Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Phillips Edison & Company, Inc. | pecoearningsreleaseq12020e.htm |

| 8-K - 8-K - Phillips Edison & Company, Inc. | peco_20200331earnings8-k.htm |

First Quarter 2020 Results Presentation Wednesday, May 13, 2020

Agenda Prepared Remarks Jeff Edison - Chairman and CEO • Overview • Q1 2020 Highlights John Caulfield - CFO • Financial Results • Balance Sheet Jeff Edison - Chairman and CEO • COVID-19 Update • Estimated Value Per Share • 2020 Outlook Question and Answer Session www.phillipsedison.com/investors 2

Forward-Looking Statement Disclosure Certain statements contained in this presentation for Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those Acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “hope,” “continue,” “remain,” “maintain,” “likely,” “outlook,” “perceived,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projecting,” “future,” “should,” “could,” “would,” “uncertainty,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the U.S. Securities and Exchange Commission (“SEC”). Such statements include, but are not limited to, statements about our plans, strategies, initiatives, and prospects; statements about the global pandemic of a novel coronavirus (“COVID-19”), including its duration and potential or expected impact on our tenants and our business; statements about the duration or extent of the suspension of our distributions, share repurchase program, and dividend reinvestment program; and statements about our future results of operations, capital expenditures, and liquidity. Such statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those projected or anticipated, including, without limitation, (i) changes in national, regional, or local economic climates; (ii) local market conditions, including an oversupply of space in, or a reduction in demand for, properties similar to those in our portfolio; (iii) vacancies, changes in market rental rates, and the need to periodically repair, renovate, and re-let space; (iv) changes in interest rates and the availability of permanent mortgage financing; (v) competition from other available properties and the attractiveness of properties in our portfolio to our tenants; (vi) the financial stability of tenants, including the ability of tenants to pay rent; (vii) changes in tax, real estate, environmental, and zoning laws; (viii) the concentration of our portfolio in a limited number of industries, geographies, or investments; (ix) the effects of the COVID-19 pandemic, including on the demand for consumer goods and services and levels of consumer confidence in the safety of visiting shopping centers as a result of the COVID-19 pandemic; (x) the measures taken by federal, state, and local government agencies and tenants in response to the COVID-19 pandemic, including mandatory business shutdowns, stay-at-home orders and social distancing guidelines; (xi) the impact of the COVID-19 pandemic on our tenants and their ability to pay rent on time or at all, or to renew their leases and, in the case of non-renewal, our ability to re-lease the space at the same or more favorable terms or at all; (xii) the length and severity of the COVID-19 pandemic in the United States; (xiii) the pace of recovery following the COVID-19 pandemic given the current severe economic contraction and increase in unemployment rates; (xiv) our ability to implement cost containment strategies; (xv) our and our tenants’ ability to obtain loans under the CARES Act or similar state programs; (xvi) our ability to pay down, refinance, restructure, or extend our indebtedness as it becomes due; (xvii) to the extent we were seeking to dispose of properties in the near term, significantly greater uncertainty regarding our ability to do so at attractive prices; (xviii) the impact of the COVID-19 pandemic on our business, results of operations, financial condition, and liquidity; and (xix) supply chain disruptions due to the COVID-19 pandemic. Additional important factors that could cause actual results to differ are described in the filings made from time to time by the Company with the SEC and include the risk factors and other risks and uncertainties described in our 2019 Annual Report on Form 10-K, filed with the SEC on March 11, 2020 and those included in our Quarterly Report on Form 10-Q filed on May 12, 2020, in each case as updated from time to time in our periodic and/or current reports filed with the SEC, which are accessible on the SEC’s website at www.sec.gov. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. www.phillipsedison.com/investors 3

PECO’s National Portfolio Our broad national footprint of grocery-anchored shopping centers is complemented by local market expertise. Wholly-owned Total Properties Occupancy 285 95.6% Percent In-line Grocery- Occupancy anchored 97.0% 90.1% Rent from States grocer, national & regional 31 neighbors* 76.8% Rent from service & Square Feet necessity-based neighbors* 31.9 million Top 5 Markets*: Atlanta, Chicago, Tampa, Dallas, Minneapolis 77.0% www.phillipsedison.com/investors All Statistics as of March 31, 2020. *Includes wholly-owned properties and the prorated share owned through our joint ventures. 4

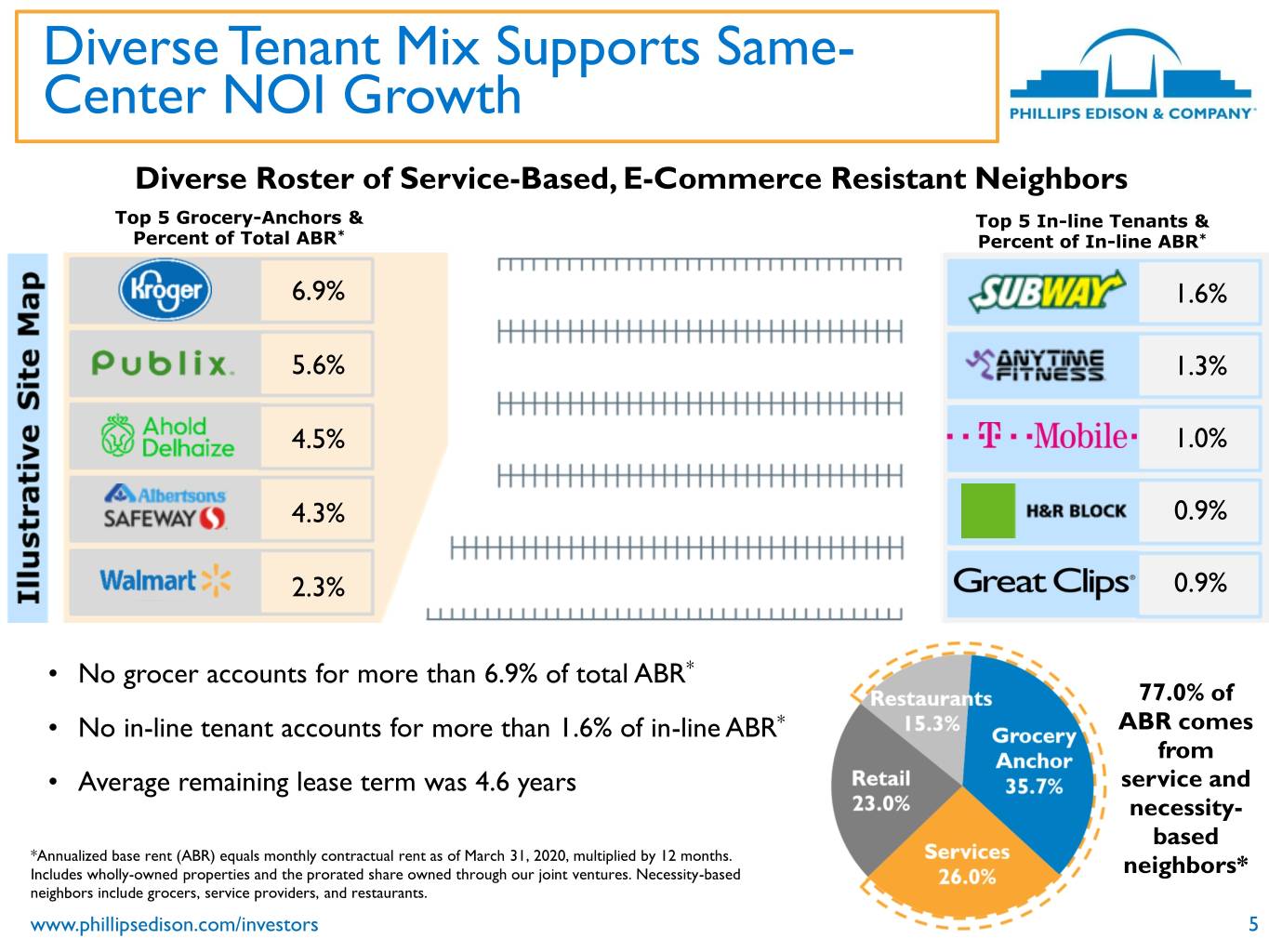

Diverse Tenant Mix Supports Same- Center NOI Growth Diverse Roster of Service-Based, E-Commerce Resistant Neighbors Top 5 Grocery-Anchors & Top 5 In-line Tenants & Percent of Total ABR* Percent of In-line ABR* 6.9% 1.6% 5.6% 1.3% 4.5% 1.0% 4.3% 0.9% 2.3% 0.9% • No grocer accounts for more than 6.9% of total ABR* 77.0% of • No in-line tenant accounts for more than 1.6% of in-line ABR* ABR comes from • Average remaining lease term was 4.6 years service and necessity- based *Annualized base rent (ABR) equals monthly contractual rent as of March 31, 2020, multiplied by 12 months. Includes wholly-owned properties and the prorated share owned through our joint ventures. Necessity-based neighbors* neighbors include grocers, service providers, and restaurants. www.phillipsedison.com/investors 5

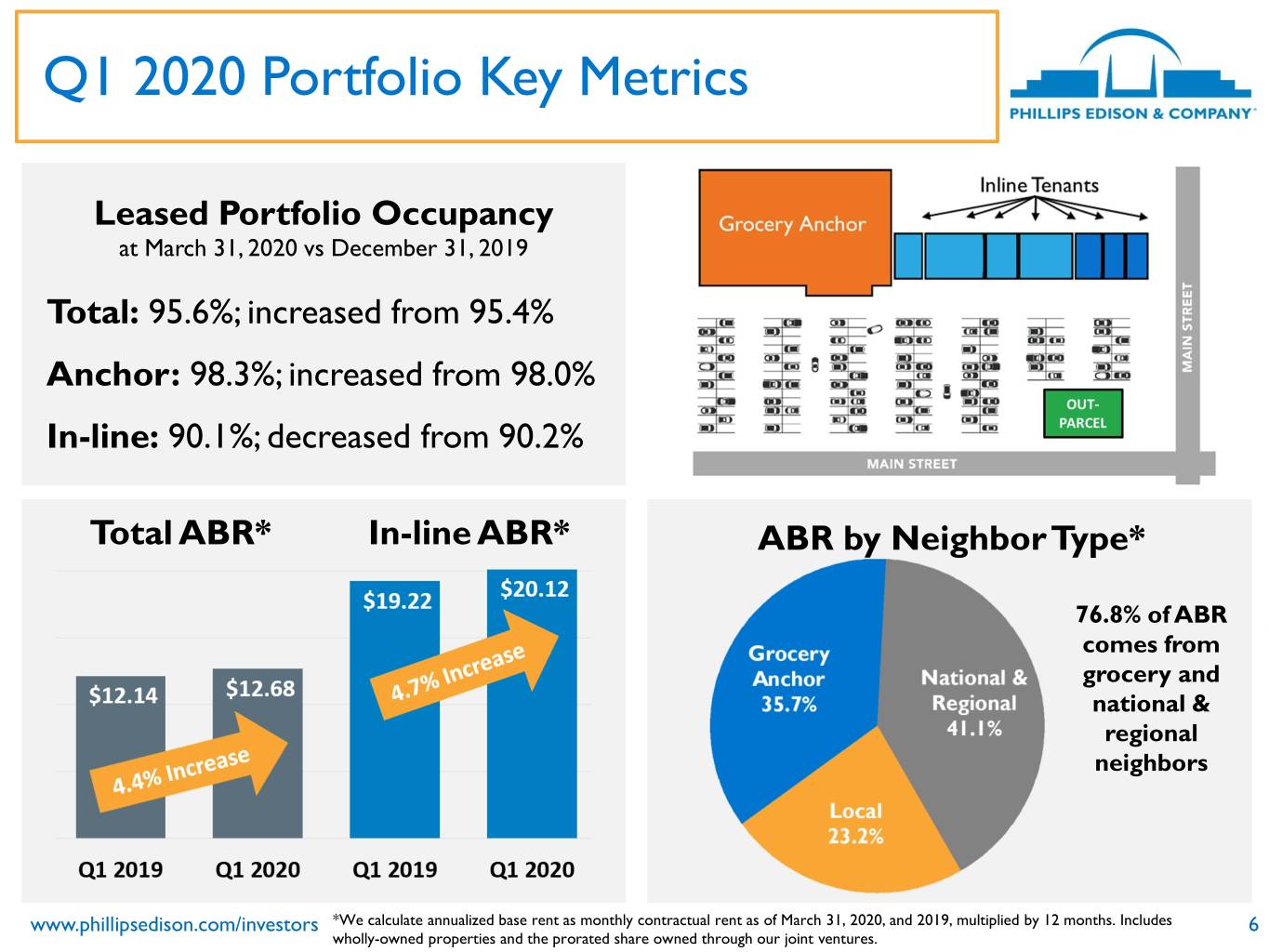

Q1 2020 Portfolio Key Metrics Leased Portfolio Occupancy at March 31, 2020 vs December 31, 2019 Total: 95.6%; increased from 95.4% Anchor: 98.3%; increased from 98.0% In-line: 90.1%; decreased from 90.2% Total ABR* In-line ABR* ABR by Neighbor Type* 76.8% of ABR comes from grocery and national & regional neighbors www.phillipsedison.com/investors *We calculate annualized base rent as monthly contractual rent as of March 31, 2020, and 2019, multiplied by 12 months. Includes 6 wholly-owned properties and the prorated share owned through our joint ventures.

Q1 2020 Highlights First Quarter 2020 Highlights (vs. First Quarter 2019) • Reported net income of $11.2 million, an improvement from a net loss of $5.8 million • Same-center net operating income (“NOI”) increased 2.6% to $86.9 million • Leased portfolio occupancy increased to 95.6% • Core FFO increased 8.4% to $60.2 million; Core FFO per diluted share increased to $0.18 from $0.17 • FFO and Core FFO totaled 122.2% and 107.9%, respectively, of total distributions made during the quarter • Paid off a $30 million term loan due in 2021, leaving the Company with no material term loan maturities until 2022 www.phillipsedison.com/investors 7

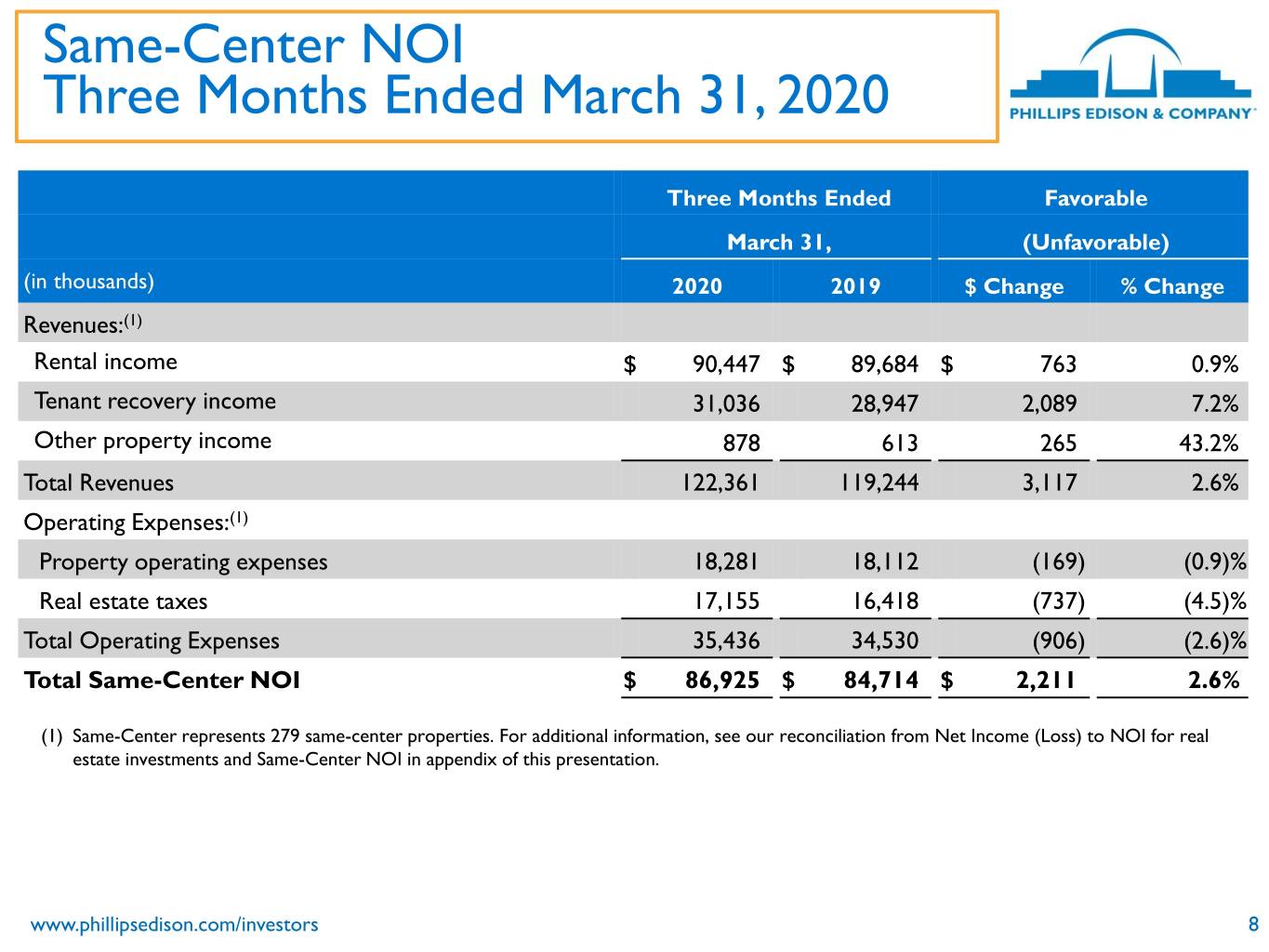

Same-Center NOI Three Months Ended March 31, 2020 Three Months Ended Favorable March 31, (Unfavorable) (in thousands) 2020 2019 $ Change % Change Revenues:(1) Rental income $ 90,447 $ 89,684 $ 763 0.9% Tenant recovery income 31,036 28,947 2,089 7.2% Other property income 878 613 265 43.2% Total Revenues 122,361 119,244 3,117 2.6% Operating Expenses:(1) Property operating expenses 18,281 18,112 (169) (0.9)% Real estate taxes 17,155 16,418 (737) (4.5)% Total Operating Expenses 35,436 34,530 (906) (2.6)% Total Same-Center NOI $ 86,925 $ 84,714 $ 2,211 2.6% (1) Same-Center represents 279 same-center properties. For additional information, see our reconciliation from Net Income (Loss) to NOI for real estate investments and Same-Center NOI in appendix of this presentation. www.phillipsedison.com/investors 8

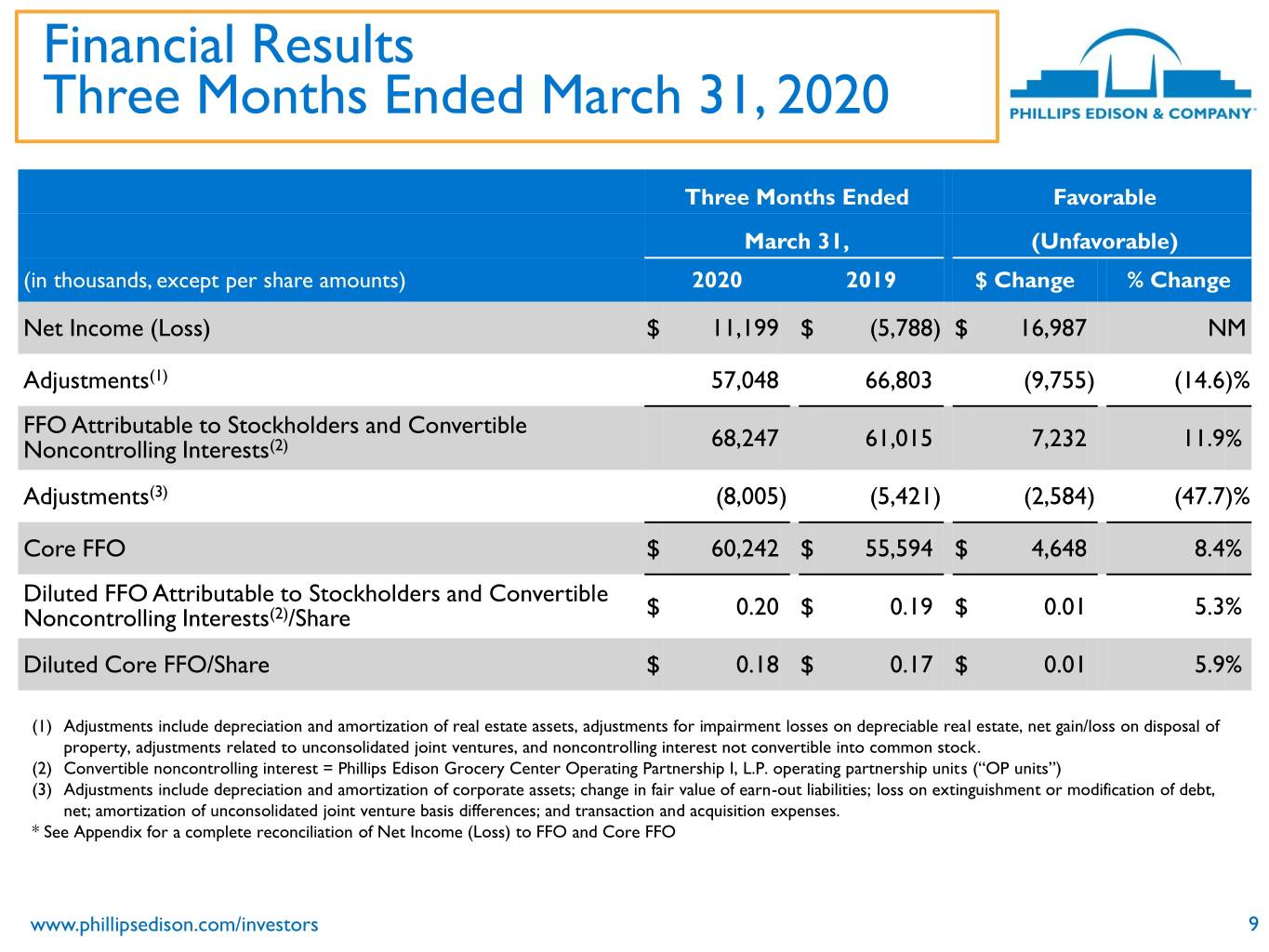

Financial Results Three Months Ended March 31, 2020 Three Months Ended Favorable March 31, (Unfavorable) (in thousands, except per share amounts) 2020 2019 $ Change % Change Net Income (Loss) $ 11,199 $ (5,788) $ 16,987 NM Adjustments(1) 57,048 66,803 (9,755) (14.6)% FFO Attributable to Stockholders and Convertible Noncontrolling Interests(2) 68,247 61,015 7,232 11.9% Adjustments(3) (8,005) (5,421) (2,584) (47.7)% Core FFO $ 60,242 $ 55,594 $ 4,648 8.4% Diluted FFO Attributable to Stockholders and Convertible Noncontrolling Interests(2)/Share $ 0.20 $ 0.19 $ 0.01 5.3% Diluted Core FFO/Share $ 0.18 $ 0.17 $ 0.01 5.9% (1) Adjustments include depreciation and amortization of real estate assets, adjustments for impairment losses on depreciable real estate, net gain/loss on disposal of property, adjustments related to unconsolidated joint ventures, and noncontrolling interest not convertible into common stock. (2) Convertible noncontrolling interest = Phillips Edison Grocery Center Operating Partnership I, L.P. operating partnership units (“OP units”) (3) Adjustments include depreciation and amortization of corporate assets; change in fair value of earn-out liabilities; loss on extinguishment or modification of debt, net; amortization of unconsolidated joint venture basis differences; and transaction and acquisition expenses. * See Appendix for a complete reconciliation of Net Income (Loss) to FFO and Core FFO www.phillipsedison.com/investors 9

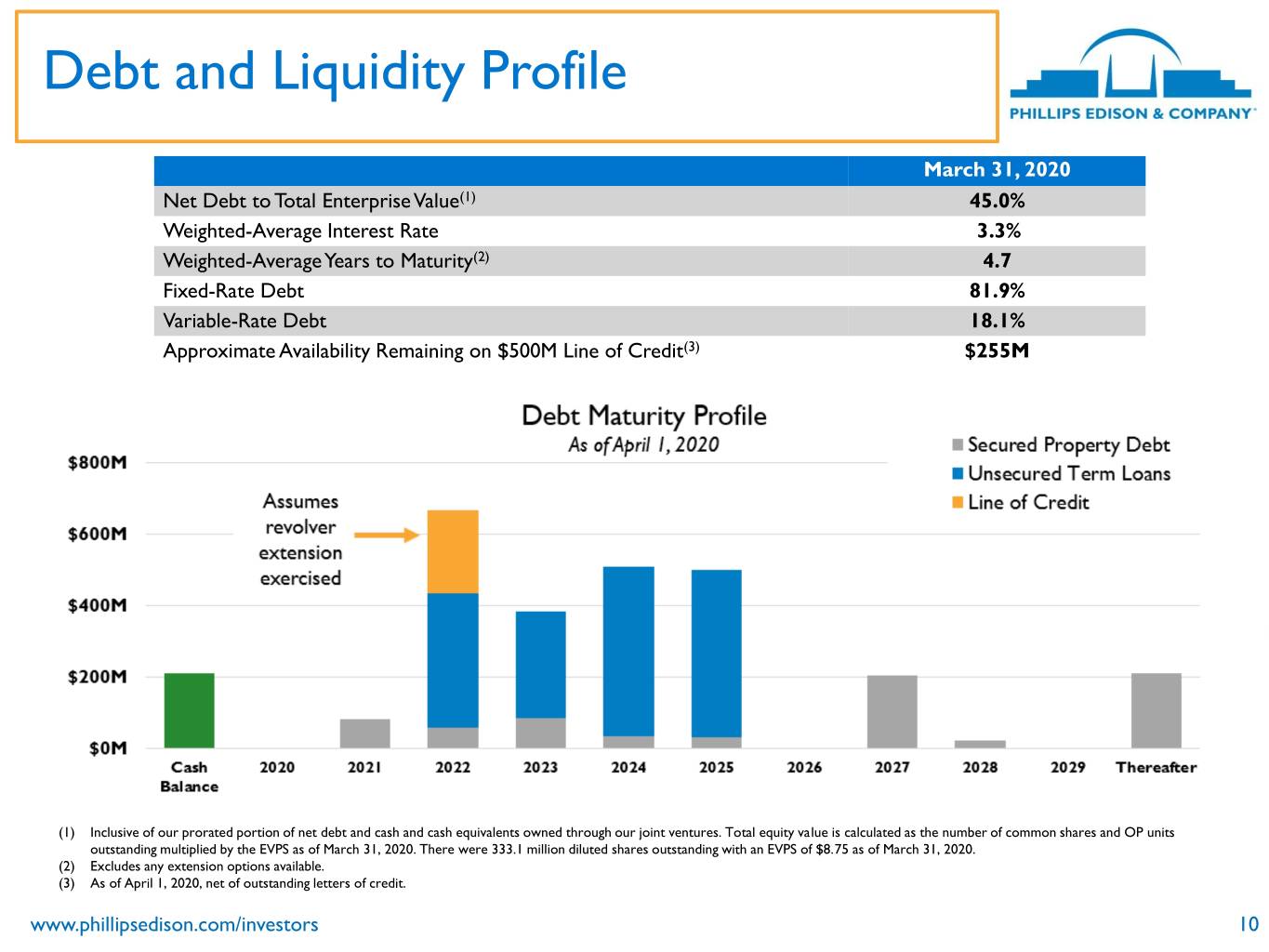

Debt and Liquidity Profile March 31, 2020 Net Debt to Total Enterprise Value(1) 45.0% Weighted-Average Interest Rate 3.3% Weighted-Average Years to Maturity(2) 4.7 Fixed-Rate Debt 81.9% Variable-Rate Debt 18.1% Approximate Availability Remaining on $500M Line of Credit(3) $255M (1) Inclusive of our prorated portion of net debt and cash and cash equivalents owned through our joint ventures. Total equity value is calculated as the number of common shares and OP units outstanding multiplied by the EVPS as of March 31, 2020. There were 333.1 million diluted shares outstanding with an EVPS of $8.75 as of March 31, 2020. (2) Excludes any extension options available. (3) As of April 1, 2020, net of outstanding letters of credit. www.phillipsedison.com/investors 10

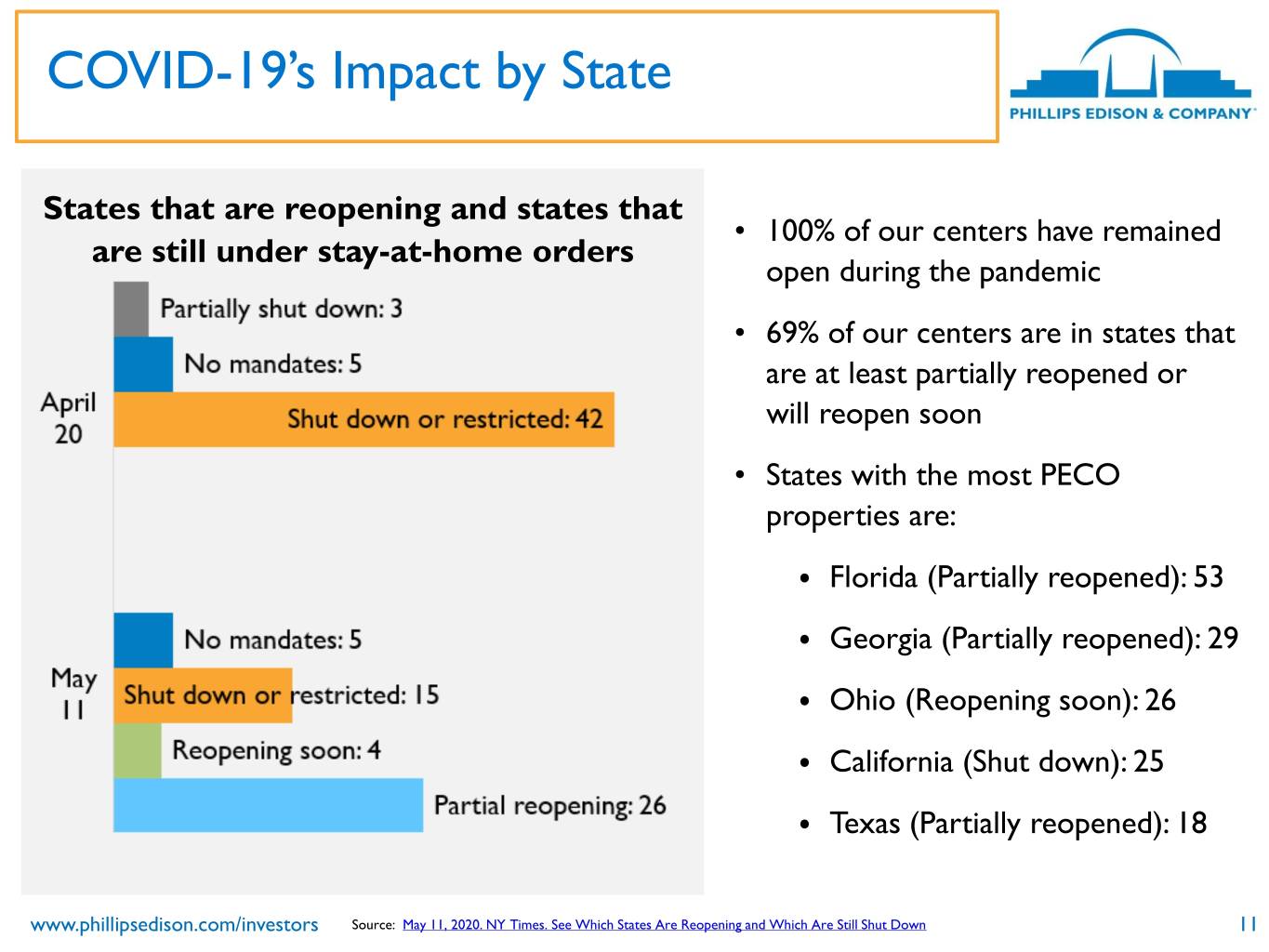

COVID-19’s Impact by State States that are reopening and states that • 100% of our centers have remained are still under stay-at-home orders open during the pandemic • 69% of our centers are in states that are at least partially reopened or will reopen soon • States with the most PECO properties are: ⦁ Florida (Partially reopened): 53 ⦁ Georgia (Partially reopened): 29 ⦁ Ohio (Reopening soon): 26 ⦁ California (Shut down): 25 ⦁ Texas (Partially reopened): 18 www.phillipsedison.com/investors Source: May 11, 2020. NY Times. See Which States Are Reopening and Which Are Still Shut Down 11

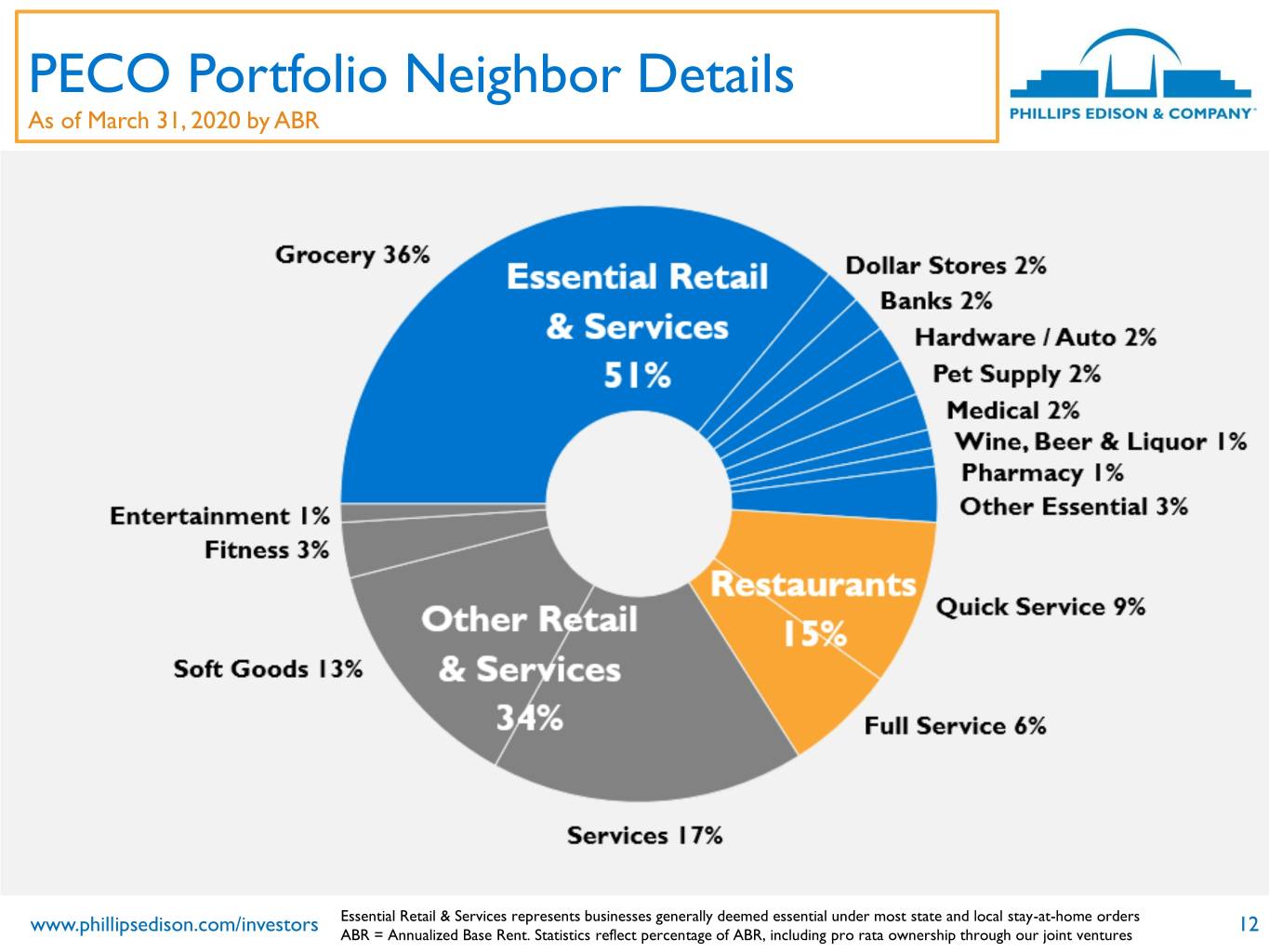

PECO Portfolio Neighbor Details As of March 31, 2020 by ABR Essential Retail & Services represents businesses generally deemed essential under most state and local stay-at-home orders www.phillipsedison.com/investors ABR = Annualized Base Rent. Statistics reflect percentage of ABR, including pro rata ownership through our joint ventures 12

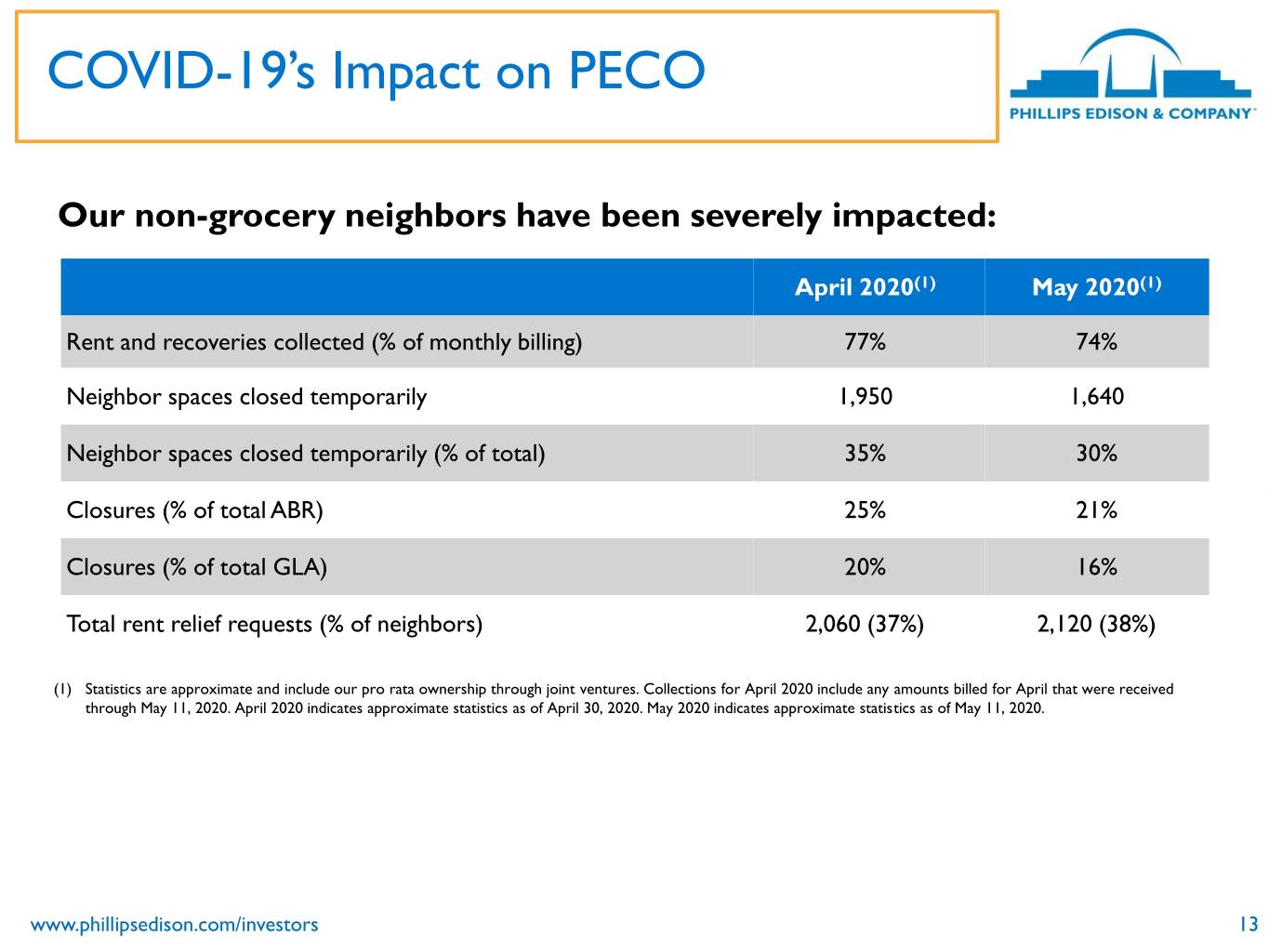

COVID-19’s Impact on PECO Our non-grocery neighbors have been severely impacted: April 2020(1) May 2020(1) Rent and recoveries collected (% of monthly billing) 77% 74% Neighbor spaces closed temporarily 1,950 1,640 Neighbor spaces closed temporarily (% of total) 35% 30% Closures (% of total ABR) 25% 21% Closures (% of total GLA) 20% 16% Total rent relief requests (% of neighbors) 2,060 (37%) 2,120 (38%) (1) Statistics are approximate and include our pro rata ownership through joint ventures. Collections for April 2020 include any amounts billed for April that were received through May 11, 2020. April 2020 indicates approximate statistics as of April 30, 2020. May 2020 indicates approximate statistics as of May 11, 2020. www.phillipsedison.com/investors 13

Our Response to COVID-19 PECO has taken the following steps to maximize its financial flexibility and preserve cash given the uncertainty and fluidity of the COVID-19 pandemic: 1. The Board approved a temporary 25% reduction to the CEO’s base salary, a temporary 10% reduction to the executive management team’s base salary (president, chief operating officer, chief financial officer, and general counsel), and a temporary 10% reduction to board members’ base compensation for the 2020-2021 term. 2. Monthly distributions have been temporarily suspended. 3. The Company drew $200 million in April on its $500 million revolving credit facility. 4. All capital projects are being delayed to the extent possible. 5. Expense reductions are being implemented at the property and corporate levels, including a reduction in workforce. 6. The Share Repurchase Program for DDI (death, qualifying disability or determination of incompetence) has been temporarily suspended. The Share Repurchase Program for standard requests remains suspended. We expect to reevaluate distributions and share repurchases once the pandemic has stabilized and we are able to fully assess the impact of COVID-19 on our business. www.phillipsedison.com/investors 14

Alignment with Stockholders • CEO and executive management base salary reductions Internal Management Structure • Reduction to independent director base compensation for the 2020-2021 term In 2017, we merged with • Total compensation for PECO’s CEO and executive our external advisor to management team is highly incentive-based and become a fully internally- dependent on Company performance: managed REIT. • Approximately 83% of total CEO compensation • Approximately 65% of President, CFO, COO, and No asset management General Counsel compensation fees, or any other management fees, are • The distribution suspension affects executives as well being paid to a third party. (Company’s largest stockholder at ~8% combined) www.phillipsedison.com/investors 15

Working with our Neighbors: Preparing to Reopen As government orders begin to lift, we are focused on helping our neighbors prepare to reopen their doors. • We have been working with our neighbors to understand their financial position and to inform them about available assistance programs. • Our focus now turns to helping neighbors reopen quickly. • We have created a resource website with state and local safety regulations, social media images for our neighbors to post, and in- store safety signage ready to be printed. • We remain in regular contact with all of our neighbors who plan to reopen when able. www.phillipsedison.com/investors 16

Estimated Value Per Share Update Duff & Phelps, an independent third-party valuation firm, produced an estimated value per share (“EVPS”) range of $8.45 to $9.68 as of March 31, 2020 • On May 6, 2020, the Company’s board of directors established the EVPS of its common stock to be $8.75 • 12.5% below the original offering price of $10.00 per share, 21.2% below the previous EVPS of $11.10 • Primary drivers for the change in EVPS: ⦁ The COVID-19 pandemic has had a material impact on retail real estate ⦁ The long-term impact of COVID-19 on our portfolio, retail real estate, and the economy is unclear ⦁ Even as neighbor spaces begin to reopen, the impact to retail and service operators is likely negative for the foreseeable future Please note that the EVPS is not intended to represent an enterprise or liquidation value of our Company. It is important to remember that the EVPS may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our assets. Further, the EVPS is as of a moment in time, and the value of our shares and assets may change over time as a result of several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, changes in the real estate and capital markets, the duration and full effects from the COVID-19 pandemic, and the pace of the economic recovery, and we do not undertake to update the EVPS to account for any such events. You should not rely on the EVPS as being an accurate measure of the then-current value of your shares in making a decision to buy or sell your shares, including whether to participate in our dividend reinvestment plan or our share repurchase program. For a description of the methodology and assumptions used to determine the EVPS, see our Form 10-Q for the quarter ended March 31, 2020 filed with the U.S. Securities and Exchange Commission. www.phillipsedison.com/investors 17

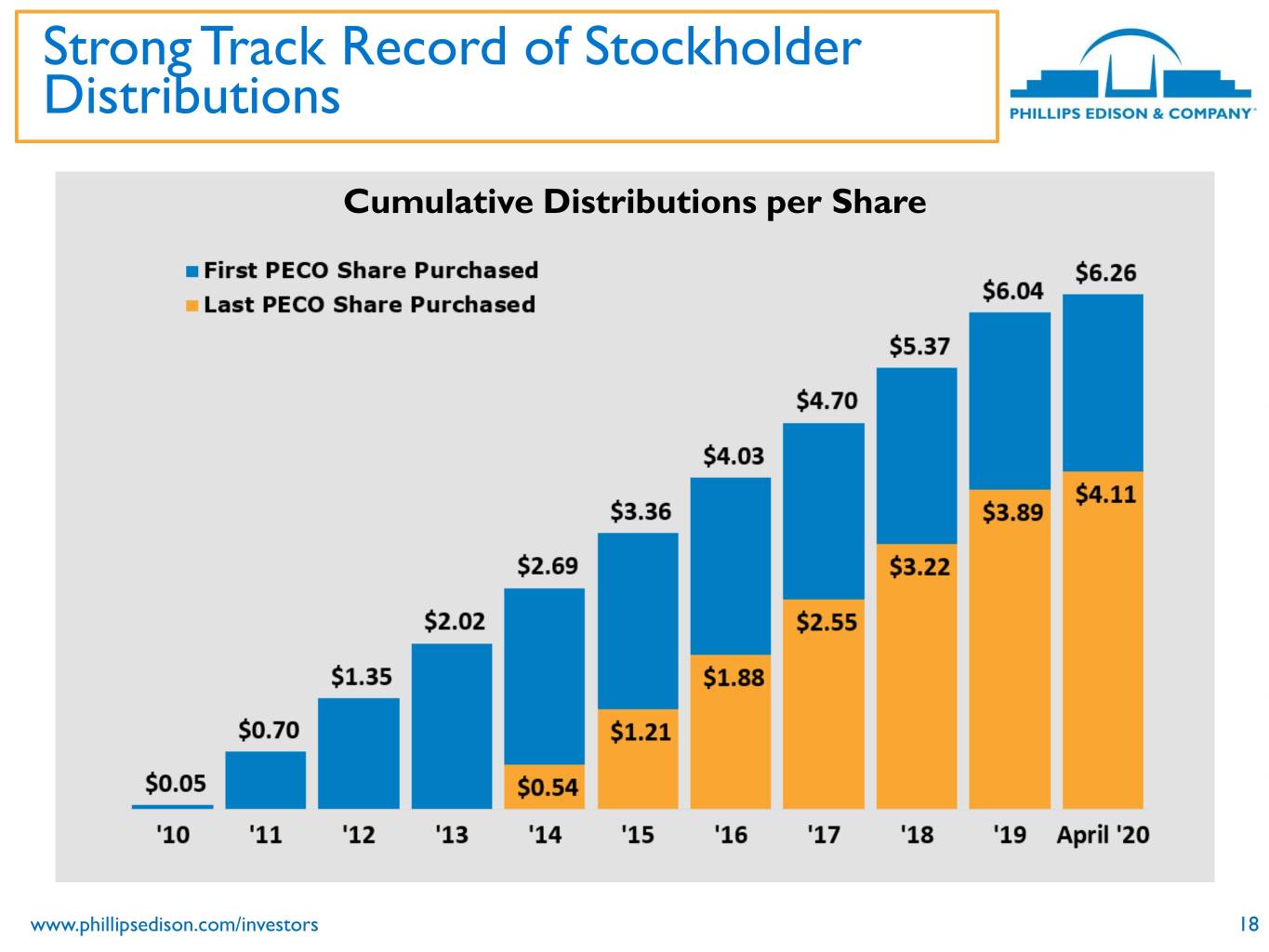

Strong Track Record of Stockholder Distributions Cumulative Distributions per Share www.phillipsedison.com/investors 18

Distributions & Total Return Distributions PECO Total Return ⦁ Distributions for original PECO stockholders total between and $4.11/share and Original PECO investors have seen a $6.26/share.(1) total return between 29% and 64% on their original investment.(2) ⦁ Over $1.3 Billion returned to stockholders in the form of monthly distributions. REIT II Total Return Made 111 consecutive monthly distributions (through April 1, 2020).(1) Former REIT II investors (now PECO investors) have seen a total Distributions temporarily suspended. return between -2% and 10% on their original investment.(3) (1) Depending on timing of investment. Distributions are not guaranteed and are made at the discretion of PECO's board of directors. Distribution rate increased from $0.65 annualized to $0.67 annualized in February 2013. (2) Assumes investment in Phillips Edison & Company, Inc. at $10.00 per share at the end of the initial public offering, assuming distributions are taken in cash; and at the beginning of the offering, assuming distributions are reinvested. (3) Assumes investment in Phillips Edison Grocery Center REIT II, Inc. at $25.00 per share at the end of the initial public offering, assuming distributions are taken in cash; and at the beginning of the offering, assuming distributions are reinvested. www.phillipsedison.com/investors 19

2020 Outlook 1. Facilitate neighbor re-openings a. Maintain regular dialogue with neighbors b. Work with our neighbors to reopen as states allow c. Discuss plans for missed rent 2. Remain focused on execution a. Maintain leased portfolio occupancy b. Identify releasing opportunities to grow same-center NOI c. Heightened focus on credit quality of new lease opportunities d. Preserve liquidity in this time of uncertainty 3. Identify new investment and growth opportunities a. Including our investment management business and partners www.phillipsedison.com/investors 20

Question and Answer Session If you are logged in to the webcast presentation you can submit a question by typing it into the text box and clicking “Submit Question” www.phillipsedison.com/investors 21

For More Information: InvestorRelations@PhillipsEdison.com www.phillipsedison.com/investors Investors and NIGO Servicing: (888) 518-8073 Phillips Edison Advisor Services: (833) 347-5717

Appendix

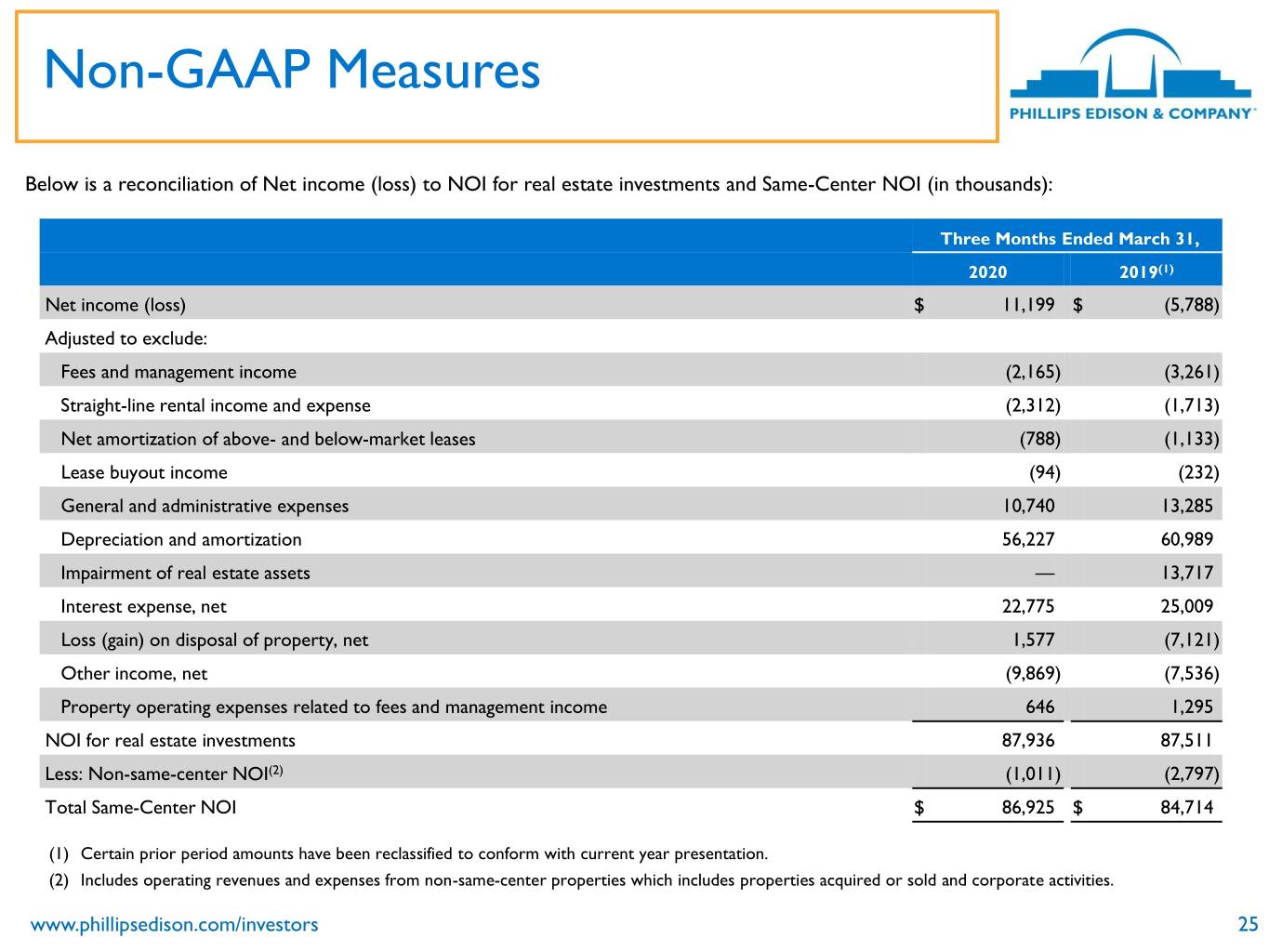

Non-GAAP Measures We present Same-Center NOI as a supplemental measure of our performance. We define NOI as total operating revenues, adjusted to exclude non-cash revenue items, less property operating expenses and real estate taxes. . As of March 31, 2020, Same-Center NOI represents the NOI for the 279 properties that were wholly-owned and operational for the entire portion of both comparable reporting periods. We believe Same-Center NOI provides useful information to our investors about our financial and operating performance because it provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income (loss). Because Same-Center NOI excludes the change in NOI from properties acquired or disposed of after December 31, 2018, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance as it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, depreciation and amortization, interest expense, other income (expense), or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. www.phillipsedison.com/investors 24

Non-GAAP Measures Below is a reconciliation of Net income (loss) to NOI for real estate investments and Same-Center NOI (in thousands): Three Months Ended March 31, 2020 2019(1) Net income (loss) $ 11,199 $ (5,788) Adjusted to exclude: Fees and management income (2,165) (3,261) Straight-line rental income and expense (2,312) (1,713) Net amortization of above- and below-market leases (788) (1,133) Lease buyout income (94) (232) General and administrative expenses 10,740 13,285 Depreciation and amortization 56,227 60,989 Impairment of real estate assets — 13,717 Interest expense, net 22,775 25,009 Loss (gain) on disposal of property, net 1,577 (7,121) Other income, net (9,869) (7,536) Property operating expenses related to fees and management income 646 1,295 NOI for real estate investments 87,936 87,511 Less: Non-same-center NOI(2) (1,011) (2,797) Total Same-Center NOI $ 86,925 $ 84,714 (1) Certain prior period amounts have been reclassified to conform with current year presentation. (2) Includes operating revenues and expenses from non-same-center properties which includes properties acquired or sold and corporate activities. www.phillipsedison.com/investors 25

Non-GAAP Measures Funds from Operations and Core Funds from Operations FFO is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. The National Association of Real Estate Investment Trusts (“Nareit”) defines FFO as net income (loss) computed in accordance with GAAP, excluding gains (or losses) from sales of property and gains (or losses) from change in control, plus depreciation and amortization, and after adjustments for impairment losses on real estate and impairments of in-substance real estate investments in investees that are driven by measurable decreases in the fair value of the depreciable real estate held by the unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. We calculate FFO Attributable to Stockholders and Convertible Noncontrolling Interests in a manner consistent with the Nareit definition, with an additional adjustment made for noncontrolling interests that are not convertible into common stock. Core FFO is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. We believe that Core FFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. We believe it is more reflective of our core operating performance and provides an additional measure to compare our performance across reporting periods on a consistent basis by excluding items that may cause short-term fluctuations in net income (loss). To arrive at Core FFO, we adjust FFO attributable to stockholders and convertible noncontrolling interests to exclude certain recurring and non-recurring items including, but not limited to, depreciation and amortization of corporate assets, changes in the fair value of the earn-out liability, gains or losses on the extinguishment or modification of debt, transaction and acquisition expenses, and amortization of unconsolidated joint venture basis differences. FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO should not be considered alternatives to net income (loss) or income (loss) from continuing operations under GAAP, as an indication of our liquidity, nor as an indication of funds available to cover our cash needs, including our ability to fund distributions. Core FFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. Our FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO, as presented, may not be comparable to amounts calculated by other REITs. www.phillipsedison.com/investors 26

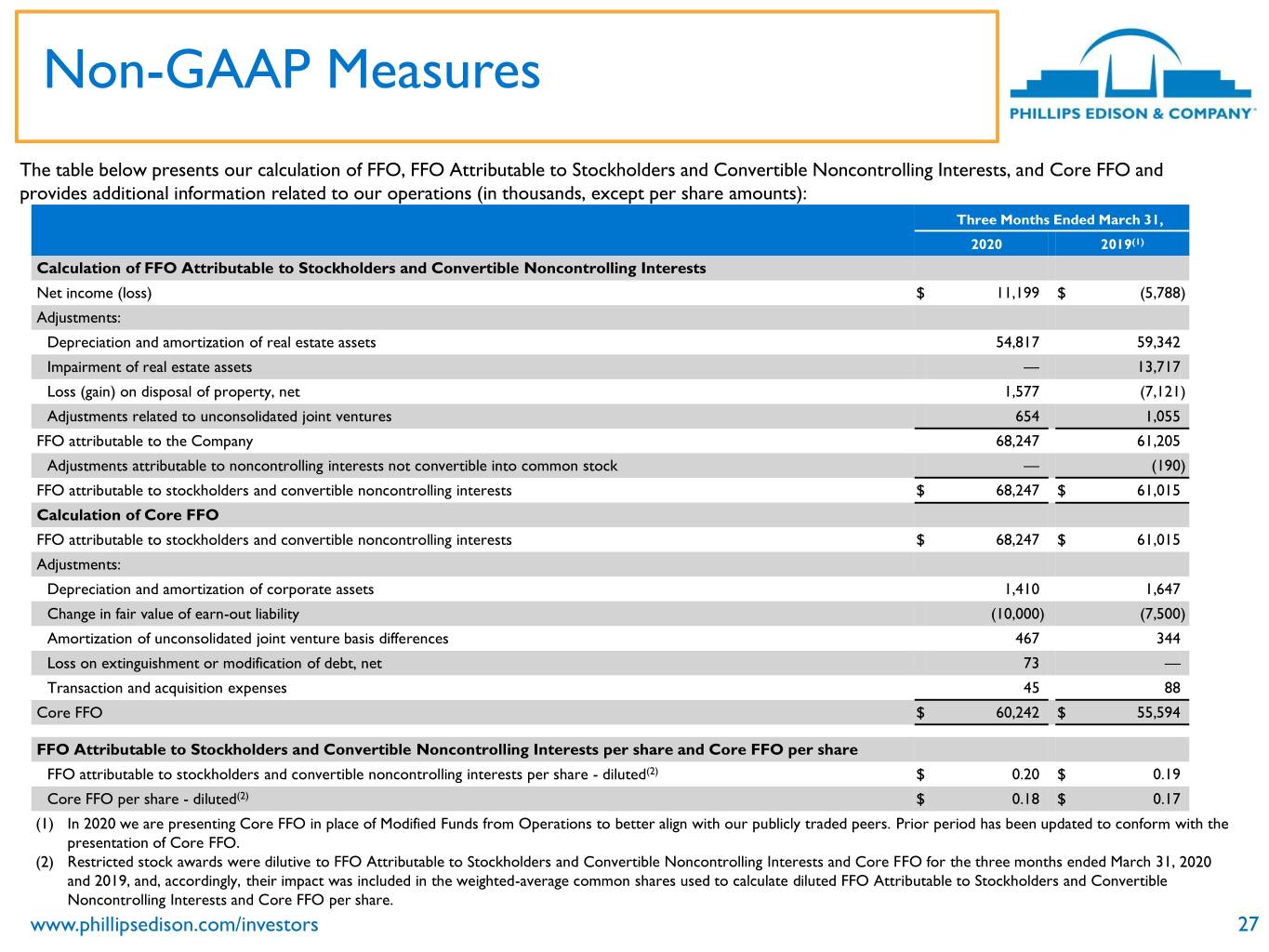

Non-GAAP Measures The table below presents our calculation of FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO and provides additional information related to our operations (in thousands, except per share amounts): Three Months Ended March 31, 2020 2019(1) Calculation of FFO Attributable to Stockholders and Convertible Noncontrolling Interests Net income (loss) $ 11,199 $ (5,788) Adjustments: Depreciation and amortization of real estate assets 54,817 59,342 Impairment of real estate assets — 13,717 Loss (gain) on disposal of property, net 1,577 (7,121) Adjustments related to unconsolidated joint ventures 654 1,055 FFO attributable to the Company 68,247 61,205 Adjustments attributable to noncontrolling interests not convertible into common stock — (190) FFO attributable to stockholders and convertible noncontrolling interests $ 68,247 $ 61,015 Calculation of Core FFO FFO attributable to stockholders and convertible noncontrolling interests $ 68,247 $ 61,015 Adjustments: Depreciation and amortization of corporate assets 1,410 1,647 Change in fair value of earn-out liability (10,000) (7,500) Amortization of unconsolidated joint venture basis differences 467 344 Loss on extinguishment or modification of debt, net 73 — Transaction and acquisition expenses 45 88 Core FFO $ 60,242 $ 55,594 FFO Attributable to Stockholders and Convertible Noncontrolling Interests per share and Core FFO per share FFO attributable to stockholders and convertible noncontrolling interests per share - diluted(2) $ 0.20 $ 0.19 Core FFO per share - diluted(2) $ 0.18 $ 0.17 (1) In 2020 we are presenting Core FFO in place of Modified Funds from Operations to better align with our publicly traded peers. Prior period has been updated to conform with the presentation of Core FFO. (2) Restricted stock awards were dilutive to FFO Attributable to Stockholders and Convertible Noncontrolling Interests and Core FFO for the three months ended March 31, 2020 and 2019, and, accordingly, their impact was included in the weighted-average common shares used to calculate diluted FFO Attributable to Stockholders and Convertible Noncontrolling Interests and Core FFO per share. www.phillipsedison.com/investors 27

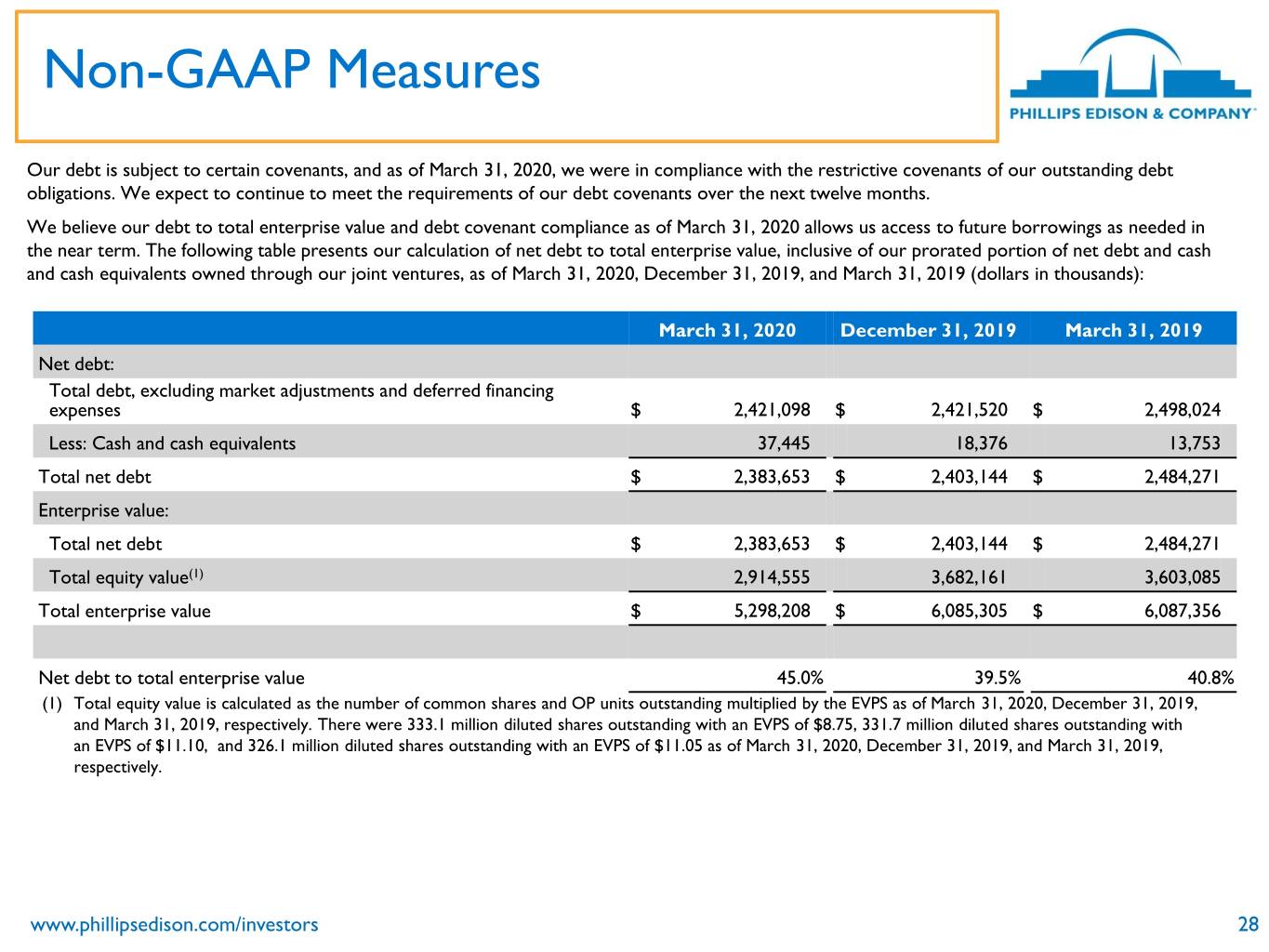

Non-GAAP Measures Our debt is subject to certain covenants, and as of March 31, 2020, we were in compliance with the restrictive covenants of our outstanding debt obligations. We expect to continue to meet the requirements of our debt covenants over the next twelve months. We believe our debt to total enterprise value and debt covenant compliance as of March 31, 2020 allows us access to future borrowings as needed in the near term. The following table presents our calculation of net debt to total enterprise value, inclusive of our prorated portion of net debt and cash and cash equivalents owned through our joint ventures, as of March 31, 2020, December 31, 2019, and March 31, 2019 (dollars in thousands): March 31, 2020 December 31, 2019 March 31, 2019 Net debt: Total debt, excluding market adjustments and deferred financing expenses $ 2,421,098 $ 2,421,520 $ 2,498,024 Less: Cash and cash equivalents 37,445 18,376 13,753 Total net debt $ 2,383,653 $ 2,403,144 $ 2,484,271 Enterprise value: Total net debt $ 2,383,653 $ 2,403,144 $ 2,484,271 Total equity value(1) 2,914,555 3,682,161 3,603,085 Total enterprise value $ 5,298,208 $ 6,085,305 $ 6,087,356 Net debt to total enterprise value 45.0% 39.5% 40.8% (1) Total equity value is calculated as the number of common shares and OP units outstanding multiplied by the EVPS as of March 31, 2020, December 31, 2019, and March 31, 2019, respectively. There were 333.1 million diluted shares outstanding with an EVPS of $8.75, 331.7 million diluted shares outstanding with an EVPS of $11.10, and 326.1 million diluted shares outstanding with an EVPS of $11.05 as of March 31, 2020, December 31, 2019, and March 31, 2019, respectively. www.phillipsedison.com/investors 28