Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - Verso Corp | d923245dex314.htm |

| EX-31.3 - EX-31.3 - Verso Corp | d923245dex313.htm |

| EX-10.1 - EX-10.1 - Verso Corp | d923245dex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Verso Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-34056 | 75-3217389 | ||

| (State of Incorporation or Organization) |

(Commission File Number) |

(IRS Employer Identification Number) |

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(Address, including zip code, of principal executive offices)

(877) 855-7243

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Class A common stock, $0.01 par value | VRS | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act: ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of June 28, 2019, the aggregate market value of the voting and non-voting common equity of Verso Corporation held by non-affiliates, computed by reference to the price at which the common equity was last sold on the last business day of the most recently completed second fiscal quarter, was $658,075,983. For purposes of this calculation, only those shares held by directors, executive officers and holders of 10% or more of the voting securities of Verso Corporation have been excluded as held by affiliates. Such exclusion should not be deemed a determination or an admission by Verso Corporation or any such person that such individuals or entities are or were, in fact, affiliates of Verso Corporation.

As of April 22, 2020, Verso Corporation had 35,049,894 shares of Class A common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None.

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 Form 10-K”) originally filed on March 2, 2020 (the “Original Filing”) by Verso Corporation, a Delaware corporation. We are filing this Amendment to present the information required by Part III of Form 10-K as we will not file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2019. Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

In this Amendment, Verso Corporation is referred to interchangeably as “Verso,” “we,” “our” and “us.”

Verso Corporation

Amendment No. 1 to Annual Report on Form 10-K

December 31, 2019

TABLE OF CONTENTS

PART III

PART IV

| Item 15. |

Exhibits, Financial Statement Schedules | 39 | ||||

| S-1 | ||||||

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors and Executive Officers of the Company

The following table and biographical descriptions provide information regarding our directors and executive officers as of the date of this Amendment.

| Name |

Age | Position(s) | ||

| Adam St. John | 56 | President, Chief Executive Officer and Director | ||

| Matthew Archambeau | 47 | Senior Vice President of Manufacturing and Energy | ||

| Allen J. Campbell | 62 | Senior Vice President and Chief Financial Officer | ||

| Aaron D. Haas | 48 | Senior Vice President of Sales and Marketing | ||

| Kenneth D. Sawyer | 64 | Senior Vice President of Human Resources and Communications | ||

| Sean T. Erwin | 68 | Director and Chairman of the Board | ||

| Dr. Robert K. Beckler | 58 | Director | ||

| Marvin Cooper | 76 | Director | ||

| Jeffrey E. Kirt | 47 | Director | ||

| Randy J. Nebel | 64 | Director | ||

| Nancy M. Taylor | 60 | Director |

Executive Officers

Information on the business background of Adam St. John is set forth below under “Directors.”

Matthew Archambeau

Mr. Archambeau has been our Senior Vice President of Manufacturing and Energy since April 2020. Prior to this role, Mr. Archambeau served as Verso’s Vice President of the Centers of Excellence/Technology since January 2018. Prior to that role, he served as the Mill Manager at Verso’s Escanaba, Michigan mill from February 2015 to December 2017. Mr. Archambeau’s previous experience at Verso also includes serving as the Mill Manager at Verso’s former Bucksport, Maine and Sartell, Minnesota mills, Director of Manufacturing Support at Verso’s former Memphis, Tennessee headquarters, and in numerous manufacturing roles at Verso’s former Bucksport, Maine mill.

Allen J. Campbell

Mr. Campbell has been our Senior Vice President and Chief Financial Officer since 2015. Before joining Verso, he worked at Cooper-Standard Holdings Inc., the parent company of Cooper-Standard Automotive Inc., a leading global supplier of systems and components for the automotive industry, from 1998 to 2015. At Cooper Standard, Mr. Campbell held accounting, finance and management positions, including Executive Vice President and Chief Infrastructure Officer in 2015 and Executive Vice President and Chief Financial Officer from 2005 to 2015. He worked at The Dow Chemical Company in accounting and finance positions from 1980 to 1998.

Aaron D. Haas

Mr. Haas has been our Senior Vice President of Sales and Marketing since March 2020. Prior to this role, Mr. Haas served as our Vice President of Supply Chain Management since January 2018. He previously served as our Vice President of Marketing from 2017 to 2018, Vice President of Commercial Print from 2015 to 2017, and Vice President of Marketing Services from January to August 2015. Mr. Haas has more than 20 years of sales and marketing experience in the paper industry.

Kenneth D. Sawyer

Mr. Sawyer has been our Senior Vice President of Human Resources and Communications since 2015. He previously served as our Vice President of Human Resources from 2011 to 2015. Before joining Verso, Mr. Sawyer worked at AbitibiBowater, Inc. (now named Resolute Forest Products Inc.), a producer of pulp, paper and wood products, from 2007 to 2010, where he was Director of Human Resources for United States operations from 2009 to 2010 and Director of Human Resources for the Commercial Printing Papers Division in the United States, Canada and South Korea from 2007 to 2009. Mr. Sawyer worked at Bowater Incorporated, a

1

manufacturer of pulp, paper and wood products, from 1999 to 2007, where he was Director of Process Improvement and Organization Effectiveness from 2006 to 2007 and Director of Human Resources of the Coated Papers Division from 1999 to 2006. Mr. Sawyer was Vice President of Human Resources of Dorsey Trailers, Inc., a transportation equipment manufacturer, from 1993 to 1999.

Directors

Verso’s board of directors currently consists of seven directors. Set forth below is a brief biographical description of each of our directors. The primary experience, qualifications, attributes and skills of each of our directors that led to the conclusion of the Corporate Governance and Nominating Committee and the board that such person should serve as a member of the board of directors are also described in the following paragraphs.

Adam St. John

Mr. St. John has served as Verso’s Chief Executive Officer since November 11, 2019 and our President since March 13, 2020. Prior to his appointment as Chief Executive Officer, Mr. St. John served as Verso’s Senior Vice President of Manufacturing from August 2016 to November 2019. He also previously served in various operations management positions with Verso, most recently as Regional Vice President of Operations from 2015 to July 2016, Mill Manager of Verso’s Quinnesec mill in Michigan from 2011 to 2015, and Operations Manager of Verso’s Androscoggin mill in Maine from 2009 to 2011. Before joining Verso, Mr. St. John worked at Georgia-Pacific Corporation, a subsidiary of Koch Industries, Inc., in operations management roles at its mill in Old Town, Maine, from 1992 to 2006.

Mr. St. John’s more than 27 years of experience in the paper industry, including in significant operational leadership roles, provides him with invaluable insight into our day-to-day operations, as well as significant business and leadership skills.

Dr. Robert K. Beckler

Dr. Beckler is the owner of RKB Consulting, LLC, which he founded in September 2016. He formerly served as President, Packaging Solutions, of WestRock Company (“WestRock,” formerly MeadWestvaco Corporation (“MWV”)), a provider of packaging solutions and a manufacturer of containerboard and paperboard, from July 1, 2015 until his retirement in July 2016. Prior to this, he was the Executive Vice President and President, Packaging, of MWV from January 2014 to June 2015. Dr. Beckler served as Senior Vice President and President of MWV’s Brazilian operations from January 2010 to December 2013. Prior to this, Dr. Beckler served in a variety of roles in MWV’s Specialty Chemicals division, a leader in pine chemicals and activated carbon derived from wood and paper manufacturing operations, from 1987 to 2009. From January 2007 to December 2009, he was President, MWV Specialty Chemicals. Dr. Beckler is also currently Chairman and Senior Advisor to TemperPac, a private producer of packaging products, and a Senior Advisor to Medicine for All Institute, which is committed to improving global access to high-quality medicines. During his 33 year career, Dr. Beckler has held various senior executive leadership roles in specialty chemicals, paper and packaging, with deep expertise in product development, supply chain, manufacturing and global markets. Dr. Beckler received a Bachelor of Science in Chemistry from Duke University and a Doctor of Philosophy in Chemical Engineering from the Georgia Institute of Technology.

Dr. Beckler’s significant executive and operating leadership experience at WestRock and MWV provides him with in-depth knowledge of the paper industry, as well as substantial leadership, strategy, mergers and acquisitions, turnaround and business experience.

Marvin Cooper

Mr. Cooper previously served as the Chief Operating Officer and Executive Vice President of Domtar Corporation (“Domtar”), a leading provider of a wide variety of fiber-based products, until his retirement in 2009. Previously, he served as Senior Vice President of Pulp, Paper, Containerboard Manufacturing and Engineering of Weyerhaeuser Co. (“Weyerhaeuser”), one of the world’s largest integrated forest products companies, from February 2002 to October 2006. Mr. Cooper’s responsibilities included the operation of Weyerhaeuser’s pulp, paper and containerboard mills, and overseeing the engineering operations. Before joining Weyerhaeuser, Mr. Cooper was with Willamette Industries (“Willamette”), an international integrated forest products company, for 22 years. Mr. Cooper served as an Executive Vice President of Willamette’s Pulp and Paper Mills beginning in May 1997 until Willamette was acquired by Weyerhaeuser in 2002. He served as Group Vice President, Pulp and Paper Mills from May 1996 to May 1997 and Division Vice President – Fine Paper Mills from May 1989 to May 1996. He also served as Regional Manager of Willamette from May 1982 to May 1989 and Mill Manager from May 1980 to May 1982. Mr. Cooper also served on the board of directors of Domtar from 2006 until 2009. Mr. Cooper received his Bachelor of Science in engineering from Virginia Polytechnic Institute and State University.

2

Mr. Cooper brings to Verso over 40 years of varied and significant operational and executive leadership experience at companies in the pulp and paper industry, giving him in-depth industry knowledge and leadership and strategic expertise pertinent to our business, and his service on the board of directors of Domtar provides him with experience in board corporate governance upon which he can draw as our director.

Mr. Cooper was appointed to the board of directors pursuant to the Cooperation Agreement, dated January 30, 2020, between Verso and Lapetus Capital II LLC (together with its affiliates, including Atlas Holdings LLC, “Atlas”) and Blue Wolf Capital Advisors IV, LLC (together with its affiliates, “Blue Wolf”) and certain of their respective affiliates, which settled a proxy contest with respect to our 2019 annual meeting of stockholders held on January 31, 2020 (the “2019 Annual Meeting”). See “Item 13. Certain Relationships and Related Transactions, and Director Independence” for additional information.

Sean T. Erwin

Mr. Erwin served as the former Chairman of the board of directors of Neenah Paper, Inc. (“Neenah Paper”), a global manufacturer of specialty materials, where he served from November 2004 until his retirement in May 2019. He served as the Chief Executive Officer and President at Neenah Paper from November 2004 to May 2011. Prior to the spin-off of Neenah Paper in 2004 from Kimberly-Clark Corporation (“Kimberly Clark”), a multinational manufacturer and marketer of personal care and consumer tissue products, he served as an employee of Kimberly-Clark beginning in 1978, and held increasingly senior positions in both finance and business management. In January 2004, Mr. Erwin was named President of Kimberly Clark’s Pulp and Paper Sector, which comprised the businesses transferred to Neenah Paper, Inc. by Kimberly Clark in the spin-off. While at Kimberly Clark, he served as the President of the Global Nonwoven business from early 2001, served as the President of the European Consumer Tissue business, Managing Director of Kimberly Clark Australia, as well as previously serving as President of the Pulp and Paper Sector, and President of the Technical Paper business. Mr. Erwin served as a director of Carmike Cinemas, Inc. from May 2012 to December 2016. Mr. Erwin received his Bachelor of Science in Accounting and Finance from Northern Illinois University.

Mr. Erwin brings to Verso over 40 years of varied and significant operational and executive leadership experience at companies in the pulp and paper industry, giving him in-depth industry knowledge and leadership and strategic expertise pertinent to our business. His experience in senior positions of finance and business management also provide him with relevant expertise for oversight of our company’s performance. His service on the board of directors of Carmike Cinemas and as Chairman of the Board of Neenah Paper provides him with strong board leadership and corporate governance experience that enhances his service as a director and as the Chairman of the Board of Verso.

Mr. Erwin was appointed to the board of directors pursuant to the Cooperation Agreement. See “Item 13. Certain Relationships and Related Transactions, and Director Independence” for additional information.

Jeffrey E. Kirt

Mr. Kirt is the founder, chief executive officer and managing partner of Fifth Lake Management, LLC, an investment manager focused on direct investments in private equity and special situations. Prior to founding Fifth Lake Management, LLC in July 2017, Mr. Kirt was a partner at Pamplona Capital Management, L.P. from October 2014 to July 2017, and a partner at Oak Hill Advisors, L.P. from July 2002 to September 2014, where he focused on making private equity and special situations investments in the industrial, aerospace, defense, business services and financial services sectors in the United States and Europe. From January 2010 until October 2014, Mr. Kirt served as a director of Capital Bank Financial Corp., a Federal Reserve and OCC regulated banking institution. Mr. Kirt also previously served as a director of Cooper Standard Holdings, Inc., a global supplier of systems and components for the automotive industry, from May 2010 until October 2014, and Avolon Aerospace, Ltd. from December 2010 to October 2014. Mr. Kirt received his Bachelor of Arts in Economics from Yale University.

Mr. Kirt has significant experience in sourcing, evaluating and managing investments in public and private companies, which, along with his financial expertise, provides him with substantial strategic and financial expertise that inform his contributions as a Verso director. In addition, Mr. Kirt’s service as a director of a number of companies in diverse industries provides him with a range of experiences on which he can draw in serving as a Verso director and increases his knowledge of effective corporate governance.

Mr. Kirt was appointed to the board of directors pursuant to the Cooperation Agreement. See “Item 13. Certain Relationships and Related Transactions, and Director Independence” for additional information.

3

Randy J. Nebel

Mr. Nebel has been a director of Verso since November 14, 2019. Mr. Nebel is the sole owner of RJNebel Consulting, which he founded in February 2019. From January 2017 to November 2018, he was the Executive Vice President of Integrated Packaging of Kapstone Paper and Packaging (“Kapstone”) and, from July 2013 to December 2016, he was the Vice President of Kapstone and President of Kapstone Kraft Paper Corp. Mr. Nebel also served as the President and Chief Operating Officer of Longview Paper and Packaging from 2009 to July 2013. He previously served on the board of directors of the National Association of Manufacturers and the American Forest & Paper Association. Mr. Nebel received his Bachelor of Science in chemical engineering from Montana State University.

Mr. Nebel has 40 years of paper industry experience, split between brown and bleached grades, including significant experience as an executive officer of a publicly traded manufacturer of pulp and paper and therefore brings significant industry, business and financial knowledge as well as leadership skills to the board.

Nancy M. Taylor

Ms. Taylor has been a director of Verso since November 14, 2019. Ms. Taylor was President and Chief Executive Officer of Tredegar Corporation, a global manufacturing company, from February 2010 to June 2015. Prior to serving as President and Chief Executive Officer of Tredegar, she was Executive Vice President of Tredegar from January 2009 through January 2010, and Division President of Tredegar Film Products from April 2005 through January 2010. Ms. Taylor was a member of Tredegar’s board of directors from early March 2010 until June 2015 and currently is a director of the following public companies: Lumber Liquidators Holdings, Inc., one of the leading specialty retailers of hard-surface flooring in North America, where she has served as Chairman of the Board since November 2015, and TopBuild Corp., a leading purchaser, installer and distributor of insulation products to the United States construction industry, where she has served as Chair of the Governance Committee since May 2019. Ms. Taylor also serves as Chairman of the Board of the Boys & Girls Club of Metro Richmond (Virginia).

Ms. Taylor has more than 20 years of experience in senior management, in both operational and commercial leadership roles with manufacturing companies, and as chief executive officer of a publicly traded global manufacturer. Through her experience, she has gained and developed extensive business, finance and leadership skills, and possesses an understanding of strategic planning, risk assessment and international operations. Having served as a director of various public companies, she brings strong corporate governance knowledge to the board of directors.

Other Matters Concerning Executive Officers and Directors

On January 26, 2016, Verso and substantially all of our direct and indirect subsidiaries (“Debtors”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (“Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (“Bankruptcy Court”). The chapter 11 cases (“Chapter 11 Cases”) were consolidated for procedural purposes only and administered jointly under the caption “In re: Verso Corporation, et al., Case No. 16-10163.” On June 23, 2016, the Bankruptcy Court entered an order confirming the Debtors’ First Modified Third Amended Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code dated as of June 20, 2016 (“Plan”). On July 15, 2016, the Plan became effective pursuant to its terms and the Debtors emerged from their Chapter 11 reorganization.

All of our executive officers, other than Mr. St. John, Mr. Archambeau and Mr. Haas, were executive officers of Verso before and during the Chapter 11 Cases. Mr. St. John was serving as our Regional Vice President of Operations during the Chapter 11 Cases, but he did not become an executive officer of Verso until he was elected our Senior Vice President of Manufacturing in August 2016. No director served in such capacity or as an executive officer of Verso prior to our emergence from Chapter 11 reorganization.

4

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and the rules of the Securities and Exchange Commission (“SEC”) thereunder require that our directors and executive officers and the beneficial owners of more than 10% of Verso’s common stock file with the SEC initial reports of, and subsequent reports of changes in, their beneficial ownership of our common stock. Based solely on our review of such Section 16(a) reports and written representations that our directors and executive officers have furnished to us, we believe that all reporting persons complied with all applicable Section 16(a) filing requirements during 2019, except for one late Form 4 for Mr. Lederer related to a grant of restricted stock units.

Code of Ethics

Our board of directors has adopted a Code of Conduct that applies to all of our directors, employees and officers, including our Chief Executive Officer and Chief Financial Officer. The current version of the Code of Conduct is available on our website under the Corporate Governance section at www.versoco.com. To the extent required by rules adopted by the SEC and the New York Stock Exchange, we intend to promptly disclose future amendments to certain provisions of the Code of Conduct, or waivers of such provisions granted to executive officers and directors, on our website under the Corporate Governance section at www.versoco.com.

The conflict of interest policy in our Code of Conduct prohibits family members, except at our mills, from working together under the same supervisor, in the same department, or in a direct or indirect reporting relationship. Adam St. John and his spouse have been employed by Verso since its formation in 2006. His brother has been employed by Verso since 2008. Mr. St. John’s spouse and brother now have an indirect reporting relationship to him as our Chief Executive Officer. See “Certain Relationships and Related Transactions, and Director Independence—Policy Relating to Related-Person Transactions” for additional information. As disclosed in the 2019 Form 10-K, our board of directors reviewed the matter and waived this prohibition in our Code of Conduct with respect to the continued employment of Mr. St. John’s spouse and brother in an indirect reporting relationship to him.

Audit and Finance Committee

We have a standing Audit Committee of the board. The Audit Committee currently consists of three directors – Ms. Taylor (Chair) and Messrs. Erwin and Kirt – appointed by the board of directors. The board of directors has determined that each director serving on the Audit Committee is independent under the applicable rules of the New York Stock Exchange (“NYSE”) and Exchange Act, satisfies the NYSE’s requirements of being financially literate and possessing accounting or related financial management expertise, and qualifies as an “audit committee financial expert” under the SEC’s rules.

5

Item 11. Executive Compensation

Compensation Discussion & Analysis

This Compensation Discussion and Analysis describes our compensation arrangements for 2019 with our “named executive officers” listed in the table below.

| Name |

Title | |

| Adam St. John | President and Chief Executive Officer(1) | |

| B. Christopher DiSantis | Former President and Chief Executive Officer(2) | |

| Leslie T. Lederer | Former Interim Chief Executive Officer and Senior Transaction Advisor(3) | |

| Michael A. Weinhold | Former President(4) | |

| Allen J. Campbell | Senior Vice President and Chief Financial Officer | |

| Kenneth D. Sawyer | Senior Vice President of Human Resources and Communications |

| (1) | Effective November 11, 2019, Mr. St. John was appointed as our Chief Executive Officer following Mr. Lederer’s resignation as our Interim Chief Executive Officer. Mr. St. John was additionally appointed as our President on March 13, 2020 following Mr. Weinhold’s departure. |

| (2) | Effective April 5, 2019, Mr. DiSantis left his position as our President and Chief Executive Officer. |

| (3) | Effective April 5, 2019, Mr. Lederer was appointed as our Interim Chief Executive Officer following Mr. DiSantis’ departure. Effective November 11, 2019, Mr. Lederer transitioned into the role of Senior Transaction Advisor since he continued to play an important role in the sale of our Androscoggin mill and Stevens Point mill to Pixelle Specialty Solutions through the sale of all of the outstanding membership interests in Verso Androscoggin LLC (“Androscoggin”), an indirect wholly owned subsidiary of the Company. Mr. Lederer’s employment as Senior Transaction Advisor ended on February 11, 2020 following the closing of the Androscoggin sale and he continued to provide certain consulting services to the Company until March 31, 2020. |

| (4) | Effective November 14, 2019, Mr. Weinhold was appointed as our President and his employment was later terminated effective March 10, 2020. |

Executive Summary

The Compensation Committee is responsible for determining the compensation of our named executive officers. Our executive compensation program includes a number of features that we believe reflect best practices in the market and help ensure that the program reinforces our stockholders’ interests. These features are described in more detail below in this Compensation Discussion and Analysis and include the following:

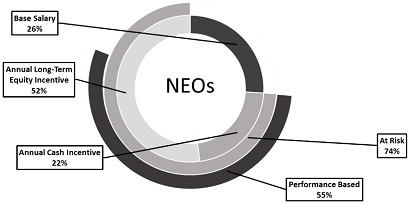

| • | Each of our named executive officers’ target direct compensation for 2019 consists of his annual base salary (which, for named executive officers who were hired or promoted in 2019, reflects annual base salary actually paid in 2019), target annual bonus and the target value of his 2019 equity award described below. The diagram below shows the percentage of our named executive officers’ target direct compensation that is “at risk” variable compensation, meaning that the compensation is performance-based and/or with a value dependent on our stock price: |

6

| • | Our Compensation Committee determined that for the annual equity awards granted to our named executive officers in 2019, a substantial portion of the award would be subject to performance-based vesting requirements. The Compensation Committee determined that the vesting of 50% of the award would be contingent on the total shareholder return (“TSR”) of our stock from January 1, 2019 to January 1, 2022 relative to the TSR over that three-year period for a peer group of companies selected by our Compensation Committee. However, no portion of that 50% component of the award would vest if the Company did not achieve a minimum TSR level during the performance period. The remaining 50% of the award vests over time and vests in three equal installments in January 2020, January 2021 and January 2022, subject to the executive’s continued employment with us through those dates. |

| • | We generally provide our named executive officers with annual performance-based cash award opportunities under an annual cash incentive plan, which in 2019 was the 2019 Verso Incentive Plan, or “VIP.” The Compensation Committee determined that our named executive officers’ bonuses for 2019 (taking into account the bonus level achieved under the VIP and discretionary bonuses approved by the Compensation Committee) would be paid at 60% of the eligible executives’ respective VIP target bonus levels. As discussed below, discretionary bonuses were awarded to produce bonuses for VIP plan participants, including for the eligible named executive officers, at this level taking into consideration the participants’ contributions during 2019, including contributions with respect to the Androscoggin sale. |

| • | The Compensation Committee has retained an independent compensation consultant to provide advice on our executive compensation program. |

Executive Compensation Philosophy and Objectives

The Compensation Committee conducts an annual review of our executive compensation program to help ensure that: (1) the program is designed to align the interests of our named executive officers with our stockholders’ interests by rewarding performance that is tied to creating stockholder value; and (2) the program provides a total compensation package for each of our named executive officers that we believe is competitive.

Our executives’ compensation package consists primarily of a base salary, an annual performance-based cash opportunity, and long-term equity-based awards. We believe that in order to attract and retain top executives, we need to provide them with compensation levels that reward their continued service. Some of the elements, such as base salaries and annual bonuses, are paid out on a short-term or current basis. Other elements, such as benefits provided upon certain terminations of employment and equity awards that are subject to multi-year vesting schedules, are paid out on a long-term basis. We believe this mix of short- and long-term elements allows us to achieve our goals of attracting, retaining and motivating our top executives.

In structuring executive compensation packages, the Compensation Committee considers how each component promotes retention and motivates performance. Base salaries, severance and other termination benefits are primarily intended to attract and retain highly qualified executives. These elements of our executive compensation program are generally not dependent on performance. Annual cash bonus and long-term equity incentive opportunities provide further incentives to achieve performance goals specified by the Compensation Committee, to enhance alignment with stockholder interests and/or to continue employment with us through specified vesting dates.

We believe that by providing a significant portion of our named executive officers’ total compensation package in the form of equity-based awards, we are able to create an incentive to build stockholder value over the long-term and closely align the interests of our named executive officers to those of our stockholders by incentivizing our named executive officers to produce stockholder value. As described in more detail below, the annual equity awards granted to the named executive officers for 2019 are structured so that one-half of the award will vest based on TSR of our stock relative to the TSR of a peer group of companies over a three-year performance period and only if the executive remains employed with us through the end of the applicable performance period. The remainder of the award generally vests in installments only if the executive remains employed with us over a multi-year period.

Our annual performance-based cash awards are determined taking into account the achievement of financial and operational performance goals established by the Compensation Committee, thereby providing additional incentives for our executives to achieve short-term or annual goals that we believe will maximize stockholder value over the long-term.

7

Compensation Determination Process

Role of the Compensation Committee and our Executive Officers

Our executive compensation program is determined and approved by our Compensation Committee. None of the named executive officers are members of the Compensation Committee or otherwise have any role in determining the compensation of the other named executive officers, although the Compensation Committee considers the recommendations of our President and Chief Executive Officer in setting compensation levels for our other executive officers.

Determination of Compensation

Except as otherwise noted, our Compensation Committee’s executive compensation determinations are subjective and are generally based on the experience and general knowledge possessed by members of our Compensation Committee, and take into account the executive’s responsibilities and experience, our performance and the individual performance of the executive. As discussed below, in determining the compensation of our named executive officers, the Compensation Committee considers the compensation provided to executives at corresponding positions with a peer group of companies. However, we do not set executive compensation levels at any specific level or “benchmark” against other companies.

Compensation Consultant

For 2019, our Compensation Committee retained Lyons, Benenson & Company Inc. (“Lyons Benenson”) to serve as its independent compensation consultant. Lyons Benenson assisted our Compensation Committee by performing a comprehensive review of our 2019 executive compensation program before it was established, including the composition of our peer group, amounts and nature of compensation paid to executive officers, structure of our various compensation programs, design of our short-term incentive performance measurement framework, performance vesting requirements for our annual long-term incentive awards and appropriate target total direct compensation levels and potential payment and vesting ranges for our executive officers. During 2019, Lyons Benenson also provided data to the Compensation Committee on the compensation and relative performance of our peer group, advised and provided peer group data regarding the Company’s compensation arrangements for its non-employee directors, provided advice as the Compensation Committee began its considerations of our executive compensation framework for 2020, and reviewed data in connection with the Compensation Committee’s determination of short-term incentive award performance. Lyons Benenson also provided advice on the payment of executive bonuses for 2019. A representative of Lyons Benenson regularly met both privately and in meetings with the Compensation Committee to discuss its recommendations.

Other than its engagement by the Compensation Committee, Lyons Benenson provided no other services to us or any of our subsidiaries. The Compensation Committee has assessed the independence of Lyons Benenson and concluded that its engagement of Lyons Benenson did not raise any conflict of interest with us or any of our directors or executive officers.

In February 2019, Lyons Benenson assisted the Compensation Committee in selecting the following peer group of companies in our industry to assist the committee in making its compensation decisions for 2019.

| Bemis Company, Inc. | P.H. Glatfelter Company | |||||

| Clearwater Paper Corporation | Packaging Corporation of America | |||||

| Domtar Corporation | Resolute Forest Products Inc. | |||||

| Graphic Packaging Holding Company | Schweitzer-Mauduit International, Inc. | |||||

| Greif, Inc. | Sonoco Products Company | |||||

| Neenah Paper, Inc. |

The Compensation Committee, with advice from Lyons Benenson, decided that the peer companies should be publicly traded U.S. companies in the Company’s industry with revenue of up to $9.0 billion, generally have an average total shareholder return above that of the Paper Products GICS Sub-Industry, and generally exceed the median for the Paper Products GICS Sub-Industry in two of three key performance areas (three-year revenue compound annual growth rate (“CAGR”), three-year average return on invested capital, and three-year average operating margin), in each case as of the time the peer group was selected. Based on the foregoing criteria, the Compensation Committee determined that the peer companies in 2018 continued to serve as appropriate peer companies for 2019, with the exception of Cenveo, Inc. which declared bankruptcy and Kapstone Paper & Packaging Corporation which was acquired. For each of our named executive officers, Lyons Benenson provided information on the compensation levels for similarly situated executives with the peer companies. Although the Compensation Committee reviewed and discussed the peer company compensation data provided by Lyons Benenson to help inform its decision making process, the Compensation Committee did not set compensation levels at any specific level or percentile against the peer group data. The peer company data is only one point of information taken into account by the Compensation Committee in making compensation decisions.

8

Beginning in February 2020, the Compensation Committee decided to engage Midwest Series of Lockton Companies, LLC (“Lockton”) as its new compensation consultant. The Compensation Committee has assessed the independence of Lockton and concluded that its engagement of Lockton does not raise any conflict of interest with us or any of our directors or executive officers.

The Role of Stockholder Say-on-Pay Votes

At our 2019 Annual Meeting, our stockholders were provided with an opportunity to cast an advisory vote on our executive compensation program through a say-on-pay proposal. Approximately 94 percent of votes cast were in favor of our executive compensation program. The Compensation Committee believes that our compensation program includes a number of features as noted above that reflect best practices in the market and that this voting result affirms stockholders’ support of the Company’s approach in compensating its executive officers. Our Compensation Committee will continue to consider the outcome of the Company’s say-on-pay proposals when making future compensation decisions for our named executive officers.

Frequency of Stockholder Say-on-Pay Votes

Consistent with the views expressed by stockholders at our 2017 Annual Meeting, the Board has determined to hold an advisory vote to approve executive compensation annually. The next say-on-pay vote will take place at the Company’s 2020 Annual Meeting of Stockholders. Our stockholders will have an opportunity to cast an advisory vote on the frequency of our say-on-pay vote at least every six years.

Current Executive Compensation Program Elements

The current elements of our executive compensation program are:

| • | base salaries; |

| • | annual performance-based cash awards; |

| • | equity-based incentive awards; and |

| • | certain retirement and other benefits. |

Base Salary

The compensation of Verso’s executive officers begins with a base salary. In determining the initial annual base salaries or the amounts by which to increase the base salaries of our executive officers, the Compensation Committee typically evaluates each executive officer’s position and functional responsibilities, considers the executive officer’s performance and contributions in the prior year, reviews the executive officer’s base salary in comparison to the base salaries of similar positions with similar functional responsibilities at comparable companies, compares the executive officer’s base salary to those of our other executive officers for internal equity purposes, and considers Verso’s financial position and our resources available for compensation purposes.

The Compensation Committee approved base salary increases for each of our named executive officers (other than Mr. Lederer) in 2019. Mr. St. John received a base salary increase in connection with his appointment as our Chief Executive Officer effective November 11, 2019. Mr. Weinhold received a base salary increase in connection with his appointment as our President effective November 14, 2019. In March 2019, the Compensation Committee approved small increases in the base salaries of Messrs. DiSantis, Campbell and Sawyer effective March 1, 2019. The Compensation Committee approved these increases (or in the case of Messrs. St. John and Weinhold, set their base salaries) based on its assessment of peer group data provided by the Compensation Committee’s compensation consultant and the Compensation Committee’s assessment of their positions and after considering the factors noted above. Mr. Lederer’s base salary was negotiated with him in connection with his commencement of employment with the Company. The amount of each named executive officer’s base salary before and after the increase is set forth in the table below.

9

| Name |

Prior Base Salary |

New Base Salary |

||||||

| Adam St. John |

$ | 382,500 | $ | 625,000 | ||||

| B. Christopher DiSantis |

$ | 825,000 | $ | 866,250 | ||||

| Leslie T. Lederer |

— | $ | 240,000 | (1) | ||||

| Michael A. Weinhold |

$ | 446,505 | $ | 525,000 | ||||

| Allen J. Campbell |

$ | 442,170 | $ | 473,122 | ||||

| Kenneth D. Sawyer |

$ | 353,500 | $ | 363,221 | ||||

| (1) | Mr. Lederer received base salary at an annualized rate of $720,000 when he was appointed as our Interim Chief Executive Officer effective April 5, 2019. Following his transition into the role of Senior Transaction Advisor effective November 11, 2019, his base salary was reduced to an annualized rate of $240,000. Mr. Lederer was not employed by us prior to 2019. |

Annual Cash Incentive Plan: 2019 Verso Incentive Plan

In May 2019, Verso, with the approval of the Compensation Committee, established and implemented the 2019 Verso Incentive Plan (“2019 VIP”), an annual, performance-based cash incentive plan for the benefit of our executive officers (other than Mr. Lederer) and certain other key employees. Mr. Lederer did not participate in the 2019 VIP in accordance with the compensation terms negotiated with him in connection with his commencement of employment with the Company.

The 2019 VIP provided the participants with an opportunity to receive a cash incentive award based on Verso’s, their departments’ and their individual performances in 2019. The 2019 VIP involved the quantitative measurement of Verso’s actual performance against a series of operational and financial performance objectives for 2019. It also entailed a qualitative assessment of the contributions of each participant and his or her department to the achievement of our performance objectives.

The 2019 VIP was designed to provide the participants with an incentive for superior work and to motivate them toward even higher achievements and business results, to tie their goals and interests to those of Verso and its stockholders, and to enable us to attract and retain highly qualified executive officers and other employees. The 2019 VIP was administered by the Compensation Committee. Generally, unless otherwise provided by an agreement with Verso, a participant must remain employed by Verso until the time bonuses are actually paid for the performance year in order to be eligible to receive a bonus under the plan.

The 2019 VIP set forth Verso’s performance objectives for 2019 to be used to establish the 2019 annual cash incentives for participants in the plan, the relative weighting of the performance objectives against each other, the threshold, target and maximum achievement levels of our performance objectives, and the funding associated with achieving the performance objectives at the various achievement levels. In establishing the performance objectives, their relative weighting, and their achievement levels, the Compensation Committee considered information provided by management concerning our operational and financial goals for 2019, with the purpose of reflecting those goals in the 2019 VIP. The Compensation Committee had authority under the 2019 VIP to increase or decrease the bonus amount for any participant.

In 2019, as compared to 2018, the Compensation Committee decided to increase the relative weighting of Adjusted EBITDA from 40% to 60%, while decreasing the relative weighting of Cash Conversion (Days) from 20% to 10% to put more of an emphasis on our financial and operating performance. The targeted achievement level for 2019 Adjusted EBITDA was greater than the Company’s targeted level for 2018 Adjusted EBITDA but less than the Company’s actual 2018 Adjusted EBITDA, while the targeted achievement levels for Cash Conversion (Days) and Price/Mix Improvement decreased relative to 2018. The Compensation Committee believed, when it set these performance goals and targeted achievement levels for 2019, that the level of increasing demand for the Company’s products during 2018 might not be sustained throughout 2019, and the Compensation Committee wanted to provide targeted incentives that were challenging but expected at the time to be attainable. In establishing the funding levels, the Compensation Committee also considered the other compensation provided to our eligible executive officers and senior managers, with the aim of establishing total incentive compensation that was competitive. The performance objectives, weightings and funding levels approved by the Compensation Committee for the 2019 VIP are shown in the following table.

10

| 2019 Performance Objectives |

Relative Weighting |

Achievement Levels and Funding Levels | ||||||||||||||

| Threshold | Target | Maximum | ||||||||||||||

| Adjusted EBITDA(1) |

60 | % | $ | 261M | $ | 290M | $ | 348M | ||||||||

| Cash Conversion (Days)(2) |

10 | % | 59 | 56 | 53 | |||||||||||

| Price Mix Improvement(3) |

20 | % | $ | 66M | $ | 74M | $ | 89M | ||||||||

| Safety TIR(4) |

10 | % | 1.24 | 1.17 | 1.11 | |||||||||||

| Funding percentage |

50 | % | 100 | % | 200 | % | ||||||||||

| Funding amount |

$ | 5.2M | $ | 10.4M | $ | 20.9M | ||||||||||

| (1) | Adjusted EBITDA is our earnings before interest, taxes, depreciation and amortization, adjusted to exclude certain unusual items and to reflect changes in accounting principles, policies, practices and procedures adopted or implemented during the term of the 2019 VIP. |

| (2) | Cash conversion is calculated by adding the number of days of inventory plus the number of days of accounts receivable minus days of accounts payable. |

| (3) | Price/mix improvement is the measure of the improvement in product pricing and grade mix optimization between 2018 and 2019, taking into account various factors. |

| (4) | Safety TIR (Total Incident Rate) refers to our number of OSHA recordable safety incidents during 2019 per 100 full-time employees. |

Under the 2019 VIP, the incentive pool, representing the total amount of incentive awards for all participants, was determined initially by adding together all the participants’ target-level incentive awards. A participant’s target-level incentive award is a specified percentage of the participant’s base salary. This initial pool represents the amount of the incentive pool at the target achievement level of performance, which also is referred to as the target-level incentive pool. If the incentive pool were to be funded at the threshold achievement level, the amount of the incentive pool would be equal to 50% of the target-level incentive pool. If, on the other hand, the incentive pool were to be funded at the maximum achievement level, the amount of the incentive pool would be equal to 200% of the target-level incentive pool. Under the 2019 VIP, the threshold, target and maximum funding levels of the incentive pool were approximately $5.2 million, $10.4 million and $20.9 million, respectively.

After determining the target-level incentive pool, the next step in determining the funding of the incentive pool was to consider the levels of achievement of Verso’s performance objectives. After year-end, we calculated the achievement level and factored in the relative weighting of each of our performance objectives. By way of illustration only, if we had achieved the Adjusted EBITDA performance objective at the threshold level of achievement, then 50% of 60%, or a net of 30%, of the target-level incentive pool would have been funded. For any performance objective that was achieved at a level between the threshold and target achievement levels or between the target and maximum achievement levels, we used linear interpolation to determine the appropriate incentive pool funding percentage attributable to such performance objective. This methodology was used to determine the incentive pool funding percentage attributable to the achievement of each of our performance objectives, and the results were added together. Next, the amount of the incentive pool was determined by multiplying the total incentive pool funding percentage by the amount of the target-level incentive pool. Under the terms of the 2019 VIP, the Compensation Committee had the discretion to make adjustments to any or all incentive awards to take into account extraordinary or unforeseen events and circumstances.

The Compensation Committee determined the following actual levels of achievement of Verso’s performance objectives as set forth in the 2019 VIP:

|

|

Relative Weighting |

Actual Achievement Levels |

Funding Levels |

|||||||||

| Adjusted EBITDA |

60 | % | $ | 252M | 0 | % | ||||||

| Cash Conversion (Days) |

10 | % | 57.7 | 6.3 | % | |||||||

| Price Mix Improvement |

20 | % | $ | 25M | 0 | % | ||||||

| Safety TIR |

10 | % | 1.23 | 5.4 | % | |||||||

| Funding percentage based on achievement levels: |

11.7 | % | ||||||||||

11

The amount of a participant’s incentive award under the 2019 VIP was determined by reference to his or her target-level incentive award percentage. A participant’s target-level incentive award percentage is the percentage of his or her base salary that the participant would receive as an incentive award under the 2019 VIP in the event that the incentive pool were to be funded at the target level of 100%. The target-level incentive award percentage reflects our assessment of a participant’s ability, considering his or her position with us, to affect our operational and financial performance. They also take into account the other compensation to which a participant is entitled, the target-level incentive award percentages for positions with similar functional responsibilities at comparable companies, and, in the case of Mr. DiSantis, the applicable provisions of his employment agreement with us. The target-level incentive award percentages range from 5% to 100% of a participant’s base salary at the end of the year, depending on the participant’s employment grade level with us. The target-level incentive award percentages of our named executive officers (other than Mr. Lederer) were 100% of base salary for Messrs. St. John and DiSantis (Mr. St. John’s target was increased from 75% of base salary in connection with his appointment as our Chief Executive Officer), 85% of base salary for Mr. Weinhold (which was increased from 75% of base salary in connection with his appointment as our President in 2019), 80% of base salary for Mr. Campbell, and 75% of base salary for Mr. Sawyer. Mr. Lederer was not eligible for an incentive award under the 2019 VIP. In each case, a participant’s incentive award is capped at 200% of his or her target-level incentive award.

The 11.7% funding level based on the 2019 VIP performance objectives reflected that 2019 was a more difficult year for our business than the Compensation Committee had expected when it initially set the targeted achievement levels for 2019. The Compensation Committee believed that the achievement levels initially set for the 2019 VIP were extremely difficult to achieve and that the Company’s actual performance against those levels did not accurately reflect the achievements and contributions of the 2019 VIP participants (including our eligible named executive officers) under challenging conditions. In particular, the Compensation Committee noted that considerable contributions of the Company’s management team were made during 2019 to the Androscoggin sale. After assessing our management team’s performance for 2019, and the need to retain and continue to incentivize the management team, the Compensation Committee exercised its discretion consistent with terms of the 2019 VIP to pay 2019 VIP participants (including our named executive officers who participated in the plan) a 2019 cash incentive award at 60% of the participant’s target-level award.

Long-Term Equity Incentive Awards

To further align the interests of our named executive officers with those of the Company’s stockholders, we believe that a significant portion of each named executive officer’s compensation opportunity should be in the form of equity-based awards. The Compensation Committee makes a subjective determination each year as to the type and number of long-term incentive equity awards to be granted to our named executive officers in that year. To help inform its decision making process, the Compensation Committee considers a number of factors, including the executive’s position with the Company and total compensation package, the executive’s performance of his individual responsibilities, the equity participation levels of comparable executives at comparable companies, the Compensation Committee’s general assessment of Company and individual performance and the executive’s contribution to the success of the Company’s financial performance. A formula is not used for these purposes and none of these factors is given any particular weight over another as the ultimate equity award grant determinations by the Compensation Committee are subjective. As described below, Mr. DiSantis’ annual equity-based award was as provided in his employment agreement with us.

For 2019, consistent with 2018, the Compensation Committee approved annual equity awards under our Performance Incentive Plan (“PIP”), in the form of RSUs, to the named executive officers (other than Mr. Lederer as he was not employed by us at the time the annual grants were made), with the vesting of 50% of the award generally based on our performance over the three-year period commencing on January 1, 2019 and ending on January 1, 2022 (“performance-based RSUs”), and the vesting of the other 50% of the award being subject to only time-based vesting requirements (“time-based RSUs”), in each case (with respect to both the performace-based RSUs and the time-based RSUs) subject to the executive’s continued employment with us through the vesting dates (subject to accelerated vesting in certain circumstances as discussed below). RSUs are designed both to link executives’ interests with those of our stockholders (as the value of the RSUs depends on the price of our Class A common stock) and to provide a long-term retention incentive for the vesting period (as the RSUs generally have value regardless of stock price volatility and vesting of the entire award is generally contingent on the executive’s continued employment through the vesting date). In addition, fewer RSUs can be awarded to deliver the same grant-date value as stock options (determined using the equity award valuation principles applied in the Company’s financial reporting).

For the 2019 annual equity awards, the Compensation Committee decided to use relative TSR (subject to the Company’s attainment of a threshold level of TSR) as the performance metric for the performance-based RSUs granted to our named executive officers (other than Mr. Lederer) to further align the link between executive compensation and returns to our stockholders. In addition, the Compensation Committee decided that the 2019 time-based RSUs would be scheduled to vest in equal annual installments over a three-year period to better align with the Compensation Committee’s assessment of peer group practices.

12

The table below reflects the number of RSUs granted to each of the named executive officers in connection with the 2019 annual equity awards as approved by the Compensation Committee in March 2019.

| Name |

Time- Based RSUs |

Performance- Based RSUs (Target) |

||||||

| Adam St. John |

11,876 | 11,877 | ||||||

| B. Christopher DiSantis |

47,506 | 47,506 | ||||||

| Michael A. Weinhold |

13,064 | 13,064 | ||||||

| Allen J. Campbell |

13,064 | 13,064 | ||||||

| Kenneth D. Sawyer |

11,876 | 11,877 | ||||||

The performance-based RSUs are eligible to vest and be paid depending on the TSR of the Company’s stock over the three-year period commencing on January 1, 2019 and ending on January 1, 2022. Vesting will be determined on the basis of two criteria. First, the TSR of the Company’s stock, determined as of the end of the 2019-2022 measurement period and compared to the beginning of such period, must have increased by an amount of at least 5% compounded annually. If this threshold requirement is not met, the performance-based RSUs will be forfeited. If this threshold requirement is met, then the performance-based RSUs will be eligible to vest and be paid depending on the TSR of the Company’s stock over the 2019-2022 performance period relative to the TSR of the stock prices over that same period for the peer group of companies selected by the Compensation Committee, in accordance with the table below (with the vesting percentage to be determined by linear interpolation for performance between the levels indicated in the table).

| TSR Performance Relative to the Peer Companies |

Vesting Percentage(1) | |||

| Below 45th Percentile |

0 | % | ||

| 45th Percentile |

50 | % | ||

| 65th Percentile |

100 | % | ||

| 80th Percentile or Higher |

150 | % | ||

| (1) | Notwithstanding performance against the peer group, no performance-based RSUs will vest if the TSR of the Company’s stock has not met the threshold requirement identified in the paragraph above. |

The performance awards cannot vest at more than 150% of the target number of RSUs subject to the award.

The time-based RSUs granted in 2019 are (except as noted below) scheduled to vest in three installments on January 1, 2020, January 1, 2021 and January 1, 2022.

In connection with Mr. St. John’s appointment as our Chief Executive Officer, on November 11, 2019 the Board approved a one-time grant to Mr. St. John of 5,623 time-based RSUs and 5,623 performance-based RSUs with the same vesting schedule and criteria applicable to the annual equity awards granted in March 2019.

The Board also approved a one-time grant to Mr. Lederer in connection with his appointment as Interim Chief Executive Officer on April 5, 2019 of 67,720 RSUs. 10% of the RSUs were time-based with 50% of the time-based RSUs becoming vested on each of the 90th and 180th day following his first day of employment with us. The remaining 90% of the RSUs were performance-based, which would vest upon a change in control of the Company. The performance-based RSUs were later modified in connection with his appointment as Senior Transaction Advisor to vest upon the closing of the Androscoggin sale.

Additional information regarding the material terms of the equity awards granted to our named executive officers for 2019 is set forth in the “Grants of Plan-Based Awards During Fiscal Year 2019” table below.

Relocation

In 2017, we moved our headquarters from Memphis, Tennessee, to Miamisburg, Ohio. In connection with the move, we provided relocating employees, including relocating named executive officers, with a cost of living adjustment to their base salaries and covered certain of their relocation expenses. The final relocation expense reimbursements under this program were paid in 2019. The amounts of such relocation expense reimbursements paid to our named executive officers in 2019, if any, are set forth in Footnote 4 of the “Summary Compensation Table—2017-2019” table below.

13

Additional Benefits

In addition to our tax-qualified retirement plans, we provide our executives the opportunity to elect to defer a portion of their compensation under our nonqualified deferred compensation plan, and we may also make additional discretionary contributions to such executives’ accounts under the plan through our Executive Retirement Program. We believe these plans offer a tax-advantaged way to help our eligible executives save for their retirement. We also provide group medical, dental, life and other insurance coverage for our executive officers and other eligible employees. In addition, under our executive financial counseling policy, we pay the costs of personal investment, estate planning, tax and other financial counseling services, subject to an annual cap of $9,500 or $6,500 (depending on the executive’s position with us), for our executive officers.

Severance and Other Benefits upon Termination of Employment

The Company believes that severance protections, particularly in the context of a change in control transaction, can play a valuable role in attracting and retaining key executive officers.

Messrs. St. John, Campbell and Sawyer participate, and Mr. Weinhold participated, in our severance policy and would be, or in the case of Mr. Weinhold, were, eligible for benefits if their employment were terminated by us without cause or in certain other circumstances. Under his employment agreement with the Company, Mr. DiSantis was entitled to severance benefits in the event of a termination of employment by the Company without cause or by him for good reason. Pursuant to his employment agreement entered into in November 11, 2019, Mr. Lederer was entitled to acceleration of his equity award granted in 2019 upon certain terminations of employment prior to the closing of the Androscoggin sale. The Company has determined that it is appropriate to provide the named executive officers with severance benefits under these circumstances in light of their positions with the Company and as part of their overall compensation package. We have also entered into confidentiality and non-competition agreements (referred to as “CNC Agreements”) with our named executive officers (other than Messrs. DiSantis and Lederer) that provide for the executive to receive compensation in consideration for the executive’s covenants not to compete with us or solicit our employees for 12 months following his termination. We believe these agreements, as well as similar restrictive covenants agreed to by Messrs. DiSantis and Lederer in connection with entering into their employment agreements with the Company, provide important protections for the Company following the termination of an executive’s employment.

The Company believes that the occurrence, or potential occurrence, of a change in control transaction could create uncertainty regarding the continued employment of the Company’s executive officers, as many change in control transactions result in significant organizational changes, particularly at the senior executive level. In order to encourage the Company’s executive officers to remain employed with the Company during an important time when their prospects for continued employment following the transaction may be uncertain, the Company’s equity award agreements with the named executive officers (other than with Mr. Lederer) provide for accelerated vesting of the award if the executive experiences a qualified termination in connection with a change in control, as described in the “Potential Payments upon Termination of Employment of Change in Control” section below.

The payment of cash severance benefits is only triggered by an actual or constructive termination of employment, including voluntary terminations for named executive officers party to CNC Agreements as consideration for certain restrictive covenants. However, as described below under “Grants of Plan-Based Awards,” outstanding equity-based awards granted under the Company’s equity incentive plans, including those awards held by the named executive officers (other than Mr. Lederer), may accelerate on a change in control of the Company if they are not assumed by the acquiring entity and are to be terminated on the transaction and, pursuant to the terms of his employment agreement, Mr. DiSantis was entitled to accelerated vesting of his equity awards in connection with a change in control of the Company.

For more information regarding these severance arrangements, please see “Potential Payments upon Termination of Employment or Change in Control” below.

DiSantis Severance Benefits

Effective as of April 5, 2019, Mr. DiSantis ceased being Chief Executive Officer and a member of the Board. We entered into a separation agreement and general release with Mr. DiSantis on April 11, 2019 in connection with his departure. For more information regarding the severance benefits provided to Mr. DiSantis under his separation agreement, please see “Potential Payments upon Termination of Employment or Change in Control—B. Christopher DiSantis Separation” below.

14

Weinhold Severance Benefits

Effective as of March 10, 2020, Mr. Weinhold ceased being our President. We entered into a separation agreement and general release with Mr. Weinhold on March 10, 2020 in connection with his departure. For more information regarding the severance benefits provided to Mr. Weinhold under his separation agreement, please see “Potential Payments upon Termination of Employment or Change in Control—Michael A. Weinhold Separation” below.

Tax Considerations

Federal income tax law generally prohibits a publicly-held company from deducting compensation paid to a current or former named executive officer that exceeds $1 million during the tax year. Certain awards granted before November 2, 2017 that were based upon attaining pre-established performance measures that were set by the Company’s Compensation Committee under a plan approved by the Company’s stockholders, as well as amounts payable to former executives pursuant to a written binding contract that was in effect on November 2, 2017, may qualify for an exception to the $1 million deductibility limit.

As one of the factors in its consideration of compensation matters, the Compensation Committee notes this deductibility limitation. However, the Compensation Committee has the flexibility to take any compensation-related actions that it determines are in the best interests of the Company and its stockholders, including awarding compensation that may not be deductible for tax purposes. There can be no assurance that any compensation will in fact be deductible.

15

Executive Compensation Tables

Summary Compensation Table – 2017-2019

The following Summary Compensation Table presents information regarding the compensation that Verso provided to our named executive officers for their services in 2017, 2018 and 2019. The Summary Compensation Table should be read in conjunction with the additional information about our executive compensation provided in the narratives and tables that follow the Summary Compensation Table.

| Name and Principal Position |

Year | Base Salary ($) |

Bonus ($)(1) |

Stock Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

|||||||||||||||||||||

| Adam St. John(5) |

2019 | 435,630 | 301,875 | 553,345 | 73,125 | 119,140 | 1,483,115 | |||||||||||||||||||||

| President and Chief Executive Officer |

2018 | 382,500 | 135,363 | 1,535,256 | 482,811 | 112,762 | 2,648,692 | |||||||||||||||||||||

| 2017 | 354,167 | 29,000 | 250,001 | 405,000 | 100,393 | 1,138,561 | ||||||||||||||||||||||

| B. Christopher DiSantis(6) |

2019 | 226,094 | — | 1,770,073 | — | 1,035,206 | 3,031,373 | |||||||||||||||||||||

| Former President and Chief Executive |

2018 | 825,000 | — | 5,097,672 | 1,388,475 | 276,381 | 7,587,528 | |||||||||||||||||||||

| Officer |

2017 | 756,250 | — | 999,995 | 1,087,103 | 68,684 | 2,912,032 | |||||||||||||||||||||

| Leslie T. Lederer(7) |

2019 | 460,519 | — | 2,403,247 | — | 30,937 | 2,894,703 | |||||||||||||||||||||

| Former Interim Chief Executive Officer and Senior Transaction Advisor |

||||||||||||||||||||||||||||

| Michael A. Weinhold(8) |

2019 | 469,329 | 215,539 | 486,764 | 52,211 | 141,877 | 1,365,720 | |||||||||||||||||||||

| Former President |

2018 | 446,505 | 177,013 | 1,688,778 | 563,601 | 143,344 | 3,019,241 | |||||||||||||||||||||

| 2017 | 433,500 | 37,931 | 274,999 | 468,180 | 197,118 | 1,411,728 | ||||||||||||||||||||||

| Allen J. Campbell |

2019 | 467,963 | 182,815 | 486,764 | 44,284 | 161,897 | 1,343,723 | |||||||||||||||||||||

| Senior Vice President and |

2018 | 442,170 | 177,013 | 1,688,778 | 595,338 | 251,923 | 3,155,222 | |||||||||||||||||||||

| Chief Financial Officer |

2017 | 433,500 | 37,931 | 274,999 | 499,392 | 167,716 | 1,413,538 | |||||||||||||||||||||

| Kenneth D. Sawyer |

2019 | 361,601 | 131,577 | 442,516 | 31,872 | 100,469 | 1,068,035 | |||||||||||||||||||||

| Senior Vice President of Human |

2018 | 353,500 | 124,950 | 1,535,256 | 446,205 | 102,581 | 2,562,492 | |||||||||||||||||||||

| Resources and Communications |

2017 | 331,667 | 26,775 | 250,001 | 378,000 | 125,490 | 1,111,933 | |||||||||||||||||||||

| (1) | The 2019 bonus compensation represents the portion of the incentive pool that was paid to our named executive officers (other than Mr. Lederer who was not eligible for a bonus) under the 2019 VIP that was funded upon the Compensation Committee’s exercise of its discretion consistent with the terms of the 2019 VIP above the funding level based on actual performance. See “Annual Cash Incentive Plan: 2019 Verso Incentive Plan” above for additional details. Mr. DiSantis received a pro-rata portion of his 2019 VIP bonus under his separation agreement and such amount is included under the “All Other Compensation” column in accordance with applicable SEC rules as set forth in Footnote 4 below. |

| (2) | The amounts reported reflect the fair value on the grant date of the stock awards granted to our named executive officers during the applicable fiscal year. For 2018, the amounts reported include the grant date fair value of performance-based RSUs approved by the Compensation Committee in 2017 but were treated as “granted” in 2018 under FASB ASC Topic 718 (for a detailed discussion of such treatment, see our definitive proxy statement filed on December 30, 2019 related to our fiscal year ended December 31, 2018). The fair values on the grant date of the time-based RSU grants and the performance-based RSU award granted to Mr. Lederer on April 5, 2019 reported in the “Stock Awards” column, computed in accordance with FASB ASC Topic 718, were based on the closing sale price per share of our Class A common stock on the NYSE on the applicable grant date. In accordance with applicable SEC rules, the grant date fair value of the performance-based RSU awards was determined based on the probable outcome (determined as of the date of grant of the awards, as the grant date is determined for accounting purposes) of the performance-based conditions applicable to the awards. For these purposes, the grant date fair value for the performance-based RSU awards granted in 2019 (other than the performance-based RSU award to Mr. Lederer) was determined based on a Monte Carlo simulation pricing model (which probability weights multiple potential outcomes) as of such grant date of the awards. The significant assumptions used in the Monte Carlo simulation pricing model were: a stock price volatility rate of 55.6% for Verso and 30.5% for the comparison group of peer companies and the average pair-wise correlation coefficients between each of these values of 30%; a simulation period of 3 years (the applicable performance period); a risk-free interest rate of 2.19%; and a dividend yield of 0.0% for Verso and 0.0% for the comparison group of peer companies. |

16

As described in the “Long-Term Equity Incentive Awards” section above, the performance-based RSUs granted to Mr. Lederer on April 5, 2019 were originally subject to vesting upon a change in control of Verso but were later modified in 2019 to vest upon the closing of the Androscoggin sale. In accordance with applicable SEC rules, the amount reported in the “Stock Awards” column for Mr. Lederer also includes the incremental fair value of this modified award of $903,249, computed as of the modification date in accordance with FASB ASC Topic 718, although no additional RSUs were granted on the modification date.

The following table presents the grant date fair value and any incremental fair value of performance-based RSUs granted in 2019 to our named executive officers under two sets of assumptions: (a) assuming the probable outcome would occur (using the Monte Carlo simulation pricing model for all performance-based RSU awards granted to our named executive officers other than Mr. Lederer) and (b) assuming the highest level of performance would be achieved. The values are the same for Mr. Lederer’s performance-based RSUs because there was no opportunity to earn more than the target number of shares subject to the award.

2019 Performance-Based RSUs

| Name |

Grant Date Value and Incremental Value (Based on Probable Outcome or Monte Carlo Simulation) ($) |

Grant Date Fair Value (Based on Maximum Performance) ($) |

||||||

| St. John |

220,022 | 499,998 | ||||||

| DiSantis |

770,072 | 1,500,001 | ||||||

| Lederer |

2,253,247 | 2,253,247 | ||||||

| Weinhold |

211,767 | 412,496 | ||||||

| Campbell |

211,767 | 412,496 | ||||||

| Sawyer |

192,526 | 375,006 | ||||||

| (3) | The 2019 non-equity incentive plan compensation represents the portion of the incentive pool that was paid to our named executive officers (other than Mr. Lederer who was not eligible for a bonus) under the 2019 VIP that was funded at 11.7% based on actual levels of achievement. See “Annual Cash Incentive Plan: 2019 Verso Incentive Plan” above for additional details. Mr. DiSantis received a pro-rata portion of his 2019 VIP bonus under his separation agreement and such amount is included under the “All Other Compensation” column in accordance with applicable SEC rules as set forth in Footnote 4 below. |

| (4) | The “all other compensation” paid to or for the benefit of our named executive officers for 2019 consists of the following: |

| Name |

Relocation | Cost of Living Adjustment |

Matching Contributions Under Retirement Savings Plan ($) |

Discretionary Contributions Under Discretionary Annual Contribution Program ($) |

Discretionary Contributions Under Deferred Compensation Plan ($) |

Matching Contributions Under Deferred Compensation Plan ($) |

Contributions Under Executive Retirement Program ($) |

Payments Under Executive Financial Counseling Policy ($) |

Company- Paid Life and Disability Insurance Premiums ($) |

|||||||||||||||||||||||||||

| St. John |

— | — | 12,600 | 8,400 | 19,153 | 15,853 | 53,550 | 6,500 | 3,084 | |||||||||||||||||||||||||||

| DiSantis |

— | — | 12,600 | — | — | 3,987 | 165,000 | 9,500 | 1,804 | |||||||||||||||||||||||||||

| Lederer |

— | — | 12,600 | 8,400 | 5,416 | — | — | — | 4,521 | |||||||||||||||||||||||||||

| Weinhold |

— | 7,358 | 12,600 | 8,400 | 22,809 | 18,102 | 62,511 | 6,500 | 3,597 | |||||||||||||||||||||||||||

| Campbell |