Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz1q20ceoletter8-k.htm |

Exhibit 99.1

DEAR SHAREHOLDERS AND FRIENDS OF FIRST BUSINESS:

As dramatic changes unfolded affecting how Americans live and work as a result of the COVID-19 pandemic, our people have truly dedicated themselves to supporting one another and our clients in exceptional ways. Leveraging our advanced technology, they shifted quickly to work remotely to serve clients and effectively assisted them with the stimulus programs, truly representing the First Business culture. I simply could not be more proud of them all.

While the human aspects of what is happening in our world have resulted in unprecedented challenges, our ability to deliver solid fundamental operating performance in the current environment is a testament to the strength of our business. During the first quarter, we reported record period-end loans and deposits, strong fee income, and well-managed operating expenses, which helped to offset the COVID-19 related increase to our loan loss provision.

While it’s clear that things will be very different for quite some time, First Business is well positioned to support our clients through this challenging period.

Prepared to Respond to the Unprecedented

Our ability to continue to provide expert counsel and high-quality business banking solutions seamlessly to our clients while prioritizing the health and safety of our employees is the result of our thorough planning and past investments in technology.

During March, management activated the company’s existing Pandemic Preparedness Plan, which is part of our robust and well-tested Business Continuity Plan. Accordingly, we took steps to limit lobby hours, prohibit business travel, and leverage phone, video conferencing, and email to ensure even more frequent communication, both internally with colleagues and externally with clients. Thanks to prior investments in advanced technologies at First Business, we were able to swiftly transition more than 90% of our employees to remote work from the safety of their own homes.

As a result of these efforts, we’ve been able to provide proactive and uninterrupted service to our clients. All of our locations remain accessible, albeit during modified hours or by appointment. In addition, clients are leveraging the multiple non-branch banking channels we offer, including online banking, mobile banking, and remote deposit capture. We’ve also established a dedicated client service team to address clients' needs expediently so they can focus their attention where they should — on managing their businesses.

Our past investments in technology proved particularly valuable in helping our clients access the Paycheck Protection Program (PPP), a component of the Coronavirus Aid, Relief, and Economic Security (CARES) Act designed to help employers maintain their payroll during this crisis. Within days of the plan’s announcement, we launched a PPP online portal specifically for prospective and existing clients, leveraging proprietary technology we had built for past business banking initiatives. This technology, which was originally built to handle our high volume vendor finance business, was modified to receive PPP applications and efficiently move them through an automated process with regular client communication and updates. For longstanding clients who were already familiar with First Business, we were proud to be able to bring our signature level of responsiveness and service to help them secure critical PPP funding. We were also gratified that new clients turned to us to help them successfully navigate the PPP application process when their incumbent financial institution could not or would not.

We mobilized a team of nearly 60 employees, representing 20% of our workforce, including employees who had significant prior Small Business Administration (SBA) lending expertise, to guide clients through the new program. During the first round of the PPP, our team processed over 600 loan applications resulting in the disbursement of approximately $325 million to small- and mid-sized businesses and impacting more than 26,000 jobs. I’m incredibly proud of the way our employees responded to this challenge, working around the clock to ensure our clients were well-supported. At the writing of this letter, the second round of the federal PPP is well underway, and our team is once again rising to the occasion to help the small business community access this vital emergency funding source.

In addition to helping clients access vital funds through the PPP, we granted payment deferral requests to clients in need of temporary relief. As of April 30, 2020, we granted 340 deferral requests, representing $246 million in total outstanding loans. We stand willing to assist clients as needed throughout the second quarter and beyond.

First Quarter 2020 Financial Results

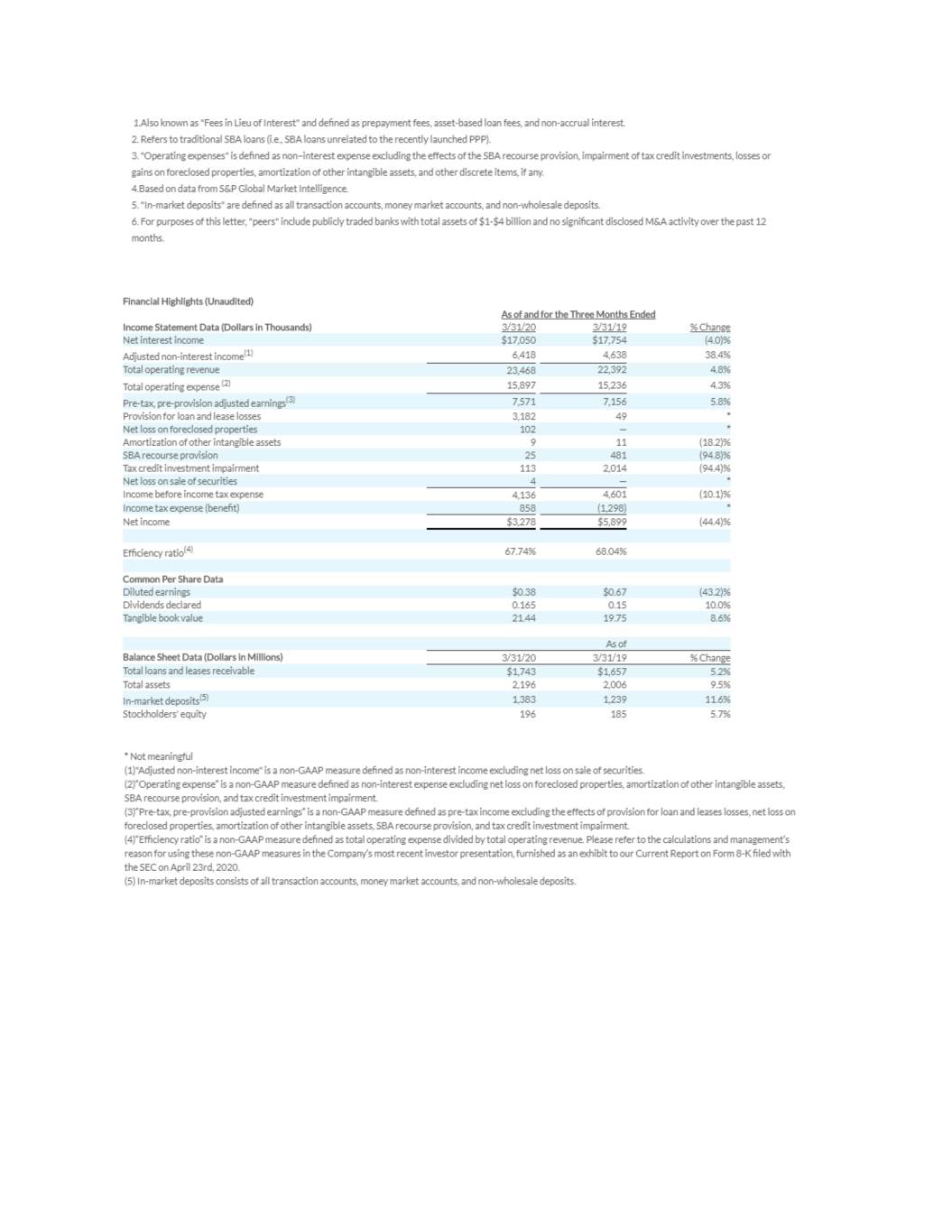

We delivered solid financial results in the first quarter of 2020 despite the onset of the COVID-19 pandemic. Total loans at quarter-end reached record levels and strong fee income helped to offset lower net interest income during the period and position us well heading into the second quarter.

First quarter 2020 net income was $3.3 million, or $0.38 per share, reflecting strong operating fundamentals partially offset by a prudent increase in loan loss reserves in the face of COVID-19 and its impact on the U.S. economy. Importantly, first quarter 2020 top line revenue, the sum of net interest income and non-interest income, was $23.5 million, up 4.8% from the first quarter of last year.

Net interest income was $17.1 million for the first quarter of 2020, compared to $17.8 million in the first quarter of last year. As you may recall from previous letters, the Company’s net interest income experiences variability from quarter to quarter primarily due to loan fees1, which were lower this quarter compared to the exceptionally high levels reported this time last year. Lower average loans and a decline in net interest margin also contributed to the lower net interest income levels in the first three months of this year. However, excluding fees, net interest margin was relatively stable, decreasing just two basis points to 3.30% from 3.32% in the first quarter of 2019. We believe a stable net interest margin is a tenet of our operating model as we limit our exposure to changes in interest rates with conservative balance sheet management.

Loan balances at March 31, 2020 reached record levels, growing 5.2% over the last 12 months to $1.744 billion at the end of the first quarter. The first quarter is historically our slowest lending quarter due to seasonal factors, so we are especially pleased with our loan growth, which was led by strong commercial and industrial (C&I) expansion, including contributions by our higher-margin nationwide accounts receivable financing division — First Business Growth Funding. Commercial real estate loans also grew nicely as the existing construction projects in our markets were not meaningfully impacted by any COVID-19 restrictions.

Non-interest income was $6.4 million, or 27% of top line revenue - once again above our target of 25% -, for the quarter on strong private wealth management and swap fee income, which offset lower gains on the sale of SBA loans. Private wealth management fees grew to $2.1 million and swap fees were strong during the quarter at $1.7 million.

While gains on the sale of SBA loans2 were down compared to recent quarters, in part due to interruptions resulting from the COVID-19 pandemic, our pipeline continues to grow and we believe that we can continue to grow this non-interest income stream over time.

Operating expenses3 declined from the fourth quarter of 2019, and we expect only modest growth over the next few quarters as business travel and new hires remain limited during these uncertain times. As we progress towards a recovery, we will be thoughtful in aligning expense with revenue to drive positive operating leverage while continuing to position the company for growth.

Asset Quality

As we navigate the current credit cycle, we do so from a much stronger capital position than we were in during the Great Recession. While we cannot predict what may happen in the current environment, we believe that our dedication to strong underwriting and our niche business banking focus, which does not include a retail consumer lending portfolio, will differentiate us relative to peers and the industry moving forward.

Within our commercial banking business, we are well-diversified by industry and have limited exposure to some that are expected to be more impacted by the social distancing and other economic impacts of the ongoing pandemic, such as retail, hospitality, entertainment, restaurant, and food service. Collectively, First Business has exposure of $171.2 million, or less than 10% of gross loans and leases, in these industries. Importantly, more than half of the outstanding loans to First Business clients in these industries are secured by commercial real estate collateral. Additionally, First Business has no meaningful direct exposure to the energy or airline industries. First Business also does not have exposure to Shared National Credits, which are loans of $100 million or more made by groups of three or more banks. Instead, we focus our attention and capital on building direct relationships with individual clients with whom we can engage one-on-one. These direct relationships have never been more important than in the current operating environment.

Our allowance for loan and lease losses (ALLL) increased by 16.5% during the quarter, due to the COVID-19 pandemic. We increased both general and specific reserves, and at March 31, 2020, the Company’s ALLL to total loans ratio was 1.30%, up 16 basis points from the first quarter of 2019. During the first quarter of 2020, in spite of the national economic challenges associated with COVID-19, we recorded $46,000 in net recoveries on loans previously charged off. While we do not expect net recoveries moving forward, we believe this activity represents the strength of our loan portfolio prior to any stress that may emerge in the industry due to the COVID-19 pandemic.

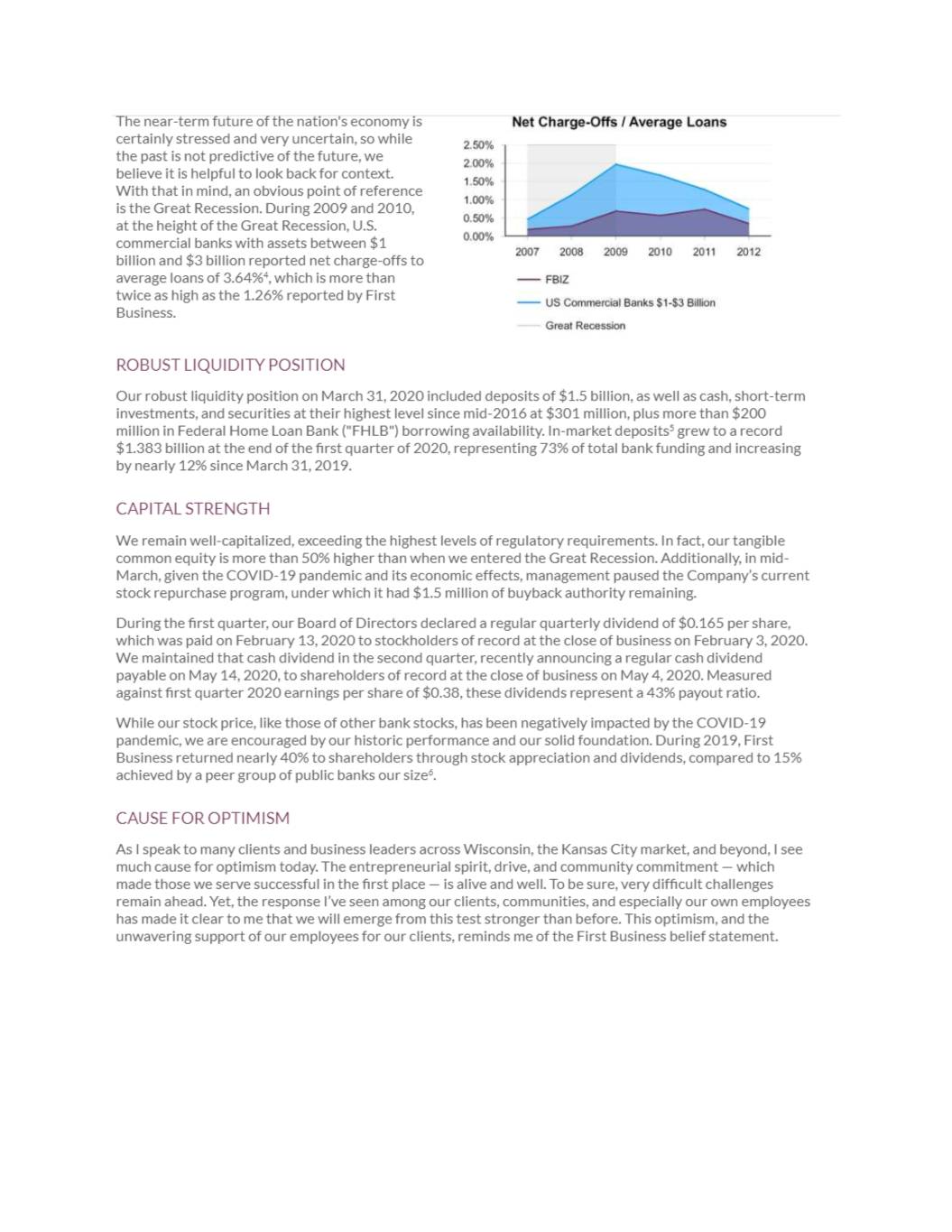

The near-term future of the nation's economy is certainly stressed and very uncertain, so while the past is not predictive of the future, we believe it is helpful to look back for context. With that in mind, an obvious point of reference is the Great Recession. During 2009 and 2010, at the height of the Great Recession, U.S. commercial banks with assets between $1 billion and $3 billion reported net charge-offs to average loans of 3.64%4, which is more than twice as high as the 1.26% reported by First Business.

Robust Liquidity Position

Our robust liquidity position on March 31, 2020 included deposits of $1.5 billion, as well as cash, short-term investments, and securities at their highest level since mid-2016 at $301 million, plus more than $200 million in Federal Home Loan Bank ("FHLB") borrowing availability. In-market deposits5 grew to a record $1.383 billion at the end of the first quarter of 2020, representing 73% of total bank funding and increasing by nearly 12% since March 31, 2019.

Capital Strength

We remain well-capitalized, exceeding the highest levels of regulatory requirements. In fact, our tangible common equity is more than 50% higher than when we entered the Great Recession. Additionally, in mid-March, given the COVID-19 pandemic and its economic effects, management paused the Company’s current stock repurchase program, under which it had $1.5 million of buyback authority remaining.

During the first quarter, our Board of Directors declared a regular quarterly dividend of $0.165 per share, which was paid on February 13, 2020 to stockholders of record at the close of business on February 3, 2020. We maintained that cash dividend in the second quarter, recently announcing a regular cash dividend payable on May 14, 2020, to shareholders of record at the close of business on May 4, 2020. Measured against first quarter 2020 earnings per share of $0.38, these dividends represent a 43% payout ratio.

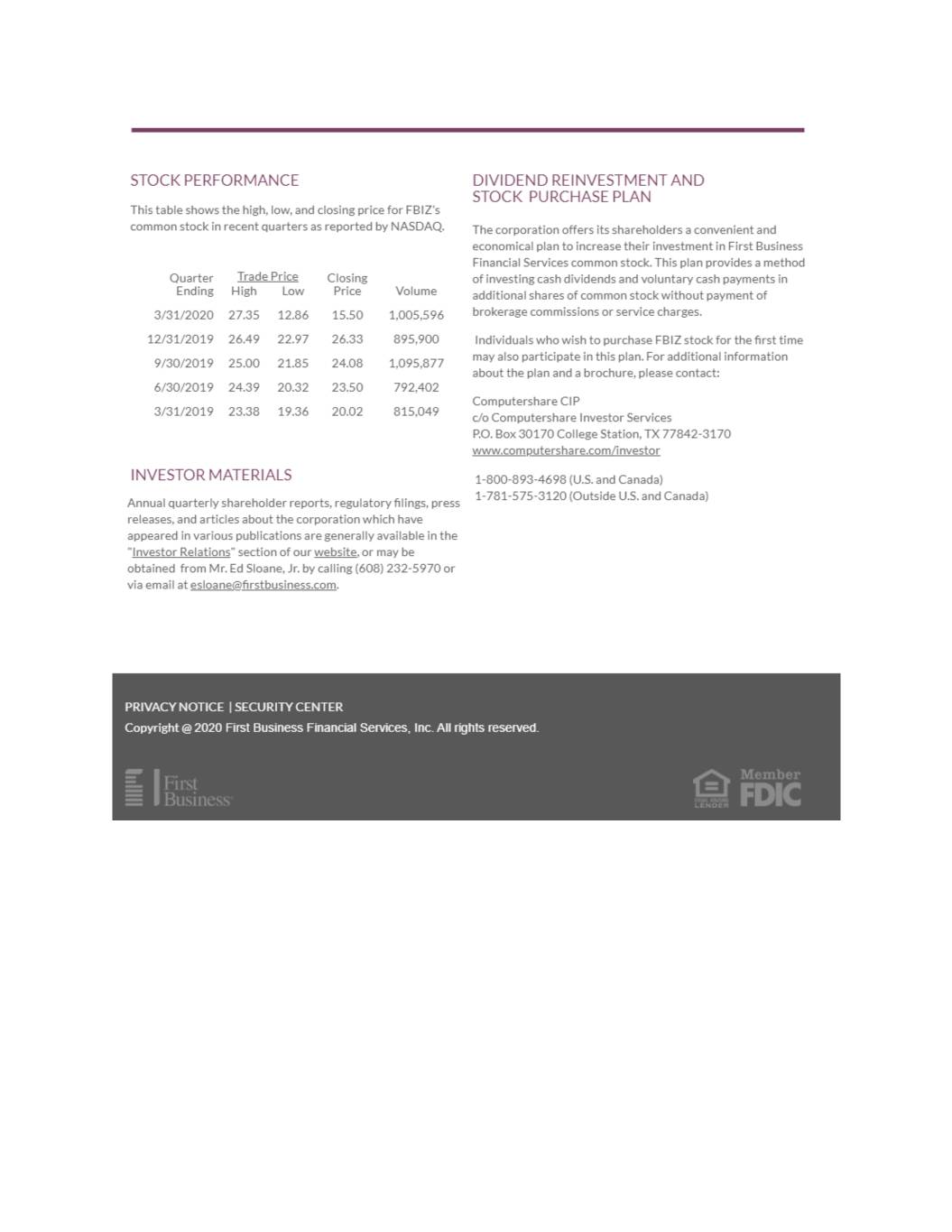

While our stock price, like those of other bank stocks, has been negatively impacted by the COVID-19 pandemic, we are encouraged by our historic performance and our solid foundation. During 2019, First Business returned nearly 40% to shareholders through stock appreciation and dividends, compared to 15% achieved by a peer group of public banks our size6.

Cause for Optimism

As I speak to many clients and business leaders across Wisconsin, the Kansas City market, and beyond, I see much cause for optimism today. The entrepreneurial spirit, drive, and community commitment — which made those we serve successful in the first place — is alive and well. To be sure, very difficult challenges remain ahead. Yet, the response I’ve seen among our clients, communities, and especially our own employees has made it clear to me that we will emerge from this test stronger than before. This optimism, and the unwavering support of our employees for our clients, reminds me of the First Business belief statement.

You can expect us to continue to do our part, and more, as the entire team commits to being a source of strength and stability for those we serve. Thank you for joining us on this journey, and for your continued interest and investment in First Business.

Sincerely,

Corey Chambas, President and CEO

This letter includes “forward-looking statements” related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We do not intend to, and specifically disclaim any obligation to, update any forward-looking statements.

1. | Also known as "Fees in Lieu of Interest" and defined as prepayment fees, asset-based loan fees, and non-accrual interest. |

2. | Refers to traditional SBA loans (i.e., SBA loans unrelated to the recently launched PPP). |

3. | "Operating expenses" is defined as non–interest expense excluding the effects of the SBA recourse provision, impairment of tax credit investments, losses or gains on foreclosed properties, amortization of other intangible assets, and other discrete items, if any. |

4. | Based on data from S&P Global Market Intelligence. |

5. | "In-market deposits" are defined as all transaction accounts, money market accounts, and non-wholesale deposits. |

6. | For purposes of this letter, "peers" include publicly traded banks with total assets of $1-$4 billion and no significant disclosed M&A activity over the past 12 months. |