Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LCNB CORP | form8-kinvestorconference6.htm |

LCNB Investment Highlights June 2020

Forward Looking Statements This presentation, as well as other written or oral communications made from time to time by us, contains certain forward-looking information within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future events, circumstances or effects. These forward-looking statements regarding future events and circumstances involve known and unknown risks, including those risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2019, and other SEC filings, uncertainties and other factors that may cause our actual results, levels of activity, financial condition, performance or achievements to be materially different from any future results, levels of activity, financial condition, performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions, estimates or judgments by us that may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include: • the significant risks and uncertainties for LCNB's business, results of operations and financial condition, as well as its regulatory capital and liquidity ratios and other regulatory requirements, caused by the on-going COVID-19 pandemic, which will depend on several factors, including the scope and duration of the pandemic or any subsequent resurgence of the virus, its influence on financial markets, the effectiveness of LCNB's work from home arrangements and staffing levels in operational facilities, the impact of market participants on which LCNB relies and actions taken by governmental authorities and other third parties in response to the pandemic; • changes in competitive and market factors that might affect our results of operations; • changes in laws and regulations, including without limitation changes in capital requirements under the Basel III capital standards; • changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events; • our ability to identify potential candidates for, and consummate, acquisition or investment transactions; • the timing of acquisition or investment transactions; • local, regional and national economic conditions and events and the impact they may have on us and our customers; • targeted or estimated returns on assets and equity, growth rates and future asset levels; • our ability to attract deposits and other sources of liquidity and capital; • changes in the financial performance and/or condition of our borrowers; • changes in the level of non-performing and classified assets and charge-offs; • changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements, as well as changes in borrowers payment behavior and creditworthiness; • changes in our capital structure resulting from future capital offerings or acquisitions; • inflation, interest rate, securities market and monetary fluctuations; 2

Forward Looking Statements • the effects on our mortgage warehouse lending and retail mortgage businesses of changes in the mortgage origination markets, including changes due to changes in monetary policies, interest rates and the regulation of mortgage originators, services and securitizers; • timely development and acceptance of new banking products and services and perceived overall value of these products and services by users; • changes in consumer spending, borrowing and saving habits; • technological changes; • our ability to grow, increase market share and control expenses, and maintain sufficient liquidity; • volatility in the credit and equity markets and its effect on the general economy; • the potential for customer fraud; • effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; • the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult, time-consuming or costly than expected; • our ability to integrate currently contemplated and future acquisition targets may be unsuccessful, or may be more difficult, time-consuming or costly than expected; and • material differences in the actual financial results of merger and acquisition activities compared with expectations. These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, financial condition, performance or achievements. Accordingly, there can be no assurance that actual results will meet our expectations or will not be materially lower than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law. 3

LCNB Investment Highlights - Overview Stable & Attractive 143 year-old community bank located in attractive markets in southwestern Ohio and Markets Columbus with good demographics, stable home prices, and strong economic activity High and consistent profitability driven by disciplined organic loan growth, diversified revenue base, and low-cost, core deposits (0.69% cost of funds as of March 31, 2020) – 39 of the last 45 years with 1% or above ROAA1 Consistent, High- Consistently stable dividends (current dividend yield of 4.45%) Performing Franchise Strong asset quality and capital ratios driven by conservative underwriting of loans and robust earnings Leverageable platform and ability to drive earnings growth through organic growth and acquisitions Seasoned Seasoned management team with extensive history of working together Management Team Top 6 executives have an average of 31 years of experience LCNB viewed as “acquirer of choice” in its markets Successfully completed four acquisitions since 20132 Financially Attractive Target-rich environment for additional acquisitions Acquisitions 23 banks with assets between $200 million and $800 million in and around current markets3 Highly selective in choosing right partner Source: S&P Global Market Intelligence & Company Documents 1 Company data from 1975 – 2020 2 Columbus First Bancorp acquisition completed 5/18, BNB Bancorp acquisition completed 4/15, Eaton National Bank and Trust acquisition completed 1/14 and First Capital Bancshares acquisition completed 1/13 3 Defined as banks and thrifts (excluding mutuals and merger targets) headquartered in the following MSAs: Athens, Bellefontaine, Celina, Chillicothe, Cincinnati, Columbus, Dayton, Greenville, Huntington-Ashland, Lima-Wapakoneta, Point Pleasant, Portsmouth, Sidney, Springfield, Urbana, Washington Court House and Wilmington. 4

LCNB Investment Highlights – Recent Events Highlights of Q1’20 LCNB reported Q1’20 and LTM EPS of $0.39 and $1.48, respectively Net Interest Income for Q1’20 was $787,000 and $3,821,000 greater than the comparable periods in 2019 Even with a $1,173,000 Provision for Loan Losses, LCNB achieved a 1.23% and 12.40% ROAA and ROATCE, respectively during the first quarter Asset quality remained strong with Q1’20 NPAs Excluding TDRs / Assets of 0.17% and LTM Net Charge-Offs / Average Loans of 0.05% LCNB continues to be well capitalized, with Q1’20 Tangible Common Equity to Tangible Assets of 10.87% Current Strategic Initiatives Continued talent acquisition for key roles (Columbus market, Human Resources, Investment Services and Mortgage & Commercial) Focus on continued infrastructure and technology investments; supporting work from home and virtual annual meeting Market expansion in key growth markets; continued branch optimization analysis and prototype development Ongoing capital management – Buybacks – Dividend growth Source: S&P Global Market Intelligence & Company Documents 5

COVID-19 Response & Paycheck Protection Program (PPP) Update Employees Customers Community Closed branch lobbies but kept drive-thrus Kept drive-thrus open and allowed for lobby Participated in the PPP loan process. Two- open the entire time. Did allow for some access by appointment only. thirds of PPP clients were non-lending clients lobby access by appointment only and took which should present new cross sell Increased communications to customers appropriate precautions. opportunities. including digital communications, enhanced Conducted an internal “call around program” website presence of related COVID-19 Purchased lunches for employees through to all employees checking in on them. information and outreach through several local businesses to support both employees centralized emails to the client base. and local community. Able to work 80 to 90 percent of non-branch personnel and lending and wealth producers Conducted a customer calling program by Increased or advanced donations to local remotely. branch personnel and made over 7,000 area organizations that are participating in personal connections with customers just to relief help to community individuals and Paid all employees 100 percent of their check in with them. businesses. This included organizations like normal pay whether they worked, could not the United Way, food pantries and YMCAs work and/or were on call. Reduced or eliminated some service fees to serving childcare for essential workers. work with customers. Enhanced cleaning procedures for all Delivered client relief by offering 90-day locations. Created loan programs to assist and aid principal and interest deferrals. Program has customers through the crisis. Includes Paid all employees a bonus in April. resulted in 145 consumer and 431 special loan rate loans for smaller commercial deferrals. Employees did not have to use personal or businesses, payment deferral program, PPP medical days if they missed time during loans and modifications. Participated in volunteering to unload some COVID-19 but were still paid. Also purchased local food pantry trucks. Focused on electronic access through: mobile personal protective equipment for all sites. banking (mobile deposit), ATM and online Reallocated some personnel to help cover for banking. additional workloads in several areas of the Managed increased call volume related to bank. stimulus payments, PPP and loan deferrals. Provided lunch daily for any employee not Prepared for lobby reopening (shields, signs, working remotely. cleaning, etc.) Brand advertising focused on “Today. Tomorrow. We’re Here for You”. Television advertising, along with digital display advertising. Digital display advertisings linked through to special content focusing on our offerings to clients through the period. 6

LCNB Franchise Market Overview $1.64 billion in assets, $1.27 billion in loans and $1.35 billion in deposits, headquartered in Lebanon, Ohio (Warren County) 33 branches in southwestern Ohio, primarily in and around the attractive Cincinnati MSA along with 1 new branch in the Columbus MSA 11th largest bank in the Cincinnati MSA by deposits Franklin County, the heart of the Columbus MSA, and Warren County, inside the Cincinnati MSA, are the third and fourth fastest growing counties of the 88 counties in Ohio with each a 4.66% and 4.01% projected 5-year population growth rate, respectively Warren County also possesses the second highest median household income in Ohio at $94,624, compared to the national average of $66,010 LCNB’s major business lines serving that market include: LCNB Deposits in Top Three Markets – Retail 2019 Deposits Percent of – Commercial Market Branches Rank ($000) Franchise (%) – Trust and Investments Cincinnati, OH-KY-IN 20 11 772,896 56.9% – Investment Services Division Columbus, OH 1 23 168,180 12.4% Dayton-Kettering, OH 3 11 128,427 9.5% Total in Top 3 24 1,069,503 78.8% Source: S&P Global Market Intelligence and Company Documents; Deposit data and rankings as of 6/30/19 7

LCNB Management Team Experienced management team with an average of 31 years of banking experience and many executives that have worked together for nearly 30 years Years of Name Experience Title Background Eric J. Meilstrup 32 President, CEO & Eric has been President of LCNB Corp. and LCNB National Bank since Director October 2018 and has been Chief Executive Officer of both LCNB Corp. and LCNB National Bank since June 2019. Robert C. Haines 28 Chief Financial Rob has been the Chief Financial Officer and Executive Vice President of Officer LCNB Corp. since January 2008. Lawrence P. Mulligan Jr. 30 Chief Operating Larry has served as Executive Vice President and Chief Operating Officer of Officer LCNB Corp. and LCNB National Bank since May 2019. Michael R. Miller 36 Executive Vice Mike has been Executive Vice President and Trust Department Head of LCNB President Corp. and LCNB National Bank since April 2017 (previously with Fifth Third). Matthew P. Layer 38 Executive Vice Matt has been Chief Lending Officer and Executive Vice President of LCNB President Corp. since January 2008. He serves as Chief Lending Officer and Executive Vice President of LCNB National Bank. Bradley A. Ruppert 21 Executive Vice Brad has been the Chief Investment Officer and Executive Vice President at President LCNB Corp. and LCNB National Bank since January 2017. 8

LCNB Financial Highlights LCNB Corp. Calendar Year Ended LTM Quarter Ended LCNB 2015 2016 2017 2018 2019 3/20 6/19 9/19 12/19 3/20 Total Assets 1,280,531 1,306,799 1,295,638 1,636,927 1,639,308 1,636,280 1,642,012 1,644,447 1,639,308 1,636,280 Gross Loans 770,938 819,803 849,060 1,198,623 1,243,451 1,272,387 1,230,261 1,225,892 1,243,451 1,272,387 Reserves 3,129 3,575 3,403 4,046 4,045 5,008 4,112 4,167 4,045 5,008 ($000) Deposits 1,087,160 1,110,905 1,085,821 1,300,919 1,348,280 1,345,872 1,357,959 1,355,383 1,348,280 1,345,872 Total Equity 140,108 142,944 150,271 218,985 228,048 233,478 222,972 225,492 228,048 233,478 Balance Sheet Sheet Balance Common Equity 140,108 142,944 150,271 218,985 228,048 233,478 222,972 225,492 228,048 233,478 Loans / Deposits 70.91 73.80 78.20 92.14 92.22 94.54 90.60 90.45 92.22 94.54 Total Equity / Assets 10.94 10.94 11.60 13.38 13.91 14.27 13.58 13.71 13.91 14.27 Tangible Equity / Tangible Assets 8.43 8.54 9.25 9.87 10.49 10.87 10.12 10.27 10.49 10.87 Common Equity / Assets 10.94 10.94 11.60 13.38 13.91 14.27 13.58 13.71 13.91 14.27 (%) Tangible Common Equity / Tangible Assets 8.43 8.54 9.25 9.87 10.49 10.87 10.12 10.27 10.49 10.87 Capital Ratios Capital Tier 1 Capital Ratio 13.46 13.00 13.29 12.65 12.21 12.44 12.44 12.36 12.21 12.44 Total Risk-Based Capital Ratio 13.85 13.41 13.66 12.98 12.52 12.82 12.77 12.68 12.52 12.82 Leverage Ratio 8.62 8.81 9.51 9.96 10.06 10.43 9.95 9.96 10.06 10.43 Net Income ($000) 11,474 12,482 12,972 14,845 18,912 19,311 4,728 4,727 4,830 5,026 Core ROAA 0.98 0.95 1.00 1.19 1.20 1.19 1.20 1.19 1.22 1.17 Core ROAE 8.83 8.56 8.86 9.46 8.75 8.64 8.75 8.75 8.78 8.30 (%) Core ROATCE 11.77 11.25 11.49 13.13 12.18 11.96 12.20 12.15 12.13 11.38 Profitability Net Interest Margin 3.64 3.51 3.58 3.63 3.71 3.77 3.70 3.70 3.79 3.90 Efficiency Ratio 60.60 61.22 62.43 61.42 63.17 62.62 63.12 62.91 62.80 61.70 NPAs / Assets 1.27 1.34 1.04 0.84 0.61 0.43 0.68 0.64 0.61 0.43 NPAs-Ex-TDRs / Assets 0.20 0.44 0.23 0.20 0.21 0.17 0.19 0.23 0.21 0.17 NPLs / Loans 2.00 2.13 1.58 1.12 0.79 0.55 0.90 0.84 0.79 0.55 (%) NCOs / Average Loans 0.18 0.06 0.05 0.03 0.02 0.05 0.02 0.07 0.04 0.07 Asset Quality Asset Reserves / Gross Loans 0.41 0.44 0.40 0.34 0.33 0.39 0.33 0.34 0.33 0.39 Reserves / NPLs 20.26 20.48 25.33 30.04 41.20 72.01 37.21 40.43 41.20 72.01 Common Shares Outstanding 9,925,547 9,998,025 10,023,059 13,295,276 12,936,783 12,969,076 12,978,554 12,927,463 12,936,783 12,969,076 Book Value Per Share 14.12 14.30 14.99 16.47 17.63 18.00 17.18 17.44 17.63 18.00 Tangible Book Value Per Share 10.58 10.86 11.64 11.67 12.78 13.18 12.30 12.57 12.78 13.18 ($) EPS after Extra 1.17 1.25 1.29 1.24 1.44 1.48 0.36 0.36 0.37 0.39 Dividends Paid 0.64 0.64 0.64 0.65 0.69 0.70 0.17 0.17 0.18 0.18 PerData Share Dividend Payout Ratio 54.70 51.20 49.61 52.42 47.92 47.30 47.22 47.22 48.65 46.15 Source: S&P Global Market Intelligence 9

LCNB Investment Highlights Consistent and Strong ROATCE1 LCNB has consistently delivered solid operating performance and profitability regardless of economic climate, as demonstrated in the chart below. LCNB has been at approximately an 11% Return on Average Tangible Common Equity or higher in various economic cycles over the last 15 years and over the last twelve months. 16.00% 14.75% 14.00% 13.54% 13.11% 12.59% 12.21% 12.26% 11.79% 11.90% 11.75% 12.00% 11.68% 11.73% 11.49% 11.08% 10.96% 11.06% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 LTM LCNB Peer Median Peer Average Source: S&P Global Market Intelligence 1 Peers defined as nationwide public banks and thrifts; LTM as of 3/31/20 10

LCNB Loan Portfolio Balanced Loan Portfolio Sound Strong Loan Portfolio LCNB has a well balanced loan portfolio in its Central Balanced real estate portfolio with a weighted average LTV and Southwestern Ohio markets which have seen of 48.1% representing roughly 85.0% of the assets in the fewer consequences due to unemployment than other portfolio. areas in our state. % by April Unemployment in Portfolio Average Loan % by Market Compared to Property Loan Balance Current Region Count Amount to State Average Type Count ($) LTV Cincinnati 47% 42% -2.20% Student Housing 42 21,768,499 74% Columbus 27% 38% -0.70% Dental 38 17,388,559 71% Dayton 27% 20% -2.10% Warehouse 57 30,494,262 54% Grand Total 100% 100% -1.67% Self-storage 25 30,959,032 56% Residential Land 12 967,875 56% Office building 170 111,320,537 54% Multi-Family Residence 156 170,904,311 52% Restaurant 35 11,186,883 52% Mixed Use 83 69,472,090 51% Retail 153 139,059,961 50% Other 24 24,389,029 47% Industrial 37 30,038,922 46% Multi-Family Tracts 1 84,147 45% Research & Development 1 1,122,984 45% Commercial Land 7 2,038,352 43% 1-4 Family Residence 4,682 333,663,320 43% Healthcare 24 27,929,075 43% Hotel 19 50,191,214 41% Agricultural Land 110 36,280,022 41% Golf/Recreation 8 9,995,636 40% Manufacturing 19 12,690,394 39% Commercial Tracts 5 3,551,295 37% Religious 56 23,630,864 34% Source: Company Documents 11

LCNB Loan Deferrals Deferrals by Type ($000) Largest Commercial Deferral Types (61% of Total) ($000) $14,024 — 4% $32,072 — 14% $51,288 — 23% $38,301 — 17% $43,173 — 19% $371,435 — 96% $62,272 — 27% Consumer Commercial Hotel/Motel Dental Retail Building Office Building Multi-Family Source: Company Documents 12

Deposit & Loan Composition Deposit Composition Loan Composition Farm Construction 3.6% HELOC 5.8% 2.3% Consumer Time > 2.3% $100k 11.5% 1-4 Family Time < C&I 22.8% $100k 6.7% 12.0% Transaction 48.9% MMDA + Savings Multifamily + CRE 27.5% 56.5% MRQ Cost of Interest-bearing Deposits 0.85% MRQ Yield on Loans 4.89% MRQ Cost of Funds 0.69% MRQ Yield on Interest-earning Assets 4.57% Source: S&P Global Market Intelligence; Regulatory data as of 3/31/20 Note: Deposits, Costs and Yields are GAAP data as of 3/31/20 13

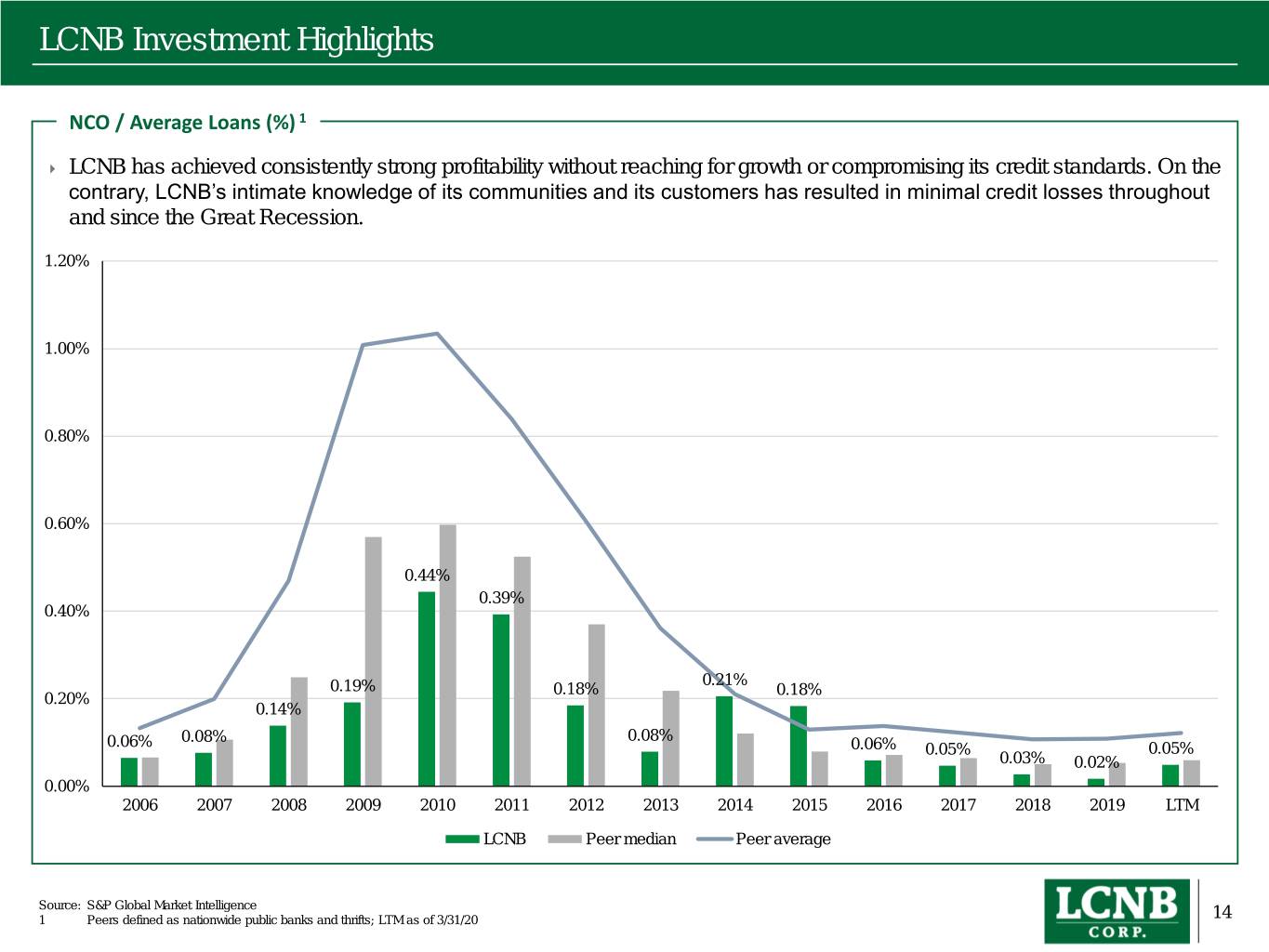

LCNB Investment Highlights NCO / Average Loans (%) 1 LCNB has achieved consistently strong profitability without reaching for growth or compromising its credit standards. On the contrary, LCNB’s intimate knowledge of its communities and its customers has resulted in minimal credit losses throughout and since the Great Recession. 1.20% 1.00% 0.80% 0.60% 0.44% 0.39% 0.40% 0.21% 0.19% 0.18% 0.18% 0.20% 0.14% 0.08% 0.08% 0.06% 0.06% 0.05% 0.05% 0.03% 0.02% 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 LTM LCNB Peer median Peer average Source: S&P Global Market Intelligence 1 Peers defined as nationwide public banks and thrifts; LTM as of 3/31/20 14

Stable Common Dividends Common Dividend Payments Per Share LCNB has never decreased or suspended its dividend Since Holding Company creation in 1998, LCNB has consistently maintained or increased its quarterly dividend LCNB shares currently yield 4.45% versus a median for exchange traded banks of 2.59% $0.72 $0.69 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.65 $0.62 $0.60 $0.58 $0.56 $0.53 $0.51 $0.46 $0.45 $0.40 $0.36 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020¹ Source: S&P Global Market Intelligence 1 2020 is annualized as of 3/31/20 2 Dividend yield as of 6/5/20 15

LCNB Return of Capital Common Dividend Payments Per Share1 In 12 of the last 15 years, LCNB has returned half or more of its net income to shareholders through dividends. Unlike many banks during the 2008 – 2011 period, LCNB never reduced its dividend and maintains a strong dividend payout ratio. In addition, LCNB has pursued stock buybacks in the last year as part of its overall capital management plan. 70% 65.96% 64.65% 64.65% 60.00% 60.95% 60% 58.18% 54.70% 53.33% 52.46% 52.42% 51.20% 49.61% 50% 47.92% 47.30% 46.04% 40% 30% 20% 10% 0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 LTM LCNB Peer median Peer average Source: S&P Global Market Intelligence 1 Peers defined as nationwide public banks and thrifts; LTM as of 3/31/20 16

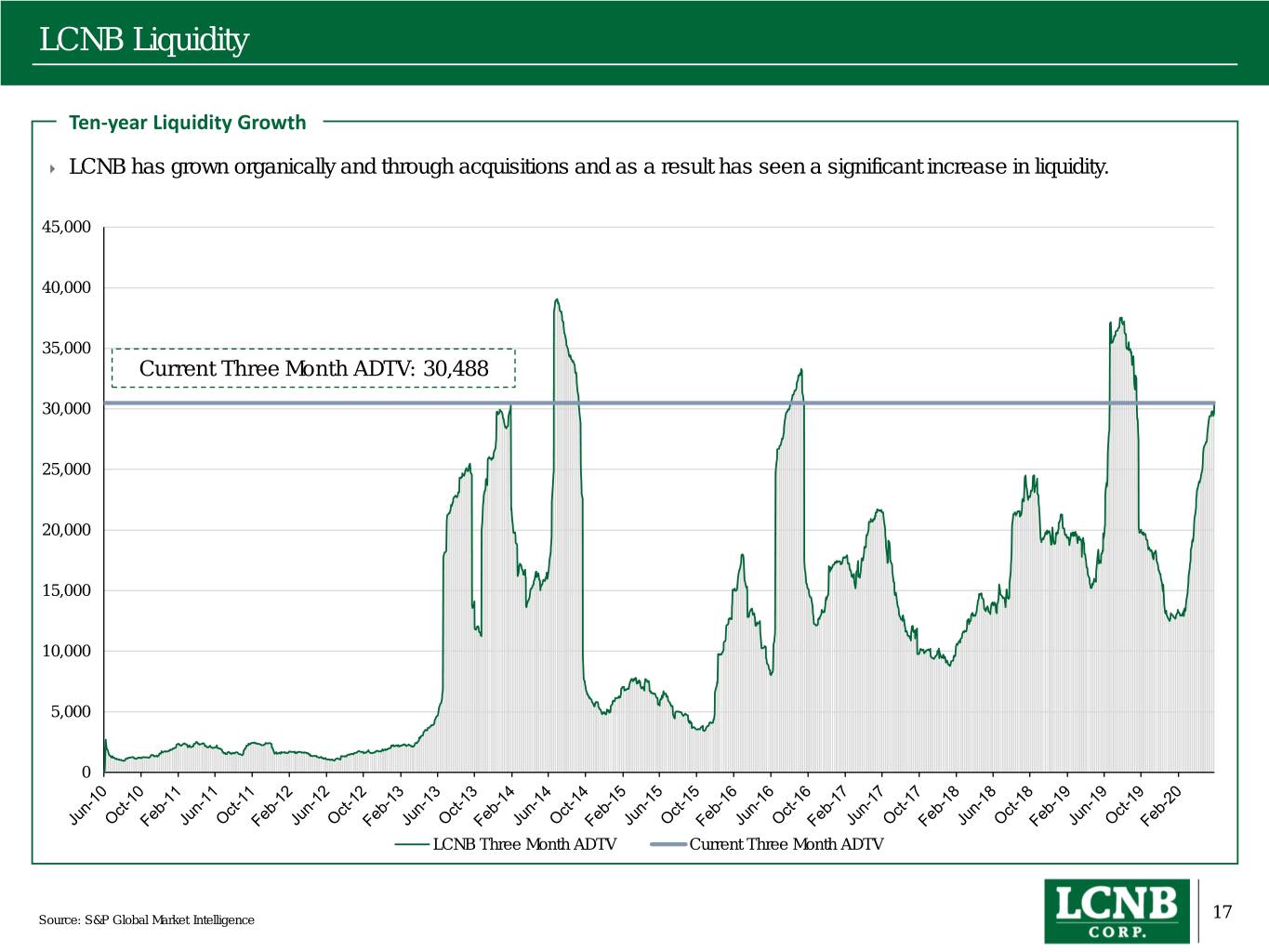

LCNB Liquidity Ten-year Liquidity Growth LCNB has grown organically and through acquisitions and as a result has seen a significant increase in liquidity. 45,000 40,000 35,000 Current Three Month ADTV: 30,488 30,000 25,000 20,000 15,000 10,000 5,000 0 LCNB Three Month ADTV Current Three Month ADTV Source: S&P Global Market Intelligence 17

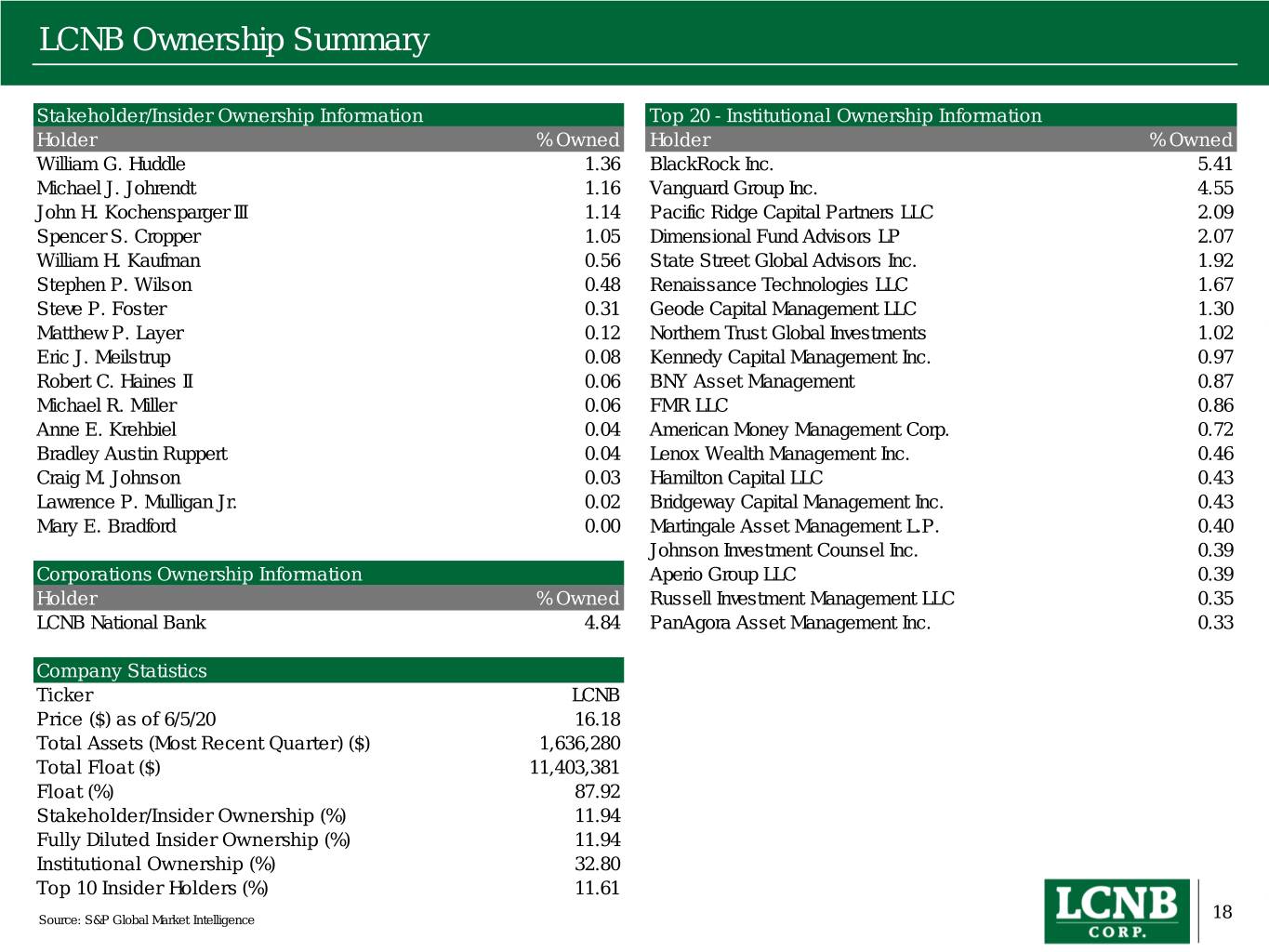

LCNB Ownership Summary Stakeholder/Insider Ownership Information Top 20 - Institutional Ownership Information Holder % Owned Holder % Owned William G. Huddle 1.36 BlackRock Inc. 5.41 Michael J. Johrendt 1.16 Vanguard Group Inc. 4.55 John H. Kochensparger III 1.14 Pacific Ridge Capital Partners LLC 2.09 Spencer S. Cropper 1.05 Dimensional Fund Advisors LP 2.07 William H. Kaufman 0.56 State Street Global Advisors Inc. 1.92 Stephen P. Wilson 0.48 Renaissance Technologies LLC 1.67 Steve P. Foster 0.31 Geode Capital Management LLC 1.30 Matthew P. Layer 0.12 Northern Trust Global Investments 1.02 Eric J. Meilstrup 0.08 Kennedy Capital Management Inc. 0.97 Robert C. Haines II 0.06 BNY Asset Management 0.87 Michael R. Miller 0.06 FMR LLC 0.86 Anne E. Krehbiel 0.04 American Money Management Corp. 0.72 Bradley Austin Ruppert 0.04 Lenox Wealth Management Inc. 0.46 Craig M. Johnson 0.03 Hamilton Capital LLC 0.43 Lawrence P. Mulligan Jr. 0.02 Bridgeway Capital Management Inc. 0.43 Mary E. Bradford 0.00 Martingale Asset Management L.P. 0.40 Johnson Investment Counsel Inc. 0.39 Corporations Ownership Information Aperio Group LLC 0.39 Holder % Owned Russell Investment Management LLC 0.35 LCNB National Bank 4.84 PanAgora Asset Management Inc. 0.33 Company Statistics Ticker LCNB Price ($) as of 6/5/20 16.18 Total Assets (Most Recent Quarter) ($) 1,636,280 Total Float ($) 11,403,381 Float (%) 87.92 Stakeholder/Insider Ownership (%) 11.94 Fully Diluted Insider Ownership (%) 11.94 Institutional Ownership (%) 32.80 Top 10 Insider Holders (%) 11.61 Source: S&P Global Market Intelligence 18

LCNB Total Return Ten-year Total Return (%) 200% 150% 98.9% 100% 86.3% 85.7% 50% 0% -50% LCNB SNL U.S. Bank & Thrift SNL Micro Cap U.S. Bank & Thrift Source: S&P Global Market Intelligence as of 6/5/20 19

Attractive Relative Valuation Selected Midwest Bank Peer Group Banks and thrifts headquartered in Ohio, Kentucky and Indiana with assets $1 billion – $3 billion, excluding merger targets Financials as of: 3/31/2020 Operating Information Market Information TCE / LTM LTM Price / Price / Tang. LTM Core LTM Core Efficiency Loans / NPAs / NCOs / 6/5/20 Market Div. Tang. Price / 20E Assets Assets ROAA ROATCE Ratio Deposits Assets Loans Price Cap Yield Book LTM EPS EPS Ticker Name HQ ($MM) (%) (%) (%) (%) (%) (%) (%) ($) ($MM) (%) (%) (x) (x) 1. FMNB Farmers National Banc Corp. Canfield, OH 2,668.2 9.61 1.55 15.34 56.0 88.0 0.56 0.10 13.18 371.4 3.34 147.5 9.7 13.4 2. CIVB Civista Bancshares, Inc. Sandusky, OH 2,575.9 9.82 1.42 13.87 61.9 87.5 0.31 0.00 16.87 270.6 2.61 110.7 8.6 10.3 3. SFIG.A STAR Financial Group, Inc. Fort Wayne, IN 2,102.6 11.16 1.15 10.45 67.9 81.5 1.16 0.12 60.00 206.4 1.92 88.1 8.7 NA 4. FFMR First Farmers Financial Corporation Converse, IN 1,974.7 10.12 1.63 17.21 52.4 89.8 2.68 0.27 44.51 316.7 2.88 168.5 10.8 NA 5. FMAO Farmers & Merchants Bancorp, Inc. Archbold, OH 1,655.1 11.58 1.25 11.18 59.8 92.5 0.28 0.06 23.89 263.8 2.68 143.1 13.4 15.6 6. FSFG First Savings Financial Group Jeffersonville, IN 1,368.3 7.71 1.00 16.60 81.6 94.8 1.58 0.14 44.97 106.3 1.51 101.7 9.0 9.9 7. NWIN NorthWest Indiana Bancorp Munster, IN 1,349.9 9.35 1.00 11.39 67.1 79.1 0.77 0.17 32.27 111.8 3.84 89.6 8.5 NA 8. LMST Limestone Bancorp, Inc. Louisville, KY 1,274.2 7.57 0.88 10.15 71.0 90.9 0.41 0.07 11.16 82.9 0.00 87.2 8.1 18.4 9. MBCN Middlefield Banc Corp. Middlefield, OH 1,213.9 9.66 0.91 9.06 63.3 99.4 1.03 0.14 20.25 129.0 2.96 111.5 12.1 15.7 10. HLAN Heartland BancCorp Whitehall, OH 1,173.8 10.64 1.18 10.76 64.1 96.6 0.23 0.01 65.00 129.5 3.51 104.3 10.1 15.5 11. KTYB Kentucky Bancshares, Inc. Paris, KY 1,143.4 9.18 1.05 11.18 70.7 91.2 0.56 0.10 15.90 94.1 4.53 91.2 8.2 NA 12. SBFG SB Financial Group, Inc. Defiance, OH 1,088.3 11.03 0.98 9.61 73.2 96.2 0.61 0.07 16.84 129.6 2.38 110.5 12.9 10.7 13. CNUN Community Bancshares, Inc. McArthur, OH 1,051.4 10.78 0.88 8.08 71.8 83.4 0.40 0.17 66.00 86.3 0.00 76.7 9.8 NA 14. OVBC Ohio Valley Banc Corp. Gallipolis, OH 1,035.8 11.96 0.66 5.77 78.5 91.6 1.57 0.23 26.49 126.8 3.17 103.1 18.5 NA 15. RMBI Richmond Mutual Bancorporation, Inc. Richmond, IN 1,007.6 19.17 0.85 5.42 67.2 114.7 0.12 0.12 12.23 165.4 1.64 85.6 NM NA Average 1,512.2 10.62 1.09 11.07 67.1 91.8 0.82 0.12 172.7 2.46 107.9 10.6 13.7 1/4/1900 Median 1,274.2 10.12 1.00 10.76 67.2 91.2 0.56 0.12 129.5 2.68 103.1 9.7 14.5 LCNB LCNB Corp. Lebanon, OH 1,636.3 10.87 1.19 11.96 62.6 94.5 0.43 0.05 16.18 209.9 4.45 122.7 10.8 11.2 Source: S&P Global; Note: Where current operating information was unavailable, bank-level or most recent available reporting period was used. NA = not available; NM = not meaningful 20