UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) June 1st 2020

Alpine 4 Technologies Ltd.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

|

|

|

|

|

Delaware |

| 000-55205 |

| 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) |

| (COMMISSION FILE NO.) |

| (IRS EMPLOYEE IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Item 8.01 Other Events.

Dear Shareholders,

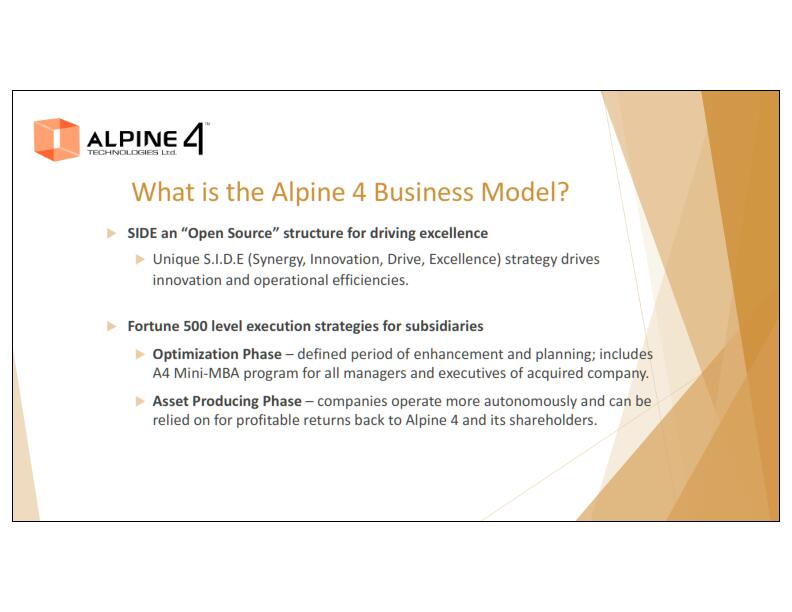

2019 was a year of tremendous growth! Building a business is never easy, nor is it for the faint of heart. But the payoff can be large for those who are patient and willing to do what it takes to succeed. Alpine 4 is no different. For the past 6 years, we have been in “build mode” and building a company like Alpine 4 takes lots of energy, vision, and capital.

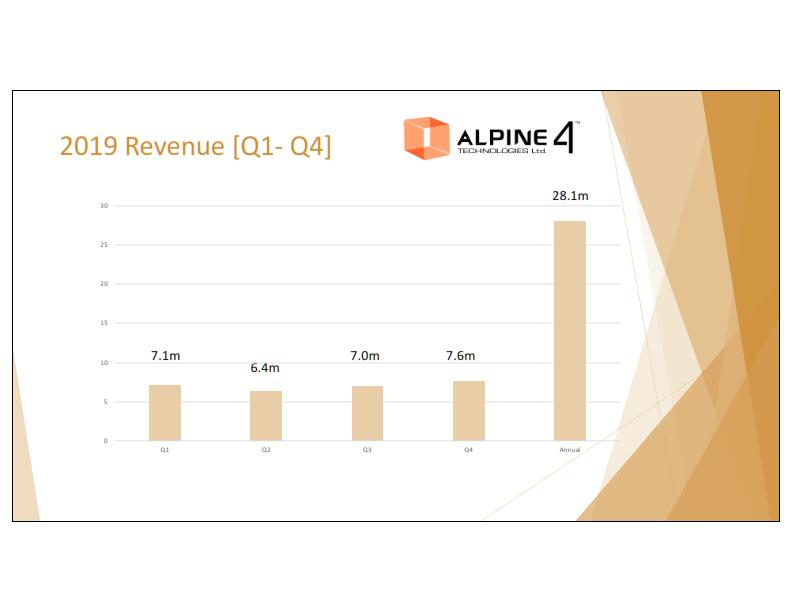

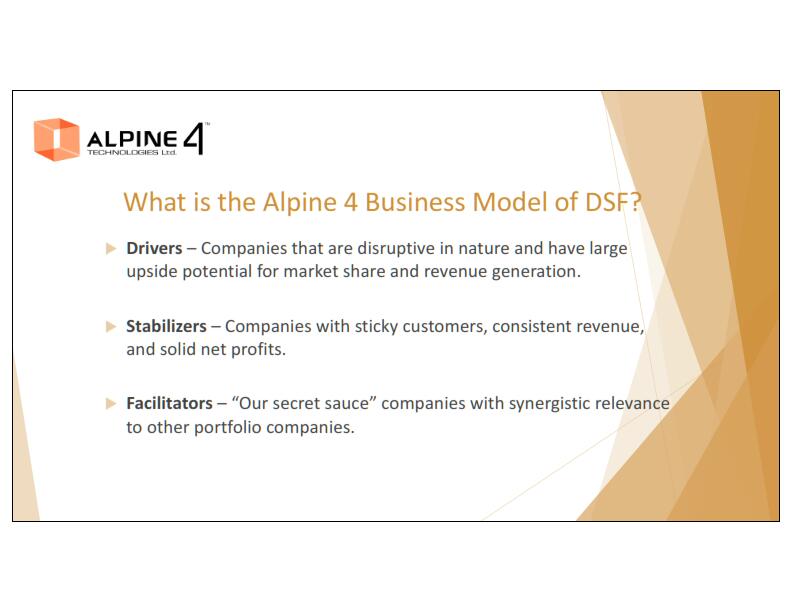

Alpine 4 invested heavily in its DSF acquisition strategy in 2019 and we grew at a rate of 97.4% over 2018. The investment into the right businesses has allowed Alpine 4 to grow beyond a start-up and we now have the substance to really become what we were designed to be.

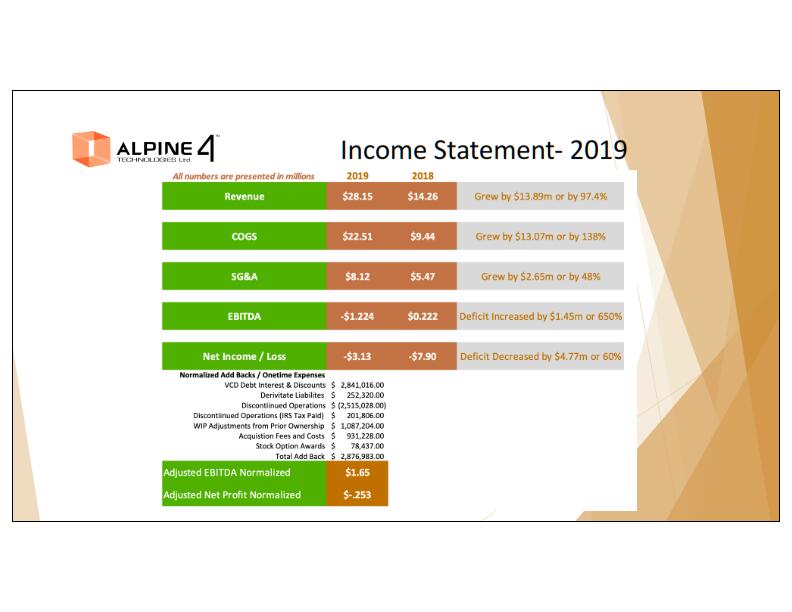

At times, GAAP reporting does not really tell the picture of what has been accomplished and can be too black and white. Further to that point, SOX compliance and other reporting requirements such as Derivative Liabilities, give a snapshot of what could happen, but really don’t give fairness to the larger picture. The hard changes we made in 2019 with restructuring our VCD (Variable Convertible Debt) that we took out to mitigate the theft event at our former subsidiary Venture West Energy Services, and transferring it into FPCD (Fix Price Convertible Debt), will play a large roll in obtaining profitability in 2020. The Interest and Discounts we paid in 2019 of $5,237,205 was mostly made up of the VCD debt, and with that now out of the way, Alpine 4 can begin to effectuate normalized debt service. Further, we also took the opportunity to restructure a larger capital lease for our subsidiary Quality Circuit Assembly, Inc that will free $69K per month in debt service.

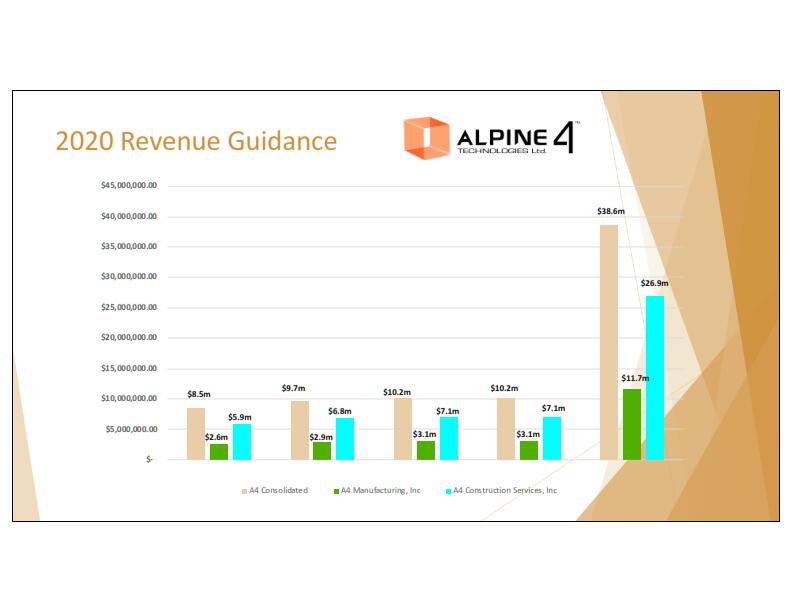

While COVID-19 had no bearing on our 2019 financials, it will play a role in how 2020 and beyond shape up. But, even when faced with a ton of adversity, the strong will persevere and figure a way forward. At Alpine 4, we are figuring out how to move forward. The constraints of labor have forced us to look at more efficient means to produce our products and services, and we answered that call and are starting to do more with less.

I hope you see what we see in Alpine 4. We believe firmly that our best days are yet to come and look forward to building on the progress of 2019.

Best regards

Kent Wilson

CEO / President

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Technologies Ltd.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: April 2, 2020