Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - ORTHOPEDIATRICS CORP | exhibit992unauditedpro.htm |

| EX-23.2 - EX-23.2 - ORTHOPEDIATRICS CORP | exhibit232-wipfliconsent.htm |

| EX-23.1 - EX-23.1 - ORTHOPEDIATRICS CORP | exhibit231-apifixxsigned.htm |

| 8-K/A - 8-K/A - ORTHOPEDIATRICS CORP | form8-kaxorthopediatri.htm |

APIFIX LTD. CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2019 IN U.S. DOLLARS IN THOUSANDS INDEX Page Report of Independent Auditor 2 Consolidated Balance Sheets 3 - 4 Consolidated Statements of Operations 5 Consolidated Statements of Changes in Shareholders' Equity (Deficiency) 6 Consolidated Statements of Cash Flows 7 Notes to Consolidated Financial Statements 8 - 25 - - - - - - - - - - - - - - - - - - -

Kost Forer Gabbay & Kasierer Tel: +972-3-6232525 144 Menachem Begin Road, Building A Fax: +972-3-5622555 Tel-Aviv 6492102, Israel ey.com REPORT OF INDEPENDENT AUDITORS To the Shareholders of APIFIX LTD. We have audited the accompanying consolidated financial statements of ApiFix Ltd. which comprise the consolidated balance sheets as of December 31, 2019 and 2018, and the related consolidated statements of operations, changes in shareholders' equity (deficiency) and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with U.S generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of ApiFix Ltd. at December 31, 2019 and 2018 and the consolidated results of their operations, its changes in shareholders' equity (deficiency) and its cash flows for the years then ended, in conformity with U.S generally accepted accounting principles. Tel-Aviv, Israel KOST FORER GABBAY & KASIERER June 8, 2020 A Member of Ernst & Young Global

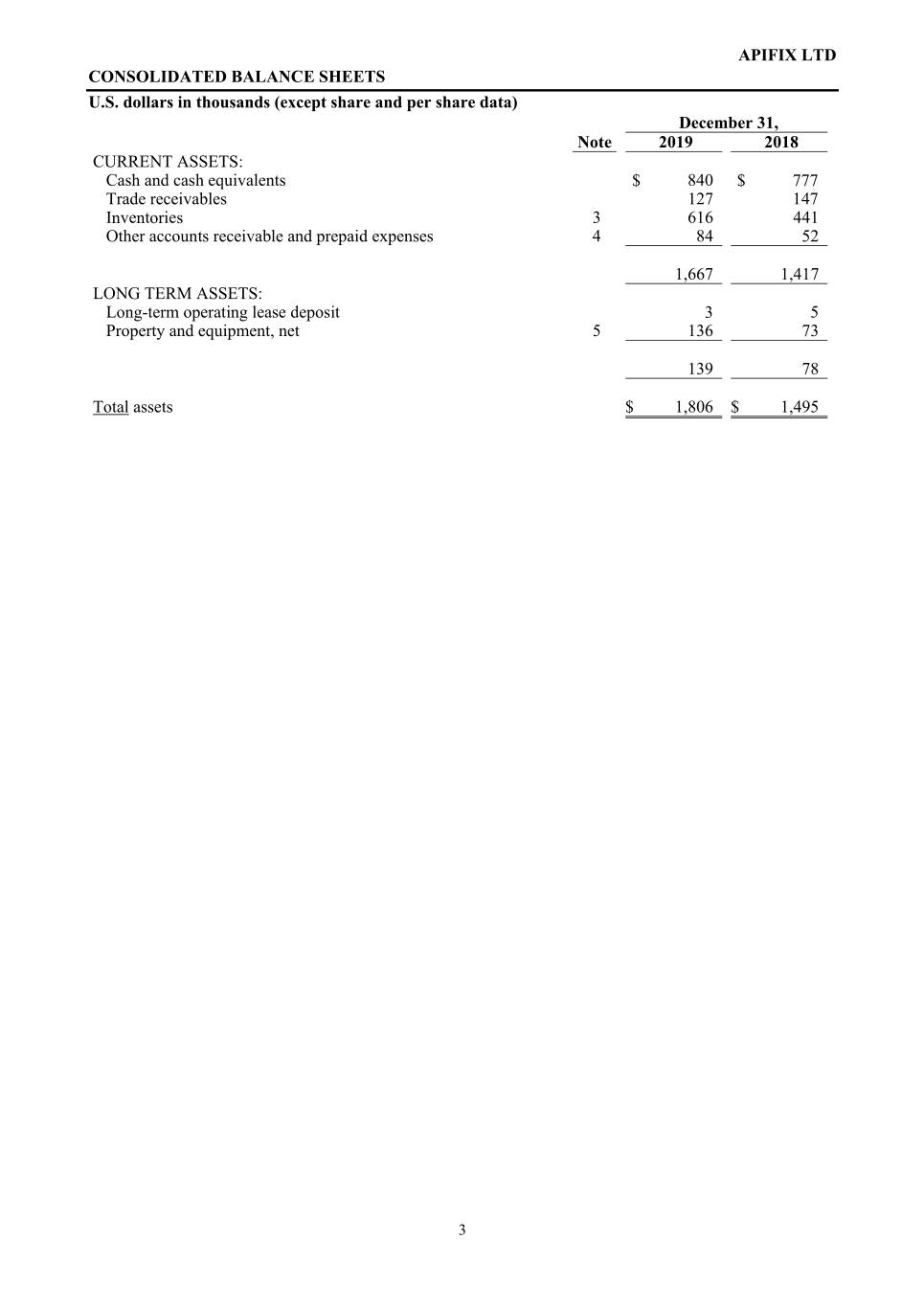

APIFIX LTD CONSOLIDATED BALANCE SHEETS U.S. dollars in thousands (except share and per share data) December 31, Note 2019 2018 CURRENT ASSETS: Cash and cash equivalents $ 840 $ 777 Trade receivables 127 147 Inventories 3 616 441 Other accounts receivable and prepaid expenses 4 84 52 1,667 1,417 LONG TERM ASSETS: Long-term operating lease deposit 3 5 Property and equipment, net 5 136 73 139 78 Total assets $ 1,806 $ 1,495 3

APIFIX LTD CONSOLIDATED BALANCE SHEETS U.S. dollars in thousands (except share and per share data) December 31, Note 2019 2018 CURRENT LIABILITIES: Trade payables $ 204 $ 242 Other payables and accrued expenses 6 320 263 524 505 LONG-TERM LIABILITIES: Convertible loan 7 - 1,560 Total liabilities 524 2,065 COMMITMENTS AND CONTINGENT LIABILITIES 8 SHAREHOLDERS' EQUITY (DEFICIENCY): 9 Share capital: Ordinary shares of NIS 0.01 par value - Authorized: 859,263 and 890,000 shares at December 31, 2019 and 2018, respectively; Issued and outstanding: 119,706 and 119,706 at December 31, 2019 and 2018, respectively; 1 1 Preferred A shares of NIS 0.01 par value - Authorized: 43,472 and 50,000 shares at December 31, 2019 and 2018, respectively; Issued and outstanding: 43,472 and 43,472 at December 31, 2019 and 2018, respectively; (* - (* - Preferred A-1 shares of NIS 0.01 par value - Authorized: 62,265 and 60,000 shares at December 31, 2019 and 2018, respectively; Issued and outstanding: 62,265 and 48,926 at December 31, 2019 and 2018, respectively; (* - (* - Preferred B shares of NIS 0.01 par value - Authorized: 35,000 and 0 shares at December 31, 2019 and 2018, respectively; Issued and outstanding: 19,252 and 0 at December 31, 2019 and 2018, respectively; (* - (* - Additional paid-in capital 13,903 9,217 Receipts on account of shares - - Accumulated deficit (12,622) (9,788) Total shareholders' equity (deficiency) 1,282 (570) Total liabilities and shareholders' equity $ 1,806 $ 1,495 *) Less than $1 The accompanying notes are an integral part of the financial statements. June 8, 2020 Date of approval Paul Mraz Adi Toister Chief Executive Officer and Chief Financial Officer Director 4

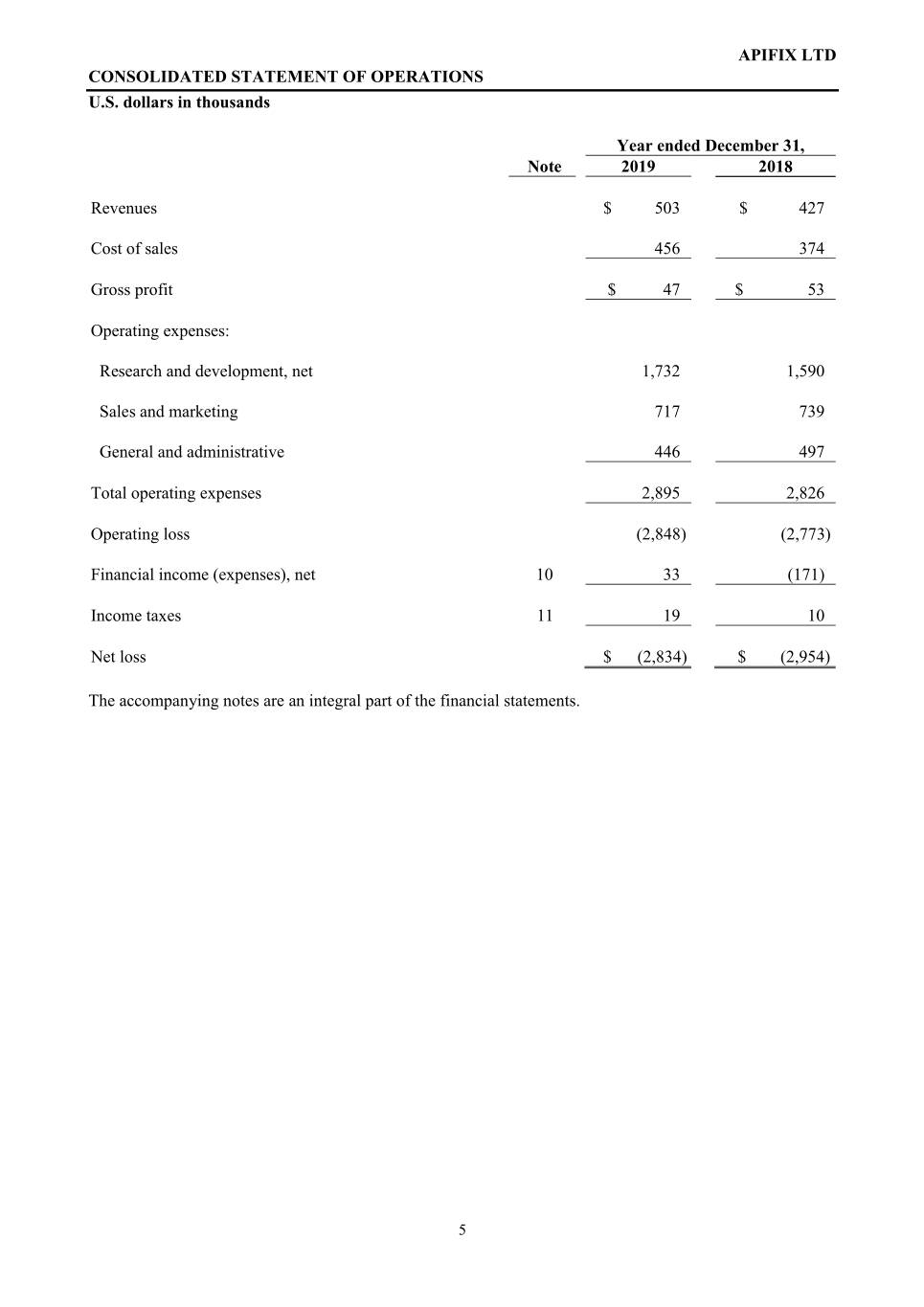

APIFIX LTD CONSOLIDATED STATEMENT OF OPERATIONS U.S. dollars in thousands Year ended December 31, Note 2019 2018 Revenues $ 503 $ 427 Cost of sales 456 374 Gross profit $ 47 $ 53 Operating expenses: Research and development, net 1,732 1,590 Sales and marketing 717 739 General and administrative 446 497 Total operating expenses 2,895 2,826 Operating loss (2,848) (2,773) Financial income (expenses), net 10 33 (171) Income taxes 11 19 10 Net loss $ (2,834) $ (2,954) The accompanying notes are an integral part of the financial statements. 5

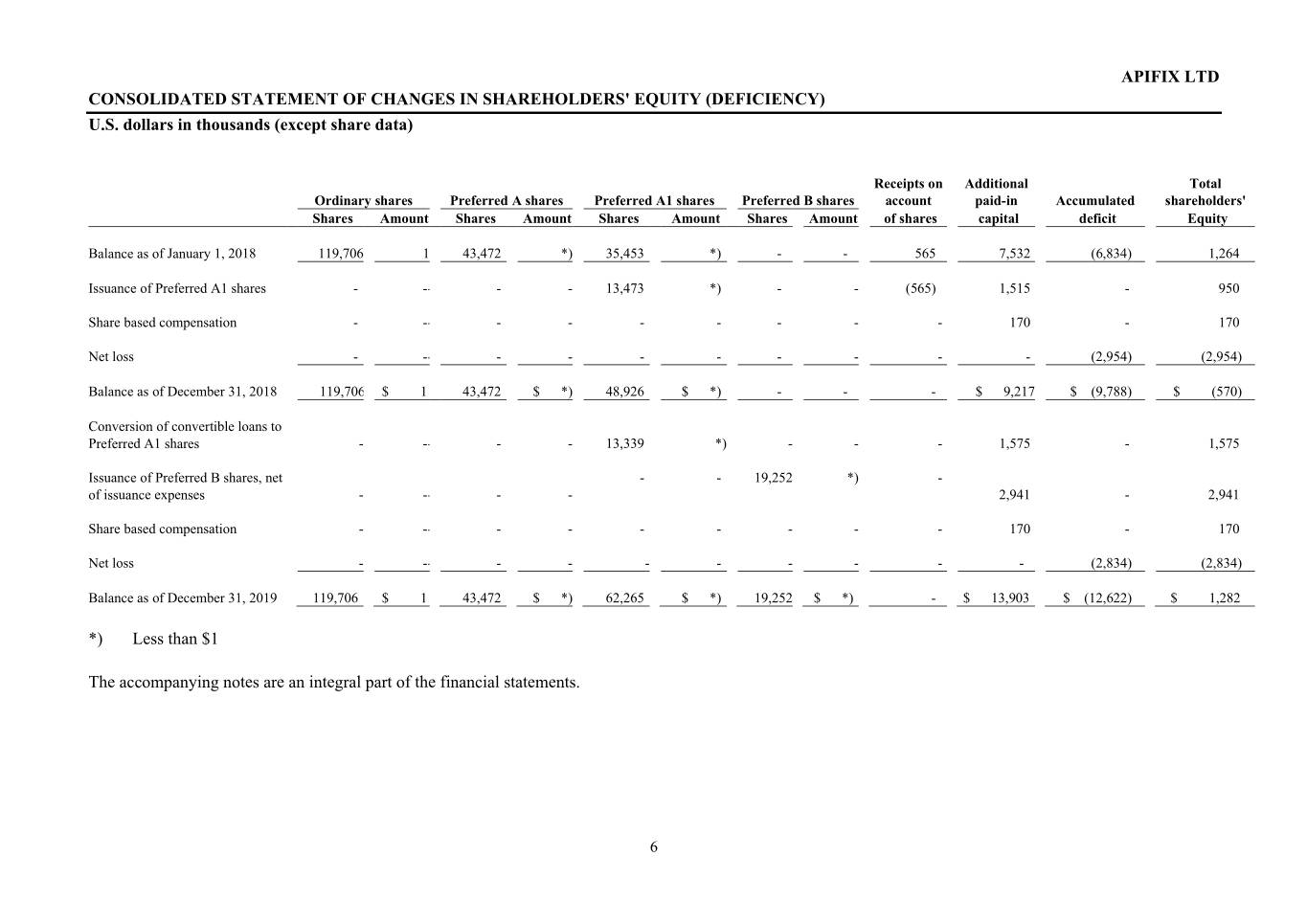

APIFIX LTD CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY (DEFICIENCY) U.S. dollars in thousands (except share data) Receipts on Additional Total Ordinary shares Preferred A shares Preferred A1 shares Preferred B shares account paid-in Accumulated shareholders' Shares Amount Shares Amount Shares Amount Shares Amount of shares capital deficit Equity Balance as of January 1, 2018 119,706 1 43,472 *) 35,453 *) - - 565 7,532 (6,834) 1,264 Issuance of Preferred A1 shares - -- - - 13,473 *) - - (565) 1,515 - 950 Share based compensation - -- - - - - - - - 170 - 170 Net loss - -- - - - - - - - - (2,954) (2,954) Balance as of December 31, 2018 119,706 $ 1 43,472 $ *) 48,926 $ *) - - - $ 9,217 $ (9,788) $ (570) Conversion of convertible loans to Preferred A1 shares - -- - - 13,339 *) - - - 1,575 - 1,575 Issuance of Preferred B shares, net - - 19,252 *) - of issuance expenses - -- - - 2,941 - 2,941 Share based compensation - -- - - - - - - - 170 - 170 Net loss - -- - - - - - - - - (2,834) (2,834) Balance as of December 31, 2019 119,706 $ 1 43,472 $ *) 62,265 $ *) 19,252 $ *) - $ 13,903 $ (12,622) $ 1,282 *) Less than $1 The accompanying notes are an integral part of the financial statements. 6

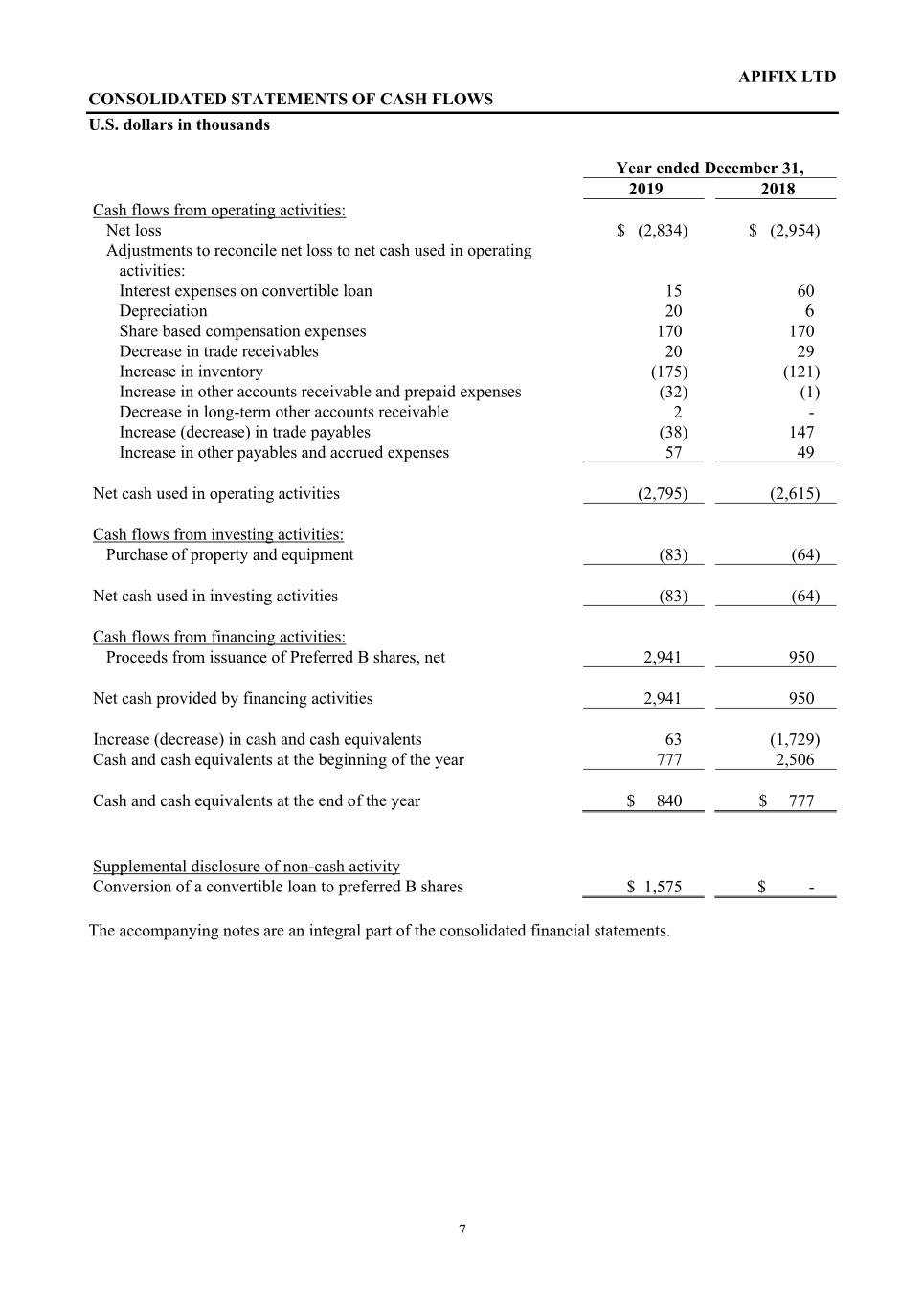

APIFIX LTD CONSOLIDATED STATEMENTS OF CASH FLOWS U.S. dollars in thousands Year ended December 31, 2019 2018 Cash flows from operating activities: Net loss $ (2,834) $ (2,954) Adjustments to reconcile net loss to net cash used in operating activities: Interest expenses on convertible loan 15 60 Depreciation 20 6 Share based compensation expenses 170 170 Decrease in trade receivables 20 29 Increase in inventory (175) (121) Increase in other accounts receivable and prepaid expenses (32) (1) Decrease in long-term other accounts receivable 2 - Increase (decrease) in trade payables (38) 147 Increase in other payables and accrued expenses 57 49 Net cash used in operating activities (2,795) (2,615) Cash flows from investing activities: Purchase of property and equipment (83) (64) Net cash used in investing activities (83) (64) Cash flows from financing activities: Proceeds from issuance of Preferred B shares, net 2,941 950 Net cash provided by financing activities 2,941 950 Increase (decrease) in cash and cash equivalents 63 (1,729) Cash and cash equivalents at the beginning of the year 777 2,506 Cash and cash equivalents at the end of the year $ 840 $ 777 Supplemental disclosure of non-cash activity Conversion of a convertible loan to preferred B shares $ 1,575 $ - The accompanying notes are an integral part of the consolidated financial statements. 7

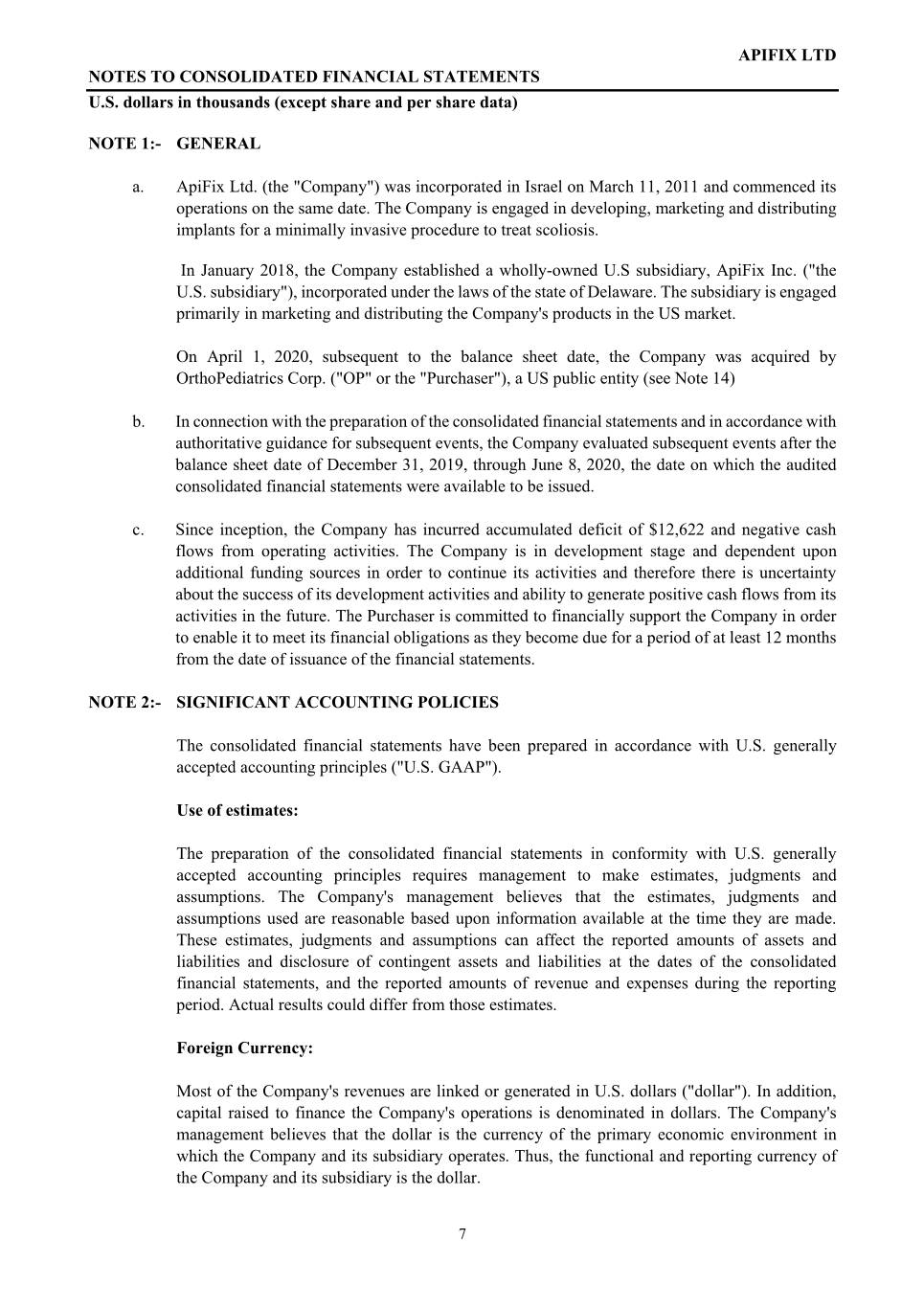

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 1:- GENERAL a. ApiFix Ltd. (the "Company") was incorporated in Israel on March 11, 2011 and commenced its operations on the same date. The Company is engaged in developing, marketing and distributing implants for a minimally invasive procedure to treat scoliosis. In January 2018, the Company established a wholly-owned U.S subsidiary, ApiFix Inc. ("the U.S. subsidiary"), incorporated under the laws of the state of Delaware. The subsidiary is engaged primarily in marketing and distributing the Company's products in the US market. On April 1, 2020, subsequent to the balance sheet date, the Company was acquired by OrthoPediatrics Corp. ("OP" or the "Purchaser"), a US public entity (see Note 14) b. In connection with the preparation of the consolidated financial statements and in accordance with authoritative guidance for subsequent events, the Company evaluated subsequent events after the balance sheet date of December 31, 2019, through June 8, 2020, the date on which the audited consolidated financial statements were available to be issued. c. Since inception, the Company has incurred accumulated deficit of $12,622 and negative cash flows from operating activities. The Company is in development stage and dependent upon additional funding sources in order to continue its activities and therefore there is uncertainty about the success of its development activities and ability to generate positive cash flows from its activities in the future. The Purchaser is committed to financially support the Company in order to enable it to meet its financial obligations as they become due for a period of at least 12 months from the date of issuance of the financial statements. NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES The consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). Use of estimates: The preparation of the consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates, judgments and assumptions. The Company's management believes that the estimates, judgments and assumptions used are reasonable based upon information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Foreign Currency: Most of the Company's revenues are linked or generated in U.S. dollars ("dollar"). In addition, capital raised to finance the Company's operations is denominated in dollars. The Company's management believes that the dollar is the currency of the primary economic environment in which the Company and its subsidiary operates. Thus, the functional and reporting currency of the Company and its subsidiary is the dollar. 7

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Accordingly, amounts in currencies other than U.S dollars, have been translated in accordance with Accounting Standard Codification 830 ("ASC"), Foreign Currency Matters. All transactions gain and losses from remeasurement of monetary balance sheet items denominated in non-dollar currencies are reflected in the statements of operations as financial income or expenses, as appropriate. Cash and cash equivalents: Cash equivalents consist of highly liquid investments that are readily convertible to cash with original maturities of three months or less, when purchased. Inventories: Inventories of raw materials and components are stated at the lower of cost or net realizable value. Cost of inventories is determined as follows: Materials and parts - using the weighted average cost method. Work in progress and Finished goods - on the basis of average costs which take into account materials, labor and other direct and indirect manufacturing costs. Inventory write-offs are provided to cover risks arising from slow-moving items or technological obsolescence for which recoverability is not probable. Property and equipment: Property and equipment are stated at cost, net of accumulated depreciation. Depreciation is calculated by the straight-line method over the estimated useful lives of the assets, at the following annual rates: % Computers and peripheral equipment 33 Equipment 15 Impairment of long-lived assets: The Company's' long-lived assets are reviewed for impairment in accordance with ASC 360-10- 35, Property, Plant, and Equipment, whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. For the years ended December 31, 2019 and 2018, the Company did not record any impairment losses. 9

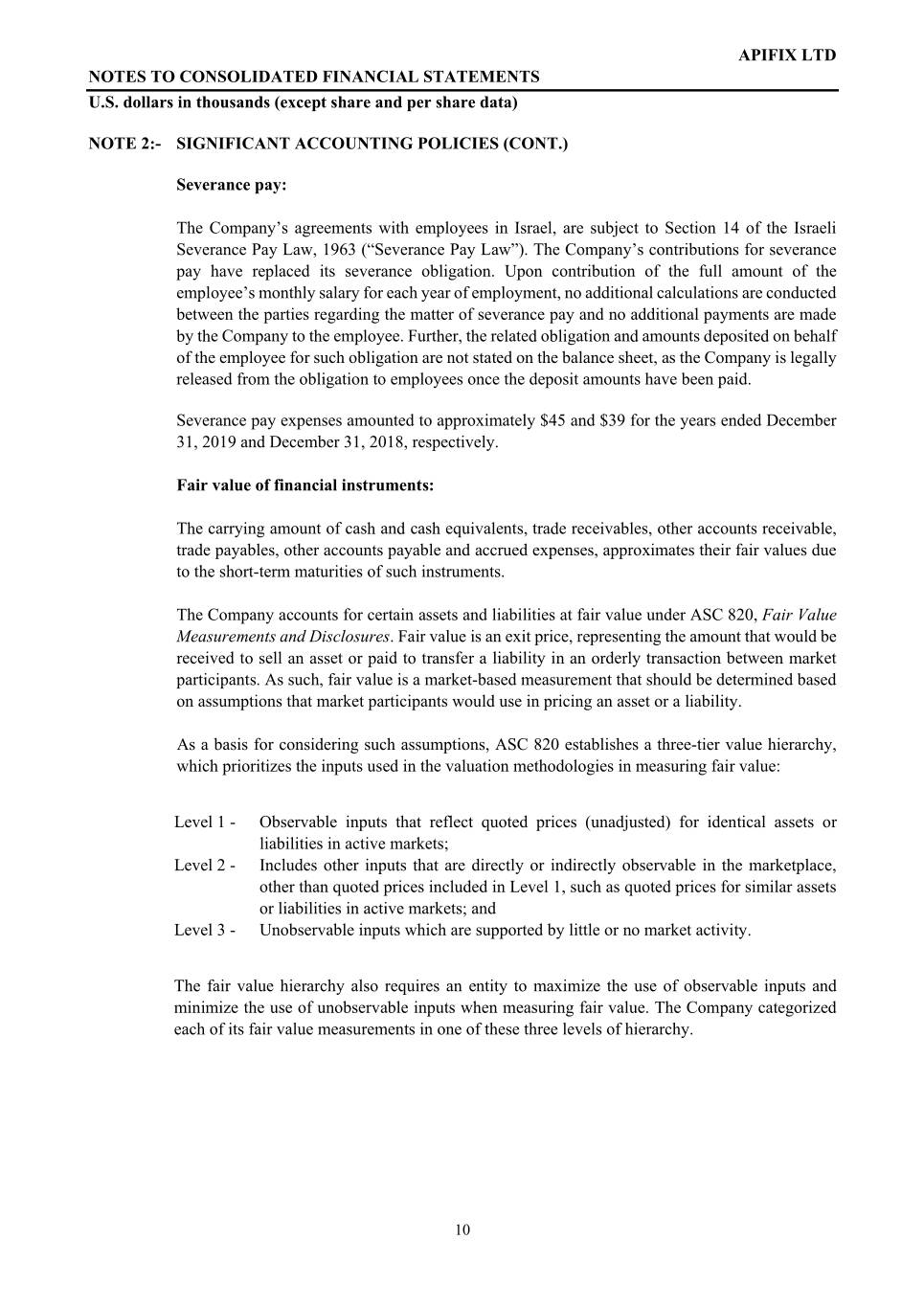

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Severance pay: The Company’s agreements with employees in Israel, are subject to Section 14 of the Israeli Severance Pay Law, 1963 (“Severance Pay Law”). The Company’s contributions for severance pay have replaced its severance obligation. Upon contribution of the full amount of the employee’s monthly salary for each year of employment, no additional calculations are conducted between the parties regarding the matter of severance pay and no additional payments are made by the Company to the employee. Further, the related obligation and amounts deposited on behalf of the employee for such obligation are not stated on the balance sheet, as the Company is legally released from the obligation to employees once the deposit amounts have been paid. Severance pay expenses amounted to approximately $45 and $39 for the years ended December 31, 2019 and December 31, 2018, respectively. Fair value of financial instruments: The carrying amount of cash and cash equivalents, trade receivables, other accounts receivable, trade payables, other accounts payable and accrued expenses, approximates their fair values due to the short-term maturities of such instruments. The Company accounts for certain assets and liabilities at fair value under ASC 820, Fair Value Measurements and Disclosures. Fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability. As a basis for considering such assumptions, ASC 820 establishes a three-tier value hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value: Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets; Level 2 - Includes other inputs that are directly or indirectly observable in the marketplace, other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets; and Level 3 - Unobservable inputs which are supported by little or no market activity. The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The Company categorized each of its fair value measurements in one of these three levels of hierarchy. 10

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Revenues recognition: The Company recognizes revenues when it satisfies a performance obligation by transferring control over a product or service to a customer, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those products or services. The Company determines revenue recognition using the following steps: � Identification of the contract, or contracts, with a customer � Identification of the performance obligations in the contract � Determination of the transaction price � Allocation of the transaction price to the performance obligations in the contract � Recognition of revenues when, or as, the Company satisfies a performance obligation In accordance with ASC 606, revenue is recognized when a customer obtains control of promised goods or services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for these goods or services. At the inception of a contract, the Company also evaluates the promised goods and services in the contract and determine if each promised good or service is distinct and therefore accounted for as a separate performance obligation or combined with other goods and/or services into a combined performance obligation. Revenue is generated primarily from the sale of implants. Sales are primarily to hospital accounts through independent sales agencies. The revenue is recognized when performance obligations under the terms of a contract with the customer are satisfied. This typically occurs when the Company transfers control of products to the customers, generally upon implantation or when title passes upon shipment. The products are generally consigned to the independent sales agencies, and revenue is recognized when the products are used by or shipped to the hospital for surgeries on a case by case basis. The Company elected to use the practical expedient and record incremental costs of obtaining a contract as an expense when incurred if the amortization period of the asset that the Company otherwise would have recognized is one year or less. The Company capitalizes sales commission as costs of obtaining a contract when they are incremental and if they are expected to be recovered. The Company applies judgment in estimating the amortization period by taking into consideration customer contract terms and expected length of customer relationship. For costs that the Company would have capitalized and amortized over one year or less, the Company has elected to apply the practical expedient and expense these contract costs as incurred. Commission expense for the years ended December 31, 2019 and 2018 were $15 and $15, respectively. Sales commission expense is included in Selling and Marketing expenses in the accompanying consolidated statements of income. Refer also to Note 12 for disaggregation of revenues by primary geographical markets. 11

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Research and development expenses: Research and development costs are charged to the statement of operations as incurred. Concentrations of credit risks: Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents and trade receivables. Cash and cash equivalents are invested in major banks in Israel and the USA. Management believes that the financial institution that holds the Company Cash and cash equivalents have high credit ratings. Trade receivables are derived from sales to major customers mainly in Europe. The Company performs ongoing credit evaluations of its customers and to date, has not experienced any material losses. The Company have no off-balance-sheet concentration of credit risk such as foreign exchange contracts, option contracts or other foreign hedging arrangements. Accounting for share-based compensation: The Company accounts for Stock based compensation in accordance with ASC 718, Compensation - Stock compensation. ASC 718 requires companies to estimate the fair value of equity-based payments awards on the date of grant using an option-pricing model. The Company recognizes compensation expenses for the value of awards granted, based on the straight-line method for service based awards.. The Company accounts for forfeitures as they occur. The Company selected the Binomial option pricing model as the most appropriate fair-value method for its share-option awards based on the fair value estimation of the Company's Ordinary shares at the date of grant. The Company estimates the fair value of share options granted with the following assumptions: Year ended December 31, 2019 2018 Dividend yield 0% 0% Expected volatility 89% 91% - 92% Risk-free interest 2.7% 2.83 - 2.94% Contractual life (in years) 10 10 The risk-free interest rate assumption is the implied yield currently available on the U.S treasury yield zero-coupon issues with a remaining term equal to the expected life term of the Company's options. The expected volatility is based on implied volatility of other comparable publicly traded companies. The valuation of the ordinary shares was based on market approach and option pricing models. 12

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Income taxes: The Company account for income taxes under the liability method of accounting in accordance with the provisions of ASC 740, Income Taxes. ASC 740 prescribes the use of the liability method whereby deferred tax asset and liability account balances are determined based on differences between financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company provides a valuation allowance, if necessary, to reduce deferred tax assets to amounts that are more likely than not to be realized. ASC 740-10 contains a two-step approach to recognizing and measuring uncertain tax positions accounted for in accordance with ASC 740. The first step is to evaluate the tax position taken or expected to be taken in a tax return by determining if the weight of available evidence indicates that it is more likely than not that, on an evaluation of the technical merits, the tax position will be sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. As of December 31, 2019, and December 31, 2018, the Company did not identify any significant uncertain tax positions. Recently adopted accounting pronouncements: ASU 2014-09 - Revenue from Contracts with Customers (Topic 606): On January 1, 2019, the Company adopted ASU No. 2014-09, "Revenue from Contracts with Customers", using the modified retrospective method applied to those contracts that were not substantially completed as of January 1, 2019. The adoption of ASC 606 did not have material impact on the Company's financial statements. Results for reporting periods beginning after January 1, 2019, are presented under ASC 606, while prior periods amounts are not adjusted and continue to be reported in accordance with legacy GAAP under prior guidance ("ASC 605"). In June 2018, the FASB issued ASU No. 2018-07, "Compensation - Stock Compensation (Topic 718) - Improvements to Nonemployee Share-Based Payment Accounting", to simplify the accounting for non-employee share-based payment transactions by expanding the scope of ASC Topic 718, Compensation - Stock Compensation, to include share-based payment transactions for acquiring goods and services from non-employees. Under the new standard, most of the guidance on stock compensation payments to non-employees would be aligned with the requirements for share-based payments granted to employees. This standard is effective for annual reporting periods beginning after December 15, 2019, with early adoption permitted. The Company early adopted the standard On January 1, 2019. The adoption of this standard did not have a material impact on the Company's consolidated financial statements. 13

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (CONT.) Recent Accounting Pronouncement: ASU 2016-02 - Leases (Topic 842): In February 2016, the FASB issued guidance on the recognition, measurement, presentation and disclosure of leases for both parties to a contract (i.e., lessees and lessors). The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight line basis over the term of the lease, respectively. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than 12 months regardless of their classification. Leases with a term of 12 months or less will be accounted for in a manner similar to the accounting under existing guidance for operating leases today. The new standard requires lessors to account for leases using an approach that is substantially equivalent to existing guidance for sales-type leases, direct financing leases and operating leases. ASC 842 supersedes the previous leases standard, ASC 840, "Leases". The guidance is effective for annual periods beginning on or after December 15, 2019. ASU No. 2016- 02 provides a number of optional practical expedients in transition. The Company estimate that it will adopt the ‘package of practical expedients’, which, under the new standard, permits it not to reassess its prior conclusions about lease identification, lease classification and initial direct costs. The adoption of this new standard will affect the Company's consolidated balance sheets by recognizing new right-of-use ("ROU") assets and lease liabilities for operating leases. The impact on the Company's results of operations and cash flows is not expected to be material. Adoption of the standard will result in the recognition of lease liabilities and ROU asset for operating leases of approximately $105 - $115. NOTE 3:- INVENTORIES December 31, 2019 2018 Raw materials and parts $ 180 $ 204 Finished products 436 237 $ 616 $ 441 NOTE 4:- OTHER ACCOUNTS RECEIVABLE AND PRE-PAID EXPENSES December 31, 2019 2018 Government authorities $ 32 $ 41 Short-term deposits 11 7 Prepaid expenses and other receivables 41 4 $ 84 $ 52 14

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 5:- PROPERTY AND EQUIPMENT, NET December 31, 2019 2018 Cost: Computers and software $ 27 $ 21 Equipment 145 68 172 89 Accumulated depreciation: Computers and software 19 15 Equipment 17 1 36 16 Property and equipment, net $ 136 $ 73 Depreciation expenses for the years ended December 31, 2019 and 2018 were approximately $20 and $6, respectively. NOTE 6:- OTHER PAYABLES AND ACCRUED EXPENSES December 31, 2019 2018 Employee and payroll accruals $ 86 $ 58 Vacation and recreational accrual 127 84 Accrued expenses and other payables 107 121 $ 320 $ 263 NOTE 7:- CONVERTIBLE LOAN On December 28, 2017 ("effective date"), the Company entered into a convertible loan agreement (the "Convertible Loan") with a lender (the "Lender"), pursuant to which the Lender provided a loan in an aggregate principal amount of $1,500 ("Principal Amount"). The Convertible Loan amount bears interest of 4% per annum. The Principal Amount shall convert into shares of the Company or repaid as follows: (i) Conversion If prior to April 1, 2019 (the "Target Date"), no transaction constituting a Deemed Liquidation (as defined in the convertible loan agreement) has been closed, at any time between and including April 1, 2019 until and including May 1, 2019, the Lender shall have the option: (i) convert the Principal Amount into Preferred A-1 Shares , at a price per share of $112.45 (the "PPS"); or (ii) choose repayment of the loan amount; provided however that, in the event the Lender chooses repayment, the Company shall be entitled to demand by providing a written notice to the Lender within 7 days after receipt of the Lender’s notice that in lieu of such repayment the Principal Amount shall convert into Preferred A-1 Shares, at the PPS. 15

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 7:- CONVERTIBLE LOANS (CONT.) (ii) Conversion upon Deemed Liquidation If prior to the Target Date, a transaction that constitutes a Deemed Liquidation (as defined in the convertible loan agreement) has been closed, then upon the closing of such transaction and conditioned thereon, the Lender shall be entitled to choose either: (i) convert the Principal Amount into Preferred A-1 Shares at the PPS; or (ii) repayment of the loan amount by the Company within 10 days from the receipt of such notice; provided however, that if the Lender has chosen the option of repayment - in the event the distribution of proceeds upon such Deemed Liquidation does not suffice for the full repayment of the Loan Amount and the Preferred A-1 Preference (as such term is defined in the Amended Articles), then the Principal Amount shall be paid to the Lender concurrently and pari passu with the Aggregate Amount (where the "Aggregate Amount" shall mean sum of the Loan Amount and the Preferred A-1 Preference). (iii) Optional Conversion At any time, beginning upon the Closing Date and ending upon the Target Date, the Lender shall have the right to convert the Principal Amount into Preferred A-1 Shares, at the PPS. (iv) Conversion upon Default Notwithstanding the aforesaid, the Principal Amount, if outstanding at the time, will immediately become due and payable upon the occurrence of Default (as defined in the loan agreement) In April 2019, following the Preferred A Share Purchase Agreement (see Note 9), the Company consummated a Qualified Financing, resulting the conversion of the convertible loan principal amount into 13,339 Preferred A-1 Shares. Interest expenses for the years ended December 31, 2019 and 2018 were approximately $15 and $60, respectively. The Company accounted for the convertible loan in accordance with ASC 470, Debt. The convertible loan was recorded as a liability and no embedded features were bifurcated. Since the conversion price of the convertible loan equals the Preferred A-1 share price, no beneficial conversion feature ("BCF") was recorded. According to ASC 470 upon conversion pursuant to the original terms of the convertible debt, the carrying amount of the convertible debt, including any unamortized premium or discount, is credited to the capital accounts and no gain or loss should be recognized. As of December 31, 2019, the outstanding accrued interest in the amount of approximately $75 was recorded against additional-paid-in capital. 16

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 8:- COMMITMENTS AND CONTINGENT LIABILITIES a. Royalty bearing grants: The Company received grants from the Research Committee of the Israel Innovation Authority of the Israeli Ministry of Economics and Industry ("IIA"), supporting the Company’s research and development project. Under the contracts with the IIA, the Company is required to pay royalties at 3-5%, in accordance with the Regulations for the Encouragement of Industrial Research and Development (Rate of Royalties and Rules for their Payment) - 1996. Royalties are to be paid based on sales of products deriving from the research and development program financed by the IIA up to a maximum of the total grants received, plus interest at LIBOR. As of December 31,2019, the Company's remaining contingent commitment to the IIA amounted to approximately $412, not including LIBOR interest as described above. Royalties expenses for the years then ended on December 31, 2019 and 2018, amounted to $23 and $13, respectively and are included in "Cost of sales". b. Lease commitments: The Company leases office facilities in Misgav, Israel, from a related party, under an operating lease agreement ending on September 1, 2021. Future minimum annual payments under the operating lease for the year subsequent to December 31, 2019, are as follows: Year ended December 31, 2020 $ 72 2021 $ 48 Total rent expenses for the years ended on December 31, 2019 and 2018, were approximately $68 and $46, respectively. NOTE 9:- SHAREHODERS' EQUITY a. Composition of share capital: The Company's authorized, outstanding and issued share capital is comprised as follows: December 31, December 31, 2019 2018 Issued and Issued and Par value Authorized Outstanding Authorized Outstanding Ordinary shares NIS 0.01 859,263 119,706 890,000 119,706 Preferred A shares NIS 0.01 43,472 43,472 50,000 43,472 Preferred A-1 shares NIS 0.01 62,265 62,265 60,000 48,926 Preferred B shares NIS 0.01 35,000 19,252 - - 1,000,000 244,695 1,000,000 240,742 17

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 9:- SHAREHODERS' EQUITY (CONT.) b. Shares' rights: Ordinary Shares: Ordinary shares confer upon their holders the right to participate in the general meeting where each one ordinary share has one voting right in all matters, receive dividends if and when declared and to participate in the distribution of surplus assets in case of liquidation of the company. Preferred Shares: The Preferred B, Preferred A-1 and Preferred A shares (collectively: the "Preferred shares") confer the same rights as the Ordinary Shares. In addition, the Preferred shares have additional rights, as detailed below: i) Liquidation and Distribution preference: In the event of Liquidation Event (as defined in the Articles of Association of the Company) any funds, assets or proceeds (the: “Distributable Proceeds”) shall be distributed in the following order and preferences: 1) The holders of the Preferred B Shares shall be entitled to receive, prior and in preference to any other securities of the Company, an amount equal to the applicable original issue price of each Preferred B share (subject to appropriate adjustment in the event of a stock split, stock dividend, combination, reclassification, or other adjustments specified in these Articles). In the event that the Distributable Proceeds shall be insufficient for the distribution of the Preferred B preference in full, the Distributable Proceeds shall be distributed among the holders of Preferred B Shares on a pro rata and pari passu basis; and 2) after payment in full of the Preferred B preference for all Preferred B Shares, the holders of Preferred A-1 Shares shall be entitled to receive out of the remaining Distributable Proceeds available for distribution, if any, for each Preferred A-1 Share, an amount equal to 100% of the original issue price of each Preferred A- 1 Share (subject to appropriate adjustment in the event of a stock split, stock dividend, combination, reclassification, or other adjustments specified in these Articles), 3) after payment in full of the Preferred B preference and the Preferred A- 1 Preference for all Preferred B Shares and Preferred A-1 Shares, respectively, the holders of the Preferred A Shares shall be entitled to receive out of the remaining Distributable Proceeds available for distribution, if any, for each Preferred A Share held by them, prior and in preference to any other securities of the Company (but after the Preferred B preference and Preferred A-1 preference), an amount equal to 250% of the Original Issue Price (subject to appropriate adjustment in the event of a stock split, stock dividend, combination, reclassification, or other adjustments specified in these Articles), of each Preferred A Share in $. The remaining amount of the assets and funds legally available for distribution, shall be distributed ratably to the holders of all Ordinary Shares. 18

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 9:- SHAREHODERS' EQUITY (CONT.) b. Shares' rights (Cont.): Notwithstanding the foregoing : (1) in the event that a pro-rata distribution (treating the Preferred B Shares A-1 Shares on an as-converted basis), among all shareholders of the Company, without application of the Preferred B preference, Preferred A-1 preference, but with the application of the Preferred A-1 preference and the Preferred A preference, shall yield to the holders of the Preferred B Shares Preferred A-1 Shares an amount that is greater than the Preferred B PreferenceA-1 Preference, then the Preferred B preference A-1 preference shall not apply; and (2) in the event that a pro-rata distribution (treating the Preferred A-1 Shares on an as-converted basis), among all shareholders of the Company, without application of the Preferred A-1 preference, but with the application of the Preferred A presence, shall yield to the holders of the Preferred A-1 Shares an amount that is greater than the Preferred A-1 preference, then the Preferred A-1 preference shall not apply; and (3) in the event that a pro-rata distribution (treating the Preferred A Shares on an as converted basis), among all shareholders of the Company, without the application of the Preferred A preference, shall yield to the holders of the Preferred A Shares an amount that is greater than the Preferred A preference, then the Preferred A preference shall not apply. As of December 31, 2019, the Preferred shares aggregate liquidation preference amounted to $16,815. ii) Conversion: Each Preferred share shall be convertible at any time, at the option of the holder, into shares of Ordinary share, without the payment of any additional consideration. The Preferred shares shall be automatically converted into Ordinary shares immediately prior to the closing of a Qualified IPO or if the majority of the holders of the outstanding Preferred shares agree so in writing. iii) Voting Rights: The Preferred shares shall vote together with the other shares of the Company in each case not as a separate class, in all General Meetings, with each Preferred Shares having votes in such number as if then converted into Ordinary shares c. Issuance of Shares: During 2017, the Company entered into a Share Purchase Agreement (the: "2017 SPA") with several investors, according to which, the Company will issue 18,991 Series A-1 Preferred shares, with NIS 0.01 per value each, at a price per each Preferred A-1 share of $112.5, for aggregate cash consideration of $2,318. As of December 31, 2017, the Company issued 5,518 Series A-1 Preferred shares, for considerations of $1,368, of which an amount of $565 was recorded as receivables on accounts of shares. In February 2018, the Company received additional amount of $950 and issued the remaining 13,473 Series A-1 Preferred shares. Issuance expenses were immaterial. 19

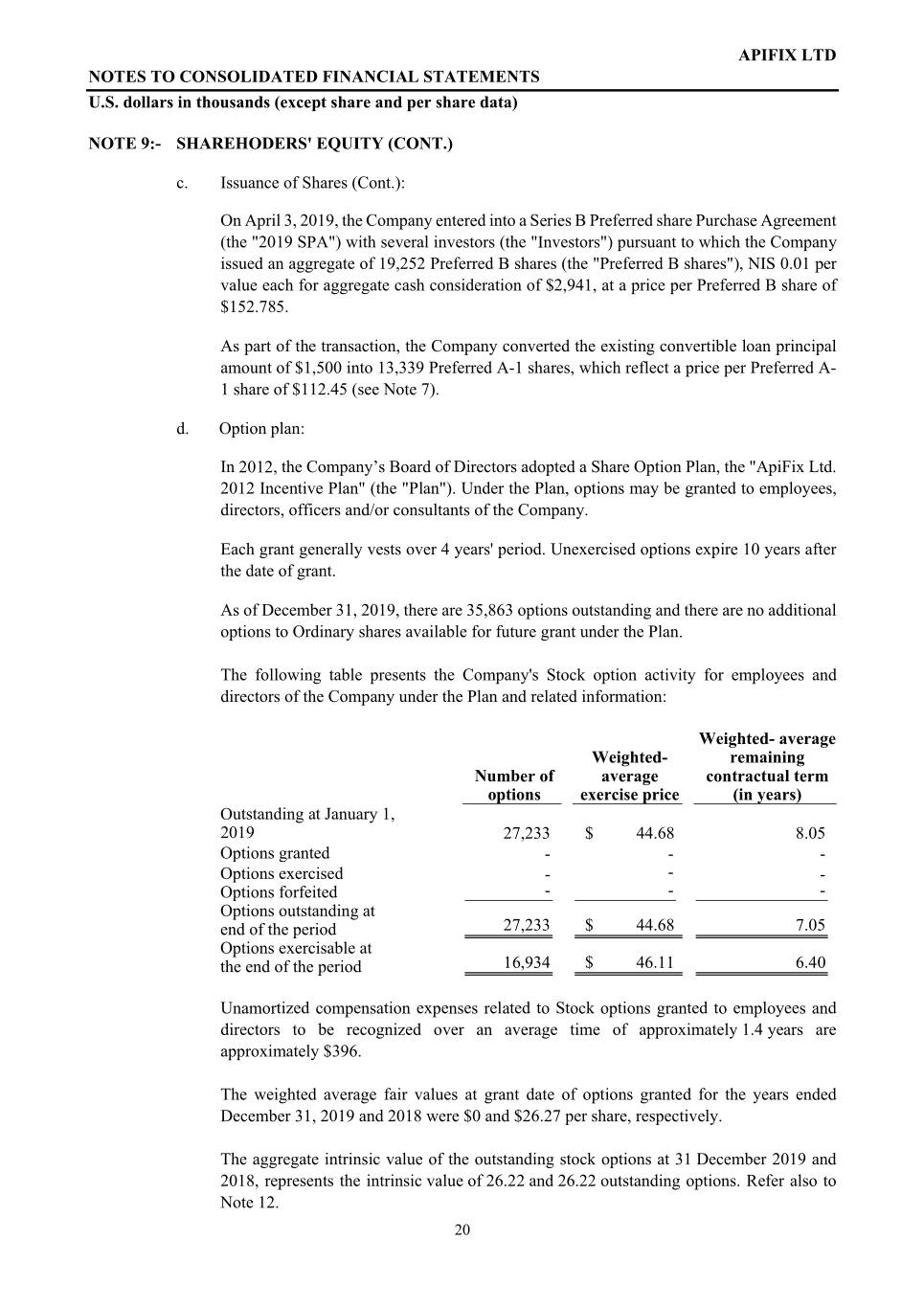

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 9:- SHAREHODERS' EQUITY (CONT.) c. Issuance of Shares (Cont.): On April 3, 2019, the Company entered into a Series B Preferred share Purchase Agreement (the "2019 SPA") with several investors (the "Investors") pursuant to which the Company issued an aggregate of 19,252 Preferred B shares (the "Preferred B shares"), NIS 0.01 per value each for aggregate cash consideration of $2,941, at a price per Preferred B share of $152.785. As part of the transaction, the Company converted the existing convertible loan principal amount of $1,500 into 13,339 Preferred A-1 shares, which reflect a price per Preferred A- 1 share of $112.45 (see Note 7). d. Option plan: In 2012, the Company’s Board of Directors adopted a Share Option Plan, the "ApiFix Ltd. 2012 Incentive Plan" (the "Plan"). Under the Plan, options may be granted to employees, directors, officers and/or consultants of the Company. Each grant generally vests over 4 years' period. Unexercised options expire 10 years after the date of grant. As of December 31, 2019, there are 35,863 options outstanding and there are no additional options to Ordinary shares available for future grant under the Plan. The following table presents the Company's Stock option activity for employees and directors of the Company under the Plan and related information: Weighted- average Weighted- remaining Number of average contractual term options exercise price (in years) Outstanding at January 1, 2019 27,233 $ 44.68 8.05 Options granted - - - Options exercised - - - Options forfeited - - - Options outstanding at end of the period 27,233 $ 44.68 7.05 Options exercisable at the end of the period 16,934 $ 46.11 6.40 Unamortized compensation expenses related to Stock options granted to employees and directors to be recognized over an average time of approximately 1.4 years are approximately $396. The weighted average fair values at grant date of options granted for the years ended December 31, 2019 and 2018 were $0 and $26.27 per share, respectively. The aggregate intrinsic value of the outstanding stock options at 31 December 2019 and 2018, represents the intrinsic value of 26.22 and 26.22 outstanding options. Refer also to Note 12. 20

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 9:- SHAREHODERS' EQUITY (CONT.) d. Option plan (Cont.): The following table sets forth the total share-based compensation expenses resulting from stock options granted to employees included in the Company's Statement of Operations: Year ended December 31, 2019 2018 Cost of sales $ 4 $ 4 Sales and marketing expenses 41 41 Research and development expenses 6 6 General and administrative expenses 89 88 $ 140 $ 139 Share options issued to non-employees: The following table presents the Company's Stock option activity for non-employees of the Company under the Plan and related information as of December 31, 2019: Outstanding Exercisable Exercisable Issuance date options Exercise price options through May 2015 1,971 $ 63.2 1,971 November 2020 November 2015 3,537 63.2 3,537 November 2025 May 2016 500 112.5 500 May 2026 June 2016 500 63.2 489 June 2026 July 2017 1,122 55.0 1,122 July 2021 July 2017 500 63.2 500 February 2020 February 2019 500 41.9 280 February 2029 8,630 8,399 Compensation expenses related to options granted to non-employees were recorded as follows: Year ended December 31, 2019 2018 Research and development expenses $ 30 $ 31 $ 30 $ 31 NOTE 10:- FINANCIAL EXPENSES (INCOME), NET Year ended December 31, 2019 2018 Bank commissions $ 5 $ 3 Interest related to convertible loans 15 60 Foreign currency translation adjustments, net (53) 108 $ (33) $ 171 21

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 11:- INCOME TAXES a. The Israeli corporate tax rate in 2019 and 2018 was 23%. The U.S subsidiary is taxed under United States federal and state tax rules. On December 22, 2017, the U.S. Tax Cuts and Jobs Act (the "ACT") was signed into law, permanently lowering the corporate federal income tax rate from 35% to 21%, effective January 1, 2018. The Tax Act also makes certain changes to the depreciation rules and implements new limits on the deductibility of certain executive compensation paid by the Company. The tax Act also eliminates the carryforward net operating losses (“NOLs”) limitation period for losses incurred after December 31, 2017 and eliminates the ability of taxpayers to carry back NOLs incurred after December 31, 2017, to previous tax years. b. Net operating losses carry forward: As of December 31, 2019, the Company has an operating tax losses and research and development costs carryforward in the aggregate amount of approximately $12,586. These losses may be offset against future taxable income for an indefinite period. c. Deferred income taxes: Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Company's deferred tax assets are as follows: December 31, 2019 2018 Deferred tax assets: Israeli net operating loss and research and development $ 2,895 $ 2,224 expenses carryforward Allowances and reserves 29 20 Total deferred tax assets before valuation allowance 2,924 2,244 Valuation allowance (2,924) (2,244) Net deferred tax asset $ - $ - c. Deferred income taxes (Cont.): As of December 31, 2019 and 2018, the Company has provided full valuation allowances in respect of deferred tax assets resulting from tax loss carryforward and other temporary differences, since they have a history of operating losses and current uncertainty concerning its ability to realize these deferred tax assets in the future. 22

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 11:- INCOME TAXES (Cont.) The Company accounts for its income tax uncertainties in accordance with ASC 740 which clarifies the accounting for uncertainties in income taxes recognized in a Company’s financial statements and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. As of December 31, 2019 and 2018, there were no unrecognized tax benefits that if recognized would affect the annual effective tax rate. d. Tax assessment: The Company received final tax assessments through 2014. Its U.S. subsidiary has not yet received final tax assessments since inception. e. Reconciliation of the theoretical tax expense (benefit) to the actual tax expense (benefit): In 2018 and 2019, the main reconciling item of the statutory tax rate of the Company to the effective tax rate is tax loss carryforwards and other deferred tax assets for which a full valuation allowance was provided. NOTE 12:- MAJOR CUSTOMERS AND GEOGRAPHIC INFORMATION Revenues from single customers that exceed 10% of the total revenues in the reported years as a percentage of total revenues are as follows: Year ended December 31, 2019 2018 % Customer A 34 24 Customer B 17 23 Customer C 22 15 Customer D 10 12 Customer E 9 10 Revenues are attributed to geographic areas based on location of the end customers as follows: Year ended December 31, 2019 2018 Israel $ 110 $ 65 Europe 393 362 $ 503 $ 427 23

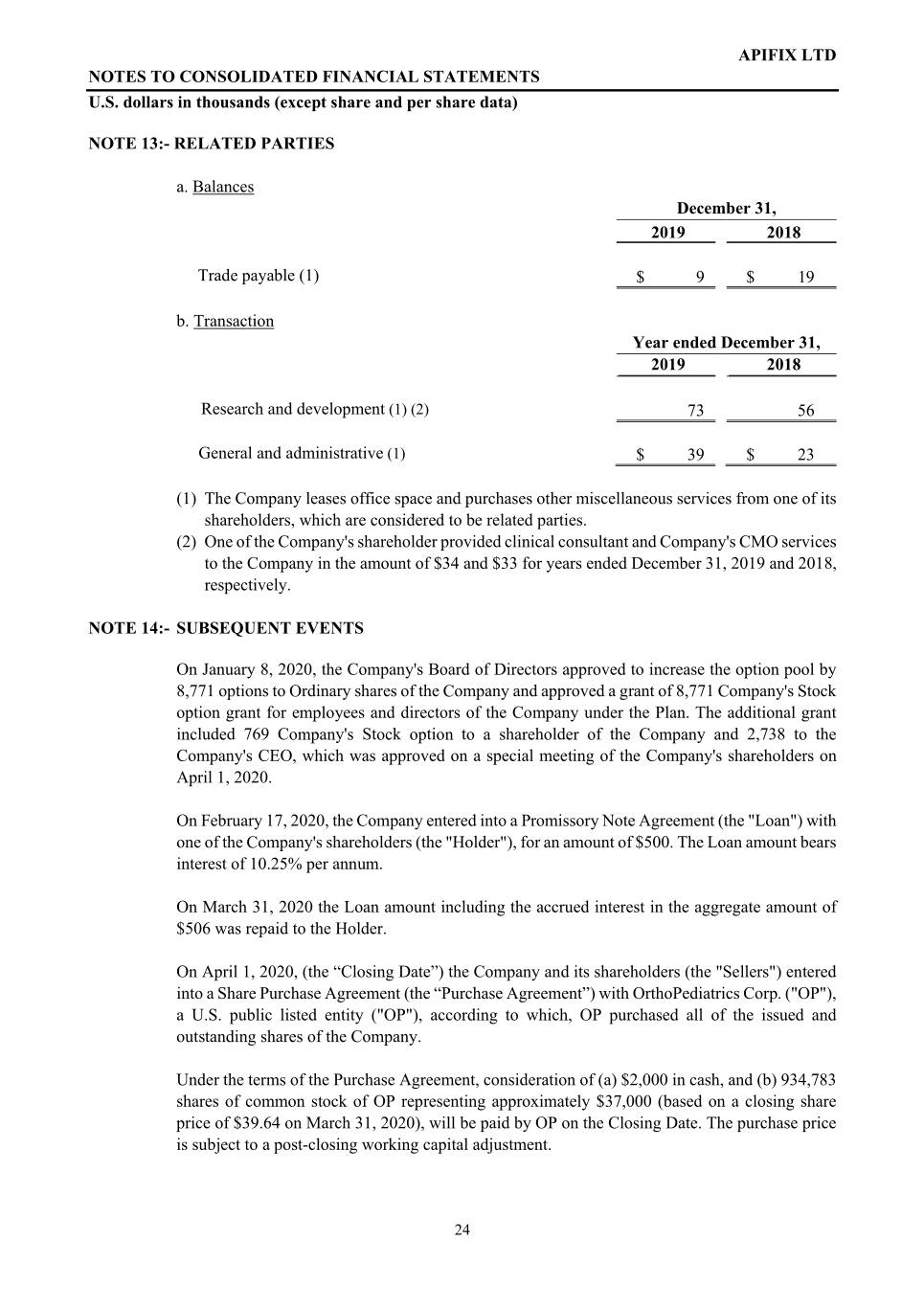

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 13:- RELATED PARTIES a. Balances December 31, 2019 2018 Trade payable (1) $ 9 $ 19 b. Transaction Year ended December 31, 2019 2018 Research and development (1) (2) 73 56 General and administrative (1) $ 39 $ 23 (1) The Company leases office space and purchases other miscellaneous services from one of its shareholders, which are considered to be related parties. (2) One of the Company's shareholder provided clinical consultant and Company's CMO services to the Company in the amount of $34 and $33 for years ended December 31, 2019 and 2018, respectively. NOTE 14:- SUBSEQUENT EVENTS On January 8, 2020, the Company's Board of Directors approved to increase the option pool by 8,771 options to Ordinary shares of the Company and approved a grant of 8,771 Company's Stock option grant for employees and directors of the Company under the Plan. The additional grant included 769 Company's Stock option to a shareholder of the Company and 2,738 to the Company's CEO, which was approved on a special meeting of the Company's shareholders on April 1, 2020. On February 17, 2020, the Company entered into a Promissory Note Agreement (the "Loan") with one of the Company's shareholders (the "Holder"), for an amount of $500. The Loan amount bears interest of 10.25% per annum. On March 31, 2020 the Loan amount including the accrued interest in the aggregate amount of $506 was repaid to the Holder. On April 1, 2020, (the “Closing Date”) the Company and its shareholders (the "Sellers") entered into a Share Purchase Agreement (the “Purchase Agreement”) with OrthoPediatrics Corp. ("OP"), a U.S. public listed entity ("OP"), according to which, OP purchased all of the issued and outstanding shares of the Company. Under the terms of the Purchase Agreement, consideration of (a) $2,000 in cash, and (b) 934,783 shares of common stock of OP representing approximately $37,000 (based on a closing share price of $39.64 on March 31, 2020), will be paid by OP on the Closing Date. The purchase price is subject to a post-closing working capital adjustment. 24

APIFIX LTD NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 14:- SUBSEQUENT EVENTS (Cont.) In addition, the purchase price may include the following payments (each, an “Anniversary Payment” and, collectively, the “Anniversary Payments”): (i) $13,000 on the second anniversary of the Closing Date, provided that such payment will be paid earlier if 150 clinical procedures using the ApiFix System are completed in the United States before such anniversary date; (ii) $8,000 on the third anniversary of the Closing Date; and (iii) $9,000 on the fourth anniversary of the Closing Date. In addition, to the extent that the product of OP’s revenues from the ApiFix System for the twelve months ended June 30, 2024 multiplied by 2.25 exceeds the Anniversary Payments actually made for the third and fourth years (or subject to offset as a result of the occurrence of a Reduction Event (as defined below), OP has agreed to pay the Sellers the amount of such excess (the “System Sales Payment”). The Anniversary Payments may be made in cash and/or Common Stock of OP, subject to certain limitations; provided that OP shall make the determination with respect to Anniversary Payments and the Sellers’ representative shall make the determination with respect to the ApiFix Systems Sales Payment, if any. Notwithstanding the foregoing, in the event that, prior to the fourth anniversary of the Closing Date, the ApiFix System (A) loses its humanitarian device exemption from the FDA, or other approval of the FDA, or its Conformité Européenne mark under European Union legislation, as a result of safety events; or (B) experiences an implant failure rate in excess of ten percent (10%) due to breakage, as calculated at the time of each of the Anniversary Payments (each a “Reduction Event”), each of the Anniversary Payments, to the extent still payable by OP at the relevant time, shall each be reduced up to a total reduction of $15,000. In addition, if OP sells a majority of the intellectual property comprising, or embodied in, the ApiFix System to a third party, through a sale of assets, an exclusive license of intellectual property rights, a sale of stock of OP or otherwise (an “ApiFix Divestiture”), on or before June 30, 2024, then OP’s obligation to make the payments under the Purchase Agreement shall remain effective; provided that the amount payable (excluding the Closing Purchase Price) shall be the higher of: (a) $45,000 less any of the Anniversary Payments already made by OP (or subject to offset as a result of a Reduction Event (if triggered); and (b) the sum of the second year Anniversary Payment (unless previously paid or subject to offset as a result of a Reduction Event (if triggered)). In the event of an ApiFix Divestiture, the remaining payments are payable in cash and/or Common Stock as determined by the Sellers’ Representative. -------------------------- 25