Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Coronado Global Resources Inc. | tm2017781d1_8k.htm |

Exhibit 99.1

QUARTERLY REPORT March 2020 Highlights OPERATIONS » ROM production for the March quarter was 6.9 Mt, up 4.3% on the December quarter. » Saleable production for the March quarter was 4.5 Mt, down 1.9% on the previous quarter. » Increase in ROM production was driven by strong performance at Buchanan and Logan during the quarter. COAL SALES » March quarter sales volumes of 4.5 Mt, down 3.3% on the previous quarter primarily due to reduced sales from Australian operations as a result of Curragh being shut down in January when a contractor was fatally injured. » Metallurgical coal as a proportion of saleable production was 82% for the March quarter, up 1.1% over the December quarter » Export sales for the March quarter of 75.4% were in line with the previous quarter. » Group realised metallurgical coal price of $102.0 per tonne for the March quarter (average for all grades with a mix of FOR and FOB pricing) was down 8.8% compared to the prior quarter. FINANCIAL AND CORPORATE » March quarter revenue was US$409 million (unaudited), down 8.1% on the previous quarter. » FY20 year to date mining cost per tonne sold of US$56.8 per tonne (unaudited). Net debt of US$437 million as at 31 March 2020 (unaudited), compared to US$303 million at 31 December 2019. » Guidance for FY20 withdrawn due to the increased uncertainties caused by COVID-19 on both global demand and pricing of metallurgical coal. Strategic initiatives implemented to strengthen the balance sheet, including reducing capital expenditure by ~40% for FY20 until market conditions improve. » 1 Coronado Global Resources Inc. ARBN: 628 199 468 Registered Office Level 33, Central Plaza One 345 Queen Street Brisbane QLD 4000 Australia T +61 7 3031 7777 F +61 7 3229 7402 E investors@coronadoglobal.com.au www.coronadoglobal.com.au About Coronado Coronado Global Resources Inc is a leading international producer of high-quality metallurgical coal, an essential element in the production of steel. Our coals, transformed in the steelmaking process, support the manufacture of every day steel-based products that enrich lives around the world. Coronado has a portfolio of operating mines and development projects in Queensland, Australia, and Pennsylvania, Virginia and West Virginia in the United States. Coronado is one of the largest metallurgical coal producers globally by export volume and the largest metallurgical coal producer in the United States by production volume. The management team has over 100 years of combined experience in all aspects of the coal value chain and has a successful track record of building and operating coal mining operations in Australia, the United States and globally. This operational experience is supplemented with a strong knowledge base of domestic and international coal markets and their key drivers. Coronado was listed on the ASX on 23 October 2018. All $ values are US dollars unless otherwise stated.

Message from the CEO The safety and welfare of our employees and contractors is our number one priority. While safety metrics for our US and Australian operations outperformed their respective national averages in FY19, a contractor at the Curragh mine was fatally injured during a tyre change activity at the main workshop in January 2020. As a result of this tragic incident, mine operations at Curragh were suspended immediately. All workers participated in return to work safety sessions and a comprehensive review of mine procedures, with particular attention to tyre handling, was performed. Coronado is conducting a full investigation to understand the causes of this incident and continues to support the third-party reviews underway. Coronado extends its deepest sympathies to the family of Donald Rabbitt and all those affected by the tragic event. COVID-19 The unprecedented and far-reaching global impacts of COVID-19 have been felt across all our operations and Coronado has taken decisive actions to address the resulting operational and financial challenges. To protect the health of our workforce, preventative measures such as social distancing practices and strict hygiene protocols, have been implemented across all mines in Australia and the US. In Australia, the Curragh mine is operating well under the new work practices and is continuing to meet the needs of its global customers and to supply the Stanwell Power Station in Queensland. In the US, the mines were temporarily idled on 30 March 2020 in response to the contraction in demand from its customers in Europe, Brazil and North America. While the mines are idled, sales are continuing from existing inventories of approximately 750,000 tonnes. Coronado has furloughed all US hourly employees while salaried employees have been retained to maintain the integrity of each asset, manage inventory, continue shipments and to ensure we can rapidly recommence operations once market conditions permit. First Quarter Operating Performance There were a number of challenges that impacted on our operations during the first quarter: the impact of the operational shutdown in response to the fatality and increased wet weather events at Curragh; the delay in the resolution of US/China trade dispute; and the emerging impacts from COVID-19. Against this backdrop, the group achieved ROM production of 6.9 Mt representing a 4.3% increase compared to the previous quarter. Curragh ROM and saleable production declined by 19.4% and 17.1% respectively. However, Curragh realised prices rose as benchmark prices increased 10.7%, which resulted in improved revenues. The US operations commenced the year strongly with ROM production at Buchanan and Logan increasing by 37.6% and 33.3% respectively, which offset the interrupted performance at Curragh. Buchanan also successfully completed a longwall move in March, with the operation tracking ahead of expectations following the Phase One trade deal between US and China. Metallurgical coal markets The macroeconomic impact of COVID-19 presents challenging times ahead for the resources sector. Steel producers have rationalised production as a result of a sharp decline in demand, notably from the automotive and construction industries and the recovery in steel production will likely be delayed until the COVID-19 lockdowns and trade restrictions are removed and stimulus initiatives are implemented. Curragh’s major customers in India, Japan, Korea and Europe have not been immune from the downturn in steel demand and impact of lockdown policies. However, they have continued to work with Curragh as a strategic supplier of ‘base load’ metallurgical coal for coke blends. Curragh has also successfully moved more coal into the Chinese market, reflecting the flexibility and quality of the product. Whilst many producers of metallurgical coal have reduced or suspended production in response to the contraction in demand, the forward curve is indicating lower prices for the remainder of 2020 with potential of further downside risks. Guidance The timing and potential recovery from the global impacts of COVID-19 remains uncertain and in response the Company has undertaken decisive actions to safeguard our operations, strengthen the balance sheet and increase liquidity. Effective immediately, Coronado has reduced total capital expenditure by approximately 40%, including deferring the expansion plans for Curragh. Our focus is to maintain a robust financial position and continue our disciplined approach to maintain low cost operating structure to withstand a period of sustained lower prices. This will ensure we are well positioned in anticipation of when the market eventually recovers. Given the heightened uncertainty caused by the pandemic, Coronado has also decided to withdraw market guidance for 2020. Gerry Spindler, Chief Executive Officer 2

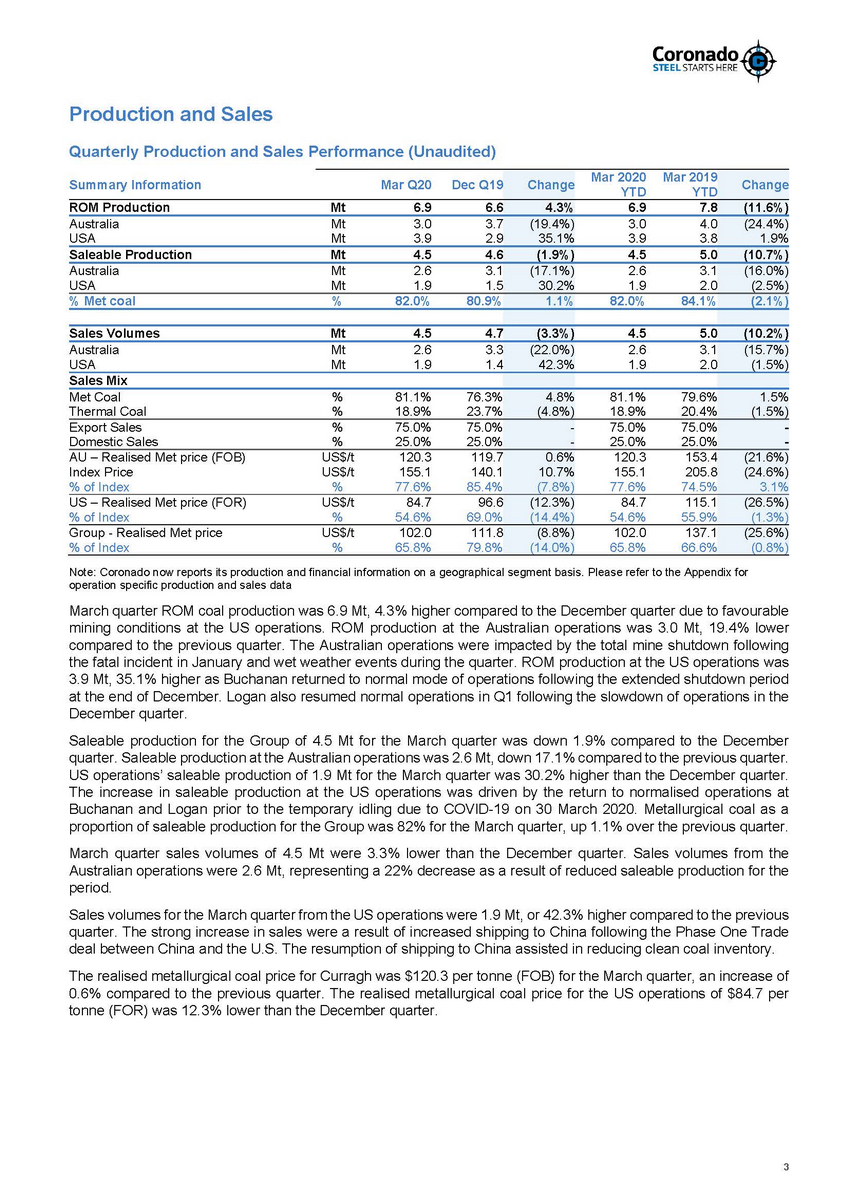

Production and Sales Quarterly Production and Sales Performance (Unaudited) Note: Coronado now reports its production and financial information on a geographical segment basis. Please refer to the Appendix for operation specific production and sales data March quarter ROM coal production was 6.9 Mt, 4.3% higher compared to the December quarter due to favourable mining conditions at the US operations. ROM production at the Australian operations was 3.0 Mt, 19.4% lower compared to the previous quarter. The Australian operations were impacted by the total mine shutdown following the fatal incident in January and wet weather events during the quarter. ROM production at the US operations was 3.9 Mt, 35.1% higher as Buchanan returned to normal mode of operations following the extended shutdown period at the end of December. Logan also resumed normal operations in Q1 following the slowdown of operations in the December quarter. Saleable production for the Group of 4.5 Mt for the March quarter was down 1.9% compared to the December quarter. Saleable production at the Australian operations was 2.6 Mt, down 17.1% compared to the previous quarter. US operations’ saleable production of 1.9 Mt for the March quarter was 30.2% higher than the December quarter. The increase in saleable production at the US operations was driven by the return to normalised operations at Buchanan and Logan prior to the temporary idling due to COVID-19 on 30 March 2020. Metallurgical coal as a proportion of saleable production for the Group was 82% for the March quarter, up 1.1% over the previous quarter. March quarter sales volumes of 4.5 Mt were 3.3% lower than the December quarter. Sales volumes from the Australian operations were 2.6 Mt, representing a 22% decrease as a result of reduced saleable production for the period. Sales volumes for the March quarter from the US operations were 1.9 Mt, or 42.3% higher compared to the previous quarter. The strong increase in sales were a result of increased shipping to China following the Phase One Trade deal between China and the U.S. The resumption of shipping to China assisted in reducing clean coal inventory. The realised metallurgical coal price for Curragh was $120.3 per tonne (FOB) for the March quarter, an increase of 0.6% compared to the previous quarter. The realised metallurgical coal price for the US operations of $84.7 per tonne (FOR) was 12.3% lower than the December quarter. 3 Summary Information Mar Q20Dec Q19 Change Mar 2020Mar 2019 YTDYTD Change ROM ProductionMt6.96.6 4.3% 6.97.8 (11.6%) AustraliaMt3.03.7 USAMt3.92.9 (19.4%) 35.1% 3.04.0 3.93.8 (24.4%) 1.9% Saleable ProductionMt4.54.6 (1.9%) 4.55.0 (10.7%) AustraliaMt2.63.1 USAMt1.91.5 (17.1%) 30.2% 2.63.1 1.92.0 (16.0%) (2.5%) % Met coal%82.0%80.9% 1.1% 82.0%84.1% (2.1%) Sales VolumesMt4.54.7 (3.3%) 4.55.0 (10.2%) AustraliaMt2.63.3 USAMt1.91.4 (22.0%) 42.3% 2.63.1 1.92.0 (15.7%) (1.5%) Sales Mix Met Coal%81.1%76.3% Thermal Coal%18.9%23.7% 4.8% (4.8%) 81.1%79.6% 18.9%20.4% 1.5% (1.5%) Export Sales%75.0%75.0% Domestic Sales%25.0%25.0% - - 75.0%75.0% 25.0%25.0% - - AU – Realised Met price (FOB)US$/t120.3119.7 Index PriceUS$/t155.1140.1 % of Index%77.6%85.4% 0.6% 10.7% (7.8%) 120.3153.4 155.1205.8 77.6%74.5% (21.6%) (24.6%) 3.1% US – Realised Met price (FOR)US$/t84.796.6 % of Index%54.6%69.0% (12.3%) (14.4%) 84.7115.1 54.6%55.9% (26.5%) (1.3%) Group - Realised Met priceUS$/t102.0111.8 % of Index%65.8%79.8% (8.8%) (14.0%) 102.0137.1 65.8%66.6% (25.6%) (0.8%)

Q1 FY20 Sales Mix Q1 FY20 Export Mix 19% 25% 75% 81% Thermal Coal Metallurgical Coal Export Sales Domestic Sales Coronado’s proportion of metallurgical coal sales in the March quarter was 81.1% of the total sales mix. Export sales as a percentage of total sales for the March quarter was 75%, in line with the previous quarter. Financial and Corporate Unaudited March quarter revenue was $409 million, down 8.1% compared to the December quarter. Unaudited FY20 year to date mining cost per tonne sold for the Group was $56.8 per tonne. Capital expenditure was $41.4 million (unaudited). At 31 March 2020 the Company’s net debt position was $437 million (made up of $18 million of cash and $455 million of debt), up from $303 million at 31 December. The Company has a syndicated facility of $550 million. In response to the global impacts of COVID-19 on the demand and price for metallurgical coal, the Company has implemented a number of strategic initiatives that aim to strengthen the balance sheet and increase liquidity. This includes reducing or deferring non-essential capital expenditure by 40%, including deferring the expansion capital for Curragh and continuing our disciplined approach to driving down unit costs of production. 4

US/China tariffs in the second half of FY19. There was also improved operating performance from Logan during the period. Saleable production was 1.9 Mt, 30.2% higher compared to the December quarter. Sales volume for March quarter was 1.9 Mt, 42.3% higher than the prior period. The increase in sales volume in the March quarter was a result of shipments to China recommencing following the agreement of the Phase One trade deal between China and the U.S. In the latter part of the March quarter, the North American and Atlantic basin steel producers have been adversely impacted by the sharp decline in demand for steel products, with producers idling production in response. This reduction in demand has delayed shipment of products from the US operations. As previously announced, the US operations have been idled since 30 March 2020 with sales to continue from existing inventories. The longwall operation at Buchanan will continue to operate intermittently with the mine expected to resume normal operations in the second quarter. The Logan mine is also expected to resume normal operations in the second quarter. Thermal mines are not expected to resume production. It is expected that the US operations will remain cash neutral during the idle period as sales continue from existing inventory. Operational Overview & Outlook Safety In Australia, the 12-month rolling average Total Reportable Injury Frequency Rate (TRIFR) at the end of the quarter (which was impacted by the fatality) was 6.4, compared to 6.5 at the end of the previous quarter. In the U.S., the 12-month rolling average Total Reportable Incident Rate (TRIR) reduced to 1.69 (from 2.14). Australia (Curragh) The March quarter was impacted by the total mine shutdown in January following the fatal incident at the Australian operations. In addition, mine operations were adversely impacted by increased wet weather which restricted mining operations intermittently during the quarter. ROM production for the March quarter was 3.0 Mt, a reduction of 19.4%. Saleable production was 2.6 Mt, 17.1% decline volumes of 2.6 quarter. from the previous quarter. Sales Mt was 22.0% lower than the prior The realised metallurgical coal price for Australian operations was $120.3 (FOB) for the quarter which was 0.6% higher than the previous quarter. This was a result of an increase in the three-month lag pricing to which Australian operations coal has price exposure. To ensure the Australian asset continues to operate during the impact of COVID-19 policies have been implemented to increase screening, hygiene and social distancing during this period. To date the Curragh mine has not registered any cases of COVID-19. The global economic slowdown resulting from the effects of COVID-19 has sharply reduced the demand for steel production. This is likely to impact on sales for the Australian operation in the second quarter of 2020 with shipping programs adjusted in response to lockdown directives in India, Japan, Korea and Europe. To date, the impact on the Australian operations has been limited due to Curragh’s unique position as a strategic supplier of ‘base load’ metallurgical coal for coke blends. However, the timing of a recovery from the impacts of COVID-19 remains unclear with potential for further downside risks to price and demand in the near term. United States (Buchanan, Logan and Greenbrier) March quarter ROM production from the US operations was 3.9 Mt, 35.1% higher than the December quarter. The increase in production was driven by Buchanan returning to a normal mode of operation following the extended late December shutdown to manage inventories that had increased due to the effects of the 5

Coal Market Outlook During the March quarter the Platts PLV Coking Coal price tracked slightly lower from $147.5/t to circa $141/t in late March. The index price has since declined below $130/t as demand for metallurgical coal continues to fall following the impacts on steel production due to COVID-19. Global steel producers have rationalized production due to a decline in steel demand from the construction and automotive sectors; a direct result of substantially lower consumer demand in a COVID-19 environment. Steel production in China remains somewhat resilient with expectations that port restrictions for imported coal remain in force, and end users will be selective in coal types purchased, on higher quality hard coking coals. Steel producers outside of China, in particular Japan, Korea, Brazil, Europe and North America, have been affected by a slowdown in the demand for steel. These regions have enforced steel production cuts between 30% to 60%. The timing of a global recovery is uncertain given the economic backdrop and the potential for further downside risks to the price of metallurgical coal is high. Indian steel production, and the corresponding demand for metallurgical coal, has been impacted following of the Indian Government’s announcement of lockdowns. The recovery of the Indian steel sector represents a new uncertainty for the seaborne market. Given the overall importance of government backed economic stimulus post COVID-19 a rapid recovery in steel demand, and a return of production is anticipated, however the timing of the recovery remains uncertain. Exploration & Development Glossary A$ ASX Capital Expenditure CHPP EBITDA Australian dollar currency Australian Securities Exchange Expenditure included as a component of Investing Activities within the Coronado Consolidated Statement of Cash Flows Coal Handling Preparation Plant Earnings before interest, tax, depreciation and amortization Free Onboard Board in the vessel at the port Free Onboard Rail in the railcar at the mine Hard coking coal High Vol A High Vol B FOB FOR HCC HVA HVB Platts Premium Low Volatile HCC, US$/t FOB East Coast Australia Index Kt Met Coal Mining costs per tonne sold Mt PCI Thousand tonnes, metric Metallurgical quality coal Costs of coal revenues / sales volumes Million tonnes, metric Pulverised Coal Injection Net Debt Defined as borrowings less cash Realised price ROM Saleable production Sales volumes Strip Ratio Weighted average revenue per tonne sold Run of Mine, coal mined Coal available to sell, either washed or bypassed Sales to third parties Ratio of overburden removed to coal mined (ROM) Total Reportable Injury Frequency Rate Total Reportable Incident Rate United States dollar currency Additional core hole drilling and subsurface geotechnicalexploration Pennsylvania USA, has atMonValley(PSF), been rescheduled to the second half of the current year reflecting the immediate reduction in capital expenditure. TRIFR TRIR US$ For further information, please contact: Corporate Matthew Sullivan P +61 412 157 276 E msullivan@coronadoglobal.com.au Investors Aidan Meka P +61 428 082 954 E ameka@coronadoglobal.com.au

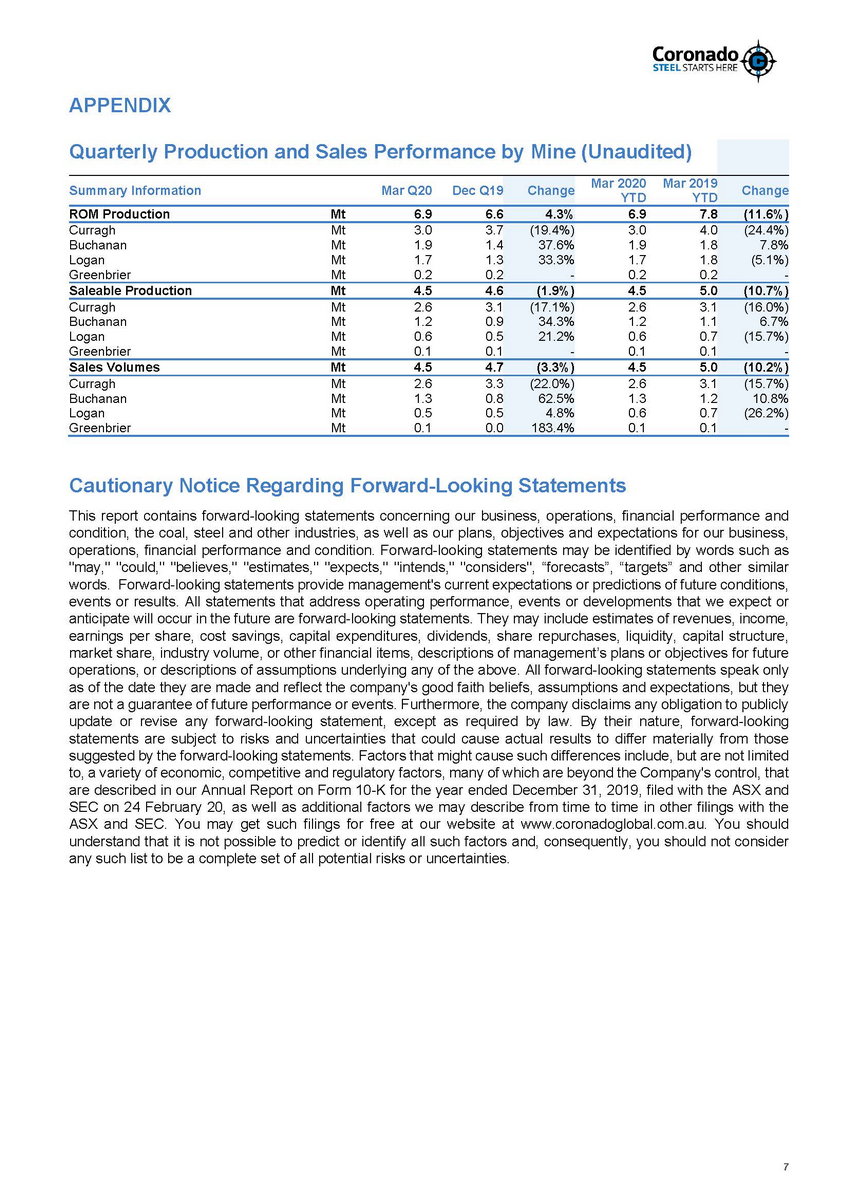

APPENDIX Cautionary Notice Regarding Forward-Looking Statements This report contains forward-looking statements concerning our business, operations, financial performance and condition, the coal, steel and other industries, as well as our plans, objectives and expectations for our business, operations, financial performance and condition. Forward-looking statements may be identified by words such as "may," "could," "believes," "estimates," "expects," "intends," "considers", “forecasts”, “targets” and other similar words. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volume, or other financial items, descriptions of management’s plans or objectives for future operations, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect the company's good faith beliefs, assumptions and expectations, but they are not a guarantee of future performance or events. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the Company's control, that are described in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the ASX and SEC on 24 February 20, as well as additional factors we may describe from time to time in other filings with the ASX and SEC. You may get such filings for free at our website at www.coronadoglobal.com.au. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. 7 Quarterly Production and Sales Performance by Mine (Unaudited) Summary InformationMar Q20Dec Q19 Change Mar 2020Mar 2019 YTDYTD Change ROM ProductionMt6.96.6 4.3% 6.97.8 (11.6%) CurraghMt3.03.7 BuchananMt1.91.4 LoganMt1.71.3 GreenbrierMt0.20.2 (19.4%) 37.6% 33.3% - 3.04.0 1.91.8 1.71.8 0.20.2 (24.4%) 7.8% (5.1%) - Saleable ProductionMt4.54.6 (1.9%) 4.55.0 (10.7%) CurraghMt2.63.1 BuchananMt1.20.9 LoganMt0.60.5 GreenbrierMt0.10.1 (17.1%) 34.3% 21.2% - 2.63.1 1.21.1 0.60.7 0.10.1 (16.0%) 6.7% (15.7%) - Sales VolumesMt4.54.7 (3.3%) 4.55.0 (10.2%) CurraghMt2.63.3 BuchananMt1.30.8 LoganMt0.50.5 GreenbrierMt0.10.0 (22.0%) 62.5% 4.8% 183.4% 2.63.1 1.31.2 0.60.7 0.10.1 (15.7%) 10.8% (26.2%) -

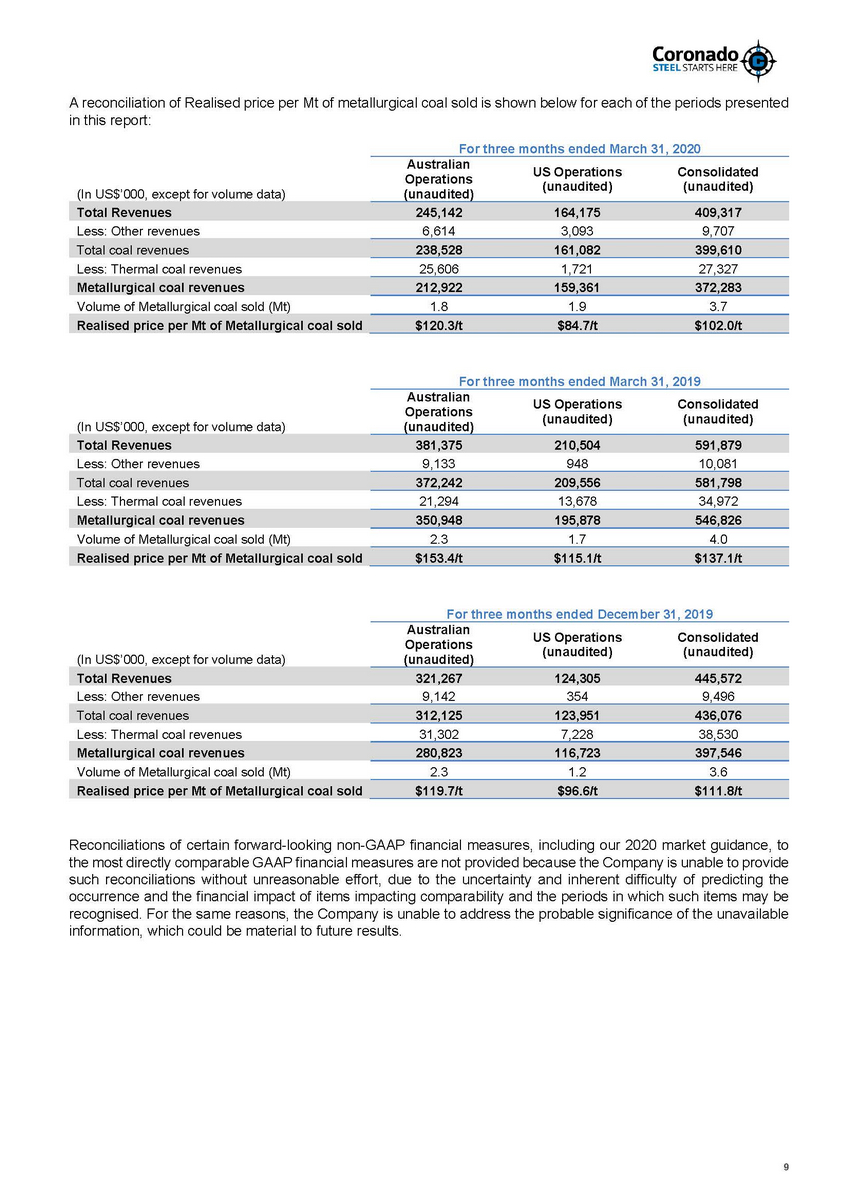

Reconciliation of Non-GAAP measures This report which includes a discussion of results of operations includes references to and analysis of certain non-GAAP measures (as described below) which are financial measures not recognised in accordance with U.S. GAAP. Non-GAAP financial measures are used by the Company and investors to measure operating performance. Management uses a variety of financial and operating metrics to analyse performance. These metrics are significant factors in assessing operating results and profitability. These financial and operating metrics include: (i) safety and environmental metrics; (ii) sales volumes and average realised price per Mt or metallurgical coal sold, which we define as metallurgical coal revenues divided by metallurgical sales volume; and (iii) average mining costs per Mt sold, which we define as mining costs divided by sales volumes. We evaluate our mining cost on a cost per metric ton basis. Mining costs is based on reported cost of coal revenues, which is shown on our statement of operations and comprehensive income exclusive of freight expense, Stanwell rebate, other royalties, depreciation, depletion and amortization and selling, general and administrative expenses, adjusted for other items that do not relate directly to the costs incurred to produce coal at mine. A reconciliation of consolidated costs and expenses, consolidated operating costs, and consolidated mining costs are shown below: For the three months ended March 31, 2020 Total Consolidated (Unaudited) (In US$000, except for volume data) Less: Selling, general and administrative expense (6,195) Total operating costs 356,194 Less: Stanwell rebate (32,628) Less: Other non-mining costs (2,118) 8 Total mining costs254,769 Sales Volume, excluding non-produced coal (Mt)4.4 Average mining costs per tonne sold$56.8/t Less: Freight expenses(42,381) Less: Other royalties(24,298) Less: Depreciation, depletion and amortization(45,302) Total costs and expenses407,691

A reconciliation of Realised price per Mt of metallurgical coal sold is shown below for each of the periods presented in this report: For three months ended March 31, 2020 Australian Operations (unaudited) US Operations (unaudited) Consolidated (unaudited) (In US$’000, except for volume data) Less: Other revenues 6,614 3,093 9,707 Less: Thermal coal revenues 25,606 1,721 27,327 Volume of Metallurgical coal sold (Mt) 1.8 1.9 3.7 For three months ended March 31, 2019 Australian Operations (unaudited) US Operations (unaudited) Consolidated (unaudited) (In US$’000, except for volume data) Less: Other revenues 9,133 948 10,081 Less: Thermal coal revenues 21,294 13,678 34,972 Volume of Metallurgical coal sold (Mt) 2.3 1.7 4.0 For three months ended December 31, 2019 Australian Operations (unaudited) US Operations (unaudited) Consolidated (unaudited) (In US$’000, except for volume data) Less: Other revenues 9,142 354 9,496 Less: Thermal coal revenues 31,302 7,228 38,530 Volume of Metallurgical coal sold (Mt) 2.3 1.2 3.6 Reconciliations of certain forward-looking non-GAAP financial measures, including our 2020 market guidance, to the most directly comparable GAAP financial measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of items impacting comparability and the periods in which such items may be recognised. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. 9 Realised price per Mt of Metallurgical coal sold$119.7/t$96.6/t$111.8/t Metallurgical coal revenues280,823116,723397,546 Total coal revenues312,125123,951436,076 Total Revenues321,267124,305445,572 Realised price per Mt of Metallurgical coal sold$153.4/t$115.1/t$137.1/t Metallurgical coal revenues350,948195,878546,826 Total coal revenues372,242209,556581,798 Total Revenues381,375210,504591,879 Realised price per Mt of Metallurgical coal sold$120.3/t$84.7/t$102.0/t Metallurgical coal revenues212,922159,361372,283 Total coal revenues238,528161,082399,610 Total Revenues245,142164,175409,317