Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MUFG Americas Holdings Corp | q12020investorpresentation.htm |

MUFG Americas Holdings Corporation Investor Presentation for the Quarter Ended March 31, 2020 MUFG Americas Holdings Corporation

Forward-Looking Statements and Non-GAAP Financial Measures This presentation describes activities of MUFG Americas Holdings Corporation and its consolidated subsidiaries (the Company) unless otherwise specified. This presentation should be read in conjunction with the financial statements, notes and other information contained in the Company’s most recent annual report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the Securities and Exchange Commission (SEC). The following appears in accordance with the Private Securities Litigation Reform Act. This presentation includes forward-looking statements that involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Often, they include the words “believe,” “expect," “target,” “anticipate,” “intend,” “plan,” “seek," "estimate,” “potential,” “project,” "forecast," "outlook," or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” "might," or “may.” They may also consist of annualized amounts based on historical interim period results. There are numerous risks and uncertainties that could and will cause actual results to differ materially from those discussed in the Company’s forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict and could have a material adverse effect on the Company’s financial condition, and results of operations or prospects. For more information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the SEC, including the discussions under “Management’s Discussion & Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the SEC and available on the SEC’s website at www.sec.gov. In addition to the aforementioned factors, the COVID-19 global pandemic is adversely affecting us, our clients, and our third-party service providers, among others, and its impact may adversely affect our business and results of operations over a period of time. Any factor described above, in this presentation, or in our SEC reports could, by itself or together with one or more other factors, adversely affect our financial condition, results of operations and prospects. All forward-looking statements contained herein are based on information available at the time of this presentation, and the Company assumes no obligation to update any forward-looking statements. This investor presentation includes the tangible common equity capital ratio to facilitate the understanding of the Company’s capital structure and for use in assessing and comparing the quality and composition of the Company's capital structure to other financial institutions. This investor presentation also includes the adjusted efficiency ratio to enhance the comparability of MUAH's efficiency ratio when compared with other financial institutions. This presentation should not be viewed as a substitute for results determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP financial measures presented by other companies. Please refer to our separate reconciliation of non-GAAP financial measures in our 10-Q for the quarter ended March 31, 2020. MUFG Americas Holdings Corporation Investor Presentation, 1Q20 2

Supporting Clients, Colleagues, and Communities affected by COVID-19 Since the CARES Act was enacted on March 27th, MUFG Union Bank took swift action to serve and support our consumer, small business, business banking, and now middle market clients through financial relief efforts. MUFG is also supporting colleagues and has made a philanthropic financial commitment to respond to local community needs globally in response to COVID-19. Supporting Clients Colleagues through the CARES Act • Provided approximately $2.5 billion of loans to • Quickly ramped up technology to enable 80%+ approx. 13,500 clients1 under Waves 1 and 2 of MUFG Americas2 colleagues to work from home the SBA Paycheck Protection Program • Employee Relief Funding of $400,0001 for • MUFG Union Bank is preparing to participate in the employees in the US, which includes 100% Main Street Lending Program, further program contributions by all participating corporate entities, details are expected from the Federal Reserve and 100% of Executive Committee members, and ~50% Department of Treasury of Senior Leadership Team members • Provided 90-day temporary credit to client • All Union Bank branch staff in CA, WA, and OR accounts that are overdrawn at the time Economic received relief pay of up to $1,500; also, all MUFG Impact Payment is deposited or cashed Americas colleagues in the US who became ill or needed to attend to family matters received • Implemented mortgage payment relief options for additional time off flexible payments and suspension of late charge assessments and delinquency reporting to credit bureau agencies Communities • Union Bank’s deposit assistance relief includes waived fees upon request, enhanced processes • $3 million commitment to support local to eliminate the need to visit a branch, increased communities globally to accelerate the path to mobile deposit limits to accelerate access to recovery funds, and we will not be netting overdrafts against the government’s stimulus checks program 1. As-of May 7, 2020 2. Colleagues from the U.S., Canada and Latin America MUFG Americas Holdings Corporation Investor Presentation, 1Q20 3

Overview of U.S. Presence • Mitsubishi UFJ Financial Group (MUFG) U.S. franchise is the 11th largest among U.S. banks with combined total assets of $341.4 billion1 as of 12/31/2019 • Strong footprint in affluent West Coast markets complemented by national reach via Global Corporate & Investment Banking and digital reach via PurePoint2 • Experienced local management team and a majority of independent board members • High quality loan portfolio with historically strong credit performance – non-performing assets and net charge-offs generally below peer group • Strong credit ratings and benefit from ownership by MUFG, one of the world’s largest financial organizations • Strong balance sheet with high-quality capital base and strong liquidity – Tier 1 risk-based capital ratio of 13.88% (vs. 9.95% reference banks average3) 1. Source: 12/31/19 FR Y-7Q 2. MUAH will be transitioning PurePoint Financial to a fully digital offering and closed the 22 Financial Centers effective February 20, 2020. 3. Reference banks consist of 12 CCAR-filing public regional banks (CFG, CMA, COF, FITB, HBAN, KEY, MTB, PNC, RF, TFC, USB, ZION) plus the four largest U.S. money center banks (BAC, C, JPM, WFC). Reference Banks’ average based on reporting through April 27, 2020 (Source: SNL Financial) MUFG Americas Holdings Corporation Investor Presentation, 1Q20 4

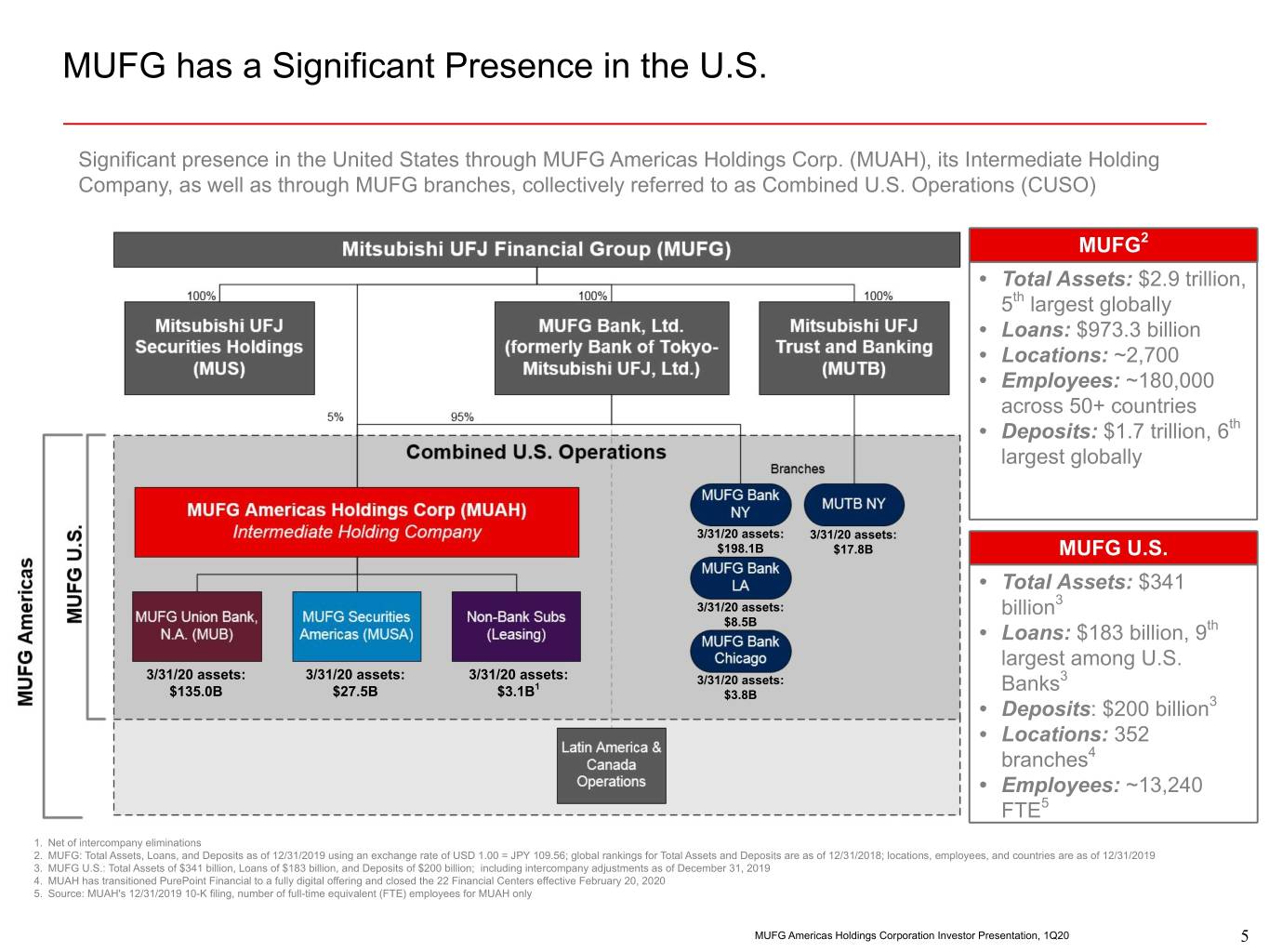

MUFG has a Significant Presence in the U.S. Significant presence in the United States through MUFG Americas Holdings Corp. (MUAH), its Intermediate Holding Company, as well as through MUFG branches, collectively referred to as Combined U.S. Operations (CUSO) MUFG2 • Total Assets: $2.9 trillion, 5th largest globally • Loans: $973.3 billion • Locations: ~2,700 • Employees: ~180,000 across 50+ countries • Deposits: $1.7 trillion, 6th largest globally 3/31/20 assets: 3/31/20 assets: $198.1B $17.8B MUFG U.S. • Total Assets: $341 3 3/31/20 assets: billion $8.5B • Loans: $183 billion, 9th largest among U.S. 3/31/20 assets: 3/31/20 assets: 3/31/20 assets: 3/31/20 assets: 3 1 Banks $135.0B $27.5B $3.1B $3.8B • Deposits: $200 billion3 • Locations: 352 branches4 • Employees: ~13,240 FTE5 1. Net of intercompany eliminations 2. MUFG: Total Assets, Loans, and Deposits as of 12/31/2019 using an exchange rate of USD 1.00 = JPY 109.56; global rankings for Total Assets and Deposits are as of 12/31/2018; locations, employees, and countries are as of 12/31/2019 3. MUFG U.S.: Total Assets of $341 billion, Loans of $183 billion, and Deposits of $200 billion; including intercompany adjustments as of December 31, 2019 4. MUAH has transitioned PurePoint Financial to a fully digital offering and closed the 22 Financial Centers effective February 20, 2020 5. Source: MUAH's 12/31/2019 10-K filing, number of full-time equivalent (FTE) employees for MUAH only MUFG Americas Holdings Corporation Investor Presentation, 1Q20 5

Who We Are MUFG has grown to become MUFG Americas serves our one of the largest individual, corporate, and comprehensive financial groups institutional clients in the United in the world, building on over States, Canada, and Latin 360 years of financial expertise America Mitsubishi UFJ Financial Group (MUFG) MUFG Americas MUFG U.S. MUFG Americas Holdings Corporation (MUAH) MUFG U.S. includes MUAH, as well MUAH is a U.S. financial and bank as our MUFG Bank and MUTB U.S. holding company that includes branches, collectively referred to as MUFG Union Bank N.A., MUFG Combined U.S. Operations (CUSO) Securities Americas and all MUFG's non-branch U.S. subsidiaries MUFG Americas Holdings Corporation Investor Presentation, 1Q20 6

MUFG's Journey in the Americas We serve our corporate and investment banking clients under the MUFG Brand; our consumer, wealth, and commercial Corporate and Investment Integration banking clients MUFG builds global banking formed of U.S. Banking under the Union network of overseas Operations Bank brand; and our bases comparable to Union Bank, formerly Union Bank becomes under MUAH/ Stephen Cummings direct banking major banks of known as Bank of wholly owned subsidiary of MUFG Union is named business under the Europe and U.S. California, is formed MUFG Bank CEO for the Americas PurePoint brand 1864 1970s 2008 2014 2015 2017 Today 1880 1988 2010 - 2013 2016 2019 2020 MUFG, formerly known MUFG acquires Acquired: Formation MUAH as Intermediate Acquired Intrepid Union Bank will as Yokohama Specie Union Bank • Tamalpais Bancorp (2010) of Regional Holding Company Investment use the FIS Bank, Bank of Tokyo, is ~$600 million assets Bank under Consolidates MUFG U.S. Bankers Modern formed Single Subsidiaries, including Banking • Frontier Bank (2010) Leadership MUFG Securities Americas Acquired Trade Platform to co- ~$3 billion assets (Enhanced Prudential Payable Services develop and Standards Implementation) (TPS), a leading co-engineer • Pacific Capital Bancorp (2012) supply chain systems that ~$6 billion assets finance platform, will be core to from GE Capital the banking • Smartstreet (2012) transformation ~$1 billion assets Acquired First program State • First Bank (2013) Investments (US) ~$550 million assets LLC as subsidiary of • PB Capital (2013) MUFG Fund ~$3.5 billion assets Services, a direct subsidiary of MUAH MUFG Americas Holdings Corporation Investor Presentation, 1Q20 7

Evolution of Strategic Plan FY2015 ~ FY2017 FY2018 ~ FY2020 Organizational Change Business Strategy • Integrated Retail and Commercial Banking units • Diversify Regional Bank balance sheet (e.g. under single leadership grow Small business, Business Banking and • Enhanced Prudential Standards implementation Middle Markets) (Intermediate Holding Company formation in • Low cost deposit gathering 2016) • Product / market expansion in Global Corporate & Investment Banking (e.g., leveraged finance, Business Strategy securitized products, working capital solutions, • Launched PurePoint Financial equity margin lending) • Entered into unsecured consumer lending and • Balance sheet optimization (e.g., liquidity and credit card businesses capital management) • Built MUFG capital markets platform • Initiated balance sheet optimization Regulatory Compliance • Continue to strengthen risk infrastructure across all Regulatory Compliance categories of risk • Enhanced liquidity & compliance areas • Invested in operational risk capabilities in areas of Operational Efficiency liquidity, IT risk, and compliance • Expand expense reduction initiatives • Launch of Technology Transformation program Operational Efficiency (core banking, data, cloud) • Implemented expense initiatives including spans • Customer journey-based digitalization and layers, and organizational simplification to • Optimize capital efficiency (including capital fund above initiatives distributions) Inorganic Opportunity • Seek opportunities having high strategic alignment and return on equity contribution (e.g., Trade Payable Services and Intrepid Investment Bankers) MUFG Americas Holdings Corporation Investor Presentation, 1Q20 8

Key Strategic Initiatives Business Strategic Imperatives Develop Lean and Nimble Operating Effectively Manage Risk and Meet Model Through Continuous Regulatory Requirements Improvement (Rewiring) Drive Technology Transformation Execute on Strategic Business Initiatives & Enhance Profitability Select Priority Initiatives Global Corporate & Enterprise Regional Bank Investment Banking - U.S. Financial Sponsors / Risk and Regulatory Diversify Balance Sheet Leveraged Finance 2 Rewiring MUFG Working Capital Solutions Drive Fees Infrastructure Transformation & Securitized Products Support Unit Initiatives Grow Small Business, Business Deposit Gathering and Equity Margin Lending/ Banking & Middle Markets Optimization1 Structured Secured Funds Finance 1. Includes PurePoint MUFG Americas Holdings Corporation Investor Presentation, 1Q20 9 2. Includes purchase of Trade Payable Services, a GE Capital unit

Rewiring for the Future To effectively compete and meet our clients' needs, we are pursuing a multi-year effort to reduce our cost base and drive continuous improvement. We are targeting a range of $250-$300 million in benefits for the first phase of the Rewiring Program by 20231, some of which will be offset by reinvestment in technology, regulatory compliance and growth initiatives. We are implementing the program through structural initiatives driven by four areas: Workforce Leverage strategic locations to reduce our high cost Geographic footprint and outsource certain activities that can be Distribution performed efficiently and safely by third-party centers of excellence Organization Break down silos and combine like functions in shared Design service centers; increase spans and reduce layers Reduce spend on consultants, travel and Procurement entertainment, and other third-party and discretionary spend Process Simplify our operations and automate manual Simplification processes to increase employee productivity and Automation Effort launched in 2018 to drive value to the bottom line with implementation and rigorous tracking; accompanied by organization change management program to sustain lower cost base over time; objective is to close cost gap to US peers. 1. Not including any potential reductions in expenses and associated fees transfer-priced to MUFG U.S. branches that may also result from the program MUFG Americas Holdings Corporation Investor Presentation, 1Q20 10

Multi-Year Transformation Focuses on Five Key Goals Client Experience Business Agility Effective Controls Collaboration Growth A differentiated user The ability for our An effective control A modern, A growth-oriented, experience for our businesses to move environment collaborative efficient enterprise for clients fast ◦ Improve and workplace for our our shareholder colleagues ◦ Delight clients with ◦ Pivot to an agile integrate controls ◦ Enable growth a seamless product operating model throughout the data ◦ Empower rich goals of our suite enabling their that allows more lifecycle knowledge sharing businesses via new technology financial goals rapid development ◦ Enhance straight- ◦ Support inorganic ◦ Provide effortless and launch through ◦ Streamline growth aspirations processing to processes with an access to the bank ◦ Deliver a flexible, ◦ Deliver committed across channels secure, and reduce operational end-to-end customer risk cost savings ◦ Anticipate client scalable view needs technology ◦ Leverage platform to capture automation to ◦ Worry about opportunities faster strengthen protecting our monitoring and risk clients, so they don’t management have to Leading to the Three Pillars of the Transformation Program Data Analytics Technology Core Banking and Modernization Transformation Functionality (API, Cloud, etc.) MUFG Americas Holdings Corporation Investor Presentation, 1Q20 11

Digitalization Roadmap: Journey Based Organization 1 CUSTOMER-CENTRIC OBJECTIVES Consumers “Make it safe “Make it “Make it “Do for “Think and secure” easy to do” faster” Me” for Me” Small Business 2 CUSTOMER-CENTRIC ORGANIZATION Leverage technology to enable and innovate digital customers’ Communication Education UI/UX DIGITAL banking experience CUSTOMER DIGITAL EXPERIENCE AWARENESS Research Coordination DIGITAL PRODUCTS & INNOVATION Enable & Innovate Chatbot Voice Banking Wearable IoT Technology Acquire Service Identify Pay Financial Account Channel Wellness Aggregation Integration 3 UTILIZING DATA & INSIGHTS Contactless Artificial Machine Learning Blockchain Intelligence -Test -Define Journeys -Learn 3. Optimize 1. Discover -Identify Pain Points -Improve Data 2. Active & Engage -Target customers -Personalize offer MUFG Americas Holdings Corporation Investor Presentation, 1Q20 12

MUAH Key Business Segments 1Q20 Revenues by Segment ($MM)4 Diversification across segments and products as illustrated through revenue and earnings mix. Key MUAH business segments1 consist of: Regional Global Corporate & Transaction MUFG Securities Bank Investment Banking - U.S. Banking Americas Provides banking products and Delivers the full suite of products Offers working capital Engages in capital markets services to individual and and services to large and mid- management and asset servicing origination transactions, domestic business customers in California, corporate customers based on solutions, including deposits and and foreign debt and equity Washington, and Oregon through industry-focused coverage teams, treasury management, trade securities transactions, private five major business lines: including credit as well as global finance, and institutional trust and placements, collateralized Consumer Banking, Commercial treasury management, capital custody to customers financings, and securities Regional Global Corporate & Transaction Banking, Real Estate Industries, market solutions and various borrowing and lending Bank Investment Banking - U.S. Banking Wealth Markets, and PurePoint foreign exchange, interest rate transactions MUSA Other³ Financial which is a national risk and commodity risk online direct bank deposit platform management products Three months ended March 31, 2020 Three months ended March 31, 2020 Revenues by Segment ($MM)2 Net Income by Segment ($MM) 1Q20 Net Income by Segment ($MM) 324 $15 23.4% $1 $(9) 673 48.6% 117 8.4% $— $— $— $— $— 74 5.3% 198 $(130) 14.3% $(183) Regional Global Corporate & Transaction Bank Investment Banking - U.S. Banking MUSA Other Regional Bank Global Corporate & Transaction Banking MUSA Other² Investment Banking - U.S. Regional Bank Global Corporate & Transaction Banking MUSA Other³ Investment Banking - U.S. 1. Source: Form 10-Q for the quarter end March 31, 2020 2. Numbers may not add to 100% due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 13

Regional Bank Overview The Regional Bank is one of the largest regional bank holding companies in the United States, serving customers nationally through PurePoint Financial and in the West Coast leveraging the 150-year history and brand of Union Bank $70 Billion Loans1 $63 Billion Deposits1 Full-service branches in Jumbo mortgage portfolio in the California, Oregon and 8th U.S.3 341 Washington th Commercial Real Estate th Retail deposit market share in 16 portfolio in the U.S.4 5 California (4.0%)6 Commercial & Industrial loans th Total deposit market share in the $10.7B as of 3/31/2020 17 U.S.7 Mid-market Commercial West PurePoint deposits as of ~7% Coast Share5 $6.2B 3/31/2020 Unsecured Consumer Loans Non-Interest Bearing Deposits $4.1B as of 3/31/20202 ~33% as of 3/31/2020 1. As of 3/31/2020 2. Does not include credit card portfolio 3. Source: Data as of 3/20/20, sourced from Inside Nonconforming Newsletter 4. Source: Commercial Mortgage Alert as of 12/31/17 5. Source: Based on % of lead relationships as a % of the total market, 2018 Greenwich Associates Market Tracking Program (Union Bank - CA/OR/WA - $20MM - 2B - Full Year 2018) 6. Source: SNL Financial as of 6/30/19, Pro Forma ownership which captures any known M&A or branch closure activity up to the current date, $500M deposit cap applied as a proxy for Retail deposits 7. Source: SNL Financial as of 6/30/19, Pro Forma ownership which captures any known M&A or branch closure activity up to the current date, no deposit cap applied MUFG Americas Holdings Corporation Investor Presentation, 1Q20 14

Regional Bank Lines of Business Consumer Commercial Real Estate Wealth PurePoint Financial Banking Banking Industries Markets AUM/AUA: $30.9B Loans: $40.6B Loans: $11.0B Loans: $16.2B Loans: $2.2B Deposits: $6.2B Deposits: $38.9B Deposits: $10.6B Deposits: $3.3B Deposits: $3.7B Revenue: $7.7MM Revenue: $436.5MM Revenue: $99.6MM Revenue: $78.8MM Revenue: $41.1MM • Branch Banking • Middle Market • Institutional Markets • Private Wealth • National Digital Bank • Private Banking • Business Banking • Regional Markets Management • Mortgage Banking • Specialty Niches • Community • Trust & Estate • Unsecured Lending • Professional Development Services • Small Business Services Finance • Investment • SBA Lending • Commercial Management Mortgage • Brokerage Regional Bank Strategic Objectives Deepen existing Enhance operational Diversify and grow customer capabilities to achieve revenue streams on Grow deposits to fund relationships and customer and revenue Improve ROE and West Coast and select assets at an optimal increase acquisition objectives while efficiency ratio products on a cost of customers in target preparing the bank for national scale segment the future Financials are based on 3 months of data for the period ending 3/31/2020. Totals may not add up due to allocations MUFG Americas Holdings Corporation Investor Presentation, 1Q20 15

Global Corporate & Investment Banking - U.S. Key Products Corporate Loan Project Leasing & • Covers wholesale and investment Loans Syndications Finance Tax Equity banking customer loans across the United States included in MUAH's total commercial loan portfolio of 1 Funds Asset-based Equity Margin Supply Chain over $49 billion Finance Loans Lending Finance • Consists of industry segments across MUAH, which are served by a broad suite of products across Treasury Capital Markets M&A/Event MUAH, including credit, Transaction Management Rates and FX (Debt & Equity) Finance Banking and securities products Services Key Market Segments U.S.: Core Businesses: Strong Core Markets: Deeply Growth Business: New Key Market Globally Momentum Entrenched Investment • Strategy – Continue • Corporate Loans • Financial Institutions • Leveraged Finance Progression, “Up and to • Project Finance • Diversified Industrials • Supply Chain Finance the Left” • Leasing & Tax Equity • Power & Utilities • Equity Margin Lending • Objective – Trusted • Funds Finance • TMT Advisor • Asset-based Loans • Oil & Gas • Balance Sheet & • Capital Markets (IG • Public Finance Investment Supports Bonds) • Entertainment Finance Strategy • Treasury Mgmt. Services • Retail • Healthcare 1. As of March 31, 2020 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 16

Leadership Team and Board of Directors Stephen Cummings Kazuo Koshi MUFG MEO, Regional Executive for the Americas and MUFG MEO and Deputy Regional Executive for the Americas MEO of Global Corporate & Investment Banking Business Group MEO, Regional Executive for the Americas, MEO, Deputy REA and Executive in charge of Latin America and MUFG Bank Deputy Chief Executive, Global Corporate & Investment Banking MUFG Bank Business Unit and CEO for MUAH, Global Commercial Banking Canadian Regions Business Unit MUAH/MUB President & CEO MUAH/MUB Executive Chairman PMO (as MUFG/MUFG Bank Deputy REA) GLOBAL CORPORATE & TRANSACTION BANKING FINANCE LEGAL INVESTMENT BANKING Kevin Cronin Ranjana Clark Johannes Worsoe Michael Coyne Head of Corporate & Investment Head of Transaction Banking Chief Financial Officer General Counsel Banking - North America REGIONAL BANK MUFG SECURITIES AMERICAS RISK HUMAN RESOURCES (MUSA) Greg Seibly William Mansfield Donna Dellosso Amy Ward Head of Regional Banking Regional Head of Global Markets / Chief Risk Officer Chief Human Resources Officer CEO MUSA JAPANESE CORPORATE CHIEF OF STAFF OPERATIONS & TECHNOLOGY CORPORATE ADMINISTRATIONS BANKING Daisuke Bito Masatoshi Komoriya Christopher Higgins Michael Thom Head of Japanese Corporate Chief of Staff Chief Information & Operations Chief Corporate Administrative Banking for the Americas Officer Officer Head of the Transformation Program Board Members Independent Board Members Shareholder Appointees • Toby S. Myerson • Ann F. Jaedicke • Stephen Cummings • Roberta (Robin) A. Bienfait • Suneel Kamlani • Kazuo Koshi • Michael D. Fraizer • Barbara L. Rambo • Masahiro Kuwahara • Mohan S. Gyani • Dean A. Yoost • Kazuto Uchida MEO: Managing Executive Officer REA: Regional Executive for the Americas MUFG Americas Holdings Corporation Investor Presentation, 1Q20 17

MUFG Americas takes pride in our Achievements in Banking and Serving Our Communities MUFG Union Bank Achievements 2020 2019 SHARP (Service Honors and Rewards Programs) Awards - Bronze Freddie Mac 2019 Ranjana Clark and Bita Ardalan, Most Powerful Women in Banking American Banker Magazine 2019 Best Regional Banks Kiplinger's 2019 Corporate Equality Index Earning a perfect score for the sixth consecutive year, Human Rights Campaign Foundation 2019 Bloomberg Gender Equality Index 2019 Top Lead Arranger for Clean-Energy and Energy-Smart Technologies Financing Seven of Last Nine Years, Bloomberg’s New Energy Finance League Table Corporate Social Responsibility for the Americas CRA Rating of Outstanding Philanthropic Commitment to Communities Community Service Action Plan Goals 61,088 hours 10 million+ $41 billion $11.1 billion Volunteer hours3 completed by Individuals provided with basic In total pledged commitments under In environmentally sustainable MUFG Union Bank employees needs1 our 5-year Community Service finance1 in 2019 Action Plan1 7,900+ 34% $2.0 billion New businesses created1 Reduction commitment in In lending and investments to The MUFG Union Bank Foundation invests in small business technical assistance and greenhouse gas emissions2 support affordable housing1 access to capital programs with the goal of helping entrepreneurs expand their businesses 1. For the year ended 12/31/2018 2. For the twelve months ended 3/31/2019 3. For the year ended 12/31/2019 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 18

Financial Summary for MUAH This section only includes financials and other disclosures for MUAH and excludes MUFG Americas operations outside of MUAH 19

2020 First Quarter MUAH Results For the Three Months Ended March 31, December 31, March 31, (Dollars in millions) 2020 2019 2019 Results of operations: Net interest income $ 774 $ 779 $ 783 Noninterest income 612 707 632 Total revenue 1,386 1,486 1,415 Noninterest expense 1,201 1,121 1,170 Pre-tax, pre-provision income1 185 365 245 (Reversal of) provision for credit losses 470 63 38 Income before income taxes and including noncontrolling interests (285) 302 207 Income tax expense (benefit) 25 52 28 Net income including noncontrolling interests (310) 250 179 Deduct: Net loss (income) from noncontrolling interests 4 5 5 Net (loss) income attributable to MUAH $ (306) $ 255 $ 184 Compared to the first quarter of 2019, net income decreased by $490 million • Net loss attributable to MUAH was $306 million for the three months ended March 31, 2020, largely due to the provision for credit losses of $470 million. • The provision for credit losses in the first quarter of 2020 was largely driven by the impact of COVID-19 and the corresponding deterioration in the economic environment. The global pandemic from the spread of COVID-19 has significantly impacted the U.S. and California economies and caused significant ongoing economic uncertainty, which may affect our critical accounting estimates, including our assumptions used to estimate the allowance for credit losses and used in our goodwill impairment analysis. • In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments, which provides new guidance on the accounting for credit losses for instruments that are within its scope. The Company adopted the ASU on January 1, 2020, and recorded an increase to the allowance for credit losses of $199 million, primarily due to an increase in the allowance for consumer loans, offset by a $52 million deferred tax asset, and a $147 million cumulative- effect adjustment reduction to retained earnings. 1. Pre-tax, pre-provision income is total revenue less noninterest expense. Management believes that this is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit losses through a credit cycle MUFG Americas Holdings Corporation Investor Presentation, 1Q20 20

MUAH Balance Sheet and Profitability Highlights as of Period End • $165.7 billion in total assets, of which MUB has $135.0 billion and MUSA has $27.5 billion • Assets comprised primarily of high-quality mortgage / C&I loans ($89.8 billion) and highly liquid securities ($24.0 billion), among others • Strong deposit base ($98.5 billion) supported with wholesale funding Compared to the previous year: • Total assets decreased $5.0 billion driven by a decline in securities As of Period End borrowed or purchased under repo of $7.1 billion, securities March 31, December 31, March 31, available for sale of $2.7 billion, (Dollars in millions) 2020 2019 2019 Balance sheet (end of period) securities held to maturity of $1.5 Total assets $ 165,696 $ 170,810 $ 170,707 billion and goodwill of $1.6 billion, Total loans held for investment 89,786 88,213 87,587 offset by increase in interest Total securities 24,008 27,210 28,216 bearing deposits in banks of $2.8 Securities borrowed or purchased under repo 15,715 23,943 22,860 billion, other assets of $2.4 billion Trading account assets 11,799 10,377 10,889 and and trading account assets of Total deposits 98,475 95,861 92,905 $0.9 billion. Securities loaned or sold under repo 22,623 28,866 27,425 Long-term debt 16,686 17,129 17,335 • Loans held for investment Trading account liabilities 2,456 3,266 3,896 increased primarily due to growth MUAH stockholders' equity 16,448 16,280 16,897 in the commercial and industrial, Performance ratios commercial mortgage and other 1,2 consumer partially offset by a Net interest margin 2.02% 1.99% 2.06% 1 decrease in the residential Return on average assets (0.72) (0.43) 0.44 Return on average MUAH stockholders' mortgage and home equity equity 1 (7.41) (4.35) 4.41 portfolio. 1,4 Return on tangible common equity (8.30) 6.29 5.76 • Total deposits increased $5.6 3 Efficiency ratio 86.65 107.18 82.67 billion primarily due to money Adjusted efficiency ratio 4 84.23 74.69 78.96 market and noninterest bearing 1. Annualized based on year to date activity deposits. 2. Net interest margin is presented on a taxable-equivalent basis using the federal statutory tax rate of 21% for 2019 and 2020 3. The efficiency ratio is total noninterest expense as a percentage of total revenue (net interest income and noninterest income) 4. Non-GAAP financial measure in our 10-Q for quarter ended March 31, 2020 and March 31, 2019 and the 10-K for the year ended December 31, 2019 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 21

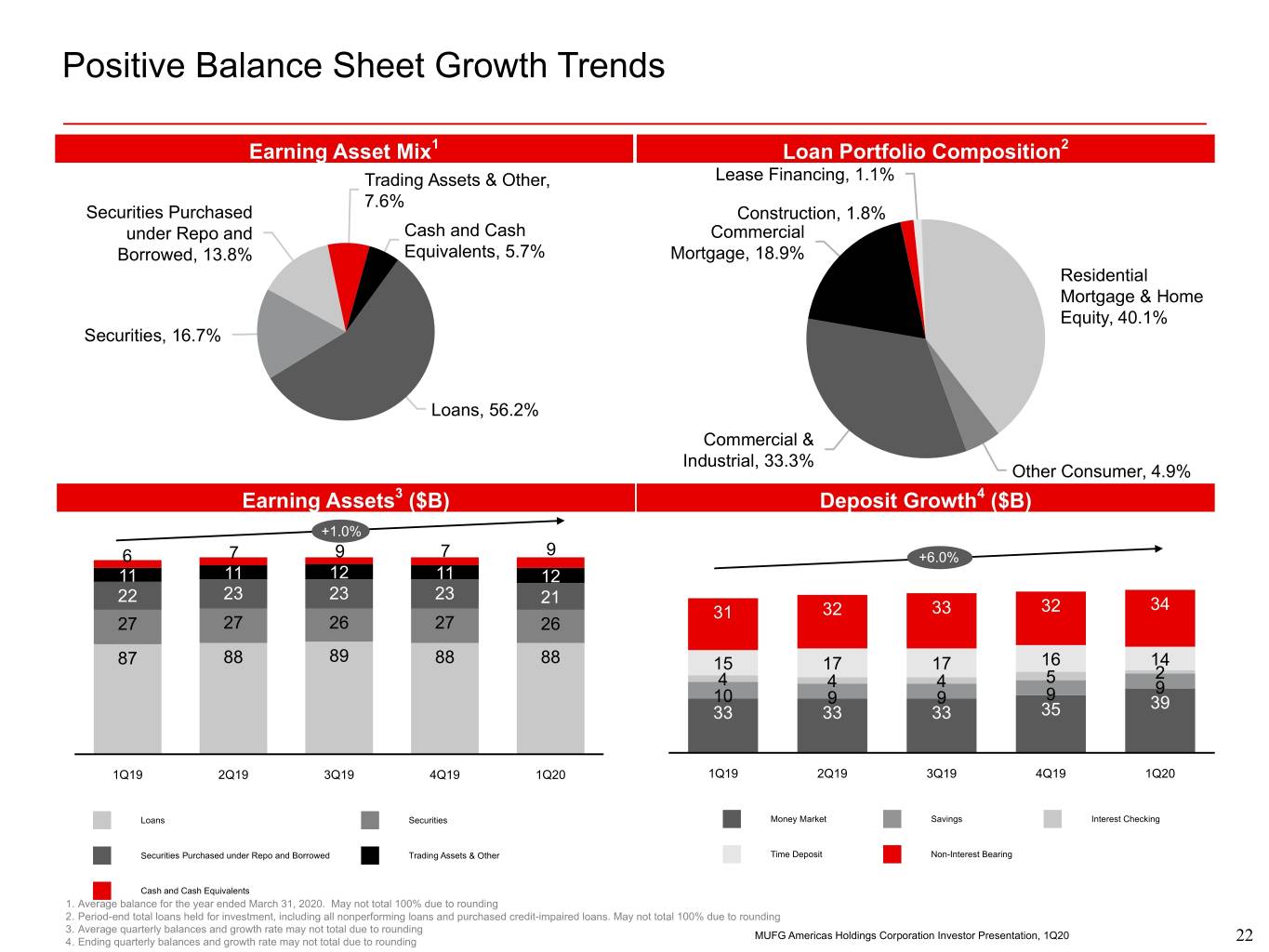

Positive Balance Sheet Growth Trends Earning Asset Mix1 Loan Portfolio Composition2 Trading Assets & Other, Lease Financing, 1.1% 7.6% Securities Purchased Construction, 1.8% under Repo and Cash and Cash Commercial Borrowed, 13.8% Equivalents, 5.7% Mortgage, 18.9% Residential Mortgage & Home Equity, 40.1% Securities, 16.7% Loans, 56.2% Commercial & Industrial, 33.3% Other Consumer, 4.9% Earning Assets3 ($B) Deposit Growth4 ($B) +1.0% 6 7 9 7 9 +6.0% 11 11 12 11 12 22 23 23 23 21 31 32 33 32 34 27 27 26 27 26 87 88 89 88 88 15 17 17 16 14 5 2 4 4 4 9 10 9 9 9 39 33 33 33 35 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 Loans Securities Money Market Savings Interest Checking Securities Purchased under Repo and Borrowed Trading Assets & Other Time Deposit Non-Interest Bearing Cash and Cash Equivalents 1. Average balance for the year ended March 31, 2020. May not total 100% due to rounding 2. Period-end total loans held for investment, including all nonperforming loans and purchased credit-impaired loans. May not total 100% due to rounding 3. Average quarterly balances and growth rate may not total due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 4. Ending quarterly balances and growth rate may not total due to rounding 22

Strong Deposit Base Retail Deposits Commercial Deposits • Focus on core deposit growth while optimizing total bank- • Align product and platform build-outs to increase PxV wide funding costs across Union Bank and PurePoint and drive core balance growth Financial • Focus on key customer segments, with improved • Launch new and innovative products to drive acquisition customer segmentation, data and reporting, and pricing and improve retention strategies • Execute COVID-19 responses to provide Consumer and Small Business deposit relief efforts Deposit Breakdown ($B)3 Major Deposit Share in Key California Locations1,2 Metropolitan Statistical Area (MSA) / State Rank Share (%) $98.5 billion Total Deposits Santa Maria-Santa Barbara, CA 2 14.80 San Diego-Chula Vista-Carlsbad, CA 4 13.25 Transaction & Money Market Savings Salinas, CA 5 8.70 Los Angeles-Long Beach-Anaheim, CA 4 8.69 Time Non-Interest Bearing Fresno, CA 4 6.98 Oxnard-Thousand Oaks-Ventura, CA 5 5.82 Sacramento-Roseville-Folsom, CA 5 4.71 $34.1 Riverside-San Bernardino-Ontario, CA 6 4.08 35% $41.3 San Francisco-Oakland-Berkeley, CA 7 2.52 42% San Jose-Sunnyvale-Santa Clara, CA 10 2.24 Overall California 4 5.91 $8.9 9% $14.2 14% 1. Source: SNL Financial as of 6/30/19, “Pro Forma” ownership which captures any known M&A or branch closure activity up to the current date, no deposit cap applied 2. The above balances do not include PurePoint deposits which are primarily placed with customers outside MUB's West Coast markets 3. Period-end total deposits may not total 100% due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 23

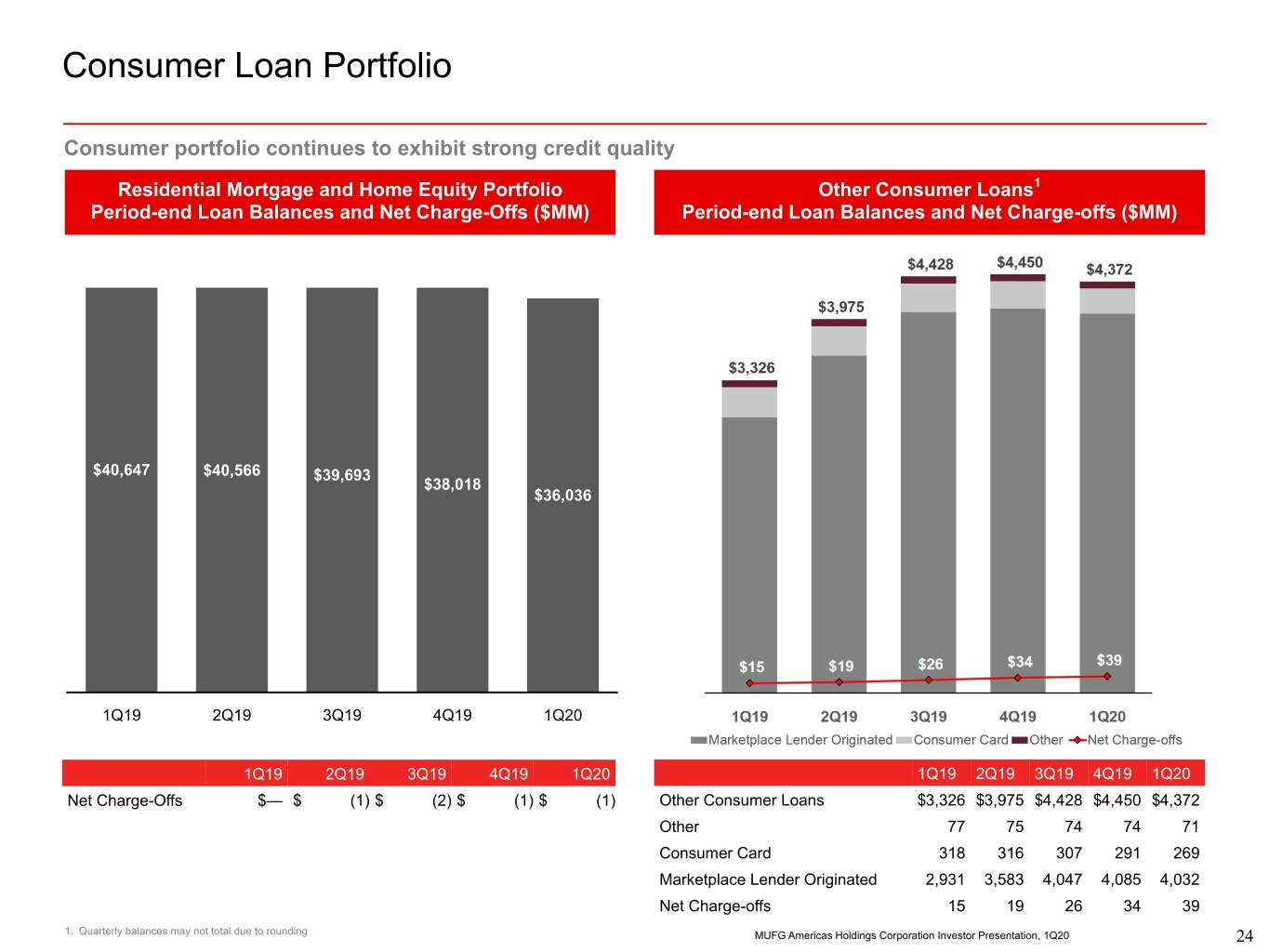

Consumer Loan Portfolio Consumer portfolio continues to exhibit strong credit quality Residential Mortgage and Home Equity Portfolio Other Consumer Loans1 Period-end Loan Balances and Net Charge-Offs ($MM) Period-end Loan Balances and Net Charge-offs ($MM) $40,647 $40,566 $39,693 $38,018 $36,036 1Q19 2Q19 3Q19 4Q19 1Q20 R1Q19esidential M2Q19ortgage and3Q19Home Equ4Q19ity 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 Net Charge-Offs $— $ (1) $ (2) $ (1) $ (1) Other Consumer Loans $3,326 $3,975 $4,428 $4,450 $4,372 Other 77 75 74 74 71 Consumer Card 318 316 307 291 269 Marketplace Lender Originated 2,931 3,583 4,047 4,085 4,032 Net Charge-offs 15 19 26 34 39 1. Quarterly balances may not total due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 24

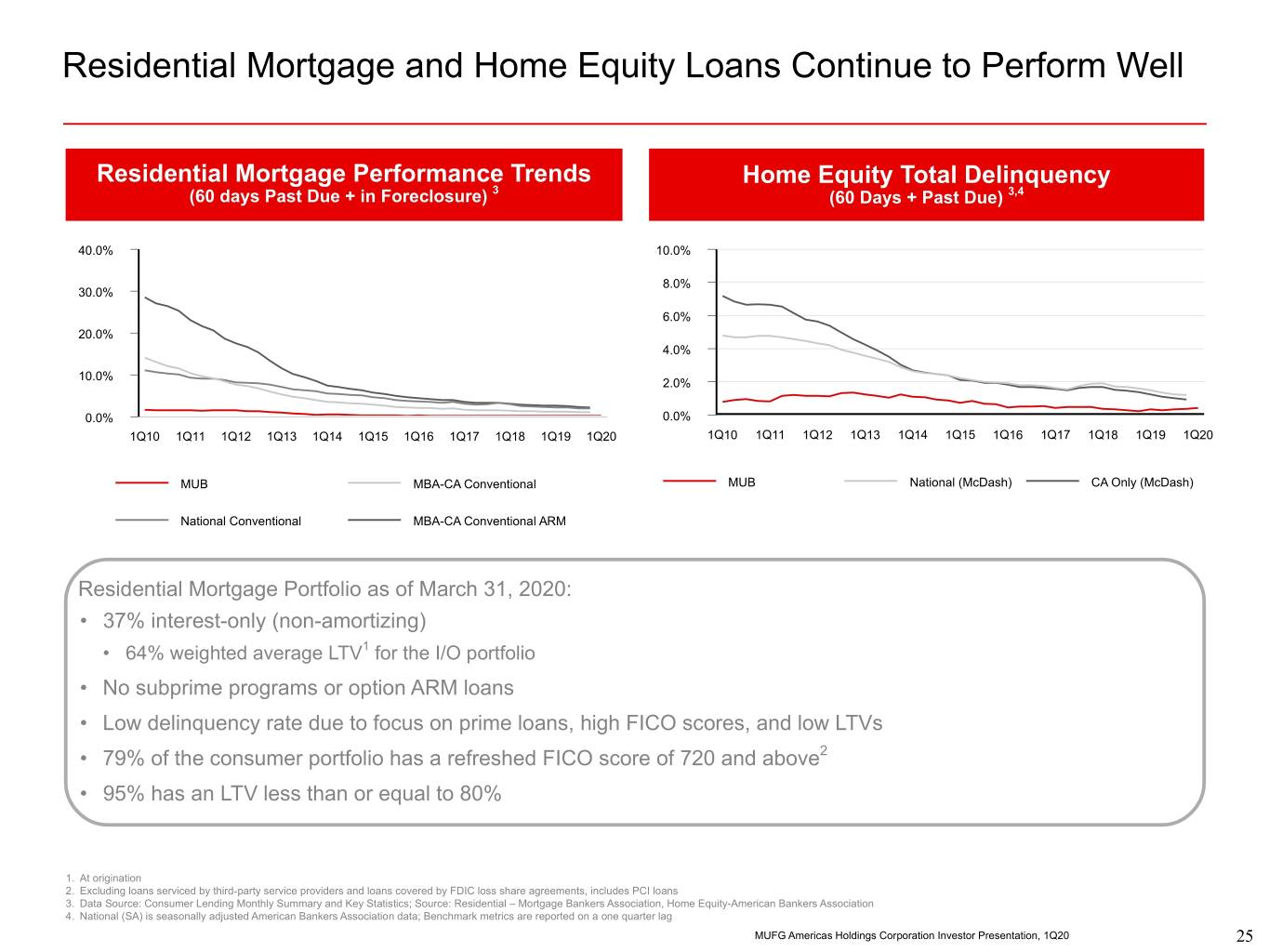

Residential Mortgage and Home Equity Loans Continue to Perform Well Residential Mortgage Performance Trends Home Equity Total Delinquency (60 days Past Due + in Foreclosure) 3 (60 Days + Past Due) 3,4 40.0% 10.0% 8.0% 30.0% 6.0% 20.0% 4.0% 10.0% 2.0% 0.0% 0.0% 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 1Q16 1Q17 1Q18 1Q19 1Q20 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 1Q16 1Q17 1Q18 1Q19 1Q20 MUB MBA-CA Conventional MUB National (McDash) CA Only (McDash) National Conventional MBA-CA Conventional ARM Residential Mortgage Portfolio as of March 31, 2020: • 37% interest-only (non-amortizing) • 64% weighted average LTV1 for the I/O portfolio • No subprime programs or option ARM loans • Low delinquency rate due to focus on prime loans, high FICO scores, and low LTVs • 79% of the consumer portfolio has a refreshed FICO score of 720 and above2 • 95% has an LTV less than or equal to 80% 1. At origination 2. Excluding loans serviced by third-party service providers and loans covered by FDIC loss share agreements, includes PCI loans 3. Data Source: Consumer Lending Monthly Summary and Key Statistics; Source: Residential – Mortgage Bankers Association, Home Equity-American Bankers Association 4. National (SA) is seasonally adjusted American Bankers Association data; Benchmark metrics are reported on a one quarter lag MUFG Americas Holdings Corporation Investor Presentation, 1Q20 25

Commercial Loan Portfolio Commercial loan balance remains stable in 1Q2020; net charge-offs continue to illustrate strong credit quality Commercial and Corporate Loan Portfolio Period-end Loan Balances and Net Charge-offs (Recoveries) ($MM) MUFG Americas Holdings Corporation Investor Presentation, 1Q20 26

Commercial Real Estate Overview Largely secured, California-focused commercial real estate-purposed loans1 with strong credit performance Q1 2020 Property Type Breakdown Q1 2020 Geographic Distribution2 Unsecured: 6.1% Other: 15.9% Los Angeles: 20.4% Other: 14.3% Oregon: 2.9% Multi-Family: Illinois: 3.1% 39.7% Washington: 7.1% Orange: 9.3% Industrial: Secured 11.5% 93.9% California New York: 5.0% 66% San Diego: 10.7% Retail: 12.9% Other (CA): Santa Clara: 4.6% 15.3% Alameda: 3.6% Office: 15.5% San Bernadino: 2.0% Commercial Real Estate Statistics March 31, December 31, March 31, (Dollars in millions) 2020 2019 2019 Commitments $ 24,514 $ 25,035 $ 22,544 Commercial and Industrial 4,336 4,833 3,835 Commercial Mortgage 17,191 17,173 15,544 Construction 2,987 3,028 3,166 Outstandings 20,910 20,248 18,553 Commercial and Industrial 2,395 1,847 1,580 Commercial Mortgage 16,933 16,891 15,282 Construction 1,582 1,511 1,691 Nonperforming Loans 70 40 12 1. Commercial real estate-purposed loans are comprised of commercial mortgage loans, construction loans and C&I loans to borrowers with real estate-exposed businesses; does not include CMBS in the investment or trading portfolios 2. Excludes loans not secured by real estate; subsets of California reported by Metropolitan Statistical Area (MSA); may not add to 100% due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 27

Materially De-Risked Oil & Gas Portfolio from 2015-2020 Total Exposure Trends Criticized Assets / NCO Trends 2015 vs. 2020 O&G Exposure by Subsectors • Materially de-risked Oil & Gas portfolio from 2015-2020: • Strategically reduced $5.7 billion (70%) of exposure through loan sales and exits • Reduction focused in the highest risk sectors ▪ Exploration and Production (E&P) exposure reduced by $5.6 billion (82%) ▪ $0.8 billion (66%) of the remaining $1.2 billion E&P exposure is Reserve Based Lending MUFG Americas Holdings Corporation Investor Presentation, 1Q20 28

Asset Quality Trends Nonaccrual Loans / Total Loans1,2 Net Charge-offs (Recoveries) / Average Loans1,4 1.0% 1.0% 0.72% 0.57% 0.68% 0.50% 0.54% 0.61% 0.47% 0.45% 0.57% 0.57% 0.5% 0.45% 0.5% 0.59% 0.36% 0.54% 0.29% 0.47% 0.0% 0.37% 0.36% 0.08% 0.09% 0.0% -0.5% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 MUAH Reference Banks' Average3 MUAH Reference Banks' Average3 Criticized5 & Nonaccrual Loans / Total Loans Nonperforming Assets by Loan Type ($MM) 5.00% $700 Commercial & 3 4.00% Industrial 20 1 2.87% $600 19 3.00% 124 Commercial Mortgage 1.99% 2.01% 120 1.78% $500 2.00% 1.74% 12 9 3 Construction 1 1.00% 0.72% 0.68% $400 0.47% 0.37% 0.36% 1 1 139 Residential 1 3 Mortgage & Home 0.00% $300 Equity 20 1Q19 2Q19 3Q19 4Q19 1Q20 137 146 478 454 $200 Other Consumer 15 55 Criticized Percent of Total Loans Held For Investment 258 OREO 0.37% 16 $100 0.35% 175 103 0.24% 0.19% Nonaccrual Loans % of Total Loans Held For Investment 0.20% NPA / Total Assets $0 1Q19 2Q19 3Q19 4Q19 1Q20 1. Source: SNL Financial and company reports 2. Total Loans for MUAH is based on Total Loans Held for Investment; Total Loans for Reference Banks' Average is based on gross loans which includes loans held for sale 3. Reference Banks consist of 12 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through April 25, 2020 (Source: SNL Financial) 4. Annualized ratio 5. Criticized loans held for investment reflect loans in the commercial portfolio segment that are monitored for credit quality based on regulatory ratings. Amounts exclude small business loans, which are monitored by business credit score and delinquency status MUFG Americas Holdings Corporation Investor Presentation, 1Q20 29

Strong Liquidity Position and Diverse Funding Mix • Under the joint agency Tailoring Rules, Category IV firms (such as MUAH) are required to maintain a liquidity buffer that is sufficient to meet the projected net stress cash-flow need over a 30-day planning horizon under the firm's internal liquidity stress test and subject to monthly tailored liquidity reporting requirements. • Unpledged securities of $21.3 billion; ability to meet expected obligations for at least 18 months without access to funding • Key sources of funding consist primarily of deposits ($98.5 billion), supplemented by wholesale funding ($22.1 billion) • Diversified wholesale funding mix, primarily including borrowings from the Federal Home Loan Bank (FHLB) of San Francisco, the parent (Total Loss Absorbing Capacity debt), and unsecured term debt in the capital markets • Unused FHLB capacity is $20.6 billion MUAH Total Funding Profile MUAH Wholesale Funding Profile Other LT Borrowings1: 0.1% $ in billions Wholesale Funding: 15.4% FHLB 10.9 Repos: 15.8% TLAC 6.8 Unsecured Term Debt 3.1 Deposits: 68.7% CP & Other ST Borrowings 0.9 Other Wholesale Funding 0.4 1. Includes non-recourse debt MUFG Americas Holdings Corporation Investor Presentation, 1Q20 30

High Quality Investment Portfolio 1 Investment Portfolio Commentary ($ in billions) • Cash and cash equivalents increased $2.3 billion between 4Q19 and 1Q20, which partially offsets the $3.0 billion decrease in the Investment Portfolio • Agency residential mortgage-backed securities consist of securities guaranteed by a U.S. government corporation, such as Ginnie Mae, or a government-sponsored agency such as Freddie Mac or Fannie Mae • Commercial mortgage-backed securities are collateralized by commercial mortgage loans and are generally subject to prepayment penalties • CLOs consist of structured finance products that securitize a diversified pool of loan assets into multiple classes of notes • Other debt securities primarily consist of direct bank purchase bonds, which are not rated by external credit rating agencies Investment Portfolio Distribution2 US Treasury and Govt-Agency: 20.0% RMBS: 2.9% CMBS: 15.1% CLOs: 5.5% Direct Bank Purchase Bonds: 3.9% Other: 0.7% Agency MBS: 51.9% 1. Source: Fair value of securities in MUAH 10-Q Filing as of March 31, 2020 and December 31, 2019 respectively 2. Source: MUAH 10-Q Filing as of March 31, 2020 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 31

High Quality Securities Financing Portfolio (MUSA) Securities Financing Maturity Profile • Securities financing activity largely conducted through MUSA 20,000 • Securities financing portfolio is primarily $15,841 collateralized by high quality, liquid assets 15,000 • Approximately 85% is collateralized by U.S. ) s n o i l Treasuries and Agency MBS and 15% is l i 10,000 $8,903 M ( $ backed by equities, credit and other $5,956 $5,726 $6,125 5,000 • Robust risk management framework governs $2,385 $1,596 secured financing profile including guidelines $762 0 and limits for tenor gaps, counterparty 1 O/N and Continuous 2-30 days 31-90 days > 90 days concentration and stressed liquidity outflows Assets Liabilities Assets2 Liabilities2 5.1% 3.4% 2.7% 3.7% 7.0% 5.8% U.S. Treasury & Government Agencies Agency MBS 38.7% Corporate Bonds 52.6% 32.6% Other Debt 48.4% Equities 1. Includes continuous maturities which include open trades and term evergreen transactions that are primarily used to fund inventory 2. Total assets and liabilities may not total 100% due to rounding MUFG Americas Holdings Corporation Investor Presentation, 1Q20 32

Interest Rate Risk Management of Exposures Other Than Trading Net Interest Income (NII) Sensitivity ($MM) +200 bps 12-month horizon Gradual parallel yield curve shift over -100 bps For additional information regarding estimates and assumptions used in our net interest income sensitivity analysis see “Market Risk Management - Interest Rate Risk Management” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2019 Form 10-K. MUFG Americas Holdings Corporation Investor Presentation, 1Q20 33

Strong and High Quality Capital Base MUAH's capital ratios exceed the average of the Reference Banks1 Reference Banks' Average1 MUAH Capital Ratios Capital ratios: March 31, 2020 March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Regulatory: Common Equity Tier 1 risk-based capital ratio 9.95% 13.88% 14.10% 13.81% 13.82% Tier 1 risk-based capital ratio 11.19 13.88 14.10 13.81 13.82 Total risk-based capital ratio 13.42 14.79 14.73 14.48 14.49 Tier 1 leverage ratio 9.17 8.91 8.88 8.62 8.68 Other: Tangible common equity ratio2 7.82 8.84 8.45 8.19 8.12 MUAH reports its regulatory capital ratios under the standardized approach of the U.S. Basel III Rules. Under the revised Enhanced Prudential Standards (EPS) and joint agency capital and liquidity Tailoring Rules, MUAH is subject to Category IV requirements; supervisory stress testing under the Federal Reserve’s (FRB) Comprehensive Capital Analysis & Review (CCAR) program is required every other year on even years and MUAH will be included in the FRB 2020 CCAR supervisory stress testing process. In March 2020, the FRB extended the deadline until April 5, 2021 for the information required in the annual FR Y-14A schedule submissions, other than “Schedule C – Regulatory Capital Instruments” for purposes of the annual capital plan required submission for Category IV Firms. MUAH submitted its 2020 Annual Capital Plan and “Schedule C – Regulatory Capital Instruments” schedule to the FRB by the deadline of April 6, 2020 for its required annual Capital Plan submission. MUAH continues to be subject to the FRB annual Horizontal Capital Review (HCR) supervisory review processes. For the 2020 HCR review, the FRB announced it would perform a limited scope monitoring exercise versus an examination in recognition that firms are managing through stress. The FRB’s 2020 HCR monitoring and outreach will focus on understanding the current challenges and risks related to the ongoing COVID-19 stress event and management’s associated risk mitigation and capital planning responses. 1. Reference Banks consist of 12 CCAR-filing public regional banks listed on slide 4 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through April 27, 2020 (Source: SNL Financial) 2. Non-GAAP financial measures. Refer to our separate reconciliation of non-GAAP financial measures in our 10-K for the for the years ended December 31, 2019 and our 10-Q for quarters March 31, 2020, September 30, 2019 and June 30, 2019 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 34

Strong Credit Ratings For the rating agencies, strong capital and conservative asset quality help offset MUAH’s lower profitability and a higher level of wholesale funding relative to peers Senior Unsecured / ST Moody’s1 S&P2 Fitch3 Reference Banks’ Credit Ratings (5/14/2020) Holding Company Ratings Bank Ratings Long-term ratings S&P Moody's Fitch S&P Moody's Fitch Mitsubishi UFJ A1 A- A- Financial Group, Inc. U.S. Bancorp A+ A1 AA- AA- A1 AA- Parent P-1 - F1 Wells Fargo & Company A- A2 A+ A+ Aa2 AA- Bank of America Corp. A- A2 A+ A+ Aa2 AA- JPMorgan Chase & Co. A- A2 AA- A+ Aa2 AA MUAH A- A2 A A A2 A MUFG Bank, Ltd. A1 A A- Truist Financial Corp. A- A3 A+ A A2 A+ OpCo P-1 A-1 F1 PNC Financial Services A- A3 A+ A A2 A+ M&T Bank A- A3 A A A3 A Citigroup Inc. BBB+ A3 A A+ Aa3 A+ MUFG Americas Holdings A2 A- A Comerica BBB+ A3 A- A- A3 A- Corporation - A-2 F1 Fifth Third Bancorp BBB+ Baa1 A- A- A3 A- Intermediate Holding Co. KeyCorp BBB+ Baa1 A- A- A3 A- Huntington BBB+ Baa1 A- A- A3 A- A2 A A Capital One Financial Corp. BBB Baa1 A- BBB+ Baa1 A- MUFG Union Bank, N.A. Citizens Financial Group BBB+ NR BBB+ A- Baa1 BBB+ OpCo P-1 A-1 F1 Regions Financial Corp. BBB+ Baa2 BBB+ A- Baa2 BBB+ Zions Bancorporation - - - BBB+ Baa2 BBB+ MUFG Securities A A N/R Americas Inc. A-1 F1 Broker Dealer 1. On November, 21, 2019, Moody's affirmed MUFG's ratings with a stable outlook. On December 4, 2019, Moody's affirmed the ratings of MUAH and MUB and the outlook was changed to negative from stable. 2. On April 24, 2020, S&P revised MUAH and MUB’s outlook to stable from positive. The change in outlook is followed by S&P’s revision to the MUFG Group’s outlook to stable from positive due to S&P's expectation that economic strain from the COVID-19 pandemic will put prolonged pressure on the asset quality and revenue of MUFG lowering the likelihood of MUFG Group. 3. On May 1, 2020, Fitch affirmed MUAH, MUB and MUSA's long and short-term ratings. The Rating Watch Negative (assigned on April 16, 2020) has been removed and a negative outlook has been assigned due to concerns on the impact from COVID-19. On April 8, 2020, Fitch downgraded MUFG and MUFG Bank to A-/F1 outlook stable from A/F1 outlook negative. The downgrade was based on Fitch's view of a weaker and more challenging operating environment for Japanese banks as a result of COVID-19. MUFG Americas Holdings Corporation Investor Presentation, 1Q20 35

Appendix 36

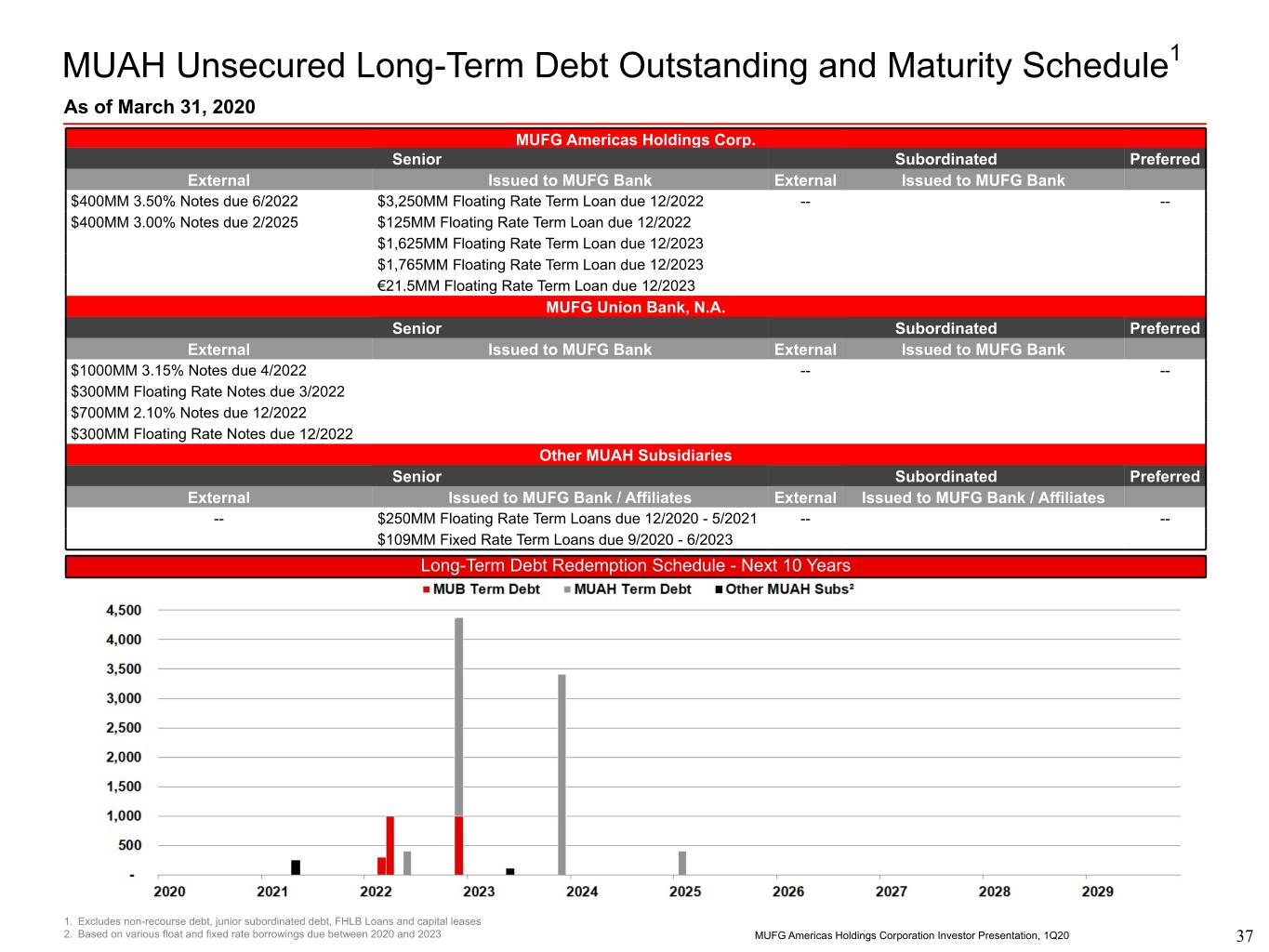

MUAH Unsecured Long-Term Debt Outstanding and Maturity Schedule1 As of March 31, 2020 MUFG Americas Holdings Corp. Senior Subordinated Preferred External Issued to MUFG Bank External Issued to MUFG Bank $400MM 3.50% Notes due 6/2022 $3,250MM Floating Rate Term Loan due 12/2022 -- -- $400MM 3.00% Notes due 2/2025 $125MM Floating Rate Term Loan due 12/2022 $1,625MM Floating Rate Term Loan due 12/2023 $1,765MM Floating Rate Term Loan due 12/2023 €21.5MM Floating Rate Term Loan due 12/2023 MUFG Union Bank, N.A. Senior Subordinated Preferred External Issued to MUFG Bank External Issued to MUFG Bank $1000MM 3.15% Notes due 4/2022 -- -- $300MM Floating Rate Notes due 3/2022 $700MM 2.10% Notes due 12/2022 $300MM Floating Rate Notes due 12/2022 Other MUAH Subsidiaries Senior Subordinated Preferred External Issued to MUFG Bank / Affiliates External Issued to MUFG Bank / Affiliates -- $250MM Floating Rate Term Loans due 12/2020 - 5/2021 -- -- $109MM Fixed Rate Term Loans due 9/2020 - 6/2023 Long-Term Debt Redemption Schedule - Next 10 Years 1. Excludes non-recourse debt, junior subordinated debt, FHLB Loans and capital leases 2. Based on various float and fixed rate borrowings due between 2020 and 2023 MUFG Americas Holdings Corporation Investor Presentation, 1Q20 37

Contacts Contacts Daniel Weidman Stanley Cecala Managing Director, Corporate Communications Director, Investor Relations 213-236-4050 212-782-5629 daniel.weidman@unionbank.com stanley.cecala@unionbank.com Investor Relations MUFG Americas Holdings Corporation 212-782-6872 DebtCapitalMarketsIR@unionbank.com MUFG Americas Holdings Corporation Investor Presentation, 1Q20 38