power and are deployed with utility, municipality, university and industrial and commercial enterprise customers ▪ Turn - key solutions from design and installation of a project to long - term operation and maintenance of fuel cell system

FUELCELL ENERGY INVESTOR PRESENTATION Fuel cells cleanly and efficiently convert chemical energy from hydrogen - rich fuels into electrical power and high quality heat via an electrochemical process The process is highly efficient and emits water rather than pollutants as there is no burning of fuel Similar to a battery, a fuel cell is comprised of many individual cells that are grouped together to form a fuel cell stack When a hydrogen - rich fuel such as clean natural gas or renewable biogas enters the fuel cell stack, it reacts electrochemically with oxygen to produce electric current, heat and water Fuel cells have the ability to continuously generate electricity as long as fuel is continuously supplied FuelCell’s SureSource power plants are based on carbonate fuel cell technology To produce electricity, carbonate fuel cells generate hydrogen directly from a fuel source, such as natural gas or renewable biogas, via an internal reforming process This approach, which is patented by FuelCell, is a distinct competitive advantage of carbonate fuel cells Diagram Description : FuelCell Energy’s SureSource 3000 power plant typically is comprised of two fuel cell modules ( green ). One of four fuel cell stacks within each of the modules is visible in the cutaway. The incoming fuel is processed by the mechanical balance of plant ( gray ). The electrical output is processed by the electrical balance of plant ( blue ) Hydrogen Rich Fuel (combination of natural gas or biogas and water) Oxidant (air) 5 FuelCell Energy – Technology Overview

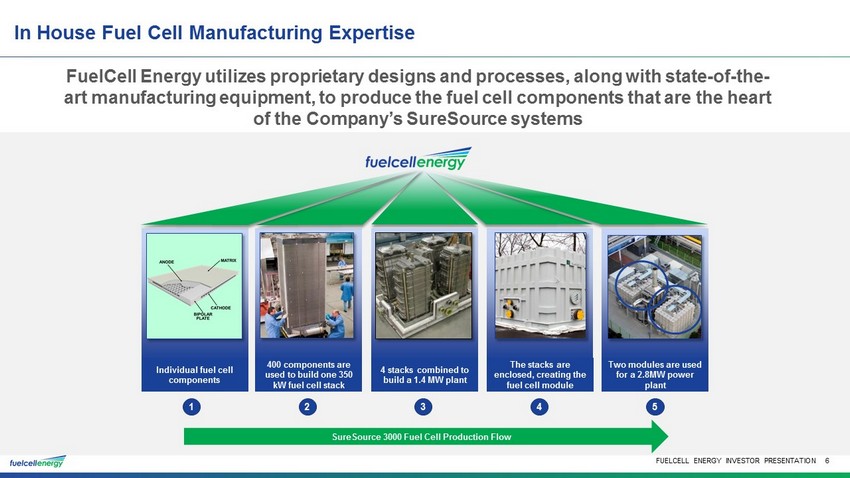

FUELCELL ENERGY INVESTOR PRESENTATION In House Fuel Cell Manufacturing Expertise FuelCell Energy utilizes proprietary designs and processes, along with state - of - the - art manufacturing equipment, to produce the fuel cell components that are the heart of the Company’s SureSource systems 400 components are used to build one 350 kW fuel cell stack 4 stacks combined to build a 1.4 MW plant The stacks are enclosed, creating the fuel cell module Two modules are used for a 2.8MW power plant Individual fuel cell components SureSource 3000 Fuel Cell Production Flow 6 1 2 3 4 5

FUELCELL ENERGY INVESTOR PRESENTATION • Utility - owned, rate - based • Enhance resiliency • 2.8 MW fuel cell on ¼ acre - ~23,000 MWh annually • 2.2 MW solar on ~9 acres - ~3,000 MWh annually • Power sold to grid • Enhance resiliency • Brownfield revitalization • 15 MW on 1 ½ acres • Only 12 mo. Installation • Owned by FuelCell • 5.6 MW with steam for company campus • Predictable power solving grid quality issues • Immediate savings vs. grid • Sustainability More than 10 Million MWh generated by SureSource power plants Grid Support with CHP Resiliency for Pharma Grid Support / Urban Redevelopment Fuel Cell / Solar Integration 7 • Power sold to grid • Heat sold to district heating system • 20 MW KOSPO site built in 2018 • 6 month construction time • Potential to easily scale larger Global Track Record

FUELCELL ENERGY INVESTOR PRESENTATION Long - term Macro Trends Supporting Clean Energy Well Positioned to Meet Growing Demand (1) Source : Guardian (2) Sierra Club Sustainable Clean Energy Renewable energy exceeded coal for the first time by providing 23% of U.S. power generation, compared to coal’s 20% share (1) in April 2019 FuelCell Energy expected to benefit from broader shift towards consumption of clean energy/power generation Grid Resiliency and Reliability Intermittency of power resources, natural disasters, and events such as the California fires have increased public awareness of grid limitations FuelCell Energy’s on - site power generation solutions are ideal for installations requiring continuous 24/7 power such as hospitals, schools, and large businesses Carbon Reduction Paris Climate Agreement: global economies committed to become carbon neutral by 2050 FuelCell Energy has the only technology in the world that produces power while capturing carbon, which we believe is the best technology today to achieve this 2050 goal Regulatory Support State and local governments are driving clean energy and climate policies; in 2018 more than 90 U.S. cities and towns have committed to sourcing their electricity from 100% renewables (2) FuelCell Energy supports the environmental objectives of state and local government 8

FUELCELL ENERGY INVESTOR PRESENTATION Recent Developments Recent Strategic Actions Position FuelCell Energy for Long - term Success Tony Leo appointed CTO and Mike Lisowski appointed COO June Jason Few appointed CEO Fully implemented business restructuring initiatives to realize annualized operating savings of approximately $15 million August Construction begins on San Bernardino biofuels project; 1.4M SureSource 1500 will run on the city’s anaerobic digester gas utilizing the Company’s proprietary SureSource Treatment System October Announced $200M corporate loan facility with an 8 - year term; Initial draw of $80M completed; enhanced liquidity to complete existing backlog Announced Ending engagement with Huron to assist with restructuring services, based on progress made by the Company Announced expanded joint - development agreement with ExxonMobil affiliate to enhance carbon capture technology: Up to $60M November Achieved significant progress on Connecticut Municipal Electric Energy Cooperative ( CMEEC) Fuel Cell Microgrid Project located on the U.S. Naval Submarine Base, Groton, CT Completed Tulare BioMAT project , with expected annual revenue in excess of $2.5M December 9 Announced update on 7 - year extended life stack modules ; 7 - year modules have been deployed for one year, realizing 40% stack replacement operating cost reductions vs. previous 5 - year stack modules Announced Powerhouse Business Strategy Closed tax equity sale - leaseback financing for the 2.8 MW Tulare BioMAT Fuel Cell Project with Crestmark Continued development of its Toyota Port of Long Beach SureSource Hydrogen project, after CPUC reaffirmed use of directed biogas is permissible Announced FQ1’2020 results; solid gross margins at 20% and 51% reduction in operating costs vs Q1’2019 January February March KEY ACCOMPLISHMENTS May April Entered strategic agreement with E.ON to develop the European Market Announced commercial operation of Triangle Street Project; first deployment of the SureSource 4000 high efficiency fuel cell power plant 2019 2020

FUELCELL ENERGY INVESTOR PRESENTATION Recent Company Highlights 10 Fiscal Q2 revenue growth reflecting growth across the business 1 Improved margins compared to prior year led by increased Advanced Technology work on Carbon Capture Technology, partially offset by unabsorbed fixed costs as a result of the Covid - 19 pandemic 2 3 Additional financing availability under Orion facility made available for working capital and general corporate needs 4 Extending leadership in sustainability and environmental stewardship 5 Managing potential impacts of Coronavirus 6 x Resumed operations at the Torrington manufacturing facility on June 22, 2020 x Minimized impact on project schedules through management of both inventory and the supply chain x Office reopening process to be staggered across the business ; We will comply with all state, federal and local jurisdictional government rules while working to meet project schedules for our customers x Managing impact on the Company’s sales and marketing opportunities due to customer delays in new projects as a result of the the global pandemic Advancing Powerhouse Strategy with milestones reached during the quarter

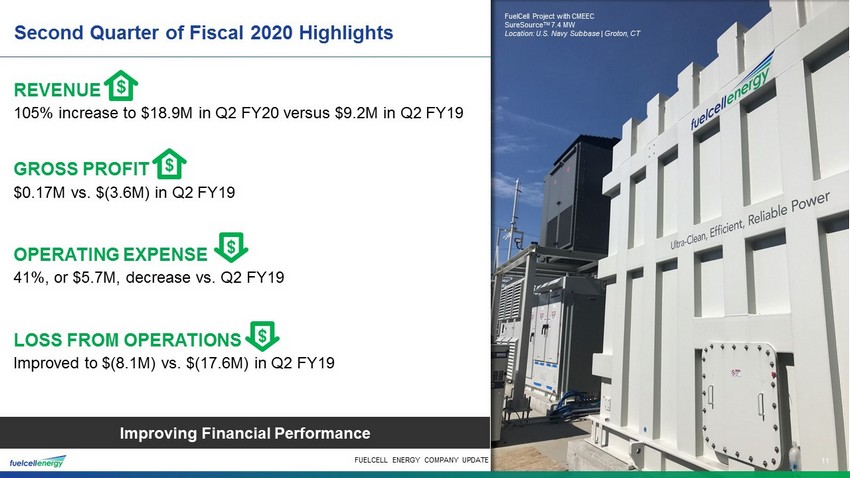

FUELCELL ENERGY INVESTOR PRESENTATION Second Quarter of Fiscal 2020 Highlights REVENUE 105% increase to $18.9M in Q2 FY20 versus $9.2M in Q2 FY19 GROSS PROFIT $0.17M vs. $(3.6M) in Q2 FY19 OPERATING EXPENSE 41%, or $5.7M, decrease vs. Q2 FY19 LOSS FROM OPERATIONS Improved to $( 8.1M ) vs. $(17.6M) in Q2 FY19 Improving Financial Performance 11 FUELCELL ENERGY COMPANY UPDATE FuelCell Project with CMEEC SureSource TM 7.4 MW Location: U.S. Navy Subbase | Groton, CT

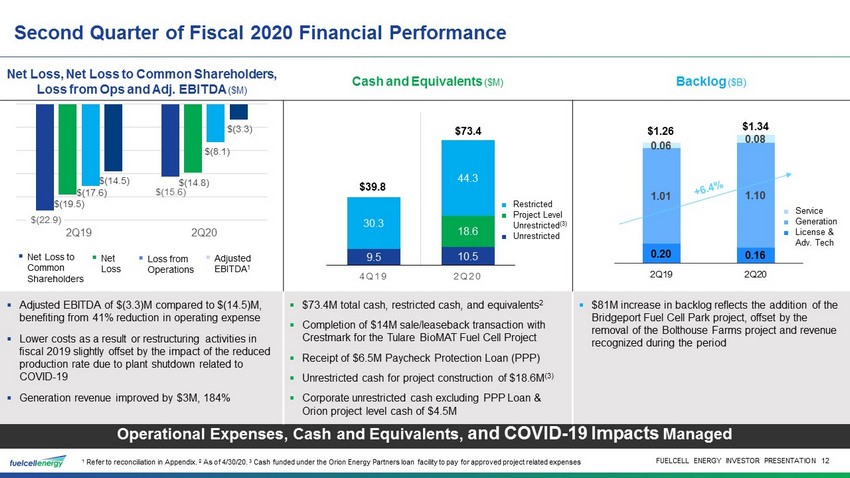

FUELCELL ENERGY INVESTOR PRESENTATION Second Quarter of Fiscal 2020 Financial Performance Operational Expenses, Cash and Equivalents, and COVID - 19 Impacts Managed 12 1 Refer to reconciliation in Appendix. 2 As of 4/30/20 . 3 Cash funded under the Orion Energy Partners loan facility to pay for approved project related expenses Net Loss , Net Loss to Common Shareholders, Loss from Ops and Adj. EBITDA ($M) Cash and Equivalents ($M) Backlog ($B) ▪ Adjusted EBITDA of $(3.3)M compared to $(14.5)M, benefiting from 41% reduction in operating expense ▪ Lower costs as a result or restructuring activities in fiscal 2019 slightly offset by the impact of the reduced production rate due to plant shutdown related to COVID - 19 ▪ Generation revenue improved by $ 3M, 184% ▪ $73.4M total cash, restricted cash, and equivalents 2 ▪ Completion of $14M sale/leaseback transaction with Crestmark for the Tulare BioMAT Fuel Cell Project ▪ Receipt of $ 6.5M Paycheck Protection Loan (PPP) ▪ Unrestricted cash for project construction of $ 18.6M (3) ▪ Corporate unrestricted cash excluding PPP Loan & Orion project level cash of $ 4.5M ▪ $81M increase in backlog reflects the addition of the Bridgeport Fuel Cell Park project, offset by the removal of the Bolthouse Farms project and revenue recognized during the period 9.5 10.5 18.6 30.3 44.3 4Q19 2Q20 $73.4 0.20 0.16 1.01 1.10 0.06 0.08 2Q19 2Q20 $1.34 $1.26 $(22.9) $(15.6) $(19.5) $(14.8) $(17.6) $(8.1) $(14.5) $(3.3) 2Q19 2Q20 ▪ Net Loss to Common Shareholders ▪ Loss from Operations ▪ Adjusted EBITDA 1 ■ Restricted ■ Project Level Unrestricted (3) ■ Unrestricted $39.8 ■ Service ■ Generation ■ License & Adv. Tech ▪ Net Loss

FUELCELL ENERGY INVESTOR PRESENTATION Powerhouse Business Strategy Positioning FuelCell Energy for Long - term Growth and Value Creation On a Three - year Execution Path to Transform the Company 13 TRANSFORM STRENGTHEN GROW Build a Solid Financial Foundation Strengthen the Business and Maximize Operational Efficiencies Capture Growth by Leveraging Core Strengths and Partnerships x Delivered cost savings: Realized annualized operating savings of ~$15M through the restructuring of our business x Capital deployment: Obtained low - cost, long - term financing for generation projects including Tulare and new loan through Connecticut Green Bank x Commercial excellence: Strengthened customer relationships and built a customer - centric reputation x Operational excellence: Backlog execution with the completion of the Tulare BioMAT project and commencement of San Bernardino site construction x Cost reductions: Lean resource management driving significant year over year change in operating expense x Sales growth: Expanded sales team focus on increased product sales and market opportunities x Innovation: Successful delivery of extended 7 - year life stack modules; expanding commercialization of new technologies including proprietary gas treatment systems x Segment leadership: Capitalizing on expertise and competitive advantages in key markets – biofuels, microgrid development, and hydrogen economy expansion x Education: Working with legislators and regulators in target geographies to increase awareness of benefits of FuelCell SureSource TM platforms x Geographic and market expansion: Targeting growth in new markets and applications

FUELCELL ENERGY INVESTOR PRESENTATION Continued Focus on Profitable Growth Enabled by Strengthened Financial Position and Sources of Funding 14 FY 2022 TARGETS Grow Generation Portfolio 1 100% Revenue Growth 1 Double - digit CAGR Adjusted EBITDA Deliver Positive Adj. EBITDA FUTURE GOALS Achieve Grid Pricing Parity Positive EBITDA Positive Free Cash Flow Deliver Return on Invested Capital 1 2 3 4 KEYS TO BUSINESS PLAN ACHIEVEMENT ▪ Execution on project backlog ▪ Winning new business around the world ▪ Continued cost control ▪ Achieving project milestones ▪ Efficient capital deployment 1 As compared to results for the fiscal year ended October 31, 2019. Long Term Targets and Goals

FUELCELL ENERGY INVESTOR PRESENTATION Key Investment Highlights 15 1 2 3 4 Strengthened balance sheet with funding secured to deliver long - term projects to generate recurring revenue New leadership committed to project execution, achieving financial milestones and operational efficiencies Unrivaled technology for ultra - clean, reliable and scalable baseload power On a three - year path of execution to Transform, Strengthen and Grow the organization for long - term success

FUELCELL ENERGY INVESTOR PRESENTATION Appendix

FUELCELL ENERGY INVESTOR PRESENTATION Projects in Process as of April 30, 2020 PROJECT NAME POWER OFF-TAKER LOCATION RATED CAPACITY (MW) ACTUAL COMMERCIAL OPERATION DATE PPA TERM (YEARS) Central CT State University ("CCSU") CCSU (CT University) New Britian, CT 1.4 FQ2'12 10 Medical Center UCI Medical Center Orange, CA 1.4 FQ1'16 19 Riverside Regional Water Quality Control Plant City of Riverside (CA Municipality Riverside, CA 1.4 FQ4'16 20 Pfizer, Inc. Pfizer, Inc. Groton, CT 5.6 FQ4'16 20 Santa Rita Jail Alameda County, California Dublin, CA 1.4 FQ1'17 20 Bridgeport Fuel Cell Project Connecticut Light and Power (CT Utility) Bridgeport, CT 14.9 FQ1'13 15 Tulare BioMAT Southern California Edison (CA Utility) Tulare, CA 2.8 FQ1'20 20 Triangle Street Tariff- Eversource (CT Utility) Danbury, CT 3.7 FQ2'20 Tariff 32.6Total MW Operating: FuelCell Energy Operating Portfolio and Project Backlog Overview 17 (1) Refers to FCEL fiscal quarter (1) (1) Operating Generation Portfolio as of April 30, 2020 PROJECT NAME POWER OFF-TAKER LOCATION RATED CAPACITY (MW) PPA TERM (YEARS) Groton Sub Base CMEEC (CT Electric Co-op) Groton, CT 7.4 20 CT RFP-2 Eversource/United Illuminating (CT Utilities) Derby, CT 14.8 20 San Bernardino City of San Bernardino Municipal Water Dept. San Bernardino, CA 1.4 20 LIPA 1 PSEG/LIPA LI NY (Utility) Long Island, NY 7.4 20 CT RFP-1 Eversource/United Illuminating (CT Utilities) Hartford, CT 7.4 20 Toyota Southern California Edison, Toyota Los Angeles, CA 2.2 20 40.6Total MW Operating:

FUELCELL ENERGY INVESTOR PRESENTATION FuelCell Energy Market Opportunity – Generation, Equipment Sales & Service Significant Potential to Expand Market Adoption Baseload is the largest segment of the U.S. electricity market U.S. Electricity Generation 4,076,675,000 Megawatt hours (MWh) U.S. Electricity Baseload: 77% 3,139,039,750 MWh Alternative Energy Baseload: 27% 1,100,000,000 MWh 810,000 MWh ~85% of fuel cell capacity has come online since 2013 $10B Equipment Market $15B Services Market 3 GW Storage $49B Equipment Market $73B Services Market 16 GW Carbon Capture Global Market 1 $70B Equipment Market $104B Services Market (1) Source : Company data. All market estimates represent FCE's near - term penetration of Total Addressable Markets. Power generation market penetration assumption varies by market, ranging 0.5% to 5% depending on application & geography — average is 1%. Represents 1% of total market opportunity FuelCell Energy Baseload: 0.02% $7B Equipment Market $11B Services Market 2 GW Distributed Power $4B Equipment Market $5B Services Market 1 GW Distributed Hydrogen 18

FUELCELL ENERGY INVESTOR PRESENTATION Introduction to Carbon Capture Technology Disruptive Carbon Capture Technology Opening New Markets FuelCell Energy has a joint development agreement with ExxonMobil Research and Engineering to develop, and commercialize a carbon capture system which utilize the Company’s carbonate fuel cell technology ~$120 billion+ equipment and services market for power generation and industrial CO 2 capture technology for FuelCell Energy Relationship with ExxonMobil & Developmental Milestones Carbon capture and storage is the process by which CO ₂ that is emitted from the exhaust streams of power plants and other industrial applications, that otherwise would be emitted into the atmosphere, is captured and injected into permanent storage facilities Existing processes for capturing CO ₂ emissions consume energy, which increases costs; but carbonate fuel cells can produce electricity while they capture and concentrate CO ₂ streams − This drastically reduces the cost of carbon capture giving this technology the potential for wide spread adoption FuelCell’s SureSource System is the Platform for Carbon Capture CONCENTRATES CO 2 Carbonate fuel cells can concentrate up to 90% of CO ₂ emissions that come out of power plants – concentrated emissions can be more easily captured and stored deep underground GENERATES POWER Carbon capture using fuel cells generates power, which is critical to lowering the cost of carbon capture CUSTOMIZABLE Fuel cells are modular solutions, allowing for gradual investments that help utilities meet carbon capture targets over time CLEANER AIR When carbonate fuel cells take CO ₂ from the power plant, they eliminate a majority of smog - producing emissions 2016 • FuelCell Energy signs Joint Development Agreement (JDA) with ExxonMobil Research and Engineering (“EMRE”) 2017 / 2018 • Joint R&D, engineering studies and market assessments completed • ITC Tax credit reintroduced, and CO 2 tax credit introduced, creating a more conducive macro environment 2019 - 2021 • New 2 - year JDA entered into to work towards large scale commercialization with EMRE 2022 - 2023 • SureSource 3000 systems enabled with carbon capture technology to be deployed into select ExxonMobil plants, bringing meaningful revenue from product sales and service agreements to FuelCell 2024 and Beyond • Large scale deployment globally 19

FUELCELL ENERGY INVESTOR PRESENTATION Distributed Hydrogen Technology & Toyota Project The SureSource Hydrogen fuel cell power plant is configured to produce additional hydrogen beyond what is needed for power production; generating a stream of hydrogen suitable for industrial or transportation applications This application helps to address the need for a hydrogen fueling infrastructure by cleanly and affordably generating high - purity hydrogen in urban locations FuelCell Energy is able to reconfigure its existing SureSource systems to generate surplus amounts of hydrogen - the first MW scale carbonate fuel cell power generation plant, with a hydrogen fueling station, is currently being developed for Toyota at the Port of Long Beach in California Distributed Hydrogen Overview Toyota Project – Port of Long Beach FuelCell Energy executing a hydrogen generation project with Toyota Toyota will purchase the hydrogen through a long term purchase agreement, as well as a portion of the electricity generated When the plant comes online, the SureSource Hydrogen system will generate approximately 2.3MW of electricity and 1.2 tons of hydrogen per day Enough to power the equivalent of about 2,250 average - sized homes and meet the daily driving needs of nearly 1,500 vehicles The power generation facility will supply Toyota Logistics Services’ operations at the Port, and the location will be the first 100% renewable Toyota facility in North America Received favorable opinion from CPUC that confirms project eligibility under BioMAT The distributed hydrogen market represents another multi - billion opportunity for FuelCell Energy 20 H 2 Onsite Hydrogen Fueling Station Fueling Station Hydrogen California Grid Anaerobic Digesters Usable Heat Biogas Ultra Clean Power Tri - Generation Direct FuelCell ® SureSource Hydrogen power plant Usable Hot Water Port of Long Beach

FUELCELL ENERGY INVESTOR PRESENTATION Relaunched Effort in Europe Including Sub - Megawatt Solutions 21 International Growth Opportunities Are Expanding, Including Large Sub - MW Applications Increasing European Distributed Power Generation Demand ▪ European SureSource solutions in Europe include megawatt scale, as well as sub - megawatt plants in both 250 kw and 400 kw outputs ▪ Government initiatives are key drivers in increasing demand in Europe ▪ Benefits additional markets with the ability to run directly on biogas ▪ Ideal for sewage, industrial and business parks, food and beverage industry, universities and colleges, as well as utilities ▪ Desirable next to buildings or in space - constrained urban ▪ locations SureSource TM 400 Radisson Blu Hotel Frankfurt, Germany Collaboration agreement with E.ON Business Solutions for a pan - European co - marketing effort of SureSource fuel cell solutions in October 2019

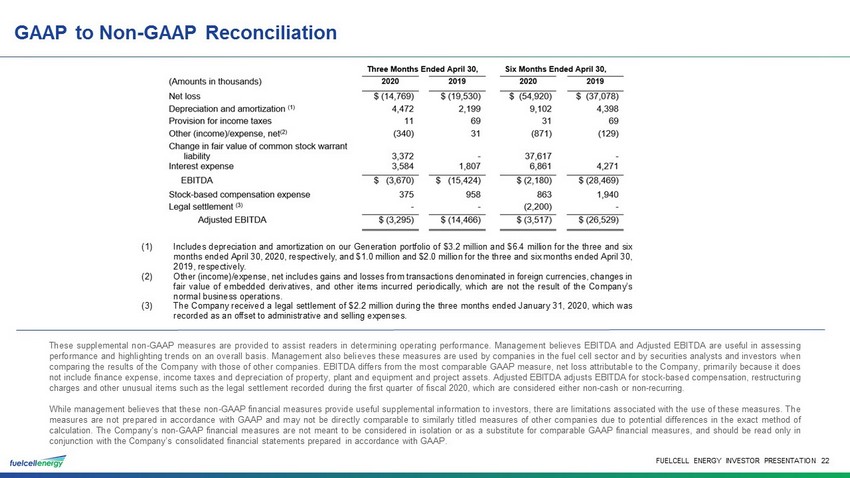

FUELCELL ENERGY INVESTOR PRESENTATION GAAP to Non - GAAP Reconciliation 22 (1) Includes depreciation and amortization on our Generation portfolio of $3.2 million and $6.4 million for the three and six months ended April 30, 2020, respectively, and $1.0 million and $2.0 million for the three and six months ended April 30, 2019, respectively. (2) Other (income)/expense, net includes gains and losses from transactions denominated in foreign currencies, changes in fair value of embedded derivatives, and other items incurred periodically, which are not the result of the Company’s normal business operations. (3) The Company received a legal settlement of $2.2 million during the three months ended January 31, 2020, which was recorded as an offset to administrative and selling expenses. These supplemental non - GAAP measures are provided to assist readers in determining operating performance . Management believes EBITDA and Adjusted EBITDA are useful in assessing performance and highlighting trends on an overall basis . Management also believes these measures are used by companies in the fuel cell sector and by securities analysts and investors when comparing the results of the Company with those of other companies . EBITDA differs from the most comparable GAAP measure, net loss attributable to the Company, primarily because it does not include finance expense, income taxes and depreciation of property, plant and equipment and project assets . Adjusted EBITDA adjusts EBITDA for stock - based compensation, restructuring charges and other unusual items such as the legal settlement recorded during the first quarter of fiscal 2020 , which are considered either non - cash or non - recurring . While management believes that these non - GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these measures . The measures are not prepared in accordance with GAAP and may not be directly comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation . The Company’s non - GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP .