Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FVCBankcorp, Inc. | tm2020612d1_8k.htm |

Exhibit 99.1

2020 Annual Shareholders’ Meeting May 20, 2020 NASDAQ: FVCB

Forward - Looking Statements; Non - GAAP Information This presentation contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities and Exchange Act of 1934 , as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of FVCB’s operations and policies and regarding general economic conditions . These forward - looking statements include, but are not limited to, statements about ( i ) FVCB’s plans, obligations, expectations and intentions and (ii) other statements that are not historical facts . In some cases, forward - looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases . These statements are based upon the expectations, beliefs and assumptions of the management of FVCB as to the expected outcomes of future events, current and anticipated economic conditions, nationally and in FVCB’s markets, and their impact on the operations and assets of FVCB, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant risks and uncertainties . Factors that could cause results and outcomes to differ materially include, among others, the expected growth opportunities or cost savings resulting from the merger, which may not be fully realized or take longer than expected to realize ; the ability of the two companies to avoid customer dislocation or runoff, and employee attrition following the merger ; changes in FVCB’s operating or expansion strategy ; availability of and costs associated with obtaining adequate and timely sources of liquidity, the ability to maintain credit quality, possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the ability of FVCB to collect amounts due under loan agreements, changes in consumer preferences, effectiveness of FVCB’s interest rate risk management strategies, laws and regulations affecting financial institutions in general or relating to taxes, the effect of pending or future legislation, business disruption following the merger with Colombo, changes in interest rates and capital markets, inflation, customer acceptance of FVCB’s products and services, customer borrowing, repayment, investment and deposit practices ; customer disintermediation ; the introduction, withdrawal, success and timing of business initiatives ; competitive conditions and other risk factors described in FVCB’s filings with the SEC . For a discussion of these and other factors, please review the “Cautionary Note Regarding Forward - Looking Statements” and Risk Factors in FVCB’s prospectus filed with the SEC on September 17 , 2018 , pursuant to Rule 424 (b) . Because of these uncertainties and the assumptions on which this discussion and the forward - looking statements are based, actual future operations and results in the future may differ materially from those indicated herein . Readers are cautioned against placing undue reliance on such forward - looking statements . Past results are not necessarily indicative of future performance . FVCB assumes no obligation to revise, update, or clarify forward - looking statements to reflect events or conditions after the date of this release . Use of Non - GAAP Financial Measures This presentation includes certain financial information that is calculated and presented on the basis of methodologies that are not in accordance with U . S . Generally Accepted Accounting Principles (“GAAP”) . These non - GAAP financial measures include core return on average assets, tangible book value, tangible common equity, tangible assets and efficiency ratio . The non - GAAP financial measures included in this presentation do not replace the presentation of FVCB’s GAAP financial results, should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies . These measurements provide supplemental information to assist management, as well as certain investors, in analyzing FVCB’s core business, capital position and results of operations . FVCB has chosen to provide this additional information to investors because it believes that these measures are meaningful in assisting investors to evaluate FVCB’s core ongoing operations, results and financial condition . Reconciliations of the non - GAAP financial measures provided in this presentation to the most directly comparable GAAP measures can be found in the appendix of this presentation . 2

3 (1) Financial data as of the year ended December 31, 2019, unless otherwise noted (2) Nonperforming assets defined as nonaccruals, loans past - due 90 days or more, and other real estate owned Source: S&P Global Market Intelligence; Company documents Company Snapshot FVCB Legacy ( 6 ) FVCB Acquired (5) 2 6 1 3 5 4 9 7 8 10 Address City , State Total Deposits ($000) 5-Year CAGR (%) 1 11325 Random Hills Rd Fairfax, VA 605,430 21.74 2 7900 Sudley Rd Manassas, VA 182,075 13.54 3 11260 Roger Bacon Dr Reston, VA 140,329 18.16 4 2500 Wilson Blvd Arlington, VA 114,691 12.08 5 6975 Springfield Blvd Springfield, VA 53,471 24.29 6 43800 Central Station Dr Ashburn, VA 67,716 – 7 224 Albemarle St Baltimore, MD 21,649 17.28 8 6929 Arlington Rd Bethesda, MD 16,749 3.36 9 1600 E Gude Dr Rockville, MD 21,501 (8.77) 10 7901 Eastern Ave Silver Spring, MD 13,529 (1.95) 11 1301 9th St NW Washington, DC 32,234 (14.87) Dollar values in thousands, except per share data Financial Highlights ¹ Total Assets $1,537,295 Gross Loans $ 1,272,863 Total Deposits $ 1,285,722 Tangible Common Equity $ 170,389 TCE / TA 11.15% Core ROAA 1.11% Core ROAE 9.45% Net Interest Margin 3.48% Core Efficiency Ratio 56.64% NPAs² / Assets 0.95% Capitalization Detail ¹ Common Shares Outstanding (actual) 13,902,067 Options Outstanding 1,797,516 Average Weighted Strike Price of Options $ 8.09 Restricted Stock Units ( Excluded from share count) 109,718 Basic Tangible Book Value per Share $ 12.26 Diluted EPS $ 1.07 11

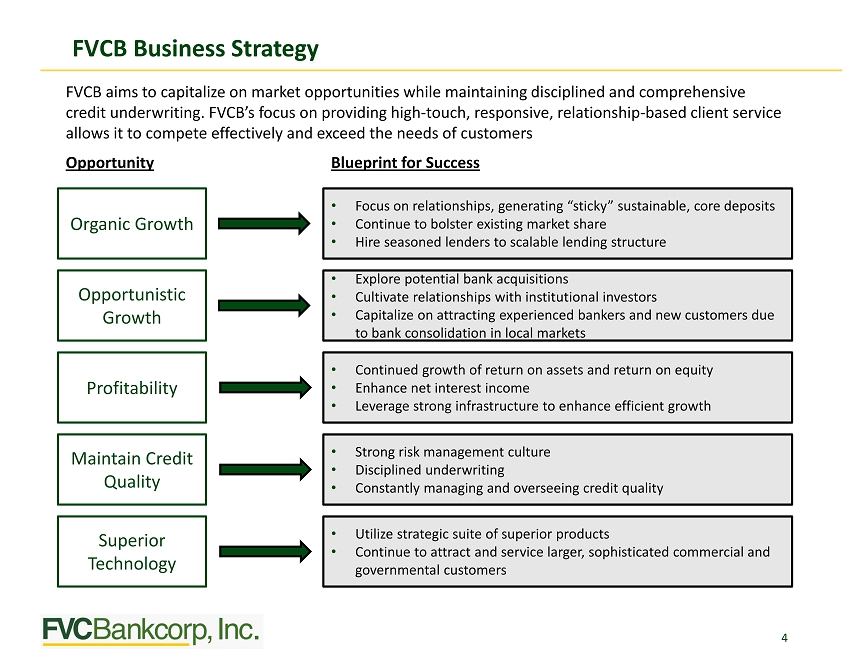

FVCB Business St r a t egy 4 FVCB aims to capitalize on market opportunities while maintaining disciplined and comprehensive credit underwriting. FVCB’s focus on providing high - touch, responsive, relationship - based client service allows it to compete effectively and exceed the needs of customers Opportunity Blueprint for Success Organic Growth • Focus on relationships, generating “sticky” sustainable, core deposits • Continue to bolster existing market share • Hire seasoned lenders to scalable lending structure Opportunistic Growth • Explore potential bank acquisitions • Cultivate relationships with institutional investors • Capitalize on attracting experienced bankers and new customers due to bank consolidation in local markets Maintain Credit Quality • Strong risk management culture • Disciplined underwriting • Constantly managing and overseeing credit quality Superior Technology • Utilize strategic suite of superior products • Continue to attract and service larger, sophisticated commercial and governmental customers Profitability • Continued growth of return on assets and return on equity • Enhance net interest income • Leverage strong infrastructure to enhance efficient growth

Colombo contribution 5 Total Assets Total Loans, Net of Fees Total Deposits CAGR: 16.8% CAGR: 16.4% CAGR: 16.9% Organic YOY Growth Rate Organic YOY Growth Rate Organic YOY Growth Rate Organic Growth Track Record of Exceptional Growth and Strong Profitability Relationship Driven Model Continues to Create Balance Sheet Leverage 19.3 % 21.8 % 23.3% 15.8 % 9.5 % 13.7 % 24.1% 22.4 % 23.1 % 15.8 % 11.8 % 11.8% 17.2% 24.4 % 23.8% 19.6% 10.3 % 10.8 %

(1) Excludes one - time transaction costs of $3.3 million for 2018 Source : S&P Global Market Intelligence; Company documents 6 Pre - Tax Income ($M) Efficiency Ratio (%) Net Interest Margin (%) Drivers of Earnings Growth : • Continued leverage and upside on Colombo franchise • Continued growth in legacy D . C . and Virginia markets Track Record of Exceptional Growth and Strong Profitability Stable Margin and Improving Efficiency Produce An Attractive Earnings Stream 21.3% CAGR

Experienced Leadership Team Management Team With Strong Ties to The Market… 7 FVCB’s executive m ana g e me n t t eam c onsi s t s o f seven o ffice r s with o v e r 185 y e a r s o f c o mbined e xperienc e in the W a shin gt on, D. C . m e t r o poli t an a r ea • D a v i d P ij or w a s the f o u n d i ng Ch a irm an o f the B o a r d o f James M on r o e Bancorp , which o pen e d in J une 1998 in Arli n g t on, V A, a n d w a s in s t rume n t al i n the g r o wth a n d s t r a t e g i c di r ection o f the b ank u n ti l it s s ale t o Me r c a n til e Ban k sha r e s C orp o r a tion i n 200 6 f or $143. 8 m illion Name Current Position Prior Community Bank Experience Years Years at FVCB Experience David W. Pijor Chairman & CEO, Company and Bank James Monroe Bancorp 20 12 Patricia A. Ferrick President, Company and Bank Southern Financial Bancorp, Potomac Bank of Virginia 32 12 B. Todd Dempsey EVP and Chief Operating Officer, Company and Bank United Bank 38 12 William G. Byers EVP and Chief Lending Officer, Company and Bank Middleburg Bank, Century National Bank 25 8 Michael G. Nassy EVP and Chief Credit Officer, Company and Bank City First Bank of DC, National Cooperative Bank 19 7 Sharon L. Jackson EVP and Chief Deposit Officer, Company and Bank MainStreet Bank 33 3 Jennifer L. Deacon EVP and Chief Financial Officer, Company and Bank Cardinal Financial Corp. 22 2

8 David Pijor Chairman & CEO • Served as Chairman of the Board and CEO of FVCB since its organization • Lead organizer, Chairman of the Board and General Counsel of James Monroe Bank from its inception to sale to Mercantile Bankshares L. Burwell Gunn Jr. Vice Chairman • Served as Vice Chairman of the Board since 2015 • Served as President and COO of FVCB from 2008 to 2013 • Served as CEO and President of Cardinal Bank from 1997 to 1999 • Served as Director of the Board since 2018 • Previous Chairman, President and Principal Owner of Colombo bank for 16 years until its sale to FVCB in 2018 Bio Bio Patricia Ferrick President & Director Scott Laughlin Director Tom Patterson Director Devin Satz Director Larry Schwartz Director Morty Bender Director Sidney Simmonds Director Daniel Testa Director Phillip Wills Director Steven Wiltse Director • Manages various Wills family real estate development firms • Co - founded Church Investments and Consolidated Green Services • President of Simmonds & Klima , Ltd • Served as Chairman of the Board at First Commonwealth Bank of Virginia • Served as Director of Bank of Northern Virginia • Owner, President and CEO of TCI since 1980 • Serves as Director of Advanced Solutions International • Partner and Co - founder of Argy , Wiltse & Robinson, P.C. • Served as Director at Cardinal Financial Corp • Serves as President of the Bank and Company • CFO and EVP from FVCB’s inception until June of 2017 • Former auditor at KPMG • Founder of Synchronous Knowledge, Inc. until its sale to IMS Health Incorporated in 2005 • Retired from the U.S. Air Force in 1999 • Co - owner of LMO Advertising • CEO of Zymetis • Advisor at First Juice, Inc. and Ardent Capital • Former Attorney with Linowes and Blocher , LLP • Served as Director at James Monroe Bank • Vice President of Friendship Place non - profit • Serves as the Managing Partner of Schwartz, Weissman & Co • Former director of Annapolis Bancorp Source : S&P Global Market Intelligence Experienced Leadership Team … Governed and Supported By An Exceptional Board

9 Positioning For Future Growth Source : S&P Global Market Intelligence; Company documents • 20 loan officers with deep connections to the markets; average experience of over 20 years • Focused effort on commercial, real estate and small business • Total loans originated during 2019 totaled $419.4 million • Small average loan balance helps mitigate risk ‒ C&I average loan size: $374,000 ‒ CRE average loan size: $1.4 million Well Diversified Commercial Portfolio

Strong Core Deposit Base • Full service relationships continue to drive core deposit growth ‒ Approximately $861.1mm in loans, or 74% of the commercial loan portfolio, retain a deposit relationship with the bank • Growth in commercial accounts provide cross selling opportunities with FVCB’s technology investment ‒ $811.4 mm in commercial deposits, across 6,100 accounts, with an average rate of 0.86% ‒ Treasury management tools and high - touch service allows FVCB to compete for larger clients • $107.8 million in public funds at an average rate of 1.96% 10 Source : S&P Global Market Intelligence; Company documents

COVID - 19 Update 11 We provide access to financial tools, financial solutions and exceptional service with proactive and responsive relationship banking matched by a commitment to safely and soundly manage bank assets, liquidity and capital. Now more than ever, these priorities have never been more important . Customer outreach and financial Solutions • Regular drive - through hours at all drive - thru locations • Access to all ATMs for deposits and withdrawals • Access to robust and secure mobile and online banking to transact banking with responsive customer support • Providing support to our customers through personal outreach, and temporary solutions such as loan modifications that provide payment deferrals up to 90 days • Participation in the Paycheck Protection Program (PPP loans) to support our customers and businesses in our community Employee and Customer Safety • Our information technology infrastructure has afforded our Bank employees the ability to work predominantly remotely as we continue to service the needs of our clients • When in office locations, employees are maintaining safe distances and we have provided more frequent cleaning of our facilities to maintain a safe environment • Provide our customers with financial solutions as well as access to bankers who understand their business and respond quickly

COVID – 19 Update ( continued) 12 Proactive Bank Management • We activated our Emergency Management Team process in February to establish the framework for social distancing protocols and involve management and necessary third parties to allow for a smooth transition given pending pandemic • Effectively managed liquidity both on balance sheet and with alternative available sources • Diligent monitoring and customer contact with identified credit exposure to high impact asset classes including hotels, churches, and public facilities including retail and other social venues • Provided regular communication on our website and via email communications to our customers • Access to all ATMs for deposits and withdrawals • Management remains connected to employees through daily departmental calls, weekly company - wide conference calls and regular notifications and updates through both email and the Company’s intranet as warranted. Community Outreach • Reallocated budgeted funds for employee engagement to providing support to community organizations selected by our employees • Contributed to local food banks - Food For Others in Fairfax, Maryland Food Bank, and Capital Area Food Bank in D.C. • Extended Burwell Gunn annual Charity award to three community based client organizations

CARES Act – Paycheck Protection Program 13 The CARES Act, which was enacted March 27, 2020, included several provisions designed to provide relief to individuals and businesses as well as the banking system. Among the more significant components of this legislation was the creation of the PPP. Loans made under the PPP are fully guaranteed as to principal and interest by the SBA, whose guarantee is backed by the full faith and credit of the U.S government. PPP loans afford borrowers forgiveness up to the principal amount of the PPP covered loan if the proceeds are used to retain workers and maintain payroll or make mortgage interest, lease and utility payments. The SBA will reimburse banks that participate in this program for any amount of a PPP covered loan that is forgiven . We are actively participating in originating PPP loans, and began processing applications at the inception of the program. Under the first round of PPP, we originated 389 applications for approximately $132 million. We continue to participate during the second round of PPP, assisting new and existing clients obtain funding under this program through the origination of 314 loans for approximately $ 48 million as of May 13, 2020.

Quarter Ended March 31, 2020 First Quarter Selected Highlights • Improved Credit Quality Metrics • Watchlist credits decreased $31.3 million or 56% • Nonperforming loans and loans past due 90 days or more were 0.56% of total assets • Continued Growth in Loan Portfolio • Total loans, net of fees increased $11.6 million • Strong Core Deposit Growth • Core deposits increased $33.8 million, 11 % annualized • Noninterest - bearing deposits represent 24% of the core deposit base • Increased Net Interest Income and Margin • Net interest margin was 3.37% compared to 3.28 % for the fourth quarter of 2019 • Cost of funds decreased by 12 basis points from the prior quarter • Increased Provision for Loan Losses • Recorded a provision for loan losses of $1.1 million during the first quarter of 2020; a result of the uncertainty of the COVID - 19 impact 14

Quarter Ended March 31, 2020 (continued) • Share Repurchase Program • The Company repurchased 487,531 shares of common stock at an average price of $14.90 • The Company has suspended stock repurchases at this time. • Well - Capitalized Bank • Capital ratios at the Company’s subsidiary bank, FVCbank , remain well - capitalized at March 31, 2020 • Improved Efficiency Ratio • Efficiency ratio for the three months ended March 31, 2020 was 55.9%, an improvement from 59.0% for the prior quarter 15

The L. Burwell Gunn Citizenship Award Each year, FVCBank identifies several nonprofit organizations to award funds from the L. Burwell Gunn Citizenship Award to support these organizations ongoing efforts to help the communities we serve. Kids R First ( https:// www.kidsrfirst.org ) Kids R First is an all - volunteer 501(c)(3) organization dedicated to the education and helping kids (grades K - 12) from families of limited financial means. They help provide the necessary school supplies for kids in need to receive the same opportunities as their peers. Montgomery Child Care Association, Inc. (MCCA ) ( www.mccaedu.org ) is a nonprofit child care provider that strives to deliver the highest quality child care and play - based education for children in Montgomery County, Maryland; professional training for child care providers; and advocacy for affordable quality child care for families of all income levels. Embry Rucker Community Shelter ( https :// www.cornerstonesva.org ) The Embry Rucker Community Shelter (ERCS) located in Reston, Virginia, is a 70 - bed residential shelter that provides healthy, safe, emergency housing for individuals and families. They are dedicated to helping their clients overcome the circumstances that led to their homelessness, and facilitate their transition to stable housing. 16

2020 Annual Shareholders’ Meeting May 20, 2020 NASDAQ: FVCB