Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Western Asset Mortgage Capital Corp | a8-kconvertibledebtpre.htm |

Investor Presentation

Safe Harbor Statement We make forward-looking statements in this presentation that are subject to risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. In particular, it is difficult to fully assess the impact of COVID-19 at this time due to, among other factors, uncertainty regarding the severity and duration of the outbreak domestically and internationally and the effectiveness of federal, state and local governments’ efforts to contain the spread of COVID-19 and respond to its direct and indirect impact on the U.S. economy and economic activity. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in our industry, interest rates, real estate values, the debt securities markets, the U.S. housing and the U.S. and foreign commercial real estate markets or the general economy or the market for residential and/or commercial mortgage loans; our business and investment strategy; our projected operating results; changes in interest rates and the market value of our target assets; credit risks; servicing-related risks, including those associated with foreclosure and liquidation; the state of the U.S. and to a lesser extent, international economy generally or in specific geographic regions; economic trends and economic recoveries; our ability to obtain and maintain financing arrangements, including under our repurchase agreements, a form of secured financing, and securitizations; the current potential return dynamics available in residential mortgage-backed securities (“RMBS”) and commercial mortgage-backed securities (“CMBS” and collectively with RMBS, “MBS”); the level of government involvement in the U.S. mortgage market; the anticipated default rates on CMBS and Commercial Loans; the loss severity on Non-Agency MBS; the general volatility of the securities markets in which we participate; changes in the value of our assets; our expected portfolio of assets; our expected investment and underwriting process; interest rate mismatches between our target assets and any borrowings used to fund such assets; changes in prepayment rates on our target assets; effects of hedging instruments on our target assets; rates of default or decreased recovery rates on our target assets; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a real estate investment trust for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940; the availability of opportunities to acquire Agency RMBS, Non-Agency RMBS, Agency CMBS, Non-Agency CMBS, Residential and Commercial Whole-Loans and other mortgage assets; the availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and the uncertainty and economic impact of pandemics, epidemics or other public health emergencies, such as the recent outbreak of COVID-19. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 1

Overview of Western Asset Mortgage Capital Corporation Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset") • One of the largest U.S. fixed income asset managers with AUM of $448.0 billion(1) ◦ The AUM of the Mortgage and Consumer Credit Group is $77.7 billion(1) ◦ Extensive mortgage and consumer credit investing track record ∙ Publicly traded diversified mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential and commercial mortgage markets ∙ Completed Initial Public Offering in May 2012 Please refer to page 12 for footnote disclosures. 2

2020 Outlook ▪ COVID-19 related growth setbacks have meaningfully reduced global and US growth ▪ The medical battle will take time with prolonged efforts; recent developments are encouraging ▪ US and global inflation rates will remain very subdued ▪ Central banks will remain extraordinarily accommodative ▪ Fiscal policy will continue to ramp up to provide relief efforts ▪ Even after recovery begins, central banks will keep rates ultra low ▪ Spread products ultimately should be primary beneficiaries of recovery ▪ The timing and scope of the eventual recovery remains the largest uncertainty 3

Portfolio View Our focus is to protect the value of the portfolio, enable shareholders to benefit from recovery, and reposition the company to resume delivering on our long term objectives ▪ We believe our credit investments secured by real estate assets with significant equity in the properties and higher quality credit will continue to perform over the longer term. ▪ We are focused on preserving liquidity and reducing our exposure to short- term repurchase agreement financing. ▪ We are committed to preserving long term value for shareholders. 4

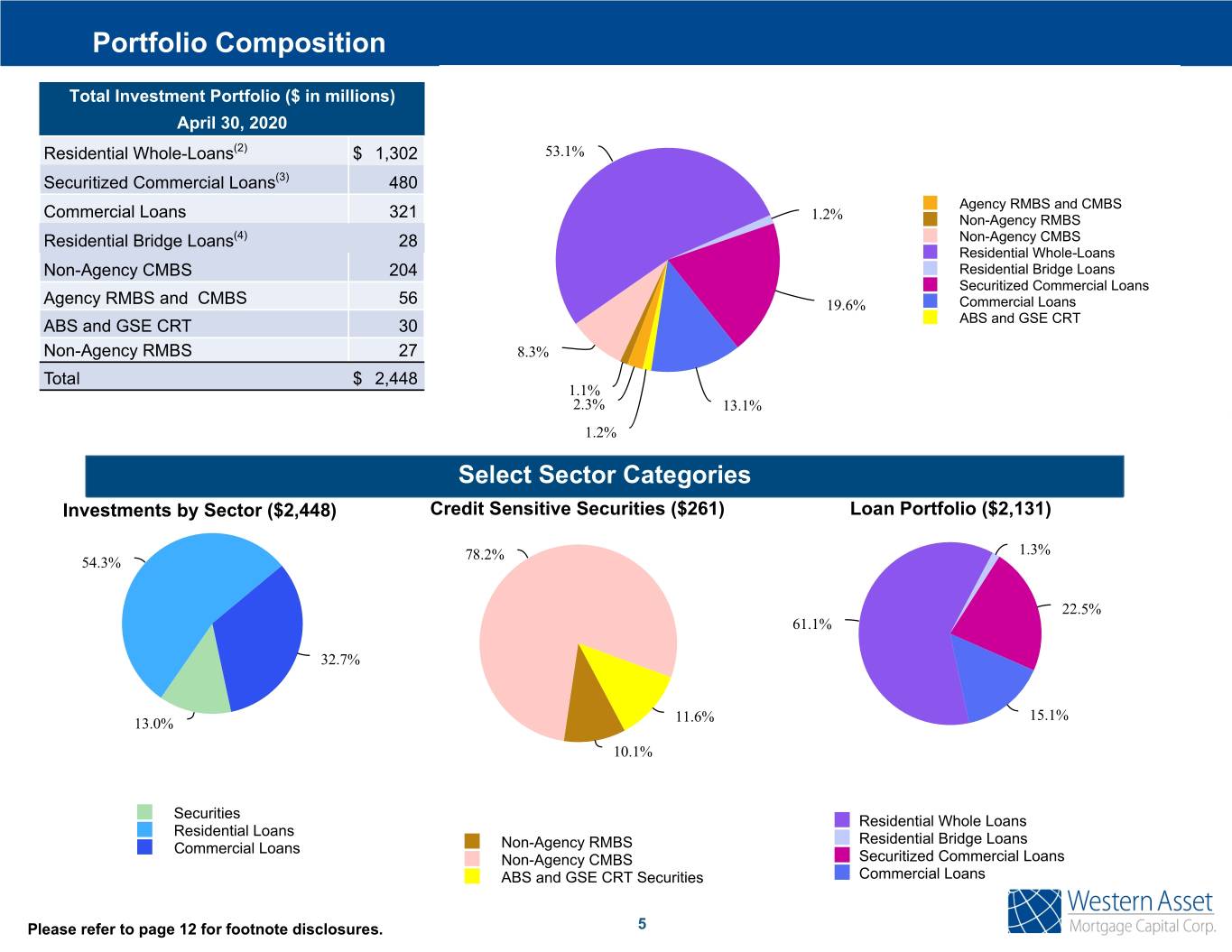

Portfolio Composition Total Investment Portfolio ($ in millions) April 30, 2020 Residential Whole-Loans(2) $ 1,302 53.1% Securitized Commercial Loans(3) 480 Agency RMBS and CMBS Commercial Loans 321 1.2% Non-Agency RMBS Residential Bridge Loans(4) 28 Non-Agency CMBS Residential Whole-Loans Non-Agency CMBS 204 Residential Bridge Loans Securitized Commercial Loans Agency RMBS and CMBS 56 19.6% Commercial Loans ABS and GSE CRT 30 ABS and GSE CRT Non-Agency RMBS 27 8.3% Total $ 2,448 1.1% 2.3% 13.1% 1.2% Select Sector Categories Investments by Sector ($2,448) Credit Sensitive Securities ($261) Loan Portfolio ($2,131) 78.2% 1.3% 54.3% 22.5% 61.1% 32.7% 15.1% 13.0% 11.6% 10.1% Securities Residential Whole Loans Residential Loans Residential Bridge Loans Commercial Loans Non-Agency RMBS Non-Agency CMBS Securitized Commercial Loans ABS and GSE CRT Securities Commercial Loans Please refer to page 12 for footnote disclosures. 5

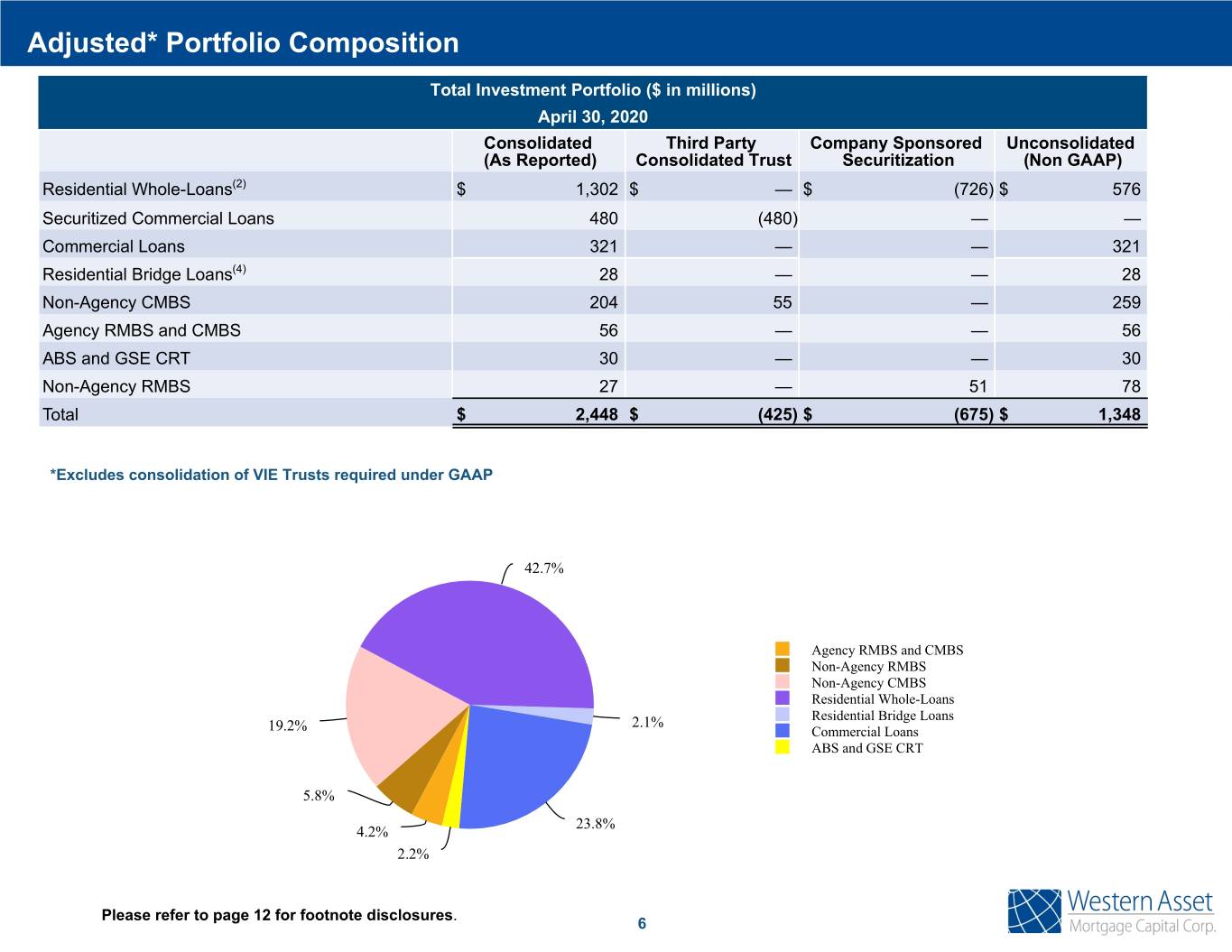

Adjusted* Portfolio Composition Total Investment Portfolio ($ in millions) April 30, 2020 Consolidated Third Party Company Sponsored Unconsolidated (As Reported) Consolidated Trust Securitization (Non GAAP) Residential Whole-Loans(2) $ 1,302 $ — $ (726) $ 576 Securitized Commercial Loans 480 (480) — — Commercial Loans 321 — — 321 Residential Bridge Loans(4) 28 — — 28 Non-Agency CMBS 204 55 — 259 Agency RMBS and CMBS 56 — — 56 ABS and GSE CRT 30 — — 30 Non-Agency RMBS 27 — 51 78 Total $ 2,448 $ (425) $ (675) $ 1,348 *Excludes consolidation of VIE Trusts required under GAAP 42.7% Agency RMBS and CMBS Non-Agency RMBS Non-Agency CMBS Residential Whole-Loans 2.1% Residential Bridge Loans 19.2% Commercial Loans ABS and GSE CRT 5.8% 23.8% 4.2% 2.2% Please refer to page 12 for footnote disclosures. 6

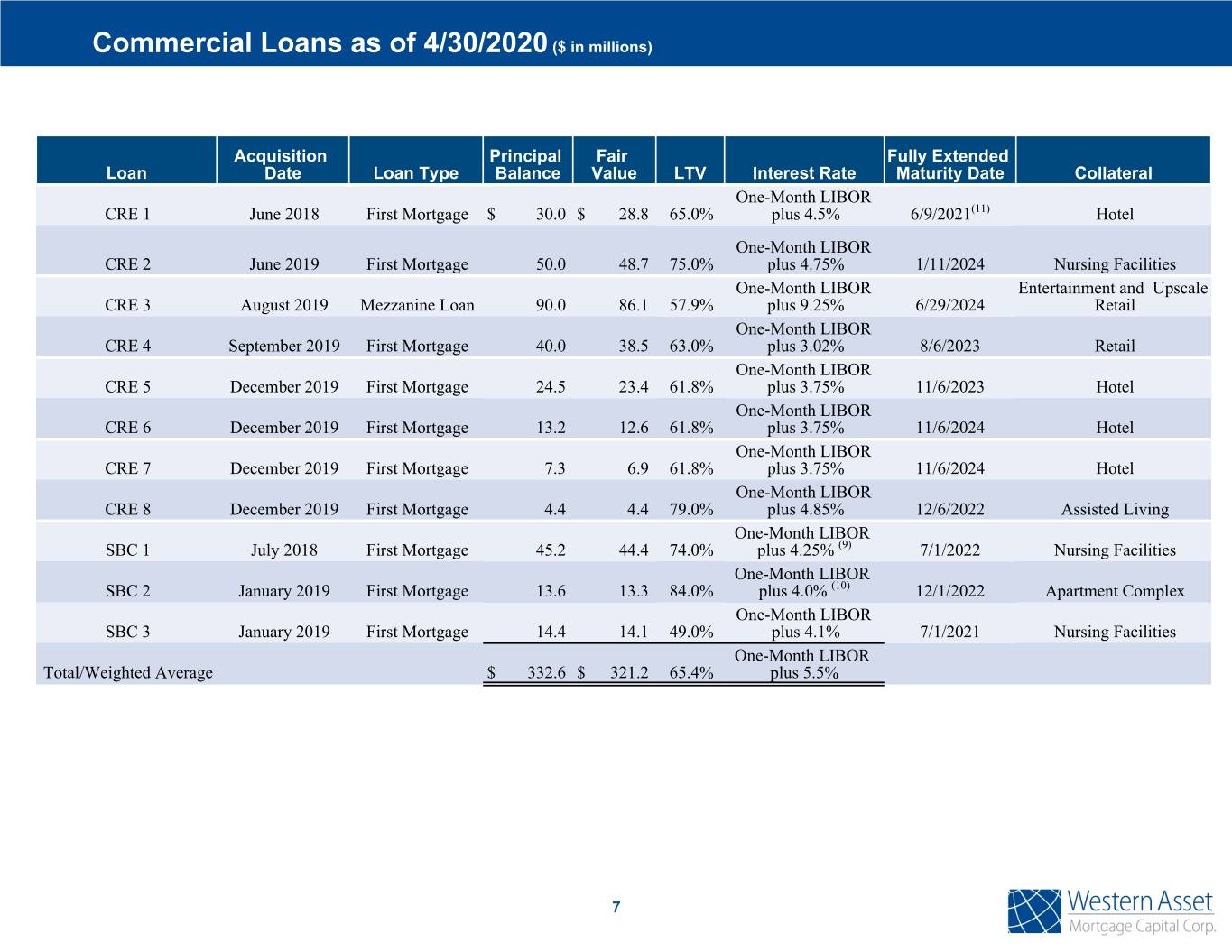

Commercial Loans as of 4/30/2020 ($ in millions) Acquisition Principal Fair Fully Extended Loan Date Loan Type Balance Value LTV Interest Rate Maturity Date Collateral One-Month LIBOR CRE 1 June 2018 First Mortgage $ 30.0 $ 28.8 65.0% plus 4.5% 6/9/2021(11) Hotel One-Month LIBOR CRE 2 June 2019 First Mortgage 50.0 48.7 75.0% plus 4.75% 1/11/2024 Nursing Facilities One-Month LIBOR Entertainment and Upscale CRE 3 August 2019 Mezzanine Loan 90.0 86.1 57.9% plus 9.25% 6/29/2024 Retail One-Month LIBOR CRE 4 September 2019 First Mortgage 40.0 38.5 63.0% plus 3.02% 8/6/2023 Retail One-Month LIBOR CRE 5 December 2019 First Mortgage 24.5 23.4 61.8% plus 3.75% 11/6/2023 Hotel One-Month LIBOR CRE 6 December 2019 First Mortgage 13.2 12.6 61.8% plus 3.75% 11/6/2024 Hotel One-Month LIBOR CRE 7 December 2019 First Mortgage 7.3 6.9 61.8% plus 3.75% 11/6/2024 Hotel One-Month LIBOR CRE 8 December 2019 First Mortgage 4.4 4.4 79.0% plus 4.85% 12/6/2022 Assisted Living One-Month LIBOR SBC 1 July 2018 First Mortgage 45.2 44.4 74.0% plus 4.25% (9) 7/1/2022 Nursing Facilities One-Month LIBOR SBC 2 January 2019 First Mortgage 13.6 13.3 84.0% plus 4.0% (10) 12/1/2022 Apartment Complex One-Month LIBOR SBC 3 January 2019 First Mortgage 14.4 14.1 49.0% plus 4.1% 7/1/2021 Nursing Facilities One-Month LIBOR Total/Weighted Average $ 332.6 $ 321.2 65.4% plus 5.5% 7

Financing Summary Financing Summary April 30, 2020 ($ in thousands) Weighted Average Weighted Average Outstanding Interest Rate Interest Remaining Days to Borrowings Rate Maturity Repurchase Agreement Borrowings Agency Mortgage-Backed Securities (5) $ 50,688 1.9% 57 Non-Agency Mortgage-Backed Securities 152,281 3.7% 45 Residential Whole-Loans(7) 147,622 1.5% 26 Residential Bridge Loan 24,442 2.9% 7 SBC Commercial loans 45,719 3.0% 7 Other securities 26,413 3.6% 57 Subtotal $ 447,165 2.6% 35 Long Term Borrowings Residential Whole-Loans Term Facility(6) 380,885 5.2% 1167 Commercial Loans(6) 153,549 2.8% 527 Subtotal $ 534,434 4.5% 983 Total borrowings $ 981,599 3.7% 551 Less unamortized debt issuance costs 63 N/A N/A Total/Weighted Average $ 981,536 3.7% 551 On May 4 2020, the Company consolidated its financing of most of its Non-Agency CMBS and Non-Agency RMBS into a single term facility with a term of twelve months. The aggregate financing provided was approximately $108.8 million and the market value of such financed assets was approximately $182.7 million. Subsequent to the closing of the securities term facility approximately 10% of the Company's secured financing arrangements were financed with daily mark to market repurchase agreements. 8 Please refer to page 12 for footnote disclosures.

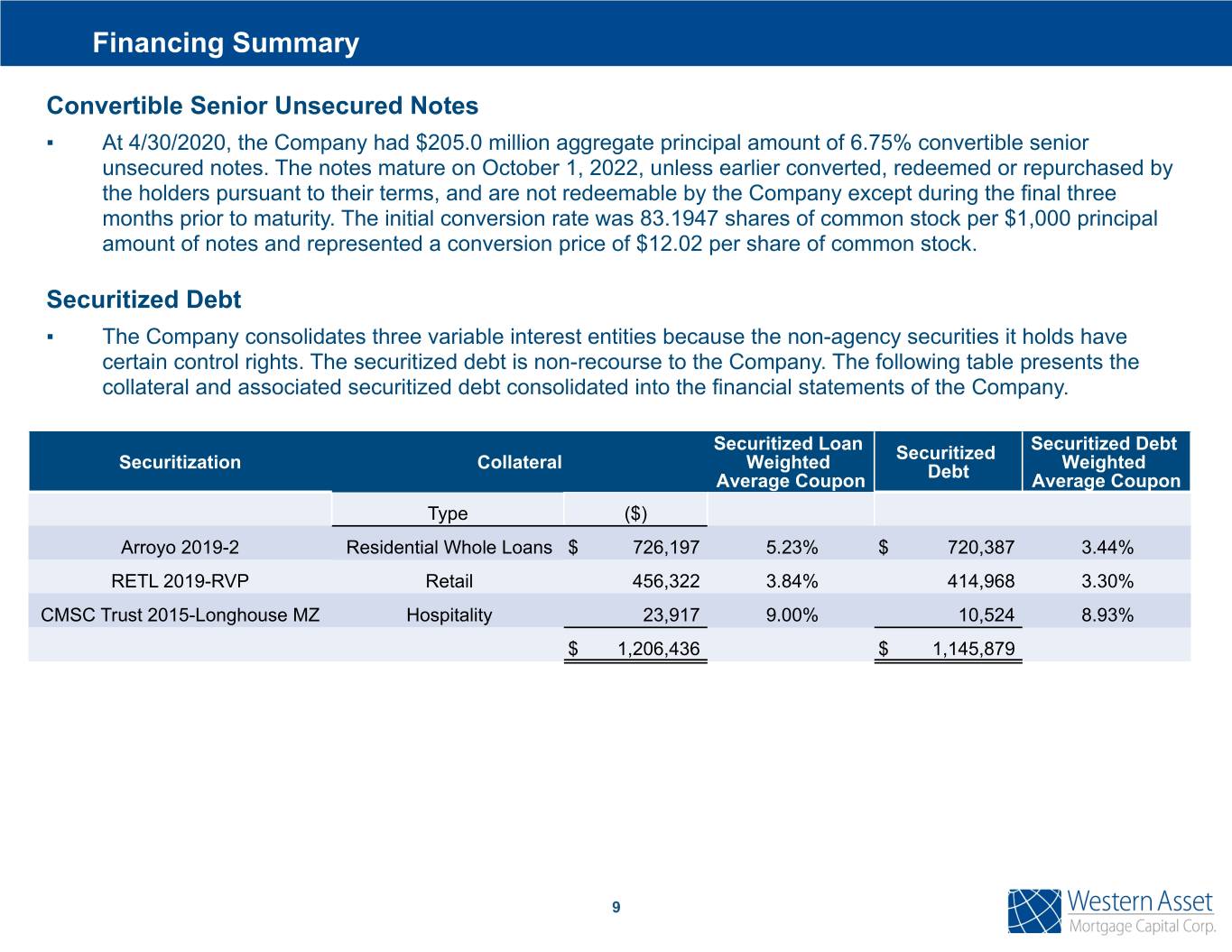

Financing Summary Convertible Senior Unsecured Notes ▪ At 4/30/2020, the Company had $205.0 million aggregate principal amount of 6.75% convertible senior unsecured notes. The notes mature on October 1, 2022, unless earlier converted, redeemed or repurchased by the holders pursuant to their terms, and are not redeemable by the Company except during the final three months prior to maturity. The initial conversion rate was 83.1947 shares of common stock per $1,000 principal amount of notes and represented a conversion price of $12.02 per share of common stock. Securitized Debt ▪ The Company consolidates three variable interest entities because the non-agency securities it holds have certain control rights. The securitized debt is non-recourse to the Company. The following table presents the collateral and associated securitized debt consolidated into the financial statements of the Company. Securitized Loan Securitized Debt Securitization Collateral Weighted Securitized Weighted Average Coupon Debt Average Coupon Type ($) Arroyo 2019-2 Residential Whole Loans $ 726,197 5.23% $ 720,387 3.44% RETL 2019-RVP Retail 456,322 3.84% 414,968 3.30% CMSC Trust 2015-Longhouse MZ Hospitality 23,917 9.00% 10,524 8.93% $ 1,206,436 $ 1,145,879 9

New Financing Facilities Residential Whole Loan Financing Facility ▪ On April 21, 2020, WMC entered into amendments with respect to certain of its loan warehouse facilities. These amendments mainly served to convert an existing residential whole loan facility into a term facility by removing any mark to market margin requirements, and to consolidate the Company’s Non-Qualified Mortgage loans, which were previously financed by three separate, unaffiliated counterparties, into a single facility. ▪ The term of the facility is 18 months and all income generated by the loans during the term of the facility will be used to incrementally repay all obligations thereunder. Upon the securitization or sale by the Company of any whole loan subject to this amended and restated facility, the counterparty will be entitled to receive an exit fee of 0.50% as well as 30% of all realized and projected cash flow on any whole loans above such counterparty’s amortized basis. • The impact of this financing was to reduce our exposure to repurchase agreement financing by $385 million and eliminate the potential for future margin calls from such agreements. Non-Agency MBS Financing Facility • On May 4, 2020, the Company supplemented one of its existing securities repurchase facilities to confirm terms pursuant to which it consolidated most of its CMBS and RMBS assets, which were financed by multiple counterparties, into a single term facility with limited mark to market margin requirements, as described below. Pursuant to this agreement, a margin deficit will not occur until such time as the loan to value ratio surpasses a certain threshold, on a weighted average basis per asset type, calculated on a portfolio level. If this threshold is reached, the Company may elect to provide cash margin or sell certain assets to the extent necessary to lower the ratio. The term of this facility is 12 months, subject to extensions at the counterparty’s option. Interest rate on the facility is three-month LIBOR plus 5.00% payable to the counterparty quarterly in arrears. • All asset sale proceeds less 50% of any excess proceeds over the counterparty’s amortized basis will be applied to repay the obligations owed to the counterparty, with the remainder paid to the Company, unless the LTV Trigger has occurred, in which case all asset sale proceeds will be applied to repay the obligations. • The aggregate financing provided by the counterparty with respect to the assets covered under this confirmation is approximately $108.8 million and the market value of such assets is approximately $182.7 million. 10

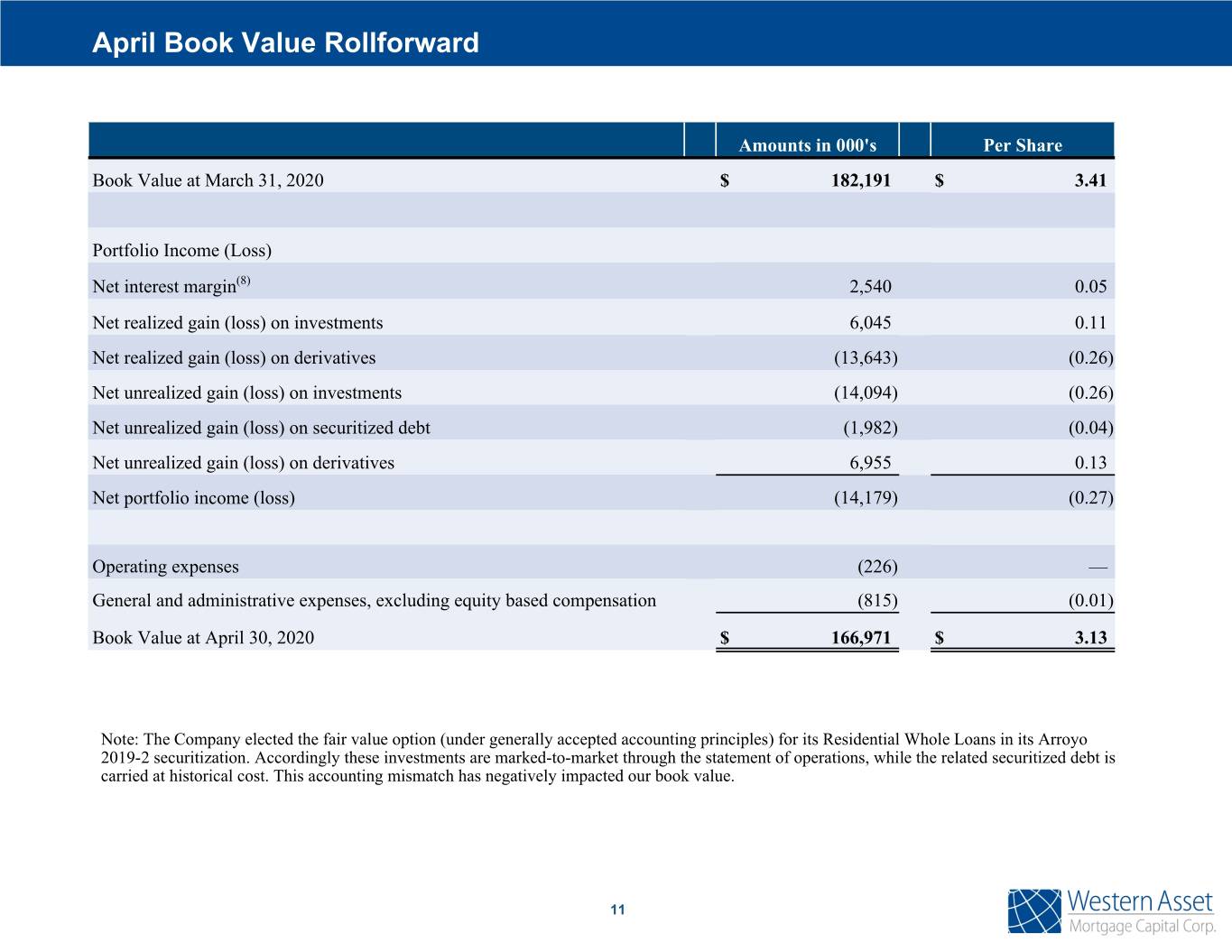

April Book Value Rollforward Amounts in 000's Per Share Book Value at March 31, 2020 $ 182,191 $ 3.41 Portfolio Income (Loss) Net interest margin(8) 2,540 0.05 Net realized gain (loss) on investments 6,045 0.11 Net realized gain (loss) on derivatives (13,643) (0.26) Net unrealized gain (loss) on investments (14,094) (0.26) Net unrealized gain (loss) on securitized debt (1,982) (0.04) Net unrealized gain (loss) on derivatives 6,955 0.13 Net portfolio income (loss) (14,179) (0.27) Operating expenses (226) — General and administrative expenses, excluding equity based compensation (815) (0.01) Book Value at April 30, 2020 $ 166,971 $ 3.13 Note: The Company elected the fair value option (under generally accepted accounting principles) for its Residential Whole Loans in its Arroyo 2019-2 securitization. Accordingly these investments are marked-to-market through the statement of operations, while the related securitized debt is carried at historical cost. This accounting mismatch has negatively impacted our book value. 11

Footnotes (1) As of 3/31/2020. (2) Includes $148.6 million conforming residential loans. These conforming residential loans were sold on May 28, 2020. (3) In March 2019, the Company acquired a $65.3 million Non-Agency CMBS security which resulted in the consolidation of a variable interest entity and the recording of a $904 million securitized commercial loan and $904 million of securitized debt. (4) The bridge loans acquired prior to October 25, 2017 are carried at amortized cost, since we did not elect the fair value option for these loans. For the bridge loans acquired subsequent to October, 25, 2017, we elected the fair value option to be consistent with the accounting of other investments. Accordingly, the carrying amount of the bridge loans as of 4/30/2020 includes $25.9 million of residential bridge loans carried at fair value and $2.6 million of residential bridge loans carried at amortized cost. (5) Includes of $28.6 million reverse repurchase agreements. (6) Certain Residential Whole Loans and Commercial Loans were financed under two long-term financing facilities. These facilities automatically roll until such time as they are terminated or until certain conditions of default. The weighted average remaining maturity days was calculated using expected weighted life of the underlying collateral. (7) The portfolio was sold on May 28, 2020 and the corresponding repurchase agreement borrowing was paid off. (8) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for month ended April 30, 2020. (9) Subject to LIBOR floor of 1.25%. (10) Subject to LIBOR floor of 2.0%. (11) Borrower requested an extension in accordance with the loan agreement. 12

Contact Information Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com