Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RING ENERGY, INC. | tm2022966d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - RING ENERGY, INC. | tm2022966d1_ex10-1.htm |

| 8-K - FORM 8-K - RING ENERGY, INC. | tm2022966d1_8k.htm |

Exhibit 99.2

www.ringenergy.com NYSE American: REI www.ringenergy.com OTCQX:RNGE www.ringenergy.com Corporate Presentation June 2020

www.ringenergy.com 2 NYSE American: REI Forward - Looking Statements and Cautionary Note Regarding Hydrocarbon Disclosures Forward – Looking Statements This Presentation includes "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 , the Securities Act of 1933 and the Securities Exchange Act of 1934 . All statements, other than statements of historical facts included in this Presentation regarding the Company's financial position, future revenues, net income, potential evaluations, business strategy and plans and objectives for future operations are "forward - looking statements . " These forward - looking statements are commonly identified by the use of such terms and phrases as “ may, ” “ will, ” “ intends, ” “ estimates, ” “ expects, ” “ anticipates ” and “ believes “ or the negative variations thereof or comparable terminology . These forward - looking statements are subject to numerous assumptions, risks and uncertainties that may cause actual results to be materially different than any future results expressed or implied in those statements . Factors that could cause actual results to differ materially from expected results are described under “ Risk Factors ” in our 2019 annual report on Form 10 - K filed with the U . S . Securities and Exchange Commission ( “ SEC ” ) on March 16 , 2020 . Although the Company believes that the assumptions upon which such forward - looking statements are based are reasonable, it can give no assurance that such assumptions will prove to be correct . All forward - looking statements in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may prove to be incorrect . The Company undertakes no obligation to publicly revise these forward - looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law . The financial and operating projections contained in this presentation represent our reasonable estimates as of the date of this presentation . Neither our auditors nor any other third party has examined, reviewed or compiled the projections and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto . The assumptions upon which the projections are based are described in more detail herein . Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results . Therefore, our actual results achieved during the periods covered by the projections will vary from the projected results . Prospective investors are cautioned not to place undue reliance on the projections included herein . Cautionary Note regarding Hydrocarbon Disclosures The SEC has generally permitted oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions . We use the terms “ estimated ultimate recovery, ” “ EUR, ” “ probable, ” “ possible, ” and “ non - proven ” reserves, reserve “ potential ” or “ upside ” or other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the SEC ’ s guidelines may prohibit us from including in filings with the SEC . Reference to EUR (estimated ultimate recovery) of natural gas and oil includes amounts that are not yet classified as proved reserves under SEC definitions, but that we believe will ultimately be produced . These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being actually realized by us . Factors affecting ultimate recovery include the scope of our drilling program, which will be directly affected by capital availability, drilling and production costs, commodity prices, availability of services and equipment, permit expirations, transportation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanical factors affecting recovery rates . Accordingly, actual quantities that may be recovered from our interests will differ from our estimates, and could be significantly less than our targeted recovery rate . In addition, our estimates may change significantly as we receive additional data .

www.ringenergy.com 3 NYSE American: REI Kelly Hoffman Chief Executive Officer and Director ▪ Co - Founded AOCO and pioneered Fuhrman Mascho field down - spacing beginning in 1996 David A. Fowler President and Director ▪ Co - Founder and former President of Simplex Energy Solutions, the leading Permian Basin divestiture firm Daniel D. Wilson Executive Vice President and Chief Operating Officer ▪ Former Vice President and Manager of Operations for Breck Operating Corporation William R. ( “ Randy ” ) Broaddrick Vice President and Chief Financial Officer ▪ Former Vice President and CFO of Arena Resources Hollie Lamb Vice President of Engineering ▪ Former Partner at HeLMS Oil & Gas R. Matthew (“Matt”) Garner General Counsel and Vice President of Land ▪ Former General Counsel and Land Advisor to Henry Petroleum, LP and its successor, Henry Resources, LLC Lloyd T. (Tim) Rochford Co - Founder and Executive Chairman of the Board ▪ Co - Founder of Arena Resources Stanley M. McCabe Co - Founder and Director ▪ Co - Founder of Arena Resources Anthony B. Petrelli Director ▪ President and Chairman of the Board of NTB Financial Corp. Regina Roesener Director ▪ Chief Operating Officer, Director of Corporate Finance and Director of NTB Financial Corp. Clayton E. Woodrum Director ▪ Founding partner of Woodrum, Tate & Associates, PLLC Ring Energy Team Management Team Key Board Members

www.ringenergy.com 4 NYSE American: REI Investment Highlights • The management team has extensive experience in the Central Basin Platform and has successfully operated through multiple cycles • Ring’s co - founders were formerly co - founders and senior managers of Arena Resources Proven Management Team • Build strong Permian acreage position in conventional reservoirs with a focused asset base in the Central Basin Platform (“CBP”), Northwest Shelf (“NWS”) and Delaware Basins • The Permian offers industry - leading returns and is one of the major producing oil plays in North America Permian Focus • Ring has experienced robust growth, with growth CAGRs of 54% a nd 105% in proved reserves and net production, respectively since 2012 Robust & Scaled Growth Profile • As of 3/31/2020, Ring had $12.5 MM in cash and a $1 BN Credit Facility with a $425 MM Borrowing Base (reduced to $375 MM at May Redetermination) with $366.5 MM outstanding (Q1 average weighted interest rate of 4.33%, effective 4/15/2020 interest rate reduced to 3.72%). On April 13, 2020 the Company drew an additional $21.5 MM increasing total to $388 MM. Through the use of hedge revenue and surplus capital, the Company has reduced current outstandings to $375 MM Financial Strength and Flexibility Attractive Well Economics • Ring’s CBP and NWS horizontal San Andres well costs are estimated at $1.8 MM and $2.2 MM, respectively • Ring is averaging IRRs of 98% on its NWS horizontal wells, 65% on CBP, at $40/Boe realized price received

www.ringenergy.com 5 NYSE American: REI Gross Acres Net Acres Central Basin Platform 90,611 63,500 Northwest Shelf 48,188 36,599 Delaware Basin 20,219 19,998 Total Acreage 159,018 120,097 Executive Summary (1) Ring reserves as of 12/31/2019 based on SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) ▪ Midland, Texas based E&P company focused on domestic exploration and production of oil and nat ural gas with current operations primarily in Texas ▪ 2019 Proved Reserves ( 1 ) : ▪ 81 . 1 MMBoe with PV - 10 of $ 1 , 103 MM ▪ 88 % Oil / 58 % Developed ▪ Q 1 ’ 20 average net production of 10 , 899 Boe/d ( 86 % oil, 8 % NGL, 6 % gas) ▪ Ring drilled 4 horizontal wells in Q 1 ’ 20 ( 4 reached peak production, plus 2 from previous quarters) ▪ The Delaware Basin asset continues to provide promising future development potential both vertically and horizontally based on existing vertical Cherry Canyon wells and encouraging results from the 5 horizontal Brushy Canyon wells drilled to date ▪ Acquired from Wishbone Energy Partners in early 2019 , Ring’s horizontal San Andres wells on the Northwest Shelf of Texas are quickly proving to have extremely attractive returns and superior EURs Market Statistics (as of 6/17/2020 ) Shares Outstanding: 68.0 MM Market Cap: $92.5 MM Last Price: $1.36 52 - Week Range: $0.52 - $3.45 Daily Avg. Volume (3M) 1.47 MM Northwest Shelf Central Basin Platform Delaware Basin Company Profile

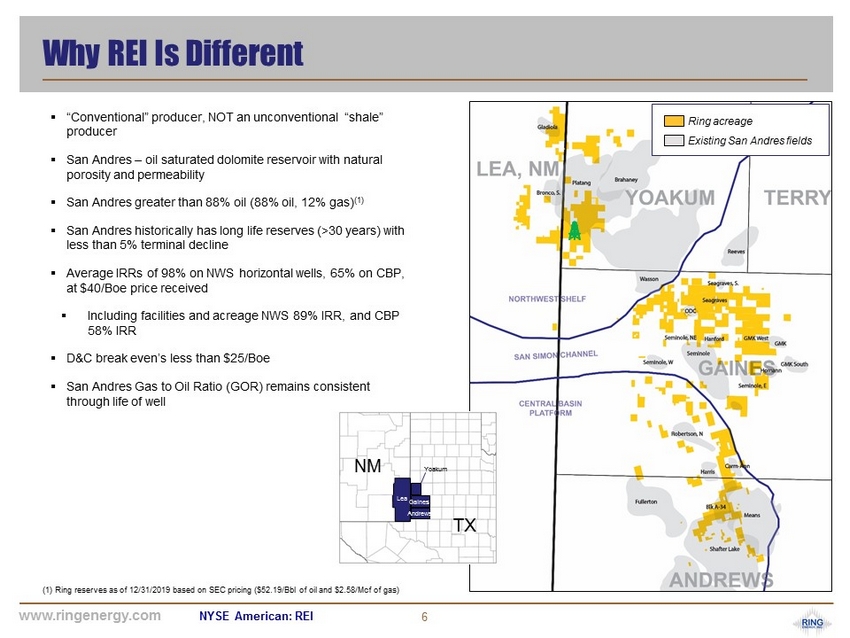

www.ringenergy.com 6 NYSE American: REI Lea Gaines Andrews Yoakum TX NM Why REI Is Different (1) Ring reserves as of 12/31/2019 based on SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) Existing San Andres fields Ring acreage ▪ “Conventional” producer, NOT an unconventional “shale” producer ▪ San Andres – oil saturated dolomite reservoir with natural porosity and permeability ▪ San Andres greater than 88% oil (88% oil, 12% gas) (1) ▪ San Andres historically has long life reserves (>30 years) with less than 5% terminal decline ▪ Average IRRs of 98% on NWS horizontal wells, 65% on CBP, at $40/Boe price received ▪ Including facilities and acreage NWS 89% IRR, and CBP 58% IRR ▪ D&C break even’s less than $25/Boe ▪ San Andres Gas to Oil Ratio (GOR) remains consistent through life of well

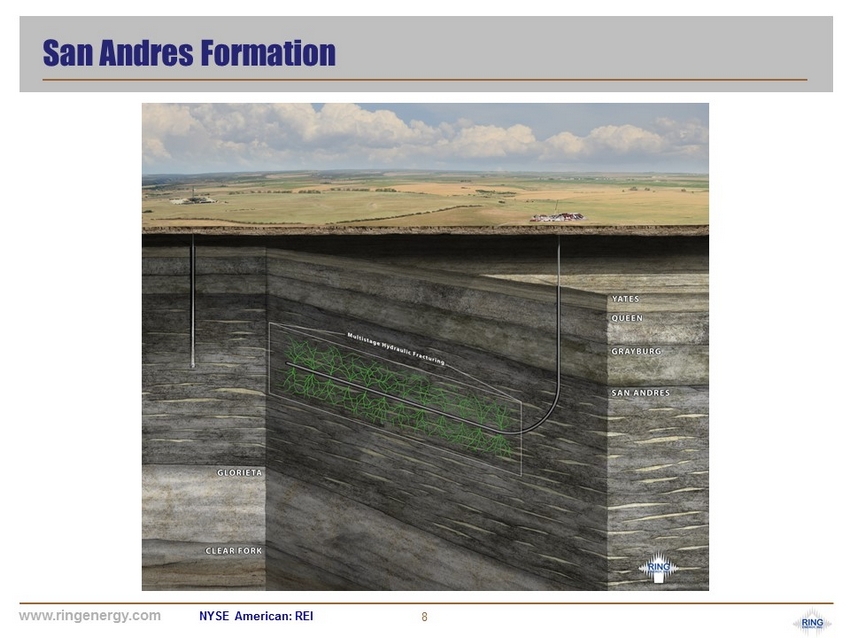

www.ringenergy.com 7 NYSE American: REI Proven Conventional Reservoir Source: US Department of Energy & DrillingInfo San Andres Overview Permian Basin Geology Denotes Ring acreage San Andres Hz Delaware Basin Hz Midland Basin Hz High ROR Oil Play x x x IPs >750 Bo/d x x Lower 1 st Year Decline x Low Terminal Decline <5% x Low D&C Costs x Low Cost of Entry/Acreage x Multiple Benches x x > 90% Black Oil x < $25/Bbl D&C Break - even x ▪ Over the past 90 years the Permian Basin has produced 30 BBbl ▪ The San Andres produced ~12 BBbl and 3 Tcf during that same time (40% of total Permian Basin production) ▪ Highly oil saturated, “conventional” dolomite reservoir with a typical oil column of 200’ - 300’ ▪ Vertical depth of approximately 5,000’ ▪ Time to peak production in ~75 days ▪ Initial peak rates of 300 - 700 Bbl/d (87% - 96% black oil) ▪ Historic waterflood and CO 2 recovery process have shown an incremental 20 - 30% Original oil in place (“OOIP”) recovery potential San Andres Hz Compares Favorably

www.ringenergy.com 8 NYSE American: REI San Andres Formation

www.ringenergy.com 9 NYSE American: REI Northwest Shelf Asset (1) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (2) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) ▪ 48 , 188 gross / 36 , 599 net total acres ▪ Q 1 ’ 20 average net production of 6 , 589 Boe/d ( 85 % oil) ▪ 151 gross active wells as of March 31 , 2020 ▪ 73 operate d horizontal San Andres wells ▪ 37 operated vertical wells ▪ 26 non - operated wells ▪ 15 SWDs ▪ Owned midstream infrastructure ▪ 1 , 385 surface acres ▪ SWD system facilitates reduction in cost ▪ Permitted capacity of ~ 241 , 000 Bw/d ▪ 15 water supply wells with greater than 12 , 000 Bw/d of supply capacity ▪ 5 frac ponds centrally located on surface acreage ▪ 3 caliche pits for road materials and new locations ▪ Horizontal drilling inventory ▪ 82 gross horizontal PUDs ( 57 San Andres operated, 12 Devonian operated, and 13 San Andres non - op) ( 1 ) ▪ 58 probable & possible gross horizontal locations ( 2 ) ▪ 231 prospective horizontal San Andres locations ( 2 ) ▪ Acreage position is approaching 50 % HBP with minimal drilling commitments providing significant organic growth platform Ring acreage Existing San Andres fields Wasson Asset Description

www.ringenergy.com 10 NYSE American: REI 82 58 231 PUD Probable & Possible Prospective San Andres Horizontal $300 $21 $355 (1) (2) (2) Northwest Shelf Accretive Drilling Inventory Note: Locations reflect gross locations on this page (1) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (2) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) All 1.0 mile and 1.5 mile horizontal San Andres wells; 6 - 8 wells per 640 acre section Spacing Assumptions: $137 $42 $363 PDP PDNP PUD Proved Reserves 45.3 MMBoe Proved PV - 10 $676 MM Q1’20 Average Net Production 6,589 Boe/d Purchase Price $300 MM $676 Assets acquired in April 2019 Total Proved PV - 10 ($ MM)

www.ringenergy.com 11 NYSE American: REI $35.00 $40.00 $45.00 IRR (%) 71% 98% 129% Years to Payout 1.5 1.2 1.0 ROI Disc 2.49x 2.92x 3.34x ROI Undisc 4.97x 5.87x 6.77x PV-10 (000s) $3,503 $4,492 $5,479 Net EUR (MBOE) 457 458 460 Net Realized Price Received ($/Boe) 1 10 100 1000 0 5 10 15 20 25 30 BOPD / MCFPD Years Northwest Shelf Well Economics & Type Curve (1) $1,000 / acre times 640 acres 1 bench $107K per location based on 6 wells per section (2) Includes conversion cost from ESP to rod pump after 12 months of production (3) LOE includes $3,500 per month for first 12 months from peak then $1,500 per month plus $1.20/Bbl of oil plus $2.20/ Mcf of gas plus $0.11/ Bbls of water (4) LOE Expense over the life of well divided by Net BOE EUR over life of the well (5) Excludes location acreage cost (6) Includes location acreage cost (7) Economics based on a gross lateral length of 5,080’ Note: Assumes $40/Boe realized price received San Andres (1.0 mile lateral) Average D&C Cost $2.17MM Average Cost per Location $107k (1) D&C Cost + Acreage Cost per Location $2.27MM Rod Conversion Cost $200k (2) Net EUR at 75% NRI (MBoe) 458 F&D ($/Boe) $4.95 LOE ($/Boe) (3)(4) $6.75 F&D + LOE ($/Boe) $11.70 Net Returns (2)(5)(7) Fully Loaded Net Returns (2)(6)(7) Discounted Net ROI 2.9x 2.8x Undiscounted Net ROI 5.9x 5.6x Net IRR 98% 89% Oil Gas Peak Rate 350 BOPD 300 MCFPD Initial Decline 85 85 B Factor 1.5 1.5 Final Decline 5 5 Curve Parameters $40/Boe Realized Price

www.ringenergy.com 12 NYSE American: REI Central Basin Platform Asset (1) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (2) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) ▪ 90 , 611 gross / 63 , 500 net total acres ▪ Q 1 ’ 20 average net production of 3 , 488 Boe/d ( 95 % oil) ▪ 410 gross active wells as of March 31 , 2020 ▪ 277 producing vertical wells ▪ 115 producing horizontal wells ▪ 18 SWDs ▪ Owned midstream infrastructure ▪ 100 surface acres ▪ SWD system facilitates reduction in cost ▪ Permitted capacity of 255 , 000 Bw/d with current volumes of 101 , 400 Bw/d ▪ 61 miles of water gathering pipeline ▪ 58 miles of oil pipeline ▪ 33 miles of gas pipeline ▪ Oil tank farm with 4 , 000 Bbl of capacity ▪ Oil pipeline sales point ▪ Horizontal drilling inventory ▪ 29 gross horizontal PUDs ( 1 ) ▪ 37 probable & possible gross horizontal locations ( 2 ) ▪ 667 additional gross potential horizontal locations ( 2 ) ▪ Organic leasehold effort helping to add net locations on a cost effective basis Ring acreage Existing San Andres fields Asset Description

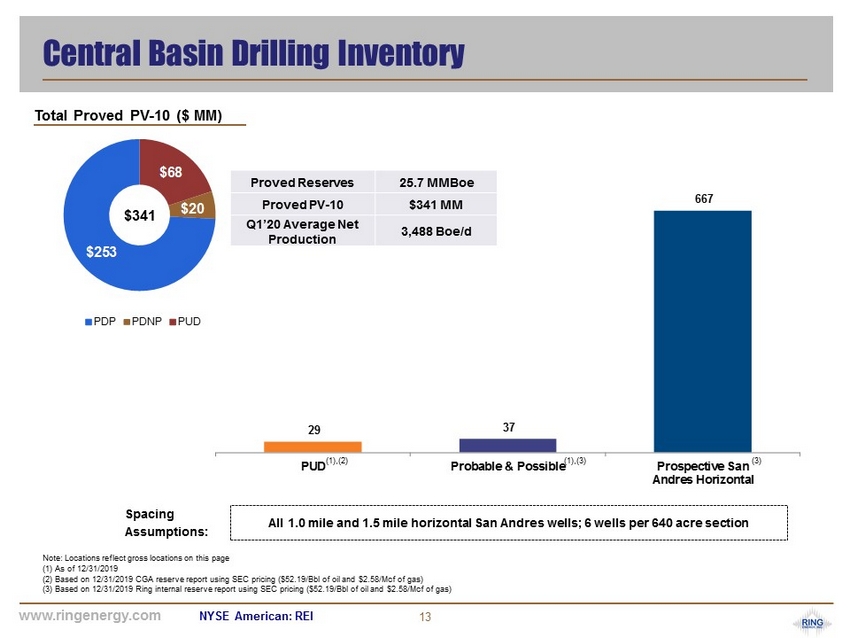

www.ringenergy.com 13 NYSE American: REI 29 37 667 PUD Probable & Possible Prospective San Andres Horizontal $68 $20 $253 Spacing Assumptions: Central Basin Drilling Inventory Note: Locations reflect gross locations on this page (1) As of 12/31/2019 (2) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (3) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (1),(2) (1),(3) (3) All 1.0 mile and 1.5 mile horizontal San Andres wells; 6 wells per 640 acre section $341 Proved Reserves 25.7 MMBoe Proved PV - 10 $341 MM Q1’20 Average Net Production 3,488 Boe/d $137 $42 $363 PDP PDNP PUD Total Proved PV - 10 ($ MM)

www.ringenergy.com 14 NYSE American: REI $35.00 $40.00 $45.00 IRR (%) 46% 65% 89% Years to Payout 2.2 1.7 1.4 ROI Disc 2.03x 2.37x 2.71x ROI Undisc 4.22x 4.98x 5.75x PV-10 (000s) $2,077 $2,773 $3,469 Net EUR (MBOE) 335 337 338 Net Realized Price Received ($/Boe) Oil Gas Peak Rate 305 BOPD 95 MCFPD Initial Decline 96.5 96.5 B Factor 1.8 1.8 Final Decline 5 5 Curve Parameters Central Basin Well Economics & Type Curve (1) $1,000 / acre times 640 acres 1 bench $107K per location based on 6 wells per section (2) Includes conversion cost from ESP to rod pump after 12 months of production (3) LOE includes $4,400 per month for first 12 months from peak then $1,100 per month plus $2.35/Bbl of oil plus $0.40/ Mcf of gas plus $0.11/ Bbls of water (4) LOE Expense over the life of well divided by Net BOE EUR over life of the well (5) Excludes location acreage cost (6) Includes location acreage cost (7) Economics based on a gross lateral length of 5,080’ Note: Assumes $40/Boe realized price received San Andres (1.0 mile lateral) Average D&C Cost $1.8MM Average Cost per Location $107k (1) D&C Cost + Acreage Cost per Location $1.9MM Rod Conversion Cost $250k (2) Net EUR at 75% NRI (MBoe) 337 F&D ($/Boe) $5.64 LOE ($/Boe) (3)(4) $6.83 F&D + LOE ($/Boe) $12.47 Net Returns (2)(5)(7) Fully Loaded Net Returns (2)(6)(7) Discounted Net ROI 2.4x 2.3x Undiscounted Net ROI 5.0x 4.8x Net IRR 65% 58% Oil Gas Peak Rate 305 BOPD 95 MCFPD Initial Decline 96.5 96.5 B Factor 1.8 1.8 Final Decline 5 5 Curve Parameters $40/Boe Realized Price

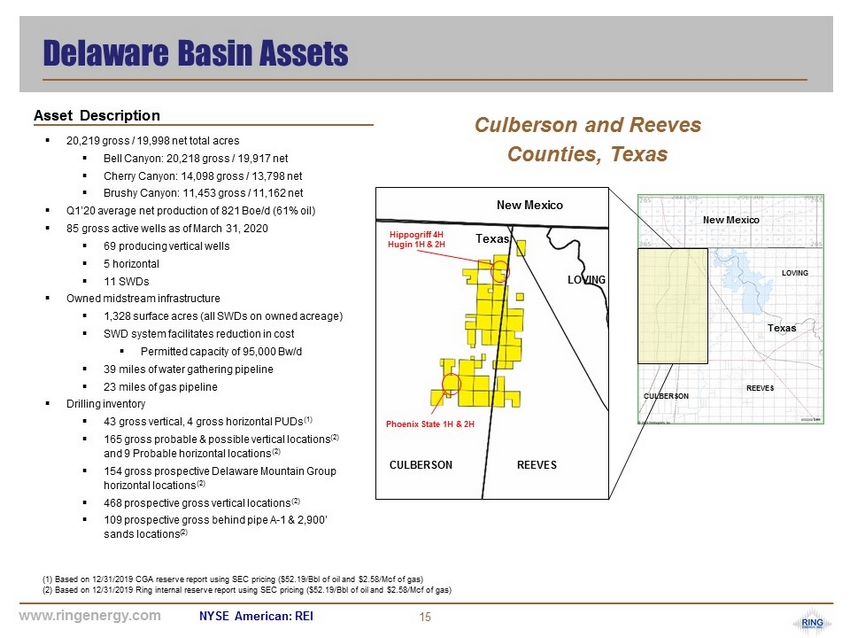

www.ringenergy.com 15 NYSE American: REI Delaware Basin Assets (1) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (2) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) Culberson and Reeves Counties, Texas CULBERSON REEVES LOVING Texas New Mexico CULBERSON REEVES LOVING Texas New Mexico Hippogriff 4H Hugin 1H & 2H Phoenix State 1H & 2H ▪ 20,219 gross / 19,998 net total acres ▪ Bell Canyon: 20,218 gross / 19,917 net ▪ Cherry Canyon: 14,098 gross / 13,798 net ▪ Brushy Canyon: 11,453 gross / 11 ,162 net ▪ Q1’20 average net production of 821 Boe/d (61% oil) ▪ 85 gross active wells as of March 31, 2020 ▪ 69 producing vertical wells ▪ 5 horizontal ▪ 11 SWDs ▪ Owned midstream infrastructure ▪ 1 , 328 surface acres (all SWDs on owned acreage) ▪ SWD system facilitates reduction in cost ▪ Permitted capacity of 95 , 000 Bw/d ▪ 39 miles of water gathering pipeline ▪ 23 miles of gas pipeline ▪ Drilling inventory ▪ 43 gross vertical, 4 gross horizontal PUDs (1) ▪ 165 gross probable & possible vertical locations (2) and 9 Probable horizontal locations (2) ▪ 154 gross prospective Delaware Mountain Group horizontal locations (2) ▪ 468 prospective gross vertical locations (2) ▪ 109 prospective gross behind pipe A - 1 & 2,900’ sands locations (2) Asset Description

www.ringenergy.com 16 NYSE American: REI 43 165 154 468 109 47 174 577 PUD Probable & Possible Prospective Delaware Mountain Group Horizontal Additional Prospective Locations $21 $22 $43 Behind pipe zones of interest Vertical Cherry Canyon (1) (2) (2) (2) Vertical 165 Horizontal 9 Vertical 43 Horizontal 4 Delaware Basin Drilling Inventory Note: Locations reflect gross locations on this page (1) Based on 12/31/2019 CGA reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) (2) Based on 12/31/2019 Ring internal reserve report using SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) Proved Reserves 10.0 MMBoe Proved PV - 10 $86 MM Q1’20 Average Net Production 821 Boe/d $137 $42 $363 PDP PDNP PUD $86 Includes a combination of 20s / 40s 6 wells per 640 - acre section Vertical - 20s / 40s Spacing Assumptions: Total Proved PV - 10 ($ MM)

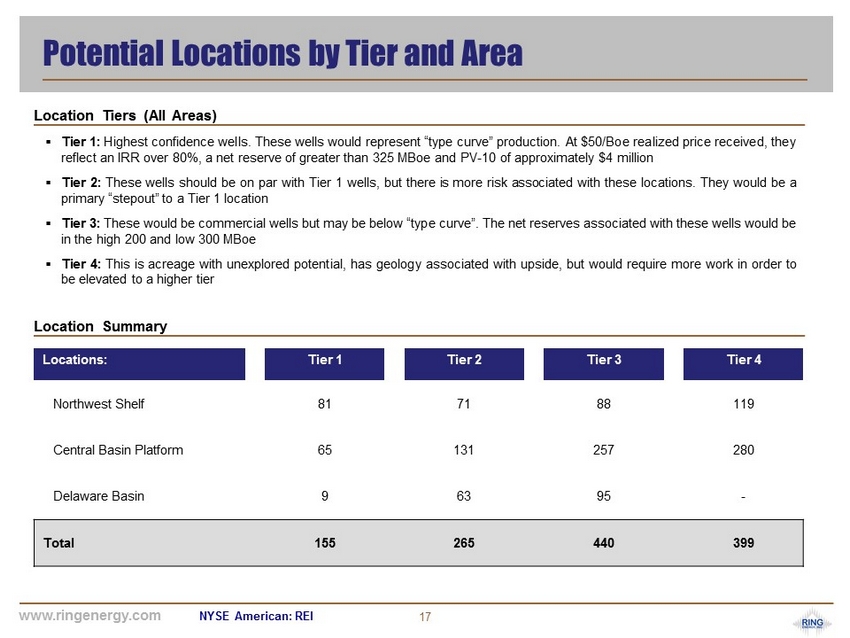

www.ringenergy.com 17 NYSE American: REI Potential Locations by Tier and Area ▪ Tier 1 : Highest confidence wells . These wells would represent “type curve” production . At $ 50 /Boe realized price received, they reflect an IRR over 80 % , a net reserve of greater than 325 MBoe and PV - 10 of approximately $ 4 million ▪ Tier 2 : These wells should be on par with Tier 1 wells, but there is more risk associated with these locations . They would be a primary “stepout” to a Tier 1 location ▪ Tier 3 : These would be commercial wells but may be below “type curve” . The net reserves associated with these wells would be in the high 200 and low 300 MBoe ▪ Tier 4 : This is acreage with unexplored potential, has geology associated with upside, but would require more work in order to be elevated to a higher tier Locations: Tier 1 Tier 2 Tier 3 Tier 4 Northwest Shelf 81 71 88 119 Central Basin Platform 65 131 257 280 Delaware Basin 9 63 95 - Total 155 265 440 399 Location Tiers (All Areas) Location Summary

www.ringenergy.com 18 NYSE American: REI $40.25 $38.25 $36.23 $34.30 $33.09 $31.96 $30.70 $26.91 $49.58 $35.22 $37.50 $44.92 $36.73 $38.23 $36.84 $31.39 - $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Q1 2020 Q4 2019 Q1 2020 Production Mix Oil 86% 61% 64% 64% 64% 63% 57% 58% Natural Gas 6% 19% 36% 18% 15% 18% 43% 27% NGL 8% 19% - 19% 20% 19% - 15% Realized $/ Boe Peer Comparison (1) Unhedged realized price, net of gathering and transportation expense Source: Publicly available information Peers include: CDEV, CPE, CXO, ESTE, FANG, MTDR, PE (Alphabetical) Observation – The greater the percent oil mix, the greater the net realized price per Boe Indicated peer names in no particular company order Q1 2020 – Q4 2019 Realized Price per Boe (Net of G&T) (1)

www.ringenergy.com 19 NYSE American: REI 500,500 506,000 506,000 1,642,500 $50.00 $50.00 $50.00 $42.22 $61.06 $61.06 $61.06 $54.57 $30.00 $34.00 $38.00 $42.00 $46.00 $50.00 $54.00 $58.00 $62.00 $66.00 $70.00 - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 Q2'20 Q3'20 Q4'20 FY2021 Price ($/Bbl) Volume (Bbls) Weighted Average Floor Weighted Average Ceiling Commodity Start Date End Date Volume (Bbl/d) Structure Floor Price Ceiling Price WTI - Crude 1/1/20 12/31/20 1,000 Collar $50.00 $65.40 WTI - Crude 1/1/20 12/31/20 1,000 Collar $50.00 $65.83 WTI - Crude 1/1/20 12/31/20 1,000 Collar $50.00 $58.40 WTI - Crude 1/1/20 12/31/20 1,500 Collar $50.00 $58.65 WTI - Crude 1/1/20 12/31/20 1,000 Collar $50.00 $58.25 WTI - Crude 1/1/21 12/31/21 1,000 Collar $45.00 $54.75 WTI - Crude 1/1/21 12/31/21 1,000 Collar $45.00 $52.71 WTI - Crude 1/1/21 12/31/21 1,000 Collar $40.00 $55.08 WTI - Crude 1/1/21 12/31/21 1,500 Collar $40.00 $55.35 Hedging Overview Summary of Crude Oil Hedges

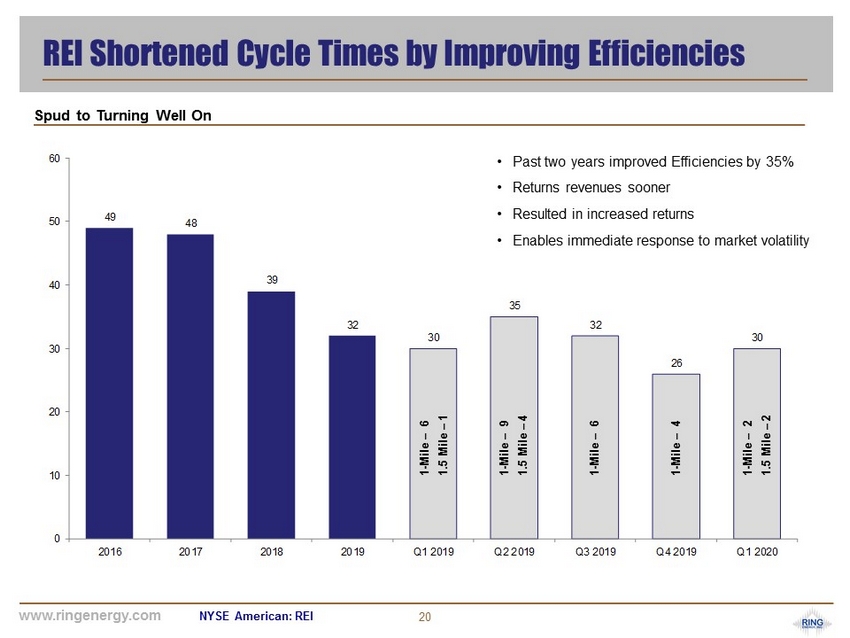

www.ringenergy.com 20 NYSE American: REI 49 48 39 32 30 35 32 26 30 0 10 20 30 40 50 60 2016 2017 2018 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 REI Shortened Cycle Times by Improving Efficiencies 1 - Mile – 6 1.5 Mile – 1 1 - Mile – 9 1.5 Mile – 4 1 - Mile – 6 1 - Mile – 4 • Past two years improved Efficiencies by 35% • Returns revenues sooner • Resulted in increased returns • Enables immediate response to market volatility Spud to Turning Well On 1 - Mile – 2 1.5 Mile – 2

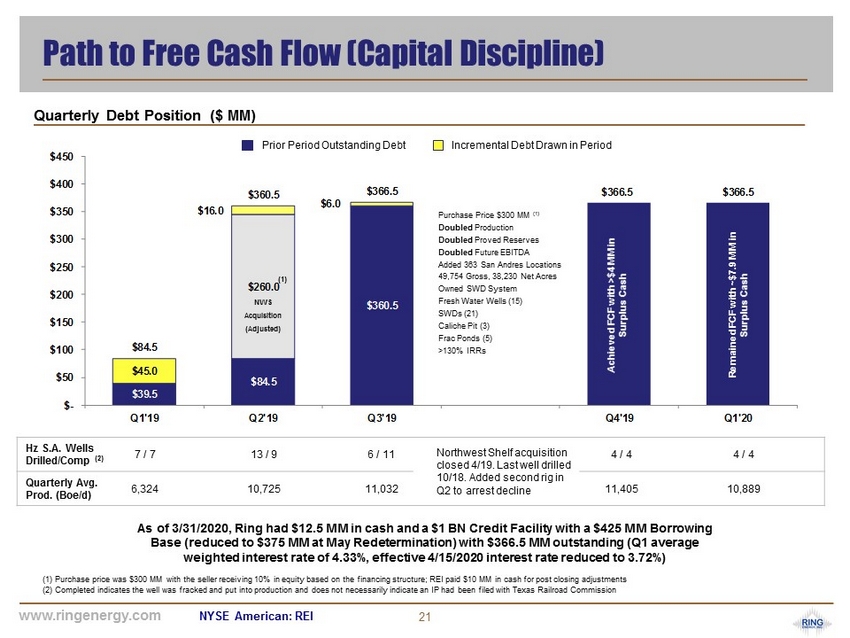

www.ringenergy.com 21 NYSE American: REI $39.5 $84.5 $360.5 $45.0 $260.0 $6.0 $16.0 $84.5 $360.5 $366.5 $366.5 $366.5 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Hz S.A. Wells Drilled/Comp (2) 7 / 7 13 / 9 6 / 11 Northwest Shelf acquisition closed 4/19. Last well drilled 10/18. Added second rig in Q2 to arrest decline 4 / 4 4 / 4 Quarterly Avg. Prod. (Boe/d) 6,324 10,725 11,032 11,405 10,889 Path to Free Cash Flow (Capital Discipline) (1) Purchase price was $300 MM with the seller receiving 10% in equity based on the financing structure; REI paid $10 MM in c ash for post closing adjustments (2) Completed indicates the well was fracked and put into production and does not necessarily indicate an IP had been filed w ith Texas Railroad Commission As of 3/31/2020, Ring had $12.5 MM in cash and a $1 BN Credit Facility with a $425 MM Borrowing Base (reduced to $375 MM at May Redetermination) with $366.5 MM outstanding (Q1 average weighted interest rate of 4.33%, effective 4/15/2020 interest rate reduced to 3.72%) Purchase Price $ 300 MM ( 1 ) Doubled Production Doubled Proved Reserves Doubled Future EBITDA Added 363 San Andres Locations 49 , 754 Gross, 38 , 230 Net Acres Owned SWD System Fresh Water Wells ( 15 ) SWDs ( 21 ) Caliche Pit ( 3 ) Frac Ponds ( 5 ) > 130 % IRRs NWS Acquisition (Adjusted) Remained FCF with ~$7.9 MM in Surplus Cash Incremental Debt Drawn in Period Prior Period Outstanding Debt (1) Quarterly Debt Position ($ MM) Achieved FCF with >$4 MM in Surplus Cash

www.ringenergy.com 22 NYSE American: REI Recent Developments & 2020 Capex ▪ During Q1’20 Ring drilled four horizontal San Andres wells on its Northwest Shelf assets (2 – 1.0 mile, 2 – 1.5 mile) in Yoakum County, Texas. All four new drills reported IP’s, plus two additional horizontal wells drilled in previous quarters. The aver age IP rate for all six of the horizontal wells IP’d in Q1’20 was 558 Boe/d, or 107 BOE/1000’ on an average lateral length of 5,246’. The four new wells drilled in Q1’20 averaged over 600 Boe/d using a larger frac and refined completion technique. The Company also performed nine conversions from electrical submersible pumps (“ESP”) to rod pumps (4 NWS, 5 CBP) ▪ As reported in early March, Ring stopped drilling new wells until stabilization returns in the marketplace ▪ For 2020, the Company has “financial hedges” in the form of a costless collar on 5,500 Bop/d with a floor of $50/ bbl , or approximately 60% of the Company’s oil volume. The hedges are used to protect the Company’s cash flow should oil prices fall below the hedge floor price. The Company strongly believes that should it become necessary to shut - in wells, or if the price differences are so high it would make no economic sense to produce and sell oil, the income from the hedges in place, in combination with the cost cutting measures being made in both operations and G&A, would be enough to sustain the Company. A summary of the Company’s crude oil hedges for 2020/2021 are further detailed on page 19 ▪ On May 11, 2020, Ring announced in its Q1 Financial and Operations Update that due to the instability in the market resulting from COVID - 19, it would decrease its preliminary 2020 capex from $85 - 90 MM to $25 - 27 MM, of which approximately $16 MM was spent in the first quarter. The revised capex of $25 - 27 MM is subject to change based on market conditions and includes the following: ▪ Suspension of drilling new wells ▪ Conversions from Electrical Submersible Pumps (ESP) to rod pumps ▪ Perform downhole workover projects ▪ Surface work on storage facilities and compressor improvements ▪ Improve efficiencies wherever possible Recent Developments 2020 Capex

www.ringenergy.com 23 NYSE American: REI 2020 Capex Objectives ▪ Capex Objectives: ▪ Revised 2020 Capex of estimated $25 - 27 MM (reduced from $85 - 90 MM) ▪ Suspend 2020 drilling to protect balance sheet and outspend ▪ Design 2020 capex to stay within cash flow ▪ Agility to immediately start drilling when commodity prices recover ▪ Company Objectives: ▪ Utilize hedges to protect cash flow during low commodity price environment ▪ Protect balance sheet by reducing and managing debt ▪ Workovers / rod conversions provide the following benefits ▪ Improved production, increased well longevity and reduced operating costs ▪ Rod conversions: ▪ Approximately 50% long - term reduction in LOE reduces lifting costs/bbl ▪ Increased EUR due to reduced LOE extends economic life of the well ▪ Major reduction in future pulling costs up to 80% per occurrence ▪ Improved Infrastructure ▪ Reduces LOE associated with water disposal ▪ Provides capacity for future water disposal 2020 Objectives 2020 Project Objectives

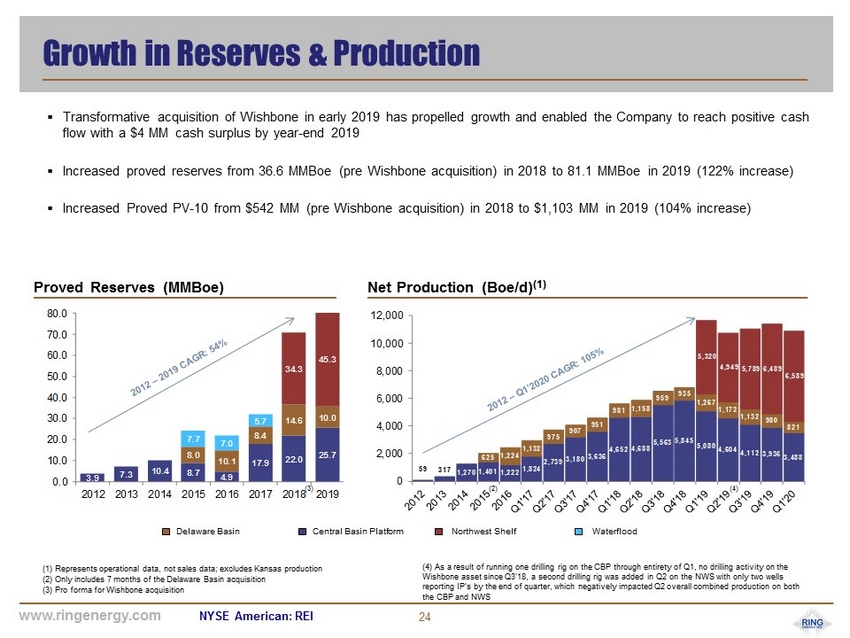

www.ringenergy.com 24 NYSE American: REI 59 317 1,270 1,401 1,222 1,824 2,739 3,180 3,636 4,652 4,688 5,563 5,845 5,080 4,604 4,112 3,936 3,488 625 1,224 1,132 975 907 951 981 1,158 959 935 1,267 1,172 1,132 980 821 5,320 4,949 5,789 6,489 6,589 0 2,000 4,000 6,000 8,000 10,000 12,000 3.9 7.3 10.4 8.7 4.9 17.9 22.0 25.7 8.0 10.1 8.4 14.6 10.0 7.7 7.0 5.7 34.3 45.3 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 2012 2013 2014 2015 2016 2017 2018 2019 Growth in Reserves & Production (1) Represents operational data, not sales data; excludes Kansas production (2) Only includes 7 months of the Delaware Basin acquisition (3) Pro forma for Wishbone acquisition ▪ Transformative acquisition of Wishbone in early 2019 has propelled growth and enabled the Company to reach positive cash flow with a $4 MM cash surplus by year - end 2019 ▪ Increased proved reserves from 36.6 MMBoe (pre Wishbone acquisition) in 2018 to 81.1 MMBoe in 2019 (122% increase) ▪ Increased Proved PV - 10 from $542 MM (pre Wishbone acquisition) in 2018 to $1,103 MM in 2019 (104% increase) (2) Delaware Basin Central Basin Platform Waterflood Northwest Shelf (3) (4) As a result of running one drilling rig on the CBP through entirety of Q1, no drilling activity on the Wishbone asset since Q3’18, a second drilling rig was added in Q2 on the NWS with only two wells reporting IP’s by the end of quarter, which negatively impacted Q2 overall combined production on both the CBP and NWS (4) Proved Reserves (MMBoe) Net Production (Boe/d) (1)

www.ringenergy.com 25 NYSE American: REI Shares Outstanding 68.0 MM Share Price (6/17/2020) $1.36 Market Capitalization $92.5 MM Debt $375.0 MM Cash $12.5 MM Enterprise Value (1) $455.0 MM Borrowing Base (Reaffirmed June 2020) $375.0 MM ▪ Indicates Market is giving little value to upside ▪ Borrowing Base is 82% of Enterprise Value REI Valuation Matrix (1) Enterprise value calculated as Market Cap + Debt – Cash Borrowing Base / Enterprise Value Net Asset Valuation Market Capitalization / EBITDA YE 2019 PDP PV - 10 $651.0 MM Debt $375.0 MM Cash $12.5 MM Implied Equity Value $288.5 MM Shares Outstanding 68.0 MM Implied Share Price $4.24 ▪ On 6/17/2020, REI share price closed at $1.36 Period EBITDA YTD Totals Q1 2019 $24.2 MM Q2 2019 $33.3 MM $57.5 MM Q3 2019 $29.5 MM $87.0 MM Q4 2019 $33.4 MM $120.4 MM Q1 2020 $28.0 MM Market Capitalization (6/17/2020) $92.5 MM ▪ REI trading at low Market Capitalization / EBITDA multiple ▪ Achieved positive free cash flow in Q4 2019 and Q1 2020

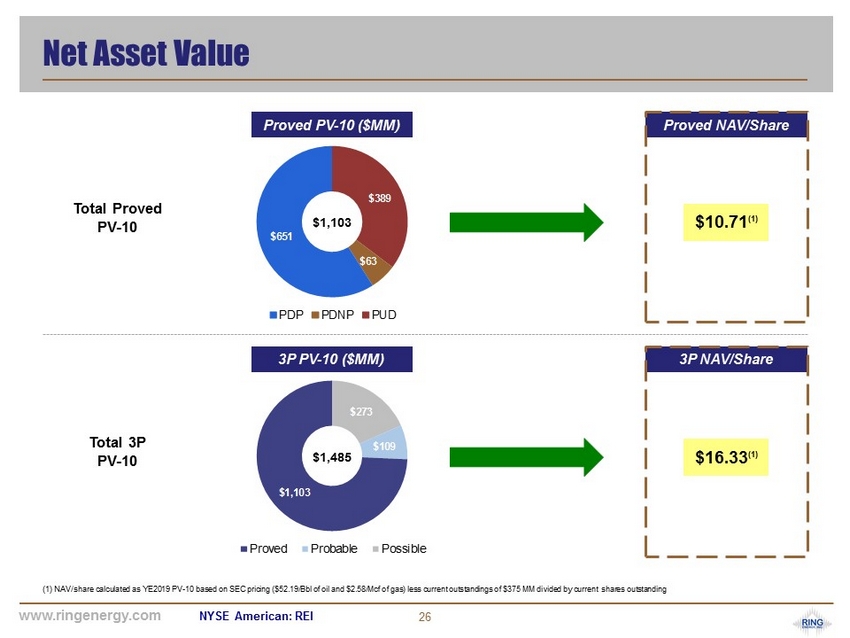

www.ringenergy.com 26 NYSE American: REI $273 $109 $1,103 $389 $63 $651 $1,123 $336 $160 Proved Probable Possible Net Asset Value (1) NAV/share calculated as YE2019 PV - 10 based on SEC pricing ($52.19/Bbl of oil and $2.58/ Mcf of gas) less current outstandings of $375 MM divided by current shares outstanding Total Proved PV - 10 Total 3P PV - 10 3P NAV/Share $16.33 (1) Proved NAV/Share $10.71 (1) $137 $42 $363 PDP PDNP PUD $1,103 Proved PV - 10 ($MM) 3P PV - 10 ($MM) $1,485

www.ringenergy.com NYSE American: REI Appendix

www.ringenergy.com 28 NYSE American: REI Management Team Lloyd T. (Tim) Rochford Co - Founder and Chairman of the Board Mr. Rochford, 73, has been active as an entrepreneur in the oil and gas industry since 1973. During that time, he has person all y founded, or co - founded, multiple oil companies with assets in Texas and the mid - continent of the United States and has raised in excess of $1.0 billion in private and public financing for these oil and gas projects and their development. Mr. Rochford has successfully formed, developed and sold/merged four na tur al resource companies, two of which were listed on the New York Stock Exchange. The most recent, Arena Resources, Inc. ( “ Arena ” ) ( “ Company ” ), was founded by Mr. Rochford and his long - time friend and associate Mr. Stan McCabe in August 2000. From inception until May of 2008, Mr. Rochford served as Presiden t, Chief Executive Officer ( “ CEO ” ) and a director of Arena. During that time, the Company received numerous accolades from publications such as Business Week (20 07 Hot Growth Companies), Entrepreneur (2007 Hot 500), Fortune (2007, 2008, 2009 Fastest Growing Companies), Fortune Small Business (2007, 200 8 Fastest Growing Companies) and Forbes (Best Small Companies of 2009). In May 2008, Mr. Rochford resigned the position of CEO and accepted the po sition of Chairman of the Board. In his role as Chairman, he continued to pursue opportunities that would enhance the current, as well as long - term va lue of the Company. Through his efforts, Arena entered into an agreement and was acquired by another New York Stock Exchange company for $1.6 billion in Jul y 2010. Stan McCabe Co - Founder and Director Mr. McCabe, 87, has been active in the oil and gas industry for over 30 years, primarily seeking individual oil and gas acqui sit ion and development opportunities. In 1979 he founded and served as Chairman and CEO of Stanton Energy, Inc., a Tulsa, Oklahoma natural resource com pany specializing in contract drilling and operation of oil and gas wells. In 1990, Mr. McCabe co - founded with Mr. Rochford, Magnum Petroleum, Inc., serving as an officer and director. In 2000, Mr. McCabe co - founded with Mr. Rochford, Arena Resources, Inc., serving as Chairman of the Board till 2008 an d then a director till 2010. Kelly Hoffman Chief Executive Officer and Director Mr. Hoffman, 62, has organized the funding, acquisition and development of many oil and gas properties. He began his career i n t he Permian Basin in 1975 with Amoco Production Company. His responsibilities included oilfield construction, crew management, and drilling and complet ion operations. In the early 1990s Mr. Hoffman co - founded AOCO and began acquiring properties in West Texas. In 1996 he arranged financing and purchased 10,0 00 acres in the Fuhrman Mascho field in Andrews, Texas. In the first six months he organized a 60 well drilling and completion program resulting in a 600% i nc rease in revenue and approximately 18 months later sold the properties to Lomak (Range Resources). In 1999 he again arranged financing and acquired 12,000 acres in Lubbock and Crosby counties. After drilling and completing 19 successful wells, unitizing the acreage, and instituting a s eco ndary recovery project he sold his interest in the property to Arrow Operating Company. David A. Fowler President and Director Mr. Fowler, 61, has served in several management positions for various companies in the insurance and financial services indu str ies. In 1994, he joined Petroleum Listing Service as Vice President of Operations, overseeing oil and gas property listings, information packages, an d m arketing oil and gas properties to industry players. In late 1998, Mr. Fowler became the Corporate Development Coordinator for the lndependent Producer Finance ( “ IPF ” ) group of Range Resources Corporation. Leaving Range IPF in April of 2001, he co - founded and became President of Simplex Energy Solutio ns, LLC ( “ Simplex ” ). Representing Permian Basin oil and gas independent operators, Simplex became known as the Permian Basin ’ s premier oil and gas divestiture firm, closing over 150 projects valued at approximately $675 million.

www.ringenergy.com 29 NYSE American: REI Management Team (cont'd) Daniel D. Wilson Executive Vice President and Chief Operating Officer Mr. Wilson, 58, has 30 years of experience in operating, evaluating and exploiting oil and gas properties. He has experience in production, drilling and reservoir engineering. For the last 22 years he has served as the Vice President and Manager of Operations for Breck Operatin g C orporation ( “ Breck ” ). He has overseen the building, operating and divestiture of two companies during this time. At Breck's peak Mr. Wilson was respon sib le for over 750 wells in seven states and had an operating staff of 27 including engineers, foremen, pumpers and clerks. Mr. Wilson personally performed or ove rsaw all of the economic evaluations for both acquisition and banking purposes. William R. (“Randy”) Broaddrick Vice President and Chief Financial Officer Mr. Broaddrick, 42, was employed from 1997 to 2000 with Amoco Production Company, performing lease revenue accounting and sta te production tax regulatory reporting functions. During 2000, Mr. Broaddrick was employed by Duke Energy Field Services, LLC performing state pro duction tax functions. From 2001 until 2010, Mr. Broaddrick was employed by Arena Resources, Inc. as Vice President and Chief Financial Officer. Dur ing 2011, Mr. Broaddrick joined Stanford Energy, Inc. as Chief Financial Officer. Subsequent to and as a result of the merger transaction between Stan for d and Ring Energy, Inc. Mr. Broaddrick became Chief Financial Officer of Ring Energy as of July 2012. Mr. Broaddrick received a Bachelor ’ s Degree in Accounting from Langston University, through Oklahoma State University – Tulsa, in 1999. Mr. Broaddrick is a Certified Public Accountant. Hollie Lamb Vice President of Engineering Ms. Lamb, 44, has 19 years of experience in domestic oil/gas evaluation, exploration and production operations, management, a nd petroleum engineering consulting. She has an extensive background in reservoir evaluation and economic evaluation. Her career has centered in the P erm ian Basin, which has enabled her to focus on the upside of the basin. R. Matthew (“Matt”) Garner General Counsel and Vice President of Land Mr. Garner, 45, has been engaged in the practice of law, both privately and in various in - house capacities, for over 19 years. Prior to joining Ring Energy, Inc., in 2016, Mr. Garner had a private practice that focused on representing clients in connection with oil and gas - related mergers, acquisitions and divestitures. Additionally, Mr. Garner assisted clients with land titles matters and a variety of oilfield - related contracts. From 2008 to 20 11, Mr. Garner served as General Counsel and Land Advisor to Henry Petroleum, LP and its successor, Henry Resources, LLC. During his time with Henry Resource s, the company drilled and completed approximately 400 Wolfberry oil and gas wells in the Permian Basin. Mr. Garner holds a Bachelor of Arts degree in Pol itical Science from Abilene Christian University and a Juris Doctor degree from Baylor University School of Law.

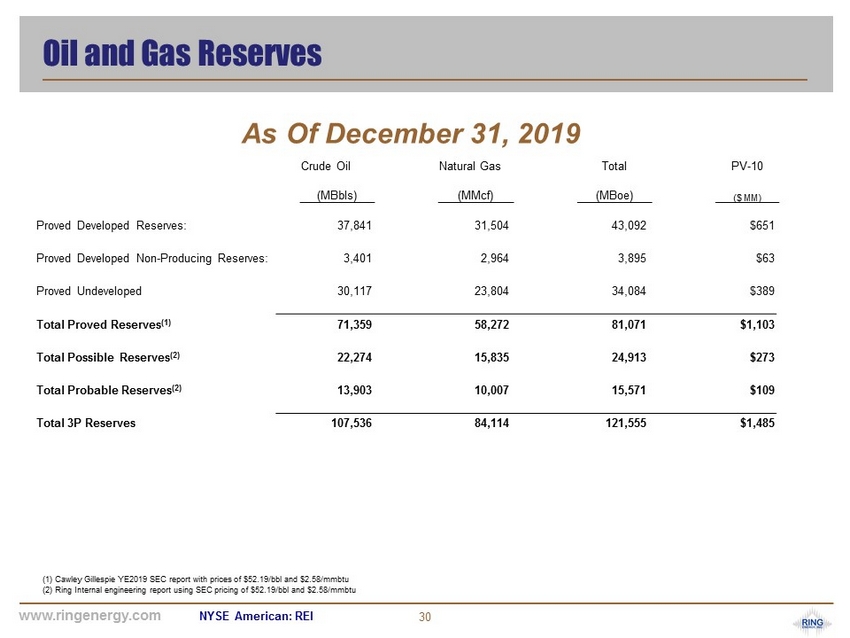

www.ringenergy.com 30 NYSE American: REI Oil and Gas Reserves (1) Cawley Gillespie YE2019 SEC report with prices of $52.19/ bbl and $2.58/ mmbtu (2) Ring Internal engineering report using SEC pricing of $52.19/ bbl and $2.58/ mmbtu As Of December 31, 2019 Proved Developed Reserves: 37,841 31,504 43,092 $651 Proved Developed Non - Producing Reserves: 3,401 2,964 3,895 $63 Proved Undeveloped 30,117 23,804 34,084 $389 Total Proved Reserves (1) 71,359 58,272 81,071 $1,103 Total Possible Reserves (2) 22,274 15,835 24,913 $273 Total Probable Reserves (2) 13,903 10,007 15,571 $109 Total 3P Reserves 107,536 84,114 121,555 $1,485 Crude Oil Natural Gas Total PV - 10 ( MBbls ) ( MMcf ) ( MBoe ) ($ MM)

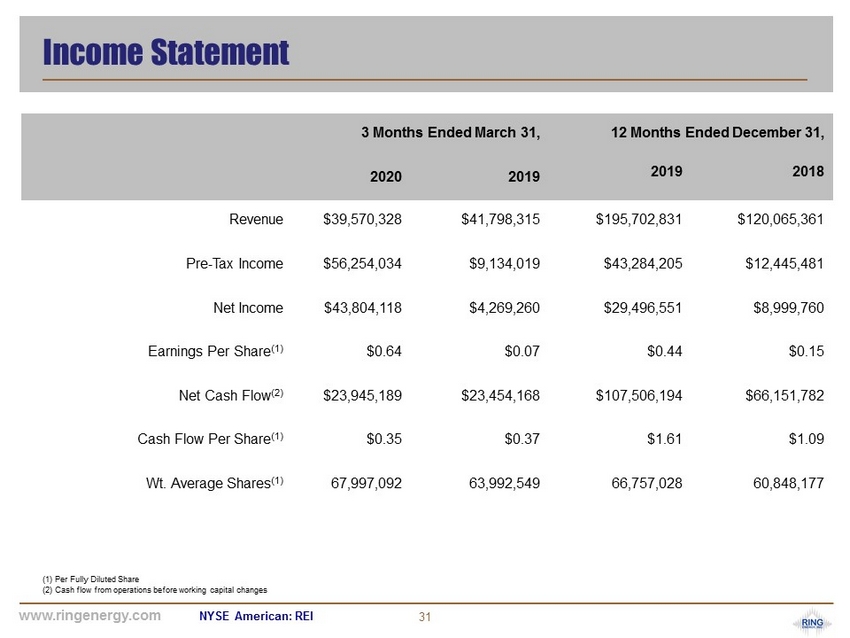

www.ringenergy.com 31 NYSE American: REI Income Statement (1) Per Fully Diluted Share (2) Cash flow from operations before working capital changes 3 Months Ended March 31, 12 Months Ended December 31, 2020 2019 2019 2018 Revenue $39,570,328 $41,798,315 $195,702,831 $120,065,361 Pre - Tax Income $56,254,034 $9,134,019 $43,284,205 $12,445,481 Net Income $43,804,118 $4,269,260 $29,496,551 $8,999,760 Earnings Per Share (1) $0.64 $0.07 $0.44 $0.15 Net Cash Flow (2) $23,945,189 $23,454,168 $107,506,194 $66,151,782 Cash Flow Per Share (1) $0.35 $0.37 $1.61 $1.09 Wt. Average Shares (1) 67,997,092 63,992,549 66,757,028 60,848,177

www.ringenergy.com 32 NYSE American: REI Balance Sheet (1) Includes Operating Lease Asset, Derivative Asset and Deferred Financing Costs As of As of ($ thousands) 3/31/2020 12/31/2019 Assets: Cash and Cash Equivalents $12,531 $10,005 Other Current Assets 52,261 28,704 Total Current Assets $64,792 $38,709 PP&E, net 931,573 929,216 Total Assets (1) $1,010,998 $973,006 Liabilities and Stockholder's Equity: Current Liabilities $40,393 $59,093 Non Current Liabilities 402,617 390,403 Total Liabilities $443,010 $449,496 Stockholders' Equity: $567,988 $523,510 Total Liabilities and Stockholders' Equity $1,010,998 $973,006

www.ringenergy.com 33 NYSE American: REI Analyst Coverage Ring Energy, Inc. Analyst Coverage FIRM ANALYST(S) Alliance Group Partners (A.G.P.) Bhakti Pavani (949) 296 - 3196 bpavani@allianceg.com Capital One Securities, Inc. Richard Tullis (504) 593 - 6118 richard.tullis@capitalone.com Coker Palmer Institutional Noel Parks (215) 913 - 7320 parks@cokerpalmer.com Johnson Rice & Company, LLC Duncan McIntosh (504) 584 - 1257 dun@jrco.com Ladenburg Thalmann & Co., Inc. Michael C. Schmitz, CFA (212) 409 - 2028 mschmitz@ladenburg.com Northland Capital Markets Jeff Grampp (949) 600 - 4150 jgrampp@northlandcapitalmarkets.com Roth Capital Partners John M. White (949) 720 - 7115 jwhite@roth.com SunTrust Robinson Humphrey Neal Dingmann (713) 247 - 9000 neal.dingmann@suntrust.com