Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Chewy, Inc. | chwyq12020exhibit991.htm |

| 8-K - 8-K - Chewy, Inc. | chwyq120208-k.htm |

Q1 Fiscal 2020 June 9, 2020 LETTER TO SHAREHOLDERS

Our mission To be the most trusted and convenient online destination for pet parents (and partners) everywhere. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 2

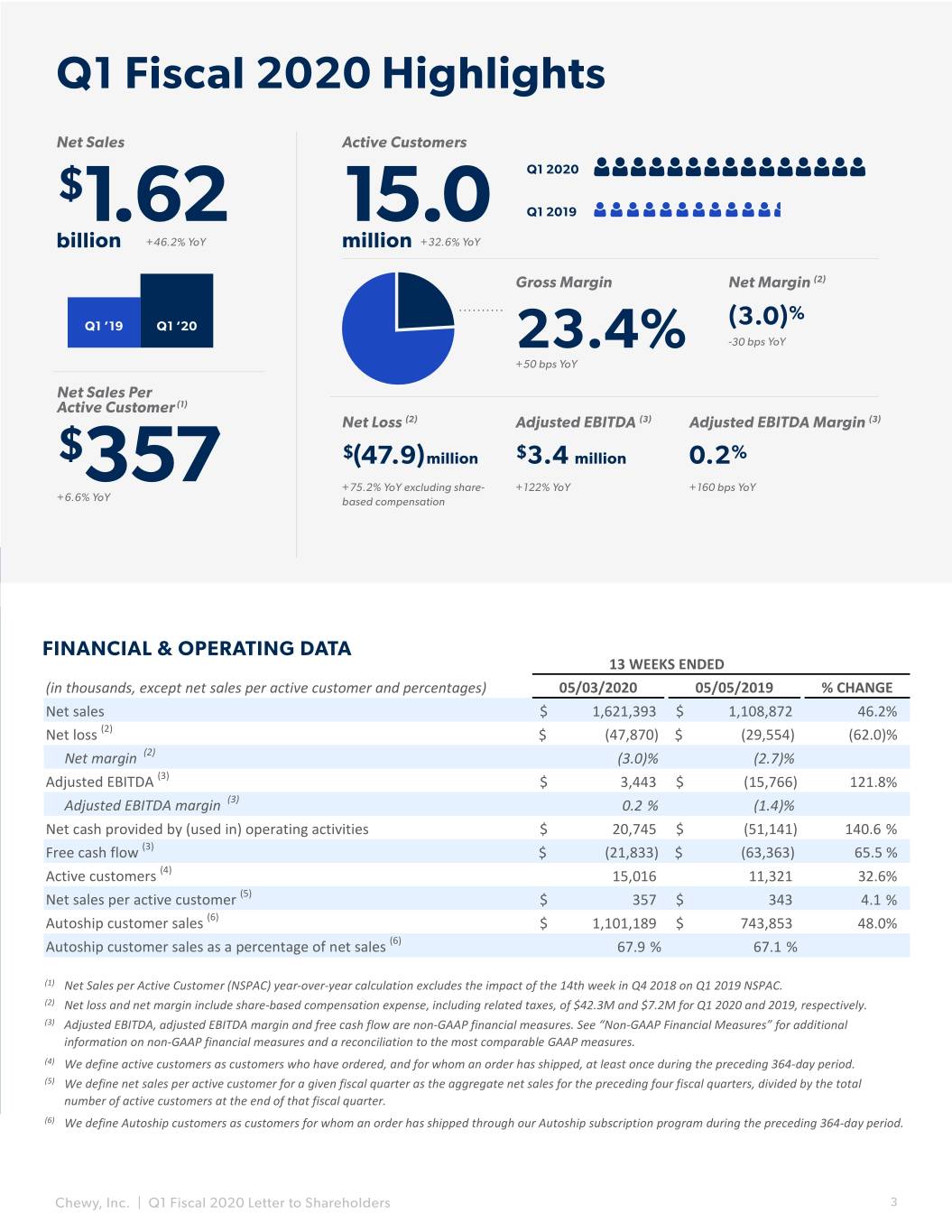

Q1 Fiscal 2020 Highlights Net Sales Active Customers $ Q1 2020 1.62 15.0 Q1 2019 billion +46.2% YoY million +32.6% YoY Gross Margin Net Margin (2) % Q1 ’19 Q1 ‘20 (3.0) 23.4% -30 bps YoY +50 bps YoY Net Sales Per Active Customer (1) Net Loss (2) Adjusted EBITDA (3) Adjusted EBITDA Margin (3) $ $(47.9) million $3.4 million 0.2% 357 +75.2% YoY excluding share- +122% YoY +160 bps YoY +6.6% YoY based compensation FINANCIAL & OPERATING DATA 13 WEEKS ENDED (in thousands, except net sales per active customer and percentages) 05/03/2020 05/05/2019 % CHANGE Net sales $ 1,621,393 $ 1,108,872 46.2% Net loss (2) $ (47,870) $ (29,554) (62.0)% Net margin (2) (3.0)% (2.7)% Adjusted EBITDA (3) $ 3,443 $ (15,766) 121.8% Adjusted EBITDA margin (3) 0.2 % (1.4)% Net cash provided by (used in) operating activities $ 20,745 $ (51,141) 140.6 % Free cash flow (3) $ (21,833) $ (63,363) 65.5 % Active customers (4) 15,016 11,321 32.6% Net sales per active customer (5) $ 357 $ 343 4.1 % Autoship customer sales (6) $ 1,101,189 $ 743,853 48.0% Autoship customer sales as a percentage of net sales (6) 67.9 % 67.1 % (1) Net Sales per Active Customer (NSPAC) year-over-year calculation excludes the impact of the 14th week in Q4 2018 on Q1 2019 NSPAC. (2) Net loss and net margin include share-based compensation expense, including related taxes, of $42.3M and $7.2M for Q1 2020 and 2019, respectively. (3) Adjusted EBITDA, adjusted EBITDA margin and free cash flow are non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures. (4) We define active customers as customers who have ordered, and for whom an order has shipped, at least once during the preceding 364-day period. (5) We define net sales per active customer for a given fiscal quarter as the aggregate net sales for the preceding four fiscal quarters, divided by the total number of active customers at the end of that fiscal quarter. (6) We define Autoship customers as customers for whom an order has shipped through our Autoship subscription program during the preceding 364-day period. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 3

Dear Shareholder, We are pleased to share our results for the first quarter ended May 3, 2020. It was a milestone quarter for Chewy, as we added a record number of new customers and recorded the first positive adjusted EBITDA quarter in the company’s history. First Quarter Financial Highlights: • Net sales exceeded $1.62 billion, an increase of 46.2 percent year-over-year • Gross margin improved 50 basis points year-over-year to 23.4 percent • Adjusted EBITDA was $3.4 million and our adjusted EBITDA margin improved 160 basis points to 0.2 percent Chewy’s mission is to be the most trusted and convenient online destination for pet parents (and partners) everywhere. We believe we are positively transforming the industry with a superior value proposition that keeps our customers at the center of everything we do, from our high-touch customer service, to our broad assortment of brands, to delivering on the core e-commerce tenets of speed and convenience. We are maniacally focused on providing a truly unique and personalized shopping experience that builds trust, brand loyalty, and drives repeat purchasing. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 4

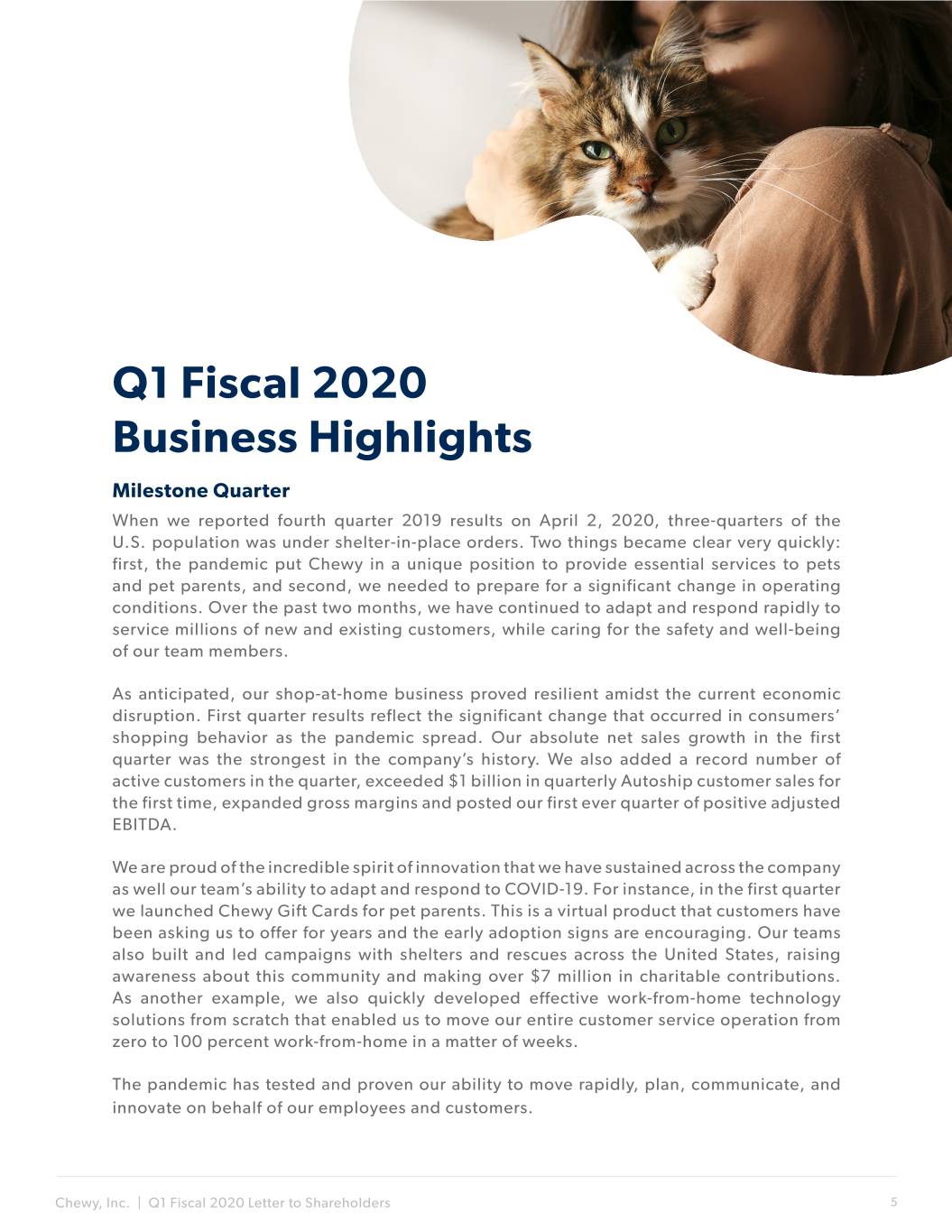

Q1 Fiscal 2020 Business Highlights Milestone Quarter When we reported fourth quarter 2019 results on April 2, 2020, three-quarters of the U.S. population was under shelter-in-place orders. Two things became clear very quickly: first, the pandemic put Chewy in a unique position to provide essential services to pets and pet parents, and second, we needed to prepare for a significant change in operating conditions. Over the past two months, we have continued to adapt and respond rapidly to service millions of new and existing customers, while caring for the safety and well-being of our team members. As anticipated, our shop-at-home business proved resilient amidst the current economic disruption. First quarter results reflect the significant change that occurred in consumers’ shopping behavior as the pandemic spread. Our absolute net sales growth in the first quarter was the strongest in the company’s history. We also added a record number of active customers in the quarter, exceeded $1 billion in quarterly Autoship customer sales for the first time, expanded gross margins and posted our first ever quarter of positive adjusted EBITDA. We are proud of the incredible spirit of innovation that we have sustained across the company as well our team’s ability to adapt and respond to COVID-19. For instance, in the first quarter we launched Chewy Gift Cards for pet parents. This is a virtual product that customers have been asking us to offer for years and the early adoption signs are encouraging. Our teams also built and led campaigns with shelters and rescues across the United States, raising awareness about this community and making over $7 million in charitable contributions. As another example, we also quickly developed effective work-from-home technology solutions from scratch that enabled us to move our entire customer service operation from zero to 100 percent work-from-home in a matter of weeks. The pandemic has tested and proven our ability to move rapidly, plan, communicate, and innovate on behalf of our employees and customers. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 5

We do not view our strong first quarter results as a one-off event. We believe that the volume- related cost pressures we have faced are temporary and we expect them to moderate as we look ahead. However, we believe the increased demand levels we are experiencing are here to stay and reflect an acceleration of e-commerce adoption that is not likely to return to pre-pandemic levels. We further believe that this combination of scaled revenues and cost discipline will accelerate us along our path of sustainable profitability. 2020 will be a pivotal year for Chewy and we plan to remain true to our mission of being the most trusted and convenient online destination for pet parents (and partners) everywhere. Now, more than ever, we are focused on execution through communication, innovation and perseverance. Encouraging Purchase Behavior From New Customers We added a record 1.6 million net active customers in the first quarter, which was more than double our average quarterly pace of net active customer adds in 2019. We examined the purchasing behavior of new customers that we acquired just after the COVID-19 outbreak and compared it to the purchasing behavior of customers that we acquired prior to the outbreak. The behavior shown so far by these new customers is promising. Initial orders were up to 11 percent larger in value than our pre-COVID-19 customers. In the first four weeks since their initial purchase, a higher percentage of those post- COVID-19 customers returned to make a second purchase and the average value of those repeat orders was as much as five percent higher than pre-COVID-19 customers. Finally, the Autoship sign-up and cancellation rates for these post-COVID customers, on a net basis, are within historical ranges. Although we cannot predict the future, we do expect these newly acquired customers to become long-term Chewy customers. We see all these as positive data points which bode well for sustained levels of customer engagement as we look ahead to the second quarter and balance of 2020. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 6

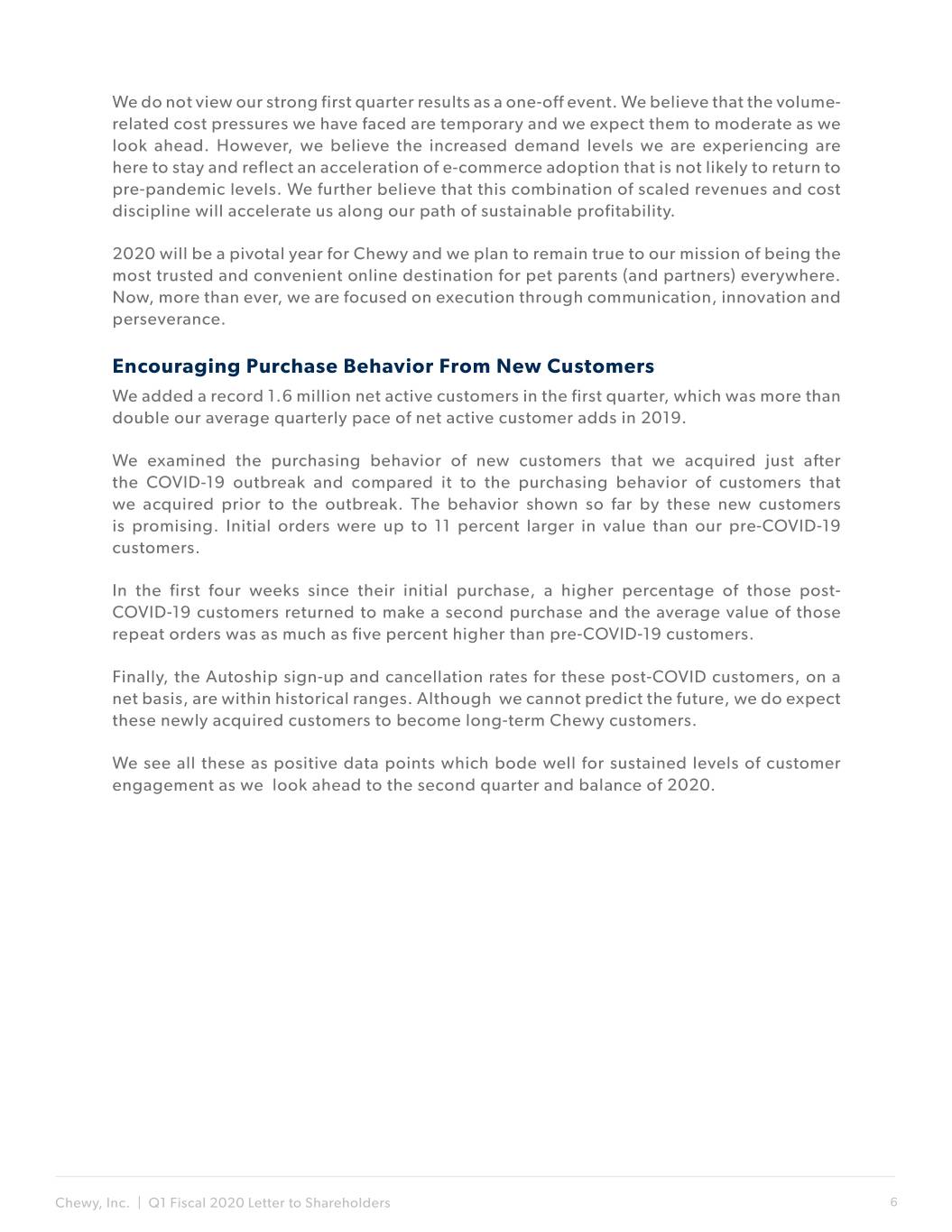

Q1 Fiscal 2020 Financial Highlights First quarter 2020 was a milestone quarter for Chewy. We grew net sales 46.2%, expanded gross margin 50 basis points, added a record 1.6 million net active customers, and generated positive adjusted EBITDA for the first time in our company’s history. Net Sales ($Millions) First quarter net sales were $1.62 billion, reflecting 46.2% year-over-year growth. The key revenue drivers in the quarter were a 32.6% year-over-year increase in active customers and a 6.6% increase in net sales per active customer, to $357, excluding the impact of the extra week in the fourth quarter of 2018. Autoship Customer Sales ($Millions) First quarter Autoship customer sales were $1.10 billion, 48.0% higher year-over-year, and surpassed $1 billion for the first time in a single quarter. We define Autoship customers as customers for whom an order has shipped through our Autoship subscription program during the preceding 364- day period. Autoship provides pet parents with convenient and flexible automatic reordering and delivery that makes meeting their recurring needs even easier. Gross Margin Gross margin expanded 50 basis points to 23.4 percent in the first quarter compared to 22.9 percent in first quarter 2019. In addition to the scale benefits from overall revenue growth, we saw positive contribution from gross margin expansion in our private label vertical, and our pharmacy business continued its robust growth. Incremental freight and logistics investments due to COVID-19 decreased gross margin by 120 basis points in the quarter. NOTE: Gross Margin is defined as Gross Profit divided by Net Sales. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 7

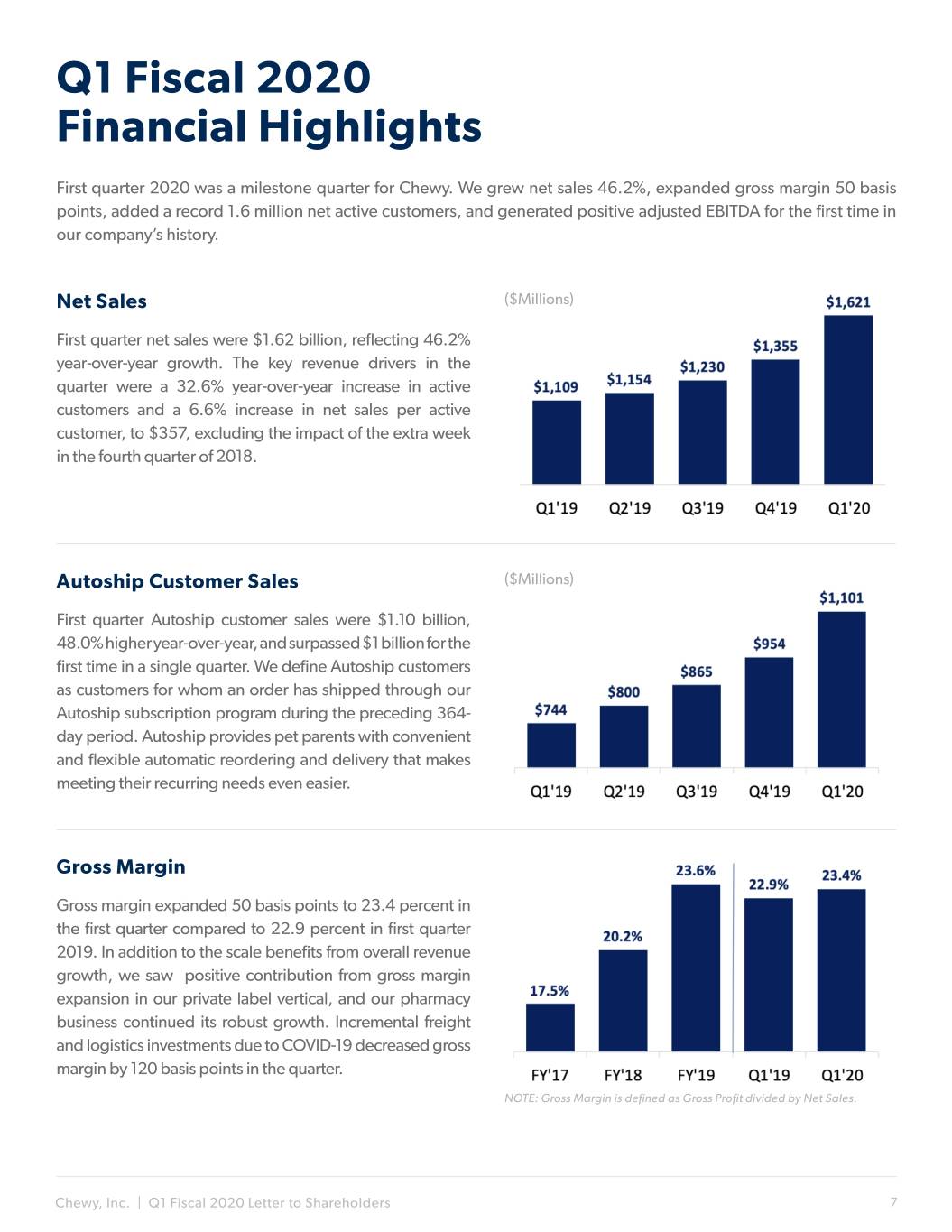

Net Loss ($Millions) First quarter net loss was $47.9 million compared to $29.6 million in first quarter 2019. Excluding $42.3 million and $7.2 million of share-based compensation and related tax expense in the first quarter of 2020 and 2019, respectively, first quarter net loss decreased 75.2% year-over-year. First quarter net margin was negative 3.0 percent, a decline of 30 basis points year-over-year. Excluding share-based compensation and related tax expense, first quarter net margin improved 170 basis points year-over-year, reflecting higher net sales, expanded gross margin, and scaled NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s marketing investments. acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. Adjusted EBITDA(1) ($Millions) First quarter adjusted EBITDA was $3.4 million, an improvement of $19.2 million compared to first quarter 2019. Adjusted EBITDA margin was positive 0.2 percent, an improvement of 160 basis points year-over-year. Our sales momentum combined with marketing efficiencies more than offset COVID-19 related expenses in the quarter, leading to our first ever quarter of positive adjusted EBITDA. NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. Net Cash Provided by (Used in) ($Millions) Operating Activities First quarter net cash provided by operating activities was $20.7 million, compared to $51.1 million net cash used in operating activities in first quarter 2019. First quarter cash provided by operating activities primarily consisted of our $47.9 million net loss, adjusted for certain non-cash items, including share based compensation expense of $42.2 million, depreciation and amortization expense of $7.3 million and favorable working capital. NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. (1) Adjusted EBITDA and adjusted EBITDA Margin are a non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non- GAAP financial measures. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 8

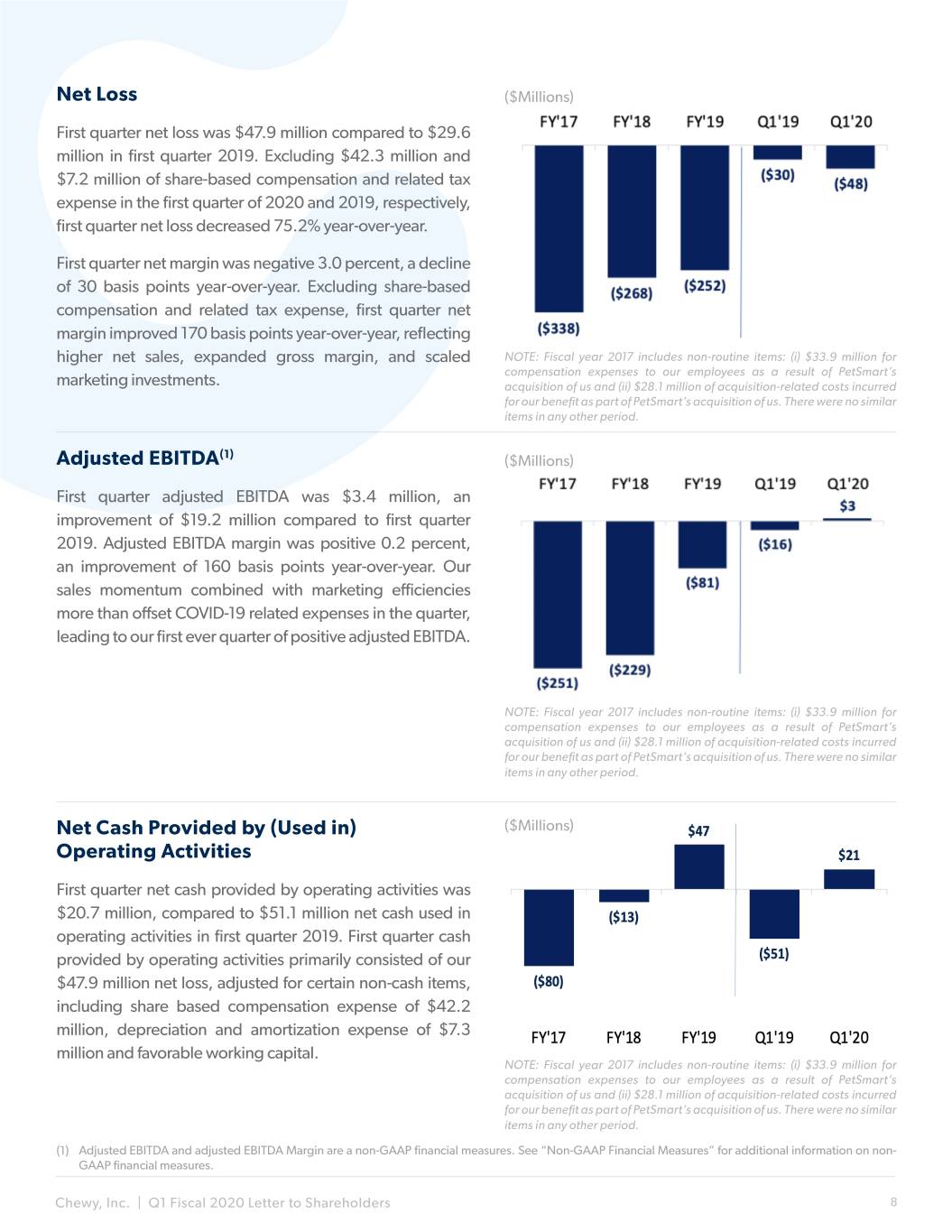

Free Cash Flow(1) ($Millions) Free cash flow was negative $21.8 million in the first quarter compared to negative $63.4 million in first quarter 2019. The components of negative free cash flow in the first quarter were $20.7 million of cash provided by operating activities, offset by $42.5 million of capital investments, primarily cash outlays for our new fulfillment centers in North Carolina and Pennsylvania, expenditures for IT equipment, and capitalization of internal and external labor. Approximately $2 million of our capital spending in the quarter was related to COVID-19 mitigation efforts, including IT equipment to NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for facilitate the shift to work-from-home and improvements to compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred workplace health and safety. for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. (1) Free cash flow is a non-GAAP financial measure. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures Closing We will host a conference call and earnings webcast at 5:00 pm Eastern time today to discuss these results. Investors and participants can access the call by dialing (866) 211-4125 in the U.S. or (647) 689-6728 internationally, using the conference code 5976029. A live webcast will also be available on Chewy’s investor relations website at investor.chewy.com. Thank you for taking the time to review our letter, and we look forward to your questions on our call this afternoon. Sincerely, Sumit Singh, CEO Mario Marte, CFO Investor Contact: Media Contact: Robert A. LaFleur Diane Pelkey ir@chewy.com dpelkey@chewy.com Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 9

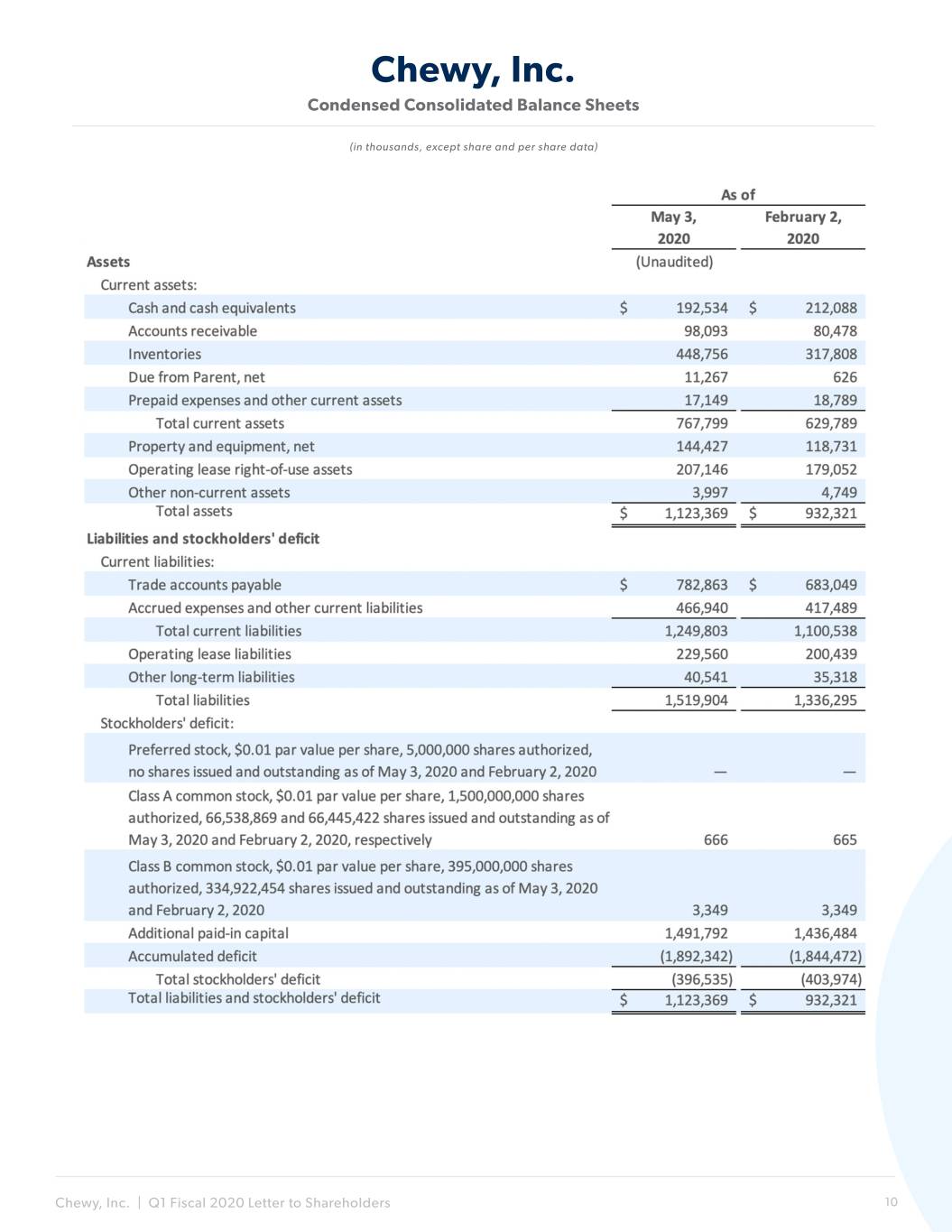

Chewy, Inc. Condensed Consolidated Balance Sheets (in thousands, except share and per share data) Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 10

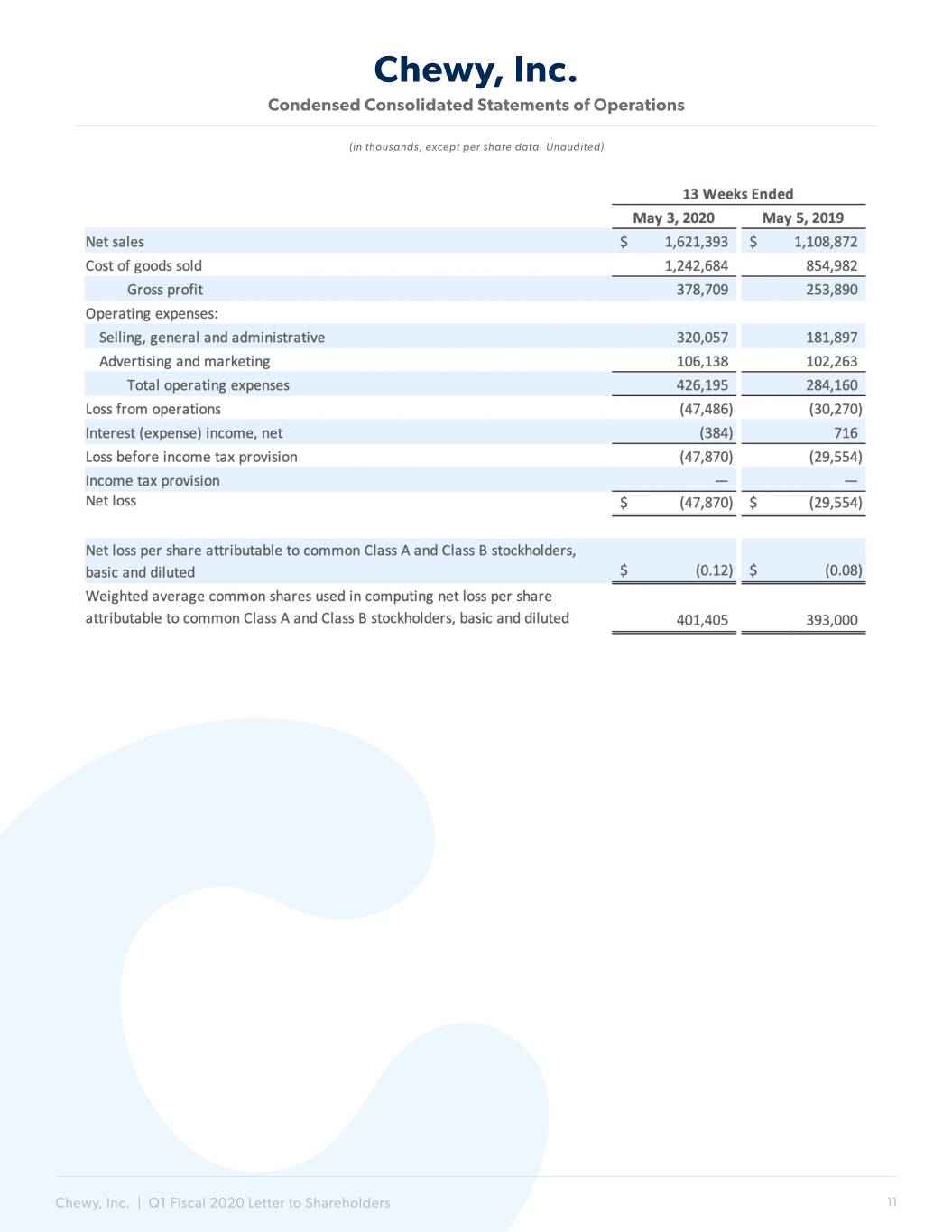

Chewy, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share data. Unaudited) Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 11

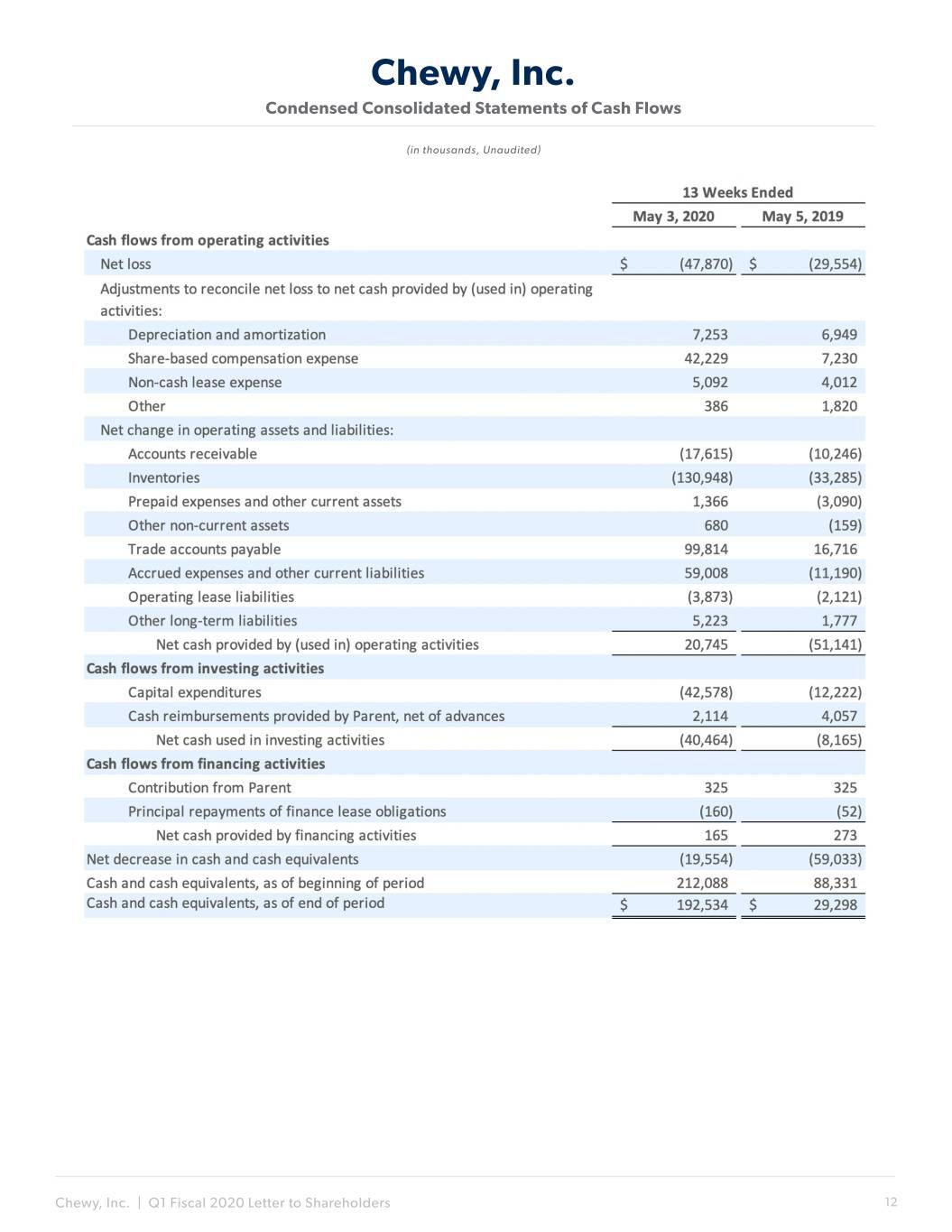

Chewy, Inc. Condensed Consolidated Statements of Cash Flows (in thousands, Unaudited) Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 12

Non-GAAP Financial Measures Adjusted EBITDA and Adjusted EBITDA Margin To provide investors with additional information regarding our financial results, we disclose adjusted EBITDA, a non-GAAP financial measure that we calculate as net loss excluding depreciation and amortization; share-based compensation expense and related taxes; income tax provision; interest income (expense), net management fee expense; transaction and other costs. We have provided a reconciliation below of adjusted EBITDA to net loss, the most directly comparable GAAP financial measure. We include adjusted EBITDA because it is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable charges. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. We believe it is useful to exclude non-cash charges, such as depreciation and amortization, share- based compensation expense and management fee expense from our adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude income tax provision; interest income (expense), net; and transaction and other costs as these items are not components of our core business operations. Adjusted EBITDA has limitations as a financial measure, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future and adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures; • adjusted EBITDA does not reflect share-based compensation and related taxes. Share-based compensation has been, and will continue to be for the foreseeable future, a recurring expense in our business and an important part of our compensation strategy; • adjusted EBITDA does not reflect interest income (expense), net; or changes in, or cash requirements for, our working capital; • adjusted EBITDA does not reflect transaction and other costs which are generally incremental costs that result from an actual or planned transaction and include transaction costs (i.e. IPO costs), integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems; and • other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider adjusted EBITDA and adjusted EBITDA margin alongside other financial performance measures, including various cash flow metrics, net loss, net margin, and our other GAAP results. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 13

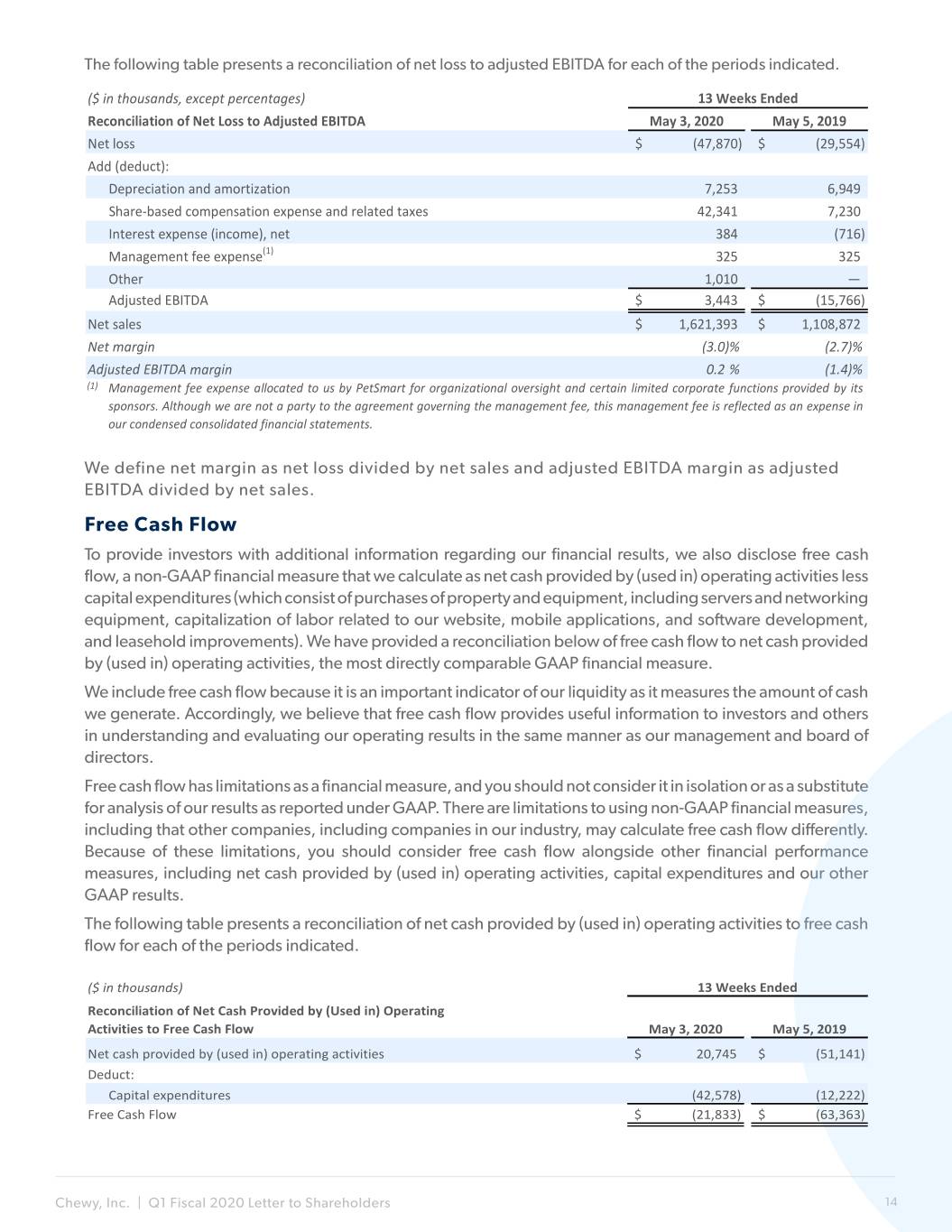

The following table presents a reconciliation of net loss to adjusted EBITDA for each of the periods indicated. ($ in thousands, except percentages) 13 Weeks Ended Reconciliation of Net Loss to Adjusted EBITDA May 3, 2020 May 5, 2019 Net loss $ (47,870) $ (29,554) Add (deduct): Depreciation and amortization 7,253 6,949 Share-based compensation expense and related taxes 42,341 7,230 Interest expense (income), net 384 (716) Management fee expense(1) 325 325 Other 1,010 — Adjusted EBITDA $ 3,443 $ (15,766) Net sales $ 1,621,393 $ 1,108,872 Net margin (3.0)% (2.7)% Adjusted EBITDA margin 0.2 % (1.4)% (1) Management fee expense allocated to us by PetSmart for organizational oversight and certain limited corporate functions provided by its sponsors. Although we are not a party to the agreement governing the management fee, this management fee is reflected as an expense in our condensed consolidated financial statements. We define net margin as net loss divided by net sales and adjusted EBITDA margin as adjusted EBITDA divided by net sales. Free Cash Flow To provide investors with additional information regarding our financial results, we also disclose free cash flow, a non-GAAP financial measure that we calculate as net cash provided by (used in) operating activities less capital expenditures (which consist of purchases of property and equipment, including servers and networking equipment, capitalization of labor related to our website, mobile applications, and software development, and leasehold improvements). We have provided a reconciliation below of free cash flow to net cash provided by (used in) operating activities, the most directly comparable GAAP financial measure. We include free cash flow because it is an important indicator of our liquidity as it measures the amount of cash we generate. Accordingly, we believe that free cash flow provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. Free cash flow has limitations as a financial measure, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. There are limitations to using non-GAAP financial measures, including that other companies, including companies in our industry, may calculate free cash flow differently. Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash provided by (used in) operating activities, capital expenditures and our other GAAP results. The following table presents a reconciliation of net cash provided by (used in) operating activities to free cash flow for each of the periods indicated. ($ in thousands) 13 Weeks Ended Reconciliation of Net Cash Provided by (Used in) Operating Activities to Free Cash Flow May 3, 2020 May 5, 2019 Net cash provided by (used in) operating activities $ 20,745 $ (51,141) Deduct: Capital expenditures (42,578) (12,222) Free Cash Flow $ (21,833) $ (63,363) Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 14

Free cash flow may be affected in the near to medium term by the timing of capital investments (such as the launch of new fulfillment centers, customer service centers, and corporate offices and purchases of IT and other equipment), fluctuations in our growth and the effect of such fluctuations on working capital, and changes in our cash conversion cycle due to increases or decreases of vendor payment terms as well as inventory turnover. COVID-19 Impact in First Quarter 2020 Pantry Stocking After the COVID-19 outbreak, our existing customers started creating larger baskets with a higher mix of consumables in them. We believe this was evidence of pandemic-related pantry-stocking and we estimate this benefited our first quarter net sales by approximately $70 million. We view this as a one-time benefit that we have not seen reverse in the second quarter, and we do not expect to see it reverse going forward. Supply Chain, Fulfillment Network and Customer Service Although our supply chain remained resilient through the quarter, the unplanned nature of the demand surge related to COVID-19 created temporary stress points in our supply chain, as well as customer service and fulfillment operations. We typically spend months preparing for our annual Q4 holiday cycle, but in this situation there was no advance warning or preparation. The demand shock, which was also felt by our supplier, caused elevated out-of-stock levels for certain product categories and led to some temporary conditions of suboptimal inventory placement across our fulfillment network as teams worked hard to restore the balance between inbound and outbound inventory flow. We were able to quickly react to this by updating our recommendation engines so customers could easily self-select different brands, sizes or patterns if their original choices were unavailable. Our private brand portfolio categories like treats, litter and hardgoods offered customers attractive substitution alternatives and these categories experienced strong year-over-year growth in the quarter. These actions helped reduce abandoned orders and maintained customer engagement and conversion levels, which kept sales momentum strong throughout the quarter. Inventory imbalances in the fulfillment network also led to higher rates of split customer orders, which, in turn, led us to ship more orders in multiple boxes and ship more orders over longer distances. For a portion of our volume, we increased the use of express shipments as a way to ensure timely deliveries and protect customer experience. This deviation from our standard playbook increased first quarter freight and packaging costs by approximately $20 million and negatively impacted gross margins. The elevated volumes also led to a sizable increase in order backlog across the fulfillment network. Our first priority was the well-being of team members, so we did everything we could to make fulfillment center workspaces as clean and safe as possible. We also hired 4,600 new hourly associates in the first quarter, most of whom were dedicated to our fulfillment centers. Since the end of the quarter, we have achieved 100% of our original 6,000 hiring target. These new team members, along with thousands of other dedicated Chewtopians, helped us work through the backlog and tackle the increase in customer demand. We also opened our ninth fulfillment center in Salisbury, North Carolina on April 6th and immediately accelerated its volume ramp to further help reduce the backlog. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 15

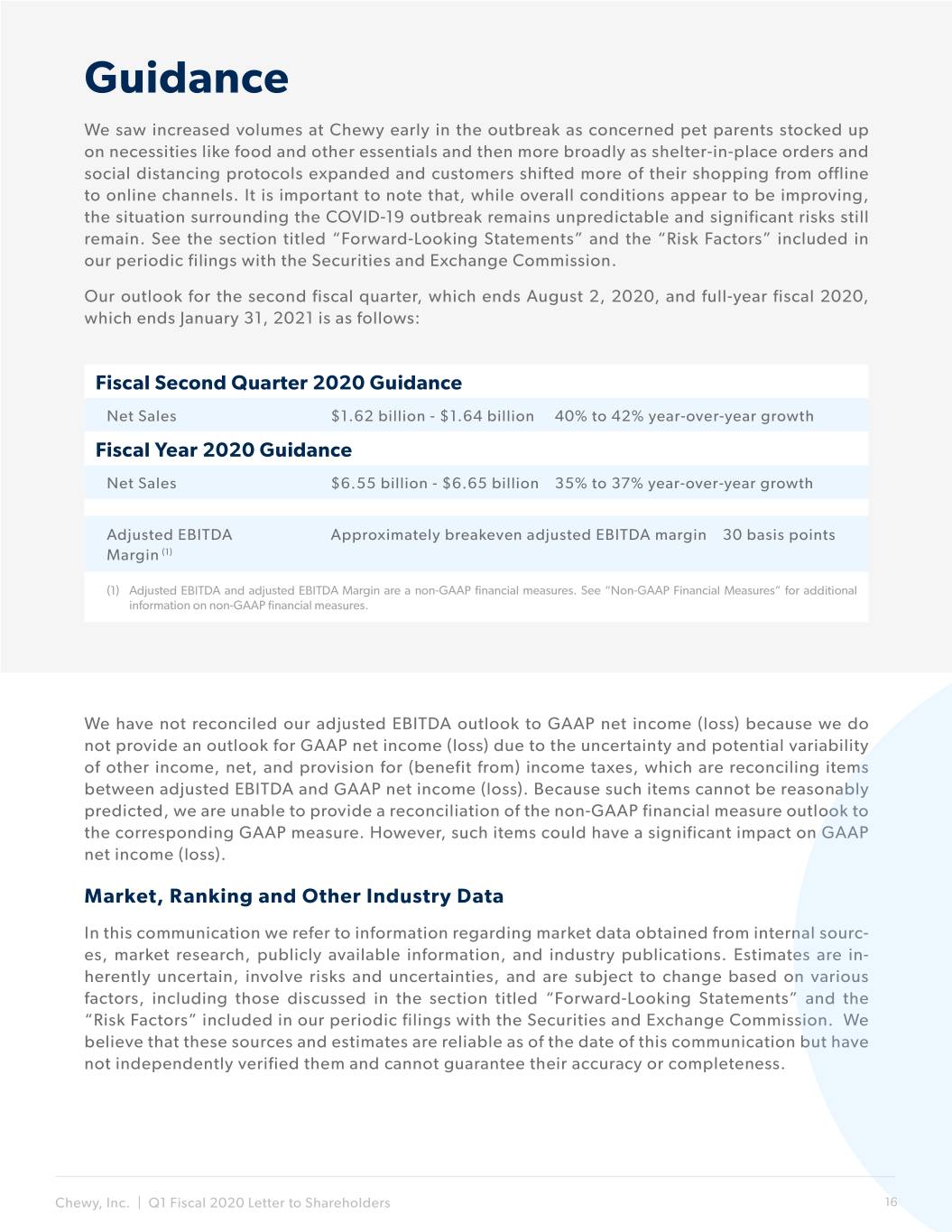

Guidance We saw increased volumes at Chewy early in the outbreak as concerned pet parents stocked up on necessities like food and other essentials and then more broadly as shelter-in-place orders and social distancing protocols expanded and customers shifted more of their shopping from offline to online channels. It is important to note that, while overall conditions appear to be improving, the situation surrounding the COVID-19 outbreak remains unpredictable and significant risks still remain. See the section titled “Forward-Looking Statements” and the “Risk Factors” included in our periodic filings with the Securities and Exchange Commission. Our outlook for the second fiscal quarter, which ends August 2, 2020, and full-year fiscal 2020, which ends January 31, 2021 is as follows: Fiscal Second Quarter 2020 Guidance Net Sales $1.62 billion - $1.64 billion 40% to 42% year-over-year growth Fiscal Year 2020 Guidance Net Sales $6.55 billion - $6.65 billion 35% to 37% year-over-year growth Adjusted EBITDA Approximately breakeven adjusted EBITDA margin ±30 basis points Margin (1) (1) Adjusted EBITDA and adjusted EBITDA Margin are a non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures. We have not reconciled our adjusted EBITDA outlook to GAAP net income (loss) because we do not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net, and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because such items cannot be reasonably predicted, we are unable to provide a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure. However, such items could have a significant impact on GAAP net income (loss). Market, Ranking and Other Industry Data In this communication we refer to information regarding market data obtained from internal sourc- es, market research, publicly available information, and industry publications. Estimates are in- herently uncertain, involve risks and uncertainties, and are subject to change based on various factors, including those discussed in the section titled “Forward-Looking Statements” and the “Risk Factors” included in our periodic filings with the Securities and Exchange Commission. We believe that these sources and estimates are reliable as of the date of this communication but have not independently verified them and cannot guarantee their accuracy or completeness. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 16

Forward-Looking Statements This communication contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this communication, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward- looking statements include, but are not limited to, statements concerning our ability to successfully manage risks relating to the spread of COVID-19, including any adverse impacts on our supply chain, workforce, facilities and operations; sustain our recent growth rates and manage our growth effectively; acquire new customers in a cost- effective manner and increase our net sales per active customer; accurately predict economic conditions and their impact on consumer spending patterns, particularly in the pet products market, and accurately forecast net sales and appropriately plan our expenses in the future; introduce new products or offerings and improve existing products; successfully compete in the pet products and services retail industry, especially in the e-commerce sector; source additional, or strengthen our existing relationships with, suppliers; negotiate acceptable pricing and other terms with third-party service providers, suppliers and outsourcing partners and maintain our relationships with such entities; optimize, operate and manage the expansion of the capacity of our fulfillment centers; provide our customers with a cost-effective platform that is able to respond and adapt to rapid changes in technology; maintain adequate cybersecurity with respect to our systems and ensure that our third-party service providers do the same with respect to their systems; successfully manufacture and sell our own private brand products; maintain consumer confidence in the safety and quality of our vendor-supplied and private brand food products and hardgood products; comply with existing or future laws and regulations in a cost-efficient manner; attract, develop, motivate and retain well-qualified employees; and adequately protect our intellectual property rights and successfully defend ourselves against any intellectual property infringement claims or other allegations that we may be subject to. You should not rely on forward-looking statements as predictions of future events. We have based the forward- looking statements contained in this communication primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in our filings with the Securities and Exchange Commission and elsewhere in this communication. Moreover, we operate in a very competitive and rapidly-changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this communication. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this communication. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this communication to reflect events or circumstances after the date of this communication or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments. Chewy, Inc. | Q1 Fiscal 2020 Letter to Shareholders 17