Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AeroVironment Inc | avav-20200623xex99d1.htm |

| 8-K - 8-K - AeroVironment Inc | avav-20200623x8k.htm |

Exhibit 99.2

| Fourth Quarter and Full Fiscal Year 2020 Earnings Presentation June 23, 2020 |

| Safe Harbor Statement Certain statements in this presentation may constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, reliance on sales to the U.S. government; availability of U.S. government funding for defense procurement and R&D programs; changes in the timing and/or amount of government spending; our ability to perform under existing contracts and obtain new contracts; risks related to our international business, including compliance with export control laws; potential need for changes in our long-term strategy in response to future developments; the extensive regulatory requirements governing our contracts with the U.S. Government and international customers; the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; unexpected technical and marketing difficulties inherent in major research and product development efforts; the impact of potential security and cyber threats; changes in the supply and/or demand and/or prices for our products and services; the activities of competitors and increased competition; failure of the markets in which we operate to grow; uncertainty in the customer adoption rate of commercial use unmanned aircraft systems; failure to remain a market innovator and create new market opportunities; changes in significant operating expenses, including components and raw materials; failure to develop new products; the extensive regulatory requirements governing our contracts with the U.S. government; risk of litigation, including but not limited to pending litigation arising from the sale of our EES business; the impact of our recent acquisition of Pulse Aerospace, LLC and our ability to successfully integrate it into our operations; product liability, infringement and other claims; changes in the regulatory environment; the impact of the outbreak related to the strain of coronavirus known as COVID-19 on our business operations; and general economic and business conditions in the United States and elsewhere in the world. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at www.sec.gov or on our website at www.investor.avinc.com/financial-information. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. |

| Fourth Quarter and Full Fiscal Year 2020 Key Messages Delivered record results Fourth quarter revenue: $135 million Fiscal year revenue: $367 million Funded backlog: $208 million Strengthened our leadership position in multiple markets High confidence in our ability to create long-term value by progressing our strategic growth opportunities Achieved Fiscal Year 2020 objectives & delivered Third consecutive year of profitable, double-digit topline growth |

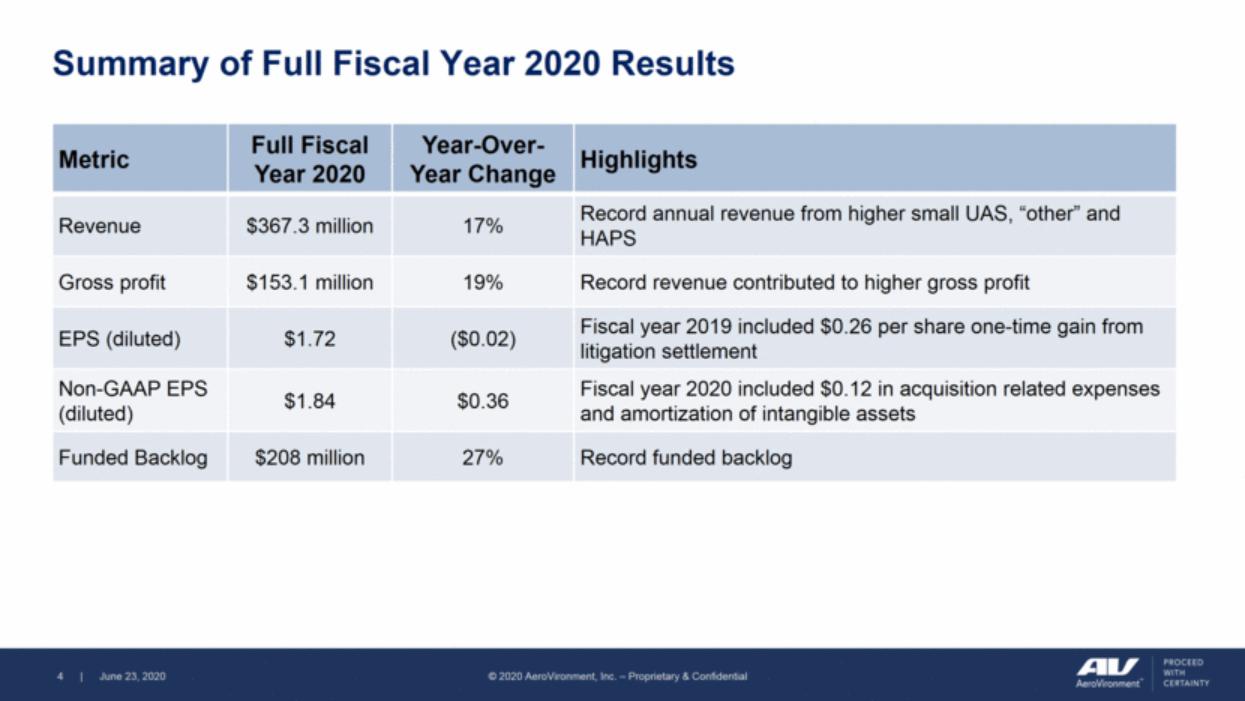

| Summary of Full Fiscal Year 2020 Results Metric Full Fiscal Year 2020 Year-Over-Year Change Highlights Revenue $367.3 million 17% Record annual revenue from higher small UAS, “other” and HAPS Gross profit $153.1 million 19% Record revenue contributed to higher gross profit EPS (diluted) $1.72 ($0.02) Fiscal year 2019 included $0.26 per share one-time gain from litigation settlement Non-GAAP EPS (diluted) $1.84 $0.36 Fiscal year 2020 included $0.12 in acquisition related expenses and amortization of intangible assets Funded Backlog $208 million 27% Record funded backlog |

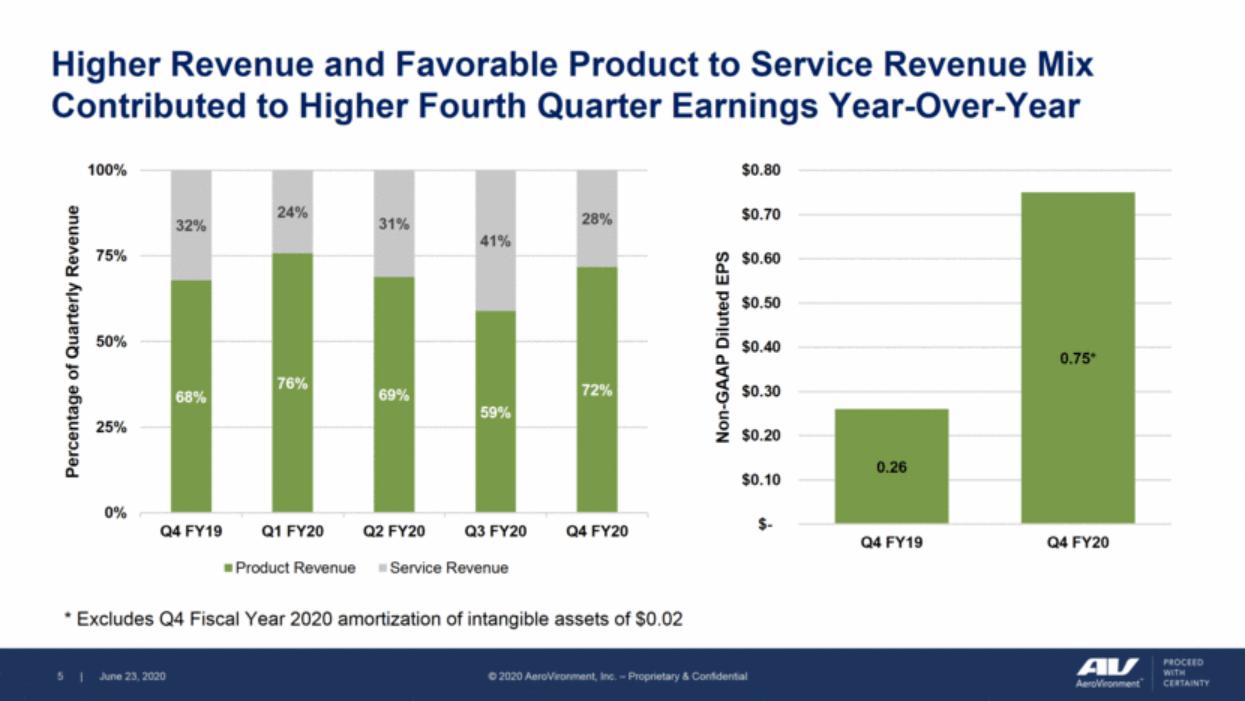

| Higher Revenue and Favorable Product to Service Revenue Mix Contributed to Higher Fourth Quarter Earnings Year-Over-Year * Excludes Q4 Fiscal Year 2020 amortization of intangible assets of $0.02 0.26 0.75 * $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 Q4 FY19 Q4 FY20 Non - GAAP Diluted EPS 68% 76% 69% 59% 72% 32% 24% 31% 41% 28% 0% 25% 50% 75% 100% Q4 FY19 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Percentage of Quarterly Revenue Product Revenue Service Revenue |

| Delivered Significant Progress Across Portfolio in Fiscal Year 2020 $226 million in small UAS revenue, driven by strong domestic demand Achieved total of 50 international allied customers First customer procurement of Puma LE Grew contract value of HAPS program to $166 million Prepared for next phase of HAWK30 flight testing in New Mexico Founding member of HAPS Alliance $76 million 1st year award of 3-year U.S. Army LMAMS program worth up to $146 million Largest LMAMS procurement, largest Switchblade order and largest AeroVironment award to-date |

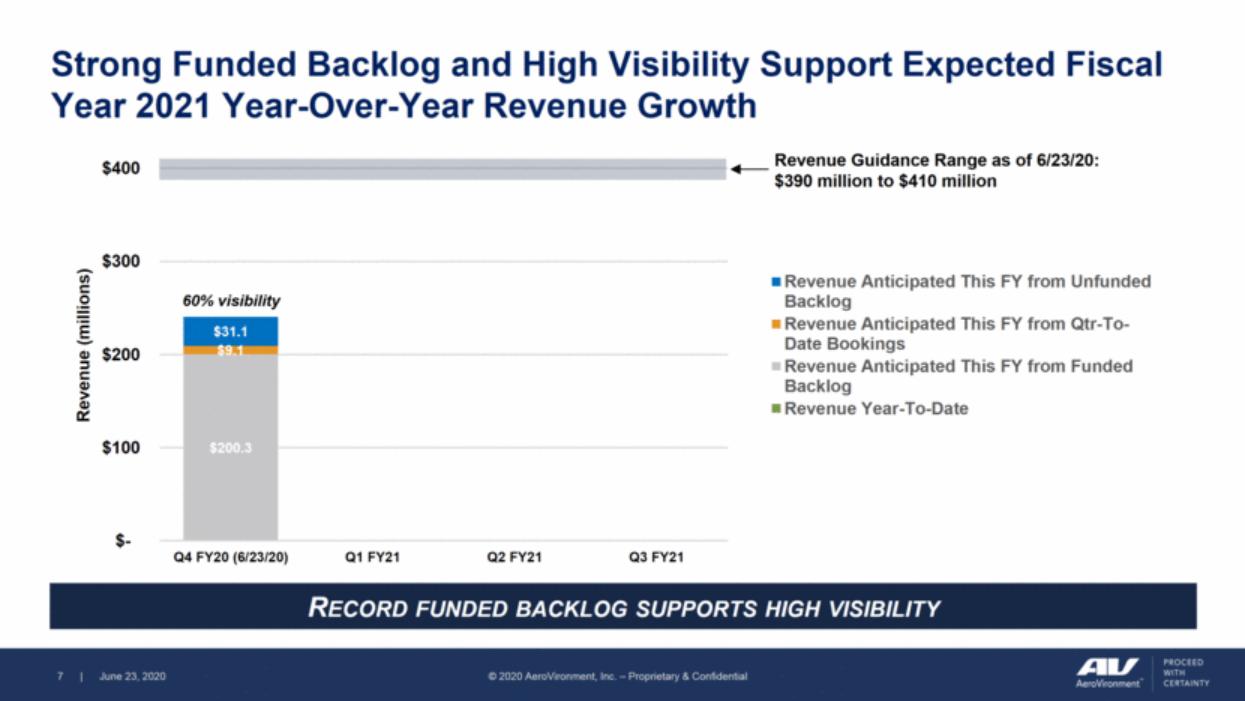

| Strong Funded Backlog and High Visibility Support Expected Fiscal Year 2021 Year-Over-Year Revenue Growth Record funded backlog supports high visibility Revenue Guidance Range as of 6/23/20: $390 million to $410 million 60% visibility $200.3 $9.1 $31.1 $- $100 $200 $300 $400 Q4 FY20 (6/23/20) Q1 FY21 Q2 FY21 Q3 FY21 Revenue (millions) Revenue Anticipated This FY from Unfunded Backlog Revenue Anticipated This FY from Qtr-To- Date Bookings Revenue Anticipated This FY from Funded Backlog Revenue Year-To-Date |

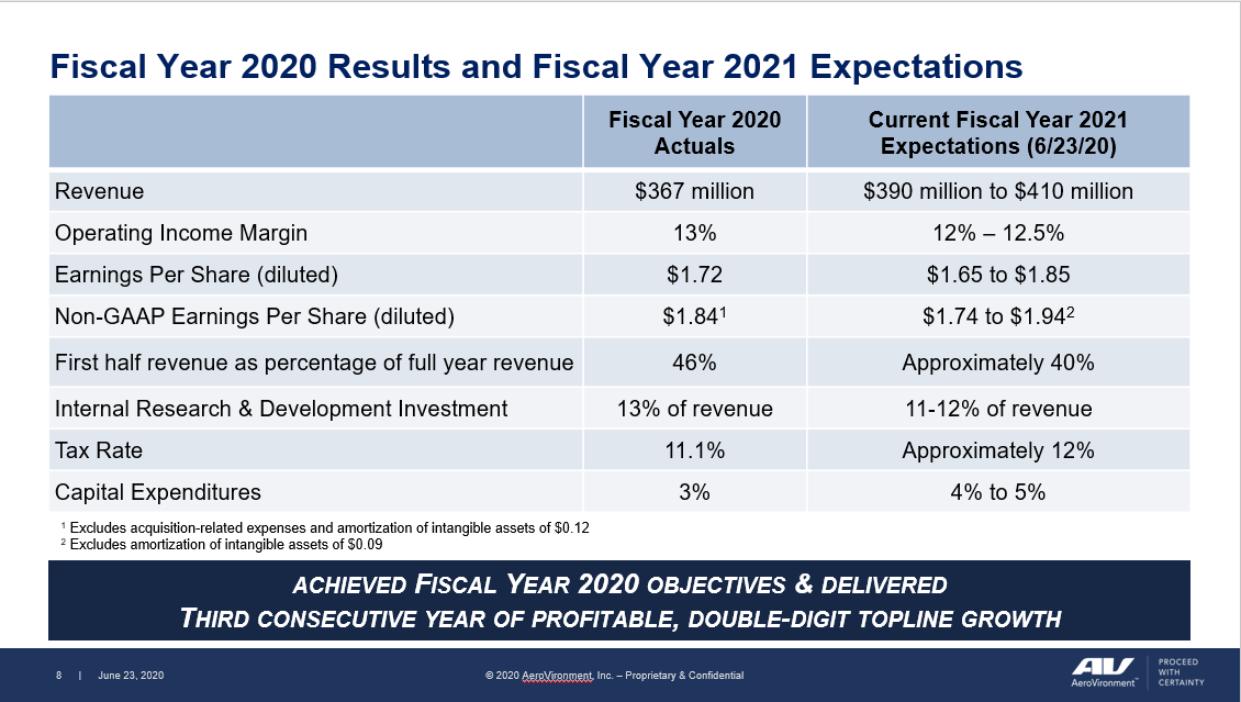

| Fiscal Year 2020 Results and Fiscal Year 2021 Expectations Fiscal Year 2020 Actuals Current Fiscal Year 2021 Expectations (6/23/20) Revenue $367 million $390 million to $410 million Operating Income Margin 12% – 12.5% Earnings Per Share (diluted) $1.72 $1.65 to $1.85 Non-GAAP Earnings Per Share (diluted) $1.841 $1.74 to $1.942 First half revenue as percentage of full year revenue 46% Approximately 40% Internal Research & Development Investment 13% of revenue 11-12% of revenue Tax Rate 11.1% 12% Capital Expenditures 3% 5% to 6% achieved Fiscal Year 2020 objectives & delivered Third consecutive year of profitable, double-digit topline growth 1 Excludes acquisition-related expenses and amortization of intangible assets of $0.12 2 Excludes amortization of intangible assets of $0.09 |

| For more information: Steven Gitlin Vice President Investor Relations ir@avinc.com +1 (805) 520-8350 |

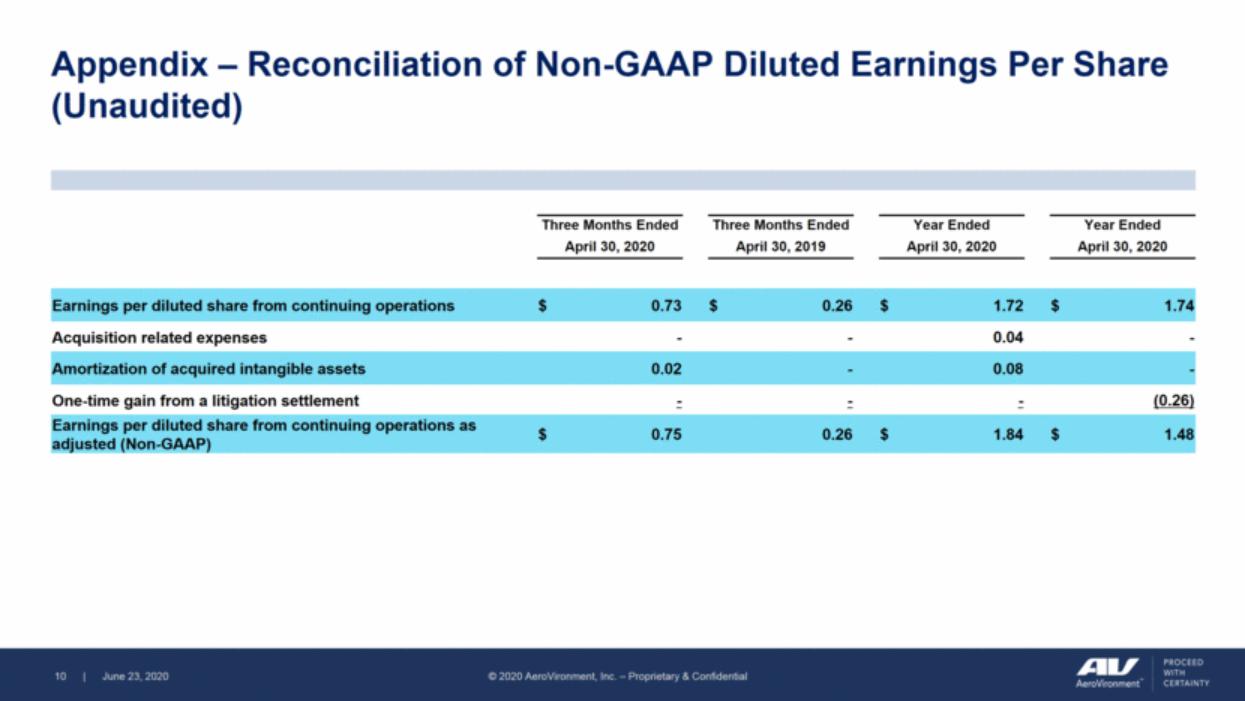

| Appendix – Reconciliation of Non-GAAP Diluted Earnings Per Share (Unaudited) Three Months Ended Three Months Ended Year Ended Year Ended April 30, 2020 April 30, 2019 April 30, 2020 April 30, 2020 Earnings per diluted share from continuing operations $ 0.73 $ 0.26 $ 1.72 $ 1.74 Acquisition related expenses - - 0.04 - Amortization of acquired intangible assets 0.02 - 0.08 - One-time gain from a litigation settlement - - - (0.26) Earnings per diluted share from continuing operations as adjusted (Non-GAAP) $ 0.75 0.26 $ 1.84 $ 1.48 |

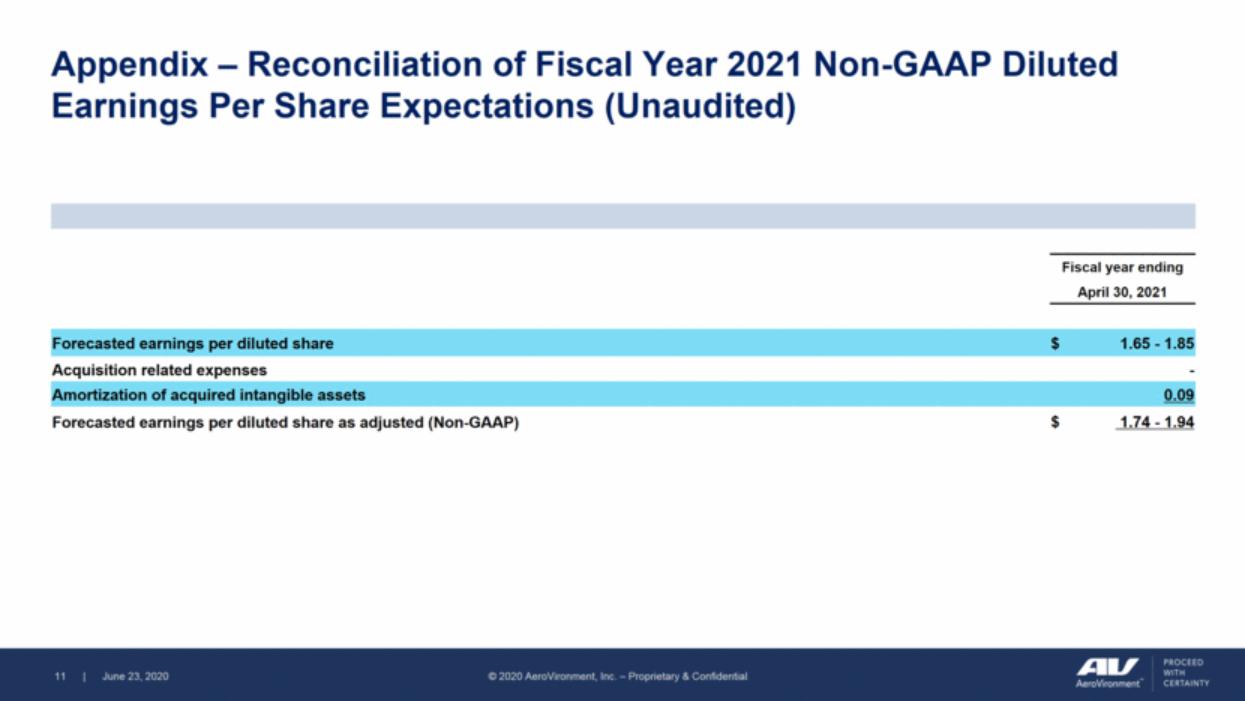

| Appendix – Reconciliation of Fiscal Year 2021 Non-GAAP Diluted Earnings Per Share Expectations (Unaudited) Fiscal year ending April 30, 2021 Forecasted earnings per diluted share $ 1.65 - 1.85 Acquisition related expenses - Amortization of acquired intangible assets 0.09 Forecasted earnings per diluted share as adjusted (Non-GAAP) $ 1.74 - 1.94 |