Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KANSAS CITY SOUTHERN | ksu-20200609.htm |

Exhibit 99.1 KANSAS CITY SOUTHERN Deutsche Bank 11th Annual Global Industrials & Materials Summit th KCS June 9 , 2020

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. In addition, management may make forward-looking statements orally or in other writing, including, but not limited to, in press releases, quarterly earnings calls, executive presentations, in the annual report to stockholders and in other filings with the Securities and Exchange Commission. Readers can usually identify these forward-looking statements by the use of such words as "may," "will," "should," "likely," "plans," "projects," "expects," "anticipates," "believes" or similar words. These statements involve a number of risks and uncertainties. Actual results could materially differ from those anticipated by such forward-looking statements as a result of a number of factors or combination of factors including, but not limited: public health threats or outbreaks of communicable diseases, such as the ongoing COVID-19 pandemic and its impact on KCS’s business, suppliers, consumers, customers, employees and supply chains; rail accidents or other incidents or accidents on KCS’s rail network or at KCS’s facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; legislative and regulatory developments and disputes, including environmental regulations; loss of the rail concession of Kansas City Southern’s subsidiary, Kansas City Southern de México, S.A. de C.V.; domestic and international economic, political and social conditions; disruptions to the Company’s technology infrastructure, including its computer systems; increased demand and traffic congestion; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; natural events such as severe weather, hurricanes and floods; the outcome of claims and litigation involving the Company or its subsidiaries; competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; the termination of, or failure to renew, agreements with customers, other railroads and third parties; fluctuation in prices or availability of key materials, in particular diesel fuel; access to capital; climate change and the market and regulatory responses to climate change; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities, war or other acts of violence; and other factors affecting the operation of the business; and other risks identified in this presentation, in KCS's Annual Report on Form 10-K for the year ended December 31, 2019, and in other reports filed by KCS with the Securities and Exchange Commission. Forward-looking statements reflect the information only as of the date on which they are made. KCS does not undertake any obligation to update any forward-looking statements to reflect future events, developments, or other information. Reconciliation to U.S. GAAP Financial Information In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying presentation contains non-GAAP financial measures. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and liquidity, and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. All reconciliations to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP can be found on the KCS's website in the Investors section. © KANSAS © KANSAS CITY SOUTHERN KCS 2

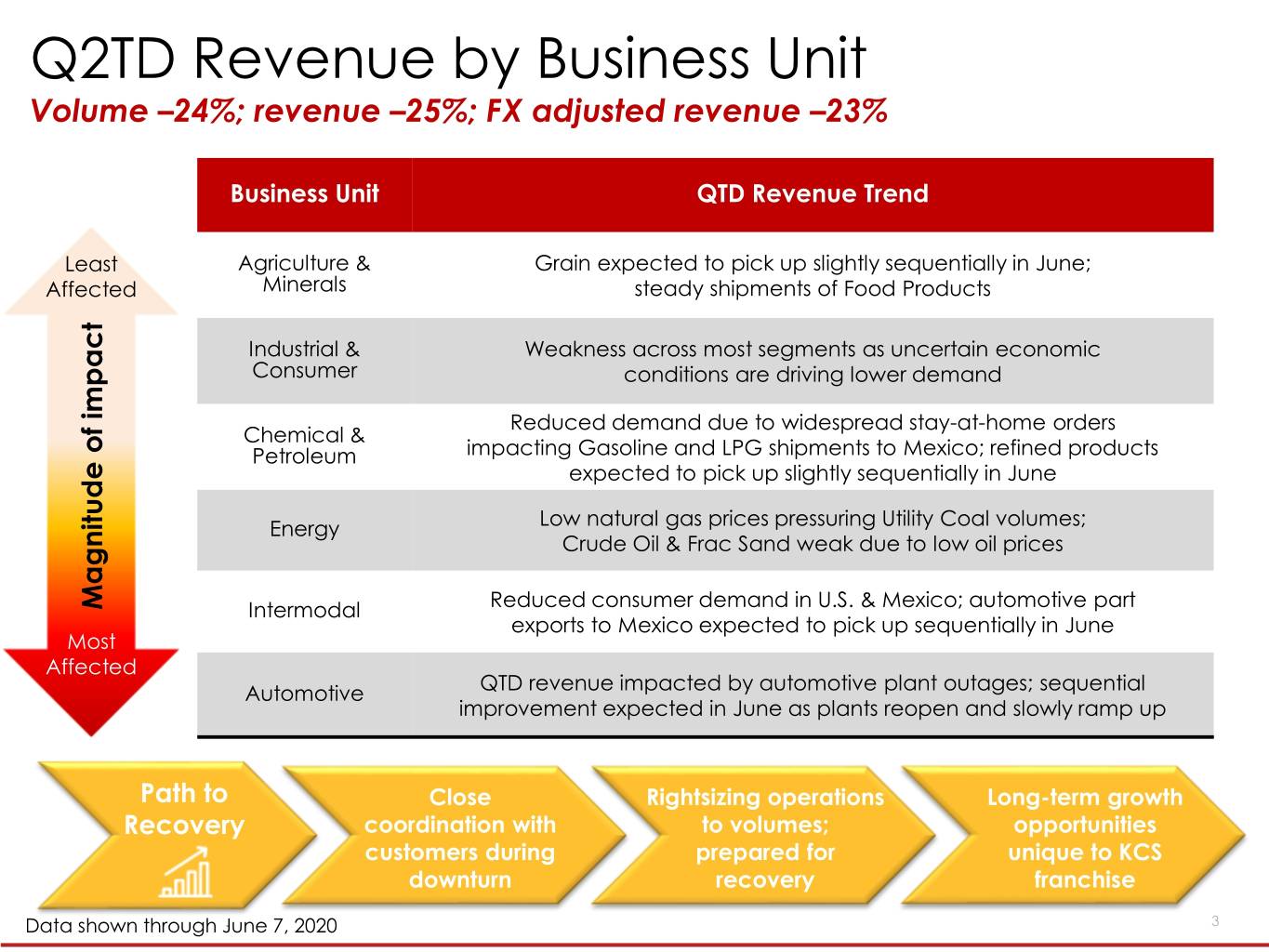

Q2TD Revenue by Business Unit Volume –24%; revenue –25%; FX adjusted revenue –23% Business Unit QTD Revenue Trend Least Agriculture & Grain expected to pick up slightly sequentially in June; Affected Minerals steady shipments of Food Products Industrial & Weakness across most segments as uncertain economic Consumer conditions are driving lower demand Reduced demand due to widespread stay-at-home orders Chemical & Petroleum impacting Gasoline and LPG shipments to Mexico; refined products expected to pick up slightly sequentially in June Energy Low natural gas prices pressuring Utility Coal volumes; Crude Oil & Frac Sand weak due to low oil prices Magnitude of impact Intermodal Reduced consumer demand in U.S. & Mexico; automotive part exports to Mexico expected to pick up sequentially in June Most Affected Automotive QTD revenue impacted by automotive plant outages; sequential improvement expected in June as plants reopen and slowly ramp up Path to Close Rightsizing operations Long-term growth Recovery coordination with to volumes; opportunities customers during prepared for unique to KCS downturn recovery franchise © KANSAS CITY SOUTHERN Data shownKCS through June 7, 2020 3

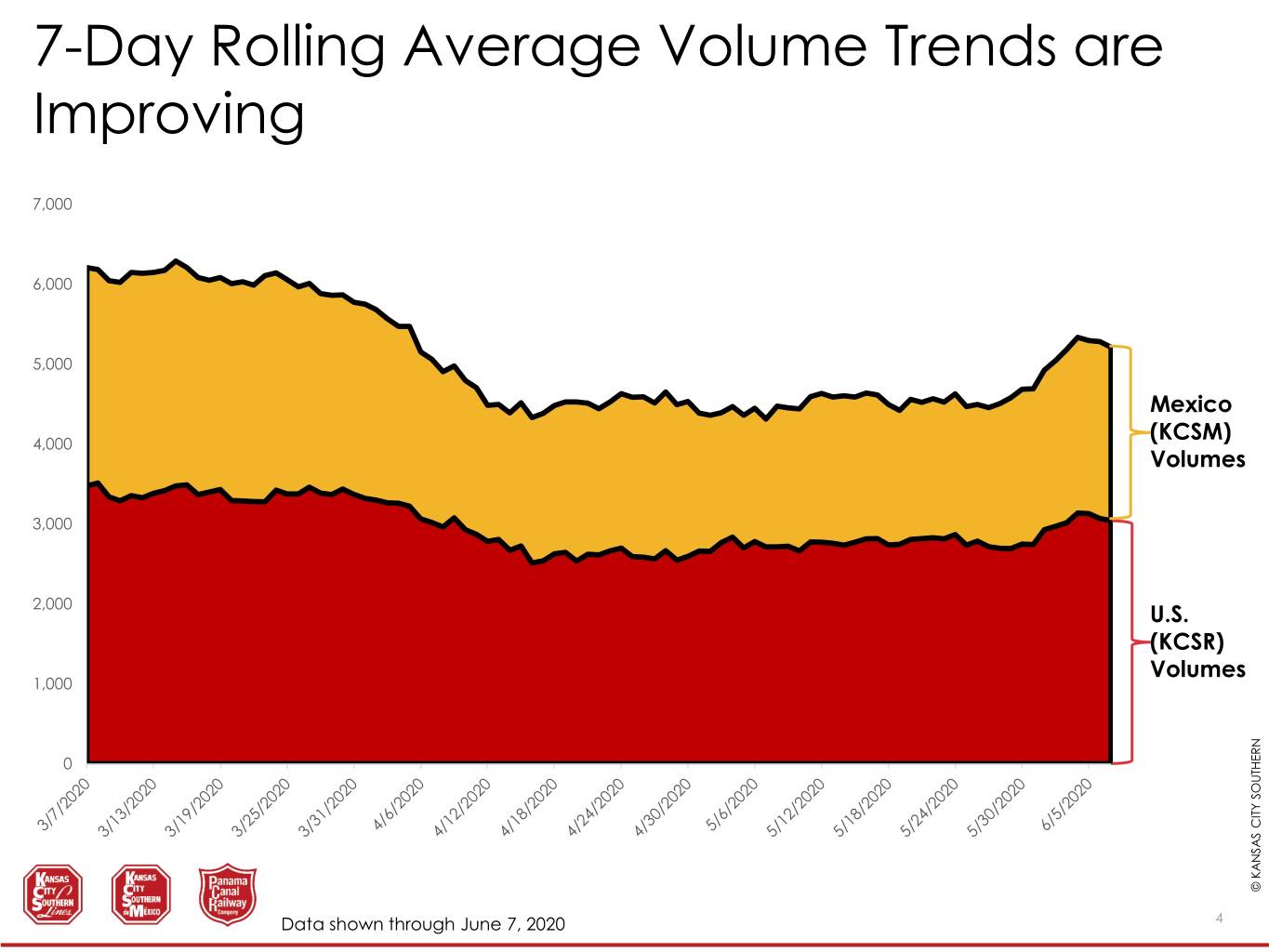

7-Day Rolling Average Volume Trends are Improving 7,000 6,000 5,000 Mexico (KCSM) 4,000 Volumes 3,000 2,000 U.S. (KCSR) Volumes 1,000 0 © KANSAS © KANSAS CITY SOUTHERN KCS Data shown through June 7, 2020 4

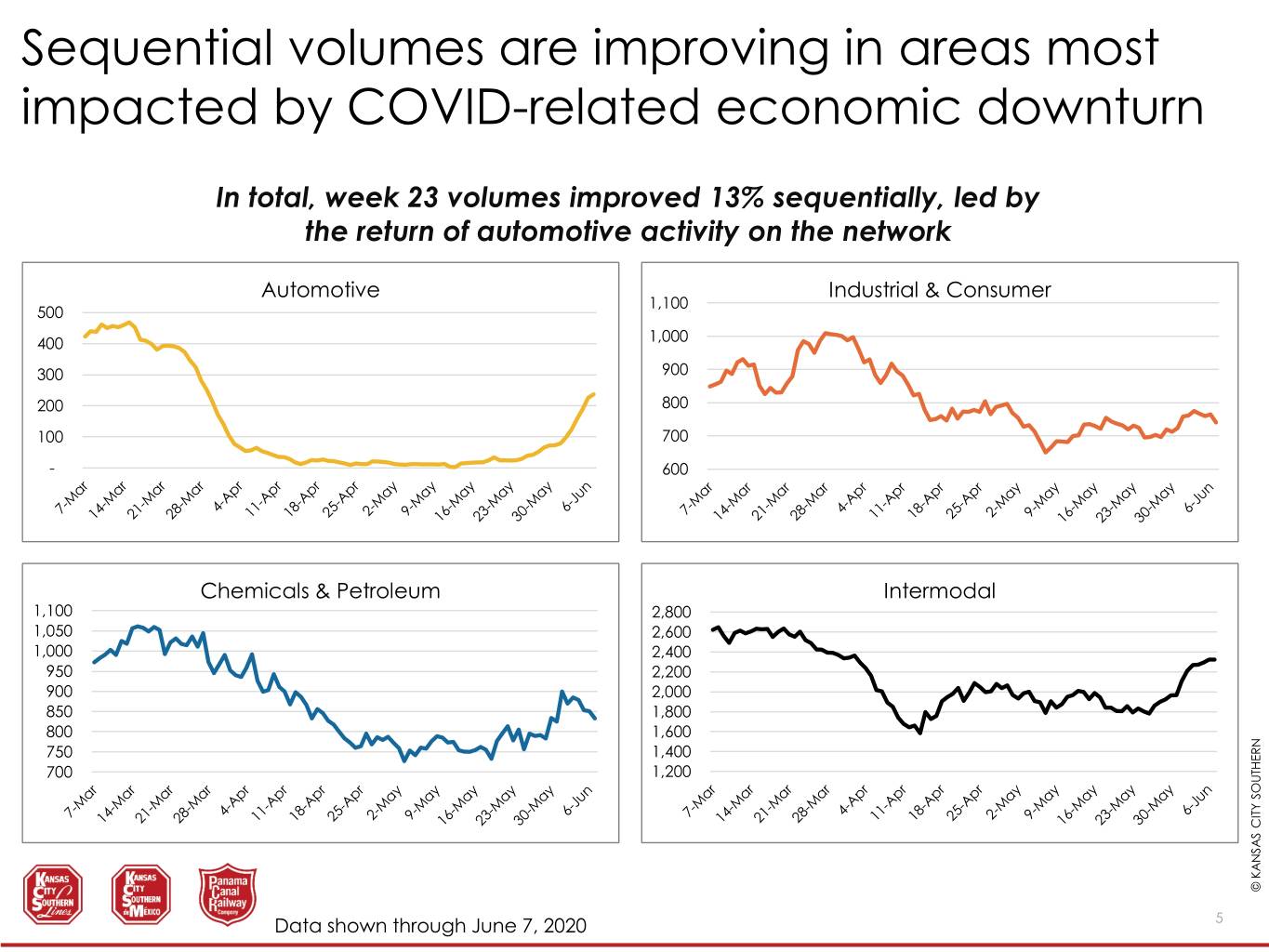

Sequential volumes are improving in areas most impacted by COVID-related economic downturn In total, week 23 volumes improved 13% sequentially, led by the return of automotive activity on the network Automotive Industrial & Consumer 1,100 500 400 1,000 300 900 200 800 100 700 - 600 Chemicals & Petroleum Intermodal 1,100 2,800 1,050 2,600 1,000 2,400 950 2,200 900 2,000 850 1,800 800 1,600 750 1,400 700 1,200 © KANSAS © KANSAS CITY SOUTHERN KCS Data shown through June 7, 2020 5

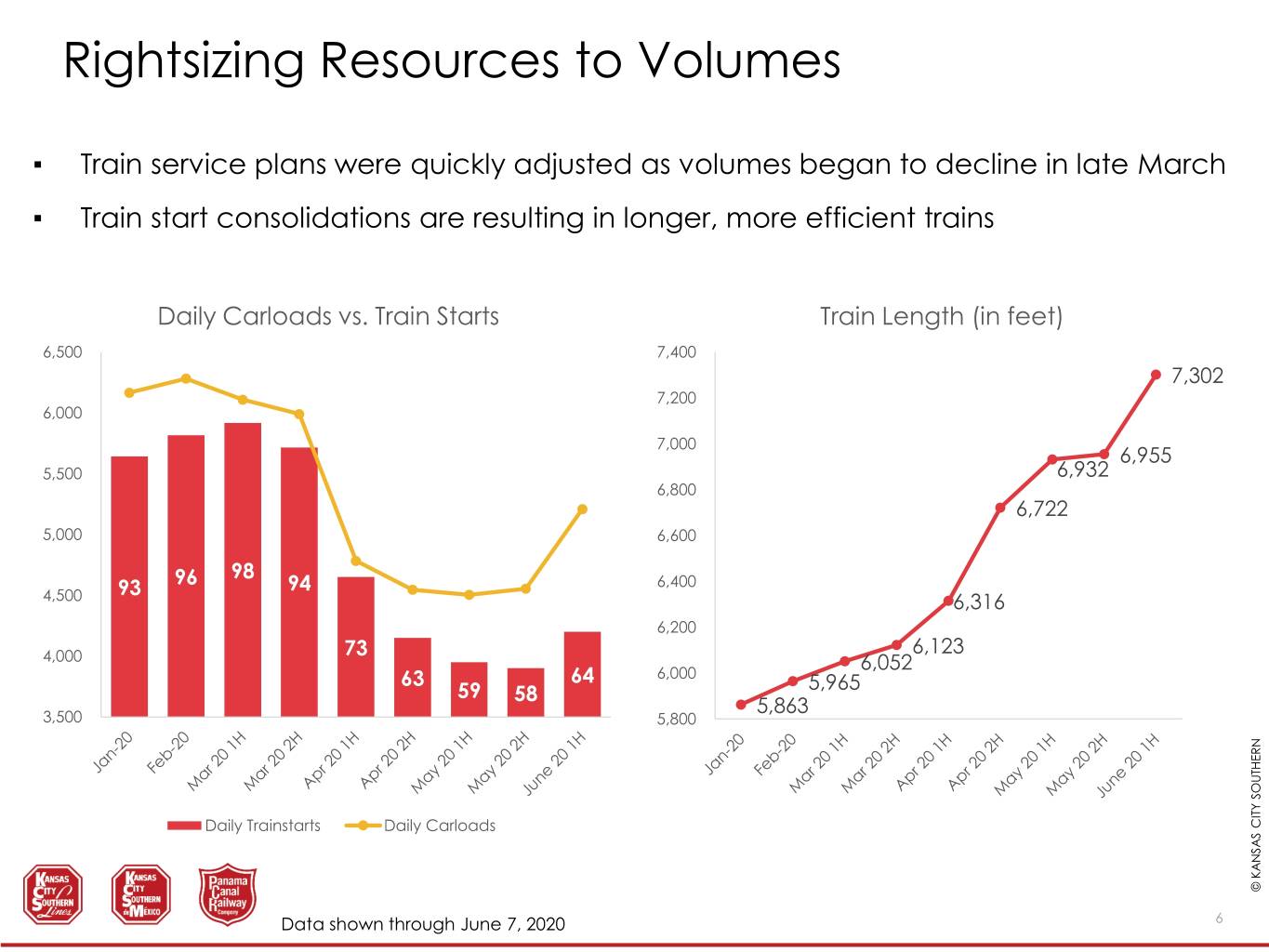

Rightsizing Resources to Volumes ▪ Train service plans were quickly adjusted as volumes began to decline in late March ▪ Train start consolidations are resulting in longer, more efficient trains Daily Carloads vs. Train Starts Train Length (in feet) 6,500 7,400 7,302 7,200 6,000 7,000 6,955 5,500 6,932 6,800 6,722 5,000 6,600 96 98 93 94 6,400 4,500 6,316 6,200 73 6,123 4,000 6,052 63 64 6,000 5,965 59 58 5,863 3,500 5,800 Daily Trainstarts Daily Carloads © KANSAS © KANSAS CITY SOUTHERN KCS Data shown through June 7, 2020 6

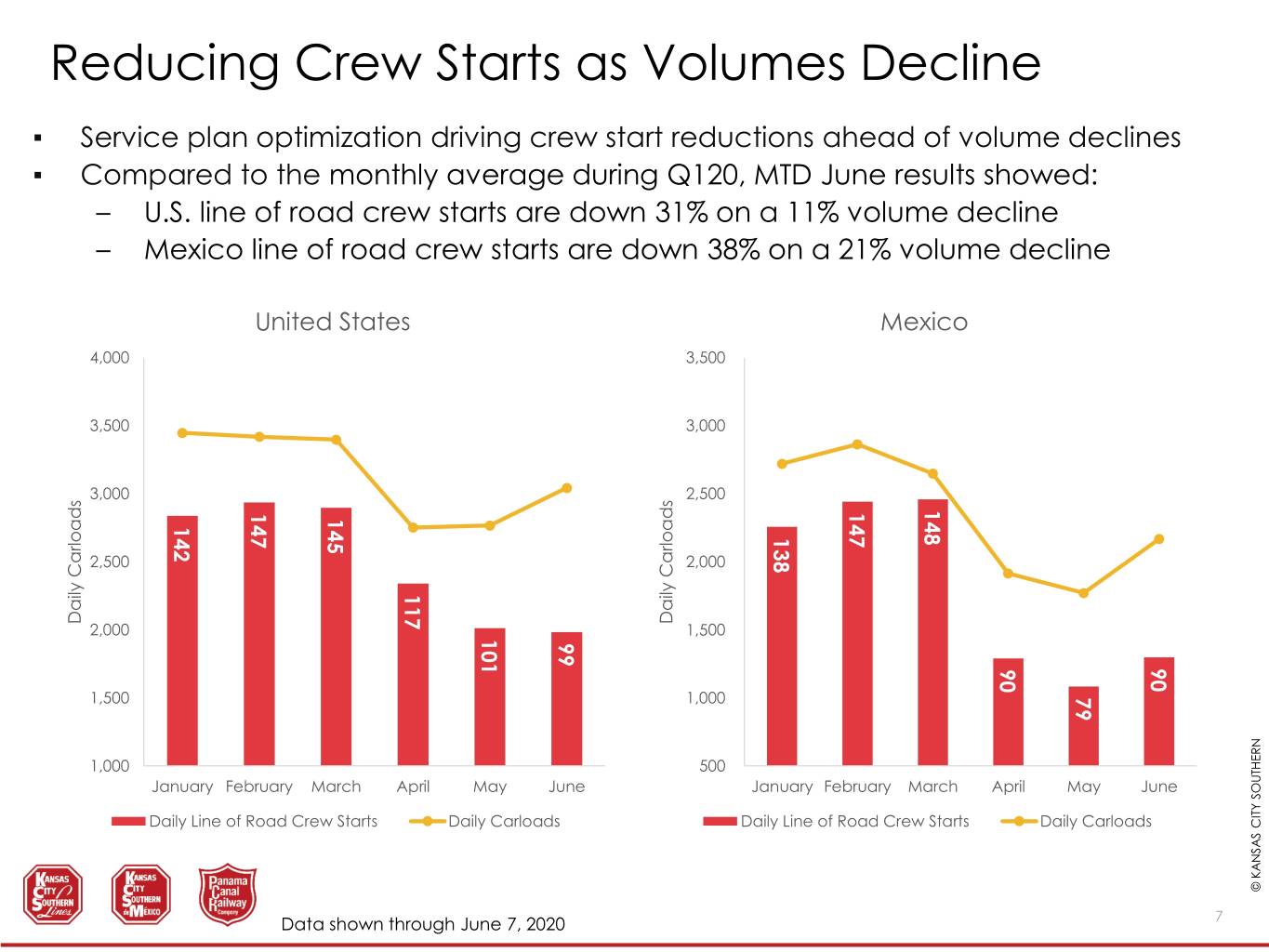

Reducing Crew Starts as Volumes Decline ▪ Service plan optimization driving crew start reductions ahead of volume declines ▪ Compared to the monthly average during Q120, MTD June results showed: – U.S. line of road crew starts are down 31% on a 11% volume decline – Mexico line of road crew starts are down 38% on a 21% volume decline United States Mexico 4,000 3,500 3,500 3,000 3,000 2,500 148 147 147 145 142 138 2,500 2,000 117 DailyCarloads DailyCarloads 2,000 1,500 101 99 90 90 1,500 1,000 79 1,000 500 January February March April May June January February March April May June Daily Line of Road Crew Starts Daily Carloads Daily Line of Road Crew Starts Daily Carloads © KANSAS © KANSAS CITY SOUTHERN KCS Data shown through June 7, 2020 7

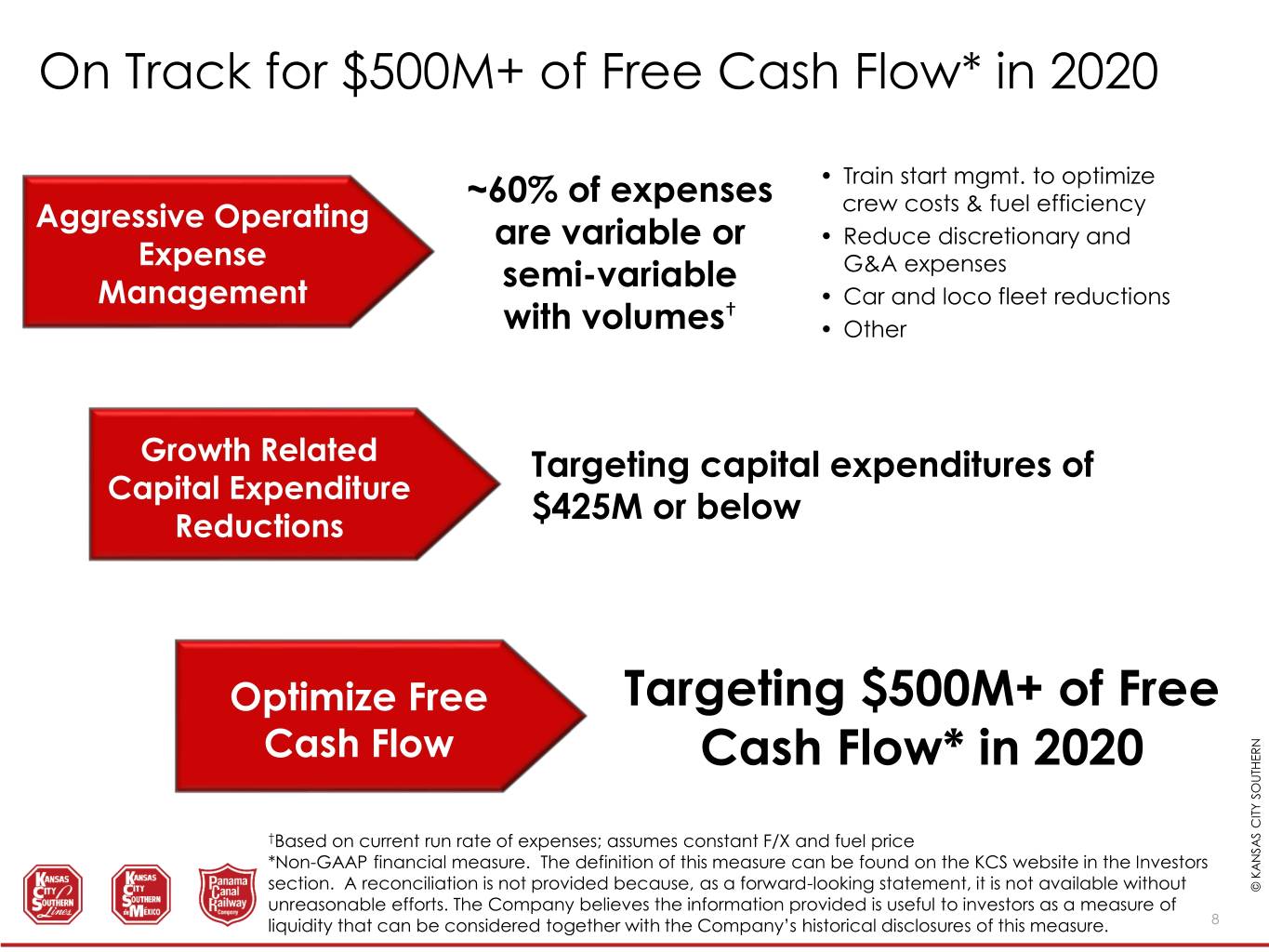

On Track for $500M+ of Free Cash Flow* in 2020 ~60% of expenses • Train start mgmt. to optimize Aggressive Operating crew costs & fuel efficiency are variable or • Reduce discretionary and Expense semi-variable G&A expenses Management • Car and loco fleet reductions † with volumes • Other Growth Related Targeting capital expenditures of Capital Expenditure $425M or below Reductions Optimize Free Targeting $500M+ of Free Cash Flow Cash Flow* in 2020 †Based on current run rate of expenses; assumes constant F/X and fuel price *Non-GAAP financial measure. The definition of this measure can be found on the KCS website in the Investors section. A reconciliation is not provided because, as a forward-looking statement, it is not available without © KANSAS CITY SOUTHERN unreasonable efforts. The Company believes the information provided is useful to investors as a measure of KCS liquidity that can be considered together with the Company’s historical disclosures of this measure. 8

Key Growth Drivers KCS links the heart of Mexico’s manufacturing region with all Class I rails, offering a single connection from Mexico to all major markets in the U.S. and Canada Uniquely-positioned to participate in Mexico’s growing economy and near- sourcing phenomenon USDG Diluent Recovery Unit will provide a more sustainable option for crude by rail movements to Port Arthur starting in 2021 Single-line intermodal service between U.S. and Mexico offers unique opportunity for long-term truck to rail conversion Sole rail provider to the port of Lázaro Cárdenas Access to the Gulf Coast petrochemical and plastics build-out due to abundant low-cost natural gas Well-positioned to participate in Mexico’s energy reform, moving refined products and LPG’s from the U.S. Gulf Coast to Northern and Central Mexico © KANSAS © KANSAS CITY SOUTHERN KCS 9

Thank You! www.KCSouthern.com © KANSAS © KANSAS CITY SOUTHERN KCS 10