Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST BANCORP /NC/ | firstbancorpform8-k617.htm |

June 2020 Bank Local. LOCALFIRSTBANK.COM

IMPORTANT INFORMATION FORWARD LOOKING STATEMENTS Information in this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially, including without limitation, reduced earnings due to larger than expected credit losses in the sectors of our loan portfolio secured by real estate due to economic factors, including declining real estate values, increasing interest rates, increasing unemployment, or changes in payment behavior or other factors; reduced earnings due to larger credit losses because our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; the rate of delinquencies and amount of loans charged-off; the adequacy of the level of our allowance for loan losses and the amount of loan loss provisions required in future periods; costs or difficulties related to the integration of the companies we acquired or may acquire may be greater than expected; results of examinations by our regulatory authorities, including the possibility that the regulatory authorities may, among other things, require us to increase our allowance for loan losses or write down assets; the amount of our loan portfolio collateralized by real estate, and weakness in the commercial real estate market; our ability to maintain appropriate levels of capital; adverse changes in asset quality and resulting credit risk-related losses and expenses; increased funding costs due to market illiquidity, increased competition for funding, and increased regulatory requirements with regard to funding; significant increases in competitive pressure in the banking and financial services industries; changes in political conditions or the legislative or regulatory environment, including the effect of financial reform legislation on the banking industry; general economic conditions, either nationally or regionally and especially in our primary service area, becoming less favorable than expected resulting in, among other things, a deterioration in credit quality; our ability to retain our existing customers, including our deposit relationships; changes occurring in business conditions and inflation; changes in monetary and tax policies; ability of borrowers to repay loans; risks associated with a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers or other third parties, including as a result of cyber-attacks, which could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; changes in accounting principles, policies or guidelines; changes in the assessment of whether a deferred tax valuation allowance is necessary; our reliance on secondary sources such as FHLB advances, sales of securities and loans, federal funds lines of credit from correspondent banks and out-of-marker time deposits, to meet our liquidity needs; loss of consumer confidence and economic disruptions resulting from terrorist activities or other military actions; and changes in the securities markets. Additional factors that could cause actual results to differ materially are discussed in the Company's filings with the Securities and Exchange Commission ("SEC"), including without limitation its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. The forward-looking statements in this presentation speak only as of the date of the presentation and the Company does not assume any obligation to update such forward-looking statements. NON-GAAP MEASURES Statements included in this presentation include non-GAAP measures and should be read along with the related earnings release and accompanying Financial Summary for the respective quarter and period ends, which provide a reconciliation of non-GAAP measures to GAAP measures. Management believes that these non-GAAP measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non-GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company's results or financial condition as reported under GAAP. 2

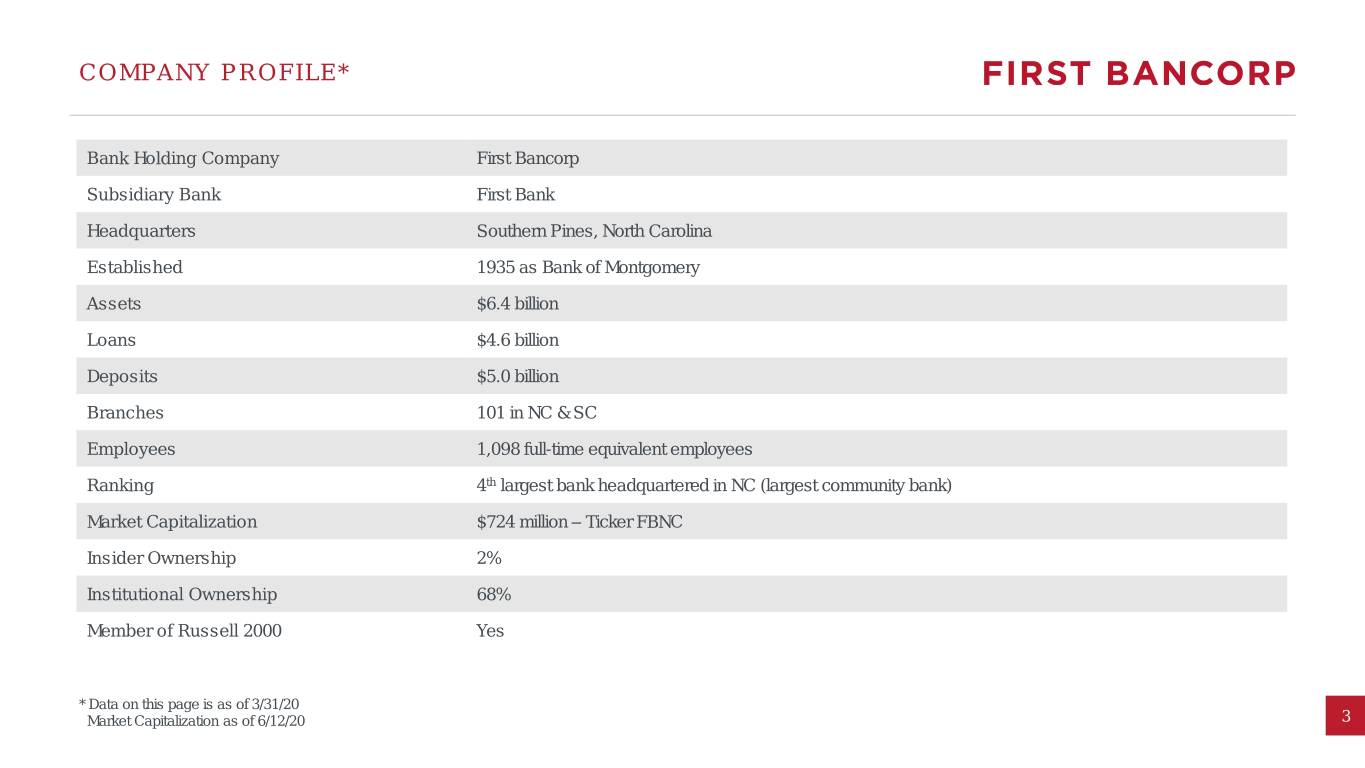

COMPANY PROFILE* Bank Holding Company First Bancorp Subsidiary Bank First Bank Headquarters Southern Pines, North Carolina Established 1935 as Bank of Montgomery Assets $6.4 billion Loans $4.6 billion Deposits $5.0 billion Branches 101 in NC & SC Employees 1,098 full-time equivalent employees Ranking 4th largest bank headquartered in NC (largest community bank) Market Capitalization $724 million – Ticker FBNC Insider Ownership 2% Institutional Ownership 68% Member of Russell 2000 Yes * Data on this page is as of 3/31/20 Market Capitalization as of 6/12/20 3

MANAGEMENT TEAM – DIVERSE BACKGROUND Richard Moore, CEO, First Bancorp – Director since 2010/CEO since 2012 • Former Managing Director, Relational Investors, Investment advisor to some of the largest pension funds in the world • Former State Treasurer of North Carolina – oversaw more than $80 billion in pension funds • Finalist, Institutional Investor, Public Funds Manager of the Year • National Public Official of the Year, Governing Magazine • Director of NYSE; Former Trustee of Wake Forest University • Honors Graduate of Wake Forest University and its School of Law • Graduate Degree in Accounting and Finance, London School of Economics Michael Mayer, CEO/President, First Bank – Since 2014 • CEO - First Financial Services Corporation/Mountain 1st Bank, 2009-2014; negotiated sale to First Citizens in January 2014 • CEO for Carolina Commerce Bank, 2008-2009; negotiated sale to Carolina Trust Bank • Bank of America, 1982-2006 • Graduate of Clemson University, BS in Business Eric Credle, CFO – Since 1997 • Overseen growth at First Bank from $370 million in assets in 1997 to over $6 billion in 2020 • Senior Audit Manager with KPMG LLP, 1990-1997 • Certified Public Accountant since 1992 • Graduate of Wake Forest University, BS in Accounting 4

FORBES & FORTUNE RECOGNITIONS June 25, 2019 – Forbes - Best In-State Banks Recognition One of three banks recognized in North Carolina and the only one headquartered in the state. Based on customer survey on satisfaction and the following attributes: • Trust • Terms & Conditions • Branch Services • Digital Services • Financial Advice September 10, 2019 – Fortune - Fastest Growing Companies for 2019 Ranked #49 in this nationwide ranking of all public companies Based on three-year growth rates in revenue, earnings per share, and total stock return 5

Q1 2020 HIGHLIGHTS Percentages annualized where applicable Q1 2020 Q1 2019 CHANGE Net income $18.2 million $22.3 million -18.4% Provision for Loan Losses $5.6 million $0.5 million +1,018% EPS Common – Diluted $0.62 $0.75 -17.3% Return on Average Assets 1.18% 1.52% -34 bps Return on Average Common Equity 8.52% 11.66% -314 bps Return on Average Tangible Common Equity (1) 12.04% 17.38% -534bps Annualized Loan/Deposit Growth - Quarter 9.0% / 9.3% 5.2% / 12.0% Net Interest Margin (2) 3.96% 4.06% -10 bps Cost of Funds 0.56% 0.66% -10 bps Tangible Common Equity to Tangible Assets 10.00% 9.21% +79 bps Total Risk-Based Capital Ratio 14.51% 14.21% +30 bps (1) Annualized net income divided by: average common shareholders’ equity less average total intangible assets (2) Tax-equivalent net-interest income divided by average earning assets 6

COVID-19 Update As of May 28, 2020, all branch lobbies were re-opened • PPP Loans - 2,825 loans totaling $244.9 million at June 12, 2020 • Fees of approximately $10.5 million • Payment Deferrals – 1,497 loans totaling $786.8 million as of June 12, 2020 (17% of loans outstanding at 3/31/20) • 20% of all deferrals are to lessors of strip centers/multi-use commercial real estate (34% of category total) • 14% hotels (76%) • 12% residential loans (6%) • 4% restaurants and bars (38%) • 4% multi-family (18%) • Remaining 47% primarily to a variety of businesses 7

Q2 2020 UPDATE • In May, $220 million of securities were sold at a gain of $8.0 million • Securities sold were believed to be favorably impacted by historically low interest rates and Federal Reserve stimulus measures • Average yield sold was 2.35%, reinvestment at 1.64% • Overall securities portfolio yield declines by 19 basis points • In April and May, the Company recorded loan loss provisions totaling $18 million • Experiencing high levels of cash and liquidity, which is negatively impacting the net interest margin • The Company’s net interest margin was 3.47% for April/May vs. 3.96% in Q1 2020 • Net interest income for Q2 2020 is expected to be 4-6% lower than Q1 2020. • $290 million in FHLB borrowings have been repaid since March 31, 2020 • Strong mortgage refinance activity • $2.8 million in fees related to PPP recorded by SBA Complete, a subsidiary of First Bank 8

YEAR ENDED 2019 Percentages annualized where applicable 2019 2018 CHANGE Net income $92.0 million $89.3 million +3.1% EPS Common – Diluted $3.10 $3.01 +3.0% Return on Average Assets 1.53% 1.57% -4 bps Return on Average Common Equity 11.32% 12.27% -95 bps Return on Average Tangible Common Equity (1) 16.46% 18.90% -244 bps Total Loans $4.5 billion $4.2 billion +4.8% Total Deposits $4.9 billion $4.7 billion +5.8% Retail Deposits (non-brokered) $4.8 billion $4.4 billion +9.6% Nonperforming Assets to Total Assets 0.62% 0.74% -12 bps Net Interest Margin (2) 4.00% 4.09% -9 bps Cost of Funds 0.66% 0.48% +18 bps Tangible Common Equity to Tangible Assets 10.20% 9.07% +113 bps (1) Annualized net income divided by: average common shareholders’ equity less average total intangible assets (2) Tax-equivalent net-interest income divided by average earning assets 9

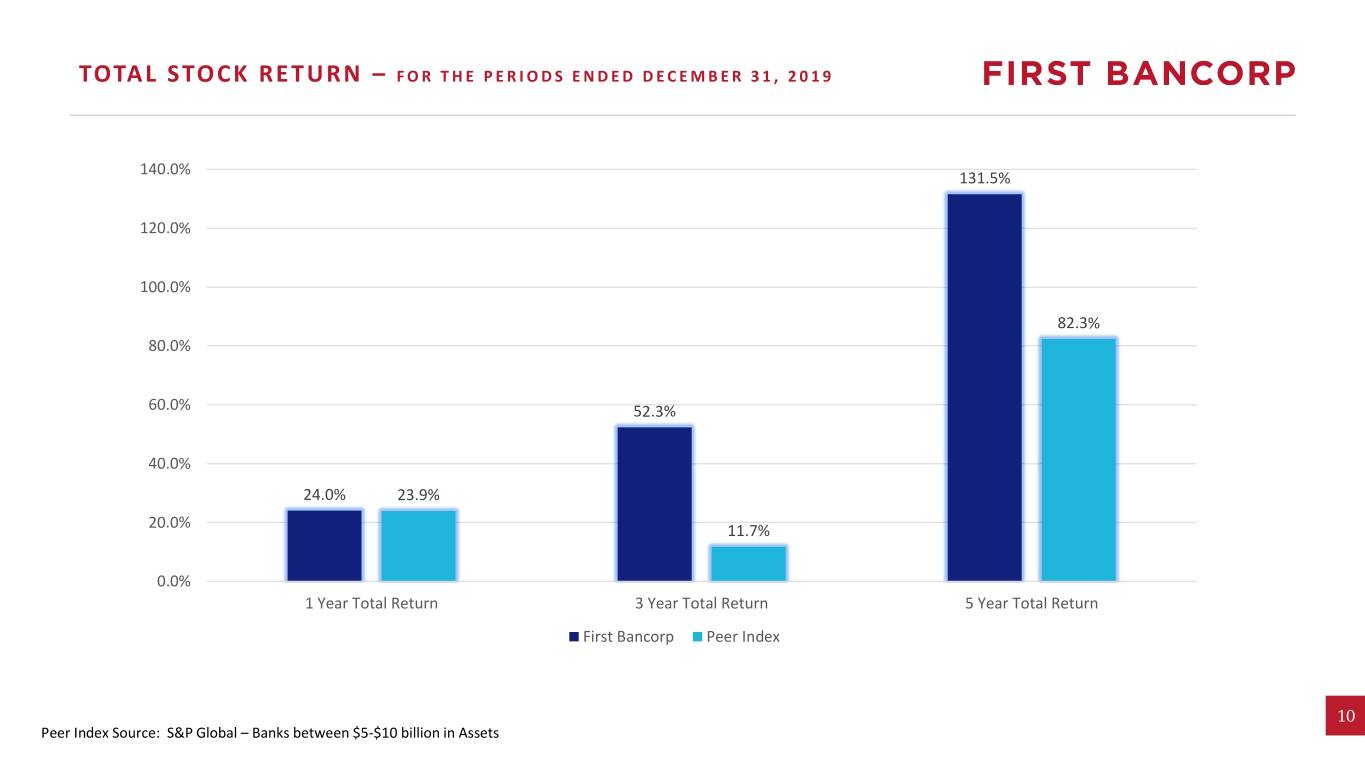

TOTAL STOCK RETURN – FOR THE PERIODS ENDED DECEMBER 31, 2019 140.0% 131.5% 120.0% 100.0% 82.3% 80.0% 60.0% 52.3% 40.0% 24.0% 23.9% 20.0% 11.7% 0.0% 1 Year Total Return 3 Year Total Return 5 Year Total Return First Bancorp Peer Index 10 Peer Index Source: S&P Global – Banks between $5-$10 billion in Assets

INVESTING IN TECHNOLOGY . New bill pay system - March 2019 . New ATM fleet - Q1 2019 . New website - May 1, 2019 . New mortgage loan app-driven process - Q2 2019 . New person-to-person payment system (Zelle) - Q4 2019 . Online deposit account opening – major upgrade - Q4 2019 . New call center software solution - Q4 2019 . New consumer loan application platform - Q4 2019 . Upgrade of all computer operating systems to Windows 10 - Q4 2019 . Online credit card lending platform - Q2 2020 11

Computer & Mobile Log-in Trends – 2016 to May 2020 January 2016 logins = 391,569 May 2020 logins = 1,447,553 12

GROWTH IN TANGIBLE BOOK VALUE (COMMON) Price/Tangible Common Book Value 5 Year Increase of 63.5% $22.00 $21.09 $20.00 $17.94 $18.00 $16.00 $15.17 $13.75 $13.53 $14.00 $12.90 $12.00 $10.00 $8.00 13 03/31/15 03/31/16 03/31/17 03/31/18 03/31/19 03/31/20

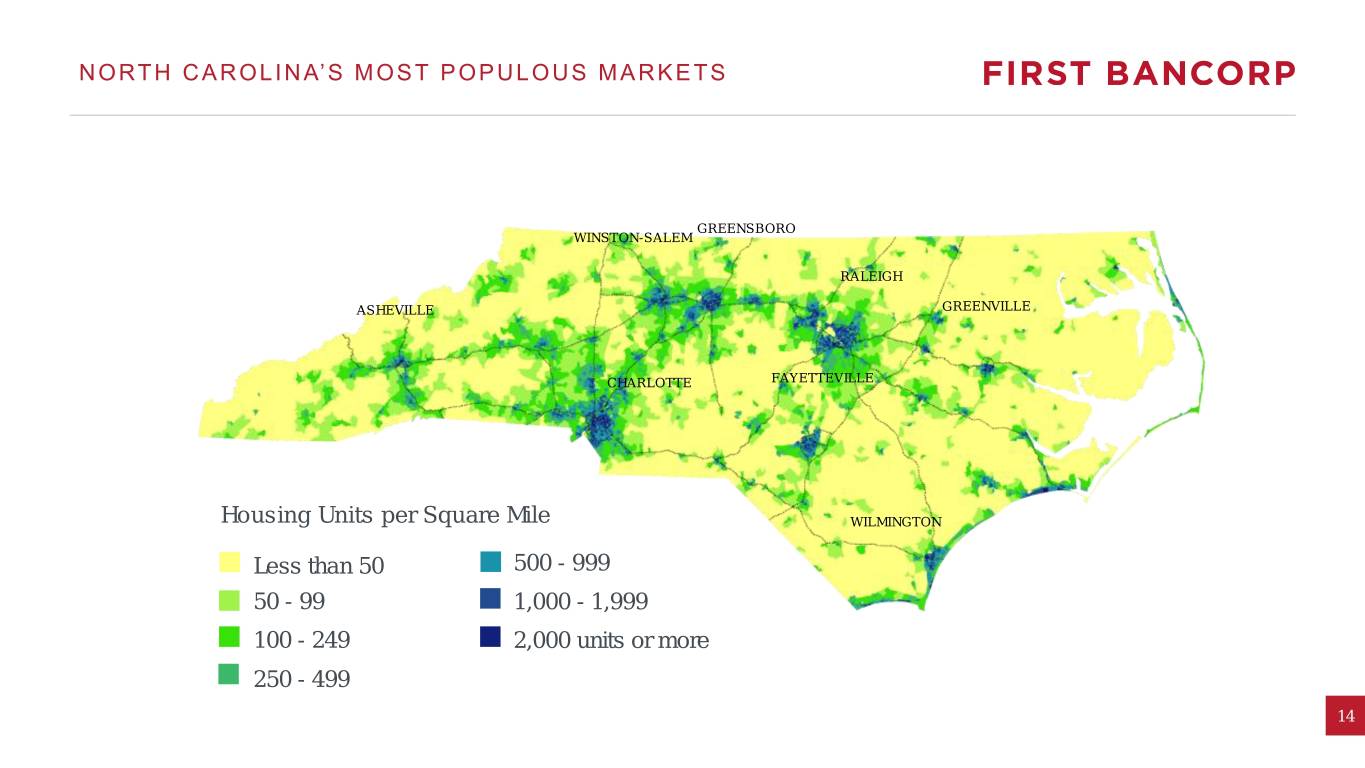

NORTH CAROLINA’S MOST POPULOUS MARKETS GREENSBORO WINSTON-SALEM RALEIGH ASHEVILLE GREENVILLE CHARLOTTE FAYETTEVILLE Housing Units per Square Mile WILMINGTON Less than 50 500 - 999 50 - 99 1,000 - 1,999 100 - 249 2,000 units or more 250 - 499 14

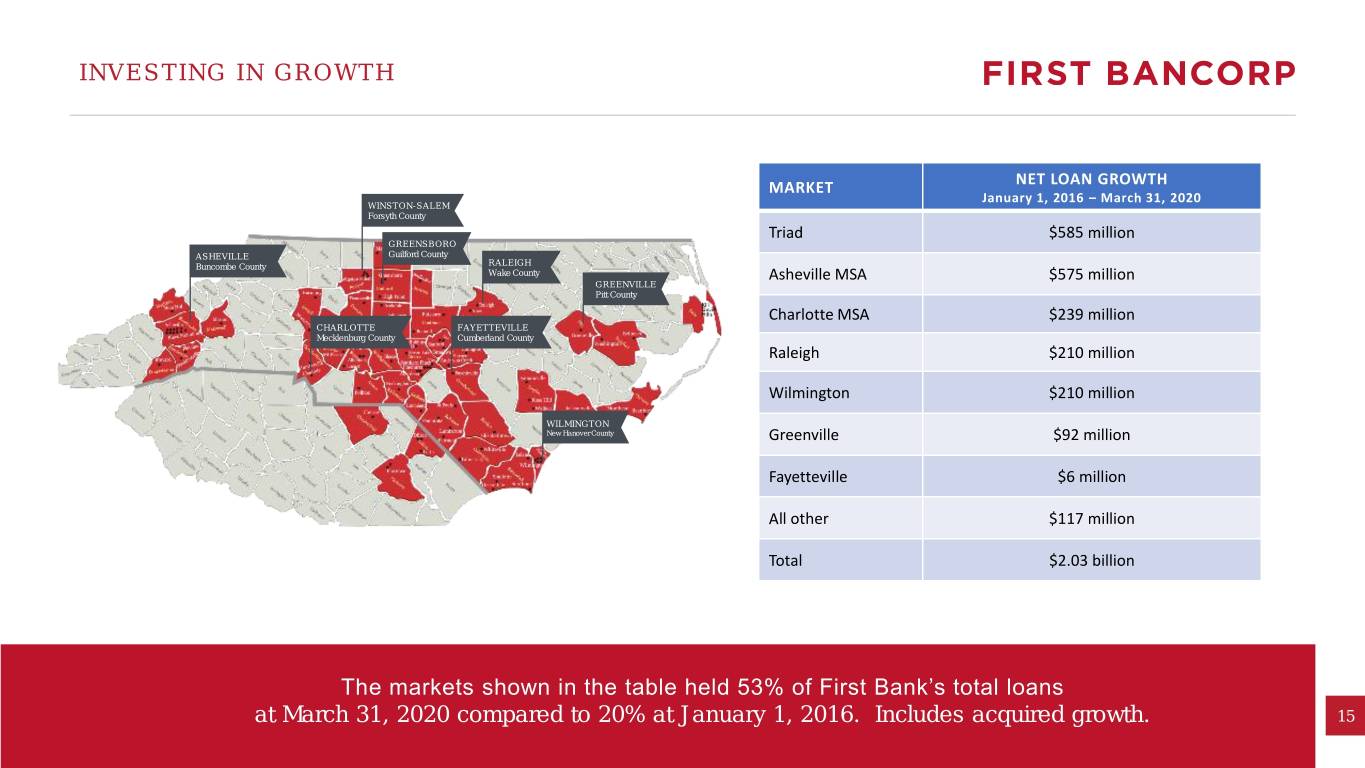

INVESTING IN GROWTH MARKET NET LOAN GROWTH January 1, 2016 – March 31, 2020 WINSTON-SALEM Forsyth County Triad $585 million GREENSBORO ASHEVILLE Guilford County Buncombe County RALEIGH Wake County Asheville MSA $575 million GREENVILLE Pitt County Charlotte MSA $239 million CHARLOTTE FAYETTEVILLE Mecklenburg County Cumberland County Raleigh $210 million Wilmington $210 million WILMINGTON New Hanover County Greenville $92 million Fayetteville $6 million GREENVILLE Pitt County All other $117 million Total $2.03 billion The markets shown in the table held 53% of First Bank’s total loans at March 31, 2020 compared to 20% at January 1, 2016. Includes acquired growth. 15

NET INTEREST MARGIN 5.00% REPORTED CORE 4.50% 4.17% 4.07% 4.03% 4.08% 4.06% 4.06% 3.95% 3.93% 3.96% 4.00% 3.99% 3.91% 3.94% 3.95% 3.93% 3.89% 3.86% 3.82% 3.83% 3.50% 3.00% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Net interest margin is calculated by dividing tax-equivalent net interest income by average earning assets Core net interest margin excludes loan discount accretion income 16

LOAN YIELDS STATED CORE 5.40% 5.16% 5.20% 5.13% 5.11% 5.03% 4.99% 4.96% 5.02% 5.00% 4.96% 4.93% 4.96% 4.98% 5.00% 4.80% 4.90% 4.90% 4.77% 4.81% 4.76% 4.60% 4.75% 4.40% 4.20% 4.00% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Core loan yield excludes loan discount accretion 17

COST OF FUNDS COST OF FUNDS COST OF DEPOSITS 0.80% 0.66% 0.67% 0.66% 0.70% 0.63% 0.58% 0.60% 0.51% 0.56% 0.45% 0.50% 0.53% 0.54% 0.38% 0.53% 0.48% 0.40% 0.47% 0.40% 0.30% 0.34% 0.29% 0.20% 0.25% 0.10% 0.00% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 18

EFFICIENCY RATIO Note: As computed and reported by S&P Global 75.00% 68.78% 70.00% 66.84% 65.00% 61.28% 60.00% 56.49% 55.28% 54.53% 55.00% 50.00% 45.00% 2015 2016 2017 2018 2019 Q1 2020 Approximately $20 million in overhead efficiencies realized from Carolina Bank and Asheville Savings Bank acquisitions in 2017 and 2018. 19

DEPOSIT ACCOUNTS – OPEN/CLOSE RATIO 1.60 1.50 1.50 1.40 1.40 1.43 1.40 1.29 1.30 1.19 1.20 1.10 0.99 1.00 0.95 0.88 0.90 0.90 0.87 0.80 0.70 0.60 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 First@Work Deposit Account – Introduced Mid-2018 20

Fee Income Growth & Expansion Revenue from Above Sources 2015 $5.1 million 2019 $24.6 million 21

CREDIT CARDS: A COMMUNITY BANK DIFFERENTIATOR First Bank owns its own credit card $31 million in outstanding receivables • 87% increase since 12/31/15 Attractive rewards program • Combined debit card/credit card points • One of the few banks that offers debit card rewards $13.8 million in annual credit card/debit interchange income • 17%+ annual growth rate over last 5 years Special emphasis on business customers Customer service located in Southern Pines, North Carolina 22

NORTH CAROLINA: A GREAT STATE FOR BUSINESS North Carolina is currently the 9th most populated state – • Projected 8th by 2040 – and within 3% of 5th largest • 5th highest net increase in population from 2010-2017 • Projected to grow 29% over the next 20 years – 5th highest total growth • Apex – a suburb of Raleigh received attention in July 2018 as America’s fastest-growing suburb Right to work state – 2nd lowest unionized state • One of five states in which collective bargaining by public employees is illegal North Carolina Pension System – 94% funded and ranked 3rd strongest in the nation • All city and county systems are 100% funded North Carolina has AAA Bond Rating Strong Education System • Strong university system with top ranked schools • Statewide community college system • Higher education system ranked 2nd in the Southeast Below average utility bill rates Tax-friendly state – 2.5% corporate tax rate 23 • Ranked 3rd overall and 1st in the Southeast in business tax climate

Our Promise to Service Excellence We help our customers realize their dreams by providing financial solutions and building trusted relationships.

SERVICE EXCELLENCE PRINCIPLES 25

INVESTMENT THESIS Bank that offers many of the product capabilities found in larger regional banks but delivers those services with a local community bank focus • Strong culture • Mobile Banking, Wealth Management, Trust Services, Credit Card, Treasury Services, Insurance, and Mortgage Banking Centered in one of the fastest-growing regions in the U.S. Focused on high growth markets Stable, low cost core deposit franchise • Built over 80 years of serving our communities • Strength of rural markets • Q1 2020 Cost of Deposits was 0.47% Strong and Improving Performance Metrics Conservative Balance Sheet • Minimal credit risk in investment portfolio • Core funded • In market loan portfolio – almost no participations Market disruptions provide opportunity 26

LOAN PORTFOLIO: AT 3/31/20 LOAN PORTFOLIO AMOUNT % of Total Consumer & Other 73 C&D C&D $ 590 13% 2% 590 13% Non Owner- Occupied CRE Multifamily 175 4% 924 Multifamily 20% 175 4% 1-4 Family 1,103 24% HELOC 332 7% 1-4 Family C&I 338 8% Owner-Occupied 1,103 CRE 24% 871 Municipalities 147 3% 19% Owner-Occupied CRE 871 19% Municipalities HELOC 147 C&I 3% 332 Non Owner-Occupied CRE 924 20% 338 7% 8% Consumer & Other 73 2% Total Loans $ 4,553 100% 27

DEPOSIT PORTFOLIO: AT 3/31/20 Avg Interest Brokered LOAN PORTFOLIO AMOUNT % of Total Rate – Q1 Time < $10086 2020 246 2% 5% Time > $100 Noninterest Checking $ 1,581 31% 0.0% 553 11% Noninterest Checking 1,581 Interest Checking 923 18% 0.18% 31% Savings 431 Money Market 1,225 24% 0.56% 9% Savings 431 9% 0.25% Time > $100K 553 11% 1.74% Money Market Interest 1,225 Checking Time < $100K 246 5% 0.78% 24% 923 18% Brokered 86 2% 2.39% Total Deposits $ 5,045 100% 0.47% 28

VALUATION: PRICE TO TANGIBLE COMMON BOOK VALUE Closing stock price on June 12, 2020 = $24.92 • Price to tangible book – 1.18x • Based on 3/31/20 tangible book value - $21.09 Price / Tangible Common Book Value 1.8x 1.57x 1.35x 1.3x 1.26x Median = 1.19x 1.2x 1.16x 1.18x 1.18x .91x .73x .76x HTBI SLCT UBNC TOWN FBNC ABCB UCBI AUB PNFP SSB TFC CHCO 29 Source: S&P Global – As of June 9, 2020

VALUATION: PRICE TO EARNINGS Price to Earnings • Based on SNL Mean EPS 2020 Estimate of $2.15, the FBNC price to earnings ratio is 11.6x based on June 12, 2020 closing price for FBNC stock of $24.92. Price / 2020 Consensus EPS 23.1x 18.6x Median =14.1x 16.7x 15.0x 15.1x 15.3x 13.2x 12.2x 12.3x 11.6x 9.7x ABCB FBNC PNFP UCBI HTBI TOWN SSB TFC AUB CHCO SLCT 30 Source: S&P Global – As of February 7, 2020