Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OGLETHORPE POWER CORP | a8kye19q120invbriefing.htm |

Year-End 2019 and First Quarter 2020 Investor Briefing May 20, 2020 Year-End 2019 and First Quarter 2020 Investor Briefing

Notice to Recipients Cautionary Note Regarding Forward Looking Statements Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe”), that are not historical facts are forward- looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward-looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS ” and “RISK FACTORS” in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020 and “RISK FACTORS” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Securities and Exchange Commission on March 23, 2020. This electronic presentation is provided as of May 20, 2020. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. Year-End 2019 and First Quarter 2020 Investor Briefing 2

Presenters and Agenda Mike Smith Betsy Higgins Mike Price President and Executive Vice President and Executive Vice President and Chief Executive Officer Chief Financial Officer Chief Operating Officer • Overview • COVID-19 Update • Vogtle 3&4 Update • Review of Operations • Member Update • Review of Financial Results and Condition Year-End 2019 and First Quarter 2020 Investor Briefing 3

Overview of Oglethorpe Power Corporation Business Power Supply Resources Ratings Senior Secured/ Outlook/ Short-Term ‣ Member-owned not-for- ‣ Largest electric profit Georgia electric cooperative in the United Moody’s: membership corporation. States by assets, among Baa1/Stable/P-2 other measures. ‣ Wholesale electric provider S&P: to 38 Member distribution ‣ Generating assets total BBB+/Negative/A-2 co-ops in Georgia. approximately 7,863 MW. ‣ Take or pay, joint and • Includes 738 MW of Fitch: several Wholesale Power member-owned assets BBB+/Negative/F1 Contracts with Members which we manage. through December 2050. • Allows for recovery of all ‣ Members purchase Financial costs, including debt 430 MW of renewables service. through Green Power ‣ 2019 revenues of over EMC, growing to 1,200 $1.4 billion. ‣ Members’ peak load: MW by 2022. • 2020 Winter: 7,845 MW ‣ Total assets over $13 (January) ‣ Also schedule federal billion. hydropower for Members • 2019 Summer: 9,477 MW – 516 MW in 2020. (August) ‣ SEC filing company. • Highest peak load: ‣ 30% of Vogtle 3&4 9,477 MW, Summer 2019 expanding generation by 660 MW in 2021-2022. Year-End 2019 and First Quarter 2020 Investor Briefing 4

Response to COVID-19 by Oglethorpe ‣ Plant operations have continued with appropriate precautions, while headquarters staff went to working remotely the week of March 16, currently into week 10. ‣ No positive cases for employees as of May 20. ‣ Plant employees and contractors are being screened daily (including temperatures) before being allowed plant site entry. ‣ All plants have performed very well and are working in preventative mode (staggered and distanced) with modified shift schedules except those with outage work underway. ‣ Plants are prepared for sequestration, if necessary. ‣ Offering grace period for Member bill payments over next 5 months; allows Members time to access liquidity if they find themselves in a “cash crunch” due to delayed payments from customers. ‣ Utilized $1.2B backup syndicated credit facility during frozen commercial paper market which has now abated. ‣ Expect to “re-open” headquarters campus in Tucker, GA on June 1 with a phased approach allowing a subset of employees to return to work. Year-End 2019 and First Quarter 2020 Investor Briefing 5

Response to COVID-19 by Oglethorpe Members ‣ Very few positive cases for our Members’ employees. ‣ All Members implemented some changes in operations to mitigate spread of COVID-19, but to varying degrees depending upon their location and circumstances. ‣ Some are now taking steps toward “normal” operations. ‣ Non-payment cutoffs and late fees have been suspended during the “shelter-in- place” by most EMCs. Impact to date is minimal. As the “shelter-in-place” has been lifted and things are now returning more to normal in Georgia, we expect this risk to decline and not materially impact us or our Members. ‣ Most EMCs report muted effects on load and delinquencies so far. • Shoulder months now; impact may be higher for summer months if situation lingers. • Members are reporting a slight increase in residential load offsetting a slight decrease in commercial and industrial load in certain parts of the state. • Total system load down in March and April, but primarily due to cooler weather compared to 2019; impact related to COVID only 1-2% for March and April. Year-End 2019 and First Quarter 2020 Investor Briefing 6

Response to COVID-19 at Vogtle 3&4 Project Site ‣ Before COVID-19, 9,000+ workers at a single site, working on two new nuclear units. Work never suspended. ‣ On-site testing via five fully-staffed medical trailers (“medical village”). Total cases peaked at ~ 230 positive cases. Recently seen steady recoveries and declining trend to ~35 net positive cases. ‣ In addition to increased medical facilities, the site has added social distancing measures, provided additional personal protective equipment for employees, implemented telecommuting where possible, and added additional cleaning measures. ‣ Coronavirus impacts have exacerbated existing productivity concerns and led to a ~20 percent reduction in existing workforce. This is expected to improve efficiency as well as allow for increased social distancing. ‣ We do not currently see any impact to our official November 2021 and November 2022 in-service dates or the $7.5B Oglethorpe budget. ‣ Our share of COVID-19 related costs at Vogtle 3-4 is currently estimated at $13 million. Year-End 2019 and First Quarter 2020 Investor Briefing 7

Vogtle 3&4 Project Status ‣ Official Schedule • Unit 3 in-service November 2021. • Unit 4 in-service November 2022. ‣ Budget – OPC $7.5 billion. ‣ Total Project Construction is ~81.2% complete. ‣ Site continues to pursue more aggressive schedule. ‣ Developed a Unit 3 November Benchmark Schedule. Year-End 2019 and First Quarter 2020 Investor Briefing 8

Major Milestones – November Benchmark Open Cold Hydro Hot Functional Fuel Substantial Vessel Test Test Load Completion Testing (start) (start) Unit 3 April Sept Jan June Nov 2020 2020 2021 2021 2021 ‣ Open Vessel Testing – Verification of design requirements through flow measurements, pump performance, line resistance, and tank mapping of the reactor coolant system and associated systems ‣ Cold Hydro Testing – Reactor coolant system and associated systems will be filled and then pressure tested to ensure no leakage ‣ Hot Functional Testing – Exercising and validating plant procedures while running primary systems at operating pressure and temperature and rolling the main turbine at normal operating speed ‣ Fuel Load – Receive authorization from the NRC and begin loading of fuel Year-End 2019 and First Quarter 2020 Investor Briefing 9

Vogtle 3&4 Construction Update U3 Progress U3 Look Ahead – Set the Integrated Head Package (top – Complete Closed Vessel photo) on the Reactor testing Vessel – Start Cold Hydro – Set the Shield Building Testing roof steel on top of the Shield Building – Set the CB20 water storage tank on top of – Completed secondary the Shield Building hydro of the Steam Generators – Turbine on Turning Gear – Completed Open Vessel Testing U4 Progress U4 Look Ahead – Set the Containment Vessel Top Head – Set Shield Building (bottom photo) courses 13 & 14 – Set and placed concrete – Begin Initial in Shield Building Energization Courses 11 & 12 – Complete testing of – Set the polar crane the polar crane and inside containment declare it operational – Set all four of the – Set the Air Inlet Panels Reactor Coolant Pumps on the Shield Building in containment Year-End 2019 and First Quarter 2020 Investor Briefing 10

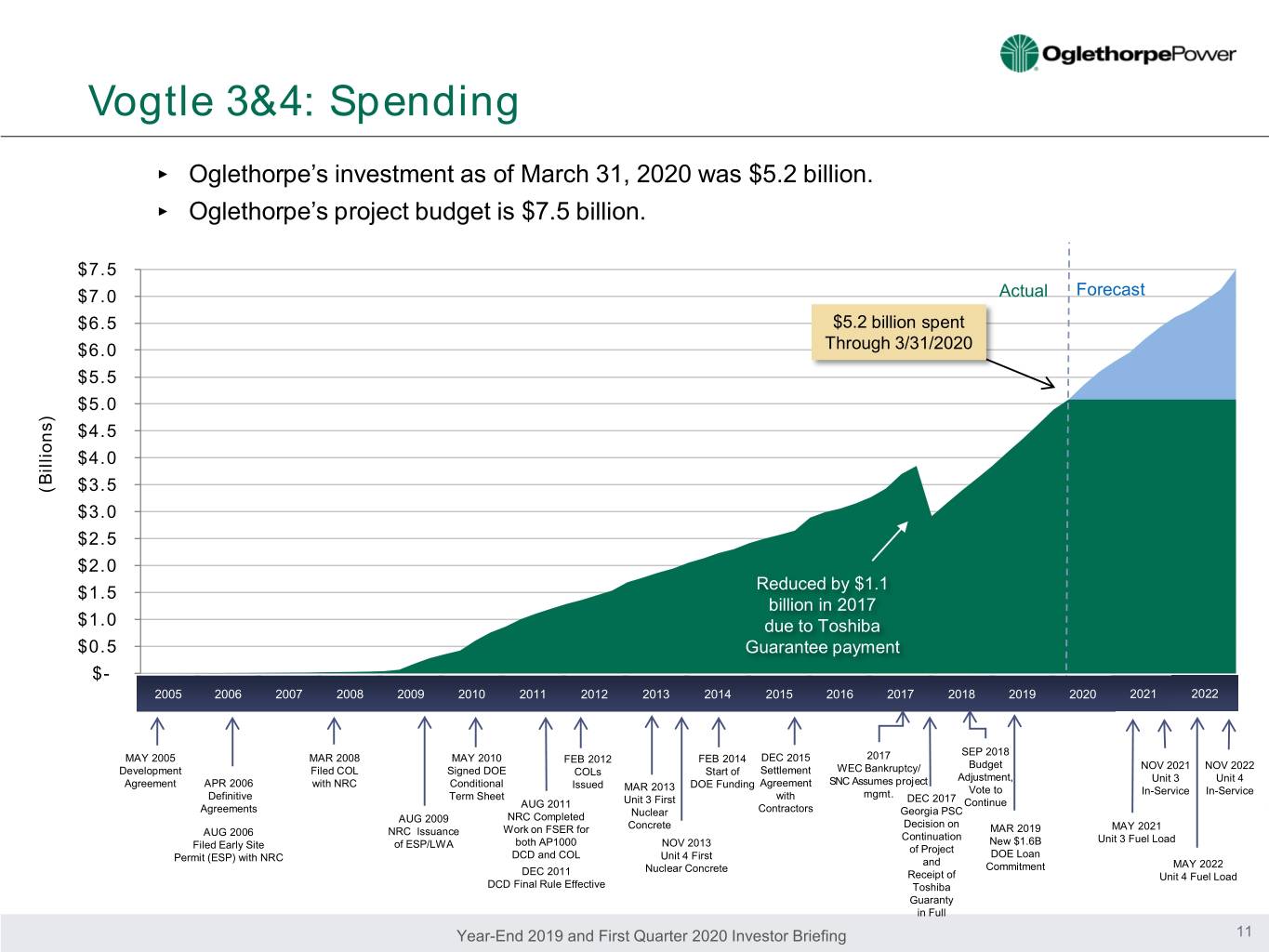

Vogtle 3&4: Spending ‣ Oglethorpe’s investment as of March 31, 2020 was $5.2 billion. ‣ Oglethorpe’s project budget is $7.5 billion. $7.5 $7.0 Actual Forecast $6.5 $5.2 billion spent $6.0 Through 3/31/2020 $5.5 $5.0 $4.5 $4.0 (Billions) $3.5 $3.0 $2.5 $2.0 $1.5 Reduced by $1.1 billion in 2017 $1.0 due to Toshiba $0.5 Guarantee payment $- 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 SEP 2018 MAY 2005 MAR 2008 MAY 2010 FEB 2012 FEB 2014 DEC 2015 2017 Budget NOV 2021 NOV 2022 Development Filed COL Signed DOE COLs Start of Settlement WEC Bankruptcy/ Adjustment, Unit 3 Unit 4 Agreement APR 2006 with NRC Conditional Issued DOE Funding Agreement SNC Assumes project MAR 2013 Vote to In-Service In-Service Definitive Term Sheet with mgmt. DEC 2017 AUG 2011 Unit 3 First Continue Agreements Contractors Georgia PSC NRC Completed Nuclear AUG 2009 Decision on Work on FSER for Concrete MAR 2019 MAY 2021 AUG 2006 NRC Issuance Continuation both AP1000 NOV 2013 New $1.6B Unit 3 Fuel Load Filed Early Site of ESP/LWA of Project DCD and COL Unit 4 First DOE Loan Permit (ESP) with NRC and Nuclear Concrete Commitment MAY 2022 DEC 2011 Receipt of Unit 4 Fuel Load DCD Final Rule Effective Toshiba Guaranty in Full Year-End 2019 and First Quarter 2020 Investor Briefing 11

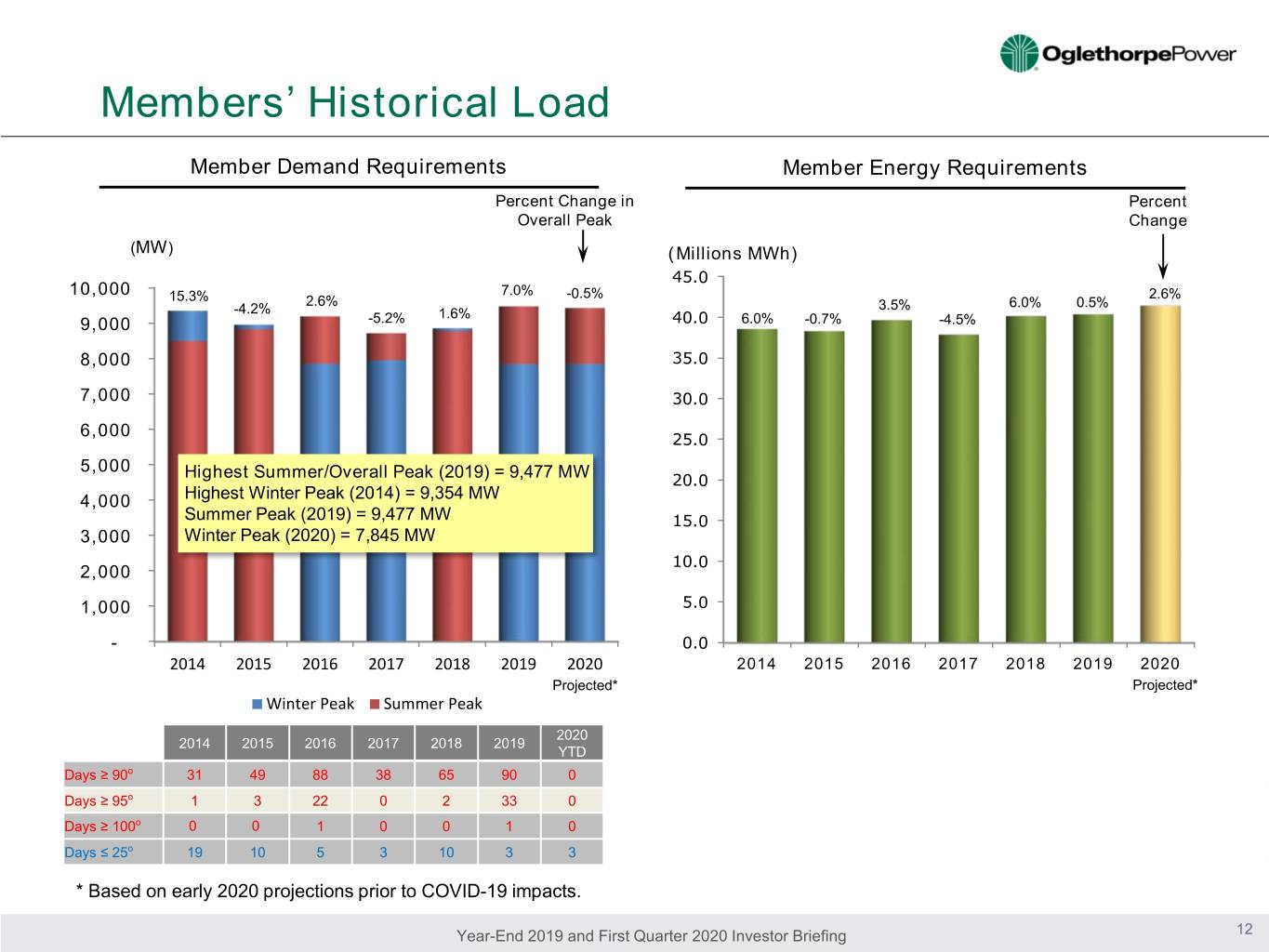

Members’ Historical Load Member Demand Requirements Member Energy Requirements Percent Change in Percent Overall Peak Change (MW) (Millions MWh) 10,000 15.3% 7.0% -0.5% 2.6% 2.6% 3.5% 6.0% 0.5% -4.2% 1.6% 9,000 -5.2% 6.0% -0.7% -4.5% 8,000 7,000 6,000 5,000 Highest Summer/Overall Peak (2019) = 9,477 MW 4,000 Highest Winter Peak (2014) = 9,354 MW Summer Peak (2019) = 9,477 MW 3,000 Winter Peak (2020) = 7,845 MW 2,000 1,000 - 2014 2015 2016 2017 2018 2019 2020 2014 2015 2016 2017 2018 2019 2020 Projected* Projected* Winter Peak Summer Peak 2020 2014 2015 2016 2017 2018 2019 YTD Days ≥ 90o 31 49 88 38 65 90 0 Days ≥ 95o 1 3 22 0 2 33 0 Days ≥ 100o 0 0 1 0 0 1 0 Days ≤ 25o 19 10 5 3 10 3 3 * Based on early 2020 projections prior to COVID-19 impacts. Year-End 2019 and First Quarter 2020 Investor Briefing 12

Oglethorpe’s Diversified Power Supply Portfolio 2020 Capacity (MW) 7,863 MW Rocky Mountain Thomas A. Smith Pumped Storage Hydro Energy Facility Hartwell Energy Facility 10% Sewell Creek Doyle Generating Energy Facility Plant 20% Plant Wansley Plant Scherer 54% Chattahoochee 16% Energy Facility Plant Vogtle Hawk Road Energy Facility 2020 Energy (MWh) Plant Hatch (April 2019 – March 2020) Talbot Energy 25.8 Million MWh Facility 5% 8% Smarr Energy Facilitiy 48% 39% Note: Capacity and energy includes Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. Year-End 2019 and First Quarter 2020 Investor Briefing 13

Oglethorpe’s Generation and Power Supply Resources Oglethorpe 2020 Summer 2019 Average Resource # Units Fuel Type Ownership Operator Planning Reserve Capacity Factor Share Capacity (MW) Oglethorpe Owned: Plant Hatch 2 Nuclear 30% Southern Nuclear 527 91% Plant Vogtle 2 Nuclear 30% Southern Nuclear 689 98% Plant Scherer 2 Coal 60% Georgia Power 1,030 27% Plant Wansley (a) 2 Coal 30% Georgia Power 523 6% Chattahoochee Energy Facility - CC 1 Gas 100% Oglethorpe 466 80% Thomas A. Smith Energy Facility - CC 2 Gas 100% Oglethorpe 1,317 57% Doyle Generating Plant – CTs(b) 5 Gas 100% Oglethorpe 281 3% Hawk Road Energy Facility - CTs 3 Gas 100% Oglethorpe 487 11% Hartwell Energy Facility - CTs 2 Gas/Oil 100% Oglethorpe 306 13% Talbot Energy Facility - CTs 6 Gas/Oil 100% Oglethorpe 682 8% Rocky Mountain Pumped Storage Hydro 3 Hydro 74.61% Oglethorpe 817 17% Subtotal 30 7,125 Member Owned/Oglethorpe Operated: Smarr / Sewell Creek - CTs 6 Gas/Oil - Oglethorpe 738 13% Member Contracted/Oglethorpe Scheduled: Southeastern Power Administration (SEPA)(c) - Hydro - 516 - Grand Total 36 8,379 (a) A combustion turbine in which Oglethorpe’s share of nameplate capacity is 15 MW is located at the Plant Wansley site. This CT is used primarily for emergency service and rarely operated except for testing so has been excluded from the above table. (b) Doyle Generating Plant has been de-rated due to unavailability of Unit 1 (~60MW). (c) Each of the Members, other than Flint, has designated Oglethorpe to schedule its energy allocation from SEPA. At December 31, 2019, Members’ total allocation was 584 MW, of which Oglethorpe scheduled 529 MW. Effective January 1, 2020, OPC will schedule 516 MW due a Member releasing its SEPA capacity; effective August 1, 2020, that schedule increases to 520 MW due to further increases and decreases among Members’ adjustment in their SEPA capacity. Year-End 2019 and First Quarter 2020 Investor Briefing 14

Capacity Factor Comparison Nuclear YE 2018 vs YE 2019 100% Gas - CC 2018 2019 75% Coal 50% Pumped Gas - CT Storage 25% Hydro 0% Hatch Vogtle Scherer Wansley Chatt Smith Doyle Hawk Hartwell Talbot Rocky Road Mountain Nuclear First Quarter 2019 vs First Quarter 2020 100% Gas - CC 2019 2020 75% Coal 50% Pumped Gas - CT Storage Hydro 25% 0% Hatch Vogtle Scherer Wansley Chatt Smith Doyle Hawk Hartwell Talbot Rocky Road Mountain Year-End 2019 and First Quarter 2020 Investor Briefing 15

2019 Plant Operations Highlights Oglethorpe-Operated Fleet • 81% performed in the top two quartiles, and 67% operated in the top quartile for summer availability • Annual generation set a new record of 13,250 GWh Gas Nuclear • CT fleet started a near record 2,678 times • Capacity factors: • Successfully transitioned Chattahoochee operations o Plant Hatch: 90% from Siemens to Oglethorpe Power o Plant Vogtle: 97% • Achieved near record capacity factors from combined-cycle sites T.A. Smith and Chattahoochee Coal Hydro • Completed new ash management • Rocky Mountain performed in the operations at Plant Scherer and top quartile for all three units with Plant Wansley no failed generation starts Year-End 2019 and First Quarter 2020 Investor Briefing 16

Generation Mix by Fuel Type As gas prices have continued to stay very low, generation mix has shifted awayAverage from coal Gas and Price more to gas. MWh ($/mmBtu) (Millions) 30 10.00 3% 9.00 4% 5% 25 4% 5% 17% 8.00 4% 4% 5% 5% 14% 10% 4% 16% 29% 5% 5% 20% 7.00 20 32% 30% 44% 27% 6.00 48% Hydro 42% 39% 43% 46% 15 40% 5.00 29% 33% Coal 24% 24% 24% 4.00 Gas 11% 12% 10 7% Nuclear 3.00 Average Gas 2.00 Price 5 40% 44% 41% 40% 38% 44% 42% 42% 37% 38% 40% 39% 1.00 0 0.00 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Note: Includes total generation from Oglethorpe and Smarr EMC resources. Year-End 2019 and First Quarter 2020 Investor Briefing 17

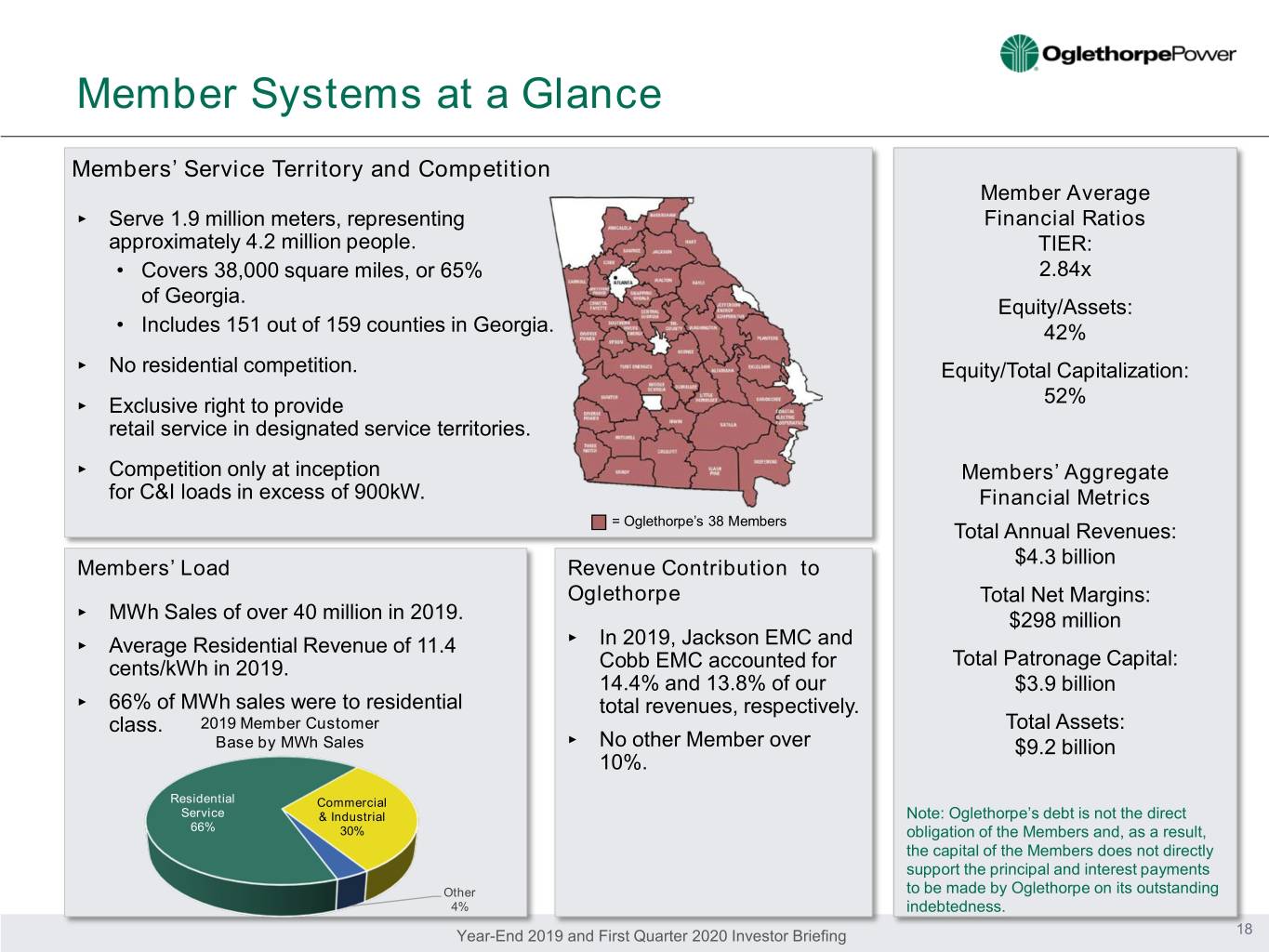

Member Systems at a Glance Members’ Service Territory and Competition Member Average ‣ Serve 1.9 million meters, representing Financial Ratios approximately 4.2 million people. TIER: • Covers 38,000 square miles, or 65% 2.84x of Georgia. Equity/Assets: • Includes 151 out of 159 counties in Georgia. 42% ‣ No residential competition. Equity/Total Capitalization: 52% ‣ Exclusive right to provide retail service in designated service territories. ‣ Competition only at inception Members’ Aggregate for C&I loads in excess of 900kW. Financial Metrics = Oglethorpe’s 38 Members Total Annual Revenues: $4.3 billion Members’ Load Revenue Contribution to Oglethorpe Total Net Margins: ‣ MWh Sales of over 40 million in 2019. $298 million ‣ Average Residential Revenue of 11.4 ‣ In 2019, Jackson EMC and cents/kWh in 2019. Cobb EMC accounted for Total Patronage Capital: 14.4% and 13.8% of our $3.9 billion ‣ 66% of MWh sales were to residential total revenues, respectively. class. 2019 Member Customer Total Assets: Base by MWh Sales ‣ No other Member over $9.2 billion 10%. Residential Commercial Service & Industrial Note: Oglethorpe’s debt is not the direct 66% 30% obligation of the Members and, as a result, the capital of the Members does not directly support the principal and interest payments Other to be made by Oglethorpe on its outstanding 4% indebtedness. Year-End 2019 and First Quarter 2020 Investor Briefing 18

Financial Strength of Oglethorpe’s Members Total Operating Revenue – 38 Member Aggregate 6,000 4,000 $ Millions$ 2,000 0 Recovery2009 2010 2011 of2012 All2013 Costs2014 2015+ Margin2016 2017 2018 2019 TIER 3.00 2.00 1.00 - 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average Equity to Assets 44% 40% 36% 32% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average Equity to Total Capitalization 60% 55% 50% 45% 40% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Year-End 2019 and First Quarter 2020 Investor Briefing 19

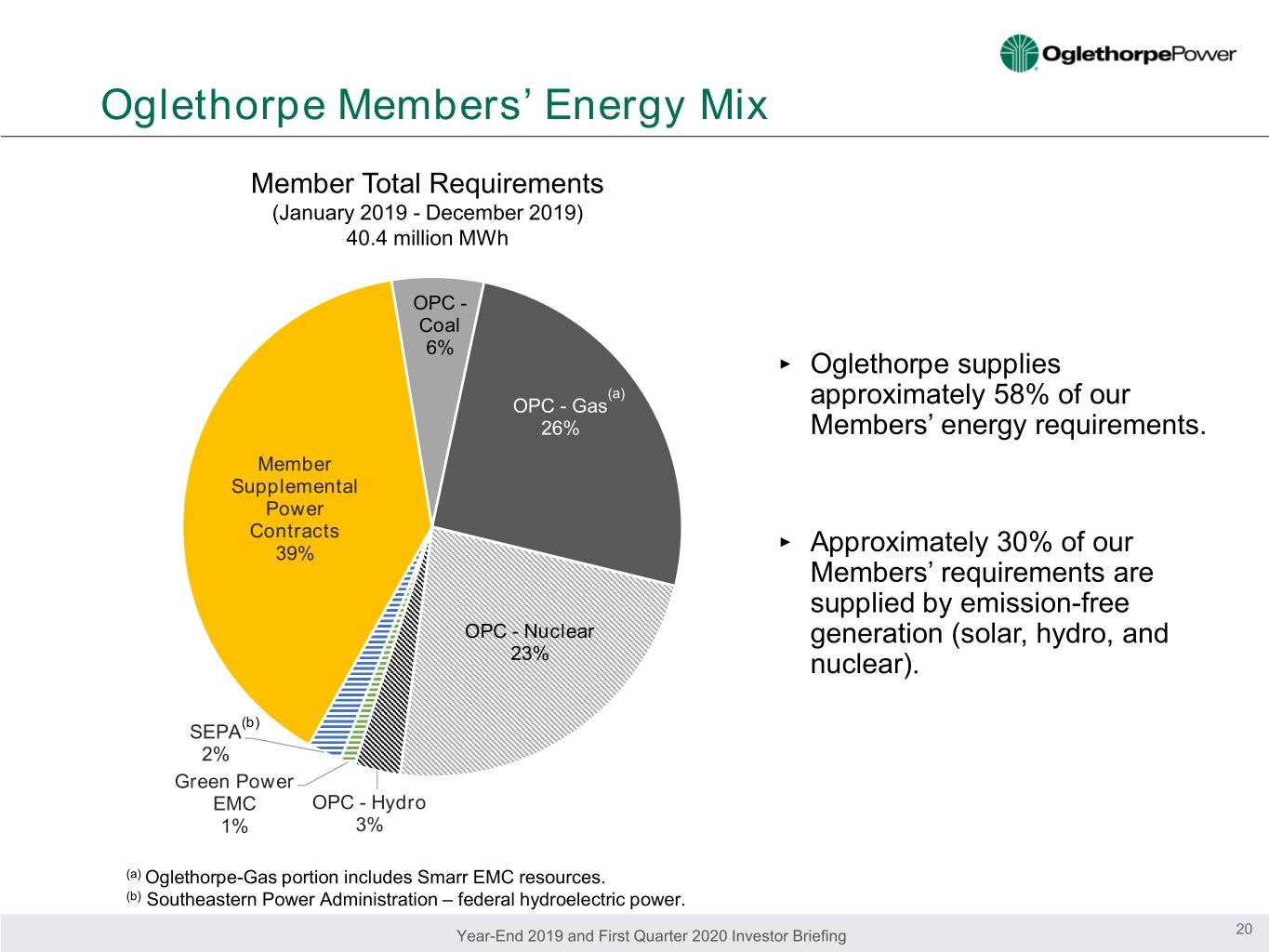

Oglethorpe Members’ Energy Mix Member Total Requirements (January 2019 - December 2019) 40.4 million MWh OPC - Coal 6% ‣ Oglethorpe supplies (a) OPC - Gas approximately 58% of our 26% Members’ energy requirements. Member Supplemental Power Contracts 39% ‣ Approximately 30% of our Members’ requirements are supplied by emission-free OPC - Nuclear generation (solar, hydro, and 23% nuclear). (b) SEPA 2% Green Power EMC OPC - Hydro 1% 3% (a) Oglethorpe-Gas portion includes Smarr EMC resources. (b) Southeastern Power Administration – federal hydroelectric power. Year-End 2019 and First Quarter 2020 Investor Briefing 20

Member Power Supply Sources Our Members’ requirements are met through several power supply sources. Oglethorpe resources are the largest contributor, but we are not the all-requirements supplier for any of our Members. Our Members’ collective projected power supply needs are currently met through the mid 2020s. (a) (b) (c) (a) Oglethorpe’s total existing capacity is 7,863 MW which includes Smarr EMC capacity of 738 MW. (b) Vogtle Units 3 and 4 (660 MW) are assumed to come on line in November 2021 and November 2022. This capacity is reflected in the summer of 2022 and 2023, respectively. (c) Total solar capacity for Green Power and Member contracts is projected to be over 1,150 MW by 2022, but due to the variable output it has been reduced for capacity planning purposes. Year-End 2019 and First Quarter 2020 Investor Briefing 21

Rate Structure Assures Recovery of All Costs + Margin ‣ Formulary Rate under Wholesale Power Contract. ‣ Minimum MFI ratio requirement of 1.10x under First Mortgage Indenture. Expense Type Components Recovery Timeframe Variable Fuel, Variable O&M 30 – 60 days Fixed Margin, Interest, Depreciation, Fixed O&M, • Billed on levelized annual budget A&G • Trued up to actuals at year end • Oglethorpe budgets conservatively Key Points: ‣ Cost inputs not subject to any regulatory approvals. ‣ Formula changes subject to RUS & DOE approval, but are infrequent. ‣ Prior period adjustment mechanism covers any year-end shortfall below the required 1.10 MFI ratio (board approval not required; to date, has never needed to be used). Margin Coverage $58.1 1.20 $54.5 $60.0 $50.3 $51.3 $51.2 $46.6 $48.3 $41.5 $37.7 $39.3 1.15 $33.7 $40.0 $26.4 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 MFI Coverage 1.12 1.10 $20.0 Net Net Margin (MM) 1.05 $0.0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Budget Year-End 2019 and First Quarter 2020 Investor Briefing 22

Total Secured Debt as of April 30, 2020 Tax-Exempt: $0.8 billion Taxable Bonds: $3.2 billion CoBank: $5.1 million DOE: RUS: $3.0 billion $2.5 billion $9.5 billion total at weighted average interest rate of 3.93%. Year-End 2019 and First Quarter 2020 Investor Briefing 23

DOE Loan Summary as of April 30, 2020 ‣ In March, 2019 we increased Oglethorpe’s DOE loan financing from $3.06 billion to $4.68 billion with a new $1.62 billion loan. We completed the remaining advances available under the original loan in December with an advance of $567 million. ‣ We typically advance under this loan twice a year and expect to begin drawing under the new loan in June 2020. • June 2020 advance expected to be ~$440 million. DOE Guaranteed Loans(a) Purpose/Use of Proceeds Approved Advanced Remaining Amount Vogtle Units 3 & 4 Principal - 2014 Loan $2,721,597,857 $2,721,597,857 $0 Capitalized Interest(b) - 2014 Loan 335,471,604 291,750,525 0 Principal - 2019 Loan 1,619,679,706 0 1,619,679,706 $4,676,749,167 $3,013,348,382 $1,619,679,706 Average interest rate on all advances to-date under this loan is 3.15% (a) DOE guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.375%. (b) Represents accrued capitalized interest being financed with the 2014 DOE guaranteed loan, which was available to be advanced through November 20, 2019. Approximately $44 million of this loan was not advanced due to timing and lower than expected interest rates. Year-End 2019 and First Quarter 2020 Investor Briefing 24

RUS Loan Summary as of April 30, 2020 RUS Guaranteed Loans(a) Remaining Purpose/Use of Proceeds Approved Advanced Amount Approved Loans General & Environmental Improvements $448,307,000 $442,470,849 $5,836,151 General & Environmental Improvements (b) $630,342,000 $0 $630,342,000 $1,078,649,000 $442,470,849 $636,178,151 Total amount outstanding under all RUS Guaranteed Loans is $2.5 billion, with an average interest rate of 3.68% ‣ Expecting $300 million advance in January, 2021. (a) RUS guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.125%. (b) RUS loan conditionally committed as of September 26, 2019. We expect to begin funding under this loan in 2021. Year-End 2019 and First Quarter 2020 Investor Briefing 25

2020-2025 Projected Capital Expenditures $1,600 Cumulative CapEx 2020-2025 Total: $3,289 $1,400 $702 $1,200 $131 $1,000 $2,455 $800 $ millions $600 $400 $200 $0 2020 2021 2022 2023 2024 2025 Fleet Environmental Fleet Additions & Replacements Vogtle 3&4 Construction (excl. nuclear fuel) Note: Includes interest during construction. Year-End 2019 and First Quarter 2020 Investor Briefing 26

Equity to Total Capitalization Ratio (Historical vs Projected) Equity Ratio (Patronage Capital / Total Capitalization) 14.0% 12.0% 10.0% Beginning of 8.0% Vogtle 3&4 Construction 6.0% 4.0% 2.0% 0.0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 Note: Assumes MFI ratio changes from current target of 1.14 to 1.10 in 2023. Year-End 2019 and First Quarter 2020 Investor Briefing 27

Oglethorpe’s Bank Credit Facilities $2,000 Time Now Increased the J.P. Morgan bilateral credit facility in March 2020 in order to repurchase $213 million of 2013 pollution control bonds subject to mandatory tender. $1,500 $150M JP Morgan Unsecured (increased to $363M on 3/27/2020) (a) $140M CFC Incremental Secured Plus Optional Term Out Until 2043 $110M CFC Unsecured $1.21B Syndicated Revolver/CP Backup $1,000 NRUCFC $ 235 (Millions) CoBank $ 150 MUFG $ 125 Bank of America $ 100 Mizuho Bank $ 100 Regions Bank $ 100 In December, renewed this facility Royal Bank of Canada $ 100 $500 originally maturing in March 2020 Truist Bank (f/k/a BB&T) $ 100 for 5 years (through December Fifth Third Bank $ 50 2024) at same size ($1.2 billion). Goldman Sachs Bank $ 50 J.P. Morgan $ 50 U.S. Bank $ 50 $0 2043 Q2 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 2024 Q4 (a) The secured term loan amount is actually $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. Year-End 2019 and First Quarter 2020 Investor Briefing 28

Oglethorpe’s Available Liquidity Borrowings Detail as of $251.5 million - Letter of Credit Support for VRDBs & T.A. Smith Facility April 30, 2020 $680.0 million - Line of Credit Borrowings in lieu of issuing CP $213.0 million - Line of Credit Borrowing to re-purchase 2013 Bonds $2,000 $1,823 $1,500 $1,145 $1,000 $1,031 $ millions $353 $678 $500 $0 (a) Total Credit Less Available Cash Total Facilities Borrowings Credit Facilities Liquidity Capacity Represents 456 days of liquidity on hand (excluding Cushion of Credit) (a) In addition, as of April 30 2020, Oglethorpe had $540 million on deposit in the RUS Cushion of Credit Account. The RUS Cushion of Credit Account is designated as restricted investments and can only be used to pay debt service on RUS guaranteed loans. Year-End 2019 and First Quarter 2020 Investor Briefing 29

Income Statement Excerpts Three Months Ended 03/31/2020- Year Ended March 31, 03/31/2019 December 31, ($ in thousands) 2020 2019 % Change 2019 2018 2017 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $259,393 $245,986 5.5% $942,057 $927,419 $862,511 Sales to Members - Energy 82,120 110,484 -25.7% 487,795 551,960 571,319 Total Sales to Members $341,513 $356,470 -4.2% $1,429,852 $1,479,379 $1,433,830 Sales to non-Members 161 130 23.8% 440 734 366 Operating Expenses: 279,159 290,568 -3.9% 1,213,083 1,255,137 1,195,326 Other Income 14,943 18,564 -19.5% 64,189 68,262 64,985 Net Interest Charges 54,254 61,000 -11.1% 226,937 242,039 252,578 Net Margin $23,204 $23,596 -1.7% $54,461 $51,199 $51,277 Margins for Interest Ratio(a) 1.14 1.14 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 1.81 2.35 -23.1% 2.10 2.40 2.40 Average Power Cost (cents/kWh) 7.52 7.59 -0.9% 6.16 6.43 6.02 Sales to Members (MWh) 4,542,832 4,698,135 -3.3% 23,225,861 23,011,079 23,813,679 (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture, and the 2020 budget also includes a 1.14 Margins for Interest ratio. Oglethorpe’s Board of Directors will continue to evaluate margin coverage throughout the Vogtle construction period and may chose to further increase, or decrease, the Margins for Interest ratio in the future, although not below 1.10. Year-End 2019 and First Quarter 2020 Investor Briefing 30

Balance Sheet Excerpts March 31, December 31, ($ in thousands) 2020 2019 2018 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $4,690,759 $4,679,690 $4,739,565 CWIP 5,084,102 4,816,896 3,866,042 Nuclear Fuel 365,244 359,270 358,358 Total Electric Plant $10,140,105 $9,855,856 $8,963,965 Total Investments and Funds 1,475,314 1,327,700 1,189,397 Total Current Assets 932,933 974,465 1,323,450 Total Deferred Charges 874,076 832,092 706,456 Total Assets $13,422,428 $12,990,113 $12,183,268 Capitalization: Patronage Capital and Membership Fees $1,039,951 $1,016,747 $962,286 Long-term Debt and Finance Leases 9,835,064 9,479,496 8,808,878 Other 26,344 25,196 21,428 Total Capitalization $10,901,359 $10,521,439 $9,792,592 Total Current Liabilities 953,685 857,263 1,064,259 Total Deferred Credits and Other Liabilities 1,567,384 1,611,411 1,326,417 Total Equity and Liabilities $13,422,428 $12,990,113 $12,183,268 Total Capitalization $10,901,359 $10,521,439 $9,792,592 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 112,539 111,222 103,332 Plus: Long-term Debt and Finance Leases due within one year 219,834 217,440 522,289 Total Long-Term Debt and Equities $11,233,732 $10,850,101 $10,418,213 Equity Ratio(a) 9.3% 9.4% 9.2% (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has a covenant in three credit agreements that currently requires a minimum total patronage capital of $750 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. Year-End 2019 and First Quarter 2020 Investor Briefing 31

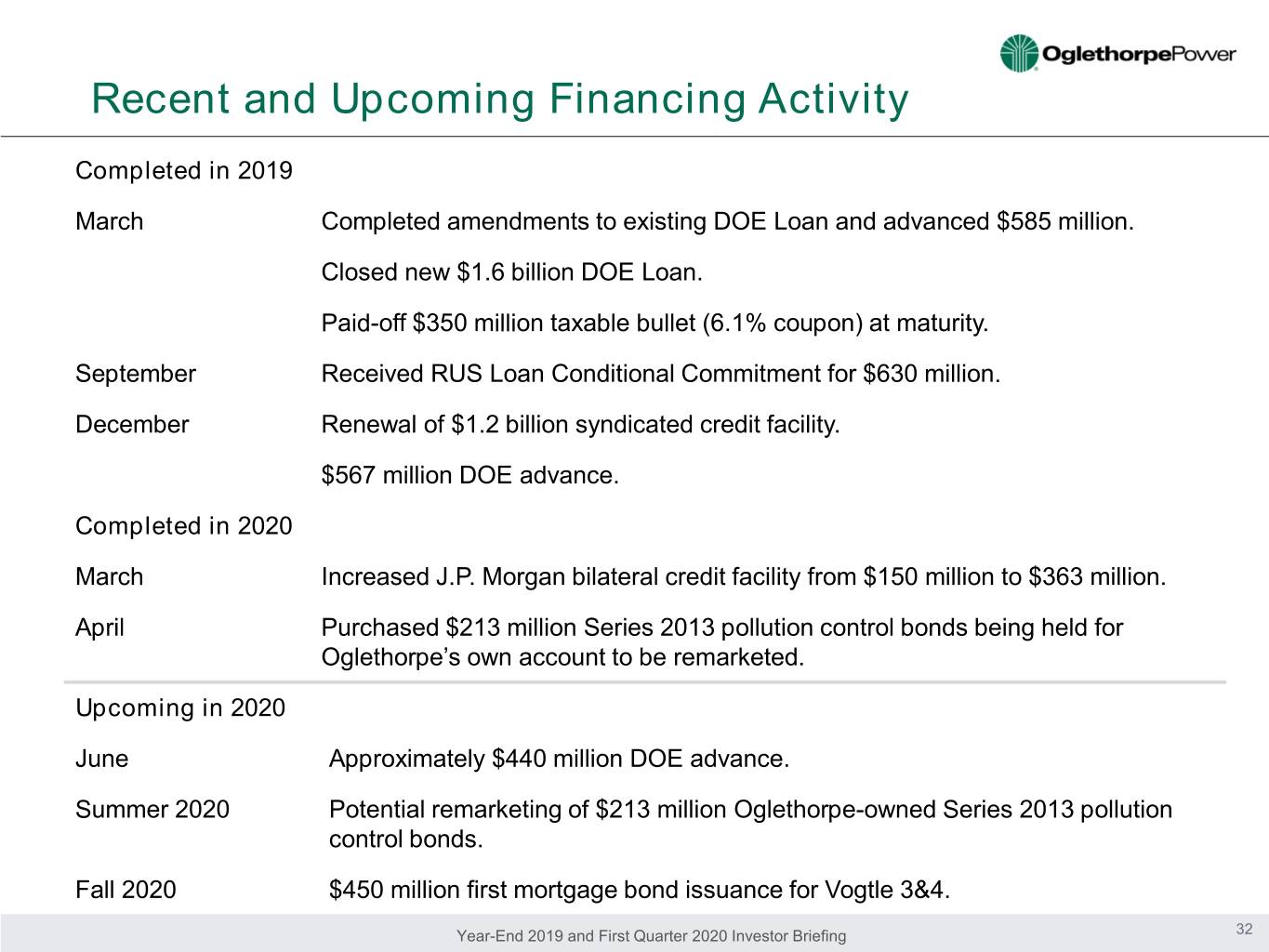

Recent and Upcoming Financing Activity Completed in 2019 March Completed amendments to existing DOE Loan and advanced $585 million. Closed new $1.6 billion DOE Loan. Paid-off $350 million taxable bullet (6.1% coupon) at maturity. September Received RUS Loan Conditional Commitment for $630 million. December Renewal of $1.2 billion syndicated credit facility. $567 million DOE advance. Completed in 2020 March Increased J.P. Morgan bilateral credit facility from $150 million to $363 million. April Purchased $213 million Series 2013 pollution control bonds being held for Oglethorpe’s own account to be remarketed. Upcoming in 2020 June Approximately $440 million DOE advance. Summer 2020 Potential remarketing of $213 million Oglethorpe-owned Series 2013 pollution control bonds. Fall 2020 $450 million first mortgage bond issuance for Vogtle 3&4. Year-End 2019 and First Quarter 2020 Investor Briefing 32

Secured Long Term Debt Balance Sheet Electric Plant Net Margin 2020 $11 2020 $100 $10 Taxable $450 $9 $80 $8 $4.82 $5.08 RUS $142 $7 1.14 MFI ratio $6 $60 Tax-Ex $213 $213 $5 $0.36 $0.37 (Billions) $4 DOE $80 $620 Millions $40 $3 $4.68 $4.69 $2 $(200) $- $200 $400 $600 $20 ($ Millions) $1 Actual Issuance Forecasted Issuance $0 YE 2019 3/31/2020 $- Actual Repayment Forecasted Repayment Total Assets $12,990 $13,422 Jul Jan Oct Apr Jun Feb Sep Mar Dec Nov Actual Remarketed Forecasted Remarketing Aug ($ Millions) May Construction Work in Progress Secured LT Debt (4.30.20): $9.5 billion Actual Budget Weighted Average Cost: 3.93% Nuclear Fuel Electric Plant in Service Liquidity Interim Financing Wholesale Power Cost 2020 April 30, 2020 2020 $2,500 7.88 8.0 $2,250 7.52 $2,000 7.0 $1,750 $1,823 CashBalances (Mil) $1,500 $1,610 J.P. Morgan LOC 6.0 7.80 NRUCFC LOC ¢/kWh 7.43 $1,250 Purchase of 2013 Vogtle 3 & 4, Bonds, $1,210 $ 1,210 $680 $1,000 $213 5.0 $750 $500 4.0 Budget Actual $250 YTD YTD Borrowings(Mil) $0 Cost of Power Sales to Members (excluding Rate Jul Jan Oct Jun Apr Feb Mar Dec Sep Aug Nov Management Program). May NRUCFC Line of Credit utilized while CP market was Cash Borrowings frozen. Average rate of 2.06%. Additional Member Collections for Expensing of IDC CP Availability Total Available Lines of Credit (dollars in millions) Rate Management Program. Year-End 2019 and First Quarter 2020 Investor Briefing 33

Additional Information • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Member information is filed as an exhibit to Form 10-Q for the first quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) • For additional information please contact: Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Terri Statham Manager, Media Relations terri.statham@opc.com 770-270-6990 Year-End 2019 and First Quarter 2020 Investor Briefing 34